381c9a420917719502c065e382f17aa1.ppt

- Количество слайдов: 18

Revitalizing Commercial Corridors for Economic Development Understanding Impacts of US 19 Construction, Or: “How the Will I Get Over There? !” WTL+a Real Estate & Economic Advisors Washington, DC & Provincetown, MA 2017 Pinellas County Economic Leadership Symposium April 21, 2017

Revitalizing Commercial Corridors for Economic Development Understanding Impacts of US 19 Construction, Or: “How the Will I Get Over There? !” WTL+a Real Estate & Economic Advisors Washington, DC & Provincetown, MA 2017 Pinellas County Economic Leadership Symposium April 21, 2017

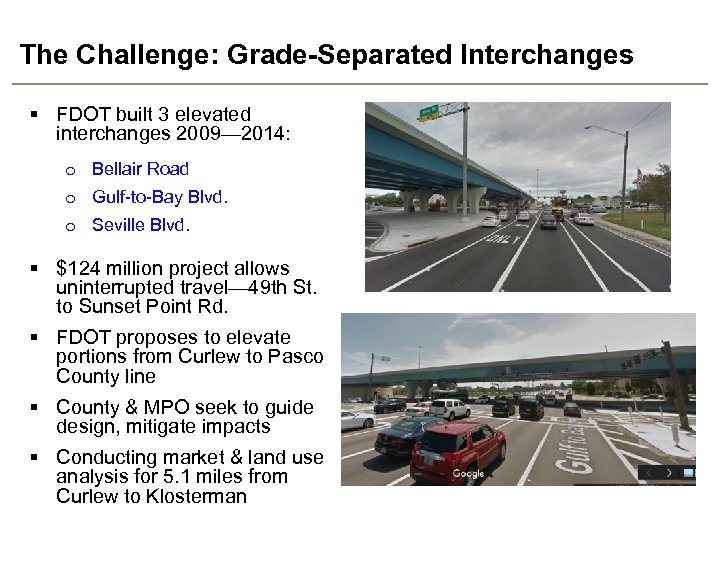

The Challenge: Grade-Separated Interchanges § FDOT built 3 elevated interchanges 2009— 2014: o Bellair Road o Gulf-to-Bay Blvd. o Seville Blvd. § $124 million project allows uninterrupted travel— 49 th St. to Sunset Point Rd. § FDOT proposes to elevate portions from Curlew to Pasco County line § County & MPO seek to guide design, mitigate impacts § Conducting market & land use analysis for 5. 1 miles from Curlew to Klosterman

The Challenge: Grade-Separated Interchanges § FDOT built 3 elevated interchanges 2009— 2014: o Bellair Road o Gulf-to-Bay Blvd. o Seville Blvd. § $124 million project allows uninterrupted travel— 49 th St. to Sunset Point Rd. § FDOT proposes to elevate portions from Curlew to Pasco County line § County & MPO seek to guide design, mitigate impacts § Conducting market & land use analysis for 5. 1 miles from Curlew to Klosterman

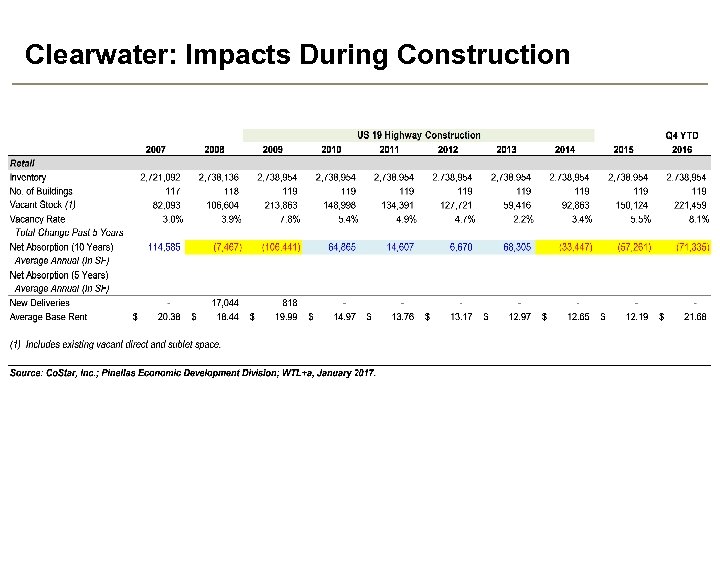

Clearwater: Impacts During Construction From Main Street/580 to SR 60: § Challenge of isolating real estate impacts of both 2007— 2009 recession & highway construction § Critical decisions among commercial property owners: o Dramatically lowered retail rents to maintain occupancies o Offered short-term retail leases § Key findings: o 4 years of positive leasing activity: +154, 400 SF o Rents declined by 39%

Clearwater: Impacts During Construction From Main Street/580 to SR 60: § Challenge of isolating real estate impacts of both 2007— 2009 recession & highway construction § Critical decisions among commercial property owners: o Dramatically lowered retail rents to maintain occupancies o Offered short-term retail leases § Key findings: o 4 years of positive leasing activity: +154, 400 SF o Rents declined by 39%

Clearwater: Impacts During Construction From Main Street/580 to SR 60: § Office vacancies peaked at 21% (2010) § Limited office leasing reduced vacancies to 15%— 19% (2011— 2015) § Retail impacts since construction completed (2014): o Negative absorption: -162, 000 SF o Vacancies jumped from 2% in 2013 to 8%

Clearwater: Impacts During Construction From Main Street/580 to SR 60: § Office vacancies peaked at 21% (2010) § Limited office leasing reduced vacancies to 15%— 19% (2011— 2015) § Retail impacts since construction completed (2014): o Negative absorption: -162, 000 SF o Vacancies jumped from 2% in 2013 to 8%

Clearwater: Impacts During Construction

Clearwater: Impacts During Construction

Study Area Today: Demographics & Housing § 27, 900 (aging) residents in 13, 600 households § Annual retail spending: $16, 200 per HH—slightly higher than County average § Stable & diverse housing stock: o 60% owner/26% renter o Average value: $228, 500 o 14% “unoccupied” but true vacancy is 5. 5% § Limited available land for new residential development suggests infill redevelopment driven by: o Population/HH growth o Very low MF vacancies (1. 8%) & absorption (40 units/year) o Site assemblage

Study Area Today: Demographics & Housing § 27, 900 (aging) residents in 13, 600 households § Annual retail spending: $16, 200 per HH—slightly higher than County average § Stable & diverse housing stock: o 60% owner/26% renter o Average value: $228, 500 o 14% “unoccupied” but true vacancy is 5. 5% § Limited available land for new residential development suggests infill redevelopment driven by: o Population/HH growth o Very low MF vacancies (1. 8%) & absorption (40 units/year) o Site assemblage

Study Area Today: Retail § Corridor serves as destination for larger retail trade area § Store sales of $418 million/year indicate larger trade area, limited competition § 2. 6 million SF of retail inventory (<5% of County’s supply): o 455 retailers (33% of total businesses) o 80 restaurants (65% locally-owned) § Fluctuating vacancies, uneven/negative commercial leasing, declining rents § Retail sales average $161 per SF: below national underwriting criteria § Key findings: o As HHs age, retail spending declines o Conversion of obsolete/vacant retail to medical use

Study Area Today: Retail § Corridor serves as destination for larger retail trade area § Store sales of $418 million/year indicate larger trade area, limited competition § 2. 6 million SF of retail inventory (<5% of County’s supply): o 455 retailers (33% of total businesses) o 80 restaurants (65% locally-owned) § Fluctuating vacancies, uneven/negative commercial leasing, declining rents § Retail sales average $161 per SF: below national underwriting criteria § Key findings: o As HHs age, retail spending declines o Conversion of obsolete/vacant retail to medical use

Study Area Today: Office & Lodging § Tertiary market: 1. 2 million SF of office inventory (<3% of County) § Vacancies peaked at 21% (2014); currently 17% § Significant negative absorption over past 10 years: -173, 000 SF § Estimated 364, 000 SF of medical office § Geographic Solutions: example of targeted recruitment strategy § 1, 600 hotel rooms (11% of County) § Hotel occupancies averaged 59% over past 5 years— improving but in recovery

Study Area Today: Office & Lodging § Tertiary market: 1. 2 million SF of office inventory (<3% of County) § Vacancies peaked at 21% (2014); currently 17% § Significant negative absorption over past 10 years: -173, 000 SF § Estimated 364, 000 SF of medical office § Geographic Solutions: example of targeted recruitment strategy § 1, 600 hotel rooms (11% of County) § Hotel occupancies averaged 59% over past 5 years— improving but in recovery

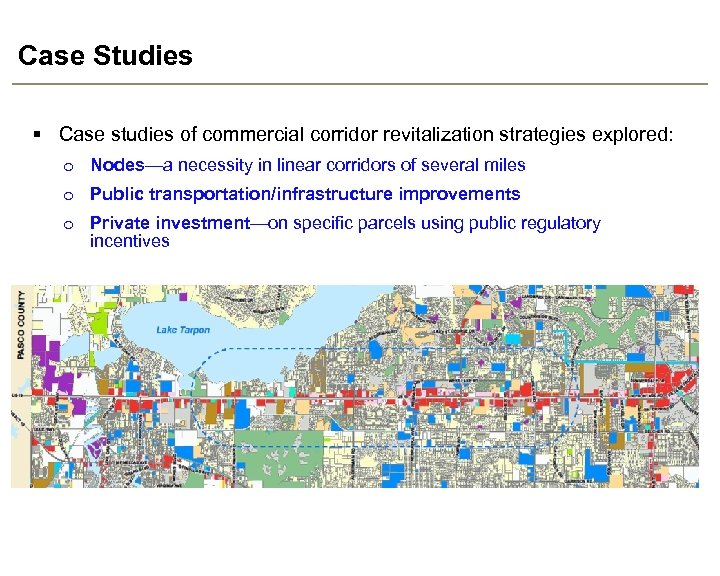

Case Studies § Case studies of commercial corridor revitalization strategies explored: o Nodes—a necessity in linear corridors of several miles o Public transportation/infrastructure improvements o Private investment—on specific parcels using public regulatory incentives

Case Studies § Case studies of commercial corridor revitalization strategies explored: o Nodes—a necessity in linear corridors of several miles o Public transportation/infrastructure improvements o Private investment—on specific parcels using public regulatory incentives

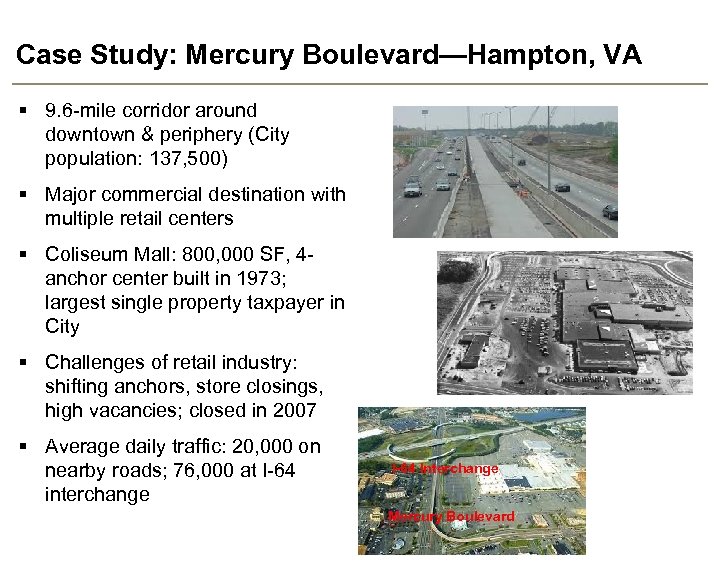

Case Study: Mercury Boulevard—Hampton, VA § 9. 6 -mile corridor around downtown & periphery (City population: 137, 500) § Major commercial destination with multiple retail centers § Coliseum Mall: 800, 000 SF, 4 anchor center built in 1973; largest single property taxpayer in City § Challenges of retail industry: shifting anchors, store closings, high vacancies; closed in 2007 § Average daily traffic: 20, 000 on nearby roads; 76, 000 at I-64 interchange I-64 Interchange Mercury Boulevard

Case Study: Mercury Boulevard—Hampton, VA § 9. 6 -mile corridor around downtown & periphery (City population: 137, 500) § Major commercial destination with multiple retail centers § Coliseum Mall: 800, 000 SF, 4 anchor center built in 1973; largest single property taxpayer in City § Challenges of retail industry: shifting anchors, store closings, high vacancies; closed in 2007 § Average daily traffic: 20, 000 on nearby roads; 76, 000 at I-64 interchange I-64 Interchange Mercury Boulevard

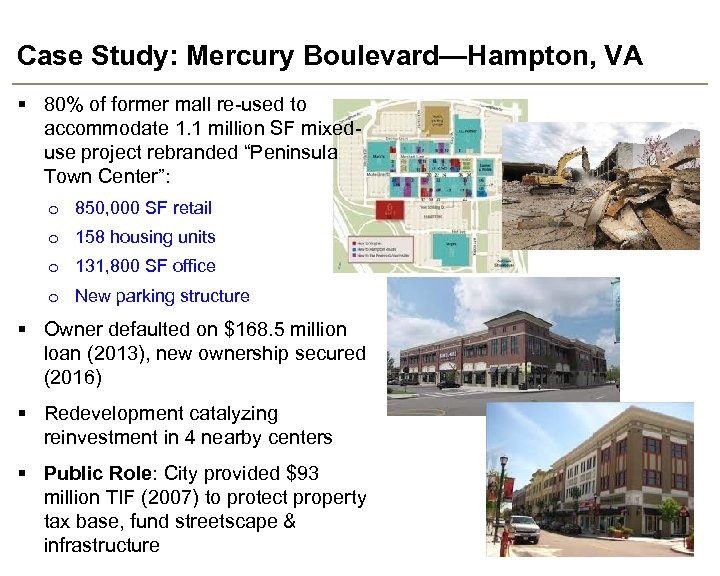

Case Study: Mercury Boulevard—Hampton, VA § 80% of former mall re-used to accommodate 1. 1 million SF mixeduse project rebranded “Peninsula Town Center”: o 850, 000 SF retail o 158 housing units o 131, 800 SF office o New parking structure § Owner defaulted on $168. 5 million loan (2013), new ownership secured (2016) § Redevelopment catalyzing reinvestment in 4 nearby centers § Public Role: City provided $93 million TIF (2007) to protect property tax base, fund streetscape & infrastructure

Case Study: Mercury Boulevard—Hampton, VA § 80% of former mall re-used to accommodate 1. 1 million SF mixeduse project rebranded “Peninsula Town Center”: o 850, 000 SF retail o 158 housing units o 131, 800 SF office o New parking structure § Owner defaulted on $168. 5 million loan (2013), new ownership secured (2016) § Redevelopment catalyzing reinvestment in 4 nearby centers § Public Role: City provided $93 million TIF (2007) to protect property tax base, fund streetscape & infrastructure

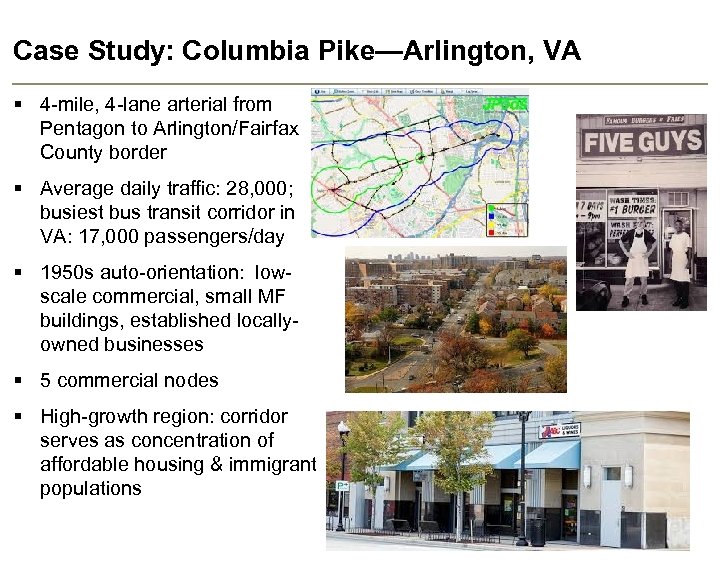

Case Study: Columbia Pike—Arlington, VA § 4 -mile, 4 -lane arterial from Pentagon to Arlington/Fairfax County border § Average daily traffic: 28, 000; busiest bus transit corridor in VA: 17, 000 passengers/day § 1950 s auto-orientation: lowscale commercial, small MF buildings, established locallyowned businesses § 5 commercial nodes § High-growth region: corridor serves as concentration of affordable housing & immigrant populations

Case Study: Columbia Pike—Arlington, VA § 4 -mile, 4 -lane arterial from Pentagon to Arlington/Fairfax County border § Average daily traffic: 28, 000; busiest bus transit corridor in VA: 17, 000 passengers/day § 1950 s auto-orientation: lowscale commercial, small MF buildings, established locallyowned businesses § 5 commercial nodes § High-growth region: corridor serves as concentration of affordable housing & immigrant populations

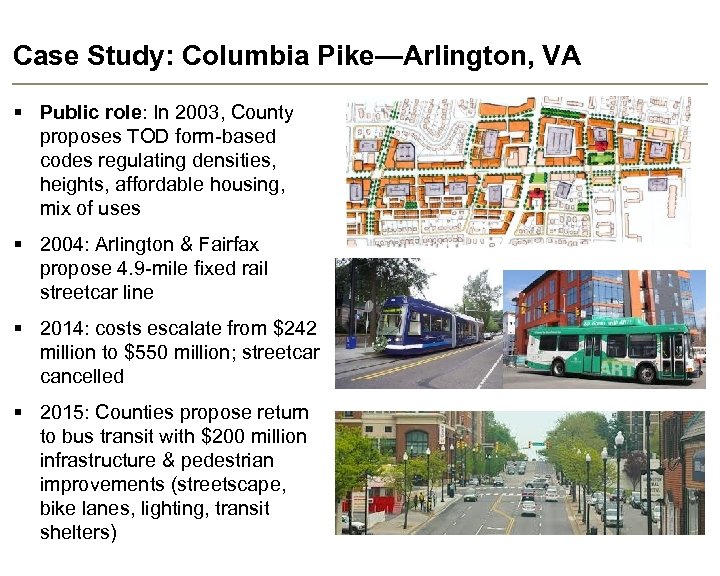

Case Study: Columbia Pike—Arlington, VA § Public role: In 2003, County proposes TOD form-based codes regulating densities, heights, affordable housing, mix of uses § 2004: Arlington & Fairfax propose 4. 9 -mile fixed rail streetcar line § 2014: costs escalate from $242 million to $550 million; streetcar cancelled § 2015: Counties propose return to bus transit with $200 million infrastructure & pedestrian improvements (streetscape, bike lanes, lighting, transit shelters)

Case Study: Columbia Pike—Arlington, VA § Public role: In 2003, County proposes TOD form-based codes regulating densities, heights, affordable housing, mix of uses § 2004: Arlington & Fairfax propose 4. 9 -mile fixed rail streetcar line § 2014: costs escalate from $242 million to $550 million; streetcar cancelled § 2015: Counties propose return to bus transit with $200 million infrastructure & pedestrian improvements (streetscape, bike lanes, lighting, transit shelters)

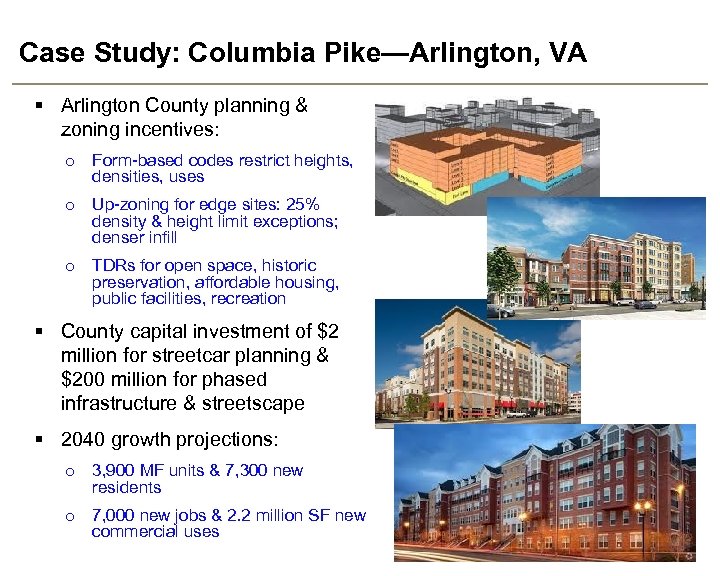

Case Study: Columbia Pike—Arlington, VA § Arlington County planning & zoning incentives: o Form-based codes restrict heights, densities, uses o Up-zoning for edge sites: 25% density & height limit exceptions; denser infill o TDRs for open space, historic preservation, affordable housing, public facilities, recreation § County capital investment of $2 million for streetcar planning & $200 million for phased infrastructure & streetscape § 2040 growth projections: o 3, 900 MF units & 7, 300 new residents o 7, 000 new jobs & 2. 2 million SF new commercial uses

Case Study: Columbia Pike—Arlington, VA § Arlington County planning & zoning incentives: o Form-based codes restrict heights, densities, uses o Up-zoning for edge sites: 25% density & height limit exceptions; denser infill o TDRs for open space, historic preservation, affordable housing, public facilities, recreation § County capital investment of $2 million for streetcar planning & $200 million for phased infrastructure & streetscape § 2040 growth projections: o 3, 900 MF units & 7, 300 new residents o 7, 000 new jobs & 2. 2 million SF new commercial uses

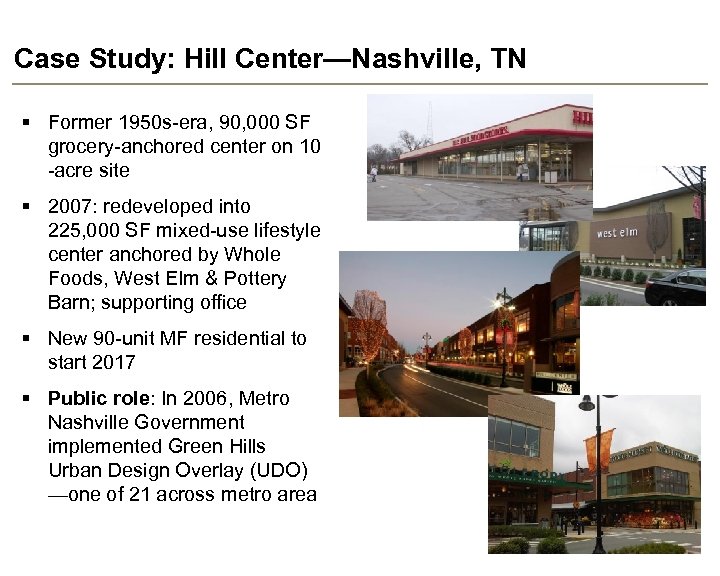

Case Study: Hill Center—Nashville, TN § Former 1950 s-era, 90, 000 SF grocery-anchored center on 10 -acre site § 2007: redeveloped into 225, 000 SF mixed-use lifestyle center anchored by Whole Foods, West Elm & Pottery Barn; supporting office § New 90 -unit MF residential to start 2017 § Public role: In 2006, Metro Nashville Government implemented Green Hills Urban Design Overlay (UDO) —one of 21 across metro area

Case Study: Hill Center—Nashville, TN § Former 1950 s-era, 90, 000 SF grocery-anchored center on 10 -acre site § 2007: redeveloped into 225, 000 SF mixed-use lifestyle center anchored by Whole Foods, West Elm & Pottery Barn; supporting office § New 90 -unit MF residential to start 2017 § Public role: In 2006, Metro Nashville Government implemented Green Hills Urban Design Overlay (UDO) —one of 21 across metro area

Case Study: Hill Center—Nashville, TN § UDOs provide development incentives for mixed-use projects with 3 or more qualified revenue uses that comply with “build to” provisions: o Floor area bonus for shared parking o Parking structure FAR exemption o Increased setback & building heights to accommodate outdoor dining o Increased FAR bonus for plazas & transportation o 10% reduction in parking if developer funds pedestrian, transit & bicycle facilities § 2017: developer partners with Hytch, LLC to offer ride-sharing options

Case Study: Hill Center—Nashville, TN § UDOs provide development incentives for mixed-use projects with 3 or more qualified revenue uses that comply with “build to” provisions: o Floor area bonus for shared parking o Parking structure FAR exemption o Increased setback & building heights to accommodate outdoor dining o Increased FAR bonus for plazas & transportation o 10% reduction in parking if developer funds pedestrian, transit & bicycle facilities § 2017: developer partners with Hytch, LLC to offer ride-sharing options

Key Findings: Corridor Revitalization § Requires comprehensive view of entire corridor in planning, regulatory & development policies to avoid piecemeal, inconsistent development § Successful revitalization strategies take decades even with consistent policies § ‘Prime the pump’ with public realm/infrastructure improvements § Value-enhancement created in projects with walkable environments § Measure market support/investment viability—is there demand for specific uses? § Challenges of suburban/transitioning locations—can parking ratios realistically be reduced given uncertainties of public transit service? § Suburban corridor revitalization is a relatively new national issue— there are no standards & few benchmarks § Developers want predictability—revitalization plans are critical, as is long-term, public-sector commitment to following plans

Key Findings: Corridor Revitalization § Requires comprehensive view of entire corridor in planning, regulatory & development policies to avoid piecemeal, inconsistent development § Successful revitalization strategies take decades even with consistent policies § ‘Prime the pump’ with public realm/infrastructure improvements § Value-enhancement created in projects with walkable environments § Measure market support/investment viability—is there demand for specific uses? § Challenges of suburban/transitioning locations—can parking ratios realistically be reduced given uncertainties of public transit service? § Suburban corridor revitalization is a relatively new national issue— there are no standards & few benchmarks § Developers want predictability—revitalization plans are critical, as is long-term, public-sector commitment to following plans

Thank You! WTL+a: Real Estate & Economic Advisors Washington, DC WThomas. Lavash@wtl-a. com

Thank You! WTL+a: Real Estate & Economic Advisors Washington, DC WThomas. Lavash@wtl-a. com