e5d9c3ebb8104c99044b98f108f57061.ppt

- Количество слайдов: 83

REVISED GUIDELINES AND DOCUMENTARY REQUIREMENTS, LAWS & RULES on GOVERNMENT EXPENDITURES COA Circular No. 2012 -001 Dated June 14, 2012

REVISED GUIDELINES AND DOCUMENTARY REQUIREMENTS, LAWS & RULES on GOVERNMENT EXPENDITURES COA Circular No. 2012 -001 Dated June 14, 2012

TOPICS • Fundamental Principles governing financial transactions • General Requirements for all Types of Disbursements • Specific Requirements for Each Type of Disbursements

TOPICS • Fundamental Principles governing financial transactions • General Requirements for all Types of Disbursements • Specific Requirements for Each Type of Disbursements

FUNDAMENTAL PRINCIPLES GOVERNING FINANCIAL TRANSACTIONS (Section 4, PD 1445/LGC 1991) 1. No money shall be paid out of any public treasury of depository except in pursuance of an appropriation law or other specific statutory authority (Section 305 a, LGC 1991); 2. Government funds or property shall be spent or used solely for public purpose (305 b); 3. Trust funds shall be available and may be spent only for the specific purpose for which the trust was created or the funds received (305 e);

FUNDAMENTAL PRINCIPLES GOVERNING FINANCIAL TRANSACTIONS (Section 4, PD 1445/LGC 1991) 1. No money shall be paid out of any public treasury of depository except in pursuance of an appropriation law or other specific statutory authority (Section 305 a, LGC 1991); 2. Government funds or property shall be spent or used solely for public purpose (305 b); 3. Trust funds shall be available and may be spent only for the specific purpose for which the trust was created or the funds received (305 e);

FUNDAMENTAL PRINCIPLES GOVERNING FINANCIAL TRANSACTIONS (Section 4, PD 1445/LGC 1991) 4. Fiscal responsibility shall be shared by all those exercising authority over the financial affairs, transactions, and operations of the LGUs (305 l); 5. Disbursements of disposition of government funds or property shall invariably bear the approval of the proper officials (Section 344);

FUNDAMENTAL PRINCIPLES GOVERNING FINANCIAL TRANSACTIONS (Section 4, PD 1445/LGC 1991) 4. Fiscal responsibility shall be shared by all those exercising authority over the financial affairs, transactions, and operations of the LGUs (305 l); 5. Disbursements of disposition of government funds or property shall invariably bear the approval of the proper officials (Section 344);

FUNDAMENTAL PRINCIPLES GOVERNING FINANCIAL TRANSACTIONS (Section 4, PD 1445/LGC 1991) 6. Claims against government funds shall be supported with complete documentation; 7. All laws and regulations applicable to financial transactions shall be faithfully adhere to; and 8. Generally accepted accounting principles and practices as well as of sound management and fiscal administration shall be observed.

FUNDAMENTAL PRINCIPLES GOVERNING FINANCIAL TRANSACTIONS (Section 4, PD 1445/LGC 1991) 6. Claims against government funds shall be supported with complete documentation; 7. All laws and regulations applicable to financial transactions shall be faithfully adhere to; and 8. Generally accepted accounting principles and practices as well as of sound management and fiscal administration shall be observed.

GENERAL REQUIREMENTS FOR ALL TYPES OF DISBURSEMENTS 1. Certificate of Availability of Funds (Sec. 86, PD 1445) a. Funds have been duly appropriated for the purpose; and b. The amount necessary to cover the proposed contract for the current FY is available for expenditure on account thereof, Sec. 474. b. 4, LGC- The Accountant shall. . . certify to the availability of budgetary allotment to which expenditures and obligations may be properly charged.

GENERAL REQUIREMENTS FOR ALL TYPES OF DISBURSEMENTS 1. Certificate of Availability of Funds (Sec. 86, PD 1445) a. Funds have been duly appropriated for the purpose; and b. The amount necessary to cover the proposed contract for the current FY is available for expenditure on account thereof, Sec. 474. b. 4, LGC- The Accountant shall. . . certify to the availability of budgetary allotment to which expenditures and obligations may be properly charged.

GENERAL REQUIREMENTS FOR ALL TYPES OF DISBURSEMENTS 2. Existence of lawful and sufficient allotment duly obligated as certified by authorized officials. COA Cir. No. 2006 -02, 01. 31. 06 (Based on Sec. 344, LGC) 1. Head of Budget Unit shall certify in the Ob. R the existence of available appropriation as provided under Section 344, LGC, and maintain the RAOs; 2. The Head of the Accounting Unit shall certify in the DV the obligation of allotment for the purposes (based on the certification of the BO as to availability of appropriations in the Ob. R; 3. The Treasurer shall certify the availability of funds in the DV as provided in the LGC.

GENERAL REQUIREMENTS FOR ALL TYPES OF DISBURSEMENTS 2. Existence of lawful and sufficient allotment duly obligated as certified by authorized officials. COA Cir. No. 2006 -02, 01. 31. 06 (Based on Sec. 344, LGC) 1. Head of Budget Unit shall certify in the Ob. R the existence of available appropriation as provided under Section 344, LGC, and maintain the RAOs; 2. The Head of the Accounting Unit shall certify in the DV the obligation of allotment for the purposes (based on the certification of the BO as to availability of appropriations in the Ob. R; 3. The Treasurer shall certify the availability of funds in the DV as provided in the LGC.

GENERAL REQUIREMENTS FOR ALL TYPES OF DISBURSEMENTS 3. Legality of transaction and conformity with laws, rules or regulations; 4. Approval of expenditure by Head of Office or his duly authorized representative; and 5. Sufficient and relevant documents to establish validity of the claim.

GENERAL REQUIREMENTS FOR ALL TYPES OF DISBURSEMENTS 3. Legality of transaction and conformity with laws, rules or regulations; 4. Approval of expenditure by Head of Office or his duly authorized representative; and 5. Sufficient and relevant documents to establish validity of the claim.

COMMON GOVERNMENT TRANSACTIONS 1. 2. 3. 4. Grant and Liquidation of Cash Advances Fund transfers to NGOs/POs Fund transfers to IA/Liquidation by SA Fund transfers from Trust Fund to the General Fund for Unspent Balance/ Excess

COMMON GOVERNMENT TRANSACTIONS 1. 2. 3. 4. Grant and Liquidation of Cash Advances Fund transfers to NGOs/POs Fund transfers to IA/Liquidation by SA Fund transfers from Trust Fund to the General Fund for Unspent Balance/ Excess

COMMON GOVERNMENT TRANSACTIONS 5. Payment of Salary 6. Allowances, Honoraria and Other Forms of Compensation 7. Other Expenditures 8. Extraordinary and Miscellaneous Expenses (Discretionary Expense) 9. Procurement

COMMON GOVERNMENT TRANSACTIONS 5. Payment of Salary 6. Allowances, Honoraria and Other Forms of Compensation 7. Other Expenditures 8. Extraordinary and Miscellaneous Expenses (Discretionary Expense) 9. Procurement

COMMON GOVERNMENT TRANSACTIONS 10. Cultural and Athletic Activities 11. Human Resource Development and Training Program 12. Financial Expenses 13. RROW/Real Property

COMMON GOVERNMENT TRANSACTIONS 10. Cultural and Athletic Activities 11. Human Resource Development and Training Program 12. Financial Expenses 13. RROW/Real Property

12

12

RULES AND REGULATIONS ON THE GRANT and LIQUIDATION OF CASH ADVANCES No cash advance shall be given unless for a legally authorized specific purpose; No additional cash advances shall be allowed to any official or employee unless the previous cash advance given to him, is first liquidated and accounted in the books;

RULES AND REGULATIONS ON THE GRANT and LIQUIDATION OF CASH ADVANCES No cash advance shall be given unless for a legally authorized specific purpose; No additional cash advances shall be allowed to any official or employee unless the previous cash advance given to him, is first liquidated and accounted in the books;

RULES AND REGULATIONS ON THE GRANT and LIQUIDATION OF CASH ADVANCES No cash advances shall be granted for payments on account of infrastructure projects or other undertaking on a project basis. A cash advance shall be reported as soon as the purpose for which is was given has been served;

RULES AND REGULATIONS ON THE GRANT and LIQUIDATION OF CASH ADVANCES No cash advances shall be granted for payments on account of infrastructure projects or other undertaking on a project basis. A cash advance shall be reported as soon as the purpose for which is was given has been served;

RULES AND REGULATIONS ON THE GRANT and LIQUIDATION OF CASH ADVANCES Only permanently appointed officials shall be designated as disbursing officers. Elected officials may be granted a cash advance only for their official traveling expenses; and Transfer of cash advances from one AO to another shall not be allowed.

RULES AND REGULATIONS ON THE GRANT and LIQUIDATION OF CASH ADVANCES Only permanently appointed officials shall be designated as disbursing officers. Elected officials may be granted a cash advance only for their official traveling expenses; and Transfer of cash advances from one AO to another shall not be allowed.

DOCUMENTARY REQUIREMENTS COMMON TO ALL CASH ADVANCES For initial cash advance – Authority of the AO issued by the LCE or his duly authorized representative indicating the maximum accountability and purpose of CA; Certification from the Accountant that previous CAs have been liquidated and accounted for in the books;

DOCUMENTARY REQUIREMENTS COMMON TO ALL CASH ADVANCES For initial cash advance – Authority of the AO issued by the LCE or his duly authorized representative indicating the maximum accountability and purpose of CA; Certification from the Accountant that previous CAs have been liquidated and accounted for in the books;

DOCUMENTARY REQUIREMENTS COMMON TO ALL CASH ADVANCES For new AO - Application for bond and/or Fidelity Bond for the cash accountability of P 5, 001 or more (as amended under COA Circular No. 2013 -001 dated January 10, 2013)

DOCUMENTARY REQUIREMENTS COMMON TO ALL CASH ADVANCES For new AO - Application for bond and/or Fidelity Bond for the cash accountability of P 5, 001 or more (as amended under COA Circular No. 2013 -001 dated January 10, 2013)

Documentary Requirements CASH ADVANCES for Traveling Allowances Local Travel (COA Cir. 96 -004) Office Order/Travel Order approved by LCE Duly approved Itinerary of Travel Certification from the Accountant that the previous cash advance has been liquidated and accounted for the in the books

Documentary Requirements CASH ADVANCES for Traveling Allowances Local Travel (COA Cir. 96 -004) Office Order/Travel Order approved by LCE Duly approved Itinerary of Travel Certification from the Accountant that the previous cash advance has been liquidated and accounted for the in the books

CASH ADVANCES FOR TRAVEL (new requirements) Foreign Travel OO/TO approved by the Sec. of the DILG regardless of the length of travel Duly approved Itinerary of Travel For plane fare, quotations of three travel agencies or its equivalent Flight itinerary issued by airline/ticketing office

CASH ADVANCES FOR TRAVEL (new requirements) Foreign Travel OO/TO approved by the Sec. of the DILG regardless of the length of travel Duly approved Itinerary of Travel For plane fare, quotations of three travel agencies or its equivalent Flight itinerary issued by airline/ticketing office

CASH ADVANCES FOR TRAVEL (new requirements) Foreign Travel Copy of UNDP rate for DSA for the country of destination Document to show the dollar to peso exchange rate at the date of grant of cash advance

CASH ADVANCES FOR TRAVEL (new requirements) Foreign Travel Copy of UNDP rate for DSA for the country of destination Document to show the dollar to peso exchange rate at the date of grant of cash advance

CASH ADVANCES for Travel (Documentary requirements) Foreign Travel – Seminars/Trainings Invitation issued by foreign country Acceptance of the nominees issued by the foreign countries Programme Agenda

CASH ADVANCES for Travel (Documentary requirements) Foreign Travel – Seminars/Trainings Invitation issued by foreign country Acceptance of the nominees issued by the foreign countries Programme Agenda

Fund Transfers to NGOs/POs (General Guidelines, COA Cir. 2007 -001) NGOs/POs not allowed to participate in the implementation of any program/project of government agencies until such time that earlier fund releases have been fully liquidated as certified by the HA and the COA Auditor.

Fund Transfers to NGOs/POs (General Guidelines, COA Cir. 2007 -001) NGOs/POs not allowed to participate in the implementation of any program/project of government agencies until such time that earlier fund releases have been fully liquidated as certified by the HA and the COA Auditor.

Fund Transfers to NGOs/POs (General Guidelines) No NGO/PO shall be a recipient of funds where any of the provisions of the COA Cir. No. 2007 -001 and the MOA entered into with the GO has not been complied with in any previous undertaking with funds allocated from the GO.

Fund Transfers to NGOs/POs (General Guidelines) No NGO/PO shall be a recipient of funds where any of the provisions of the COA Cir. No. 2007 -001 and the MOA entered into with the GO has not been complied with in any previous undertaking with funds allocated from the GO.

GPPB Resolution No. 12 -007 dated June 29, 2007 NGOs may be selected to implement government projects thru competitive public bidding or negotiated procurement. Release of funds shall follow the payment schedule prescribed by the MOA/Contract No funds may be released prior to signing the MOA/contract The selected NGO shall return unutilized amounts upon completion of the project.

GPPB Resolution No. 12 -007 dated June 29, 2007 NGOs may be selected to implement government projects thru competitive public bidding or negotiated procurement. Release of funds shall follow the payment schedule prescribed by the MOA/Contract No funds may be released prior to signing the MOA/contract The selected NGO shall return unutilized amounts upon completion of the project.

Documentary Requirements Release of Funds to NGOs/POs Approved Summary of Budgetary Requirements; List of priority projects to be implementation by the NGO/PO published in the newspaper, agency website, bulletin board and the like; Accreditation of the NGO/PO by the BAC;

Documentary Requirements Release of Funds to NGOs/POs Approved Summary of Budgetary Requirements; List of priority projects to be implementation by the NGO/PO published in the newspaper, agency website, bulletin board and the like; Accreditation of the NGO/PO by the BAC;

Documentary Requirements Release of Funds to NGOs/POs Results of evaluation of financial and technical capability of selected NGO/PO; Performance security for infra project; NGO/PO proposal/application for funding with required supporting documents;

Documentary Requirements Release of Funds to NGOs/POs Results of evaluation of financial and technical capability of selected NGO/PO; Performance security for infra project; NGO/PO proposal/application for funding with required supporting documents;

Documentary Requirements Release of Funds to NGOs/POs Documents showing that the NGO has equity equivalent to 20 percent of the total project cost, which shall be in the form of labor, land for the project site, facilities, equipment and the like to be used in the project; MOA; Certification from the Accountant that previous CA has been liquidated, liquidation documents are post-audited and properly taken up in the books;

Documentary Requirements Release of Funds to NGOs/POs Documents showing that the NGO has equity equivalent to 20 percent of the total project cost, which shall be in the form of labor, land for the project site, facilities, equipment and the like to be used in the project; MOA; Certification from the Accountant that previous CA has been liquidated, liquidation documents are post-audited and properly taken up in the books;

Documentary Requirements Release of Funds to NGOs/POs Other relevant requirements under GPPB Resolution No. 12 -007 dated June 29, 2007: 1. Legal basis or appropriation law/ordinance which earmarks a specific project to the NGOs/PO; 2. Statement that the project shall be limited to NGOs 3. Eligibility documents (legal, technical, financial)

Documentary Requirements Release of Funds to NGOs/POs Other relevant requirements under GPPB Resolution No. 12 -007 dated June 29, 2007: 1. Legal basis or appropriation law/ordinance which earmarks a specific project to the NGOs/PO; 2. Statement that the project shall be limited to NGOs 3. Eligibility documents (legal, technical, financial)

General Guidelines for the Implementation of Projects Using Funds Released to NGOs/POs No portion of the funds transferred to the NGO/PO shall be used for the following: (Section 6 of COA Cir. No. 2007 -001) o Money market placement, time deposit or other forms of investment; o Cash advance of any official of the NGO/PO unless related to the implementation of the project;

General Guidelines for the Implementation of Projects Using Funds Released to NGOs/POs No portion of the funds transferred to the NGO/PO shall be used for the following: (Section 6 of COA Cir. No. 2007 -001) o Money market placement, time deposit or other forms of investment; o Cash advance of any official of the NGO/PO unless related to the implementation of the project;

General Guidelines for the Implementation of Projects Using Funds Released to NGOs/POs No portion of the funds transferred to the NGO/PO shall be used for the following: o Payment of salaries, honoraria or any form of allowances of the personnel of the GO or the NGO/PO who are not connected with the project; o Purchase of supplies, materials and equipment and motor vehicles of the GO; and o Acquisition of assets of the NGO/PO unless necessary for the prosecution of the project and specifically stipulated in the MOA.

General Guidelines for the Implementation of Projects Using Funds Released to NGOs/POs No portion of the funds transferred to the NGO/PO shall be used for the following: o Payment of salaries, honoraria or any form of allowances of the personnel of the GO or the NGO/PO who are not connected with the project; o Purchase of supplies, materials and equipment and motor vehicles of the GO; and o Acquisition of assets of the NGO/PO unless necessary for the prosecution of the project and specifically stipulated in the MOA.

Documentary Requirements Liquidation of Funds Released to NGOs/POs Final Fund Utilization Report; Pictures of implemented projects; Inspection report and certificate of project completion issued by the GO authorized representative; List of beneficiaries with their signatures signifying acceptance/acknowledgment of projects/funds/goods/services received; Proof of verification by the GO official of the validity of the documents submitted by the NGO/PO;

Documentary Requirements Liquidation of Funds Released to NGOs/POs Final Fund Utilization Report; Pictures of implemented projects; Inspection report and certificate of project completion issued by the GO authorized representative; List of beneficiaries with their signatures signifying acceptance/acknowledgment of projects/funds/goods/services received; Proof of verification by the GO official of the validity of the documents submitted by the NGO/PO;

Documentary Requirements Liquidation of Funds Released to NGOs/POs OR issued by the GO acknowledging return by the NGO/PO of any unutilized/excess amounts, including interest, if any; List of equipment/vehicles procured by the NGO/PO out of the project funds; Warranty for procurement of equipment and projects; Liquidation Report; and In case of dissolution of the recipient NGO/PO, in addition to the OR for the return of unutilized amount, copy of vouchers paid by the NGO/PO.

Documentary Requirements Liquidation of Funds Released to NGOs/POs OR issued by the GO acknowledging return by the NGO/PO of any unutilized/excess amounts, including interest, if any; List of equipment/vehicles procured by the NGO/PO out of the project funds; Warranty for procurement of equipment and projects; Liquidation Report; and In case of dissolution of the recipient NGO/PO, in addition to the OR for the return of unutilized amount, copy of vouchers paid by the NGO/PO.

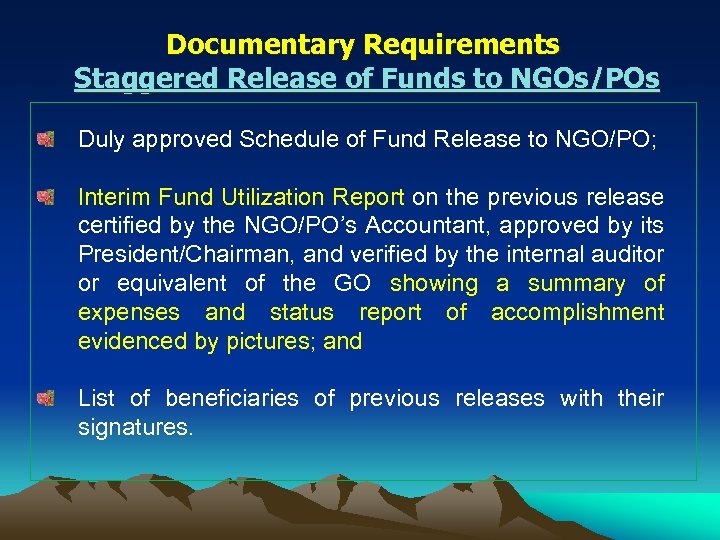

Documentary Requirements Staggered Release of Funds to NGOs/POs Duly approved Schedule of Fund Release to NGO/PO; Interim Fund Utilization Report on the previous release certified by the NGO/PO’s Accountant, approved by its President/Chairman, and verified by the internal auditor or equivalent of the GO showing a summary of expenses and status report of accomplishment evidenced by pictures; and List of beneficiaries of previous releases with their signatures.

Documentary Requirements Staggered Release of Funds to NGOs/POs Duly approved Schedule of Fund Release to NGO/PO; Interim Fund Utilization Report on the previous release certified by the NGO/PO’s Accountant, approved by its President/Chairman, and verified by the internal auditor or equivalent of the GO showing a summary of expenses and status report of accomplishment evidenced by pictures; and List of beneficiaries of previous releases with their signatures.

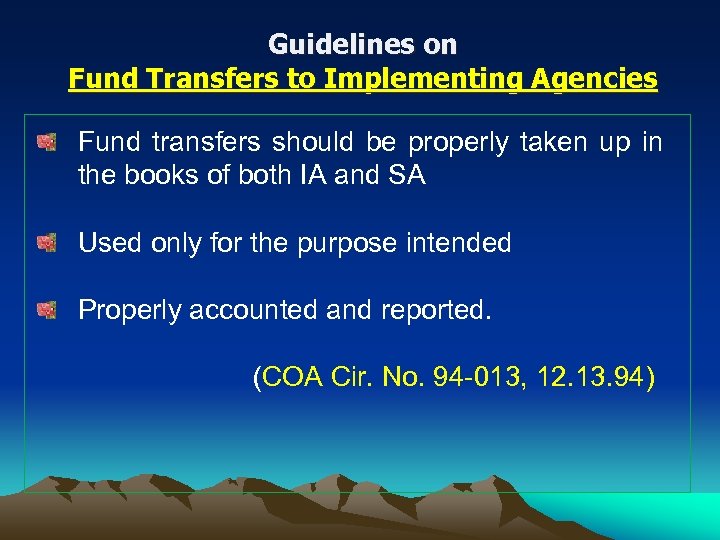

Guidelines on Fund Transfers to Implementing Agencies Fund transfers should be properly taken up in the books of both IA and SA Used only for the purpose intended Properly accounted and reported. (COA Cir. No. 94 -013, 12. 13. 94)

Guidelines on Fund Transfers to Implementing Agencies Fund transfers should be properly taken up in the books of both IA and SA Used only for the purpose intended Properly accounted and reported. (COA Cir. No. 94 -013, 12. 13. 94)

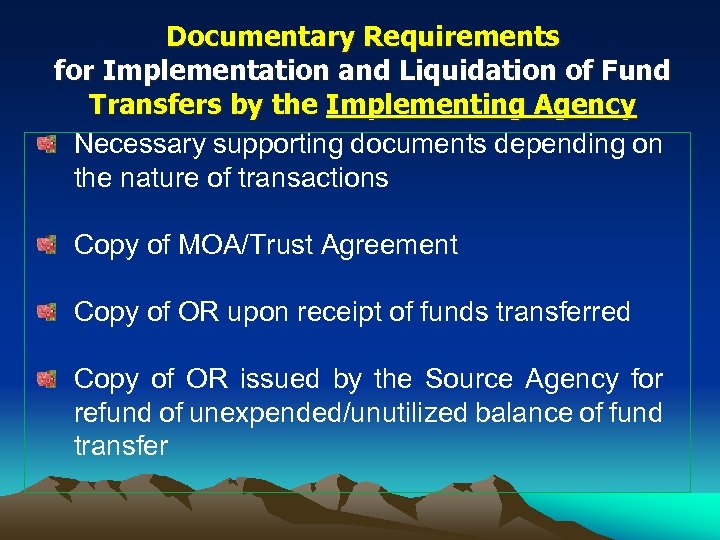

Documentary Requirements for Implementation and Liquidation of Fund Transfers by the Implementing Agency Necessary supporting documents depending on the nature of transactions Copy of MOA/Trust Agreement Copy of OR upon receipt of funds transferred Copy of OR issued by the Source Agency for refund of unexpended/unutilized balance of fund transfer

Documentary Requirements for Implementation and Liquidation of Fund Transfers by the Implementing Agency Necessary supporting documents depending on the nature of transactions Copy of MOA/Trust Agreement Copy of OR upon receipt of funds transferred Copy of OR issued by the Source Agency for refund of unexpended/unutilized balance of fund transfer

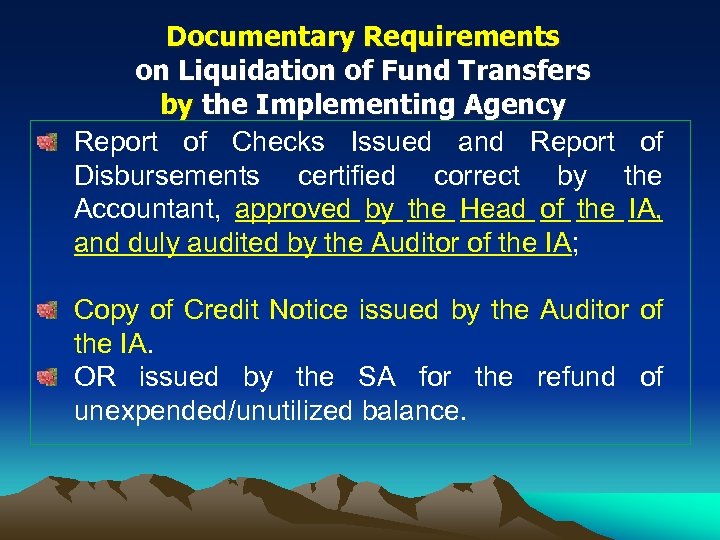

Documentary Requirements on Liquidation of Fund Transfers by the Implementing Agency Report of Checks Issued and Report of Disbursements certified correct by the Accountant, approved by the Head of the IA, and duly audited by the Auditor of the IA; Copy of Credit Notice issued by the Auditor of the IA. OR issued by the SA for the refund of unexpended/unutilized balance.

Documentary Requirements on Liquidation of Fund Transfers by the Implementing Agency Report of Checks Issued and Report of Disbursements certified correct by the Accountant, approved by the Head of the IA, and duly audited by the Auditor of the IA; Copy of Credit Notice issued by the Auditor of the IA. OR issued by the SA for the refund of unexpended/unutilized balance.

Rules/Regulations on Salaries LGC prohibits any local authority from giving salary rates higher than the maximum fixed for the position of any official or employees. The budget limitation for PS of 45% in case of 1 st to 3 rd class provinces, cities and municipalities, and 55% in case of 4 th class or lower, of the total income from regular sources realized in the next preceding fiscal year shall be strictly observed.

Rules/Regulations on Salaries LGC prohibits any local authority from giving salary rates higher than the maximum fixed for the position of any official or employees. The budget limitation for PS of 45% in case of 1 st to 3 rd class provinces, cities and municipalities, and 55% in case of 4 th class or lower, of the total income from regular sources realized in the next preceding fiscal year shall be strictly observed.

Rules and Regulations on Salaries No one shall be appointed in the career service of the local government if he is related within the 4 th civil degree of consanguinity or affinity to the recommending/appointing authority. An ordinance may increase the compensation of elective local officials but the increase shall take effect only after the term of office of those who approved it. (Sec. 81, LGC)

Rules and Regulations on Salaries No one shall be appointed in the career service of the local government if he is related within the 4 th civil degree of consanguinity or affinity to the recommending/appointing authority. An ordinance may increase the compensation of elective local officials but the increase shall take effect only after the term of office of those who approved it. (Sec. 81, LGC)

(New Documentary Requirements) Salaries of Casual/Contractual Personnel Certification by the LCE that the employment/hiring is still within the 45% PS limitation under Section 325(a) of RA 7160 For 1 st claim – certification by the LCE/Personnel Officer that the activities/services cannot be provided by regular or permanent personnel of the agency.

(New Documentary Requirements) Salaries of Casual/Contractual Personnel Certification by the LCE that the employment/hiring is still within the 45% PS limitation under Section 325(a) of RA 7160 For 1 st claim – certification by the LCE/Personnel Officer that the activities/services cannot be provided by regular or permanent personnel of the agency.

Salary Differentials due to Promotion/Step Increment (New Documentary Requirement) Certification by the LCE that the promotion/step increment (payment) still within the 45% PS limitation under Section 325(a) of RA 7160

Salary Differentials due to Promotion/Step Increment (New Documentary Requirement) Certification by the LCE that the promotion/step increment (payment) still within the 45% PS limitation under Section 325(a) of RA 7160

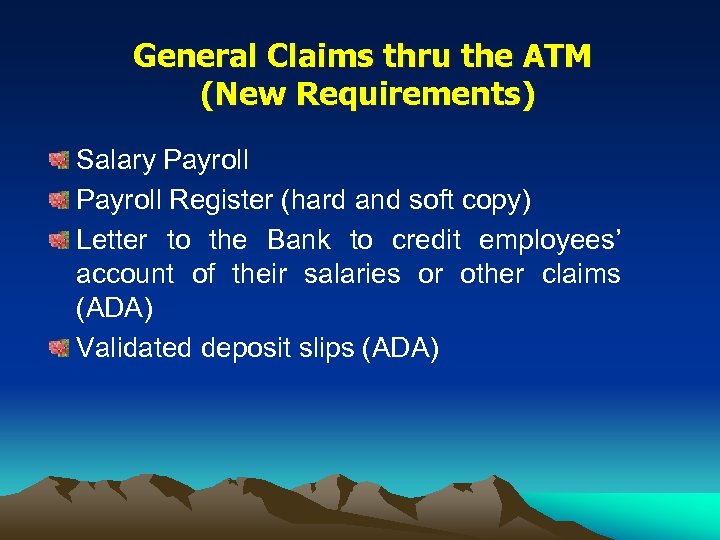

General Claims thru the ATM (New Requirements) Salary Payroll Register (hard and soft copy) Letter to the Bank to credit employees’ account of their salaries or other claims (ADA) Validated deposit slips (ADA)

General Claims thru the ATM (New Requirements) Salary Payroll Register (hard and soft copy) Letter to the Bank to credit employees’ account of their salaries or other claims (ADA) Validated deposit slips (ADA)

ALLOWANCES, HONORARIA, AND OTHER FORMS OF COMPENSATION General Guidelines: (COA Cir. 2013 -001, 01. 30. 13) ü No official/employee of the government shall be paid any personnel benefits charged against public funds unless authorized by law. ü Grant of personnel benefits authorized by law but not supported by a specific appropriations shall be deemed unauthorized.

ALLOWANCES, HONORARIA, AND OTHER FORMS OF COMPENSATION General Guidelines: (COA Cir. 2013 -001, 01. 30. 13) ü No official/employee of the government shall be paid any personnel benefits charged against public funds unless authorized by law. ü Grant of personnel benefits authorized by law but not supported by a specific appropriations shall be deemed unauthorized.

ALLOWANCES, HONORARIA, AND OTHER FORMS OF COMPENSATION PERA RATA Clothing/Uniform Allowance Productivity Incentive Bonus/Allowance Honoraria Overtime Pay Mid year and Year-End Bonus and Cash Gift Retirement Benefits Terminal Leave Benefits Loyalty Cash Award Collective Negotiation Agreement Incentives

ALLOWANCES, HONORARIA, AND OTHER FORMS OF COMPENSATION PERA RATA Clothing/Uniform Allowance Productivity Incentive Bonus/Allowance Honoraria Overtime Pay Mid year and Year-End Bonus and Cash Gift Retirement Benefits Terminal Leave Benefits Loyalty Cash Award Collective Negotiation Agreement Incentives

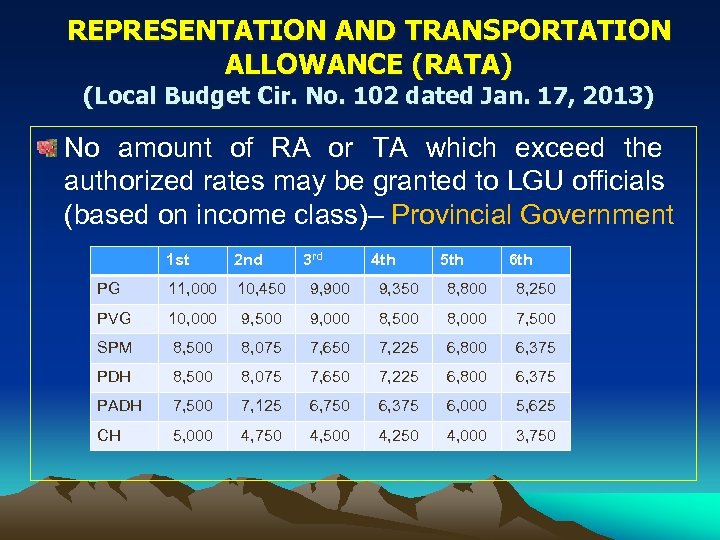

REPRESENTATION AND TRANSPORTATION ALLOWANCE (RATA) (Local Budget Cir. No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials (based on income class)– Provincial Government 1 st 2 nd 3 rd 4 th 5 th 6 th PG 11, 000 10, 450 9, 900 9, 350 8, 800 8, 250 PVG 10, 000 9, 500 9, 000 8, 500 8, 000 7, 500 SPM 8, 500 8, 075 7, 650 7, 225 6, 800 6, 375 PDH 8, 500 8, 075 7, 650 7, 225 6, 800 6, 375 PADH 7, 500 7, 125 6, 750 6, 375 6, 000 5, 625 CH 5, 000 4, 750 4, 500 4, 250 4, 000 3, 750

REPRESENTATION AND TRANSPORTATION ALLOWANCE (RATA) (Local Budget Cir. No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials (based on income class)– Provincial Government 1 st 2 nd 3 rd 4 th 5 th 6 th PG 11, 000 10, 450 9, 900 9, 350 8, 800 8, 250 PVG 10, 000 9, 500 9, 000 8, 500 8, 000 7, 500 SPM 8, 500 8, 075 7, 650 7, 225 6, 800 6, 375 PDH 8, 500 8, 075 7, 650 7, 225 6, 800 6, 375 PADH 7, 500 7, 125 6, 750 6, 375 6, 000 5, 625 CH 5, 000 4, 750 4, 500 4, 250 4, 000 3, 750

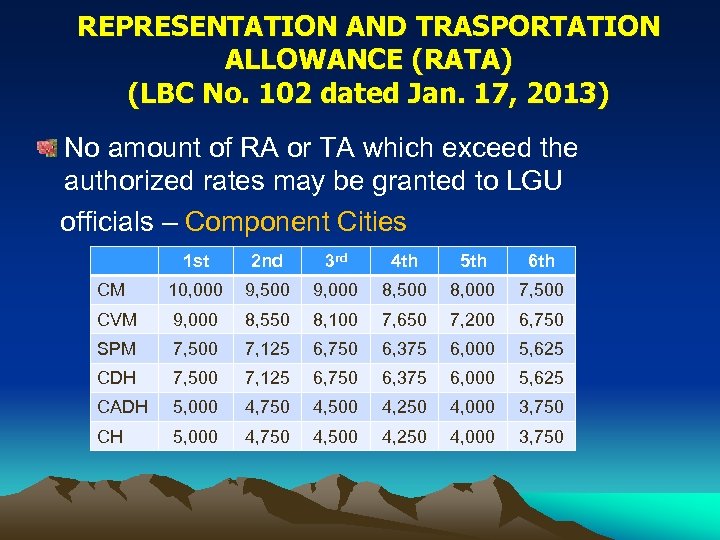

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Component Cities 1 st 2 nd 3 rd 4 th 5 th 6 th CM 10, 000 9, 500 9, 000 8, 500 8, 000 7, 500 CVM 9, 000 8, 550 8, 100 7, 650 7, 200 6, 750 SPM 7, 500 7, 125 6, 750 6, 375 6, 000 5, 625 CDH 7, 500 7, 125 6, 750 6, 375 6, 000 5, 625 CADH 5, 000 4, 750 4, 500 4, 250 4, 000 3, 750 CH 5, 000 4, 750 4, 500 4, 250 4, 000 3, 750

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Component Cities 1 st 2 nd 3 rd 4 th 5 th 6 th CM 10, 000 9, 500 9, 000 8, 500 8, 000 7, 500 CVM 9, 000 8, 550 8, 100 7, 650 7, 200 6, 750 SPM 7, 500 7, 125 6, 750 6, 375 6, 000 5, 625 CDH 7, 500 7, 125 6, 750 6, 375 6, 000 5, 625 CADH 5, 000 4, 750 4, 500 4, 250 4, 000 3, 750 CH 5, 000 4, 750 4, 500 4, 250 4, 000 3, 750

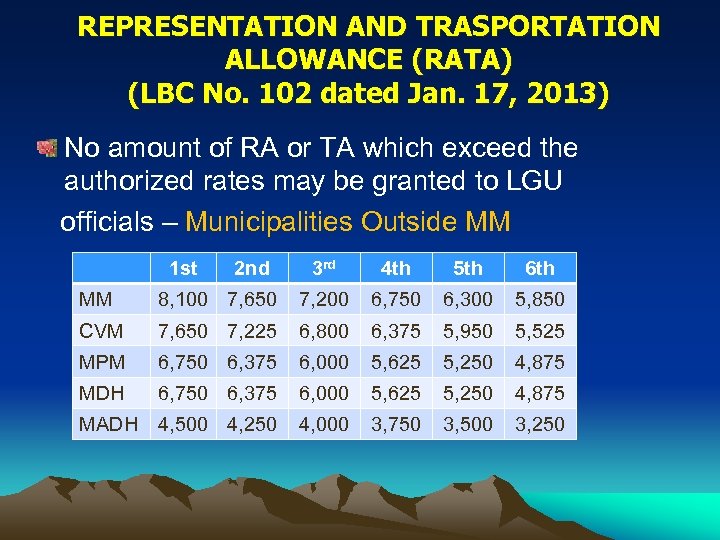

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Municipalities Outside MM 1 st 2 nd 3 rd 4 th 5 th 6 th MM 8, 100 7, 650 7, 200 6, 750 6, 300 5, 850 CVM 7, 650 7, 225 6, 800 6, 375 5, 950 5, 525 MPM 6, 750 6, 375 6, 000 5, 625 5, 250 4, 875 MDH 6, 750 6, 375 6, 000 5, 625 5, 250 4, 875 MADH 4, 500 4, 250 4, 000 3, 750 3, 500 3, 250

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Municipalities Outside MM 1 st 2 nd 3 rd 4 th 5 th 6 th MM 8, 100 7, 650 7, 200 6, 750 6, 300 5, 850 CVM 7, 650 7, 225 6, 800 6, 375 5, 950 5, 525 MPM 6, 750 6, 375 6, 000 5, 625 5, 250 4, 875 MDH 6, 750 6, 375 6, 000 5, 625 5, 250 4, 875 MADH 4, 500 4, 250 4, 000 3, 750 3, 500 3, 250

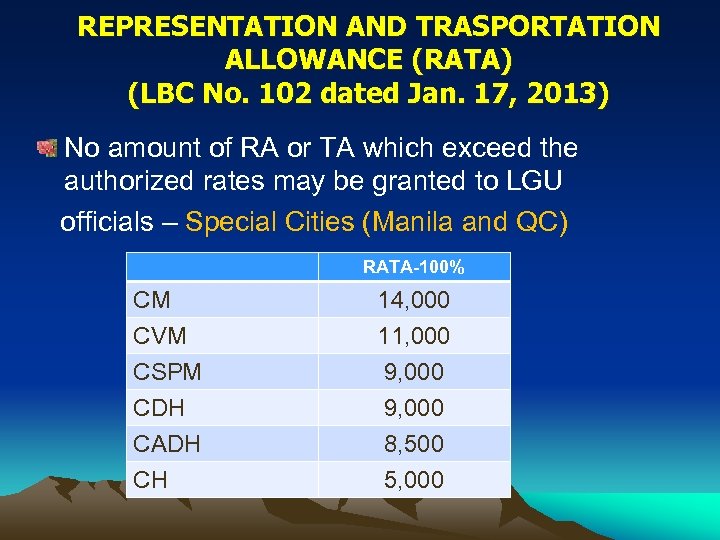

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Special Cities (Manila and QC) RATA-100% CM 14, 000 CVM 11, 000 CSPM 9, 000 CDH 9, 000 CADH 8, 500 CH 5, 000

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Special Cities (Manila and QC) RATA-100% CM 14, 000 CVM 11, 000 CSPM 9, 000 CDH 9, 000 CADH 8, 500 CH 5, 000

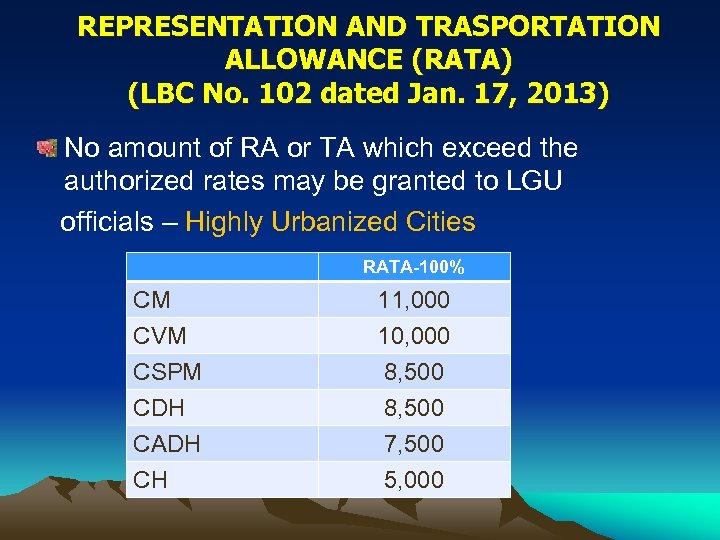

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Highly Urbanized Cities RATA-100% CM 11, 000 CVM 10, 000 CSPM 8, 500 CDH 8, 500 CADH 7, 500 CH 5, 000

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Highly Urbanized Cities RATA-100% CM 11, 000 CVM 10, 000 CSPM 8, 500 CDH 8, 500 CADH 7, 500 CH 5, 000

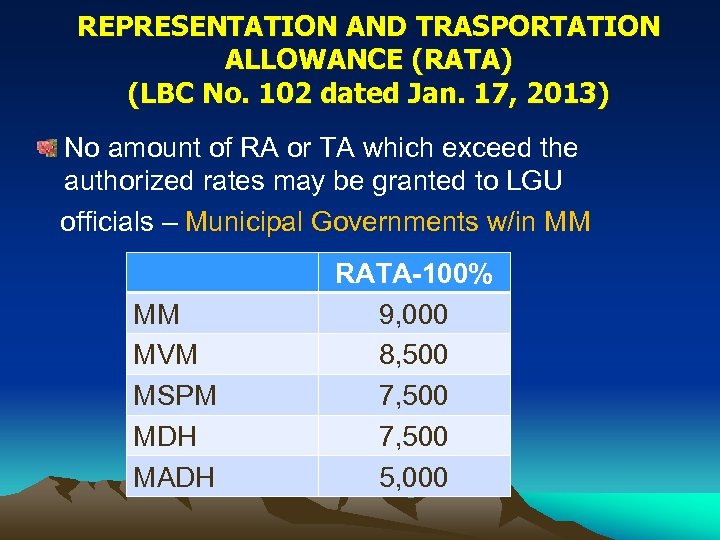

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Municipal Governments w/in MM MM MVM MSPM MDH MADH RATA-100% 9, 000 8, 500 7, 500 5, 000

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) No amount of RA or TA which exceed the authorized rates may be granted to LGU officials – Municipal Governments w/in MM MM MVM MSPM MDH MADH RATA-100% 9, 000 8, 500 7, 500 5, 000

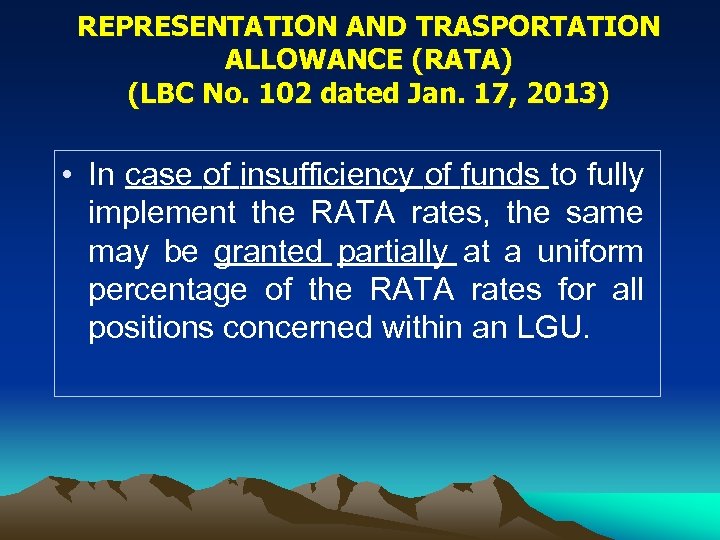

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) • In case of insufficiency of funds to fully implement the RATA rates, the same may be granted partially at a uniform percentage of the RATA rates for all positions concerned within an LGU.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) • In case of insufficiency of funds to fully implement the RATA rates, the same may be granted partially at a uniform percentage of the RATA rates for all positions concerned within an LGU.

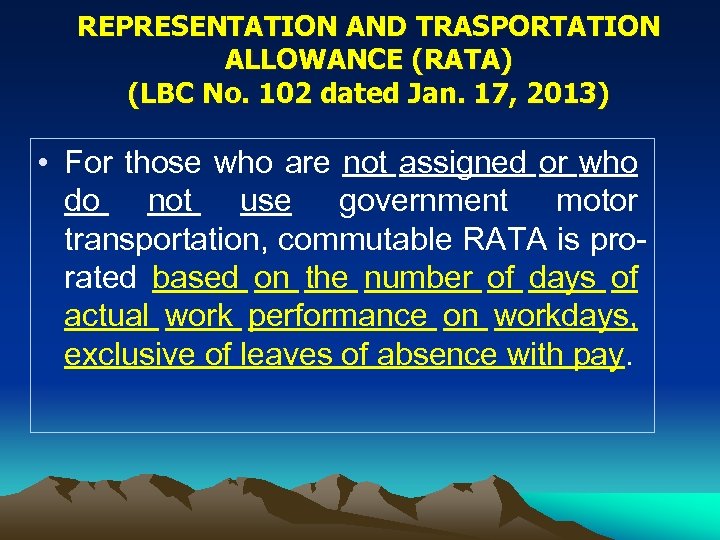

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) • For those who are not assigned or who do not use government motor transportation, commutable RATA is prorated based on the number of days of actual work performance on workdays, exclusive of leaves of absence with pay.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) • For those who are not assigned or who do not use government motor transportation, commutable RATA is prorated based on the number of days of actual work performance on workdays, exclusive of leaves of absence with pay.

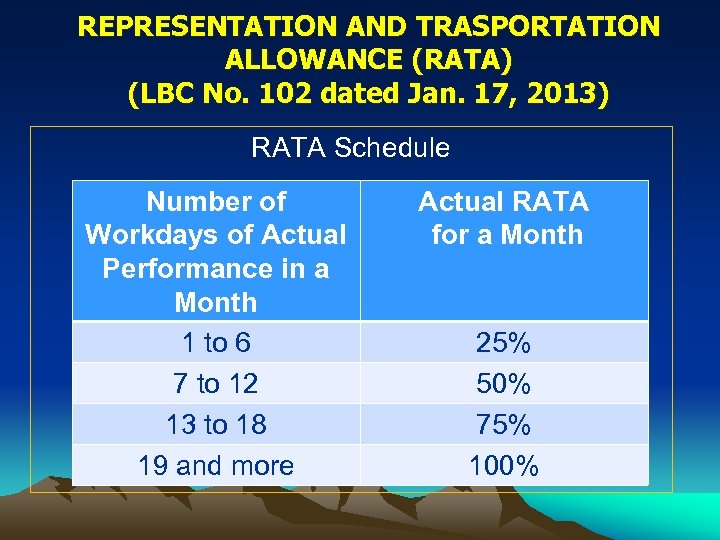

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) RATA Schedule Number of Workdays of Actual Performance in a Month 1 to 6 7 to 12 13 to 18 19 and more Actual RATA for a Month 25% 50% 75% 100%

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) RATA Schedule Number of Workdays of Actual Performance in a Month 1 to 6 7 to 12 13 to 18 19 and more Actual RATA for a Month 25% 50% 75% 100%

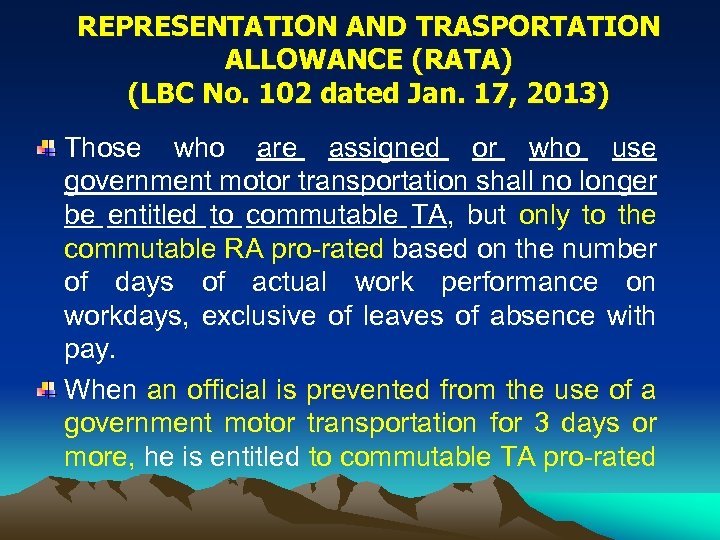

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) Those who are assigned or who use government motor transportation shall no longer be entitled to commutable TA, but only to the commutable RA pro-rated based on the number of days of actual work performance on workdays, exclusive of leaves of absence with pay. When an official is prevented from the use of a government motor transportation for 3 days or more, he is entitled to commutable TA pro-rated

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) Those who are assigned or who use government motor transportation shall no longer be entitled to commutable TA, but only to the commutable RA pro-rated based on the number of days of actual work performance on workdays, exclusive of leaves of absence with pay. When an official is prevented from the use of a government motor transportation for 3 days or more, he is entitled to commutable TA pro-rated

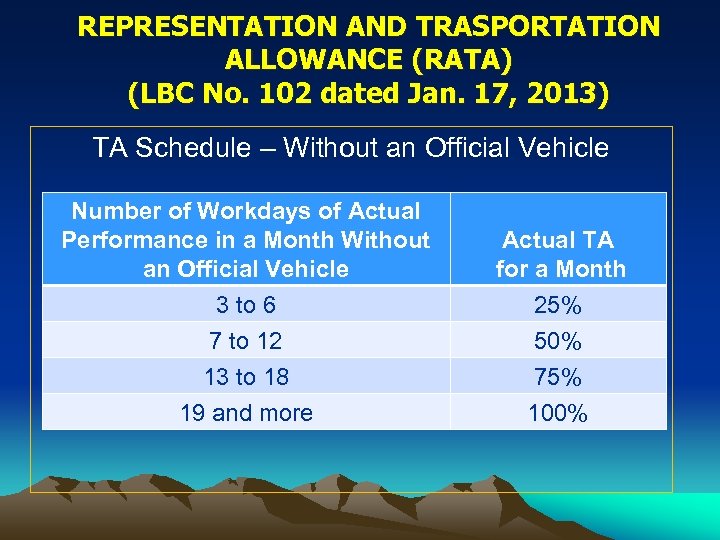

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) TA Schedule – Without an Official Vehicle Number of Workdays of Actual Performance in a Month Without an Official Vehicle Actual TA for a Month 3 to 6 7 to 12 13 to 18 19 and more 25% 50% 75% 100%

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) TA Schedule – Without an Official Vehicle Number of Workdays of Actual Performance in a Month Without an Official Vehicle Actual TA for a Month 3 to 6 7 to 12 13 to 18 19 and more 25% 50% 75% 100%

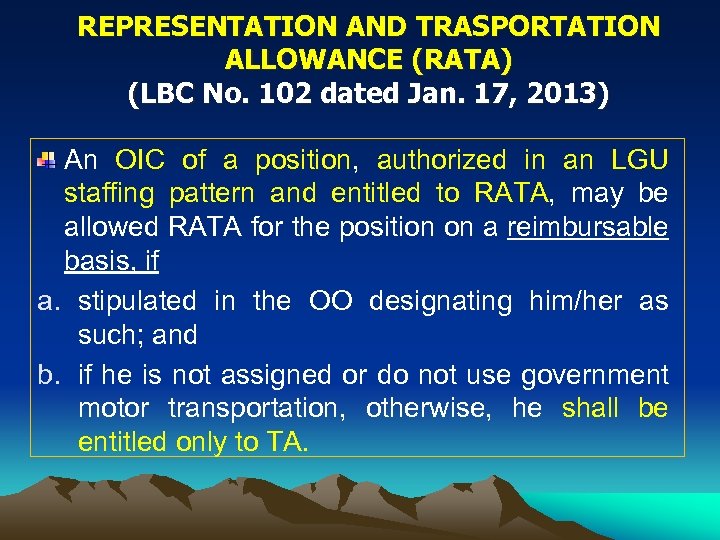

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) An OIC of a position, authorized in an LGU staffing pattern and entitled to RATA, may be allowed RATA for the position on a reimbursable basis, if a. stipulated in the OO designating him/her as such; and b. if he is not assigned or do not use government motor transportation, otherwise, he shall be entitled only to TA.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) An OIC of a position, authorized in an LGU staffing pattern and entitled to RATA, may be allowed RATA for the position on a reimbursable basis, if a. stipulated in the OO designating him/her as such; and b. if he is not assigned or do not use government motor transportation, otherwise, he shall be entitled only to TA.

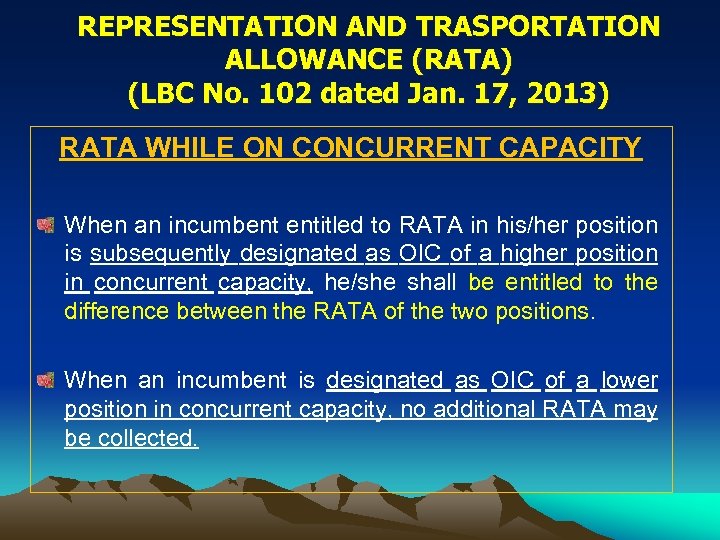

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) RATA WHILE ON CONCURRENT CAPACITY When an incumbent entitled to RATA in his/her position is subsequently designated as OIC of a higher position in concurrent capacity, he/she shall be entitled to the difference between the RATA of the two positions. When an incumbent is designated as OIC of a lower position in concurrent capacity, no additional RATA may be collected.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) RATA WHILE ON CONCURRENT CAPACITY When an incumbent entitled to RATA in his/her position is subsequently designated as OIC of a higher position in concurrent capacity, he/she shall be entitled to the difference between the RATA of the two positions. When an incumbent is designated as OIC of a lower position in concurrent capacity, no additional RATA may be collected.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) WHILE ON FULL-TIME DETAIL OR RE-ASSIGNMENT An official shall not be entitled to RATA while on full-time detail to another government agency or on re-assignment within the same agency or to a special project, as mandated or as a direct consequence of law or office order, or personnel action based on his/her voluntary action and consent. However, when his duties and responsibilities are comparable with those of his/her regular position, as certified by the LCE, he may continue to collect RATA, subject to availability of funds.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) WHILE ON FULL-TIME DETAIL OR RE-ASSIGNMENT An official shall not be entitled to RATA while on full-time detail to another government agency or on re-assignment within the same agency or to a special project, as mandated or as a direct consequence of law or office order, or personnel action based on his/her voluntary action and consent. However, when his duties and responsibilities are comparable with those of his/her regular position, as certified by the LCE, he may continue to collect RATA, subject to availability of funds.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) WHILE ON SCHOLARSHIP/STUDY/TRAINING GRANT An official shall not be entitled to RATA since he/she is unable to perform the duties and responsibilities of his/per position. However, he may be authorized to continue to collect RATA on a reimbursable basis, subject to availability of funds and to the certain conditions.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) WHILE ON SCHOLARSHIP/STUDY/TRAINING GRANT An official shall not be entitled to RATA since he/she is unable to perform the duties and responsibilities of his/per position. However, he may be authorized to continue to collect RATA on a reimbursable basis, subject to availability of funds and to the certain conditions.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) Conditions to be entitled to RATA on a reimbursable basis - WHILE ON SCHOLARSHIP/STUDY/TRAINING GRANT 1. Attendance in the study/training/similar activity is short term; 2. The study/training is aimed to directly enhance the performance of the duties and responsibilities of the position; and

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) Conditions to be entitled to RATA on a reimbursable basis - WHILE ON SCHOLARSHIP/STUDY/TRAINING GRANT 1. Attendance in the study/training/similar activity is short term; 2. The study/training is aimed to directly enhance the performance of the duties and responsibilities of the position; and

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) Conditions to be entitled to RATA on a reimbursable basis-WHILE ON SCHOLARSHIP/STUDY/TRAINING GRANT 3. The study/training requires frequent interaction, coordination and mobility in order to fulfill the requirements of the course, for which expenses are not covered by the study/training grant as certified by the LCE.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) Conditions to be entitled to RATA on a reimbursable basis-WHILE ON SCHOLARSHIP/STUDY/TRAINING GRANT 3. The study/training requires frequent interaction, coordination and mobility in order to fulfill the requirements of the course, for which expenses are not covered by the study/training grant as certified by the LCE.

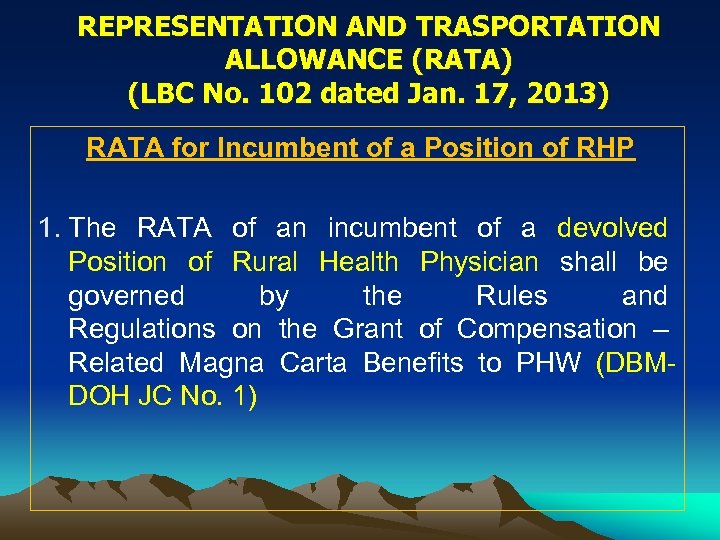

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) RATA for Incumbent of a Position of RHP 1. The RATA of an incumbent of a devolved Position of Rural Health Physician shall be governed by the Rules and Regulations on the Grant of Compensation – Related Magna Carta Benefits to PHW (DBMDOH JC No. 1)

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) RATA for Incumbent of a Position of RHP 1. The RATA of an incumbent of a devolved Position of Rural Health Physician shall be governed by the Rules and Regulations on the Grant of Compensation – Related Magna Carta Benefits to PHW (DBMDOH JC No. 1)

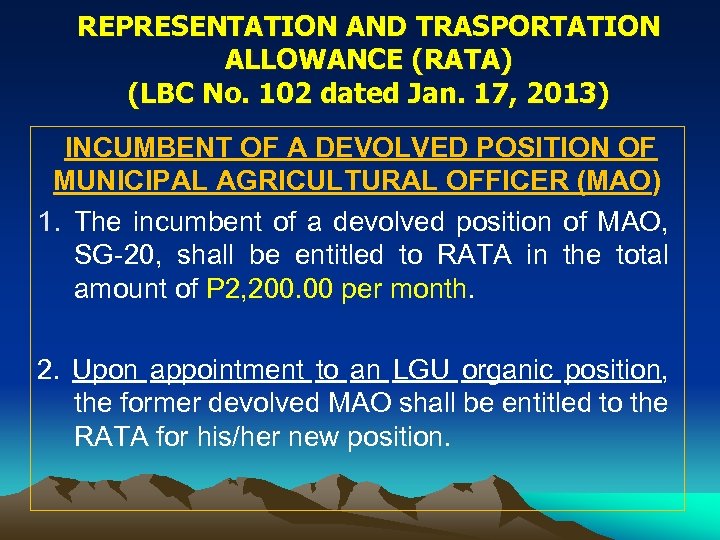

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) INCUMBENT OF A DEVOLVED POSITION OF MUNICIPAL AGRICULTURAL OFFICER (MAO) 1. The incumbent of a devolved position of MAO, SG-20, shall be entitled to RATA in the total amount of P 2, 200. 00 per month. 2. Upon appointment to an LGU organic position, the former devolved MAO shall be entitled to the RATA for his/her new position.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) INCUMBENT OF A DEVOLVED POSITION OF MUNICIPAL AGRICULTURAL OFFICER (MAO) 1. The incumbent of a devolved position of MAO, SG-20, shall be entitled to RATA in the total amount of P 2, 200. 00 per month. 2. Upon appointment to an LGU organic position, the former devolved MAO shall be entitled to the RATA for his/her new position.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) INCUMBENT OF A DEVOLVED POSITION OF MUNICIPAL AGRICULTURAL OFFICER (MAO) 3. A new appointee to the position of MAO shall no longer be entitled to RATA.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) INCUMBENT OF A DEVOLVED POSITION OF MUNICIPAL AGRICULTURAL OFFICER (MAO) 3. A new appointee to the position of MAO shall no longer be entitled to RATA.

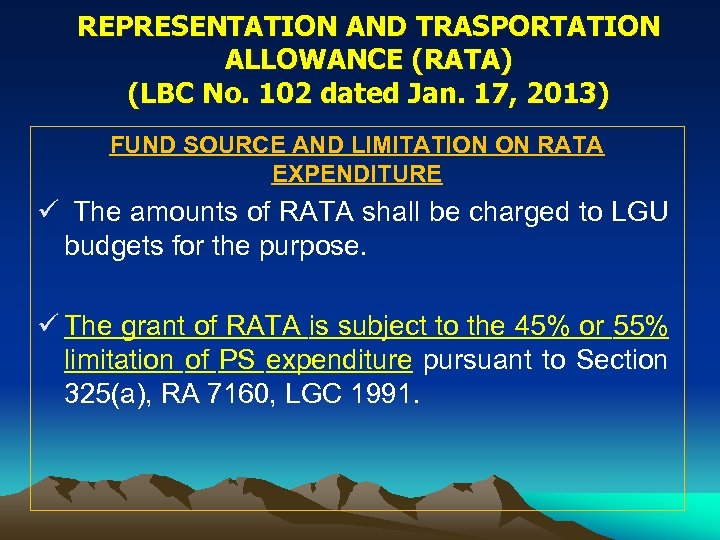

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) FUND SOURCE AND LIMITATION ON RATA EXPENDITURE ü The amounts of RATA shall be charged to LGU budgets for the purpose. ü The grant of RATA is subject to the 45% or 55% limitation of PS expenditure pursuant to Section 325(a), RA 7160, LGC 1991.

REPRESENTATION AND TRASPORTATION ALLOWANCE (RATA) (LBC No. 102 dated Jan. 17, 2013) FUND SOURCE AND LIMITATION ON RATA EXPENDITURE ü The amounts of RATA shall be charged to LGU budgets for the purpose. ü The grant of RATA is subject to the 45% or 55% limitation of PS expenditure pursuant to Section 325(a), RA 7160, LGC 1991.

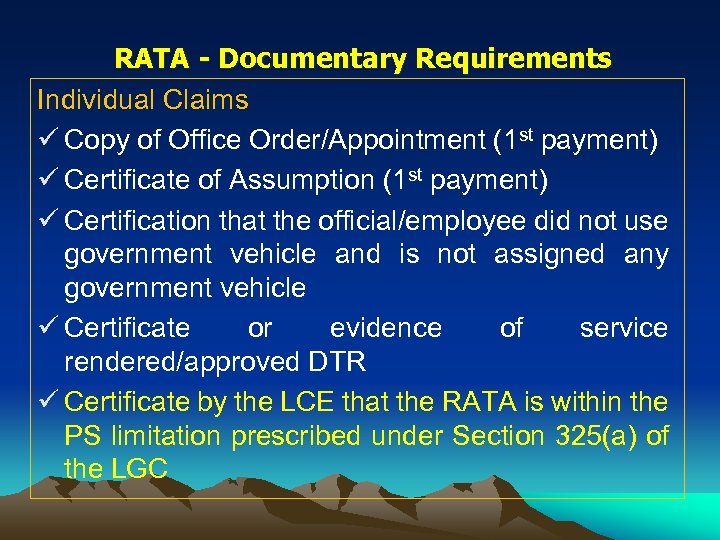

RATA - Documentary Requirements Individual Claims ü Copy of Office Order/Appointment (1 st payment) ü Certificate of Assumption (1 st payment) ü Certification that the official/employee did not use government vehicle and is not assigned any government vehicle ü Certificate or evidence of service rendered/approved DTR ü Certificate by the LCE that the RATA is within the PS limitation prescribed under Section 325(a) of the LGC

RATA - Documentary Requirements Individual Claims ü Copy of Office Order/Appointment (1 st payment) ü Certificate of Assumption (1 st payment) ü Certification that the official/employee did not use government vehicle and is not assigned any government vehicle ü Certificate or evidence of service rendered/approved DTR ü Certificate by the LCE that the RATA is within the PS limitation prescribed under Section 325(a) of the LGC

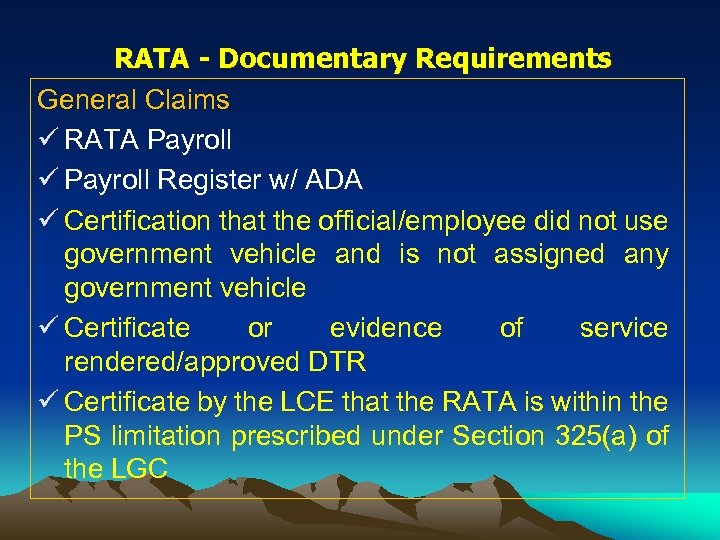

RATA - Documentary Requirements General Claims ü RATA Payroll ü Payroll Register w/ ADA ü Certification that the official/employee did not use government vehicle and is not assigned any government vehicle ü Certificate or evidence of service rendered/approved DTR ü Certificate by the LCE that the RATA is within the PS limitation prescribed under Section 325(a) of the LGC

RATA - Documentary Requirements General Claims ü RATA Payroll ü Payroll Register w/ ADA ü Certification that the official/employee did not use government vehicle and is not assigned any government vehicle ü Certificate or evidence of service rendered/approved DTR ü Certificate by the LCE that the RATA is within the PS limitation prescribed under Section 325(a) of the LGC

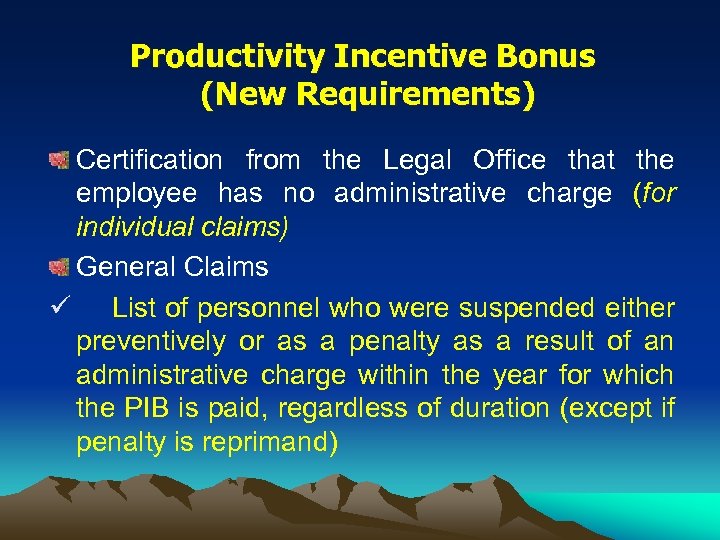

Productivity Incentive Bonus (New Requirements) Certification from the Legal Office that the employee has no administrative charge (for individual claims) General Claims ü List of personnel who were suspended either preventively or as a penalty as a result of an administrative charge within the year for which the PIB is paid, regardless of duration (except if penalty is reprimand)

Productivity Incentive Bonus (New Requirements) Certification from the Legal Office that the employee has no administrative charge (for individual claims) General Claims ü List of personnel who were suspended either preventively or as a penalty as a result of an administrative charge within the year for which the PIB is paid, regardless of duration (except if penalty is reprimand)

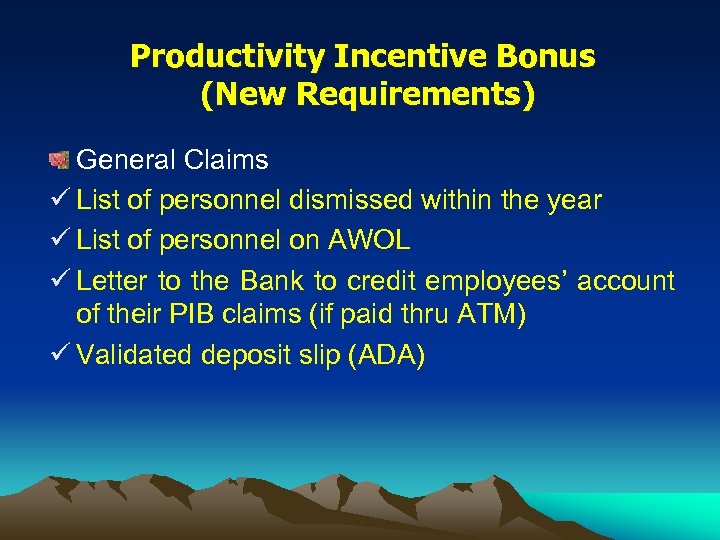

Productivity Incentive Bonus (New Requirements) General Claims ü List of personnel dismissed within the year ü List of personnel on AWOL ü Letter to the Bank to credit employees’ account of their PIB claims (if paid thru ATM) ü Validated deposit slip (ADA)

Productivity Incentive Bonus (New Requirements) General Claims ü List of personnel dismissed within the year ü List of personnel on AWOL ü Letter to the Bank to credit employees’ account of their PIB claims (if paid thru ATM) ü Validated deposit slip (ADA)

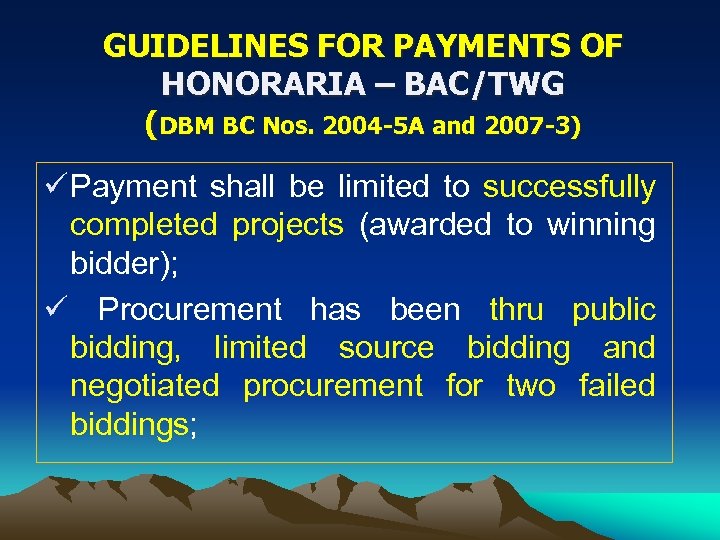

GUIDELINES FOR PAYMENTS OF HONORARIA – BAC/TWG (DBM BC Nos. 2004 -5 A and 2007 -3) ü Payment shall be limited to successfully completed projects (awarded to winning bidder); ü Procurement has been thru public bidding, limited source bidding and negotiated procurement for two failed biddings;

GUIDELINES FOR PAYMENTS OF HONORARIA – BAC/TWG (DBM BC Nos. 2004 -5 A and 2007 -3) ü Payment shall be limited to successfully completed projects (awarded to winning bidder); ü Procurement has been thru public bidding, limited source bidding and negotiated procurement for two failed biddings;

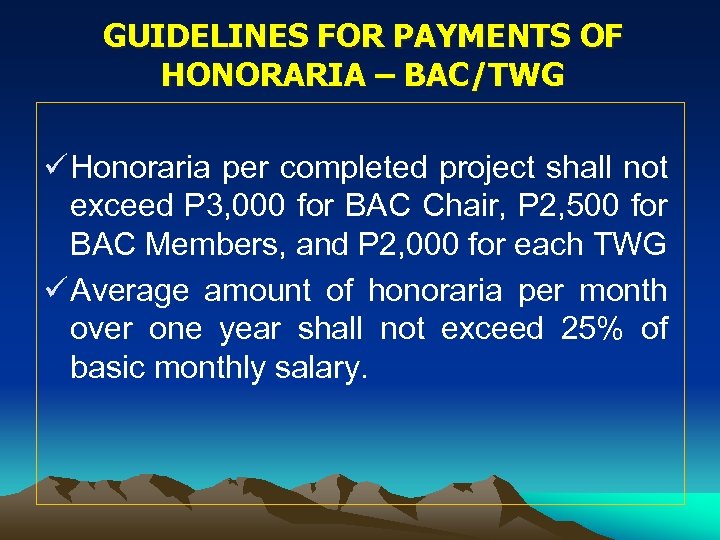

GUIDELINES FOR PAYMENTS OF HONORARIA – BAC/TWG ü Honoraria per completed project shall not exceed P 3, 000 for BAC Chair, P 2, 500 for BAC Members, and P 2, 000 for each TWG ü Average amount of honoraria per month over one year shall not exceed 25% of basic monthly salary.

GUIDELINES FOR PAYMENTS OF HONORARIA – BAC/TWG ü Honoraria per completed project shall not exceed P 3, 000 for BAC Chair, P 2, 500 for BAC Members, and P 2, 000 for each TWG ü Average amount of honoraria per month over one year shall not exceed 25% of basic monthly salary.

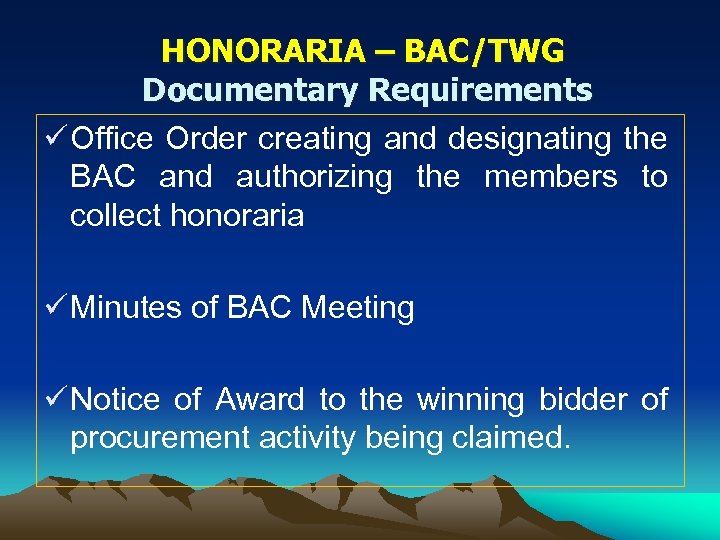

HONORARIA – BAC/TWG Documentary Requirements ü Office Order creating and designating the BAC and authorizing the members to collect honoraria ü Minutes of BAC Meeting ü Notice of Award to the winning bidder of procurement activity being claimed.

HONORARIA – BAC/TWG Documentary Requirements ü Office Order creating and designating the BAC and authorizing the members to collect honoraria ü Minutes of BAC Meeting ü Notice of Award to the winning bidder of procurement activity being claimed.

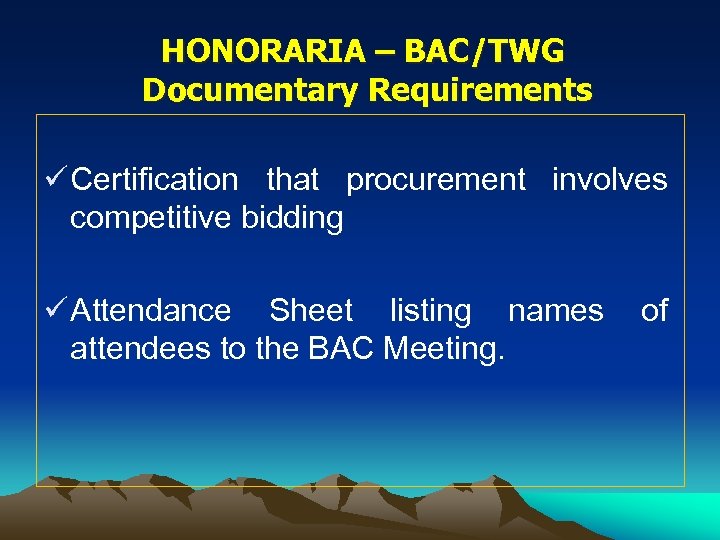

HONORARIA – BAC/TWG Documentary Requirements ü Certification that procurement involves competitive bidding ü Attendance Sheet listing names attendees to the BAC Meeting. of

HONORARIA – BAC/TWG Documentary Requirements ü Certification that procurement involves competitive bidding ü Attendance Sheet listing names attendees to the BAC Meeting. of

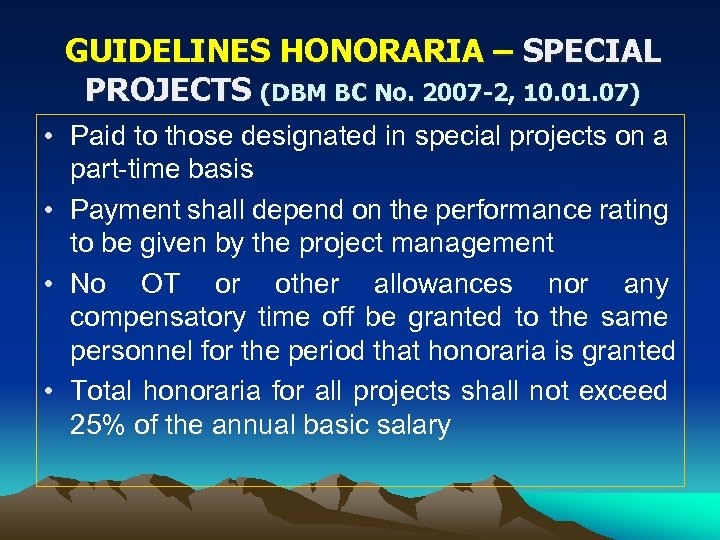

GUIDELINES HONORARIA – SPECIAL PROJECTS (DBM BC No. 2007 -2, 10. 01. 07) • Paid to those designated in special projects on a part-time basis • Payment shall depend on the performance rating to be given by the project management • No OT or other allowances nor any compensatory time off be granted to the same personnel for the period that honoraria is granted • Total honoraria for all projects shall not exceed 25% of the annual basic salary

GUIDELINES HONORARIA – SPECIAL PROJECTS (DBM BC No. 2007 -2, 10. 01. 07) • Paid to those designated in special projects on a part-time basis • Payment shall depend on the performance rating to be given by the project management • No OT or other allowances nor any compensatory time off be granted to the same personnel for the period that honoraria is granted • Total honoraria for all projects shall not exceed 25% of the annual basic salary

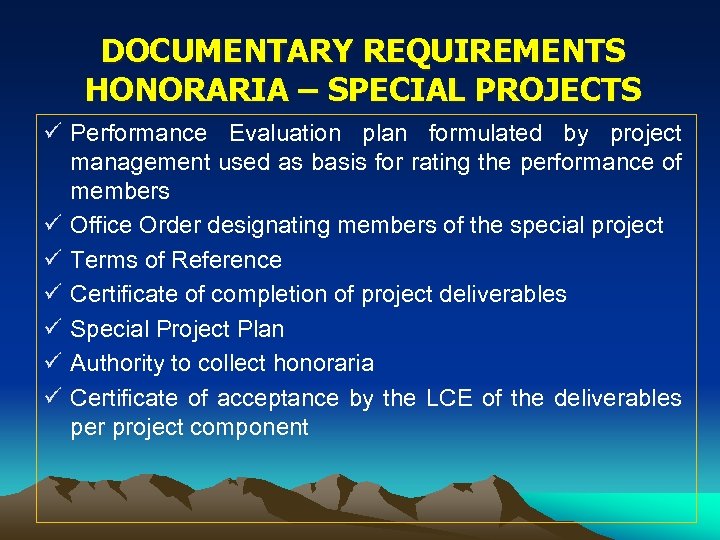

DOCUMENTARY REQUIREMENTS HONORARIA – SPECIAL PROJECTS ü Performance Evaluation plan formulated by project management used as basis for rating the performance of members ü Office Order designating members of the special project ü Terms of Reference ü Certificate of completion of project deliverables ü Special Project Plan ü Authority to collect honoraria ü Certificate of acceptance by the LCE of the deliverables per project component

DOCUMENTARY REQUIREMENTS HONORARIA – SPECIAL PROJECTS ü Performance Evaluation plan formulated by project management used as basis for rating the performance of members ü Office Order designating members of the special project ü Terms of Reference ü Certificate of completion of project deliverables ü Special Project Plan ü Authority to collect honoraria ü Certificate of acceptance by the LCE of the deliverables per project component

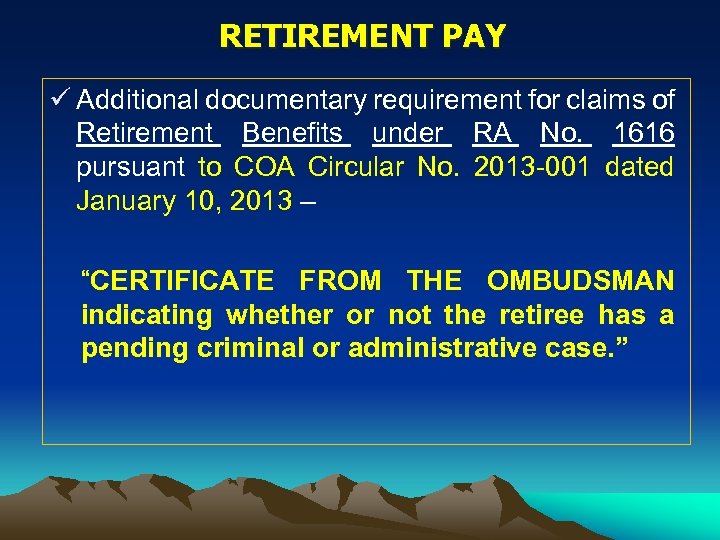

RETIREMENT PAY ü Additional documentary requirement for claims of Retirement Benefits under RA No. 1616 pursuant to COA Circular No. 2013 -001 dated January 10, 2013 – “CERTIFICATE FROM THE OMBUDSMAN indicating whether or not the retiree has a pending criminal or administrative case. ”

RETIREMENT PAY ü Additional documentary requirement for claims of Retirement Benefits under RA No. 1616 pursuant to COA Circular No. 2013 -001 dated January 10, 2013 – “CERTIFICATE FROM THE OMBUDSMAN indicating whether or not the retiree has a pending criminal or administrative case. ”

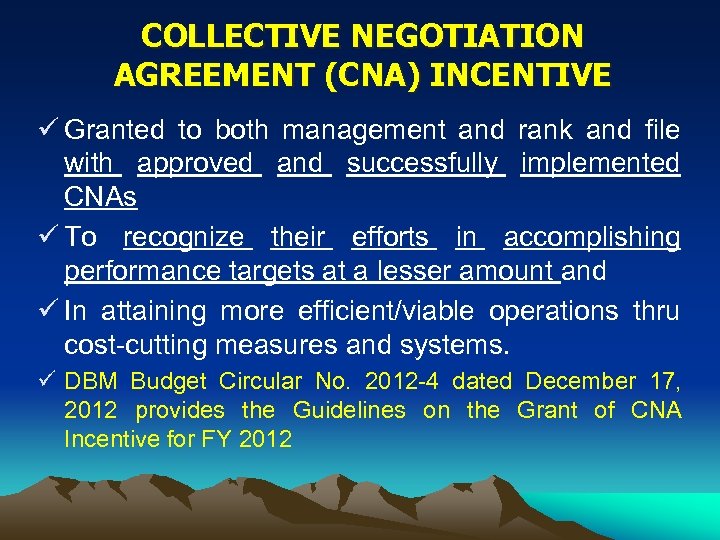

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE ü Granted to both management and rank and file with approved and successfully implemented CNAs ü To recognize their efforts in accomplishing performance targets at a lesser amount and ü In attaining more efficient/viable operations thru cost-cutting measures and systems. ü DBM Budget Circular No. 2012 -4 dated December 17, 2012 provides the Guidelines on the Grant of CNA Incentive for FY 2012

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE ü Granted to both management and rank and file with approved and successfully implemented CNAs ü To recognize their efforts in accomplishing performance targets at a lesser amount and ü In attaining more efficient/viable operations thru cost-cutting measures and systems. ü DBM Budget Circular No. 2012 -4 dated December 17, 2012 provides the Guidelines on the Grant of CNA Incentive for FY 2012

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Coverage: Rank and file government personnel occupying regular, contractual, or casual positions, rendering services on full-time or part-time basis in LGUs, among others, whether or not covered by RA 6758 Those who perform managerial functions

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Coverage: Rank and file government personnel occupying regular, contractual, or casual positions, rendering services on full-time or part-time basis in LGUs, among others, whether or not covered by RA 6758 Those who perform managerial functions

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Pre-conditions for the grant of CNA Incentive: Valid and subsisting CNA; Grant of the incentive is provided for in the CNA and supplements thereto LGU may grant the CNA Incentive only when it has completed at least 90% of the targets under its P/A/Ps approved in the LGU budget for the year;

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Pre-conditions for the grant of CNA Incentive: Valid and subsisting CNA; Grant of the incentive is provided for in the CNA and supplements thereto LGU may grant the CNA Incentive only when it has completed at least 90% of the targets under its P/A/Ps approved in the LGU budget for the year;

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Pre-conditions for the grant of CNA Incentive: The LGU has realized savings from only the following MOOE budgets for 2012: 1. Traveling Expenses; 2. Communication Expenses; 3. Repairs and Maintenance Expenses; 4. Transportation and Delivery Expenses; 5. Supplies and Materials; and 6. Utility Expenses.

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Pre-conditions for the grant of CNA Incentive: The LGU has realized savings from only the following MOOE budgets for 2012: 1. Traveling Expenses; 2. Communication Expenses; 3. Repairs and Maintenance Expenses; 4. Transportation and Delivery Expenses; 5. Supplies and Materials; and 6. Utility Expenses.

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Guidelines: The CNA Incentive for FY 2012 shall not exceed P 25, 000. 00 per qualified employee The CNA for the year shall be a one-time benefit to be granted not earlier than January 15 of the following year. The CNA shall be recorded under account code: Personal Services – Other Bonuses

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Guidelines: The CNA Incentive for FY 2012 shall not exceed P 25, 000. 00 per qualified employee The CNA for the year shall be a one-time benefit to be granted not earlier than January 15 of the following year. The CNA shall be recorded under account code: Personal Services – Other Bonuses

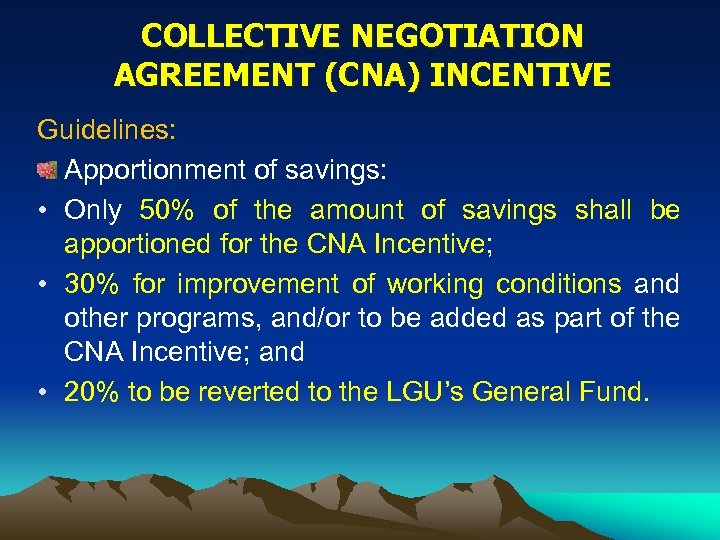

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Guidelines: Apportionment of savings: • Only 50% of the amount of savings shall be apportioned for the CNA Incentive; • 30% for improvement of working conditions and other programs, and/or to be added as part of the CNA Incentive; and • 20% to be reverted to the LGU’s General Fund.

COLLECTIVE NEGOTIATION AGREEMENT (CNA) INCENTIVE Guidelines: Apportionment of savings: • Only 50% of the amount of savings shall be apportioned for the CNA Incentive; • 30% for improvement of working conditions and other programs, and/or to be added as part of the CNA Incentive; and • 20% to be reverted to the LGU’s General Fund.

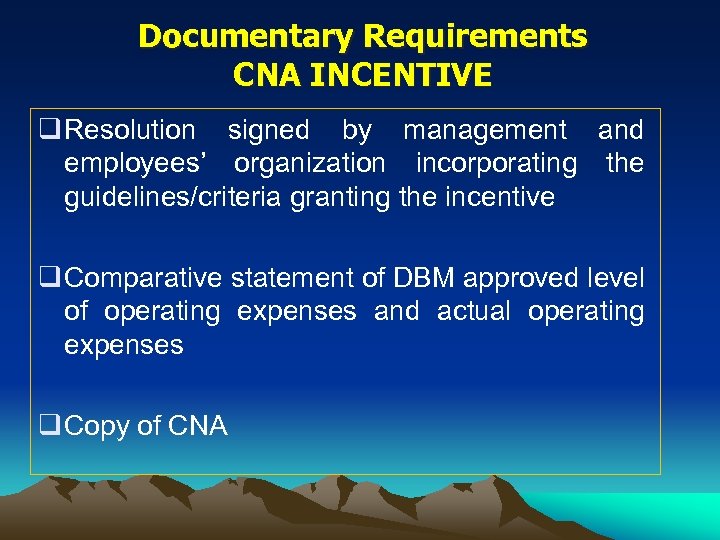

Documentary Requirements CNA INCENTIVE q Resolution signed by management and employees’ organization incorporating the guidelines/criteria granting the incentive q Comparative statement of DBM approved level of operating expenses and actual operating expenses q Copy of CNA

Documentary Requirements CNA INCENTIVE q Resolution signed by management and employees’ organization incorporating the guidelines/criteria granting the incentive q Comparative statement of DBM approved level of operating expenses and actual operating expenses q Copy of CNA

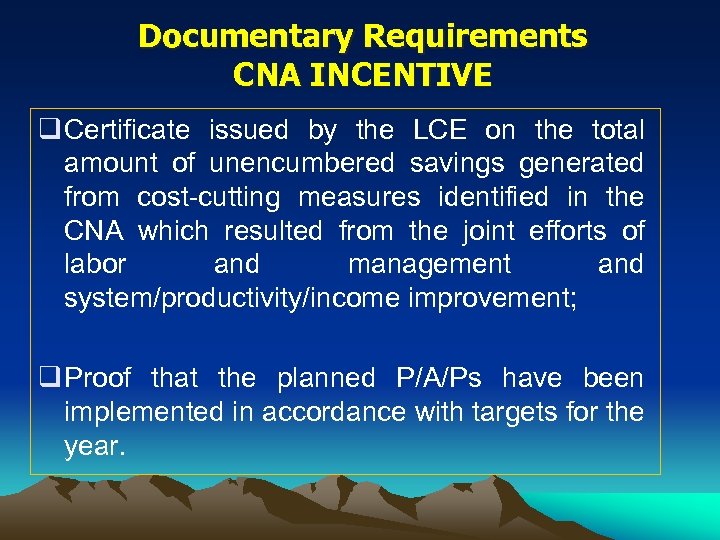

Documentary Requirements CNA INCENTIVE q Certificate issued by the LCE on the total amount of unencumbered savings generated from cost-cutting measures identified in the CNA which resulted from the joint efforts of labor and management and system/productivity/income improvement; q Proof that the planned P/A/Ps have been implemented in accordance with targets for the year.

Documentary Requirements CNA INCENTIVE q Certificate issued by the LCE on the total amount of unencumbered savings generated from cost-cutting measures identified in the CNA which resulted from the joint efforts of labor and management and system/productivity/income improvement; q Proof that the planned P/A/Ps have been implemented in accordance with targets for the year.