2a3777eedb354b0fd905af977359467d.ppt

- Количество слайдов: 62

Review of Corporate Financial Restructuring Prof. Ian Giddy New York University

Review of Corporate Financial Restructuring Prof. Ian Giddy New York University

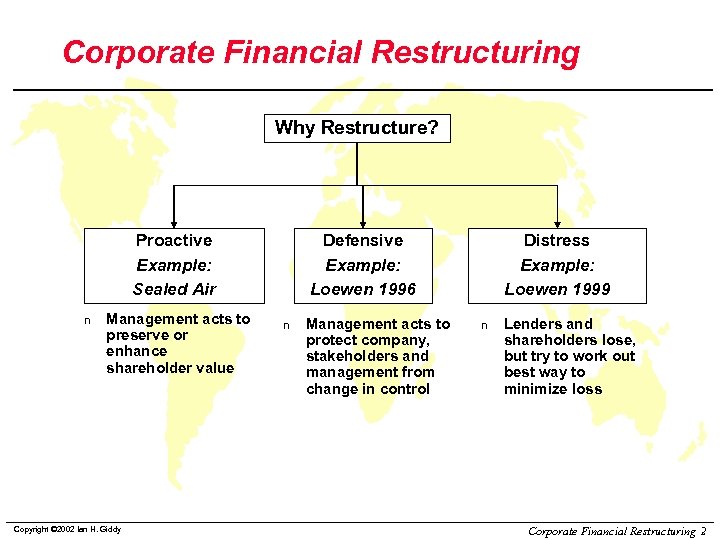

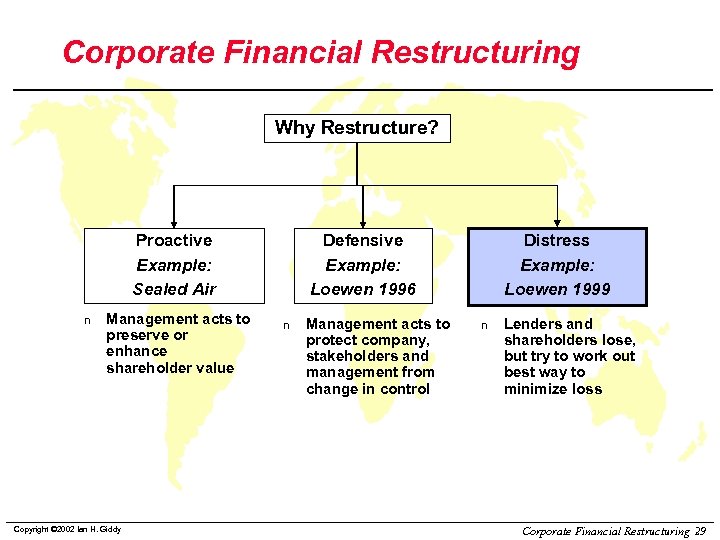

Corporate Financial Restructuring Why Restructure? Proactive Example: Sealed Air n Management acts to preserve or enhance shareholder value Copyright © 2002 Ian H. Giddy Defensive Example: Loewen 1996 n Management acts to protect company, stakeholders and management from change in control Distress Example: Loewen 1999 n Lenders and shareholders lose, but try to work out best way to minimize loss Corporate Financial Restructuring 2

Corporate Financial Restructuring Why Restructure? Proactive Example: Sealed Air n Management acts to preserve or enhance shareholder value Copyright © 2002 Ian H. Giddy Defensive Example: Loewen 1996 n Management acts to protect company, stakeholders and management from change in control Distress Example: Loewen 1999 n Lenders and shareholders lose, but try to work out best way to minimize loss Corporate Financial Restructuring 2

Corporate Financial Restructuring l l l Corporate restructuring – business and financial Structured financing techniques Proactive restructuring Distress-induced restructuring Mergers, divestitures and LBOs Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 3

Corporate Financial Restructuring l l l Corporate restructuring – business and financial Structured financing techniques Proactive restructuring Distress-induced restructuring Mergers, divestitures and LBOs Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 3

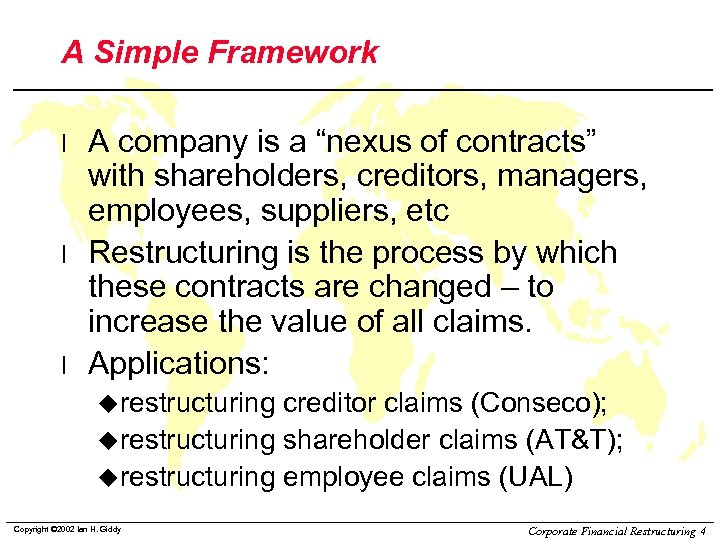

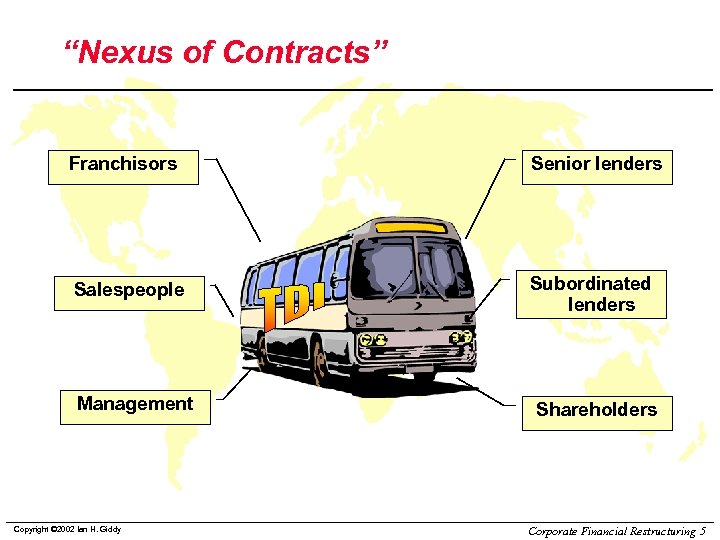

A Simple Framework l l l A company is a “nexus of contracts” with shareholders, creditors, managers, employees, suppliers, etc Restructuring is the process by which these contracts are changed – to increase the value of all claims. Applications: urestructuring creditor claims (Conseco); urestructuring shareholder claims (AT&T); urestructuring employee claims (UAL) Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 4

A Simple Framework l l l A company is a “nexus of contracts” with shareholders, creditors, managers, employees, suppliers, etc Restructuring is the process by which these contracts are changed – to increase the value of all claims. Applications: urestructuring creditor claims (Conseco); urestructuring shareholder claims (AT&T); urestructuring employee claims (UAL) Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 4

“Nexus of Contracts” Franchisors Senior lenders Salespeople Subordinated lenders Management Copyright © 2002 Ian H. Giddy Shareholders Corporate Financial Restructuring 5

“Nexus of Contracts” Franchisors Senior lenders Salespeople Subordinated lenders Management Copyright © 2002 Ian H. Giddy Shareholders Corporate Financial Restructuring 5

Examples l l l SAP – upgrading shareholder control rights Sealed Air – exploiting free cash flow Marvel – post-bankruptcy negotiations Westpac – structured finance Novartis – merged and divested Alphatec – rescuing residual value Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 6

Examples l l l SAP – upgrading shareholder control rights Sealed Air – exploiting free cash flow Marvel – post-bankruptcy negotiations Westpac – structured finance Novartis – merged and divested Alphatec – rescuing residual value Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 6

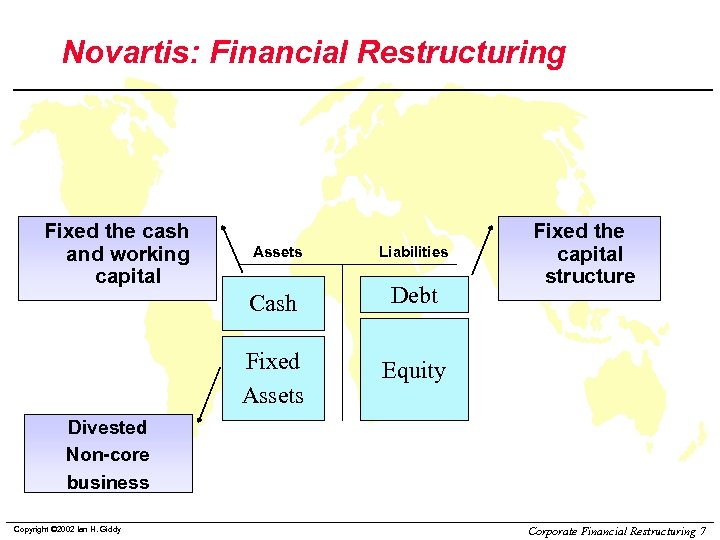

Novartis: Financial Restructuring Fixed the cash and working capital Assets Liabilities Cash Debt Fixed Assets Fixed the capital structure Equity Divested Non-core business Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 7

Novartis: Financial Restructuring Fixed the cash and working capital Assets Liabilities Cash Debt Fixed Assets Fixed the capital structure Equity Divested Non-core business Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 7

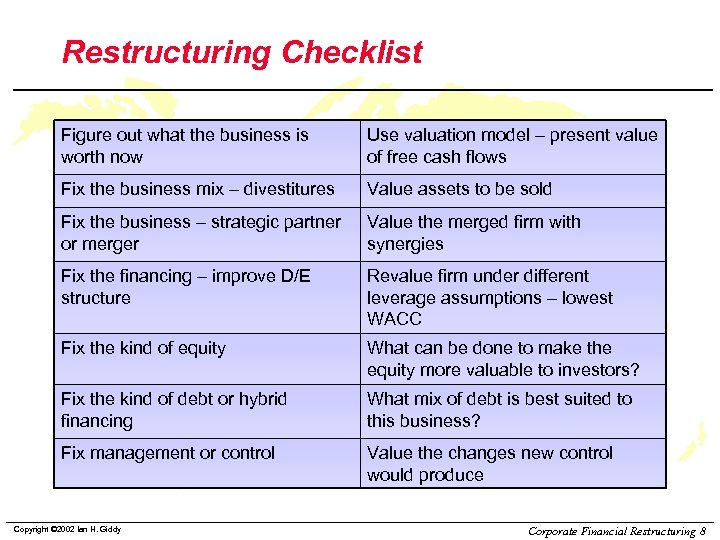

Restructuring Checklist Figure out what the business is worth now Use valuation model – present value of free cash flows Fix the business mix – divestitures Value assets to be sold Fix the business – strategic partner or merger Value the merged firm with synergies Fix the financing – improve D/E structure Revalue firm under different leverage assumptions – lowest WACC Fix the kind of equity What can be done to make the equity more valuable to investors? Fix the kind of debt or hybrid financing What mix of debt is best suited to this business? Fix management or control Value the changes new control would produce Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 8

Restructuring Checklist Figure out what the business is worth now Use valuation model – present value of free cash flows Fix the business mix – divestitures Value assets to be sold Fix the business – strategic partner or merger Value the merged firm with synergies Fix the financing – improve D/E structure Revalue firm under different leverage assumptions – lowest WACC Fix the kind of equity What can be done to make the equity more valuable to investors? Fix the kind of debt or hybrid financing What mix of debt is best suited to this business? Fix management or control Value the changes new control would produce Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 8

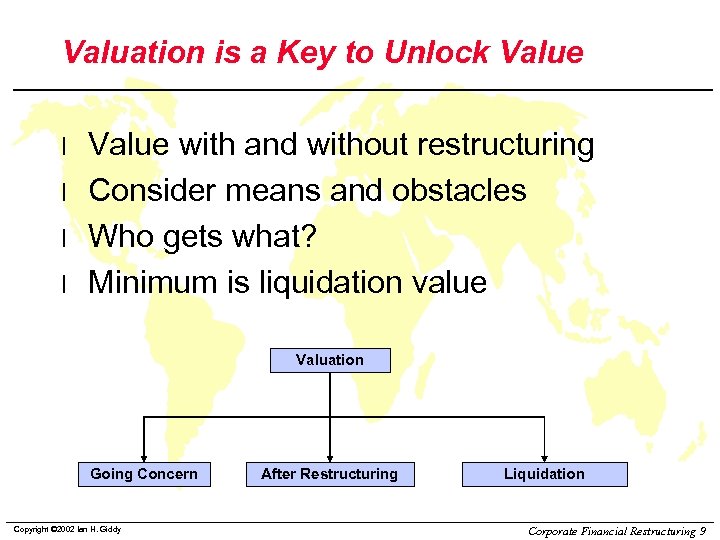

Valuation is a Key to Unlock Value l l Value with and without restructuring Consider means and obstacles Who gets what? Minimum is liquidation value Valuation Going Concern Copyright © 2002 Ian H. Giddy After Restructuring Liquidation Corporate Financial Restructuring 9

Valuation is a Key to Unlock Value l l Value with and without restructuring Consider means and obstacles Who gets what? Minimum is liquidation value Valuation Going Concern Copyright © 2002 Ian H. Giddy After Restructuring Liquidation Corporate Financial Restructuring 9

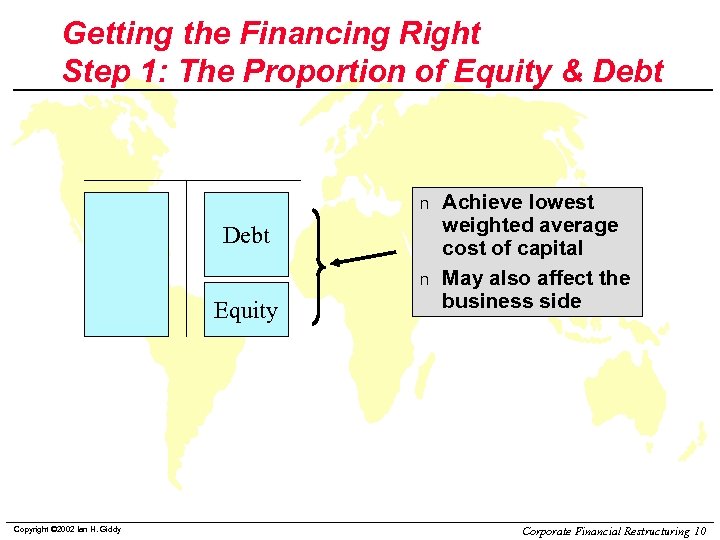

Getting the Financing Right Step 1: The Proportion of Equity & Debt n Equity Copyright © 2002 Ian H. Giddy Achieve lowest weighted average cost of capital May also affect the business side Corporate Financial Restructuring 10

Getting the Financing Right Step 1: The Proportion of Equity & Debt n Equity Copyright © 2002 Ian H. Giddy Achieve lowest weighted average cost of capital May also affect the business side Corporate Financial Restructuring 10

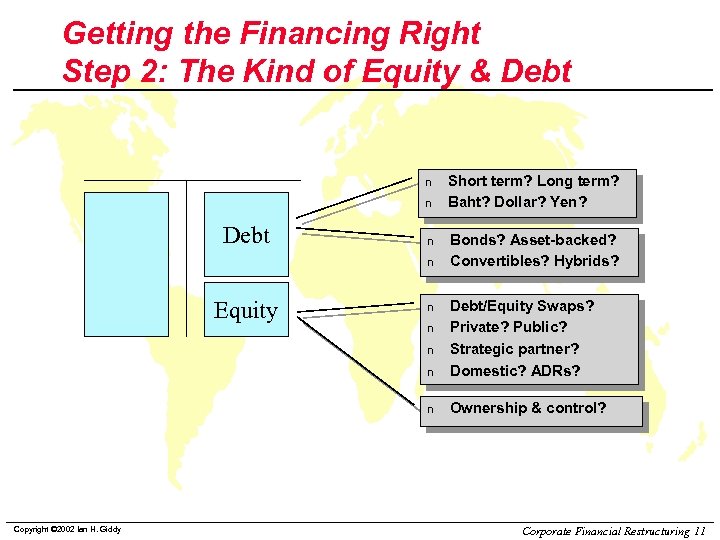

Getting the Financing Right Step 2: The Kind of Equity & Debt n n Equity Short term? Long term? Baht? Dollar? Yen? Bonds? Asset-backed? Convertibles? Hybrids? n Debt/Equity Swaps? Private? Public? Strategic partner? Domestic? ADRs? n Ownership & control? n n n Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 11

Getting the Financing Right Step 2: The Kind of Equity & Debt n n Equity Short term? Long term? Baht? Dollar? Yen? Bonds? Asset-backed? Convertibles? Hybrids? n Debt/Equity Swaps? Private? Public? Strategic partner? Domestic? ADRs? n Ownership & control? n n n Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 11

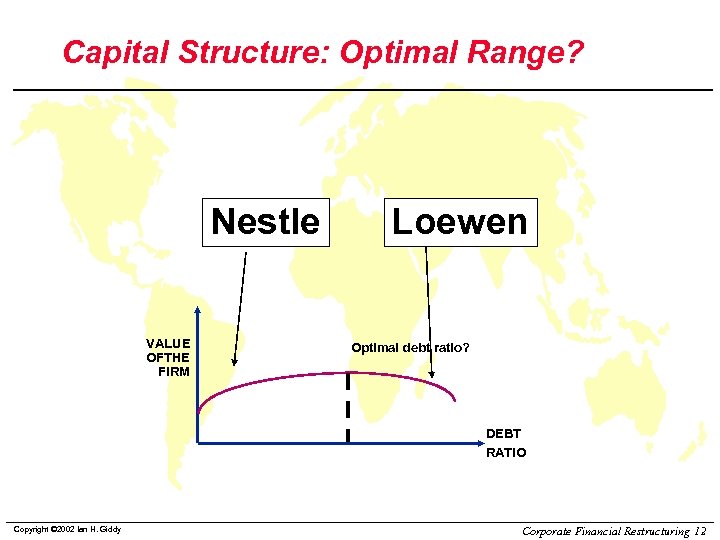

Capital Structure: Optimal Range? Nestle VALUE OFTHE FIRM Loewen Optimal debt ratio? DEBT RATIO Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 12

Capital Structure: Optimal Range? Nestle VALUE OFTHE FIRM Loewen Optimal debt ratio? DEBT RATIO Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 12

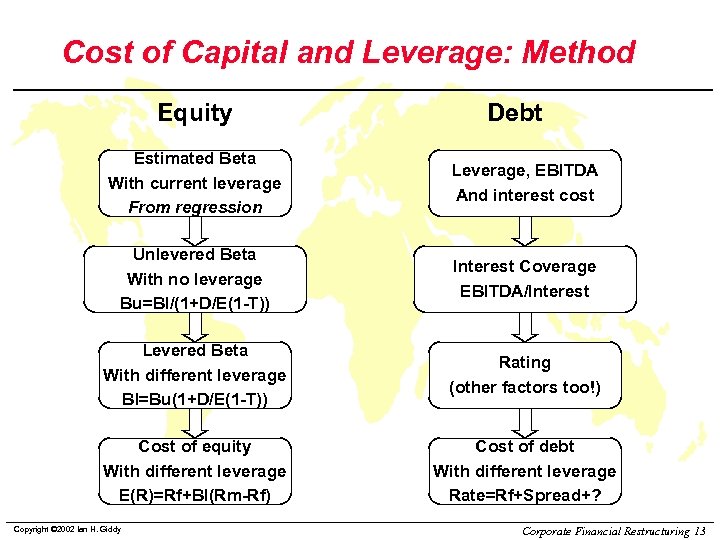

Cost of Capital and Leverage: Method Equity Debt Estimated Beta With current leverage From regression Leverage, EBITDA And interest cost Unlevered Beta With no leverage Bu=Bl/(1+D/E(1 -T)) Interest Coverage EBITDA/Interest Levered Beta With different leverage Bl=Bu(1+D/E(1 -T)) Rating (other factors too!) Cost of equity With different leverage E(R)=Rf+Bl(Rm-Rf) Cost of debt With different leverage Rate=Rf+Spread+? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 13

Cost of Capital and Leverage: Method Equity Debt Estimated Beta With current leverage From regression Leverage, EBITDA And interest cost Unlevered Beta With no leverage Bu=Bl/(1+D/E(1 -T)) Interest Coverage EBITDA/Interest Levered Beta With different leverage Bl=Bu(1+D/E(1 -T)) Rating (other factors too!) Cost of equity With different leverage E(R)=Rf+Bl(Rm-Rf) Cost of debt With different leverage Rate=Rf+Spread+? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 13

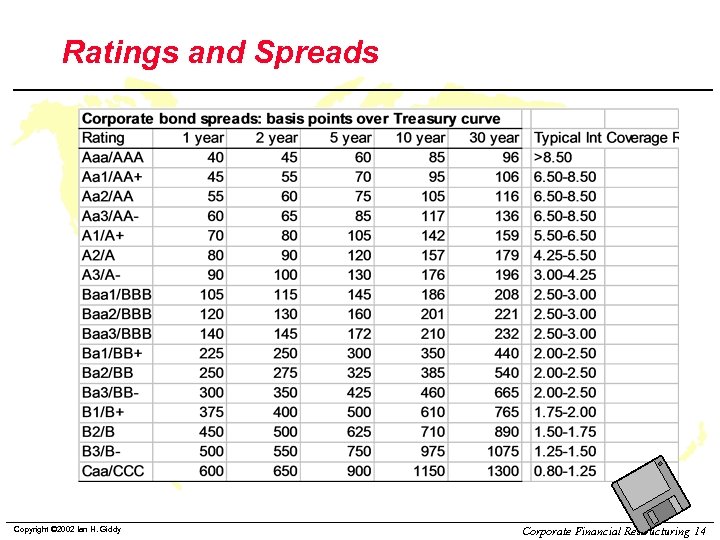

Ratings and Spreads Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 14

Ratings and Spreads Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 14

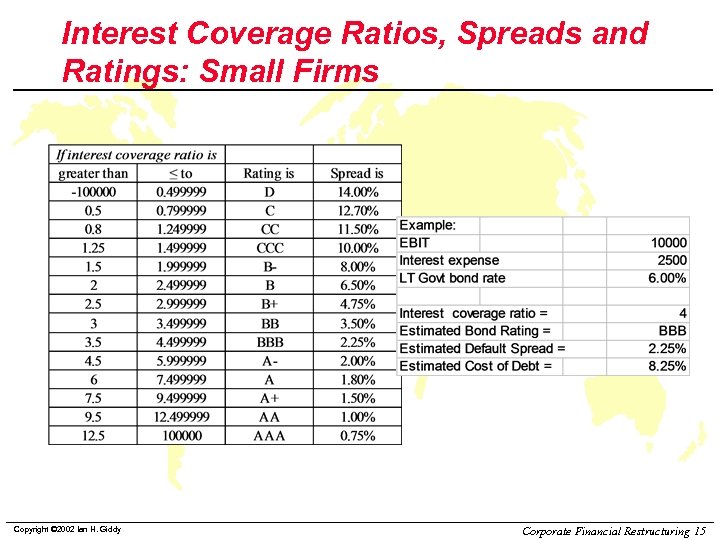

Interest Coverage Ratios, Spreads and Ratings: Small Firms Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 15

Interest Coverage Ratios, Spreads and Ratings: Small Firms Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 15

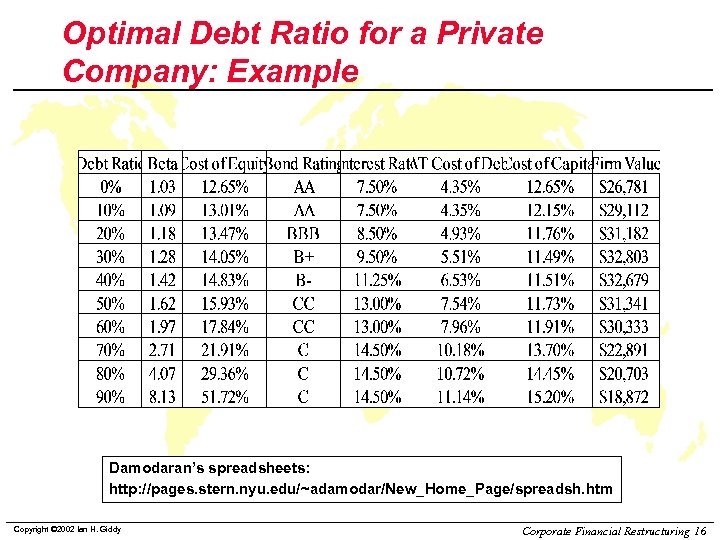

Optimal Debt Ratio for a Private Company: Example Damodaran’s spreadsheets: http: //pages. stern. nyu. edu/~adamodar/New_Home_Page/spreadsh. htm Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 16

Optimal Debt Ratio for a Private Company: Example Damodaran’s spreadsheets: http: //pages. stern. nyu. edu/~adamodar/New_Home_Page/spreadsh. htm Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 16

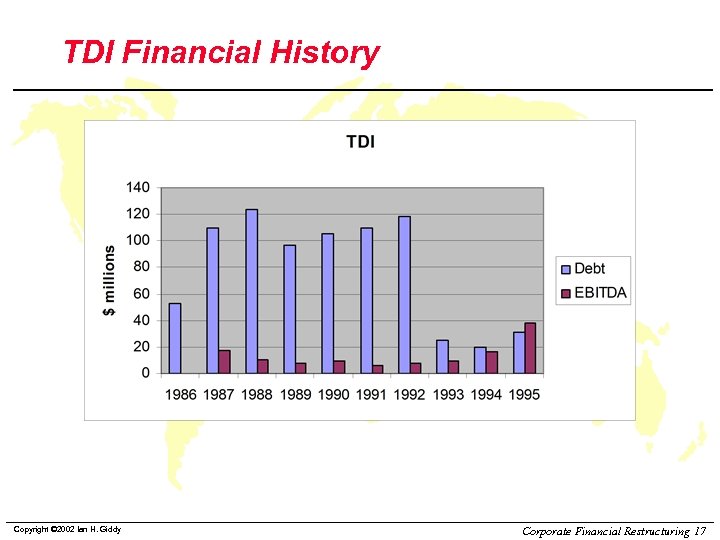

TDI Financial History Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 17

TDI Financial History Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 17

Restructuring Debt and Equity at TDI (A & B) Evaluate the financial restructuring taking place at TDI: l Effect of the LBO on capital structure? l How did LBO lenders protect their interests? l Alternative restructuring plans? l Post Dec 89 operational, portfolio and financial restructuring proposals? l 1992 -93 restructuring, before-and-after comparison Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 18

Restructuring Debt and Equity at TDI (A & B) Evaluate the financial restructuring taking place at TDI: l Effect of the LBO on capital structure? l How did LBO lenders protect their interests? l Alternative restructuring plans? l Post Dec 89 operational, portfolio and financial restructuring proposals? l 1992 -93 restructuring, before-and-after comparison Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 18

Restructuring Debt and Equity at TDI (C) Consider the choices facing TDI in 1994: l Evaluate the alternatives available to take best advantage of TDI’s free cash flow: u Leveraged buyout u Leveraged ESOP u Leveraged recapitalization l l Or: Invest cash or debt in growth opportunities Or: Do nothing to retain flexibility Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 19

Restructuring Debt and Equity at TDI (C) Consider the choices facing TDI in 1994: l Evaluate the alternatives available to take best advantage of TDI’s free cash flow: u Leveraged buyout u Leveraged ESOP u Leveraged recapitalization l l Or: Invest cash or debt in growth opportunities Or: Do nothing to retain flexibility Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 19

Restructuring Debt and Equity at TDI (D) Evaluate the possible means for cashing out shareholder value in a private company such as TDI in 1996: u. Leveraged recap u. IPO u. Sale to financial buyer u. Sale to strategic buyer l Which when? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 20

Restructuring Debt and Equity at TDI (D) Evaluate the possible means for cashing out shareholder value in a private company such as TDI in 1996: u. Leveraged recap u. IPO u. Sale to financial buyer u. Sale to strategic buyer l Which when? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 20

Leveraged Recapitalization l l l Strategy where a company takes on significant additional debt with the purpose of paying a large dividend (or repurchasing shares) Result is a far more leveraged company -- usually in excess of the "optimal" debt capacity After the large dividend has been paid, the market value of the shares will drop. Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 21

Leveraged Recapitalization l l l Strategy where a company takes on significant additional debt with the purpose of paying a large dividend (or repurchasing shares) Result is a far more leveraged company -- usually in excess of the "optimal" debt capacity After the large dividend has been paid, the market value of the shares will drop. Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 21

Leveraged Recapitalizations l Motivations: u. Defensive u. Proactive u. Ownership transition/liquidity l Which produces what value? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 22

Leveraged Recapitalizations l Motivations: u. Defensive u. Proactive u. Ownership transition/liquidity l Which produces what value? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 22

Exchange Offers l l Give one or more classes of claimholders the option to trade their holdings for a different class of securities of the firm. Typical examples are allowing common shareholders to exchange their shares for bonds or preferred stock, Or vice-versa Motivations? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 23

Exchange Offers l l Give one or more classes of claimholders the option to trade their holdings for a different class of securities of the firm. Typical examples are allowing common shareholders to exchange their shares for bonds or preferred stock, Or vice-versa Motivations? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 23

Exchange Offers-Effect Depends On: l l l Leverage increasing or decreasing Implied increases or decreases in future operating cash flows Implied undervaluation or overvaluation of common stock Increase or decrease in management share ownership Increase or decrease in management control over cash usage Positive or negative signalling effects. Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 24

Exchange Offers-Effect Depends On: l l l Leverage increasing or decreasing Implied increases or decreases in future operating cash flows Implied undervaluation or overvaluation of common stock Increase or decrease in management share ownership Increase or decrease in management control over cash usage Positive or negative signalling effects. Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 24

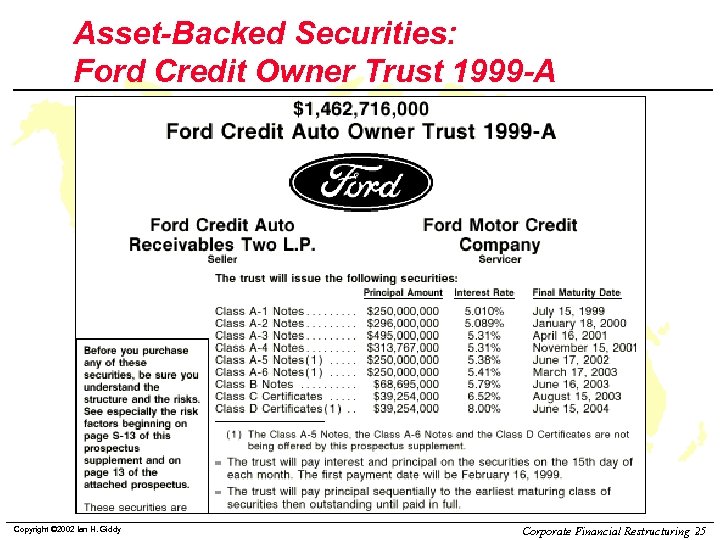

Asset-Backed Securities: Ford Credit Owner Trust 1999 -A Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 25

Asset-Backed Securities: Ford Credit Owner Trust 1999 -A Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 25

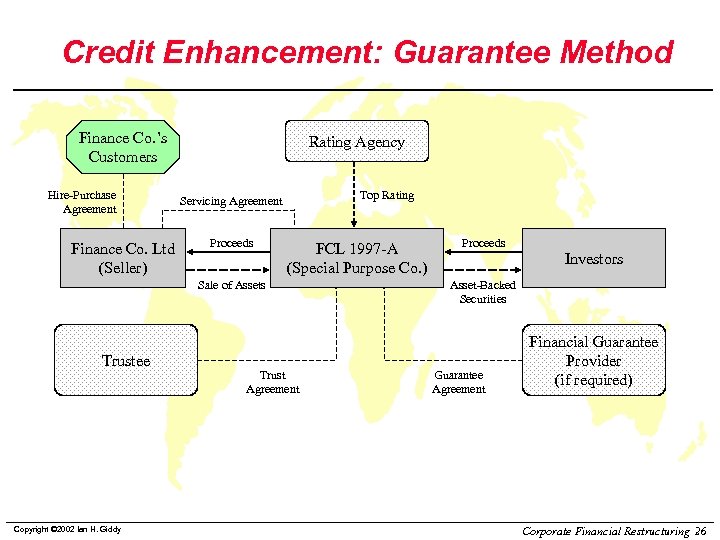

Credit Enhancement: Guarantee Method Finance Co. ’s Customers Hire-Purchase Agreement Finance Co. Ltd (Seller) Rating Agency Top Rating Servicing Agreement Proceeds FCL 1997 -A (Special Purpose Co. ) Sale of Assets Proceeds Investors Asset-Backed Securities Trustee Copyright © 2002 Ian H. Giddy Trust Agreement Guarantee Agreement Financial Guarantee Provider (if required) Corporate Financial Restructuring 26

Credit Enhancement: Guarantee Method Finance Co. ’s Customers Hire-Purchase Agreement Finance Co. Ltd (Seller) Rating Agency Top Rating Servicing Agreement Proceeds FCL 1997 -A (Special Purpose Co. ) Sale of Assets Proceeds Investors Asset-Backed Securities Trustee Copyright © 2002 Ian H. Giddy Trust Agreement Guarantee Agreement Financial Guarantee Provider (if required) Corporate Financial Restructuring 26

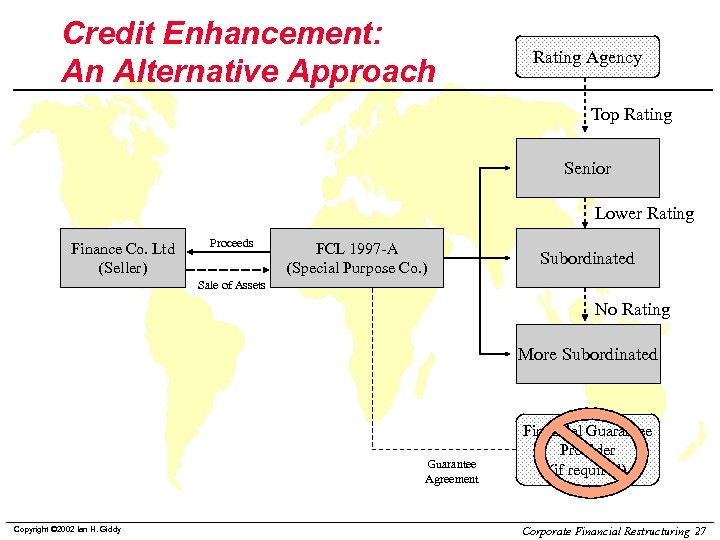

Credit Enhancement: An Alternative Approach Rating Agency Top Rating Senior Lower Rating Finance Co. Ltd (Seller) Proceeds FCL 1997 -A (Special Purpose Co. ) Subordinated Sale of Assets No Rating More Subordinated Guarantee Agreement Copyright © 2002 Ian H. Giddy Financial Guarantee Provider (if required) Corporate Financial Restructuring 27

Credit Enhancement: An Alternative Approach Rating Agency Top Rating Senior Lower Rating Finance Co. Ltd (Seller) Proceeds FCL 1997 -A (Special Purpose Co. ) Subordinated Sale of Assets No Rating More Subordinated Guarantee Agreement Copyright © 2002 Ian H. Giddy Financial Guarantee Provider (if required) Corporate Financial Restructuring 27

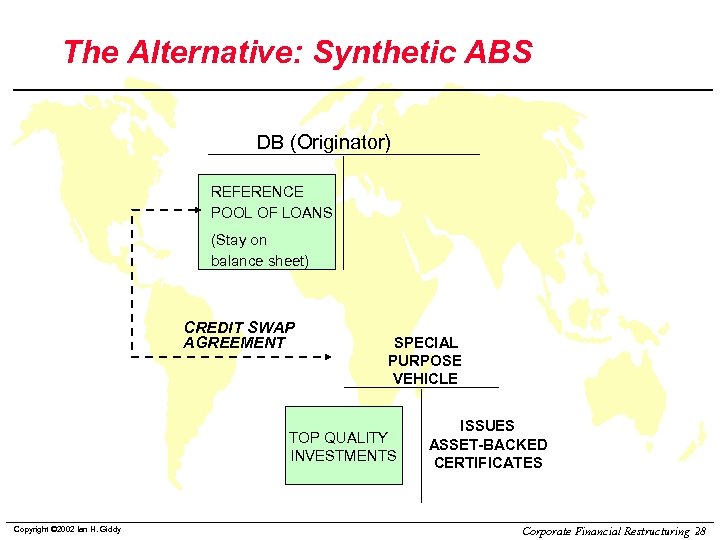

The Alternative: Synthetic ABS DB (Originator) REFERENCE POOL OF LOANS (Stay on balance sheet) CREDIT SWAP AGREEMENT SPECIAL PURPOSE VEHICLE TOP QUALITY INVESTMENTS Copyright © 2002 Ian H. Giddy ISSUES ASSET-BACKED CERTIFICATES Corporate Financial Restructuring 28

The Alternative: Synthetic ABS DB (Originator) REFERENCE POOL OF LOANS (Stay on balance sheet) CREDIT SWAP AGREEMENT SPECIAL PURPOSE VEHICLE TOP QUALITY INVESTMENTS Copyright © 2002 Ian H. Giddy ISSUES ASSET-BACKED CERTIFICATES Corporate Financial Restructuring 28

Corporate Financial Restructuring Why Restructure? Proactive Example: Sealed Air n Management acts to preserve or enhance shareholder value Copyright © 2002 Ian H. Giddy Defensive Example: Loewen 1996 n Management acts to protect company, stakeholders and management from change in control Distress Example: Loewen 1999 n Lenders and shareholders lose, but try to work out best way to minimize loss Corporate Financial Restructuring 29

Corporate Financial Restructuring Why Restructure? Proactive Example: Sealed Air n Management acts to preserve or enhance shareholder value Copyright © 2002 Ian H. Giddy Defensive Example: Loewen 1996 n Management acts to protect company, stakeholders and management from change in control Distress Example: Loewen 1999 n Lenders and shareholders lose, but try to work out best way to minimize loss Corporate Financial Restructuring 29

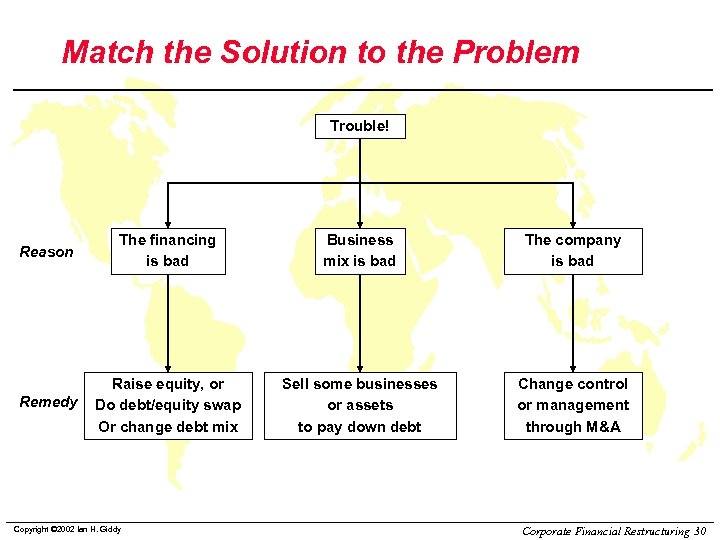

Match the Solution to the Problem Trouble! Reason The financing is bad Business mix is bad The company is bad Remedy Raise equity, or Do debt/equity swap Or change debt mix Sell some businesses or assets to pay down debt Change control or management through M&A Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 30

Match the Solution to the Problem Trouble! Reason The financing is bad Business mix is bad The company is bad Remedy Raise equity, or Do debt/equity swap Or change debt mix Sell some businesses or assets to pay down debt Change control or management through M&A Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 30

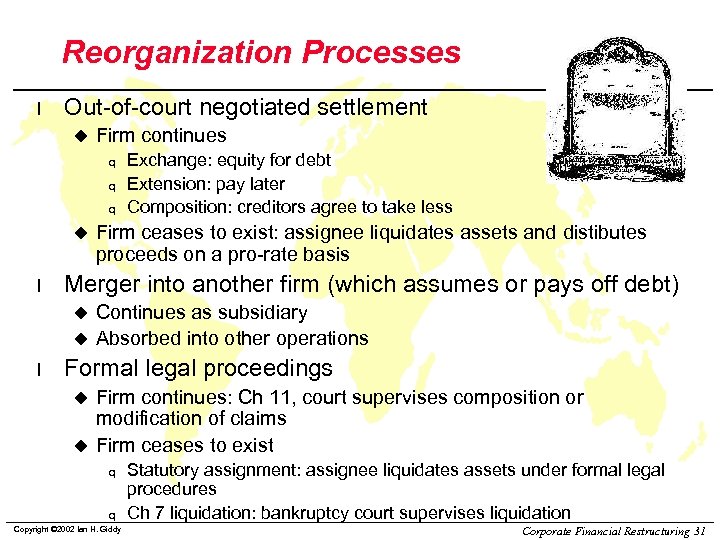

Reorganization Processes l Out-of-court negotiated settlement u Firm continues q q q u l Exchange: equity for debt Extension: pay later Composition: creditors agree to take less Firm ceases to exist: assignee liquidates assets and distibutes proceeds on a pro-rate basis Merger into another firm (which assumes or pays off debt) Continues as subsidiary u Absorbed into other operations u l Formal legal proceedings Firm continues: Ch 11, court supervises composition or modification of claims u Firm ceases to exist u q q Copyright © 2002 Ian H. Giddy Statutory assignment: assignee liquidates assets under formal legal procedures Ch 7 liquidation: bankruptcy court supervises liquidation Corporate Financial Restructuring 31

Reorganization Processes l Out-of-court negotiated settlement u Firm continues q q q u l Exchange: equity for debt Extension: pay later Composition: creditors agree to take less Firm ceases to exist: assignee liquidates assets and distibutes proceeds on a pro-rate basis Merger into another firm (which assumes or pays off debt) Continues as subsidiary u Absorbed into other operations u l Formal legal proceedings Firm continues: Ch 11, court supervises composition or modification of claims u Firm ceases to exist u q q Copyright © 2002 Ian H. Giddy Statutory assignment: assignee liquidates assets under formal legal procedures Ch 7 liquidation: bankruptcy court supervises liquidation Corporate Financial Restructuring 31

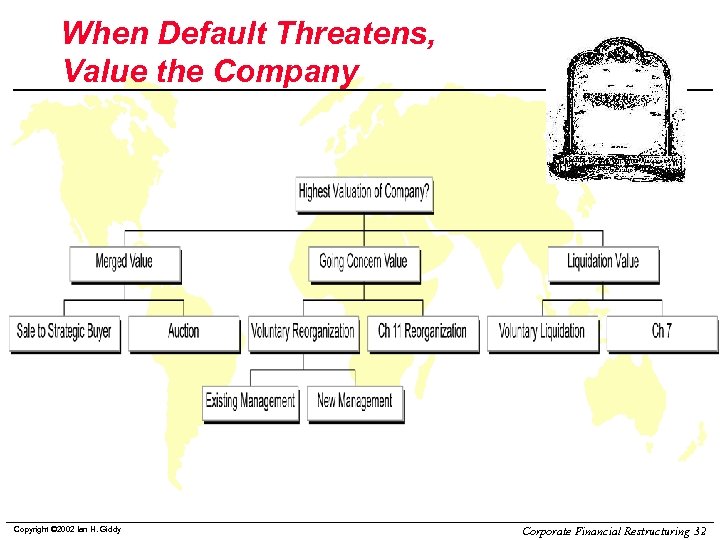

When Default Threatens, Value the Company Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 32

When Default Threatens, Value the Company Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 32

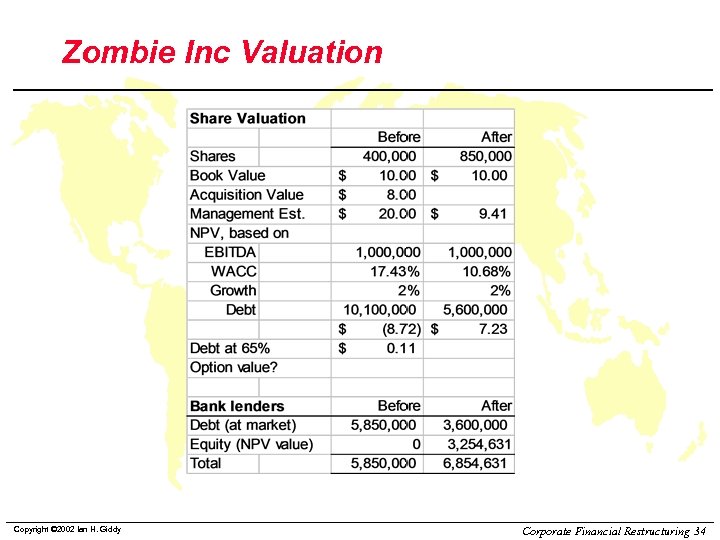

Zombie Inc Valuation Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 34

Zombie Inc Valuation Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 34

Valuation in Distress Restructuring l l l Liquidation value Acquisition price Enterprise value Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 35

Valuation in Distress Restructuring l l l Liquidation value Acquisition price Enterprise value Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 35

Enterprise Valuation in Distress Restructuring l l l Multiples FCFF discounted at WACC APV Capital Cash Flows Option Value Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 36

Enterprise Valuation in Distress Restructuring l l l Multiples FCFF discounted at WACC APV Capital Cash Flows Option Value Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 36

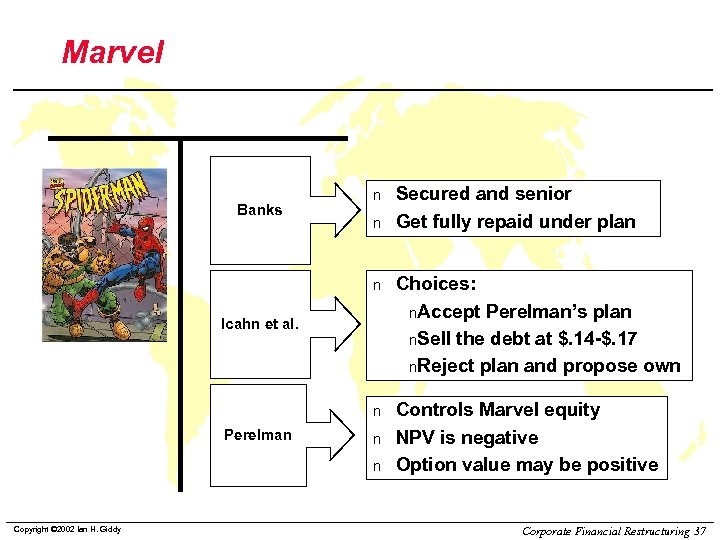

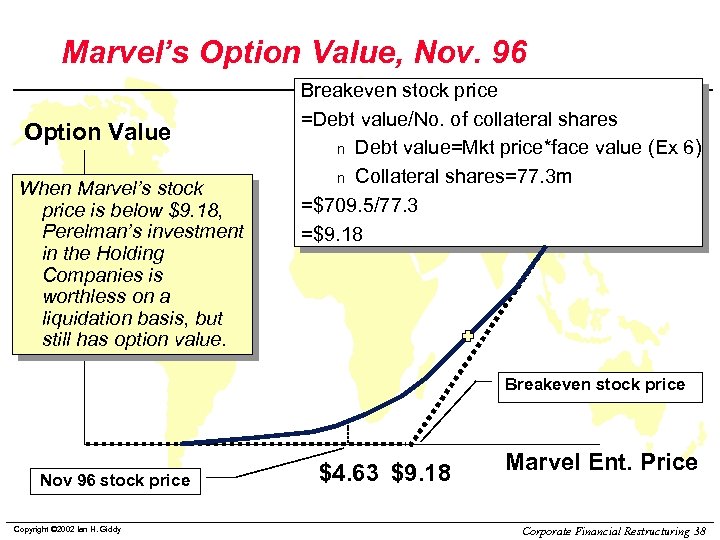

Marvel Banks n n Secured and senior Get fully repaid under plan n Choices: n. Accept Perelman’s plan n. Sell the debt at $. 14 -$. 17 n. Reject plan and propose own n Controls Marvel equity NPV is negative Option value may be positive Icahn et al. Perelman n n Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 37

Marvel Banks n n Secured and senior Get fully repaid under plan n Choices: n. Accept Perelman’s plan n. Sell the debt at $. 14 -$. 17 n. Reject plan and propose own n Controls Marvel equity NPV is negative Option value may be positive Icahn et al. Perelman n n Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 37

Marvel’s Option Value, Nov. 96 Option Value When Marvel’s stock price is below $9. 18, Perelman’s investment in the Holding Companies is worthless on a liquidation basis, but still has option value. Breakeven stock price =Debt value/No. of collateral shares n Debt value=Mkt price*face value (Ex 6) n Collateral shares=77. 3 m =$709. 5/77. 3 =$9. 18 Breakeven stock price Nov 96 stock price Copyright © 2002 Ian H. Giddy $4. 63 $9. 18 Marvel Ent. Price Corporate Financial Restructuring 38

Marvel’s Option Value, Nov. 96 Option Value When Marvel’s stock price is below $9. 18, Perelman’s investment in the Holding Companies is worthless on a liquidation basis, but still has option value. Breakeven stock price =Debt value/No. of collateral shares n Debt value=Mkt price*face value (Ex 6) n Collateral shares=77. 3 m =$709. 5/77. 3 =$9. 18 Breakeven stock price Nov 96 stock price Copyright © 2002 Ian H. Giddy $4. 63 $9. 18 Marvel Ent. Price Corporate Financial Restructuring 38

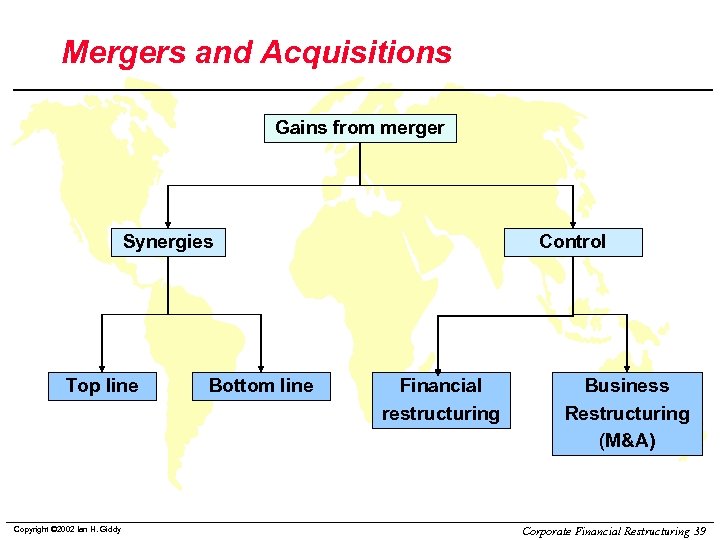

Mergers and Acquisitions Gains from merger Synergies Top line Copyright © 2002 Ian H. Giddy Bottom line Control Financial restructuring Business Restructuring (M&A) Corporate Financial Restructuring 39

Mergers and Acquisitions Gains from merger Synergies Top line Copyright © 2002 Ian H. Giddy Bottom line Control Financial restructuring Business Restructuring (M&A) Corporate Financial Restructuring 39

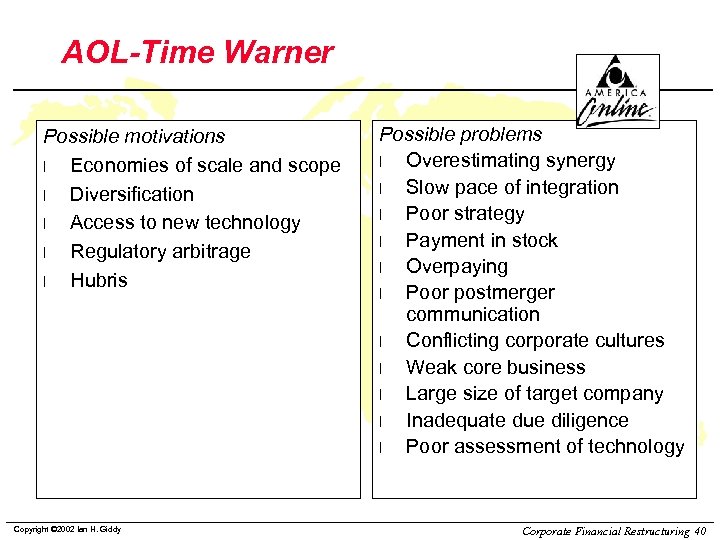

AOL-Time Warner Possible motivations l Economies of scale and scope l Diversification l Access to new technology l Regulatory arbitrage l Hubris Copyright © 2002 Ian H. Giddy Possible problems l Overestimating synergy l Slow pace of integration l Poor strategy l Payment in stock l Overpaying l Poor postmerger communication l Conflicting corporate cultures l Weak core business l Large size of target company l Inadequate due diligence l Poor assessment of technology Corporate Financial Restructuring 40

AOL-Time Warner Possible motivations l Economies of scale and scope l Diversification l Access to new technology l Regulatory arbitrage l Hubris Copyright © 2002 Ian H. Giddy Possible problems l Overestimating synergy l Slow pace of integration l Poor strategy l Payment in stock l Overpaying l Poor postmerger communication l Conflicting corporate cultures l Weak core business l Large size of target company l Inadequate due diligence l Poor assessment of technology Corporate Financial Restructuring 40

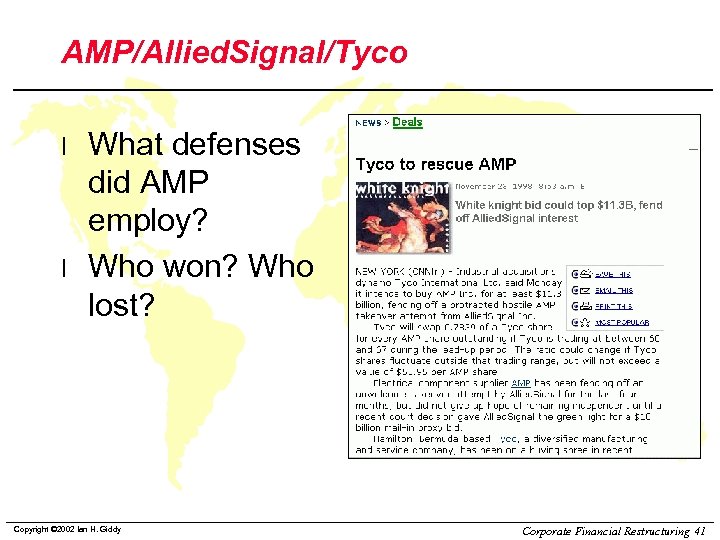

AMP/Allied. Signal/Tyco l l What defenses did AMP employ? Who won? Who lost? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 41

AMP/Allied. Signal/Tyco l l What defenses did AMP employ? Who won? Who lost? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 41

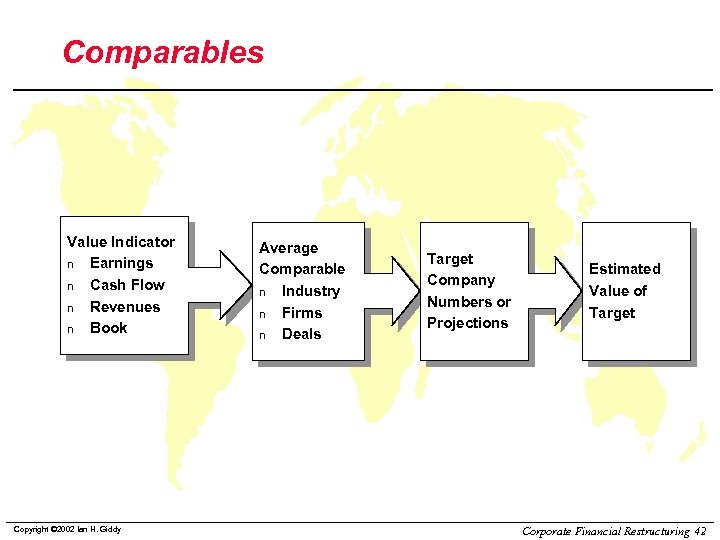

Comparables Value Indicator n Earnings n Cash Flow n Revenues n Book Copyright © 2002 Ian H. Giddy Average Comparable n Industry n Firms n Deals Target Company Numbers or Projections Estimated Value of Target Corporate Financial Restructuring 42

Comparables Value Indicator n Earnings n Cash Flow n Revenues n Book Copyright © 2002 Ian H. Giddy Average Comparable n Industry n Firms n Deals Target Company Numbers or Projections Estimated Value of Target Corporate Financial Restructuring 42

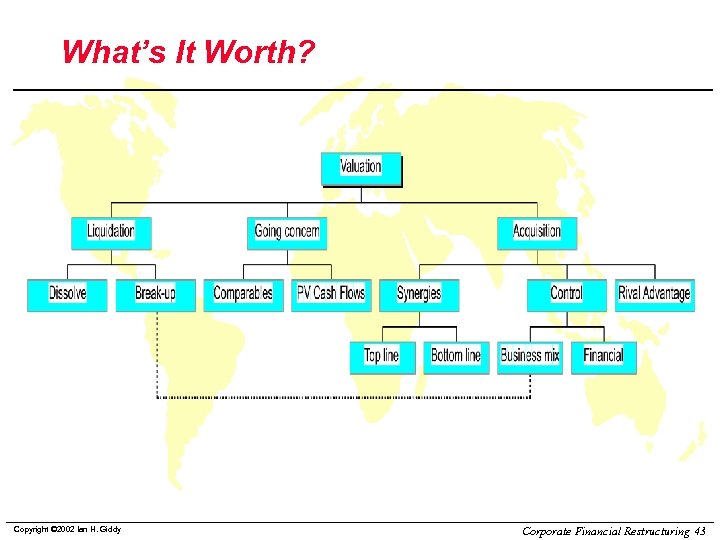

What’s It Worth? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 43

What’s It Worth? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 43

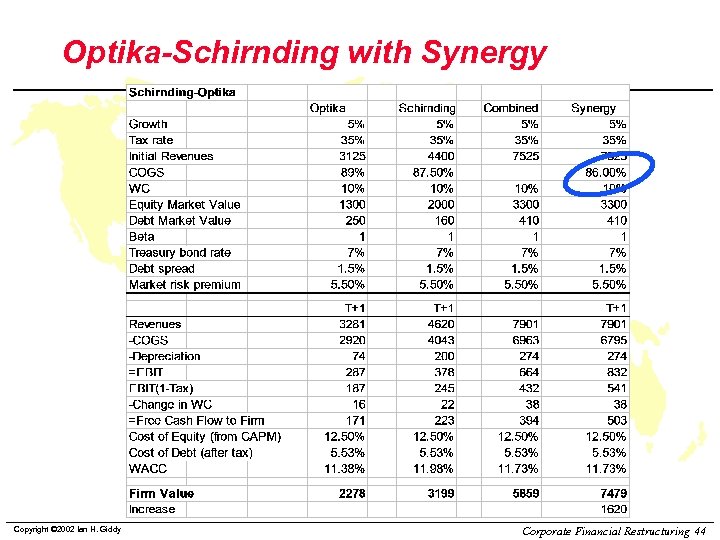

Optika-Schirnding with Synergy Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 44

Optika-Schirnding with Synergy Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 44

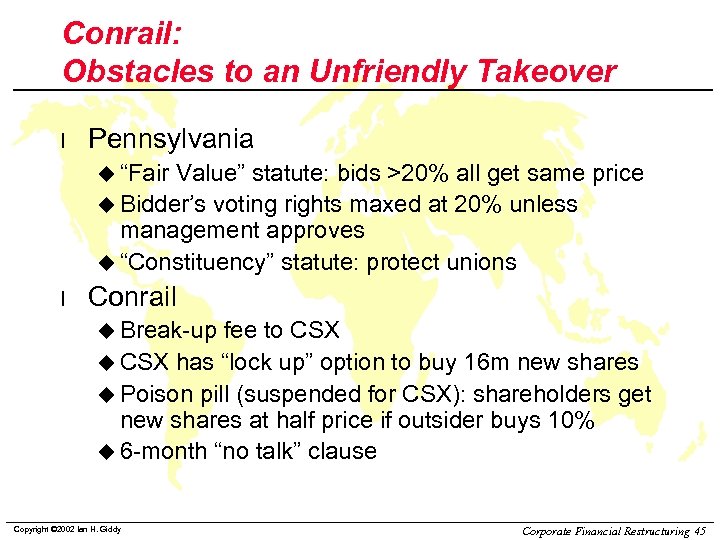

Conrail: Obstacles to an Unfriendly Takeover l Pennsylvania u “Fair Value” statute: bids >20% all get same price u Bidder’s voting rights maxed at 20% unless management approves u “Constituency” statute: protect unions l Conrail u Break-up fee to CSX u CSX has “lock up” option to buy 16 m new shares u Poison pill (suspended for CSX): shareholders get new shares at half price if outsider buys 10% u 6 -month “no talk” clause Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 45

Conrail: Obstacles to an Unfriendly Takeover l Pennsylvania u “Fair Value” statute: bids >20% all get same price u Bidder’s voting rights maxed at 20% unless management approves u “Constituency” statute: protect unions l Conrail u Break-up fee to CSX u CSX has “lock up” option to buy 16 m new shares u Poison pill (suspended for CSX): shareholders get new shares at half price if outsider buys 10% u 6 -month “no talk” clause Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 45

Takeover Defenses l Poison Pills Preferred flip-over stock u Flip-over rights u Flip-in rights u Poison put bonds u l Shark Repellants u u u u l Limitations on board changes Limitations on shareholder actions Supermajority rules Anti-greenmail limits on share repurchases Fair-price provisions Supervoting stock exchange offers Reincorporation Golden parachutes Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 46

Takeover Defenses l Poison Pills Preferred flip-over stock u Flip-over rights u Flip-in rights u Poison put bonds u l Shark Repellants u u u u l Limitations on board changes Limitations on shareholder actions Supermajority rules Anti-greenmail limits on share repurchases Fair-price provisions Supervoting stock exchange offers Reincorporation Golden parachutes Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 46

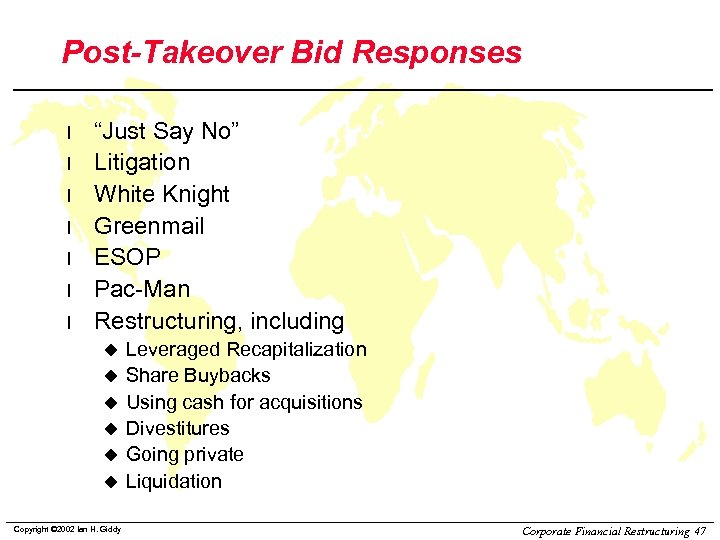

Post-Takeover Bid Responses l l l l “Just Say No” Litigation White Knight Greenmail ESOP Pac-Man Restructuring, including u u u Copyright © 2002 Ian H. Giddy Leveraged Recapitalization Share Buybacks Using cash for acquisitions Divestitures Going private Liquidation Corporate Financial Restructuring 47

Post-Takeover Bid Responses l l l l “Just Say No” Litigation White Knight Greenmail ESOP Pac-Man Restructuring, including u u u Copyright © 2002 Ian H. Giddy Leveraged Recapitalization Share Buybacks Using cash for acquisitions Divestitures Going private Liquidation Corporate Financial Restructuring 47

Breaking Up l l Why—The business may be worth more outside the company than within How—Sell to another company, or to the public, or give it to existing shareholders Tax Aspects—As a rule if you get paid in cash you realize a taxable gain; not otherwise Effect on Shareholders—The bigger the part sold off, the greater the percentage gain Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 48

Breaking Up l l Why—The business may be worth more outside the company than within How—Sell to another company, or to the public, or give it to existing shareholders Tax Aspects—As a rule if you get paid in cash you realize a taxable gain; not otherwise Effect on Shareholders—The bigger the part sold off, the greater the percentage gain Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 48

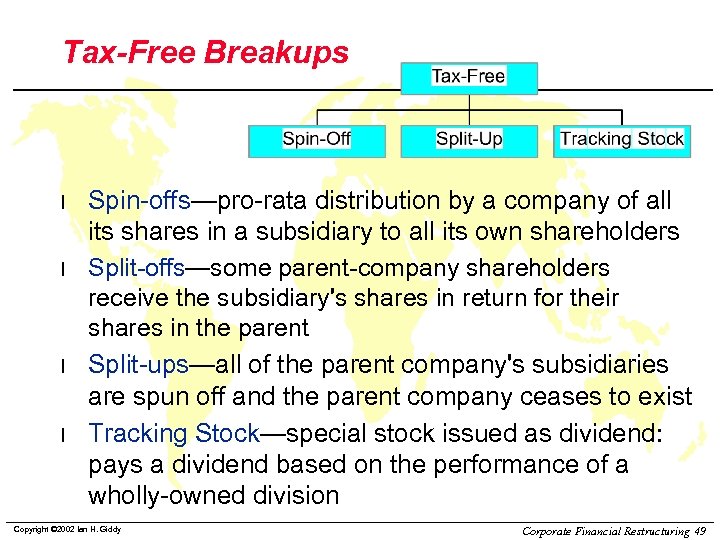

Tax-Free Breakups l l Spin-offs—pro-rata distribution by a company of all its shares in a subsidiary to all its own shareholders Split-offs—some parent-company shareholders receive the subsidiary's shares in return for their shares in the parent Split-ups—all of the parent company's subsidiaries are spun off and the parent company ceases to exist Tracking Stock—special stock issued as dividend: pays a dividend based on the performance of a wholly-owned division Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 49

Tax-Free Breakups l l Spin-offs—pro-rata distribution by a company of all its shares in a subsidiary to all its own shareholders Split-offs—some parent-company shareholders receive the subsidiary's shares in return for their shares in the parent Split-ups—all of the parent company's subsidiaries are spun off and the parent company ceases to exist Tracking Stock—special stock issued as dividend: pays a dividend based on the performance of a wholly-owned division Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 49

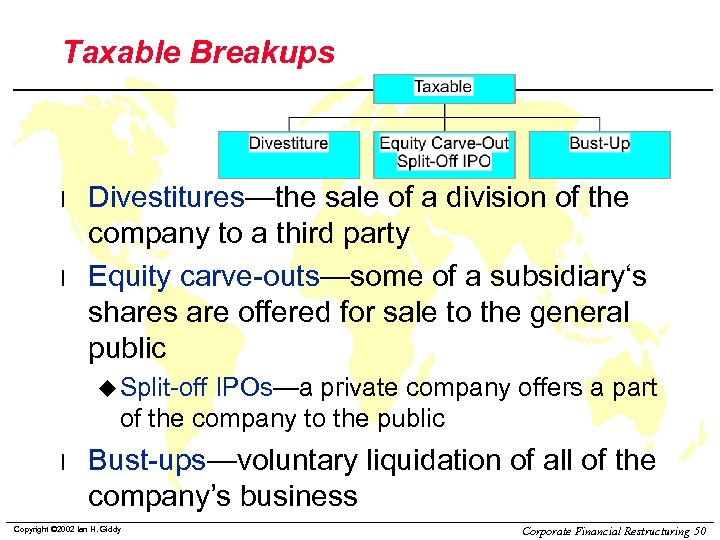

Taxable Breakups l l Divestitures—the sale of a division of the company to a third party Equity carve-outs—some of a subsidiary‘s shares are offered for sale to the general public u Split-off IPOs—a private company offers a part of the company to the public l Bust-ups—voluntary liquidation of all of the company’s business Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 50

Taxable Breakups l l Divestitures—the sale of a division of the company to a third party Equity carve-outs—some of a subsidiary‘s shares are offered for sale to the general public u Split-off IPOs—a private company offers a part of the company to the public l Bust-ups—voluntary liquidation of all of the company’s business Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 50

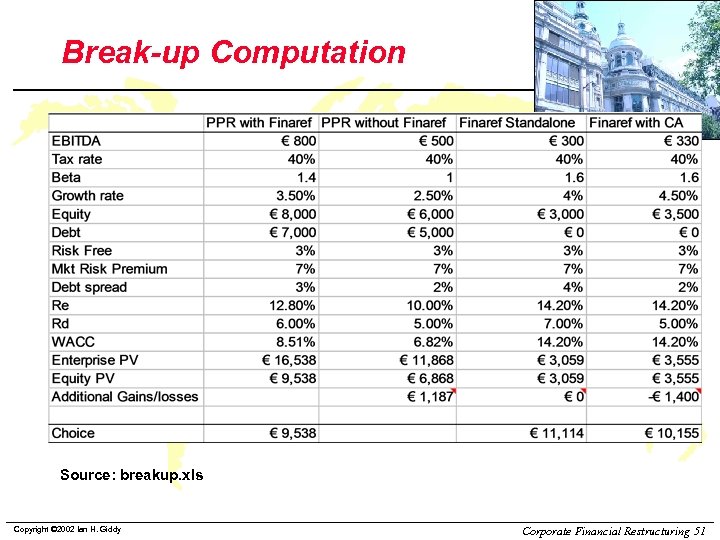

Break-up Computation Source: breakup. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 51

Break-up Computation Source: breakup. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 51

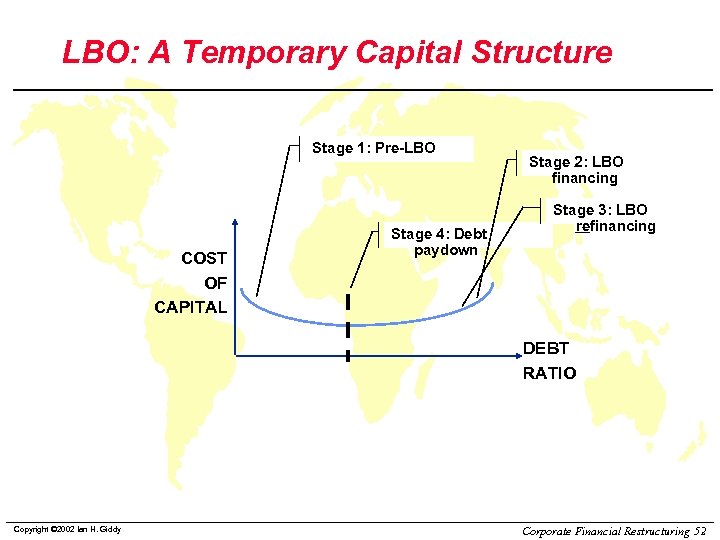

LBO: A Temporary Capital Structure Stage 1: Pre-LBO COST OF CAPITAL Stage 4: Debt paydown Stage 2: LBO financing Stage 3: LBO refinancing DEBT RATIO Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 52

LBO: A Temporary Capital Structure Stage 1: Pre-LBO COST OF CAPITAL Stage 4: Debt paydown Stage 2: LBO financing Stage 3: LBO refinancing DEBT RATIO Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 52

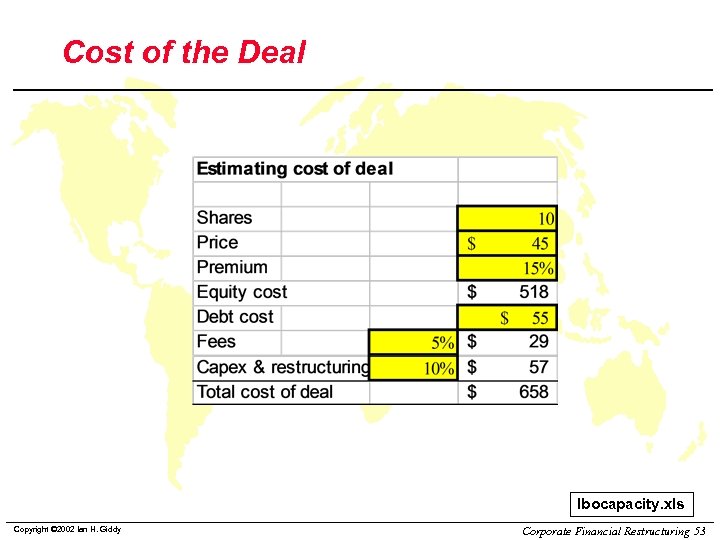

Cost of the Deal lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 53

Cost of the Deal lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 53

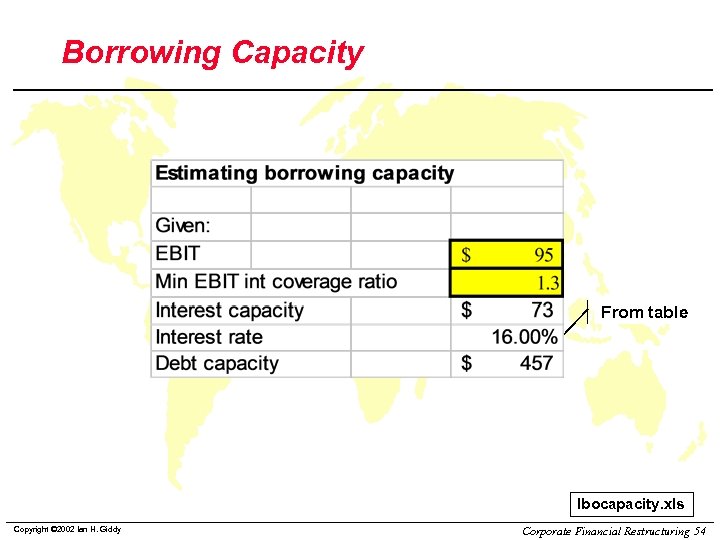

Borrowing Capacity From table lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 54

Borrowing Capacity From table lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 54

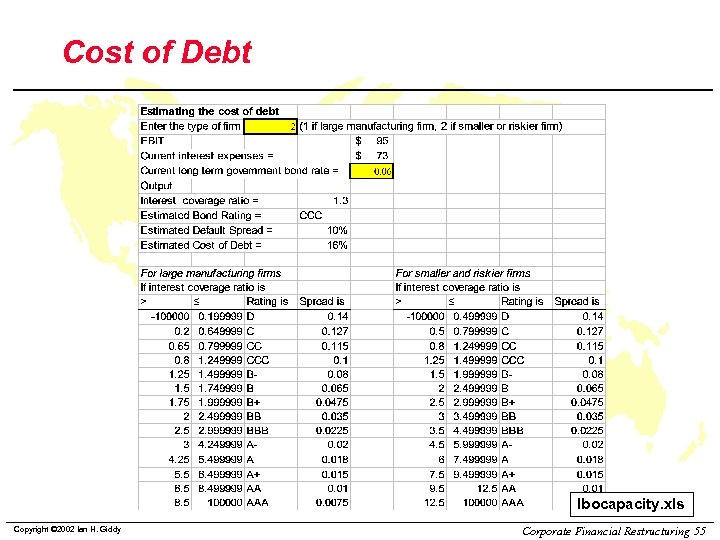

Cost of Debt lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 55

Cost of Debt lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 55

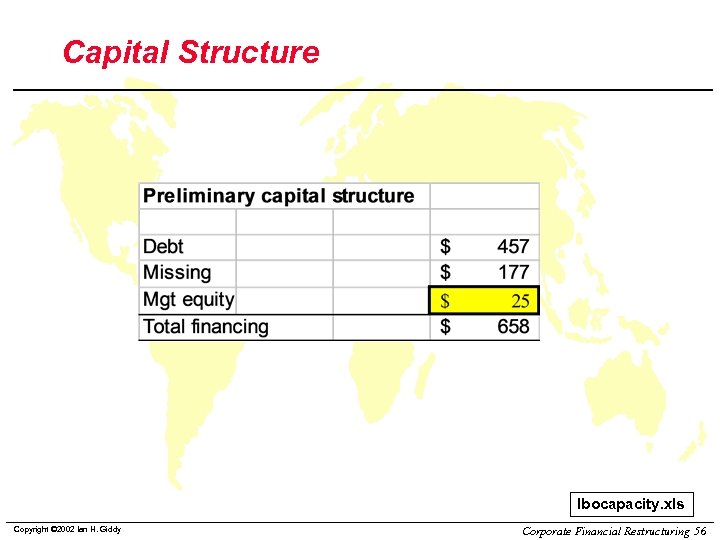

Capital Structure lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 56

Capital Structure lbocapacity. xls Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 56

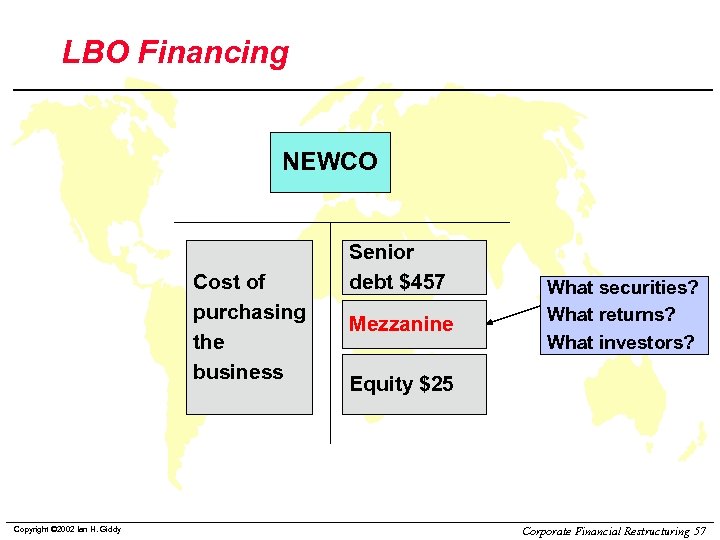

LBO Financing NEWCO Cost of purchasing the business Copyright © 2002 Ian H. Giddy Senior debt $457 Mezzanine What securities? What returns? What investors? Equity $25 Corporate Financial Restructuring 57

LBO Financing NEWCO Cost of purchasing the business Copyright © 2002 Ian H. Giddy Senior debt $457 Mezzanine What securities? What returns? What investors? Equity $25 Corporate Financial Restructuring 57

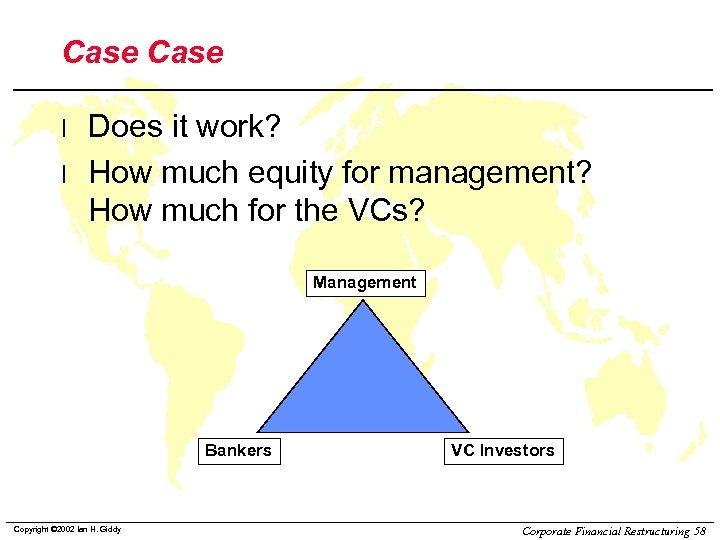

Case l l Does it work? How much equity for management? How much for the VCs? Management Bankers Copyright © 2002 Ian H. Giddy VC Investors Corporate Financial Restructuring 58

Case l l Does it work? How much equity for management? How much for the VCs? Management Bankers Copyright © 2002 Ian H. Giddy VC Investors Corporate Financial Restructuring 58

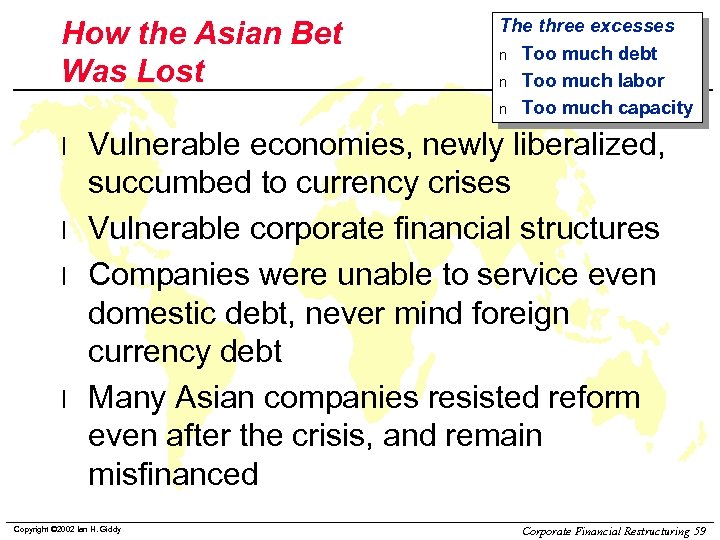

How the Asian Bet Was Lost l l The three excesses n Too much debt n Too much labor n Too much capacity Vulnerable economies, newly liberalized, succumbed to currency crises Vulnerable corporate financial structures Companies were unable to service even domestic debt, never mind foreign currency debt Many Asian companies resisted reform even after the crisis, and remain misfinanced Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 59

How the Asian Bet Was Lost l l The three excesses n Too much debt n Too much labor n Too much capacity Vulnerable economies, newly liberalized, succumbed to currency crises Vulnerable corporate financial structures Companies were unable to service even domestic debt, never mind foreign currency debt Many Asian companies resisted reform even after the crisis, and remain misfinanced Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 59

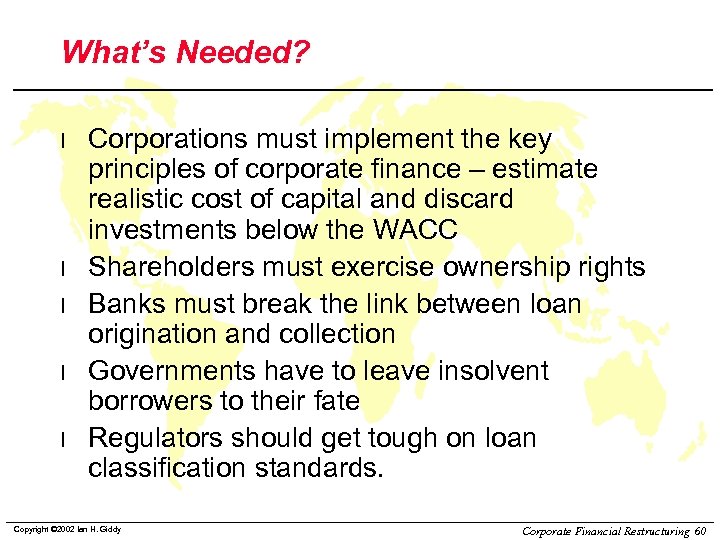

What’s Needed? l l l Corporations must implement the key principles of corporate finance – estimate realistic cost of capital and discard investments below the WACC Shareholders must exercise ownership rights Banks must break the link between loan origination and collection Governments have to leave insolvent borrowers to their fate Regulators should get tough on loan classification standards. Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 60

What’s Needed? l l l Corporations must implement the key principles of corporate finance – estimate realistic cost of capital and discard investments below the WACC Shareholders must exercise ownership rights Banks must break the link between loan origination and collection Governments have to leave insolvent borrowers to their fate Regulators should get tough on loan classification standards. Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 60

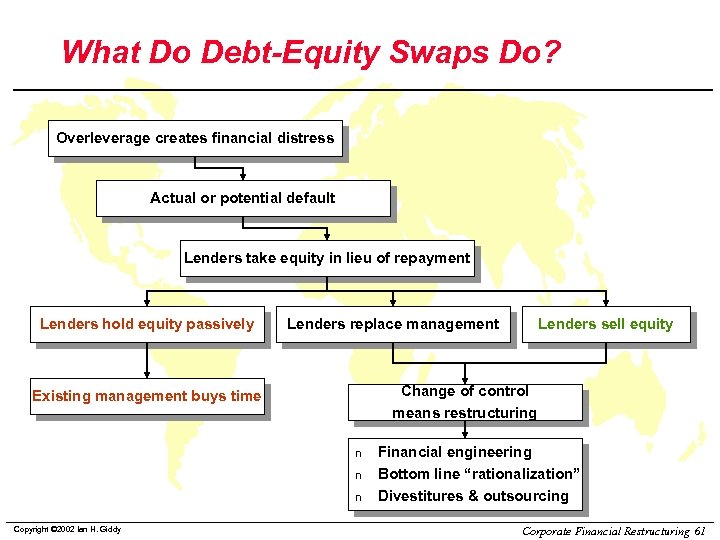

What Do Debt-Equity Swaps Do? Overleverage creates financial distress Actual or potential default Lenders take equity in lieu of repayment Lenders hold equity passively Lenders replace management Change of control means restructuring Existing management buys time n n n Copyright © 2002 Ian H. Giddy Lenders sell equity Financial engineering Bottom line “rationalization” Divestitures & outsourcing Corporate Financial Restructuring 61

What Do Debt-Equity Swaps Do? Overleverage creates financial distress Actual or potential default Lenders take equity in lieu of repayment Lenders hold equity passively Lenders replace management Change of control means restructuring Existing management buys time n n n Copyright © 2002 Ian H. Giddy Lenders sell equity Financial engineering Bottom line “rationalization” Divestitures & outsourcing Corporate Financial Restructuring 61

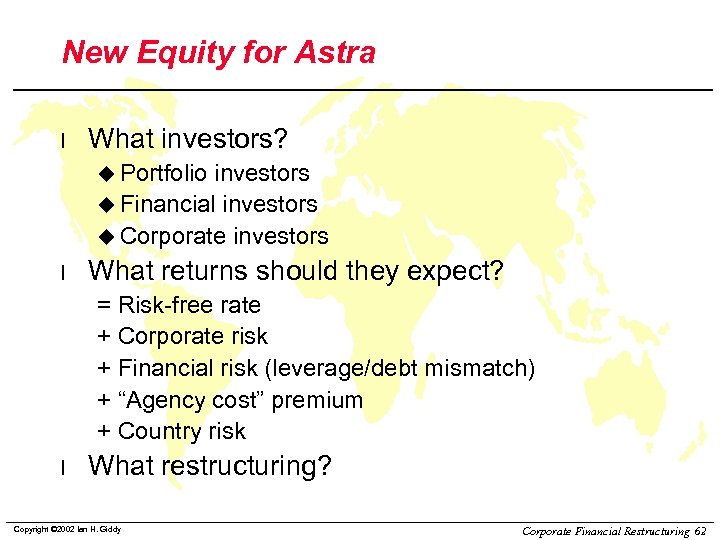

New Equity for Astra l What investors? u Portfolio investors u Financial investors u Corporate investors l What returns should they expect? = Risk-free rate + Corporate risk + Financial risk (leverage/debt mismatch) + “Agency cost” premium + Country risk l What restructuring? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 62

New Equity for Astra l What investors? u Portfolio investors u Financial investors u Corporate investors l What returns should they expect? = Risk-free rate + Corporate risk + Financial risk (leverage/debt mismatch) + “Agency cost” premium + Country risk l What restructuring? Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 62

Contact Info Ian H. Giddy NYU Stern School of Business Tel 212 -998 -0426; Fax 212 -995 -4233 Ian. giddy@nyu. edu http: //giddy. org Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 66

Contact Info Ian H. Giddy NYU Stern School of Business Tel 212 -998 -0426; Fax 212 -995 -4233 Ian. giddy@nyu. edu http: //giddy. org Copyright © 2002 Ian H. Giddy Corporate Financial Restructuring 66