0f2dc234719e593137be6b65678eb7ef.ppt

- Количество слайдов: 19

Review Group 291 – Balancing Arrangements Default Cashout Workshop 3 – 21 st June 2010

Introduction ® Primary objective is to update the SMP default values ® A number of ways to achieve the objective: ® Use ‘operational costs’ to reflect imbalance costs to SO ® Use ‘market prices’ to reflect possible shipper actions to balance ® SMP default values should essentially provide: ® a commercial incentive to balance and, ® a proxy for the use and valuation of system flexibility ® We should also consider the interactions between the use of SMP defaults and the development of a Linepack product

Contents ® Action from previous meeting ® Overview of potential options ® Other considerations ® Recommendations

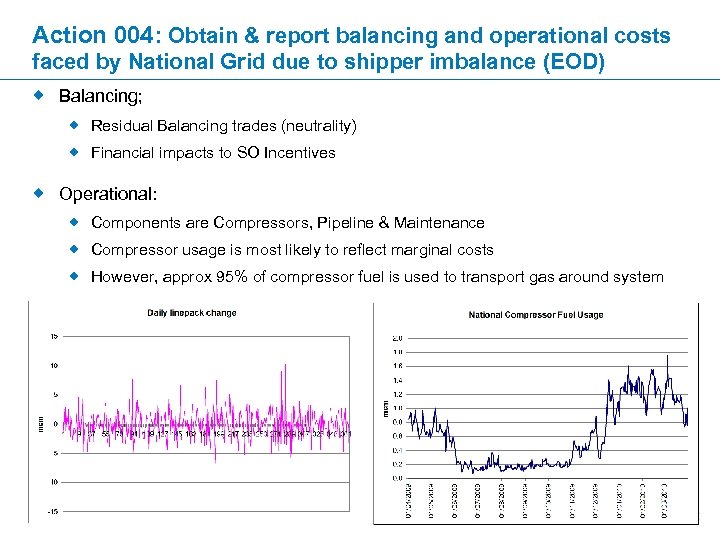

Action 004: Obtain & report balancing and operational costs faced by National Grid due to shipper imbalance (EOD) ® Balancing; ® Residual Balancing trades (neutrality) ® Financial impacts to SO Incentives ® Operational: ® Components are Compressors, Pipeline & Maintenance ® Compressor usage is most likely to reflect marginal costs ® However, approx 95% of compressor fuel is used to transport gas around system

Compressor costs to derive default values? Current SMP Buy = 0. 0288 p/k. Wh Current SMP Sell = 0. 0324 p/k. Wh ® Some initial figures; ® In 2008/9 approx 3, 894 GWh of gas to fuel NTS compressors ® 5% of the above = 195 GWh ® In 2009 the gross shipper imbalance i. e. total amount of gas ‘cashed out’ was 28, 378 GWh, net 41. 6 GWh ® Average SAP for 2008/9 was 1. 89 p/k. Wh ® Possible methodology; ® Multiply 5% of compressor fuel use by average SAP = £ 3. 7 M ® Divide £ 3. 7 M by 28, 378 GWh = 0. 0128 p/k. Wh

Further development of RG 291 options 1. Retain the current SMP default values 2. Remove the SMP fixed differentials 3. Base differentials on transportation charges 4. Update SMP default values with current Hornsea prices 5. Use Market prices; a) Apply a % SAP or alternative market price b) Use forward prices to calculate default 6. Existing Methodology Any other possible options?

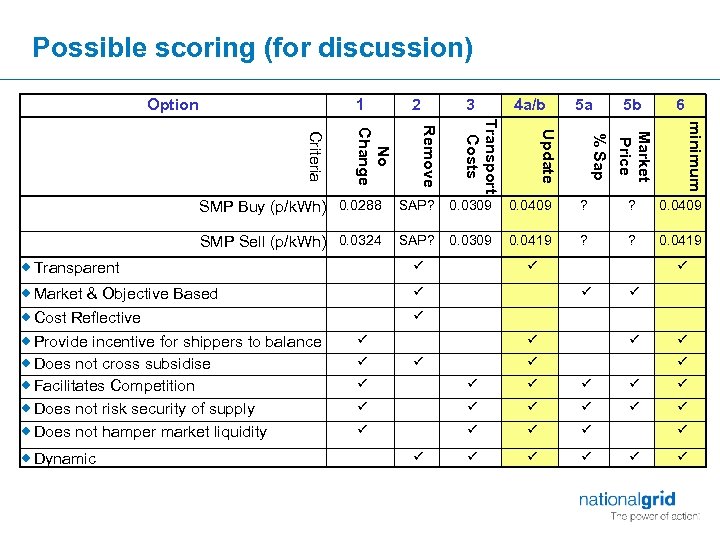

Criteria ® ® ® ® ® Transparent Market & objective based Cost reflective Provide incentive for shippers to balance Does not cross-subsidise Facilitates competition Does not risk security of supply Does not hamper market liquidity Dynamic

Option 1 – Retain current default values Current SMP Buy = 0. 0288 p/k. Wh Current SMP Sell = 0. 0324 p/k. Wh ® Retain SMP Buy default as SAP +0. 0288 p/k. Wh, SMP Sell as SAP -0. 0324 p/k. Wh ® Pros ® Comparing pre 2001 to 2009, the volume of gas ‘cashed out’ has decreased from 7% to between 2 -4% ® Reduction in neutrality costs to industry ® Consensus of Review Group was that current values are potentially arbitrary (may not satisfy EU balancing rules) ® Gas sources & flows in 2010 are different to 2001 (not reflective of market) ® National Grid believes that ‘do nothing’ is not an option

Option 2 – Remove SMP fixed defaults Current SMP Buy = 0. 0288 p/k. Wh Current SMP Sell = 0. 0324 p/k. Wh ® Remove default cashout so that SMP Buy & Sell is set solely by Residual Balancing trades ® What do we do use for days with no trades? SAP? ® Pros ® Removes arbitrary nature of defaults ® Solely reflects Residual Balancing trades ® Cons ® Might reduce the shippers’ commercial incentive to balance ® Increase in SO Residual Balancing actions? ® Wider industry impacts e. g. Investment signals, NBP & Storage contracts

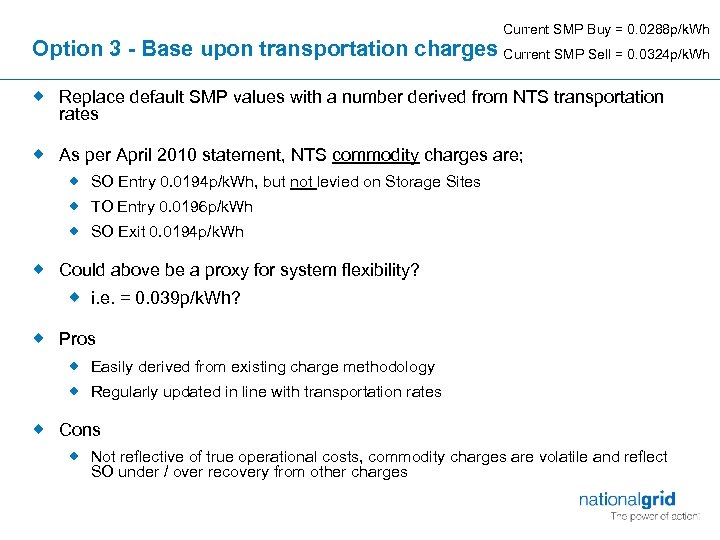

Current SMP Buy = 0. 0288 p/k. Wh Option 3 - Base upon transportation charges Current SMP Sell = 0. 0324 p/k. Wh ® Replace default SMP values with a number derived from NTS transportation rates ® As per April 2010 statement, NTS commodity charges are; ® SO Entry 0. 0194 p/k. Wh, but not levied on Storage Sites ® TO Entry 0. 0196 p/k. Wh ® SO Exit 0. 0194 p/k. Wh ® Could above be a proxy for system flexibility? ® i. e. = 0. 039 p/k. Wh? ® Pros ® Easily derived from existing charge methodology ® Regularly updated in line with transportation rates ® Cons ® Not reflective of true operational costs, commodity charges are volatile and reflect SO under / over recovery from other charges

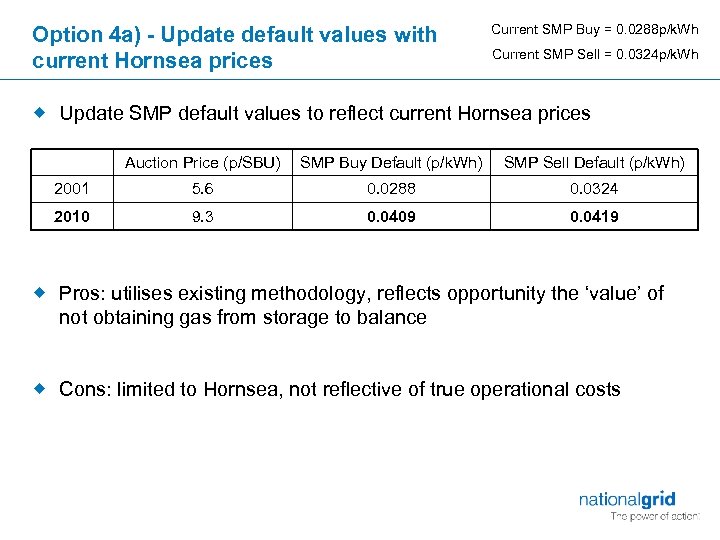

Option 4 a) - Update default values with current Hornsea prices Current SMP Buy = 0. 0288 p/k. Wh Current SMP Sell = 0. 0324 p/k. Wh ® Update SMP default values to reflect current Hornsea prices Auction Price (p/SBU) SMP Buy Default (p/k. Wh) SMP Sell Default (p/k. Wh) 2001 5. 6 0. 0288 0. 0324 2010 9. 3 0. 0409 0. 0419 ® Pros: utilises existing methodology, reflects opportunity the ‘value’ of not obtaining gas from storage to balance ® Cons: limited to Hornsea, not reflective of true operational costs

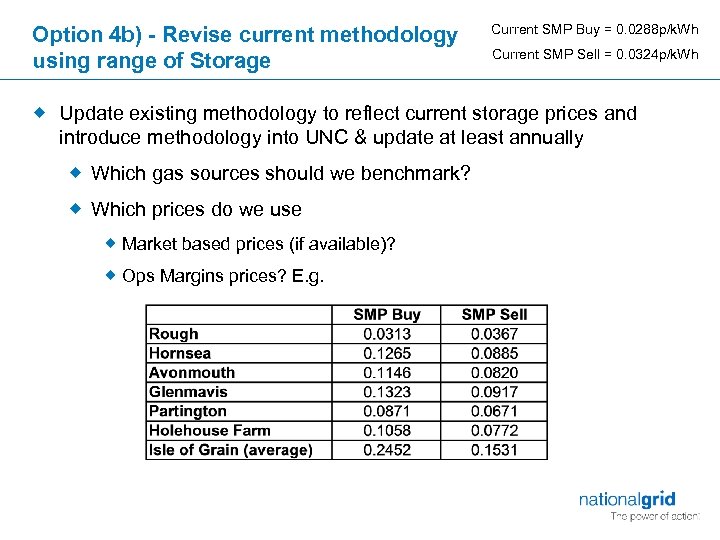

Option 4 b) - Revise current methodology using range of Storage Current SMP Buy = 0. 0288 p/k. Wh Current SMP Sell = 0. 0324 p/k. Wh ® Update existing methodology to reflect current storage prices and introduce methodology into UNC & update at least annually ® Which gas sources should we benchmark? ® Which prices do we use ® Market based prices (if available)? ® Ops Margins prices? E. g.

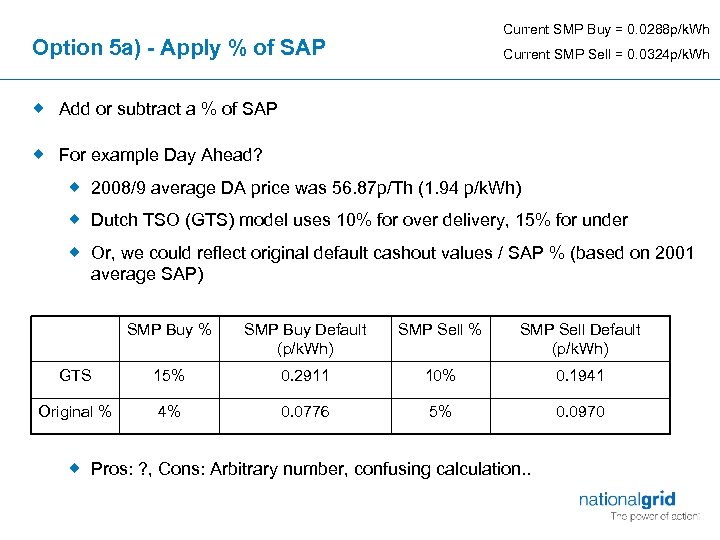

Current SMP Buy = 0. 0288 p/k. Wh Option 5 a) - Apply % of SAP Current SMP Sell = 0. 0324 p/k. Wh ® Add or subtract a % of SAP ® For example Day Ahead? ® 2008/9 average DA price was 56. 87 p/Th (1. 94 p/k. Wh) ® Dutch TSO (GTS) model uses 10% for over delivery, 15% for under ® Or, we could reflect original default cashout values / SAP % (based on 2001 average SAP) SMP Buy % SMP Buy Default (p/k. Wh) SMP Sell % SMP Sell Default (p/k. Wh) GTS 15% 0. 2911 10% 0. 1941 Original % 4% 0. 0776 5% 0. 0970 ® Pros: ? , Cons: Arbitrary number, confusing calculation. .

Current SMP Buy = 0. 0288 p/k. Wh Option 5 b) – Utilise forward prices Current SMP Sell = 0. 0324 p/k. Wh ® Replace current default prices with figure derived from a price-spread based on market prices? ® Assumption is that market prices should reflect all associated costs (e. g. storage etc) ® Options; ® SAP Day 1 less SAP Day 2? ® WD less DA, or DA less WD (depending on which is larger)? ® A rolling average of WD-DA premium? ® Winter vs Summer Premium? ® Reference to Project Discovery work e. g. encourage Seasonal Storage? ® Pros: market based, dynamic. ® Cons: Potentially confusing, no consistent default

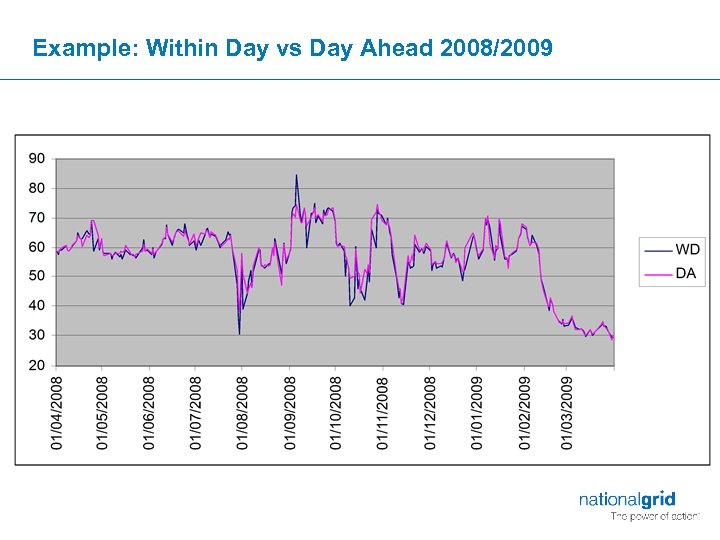

Example: Within Day vs Day Ahead 2008/2009

Option 6 – Existing Methodology? Current SMP Buy = 0. 0288 p/k. Wh Current SMP Sell = 0. 0324 p/k. Wh ® Update current defaults ® Introduce existing default cashout methodology into UNC ® Introduce regular (annual) reviews of input prices ® Introduce a regular review of gas source inputs to ensure relevance

Possible scoring (for discussion) Option 1 2 3 4 a/b 5 a 5 b 6 minimum Market Price % Sap Update Transport Costs Remove No Change Criteria SMP Buy (p/k. Wh) 0. 0288 SAP? 0. 0309 0. 0409 ? ? 0. 0409 SMP Sell (p/k. Wh) 0. 0324 SAP? 0. 0309 0. 0419 ? ? 0. 0419 ® Transparent ü ® Market & Objective Based ® Cost Reflective ® Provide incentive for shippers to balance ® Does not cross subsidise ® Facilitates Competition ® Does not risk security of supply ® Does not hamper market liquidity ü ® Dynamic ü ü ü ü ü ü ü ü ü

Other considerations ® IS ® Development lead-times ® Costs ® SMP references within Industry contracts ® NBP ’ 97 (trading) contracts ® Storage ® SO Incentive ® Linepack ® Price Performance Measure

Recommendations ® Baseline ‘Option 6’ ® Update fixed defaults using current default values & relevant sources ® Incorporate methodology into UNC ® Update methodology on an annual basis, or when new relevant UK gas sources become available ® Further develop Operational Costs & Market based default?

0f2dc234719e593137be6b65678eb7ef.ppt