Царева,презентация.pptx

- Количество слайдов: 5

Revenue recognition

Revenue recognition

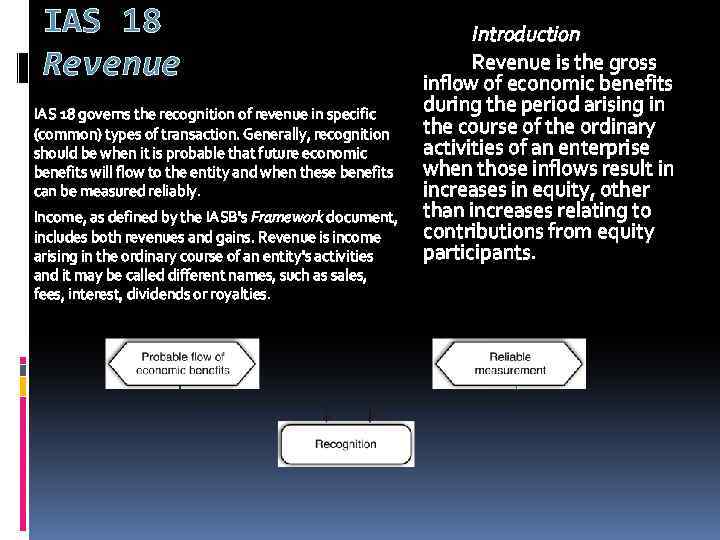

IAS 18 Revenue IAS 18 governs the recognition of revenue in specific (common) types of transaction. Generally, recognition should be when it is probable that future economic benefits will flow to the entity and when these benefits can be measured reliably. Income, as defined by the IASB's Framework document, includes both revenues and gains. Revenue is income arising in the ordinary course of an entity's activities and it may be called different names, such as sales, fees, interest, dividends or royalties. Introduction Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an enterprise when those inflows result in increases in equity, other than increases relating to contributions from equity participants.

IAS 18 Revenue IAS 18 governs the recognition of revenue in specific (common) types of transaction. Generally, recognition should be when it is probable that future economic benefits will flow to the entity and when these benefits can be measured reliably. Income, as defined by the IASB's Framework document, includes both revenues and gains. Revenue is income arising in the ordinary course of an entity's activities and it may be called different names, such as sales, fees, interest, dividends or royalties. Introduction Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an enterprise when those inflows result in increases in equity, other than increases relating to contributions from equity participants.

Scope Interest is the charge for the use of cash or cash equivalents or amounts due to the enterprise. Royalties are charges for the use of non-current assets of the enterprise, eg patents, computer software and trademarks. Dividends are distributions of profit to holders of equity investments, in proportion with their holdings, of each relevant class of capital. The standard specifically excludes various types of revenue arising from leases, insurance contracts, changes in value of financial instruments or other current assets natural increases in agricultural assets and mineral ore extraction. IAS 18 Revenue is concerned with the recognition of revenues arising from fairly common transactions or events. – The sale of goods – The rendering of services – The use by others of enterprise assets yielding interest, royalties and dividends Interest, royalties and dividends are included as income because they arise from the use of an enterprise's assets by other parties.

Scope Interest is the charge for the use of cash or cash equivalents or amounts due to the enterprise. Royalties are charges for the use of non-current assets of the enterprise, eg patents, computer software and trademarks. Dividends are distributions of profit to holders of equity investments, in proportion with their holdings, of each relevant class of capital. The standard specifically excludes various types of revenue arising from leases, insurance contracts, changes in value of financial instruments or other current assets natural increases in agricultural assets and mineral ore extraction. IAS 18 Revenue is concerned with the recognition of revenues arising from fairly common transactions or events. – The sale of goods – The rendering of services – The use by others of enterprise assets yielding interest, royalties and dividends Interest, royalties and dividends are included as income because they arise from the use of an enterprise's assets by other parties.

Reporting the substance of the transaction In some cases, what initially appears to be a sale transaction may turn out to be something different and a sale should not be recognised. It is important that the substance of the transaction is reported and not just its legal form. In other words, you need to understand exactly what is happening with a single transaction or series of transactions. For example, Mac. Dougal Drinks sold 100 barrels of Brew No 1 to the Scots Bank, on 30 June 2009 for $100 per barrel. When Brew No 1 is mature in two years time it will be worth $500 per barrel. Mac. Dougal retains custody of the barrels. The sale contract contains a clause requiring Mac. Dougal to repurchase the barrels on 30 June 2011 for $150 per barrel.

Reporting the substance of the transaction In some cases, what initially appears to be a sale transaction may turn out to be something different and a sale should not be recognised. It is important that the substance of the transaction is reported and not just its legal form. In other words, you need to understand exactly what is happening with a single transaction or series of transactions. For example, Mac. Dougal Drinks sold 100 barrels of Brew No 1 to the Scots Bank, on 30 June 2009 for $100 per barrel. When Brew No 1 is mature in two years time it will be worth $500 per barrel. Mac. Dougal retains custody of the barrels. The sale contract contains a clause requiring Mac. Dougal to repurchase the barrels on 30 June 2011 for $150 per barrel.

Revenue recognition – interpretations A number of Interpretations have been issued, first by the SIC and then by the IFRIC in relation to IAS 18. These Interpretations carry the same authority as IAS 18 itself. The issue IAS 18 made a distinction between barter transactions involving goods or services that are similar in nature, and barter transactions of goods/services that are dissimilar in nature. It allowed entities to recognise revenue where the goods/services exchanged are dissimilar, but not when they are similar. IAS 18 then measured this barter revenue at the fair value of the goods exchanged, plus or minus any cash that was included in the deal. If the value of the goods received could not be measured reliably, then per IAS 18 the revenue is to be measured as the fair value of the goods provided. SIC 31 (issued in 2001) seeks to clarify the situation where the good/service being bartered is advertising. The issue is: how to reliably measure the fair value of advertising services received? The answer according to SIC 31 is that this is impossible. SIC 31’s solution is not to measure revenue as the fair value of the actual advertising service being received, but to measure instead the fair value of the advertising services that the entity provided or sold. This can be measured as the fair value of similar advertising services to those sold, but which were not sold in barter transactions. SIC 31’s criteria are that these non-barter transactions must: (a)Involve advertising similar to the advertising in the barter transaction (b)Occur frequently (c)Represent a predominant number of transactions and amount when compared to all transactions to provide advertising that is similar to the advertising in the barter transaction (d)Involve cash and/or another form of consideration (eg marketable securities, non-monetary assets, and other services) that has a reliably measurable fair value (e)Not involve the same counterparty as in the barter transaction So broadly speaking, where dissimilar advertising services are bartered, the entity should measure revenue received at the fair value of advertising services that it has sold that are similar to those that it provided in the barter transaction.

Revenue recognition – interpretations A number of Interpretations have been issued, first by the SIC and then by the IFRIC in relation to IAS 18. These Interpretations carry the same authority as IAS 18 itself. The issue IAS 18 made a distinction between barter transactions involving goods or services that are similar in nature, and barter transactions of goods/services that are dissimilar in nature. It allowed entities to recognise revenue where the goods/services exchanged are dissimilar, but not when they are similar. IAS 18 then measured this barter revenue at the fair value of the goods exchanged, plus or minus any cash that was included in the deal. If the value of the goods received could not be measured reliably, then per IAS 18 the revenue is to be measured as the fair value of the goods provided. SIC 31 (issued in 2001) seeks to clarify the situation where the good/service being bartered is advertising. The issue is: how to reliably measure the fair value of advertising services received? The answer according to SIC 31 is that this is impossible. SIC 31’s solution is not to measure revenue as the fair value of the actual advertising service being received, but to measure instead the fair value of the advertising services that the entity provided or sold. This can be measured as the fair value of similar advertising services to those sold, but which were not sold in barter transactions. SIC 31’s criteria are that these non-barter transactions must: (a)Involve advertising similar to the advertising in the barter transaction (b)Occur frequently (c)Represent a predominant number of transactions and amount when compared to all transactions to provide advertising that is similar to the advertising in the barter transaction (d)Involve cash and/or another form of consideration (eg marketable securities, non-monetary assets, and other services) that has a reliably measurable fair value (e)Not involve the same counterparty as in the barter transaction So broadly speaking, where dissimilar advertising services are bartered, the entity should measure revenue received at the fair value of advertising services that it has sold that are similar to those that it provided in the barter transaction.