11a04e9e04157ccaf18e59f2fa170c7b.ppt

- Количество слайдов: 27

Return to Risk Limited website: www. Risk. Limited. com Managing Credit Risk in Volatile Environments Energy Credit Risk Congress 2003 The Houstonian Hotel, Houston, TX November 12 -13, 2003 Organized by Risk Limited Michael K. Ong Professor and Director, Finance Program Executive Director, Center for Financial Markets Stuart Graduate School of Business Illinois Institute of Technology 312. 906. 6568. ong@stuart. iit. edu

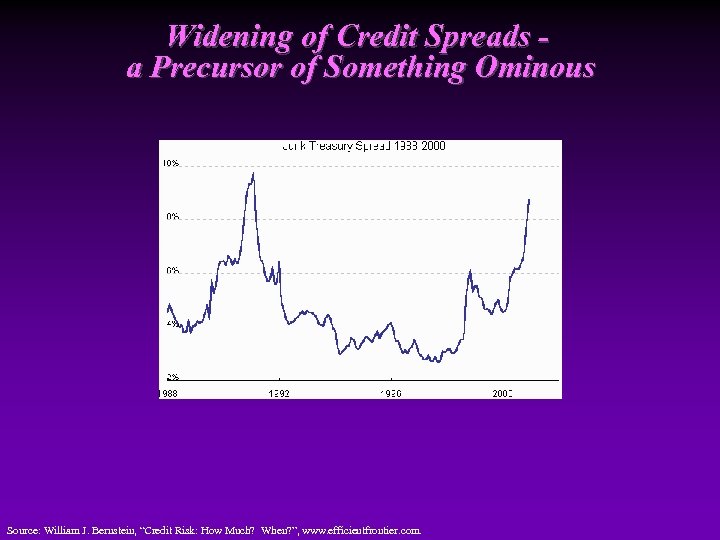

Widening of Credit Spreads a Precursor of Something Ominous Source: William J. Bernstein, “Credit Risk: How Much? When? ”, www. efficientfrontier. com.

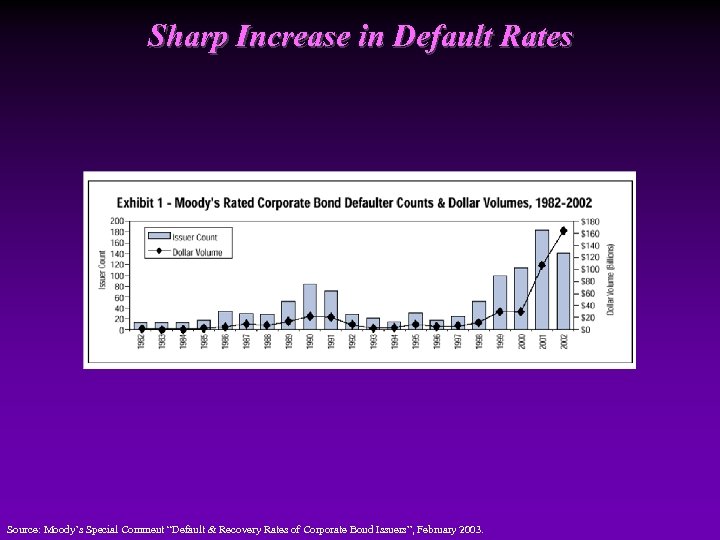

Sharp Increase in Default Rates Source: Moody’s Special Comment “Default & Recovery Rates of Corporate Bond Issuers”, February 2003.

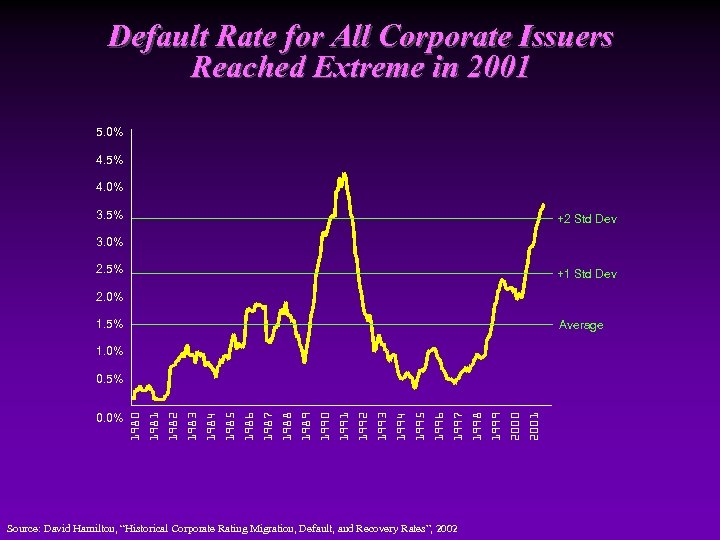

Default Rate for All Corporate Issuers Reached Extreme in 2001 5. 0% 4. 5% 4. 0% 3. 5% +2 Std Dev 3. 0% 2. 5% +1 Std Dev 2. 0% 1. 5% Average 1. 0% Source: David Hamilton, “Historical Corporate Rating Migration, Default, and Recovery Rates”, 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 0. 0% 1980 0. 5%

10 Largest Rated Corporate Bond Defaults 1) World. Com, Inc. $23. 2 Billion 2) Enron Corp. $9. 9 Billion 3) NTL Communications Corp. $8. 5 Billion 4) Adelphia Communications Corp. $6. 9 Billion 5) Finova Capital Corp. $6. 3 Billion 6) United Pan-Europe Communications $5. 1 Billion 7) Pacific Gas & Electric Co. $5. 0 Billion 8) XO Communications Inc. $4. 9 Billion 9) Southern California Edison Co. $4. 7 Billion 10) Global Crossing Holdings LTD $3. 8 Billion Total: Source: David Hamilton, “Historical Corporate Rating Migration, Default, and Recovery Rates”, 2002 $78. 3 Billion

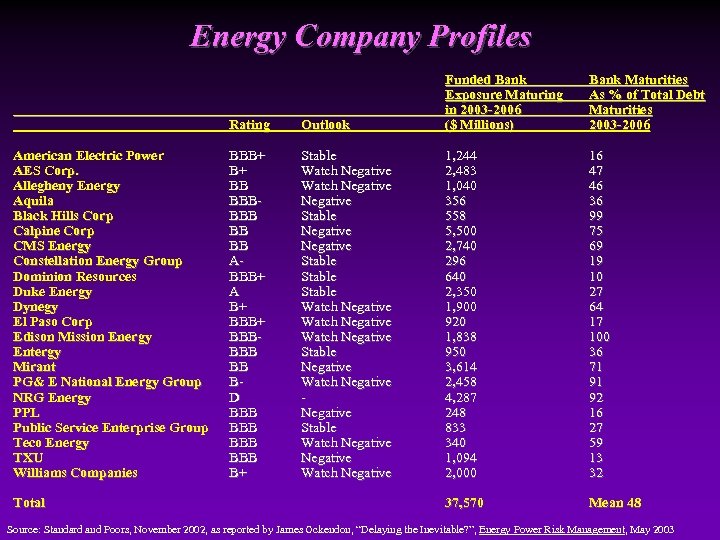

Energy Company Profiles Rating American Electric Power AES Corp. Allegheny Energy Aquila Black Hills Corp Calpine Corp CMS Energy Constellation Energy Group Dominion Resources Duke Energy Dynegy El Paso Corp Edison Mission Energy Entergy Mirant PG& E National Energy Group NRG Energy PPL Public Service Enterprise Group Teco Energy TXU Williams Companies Total Outlook Funded Bank Exposure Maturing in 2003 -2006 ($ Millions) Bank Maturities As % of Total Debt Maturities 2003 -2006 BBB+ B+ BB BBBBBB BB BB ABBB+ A B+ BBBBBB BB BD BBB BBB B+ Stable Watch Negative Stable Negative Stable Watch Negative Stable Negative Watch Negative Stable Watch Negative 1, 244 2, 483 1, 040 356 558 5, 500 2, 740 296 640 2, 350 1, 900 920 1, 838 950 3, 614 2, 458 4, 287 248 833 340 1, 094 2, 000 16 47 46 36 99 75 69 19 10 27 64 17 100 36 71 91 92 16 27 59 13 32 37, 570 Mean 48 Source: Standard and Poors, November 2002, as reported by James Ockendon, “Delaying the Inevitable? ”, Energy Power Risk Management, May 2003

Behavioral Reactions to Uncertainty • Defining credit culture “A credit culture is made up of principles that need to be communicated. A credit culture is rooted in corporate attitudes, philosophies, traditions, and standards that require administrative underpinnings. The role of credit culture is to create a risk management climate that will foster … good banking …” Henry Muller* • Corporate priorities “How much risk? ” versus “How much return? ” • Credit discipline Proper metrics for risk and performance measurement. * Henry Muller, “Risk Management and the Credit Culture - A Necessary Interaction”, Credit Risk Management (Robert Morris Associates) 1995.

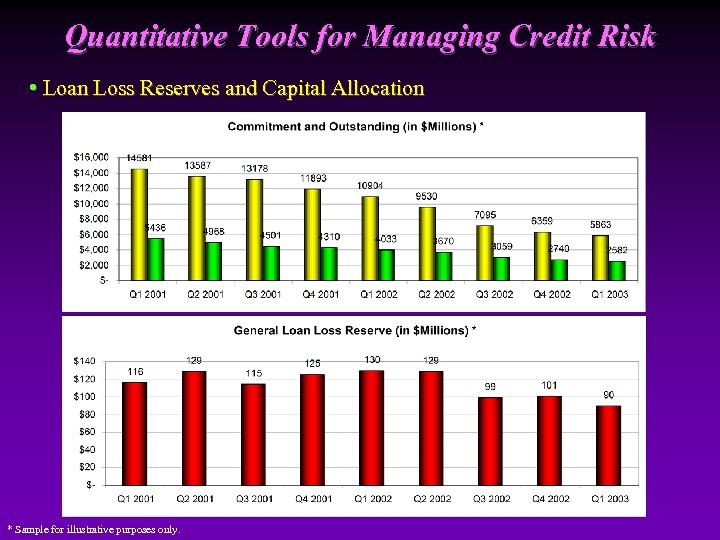

Quantitative Tools for Managing Credit Risk • Loan Loss Reserves and Capital Allocation * Sample for illustrative purposes only.

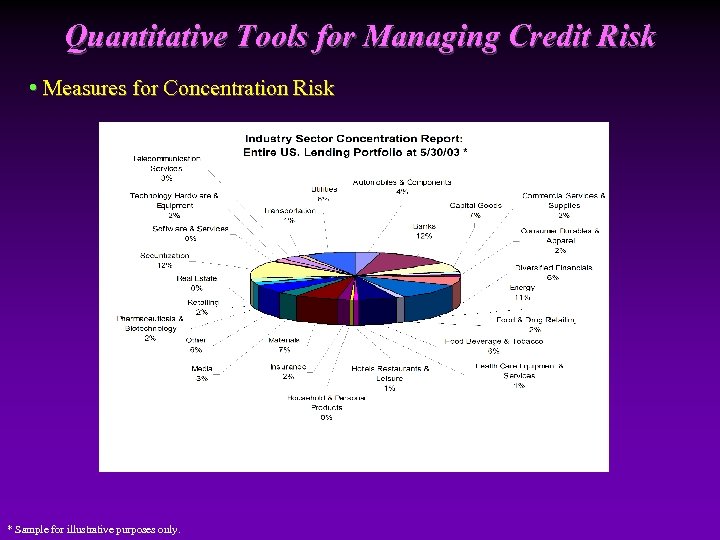

Quantitative Tools for Managing Credit Risk • Measures for Concentration Risk * Sample for illustrative purposes only.

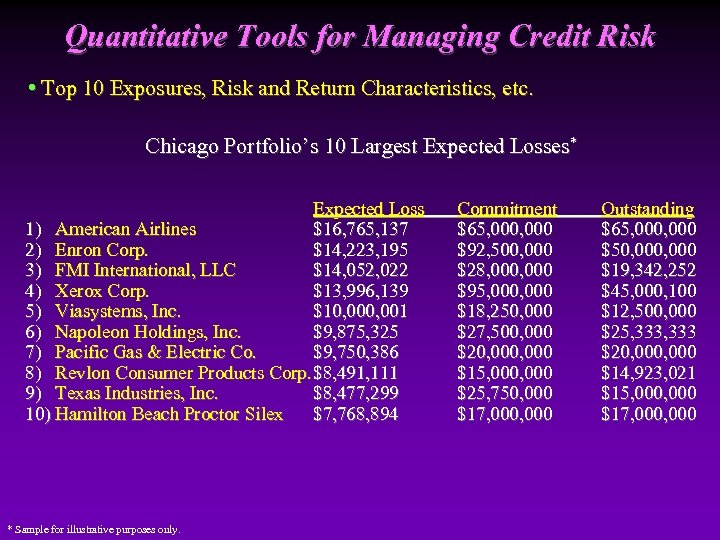

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. Chicago Portfolio’s 10 Largest Expected Losses* Expected Loss 1) American Airlines $16, 765, 137 2) Enron Corp. $14, 223, 195 3) FMI International, LLC $14, 052, 022 4) Xerox Corp. $13, 996, 139 5) Viasystems, Inc. $10, 001 6) Napoleon Holdings, Inc. $9, 875, 325 7) Pacific Gas & Electric Co. $9, 750, 386 8) Revlon Consumer Products Corp. $8, 491, 111 9) Texas Industries, Inc. $8, 477, 299 10) Hamilton Beach Proctor Silex $7, 768, 894 * Sample for illustrative purposes only. Commitment $65, 000 $92, 500, 000 $28, 000 $95, 000 $18, 250, 000 $27, 500, 000 $20, 000 $15, 000 $25, 750, 000 $17, 000 Outstanding $65, 000 $50, 000 $19, 342, 252 $45, 000, 100 $12, 500, 000 $25, 333 $20, 000 $14, 923, 021 $15, 000 $17, 000

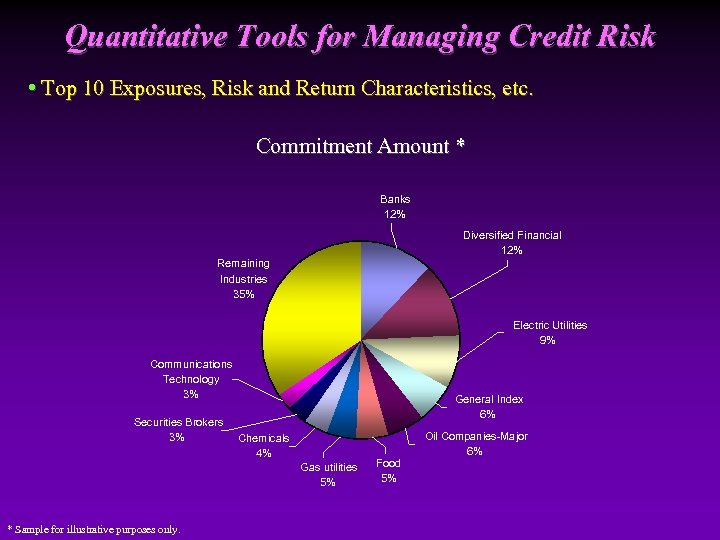

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. Commitment Amount * Banks 12% Diversified Financial 12% Remaining Industries 35% Electric Utilities 9% Communications Technology 3% Securities Brokers 3% General Index 6% Chemicals 4% Gas utilities 5% * Sample for illustrative purposes only. Food 5% Oil Companies-Major 6%

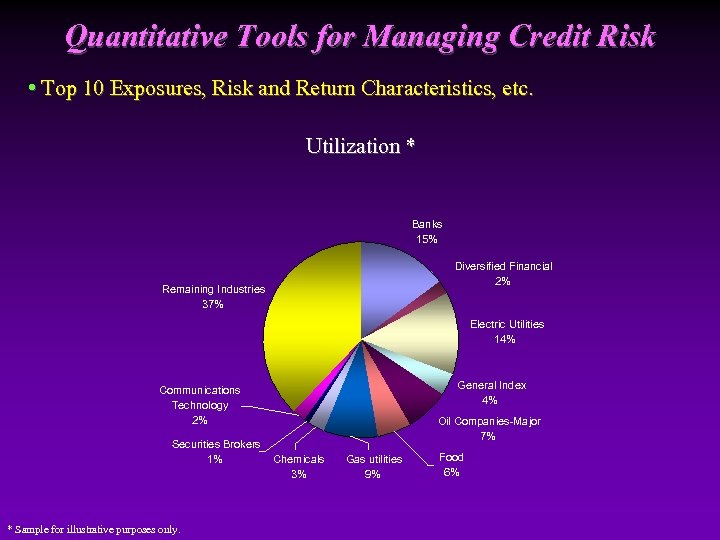

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. Utilization * Banks 15% Diversified Financial 2% Remaining Industries 37% Electric Utilities 14% General Index 4% Communications Technology 2% Securities Brokers 1% * Sample for illustrative purposes only. Oil Companies-Major 7% Chemicals 3% Gas utilities 9% Food 6%

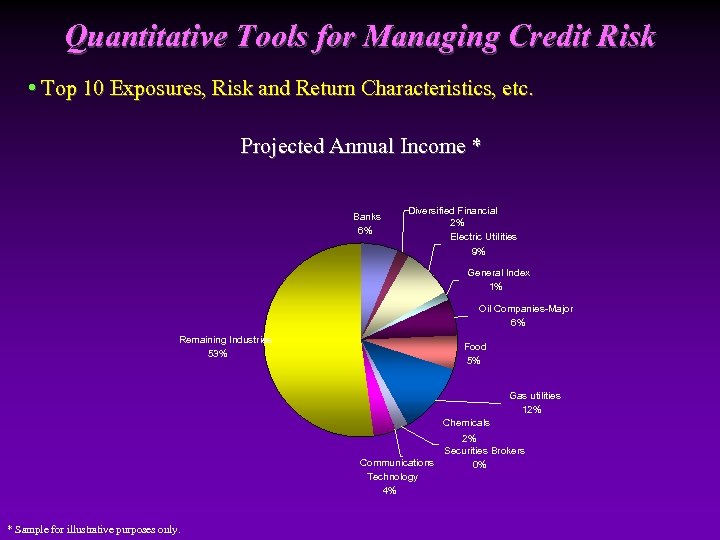

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. Projected Annual Income * Banks 6% Diversified Financial 2% Electric Utilities 9% General Index 1% Oil Companies-Major 6% Remaining Industries 53% Food 5% Gas utilities 12% Chemicals 2% Securities Brokers Communications 0% Technology 4% * Sample for illustrative purposes only.

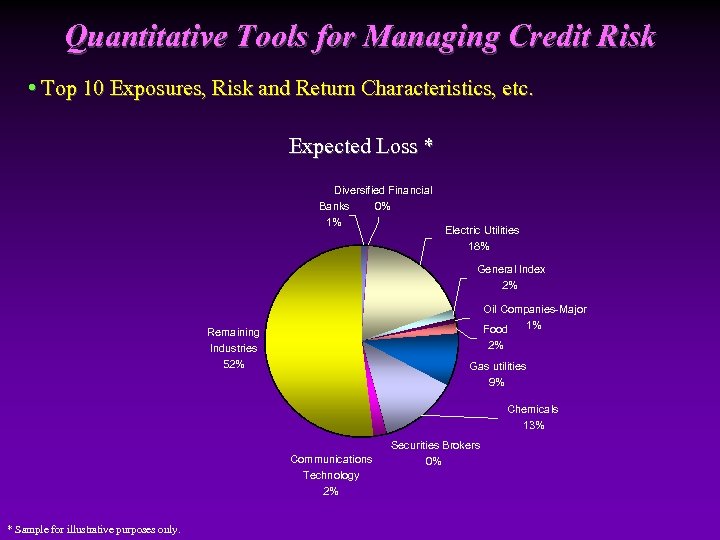

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. Expected Loss * Diversified Financial Banks 0% 1% Electric Utilities 18% General Index 2% Oil Companies-Major 1% Food Remaining Industries 52% 2% Gas utilities 9% Chemicals 13% Communications Technology 2% * Sample for illustrative purposes only. Securities Brokers 0%

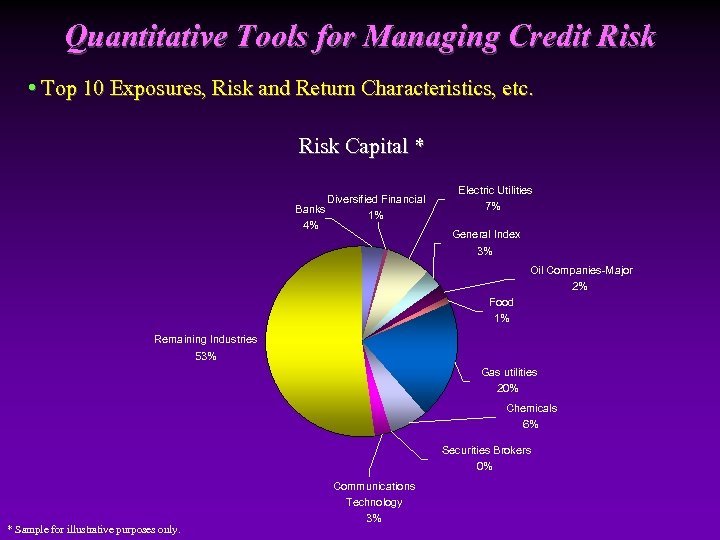

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. Risk Capital * Diversified Financial Banks 1% 4% Electric Utilities 7% General Index 3% Oil Companies-Major 2% Food 1% Remaining Industries 53% Gas utilities 20% Chemicals 6% Securities Brokers 0% * Sample for illustrative purposes only. Communications Technology 3%

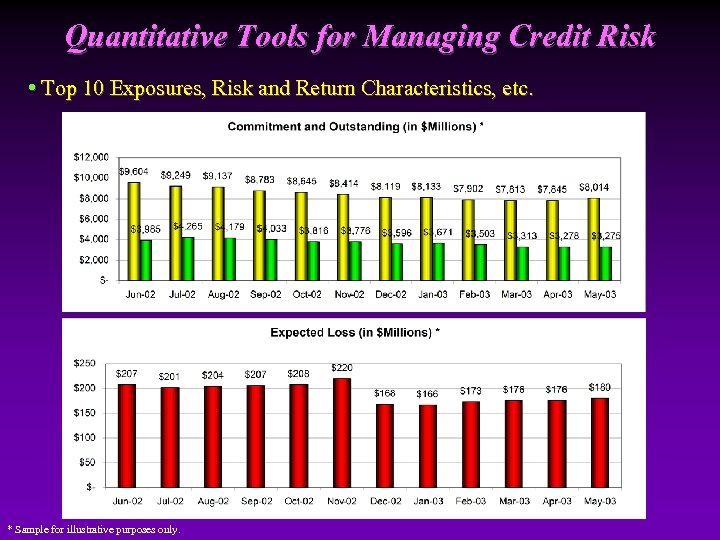

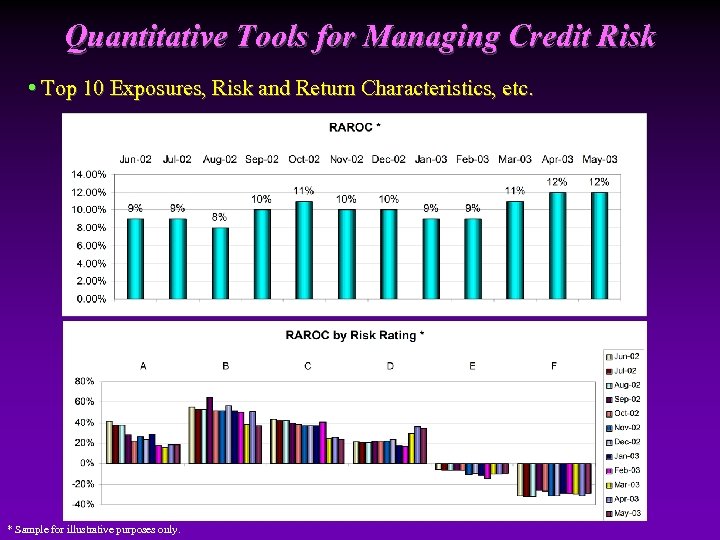

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. * Sample for illustrative purposes only.

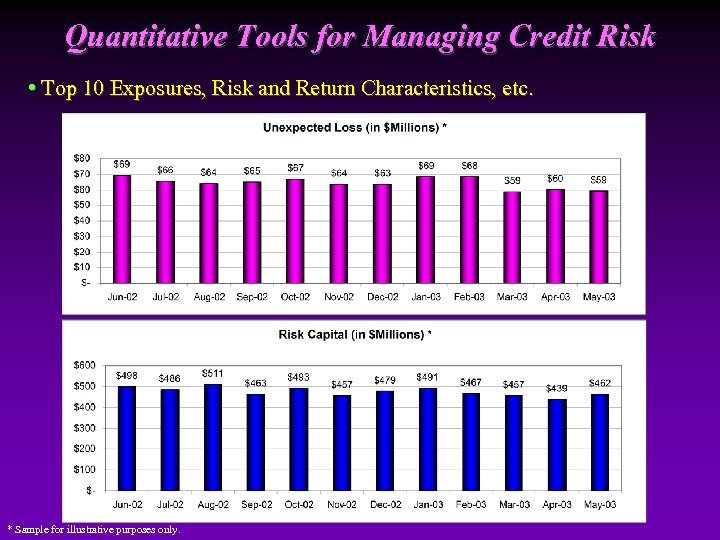

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. * Sample for illustrative purposes only.

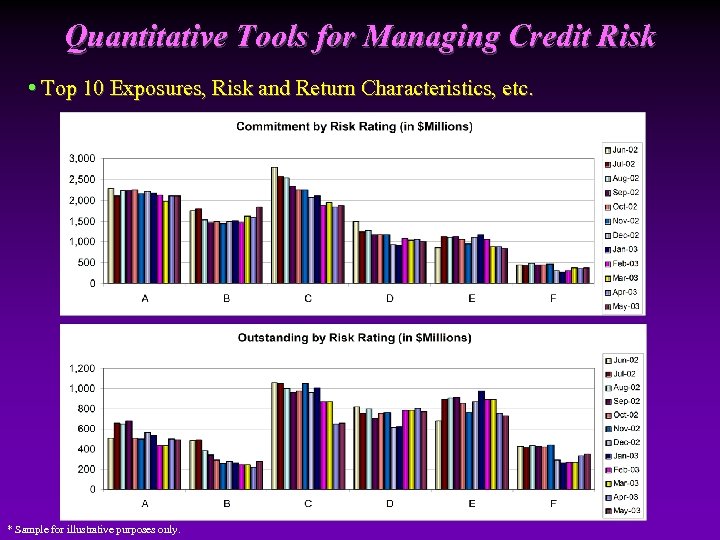

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. * Sample for illustrative purposes only.

Quantitative Tools for Managing Credit Risk • Top 10 Exposures, Risk and Return Characteristics, etc. * Sample for illustrative purposes only.

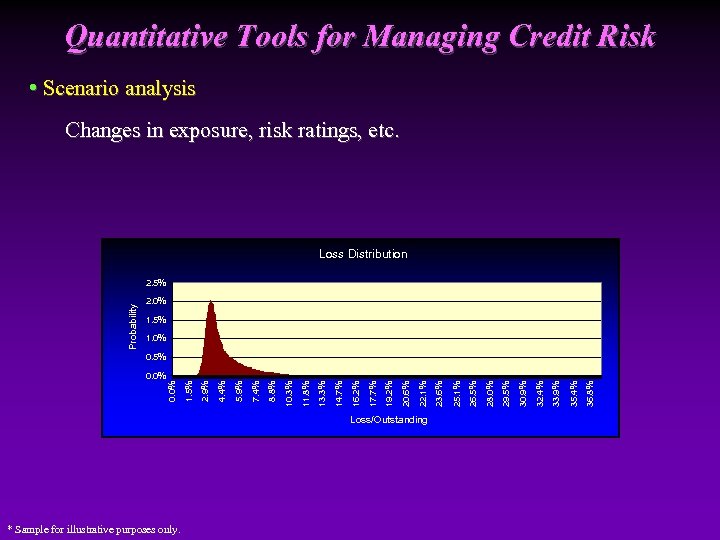

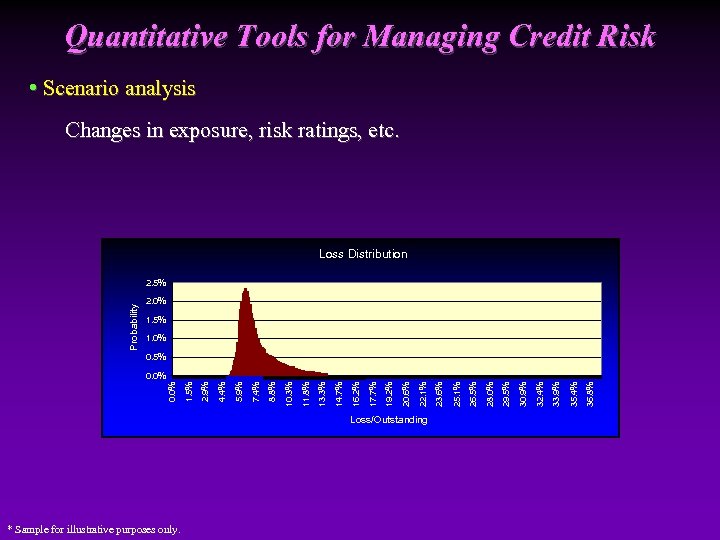

Quantitative Tools for Managing Credit Risk • Scenario analysis Changes in exposure, risk ratings, etc. Loss Distribution Probability 2. 5% 2. 0% 1. 5% 1. 0% 0. 5% Loss/Outstanding * Sample for illustrative purposes only. 36. 8% 35. 4% 33. 9% 32. 4% 30. 9% 29. 5% 28. 0% 26. 5% 25. 1% 23. 6% 22. 1% 20. 6% 19. 2% 17. 7% 16. 2% 14. 7% 13. 3% 11. 8% 10. 3% 8. 8% 7. 4% 5. 9% 4. 4% 2. 9% 1. 5% 0. 0%

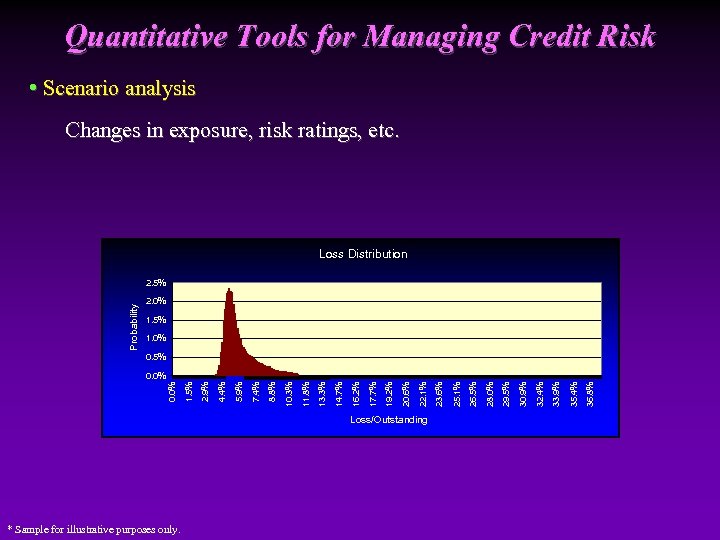

Quantitative Tools for Managing Credit Risk • Scenario analysis Changes in exposure, risk ratings, etc. Loss Distribution Probability 2. 5% 2. 0% 1. 5% 1. 0% 0. 5% Loss/Outstanding * Sample for illustrative purposes only. 36. 8% 35. 4% 33. 9% 32. 4% 30. 9% 29. 5% 28. 0% 26. 5% 25. 1% 23. 6% 22. 1% 20. 6% 19. 2% 17. 7% 16. 2% 14. 7% 13. 3% 11. 8% 10. 3% 8. 8% 7. 4% 5. 9% 4. 4% 2. 9% 1. 5% 0. 0%

Quantitative Tools for Managing Credit Risk • Scenario analysis Changes in exposure, risk ratings, etc. Loss Distribution Probability 2. 5% 2. 0% 1. 5% 1. 0% 0. 5% Loss/Outstanding * Sample for illustrative purposes only. 36. 8% 35. 4% 33. 9% 32. 4% 30. 9% 29. 5% 28. 0% 26. 5% 25. 1% 23. 6% 22. 1% 20. 6% 19. 2% 17. 7% 16. 2% 14. 7% 13. 3% 11. 8% 10. 3% 8. 8% 7. 4% 5. 9% 4. 4% 2. 9% 1. 5% 0. 0%

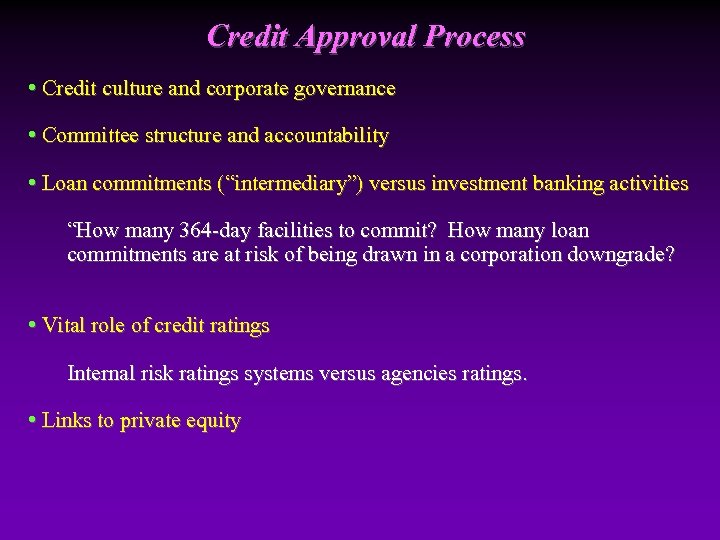

Credit Approval Process • Credit culture and corporate governance • Committee structure and accountability • Loan commitments (“intermediary”) versus investment banking activities “How many 364 -day facilities to commit? How many loan commitments are at risk of being drawn in a corporation downgrade? • Vital role of credit ratings Internal risk ratings systems versus agencies ratings. • Links to private equity

Loan Review Process and the Role of Workout • Review process Monitoring frequency. What drives an upgrade/downgrade? • Disciplined approach • Close involvement of relationship managers, risk managers, and investment bankers • When does “Workout” begin? Asset and collateral valuation Expected loss Restructuring schemes

Credit Culture Revisited • Communicating risk and hedging policies Limits on concentration risk. Use of credit derivatives. • List of qualified buy/sell protection names • Curse of concentration

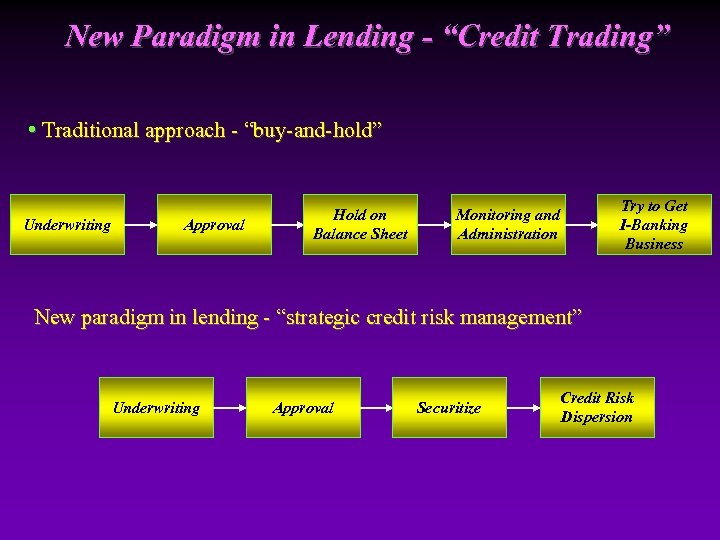

New Paradigm in Lending - “Credit Trading” • Traditional approach - “buy-and-hold” Underwriting Approval Hold on Balance Sheet Monitoring and Administration Try to Get I-Banking Business New paradigm in lending - “strategic credit risk management” Underwriting Approval Securitize Credit Risk Dispersion

Concluding Remark A good credit risk management process built on sound credit culture and solid principles can withstand any volatile market conditions.

11a04e9e04157ccaf18e59f2fa170c7b.ppt