2b0651c95f5f4486b5d1534befcc65b6.ppt

- Количество слайдов: 58

Retirement

Retirement

FEATURING THE PPC PROCEDURES & DEVELOPMENT STAFF

FEATURING THE PPC PROCEDURES & DEVELOPMENT STAFF

Top 10 Things You Should Know About Retirement

Top 10 Things You Should Know About Retirement

10 References • VOW TO HIRE HEROES ACT (2011) • TITLE TEN, US CODE (CHAPTER 58) • TITLE TEN, US CODE (CHAPTER 59) • TITLE TEN, US CODE (SECTION 1293) • COMMANDANT INSTRUCTION 1900. 1 (PRE-SEPARATION COUNSELING) • COMMANDANT INSTRUCTION 1900. 2 A (TRANSITION ASSISTANCE PROGRAM)

10 References • VOW TO HIRE HEROES ACT (2011) • TITLE TEN, US CODE (CHAPTER 58) • TITLE TEN, US CODE (CHAPTER 59) • TITLE TEN, US CODE (SECTION 1293) • COMMANDANT INSTRUCTION 1900. 1 (PRE-SEPARATION COUNSELING) • COMMANDANT INSTRUCTION 1900. 2 A (TRANSITION ASSISTANCE PROGRAM)

10 References • TRICARE DENTAL • EXPRESS SCRIPTS • SGLI • SBPRCSBP RAS WEBSITE

10 References • TRICARE DENTAL • EXPRESS SCRIPTS • SGLI • SBPRCSBP RAS WEBSITE

9 TAPS TRANSITION ASSISTANCE PROGRAM • 2 years prior to Retirement and 1 year before separation • Work Life Staff SEMINAR HANDOUT

9 TAPS TRANSITION ASSISTANCE PROGRAM • 2 years prior to Retirement and 1 year before separation • Work Life Staff SEMINAR HANDOUT

9 TAPS WHAT’S THE PROCESS? Step 1: Pre-Separation Counseling Brief (Log in to CG LMS at http: //elearning. uscg. mil) • Transition e. Form DD-2648 (https: //www. dodtap. mil/login. html) • Complete Military Occupational Codes (MOC) Crosswalk on-line course (http: //jko. jten. mil/) • Register for your e. Benefits Premium account: (http: //www. ebenefits. va. gov) • Ensure DEERS is correct

9 TAPS WHAT’S THE PROCESS? Step 1: Pre-Separation Counseling Brief (Log in to CG LMS at http: //elearning. uscg. mil) • Transition e. Form DD-2648 (https: //www. dodtap. mil/login. html) • Complete Military Occupational Codes (MOC) Crosswalk on-line course (http: //jko. jten. mil/) • Register for your e. Benefits Premium account: (http: //www. ebenefits. va. gov) • Ensure DEERS is correct

9 TAPS WHAT’S THE PROCESS (Cont’d)? Step Two: • Transition Assistance Manager • Schedule your attendance

9 TAPS WHAT’S THE PROCESS (Cont’d)? Step Two: • Transition Assistance Manager • Schedule your attendance

9 TAPS WHAT’S COVERED? • VA BENEFITS • RESUME WRITING • JOB INTERVIEWING • JOB SKILLS Do. DTAP • DISABILITY (TAKE MEDICAL RECORDS)

9 TAPS WHAT’S COVERED? • VA BENEFITS • RESUME WRITING • JOB INTERVIEWING • JOB SKILLS Do. DTAP • DISABILITY (TAKE MEDICAL RECORDS)

8 Relocation Retirement Relocation Entitlements: q. Travel and Transportation Entitlements q. Household Goods (HHG) q. Storage in Transit (SIT)

8 Relocation Retirement Relocation Entitlements: q. Travel and Transportation Entitlements q. Household Goods (HHG) q. Storage in Transit (SIT)

7 Ret. Pay Calc. 4 Different Military Retirement Plans: • DIEMS date on or before 7 SEP 80 – 2. 5% X YOS (50% at 20) • DIEMS date after 8 SEP 80 prior to 1 AUG 86 (No CSB – 2. 5 X YOS, High 36) • DIEMS date after 1 AUG 86 (Elected CSB – 2% X YOS – 3 ½% after 20 YOS X High 36) - REDUX • Effective 1 JAN 18 - Blended Retirement System (BRS) Military Separations - COMDTINST M 1000. 4

7 Ret. Pay Calc. 4 Different Military Retirement Plans: • DIEMS date on or before 7 SEP 80 – 2. 5% X YOS (50% at 20) • DIEMS date after 8 SEP 80 prior to 1 AUG 86 (No CSB – 2. 5 X YOS, High 36) • DIEMS date after 1 AUG 86 (Elected CSB – 2% X YOS – 3 ½% after 20 YOS X High 36) - REDUX • Effective 1 JAN 18 - Blended Retirement System (BRS) Military Separations - COMDTINST M 1000. 4

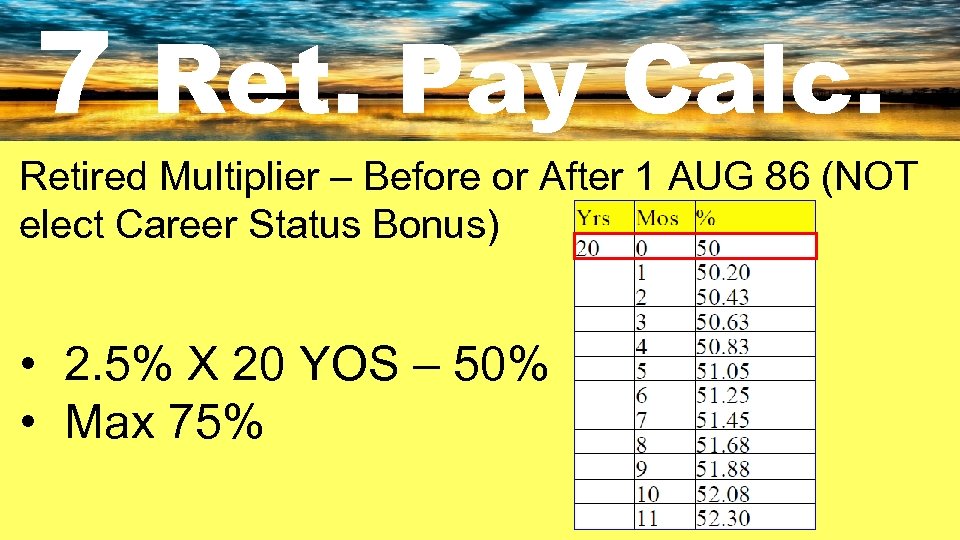

7 Ret. Pay Calc. Retired Multiplier – Before or After 1 AUG 86 (NOT elect Career Status Bonus) • 2. 5% X 20 YOS – 50% • Max 75%

7 Ret. Pay Calc. Retired Multiplier – Before or After 1 AUG 86 (NOT elect Career Status Bonus) • 2. 5% X 20 YOS – 50% • Max 75%

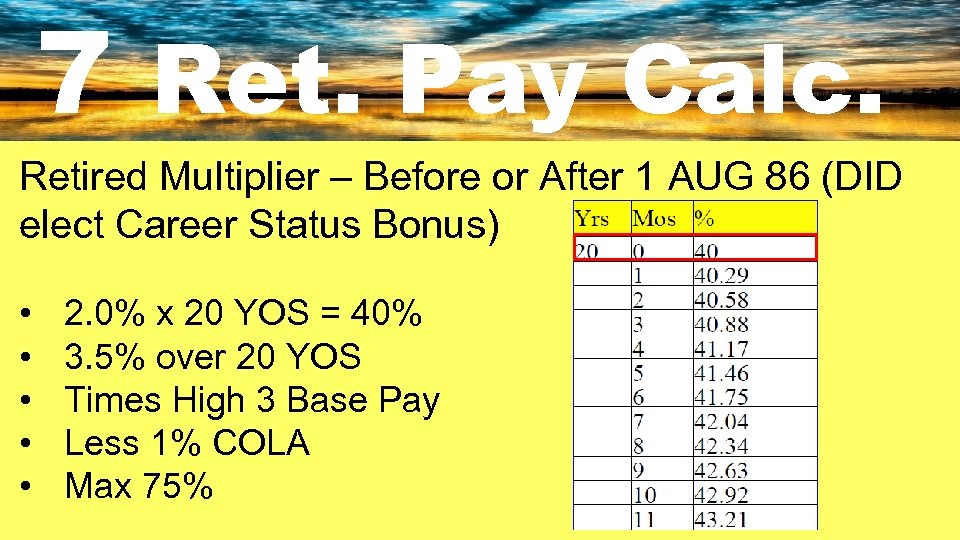

7 Ret. Pay Calc. Retired Multiplier – Before or After 1 AUG 86 (DID elect Career Status Bonus) • • • 2. 0% x 20 YOS = 40% 3. 5% over 20 YOS Times High 3 Base Pay Less 1% COLA Max 75%

7 Ret. Pay Calc. Retired Multiplier – Before or After 1 AUG 86 (DID elect Career Status Bonus) • • • 2. 0% x 20 YOS = 40% 3. 5% over 20 YOS Times High 3 Base Pay Less 1% COLA Max 75%

7 Ret. Pay Calc. • In ALL cases members who had previously drilling Reserve service are entitled to an additional day of active duty credit for each Reserve Point Earned. • Currently credit is given to DRILLS only! • Veterans Administration compensation factor. • Delayed Entry Program (DEP) and Service Academy is not creditable • 10% Extra for Heroism

7 Ret. Pay Calc. • In ALL cases members who had previously drilling Reserve service are entitled to an additional day of active duty credit for each Reserve Point Earned. • Currently credit is given to DRILLS only! • Veterans Administration compensation factor. • Delayed Entry Program (DEP) and Service Academy is not creditable • 10% Extra for Heroism

7 Ret. Pay Calc. Blended Retirement System (BRS) Effective 1 Jan 18 Standby for additional information to be announced

7 Ret. Pay Calc. Blended Retirement System (BRS) Effective 1 Jan 18 Standby for additional information to be announced

6 Leave & Authorized Absences When you retire, you can: • Use or sell all of your leave. • Sell a total of 60 days in a military career. • Career Intentions Worksheet 60 days prior to using your terminal leave.

6 Leave & Authorized Absences When you retire, you can: • Use or sell all of your leave. • Sell a total of 60 days in a military career. • Career Intentions Worksheet 60 days prior to using your terminal leave.

6 Leave & Authorized Absences Permissive Orders: Retiring members are eligible for an administrative absence not to exceed 20 days (INCONUS) or 30 days (OCONUS) • CO’s discretion • Can be consecutive or in increments • Cannot be combined with leave or liberty

6 Leave & Authorized Absences Permissive Orders: Retiring members are eligible for an administrative absence not to exceed 20 days (INCONUS) or 30 days (OCONUS) • CO’s discretion • Can be consecutive or in increments • Cannot be combined with leave or liberty

6 Leave & Authorized Absences Retirement Processing Point (RPP): • • • RPP policy helps a retiring member transition to their desired area and is granted by PSC - EPM/OPM RPP is not a PCS transfer and a member cannot be reimbursed for any costs. RPP must be a Coast Guard unit. RPP is within a reasonable commuting distance to the member’s Home of Selection (HOS) HOS must be designated on their retirement orders.

6 Leave & Authorized Absences Retirement Processing Point (RPP): • • • RPP policy helps a retiring member transition to their desired area and is granted by PSC - EPM/OPM RPP is not a PCS transfer and a member cannot be reimbursed for any costs. RPP must be a Coast Guard unit. RPP is within a reasonable commuting distance to the member’s Home of Selection (HOS) HOS must be designated on their retirement orders.

6 Leave & Authorized Absences Retirement Processing Point (RPP): • • Once approved, the member will be directed to report to a CG unit (their RPP) between 12 and 15 working days before their approved retirement date. Commanding Officers and SPOs must ensure all retirement related documentation is completed and signed prior to the member departing to their RPP.

6 Leave & Authorized Absences Retirement Processing Point (RPP): • • Once approved, the member will be directed to report to a CG unit (their RPP) between 12 and 15 working days before their approved retirement date. Commanding Officers and SPOs must ensure all retirement related documentation is completed and signed prior to the member departing to their RPP.

6 Leave & Authorized Absences Retirement Processing Point (RPP): • “This authorization issued with the understanding you will not receive reimbursement for expenses in connection with it. If you do not desire to bear this expense, consider this authorization cancelled. ” • Proceed time is not authorized to the RPP (1. G. 6. c of M 1000. 8 (series)) • RPP Authorization found in the JTR (5068 A. 3)

6 Leave & Authorized Absences Retirement Processing Point (RPP): • “This authorization issued with the understanding you will not receive reimbursement for expenses in connection with it. If you do not desire to bear this expense, consider this authorization cancelled. ” • Proceed time is not authorized to the RPP (1. G. 6. c of M 1000. 8 (series)) • RPP Authorization found in the JTR (5068 A. 3)

5 Entitlements Active Duty Entitlements/Benefits upon Retirement: • Paid through your last day of AD & deducted from your final pay. • Overpayments will be collected from your retired pay account. • SGLI for 120 days but VGLI must be started by you. Office of Servicemembers Group Life Insurance 1 -800 -419 -1473

5 Entitlements Active Duty Entitlements/Benefits upon Retirement: • Paid through your last day of AD & deducted from your final pay. • Overpayments will be collected from your retired pay account. • SGLI for 120 days but VGLI must be started by you. Office of Servicemembers Group Life Insurance 1 -800 -419 -1473

5 Entitlements Allotments/Benefits with Retirement: • CG_7221 Retired Allotment Authorization Form • Authorized allotments are on the reverse of the form • Delta Dental is not an allotment. • Cancel/changes through Delta Dental by calling 1 -888 -838 -8737 or 1 -888 -336 -3260. • CFC allotments are not authorized.

5 Entitlements Allotments/Benefits with Retirement: • CG_7221 Retired Allotment Authorization Form • Authorized allotments are on the reverse of the form • Delta Dental is not an allotment. • Cancel/changes through Delta Dental by calling 1 -888 -838 -8737 or 1 -888 -336 -3260. • CFC allotments are not authorized.

5 Entitlements Reserve Allotments/Benefits with Ret-1 Retirement: Retirement with Pay (Age 60) • CG-2055 A Retirement Transfer Request • Retired Military ID Card (blue) • Commissary/Exchange Benefits • TRICARE Medical Plan/Delta Dental • Eligible to convert SGLI to VGLI

5 Entitlements Reserve Allotments/Benefits with Ret-1 Retirement: Retirement with Pay (Age 60) • CG-2055 A Retirement Transfer Request • Retired Military ID Card (blue) • Commissary/Exchange Benefits • TRICARE Medical Plan/Delta Dental • Eligible to convert SGLI to VGLI

5 Entitlements Reserve Allotments/Benefits with Ret-2 Retirement: Retirement awaiting pay (Age 60) • CG-2055 A Retirement Transfer Request • Retired Military ID Card (pink) • Commissary/Exchange Benefits • TRICARE Retired Reserve ($$$$$$) • TRICARE Retired Dental Plan • Eligible to convert SGLI to VGLI

5 Entitlements Reserve Allotments/Benefits with Ret-2 Retirement: Retirement awaiting pay (Age 60) • CG-2055 A Retirement Transfer Request • Retired Military ID Card (pink) • Commissary/Exchange Benefits • TRICARE Retired Reserve ($$$$$$) • TRICARE Retired Dental Plan • Eligible to convert SGLI to VGLI

4 Requirements Reserve Retirement Eligibility (Non-regular Retirement) 20 Years of “Satisfactory Service” • • • Minimum 50 retirement points each Anniversary Year Combine Active Duty and Reserve service Must request retirement (CG-2055 A) Eligible for Ret-2 status (Retirement Awaiting Pay) Eligible for Ret-1 at 60 YOA (unless qualified earlier)

4 Requirements Reserve Retirement Eligibility (Non-regular Retirement) 20 Years of “Satisfactory Service” • • • Minimum 50 retirement points each Anniversary Year Combine Active Duty and Reserve service Must request retirement (CG-2055 A) Eligible for Ret-2 status (Retirement Awaiting Pay) Eligible for Ret-1 at 60 YOA (unless qualified earlier)

4 Requirements Reserve Retirement Eligibility (Non-regular Retirement) 30 Years of “Total Service” • • ALL military service, Active and Reserve (does not need to be “satisfactory”) Must request retirement (CG-2055 A) Removed from active status May request waiver

4 Requirements Reserve Retirement Eligibility (Non-regular Retirement) 30 Years of “Total Service” • • ALL military service, Active and Reserve (does not need to be “satisfactory”) Must request retirement (CG-2055 A) Removed from active status May request waiver

4 Requirements Reserve Retirement Eligibility (Regular Retirement) A Reservist may earn a regular retirement if they serve a minimum of 20 years of Active Duty military service.

4 Requirements Reserve Retirement Eligibility (Regular Retirement) A Reservist may earn a regular retirement if they serve a minimum of 20 years of Active Duty military service.

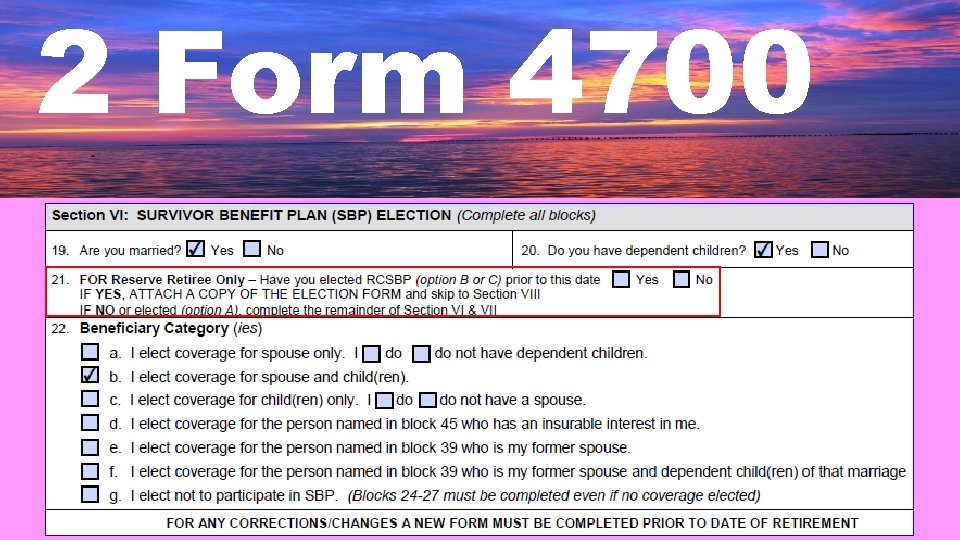

3 S. B. P. The Survivor Benefit Plan will provide a monthly income for a retiree’s survivors after his/her death.

3 S. B. P. The Survivor Benefit Plan will provide a monthly income for a retiree’s survivors after his/her death.

3 S. B. P. Definitions • Base Amount • Annuity

3 S. B. P. Definitions • Base Amount • Annuity

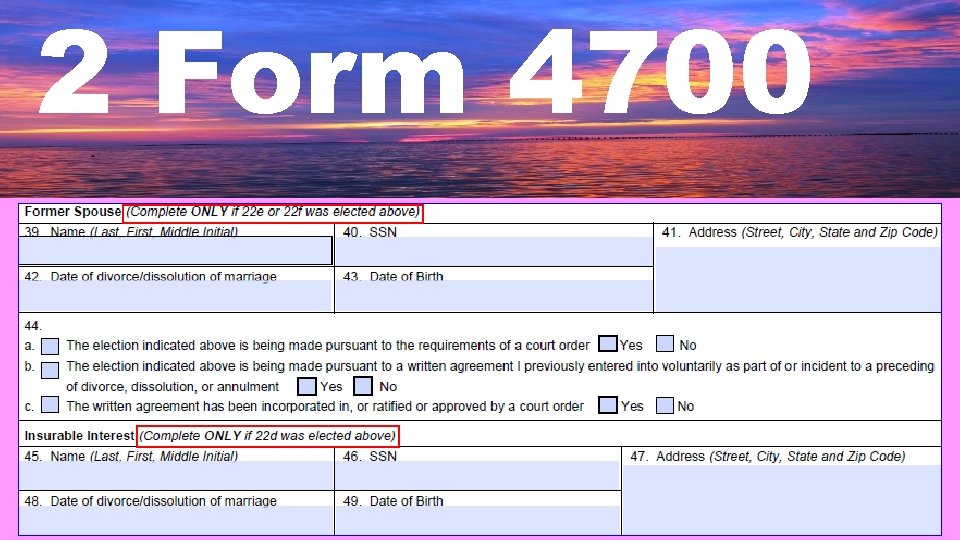

3 S. B. P. Beneficiary Options • Spouse and Children • Children Only • Permanently Incapacitated Children • Former Spouse and Children • Insurable Interest

3 S. B. P. Beneficiary Options • Spouse and Children • Children Only • Permanently Incapacitated Children • Former Spouse and Children • Insurable Interest

3 S. B. P. • No more than 6. 5% of gross retired pay • Minimum level of coverage required • Reduces taxable Retired Pay • Monthly premiums increase with COLAs

3 S. B. P. • No more than 6. 5% of gross retired pay • Minimum level of coverage required • Reduces taxable Retired Pay • Monthly premiums increase with COLAs

3 S. B. P. - RC • Completion of 20 years of Satisfactory Service • Elect or Decline enrollment via CG-11221 • Both elections require spousal concurrence

3 S. B. P. - RC • Completion of 20 years of Satisfactory Service • Elect or Decline enrollment via CG-11221 • Both elections require spousal concurrence

3 S. B. P. - RC Option A - Defer election until age 60 • Automatic maximum coverage unless decline or elect reduced coverage • No benefit if death occurs prior to age 60 • Opportunity to elect at age 60

3 S. B. P. - RC Option A - Defer election until age 60 • Automatic maximum coverage unless decline or elect reduced coverage • No benefit if death occurs prior to age 60 • Opportunity to elect at age 60

3 S. B. P. - RC Option A - Variables • What if you have no spouse, children or insurable interest? • What if you acquire a spouse and/or children after initial election?

3 S. B. P. - RC Option A - Variables • What if you have no spouse, children or insurable interest? • What if you acquire a spouse and/or children after initial election?

3 S. B. P. - RC Option B – Elect RC-SBP • Elect annuity based on full or reduced amount • Benefit when you would have reached age 60

3 S. B. P. - RC Option B – Elect RC-SBP • Elect annuity based on full or reduced amount • Benefit when you would have reached age 60

3 S. B. P. - RC Option C – Elect RC-SBP • Elect annuity based on full or reduced amount • Benefit if death occurs prior to age 60

3 S. B. P. - RC Option C – Elect RC-SBP • Elect annuity based on full or reduced amount • Benefit if death occurs prior to age 60

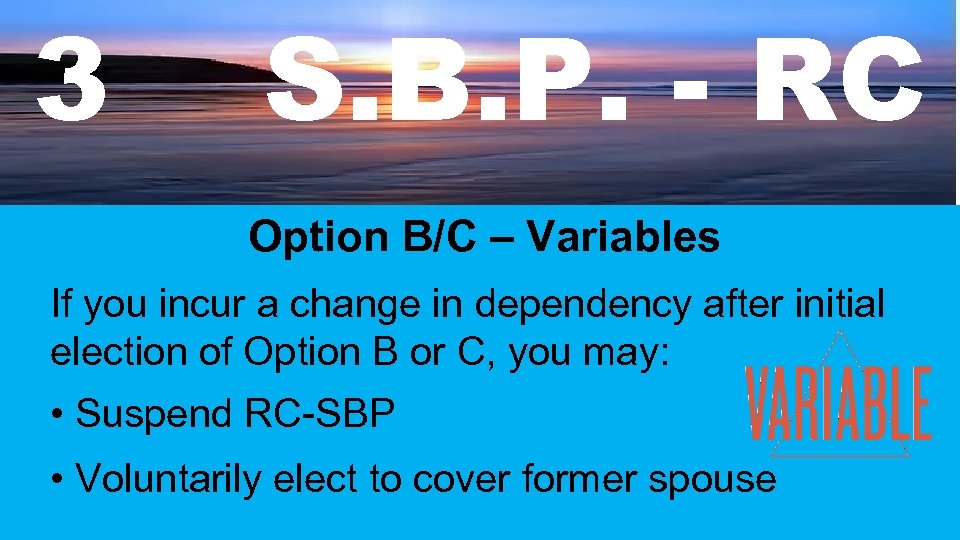

3 S. B. P. - RC Option B/C – Variables If you incur a change in dependency after initial election of Option B or C, you may: • Suspend RC-SBP • Voluntarily elect to cover former spouse

3 S. B. P. - RC Option B/C – Variables If you incur a change in dependency after initial election of Option B or C, you may: • Suspend RC-SBP • Voluntarily elect to cover former spouse

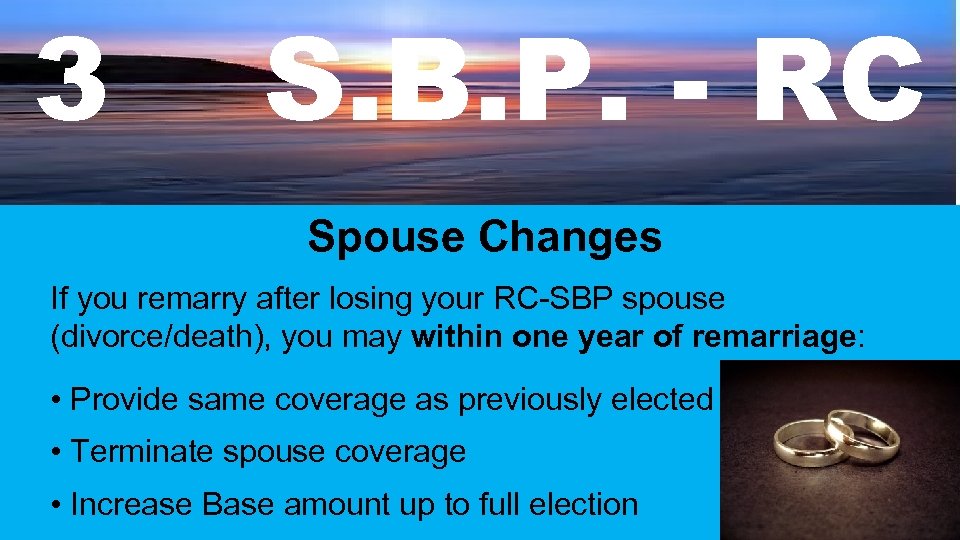

3 S. B. P. - RC Spouse Changes If you remarry after losing your RC-SBP spouse (divorce/death), you may within one year of remarriage: • Provide same coverage as previously elected • Terminate spouse coverage • Increase Base amount up to full election

3 S. B. P. - RC Spouse Changes If you remarry after losing your RC-SBP spouse (divorce/death), you may within one year of remarriage: • Provide same coverage as previously elected • Terminate spouse coverage • Increase Base amount up to full election

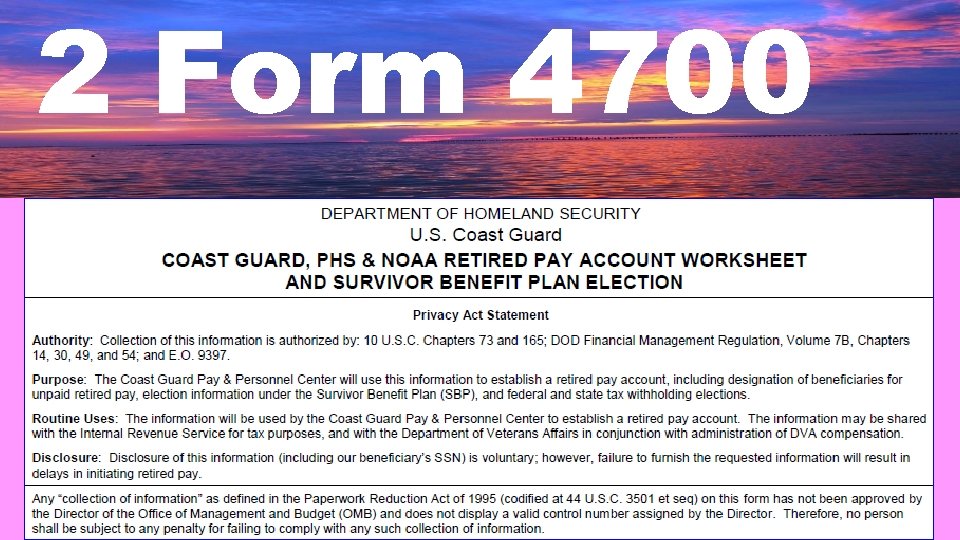

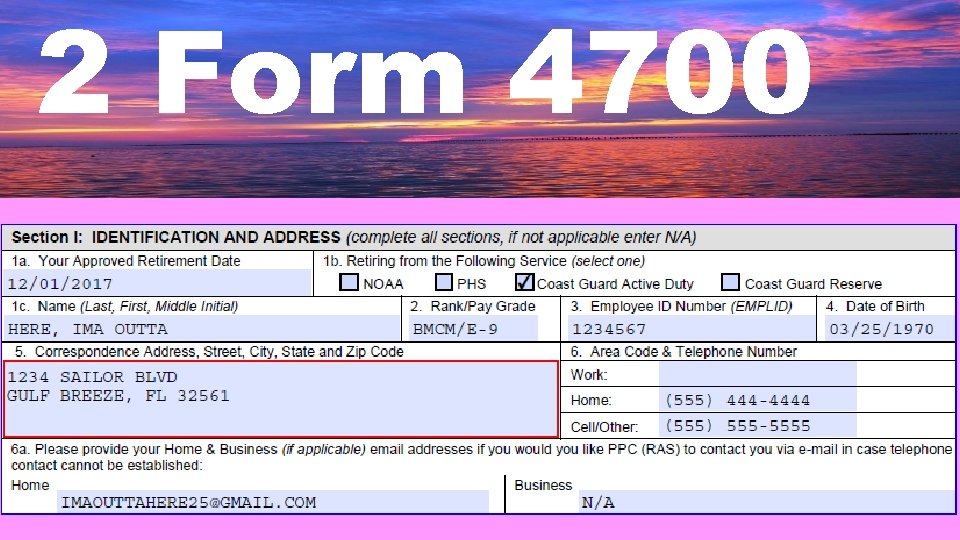

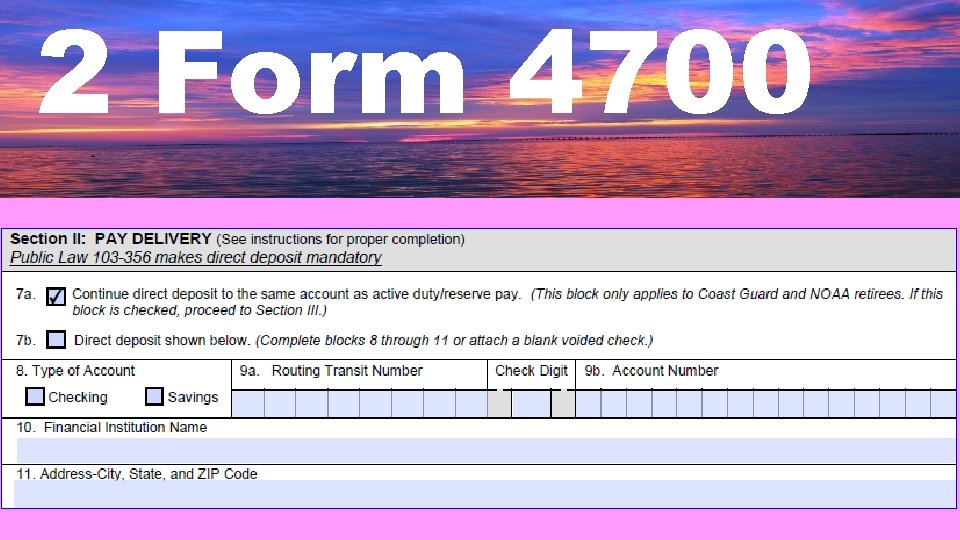

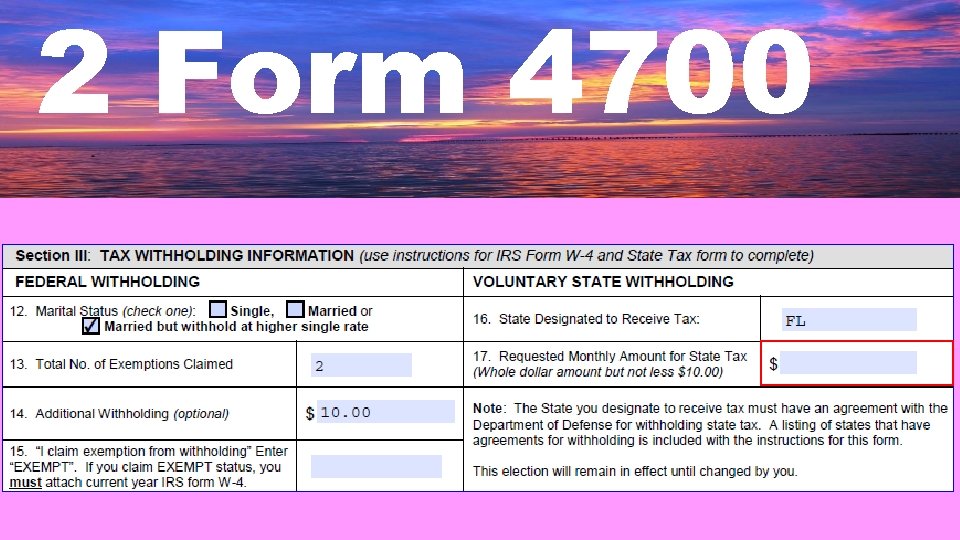

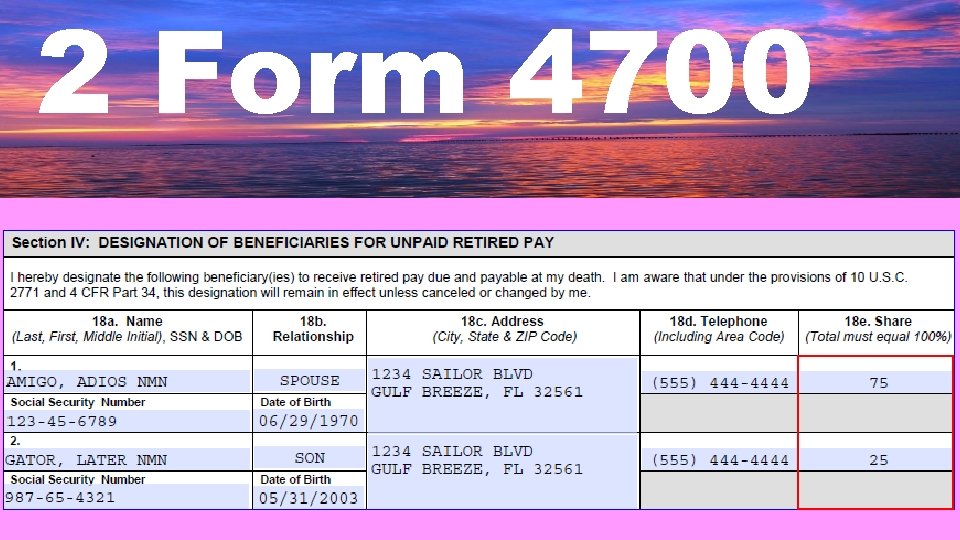

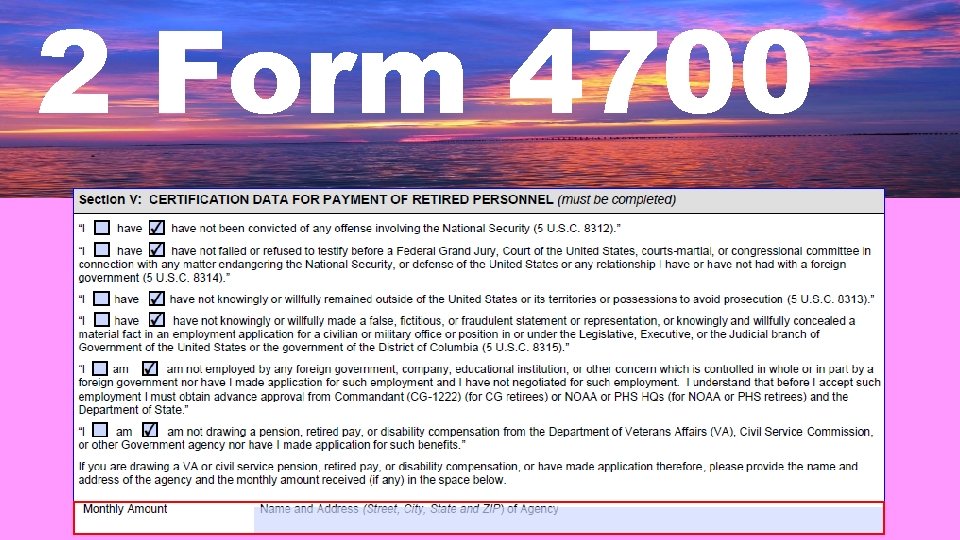

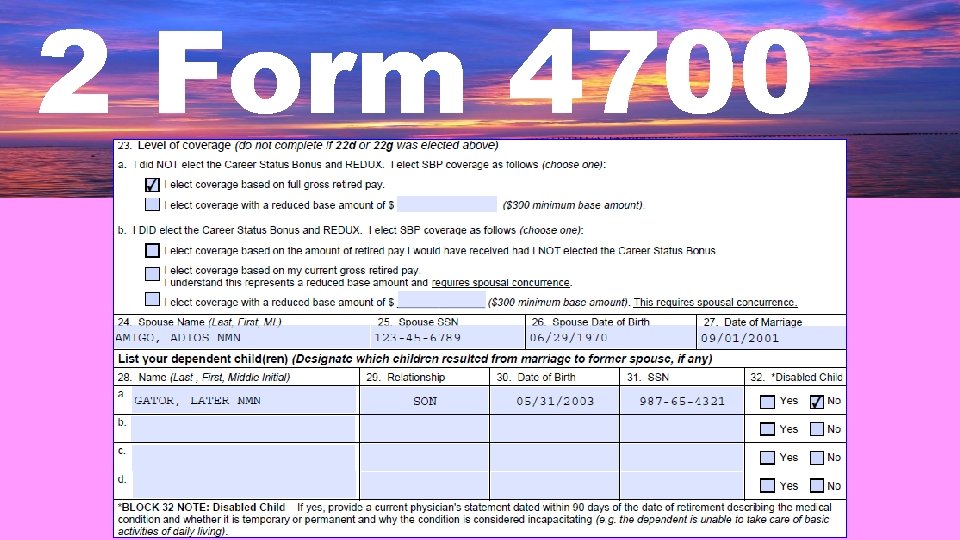

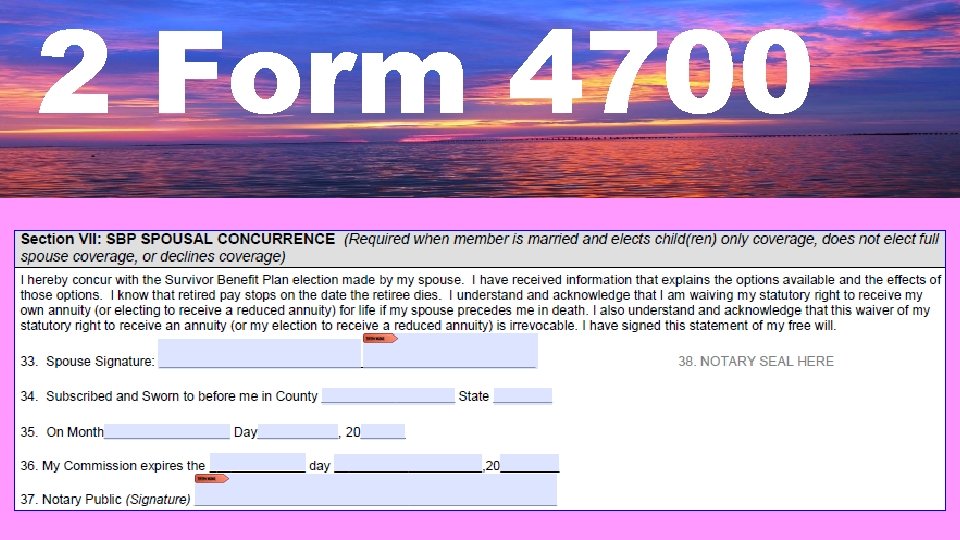

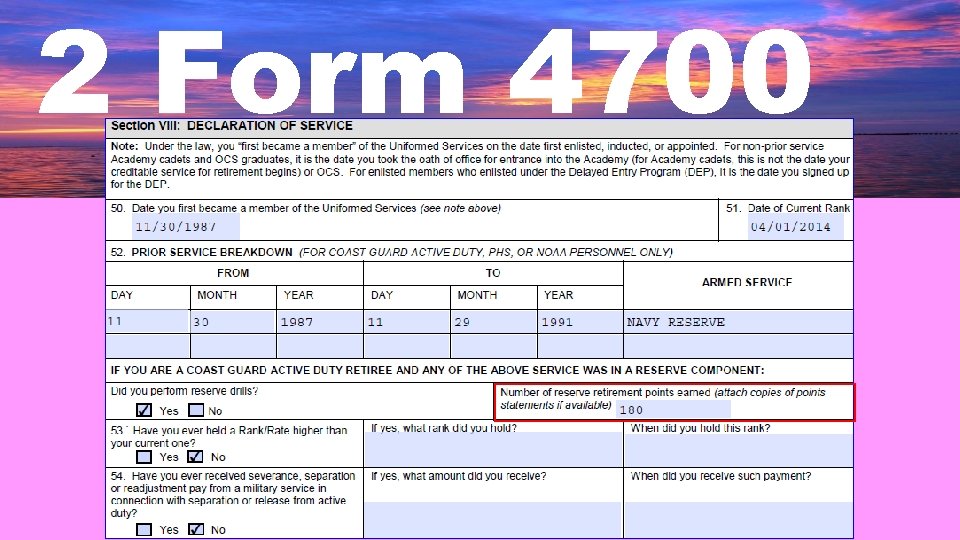

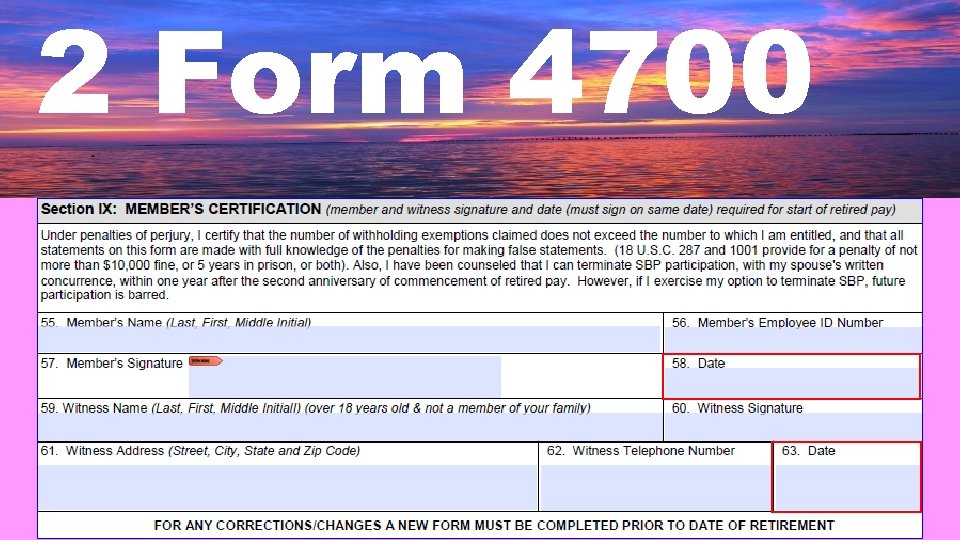

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

2 Form 4700

1 Common Errors CG-4700 q. State taxes q. Dates q. Missing information q. Completion and Submission

1 Common Errors CG-4700 q. State taxes q. Dates q. Missing information q. Completion and Submission

1 Common Errors Self Service q. Address q. Payslips, W 2’s, and 1099 R’s

1 Common Errors Self Service q. Address q. Payslips, W 2’s, and 1099 R’s

1 Common Errors State & Federal Taxes q. Address update & State Tax q. Dollar amount q. Federal withholdings/W 4 q. Tax professionals

1 Common Errors State & Federal Taxes q. Address update & State Tax q. Dollar amount q. Federal withholdings/W 4 q. Tax professionals

1 Common Errors Marital Status q. Divorce decree q. Marriage Certificate q. Death Certificate q. Former Spouse Payment

1 Common Errors Marital Status q. Divorce decree q. Marriage Certificate q. Death Certificate q. Former Spouse Payment

1 Common Errors Allotments q. Tricare q. Delta Dental q. VGLI

1 Common Errors Allotments q. Tricare q. Delta Dental q. VGLI

Final Note Retired Military Obligations • Retired members are subject to Coast Guard and Uniform Code of Military Justice (UCMJ) regulations • May be ordered to active duty in time of war or national emergency at the Secretary’s discretion, but may be ordered in time of peace with their consent

Final Note Retired Military Obligations • Retired members are subject to Coast Guard and Uniform Code of Military Justice (UCMJ) regulations • May be ordered to active duty in time of war or national emergency at the Secretary’s discretion, but may be ordered in time of peace with their consent

Q&A

Q&A

FEATURING THE PPC PROCEDURES & DEVELOPMENT STAFF PPC-PF-PD@uscg. mil

FEATURING THE PPC PROCEDURES & DEVELOPMENT STAFF PPC-PF-PD@uscg. mil