c39681733d0c684ff459849c9029974f.ppt

- Количество слайдов: 33

“Retail Financing on Developers Housing Project” October 31, 2011 Presented by Naeem Akhtar Qureshi

Builder’s Status Builder/ Developer is a sole proprietor. • Proprietorship certificate from FBR. Builder/ Developer is a partnership firm. • • • Registered Partnership Deed Certificate of Registration of Firm from Registrar of Firms Or NTN along with Association of Persons (AOPs) Builder / Developer is a Private Limited Company , • • Memorandum and Article of Association SECP Registration 2

Documents related to the Builder • Copy of CNIC of Sole proprietor / Partners/ Directors. • Copy of acknowledgement of last year Income Tax Return. • Address of the registered office and detail of administrative and technical setup. • Membership Certificate from ABAD. • List of projects completed earlier. • Bank Statement of company’s account for last two years. • Valid Architect License • Valid Builder License • Copy of feasibility report / Market study • Copy of project brochure for prospective buyers.

Credit Checks / Verifications of the Builder The following Credit Checks / Verifications of the Sole proprietor / Partners/ Directors. • • e-CIB News Vis Data Check CNIC verification from NADRA.

Status of the Land of the Project Title can be defined as the evidence of the right which an owner has to possess his (her) property. Marketable Title Marketable title means that the land is free from encumbrances and free from litigation.

Status of the Land of the Project Defected Title A title is said to be defected when there is some absence of legal requisite or deficiency, imperfection or in sufficiency in the evidence or when it is encumbered by other interest. The expression “title defects” has come to mean the existence of encumbrances, Restrictions, encroachments and other interest or claims which affects the owner’s rights over the property.

Status of the Land of the Project Types of Land • • • Allotted Land Free hold Land Lease hold Land Cantonment Land Government granted Land

Status of the Land of the Project Who maintains Record of Rights • Development Authorities • Land Revenue Departments (Tehsildar/ Mukhtarkar Office) • Societies • Military Estate Office / Cantonment Board

Status of the Land of the Project Forms of Legal Transfer • • Sale Deed Gift Deed Allotment Order Exchange Deed Lease/Sub-Lease License/Sub-License Mutation

Availability of HBFCL Investment to the owners / allottees of flats undertaken by the Builders / Developers HBFCL finance is available in three categories of cases v. Where the structure of the multi-storey building is complete. v. Where the project is complete in all respect and ready for possession. v. Where the company has offered possession to its allottees with out having approached HBFCL for financing but the individual allottees applied to the HBFCL for loan.

Status of the Land of the Project Requirement of documents as per type of Land: In case of Allotted Land: a. b. c. d. e. f. Allotment order. Possession Order. Acknowledgement of possession. Site plan. Proof of payment of full cost of land. Indenture of Lease Deed to be given to individual allottees.

Status of the Land of the Project In case of Lease hold Land: a. b. Lease deed and subsequent transfer deed with mutation. Up to date search certificate from the date of Registration of Lease Deed. c. Site Plan showing boundaries of the plot. d. Permission from the Lessor to issue sub-lease. (If it is built-in in lease deed then not required. ) e. Permission by Lessor to issue permission to mortgage to the allottees of the flats/housing units. f. Specimen of title to be given to individual allottees. G. Permission from the Lessor to sub-divide the plot.

Status of the Land of the Project In case of Freehold Land: a. b. c. d. e. Registered sale deed. Unbroken chain of Jamabandi / city survey record for last 15 years. Mutation Non encumbrance certificate for the last twelve years. Entry of plots in Deh-form II as per approved Lay out plan.

Documents required from Regulatory Authorities • NOC for Construction and Sale of Apartments / Houses from Building control authorities having details like, i) Date of completion of project. ii) No. of Units (Shops / Apartments/ Houses) iii) Category of units with size. Iv) Cost of Shops / Apartments / Houses per Sq. Ft. • NOC for Advertisement alongwith the draft of advertisement.

Documents required from Regulatory Authorities • NOC for all utilities (Gas, Electricity, Water & Sewerage). • Valid Architect License from PCATP • Valid Builder License from concerned issuing authority. • Approved building plan with letter of approval. • Sub-Division Plan showing the details of Apartment. • Approved Lay out plan in case of independent housing units. • Valuation of the project by the approved valuator.

Documents from the Builders related to the Project • Undertaking by the builder that till the completion of the project and possession of all the flats / Houses to the Purchaser / Allottees / Borrowers of HBFCL, will not transfer the title of the project to any other person / party / firms etc by any mode of transaction subject to prior intimation to HBFCL. • Builder’s assurance for availability of all amenities such as GAS, Electricity, Water etc at site before disbursement of final tranche of the approved loan. • Supply of floor plan of each block, identifying the block and flat No. mentioning the name of the allottee to which the flat is booked /sold. • Brochure of the proposed project. • Declaration by the Builder that other projects constructed / being constructed are not banned or stayed by any authorities.

Documents from the Builders related to the Project • Builder’s assurance that at the time of handing over the possession to the HBFCL borrowers the copy of possession letter will forward to HBFCL. • To evaluate the past performance builder/ developer will provide the list of other projects financed by HBFCL. • Indemnity bond by the builder to indemnify HBFCL in case of delayed possession to the HBFCL borrowers. • Copies of paid challan for utilities before release of final tranche of approved investment. • Builder will intimate to the allottee that approval of loan by HBFCL will be subject to their fulfilling of HBFCL credit criteria.

Concept of Credit The word "credit" has been derived from a Latin word creditum. It means trust. Credit refers to the ability to acquire something of value like goods, services, money, or securities at the present time in return for a promise to pay at a certain future time.

Concept of Credit Definition Credit is : • • Borrowed money that you payback at a specific time. A sum of money that is made available for you to borrow. A financial trustworthiness. A confidence in a borrower’s ability and intention to repay.

5 Cs of Mortgage Lending. • • • Character Capacity to pay Creditworthiness Collateral Cash follow.

5 Cs of Mortgage Lending. • Character Some individuals are more persistent in ensuring their loan payments are made than others. To assess the character of the intending borrower one should see the previous credit history reports, payment of utility bills such as electricity, gas, water conservancy and telephone bills etc.

5 Cs of Mortgage Lending. • Capacity to pay The borrower has to possess the capacity to meet payment obligations from income. Beyond capacity is the willingness to pay. At the point of origination, lenders focus on the underlying capacity and creditworthiness of the borrower as the basis for loan service and repayment. • Collateral Properties or assets that are offered to secure a loan.

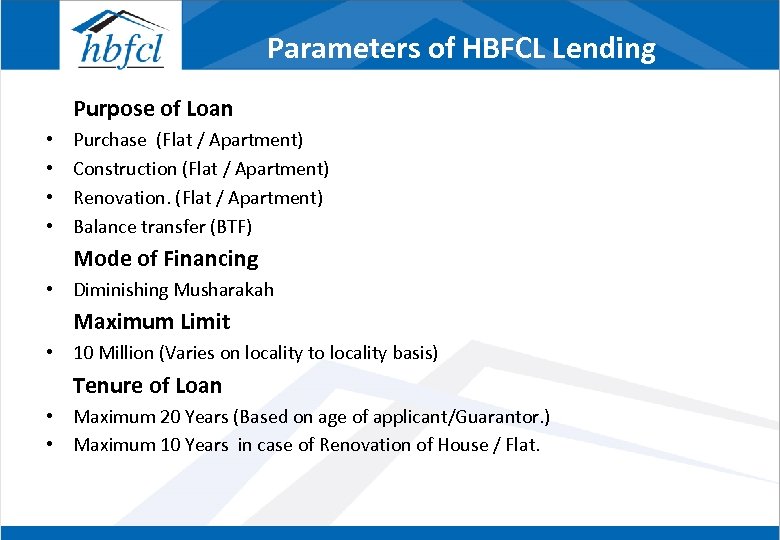

Parameters of HBFCL Lending Purpose of Loan • • Purchase (Flat / Apartment) Construction (Flat / Apartment) Renovation. (Flat / Apartment) Balance transfer (BTF) Mode of Financing • Diminishing Musharakah Maximum Limit • 10 Million (Varies on locality to locality basis) Tenure of Loan • Maximum 20 Years (Based on age of applicant/Guarantor. ) • Maximum 10 Years in case of Renovation of House / Flat.

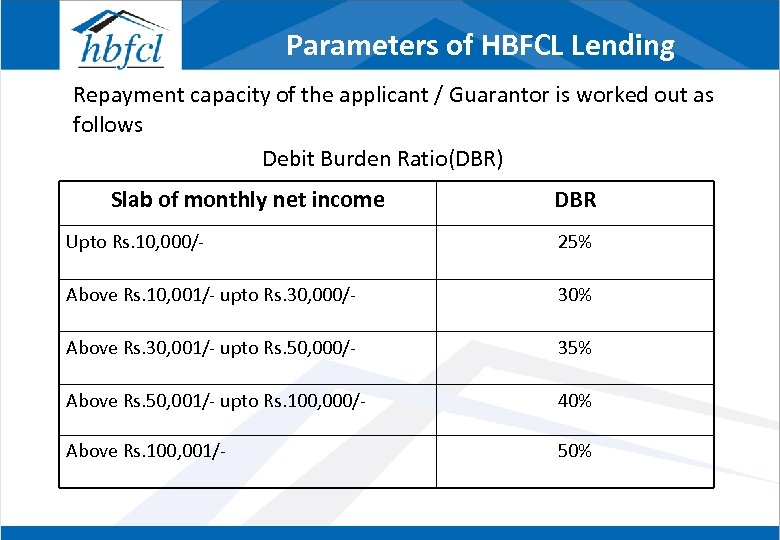

Parameters of HBFCL Lending Repayment capacity of the applicant / Guarantor is worked out as follows Debit Burden Ratio(DBR) Slab of monthly net income DBR Upto Rs. 10, 000/- 25% Above Rs. 10, 001/- upto Rs. 30, 000/- 30% Above Rs. 30, 001/- upto Rs. 50, 000/- 35% Above Rs. 50, 001/- upto Rs. 100, 000/- 40% Above Rs. 100, 001/- 50%

Parameters of HBFCL Lending Loan to Value (LTV) • In case of Purchas of house / Flat maximum 70% of the forced Sale Value of the property. (Valuation of the property by the PBA approved Valuer). • In case of Construction maximum 60% of the total projected cost of House/ Flat. • • • Verifications Income of the applicant / Guarantor from outsource agencies. Property Documents from issuing authority/ Registrar office. CNIC from NADRA Very sis. Property address By Branch Manager Current residence address By Branch Manager References. By Branch Manager Credit Checks. • e. CIB • Data. Check • News-Vis

Parameters of HBFCL Lending • Title Examination • Title examination of the property by the approved legal counsel/ HBFCL legal advisor. Type of Mortgages • Registered Mortgage • Equitable Mortgage Insurance Coverage – Life insurance of the applicant / Guarantor (on whose income HBFCL loan facility is provided. – Property Takaful.

Documents relating to Individual Allottees of the Project • Registered Sub-lease deed • Up to date search certificate • Permission to Mortgage • Approved Building Plan along with approval letter in case of independent housing unit. • Proof of Income • Sale Agreement ( in case of purchase of flat). • Valuation of the flat ( in case of purchase of flat). • Copies of utility bills.

Islamic Mode of Financing Musharakah’ is a word of Arabic origin which literally means sharing. In the context of business and trade it means a joint enterprise in which all the partners share the profit or loss of the joint venture. According to Islamic principles, a financier must determine whether he is advancing a loan to assist the debtor on humanitarian grounds or he desires to share his profits. If he wants to assist the debtor, he should resist from claim any excess on the principal of his loan, because his aim is to assist him. However, if he wants to have a share in the profits of his debtor, it is necessary that he should also share him in his losses. Thus the returns of the financier in Musharakah have been tied up with the actual profits accrued through the enterprise.

Islamic Mode of Financing Diminishing Musharakah. According to this concept, a financier and his client participate in the joint ownership of a property. The share of the financier is further divided into a number of units and it is understood that the client will purchase the units of the share of the financier one by one periodically, thus increasing his own share till all the units of the financier are purchased by him so as to make him the sole owner of the property.

Islamic Mode of Financing Housing finance on the basis of Diminishing Musharakah The proposed arrangement is composed of the following transactions: 1. 2. 3. 4. 5. To create joint ownership in the property (Shirkat-ul-Milk). Giving the share of the financier to the client on rent. Promise from the client to purchase the units of share of the financier. Actual purchase of the units at different stages. Adjustment of the rental according to the remaining share of the financier in the property.

Islamic Mode of Financing Murabahah “Murabahah” is, in fact, a term of Islamic Fiqh and it refers to a particular kind of sale having nothing to do with financing in its original sense. If a seller agrees with the purchaser to provide him a specific commodity on a certain profit added to his cost, it is called a “Murabahah” transaction. The basic ingredient of “Murabahah” is that the seller discloses the actual cost he has incurred in acquiring the commodity, and then adds some profit thereon. This profit may be in lump sum or may be based on a percentage. The payment in the case of Murabahah may be at spot, and may be on a subsequent date agreed upon by he parties. Murabahah, in its original Islamic connotation, is simply a sale. The only feature distinguishing it from other kinds of sale is that the seller in murabahah expressly tells the purchaser how much cost he has incurred and how much profit he is going to charge in addition to the cost. .

Islamic Mode of Financing Some Basic Rules of Sale 1. 2. 3. 4. 5. 7. The subject of sale must be existing at the time of sale. The subject of sale must be in the ownership of the seller at the time of sale. The subject of sale must be in the physical or constructive possession of the seller when he sells it to another person. “Constructive possession” means a situation where the possessor has not taken the physical delivery of the commodity, yet the commodity has come into his control, and all the rights and liabilities of the commodity are passed on to him, including the risk of its destruction. The sale must be instant and absolute. The subject of sale must be a property of value. The subject of sale must be specifically known and identified to the buyer

Islamic Mode of Financing Basic features of Murabahah Financing 1. Murabahah is not a loan given on interest. It is the sale of a commodity for a deferred Price which includes an agreed profit added to the cost. 2. The financier must have owned the commodity before he sells it to his client. 3. The commodity must come into the possession of the financier, whether physical or constructive, in the sense that the commodity must be in his risk, though for a short period. 4. The best way for Murabahah, according to Shariah, is that the financier himself purchases the commodity and keeps it in his own possession, or purchases the commodity through a third person appointed by him as agent, before he sells it to the customer. However, in exceptional cases, where direct purchase from the supplier is not practicable for some reason, it is also allowed that he makes the customer himself his agent to buy the commodity on his behalf. 5. In the case of default by the buyer in the payment of price at the due date, the price can not be increased.

c39681733d0c684ff459849c9029974f.ppt