519939cf30963f219c7982a7252bb604.ppt

- Количество слайдов: 25

Restricted Basel II Update Dubrovnik, 27 -28 May 2004 Charles Freeland Deputy Secretary General

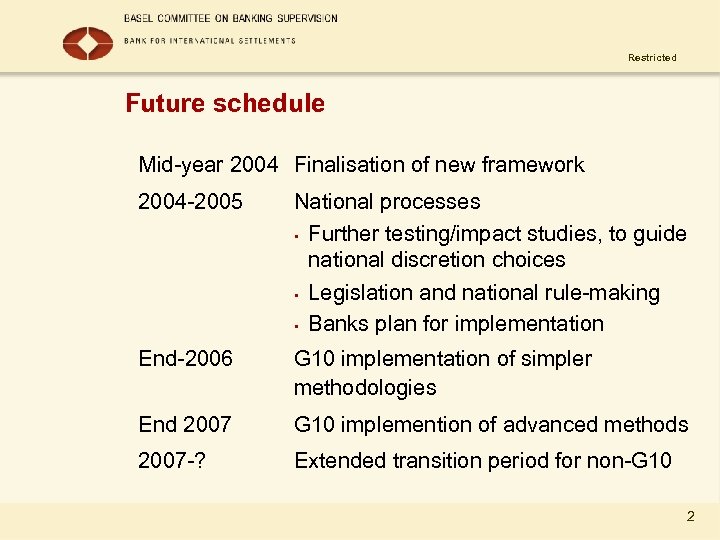

Restricted Future schedule Mid-year 2004 Finalisation of new framework 2004 -2005 National processes • Further testing/impact studies, to guide national discretion choices • Legislation and national rule-making • Banks plan for implementation End-2006 G 10 implementation of simpler methodologies End 2007 G 10 implemention of advanced methods 2007 -? Extended transition period for non-G 10 2

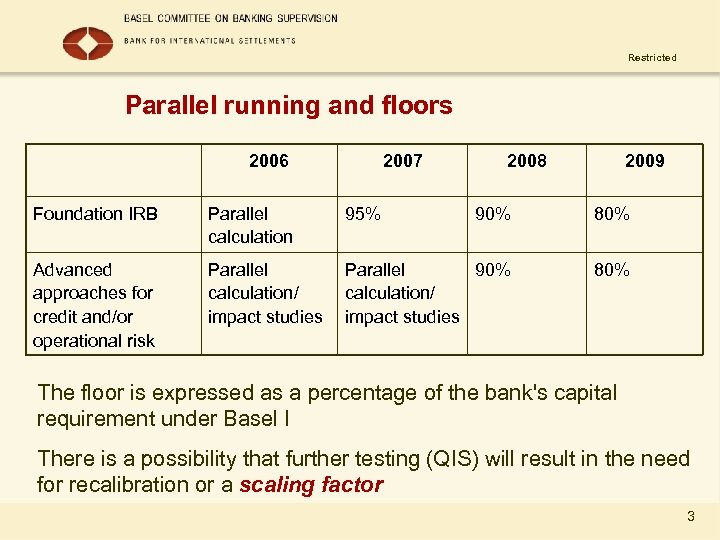

Restricted Parallel running and floors 2006 2007 2008 2009 Foundation IRB Parallel calculation 95% 90% 80% Advanced approaches for credit and/or operational risk Parallel calculation/ impact studies Parallel 90% calculation/ impact studies 80% The floor is expressed as a percentage of the bank's capital requirement under Basel I There is a possibility that further testing (QIS) will result in the need for recalibration or a scaling factor 3

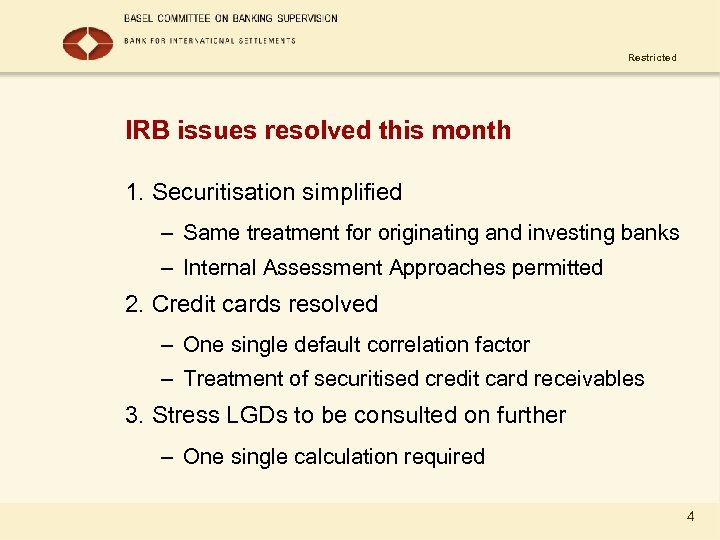

Restricted IRB issues resolved this month 1. Securitisation simplified – Same treatment for originating and investing banks – Internal Assessment Approaches permitted 2. Credit cards resolved – One single default correlation factor – Treatment of securitised credit card receivables 3. Stress LGDs to be consulted on further – One single calculation required 4

Restricted The Madrid "breakthrough" l l The BCBS had previously decided to calibrate IRB against expected plus unexpected losses (EL + UL) The reason was essentially a lack of uniformity in national provisioning rules and accounting rules In Madrid, the BCBS decided to respond to industry requests to calibrate IRB to UL only In addition, a calculation of EL will be made by each IRB bank and the numerator of the ratio will be adjusted accordingly 5

Restricted Adjustment to the numerator l l General provisions will be removed from the numerator for IRB banks EL will be compared with the sum of general plus specific provisions for the portfolios in question If provisions < EL, the deficiency will be deducted 50% from Tier 1 and 50% from Tier 2 If provisions > EL, the excess will be added to Tier 2 (to a limit of 0 -6% of risk-weighted assets at national discretion) 6

Restricted Why did we correct EL/UL? l It is how the banks calibrate their IRB l The new proposal: – Is conceptually purer – Simplifies the framework – Recognises different provisioning practices in different jurisdictions l Accountants continue to insist on "incurred losses“ but they acknowledge "experienced credit judgement" 7

Restricted Position of non-BCBS/EU member countries l l l Australia, Hong Kong, Singapore and South Africa will be ready by 2006 Brazil, Chile, Malaysia, Mexico may be a bit slower China and India have NOT rejected Basel II (their opinions are public) China have already introduced Pillars 2 and 3 but will wait for an appropriate time to adopt Pillar 1 India is now introducing market risk and intends to adopt Basel II subject to some local adjustments 8

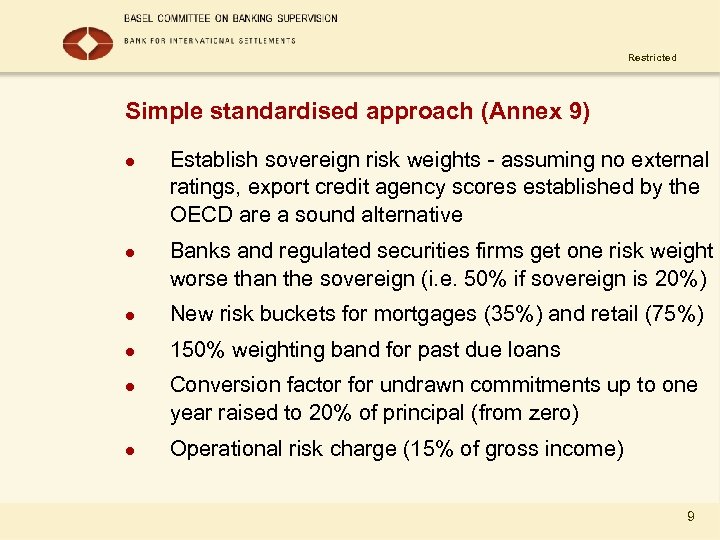

Restricted Simple standardised approach (Annex 9) l l Establish sovereign risk weights - assuming no external ratings, export credit agency scores established by the OECD are a sound alternative Banks and regulated securities firms get one risk weight worse than the sovereign (i. e. 50% if sovereign is 20%) l New risk buckets for mortgages (35%) and retail (75%) l 150% weighting band for past due loans l l Conversion factor for undrawn commitments up to one year raised to 20% of principal (from zero) Operational risk charge (15% of gross income) 9

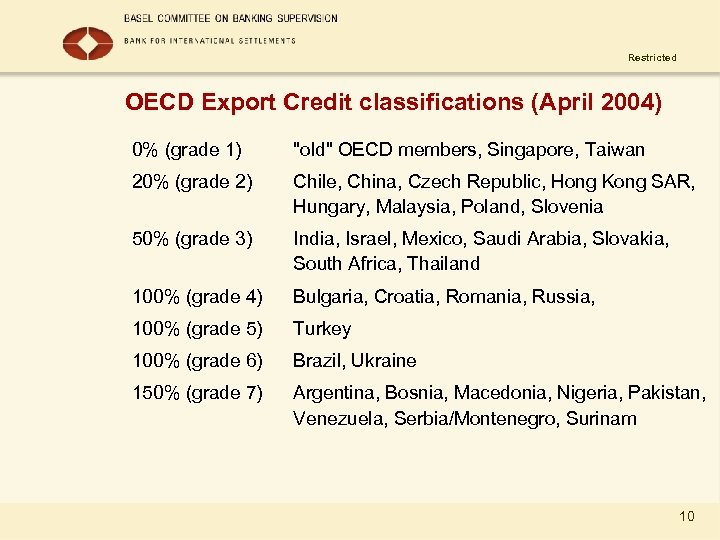

Restricted OECD Export Credit classifications (April 2004) 0% (grade 1) "old" OECD members, Singapore, Taiwan 20% (grade 2) Chile, China, Czech Republic, Hong Kong SAR, Hungary, Malaysia, Poland, Slovenia 50% (grade 3) India, Israel, Mexico, Saudi Arabia, Slovakia, South Africa, Thailand 100% (grade 4) Bulgaria, Croatia, Romania, Russia, 100% (grade 5) Turkey 100% (grade 6) Brazil, Ukraine 150% (grade 7) Argentina, Bosnia, Macedonia, Nigeria, Pakistan, Venezuela, Serbia/Montenegro, Surinam 10

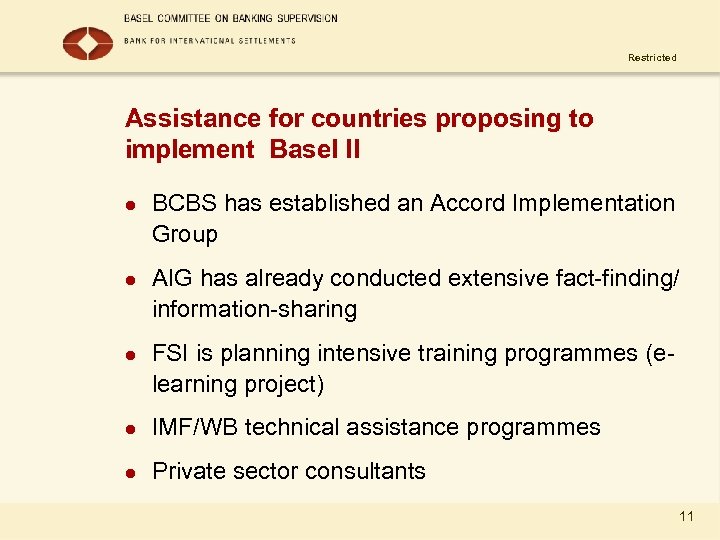

Restricted Assistance for countries proposing to implement Basel II l l l BCBS has established an Accord Implementation Group AIG has already conducted extensive fact-finding/ information-sharing FSI is planning intensive training programmes (elearning project) l IMF/WB technical assistance programmes l Private sector consultants 11

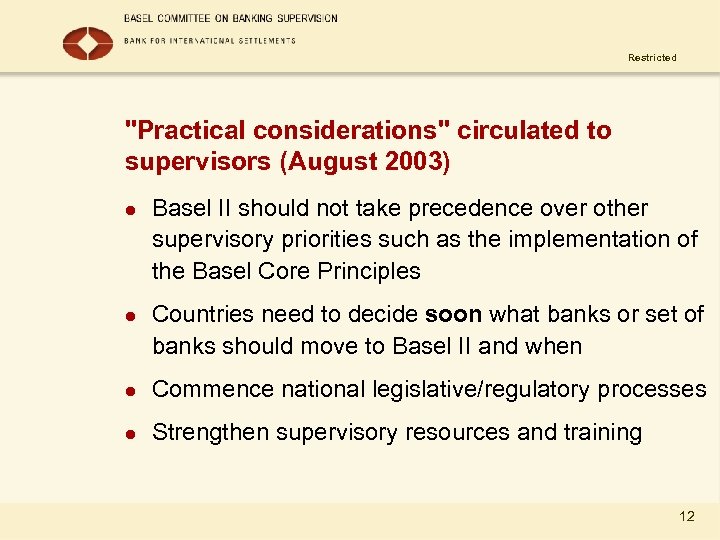

Restricted "Practical considerations" circulated to supervisors (August 2003) l l Basel II should not take precedence over other supervisory priorities such as the implementation of the Basel Core Principles Countries need to decide soon what banks or set of banks should move to Basel II and when l Commence national legislative/regulatory processes l Strengthen supervisory resources and training 12

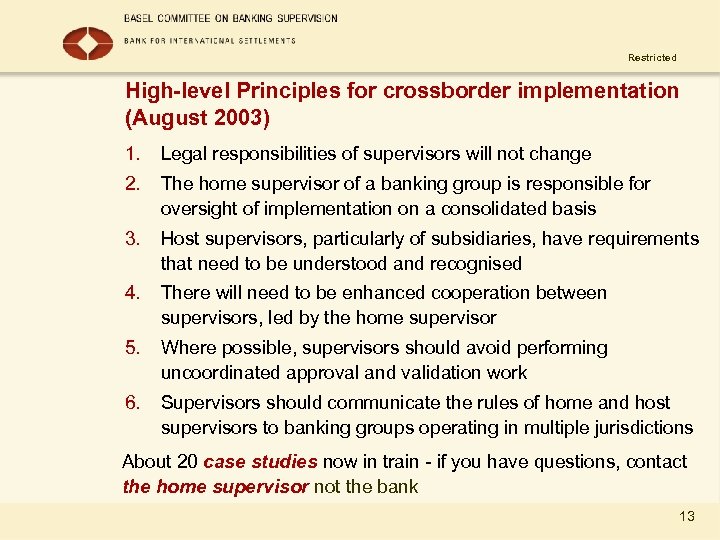

Restricted High-level Principles for crossborder implementation (August 2003) 1. Legal responsibilities of supervisors will not change 2. The home supervisor of a banking group is responsible for oversight of implementation on a consolidated basis 3. Host supervisors, particularly of subsidiaries, have requirements that need to be understood and recognised 4. There will need to be enhanced cooperation between supervisors, led by the home supervisor 5. Where possible, supervisors should avoid performing uncoordinated approval and validation work 6. Supervisors should communicate the rules of home and host supervisors to banking groups operating in multiple jurisdictions About 20 case studies now in train - if you have questions, contact the home supervisor not the bank 13

Restricted The level playing field! 14

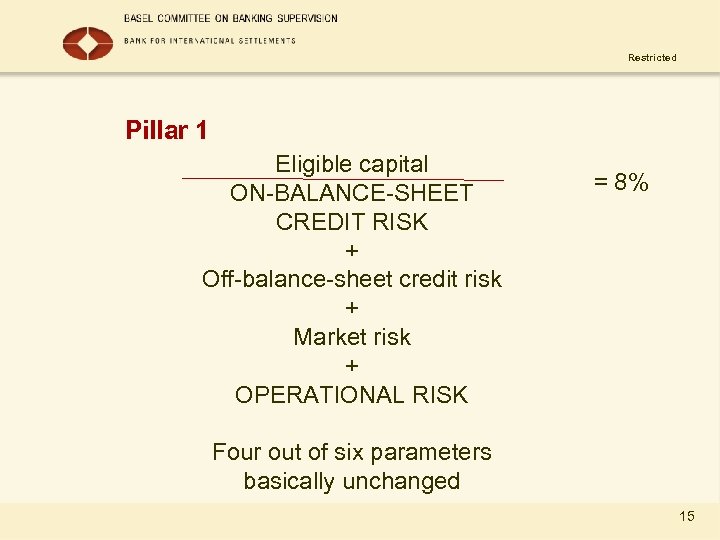

Restricted Pillar 1 Eligible capital ON-BALANCE-SHEET CREDIT RISK + Off-balance-sheet credit risk + Market risk + OPERATIONAL RISK = 8% Four out of six parameters basically unchanged 15

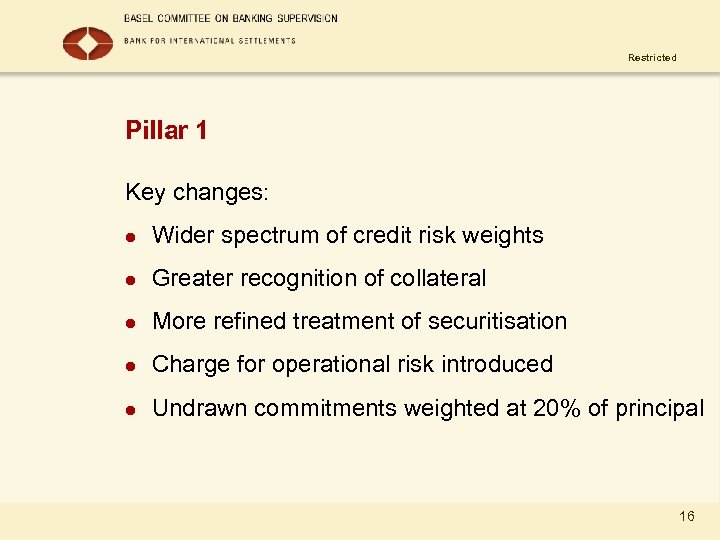

Restricted Pillar 1 Key changes: l Wider spectrum of credit risk weights l Greater recognition of collateral l More refined treatment of securitisation l Charge for operational risk introduced l Undrawn commitments weighted at 20% of principal 16

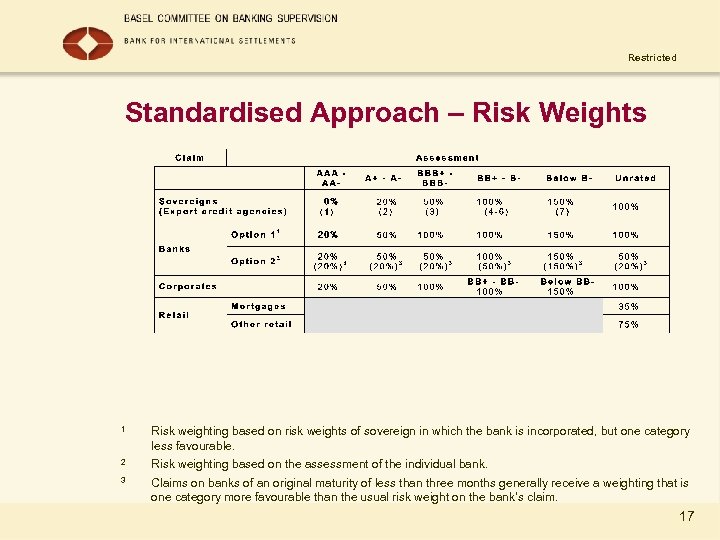

Restricted Standardised Approach – Risk Weights 1 Risk weighting based on risk weights of sovereign in which the bank is incorporated, but one category less favourable. 2 Risk weighting based on the assessment of the individual bank. 3 Claims on banks of an original maturity of less than three months generally receive a weighting that is one category more favourable than the usual risk weight on the bank’s claim. 17

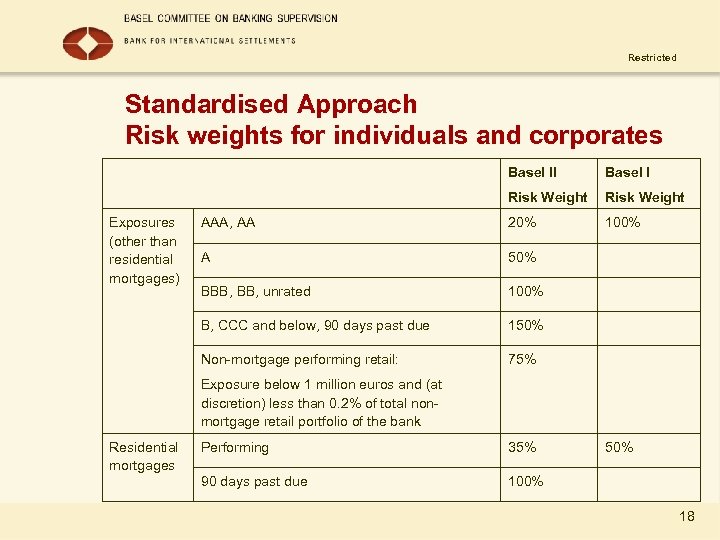

Restricted Standardised Approach Risk weights for individuals and corporates Basel II Risk Weight AAA, AA 20% 100% A 50% BBB, unrated 100% B, CCC and below, 90 days past due 150% Non-mortgage performing retail: Exposures (other than residential mortgages) Basel I 75% Exposure below 1 million euros and (at discretion) less than 0. 2% of total nonmortgage retail portfolio of the bank Residential mortgages Performing 35% 90 days past due 50% 100% 18

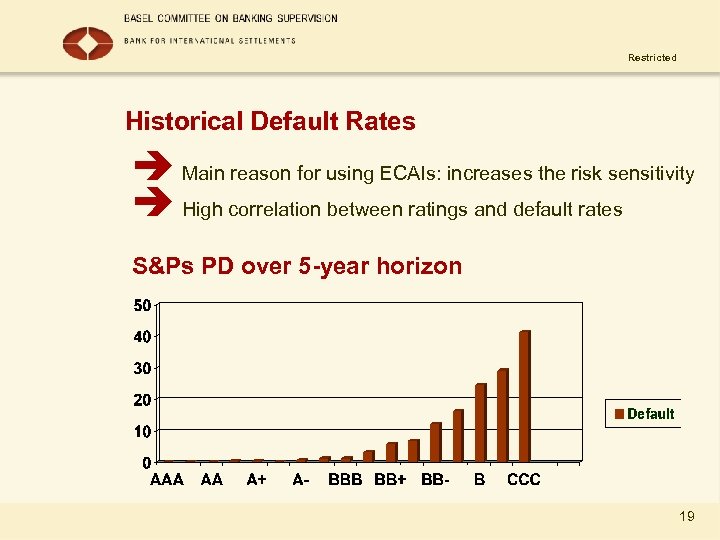

Restricted Historical Default Rates è Main reason for using ECAIs: increases the risk sensitivity è High correlation between ratings and default rates S&Ps PD over 5 -year horizon 19

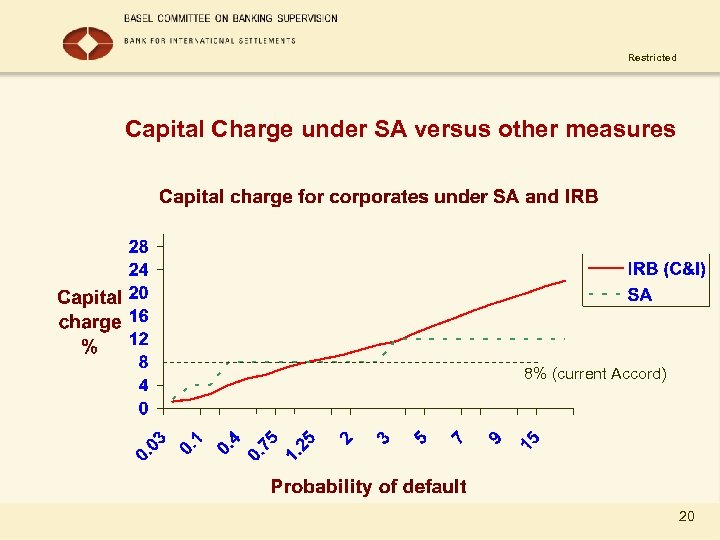

Restricted Capital Charge under SA versus other measures 8% (current Accord) 20

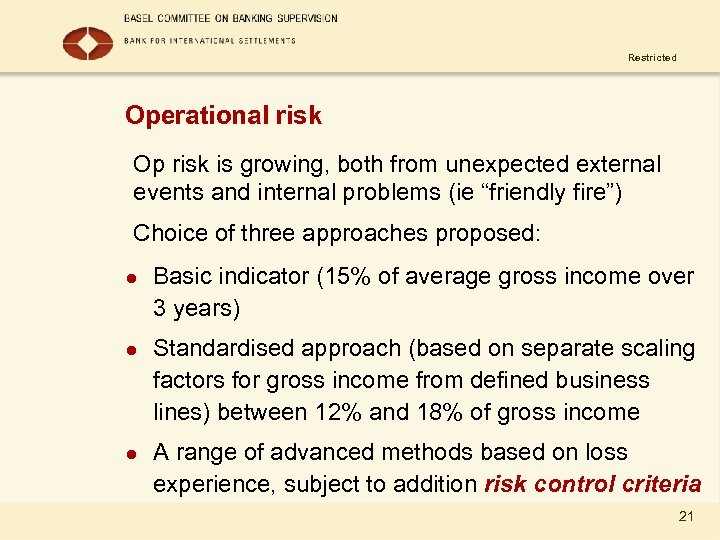

Restricted Operational risk Op risk is growing, both from unexpected external events and internal problems (ie “friendly fire”) Choice of three approaches proposed: l l l Basic indicator (15% of average gross income over 3 years) Standardised approach (based on separate scaling factors for gross income from defined business lines) between 12% and 18% of gross income A range of advanced methods based on loss experience, subject to addition risk control criteria 21

Restricted Pillars 2 and 3 l l Critical to the “balance” of the proposal Pillar 2 (Supervisory review) includes attention to risk management generally, including: – Concentration risk – Interest rate risk – Collateral management risk l Pillar 3 (disclosure) is designed to enforce market discipline 22

Restricted The challenge for banks and supervisors Initial phase – Determine approach to be used – Revise legislation/administrative guidance (e. g. EU Directives) – Draw up reporting forms/guidance notes – Train staff for implementation Ongoing – Activate Pillar 2 – Review standards for IRB banks 23

Restricted What are the basic aims of Basel II? l l To deliver a prudent amount of capital in relation to the risk that is run To provide the right incentives for sound risk management Basel II is not intended to be neutral between different banks/different exposures However, there is a desire not to change the overall amount of capital in the system 24

Restricted Keep an eye on BCBS website www. bis. org/BCBS 25

519939cf30963f219c7982a7252bb604.ppt