86425556ea0baacf0a1cb52f5c86f932.ppt

- Количество слайдов: 51

Responsible ownership Erik Breen Presentation for VBA April 29 th, 2008 17 -04 -2007

Statement 1 Responsible ownership is a hype and will pass by For 17 -04 -2007 Abstain Against

Statement 2 Only large pension funds (over 15 billion euro) can fill in their responsible ownership For 17 -04 -2007 Abstain Against

Context and agenda Clients and society ask for responsible ownership – Hype or trend? Institutional investors have to have a response – Building your own policy or use international codes? – Which instruments are available for implementation? Engagement led divestment – Elaboration of the latest innovations Conclusion 7 februari 2007 4

What is responsible ownership? “The choice of a common stock is a single act, its ownership is a continuing process. Certainly there is just as much reason to exercise care and judgment in being a shareholder as in becoming one. ” B. Graham and D. Dodd, Security Analysis, 1 st Ed. (Mc. Graw Hill, 1934) at p. 508. 7 februari 2007 5

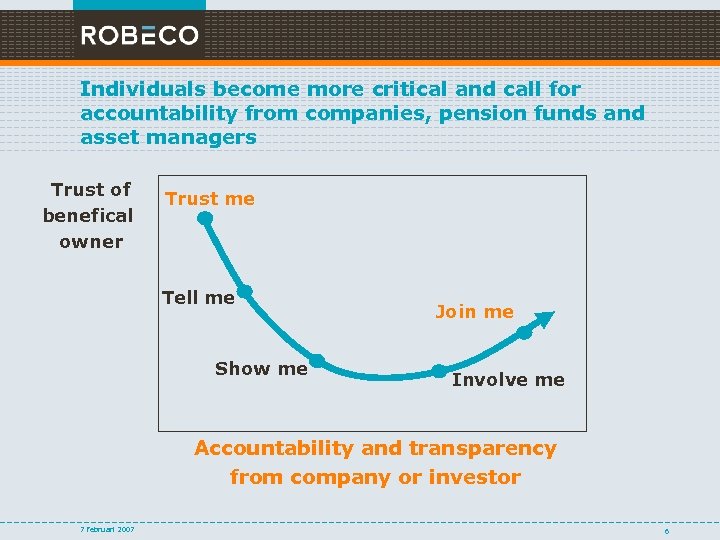

Individuals become more critical and call for accountability from companies, pension funds and asset managers Trust of benefical owner Trust me Tell me Show me Join me Involve me Accountability and transparency from company or investor 7 februari 2007 6

The call for responsible behavior is a trend Growing, long term trends – Scarcity of natural resources – Population and global wealth – Impact of international NGO’s – Spread of information – Awareness and demands from individuals – Globalisation and increasing power of companies – Transparency and accountability of companies 7 februari 2007 7

Building a response as institutional investor 17 -04 -2007

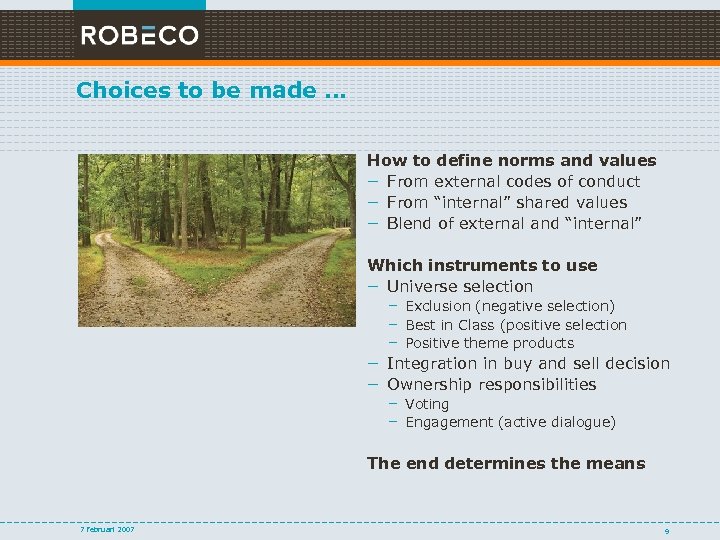

Choices to be made … How to define norms and values – From external codes of conduct – From “internal” shared values – Blend of external and “internal” Which instruments to use – Universe selection – Exclusion (negative selection) – Best in Class (positive selection – Positive theme products – Integration in buy and sell decision – Ownership responsibilities – Voting – Engagement (active dialogue) The end determines the means 7 februari 2007 9

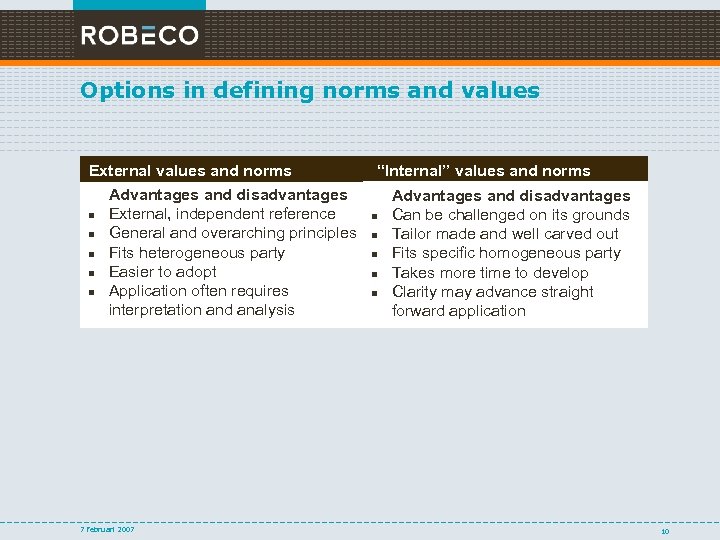

Options in defining norms and values External values and norms Advantages and disadvantages n External, independent reference n General and overarching principles n Fits heterogeneous party n Easier to adopt n Application often requires interpretation and analysis 7 februari 2007 “Internal” values and norms n n n Advantages and disadvantages Can be challenged on its grounds Tailor made and well carved out Fits specific homogeneous party Takes more time to develop Clarity may advance straight forward application 10

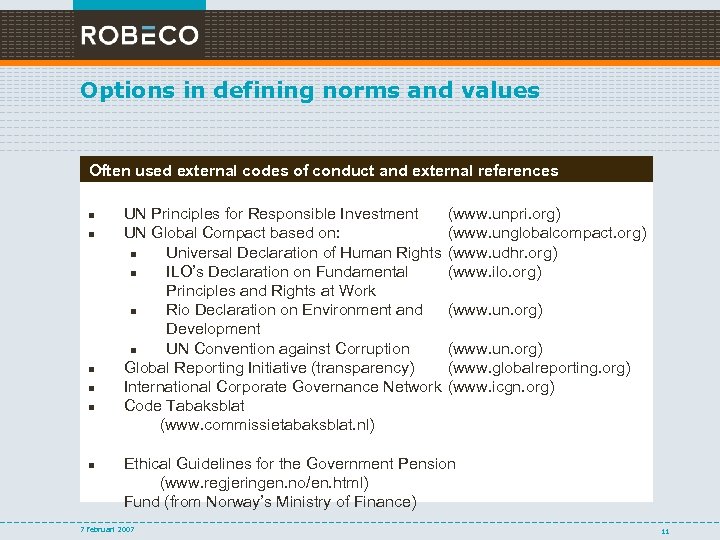

Options in defining norms and values Often used external codes of conduct and external references n n n UN Principles for Responsible Investment (www. unpri. org) UN Global Compact based on: (www. unglobalcompact. org) n Universal Declaration of Human Rights (www. udhr. org) n ILO’s Declaration on Fundamental (www. ilo. org) Principles and Rights at Work n Rio Declaration on Environment and (www. un. org) Development n UN Convention against Corruption (www. un. org) Global Reporting Initiative (transparency) (www. globalreporting. org) International Corporate Governance Network (www. icgn. org) Code Tabaksblat (www. commissietabaksblat. nl) Ethical Guidelines for the Government Pension (www. regjeringen. no/en. html) Fund (from Norway’s Ministry of Finance) 7 februari 2007 11

Available instruments to implement a responsible policy 17 -04 -2007

How can investors influence companies? Through legal rights … – Voting rights – Class actions … and other practices … – Private dialogues – Public statements – Shareholder coalitions – Buy and sell – Exclusions … on numerous topics – Corporate governance – Social and environmental – Strategy and capital structure 7 februari 2007 13

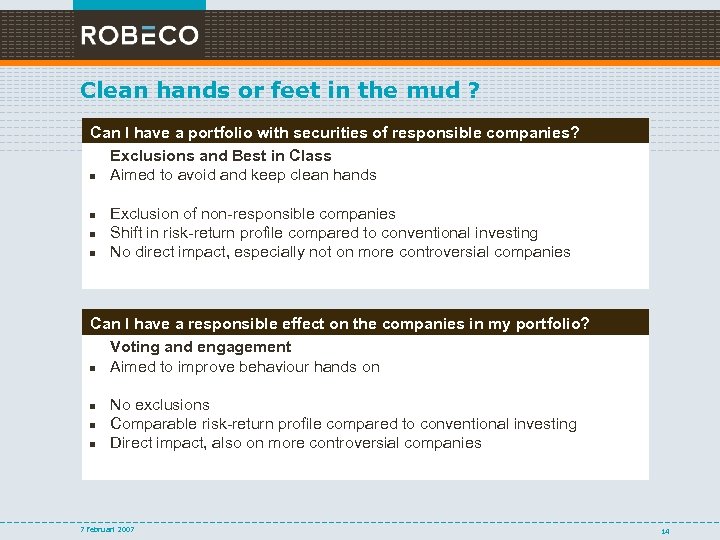

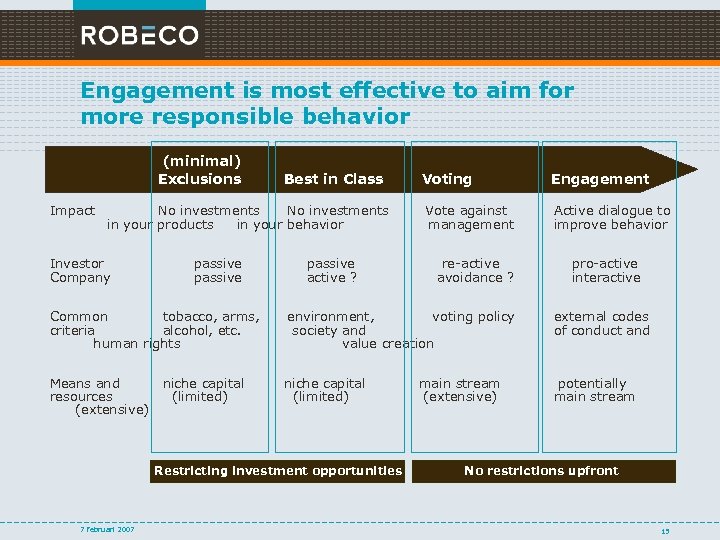

Clean hands or feet in the mud ? Can I have a portfolio with securities of responsible companies? Exclusions and Best in Class n Aimed to avoid and keep clean hands n n n Exclusion of non-responsible companies Shift in risk-return profile compared to conventional investing No direct impact, especially not on more controversial companies Can I have a responsible effect on the companies in my portfolio? Voting and engagement n Aimed to improve behaviour hands on n No exclusions Comparable risk-return profile compared to conventional investing Direct impact, also on more controversial companies 7 februari 2007 14

Engagement is most effective to aim for more responsible behavior (minimal) Exclusions Impact Best in Class No investments in your products in your behavior Investor Company passive active ? Voting Engagement Vote against management Active dialogue to improve behavior re-active avoidance ? pro-active interactive Common tobacco, arms, criteria alcohol, etc. human rights environment, voting policy society and value creation external codes of conduct and Means and resources (extensive) niche capital (limited) potentially main stream niche capital (limited) Restricting investment opportunities 7 februari 2007 main stream (extensive) No restrictions upfront 15

Exclusions and best in class 17 -04 -2007

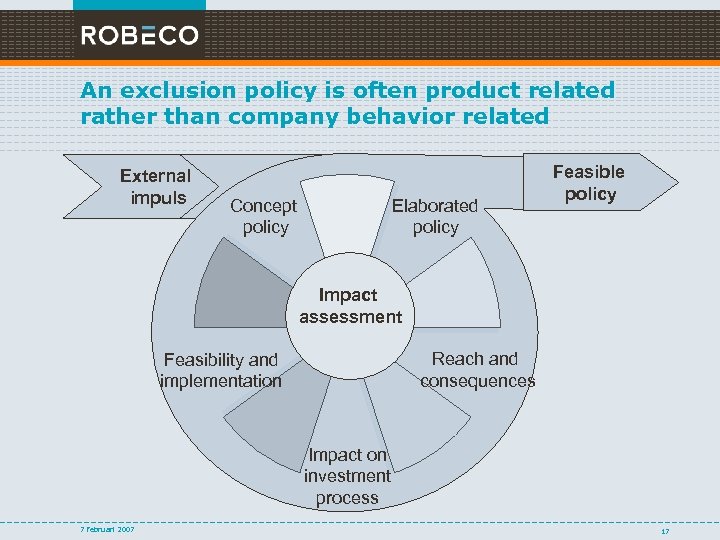

An exclusion policy is often product related rather than company behavior related External impuls Concept policy Elaborated policy Feasible policy Impact assessment Reach and consequences Feasibility and implementation Impact on investment process 7 februari 2007 17

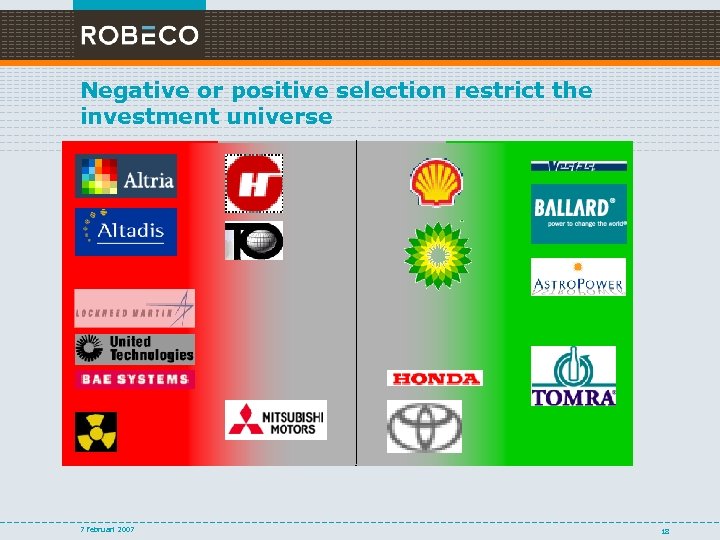

Negative or positive selection restrict the investment universe NO Unacceptable Best in Class Preferred Best in class universe 7 februari 2007 18

Voting your shares 17 -04 -2007

Institutional investors have to apply transparency or explain Best practices will be effectuated by law from January 1 st, 2007 – Institutions publish voting policy – Institutions report on execution – Institutions publish voting records Underlying principle – Institutional investors make a careful and transparent judgment whether or not they will use their voting rights. 7 februari 2007 20

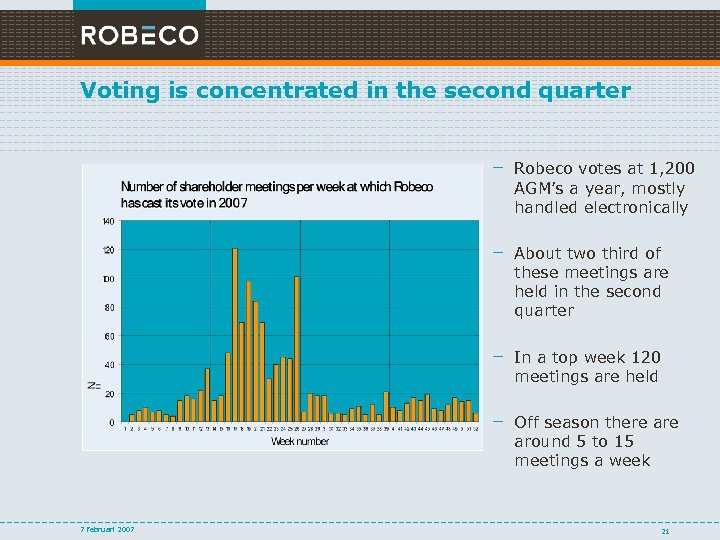

Voting is concentrated in the second quarter – Robeco votes at 1, 200 AGM’s a year, mostly handled electronically – About two third of these meetings are held in the second quarter – In a top week 120 meetings are held – Off season there around 5 to 15 meetings a week 7 februari 2007 21

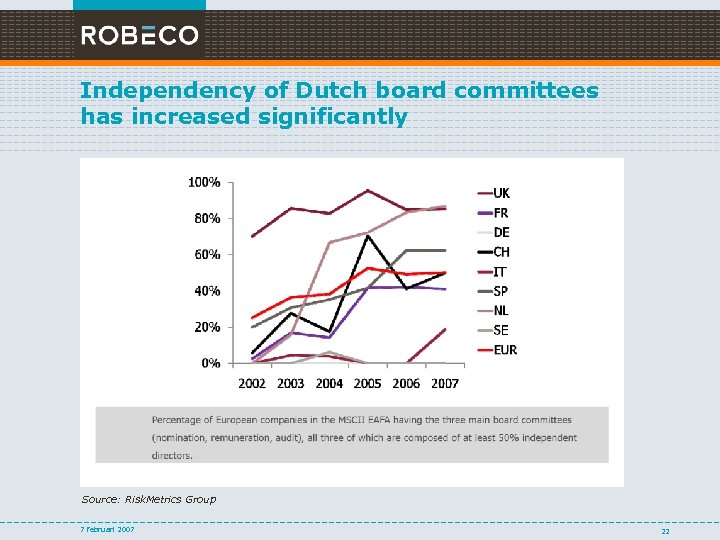

Independency of Dutch board committees has increased significantly Source: Risk. Metrics Group 7 februari 2007 22

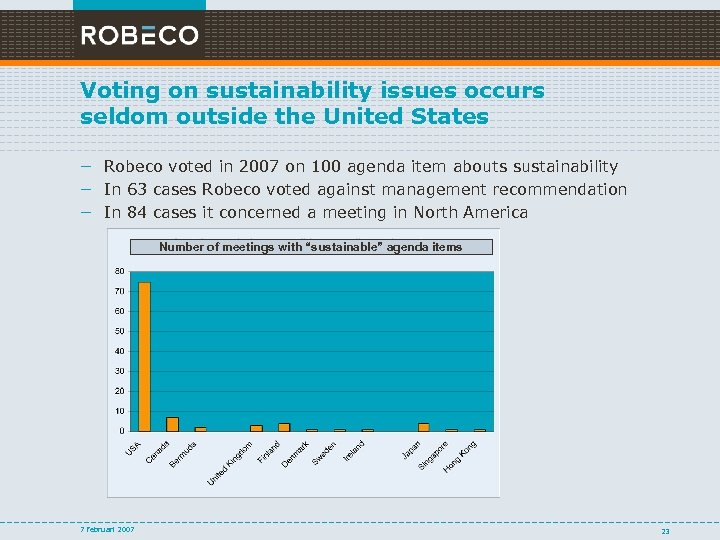

Voting on sustainability issues occurs seldom outside the United States – Robeco voted in 2007 on 100 agenda item abouts sustainability – In 63 cases Robeco voted against management recommendation – In 84 cases it concerned a meeting in North America Number of meetings with “sustainable” agenda items 7 februari 2007 23

Money starts talking Voting is more and more used to influence decision making. Reasoning for votes against management proposals are more often explained. Selling is no longer the only option an institutional investor has. Having a continued, constructive dialogue is seen as the way forward. 7 februari 2007 24

Engagement aims to influence company behavior 17 -04 -2007

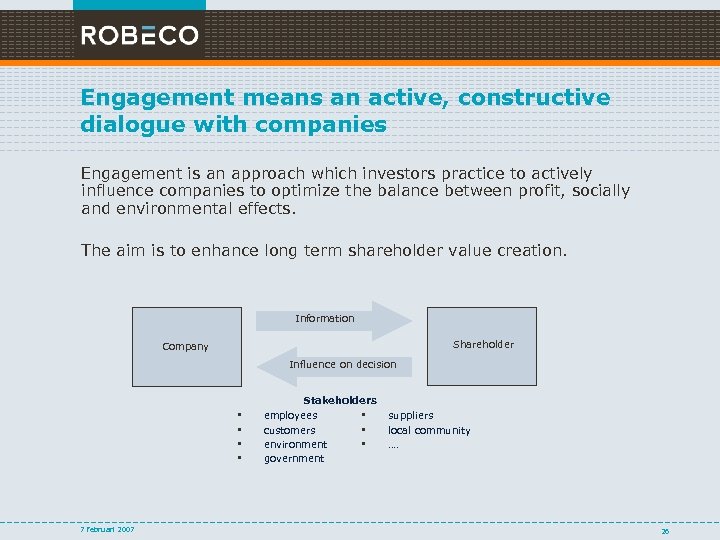

Engagement means an active, constructive dialogue with companies • Engagement is an approach which investors practice to actively influence companies to optimize the balance between profit, socially and environmental effects. • The aim is to enhance long term shareholder value creation. Bedrijf Information Invloed op beslissingen Shareholder Company Influence on decision Omgeving § § 7 februari 2007 Stakeholders werknemers § suppliers klantentoeleveranciers – § local community milieu locatie van vestiging – § …. overheid – …. employees – customers – – environment – government 26

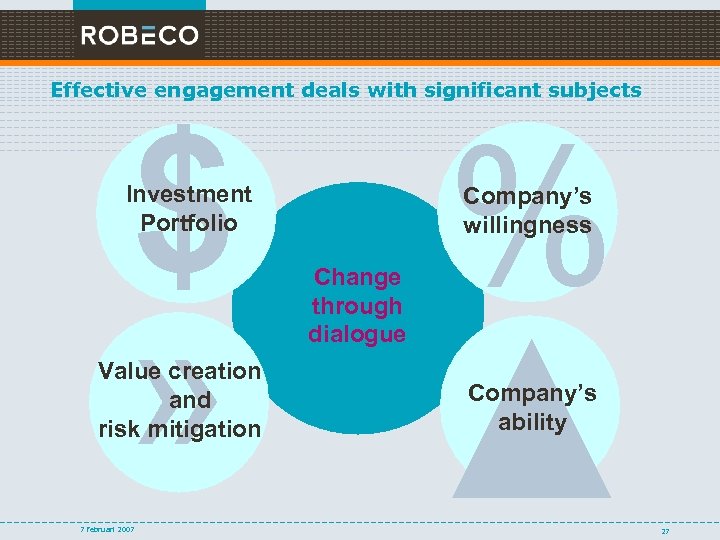

Effective engagement deals with significant subjects $ » Investment Portfolio Value creation and risk mitigation 7 februari 2007 % Company’s willingness Change through dialogue ▲ Company’s ability 27

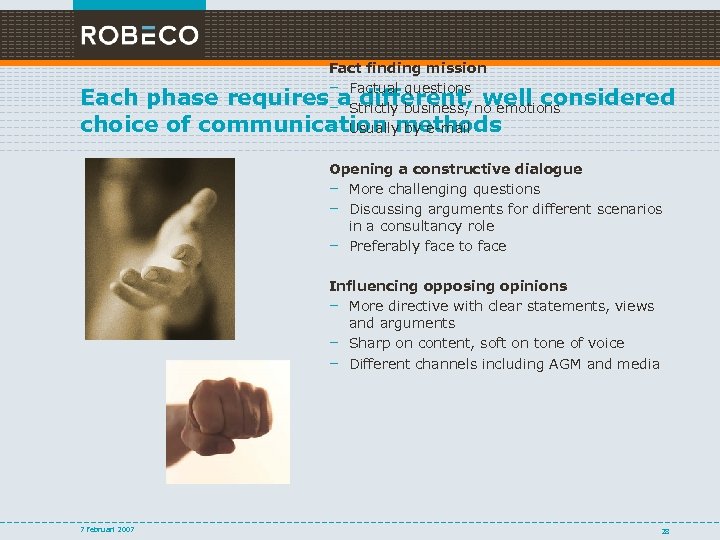

Fact finding mission – Factual questions Each phase requires–a. Strictly business, no emotions different, well considered choice of communication methods – Usually by e-mail Opening a constructive dialogue – More challenging questions – Discussing arguments for different scenarios in a consultancy role – Preferably face to face Influencing opposing opinions – More directive with clear statements, views and arguments – Sharp on content, soft on tone of voice – Different channels including AGM and media 7 februari 2007 28

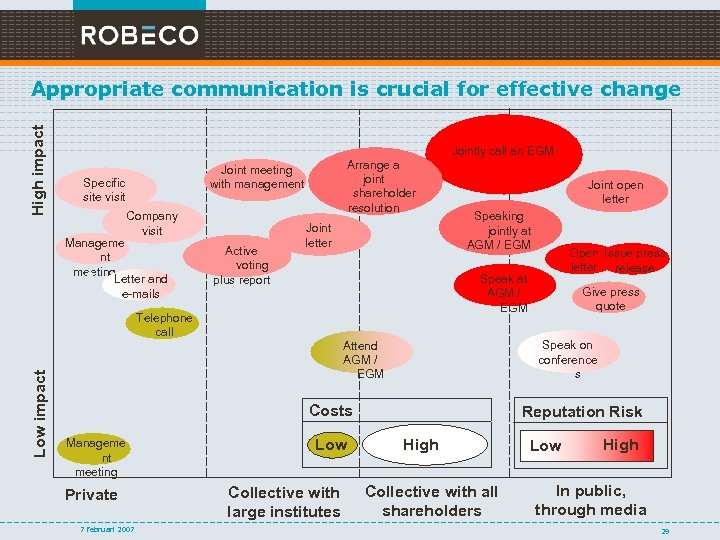

High impact Appropriate communication is crucial for effective change Arrange a joint shareholder resolution Joint meeting with management Specific site visit Company visit Manageme nt meeting Letter and e-mails Active voting plus report Joint letter Joint open letter Speaking jointly at AGM / EGM Costs Private 7 februari 2007 Low Collective with large institutes Give press quote Speak on conference s Attend AGM / EGM Manageme nt meeting Open Issue press letter release Speak at AGM / EGM Telephone call Low impact Jointly call an EGM Reputation Risk High Collective with all shareholders Low High In public, through media 29

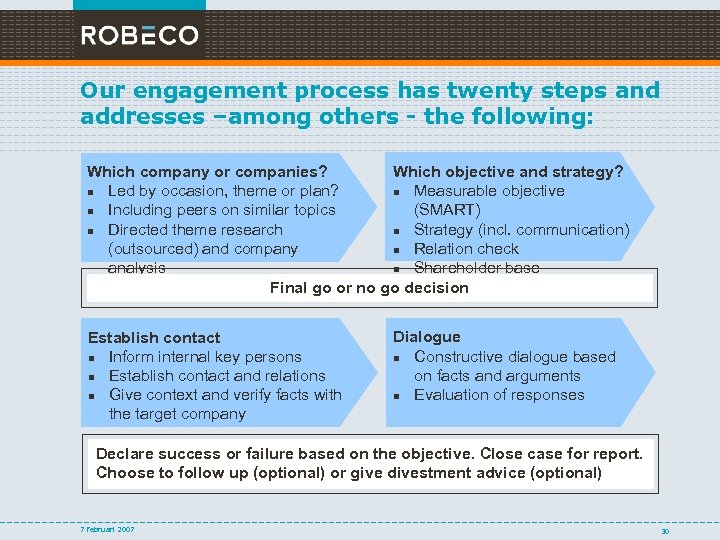

Our engagement process has twenty steps and addresses –among others - the following: Which objective and strategy? Which company or companies? n Measurable objective n Led by occasion, theme or plan? (SMART) n Including peers on similar topics n Strategy (incl. communication) n Directed theme research n Relation check (outsourced) and company n Shareholder base analysis Final go or no go decision Establish contact n Inform internal key persons n Establish contact and relations n Give context and verify facts with the target company Dialogue n Constructive dialogue based on facts and arguments n Evaluation of responses Declare success or failure based on the objective. Close case for report. Choose to follow up (optional) or give divestment advice (optional) 7 februari 2007 30

Necessary conditions for successful engagement Large pension funds and independent asset managers are well positioned to practise engagement successfully – Size creates access (voice can only create access in consumer stock) – Independence avoids conflicts of interest – Knowledge creates a level playing field – Resources to deal with the workload 7 februari 2007 31

Pieces falling together in the latest innovation: Engagement led divestment 17 -04 -2007

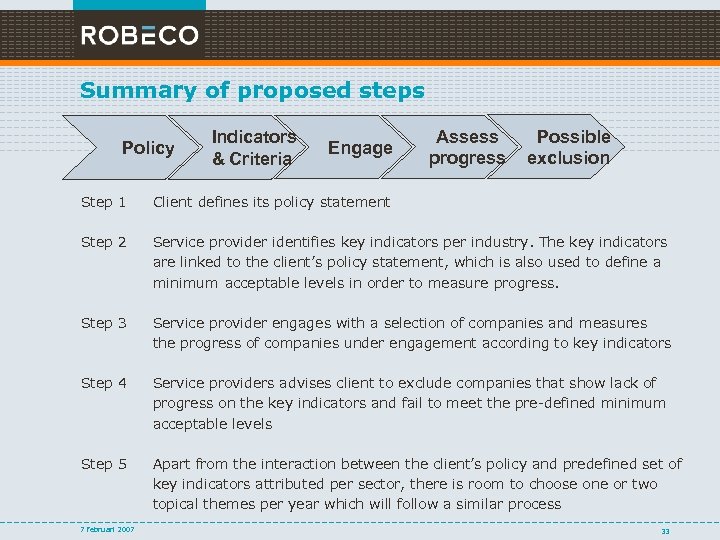

Summary of proposed steps Policy Indicators & Criteria Engage Assess progress Possible exclusion Step 1 Client defines its policy statement Step 2 Service provider identifies key indicators per industry. The key indicators are linked to the client’s policy statement, which is also used to define a minimum acceptable levels in order to measure progress. Step 3 Service provider engages with a selection of companies and measures the progress of companies under engagement according to key indicators Step 4 Service providers advises client to exclude companies that show lack of progress on the key indicators and fail to meet the pre-defined minimum acceptable levels Step 5 Apart from the interaction between the client’s policy and predefined set of key indicators attributed per sector, there is room to choose one or two topical themes per year which will follow a similar process 7 februari 2007 33

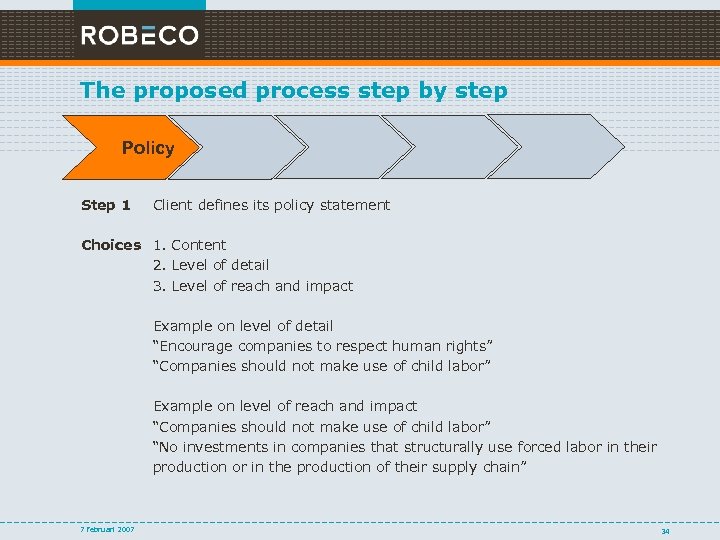

The proposed process step by step Policy Step 1 Client defines its policy statement Choices 1. Content 2. Level of detail 3. Level of reach and impact Example on level of detail “Encourage companies to respect human rights” “Companies should not make use of child labor” Example on level of reach and impact “Companies should not make use of child labor” “No investments in companies that structurally use forced labor in their production or in the production of their supply chain” 7 februari 2007 34

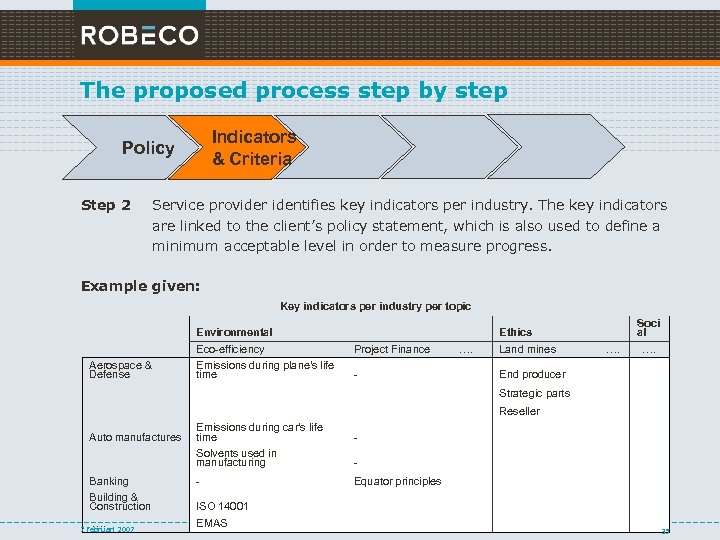

The proposed process step by step Indicators & Criteria Policy Step 2 Service provider identifies key indicators per industry. The key indicators are linked to the client’s policy statement, which is also used to define a minimum acceptable level in order to measure progress. Example given: Key indicators per industry per topic Aerospace & Defense Environmental Eco-efficiency Emissions during plane's life time Auto manufactures Banking Building & Construction …. 7 februari 2007 Project Finance …. …. Soci al …. End producer Strategic parts Emissions during car's life time Solvents used in manufacturing Reseller - - - Equator principles ISO 14001 EMAS - Ethics Land mines 35

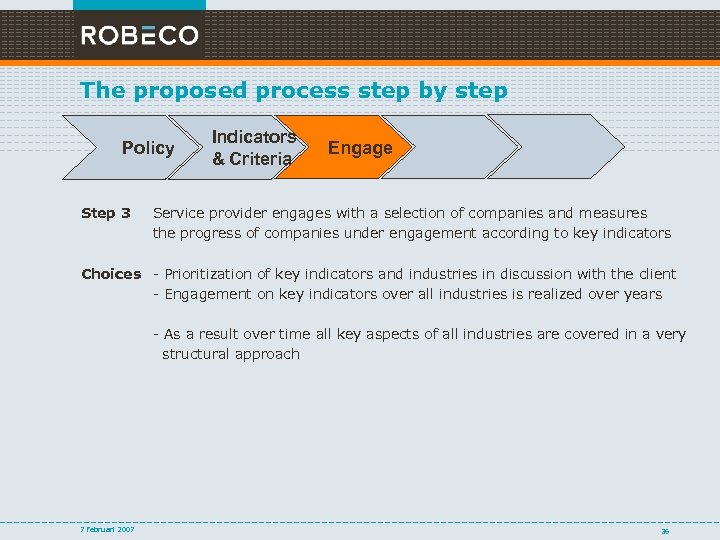

The proposed process step by step Policy Step 3 Indicators & Criteria Engage Service provider engages with a selection of companies and measures the progress of companies under engagement according to key indicators Choices - Prioritization of key indicators and industries in discussion with the client - Engagement on key indicators over all industries is realized over years - As a result over time all key aspects of all industries are covered in a very structural approach 7 februari 2007 36

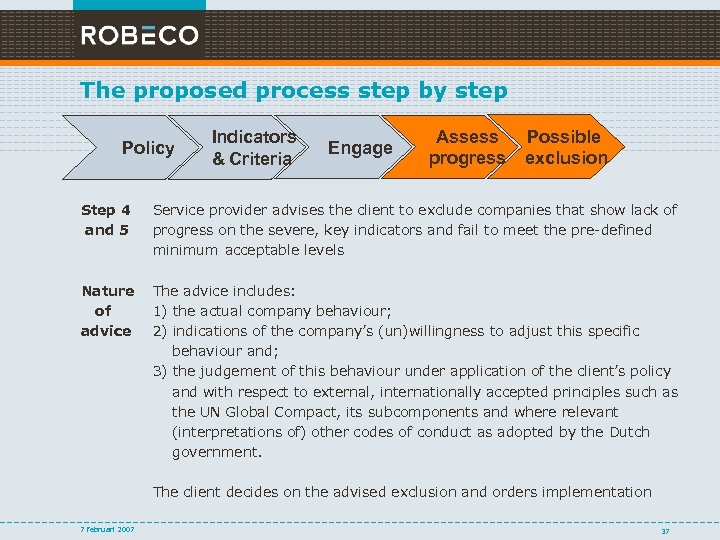

The proposed process step by step Policy Indicators & Criteria Engage Assess progress Possible exclusion Step 4 and 5 Service provider advises the client to exclude companies that show lack of progress on the severe, key indicators and fail to meet the pre-defined minimum acceptable levels Nature of advice The advice includes: 1) the actual company behaviour; 2) indications of the company’s (un)willingness to adjust this specific behaviour and; 3) the judgement of this behaviour under application of the client’s policy and with respect to external, internationally accepted principles such as the UN Global Compact, its subcomponents and where relevant (interpretations of) other codes of conduct as adopted by the Dutch government. The client decides on the advised exclusion and orders implementation 7 februari 2007 37

Possible developments in mainstreaming responsible investments 17 -04 -2007

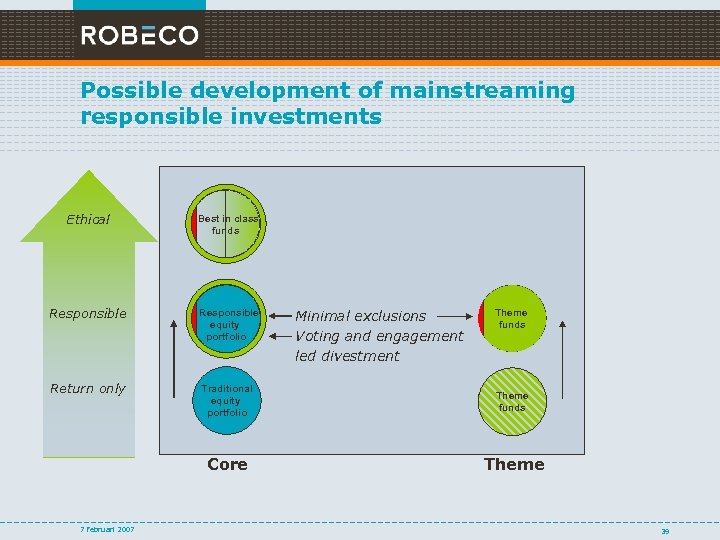

Possible development of mainstreaming responsible investments Ethical Best in class funds Responsible equity portfolio Return only Traditional equity portfolio Theme funds Core Theme 7 februari 2007 Minimal exclusions Voting and engagement led divestment Theme funds 39

Questions? 7 februari 2007 40

Contact details: F. C. Breen@robeco. nl 17 -04 -2007

APPENDICES 17 -04 -2007

APPENDIX 1 Collaboration of institutional investors About fellow shareholders in the same game 17 -04 -2007

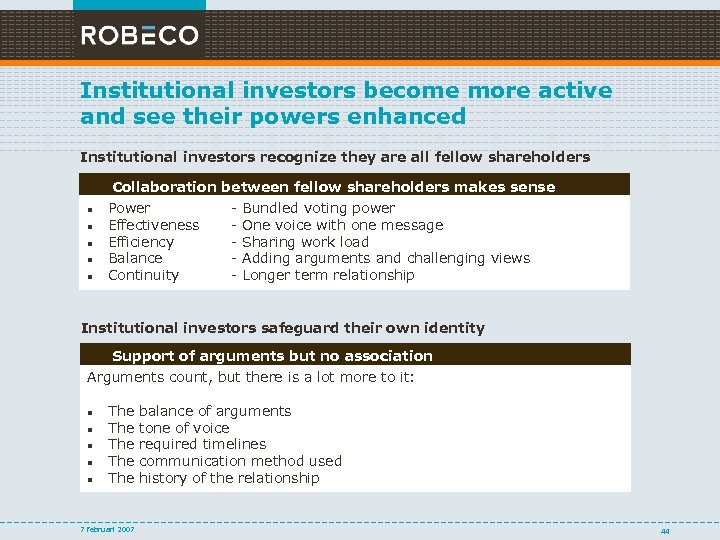

Institutional investors become more active and see their powers enhanced Institutional investors recognize they are all fellow shareholders Collaboration between fellow shareholders makes sense n n n Power Effectiveness Efficiency Balance Continuity - Bundled voting power One voice with one message Sharing work load Adding arguments and challenging views Longer term relationship Institutional investors safeguard their own identity Support of arguments but no association Arguments count, but there is a lot more to it: n n n The The The 7 februari 2007 balance of arguments tone of voice required timelines communication method used history of the relationship 44

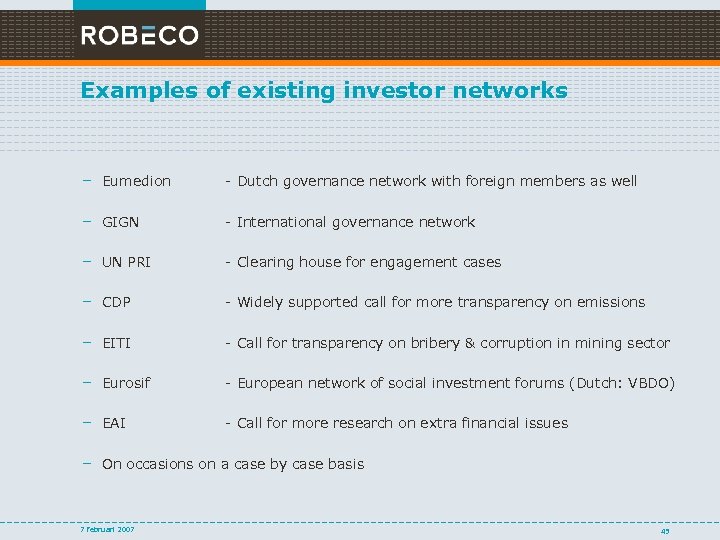

Examples of existing investor networks – Eumedion - Dutch governance network with foreign members as well – GIGN - International governance network – UN PRI - Clearing house for engagement cases – CDP - Widely supported call for more transparency on emissions – EITI - Call for transparency on bribery & corruption in mining sector – Eurosif - European network of social investment forums (Dutch: VBDO) – EAI - Call for more research on extra financial issues – On occasions on a case by case basis 7 februari 2007 45

APPENDIX 2 Real life examples About Royal Dutch Shell, VNU, CSM, Euronext, Stork and ABN AMRO … 17 -04 -2007

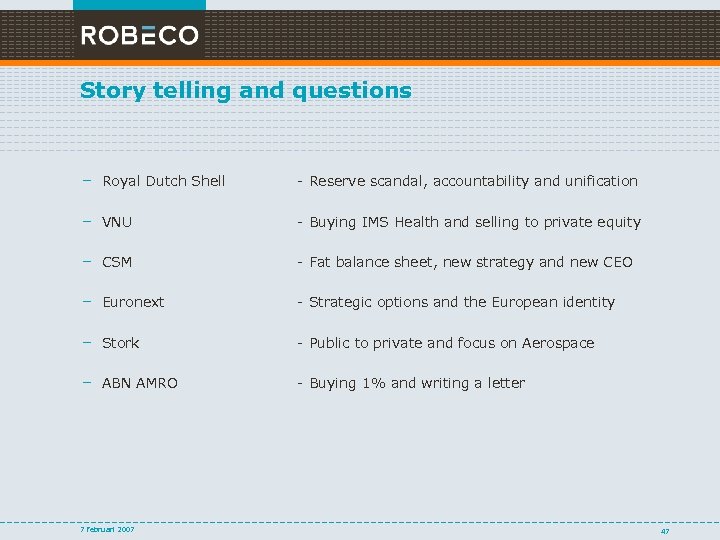

Story telling and questions – Royal Dutch Shell - Reserve scandal, accountability and unification – VNU - Buying IMS Health and selling to private equity – CSM - Fat balance sheet, new strategy and new CEO – Euronext - Strategic options and the European identity – Stork - Public to private and focus on Aerospace – ABN AMRO - Buying 1% and writing a letter 7 februari 2007 47

Why would investors influence companies? Responsibility as owner – Obligation of having power General value perspective – Universal owner – In general and in precedents Identity as investor – Labour organisations, churches Focused value strategy – Strong aligned with investments – Strategic consultancy “offered” 7 februari 2007 48

APPENDIX 3 Voting 17 -04 -2007

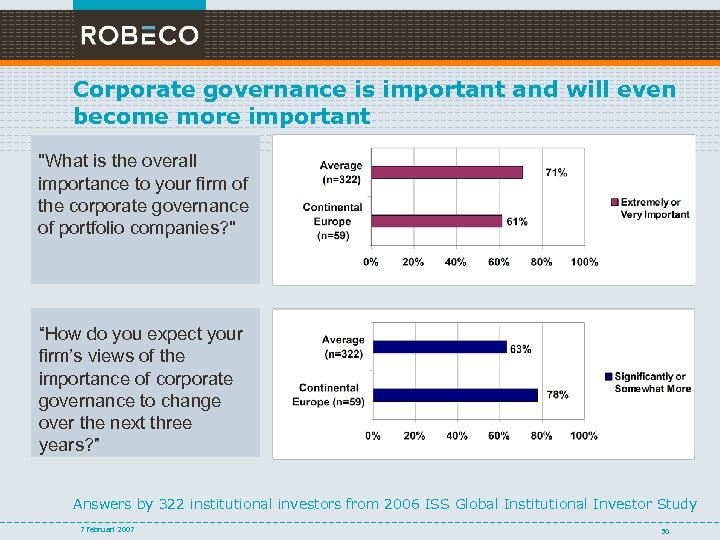

Corporate governance is important and will even become more important "What is the overall importance to your firm of the corporate governance of portfolio companies? " “How do you expect your firm’s views of the importance of corporate governance to change over the next three years? ” Answers by 322 institutional investors from 2006 ISS Global Institutional Investor Study 7 februari 2007 50

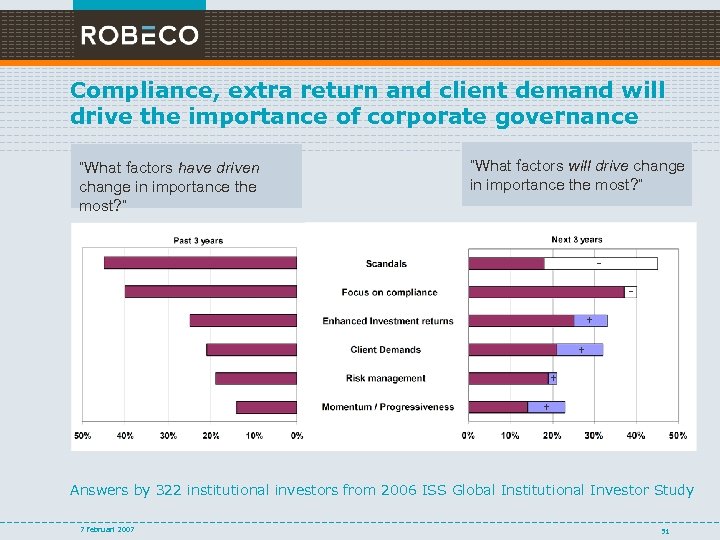

Compliance, extra return and client demand will drive the importance of corporate governance “What factors have driven change in importance the most? ” “What factors will drive change in importance the most? ” + + Answers by 322 institutional investors from 2006 ISS Global Institutional Investor Study 7 februari 2007 51

86425556ea0baacf0a1cb52f5c86f932.ppt