1a802153d38837b5b707fa7da2ef0a59.ppt

- Количество слайдов: 14

Residential Property Investment – Is There More Upside? Malaysia As An International Real Estate Investment Destination

Residential Property Investment – Is There More Upside? Malaysia As An International Real Estate Investment Destination

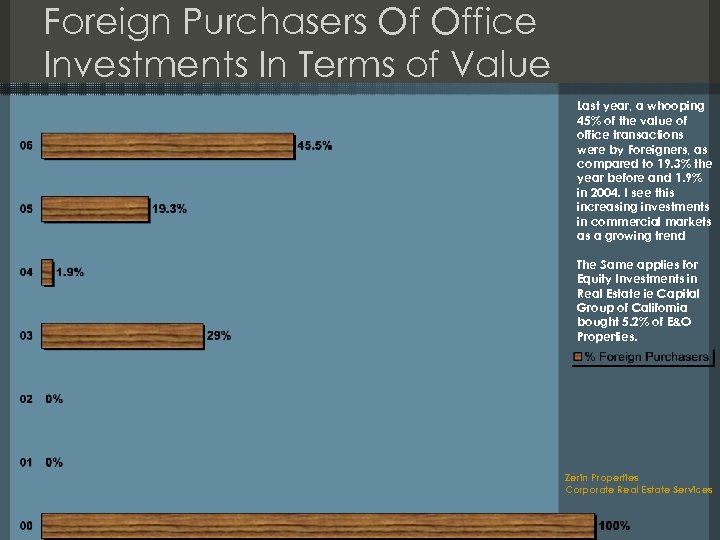

Foreign Purchasers Of Office Investments In Terms of Value Last year, a whooping 45% of the value of office transactions were by Foreigners, as compared to 19. 3% the year before and 1. 9% in 2004. I see this increasing investments in commercial markets as a growing trend The Same applies for Equity Investments in Real Estate ie Capital Group of California bought 5. 2% of E&O Properties. Zerin Properties Corporate Real Estate Services

Foreign Purchasers Of Office Investments In Terms of Value Last year, a whooping 45% of the value of office transactions were by Foreigners, as compared to 19. 3% the year before and 1. 9% in 2004. I see this increasing investments in commercial markets as a growing trend The Same applies for Equity Investments in Real Estate ie Capital Group of California bought 5. 2% of E&O Properties. Zerin Properties Corporate Real Estate Services

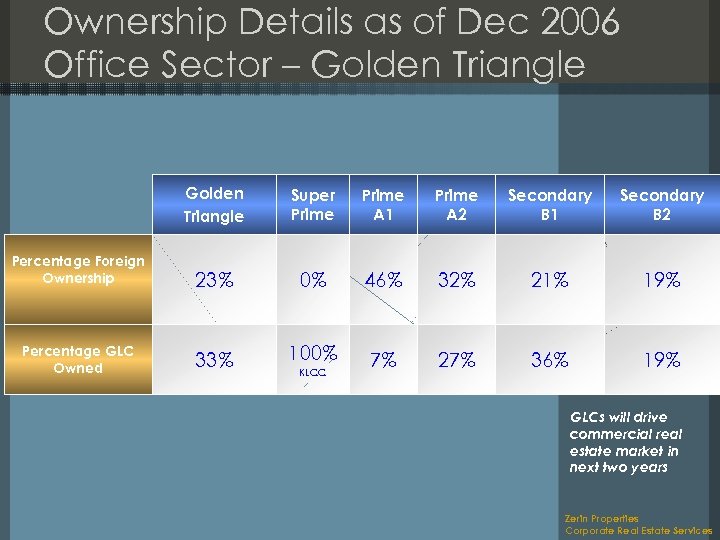

Ownership Details as of Dec 2006 Office Sector – Golden Triangle Super Prime A 1 Prime A 2 Secondary B 1 Secondary B 2 Percentage Foreign Ownership 23% 0% 46% 32% 21% 19% Percentage GLC Owned 33% 100% 7% 27% 36% 19% KLCC GLCs will drive commercial real estate market in next two years Zerin Properties Corporate Real Estate Services

Ownership Details as of Dec 2006 Office Sector – Golden Triangle Super Prime A 1 Prime A 2 Secondary B 1 Secondary B 2 Percentage Foreign Ownership 23% 0% 46% 32% 21% 19% Percentage GLC Owned 33% 100% 7% 27% 36% 19% KLCC GLCs will drive commercial real estate market in next two years Zerin Properties Corporate Real Estate Services

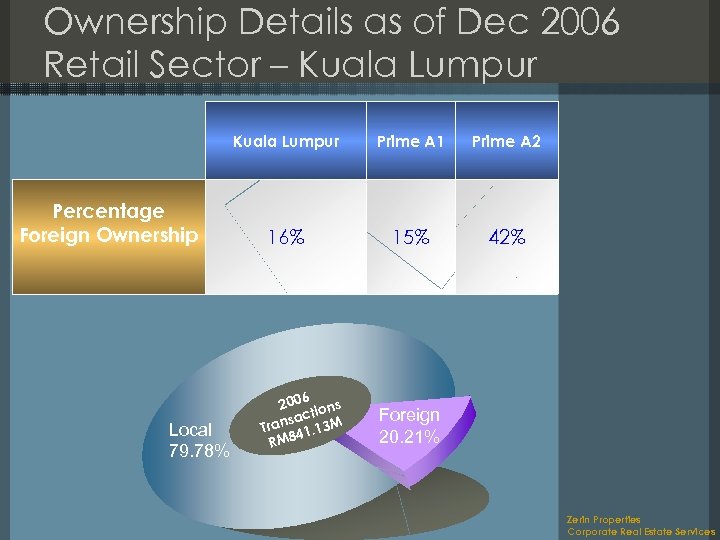

Ownership Details as of Dec 2006 Retail Sector – Kuala Lumpur Percentage Foreign Ownership Local 79. 78% Prime A 1 Prime A 2 16% 15% 42% 2006 ions act rans 1. 13 M T 4 RM 8 Foreign 20. 21% Zerin Properties Corporate Real Estate Services

Ownership Details as of Dec 2006 Retail Sector – Kuala Lumpur Percentage Foreign Ownership Local 79. 78% Prime A 1 Prime A 2 16% 15% 42% 2006 ions act rans 1. 13 M T 4 RM 8 Foreign 20. 21% Zerin Properties Corporate Real Estate Services

Trend Of Hospitality Investments Malaysia And again, a huge 85% of the value of hotels transactions were by Foreigners, as compared to 44% for the year before. Foreign Investments In Hotels Grew By 64% in 2006. Hotel Funds and Foreign Investment Funds Driving Demand Zerin Properties Corporate Real Estate Services

Trend Of Hospitality Investments Malaysia And again, a huge 85% of the value of hotels transactions were by Foreigners, as compared to 44% for the year before. Foreign Investments In Hotels Grew By 64% in 2006. Hotel Funds and Foreign Investment Funds Driving Demand Zerin Properties Corporate Real Estate Services

Interest Outside Klang Valley • Penang – – Good MM 2 H Following Mid East Fund and Capital Land in E&O’s project Residential (landed and flatted) Hospitality – HPL/Hard Rock Hotel • Johor – Mudabala and KFH in Node 1 – Multi Level Interest in IDR • Sabah – – Kudat Riveria Labuan Sandakan Kota Kinabalu Zerin Properties Corporate Real Estate Services

Interest Outside Klang Valley • Penang – – Good MM 2 H Following Mid East Fund and Capital Land in E&O’s project Residential (landed and flatted) Hospitality – HPL/Hard Rock Hotel • Johor – Mudabala and KFH in Node 1 – Multi Level Interest in IDR • Sabah – – Kudat Riveria Labuan Sandakan Kota Kinabalu Zerin Properties Corporate Real Estate Services

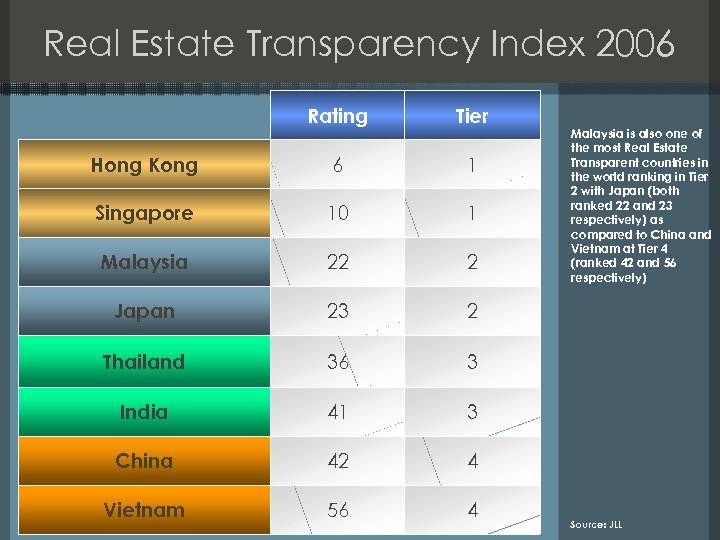

Real Estate Transparency Index 2006 Rating Tier Hong Kong 6 1 Singapore 10 1 Malaysia 22 2 Japan 23 2 Thailand 36 3 India 41 3 China 42 4 Vietnam 56 4 Malaysia is also one of the most Real Estate Transparent countries in the world ranking in Tier 2 with Japan (both ranked 22 and 23 respectively) as compared to China and Vietnam at Tier 4 (ranked 42 and 56 respectively) Source: JLL

Real Estate Transparency Index 2006 Rating Tier Hong Kong 6 1 Singapore 10 1 Malaysia 22 2 Japan 23 2 Thailand 36 3 India 41 3 China 42 4 Vietnam 56 4 Malaysia is also one of the most Real Estate Transparent countries in the world ranking in Tier 2 with Japan (both ranked 22 and 23 respectively) as compared to China and Vietnam at Tier 4 (ranked 42 and 56 respectively) Source: JLL

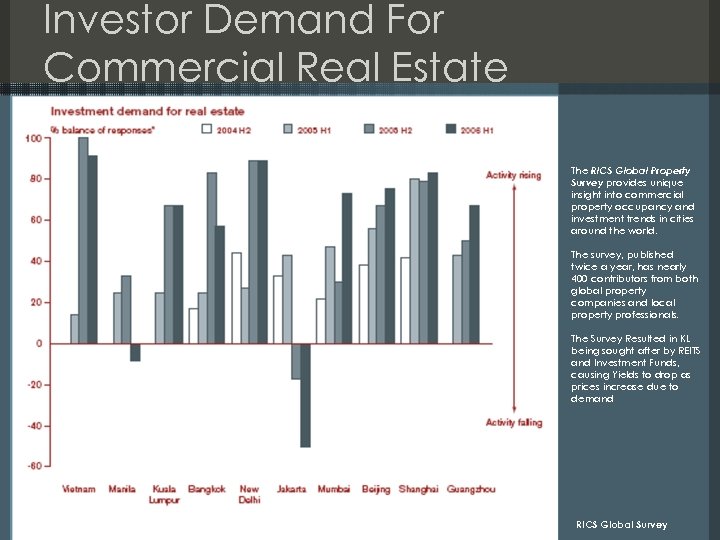

Investor Demand For Commercial Real Estate The RICS Global Property Survey provides unique insight into commercial property occupancy and investment trends in cities around the world. The survey, published twice a year, has nearly 400 contributors from both global property companies and local property professionals. The Survey Resulted in KL being sought after by REITS and Investment Funds, causing Yields to drop as prices increase due to demand RICS Global Survey

Investor Demand For Commercial Real Estate The RICS Global Property Survey provides unique insight into commercial property occupancy and investment trends in cities around the world. The survey, published twice a year, has nearly 400 contributors from both global property companies and local property professionals. The Survey Resulted in KL being sought after by REITS and Investment Funds, causing Yields to drop as prices increase due to demand RICS Global Survey

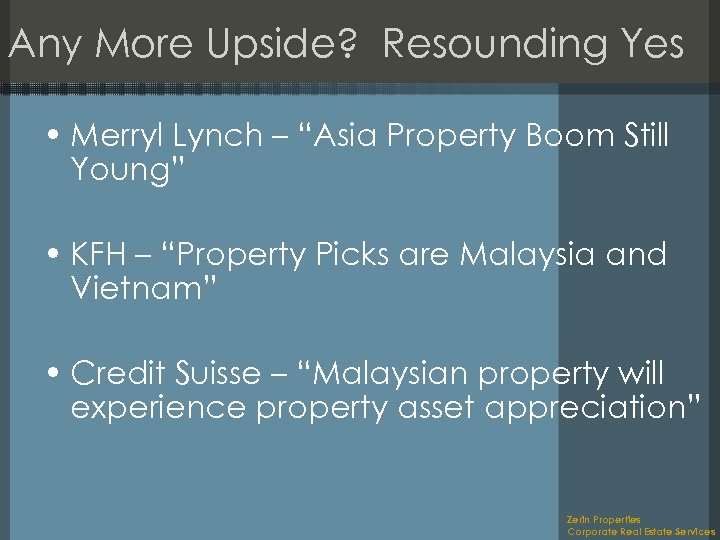

Any More Upside? Resounding Yes • Merryl Lynch – “Asia Property Boom Still Young” • KFH – “Property Picks are Malaysia and Vietnam” • Credit Suisse – “Malaysian property will experience property asset appreciation” Zerin Properties Corporate Real Estate Services

Any More Upside? Resounding Yes • Merryl Lynch – “Asia Property Boom Still Young” • KFH – “Property Picks are Malaysia and Vietnam” • Credit Suisse – “Malaysian property will experience property asset appreciation” Zerin Properties Corporate Real Estate Services

Any More Upside? Resounding Yes • Due to the wealth effect of the stock market • Government pump-priming • Foreigners snapping up high-end property as a result of perception that it is relatively undervalued compared with other major regional countries such as Hong Kong and Singapore, coupled with an undervalued currency. Kuala Lumpur could be the next property play after Hong Kong and Singapore. • More fund managers have been deviating from the normal routine of company visits to view property developments in Kuala Lumpur, Penang and Johor. Zerin Properties Corporate Real Estate Services

Any More Upside? Resounding Yes • Due to the wealth effect of the stock market • Government pump-priming • Foreigners snapping up high-end property as a result of perception that it is relatively undervalued compared with other major regional countries such as Hong Kong and Singapore, coupled with an undervalued currency. Kuala Lumpur could be the next property play after Hong Kong and Singapore. • More fund managers have been deviating from the normal routine of company visits to view property developments in Kuala Lumpur, Penang and Johor. Zerin Properties Corporate Real Estate Services

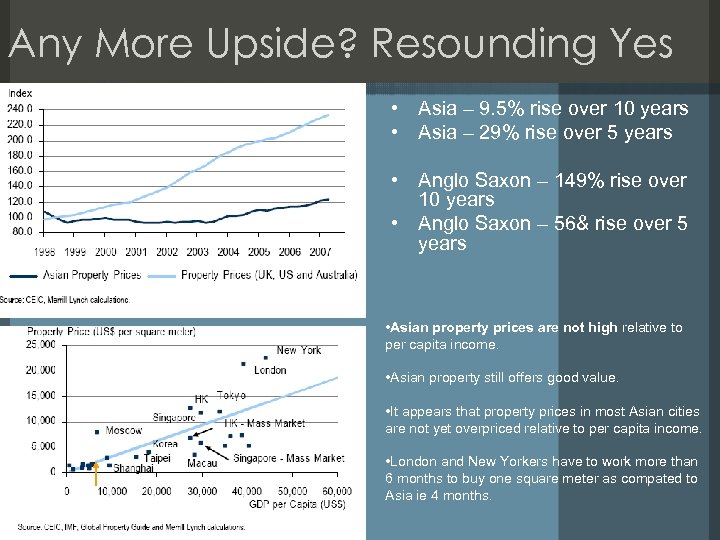

Any More Upside? Resounding Yes • Asia – 9. 5% rise over 10 years • Asia – 29% rise over 5 years • Anglo Saxon – 149% rise over 10 years • Anglo Saxon – 56& rise over 5 years • Asian property prices are not high relative to per capita income. • Asian property still offers good value. • It appears that property prices in most Asian cities are not yet overpriced relative to per capita income. • London and New Yorkers have to work more than 6 months to buy one square meter as compated to Asia ie 4 months.

Any More Upside? Resounding Yes • Asia – 9. 5% rise over 10 years • Asia – 29% rise over 5 years • Anglo Saxon – 149% rise over 10 years • Anglo Saxon – 56& rise over 5 years • Asian property prices are not high relative to per capita income. • Asian property still offers good value. • It appears that property prices in most Asian cities are not yet overpriced relative to per capita income. • London and New Yorkers have to work more than 6 months to buy one square meter as compated to Asia ie 4 months.

Any More Upside? Resounding Yes • Main Drivers in Place – Low Interest Rates – Sustained Growth – Employment and Wages – Young Population and Urbanization – Tourism Juggernaut – LCC Induced Growth • How Long Will It Last – Based on GDP Growth, Population Requirements, Globalisation Zerin Properties Corporate Real Estate Services

Any More Upside? Resounding Yes • Main Drivers in Place – Low Interest Rates – Sustained Growth – Employment and Wages – Young Population and Urbanization – Tourism Juggernaut – LCC Induced Growth • How Long Will It Last – Based on GDP Growth, Population Requirements, Globalisation Zerin Properties Corporate Real Estate Services

3 Hot Property Locations • Kuala Lumpur – KLCC, Mont Kiara, Ampang Hilir • Penang Island • JB – IDR • Followed By – Kota Kinabalu (I am Sabahan) – Kuantan-Cherating-KT Zerin Properties Corporate Real Estate Services

3 Hot Property Locations • Kuala Lumpur – KLCC, Mont Kiara, Ampang Hilir • Penang Island • JB – IDR • Followed By – Kota Kinabalu (I am Sabahan) – Kuantan-Cherating-KT Zerin Properties Corporate Real Estate Services