d3ae875dac58ad84ebcd2790d5448698.ppt

- Количество слайдов: 41

Research report The business case for nextgeneration access l Margaret Hopkins November 2009

![The business case for next-generation access 2 Contents [1] Slide no. 4. Document map The business case for next-generation access 2 Contents [1] Slide no. 4. Document map](https://present5.com/presentation/d3ae875dac58ad84ebcd2790d5448698/image-2.jpg)

The business case for next-generation access 2 Contents [1] Slide no. 4. Document map – Executive summary 5. Provision of next-generation access (NGA) is a hot topic, but many countries will find it problematic 6. Fibre installation, which depends on topology, is the biggest cost, but circumstances determine likely revenue 7. Using likely assumptions about costs, ARPU and take-up, roll-out of all technologies is only viable in high-rise areas 8. Document map – VDSL, GPON and point-topoint fibre are compared 9. Much of the discussion of fibre to the home ignores commercial realities 10. This report examines a number of scenarios in order to assess what NGA investment is likely 11. Document map – Costs are well understood 12. Even for VDSL, the main cost is fibre 13. Point-to-point fibre is the most expensive option 14. 15. 16. GPON offers a small cost saving over P 2 P High-rise areas require a lot less digging Document map – There a number of big uncertainties Slide no. 17. Topographical factors make a big difference to a roll-out 18. Where there is a strong competitor, the incumbent’s business case is much easier to make 19. Prices vary across markets: we have assumed that higher bandwidth brings higher take-up and ARPU 20. TV costs and revenue also vary widely between markets, and many subscribers will not be retail customers 21. Document map – High-rise areas are likely to be profitable 22. Using likely assumptions about costs, ARPU and take-up, roll-out of all technologies is only viable in high-rise areas 23. In the base case, and recognising all the revenue, only high-rise areas get a viable utility roll-out 24. In order to justify roll-out in suburbs, ARPUs of over EUR 100 are needed, using likely take-up assumptions 25. Take-up rates of 50% or more are needed to justify roll-out in suburbs, using likely ARPU assumptions 26. Much higher percentages of duct re-use helps the business case, as does putting fibre on poles © Analysys Mason Limited 2009

![The business case for next-generation access 3 Contents [2] Slide no. 31. Document map The business case for next-generation access 3 Contents [2] Slide no. 31. Document map](https://present5.com/presentation/d3ae875dac58ad84ebcd2790d5448698/image-3.jpg)

The business case for next-generation access 3 Contents [2] Slide no. 31. Document map – Special factors allow current roll-outs 32. Special factors behind current roll-outs (1) 33. Special factors behind current roll-outs (2) 34. Document map – How can FTTH be made more widely possible? 35. How can FTTH roll-out be made more widely possible? 36. Document map – Author, copyright and key to acronyms 37. Author 38. Copyright and disclaimer 39. Key to acronyms 40. Document map – List of figures and tables 41. List of figures and tables 42. Document map – About Analysys Mason 43. About Analysys Mason 44. Research from Analysys Mason 45. Consulting from Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 4 Document map: Executive summary Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 5 Executive summary Provision of next-generation access (NGA) is a hot topic, but many countries will find it problematic l l l High broadband speeds – of up to 100 Mbit/s – are already being provided in, for example, Hong Kong, Japan, the Netherlands, Scandinavia, Singapore and South Korea. Political pressure is building in other countries to demand that network operators and regulators catch up with these leaders. Countries not in the leading group worry that NGA will be essential to economic development. However, many variables affect whether rolling out such a network is economically viable and some countries will find the appropriate conditions harder to meet than others. For example, the following factors play a big role: w housing density: subscriber density is critical – the more fibre that has to be installed per subscriber, the harder it is to make NGA pay and this depends on housing density w w type of ground that must be dug up to lay cables and the number of cases in which this has to be done w householders’ willingness to pay for high-speed broadband TV services w l acceptability of aerial fibre on poles: this is much cheaper than underground installation level of government and regulator support. Much of the media coverage fails to acknowledge the different challenges that countries face in moving to nextgeneration broadband. Some incumbent operators cannot make a commercial business case for market-driven investment because of factors beyond their control. © Analysys Mason Limited 2009

The business case for next-generation access 6 Executive summary Fibre installation, which depends on topology, is the biggest cost, but circumstances determine likely revenue l l The top three uncertainties in the list in the previous slide relate to the cost of deploying the fibre necessary to link every home to the network. Some countries, such as Hong Kong, have been able to move quickly because very high-density housing makes the business case very straightforward. Others, such as Australia, have some housing that is so spread out that it is still not clear how coverage will be achieved. The USA has extreme examples of both types of area, and most European countries have both types, often side by side. In all the areas studied, in the base case, fibre installation accounts for 80% or more of the total cost of FTTH. One simple way to make the investment more viable is to allow the use of aerial fibre on poles, instead of digging trenches to bury cables. This single factor reduces the fibre installation from 57% to 26% of the cost for a VDSL roll-out, from 80% to 62% for GPON and from 84% to 65% for point-to-point in our urban base case. The revenue that can be used to pay for this roll-out is the other key variable. Subscribers in some countries are more willing to pay for high-speed broadband TV than those in others, depending on expectations, incomes and the availability of other options. The overriding factor, however, is how much of this revenue can be regarded as relevant when following good accounting practice. If the investment has to be compared with an existing broadband business, and only the additional revenue can be regarded as relevant, then there is no business case for anything other than urban VDSL. On the other hand, if the operator faces the prospect of an aggressive competitor taking all its high-paying customers, the opportunity cost may be such that the full ARPU can be recognised and the business case starts to look plausible. Levels of government support vary markedly around the globe, from that in South Korea, where there has been a great deal, to that in other economies, where there is little or none. In Europe, regulation is being re-examined to determine whether changes might stimulate development. © Analysys Mason Limited 2009

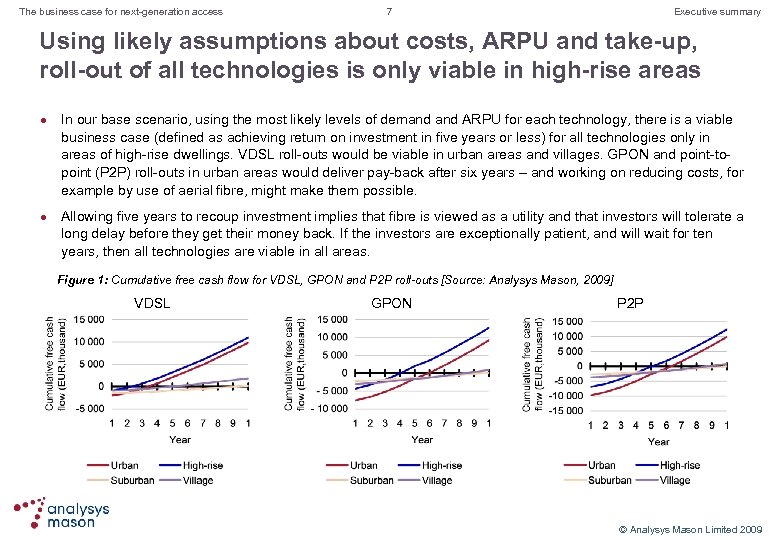

The business case for next-generation access 7 Executive summary Using likely assumptions about costs, ARPU and take-up, roll-out of all technologies is only viable in high-rise areas l l In our base scenario, using the most likely levels of demand ARPU for each technology, there is a viable business case (defined as achieving return on investment in five years or less) for all technologies only in areas of high-rise dwellings. VDSL roll-outs would be viable in urban areas and villages. GPON and point-topoint (P 2 P) roll-outs in urban areas would deliver pay-back after six years – and working on reducing costs, for example by use of aerial fibre, might make them possible. Allowing five years to recoup investment implies that fibre is viewed as a utility and that investors will tolerate a long delay before they get their money back. If the investors are exceptionally patient, and will wait for ten years, then all technologies are viable in all areas. Figure 1: Cumulative free cash flow for VDSL, GPON and P 2 P roll-outs [Source: Analysys Mason, 2009] VDSL GPON P 2 P © Analysys Mason Limited 2009

The business case for next-generation access 8 Document map: VDSL, GPON and point-to-point fibre are compared Document map Executive summary VDSL, GPON and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 9 VDSL, GPON and point-to-point fibre are compared Much of the discussion of fibre to the home ignores commercial realities l l There has been a great deal of media discussion about the need for next-generation access to be rolled out throughout the developed world, in order for countries to be able to compete in an information-based globalised economy, but circumstances vary and some countries will find this harder than others. In this report, we present the results of some business case models of the costs of, and revenue from, the roll-out by an incumbent telecoms operator of a triple-play product (comprising bundled broadband, voice and TV), using three different technologies in four types of geographical area for a single MDF site (the former location of an old-fashioned telephone exchange, which is where the existing copper wires are terminated). Technologies l l l Fibre to the cabinet, specifically VDSL 2, in which the customer is still connected over copper, but the active electronics are moved to the street cabinet so the distance to the house is shorter and speeds can be higher than those of ADSL GPON, in which fibre reaches the house, but is connected through an optical splitter so that fewer fibres are needed to connect back to the MDF site P 2 P fibre, in which each house has a dedicated fibre all the way from the MDF site Types of area l l Urban, in which the housing is fairly dense, for example, terraced houses (townhouses), but not blocks of flats (apartment buildings) High-rise, where people live in apartment blocks Suburban, where each house is set in its own garden and, consequently, dwellings are quite spread out Village, where there are small, quite closely packed, groups of a few thousand houses, but they are some distance from the exchange © Analysys Mason Limited 2009

The business case for next-generation access 10 VDSL, GPON and point-to-point fibre are compared This report examines a number of scenarios in order to assess what NGA investment is likely l A number of cases have been modelled to examine the sensitivities of the NGA investment decision: w w l l the base case uses our best estimates of spend and take-up and of the proportion of fibre deployment that requires new trenches; the detailed assumptions for this case are set out in the next two sections we also calculate the business case based on the same demand assumptions, but using aerial fibre throughout for both the base case and the aerial fibre scenarios, we calculate the net ARPU required to give a viable business case for NGA roll-out, assuming all other costs and level of take-up remain the same. We also calculate what level of take-up would be necessary for a viable business case, given the base case ARPUs for the base case demand cost assumptions, the percentage of ducts that have to be re-used to make a viable business case is calculated. A viable business case is defined as one in which return on investment is reached on cumulative free cash flow within five years. This is longer than most investment opportunities would be allowed – a typical commercial business case requires pay-back within three years – but there is an argument for viewing telecoms as a utility, with reliable cash flows, for which a longer delay is acceptable. The conditions required to achieve pay-back in ten years are also calculated, but this is not a commercial proposition. To make an investment decision requires more-sophisticated measures, that take into account other factors, such as the cost of capital and level of taxation. These factors vary between operators and countries and are not directly related to the debate about next-generation access. Pay-back on free cash flow is a simple, widely applicable, rule of thumb that can be used to decide whether more-detailed analysis is worthwhile. © Analysys Mason Limited 2009

The business case for next-generation access 11 Document map: Costs are well understood Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

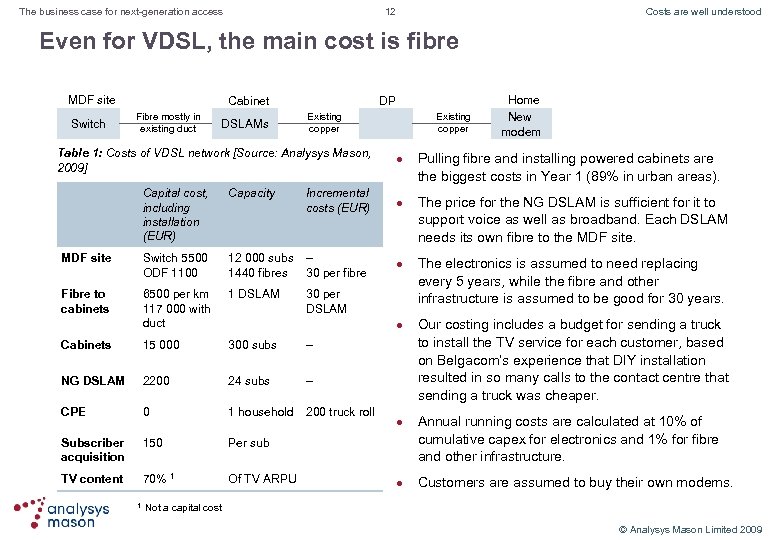

12 The business case for next-generation access Costs are well understood Even for VDSL, the main cost is fibre MDF site Switch Cabinet Fibre mostly in existing duct DSLAMs DP Existing copper Table 1: Costs of VDSL network [Source: Analysys Mason, 2009] Existing copper l Capital cost, including installation (EUR) Capacity Incremental costs (EUR) l MDF site Switch 5500 ODF 1100 12 000 subs 1440 fibres – 30 per fibre l Fibre to cabinets 6500 per km 117 000 with duct 1 DSLAM 30 per DSLAM Cabinets 15 000 300 subs – NG DSLAM 2200 24 subs – CPE 0 1 household 200 truck roll Subscriber acquisition 150 Per sub TV content 70% 1 Of TV ARPU 1 l l l Home New modem Pulling fibre and installing powered cabinets are the biggest costs in Year 1 (89% in urban areas). The price for the NG DSLAM is sufficient for it to support voice as well as broadband. Each DSLAM needs its own fibre to the MDF site. The electronics is assumed to need replacing every 5 years, while the fibre and other infrastructure is assumed to be good for 30 years. Our costing includes a budget for sending a truck to install the TV service for each customer, based on Belgacom’s experience that DIY installation resulted in so many calls to the contact centre that sending a truck was cheaper. Annual running costs are calculated at 10% of cumulative capex for electronics and 1% for fibre and other infrastructure. Customers are assumed to buy their own modems. Not a capital cost © Analysys Mason Limited 2009

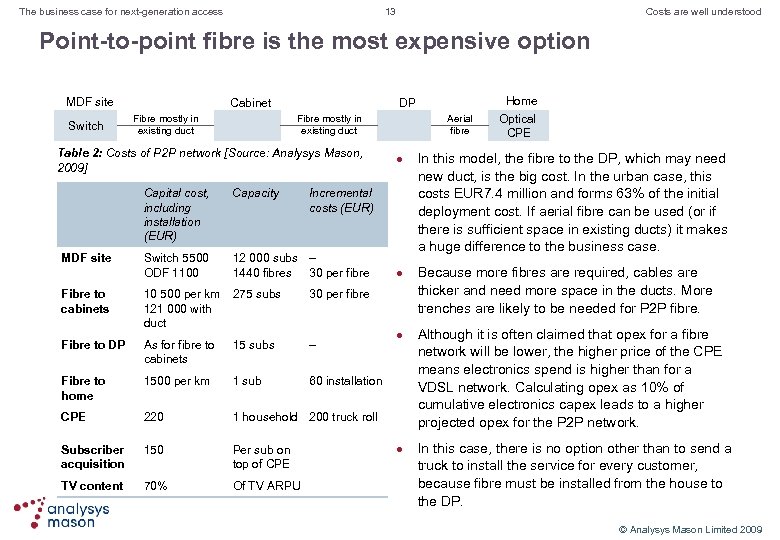

13 The business case for next-generation access Costs are well understood Point-to-point fibre is the most expensive option MDF site Switch Cabinet Fibre mostly in existing duct DP Fibre mostly in existing duct Table 2: Costs of P 2 P network [Source: Analysys Mason, 2009] Capital cost, including installation (EUR) Capacity Switch 5500 ODF 1100 12 000 subs – 1440 fibres 30 per fibre Fibre to cabinets 10 500 per km 121 000 with duct 275 subs As for fibre to cabinets 15 subs – Fibre to home 1500 per km 1 sub 60 installation CPE 220 1 household 200 truck roll Subscriber acquisition 150 Per sub on top of CPE TV content 70% Of TV ARPU l 30 per fibre Fibre to DP Aerial fibre MDF site Incremental costs (EUR) l l l Home Optical CPE In this model, the fibre to the DP, which may need new duct, is the big cost. In the urban case, this costs EUR 7. 4 million and forms 63% of the initial deployment cost. If aerial fibre can be used (or if there is sufficient space in existing ducts) it makes a huge difference to the business case. Because more fibres are required, cables are thicker and need more space in the ducts. More trenches are likely to be needed for P 2 P fibre. Although it is often claimed that opex for a fibre network will be lower, the higher price of the CPE means electronics spend is higher than for a VDSL network. Calculating opex as 10% of cumulative electronics capex leads to a higher projected opex for the P 2 P network. In this case, there is no option other than to send a truck to install the service for every customer, because fibre must be installed from the house to the DP. © Analysys Mason Limited 2009

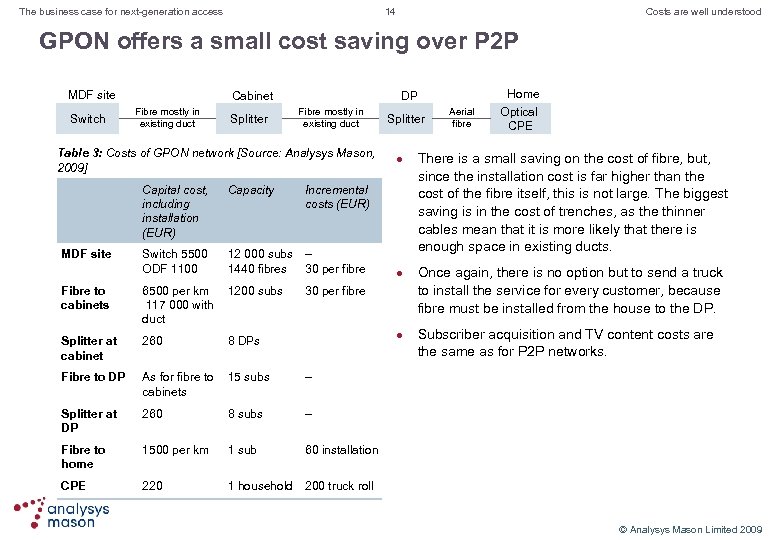

14 The business case for next-generation access Costs are well understood GPON offers a small cost saving over P 2 P MDF site Switch Cabinet Fibre mostly in existing duct Splitter DP Fibre mostly in existing duct Table 3: Costs of GPON network [Source: Analysys Mason, 2009] Capital cost, including installation (EUR) MDF site Capacity Switch 5500 ODF 1100 12 000 subs – 1440 fibres 30 per fibre Splitter l Incremental costs (EUR) Fibre to cabinets 6500 per km 1200 subs 117 000 with duct Splitter at cabinet 260 Fibre to DP As for fibre to 15 subs cabinets 30 per fibre 260 8 subs 1500 per km 1 sub 60 installation CPE 220 Once again, there is no option but to send a truck to install the service for every customer, because fibre must be installed from the house to the DP. – Fibre to home There is a small saving on the cost of fibre, but, since the installation cost is far higher than the cost of the fibre itself, this is not large. The biggest saving is in the cost of trenches, as the thinner cables mean that it is more likely that there is enough space in existing ducts. – Splitter at DP l Aerial fibre Home Optical CPE 1 household 200 truck roll l 8 DPs Subscriber acquisition and TV content costs are the same as for P 2 P networks. © Analysys Mason Limited 2009

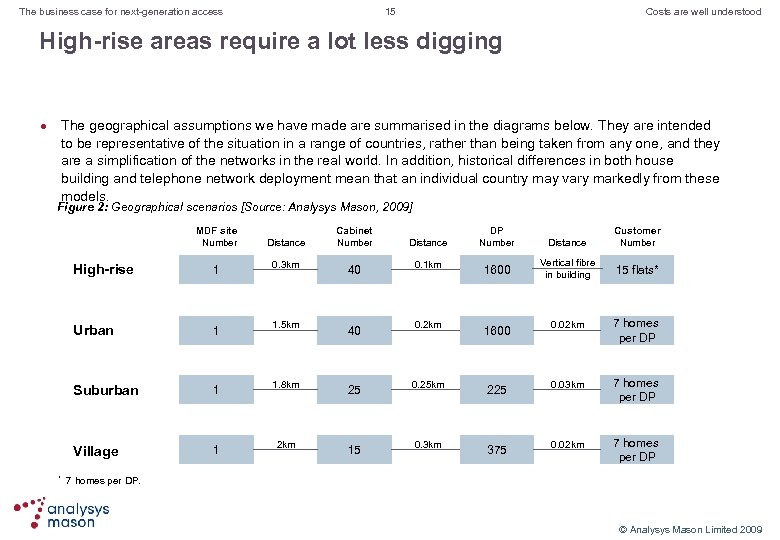

15 The business case for next-generation access Costs are well understood High-rise areas require a lot less digging The geographical assumptions we have made are summarised in the diagrams below. They are intended to be representative of the situation in a range of countries, rather than being taken from any one, and they are a simplification of the networks in the real world. In addition, historical differences in both house building and telephone network deployment mean that an individual country may vary markedly from these models. l Figure 2: Geographical scenarios [Source: Analysys Mason, 2009] MDF site Number Distance Cabinet Number Distance DP Number Distance Customer Number Vertical fibre in building 15 flats* High-rise 0. 3 km 40 0. 1 km 1600 Urban 1 1. 5 km 40 0. 2 km 1600 0. 02 km 7 homes per DP Suburban 1 1. 8 km 25 0. 25 km 225 0. 03 km 7 homes per DP Village * 1 1 2 km 15 0. 3 km 375 0. 02 km 7 homes per DP. © Analysys Mason Limited 2009

The business case for next-generation access 16 Document map: There a number of big uncertainties Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 17 There a number of big uncertainties Topographical factors make a big difference to a roll-out l l l Some topographical factors make a big difference to roll-out costs, one of which is housing density: the more trench you have to dig to install the fibre, the more it costs. Trenches are expensive, as many people and machines are needed to dig them, and they require multiple visits because they must be allowed to settle before they can be made good. The cost of trenches depends on the type of soil – rock is very expensive – and whether the trench is in the middle of a busy road or in the footpath or grass verge. Even with a given housing density, the amount of new trench needed varies greatly by location. There may be existing ducts with space for more fibres, or the ducts may be full or have other problems. The centrally held records often do not match the actual situation: there may have been errors in the paperwork, or trenches may have collapsed or filled with water. Our assumption, based on the duct survey carried out in the UK for Ofcom, is that for GPON, 15% of fibres from the MDF site to the cabinet require new trenches and 10% of fibres to DPs – the latter section was not included in the duct survey, so we have assumed levels similar to those for ducts, but this section of fibre may also be carried on a pole already. More space will be needed in the ducts to carry the bigger volume of P 2 P fibre, but, for these scenarios, the diameter will still be less than 25 mm, even from cabinet to MDF site. We have assumed that 22% of fibres from the cabinet to the MDF site will need new ducts and 15% of fibres from the cabinet to the DP. There are various ways to reduce the cost of laying fibre: w use some existing tunnels, such as sewers w put aerial fibre on poles w ask the customer to do their own digging, as Altibox are doing in rural Norway. © Analysys Mason Limited 2009

The business case for next-generation access 18 There a number of big uncertainties Where there is a strong competitor, the incumbent’s business case is much easier to make l l l Commercial roll-out depends on being able to make a business case that justifies substantial investment and that gets a return on the investment within a reasonable period of time. If an incumbent telecoms operator has a broadband business that is already making money from an ADSL deployment, the first question is: will it be able to make more money from a high-speed network? The answer is, unfortunately, not very much more. Some users will pay a premium for high-speed broadband, but not many, and the premium is likely to be less than 100% – perhaps an extra EUR 10 per month. The telecoms operator may be able to offer more and better TV services, which might earn another EUR 10– 20 per month. This extra EUR 20– 30 per triple-play subscriber is not enough to pay for the investment, except for VDSL in urban areas, as our modelling shows (see slide 24). However, if the incumbent is faced with a competitor with a triple-play offer, probably a cable operator, to which it is losing its best customers, then the business case is quite different. The incumbent can justify including all the revenue from the customers that take its new triple-play service, on the grounds that these customers would otherwise have gone to the cable operator. This is the approach taken in this model. A Belgacom spokesperson says, “We saw that it was interesting for us as a telco to start providing digital TV because we knew that our main competitor was cable and that it would be very difficult to convince a customer on analogue TV to come to Belgacom without having any trigger. [With digital switchover] the customer had a trigger: he had to make a decision to go to digital TV and we wanted to be a choice. In the beginning the offer was on ADSL and ADSL 2+, but to support two TV sets and fast Internet we needed VDSL 2. ” Jan van Rooijen of Reggefiber says, “What people find interesting is that they have a flat-fee phone connection, digital TV possibilities – that is very important – symmetrical bandwidth upstream and downstream and the point to point network – they don’t care about the architecture, but they care about not sharing their bandwidth with their neighbours. ” © Analysys Mason Limited 2009

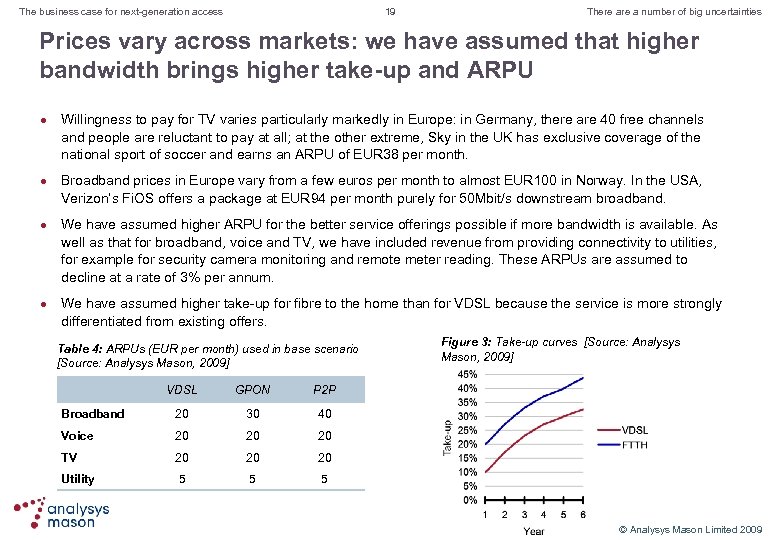

19 The business case for next-generation access There a number of big uncertainties Prices vary across markets: we have assumed that higher bandwidth brings higher take-up and ARPU l l Willingness to pay for TV varies particularly markedly in Europe: in Germany, there are 40 free channels and people are reluctant to pay at all; at the other extreme, Sky in the UK has exclusive coverage of the national sport of soccer and earns an ARPU of EUR 38 per month. Broadband prices in Europe vary from a few euros per month to almost EUR 100 in Norway. In the USA, Verizon’s Fi. OS offers a package at EUR 94 per month purely for 50 Mbit/s downstream broadband. We have assumed higher ARPU for the better service offerings possible if more bandwidth is available. As well as that for broadband, voice and TV, we have included revenue from providing connectivity to utilities, for example for security camera monitoring and remote meter reading. These ARPUs are assumed to decline at a rate of 3% per annum. We have assumed higher take-up for fibre to the home than for VDSL because the service is more strongly differentiated from existing offers. Table 4: ARPUs (EUR per month) used in base scenario [Source: Analysys Mason, 2009] VDSL GPON P 2 P Broadband 20 30 40 Voice 20 20 20 TV 20 20 20 Utility 5 5 Figure 3: Take-up curves [Source: Analysys Mason, 2009] 5 © Analysys Mason Limited 2009

The business case for next-generation access 20 There a number of big uncertainties TV costs and revenue also vary widely between markets, and many subscribers will not be retail customers l l l TV revenue is not all net revenue for the service provider because the content must be paid for. The cost depends on how easy it is to get access to desirable content and on how the pricing for the content is structured. Most content deals are based on a flat-rate minimum payment and a payment per subscriber, although some channels, such as shopping, may pay the operator to carry them. Typically, the flat rate for a desirable channel will be many millions of euros, so a large subscriber base is necessary in order to spread the cost. In our model, the operator is assumed to keep 30% of its TV revenue. Each country has it’s own ‘must-have’ sports content that drives take-up for its owner, although some countries have legislated that the sports regarded as part of the national identity must be available on freeto-air TV. If a telco decides to be an aggressive TV provider and to bid the large sums required to buy its own top sports content, it can expect high take-up and high TV ARPUs, but this is a risky investment. In some cases, a satellite operator that has cornered the market in premium sports coverage has been forced to provide the content to other TV operators at regulated rates. This happened in Italy, where Sky Italia was forced to provide football programming at a regulated price per subscriber, and this made FASTWEB’s triple play viable. Belgacom has bought the rights to football in Belgium, but, despite this, earns TV ARPUs of only about EUR 17 per month. In France, Canal Plus has provided TV content to all of the broadband providers allowing them all to offer a similar TV package. In the UK, Ofcom is consulting on imposing a wholesale must-offer obligation at regulated prices for football rights currently owned by BSky. B. Under EU rules, incumbent operators must offer network access to their competitors at regulated rates. Our model assumes that 30% of the subscribers are retail customers, while the rest take service from other providers and the network operator is assumed to get 60% of this spend. © Analysys Mason Limited 2009

The business case for next-generation access 21 Document map: High-rise areas are likely to be profitable Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

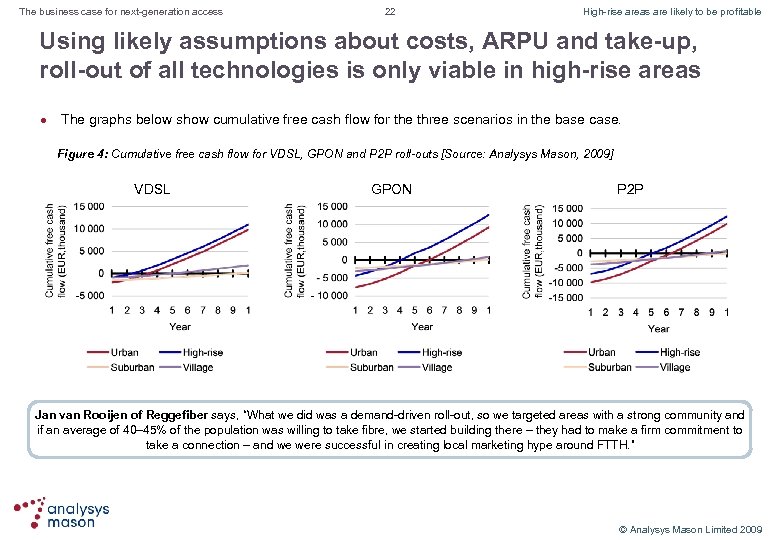

The business case for next-generation access 22 High-rise areas are likely to be profitable Using likely assumptions about costs, ARPU and take-up, roll-out of all technologies is only viable in high-rise areas l The graphs below show cumulative free cash flow for the three scenarios in the base case. Figure 4: Cumulative free cash flow for VDSL, GPON and P 2 P roll-outs [Source: Analysys Mason, 2009] VDSL GPON P 2 P Jan van Rooijen of Reggefiber says, “What we did was a demand-driven roll-out, so we targeted areas with a strong community and if an average of 40– 45% of the population was willing to take fibre, we started building there – they had to make a firm commitment to take a connection – and we were successful in creating local marketing hype around FTTH. ” © Analysys Mason Limited 2009

The business case for next-generation access 23 High-rise areas are likely to be profitable In the base case, and recognising all the revenue, only high-rise areas get a viable utility roll-out l l l For all three technologies, only high-rise areas present a viable business case in which it takes less than five years to pay-back on free cash flow. For VDSL, low take-up is less damaging: pay back is reached in urban areas in five years even when takeup is only 15% by then, and in high-rise areas pay back is in three and a half years, using the same demand assumptions. Apart from the level of take-up, the big unknown in the fibre to the home models is the overall length of trenches that must be dug. We based our assumptions on a duct survey carried out by Analysys Mason in the UK for Ofcom (the biggest such survey undertaken in Europe), but underground plant in other countries may be very different. P 2 P fibre cables will be particularly thick and therefore require more space in the ducts, but they will be less than 25 mm in diameter even between the cabinet and the MDF site, allowing one fibre per subscriber and a maximum of 280 homes per cabinet. The main difference in cost between P 2 P and GPON rests on our assumption that more trenches will be needed. Use of aerial fibre allows both GPON and P 2 P fibre to meet the target of pay-back in five years in urban areas. Other changes could help a bit – making a big push to connect every home in the area during roll-out saves on future truck rolls – but our model is not greatly affected even by assuming DIY installation. A Belgacom spokesperson says, “To break up all streets and start implementing FTTH is a huge investment and, for the time being, we don’t see the need. We see that there are still some new developments going on in technology that will allow us to push DSL further. ” © Analysys Mason Limited 2009

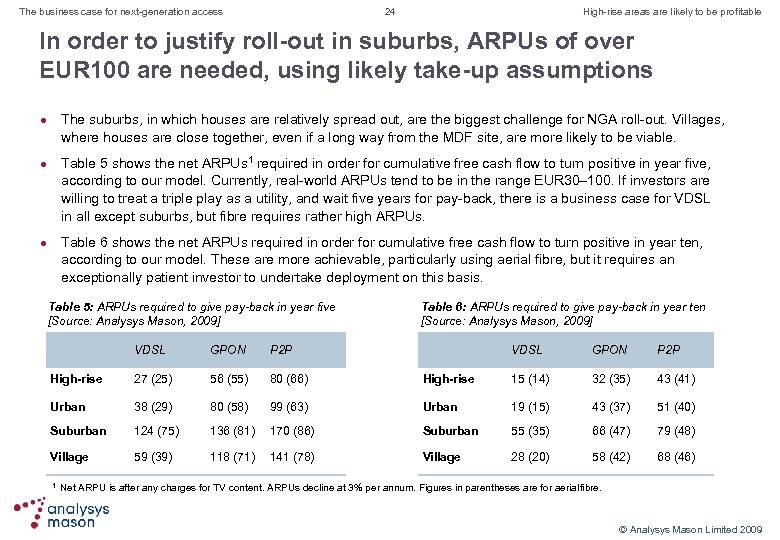

24 The business case for next-generation access High-rise areas are likely to be profitable In order to justify roll-out in suburbs, ARPUs of over EUR 100 are needed, using likely take-up assumptions The suburbs, in which houses are relatively spread out, are the biggest challenge for NGA roll-out. Villages, where houses are close together, even if a long way from the MDF site, are more likely to be viable. l Table 5 shows the net ARPUs 1 required in order for cumulative free cash flow to turn positive in year five, according to our model. Currently, real-world ARPUs tend to be in the range EUR 30– 100. If investors are willing to treat a triple play as a utility, and wait five years for pay-back, there is a business case for VDSL in all except suburbs, but fibre requires rather high ARPUs. l Table 6 shows the net ARPUs required in order for cumulative free cash flow to turn positive in year ten, according to our model. These are more achievable, particularly using aerial fibre, but it requires an exceptionally patient investor to undertake deployment on this basis. l Table 5: ARPUs required to give pay-back in year five [Source: Analysys Mason, 2009] Table 6: ARPUs required to give pay-back in year ten [Source: Analysys Mason, 2009] VDSL GPON P 2 P High-rise 15 (14) 32 (35) 43 (41) 99 (63) Urban 19 (15) 43 (37) 51 (40) 136 (81) 170 (86) Suburban 55 (35) 66 (47) 79 (48) 118 (71) 141 (78) Village 28 (20) 58 (42) 68 (46) VDSL GPON P 2 P High-rise 27 (25) 56 (55) 80 (66) Urban 38 (29) 80 (58) Suburban 124 (75) Village 59 (39) 1 Net ARPU is after any charges for TV content. ARPUs decline at 3% per annum. Figures in parentheses are for aerial ibre. f © Analysys Mason Limited 2009

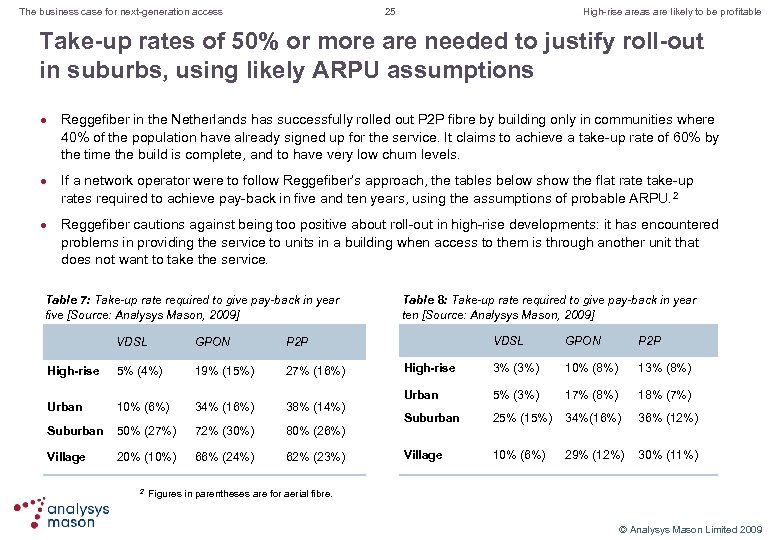

25 The business case for next-generation access High-rise areas are likely to be profitable Take-up rates of 50% or more are needed to justify roll-out in suburbs, using likely ARPU assumptions l l l Reggefiber in the Netherlands has successfully rolled out P 2 P fibre by building only in communities where 40% of the population have already signed up for the service. It claims to achieve a take-up rate of 60% by the time the build is complete, and to have very low churn levels. If a network operator were to follow Reggefiber’s approach, the tables below show the flat rate take-up rates required to achieve pay-back in five and ten years, using the assumptions of probable ARPU. 2 Reggefiber cautions against being too positive about roll-out in high-rise developments: it has encountered problems in providing the service to units in a building when access to them is through another unit that does not want to take the service. Table 7: Take-up rate required to give pay-back in year five [Source: Analysys Mason, 2009] VDSL GPON 5% (4%) 19% (15%) 27% (16%) Urban 10% (6%) 34% (16%) 38% (14%) Suburban 50% (27%) 72% (30%) 20% (10%) 66% (24%) 62% (23%) GPON P 2 P High-rise 3% (3%) 10% (8%) 13% (8%) Urban 5% (3%) 17% (8%) 18% (7%) Suburban 25% (15%) 34%(16%) 36% (12%) Village 10% (6%) 29% (12%) 30% (11%) 80% (26%) Village VDSL P 2 P High-rise Table 8: Take-up rate required to give pay-back in year ten [Source: Analysys Mason, 2009] 2 Figures in parentheses are for aerial fibre. © Analysys Mason Limited 2009

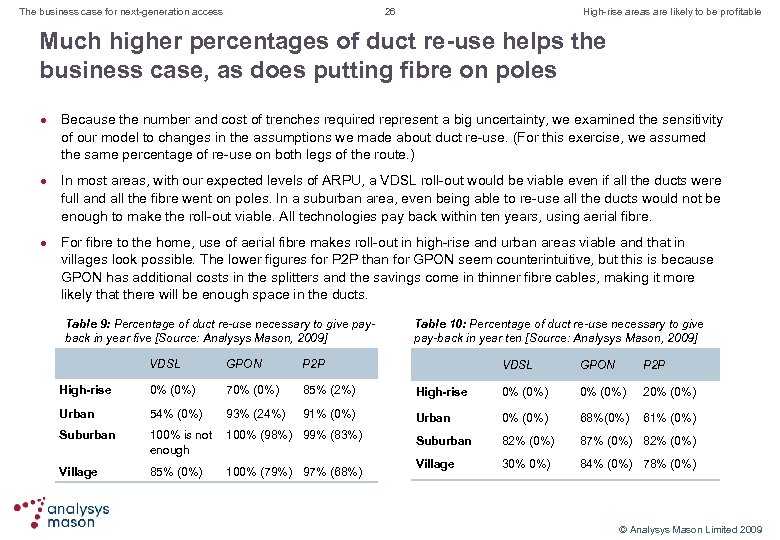

26 The business case for next-generation access High-rise areas are likely to be profitable Much higher percentages of duct re-use helps the business case, as does putting fibre on poles l l l Because the number and cost of trenches required represent a big uncertainty, we examined the sensitivity of our model to changes in the assumptions we made about duct re-use. (For this exercise, we assumed the same percentage of re-use on both legs of the route. ) In most areas, with our expected levels of ARPU, a VDSL roll-out would be viable even if all the ducts were full and all the fibre went on poles. In a suburban area, even being able to re-use all the ducts would not be enough to make the roll-out viable. All technologies pay back within ten years, using aerial fibre. For fibre to the home, use of aerial fibre makes roll-out in high-rise and urban areas viable and that in villages look possible. The lower figures for P 2 P than for GPON seem counterintuitive, but this is because GPON has additional costs in the splitters and the savings come in thinner fibre cables, making it more likely that there will be enough space in the ducts. Table 9: Percentage of duct re-use necessary to give payback in year five [Source: Analysys Mason, 2009] VDSL GPON P 2 P High-rise 0% (0%) 70% (0%) 85% (2%) Urban 54% (0%) 93% (24%) 91% (0%) Suburban 100% is not 100% (98%) 99% (83%) enough Village 85% (0%) Table 10: Percentage of duct re-use necessary to give pay-back in year ten [Source: Analysys Mason, 2009] 100% (79%) 97% (68%) VDSL GPON P 2 P High-rise 0% (0%) 20% (0%) Urban 0% (0%) 68%(0%) 61% (0%) Suburban 82% (0%) 87% (0%) 82% (0%) Village 30% 0%) 84% (0%) 78% (0%) © Analysys Mason Limited 2009

The business case for next-generation access 27 Document map: Special factors allow current roll-outs Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

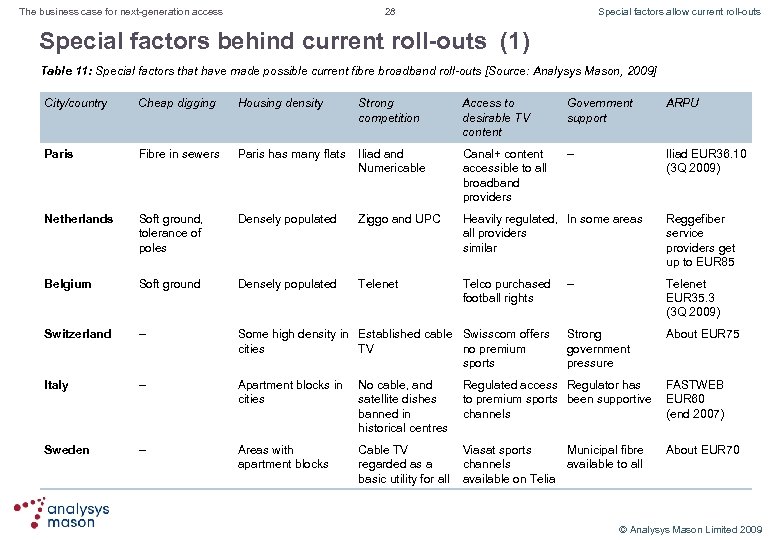

28 The business case for next-generation access Special factors allow current roll-outs Special factors behind current roll-outs (1) Table 11: Special factors that have made possible current fibre broadband roll-outs [Source: Analysys Mason, 2009] City/country Cheap digging Housing density Strong competition Access to desirable TV content Government support ARPU Paris Fibre in sewers Paris has many flats Iliad and Numericable Canal+ content accessible to all broadband providers – Iliad EUR 36. 10 (3 Q 2009) Netherlands Soft ground, tolerance of poles Densely populated Ziggo and UPC Heavily regulated, In some areas all providers similar Reggefiber service providers get up to EUR 85 Belgium Soft ground Densely populated Telenet Telco purchased football rights – Telenet EUR 35. 3 (3 Q 2009) Switzerland – Some high density in Established cable Swisscom offers cities TV no premium sports Strong government pressure About EUR 75 Italy – Apartment blocks in No cable, and cities satellite dishes banned in historical centres Regulated access Regulator has to premium sports been supportive channels FASTWEB EUR 60 (end 2007) Sweden – Areas with apartment blocks Viasat sports Municipal fibre channels available to all available on Telia About EUR 70 Cable TV regarded as a basic utility for all © Analysys Mason Limited 2009

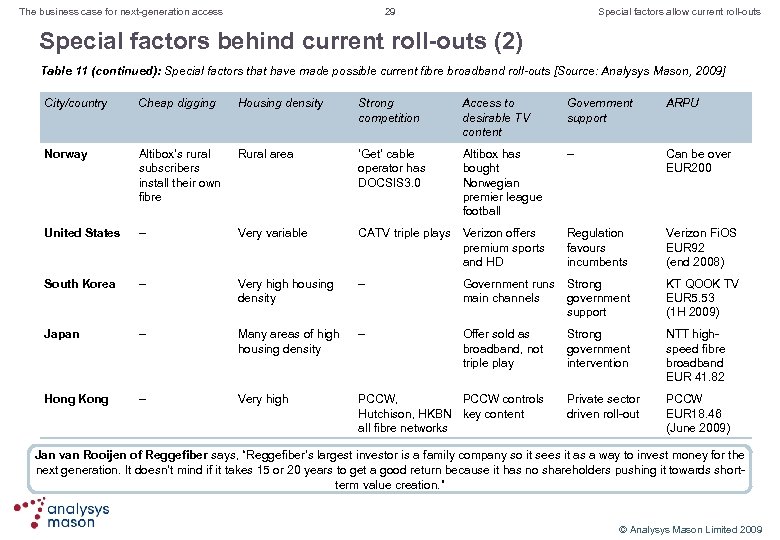

29 The business case for next-generation access Special factors allow current roll-outs Special factors behind current roll-outs (2) Table 11 (continued): Special factors that have made possible current fibre broadband roll-outs [Source: Analysys Mason, 2009] City/country Cheap digging Housing density Strong competition Access to desirable TV content Government support ARPU Norway Altibox’s rural subscribers install their own fibre Rural area ‘Get’ cable operator has DOCSIS 3. 0 Altibox has bought Norwegian premier league football – Can be over EUR 200 United States – Very variable CATV triple plays Verizon offers premium sports and HD Regulation favours incumbents Verizon Fi. OS EUR 92 (end 2008) South Korea – Very high housing density – Government runs Strong main channels government support KT QOOK TV EUR 5. 53 (1 H 2009) Japan – Many areas of high housing density – Offer sold as broadband, not triple play Strong government intervention NTT highspeed fibre broadband EUR 41. 82 Hong Kong – Very high PCCW, PCCW controls Hutchison, HKBN key content all fibre networks Private sector driven roll-out PCCW EUR 18. 46 (June 2009) Jan van Rooijen of Reggefiber says, “Reggefiber’s largest investor is a family company so it sees it as a way to invest money for the next generation. It doesn’t mind if it takes 15 or 20 years to get a good return because it has no shareholders pushing it towards shortterm value creation. ” © Analysys Mason Limited 2009

The business case for next-generation access 30 Document map: How can FTTH be made more widely possible? Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 31 How can FTTH be made more widely possible? How can FTTH roll-out be made more widely possible? l l l Our models show that, outside dense urban areas, investors undertaking the civil works necessary to connect fibre to every home must be very patient. Because shareholders in public companies expect returns sooner than the five to ten years necessary to recoup investment in NGA, few such organisations are likely to participate. All incumbent telcos in Europe have at least some private shareholders, and are tending to favour VDSL; this represents a much lower risk and is likely to be viable in urban areas and some villages. Incremental ARPUs might justify VDSL roll-out in high-rise areas where there is no cable competitor. A telco may go further still if the digging cost can be shared with essential network upgrades. All current FTTH roll-outs have been made possible by special factors: high housing density, rich subscribers paying high ARPUs, unusually patient investors, government support, aggressive cable competition or a combination of these. Governments can take some actions to help make FTTH roll-out possible: w w l allow fibre to be set on poles. Digging trenches is the biggest cost in NGA provision and, if this can be circumvented, deployment becomes much more likely. Putting fibre on poles may be unsightly, but it is costs only about 10% as much as digging a trench Invest public funds in fibre infrastructure. Municipal fibre has worked well in Sweden, where local governments deployed fibre and offered open access to all service providers. Connecting an optical fibre to every single home may not be a sensible use of resources. Telcos might prefer to invest in wireless technology. Governments might prefer to invest in high-speed railways or home insulation to reduce carbon emissions. This is a decision about priorities for future infrastructure that telcos’ management and shareholders, and government ministers and voters, have to make. © Analysys Mason Limited 2009

The business case for next-generation access 32 Document map: Author, copyright and key to acronyms Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 33 Author, copyright and key to acronyms Author Margaret Hopkins (Analysys Mason Associate) is Principal Analyst with Exegesys and undertakes research for Analysys Mason, specialising in fixed and mobile voice and data services for enterprise and SME customers. She has produced research for Analysys Mason in the areas of IP telephony, FMC voice, data services in the WAN, managed services for business, broadband access, network cost modelling and valueadded services for residential customers. She has written a number of reports on areas including Ethernet in the WAN, NGNs and IP local-loop and Internet telephony. Margaret regularly contributes to the international press on a wide range of telecoms issues and has been quoted by the Financial Times, Global Telecoms Business, Telecommunications Online and Total Telecom. She has been associated with Analysys Mason for 20 years. She has an MSc in Telecommunications and Information Systems and started her career in the Post Office Telecommunications Long Range Planning Department. Acknowledgements The author would like to thank all those who assisted in the preparation of this report, especially those who gave their time for interviews: Ann Maes, Investor Relations, Belgacom; and Jan van Rooijen, Financial Director, Reggefiber. In addition, the author is grateful to the following individuals from Analysys Mason for their contributions to this report: James Allen, Cesar Bachelet, Graham Johnson, Steve Liput, Mark Main, Rupert Wood and Matt Yardley for information and helpful suggestions; Hilary Bailey for support with Excel models; and Claire Varley for editorial support. © Analysys Mason Limited 2009

The business case for next-generation access 34 Author, copyright and key to acronyms Copyright Published by Analysys Mason Limited, St Giles Court, 24 Castle Street, Cambridge, CB 3 0 AJ, UK Tel: +44 (0)1223 460600; Fax: +44 (0)1223 452800; Email: research@analysysmason. com; Web: www. analysysmason. com/research Registered in England No. 5177472 © Analysys Mason Limited 2009 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise – without the prior written permission of the publisher. ISBN 978 1 906881 02 3 Disclaimer Analysys Mason Limited maintains that all reasonable care and skill have been used in the compilation of this publication. However, Analysys Mason Limited shall not be under any liability for loss or damage (including consequential loss) whatsoever or howsoever arising as a result of the use of this publication by the customer, his servants, agents or any third party. Analysys Mason Limited recognises that many terms appearing in this report are proprietary; all such trademarks are acknowledged and every effort has been made to indicate them by the normal UK publishing practice of capitalisation. However, the presence of a term, in whatever form, does not affect its legal status as a trademark. The opinions expressed are those of the stated author only. © Analysys Mason Limited 2009

The business case for next-generation access 35 Author, copyright and key to acronyms Key to acronyms ADSL Asymmetrical digital subscriber line MDF Main distribution frame ADSL 2+ Asymmetrical digital subscriber line 2 (ITU-T G. 992. 3 and G. 992. 4) NG Next generation NGA Next-generation access ODF Optical distribution frame P 2 P Point to point TV Television VDSL Very-high-bitrate digital subscriber line VDSL 2 Very-high-bitrate digital subscriber line 2 ARPU Average revenue per user CATV Cable TV CPE Customer premises equipment DIY Do it yourself DOCSIS 3. 0 Data Over Cable Service Interface Specification 3. 0 DP Distribution point DSLAM Digital subscriber line access multiplexer EU European Union FTTH Fibre to the home GPON Gigabit Passive Optical Network HD High definition © Analysys Mason Limited 2009

The business case for next-generation access 36 Document map: List of figures and tables Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 37 List of figures and tables Figure 1: Cumulative free cash flow for VDSL, GPON and P 2 P roll-outs Figure 2: Geographical scenarios Figure 3: Take-up curves Figure 4: Cumulative free cash flow for VDSL, GPON and P 2 P roll-outs Table 1: Costs of VDSL network Table 2: Costs of P 2 P network Table 3: Costs of GPON network Table 4: ARPUs (EUR per month) used in base scenario Table 5: ARPUs required to give pay-back in year five Table 6: ARPUs required to give pay-back in year ten Table 7: Take-up rate required to give pay-back in year five Table 8: Take-up rate required to give pay-back in year ten Table 9: Percentage of duct re-use necessary to give pay-back in year five Table 10: Percentage of duct re-use necessary to give pay-back in year ten Table 11: Special factors that have made possible current fibre broadband roll-outs Table 11 (continued): Special factors that have made possible current fibre broadband roll-outs © Analysys Mason Limited 2009

The business case for next-generation access 38 Document map: About Analysys Mason Document map Executive summary VDSL, PONs and point-to-point fibre are compared Costs are well understood There a number of big uncertainties High-rise areas are likely to be profitable Special factors allow current roll-outs How can FTTH be made more widely possible? Author, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2009

The business case for next-generation access 39 About Analysys Mason is the preferred partner to telecoms, IT and media organisations worldwide. Through our global presence, we deliver strategy advice, operations support and market intelligence to leading commercial and public sector organisations in more than 80 countries. Our clients rely on our consulting and research services to make better business decisions. The intellectual rigour, operational experience and insight of our people have helped our clients to meet some of the toughest challenges they face within the industry. We have consistently delivered significant and sustainable business benefits to our clients during the past 20 years on issues ranging from advising on operator strategy and tactics, development of national sector regulation, through execution of major financial transactions, to the deployment of public and private network infrastructure. We are respected worldwide for the exceptional quality of our work, our independence and the flexibility of our teams in responding to client needs. We are passionate about what we do and are committed to delivering excellence to our clients. Analysys Mason offers two types of service: l l Consulting: We work with our clients to provide customised advice and support throughout the business cycle, helping major players to set strategy, plan for change and implement that change. We have worked on a wide range of projects that support our partners and help them to increase revenue, reduce costs, plan for the future and minimise risk. Research: We offer research programmes and custom research to help our clients to identify key strategic issues, formulate strategies, identify trends and opportunities, and measure performance. For more information visit our website at www. analysysmason. com. © Analysys Mason Limited 2009

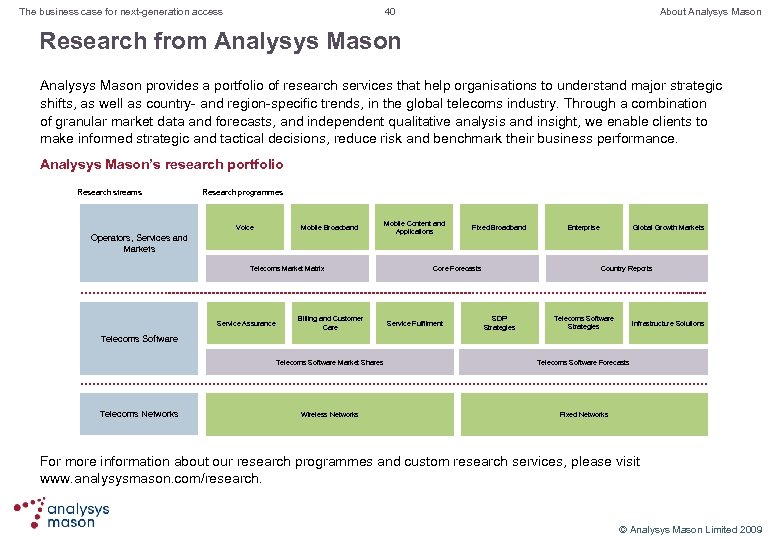

40 The business case for next-generation access About Analysys Mason Research from Analysys Mason provides a portfolio of research services that help organisations to understand major strategic shifts, as well as country- and region-specific trends, in the global telecoms industry. Through a combination of granular market data and forecasts, and independent qualitative analysis and insight, we enable clients to make informed strategic and tactical decisions, reduce risk and benchmark their business performance. Analysys Mason’s research portfolio Research streams Research programmes Voice Mobile Broadband Operators, Services and Markets Telecoms Market Matrix Service Assurance Billing and Customer Care Mobile Content and Applications Fixed Broadband Core Forecasts Service Fulfilment Enterprise Global Growth Markets Country Reports SDP Strategies Telecoms Software Strategies Infrastructure Solutions Telecoms Software Market Shares Telecoms Networks Telecoms Software Forecasts Wireless Networks Fixed Networks For more information about our research programmes and custom research services, please visit www. analysysmason. com/research. © Analysys Mason Limited 2009

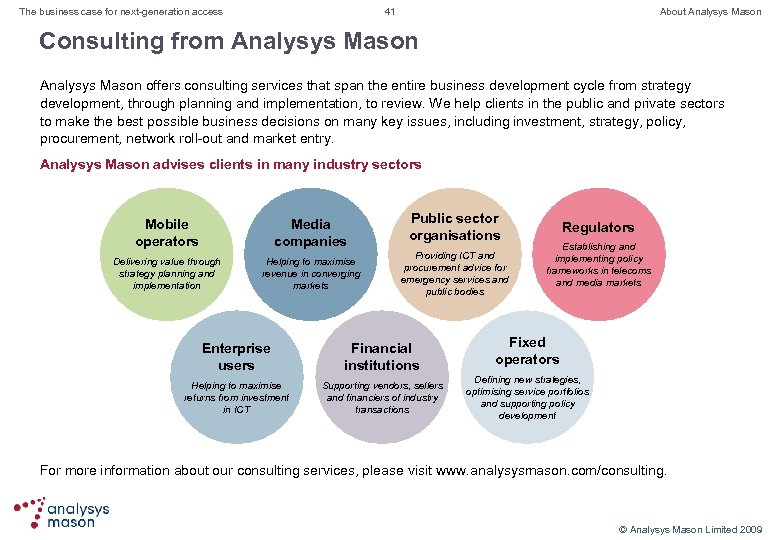

41 The business case for next-generation access About Analysys Mason Consulting from Analysys Mason offers consulting services that span the entire business development cycle from strategy development, through planning and implementation, to review. We help clients in the public and private sectors to make the best possible business decisions on many key issues, including investment, strategy, policy, procurement, network roll-out and market entry. Analysys Mason advises clients in many industry sectors Mobile operators Media companies Delivering value through strategy planning and implementation Helping to maximise revenue in converging markets Public sector organisations Providing ICT and procurement advice for emergency services and public bodies Enterprise users Financial institutions Helping to maximise returns from investment in ICT Supporting vendors, sellers and financiers of industry transactions Regulators Establishing and implementing policy frameworks in telecoms and media markets Fixed operators Defining new strategies, optimising service portfolios and supporting policy development For more information about our consulting services, please visit www. analysysmason. com/consulting. © Analysys Mason Limited 2009

d3ae875dac58ad84ebcd2790d5448698.ppt