646d35461dc9872a5344501a2bf0fc8f.ppt

- Количество слайдов: 80

Research report Service fulfilment market share report 2009 Mark H. Mortensen May 2010

Research report Service fulfilment market share report 2009 Mark H. Mortensen May 2010

![Service fulfilment market share report 2009 2 Contents [1] Slide no. 4. Document map Service fulfilment market share report 2009 2 Contents [1] Slide no. 4. Document map](https://present5.com/presentation/646d35461dc9872a5344501a2bf0fc8f/image-2.jpg) Service fulfilment market share report 2009 2 Contents [1] Slide no. 4. Document map – Executive summary 5. Overall service fulfilment market shares for 2009 6. Overall service fulfilment market shares, with 2008 comparison 7. Overall service fulfilment market trends 8. Service fulfilment market summary by sub-segment 9. Service fulfilment regional market summary, with 2008 comparison 10. Document map – Recommendations 11. Recommendations for CSPs 12. Recommendations for ISVs 13. Document map – Market definition 14. Telecoms software market segmentation 15. Definitions of service fulfilment and its subsegments 16. Definitions of service segments and revenue types 17. Document map: Business environment 18. Overall telecoms market growth was dampened, except in specific technological and geographical areas 19. CSPs are targeting service needs 20. Transformations and federation 21. Professional services have been expanded 22. Regional service fulfilment outlook for 2010 Slide no. 23. Document map – Market shares 24. Service fulfilment overall market shares in 2009 25. Service fulfilment product market shares in 2009 26. Service fulfilment product-related services market shares in 2009 27. Service fulfilment market 2009: ratios of product to product-related services 28. Order management overall market shares in 2009 29. Order management vendors in 2009 30. Inventory overall market shares in 2009 31. Inventory vendors in 2009 [1] 32. Inventory vendors in 2009 [2] 33. Activation overall market shares in 2009 34. Activation vendors in 2009 35. Engineering tools overall market shares in 2009 36. Document map – Vendor analysis 37. Actix 38. AIRCOM International 39. Amdocs 40. Ascom Holding 41. Comptel 42. GE Smallworld 43. Hewlett-Packard © Analysys Mason Limited 2010

Service fulfilment market share report 2009 2 Contents [1] Slide no. 4. Document map – Executive summary 5. Overall service fulfilment market shares for 2009 6. Overall service fulfilment market shares, with 2008 comparison 7. Overall service fulfilment market trends 8. Service fulfilment market summary by sub-segment 9. Service fulfilment regional market summary, with 2008 comparison 10. Document map – Recommendations 11. Recommendations for CSPs 12. Recommendations for ISVs 13. Document map – Market definition 14. Telecoms software market segmentation 15. Definitions of service fulfilment and its subsegments 16. Definitions of service segments and revenue types 17. Document map: Business environment 18. Overall telecoms market growth was dampened, except in specific technological and geographical areas 19. CSPs are targeting service needs 20. Transformations and federation 21. Professional services have been expanded 22. Regional service fulfilment outlook for 2010 Slide no. 23. Document map – Market shares 24. Service fulfilment overall market shares in 2009 25. Service fulfilment product market shares in 2009 26. Service fulfilment product-related services market shares in 2009 27. Service fulfilment market 2009: ratios of product to product-related services 28. Order management overall market shares in 2009 29. Order management vendors in 2009 30. Inventory overall market shares in 2009 31. Inventory vendors in 2009 [1] 32. Inventory vendors in 2009 [2] 33. Activation overall market shares in 2009 34. Activation vendors in 2009 35. Engineering tools overall market shares in 2009 36. Document map – Vendor analysis 37. Actix 38. AIRCOM International 39. Amdocs 40. Ascom Holding 41. Comptel 42. GE Smallworld 43. Hewlett-Packard © Analysys Mason Limited 2010

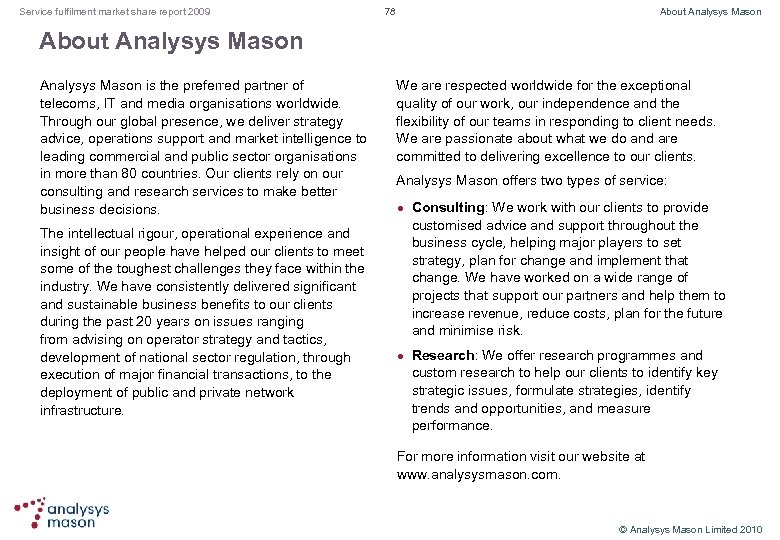

![Service fulfilment market share report 2009 3 Contents [2] Slide no. 44. Intergraph 45. Service fulfilment market share report 2009 3 Contents [2] Slide no. 44. Intergraph 45.](https://present5.com/presentation/646d35461dc9872a5344501a2bf0fc8f/image-3.jpg) Service fulfilment market share report 2009 3 Contents [2] Slide no. 44. Intergraph 45. NEC Net. Cracker 46. Oracle 47. Sigma Systems 48. Subex 49. Synchronoss 50. Telcordia 51. Visionael 52. Vendor analysis summary [1] 53. Vendor analysis summary [2] 54. Vendor analysis summary [3] 55. Document map – Annexes 56. Annexes: Sub-segment definitions and deployment architecture 57. Order management 58. Inventory 59. Activation 60. Engineering tools 61. Traditional wireline service fulfilment flow 62. Modern service fulfilment flow 63. Annexes: Mergers and acquisitions 64. Service fulfilment mergers and acquisitions [1] 65. Service fulfilment mergers and acquisitions [2] Slide no. 66. Document map – Author, copyright and key to acronyms 67. Author 68. Copyright 69. Key to acronyms [1] 70. Key to acronyms [2] 71. Document map – List of figures and tables 72. List of figures and tables [1] 73. List of figures and tables [2] 74. List of figures and tables [3] 75. List of figures and tables [4] 76. List of figures and tables [5] 77. Document map – About Analysys Mason 78. About Analysys Mason 79. Research from Analysys Mason 80. Consulting from Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 3 Contents [2] Slide no. 44. Intergraph 45. NEC Net. Cracker 46. Oracle 47. Sigma Systems 48. Subex 49. Synchronoss 50. Telcordia 51. Visionael 52. Vendor analysis summary [1] 53. Vendor analysis summary [2] 54. Vendor analysis summary [3] 55. Document map – Annexes 56. Annexes: Sub-segment definitions and deployment architecture 57. Order management 58. Inventory 59. Activation 60. Engineering tools 61. Traditional wireline service fulfilment flow 62. Modern service fulfilment flow 63. Annexes: Mergers and acquisitions 64. Service fulfilment mergers and acquisitions [1] 65. Service fulfilment mergers and acquisitions [2] Slide no. 66. Document map – Author, copyright and key to acronyms 67. Author 68. Copyright 69. Key to acronyms [1] 70. Key to acronyms [2] 71. Document map – List of figures and tables 72. List of figures and tables [1] 73. List of figures and tables [2] 74. List of figures and tables [3] 75. List of figures and tables [4] 76. List of figures and tables [5] 77. Document map – About Analysys Mason 78. About Analysys Mason 79. Research from Analysys Mason 80. Consulting from Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 4 Document map: Executive summary Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 4 Document map: Executive summary Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

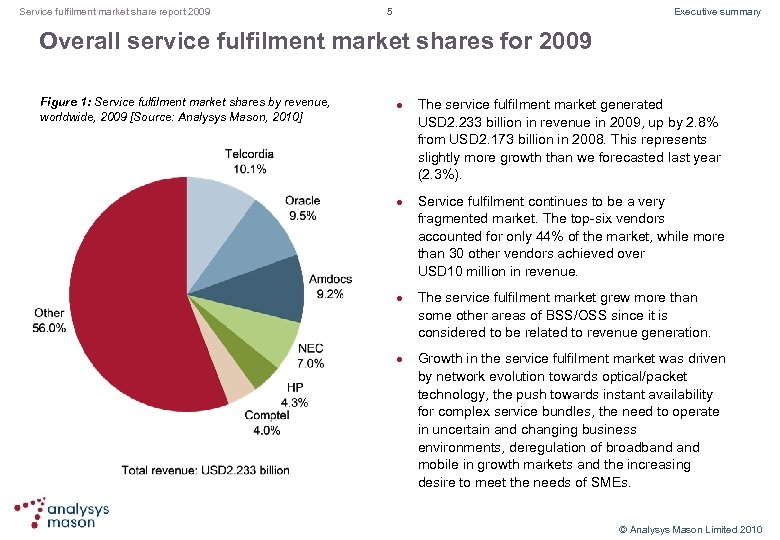

Service fulfilment market share report 2009 5 Executive summary Overall service fulfilment market shares for 2009 Figure 1: Service fulfilment market shares by revenue, worldwide, 2009 [Source: Analysys Mason, 2010] l l The service fulfilment market generated USD 2. 233 billion in revenue in 2009, up by 2. 8% from USD 2. 173 billion in 2008. This represents slightly more growth than we forecasted last year (2. 3%). Service fulfilment continues to be a very fragmented market. The top-six vendors accounted for only 44% of the market, while more than 30 other vendors achieved over USD 10 million in revenue. The service fulfilment market grew more than some other areas of BSS/OSS since it is considered to be related to revenue generation. Growth in the service fulfilment market was driven by network evolution towards optical/packet technology, the push towards instant availability for complex service bundles, the need to operate in uncertain and changing business environments, deregulation of broadband mobile in growth markets and the increasing desire to meet the needs of SMEs. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 5 Executive summary Overall service fulfilment market shares for 2009 Figure 1: Service fulfilment market shares by revenue, worldwide, 2009 [Source: Analysys Mason, 2010] l l The service fulfilment market generated USD 2. 233 billion in revenue in 2009, up by 2. 8% from USD 2. 173 billion in 2008. This represents slightly more growth than we forecasted last year (2. 3%). Service fulfilment continues to be a very fragmented market. The top-six vendors accounted for only 44% of the market, while more than 30 other vendors achieved over USD 10 million in revenue. The service fulfilment market grew more than some other areas of BSS/OSS since it is considered to be related to revenue generation. Growth in the service fulfilment market was driven by network evolution towards optical/packet technology, the push towards instant availability for complex service bundles, the need to operate in uncertain and changing business environments, deregulation of broadband mobile in growth markets and the increasing desire to meet the needs of SMEs. © Analysys Mason Limited 2010

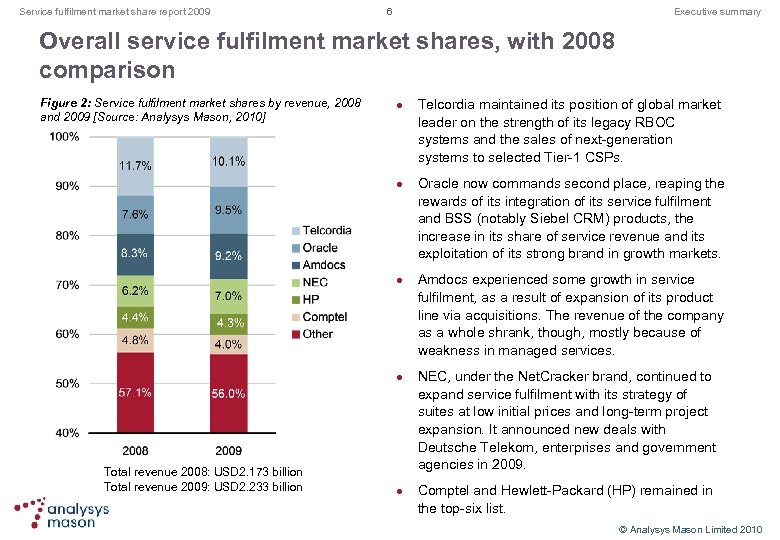

Service fulfilment market share report 2009 6 Executive summary Overall service fulfilment market shares, with 2008 comparison Figure 2: Service fulfilment market shares by revenue, 2008 and 2009 [Source: Analysys Mason, 2010] l l Total revenue 2008: USD 2. 173 billion Total revenue 2009: USD 2. 233 billion l Telcordia maintained its position of global market leader on the strength of its legacy RBOC systems and the sales of next-generation systems to selected Tier-1 CSPs. Oracle now commands second place, reaping the rewards of its integration of its service fulfilment and BSS (notably Siebel CRM) products, the increase in its share of service revenue and its exploitation of its strong brand in growth markets. Amdocs experienced some growth in service fulfilment, as a result of expansion of its product line via acquisitions. The revenue of the company as a whole shrank, though, mostly because of weakness in managed services. NEC, under the Net. Cracker brand, continued to expand service fulfilment with its strategy of suites at low initial prices and long-term project expansion. It announced new deals with Deutsche Telekom, enterprises and government agencies in 2009. Comptel and Hewlett-Packard (HP) remained in the top-six list. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 6 Executive summary Overall service fulfilment market shares, with 2008 comparison Figure 2: Service fulfilment market shares by revenue, 2008 and 2009 [Source: Analysys Mason, 2010] l l Total revenue 2008: USD 2. 173 billion Total revenue 2009: USD 2. 233 billion l Telcordia maintained its position of global market leader on the strength of its legacy RBOC systems and the sales of next-generation systems to selected Tier-1 CSPs. Oracle now commands second place, reaping the rewards of its integration of its service fulfilment and BSS (notably Siebel CRM) products, the increase in its share of service revenue and its exploitation of its strong brand in growth markets. Amdocs experienced some growth in service fulfilment, as a result of expansion of its product line via acquisitions. The revenue of the company as a whole shrank, though, mostly because of weakness in managed services. NEC, under the Net. Cracker brand, continued to expand service fulfilment with its strategy of suites at low initial prices and long-term project expansion. It announced new deals with Deutsche Telekom, enterprises and government agencies in 2009. Comptel and Hewlett-Packard (HP) remained in the top-six list. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 7 Executive summary Overall service fulfilment market trends l l l l Service fulfilment is changing as CSPs continue to shift their emphasis from voice-focused support systems to more-modern platforms that support automated fulfilment of new residential broadband mobile data services. Leading-edge ISVs are providing service fulfilment systems that can handle the complexity of the new access arrangements, such as x. DSL and FTTH, the dependence of available services on access technology and end-user devices, and the increasingly complex bundles of services, especially in mobile. Because of the worldwide economic conditions that led to recessions in many countries, the service fulfilment market failed to achieve much of its previously projected growth in 2008 and 2009. However, it has lost less than other areas of OSS that are not considered by the CSPs to be revenue affecting. Large transformation projects have fallen out of favour. However, department-sized transformation projects, especially those that provide integrated inventory solutions, are still being sold and implemented. Service fulfilment projects are primarily driven by increased revenue opportunities, but cost reduction still remains an important consideration in project approval. Mature CSPs are implementing order management functions in their BSS stack. These are called enterprise order control functions. They manage the multi-channel nature of sales and the complexity of service bundles, which require more data sharing with service fulfilment systems than usual. Growth-market CSPs, under pressure to expand the range of their services, are increasingly turning to vendors that can provide them with total solutions to their automated service fulfilment needs. They are implementing order management and activation systems to provide automated service activation for specific services, especially for mobile services. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 7 Executive summary Overall service fulfilment market trends l l l l Service fulfilment is changing as CSPs continue to shift their emphasis from voice-focused support systems to more-modern platforms that support automated fulfilment of new residential broadband mobile data services. Leading-edge ISVs are providing service fulfilment systems that can handle the complexity of the new access arrangements, such as x. DSL and FTTH, the dependence of available services on access technology and end-user devices, and the increasingly complex bundles of services, especially in mobile. Because of the worldwide economic conditions that led to recessions in many countries, the service fulfilment market failed to achieve much of its previously projected growth in 2008 and 2009. However, it has lost less than other areas of OSS that are not considered by the CSPs to be revenue affecting. Large transformation projects have fallen out of favour. However, department-sized transformation projects, especially those that provide integrated inventory solutions, are still being sold and implemented. Service fulfilment projects are primarily driven by increased revenue opportunities, but cost reduction still remains an important consideration in project approval. Mature CSPs are implementing order management functions in their BSS stack. These are called enterprise order control functions. They manage the multi-channel nature of sales and the complexity of service bundles, which require more data sharing with service fulfilment systems than usual. Growth-market CSPs, under pressure to expand the range of their services, are increasingly turning to vendors that can provide them with total solutions to their automated service fulfilment needs. They are implementing order management and activation systems to provide automated service activation for specific services, especially for mobile services. © Analysys Mason Limited 2010

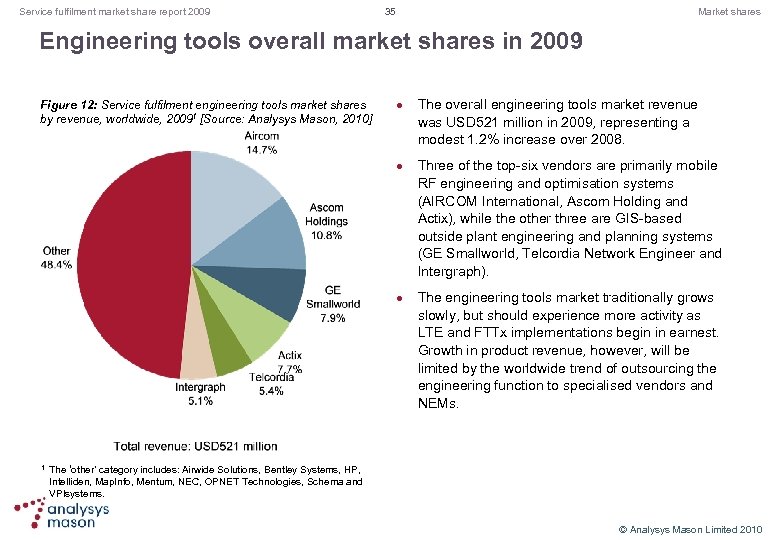

Service fulfilment market share report 2009 8 Executive summary Service fulfilment market summary by sub-segment Order management (revenue: USD 627 million) l l Grew by 1. 1%, compared with our forecast of 2. 7% The OM market was driven by the dependence of complex services on equipment, end-user device capabilities and service bundles OM products also moved into CRM to provide overall enterprise order control functions for service bundles (revenue is included in CRM in customer care, not here) Inventory (revenue: USD 620 million) l l l New players entered OM or expanded their products Activation (revenue: USD 465 million) l l Grew by 5. 4%, compared with our forecast of 3. 4% Activation of IP-based mobile and wireline services, as well as IPTV, x. DSL and Vo. IP, continues to drive the market Grew by 3. 6%, compared with our forecast of 1. 5% Departmental-sized inventory transformation projects, focused on supporting IP-related services, but also replacing many other systems. Nearly all also implemented flow-through provisioning with OM and activation systems included Design and inventory of business services on IP infrastructure grew Engineering tools (revenue: USD 521 million) l l Grew by 1. 2% compared with our forecast of 1. 4% Mobile RF engineering systems was relatively flat as CSPs have not yet started their major LTE evolution Wireline planning systems grew, with new modules from major players IBM acquired Intelliden to expand its IT equipment configuration management offering into the telecoms sector © Analysys Mason Limited 2010

Service fulfilment market share report 2009 8 Executive summary Service fulfilment market summary by sub-segment Order management (revenue: USD 627 million) l l Grew by 1. 1%, compared with our forecast of 2. 7% The OM market was driven by the dependence of complex services on equipment, end-user device capabilities and service bundles OM products also moved into CRM to provide overall enterprise order control functions for service bundles (revenue is included in CRM in customer care, not here) Inventory (revenue: USD 620 million) l l l New players entered OM or expanded their products Activation (revenue: USD 465 million) l l Grew by 5. 4%, compared with our forecast of 3. 4% Activation of IP-based mobile and wireline services, as well as IPTV, x. DSL and Vo. IP, continues to drive the market Grew by 3. 6%, compared with our forecast of 1. 5% Departmental-sized inventory transformation projects, focused on supporting IP-related services, but also replacing many other systems. Nearly all also implemented flow-through provisioning with OM and activation systems included Design and inventory of business services on IP infrastructure grew Engineering tools (revenue: USD 521 million) l l Grew by 1. 2% compared with our forecast of 1. 4% Mobile RF engineering systems was relatively flat as CSPs have not yet started their major LTE evolution Wireline planning systems grew, with new modules from major players IBM acquired Intelliden to expand its IT equipment configuration management offering into the telecoms sector © Analysys Mason Limited 2010

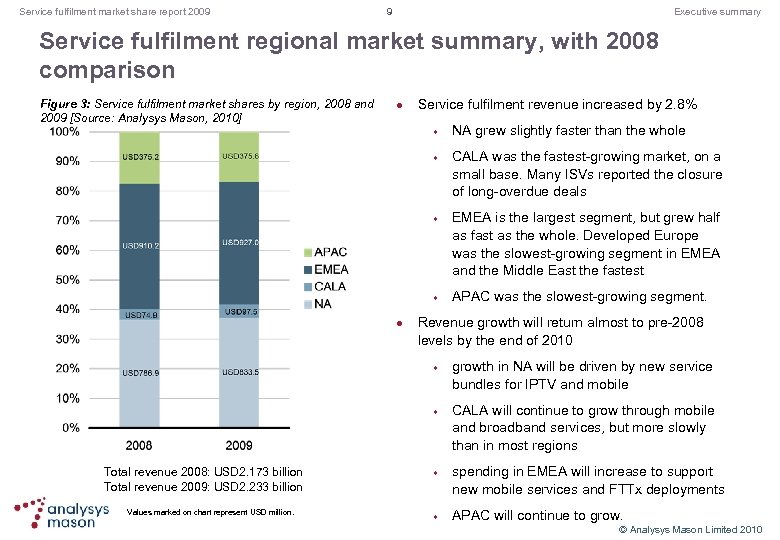

Service fulfilment market share report 2009 9 Executive summary Service fulfilment regional market summary, with 2008 comparison Figure 3: Service fulfilment market shares by region, 2008 and 2009 [Source: Analysys Mason, 2010] l Service fulfilment revenue increased by 2. 8% w w l w Values marked on chart represent USD million. CALA was the fastest-growing market, on a small base. Many ISVs reported the closure of long-overdue deals EMEA is the largest segment, but grew half as fast as the whole. Developed Europe was the slowest-growing segment in EMEA and the Middle East the fastest APAC was the slowest-growing segment. Revenue growth will return almost to pre-2008 levels by the end of 2010 w Total revenue 2008: USD 2. 173 billion Total revenue 2009: USD 2. 233 billion NA grew slightly faster than the whole w w growth in NA will be driven by new service bundles for IPTV and mobile CALA will continue to grow through mobile and broadband services, but more slowly than in most regions spending in EMEA will increase to support new mobile services and FTTx deployments APAC will continue to grow. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 9 Executive summary Service fulfilment regional market summary, with 2008 comparison Figure 3: Service fulfilment market shares by region, 2008 and 2009 [Source: Analysys Mason, 2010] l Service fulfilment revenue increased by 2. 8% w w l w Values marked on chart represent USD million. CALA was the fastest-growing market, on a small base. Many ISVs reported the closure of long-overdue deals EMEA is the largest segment, but grew half as fast as the whole. Developed Europe was the slowest-growing segment in EMEA and the Middle East the fastest APAC was the slowest-growing segment. Revenue growth will return almost to pre-2008 levels by the end of 2010 w Total revenue 2008: USD 2. 173 billion Total revenue 2009: USD 2. 233 billion NA grew slightly faster than the whole w w growth in NA will be driven by new service bundles for IPTV and mobile CALA will continue to grow through mobile and broadband services, but more slowly than in most regions spending in EMEA will increase to support new mobile services and FTTx deployments APAC will continue to grow. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 10 Document map: Recommendations Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 10 Document map: Recommendations Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 11 Recommendations for CSPs l l l CSPs that are still using manual procedures for service fulfilment should implement integrated service fulfilment suites from leading ISVs. This will allow them to handle the complexity of the new services and service bundles. CSPs’ projects in service fulfilment should focus primarily on supporting new service roll-outs, rather than on trying to achieve consolidation. The solution should support both the current new service and future services, since CSPs will quickly be introducing many more. CSPs must invest in multi-service activation systems to meet time-to-market demands for delivery of complex video services. Activation from the STB to the head-end or central office systems requires knowledge of the configuration of transport, service layer and application layer. CSPs should look to vendors that not only provide integrated systems, but also have predefined processes, service templates and work flows that can quickly be implemented without costly and time-consuming customisation. CSPs should hire an SI that is well-steeped in process design to address changes in organisation and business processes. This will enable them to achieve the necessary benefits from service fulfilment technology. Many CSPs have failed to get much benefit from investment in service fulfilment because they have been unable to align the goals and processes of different groups within the organisation. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 11 Recommendations for CSPs l l l CSPs that are still using manual procedures for service fulfilment should implement integrated service fulfilment suites from leading ISVs. This will allow them to handle the complexity of the new services and service bundles. CSPs’ projects in service fulfilment should focus primarily on supporting new service roll-outs, rather than on trying to achieve consolidation. The solution should support both the current new service and future services, since CSPs will quickly be introducing many more. CSPs must invest in multi-service activation systems to meet time-to-market demands for delivery of complex video services. Activation from the STB to the head-end or central office systems requires knowledge of the configuration of transport, service layer and application layer. CSPs should look to vendors that not only provide integrated systems, but also have predefined processes, service templates and work flows that can quickly be implemented without costly and time-consuming customisation. CSPs should hire an SI that is well-steeped in process design to address changes in organisation and business processes. This will enable them to achieve the necessary benefits from service fulfilment technology. Many CSPs have failed to get much benefit from investment in service fulfilment because they have been unable to align the goals and processes of different groups within the organisation. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 12 Recommendations for ISVs l l l If possible, provide a full service-fulfilment suite yourself, or as a preconfigured component of another’s suite. If this is not possible, seek out CSPs that are technology focused and looking for a competitive advantage from your product. Smaller, growing CSPs are looking for systems that are relatively simple to deploy, that are preconfigured for their basic use and that can solve their current problems quickly, while providing future growth opportunities. The key to these sales is to solve the known fulfilment problems quickly, with the lowest risk, while keeping costs reasonable. Transformation projects, such as consolidation of order management and inventory systems, should be targeted at the level of the department, not the enterprise, where risks of project failure are higher. Supporting dynamic and complex mobile services and service bundles is a major opportunity area. New data and content services delivered on IP networks force CSPs to be more aware of network and end-user device configurations and capabilities and to interact more dynamically with partners. Vendors with the strong ability to sell solutions should seek to get as much revenue as possible from each sale. Most of the total revenue for service fulfilment solutions comes from services. Many CSPs prefer to purchase some professional services from their software suppliers, rather than to depend entirely on systems integrators. ISVs capable of delivering both products and services can earn more revenue from each deal they win than vendors offering only products. Although the combination is hard to manage, there is a significant pay-off for vendors that succeed. Meeting industry standards, such as TMF SID compliance and harmonisation with e. TOM, can provide a marketing advantage in service fulfilment, but is very rarely mandatory. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 12 Recommendations for ISVs l l l If possible, provide a full service-fulfilment suite yourself, or as a preconfigured component of another’s suite. If this is not possible, seek out CSPs that are technology focused and looking for a competitive advantage from your product. Smaller, growing CSPs are looking for systems that are relatively simple to deploy, that are preconfigured for their basic use and that can solve their current problems quickly, while providing future growth opportunities. The key to these sales is to solve the known fulfilment problems quickly, with the lowest risk, while keeping costs reasonable. Transformation projects, such as consolidation of order management and inventory systems, should be targeted at the level of the department, not the enterprise, where risks of project failure are higher. Supporting dynamic and complex mobile services and service bundles is a major opportunity area. New data and content services delivered on IP networks force CSPs to be more aware of network and end-user device configurations and capabilities and to interact more dynamically with partners. Vendors with the strong ability to sell solutions should seek to get as much revenue as possible from each sale. Most of the total revenue for service fulfilment solutions comes from services. Many CSPs prefer to purchase some professional services from their software suppliers, rather than to depend entirely on systems integrators. ISVs capable of delivering both products and services can earn more revenue from each deal they win than vendors offering only products. Although the combination is hard to manage, there is a significant pay-off for vendors that succeed. Meeting industry standards, such as TMF SID compliance and harmonisation with e. TOM, can provide a marketing advantage in service fulfilment, but is very rarely mandatory. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 13 Document map: Market definition Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 13 Document map: Market definition Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

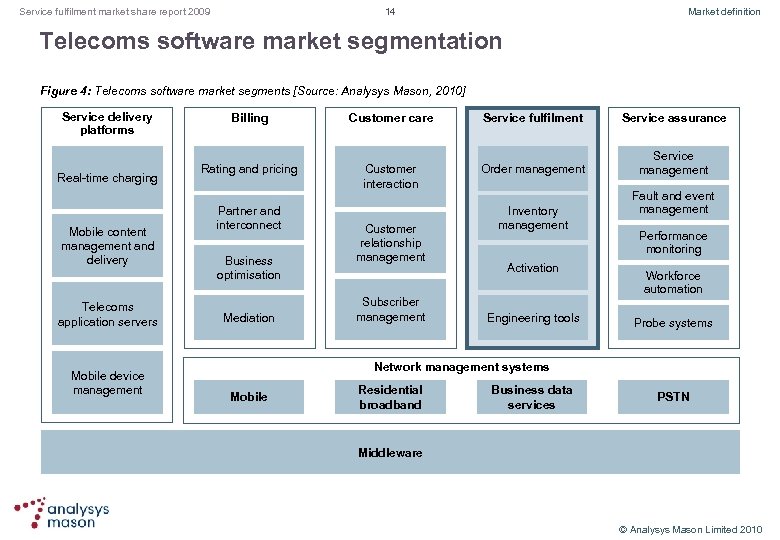

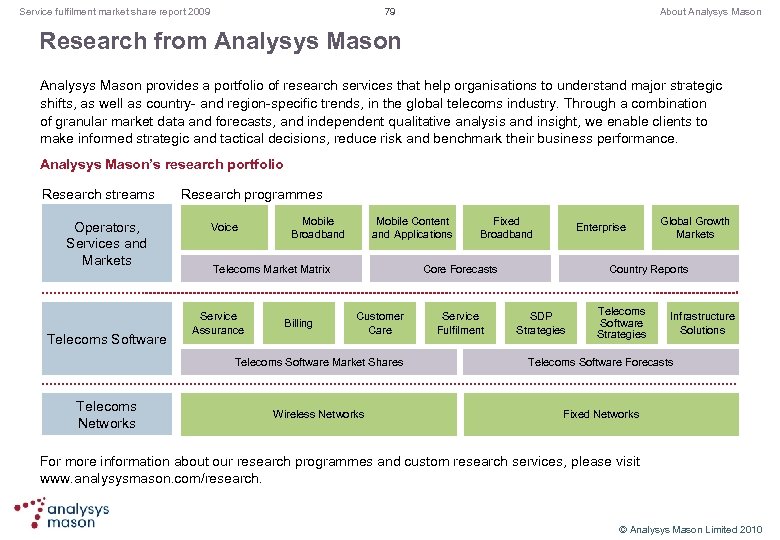

14 Service fulfilment market share report 2009 Market definition Telecoms software market segmentation Figure 4: Telecoms software market segments [Source: Analysys Mason, 2010] Service delivery platforms Real-time charging Mobile content management and delivery Telecoms application servers Mobile device management Billing Customer care Service fulfilment Service assurance Rating and pricing Customer interaction Order management Service management Partner and interconnect Business optimisation Mediation Customer relationship management Subscriber management Inventory management Activation Engineering tools Fault and event management Performance monitoring Workforce automation Probe systems Network management systems Mobile Residential broadband Business data services PSTN Middleware © Analysys Mason Limited 2010

14 Service fulfilment market share report 2009 Market definition Telecoms software market segmentation Figure 4: Telecoms software market segments [Source: Analysys Mason, 2010] Service delivery platforms Real-time charging Mobile content management and delivery Telecoms application servers Mobile device management Billing Customer care Service fulfilment Service assurance Rating and pricing Customer interaction Order management Service management Partner and interconnect Business optimisation Mediation Customer relationship management Subscriber management Inventory management Activation Engineering tools Fault and event management Performance monitoring Workforce automation Probe systems Network management systems Mobile Residential broadband Business data services PSTN Middleware © Analysys Mason Limited 2010

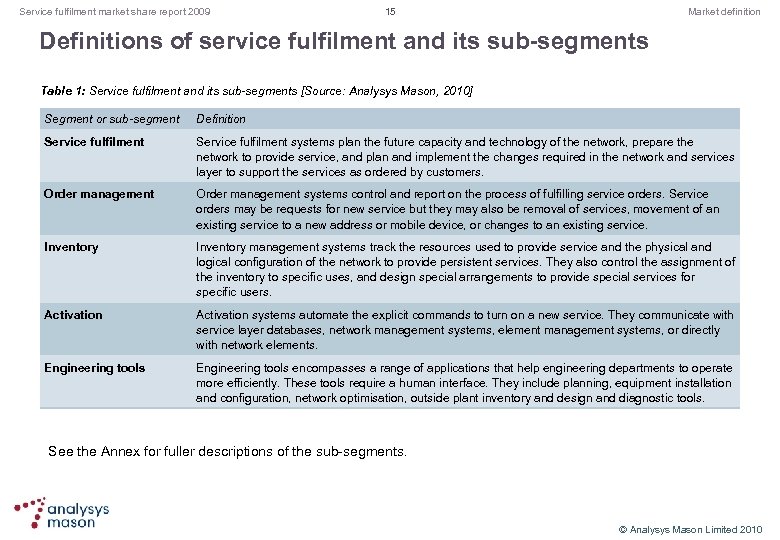

Service fulfilment market share report 2009 15 Market definition Definitions of service fulfilment and its sub-segments Table 1: Service fulfilment and its sub-segments [Source: Analysys Mason, 2010] Segment or sub-segment Definition Service fulfilment systems plan the future capacity and technology of the network, prepare the network to provide service, and plan and implement the changes required in the network and services layer to support the services as ordered by customers. Order management systems control and report on the process of fulfilling service orders. Service orders may be requests for new service but they may also be removal of services, movement of an existing service to a new address or mobile device, or changes to an existing service. Inventory management systems track the resources used to provide service and the physical and logical configuration of the network to provide persistent services. They also control the assignment of the inventory to specific uses, and design special arrangements to provide special services for specific users. Activation systems automate the explicit commands to turn on a new service. They communicate with service layer databases, network management systems, element management systems, or directly with network elements. Engineering tools encompasses a range of applications that help engineering departments to operate more efficiently. These tools require a human interface. They include planning, equipment installation and configuration, network optimisation, outside plant inventory and design and diagnostic tools. See the Annex for fuller descriptions of the sub-segments. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 15 Market definition Definitions of service fulfilment and its sub-segments Table 1: Service fulfilment and its sub-segments [Source: Analysys Mason, 2010] Segment or sub-segment Definition Service fulfilment systems plan the future capacity and technology of the network, prepare the network to provide service, and plan and implement the changes required in the network and services layer to support the services as ordered by customers. Order management systems control and report on the process of fulfilling service orders. Service orders may be requests for new service but they may also be removal of services, movement of an existing service to a new address or mobile device, or changes to an existing service. Inventory management systems track the resources used to provide service and the physical and logical configuration of the network to provide persistent services. They also control the assignment of the inventory to specific uses, and design special arrangements to provide special services for specific users. Activation systems automate the explicit commands to turn on a new service. They communicate with service layer databases, network management systems, element management systems, or directly with network elements. Engineering tools encompasses a range of applications that help engineering departments to operate more efficiently. These tools require a human interface. They include planning, equipment installation and configuration, network optimisation, outside plant inventory and design and diagnostic tools. See the Annex for fuller descriptions of the sub-segments. © Analysys Mason Limited 2010

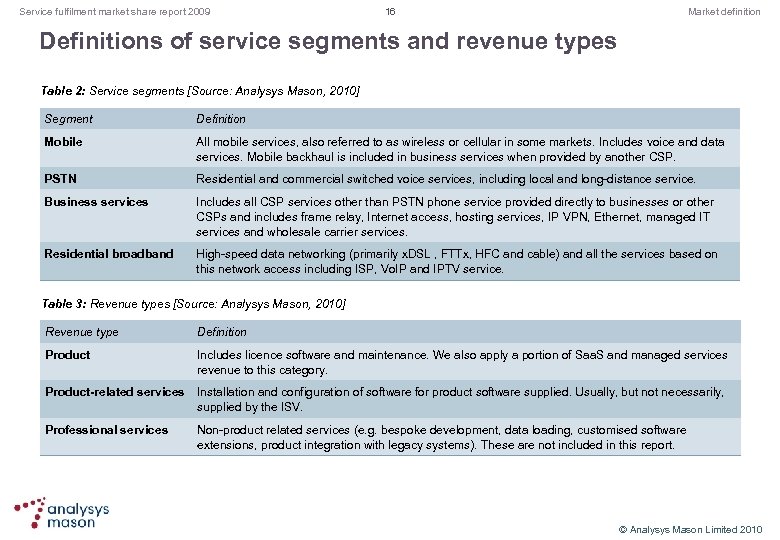

Service fulfilment market share report 2009 16 Market definition Definitions of service segments and revenue types Table 2: Service segments [Source: Analysys Mason, 2010] Segment Definition Mobile All mobile services, also referred to as wireless or cellular in some markets. Includes voice and data services. Mobile backhaul is included in business services when provided by another CSP. PSTN Residential and commercial switched voice services, including local and long-distance service. Business services Includes all CSP services other than PSTN phone service provided directly to businesses or other CSPs and includes frame relay, Internet access, hosting services, IP VPN, Ethernet, managed IT services and wholesale carrier services. Residential broadband High-speed data networking (primarily x. DSL , FTTx, HFC and cable) and all the services based on this network access including ISP, Vo. IP and IPTV service. Table 3: Revenue types [Source: Analysys Mason, 2010] Revenue type Definition Product Includes licence software and maintenance. We also apply a portion of Saa. S and managed services revenue to this category. Product-related services Installation and configuration of software for product software supplied. Usually, but not necessarily, supplied by the ISV. Professional services Non-product related services (e. g. bespoke development, data loading, customised software extensions, product integration with legacy systems). These are not included in this report. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 16 Market definition Definitions of service segments and revenue types Table 2: Service segments [Source: Analysys Mason, 2010] Segment Definition Mobile All mobile services, also referred to as wireless or cellular in some markets. Includes voice and data services. Mobile backhaul is included in business services when provided by another CSP. PSTN Residential and commercial switched voice services, including local and long-distance service. Business services Includes all CSP services other than PSTN phone service provided directly to businesses or other CSPs and includes frame relay, Internet access, hosting services, IP VPN, Ethernet, managed IT services and wholesale carrier services. Residential broadband High-speed data networking (primarily x. DSL , FTTx, HFC and cable) and all the services based on this network access including ISP, Vo. IP and IPTV service. Table 3: Revenue types [Source: Analysys Mason, 2010] Revenue type Definition Product Includes licence software and maintenance. We also apply a portion of Saa. S and managed services revenue to this category. Product-related services Installation and configuration of software for product software supplied. Usually, but not necessarily, supplied by the ISV. Professional services Non-product related services (e. g. bespoke development, data loading, customised software extensions, product integration with legacy systems). These are not included in this report. © Analysys Mason Limited 2010

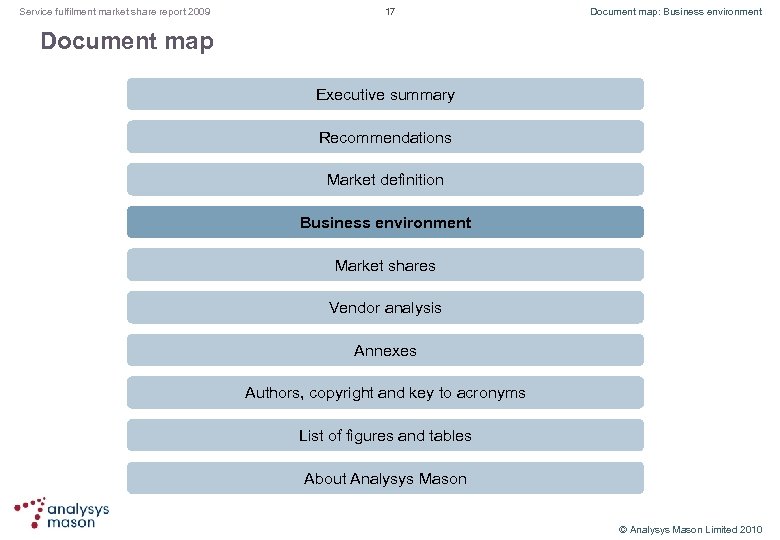

Service fulfilment market share report 2009 17 Document map: Business environment Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 17 Document map: Business environment Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

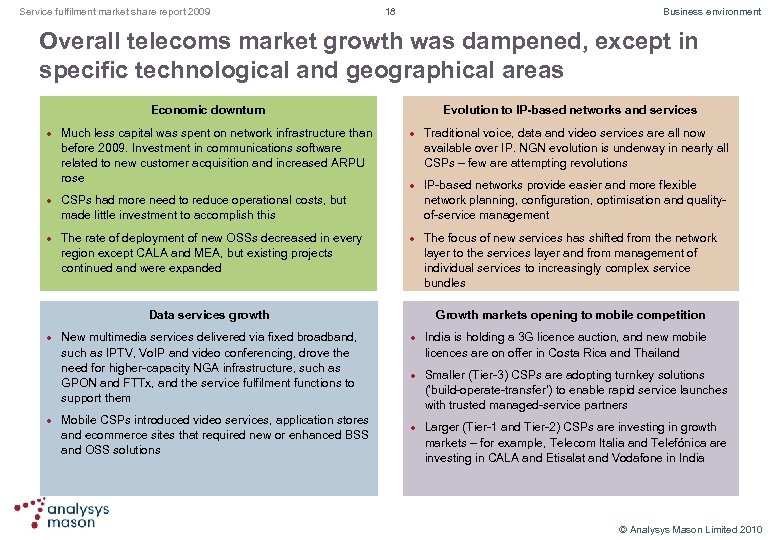

Service fulfilment market share report 2009 18 Business environment Overall telecoms market growth was dampened, except in specific technological and geographical areas Economic downturn l l l Much less capital was spent on network infrastructure than before 2009. Investment in communications software related to new customer acquisition and increased ARPU rose Evolution to IP-based networks and services l l CSPs had more need to reduce operational costs, but made little investment to accomplish this The rate of deployment of new OSSs decreased in every region except CALA and MEA, but existing projects continued and were expanded l Data services growth l l New multimedia services delivered via fixed broadband, such as IPTV, Vo. IP and video conferencing, drove the need for higher-capacity NGA infrastructure, such as GPON and FTTx, and the service fulfilment functions to support them Mobile CSPs introduced video services, application stores and ecommerce sites that required new or enhanced BSS and OSS solutions Traditional voice, data and video services are all now available over IP. NGN evolution is underway in nearly all CSPs – few are attempting revolutions IP-based networks provide easier and more flexible network planning, configuration, optimisation and qualityof-service management The focus of new services has shifted from the network layer to the services layer and from management of individual services to increasingly complex service bundles Growth markets opening to mobile competition l l l India is holding a 3 G licence auction, and new mobile licences are on offer in Costa Rica and Thailand Smaller (Tier-3) CSPs are adopting turnkey solutions (‘build-operate-transfer’) to enable rapid service launches with trusted managed-service partners Larger (Tier-1 and Tier-2) CSPs are investing in growth markets – for example, Telecom Italia and Telefónica are investing in CALA and Etisalat and Vodafone in India © Analysys Mason Limited 2010

Service fulfilment market share report 2009 18 Business environment Overall telecoms market growth was dampened, except in specific technological and geographical areas Economic downturn l l l Much less capital was spent on network infrastructure than before 2009. Investment in communications software related to new customer acquisition and increased ARPU rose Evolution to IP-based networks and services l l CSPs had more need to reduce operational costs, but made little investment to accomplish this The rate of deployment of new OSSs decreased in every region except CALA and MEA, but existing projects continued and were expanded l Data services growth l l New multimedia services delivered via fixed broadband, such as IPTV, Vo. IP and video conferencing, drove the need for higher-capacity NGA infrastructure, such as GPON and FTTx, and the service fulfilment functions to support them Mobile CSPs introduced video services, application stores and ecommerce sites that required new or enhanced BSS and OSS solutions Traditional voice, data and video services are all now available over IP. NGN evolution is underway in nearly all CSPs – few are attempting revolutions IP-based networks provide easier and more flexible network planning, configuration, optimisation and qualityof-service management The focus of new services has shifted from the network layer to the services layer and from management of individual services to increasingly complex service bundles Growth markets opening to mobile competition l l l India is holding a 3 G licence auction, and new mobile licences are on offer in Costa Rica and Thailand Smaller (Tier-3) CSPs are adopting turnkey solutions (‘build-operate-transfer’) to enable rapid service launches with trusted managed-service partners Larger (Tier-1 and Tier-2) CSPs are investing in growth markets – for example, Telecom Italia and Telefónica are investing in CALA and Etisalat and Vodafone in India © Analysys Mason Limited 2010

Service fulfilment market share report 2009 19 Business environment CSPs are targeting service needs l l l CSPs use a wide variety of methods to implement service fulfilment. Even the most sophisticated CSPs use many manual steps to manage low-volume, complex services. However, all modern CSPs implement automated fulfilment systems for high-volume services, such as residential voice, mobile voice and data, Vo. IP, x. DSL and FTTx. Large, established CSPs have a legacy of department-specific approaches to service fulfilment. These larger CSPs find it easier to implement specific best-of-breed systems from different vendors than to implement a complete change in service fulfilment processes and support systems. New CSPs and some older CSPs that are facing high growth with few support systems in place are more inclined to implement complete, integrated service fulfilment systems. These CSPs are very conscious of cost, but they make quicker decisions and depend on an SI, or, increasingly, on a full-solution ISV to solve problems and get their systems working. CSPs are putting in systems that can support multiple network technologies for converged services. Their greatest attention has been paid to inventory management systems because of the need to understand the capabilities of available resources and the configuration of these resources in serving their customers. Although there is a strategic move towards consolidation of fulfilment systems, in the near future, this consolidation will maintain four distinct environments in most CSPs: PSTN, residential broadband, mobile and business services. There were fewer new projects during 2008 and 2009 than in past years, but projects that were already ongoing were not stopped, and were often expanded. There was significant price pressure on all industry participants in 2008– 2009 and margins were tight. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 19 Business environment CSPs are targeting service needs l l l CSPs use a wide variety of methods to implement service fulfilment. Even the most sophisticated CSPs use many manual steps to manage low-volume, complex services. However, all modern CSPs implement automated fulfilment systems for high-volume services, such as residential voice, mobile voice and data, Vo. IP, x. DSL and FTTx. Large, established CSPs have a legacy of department-specific approaches to service fulfilment. These larger CSPs find it easier to implement specific best-of-breed systems from different vendors than to implement a complete change in service fulfilment processes and support systems. New CSPs and some older CSPs that are facing high growth with few support systems in place are more inclined to implement complete, integrated service fulfilment systems. These CSPs are very conscious of cost, but they make quicker decisions and depend on an SI, or, increasingly, on a full-solution ISV to solve problems and get their systems working. CSPs are putting in systems that can support multiple network technologies for converged services. Their greatest attention has been paid to inventory management systems because of the need to understand the capabilities of available resources and the configuration of these resources in serving their customers. Although there is a strategic move towards consolidation of fulfilment systems, in the near future, this consolidation will maintain four distinct environments in most CSPs: PSTN, residential broadband, mobile and business services. There were fewer new projects during 2008 and 2009 than in past years, but projects that were already ongoing were not stopped, and were often expanded. There was significant price pressure on all industry participants in 2008– 2009 and margins were tight. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 20 Business environment Transformations and federation l l The general market is showing more interest in convergent fulfilment systems that can support immediate service needs and, at the same time, provide a basis for supporting future services. There is little interest in converting or consolidating old fulfilment systems that work for the services they support. In order to deal with the need for regional consolidation and functional integration, many CSPs are turning to a federated approach. Instead of picking one system and converting the others, they are focusing on a subset of functionality and data that must be held in common. They implement a complementary, usually new, system that provides the common functionality and controls the shared data. They then migrate data to this system from the existing systems, which continue to handle their own unique needs. Over time, the common system takes over more functions, but a forced conversion is not necessary. This approach has been used in the billing arena for some time and is finding its way into the service catalogue and the inventory and order management markets. Spend on service fulfilment goes to many small ISVs. This segment is continuing slowly to consolidate, as CSPs pursue larger projects using multiple technologies. In the past few years, Amdocs has acquired Cramer and Jacobs. Rimmel, CSG Systems has bought Telution, Oracle purchased Meta. Solv and Netsure, and Subex acquired Syndesis, among others (see the list of acquisitions later in this document). In 2009, a number of vendors entered the inventory, order management, and network planning areas for the first time. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 20 Business environment Transformations and federation l l The general market is showing more interest in convergent fulfilment systems that can support immediate service needs and, at the same time, provide a basis for supporting future services. There is little interest in converting or consolidating old fulfilment systems that work for the services they support. In order to deal with the need for regional consolidation and functional integration, many CSPs are turning to a federated approach. Instead of picking one system and converting the others, they are focusing on a subset of functionality and data that must be held in common. They implement a complementary, usually new, system that provides the common functionality and controls the shared data. They then migrate data to this system from the existing systems, which continue to handle their own unique needs. Over time, the common system takes over more functions, but a forced conversion is not necessary. This approach has been used in the billing arena for some time and is finding its way into the service catalogue and the inventory and order management markets. Spend on service fulfilment goes to many small ISVs. This segment is continuing slowly to consolidate, as CSPs pursue larger projects using multiple technologies. In the past few years, Amdocs has acquired Cramer and Jacobs. Rimmel, CSG Systems has bought Telution, Oracle purchased Meta. Solv and Netsure, and Subex acquired Syndesis, among others (see the list of acquisitions later in this document). In 2009, a number of vendors entered the inventory, order management, and network planning areas for the first time. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 21 Business environment Professional services have been expanded l l l A service fulfilment installation involves a significant amount of software and services. Typically, the value of the associated professional services is three to five times that of the software, when customised features, integration with other OSS and data migration are included. The CSP’s IT staff often handles many of the services. Local IT-integration firms frequently play a large role, as do the major SIs, such as Accenture and IBM. These obtain significant amounts of revenue from professional services for service fulfilment – more than do the software vendors, in many situations. However, a notable minority of ISVs , including Amdocs, Net. Cracker (a part of NEC), and several vendors in growth markets, including Clarity, Comarch, and Comptel, have also successfully sought this work. Some of the ISVs that provide service fulfilment also provide outsourced operations, often as an option. In an outsourced operation, the CSP makes a contract with the vendor to provide software and the IT systems to run the software and the operations personnel to handle orders. This mode has been popular for cable billing and mobile RF engineering for many years and shows some signs of migrating into other operational areas. The re-emergence of start-up CSPs with little existing infrastructure and limited expertise creates the greatest demand for outsourced service fulfilment or Saa. S. Synchronoss Technologies is the largest vendor of outsourced service fulfilment in the USA. Some vendors are using Saa. S as a temporary measure to provide functionality quickly, until the CSPs’ data centres are ready to implement the software. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 21 Business environment Professional services have been expanded l l l A service fulfilment installation involves a significant amount of software and services. Typically, the value of the associated professional services is three to five times that of the software, when customised features, integration with other OSS and data migration are included. The CSP’s IT staff often handles many of the services. Local IT-integration firms frequently play a large role, as do the major SIs, such as Accenture and IBM. These obtain significant amounts of revenue from professional services for service fulfilment – more than do the software vendors, in many situations. However, a notable minority of ISVs , including Amdocs, Net. Cracker (a part of NEC), and several vendors in growth markets, including Clarity, Comarch, and Comptel, have also successfully sought this work. Some of the ISVs that provide service fulfilment also provide outsourced operations, often as an option. In an outsourced operation, the CSP makes a contract with the vendor to provide software and the IT systems to run the software and the operations personnel to handle orders. This mode has been popular for cable billing and mobile RF engineering for many years and shows some signs of migrating into other operational areas. The re-emergence of start-up CSPs with little existing infrastructure and limited expertise creates the greatest demand for outsourced service fulfilment or Saa. S. Synchronoss Technologies is the largest vendor of outsourced service fulfilment in the USA. Some vendors are using Saa. S as a temporary measure to provide functionality quickly, until the CSPs’ data centres are ready to implement the software. © Analysys Mason Limited 2010

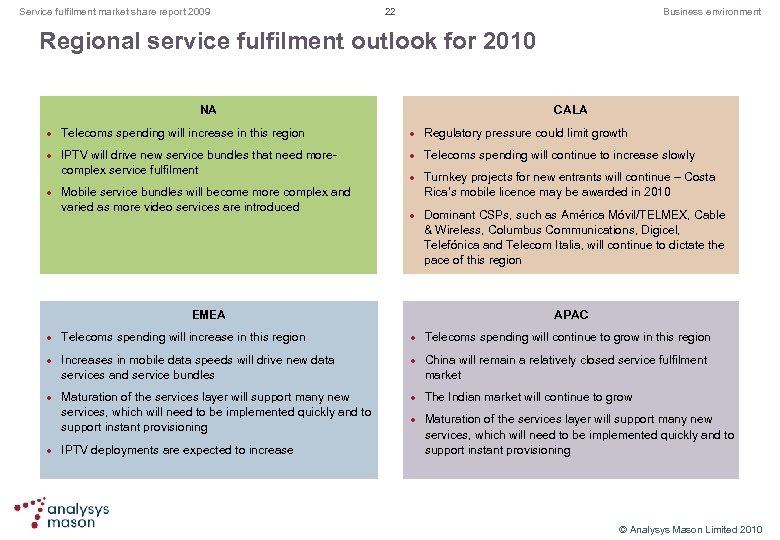

Service fulfilment market share report 2009 22 Business environment Regional service fulfilment outlook for 2010 NA l l l Telecoms spending will increase in this region IPTV will drive new service bundles that need morecomplex service fulfilment Mobile service bundles will become more complex and varied as more video services are introduced CALA l Regulatory pressure could limit growth l Telecoms spending will continue to increase slowly l l EMEA l l Telecoms spending will increase in this region Increases in mobile data speeds will drive new data services and service bundles Maturation of the services layer will support many new services, which will need to be implemented quickly and to support instant provisioning IPTV deployments are expected to increase Turnkey projects for new entrants will continue – Costa Rica’s mobile licence may be awarded in 2010 Dominant CSPs, such as América Móvil/TELMEX, Cable & Wireless, Columbus Communications, Digicel, Telefónica and Telecom Italia, will continue to dictate the pace of this region APAC l l Telecoms spending will continue to grow in this region China will remain a relatively closed service fulfilment market The Indian market will continue to grow Maturation of the services layer will support many new services, which will need to be implemented quickly and to support instant provisioning © Analysys Mason Limited 2010

Service fulfilment market share report 2009 22 Business environment Regional service fulfilment outlook for 2010 NA l l l Telecoms spending will increase in this region IPTV will drive new service bundles that need morecomplex service fulfilment Mobile service bundles will become more complex and varied as more video services are introduced CALA l Regulatory pressure could limit growth l Telecoms spending will continue to increase slowly l l EMEA l l Telecoms spending will increase in this region Increases in mobile data speeds will drive new data services and service bundles Maturation of the services layer will support many new services, which will need to be implemented quickly and to support instant provisioning IPTV deployments are expected to increase Turnkey projects for new entrants will continue – Costa Rica’s mobile licence may be awarded in 2010 Dominant CSPs, such as América Móvil/TELMEX, Cable & Wireless, Columbus Communications, Digicel, Telefónica and Telecom Italia, will continue to dictate the pace of this region APAC l l Telecoms spending will continue to grow in this region China will remain a relatively closed service fulfilment market The Indian market will continue to grow Maturation of the services layer will support many new services, which will need to be implemented quickly and to support instant provisioning © Analysys Mason Limited 2010

Service fulfilment market share report 2009 23 Document map: Market shares Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 23 Document map: Market shares Document map Executive summary Recommendations Market definition Business environment Market shares Vendor analysis Annexes Authors, copyright and key to acronyms List of figures and tables About Analysys Mason © Analysys Mason Limited 2010

Service fulfilment market share report 2009 24 Market shares Service fulfilment overall market shares in 2009 Figure 5: Service fulfilment market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l 1 The overall market revenue for service fulfilment was USD 2. 23 billion in 2009. The top-six suppliers accounted for 44% of the market, which is about the same as last year. Generally speaking, the leading vendors that maintained or gained market share did so by taking on more services work and by expanding existing projects, with some new projects in growth markets. Some vendors reaped the rewards of their earlier acquisitions to fill holes in their product sites and of efforts to integrate these acquisitions more fully into their product lines. This report does not include the fulfilment software products offered by NEMs, even if those systems have limited multi-vendor capabilities. An assessment of these vendors’ offerings is underway. The ‘other’ category includes: Actix, AIRCOM International, Ascom, Clarity, Comarch, GE Smallworld, Sigma Systems, Subex, Synchronoss and Visionael, with an aggregate market share of 21%, and many other small vendors, with an aggregate market share of 35%. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 24 Market shares Service fulfilment overall market shares in 2009 Figure 5: Service fulfilment market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l 1 The overall market revenue for service fulfilment was USD 2. 23 billion in 2009. The top-six suppliers accounted for 44% of the market, which is about the same as last year. Generally speaking, the leading vendors that maintained or gained market share did so by taking on more services work and by expanding existing projects, with some new projects in growth markets. Some vendors reaped the rewards of their earlier acquisitions to fill holes in their product sites and of efforts to integrate these acquisitions more fully into their product lines. This report does not include the fulfilment software products offered by NEMs, even if those systems have limited multi-vendor capabilities. An assessment of these vendors’ offerings is underway. The ‘other’ category includes: Actix, AIRCOM International, Ascom, Clarity, Comarch, GE Smallworld, Sigma Systems, Subex, Synchronoss and Visionael, with an aggregate market share of 21%, and many other small vendors, with an aggregate market share of 35%. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 25 Market shares Service fulfilment product market shares in 2009 Figure 6: Service fulfilment product market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l 1 The overall market revenue for service fulfilment products was USD 1. 362 billion in 2009. The topsix suppliers accounted for 45% of the market, which is about the same as last year. Oracle and Amdocs swapped market share positions in 2009. The rest of the top-six vendors maintained the same market share position as last year. ‘Product’ includes licence software, maintenance and a portion of managed services and Saa. S revenue attributed to products. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 25 Market shares Service fulfilment product market shares in 2009 Figure 6: Service fulfilment product market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l 1 The overall market revenue for service fulfilment products was USD 1. 362 billion in 2009. The topsix suppliers accounted for 45% of the market, which is about the same as last year. Oracle and Amdocs swapped market share positions in 2009. The rest of the top-six vendors maintained the same market share position as last year. ‘Product’ includes licence software, maintenance and a portion of managed services and Saa. S revenue attributed to products. © Analysys Mason Limited 2010

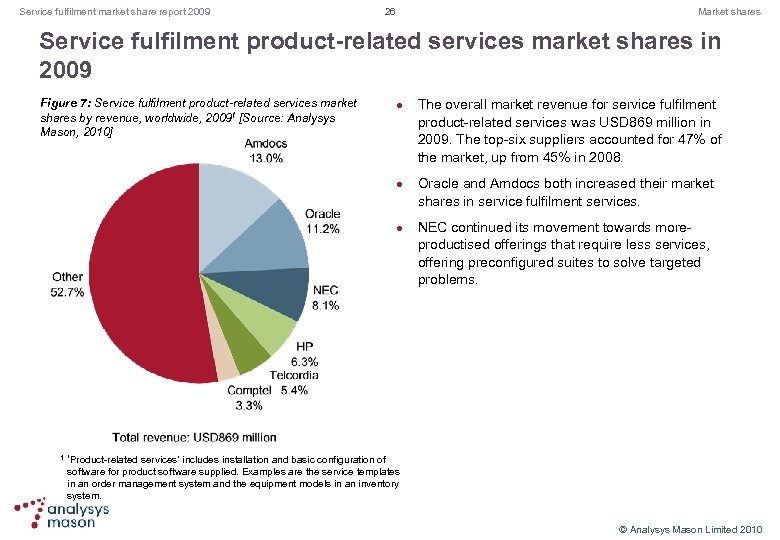

Service fulfilment market share report 2009 26 Market shares Service fulfilment product-related services market shares in 2009 Figure 7: Service fulfilment product-related services market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l l 1 The overall market revenue for service fulfilment product-related services was USD 869 million in 2009. The top-six suppliers accounted for 47% of the market, up from 45% in 2008. Oracle and Amdocs both increased their market shares in service fulfilment services. NEC continued its movement towards moreproductised offerings that require less services, offering preconfigured suites to solve targeted problems. ‘Product-related services’ includes installation and basic configuration of software for product software supplied. Examples are the service templates in an order management system and the equipment models in an inventory system. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 26 Market shares Service fulfilment product-related services market shares in 2009 Figure 7: Service fulfilment product-related services market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l l 1 The overall market revenue for service fulfilment product-related services was USD 869 million in 2009. The top-six suppliers accounted for 47% of the market, up from 45% in 2008. Oracle and Amdocs both increased their market shares in service fulfilment services. NEC continued its movement towards moreproductised offerings that require less services, offering preconfigured suites to solve targeted problems. ‘Product-related services’ includes installation and basic configuration of software for product software supplied. Examples are the service templates in an order management system and the equipment models in an inventory system. © Analysys Mason Limited 2010

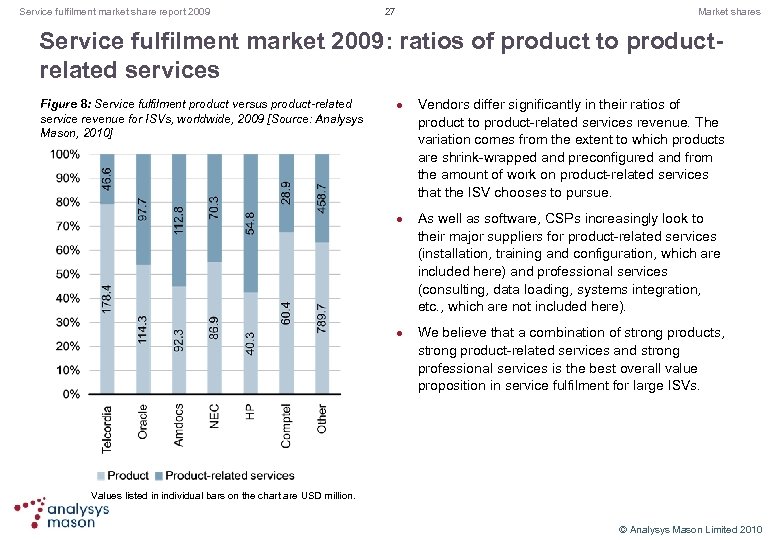

Service fulfilment market share report 2009 27 Market shares Service fulfilment market 2009: ratios of product to productrelated services Figure 8: Service fulfilment product versus product-related service revenue for ISVs, worldwide, 2009 [Source: Analysys Mason, 2010] l l l Vendors differ significantly in their ratios of product to product-related services revenue. The variation comes from the extent to which products are shrink-wrapped and preconfigured and from the amount of work on product-related services that the ISV chooses to pursue. As well as software, CSPs increasingly look to their major suppliers for product-related services (installation, training and configuration, which are included here) and professional services (consulting, data loading, systems integration, etc. , which are not included here). We believe that a combination of strong products, strong product-related services and strong professional services is the best overall value proposition in service fulfilment for large ISVs. Values listed in individual bars on the chart are USD million. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 27 Market shares Service fulfilment market 2009: ratios of product to productrelated services Figure 8: Service fulfilment product versus product-related service revenue for ISVs, worldwide, 2009 [Source: Analysys Mason, 2010] l l l Vendors differ significantly in their ratios of product to product-related services revenue. The variation comes from the extent to which products are shrink-wrapped and preconfigured and from the amount of work on product-related services that the ISV chooses to pursue. As well as software, CSPs increasingly look to their major suppliers for product-related services (installation, training and configuration, which are included here) and professional services (consulting, data loading, systems integration, etc. , which are not included here). We believe that a combination of strong products, strong product-related services and strong professional services is the best overall value proposition in service fulfilment for large ISVs. Values listed in individual bars on the chart are USD million. © Analysys Mason Limited 2010

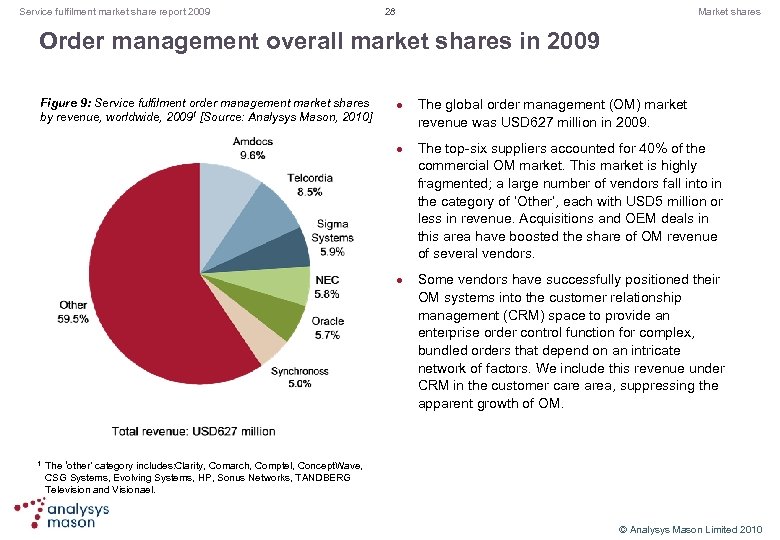

Service fulfilment market share report 2009 28 Market shares Order management overall market shares in 2009 Figure 9: Service fulfilment order management market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l l 1 The global order management (OM) market revenue was USD 627 million in 2009. The top-six suppliers accounted for 40% of the commercial OM market. This market is highly fragmented; a large number of vendors fall into in the category of ‘Other’, each with USD 5 million or less in revenue. Acquisitions and OEM deals in this area have boosted the share of OM revenue of several vendors. Some vendors have successfully positioned their OM systems into the customer relationship management (CRM) space to provide an enterprise order control function for complex, bundled orders that depend on an intricate network of factors. We include this revenue under CRM in the customer care area, suppressing the apparent growth of OM. The ‘other’ category includes: Clarity, Comarch, Comptel, Concept. Wave, CSG Systems, Evolving Systems, HP, Sonus Networks, TANDBERG Television and Visionael. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 28 Market shares Order management overall market shares in 2009 Figure 9: Service fulfilment order management market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l l 1 The global order management (OM) market revenue was USD 627 million in 2009. The top-six suppliers accounted for 40% of the commercial OM market. This market is highly fragmented; a large number of vendors fall into in the category of ‘Other’, each with USD 5 million or less in revenue. Acquisitions and OEM deals in this area have boosted the share of OM revenue of several vendors. Some vendors have successfully positioned their OM systems into the customer relationship management (CRM) space to provide an enterprise order control function for complex, bundled orders that depend on an intricate network of factors. We include this revenue under CRM in the customer care area, suppressing the apparent growth of OM. The ‘other’ category includes: Clarity, Comarch, Comptel, Concept. Wave, CSG Systems, Evolving Systems, HP, Sonus Networks, TANDBERG Television and Visionael. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 29 Market shares Order management vendors in 2009 l l l Amdocs has created its own OM portfolio by building on the technology of its acquisition Cramer Systems. Much of Telcordia’s OM revenue is from legacy business with North American wireline incumbent operators; Telcordia’s Service Order Activation and Control (SOAC) product continues to handle the majority of PSTN orders in the USA. Telcordia’s Expediter and Exception Manager Systems are built on Concept. Wave’s Order Management offering. Sigma Systems is the leading supplier of OM for cable MSOs. Sigma Systems continues to benefit from the broader converged residential broadband services business, handling orders for Vo. D, gaming and other value-added services. OM is an important part of NEC’s (Net. Cracker) overall service fulfilment solution. Although many vendors sell OM separately from other fulfilment, NEC’s Net. Cracker OM is nearly always integrated into its inventory product. Oracle’s overall OM business includes Oracle-developed products, Siebel-based OM and Oracle Communications Order and Service Management (OSM), originally developed by Meta. Solv, which has been enhanced to address the enterprise order management space. Synchronoss is an outsourced fulfilment supplier in NA for mobile CSPs. We count a portion of Synchronoss’s revenue, which accounts for the product and professional services value, and subtract the fulfilment operations value. Most of Synchronoss’s customers use it to handle orders for business services, but Synchronoss also handles mobile and Vo. IP services. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 29 Market shares Order management vendors in 2009 l l l Amdocs has created its own OM portfolio by building on the technology of its acquisition Cramer Systems. Much of Telcordia’s OM revenue is from legacy business with North American wireline incumbent operators; Telcordia’s Service Order Activation and Control (SOAC) product continues to handle the majority of PSTN orders in the USA. Telcordia’s Expediter and Exception Manager Systems are built on Concept. Wave’s Order Management offering. Sigma Systems is the leading supplier of OM for cable MSOs. Sigma Systems continues to benefit from the broader converged residential broadband services business, handling orders for Vo. D, gaming and other value-added services. OM is an important part of NEC’s (Net. Cracker) overall service fulfilment solution. Although many vendors sell OM separately from other fulfilment, NEC’s Net. Cracker OM is nearly always integrated into its inventory product. Oracle’s overall OM business includes Oracle-developed products, Siebel-based OM and Oracle Communications Order and Service Management (OSM), originally developed by Meta. Solv, which has been enhanced to address the enterprise order management space. Synchronoss is an outsourced fulfilment supplier in NA for mobile CSPs. We count a portion of Synchronoss’s revenue, which accounts for the product and professional services value, and subtract the fulfilment operations value. Most of Synchronoss’s customers use it to handle orders for business services, but Synchronoss also handles mobile and Vo. IP services. © Analysys Mason Limited 2010

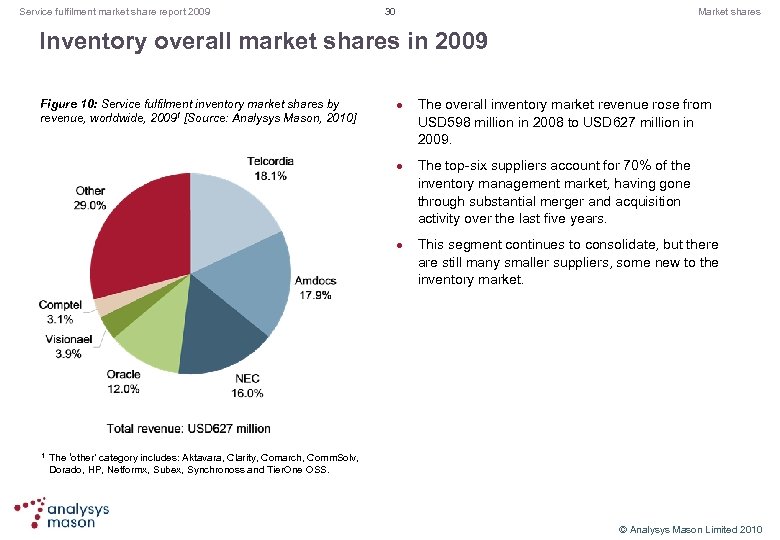

Service fulfilment market share report 2009 30 Market shares Inventory overall market shares in 2009 Figure 10: Service fulfilment inventory market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l l 1 The overall inventory market revenue rose from USD 598 million in 2008 to USD 627 million in 2009. The top-six suppliers account for 70% of the inventory management market, having gone through substantial merger and acquisition activity over the last five years. This segment continues to consolidate, but there are still many smaller suppliers, some new to the inventory market. The ‘other’ category includes: Aktavara, Clarity, Comarch, Comm. Solv, Dorado, HP, Netformx, Subex, Synchronoss and Tier. One OSS. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 30 Market shares Inventory overall market shares in 2009 Figure 10: Service fulfilment inventory market shares by revenue, worldwide, 20091 [Source: Analysys Mason, 2010] l l l 1 The overall inventory market revenue rose from USD 598 million in 2008 to USD 627 million in 2009. The top-six suppliers account for 70% of the inventory management market, having gone through substantial merger and acquisition activity over the last five years. This segment continues to consolidate, but there are still many smaller suppliers, some new to the inventory market. The ‘other’ category includes: Aktavara, Clarity, Comarch, Comm. Solv, Dorado, HP, Netformx, Subex, Synchronoss and Tier. One OSS. © Analysys Mason Limited 2010

![Service fulfilment market share report 2009 31 Market shares Inventory vendors in 2009 [1] Service fulfilment market share report 2009 31 Market shares Inventory vendors in 2009 [1]](https://present5.com/presentation/646d35461dc9872a5344501a2bf0fc8f/image-31.jpg) Service fulfilment market share report 2009 31 Market shares Inventory vendors in 2009 [1] l l Telcordia maintained its leadership position on the strength of its legacy TIRKS, LFACS and SWITCH systems, as well as that of its modern Telcordia Granite Inventory system and the Telcordia Network Engineer systems when it used to provide physical inventory of inside equipment (the majority of the revenue from Network Engineer is included under engineering tools, however). These two systems have also been integrated to provide full logical and physical inventory functions. Amdocs continues to sell its overall service fulfilment solution, which was expanded in 2009 to include new capacity planning functions. Amdocs’ major strength is in the European market, which has traditionally been the strongest geographical segment, but suffered from the economic downturn in 2009. The acquisition of cable inventory, OM and activation specialist Jacobs. Rimmel and the integration of its products into the Amdocs OSS product line has brought Amdocs greater presence in the cable MSO CSP space. Net. Cracker, now a part of NEC, was able to continue to grow as it expanded earlier service fulfilment installations, extending them to new services and technologies. Net. Cracker also closed about six new service fulfilment deals in 2009. In 2010, NEC announced that all of the NEC OSS and BSS software had been consolidated into the Net. Cracker unit (this consolidation is not included in this report). This will create a new BSS/OSS powerhouse with revenue of over USD 1 billion. Oracle has two principal inventory solutions: UIM for inventory of IT and network-based services, and MSS for network resource management with regulated ordering support. These are usually purchased by CSPs, together with OSM and Activation, to enable the fulfilment of IT and network-based services. Much of Oracle’s business comes from growth markets that are deploying broadband mobile services, as well as from continued expansion of MSS for business-to-business services, primarily in the Americas. © Analysys Mason Limited 2010

Service fulfilment market share report 2009 31 Market shares Inventory vendors in 2009 [1] l l Telcordia maintained its leadership position on the strength of its legacy TIRKS, LFACS and SWITCH systems, as well as that of its modern Telcordia Granite Inventory system and the Telcordia Network Engineer systems when it used to provide physical inventory of inside equipment (the majority of the revenue from Network Engineer is included under engineering tools, however). These two systems have also been integrated to provide full logical and physical inventory functions. Amdocs continues to sell its overall service fulfilment solution, which was expanded in 2009 to include new capacity planning functions. Amdocs’ major strength is in the European market, which has traditionally been the strongest geographical segment, but suffered from the economic downturn in 2009. The acquisition of cable inventory, OM and activation specialist Jacobs. Rimmel and the integration of its products into the Amdocs OSS product line has brought Amdocs greater presence in the cable MSO CSP space. Net. Cracker, now a part of NEC, was able to continue to grow as it expanded earlier service fulfilment installations, extending them to new services and technologies. Net. Cracker also closed about six new service fulfilment deals in 2009. In 2010, NEC announced that all of the NEC OSS and BSS software had been consolidated into the Net. Cracker unit (this consolidation is not included in this report). This will create a new BSS/OSS powerhouse with revenue of over USD 1 billion. Oracle has two principal inventory solutions: UIM for inventory of IT and network-based services, and MSS for network resource management with regulated ordering support. These are usually purchased by CSPs, together with OSM and Activation, to enable the fulfilment of IT and network-based services. Much of Oracle’s business comes from growth markets that are deploying broadband mobile services, as well as from continued expansion of MSS for business-to-business services, primarily in the Americas. © Analysys Mason Limited 2010

![Service fulfilment market share report 2009 32 Market shares Inventory vendors in 2009 [2] Service fulfilment market share report 2009 32 Market shares Inventory vendors in 2009 [2]](https://present5.com/presentation/646d35461dc9872a5344501a2bf0fc8f/image-32.jpg) Service fulfilment market share report 2009 32 Market shares Inventory vendors in 2009 [2] l l Comptel is Finland’s public OSS provider. Its inventory customers include América Móvil, Bharti Airtel, China Mobile, O 2, Saudi Telecom, T-Mobile, Telefónica and Vodafone. These solid, convergent inventory deployments are a part of the overall Comptel Dynamic OSS fulfilment solution. Visionael has been up and down, and in and out of the CSP market, over the past five years. It is still focused primarily on enterprises and government, but gets about one-third of its business from CSPs. In the past three years, its IP-focused inventory management system has been successful in many CSPs, including cable MSOs and business service groups of major CSPs, keeping it among the leaders in the telecoms market. Other companies with stronger inventory are those that are focused especially on activation. Notable in that category are HP and Subex (via its Syndesis acquisition). Also, Australia’s Clarity and Poland’s Comarch, which offer complete OSS solutions, mostly in growth markets, have experienced significant growth in their inventory businesses. New to the list of the top-sixteen suppliers is Netformx. It provides an assign and design solution for business services, as well as a repository for the logical configuration of the IP network to support business users. We expect many new entrants from the enterprise market to come into the inventory market, as the CSP infrastructure looks increasingly like an enterprise IT shop. © Analysys Mason Limited 2010

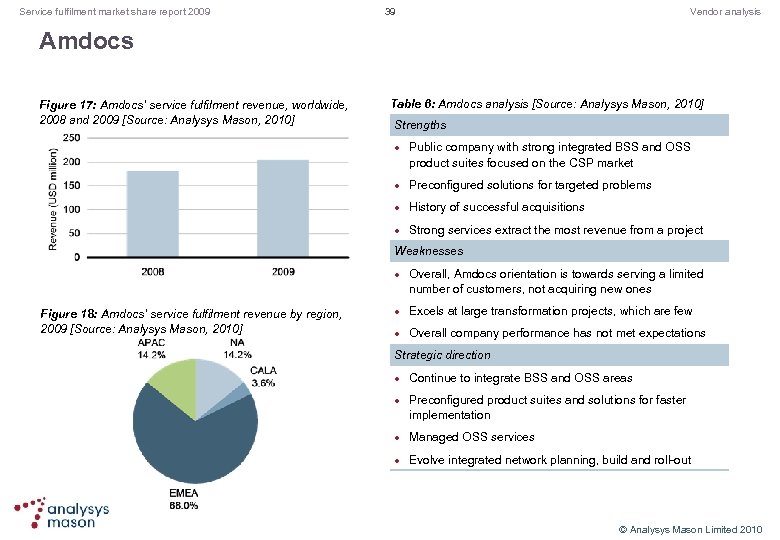

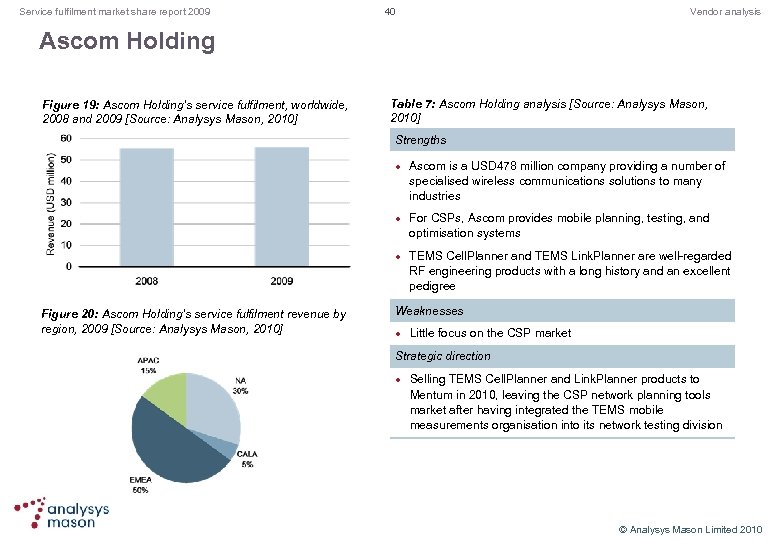

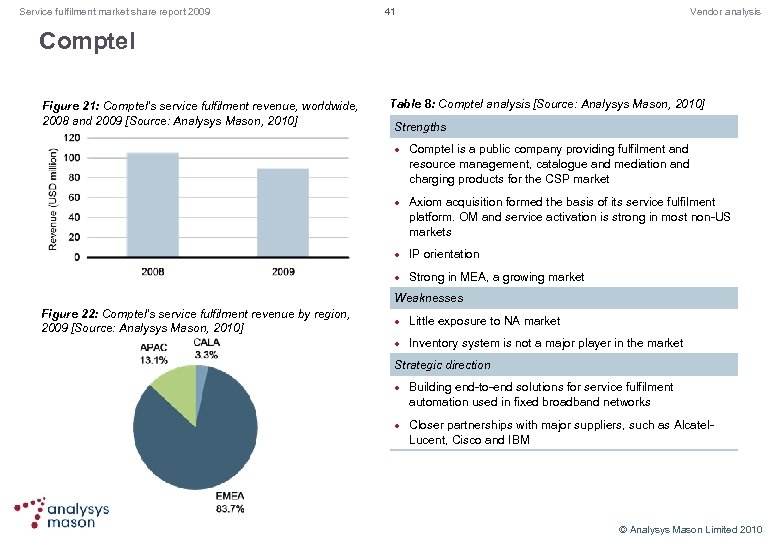

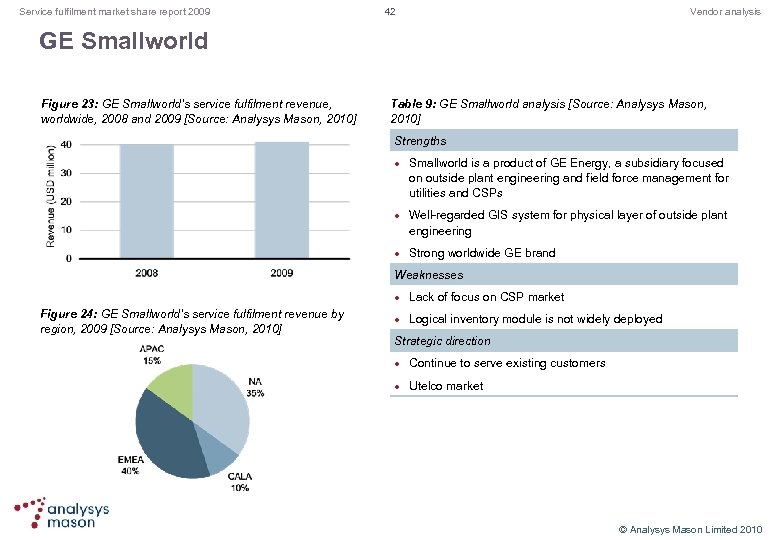

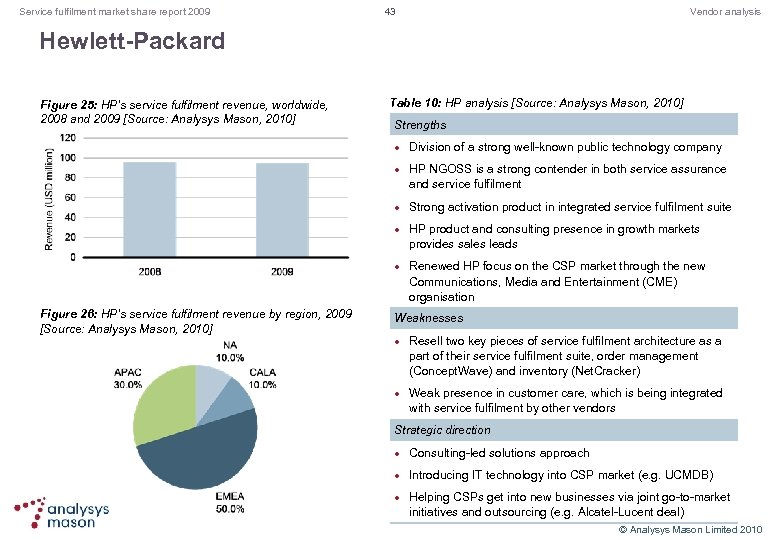

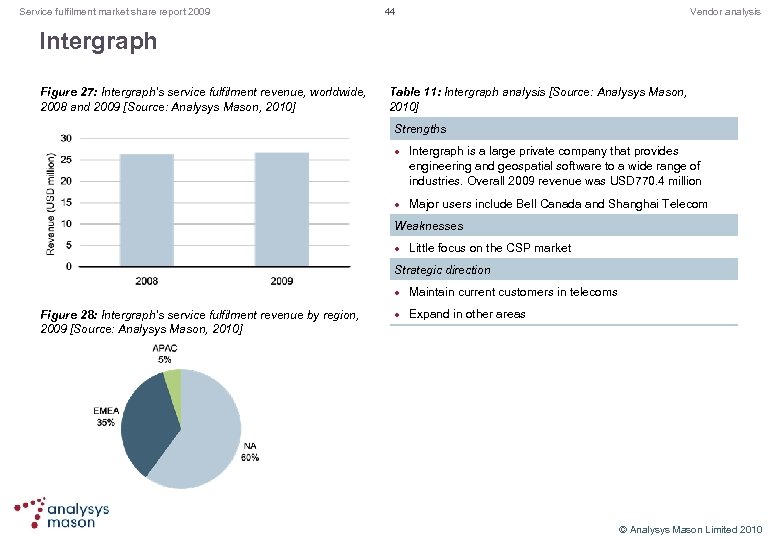

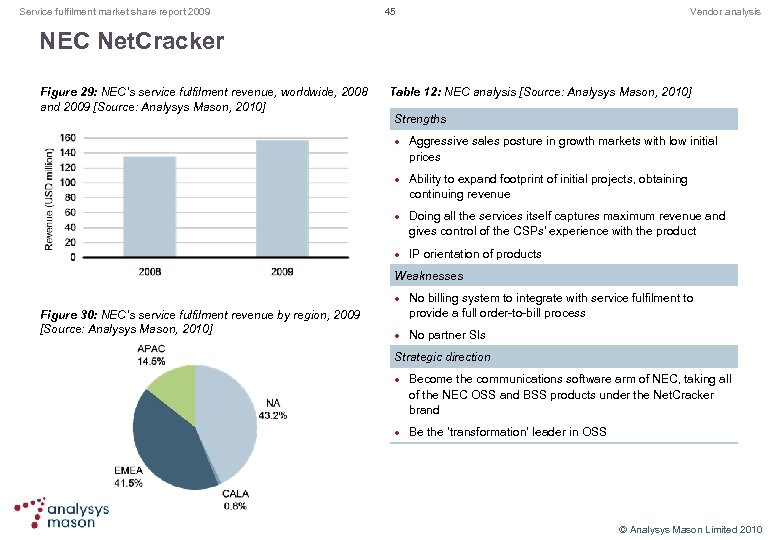

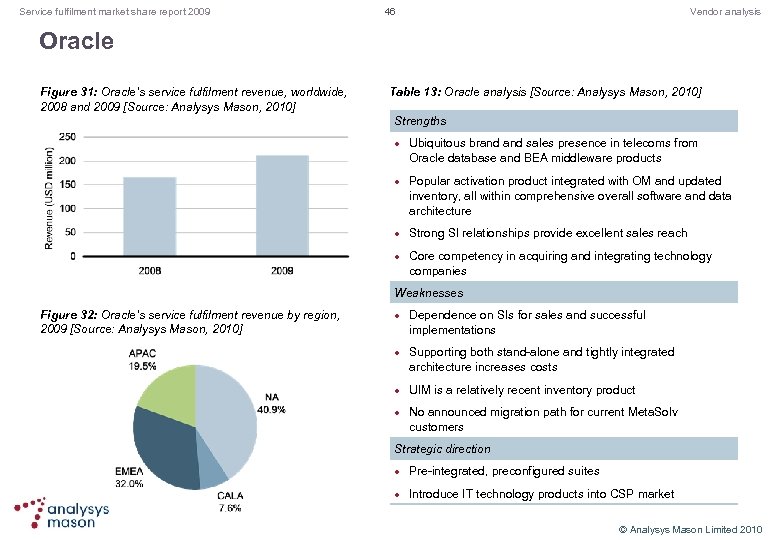

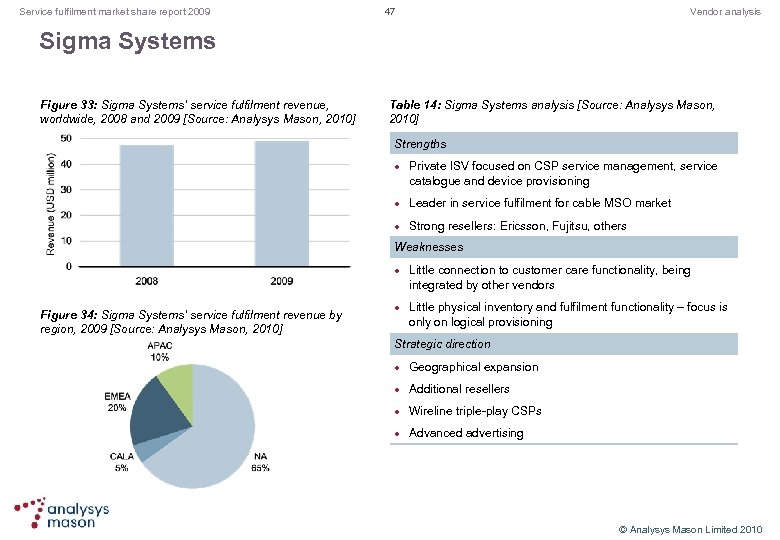

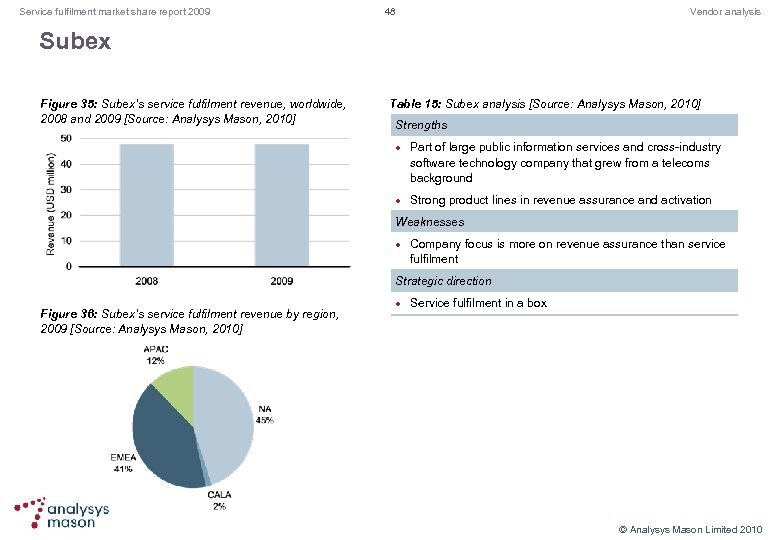

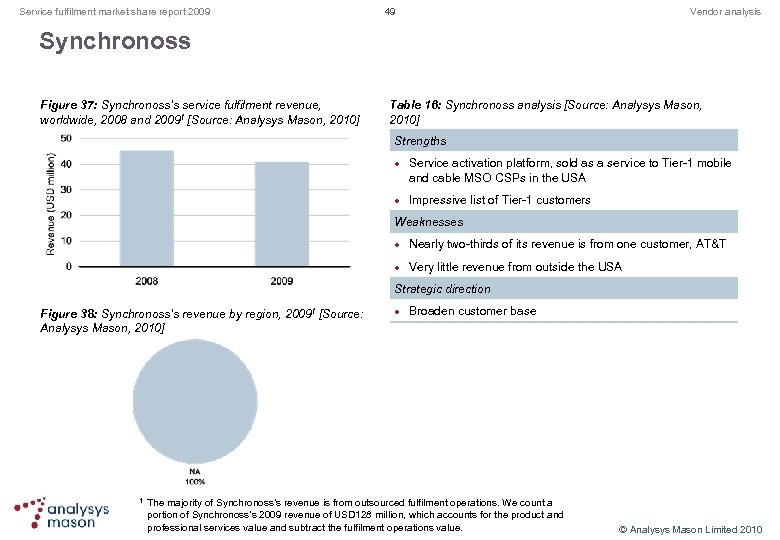

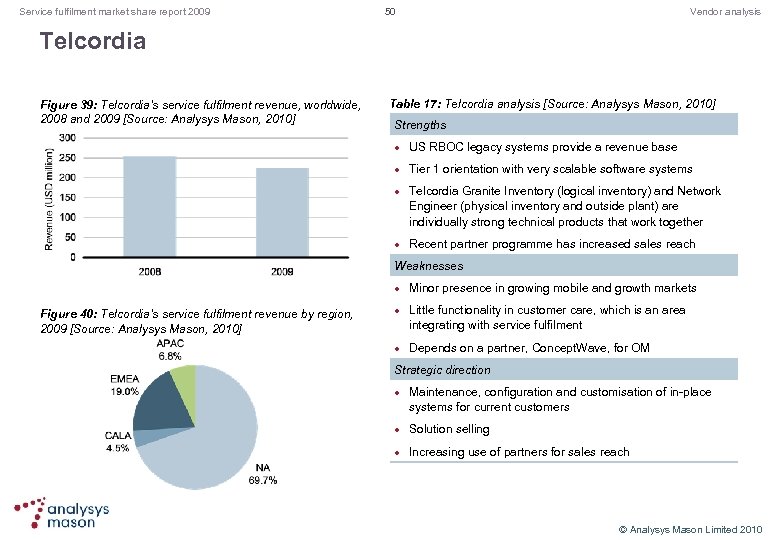

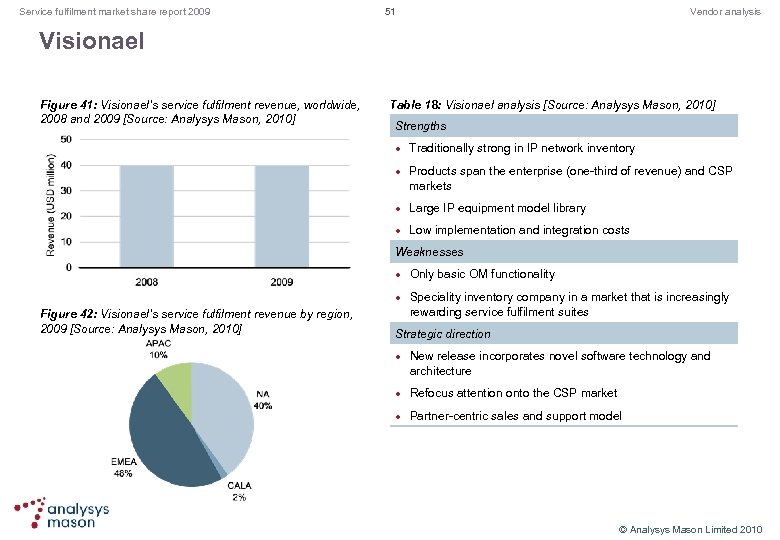

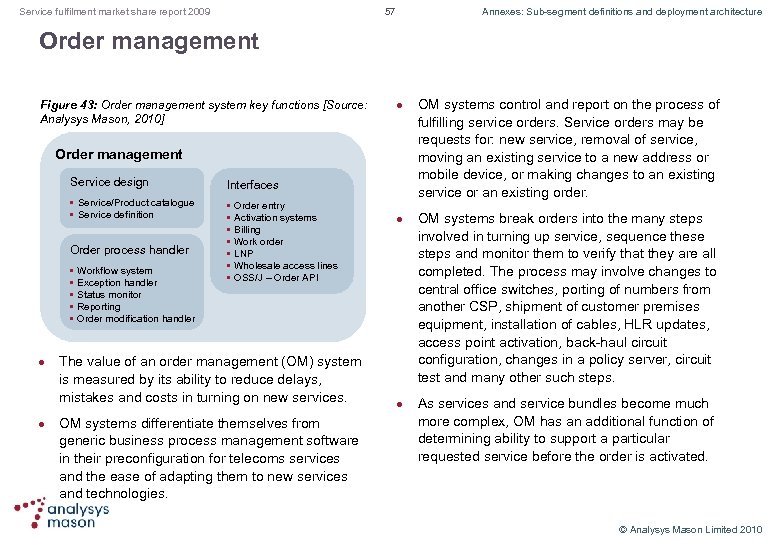

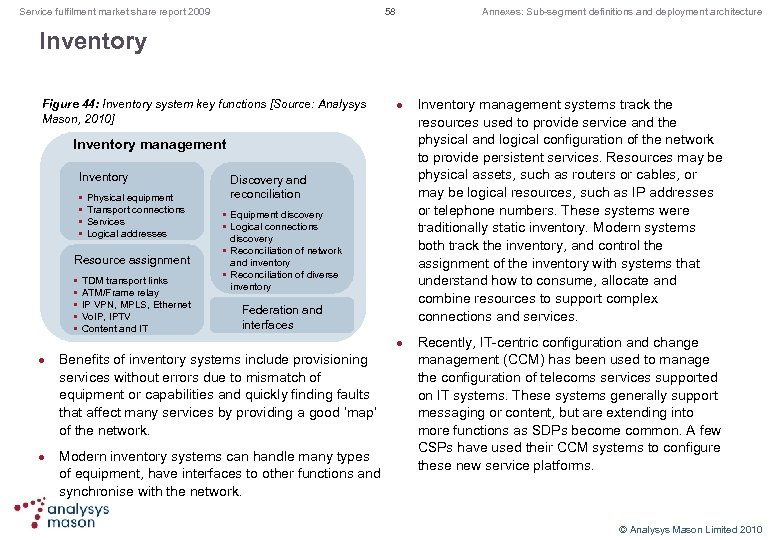

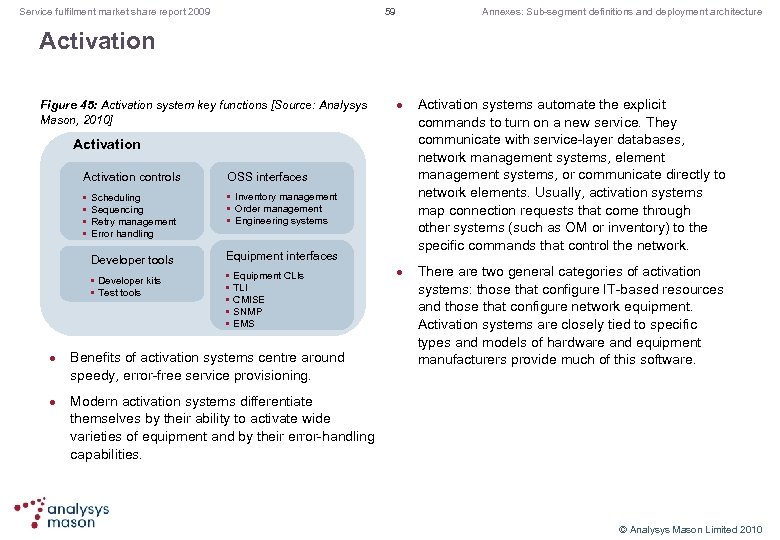

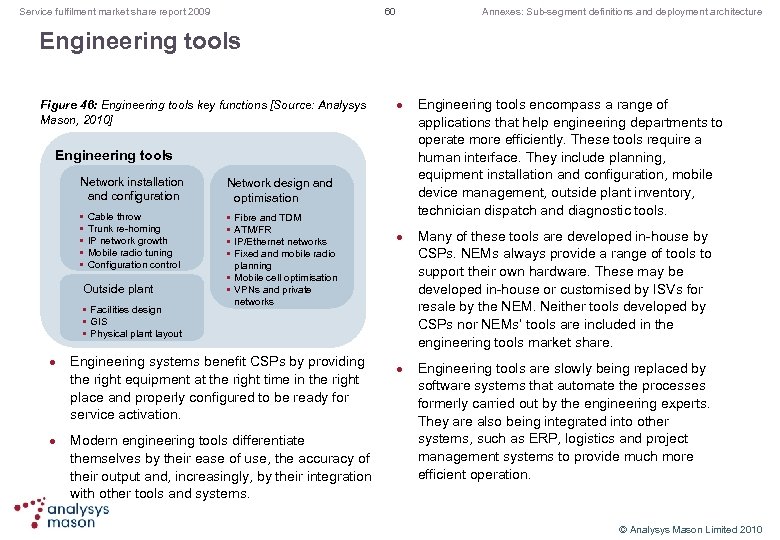

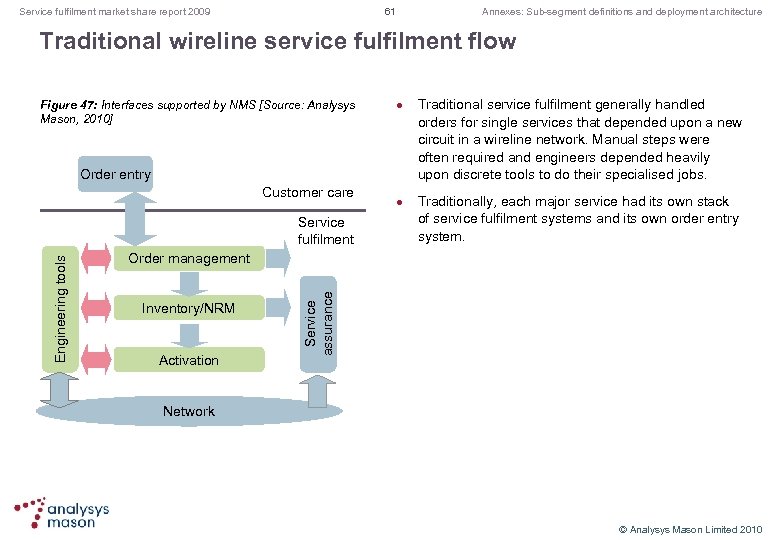

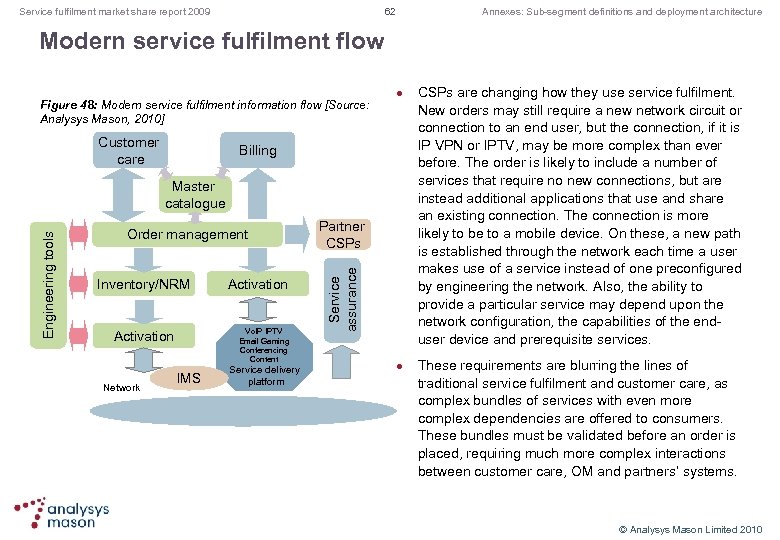

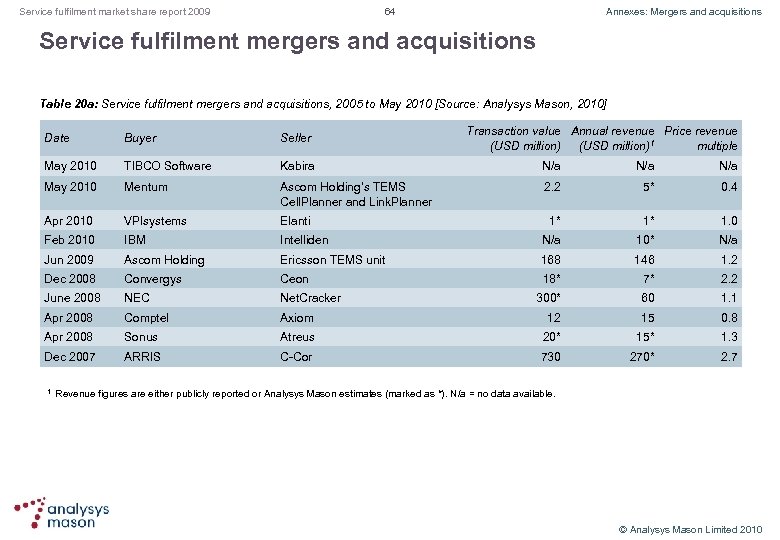

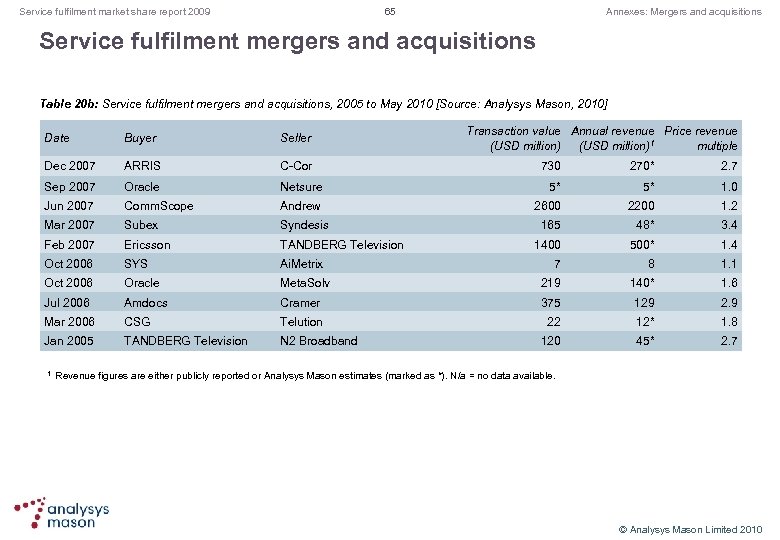

Service fulfilment market share report 2009 32 Market shares Inventory vendors in 2009 [2] l l Comptel is Finland’s public OSS provider. Its inventory customers include América Móvil, Bharti Airtel, China Mobile, O 2, Saudi Telecom, T-Mobile, Telefónica and Vodafone. These solid, convergent inventory deployments are a part of the overall Comptel Dynamic OSS fulfilment solution. Visionael has been up and down, and in and out of the CSP market, over the past five years. It is still focused primarily on enterprises and government, but gets about one-third of its business from CSPs. In the past three years, its IP-focused inventory management system has been successful in many CSPs, including cable MSOs and business service groups of major CSPs, keeping it among the leaders in the telecoms market. Other companies with stronger inventory are those that are focused especially on activation. Notable in that category are HP and Subex (via its Syndesis acquisition). Also, Australia’s Clarity and Poland’s Comarch, which offer complete OSS solutions, mostly in growth markets, have experienced significant growth in their inventory businesses. New to the list of the top-sixteen suppliers is Netformx. It provides an assign and design solution for business services, as well as a repository for the logical configuration of the IP network to support business users. We expect many new entrants from the enterprise market to come into the inventory market, as the CSP infrastructure looks increasingly like an enterprise IT shop. © Analysys Mason Limited 2010