9930ccc2c13346167e6253e1c66921bc.ppt

- Количество слайдов: 46

Research report NGNs and the changing face of voice migration l Rupert Wood September 2009

Research report NGNs and the changing face of voice migration l Rupert Wood September 2009

![NGNs and the changing face of voice migration 2 Contents [1] Slide no. 4. NGNs and the changing face of voice migration 2 Contents [1] Slide no. 4.](https://present5.com/presentation/9930ccc2c13346167e6253e1c66921bc/image-2.jpg) NGNs and the changing face of voice migration 2 Contents [1] Slide no. 4. Document map: Changes in incumbent telco strategy 5. Incumbent operators have adopted varying strategies for core and access re-engineering 6. Voice in the NGN extends at least to the DLE and thereby replaces all circuit switching 7. What we wrote 18 months ago and what has changed since then 8. Timelines for PSTN phase-out (1) 9. Timelines for PSTN phase-out (2) 10. Recessions tend to make operators reverse their attitudes to costs 11. FTTH will make operators rethink voice migration 12. Fixed line loss has slowed a little since 2007, easing some pressure to reduce costs 13. Document map: Case studies 14. BT’s original 21 CN target architecture 15. BT has altered its voice strategy 16. BT’s focus is changing from MSANs to Vo. BBbased services 17. Voice on BT’s FTTx will eventually move over to SIP-based Vo. BB architecture 18. KPN’s original FTTC target architecture 19. KPN is switching its attention to FTTH and this has led to some halts in MSAN deployment Slide no. 20. Telstra’s target architecture 21. The Australian National Broadband Network has rendered Telstra’s original MSAN-based plans redundant 22. Telecom Italia’s target architecture 23. Telecom Italia is taking a phased approach to both NGN and NGA 24. Target architecture of Deutsche Telekom (Germany and group) 25. Deutsche Telekom has tended to play down the urgency of NGN migration 26. T-Com Slovakia’s target architecture 27. T-Com Slovakia has shifted strategy from a timetabled, full PSTN phase-out to a selective rollout of NGN 28. Document map: Altnets, cablecos and MNOs 29. Alternative fixed operators have a different set of priorities for NGN 30. The main options for cablecos are to migrate to Vo. BB or to outsource PSTN management 31. Switched voice and 4 G can co-exist 32. Document map: Looking ahead, conclusions and recommendations 33. Incumbent operators without NGNs must find a cost-effective way to switch off the PSTN when the time comes © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 2 Contents [1] Slide no. 4. Document map: Changes in incumbent telco strategy 5. Incumbent operators have adopted varying strategies for core and access re-engineering 6. Voice in the NGN extends at least to the DLE and thereby replaces all circuit switching 7. What we wrote 18 months ago and what has changed since then 8. Timelines for PSTN phase-out (1) 9. Timelines for PSTN phase-out (2) 10. Recessions tend to make operators reverse their attitudes to costs 11. FTTH will make operators rethink voice migration 12. Fixed line loss has slowed a little since 2007, easing some pressure to reduce costs 13. Document map: Case studies 14. BT’s original 21 CN target architecture 15. BT has altered its voice strategy 16. BT’s focus is changing from MSANs to Vo. BBbased services 17. Voice on BT’s FTTx will eventually move over to SIP-based Vo. BB architecture 18. KPN’s original FTTC target architecture 19. KPN is switching its attention to FTTH and this has led to some halts in MSAN deployment Slide no. 20. Telstra’s target architecture 21. The Australian National Broadband Network has rendered Telstra’s original MSAN-based plans redundant 22. Telecom Italia’s target architecture 23. Telecom Italia is taking a phased approach to both NGN and NGA 24. Target architecture of Deutsche Telekom (Germany and group) 25. Deutsche Telekom has tended to play down the urgency of NGN migration 26. T-Com Slovakia’s target architecture 27. T-Com Slovakia has shifted strategy from a timetabled, full PSTN phase-out to a selective rollout of NGN 28. Document map: Altnets, cablecos and MNOs 29. Alternative fixed operators have a different set of priorities for NGN 30. The main options for cablecos are to migrate to Vo. BB or to outsource PSTN management 31. Switched voice and 4 G can co-exist 32. Document map: Looking ahead, conclusions and recommendations 33. Incumbent operators without NGNs must find a cost-effective way to switch off the PSTN when the time comes © Analysys Mason Limited 2009

![NGNs and the changing face of voice migration 3 Contents [2] Slide no. 34. NGNs and the changing face of voice migration 3 Contents [2] Slide no. 34.](https://present5.com/presentation/9930ccc2c13346167e6253e1c66921bc/image-3.jpg) NGNs and the changing face of voice migration 3 Contents [2] Slide no. 34. Conclusions 35. Recommendations 36. Document map: Author, copyright and key to acronyms 37. Author 38. Copyright 39. Key to acronyms [1] 40. Key to acronyms [2] 41. Document map: List of figures 42. List of figures 43. Document map: About Analysys Mason 44. About Analysys Mason 45. Research from Analysys Mason 46. Consulting from Analysys Mason © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 3 Contents [2] Slide no. 34. Conclusions 35. Recommendations 36. Document map: Author, copyright and key to acronyms 37. Author 38. Copyright 39. Key to acronyms [1] 40. Key to acronyms [2] 41. Document map: List of figures 42. List of figures 43. Document map: About Analysys Mason 44. About Analysys Mason 45. Research from Analysys Mason 46. Consulting from Analysys Mason © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 4 Document map: Changes in incumbent telco strategy Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 4 Document map: Changes in incumbent telco strategy Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

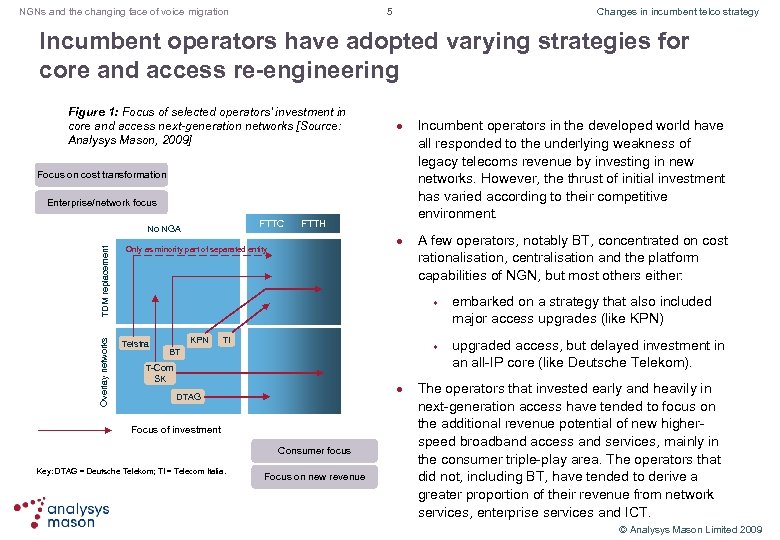

5 NGNs and the changing face of voice migration Changes in incumbent telco strategy Incumbent operators have adopted varying strategies for core and access re-engineering Figure 1: Focus of selected operators’ investment in core and access next-generation networks [Source: Analysys Mason, 2009] l Focus on cost transformation Enterprise/network focus FTTC FTTH Overlay networks TDM replacement No NGA l Only as minority part of separated entity ? BT ? Incumbent operators in the developed world have all responded to the underlying weakness of legacy telecoms revenue by investing in new networks. However, the thrust of initial investment has varied according to their competitive environment. A few operators, notably BT, concentrated on cost rationalisation, centralisation and the platform capabilities of NGN, but most others either: w Telstra KPN BT T-Com SK SK TI TI DTAG eircom w DTAG ? AT&T Focus of investment Consumer focus Key: DTAG = Deutsche Telekom; TI = Telecom Italia. Focus on new revenue l embarked on a strategy that also included major access upgrades (like KPN) upgraded access, but delayed investment in an all-IP core (like Deutsche Telekom). The operators that invested early and heavily in next-generation access have tended to focus on the additional revenue potential of new higherspeed broadband access and services, mainly in the consumer triple-play area. The operators that did not, including BT, have tended to derive a greater proportion of their revenue from network services, enterprise services and ICT. © Analysys Mason Limited 2009

5 NGNs and the changing face of voice migration Changes in incumbent telco strategy Incumbent operators have adopted varying strategies for core and access re-engineering Figure 1: Focus of selected operators’ investment in core and access next-generation networks [Source: Analysys Mason, 2009] l Focus on cost transformation Enterprise/network focus FTTC FTTH Overlay networks TDM replacement No NGA l Only as minority part of separated entity ? BT ? Incumbent operators in the developed world have all responded to the underlying weakness of legacy telecoms revenue by investing in new networks. However, the thrust of initial investment has varied according to their competitive environment. A few operators, notably BT, concentrated on cost rationalisation, centralisation and the platform capabilities of NGN, but most others either: w Telstra KPN BT T-Com SK SK TI TI DTAG eircom w DTAG ? AT&T Focus of investment Consumer focus Key: DTAG = Deutsche Telekom; TI = Telecom Italia. Focus on new revenue l embarked on a strategy that also included major access upgrades (like KPN) upgraded access, but delayed investment in an all-IP core (like Deutsche Telekom). The operators that invested early and heavily in next-generation access have tended to focus on the additional revenue potential of new higherspeed broadband access and services, mainly in the consumer triple-play area. The operators that did not, including BT, have tended to derive a greater proportion of their revenue from network services, enterprise services and ICT. © Analysys Mason Limited 2009

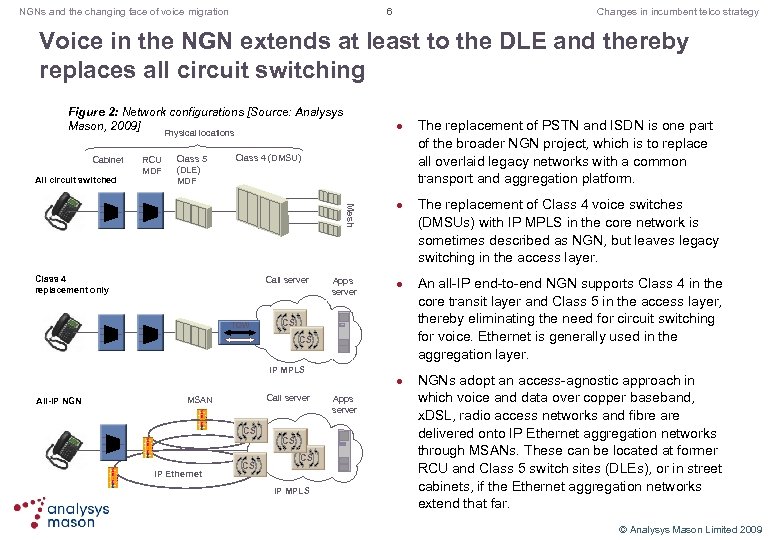

6 NGNs and the changing face of voice migration Changes in incumbent telco strategy Voice in the NGN extends at least to the DLE and thereby replaces all circuit switching Figure 2: Network configurations [Source: Analysys Mason, 2009] Physical locations Cabinet All circuit switched RCU MDF Class 5 (DLE) MDF l Class 4 (DMSU) Mesh Class 4 replacement only Call server TGW Apps server l l CS CS IP MPLS l All-IP NGN Call server MSAN CS IP Ethernet CS CS CS IP MPLS Apps server The replacement of PSTN and ISDN is one part of the broader NGN project, which is to replace all overlaid legacy networks with a common transport and aggregation platform. The replacement of Class 4 voice switches (DMSUs) with IP MPLS in the core network is sometimes described as NGN, but leaves legacy switching in the access layer. An all-IP end-to-end NGN supports Class 4 in the core transit layer and Class 5 in the access layer, thereby eliminating the need for circuit switching for voice. Ethernet is generally used in the aggregation layer. NGNs adopt an access-agnostic approach in which voice and data over copper baseband, x. DSL, radio access networks and fibre are delivered onto IP Ethernet aggregation networks through MSANs. These can be located at former RCU and Class 5 switch sites (DLEs), or in street cabinets, if the Ethernet aggregation networks extend that far. © Analysys Mason Limited 2009

6 NGNs and the changing face of voice migration Changes in incumbent telco strategy Voice in the NGN extends at least to the DLE and thereby replaces all circuit switching Figure 2: Network configurations [Source: Analysys Mason, 2009] Physical locations Cabinet All circuit switched RCU MDF Class 5 (DLE) MDF l Class 4 (DMSU) Mesh Class 4 replacement only Call server TGW Apps server l l CS CS IP MPLS l All-IP NGN Call server MSAN CS IP Ethernet CS CS CS IP MPLS Apps server The replacement of PSTN and ISDN is one part of the broader NGN project, which is to replace all overlaid legacy networks with a common transport and aggregation platform. The replacement of Class 4 voice switches (DMSUs) with IP MPLS in the core network is sometimes described as NGN, but leaves legacy switching in the access layer. An all-IP end-to-end NGN supports Class 4 in the core transit layer and Class 5 in the access layer, thereby eliminating the need for circuit switching for voice. Ethernet is generally used in the aggregation layer. NGNs adopt an access-agnostic approach in which voice and data over copper baseband, x. DSL, radio access networks and fibre are delivered onto IP Ethernet aggregation networks through MSANs. These can be located at former RCU and Class 5 switch sites (DLEs), or in street cabinets, if the Ethernet aggregation networks extend that far. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 7 Changes in incumbent telco strategy What we wrote 18 months ago and what has changed since then What we said then l l In January 2008, we published a report, Next-generation network architecture: what and when, that argued that NGN investment was essential to secure the long-term futures of incumbent fixed-network operators. “Fixed-line incumbents will not be made future-proof by building out next-generation access networks alone, and they should address core network transformation with greater urgency. ” “The network-rationalising aspects of NGNs can deliver real cost savings, but operators need to act quickly to realise these efficiencies. ” “VDSL NGAs can cost less than NGNs, but […] will not generally be sufficient to boost revenue by more than single-digit percentages. FTTH has to be considered for much longer-term investment, but there are better immediate prospects for most operators. […] investment in NGAs may do no more than stabilise broadband ARPU and triple-play market share. ” What has changed l l l The economic downturn has changed the landscape for investment. Many operators are focusing capex on revenue upside, rather than on savings. FTTH seems closer to being a reality than seemed likely 18 months ago. FTTH implementations obviate the need for MSANs now appear to be a rural option, rather than a national one. Implementations have been bedevilled by technical difficulties, especially in the reliability of softswitching equipment and of ISDN emulation. The value of fixed voice appears to be holding up better than expected and there is growing scepticism about the value of integrated voice and data services. The result is that among incumbent fixed-line operators there has been a perceptible slowdown in TDM migrations and in the timelines for transformation. Operators have not abandoned the idea of a single platform, but these projects have slipped down the fixed operators’ list of priorities. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 7 Changes in incumbent telco strategy What we wrote 18 months ago and what has changed since then What we said then l l In January 2008, we published a report, Next-generation network architecture: what and when, that argued that NGN investment was essential to secure the long-term futures of incumbent fixed-network operators. “Fixed-line incumbents will not be made future-proof by building out next-generation access networks alone, and they should address core network transformation with greater urgency. ” “The network-rationalising aspects of NGNs can deliver real cost savings, but operators need to act quickly to realise these efficiencies. ” “VDSL NGAs can cost less than NGNs, but […] will not generally be sufficient to boost revenue by more than single-digit percentages. FTTH has to be considered for much longer-term investment, but there are better immediate prospects for most operators. […] investment in NGAs may do no more than stabilise broadband ARPU and triple-play market share. ” What has changed l l l The economic downturn has changed the landscape for investment. Many operators are focusing capex on revenue upside, rather than on savings. FTTH seems closer to being a reality than seemed likely 18 months ago. FTTH implementations obviate the need for MSANs now appear to be a rural option, rather than a national one. Implementations have been bedevilled by technical difficulties, especially in the reliability of softswitching equipment and of ISDN emulation. The value of fixed voice appears to be holding up better than expected and there is growing scepticism about the value of integrated voice and data services. The result is that among incumbent fixed-line operators there has been a perceptible slowdown in TDM migrations and in the timelines for transformation. Operators have not abandoned the idea of a single platform, but these projects have slipped down the fixed operators’ list of priorities. © Analysys Mason Limited 2009

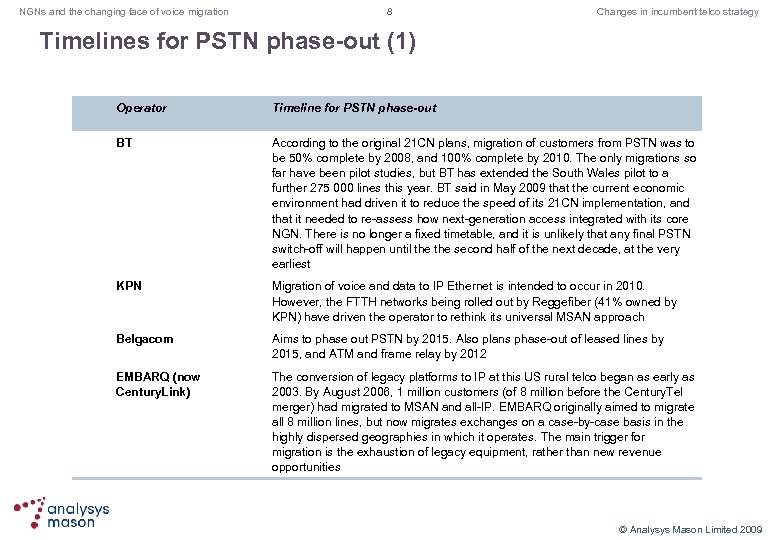

NGNs and the changing face of voice migration 8 Changes in incumbent telco strategy Timelines for PSTN phase-out (1) Operator Timeline for PSTN phase-out BT According to the original 21 CN plans, migration of customers from PSTN was to be 50% complete by 2008, and 100% complete by 2010. The only migrations so far have been pilot studies, but BT has extended the South Wales pilot to a further 275 000 lines this year. BT said in May 2009 that the current economic environment had driven it to reduce the speed of its 21 CN implementation, and that it needed to re-assess how next-generation access integrated with its core NGN. There is no longer a fixed timetable, and it is unlikely that any final PSTN switch-off will happen until the second half of the next decade, at the very earliest KPN Migration of voice and data to IP Ethernet is intended to occur in 2010. However, the FTTH networks being rolled out by Reggefiber (41% owned by KPN) have driven the operator to rethink its universal MSAN approach Belgacom Aims to phase out PSTN by 2015. Also plans phase-out of leased lines by 2015, and ATM and frame relay by 2012 EMBARQ (now Century. Link) The conversion of legacy platforms to IP at this US rural telco began as early as 2003. By August 2006, 1 million customers (of 8 million before the Century. Tel merger) had migrated to MSAN and all-IP. EMBARQ originally aimed to migrate all 8 million lines, but now migrates exchanges on a case-by-case basis in the highly dispersed geographies in which it operates. The main trigger for migration is the exhaustion of legacy equipment, rather than new revenue opportunities © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 8 Changes in incumbent telco strategy Timelines for PSTN phase-out (1) Operator Timeline for PSTN phase-out BT According to the original 21 CN plans, migration of customers from PSTN was to be 50% complete by 2008, and 100% complete by 2010. The only migrations so far have been pilot studies, but BT has extended the South Wales pilot to a further 275 000 lines this year. BT said in May 2009 that the current economic environment had driven it to reduce the speed of its 21 CN implementation, and that it needed to re-assess how next-generation access integrated with its core NGN. There is no longer a fixed timetable, and it is unlikely that any final PSTN switch-off will happen until the second half of the next decade, at the very earliest KPN Migration of voice and data to IP Ethernet is intended to occur in 2010. However, the FTTH networks being rolled out by Reggefiber (41% owned by KPN) have driven the operator to rethink its universal MSAN approach Belgacom Aims to phase out PSTN by 2015. Also plans phase-out of leased lines by 2015, and ATM and frame relay by 2012 EMBARQ (now Century. Link) The conversion of legacy platforms to IP at this US rural telco began as early as 2003. By August 2006, 1 million customers (of 8 million before the Century. Tel merger) had migrated to MSAN and all-IP. EMBARQ originally aimed to migrate all 8 million lines, but now migrates exchanges on a case-by-case basis in the highly dispersed geographies in which it operates. The main trigger for migration is the exhaustion of legacy equipment, rather than new revenue opportunities © Analysys Mason Limited 2009

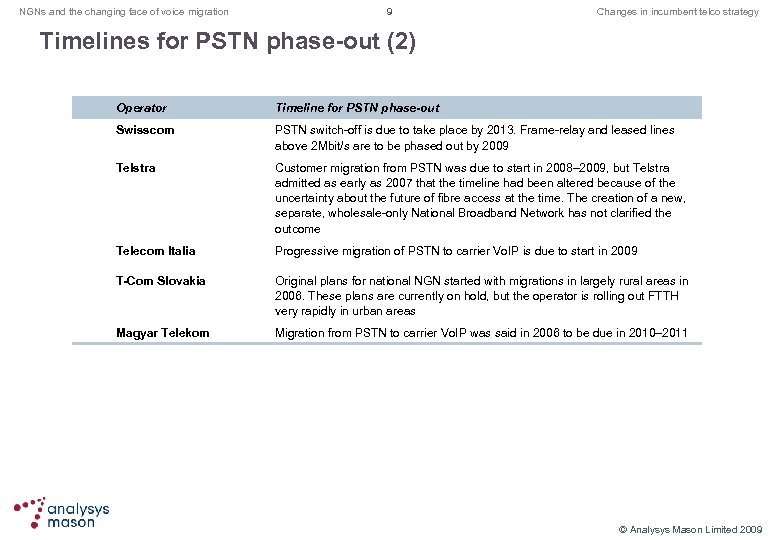

NGNs and the changing face of voice migration 9 Changes in incumbent telco strategy Timelines for PSTN phase-out (2) Operator Timeline for PSTN phase-out Swisscom PSTN switch-off is due to take place by 2013. Frame-relay and leased lines above 2 Mbit/s are to be phased out by 2009 Telstra Customer migration from PSTN was due to start in 2008– 2009, but Telstra admitted as early as 2007 that the timeline had been altered because of the uncertainty about the future of fibre access at the time. The creation of a new, separate, wholesale-only National Broadband Network has not clarified the outcome Telecom Italia Progressive migration of PSTN to carrier Vo. IP is due to start in 2009 T-Com Slovakia Original plans for national NGN started with migrations in largely rural areas in 2006. These plans are currently on hold, but the operator is rolling out FTTH very rapidly in urban areas Magyar Telekom Migration from PSTN to carrier Vo. IP was said in 2006 to be due in 2010– 2011 © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 9 Changes in incumbent telco strategy Timelines for PSTN phase-out (2) Operator Timeline for PSTN phase-out Swisscom PSTN switch-off is due to take place by 2013. Frame-relay and leased lines above 2 Mbit/s are to be phased out by 2009 Telstra Customer migration from PSTN was due to start in 2008– 2009, but Telstra admitted as early as 2007 that the timeline had been altered because of the uncertainty about the future of fibre access at the time. The creation of a new, separate, wholesale-only National Broadband Network has not clarified the outcome Telecom Italia Progressive migration of PSTN to carrier Vo. IP is due to start in 2009 T-Com Slovakia Original plans for national NGN started with migrations in largely rural areas in 2006. These plans are currently on hold, but the operator is rolling out FTTH very rapidly in urban areas Magyar Telekom Migration from PSTN to carrier Vo. IP was said in 2006 to be due in 2010– 2011 © Analysys Mason Limited 2009

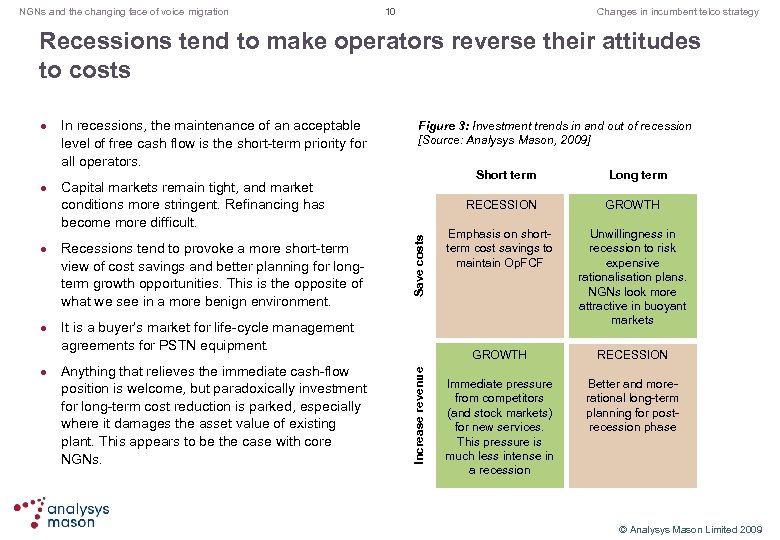

NGNs and the changing face of voice migration 10 Changes in incumbent telco strategy Recessions tend to make operators reverse their attitudes to costs l l l Figure 3: Investment trends in and out of recession [Source: Analysys Mason, 2009] Short term Capital markets remain tight, and market conditions more stringent. Refinancing has become more difficult. Recessions tend to provoke a more short-term view of cost savings and better planning for longterm growth opportunities. This is the opposite of what we see in a more benign environment. GROWTH Emphasis on shortterm cost savings to maintain Op. FCF Unwillingness in recession to risk expensive rationalisation plans. NGNs look more attractive in buoyant markets GROWTH It is a buyer’s market for life-cycle management agreements for PSTN equipment. Anything that relieves the immediate cash-flow position is welcome, but paradoxically investment for long-term cost reduction is parked, especially where it damages the asset value of existing plant. This appears to be the case with core NGNs. Long term RECESSION Save costs l In recessions, the maintenance of an acceptable level of free cash flow is the short-term priority for all operators. Increase revenue l RECESSION Immediate pressure from competitors (and stock markets) for new services. This pressure is much less intense in a recession Better and morerational long-term planning for postrecession phase © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 10 Changes in incumbent telco strategy Recessions tend to make operators reverse their attitudes to costs l l l Figure 3: Investment trends in and out of recession [Source: Analysys Mason, 2009] Short term Capital markets remain tight, and market conditions more stringent. Refinancing has become more difficult. Recessions tend to provoke a more short-term view of cost savings and better planning for longterm growth opportunities. This is the opposite of what we see in a more benign environment. GROWTH Emphasis on shortterm cost savings to maintain Op. FCF Unwillingness in recession to risk expensive rationalisation plans. NGNs look more attractive in buoyant markets GROWTH It is a buyer’s market for life-cycle management agreements for PSTN equipment. Anything that relieves the immediate cash-flow position is welcome, but paradoxically investment for long-term cost reduction is parked, especially where it damages the asset value of existing plant. This appears to be the case with core NGNs. Long term RECESSION Save costs l In recessions, the maintenance of an acceptable level of free cash flow is the short-term priority for all operators. Increase revenue l RECESSION Immediate pressure from competitors (and stock markets) for new services. This pressure is much less intense in a recession Better and morerational long-term planning for postrecession phase © Analysys Mason Limited 2009

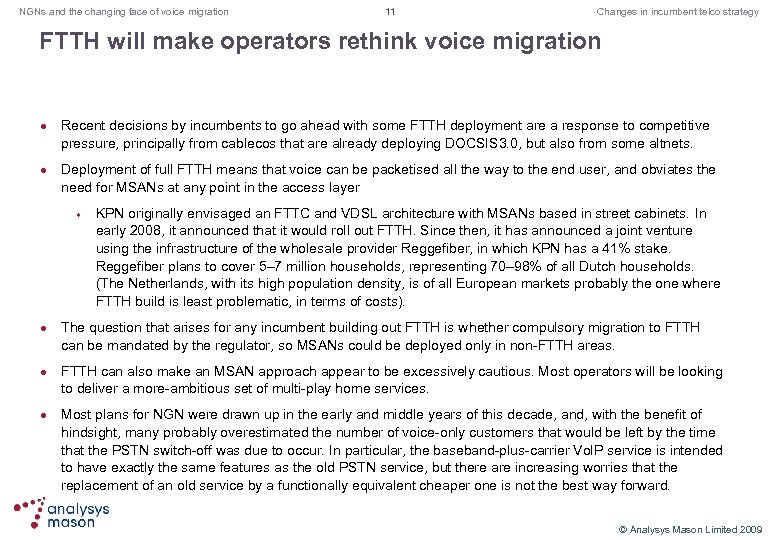

NGNs and the changing face of voice migration 11 Changes in incumbent telco strategy FTTH will make operators rethink voice migration l l Recent decisions by incumbents to go ahead with some FTTH deployment are a response to competitive pressure, principally from cablecos that are already deploying DOCSIS 3. 0, but also from some altnets. Deployment of full FTTH means that voice can be packetised all the way to the end user, and obviates the need for MSANs at any point in the access layer w l l l KPN originally envisaged an FTTC and VDSL architecture with MSANs based in street cabinets. In early 2008, it announced that it would roll out FTTH. Since then, it has announced a joint venture using the infrastructure of the wholesale provider Reggefiber, in which KPN has a 41% stake. Reggefiber plans to cover 5– 7 million households, representing 70– 98% of all Dutch households. (The Netherlands, with its high population density, is of all European markets probably the one where FTTH build is least problematic, in terms of costs). The question that arises for any incumbent building out FTTH is whether compulsory migration to FTTH can be mandated by the regulator, so MSANs could be deployed only in non-FTTH areas. FTTH can also make an MSAN approach appear to be excessively cautious. Most operators will be looking to deliver a more-ambitious set of multi-play home services. Most plans for NGN were drawn up in the early and middle years of this decade, and, with the benefit of hindsight, many probably overestimated the number of voice-only customers that would be left by the time that the PSTN switch-off was due to occur. In particular, the baseband-plus-carrier Vo. IP service is intended to have exactly the same features as the old PSTN service, but there are increasing worries that the replacement of an old service by a functionally equivalent cheaper one is not the best way forward. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 11 Changes in incumbent telco strategy FTTH will make operators rethink voice migration l l Recent decisions by incumbents to go ahead with some FTTH deployment are a response to competitive pressure, principally from cablecos that are already deploying DOCSIS 3. 0, but also from some altnets. Deployment of full FTTH means that voice can be packetised all the way to the end user, and obviates the need for MSANs at any point in the access layer w l l l KPN originally envisaged an FTTC and VDSL architecture with MSANs based in street cabinets. In early 2008, it announced that it would roll out FTTH. Since then, it has announced a joint venture using the infrastructure of the wholesale provider Reggefiber, in which KPN has a 41% stake. Reggefiber plans to cover 5– 7 million households, representing 70– 98% of all Dutch households. (The Netherlands, with its high population density, is of all European markets probably the one where FTTH build is least problematic, in terms of costs). The question that arises for any incumbent building out FTTH is whether compulsory migration to FTTH can be mandated by the regulator, so MSANs could be deployed only in non-FTTH areas. FTTH can also make an MSAN approach appear to be excessively cautious. Most operators will be looking to deliver a more-ambitious set of multi-play home services. Most plans for NGN were drawn up in the early and middle years of this decade, and, with the benefit of hindsight, many probably overestimated the number of voice-only customers that would be left by the time that the PSTN switch-off was due to occur. In particular, the baseband-plus-carrier Vo. IP service is intended to have exactly the same features as the old PSTN service, but there are increasing worries that the replacement of an old service by a functionally equivalent cheaper one is not the best way forward. © Analysys Mason Limited 2009

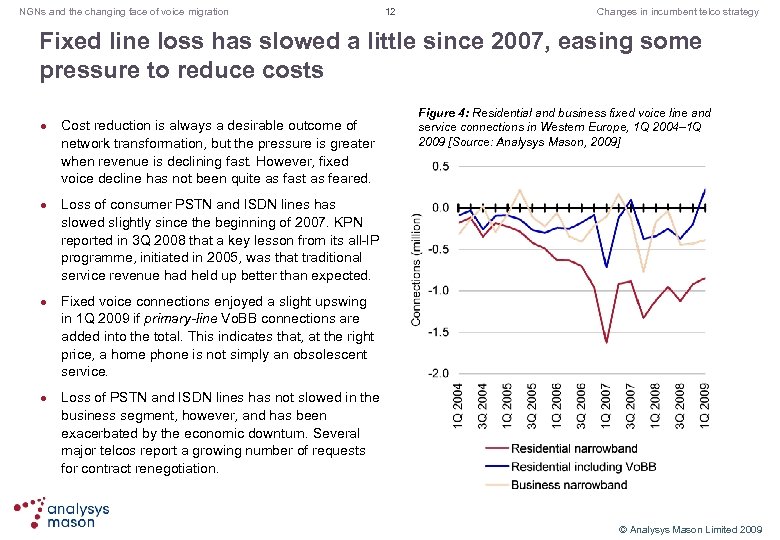

NGNs and the changing face of voice migration 12 Changes in incumbent telco strategy Fixed line loss has slowed a little since 2007, easing some pressure to reduce costs l l Cost reduction is always a desirable outcome of network transformation, but the pressure is greater when revenue is declining fast. However, fixed voice decline has not been quite as fast as feared. Figure 4: Residential and business fixed voice line and service connections in Western Europe, 1 Q 2004– 1 Q 2009 [Source: Analysys Mason, 2009] Loss of consumer PSTN and ISDN lines has slowed slightly since the beginning of 2007. KPN reported in 3 Q 2008 that a key lesson from its all-IP programme, initiated in 2005, was that traditional service revenue had held up better than expected. Fixed voice connections enjoyed a slight upswing in 1 Q 2009 if primary-line Vo. BB connections are added into the total. This indicates that, at the right price, a home phone is not simply an obsolescent service. Loss of PSTN and ISDN lines has not slowed in the business segment, however, and has been exacerbated by the economic downturn. Several major telcos report a growing number of requests for contract renegotiation. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 12 Changes in incumbent telco strategy Fixed line loss has slowed a little since 2007, easing some pressure to reduce costs l l Cost reduction is always a desirable outcome of network transformation, but the pressure is greater when revenue is declining fast. However, fixed voice decline has not been quite as fast as feared. Figure 4: Residential and business fixed voice line and service connections in Western Europe, 1 Q 2004– 1 Q 2009 [Source: Analysys Mason, 2009] Loss of consumer PSTN and ISDN lines has slowed slightly since the beginning of 2007. KPN reported in 3 Q 2008 that a key lesson from its all-IP programme, initiated in 2005, was that traditional service revenue had held up better than expected. Fixed voice connections enjoyed a slight upswing in 1 Q 2009 if primary-line Vo. BB connections are added into the total. This indicates that, at the right price, a home phone is not simply an obsolescent service. Loss of PSTN and ISDN lines has not slowed in the business segment, however, and has been exacerbated by the economic downturn. Several major telcos report a growing number of requests for contract renegotiation. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 13 Document map: Case studies Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 13 Document map: Case studies Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

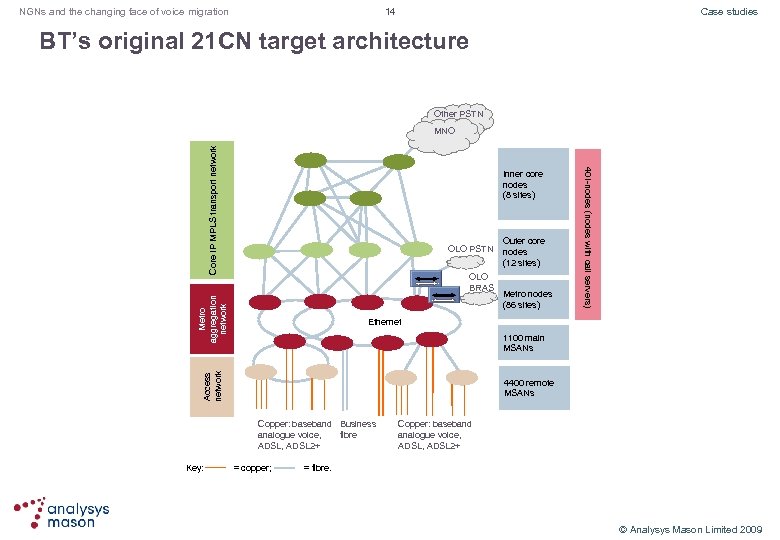

14 NGNs and the changing face of voice migration Case studies BT’s original 21 CN target architecture Other PSTN Inner core nodes (8 sites) OLO PSTN Metro aggregation network OLO BRAS Outer core nodes (12 sites) Metro nodes (86 sites) 40 i-nodes (nodes with call servers) Core IP MPLS transport network MNO Ethernet Access network 1100 main MSANs 4400 remote MSANs Copper: baseband Business fibre analogue voice, ADSL, ADSL 2+ Copper: baseband analogue voice, ADSL, ADSL 2+ Key: = copper; = fibre. © Analysys Mason Limited 2009

14 NGNs and the changing face of voice migration Case studies BT’s original 21 CN target architecture Other PSTN Inner core nodes (8 sites) OLO PSTN Metro aggregation network OLO BRAS Outer core nodes (12 sites) Metro nodes (86 sites) 40 i-nodes (nodes with call servers) Core IP MPLS transport network MNO Ethernet Access network 1100 main MSANs 4400 remote MSANs Copper: baseband Business fibre analogue voice, ADSL, ADSL 2+ Copper: baseband analogue voice, ADSL, ADSL 2+ Key: = copper; = fibre. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 15 Case studies BT has altered its voice strategy l l l BT’s overhaul of its core and aggregation networks is complete. The IP MPLS core has 8 inner and 12 outer core POPs, with call server intelligence at the inner core nodes. There are 86 metro nodes with Ethernet aggregation and IP MPLS capability. These servers are fully meshed with 10 Gbit/s multiples. Outer core nodes are at least triple-parented and are connected by 10 Gbit/s multiples. The original 21 CN plan was to replace all DSLAMs and Class 5 switches with 1100 MSANs linked by Ethernet over WDM and a further 4400 MSANs linked by fibre connections of up to 2. 5 Gbit/s. These 5500 MSANs were to be located at current digital local exchanges and RCUs. The MSANs would handle broadband data and baseband analogue voice and deliver both onto IP Ethernet. Technical difficulties were reported with the call servers, but these have been overcome, according to BT. BT’s first timelines indicated that the migration of PSTN services would start in 2008 and be completed in 2010. Since then, timelines have slipped, and few firm announcements have been made about 21 CN MSAN activation. A trial involving about 75 000 lines was started in 2008 in South Wales. In 2009, BT announced that it would extend the coverage to a further 275 000 lines in South Wales. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 15 Case studies BT has altered its voice strategy l l l BT’s overhaul of its core and aggregation networks is complete. The IP MPLS core has 8 inner and 12 outer core POPs, with call server intelligence at the inner core nodes. There are 86 metro nodes with Ethernet aggregation and IP MPLS capability. These servers are fully meshed with 10 Gbit/s multiples. Outer core nodes are at least triple-parented and are connected by 10 Gbit/s multiples. The original 21 CN plan was to replace all DSLAMs and Class 5 switches with 1100 MSANs linked by Ethernet over WDM and a further 4400 MSANs linked by fibre connections of up to 2. 5 Gbit/s. These 5500 MSANs were to be located at current digital local exchanges and RCUs. The MSANs would handle broadband data and baseband analogue voice and deliver both onto IP Ethernet. Technical difficulties were reported with the call servers, but these have been overcome, according to BT. BT’s first timelines indicated that the migration of PSTN services would start in 2008 and be completed in 2010. Since then, timelines have slipped, and few firm announcements have been made about 21 CN MSAN activation. A trial involving about 75 000 lines was started in 2008 in South Wales. In 2009, BT announced that it would extend the coverage to a further 275 000 lines in South Wales. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 16 Case studies BT’s focus is changing from MSANs to Vo. BB-based services The revisions l l BT is currently revising some voice-related aspects of its 21 CN plans, in particular what happens to voice in the access layer. This change is subject to consultation with BT’s operator customers, including BT Retail. The revision of the plans is independent of Openreach’s FTTC plans, first announced in 2008. After consulting operator customers, BT decided that likefor-like migration from analogue PSTN to analogue baseband was not an attractive investment, given the economic outlook, the desire to simplify implementation of 21 CN for its operator customers, and the chance to skip technologies in light of its fibre access plans. More consultation is currently underway on reducing the speed of migration and moving voice into a SIP environment. The main reasons given by BT for this change are that it has prioritised the transfer of voice to 21 CN below the need to deliver new broadband Ethernet products, and also recognises the need to support PSTN for some time to come. It still intends to migrate end users of PSTN voice to 21 CN as part of the rationalisation of DLEs, but migration will be driven by the circumstances of individual DLEs, rather than by a fixed timetable. Consequences l l BT is now slowing the pace of voice migration, which will continue in an ‘opportunistic’ manner and will primarily be driven by economic factors. BT anticipates that 2– 3 million lines (barely 10% of lines) will be served by MSANs, in the short term. MSAN deployment is driven by roll-out of ADSL 2+, available to 40% of the UK in 3 Q 2009, and to 55% by the end of March 2010. However, this will not line up with PSTN migrations. SIP-based offerings are being developed in consultation with customers. At the same time, a proposed baseband voice plus ADSL 2+ product, Wholesale Broadband Connect Converged (WBCC), has been dropped. This would have been, in effect, a wholesale version of the voice and data services currently offered over a fully unbundled local loop by, for example, Talk. This means that there is no final timeline for the switch-off or phase-out of the PSTN. If demand for new services takes enough customers onto Vo. BB, then clearly the decision to switch off will have to be taken, but it is unclear when this might happen and, in the meantime, BT will let customer demand decide. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 16 Case studies BT’s focus is changing from MSANs to Vo. BB-based services The revisions l l BT is currently revising some voice-related aspects of its 21 CN plans, in particular what happens to voice in the access layer. This change is subject to consultation with BT’s operator customers, including BT Retail. The revision of the plans is independent of Openreach’s FTTC plans, first announced in 2008. After consulting operator customers, BT decided that likefor-like migration from analogue PSTN to analogue baseband was not an attractive investment, given the economic outlook, the desire to simplify implementation of 21 CN for its operator customers, and the chance to skip technologies in light of its fibre access plans. More consultation is currently underway on reducing the speed of migration and moving voice into a SIP environment. The main reasons given by BT for this change are that it has prioritised the transfer of voice to 21 CN below the need to deliver new broadband Ethernet products, and also recognises the need to support PSTN for some time to come. It still intends to migrate end users of PSTN voice to 21 CN as part of the rationalisation of DLEs, but migration will be driven by the circumstances of individual DLEs, rather than by a fixed timetable. Consequences l l BT is now slowing the pace of voice migration, which will continue in an ‘opportunistic’ manner and will primarily be driven by economic factors. BT anticipates that 2– 3 million lines (barely 10% of lines) will be served by MSANs, in the short term. MSAN deployment is driven by roll-out of ADSL 2+, available to 40% of the UK in 3 Q 2009, and to 55% by the end of March 2010. However, this will not line up with PSTN migrations. SIP-based offerings are being developed in consultation with customers. At the same time, a proposed baseband voice plus ADSL 2+ product, Wholesale Broadband Connect Converged (WBCC), has been dropped. This would have been, in effect, a wholesale version of the voice and data services currently offered over a fully unbundled local loop by, for example, Talk. This means that there is no final timeline for the switch-off or phase-out of the PSTN. If demand for new services takes enough customers onto Vo. BB, then clearly the decision to switch off will have to be taken, but it is unclear when this might happen and, in the meantime, BT will let customer demand decide. © Analysys Mason Limited 2009

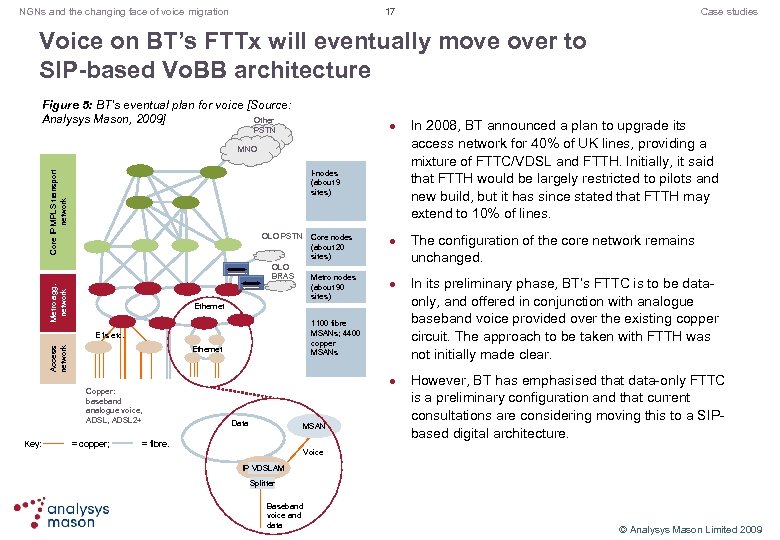

17 NGNs and the changing face of voice migration Case studies Voice on BT’s FTTx will eventually move over to SIP-based Vo. BB architecture Figure 5: BT’s eventual plan for voice [Source: Other Analysys Mason, 2009] l PSTN Core IP MPLS transport network MNO I-nodes (about 9 sites) OLO PSTN Core nodes (about 20 sites) Metro agg. network OLO BRAS Metro nodes (about 90 sites) l l Ethernet 1100 fibre MSANs; 4400 copper MSANs Access network E 1 s etc. Ethernet l Copper: baseband analogue voice, ADSL, ADSL 2+ Data MSAN Key: = copper; = fibre. In 2008, BT announced a plan to upgrade its access network for 40% of UK lines, providing a mixture of FTTC/VDSL and FTTH. Initially, it said that FTTH would be largely restricted to pilots and new build, but it has since stated that FTTH may extend to 10% of lines. The configuration of the core network remains unchanged. In its preliminary phase, BT’s FTTC is to be dataonly, and offered in conjunction with analogue baseband voice provided over the existing copper circuit. The approach to be taken with FTTH was not initially made clear. However, BT has emphasised that data-only FTTC is a preliminary configuration and that current consultations are considering moving this to a SIPbased digital architecture. Voice IP VDSLAM Splitter Baseband voice and data © Analysys Mason Limited 2009

17 NGNs and the changing face of voice migration Case studies Voice on BT’s FTTx will eventually move over to SIP-based Vo. BB architecture Figure 5: BT’s eventual plan for voice [Source: Other Analysys Mason, 2009] l PSTN Core IP MPLS transport network MNO I-nodes (about 9 sites) OLO PSTN Core nodes (about 20 sites) Metro agg. network OLO BRAS Metro nodes (about 90 sites) l l Ethernet 1100 fibre MSANs; 4400 copper MSANs Access network E 1 s etc. Ethernet l Copper: baseband analogue voice, ADSL, ADSL 2+ Data MSAN Key: = copper; = fibre. In 2008, BT announced a plan to upgrade its access network for 40% of UK lines, providing a mixture of FTTC/VDSL and FTTH. Initially, it said that FTTH would be largely restricted to pilots and new build, but it has since stated that FTTH may extend to 10% of lines. The configuration of the core network remains unchanged. In its preliminary phase, BT’s FTTC is to be dataonly, and offered in conjunction with analogue baseband voice provided over the existing copper circuit. The approach to be taken with FTTH was not initially made clear. However, BT has emphasised that data-only FTTC is a preliminary configuration and that current consultations are considering moving this to a SIPbased digital architecture. Voice IP VDSLAM Splitter Baseband voice and data © Analysys Mason Limited 2009

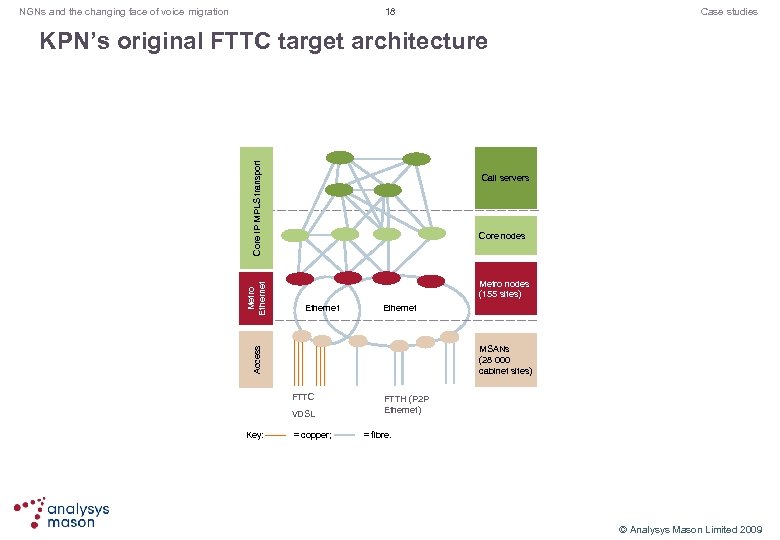

18 NGNs and the changing face of voice migration Case studies Call servers Core nodes Metro nodes (155 sites) Ethernet MSANs (28 000 cabinet sites) Access Metro Ethernet Core IP MPLS transport KPN’s original FTTC target architecture FTTC VDSL FTTH (P 2 P Ethernet) Key: = copper; = fibre. © Analysys Mason Limited 2009

18 NGNs and the changing face of voice migration Case studies Call servers Core nodes Metro nodes (155 sites) Ethernet MSANs (28 000 cabinet sites) Access Metro Ethernet Core IP MPLS transport KPN’s original FTTC target architecture FTTC VDSL FTTH (P 2 P Ethernet) Key: = copper; = fibre. © Analysys Mason Limited 2009

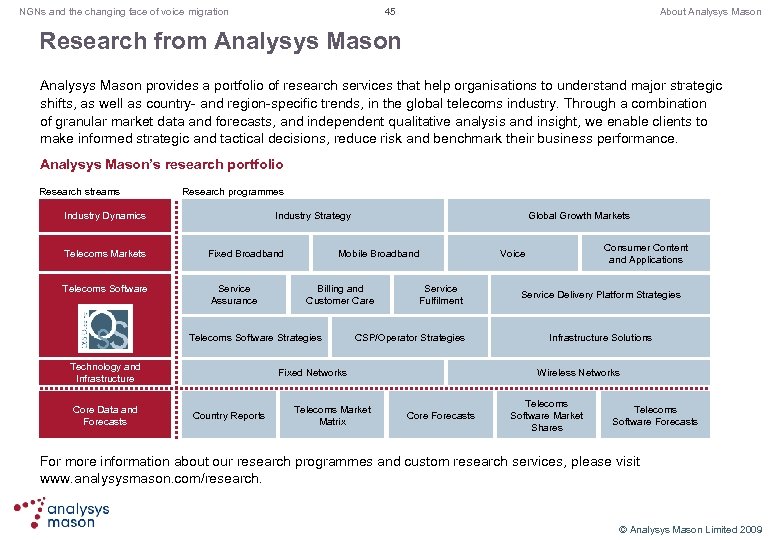

NGNs and the changing face of voice migration 19 Case studies KPN is switching its attention to FTTH and this halted some MSAN deployments l l l KPN’s core transformation is part of a national all-IP transformation of core, aggregation and access. However, the original plans are being revised because of the FTTH joint venture with Reggefiber. The original FTTC and VDSL plan had Ethernet aggregation rings totalling 38 000 km connecting cabinetbased MSANs. Data aggregation was to be migrated to Ethernet entirely by 3 Q 2008. Interconnection for altnets’ exchange-based ADSL is to be continued for a fixed period under agreement with the altnets. KPN has indicated that the transformation requires an additional EUR 900 million over and above its normal recurrent capex budget. The transformation is in part funded by the sale and lease of real estate released by decommissioning about 1350, mainly DLE, buildings. This enables the overall capex/sales ratio to be kept under 20% for the period of transformation. KPN aims to raise EUR 1 billion from real estate sales. KPN now sees FTTH as the ‘endgame’. It holds a 41% stake in open-access network builder and provider Reggefiber and uses these networks itself. The deployment of MSANs and the migration of PSTN have been put on hold in areas where Reggefiber has rolled out FTTH. Building of FTTC networks has gone ahead in other areas, prior to KPN assessing the best way forward in late 2009. KPN also has a popular Vo. BB service and it is possible that it will now adopt an approach to migration that is more demand driven. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 19 Case studies KPN is switching its attention to FTTH and this halted some MSAN deployments l l l KPN’s core transformation is part of a national all-IP transformation of core, aggregation and access. However, the original plans are being revised because of the FTTH joint venture with Reggefiber. The original FTTC and VDSL plan had Ethernet aggregation rings totalling 38 000 km connecting cabinetbased MSANs. Data aggregation was to be migrated to Ethernet entirely by 3 Q 2008. Interconnection for altnets’ exchange-based ADSL is to be continued for a fixed period under agreement with the altnets. KPN has indicated that the transformation requires an additional EUR 900 million over and above its normal recurrent capex budget. The transformation is in part funded by the sale and lease of real estate released by decommissioning about 1350, mainly DLE, buildings. This enables the overall capex/sales ratio to be kept under 20% for the period of transformation. KPN aims to raise EUR 1 billion from real estate sales. KPN now sees FTTH as the ‘endgame’. It holds a 41% stake in open-access network builder and provider Reggefiber and uses these networks itself. The deployment of MSANs and the migration of PSTN have been put on hold in areas where Reggefiber has rolled out FTTH. Building of FTTC networks has gone ahead in other areas, prior to KPN assessing the best way forward in late 2009. KPN also has a popular Vo. BB service and it is possible that it will now adopt an approach to migration that is more demand driven. © Analysys Mason Limited 2009

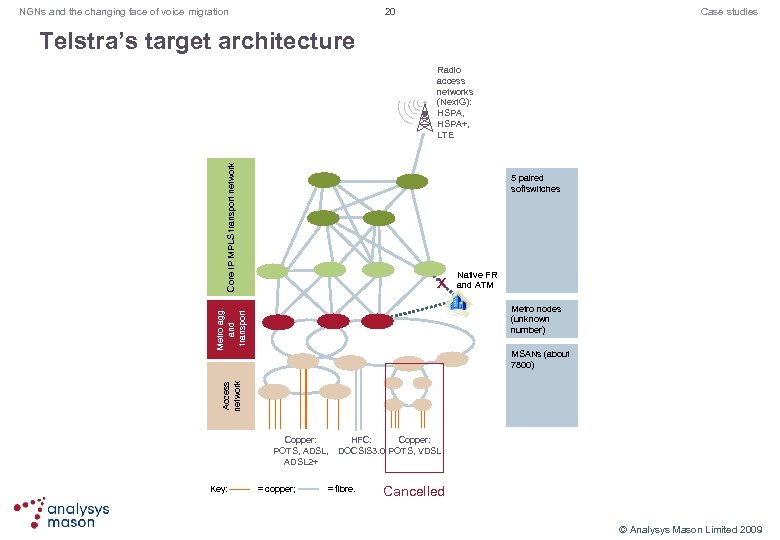

20 NGNs and the changing face of voice migration Case studies Telstra’s target architecture Core IP MPLS transport network Radio access networks (Next. G): HSPA, HSPA+, LTE 5 paired softswitches x Native FR and ATM Metro agg. and transport Metro nodes (unknown number) Access network MSANs (about 7800) Copper: HFC: Copper: POTS, ADSL, DOCSIS 3. 0 POTS, VDSL ADSL 2+ Key: = copper; = fibre. Cancelled © Analysys Mason Limited 2009

20 NGNs and the changing face of voice migration Case studies Telstra’s target architecture Core IP MPLS transport network Radio access networks (Next. G): HSPA, HSPA+, LTE 5 paired softswitches x Native FR and ATM Metro agg. and transport Metro nodes (unknown number) Access network MSANs (about 7800) Copper: HFC: Copper: POTS, ADSL, DOCSIS 3. 0 POTS, VDSL ADSL 2+ Key: = copper; = fibre. Cancelled © Analysys Mason Limited 2009

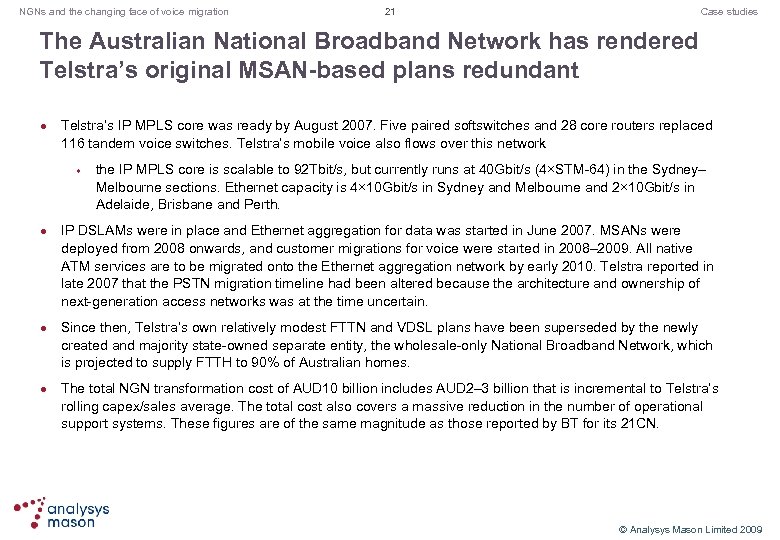

NGNs and the changing face of voice migration 21 Case studies The Australian National Broadband Network has rendered Telstra’s original MSAN-based plans redundant l Telstra’s IP MPLS core was ready by August 2007. Five paired softswitches and 28 core routers replaced 116 tandem voice switches. Telstra’s mobile voice also flows over this network w l l l the IP MPLS core is scalable to 92 Tbit/s, but currently runs at 40 Gbit/s (4×STM-64) in the Sydney– Melbourne sections. Ethernet capacity is 4× 10 Gbit/s in Sydney and Melbourne and 2× 10 Gbit/s in Adelaide, Brisbane and Perth. IP DSLAMs were in place and Ethernet aggregation for data was started in June 2007. MSANs were deployed from 2008 onwards, and customer migrations for voice were started in 2008– 2009. All native ATM services are to be migrated onto the Ethernet aggregation network by early 2010. Telstra reported in late 2007 that the PSTN migration timeline had been altered because the architecture and ownership of next-generation access networks was at the time uncertain. Since then, Telstra’s own relatively modest FTTN and VDSL plans have been superseded by the newly created and majority state-owned separate entity, the wholesale-only National Broadband Network, which is projected to supply FTTH to 90% of Australian homes. The total NGN transformation cost of AUD 10 billion includes AUD 2– 3 billion that is incremental to Telstra’s rolling capex/sales average. The total cost also covers a massive reduction in the number of operational support systems. These figures are of the same magnitude as those reported by BT for its 21 CN. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 21 Case studies The Australian National Broadband Network has rendered Telstra’s original MSAN-based plans redundant l Telstra’s IP MPLS core was ready by August 2007. Five paired softswitches and 28 core routers replaced 116 tandem voice switches. Telstra’s mobile voice also flows over this network w l l l the IP MPLS core is scalable to 92 Tbit/s, but currently runs at 40 Gbit/s (4×STM-64) in the Sydney– Melbourne sections. Ethernet capacity is 4× 10 Gbit/s in Sydney and Melbourne and 2× 10 Gbit/s in Adelaide, Brisbane and Perth. IP DSLAMs were in place and Ethernet aggregation for data was started in June 2007. MSANs were deployed from 2008 onwards, and customer migrations for voice were started in 2008– 2009. All native ATM services are to be migrated onto the Ethernet aggregation network by early 2010. Telstra reported in late 2007 that the PSTN migration timeline had been altered because the architecture and ownership of next-generation access networks was at the time uncertain. Since then, Telstra’s own relatively modest FTTN and VDSL plans have been superseded by the newly created and majority state-owned separate entity, the wholesale-only National Broadband Network, which is projected to supply FTTH to 90% of Australian homes. The total NGN transformation cost of AUD 10 billion includes AUD 2– 3 billion that is incremental to Telstra’s rolling capex/sales average. The total cost also covers a massive reduction in the number of operational support systems. These figures are of the same magnitude as those reported by BT for its 21 CN. © Analysys Mason Limited 2009

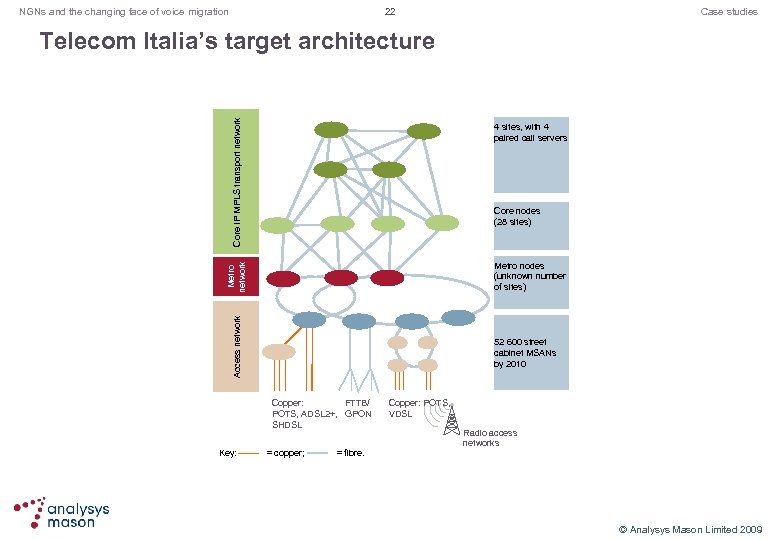

22 NGNs and the changing face of voice migration Case studies Core IP MPLS transport network Telecom Italia’s target architecture 4 sites, with 4 paired call servers Core nodes (28 sites) Access network Metro nodes (unknown number of sites) 52 600 street cabinet MSANs by 2010 FTTB/ Copper: POTS, ADSL 2+, GPON SHDSL Copper: POTS, VDSL Radio access networks Key: = copper; = fibre. © Analysys Mason Limited 2009

22 NGNs and the changing face of voice migration Case studies Core IP MPLS transport network Telecom Italia’s target architecture 4 sites, with 4 paired call servers Core nodes (28 sites) Access network Metro nodes (unknown number of sites) 52 600 street cabinet MSANs by 2010 FTTB/ Copper: POTS, ADSL 2+, GPON SHDSL Copper: POTS, VDSL Radio access networks Key: = copper; = fibre. © Analysys Mason Limited 2009

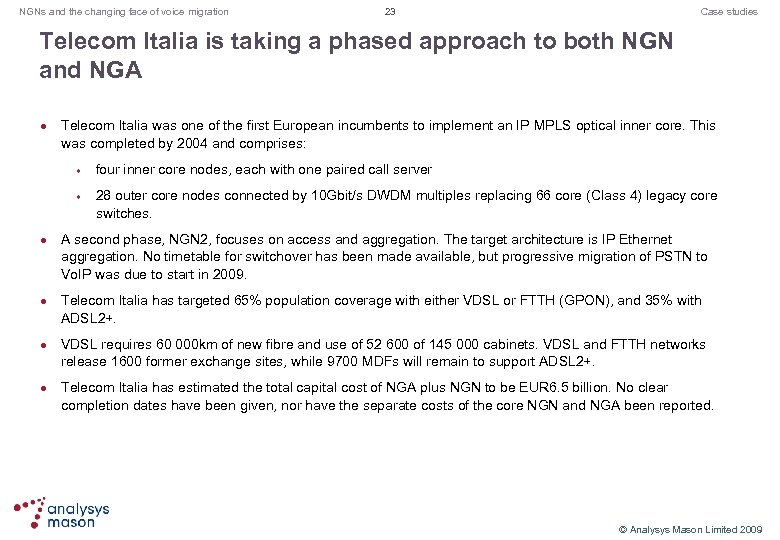

NGNs and the changing face of voice migration 23 Case studies Telecom Italia is taking a phased approach to both NGN and NGA l Telecom Italia was one of the first European incumbents to implement an IP MPLS optical inner core. This was completed by 2004 and comprises: w w l l four inner core nodes, each with one paired call server 28 outer core nodes connected by 10 Gbit/s DWDM multiples replacing 66 core (Class 4) legacy core switches. A second phase, NGN 2, focuses on access and aggregation. The target architecture is IP Ethernet aggregation. No timetable for switchover has been made available, but progressive migration of PSTN to Vo. IP was due to start in 2009. Telecom Italia has targeted 65% population coverage with either VDSL or FTTH (GPON), and 35% with ADSL 2+. VDSL requires 60 000 km of new fibre and use of 52 600 of 145 000 cabinets. VDSL and FTTH networks release 1600 former exchange sites, while 9700 MDFs will remain to support ADSL 2+. Telecom Italia has estimated the total capital cost of NGA plus NGN to be EUR 6. 5 billion. No clear completion dates have been given, nor have the separate costs of the core NGN and NGA been reported. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 23 Case studies Telecom Italia is taking a phased approach to both NGN and NGA l Telecom Italia was one of the first European incumbents to implement an IP MPLS optical inner core. This was completed by 2004 and comprises: w w l l four inner core nodes, each with one paired call server 28 outer core nodes connected by 10 Gbit/s DWDM multiples replacing 66 core (Class 4) legacy core switches. A second phase, NGN 2, focuses on access and aggregation. The target architecture is IP Ethernet aggregation. No timetable for switchover has been made available, but progressive migration of PSTN to Vo. IP was due to start in 2009. Telecom Italia has targeted 65% population coverage with either VDSL or FTTH (GPON), and 35% with ADSL 2+. VDSL requires 60 000 km of new fibre and use of 52 600 of 145 000 cabinets. VDSL and FTTH networks release 1600 former exchange sites, while 9700 MDFs will remain to support ADSL 2+. Telecom Italia has estimated the total capital cost of NGA plus NGN to be EUR 6. 5 billion. No clear completion dates have been given, nor have the separate costs of the core NGN and NGA been reported. © Analysys Mason Limited 2009

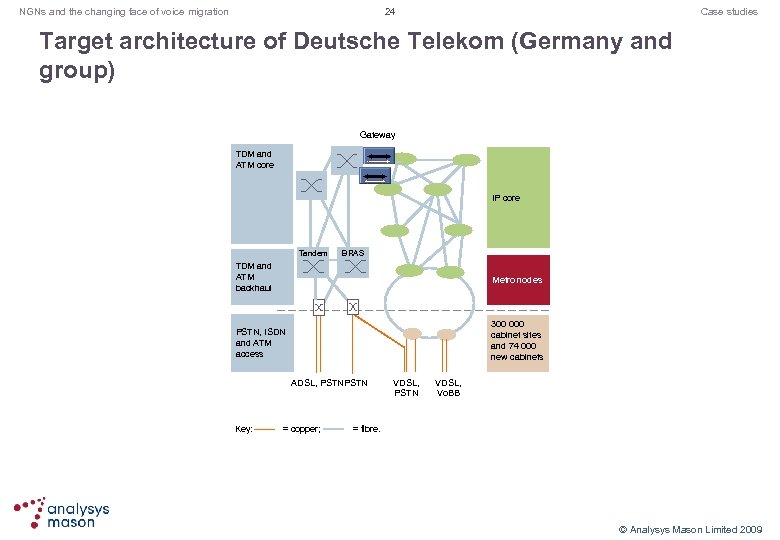

24 NGNs and the changing face of voice migration Case studies Target architecture of Deutsche Telekom (Germany and group) Gateway TDM and ATM core IP core Tandem BRAS TDM and ATM backhaul Metro nodes PSTN, ISDN and ATM access 300 000 cabinet sites and 74 000 new cabinets ADSL, PSTN VDSL, Vo. BB Key: = copper; = fibre. © Analysys Mason Limited 2009

24 NGNs and the changing face of voice migration Case studies Target architecture of Deutsche Telekom (Germany and group) Gateway TDM and ATM core IP core Tandem BRAS TDM and ATM backhaul Metro nodes PSTN, ISDN and ATM access 300 000 cabinet sites and 74 000 new cabinets ADSL, PSTN VDSL, Vo. BB Key: = copper; = fibre. © Analysys Mason Limited 2009

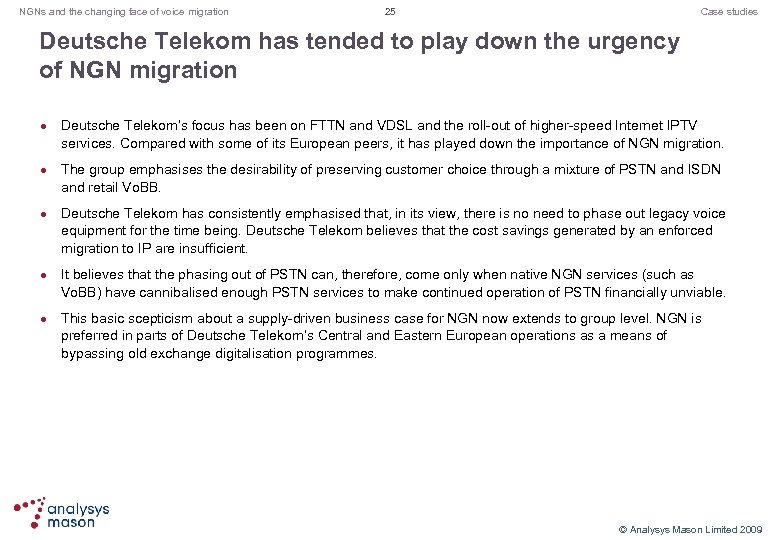

NGNs and the changing face of voice migration 25 Case studies Deutsche Telekom has tended to play down the urgency of NGN migration l l l Deutsche Telekom’s focus has been on FTTN and VDSL and the roll-out of higher-speed Internet IPTV services. Compared with some of its European peers, it has played down the importance of NGN migration. The group emphasises the desirability of preserving customer choice through a mixture of PSTN and ISDN and retail Vo. BB. Deutsche Telekom has consistently emphasised that, in its view, there is no need to phase out legacy voice equipment for the time being. Deutsche Telekom believes that the cost savings generated by an enforced migration to IP are insufficient. It believes that the phasing out of PSTN can, therefore, come only when native NGN services (such as Vo. BB) have cannibalised enough PSTN services to make continued operation of PSTN financially unviable. This basic scepticism about a supply-driven business case for NGN now extends to group level. NGN is preferred in parts of Deutsche Telekom’s Central and Eastern European operations as a means of bypassing old exchange digitalisation programmes. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 25 Case studies Deutsche Telekom has tended to play down the urgency of NGN migration l l l Deutsche Telekom’s focus has been on FTTN and VDSL and the roll-out of higher-speed Internet IPTV services. Compared with some of its European peers, it has played down the importance of NGN migration. The group emphasises the desirability of preserving customer choice through a mixture of PSTN and ISDN and retail Vo. BB. Deutsche Telekom has consistently emphasised that, in its view, there is no need to phase out legacy voice equipment for the time being. Deutsche Telekom believes that the cost savings generated by an enforced migration to IP are insufficient. It believes that the phasing out of PSTN can, therefore, come only when native NGN services (such as Vo. BB) have cannibalised enough PSTN services to make continued operation of PSTN financially unviable. This basic scepticism about a supply-driven business case for NGN now extends to group level. NGN is preferred in parts of Deutsche Telekom’s Central and Eastern European operations as a means of bypassing old exchange digitalisation programmes. © Analysys Mason Limited 2009

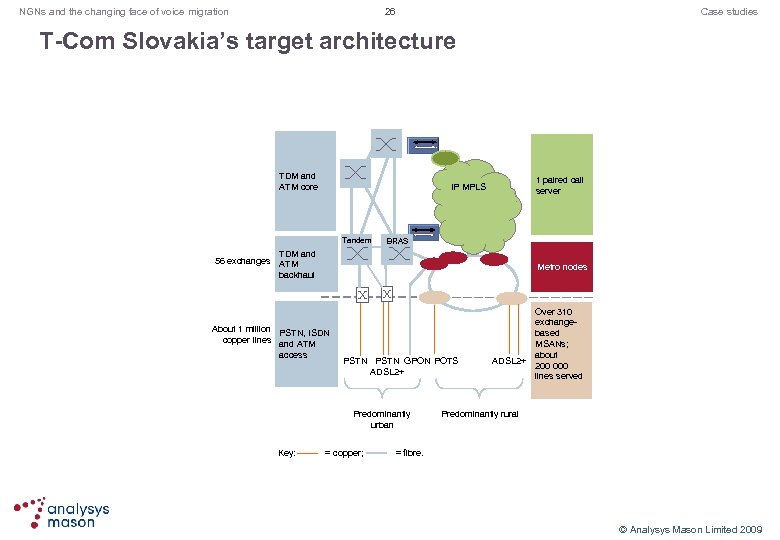

26 NGNs and the changing face of voice migration Case studies T-Com Slovakia’s target architecture TDM and ATM core 1 paired call server IP MPLS Tandem BRAS TDM and 56 exchanges ATM backhaul About 1 million PSTN, ISDN copper lines and ATM access Metro nodes PSTN GPON POTS ADSL 2+ Predominantly urban Over 310 exchangebased MSANs; about ADSL 2+ 200 000 lines served Predominantly rural Key: = copper; = fibre. © Analysys Mason Limited 2009

26 NGNs and the changing face of voice migration Case studies T-Com Slovakia’s target architecture TDM and ATM core 1 paired call server IP MPLS Tandem BRAS TDM and 56 exchanges ATM backhaul About 1 million PSTN, ISDN copper lines and ATM access Metro nodes PSTN GPON POTS ADSL 2+ Predominantly urban Over 310 exchangebased MSANs; about ADSL 2+ 200 000 lines served Predominantly rural Key: = copper; = fibre. © Analysys Mason Limited 2009

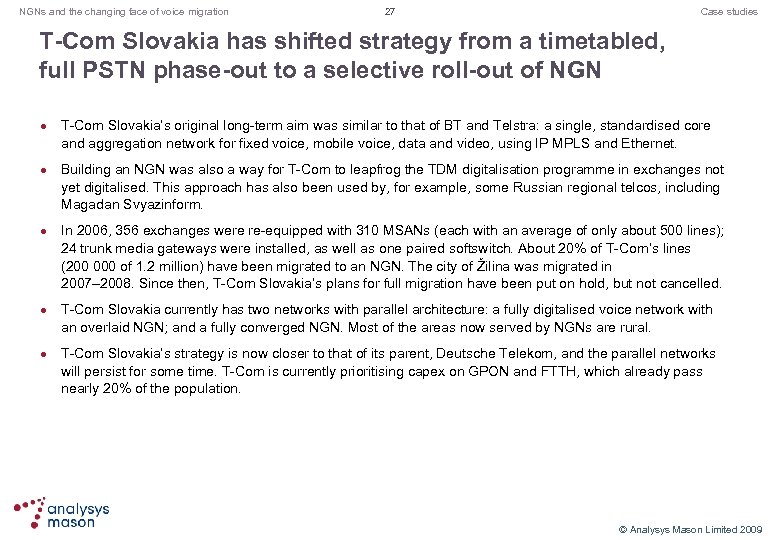

NGNs and the changing face of voice migration 27 Case studies T-Com Slovakia has shifted strategy from a timetabled, full PSTN phase-out to a selective roll-out of NGN l l l T-Com Slovakia’s original long-term aim was similar to that of BT and Telstra: a single, standardised core and aggregation network for fixed voice, mobile voice, data and video, using IP MPLS and Ethernet. Building an NGN was also a way for T-Com to leapfrog the TDM digitalisation programme in exchanges not yet digitalised. This approach has also been used by, for example, some Russian regional telcos, including Magadan Svyazinform. In 2006, 356 exchanges were re-equipped with 310 MSANs (each with an average of only about 500 lines); 24 trunk media gateways were installed, as well as one paired softswitch. About 20% of T-Com’s lines (200 000 of 1. 2 million) have been migrated to an NGN. The city of Žilina was migrated in 2007– 2008. Since then, T-Com Slovakia’s plans for full migration have been put on hold, but not cancelled. T-Com Slovakia currently has two networks with parallel architecture: a fully digitalised voice network with an overlaid NGN; and a fully converged NGN. Most of the areas now served by NGNs are rural. T-Com Slovakia’s strategy is now closer to that of its parent, Deutsche Telekom, and the parallel networks will persist for some time. T-Com is currently prioritising capex on GPON and FTTH, which already pass nearly 20% of the population. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 27 Case studies T-Com Slovakia has shifted strategy from a timetabled, full PSTN phase-out to a selective roll-out of NGN l l l T-Com Slovakia’s original long-term aim was similar to that of BT and Telstra: a single, standardised core and aggregation network for fixed voice, mobile voice, data and video, using IP MPLS and Ethernet. Building an NGN was also a way for T-Com to leapfrog the TDM digitalisation programme in exchanges not yet digitalised. This approach has also been used by, for example, some Russian regional telcos, including Magadan Svyazinform. In 2006, 356 exchanges were re-equipped with 310 MSANs (each with an average of only about 500 lines); 24 trunk media gateways were installed, as well as one paired softswitch. About 20% of T-Com’s lines (200 000 of 1. 2 million) have been migrated to an NGN. The city of Žilina was migrated in 2007– 2008. Since then, T-Com Slovakia’s plans for full migration have been put on hold, but not cancelled. T-Com Slovakia currently has two networks with parallel architecture: a fully digitalised voice network with an overlaid NGN; and a fully converged NGN. Most of the areas now served by NGNs are rural. T-Com Slovakia’s strategy is now closer to that of its parent, Deutsche Telekom, and the parallel networks will persist for some time. T-Com is currently prioritising capex on GPON and FTTH, which already pass nearly 20% of the population. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 28 Document map: Altnets, cablecos and MNOs Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 28 Document map: Altnets, cablecos and MNOs Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

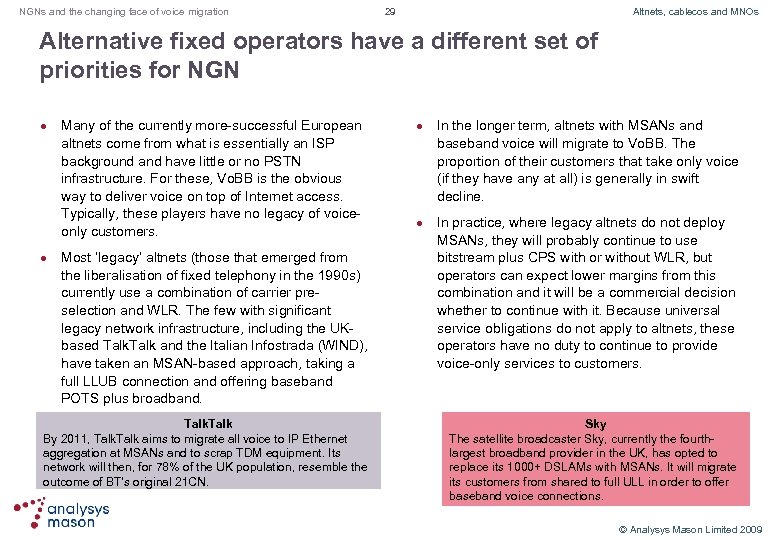

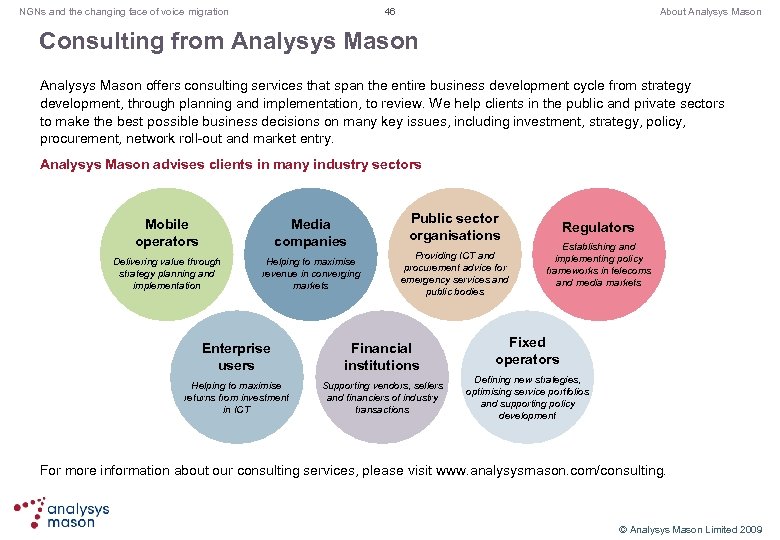

NGNs and the changing face of voice migration 29 Altnets, cablecos and MNOs Alternative fixed operators have a different set of priorities for NGN l l Many of the currently more-successful European altnets come from what is essentially an ISP background and have little or no PSTN infrastructure. For these, Vo. BB is the obvious way to deliver voice on top of Internet access. Typically, these players have no legacy of voiceonly customers. Most ‘legacy’ altnets (those that emerged from the liberalisation of fixed telephony in the 1990 s) currently use a combination of carrier preselection and WLR. The few with significant legacy network infrastructure, including the UKbased Talk and the Italian Infostrada (WIND), have taken an MSAN-based approach, taking a full LLUB connection and offering baseband POTS plus broadband. Talk By 2011, Talk aims to migrate all voice to IP Ethernet aggregation at MSANs and to scrap TDM equipment. Its network will then, for 78% of the UK population, resemble the outcome of BT’s original 21 CN. l l In the longer term, altnets with MSANs and baseband voice will migrate to Vo. BB. The proportion of their customers that take only voice (if they have any at all) is generally in swift decline. In practice, where legacy altnets do not deploy MSANs, they will probably continue to use bitstream plus CPS with or without WLR, but operators can expect lower margins from this combination and it will be a commercial decision whether to continue with it. Because universal service obligations do not apply to altnets, these operators have no duty to continue to provide voice-only services to customers. Sky The satellite broadcaster Sky, currently the fourthlargest broadband provider in the UK, has opted to replace its 1000+ DSLAMs with MSANs. It will migrate its customers from shared to full ULL in order to offer baseband voice connections. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 29 Altnets, cablecos and MNOs Alternative fixed operators have a different set of priorities for NGN l l Many of the currently more-successful European altnets come from what is essentially an ISP background and have little or no PSTN infrastructure. For these, Vo. BB is the obvious way to deliver voice on top of Internet access. Typically, these players have no legacy of voiceonly customers. Most ‘legacy’ altnets (those that emerged from the liberalisation of fixed telephony in the 1990 s) currently use a combination of carrier preselection and WLR. The few with significant legacy network infrastructure, including the UKbased Talk and the Italian Infostrada (WIND), have taken an MSAN-based approach, taking a full LLUB connection and offering baseband POTS plus broadband. Talk By 2011, Talk aims to migrate all voice to IP Ethernet aggregation at MSANs and to scrap TDM equipment. Its network will then, for 78% of the UK population, resemble the outcome of BT’s original 21 CN. l l In the longer term, altnets with MSANs and baseband voice will migrate to Vo. BB. The proportion of their customers that take only voice (if they have any at all) is generally in swift decline. In practice, where legacy altnets do not deploy MSANs, they will probably continue to use bitstream plus CPS with or without WLR, but operators can expect lower margins from this combination and it will be a commercial decision whether to continue with it. Because universal service obligations do not apply to altnets, these operators have no duty to continue to provide voice-only services to customers. Sky The satellite broadcaster Sky, currently the fourthlargest broadband provider in the UK, has opted to replace its 1000+ DSLAMs with MSANs. It will migrate its customers from shared to full ULL in order to offer baseband voice connections. © Analysys Mason Limited 2009

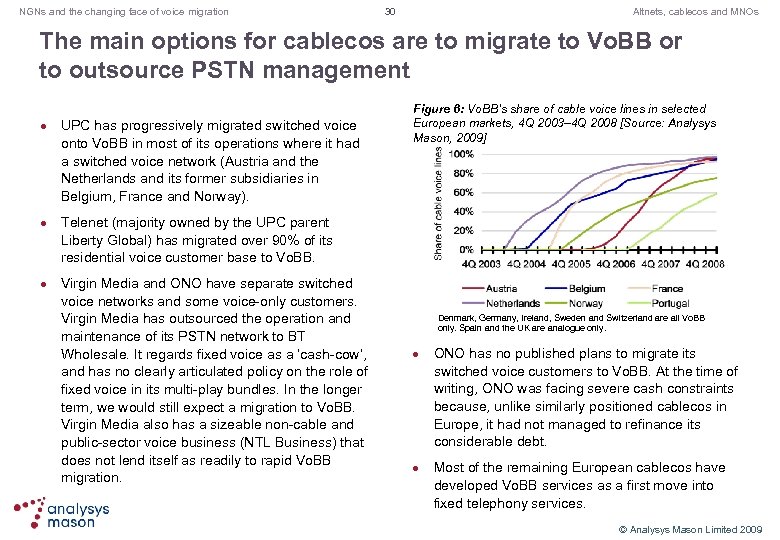

NGNs and the changing face of voice migration 30 Altnets, cablecos and MNOs The main options for cablecos are to migrate to Vo. BB or to outsource PSTN management l l l UPC has progressively migrated switched voice onto Vo. BB in most of its operations where it had a switched voice network (Austria and the Netherlands and its former subsidiaries in Belgium, France and Norway). Figure 6: Vo. BB’s share of cable voice lines in selected European markets, 4 Q 2003– 4 Q 2008 [Source: Analysys Mason, 2009] Telenet (majority owned by the UPC parent Liberty Global) has migrated over 90% of its residential voice customer base to Vo. BB. Virgin Media and ONO have separate switched voice networks and some voice-only customers. Virgin Media has outsourced the operation and maintenance of its PSTN network to BT Wholesale. It regards fixed voice as a ‘cash-cow’, and has no clearly articulated policy on the role of fixed voice in its multi-play bundles. In the longer term, we would still expect a migration to Vo. BB. Virgin Media also has a sizeable non-cable and public-sector voice business (NTL Business) that does not lend itself as readily to rapid Vo. BB migration. Denmark, Germany, Ireland, Sweden and Switzerland are all Vo. BB only. Spain and the UK are analogue only. l l ONO has no published plans to migrate its switched voice customers to Vo. BB. At the time of writing, ONO was facing severe cash constraints because, unlike similarly positioned cablecos in Europe, it had not managed to refinance its considerable debt. Most of the remaining European cablecos have developed Vo. BB services as a first move into fixed telephony services. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 30 Altnets, cablecos and MNOs The main options for cablecos are to migrate to Vo. BB or to outsource PSTN management l l l UPC has progressively migrated switched voice onto Vo. BB in most of its operations where it had a switched voice network (Austria and the Netherlands and its former subsidiaries in Belgium, France and Norway). Figure 6: Vo. BB’s share of cable voice lines in selected European markets, 4 Q 2003– 4 Q 2008 [Source: Analysys Mason, 2009] Telenet (majority owned by the UPC parent Liberty Global) has migrated over 90% of its residential voice customer base to Vo. BB. Virgin Media and ONO have separate switched voice networks and some voice-only customers. Virgin Media has outsourced the operation and maintenance of its PSTN network to BT Wholesale. It regards fixed voice as a ‘cash-cow’, and has no clearly articulated policy on the role of fixed voice in its multi-play bundles. In the longer term, we would still expect a migration to Vo. BB. Virgin Media also has a sizeable non-cable and public-sector voice business (NTL Business) that does not lend itself as readily to rapid Vo. BB migration. Denmark, Germany, Ireland, Sweden and Switzerland are all Vo. BB only. Spain and the UK are analogue only. l l ONO has no published plans to migrate its switched voice customers to Vo. BB. At the time of writing, ONO was facing severe cash constraints because, unlike similarly positioned cablecos in Europe, it had not managed to refinance its considerable debt. Most of the remaining European cablecos have developed Vo. BB services as a first move into fixed telephony services. © Analysys Mason Limited 2009

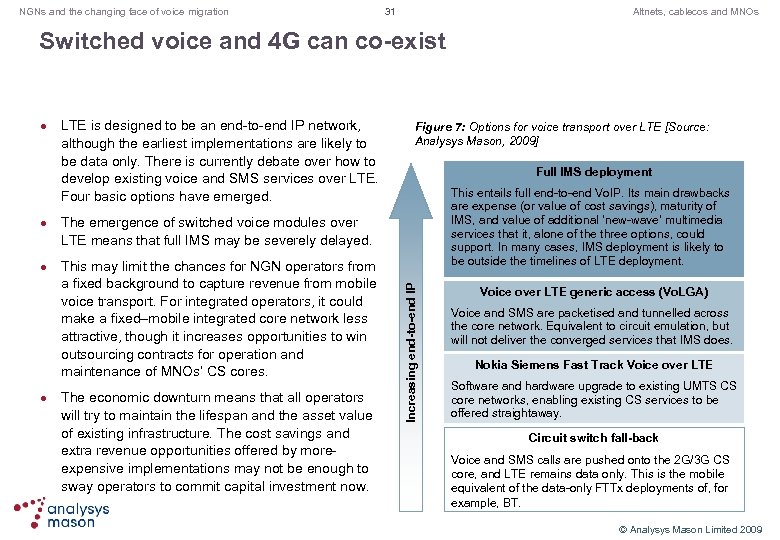

NGNs and the changing face of voice migration 31 Altnets, cablecos and MNOs Switched voice and 4 G can co-exist l l l LTE is designed to be an end-to-end IP network, although the earliest implementations are likely to be data only. There is currently debate over how to develop existing voice and SMS services over LTE. Four basic options have emerged. Figure 7: Options for voice transport over LTE [Source: Analysys Mason, 2009] Full IMS deployment This entails full end-to-end Vo. IP. Its main drawbacks are expense (or value of cost savings), maturity of IMS, and value of additional ‘new-wave’ multimedia services that it, alone of the three options, could support. In many cases, IMS deployment is likely to be outside the timelines of LTE deployment. The emergence of switched voice modules over LTE means that full IMS may be severely delayed. This may limit the chances for NGN operators from a fixed background to capture revenue from mobile voice transport. For integrated operators, it could make a fixed–mobile integrated core network less attractive, though it increases opportunities to win outsourcing contracts for operation and maintenance of MNOs’ CS cores. The economic downturn means that all operators will try to maintain the lifespan and the asset value of existing infrastructure. The cost savings and extra revenue opportunities offered by moreexpensive implementations may not be enough to sway operators to commit capital investment now. Increasing end-to-end IP l Voice over LTE generic access (Vo. LGA) Voice and SMS are packetised and tunnelled across the core network. Equivalent to circuit emulation, but will not deliver the converged services that IMS does. Nokia Siemens Fast Track Voice over LTE Software and hardware upgrade to existing UMTS CS core networks, enabling existing CS services to be offered straightaway. Circuit switch fall-back Voice and SMS calls are pushed onto the 2 G/3 G CS core, and LTE remains data only. This is the mobile equivalent of the data-only FTTx deployments of, for example, BT. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 31 Altnets, cablecos and MNOs Switched voice and 4 G can co-exist l l l LTE is designed to be an end-to-end IP network, although the earliest implementations are likely to be data only. There is currently debate over how to develop existing voice and SMS services over LTE. Four basic options have emerged. Figure 7: Options for voice transport over LTE [Source: Analysys Mason, 2009] Full IMS deployment This entails full end-to-end Vo. IP. Its main drawbacks are expense (or value of cost savings), maturity of IMS, and value of additional ‘new-wave’ multimedia services that it, alone of the three options, could support. In many cases, IMS deployment is likely to be outside the timelines of LTE deployment. The emergence of switched voice modules over LTE means that full IMS may be severely delayed. This may limit the chances for NGN operators from a fixed background to capture revenue from mobile voice transport. For integrated operators, it could make a fixed–mobile integrated core network less attractive, though it increases opportunities to win outsourcing contracts for operation and maintenance of MNOs’ CS cores. The economic downturn means that all operators will try to maintain the lifespan and the asset value of existing infrastructure. The cost savings and extra revenue opportunities offered by moreexpensive implementations may not be enough to sway operators to commit capital investment now. Increasing end-to-end IP l Voice over LTE generic access (Vo. LGA) Voice and SMS are packetised and tunnelled across the core network. Equivalent to circuit emulation, but will not deliver the converged services that IMS does. Nokia Siemens Fast Track Voice over LTE Software and hardware upgrade to existing UMTS CS core networks, enabling existing CS services to be offered straightaway. Circuit switch fall-back Voice and SMS calls are pushed onto the 2 G/3 G CS core, and LTE remains data only. This is the mobile equivalent of the data-only FTTx deployments of, for example, BT. © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 32 Document map: Looking ahead, conclusions and recommendations Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

NGNs and the changing face of voice migration 32 Document map: Looking ahead, conclusions and recommendations Document map Changes in incumbent telco strategy Case studies Altnets, cablecos and MNOs Looking ahead, conclusions and recommendations Author, copyright and key to acronyms List of figures About Analysys Mason © Analysys Mason Limited 2009

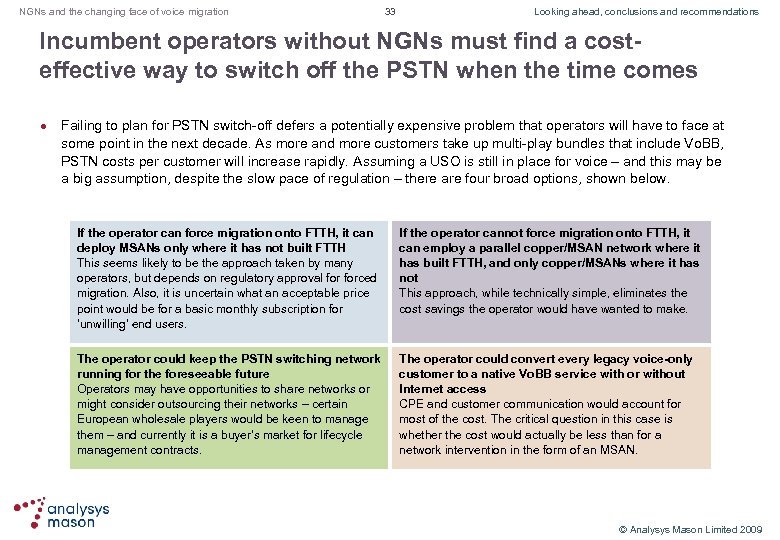

NGNs and the changing face of voice migration 33 Looking ahead, conclusions and recommendations Incumbent operators without NGNs must find a costeffective way to switch off the PSTN when the time comes l Failing to plan for PSTN switch-off defers a potentially expensive problem that operators will have to face at some point in the next decade. As more and more customers take up multi-play bundles that include Vo. BB, PSTN costs per customer will increase rapidly. Assuming a USO is still in place for voice – and this may be a big assumption, despite the slow pace of regulation – there are four broad options, shown below. If the operator can force migration onto FTTH, it can deploy MSANs only where it has not built FTTH This seems likely to be the approach taken by many operators, but depends on regulatory approval forced migration. Also, it is uncertain what an acceptable price point would be for a basic monthly subscription for ‘unwilling’ end users. If the operator cannot force migration onto FTTH, it can employ a parallel copper/MSAN network where it has built FTTH, and only copper/MSANs where it has not This approach, while technically simple, eliminates the cost savings the operator would have wanted to make. The operator could keep the PSTN switching network running for the foreseeable future Operators may have opportunities to share networks or might consider outsourcing their networks – certain European wholesale players would be keen to manage them – and currently it is a buyer’s market for lifecycle management contracts. The operator could convert every legacy voice-only customer to a native Vo. BB service with or without Internet access CPE and customer communication would account for most of the cost. The critical question in this case is whether the cost would actually be less than for a network intervention in the form of an MSAN. © Analysys Mason Limited 2009

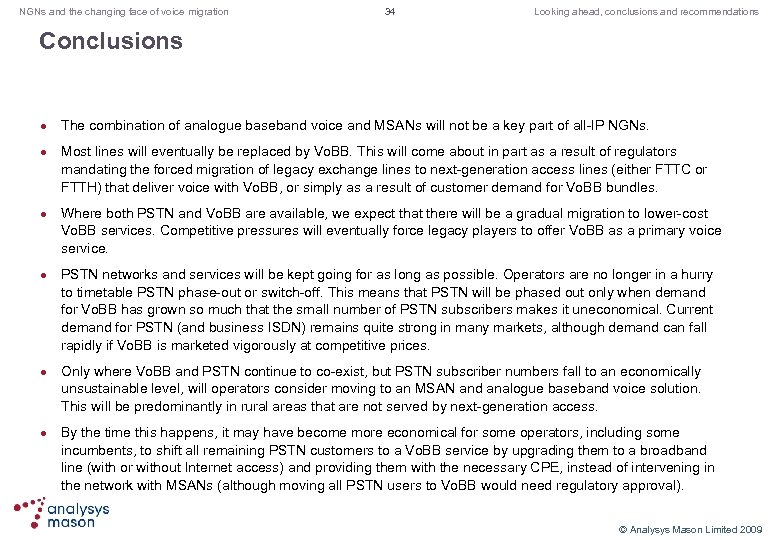

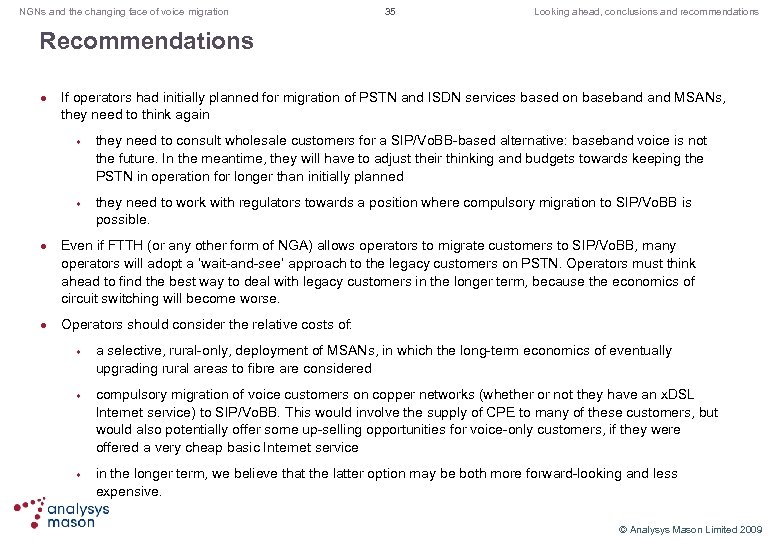

NGNs and the changing face of voice migration 33 Looking ahead, conclusions and recommendations Incumbent operators without NGNs must find a costeffective way to switch off the PSTN when the time comes l Failing to plan for PSTN switch-off defers a potentially expensive problem that operators will have to face at some point in the next decade. As more and more customers take up multi-play bundles that include Vo. BB, PSTN costs per customer will increase rapidly. Assuming a USO is still in place for voice – and this may be a big assumption, despite the slow pace of regulation – there are four broad options, shown below. If the operator can force migration onto FTTH, it can deploy MSANs only where it has not built FTTH This seems likely to be the approach taken by many operators, but depends on regulatory approval forced migration. Also, it is uncertain what an acceptable price point would be for a basic monthly subscription for ‘unwilling’ end users. If the operator cannot force migration onto FTTH, it can employ a parallel copper/MSAN network where it has built FTTH, and only copper/MSANs where it has not This approach, while technically simple, eliminates the cost savings the operator would have wanted to make. The operator could keep the PSTN switching network running for the foreseeable future Operators may have opportunities to share networks or might consider outsourcing their networks – certain European wholesale players would be keen to manage them – and currently it is a buyer’s market for lifecycle management contracts. The operator could convert every legacy voice-only customer to a native Vo. BB service with or without Internet access CPE and customer communication would account for most of the cost. The critical question in this case is whether the cost would actually be less than for a network intervention in the form of an MSAN. © Analysys Mason Limited 2009