32d7f7b3eee405e0d06e497027eec3b8.ppt

- Количество слайдов: 12

Republic of Rwanda ELECTRICITY GENERATION PRIORITIES PRESENTATION 8 TH National Leadership Retreat March 2011 © Strategy & Policy Unit, Confidential This document does not constitute Government policy This document forms part of an oral presentation and should not be reproduced or distributed without prior permission

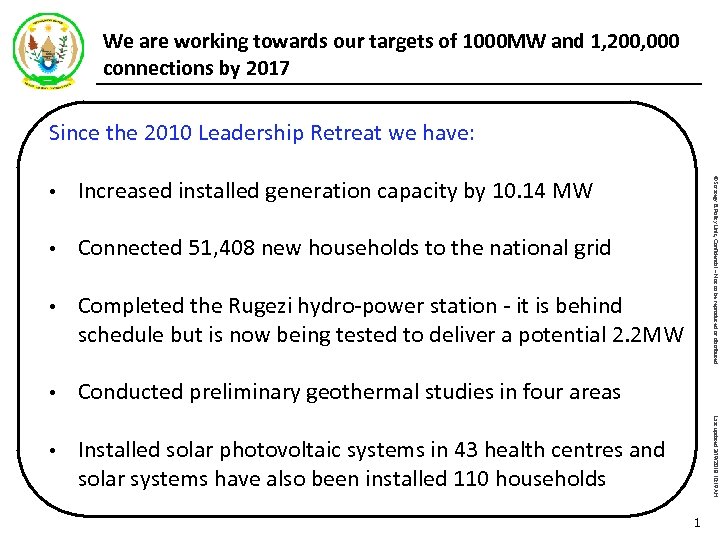

We are working towards our targets of 1000 MW and 1, 200, 000 connections by 2017 Since the 2010 Leadership Retreat we have: Increased installed generation capacity by 10. 14 MW Connected 51, 408 new households to the national grid • Completed the Rugezi hydro-power station - it is behind schedule but is now being tested to deliver a potential 2. 2 MW • Conducted preliminary geothermal studies in four areas • Installed solar photovoltaic systems in 43 health centres and solar systems have also been installed 110 households Last updated 3/19/2018 10: 19 AM • © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed • 1

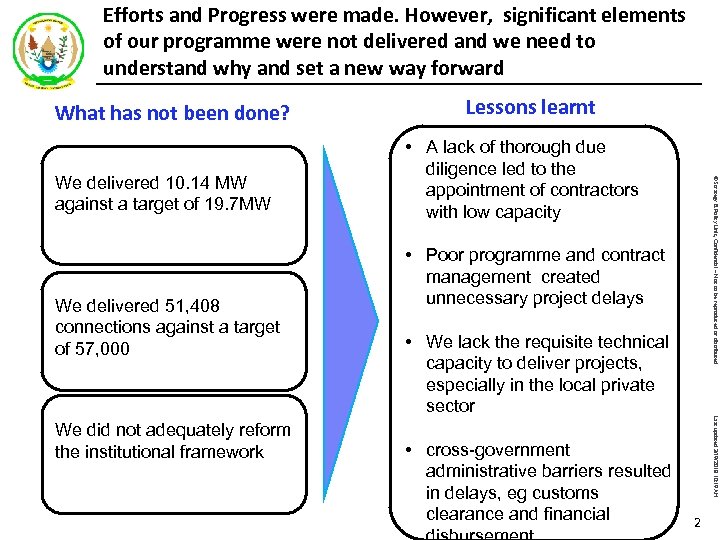

Efforts and Progress were made. However, significant elements of our programme were not delivered and we need to understand why and set a new way forward What has not been done? We delivered 51, 408 connections against a target of 57, 000 • Poor programme and contract management created unnecessary project delays • We lack the requisite technical capacity to deliver projects, especially in the local private sector • cross-government administrative barriers resulted in delays, eg customs clearance and financial Last updated 3/19/2018 10: 19 AM We did not adequately reform the institutional framework • A lack of thorough due diligence led to the appointment of contractors with low capacity © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed We delivered 10. 14 MW against a target of 19. 7 MW Lessons learnt 2

This year we aim to increase installed generation capacity by 30. 4 MW and deliver 65, 000 new connections We will deliver this through a combination of ‘quick wins’ and work to prepare for longer term projects To prepare for the future we will: • Exit contracts with non-performing in hydro and methane and engage new investors • Engage neighbouring governments to fast-track the development of regional power projects • Conclude negotiations with Israel. Africa to upgrade the KP 1 methane plant to 50 MW Last updated 3/19/2018 10: 19 AM • Geothermal drilling, generating a potential 10 MW by 2012 • Peat to power projects to deliver 15 MW by mid 2012, and 100 MW (PPP Go. R/Chinese/Madhivani) by 2013. • Complete ongoing hydro-power plants, delivering 10. 4 MW • 20 MW of new diesel generation by July 2011 to meet a prospective shortfall in supply. • Extend the network and deliver 16, 250 new connections quarterly © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed For the quick wins, we aim to deliver: 3

The need for additional finance presents a challenge to the delivery of our 2017 goals Meeting our 2017 goals requires an additional $4. 5 Billion. Funding in 2011/12 will deliver power now and lay the foundation for future years. In 2011/12 we will need a total of $190 million (including 22 million for peat, 30. 2 million for geothermal drilling). Learning the lessons from past delivery, we need a more focused approach to securing private sector investment, including: Last updated 3/19/2018 10: 19 AM • MININFRA and RDB focusing on attracting investment in electricity generation as a priority, delivering a coordinated investment strategy • Identifying and promoting ‘bankable’ projects (peat, geothermal, hydro and methane gas) • Organization of Roundtable with development partners and investors ( June 2011, subsequently on an annual basis) • Creation of financial incentives (guarantee fund, mezzanine fund, feed-in tariff, accelerated depreciation) • Privatization of completed generation plants 4 © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed We aim to secure $3 Billion of private sector investment. But Government resources or guarantees are needed where it is too risky for the private sector to invest.

An acceleration of the pace of regional cooperation is needed to meet our goals © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed Our large hydro-electric projects (Rusizi III, Rusizi IV and Rusumo) require regional cooperation. Discussions of our regional projects have been going on for a long time Projects have been delayed due to challenges involved in negotiating and managing international projects • • To take on the central role in spearheading regional hydro projects by engaging interested investors and get partner countries to endorse the deal To bring in multilateral institutions (World Bank, Af. DB) and Governments of Tanzania, Burundi and DRC on board. Last updated 3/19/2018 10: 19 AM To overcome this we want: 5

Future gas to power generation projects are reliant on unmastered technology The KP 1 pilot is the only benchmark for extraction technology. We are planning the following strategic interventions to mitigate this barrier: Exiting the contracts with underperforming developers (REC and IPS-IFC) and attracting new investors ( ORASCOM-Egypt, Aggreko-UK, PUNJ-India, etc. with performance based contract with clear exit clauses. Conclude negotiations by Sept. 2011 • We have appointed Mott Mac. Donald, an international Company to supervise and 6 ensure quality control of projects Last updated 3/19/2018 10: 19 AM • © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed Lenders are slow/reluctant to support investors due to technological risks

We need to strengthen MININFRA capacity to negotiate and deliver large energy projects and develop the legislative framework MININFRA lacks sufficient experience of planning, development and project management. To address this issue, the following is being done: © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed Current status Medium term plan Local staff: 32 engineers (9 Masters), 11 66 engineers (20 Masters) applied scientists 15 applied scientists Additional 6 international experts under recruitment 3 consulting firms (RSW, SHER, Mott Mac. Donald) Additional 4 consulting firms for geothermal, peat, hydro to be hired 15 engineers trained in operation and maintenance of hydro power plants Additional 15 engineer trainees to depart in mid March The Strategic Capacity Building Initiative is being implemented to support the establishment of a large infrastructure unit and the expertise to carry out legal, and regulatory reform Last updated 3/19/2018 10: 19 AM 10 international experts 7

We also need to build the technical capacity to deliver our projects, including in RECO and in our local private sector The lack of adequate technical capacity in RECO and the local private sector to deliver the roll out programme (50% access rate by 2017) © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed We will tackle this barrier through the following activities: • Industrial attachment of a mass of engineers within better performing utility companies (Egypt, Tunisia, South Africa, USA, Japan, …) first batch of 60 engineers and technicians in utility companies to start in July. • • Increase the number of electricity service companies in Rwanda • Introducing energy courses in institutions of higher learning (masters in sustainable energy engineering at KIST with KTH in Sweden) • Design and joint venture with WDA in electricity capacity building. We are developing an incubation centre in KIST to develop the private sector’s capacity Last updated 3/19/2018 10: 19 AM 8

Institutional and regulatory reform is needed to make the sector attractive and reliable to deliver our 2017 goals © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed The current institutional, legal and regulatory framework does not maximise the delivery or our projects or attract investors. Strategic actions to mitigate this challenge; • • • Last updated 3/19/2018 10: 19 AM Finalise laws that create a conducive environment for the Sector (gas and electricity laws, geothermal exploration act, standards and regulations) Fully operationalize EWSA (staffing, procedures manual, and business plan) Effective performance management in MININFRA and EWSA Finalize the updated energy policy and the 7 year strategic plan for submission to Cabinet in April MININFRA to deal with policy and overall implementation coordination, while the Energy, Water and Sanitation Authority deals with design and implementation of projects and programmes 9

Discussion: 2. Effective Coordination of institutions to address administrative barriers ( Effective synergies with RDB, MINIJUST, RRA and MINECOFIN to speed up negotiations, timely customs clearances and payment procedures) Our suggestion: A Committee chaired by the PM to ensure all players are fast and effective. 4. Put up a special scheme for skills recruitment and retention Our suggestion: A scheme similar to MINECOFIN be implemented in MININFRA. 10 Last updated 3/19/2018 10: 19 AM 3. The role of Rwanda in engaging diplomatic talks to fast track the development of regionally shared energy generation resources. Our suggestion: MINAFFET, MINEAC and MININFRA to strategize © Strategy & Policy Unit, Confidential – Not to be reproduced or distributed 1. Mobilization of required funds (Public, Private) How can we scale up resource mobilization? Our Suggestion: A national Steering Committee comprising of MINECOFIN, MININFRA and RDB with clear TOR to develop and implement

© Strategy & Policy Unit, Confidential – Not to be reproduced or distributed Last updated 3/19/2018 10: 19 AM THANK YOU FOR YOUR KIND ATTENTION! 11

32d7f7b3eee405e0d06e497027eec3b8.ppt