ee7c1999a433da694899cda5e98d35c5.ppt

- Количество слайдов: 14

REPO TRADES ON RTS STANDARD

REPO TRADES ON RTS STANDARD

RTS STANDARD RTS Stock Exchange came up with the idea to create a new cash equity market in Russia during the financial crisis of 2008 when all Russian market participants faced two major problems – bilateral credit limits and full advance depositing of assets. To avoid these pitfalls RTS Stock Exchange decided to run the new RTS Standard market on the trading platform of the derivatives market FORTS that had been successfully tested in various conditions and demonstrated the extraordinary reliability of its risk management system. Bringing the two markets onto the same trading platform allowed RTS to consolidate the cash position for RTS Standard and FORTS and to introduce joint margining for trades executed on these markets. Thus on April 23, 2009 RTS Stock Exchange launched RTS Standard, a new cash equity market meeting the best practice of stocks trading. 2

RTS STANDARD RTS Stock Exchange came up with the idea to create a new cash equity market in Russia during the financial crisis of 2008 when all Russian market participants faced two major problems – bilateral credit limits and full advance depositing of assets. To avoid these pitfalls RTS Stock Exchange decided to run the new RTS Standard market on the trading platform of the derivatives market FORTS that had been successfully tested in various conditions and demonstrated the extraordinary reliability of its risk management system. Bringing the two markets onto the same trading platform allowed RTS to consolidate the cash position for RTS Standard and FORTS and to introduce joint margining for trades executed on these markets. Thus on April 23, 2009 RTS Stock Exchange launched RTS Standard, a new cash equity market meeting the best practice of stocks trading. 2

MAIN FEATURES – No need to deposit 100% of assets in advance (the settlement cycle ranges from T+1 to T+4) – Quotes and settlement in RUB – Central Counterparty – risk-free repo and buy/sell back trades (now it is possible to trade without establishing bilateral credit limits) – Multilateral netting – Anonymous repo trades (overnight T+0/T+1) – Risk minimization (positions are marked-to-market twice a day) – Financial result on the trade date – No need to confirm each execution report for the first and second legs of repo trades (you either deliver the asset, or close out the position by entering into an offsetting trade) – Trading hours 10. 00 am – 11. 50 pm MSK 3

MAIN FEATURES – No need to deposit 100% of assets in advance (the settlement cycle ranges from T+1 to T+4) – Quotes and settlement in RUB – Central Counterparty – risk-free repo and buy/sell back trades (now it is possible to trade without establishing bilateral credit limits) – Multilateral netting – Anonymous repo trades (overnight T+0/T+1) – Risk minimization (positions are marked-to-market twice a day) – Financial result on the trade date – No need to confirm each execution report for the first and second legs of repo trades (you either deliver the asset, or close out the position by entering into an offsetting trade) – Trading hours 10. 00 am – 11. 50 pm MSK 3

INSTRUMENTS The set of instruments traded on the new market includes the liquid stocks of Russian companies. Currently these are 22 blue chips available for trading with the Central Counterparty. CHMF GAZP GMKN LKOH MAGN MTSS NLMK PLZL PMTL ROSN SBERP SNGSP TATN URSI VTBR FEES TRNFP URKA NVTK HYDR RTS Stock Exchange plans to add more equities to this list and to admit bonds to trading on RTS Standard. 4

INSTRUMENTS The set of instruments traded on the new market includes the liquid stocks of Russian companies. Currently these are 22 blue chips available for trading with the Central Counterparty. CHMF GAZP GMKN LKOH MAGN MTSS NLMK PLZL PMTL ROSN SBERP SNGSP TATN URSI VTBR FEES TRNFP URKA NVTK HYDR RTS Stock Exchange plans to add more equities to this list and to admit bonds to trading on RTS Standard. 4

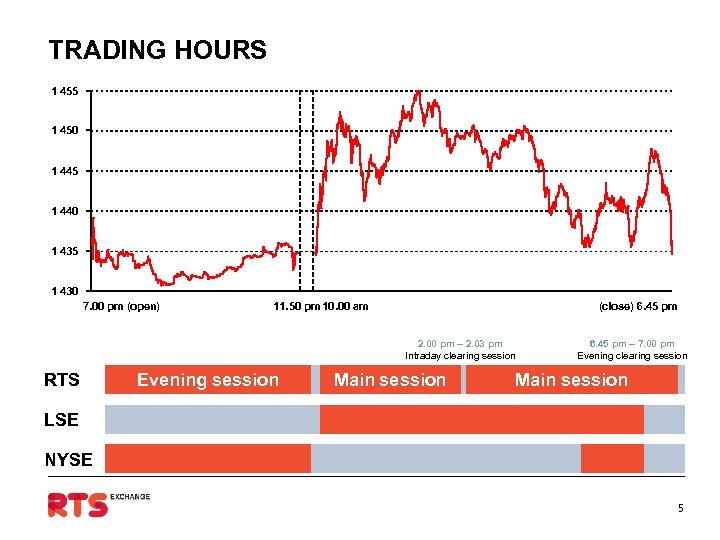

TRADING HOURS 1 455 Moscow time 1 450 1 445 1 440 1 435 1 430 7. 00 pm (open) 11. 50 pm 10. 00 am (close) 6. 45 pm 2. 00 pm – 2. 03 pm Intraday clearing session RTS Evening session Main session 6. 45 pm – 7. 00 pm Evening clearing session Main session LSE NYSE 5

TRADING HOURS 1 455 Moscow time 1 450 1 445 1 440 1 435 1 430 7. 00 pm (open) 11. 50 pm 10. 00 am (close) 6. 45 pm 2. 00 pm – 2. 03 pm Intraday clearing session RTS Evening session Main session 6. 45 pm – 7. 00 pm Evening clearing session Main session LSE NYSE 5

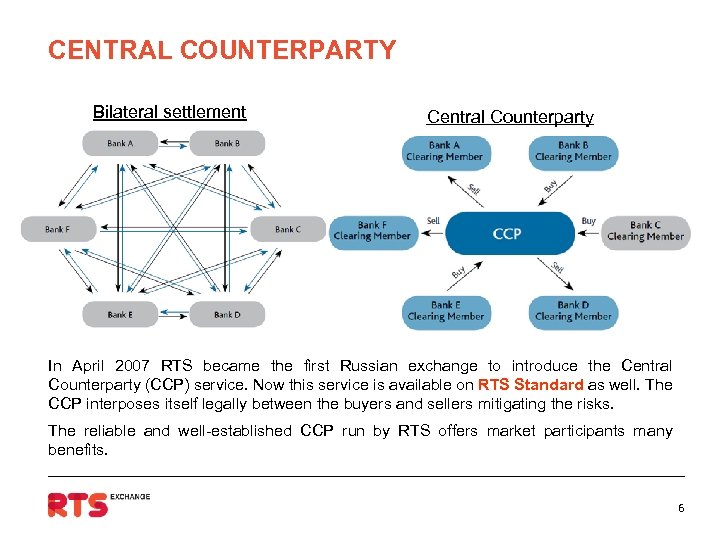

CENTRAL COUNTERPARTY Bilateral settlement Central Counterparty In April 2007 RTS became the first Russian exchange to introduce the Central Counterparty (CCP) service. Now this service is available on RTS Standard as well. The CCP interposes itself legally between the buyers and sellers mitigating the risks. The reliable and well-established CCP run by RTS offers market participants many benefits. 6

CENTRAL COUNTERPARTY Bilateral settlement Central Counterparty In April 2007 RTS became the first Russian exchange to introduce the Central Counterparty (CCP) service. Now this service is available on RTS Standard as well. The CCP interposes itself legally between the buyers and sellers mitigating the risks. The reliable and well-established CCP run by RTS offers market participants many benefits. 6

CCP RELIABILITY ‒ Risks are calculated on the basis of price movements during the day (two clearing sessions). ‒ Price limit management is in place ensuring fast response to sharp price fluctuations. This system supports continuous trading in the event of a “force majeure”, exceptional price movement and high volatility. ‒ To prevent a clearing member’s default there is a granular system for monitoring clearing member’s obligations (notifications, procedure for closing out positions). ‒ The system remains stable in any situation thanks to the special money cushion. ‒ In the autumn of 2008 when the financial crisis was at its worst driving the market volatility up: ‒ RTS CCP never failed to meet its obligations. ‒ Foreign and Russian investors came to realize and appreciate the effectiveness of hedging opportunities of the financial market. 7

CCP RELIABILITY ‒ Risks are calculated on the basis of price movements during the day (two clearing sessions). ‒ Price limit management is in place ensuring fast response to sharp price fluctuations. This system supports continuous trading in the event of a “force majeure”, exceptional price movement and high volatility. ‒ To prevent a clearing member’s default there is a granular system for monitoring clearing member’s obligations (notifications, procedure for closing out positions). ‒ The system remains stable in any situation thanks to the special money cushion. ‒ In the autumn of 2008 when the financial crisis was at its worst driving the market volatility up: ‒ RTS CCP never failed to meet its obligations. ‒ Foreign and Russian investors came to realize and appreciate the effectiveness of hedging opportunities of the financial market. 7

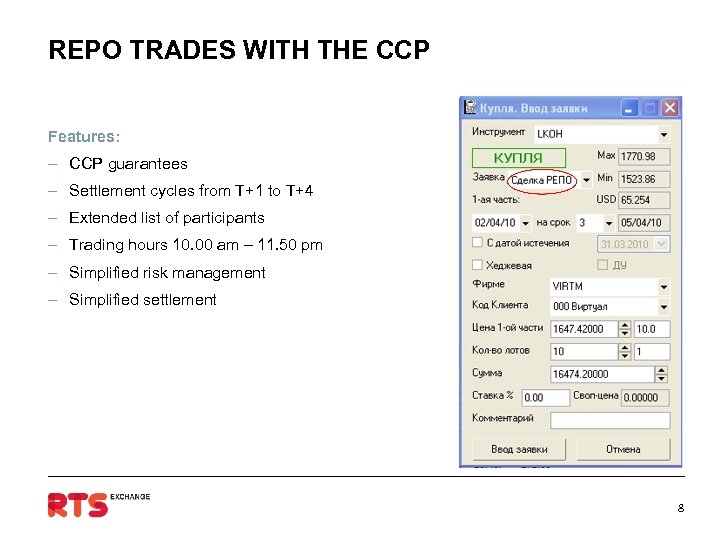

REPO TRADES WITH THE CCP Features: ‒ CCP guarantees ‒ Settlement cycles from T+1 to T+4 ‒ Extended list of participants ‒ Trading hours 10. 00 am – 11. 50 pm ‒ Simplified risk management ‒ Simplified settlement 8

REPO TRADES WITH THE CCP Features: ‒ CCP guarantees ‒ Settlement cycles from T+1 to T+4 ‒ Extended list of participants ‒ Trading hours 10. 00 am – 11. 50 pm ‒ Simplified risk management ‒ Simplified settlement 8

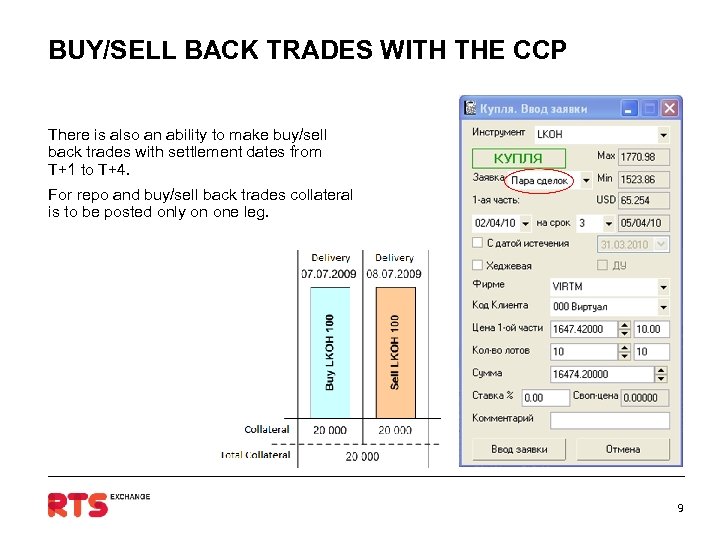

BUY/SELL BACK TRADES WITH THE CCP There is also an ability to make buy/sell back trades with settlement dates from T+1 to T+4. For repo and buy/sell back trades collateral is to be posted only on one leg. 9

BUY/SELL BACK TRADES WITH THE CCP There is also an ability to make buy/sell back trades with settlement dates from T+1 to T+4. For repo and buy/sell back trades collateral is to be posted only on one leg. 9

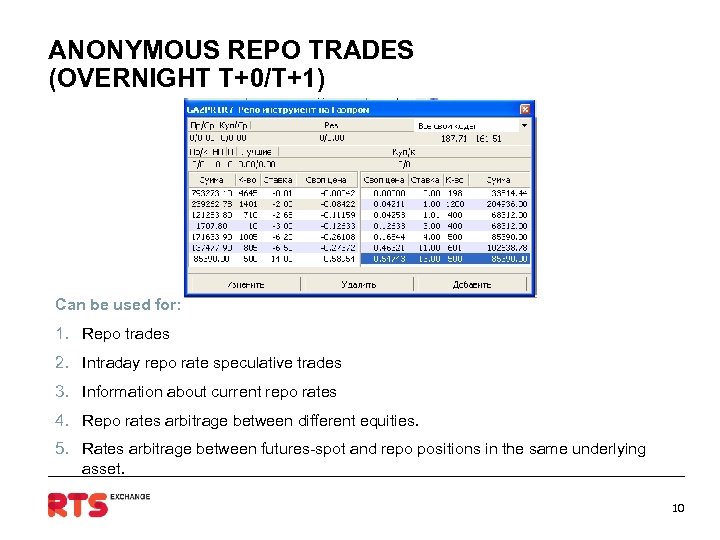

ANONYMOUS REPO TRADES (OVERNIGHT T+0/T+1) Can be used for: 1. Repo trades 2. Intraday repo rate speculative trades 3. Information about current repo rates 4. Repo rates arbitrage between different equities. 5. Rates arbitrage between futures-spot and repo positions in the same underlying asset. 10

ANONYMOUS REPO TRADES (OVERNIGHT T+0/T+1) Can be used for: 1. Repo trades 2. Intraday repo rate speculative trades 3. Information about current repo rates 4. Repo rates arbitrage between different equities. 5. Rates arbitrage between futures-spot and repo positions in the same underlying asset. 10

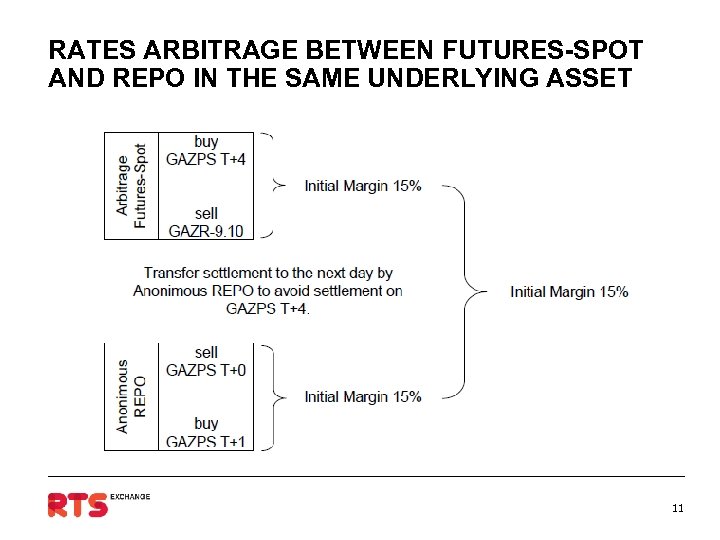

RATES ARBITRAGE BETWEEN FUTURES-SPOT AND REPO IN THE SAME UNDERLYING ASSET 11

RATES ARBITRAGE BETWEEN FUTURES-SPOT AND REPO IN THE SAME UNDERLYING ASSET 11

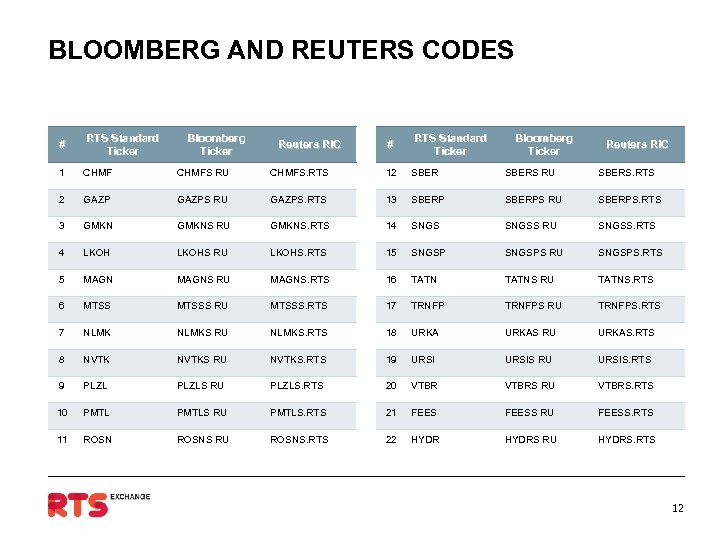

BLOOMBERG AND REUTERS CODES # RTS Standard Ticker Bloomberg Ticker Reuters RIC 1 CHMFS RU CHMFS. RTS 12 SBERS RU SBERS. RTS 2 GAZPS RU GAZPS. RTS 13 SBERPS RU SBERPS. RTS 3 GMKNS RU GMKNS. RTS 14 SNGSS RU SNGSS. RTS 4 LKOHS RU LKOHS. RTS 15 SNGSPS RU SNGSPS. RTS 5 MAGNS RU MAGNS. RTS 16 TATNS RU TATNS. RTS 6 MTSSS RU MTSSS. RTS 17 TRNFPS RU TRNFPS. RTS 7 NLMKS RU NLMKS. RTS 18 URKAS RU URKAS. RTS 8 NVTKS RU NVTKS. RTS 19 URSIS RU URSIS. RTS 9 PLZLS RU PLZLS. RTS 20 VTBRS RU VTBRS. RTS 10 PMTLS RU PMTLS. RTS 21 FEESS RU FEESS. RTS 11 ROSNS RU ROSNS. RTS 22 HYDRS RU HYDRS. RTS 12

BLOOMBERG AND REUTERS CODES # RTS Standard Ticker Bloomberg Ticker Reuters RIC 1 CHMFS RU CHMFS. RTS 12 SBERS RU SBERS. RTS 2 GAZPS RU GAZPS. RTS 13 SBERPS RU SBERPS. RTS 3 GMKNS RU GMKNS. RTS 14 SNGSS RU SNGSS. RTS 4 LKOHS RU LKOHS. RTS 15 SNGSPS RU SNGSPS. RTS 5 MAGNS RU MAGNS. RTS 16 TATNS RU TATNS. RTS 6 MTSSS RU MTSSS. RTS 17 TRNFPS RU TRNFPS. RTS 7 NLMKS RU NLMKS. RTS 18 URKAS RU URKAS. RTS 8 NVTKS RU NVTKS. RTS 19 URSIS RU URSIS. RTS 9 PLZLS RU PLZLS. RTS 20 VTBRS RU VTBRS. RTS 10 PMTLS RU PMTLS. RTS 21 FEESS RU FEESS. RTS 11 ROSNS RU ROSNS. RTS 22 HYDRS RU HYDRS. RTS 12

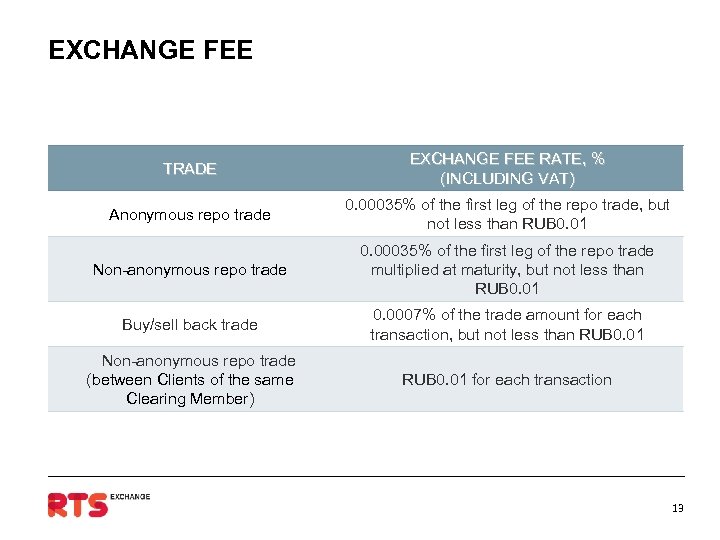

EXCHANGE FEE TRADE EXCHANGE FEE RATE, % (INCLUDING VAT) Anonymous repo trade 0. 00035% of the first leg of the repo trade, but not less than RUB 0. 01 Non-anonymous repo trade 0. 00035% of the first leg of the repo trade multiplied at maturity, but not less than RUB 0. 01 Buy/sell back trade 0. 0007% of the trade amount for each transaction, but not less than RUB 0. 01 Non-anonymous repo trade (between Clients of the same Clearing Member) RUB 0. 01 for each transaction 13

EXCHANGE FEE TRADE EXCHANGE FEE RATE, % (INCLUDING VAT) Anonymous repo trade 0. 00035% of the first leg of the repo trade, but not less than RUB 0. 01 Non-anonymous repo trade 0. 00035% of the first leg of the repo trade multiplied at maturity, but not less than RUB 0. 01 Buy/sell back trade 0. 0007% of the trade amount for each transaction, but not less than RUB 0. 01 Non-anonymous repo trade (between Clients of the same Clearing Member) RUB 0. 01 for each transaction 13

Timur Abushkin Head of Stock Market Sales RTS Stock Exchange +7 (495) 705 -90 -31 ext. 26118 timur@rts. ru standard@rts. ru

Timur Abushkin Head of Stock Market Sales RTS Stock Exchange +7 (495) 705 -90 -31 ext. 26118 timur@rts. ru standard@rts. ru