c06e5b65f0757ef10a3729ab8457f8dc.ppt

- Количество слайдов: 10

REMARKS AT MEDIA BRIEFING J. K. Njiraini, MBS Commissioner General Kenya Revenue Authority 22 ND SEPTEMBER 2015 1 www. KRA. go. ke 18/03/2018

1. FOCUS Briefing on Rental Income Taxation Reform 2 Core Tax Reform Drivers Briefing on Withholding VAT Scope Expansion www. KRA. go. ke 18/03/2018

2. CORE REFORM DRIVERS Simplicity – Make legislative/administrative processes simpler – reduce legal and administrative complexities. Convenience – Offer convenient compliance mechanisms – primarily focus on automation via electronic and mobile platforms • Lower Compliance and Administration Costs – implement processes that make tax collection cheaper for both Taxpayer and KRA. 3 www. KRA. go. ke 18/03/2018

2. Core Reform Drivers (Contd. ) • Expand Taxpayer and Tax Base – Implement mechanisms that facilitate: v. Easy recruitment of eligible taxpayers v. Detection/prevention of tax fraud Both objectives can be addressed effectively by leveraging Third Party Data 4 www. KRA. go. ke 18/03/2018

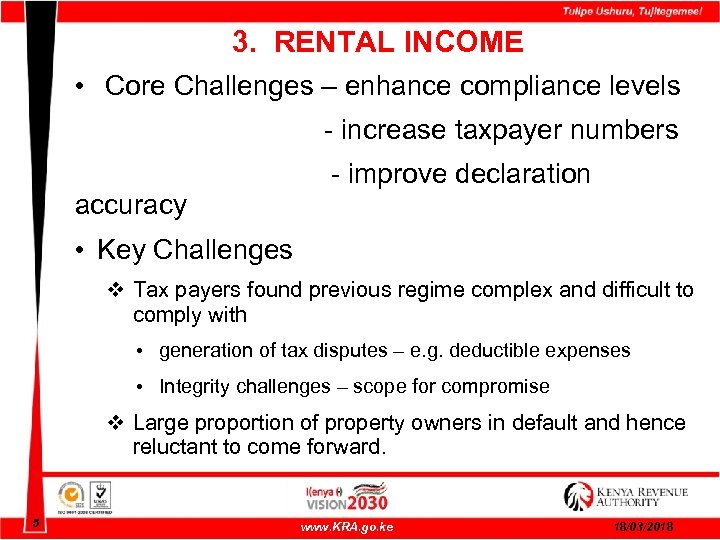

3. RENTAL INCOME • Core Challenges – enhance compliance levels - increase taxpayer numbers - improve declaration accuracy • Key Challenges v Tax payers found previous regime complex and difficult to comply with • generation of tax disputes – e. g. deductible expenses • Integrity challenges – scope for compromise v Large proportion of property owners in default and hence reluctant to come forward. 5 www. KRA. go. ke 18/03/2018

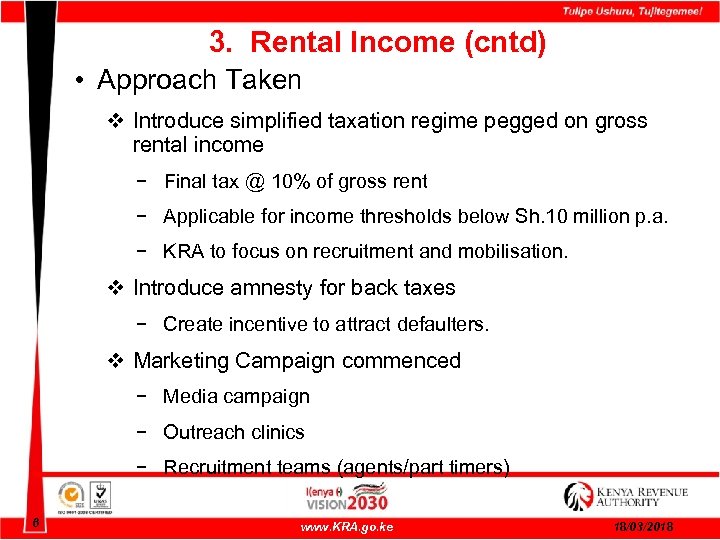

3. Rental Income (cntd) • Approach Taken v Introduce simplified taxation regime pegged on gross rental income − Final tax @ 10% of gross rent − Applicable for income thresholds below Sh. 10 million p. a. − KRA to focus on recruitment and mobilisation. v Introduce amnesty for back taxes − Create incentive to attract defaulters. v Marketing Campaign commenced − Media campaign − Outreach clinics − Recruitment teams (agents/part timers) 6 www. KRA. go. ke 18/03/2018

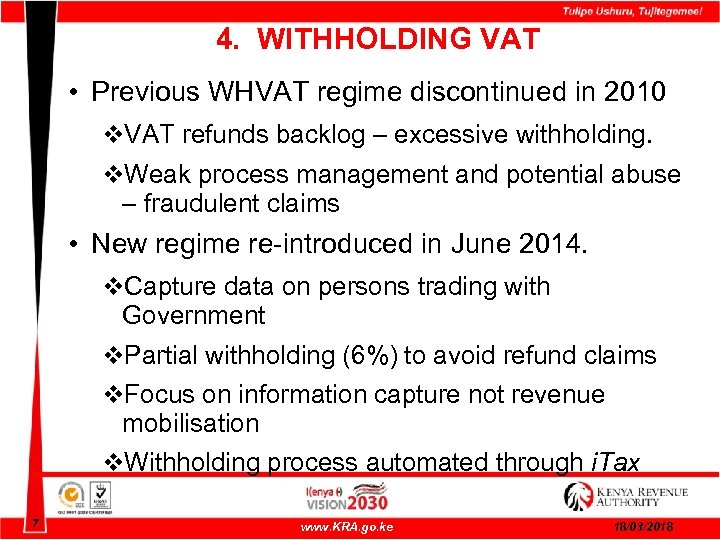

4. WITHHOLDING VAT • Previous WHVAT regime discontinued in 2010 v. VAT refunds backlog – excessive withholding. v. Weak process management and potential abuse – fraudulent claims • New regime re-introduced in June 2014. v. Capture data on persons trading with Government v. Partial withholding (6%) to avoid refund claims v. Focus on information capture not revenue mobilisation v. Withholding process automated through i. Tax 7 www. KRA. go. ke 18/03/2018

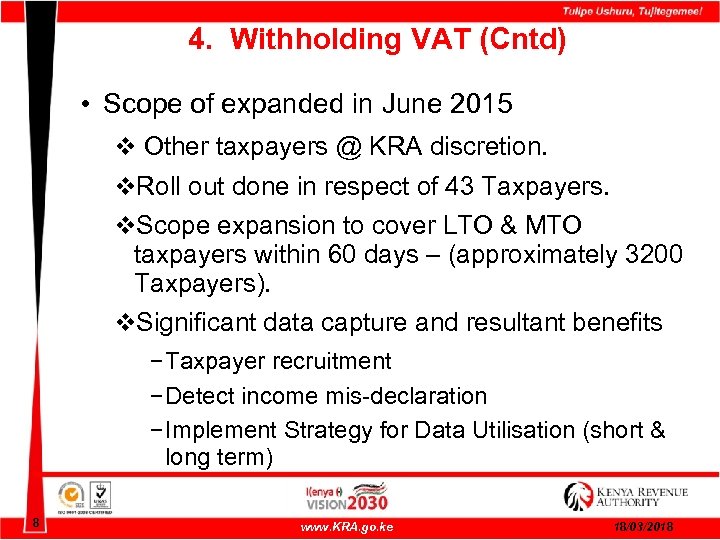

4. Withholding VAT (Cntd) • Scope of expanded in June 2015 v Other taxpayers @ KRA discretion. v. Roll out done in respect of 43 Taxpayers. v. Scope expansion to cover LTO & MTO taxpayers within 60 days – (approximately 3200 Taxpayers). v. Significant data capture and resultant benefits − Taxpayer recruitment − Detect income mis-declaration − Implement Strategy for Data Utilisation (short & long term) 8 www. KRA. go. ke 18/03/2018

5. CONCLUSIONS • Continuously Pursue Innovations v. Leverage Technology v. Process Reforms • Expand Partnerships with Key Players v. Counties – Exploit Synergies. v. Professional & Business Associations v. International Partners – best practices, knowledge sharing. 9 www. KRA. go. ke 18/03/2018

5. Conclusions (Cntd) • Sustain Reforms for Enhanced Service Delivery v 6 th Corporate Plan Theme & Vision. ‘Building Trust through Facilitation so as to Foster Compliance with Tax and Customs Legislation’ v. Organisational Process Reforms – Audit Governance, Tax Dispute Resolution v. Pursue “Total Automation” v. Accelerate Staff Culture Change 10 www. KRA. go. ke 18/03/2018

c06e5b65f0757ef10a3729ab8457f8dc.ppt