e93f6084a6d95c68e654fa91335d92ee.ppt

- Количество слайдов: 31

RELATIONSHIP BETWEEN FORWARDS/FUTURES and THEIR UNDERLYING ASSET Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 1

3. 2 Compounding Frequency • The compounding frequency used for an interest rate is the unit of measurement • The difference between quarterly and annual compounding is analogous to the difference between miles and kilometers Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

Continuous Compounding • In the limit as we compound more and more frequently we obtain continuously compounded interest rates • $100 grows to $100 e. RT when invested at a continuously compounded rate R for time T • $100 received at time T discounts to $100 e. RT at time zero when the continuously compounded discount rate is R Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 3

3. 4 $20 000 invested at a continously compounded rate of 7% for six months grows to …. ? 20, 000 e 0. 07 * 6/12 = $20, 713 Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

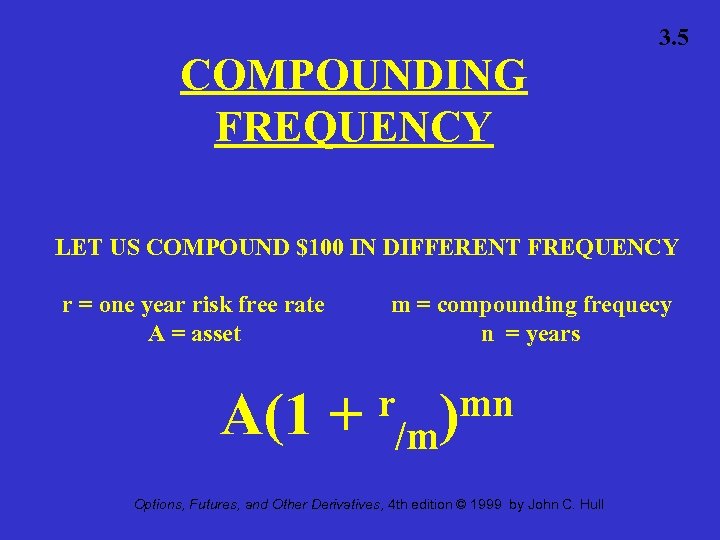

COMPOUNDING FREQUENCY 3. 5 LET US COMPOUND $100 IN DIFFERENT FREQUENCY r = one year risk free rate A = asset A(1 + m = compounding frequecy n = years r /m mn ) Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

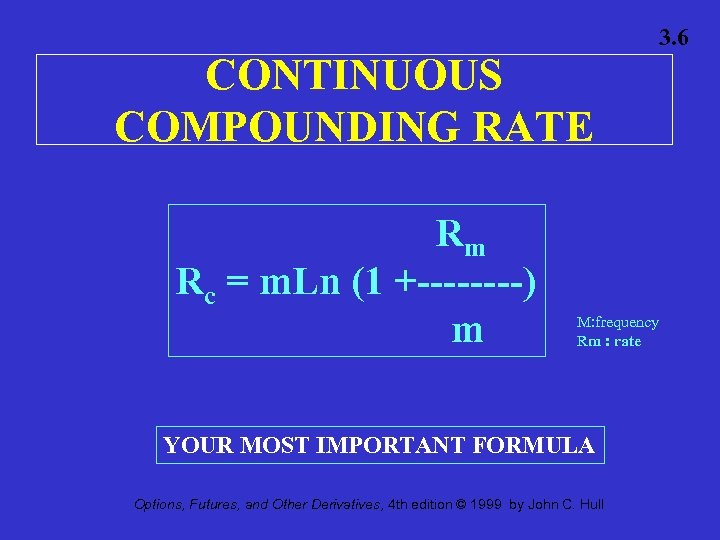

CONTINUOUS COMPOUNDING RATE Rm Rc = m. Ln (1 +----) m M: frequency Rm : rate YOUR MOST IMPORTANT FORMULA Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 6

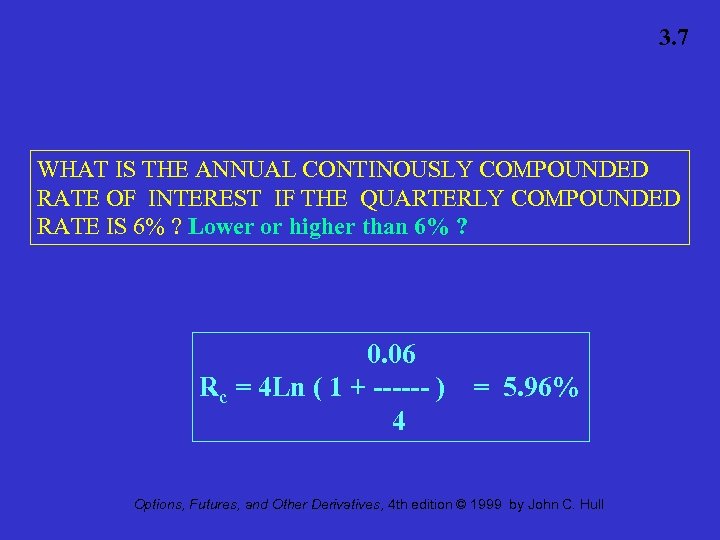

3. 7 WHAT IS THE ANNUAL CONTINOUSLY COMPOUNDED RATE OF INTEREST IF THE QUARTERLY COMPOUNDED RATE IS 6% ? Lower or higher than 6% ? 0. 06 Rc = 4 Ln ( 1 + ------ ) 4 = 5. 96% Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

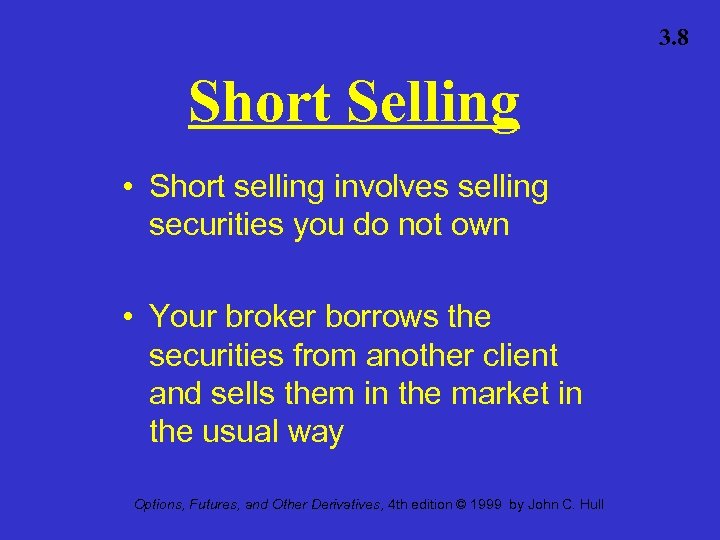

3. 8 Short Selling • Short selling involves selling securities you do not own • Your broker borrows the securities from another client and sells them in the market in the usual way Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

Short Selling • At some stage you must buy the securities back so they can be replaced in the account of the client • You must pay dividends & other benefits the owner of the securities receives Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 9

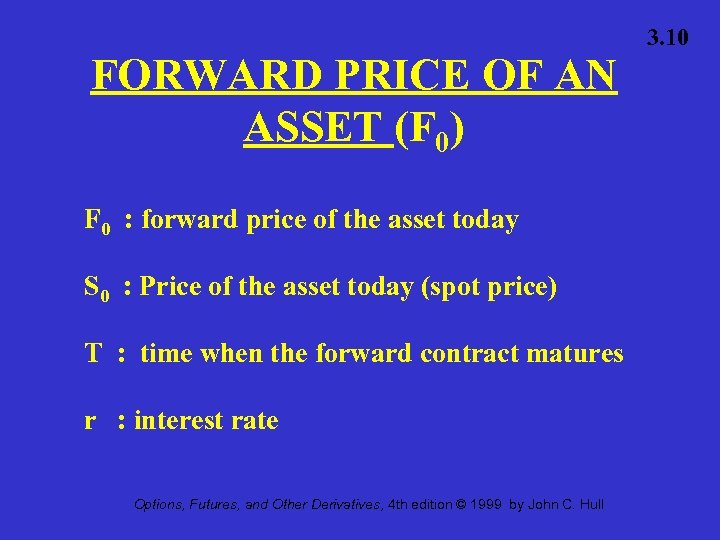

FORWARD PRICE OF AN ASSET (F 0) F 0 : forward price of the asset today S 0 : Price of the asset today (spot price) T : time when the forward contract matures r : interest rate Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 10

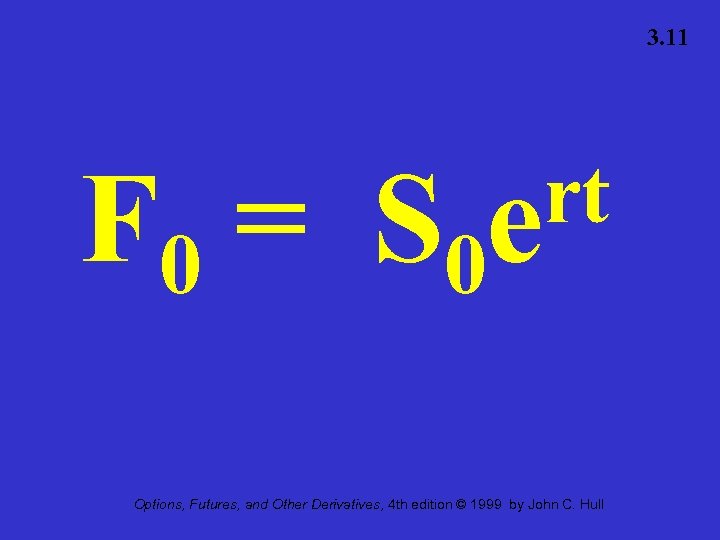

3. 11 F 0 = S 0 rt e Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

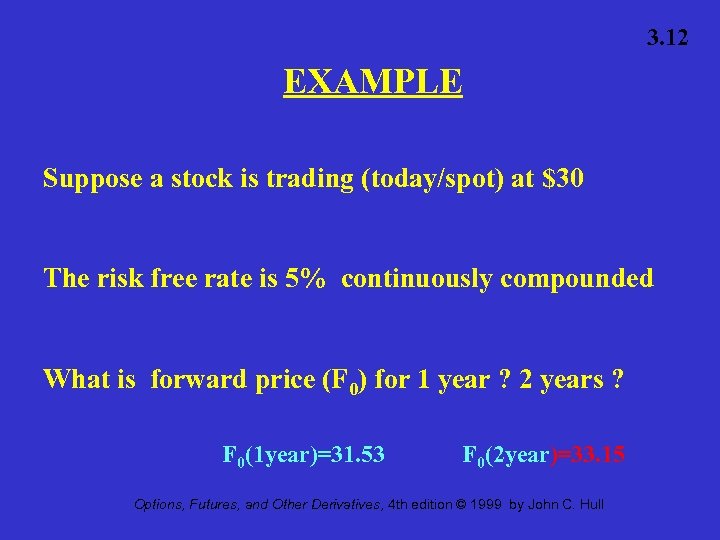

3. 12 EXAMPLE Suppose a stock is trading (today/spot) at $30 The risk free rate is 5% continuously compounded What is forward price (F 0) for 1 year ? 2 years ? F 0(1 year)=31. 53 F 0(2 year)=33. 15 Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

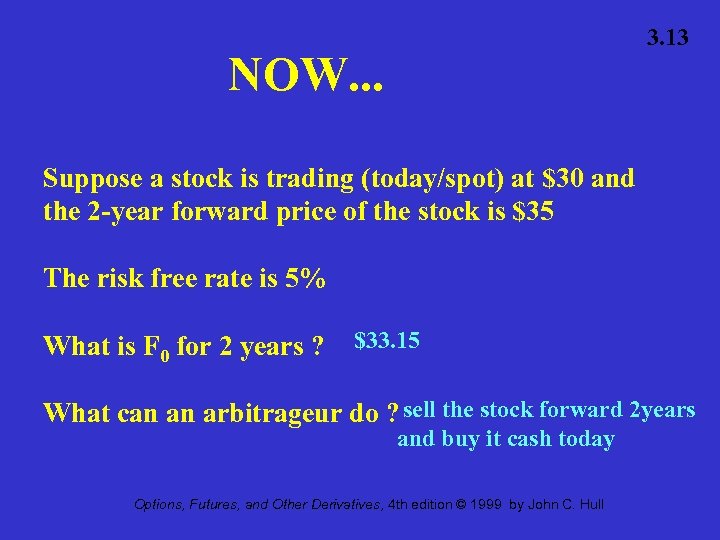

3. 13 NOW. . . Suppose a stock is trading (today/spot) at $30 and the 2 -year forward price of the stock is $35 The risk free rate is 5% What is F 0 for 2 years ? $33. 15 What can an arbitrageur do ? sell the stock forward 2 years and buy it cash today Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

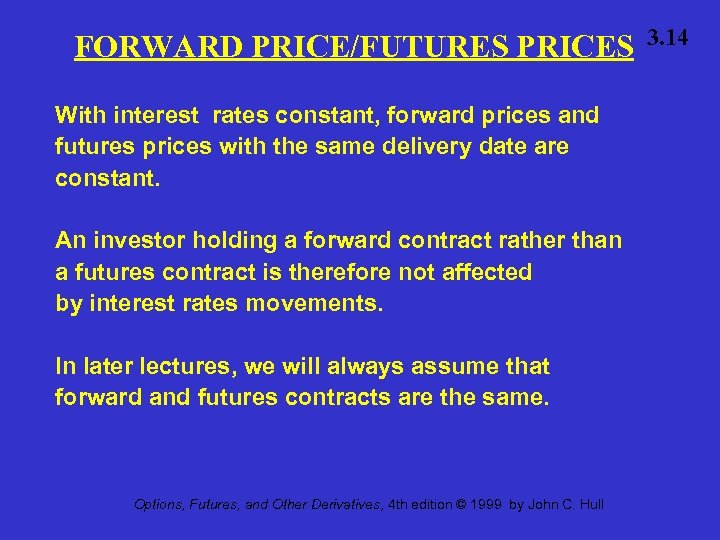

FORWARD PRICE/FUTURES PRICES With interest rates constant, forward prices and futures prices with the same delivery date are constant. An investor holding a forward contract rather than a futures contract is therefore not affected by interest rates movements. In later lectures, we will always assume that forward and futures contracts are the same. Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 14

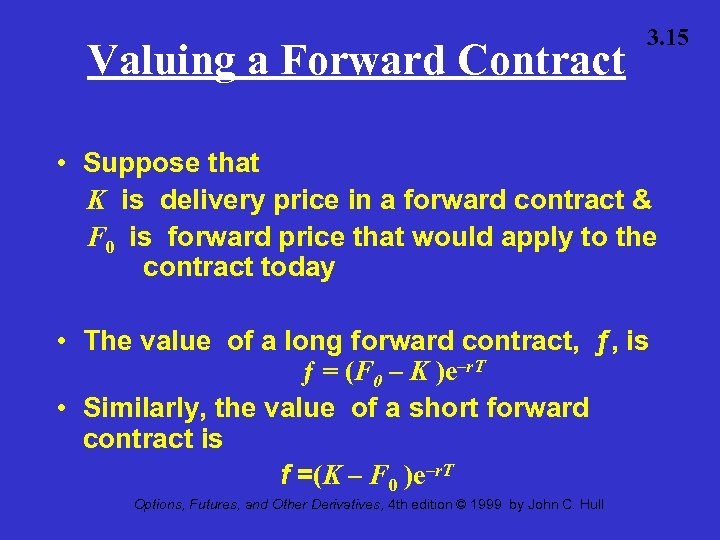

Valuing a Forward Contract 3. 15 • Suppose that K is delivery price in a forward contract & F 0 is forward price that would apply to the contract today • The value of a long forward contract, ƒ, is ƒ = (F 0 – K )e–r. T • Similarly, the value of a short forward contract is f =(K – F 0 )e–r. T Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

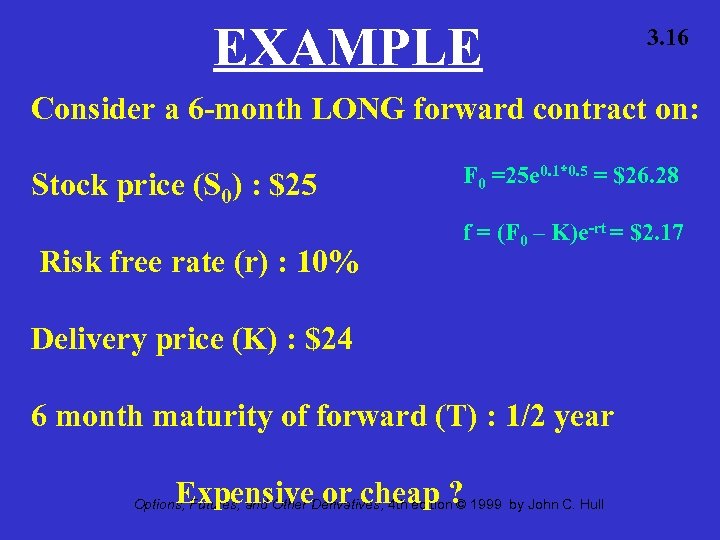

EXAMPLE 3. 16 Consider a 6 -month LONG forward contract on: Stock price (S 0) : $25 Risk free rate (r) : 10% F 0 =25 e 0. 1*0. 5 = $26. 28 f = (F 0 – K)e-rt = $2. 17 Delivery price (K) : $24 6 month maturity of forward (T) : 1/2 year Expensive or cheap ? Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

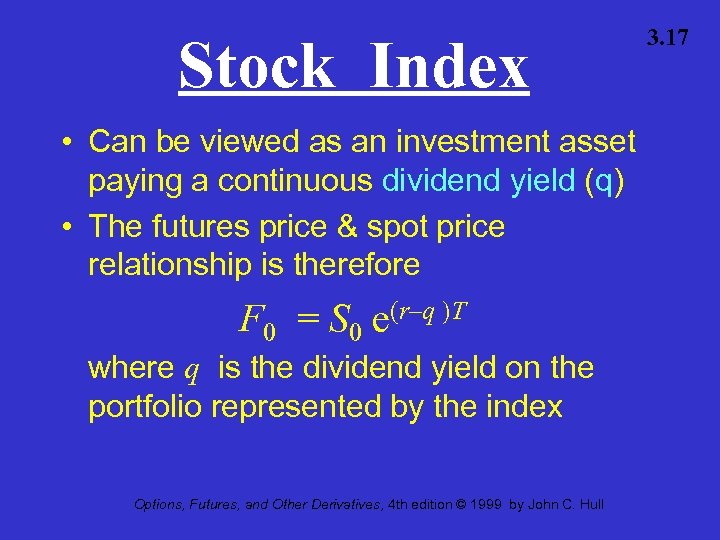

Stock Index • Can be viewed as an investment asset paying a continuous dividend yield (q) • The futures price & spot price relationship is therefore F 0 = S 0 e(r–q )T where q is the dividend yield on the portfolio represented by the index Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 17

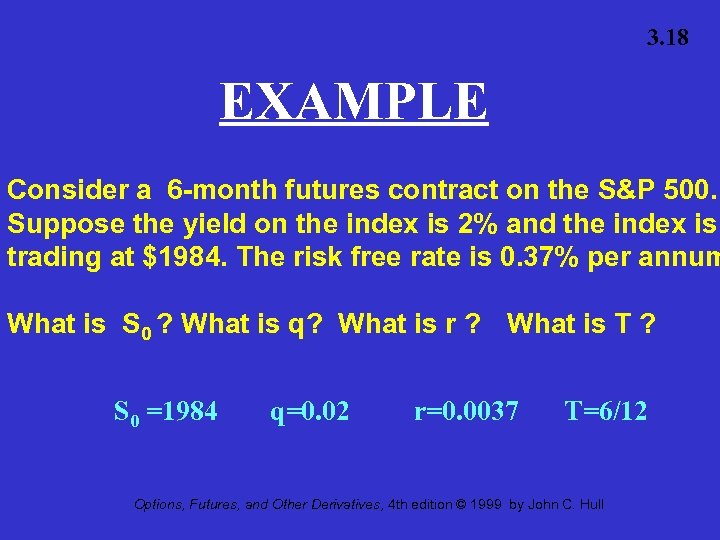

3. 18 EXAMPLE Consider a 6 -month futures contract on the S&P 500. Suppose the yield on the index is 2% and the index is trading at $1984. The risk free rate is 0. 37% per annum What is S 0 ? What is q? What is r ? What is T ? S 0 =1984 q=0. 02 r=0. 0037 T=6/12 Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

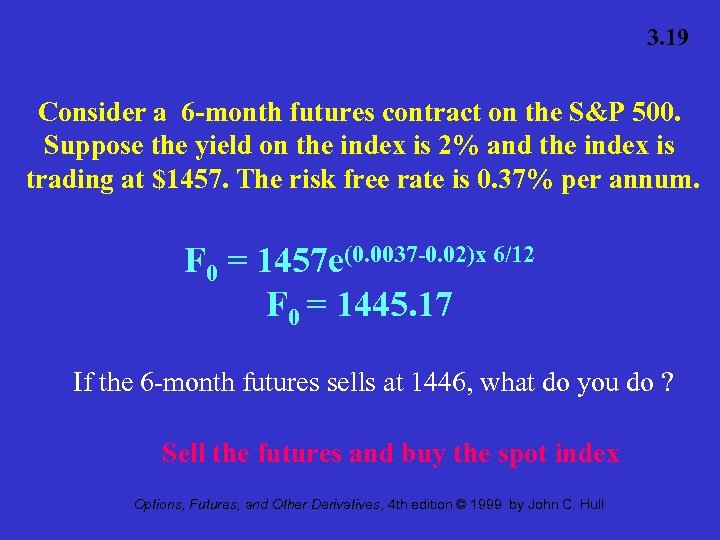

3. 19 Consider a 6 -month futures contract on the S&P 500. Suppose the yield on the index is 2% and the index is trading at $1457. The risk free rate is 0. 37% per annum. F 0 = 1457 e(0. 0037 -0. 02)x 6/12 F 0 = 1445. 17 If the 6 -month futures sells at 1446, what do you do ? Sell the futures and buy the spot index Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

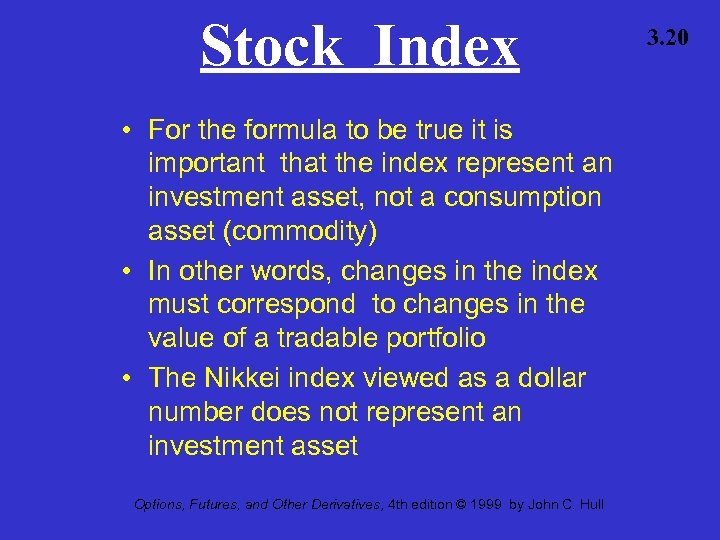

Stock Index • For the formula to be true it is important that the index represent an investment asset, not a consumption asset (commodity) • In other words, changes in the index must correspond to changes in the value of a tradable portfolio • The Nikkei index viewed as a dollar number does not represent an investment asset Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 20

Talk about the CFTC commitment of trade report cftc on bloomberg Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 21

3. 22 Index Arbitrage • When F 0>S 0 e(r-q)T an arbitrageur buys the stocks underlying the index and sells futures • When F 0<S 0 e(r-q)T an arbitrageur buys futures and shorts or sells the stocks underlying the index Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

Index Arbitrage • Index arbitrage involves simultaneous trades in futures & many different stocks • Very often a computer is used to generate the trades • Occasionally (e. g. , on Black Monday) simultaneous trades are not possible and theoretical no-arbitrage relationship between F 0 and S 0 may not hold Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull 3. 23

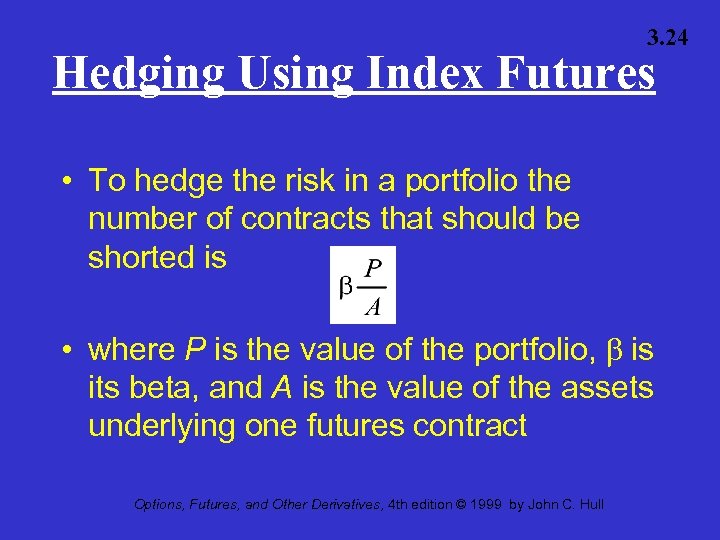

3. 24 Hedging Using Index Futures • To hedge the risk in a portfolio the number of contracts that should be shorted is • where P is the value of the portfolio, b is its beta, and A is the value of the assets underlying one futures contract Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

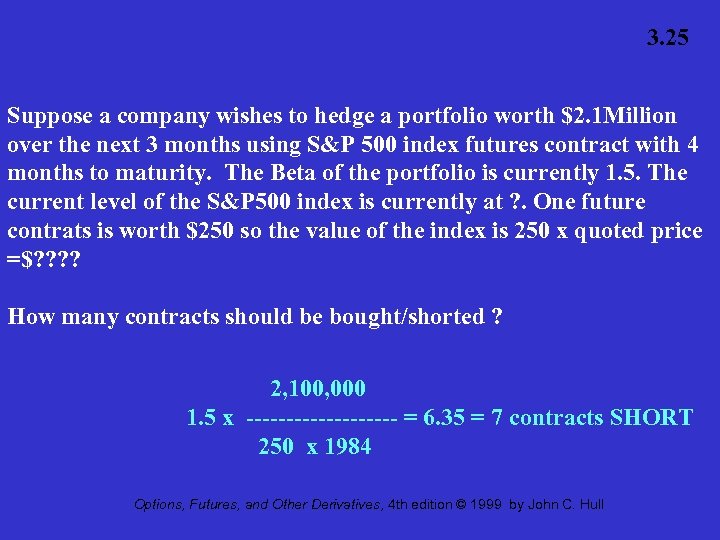

3. 25 Suppose a company wishes to hedge a portfolio worth $2. 1 Million over the next 3 months using S&P 500 index futures contract with 4 months to maturity. The Beta of the portfolio is currently 1. 5. The current level of the S&P 500 index is currently at ? . One future contrats is worth $250 so the value of the index is 250 x quoted price =$? ? How many contracts should be bought/shorted ? 2, 100, 000 1. 5 x ---------- = 6. 35 = 7 contracts SHORT 250 x 1984 Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

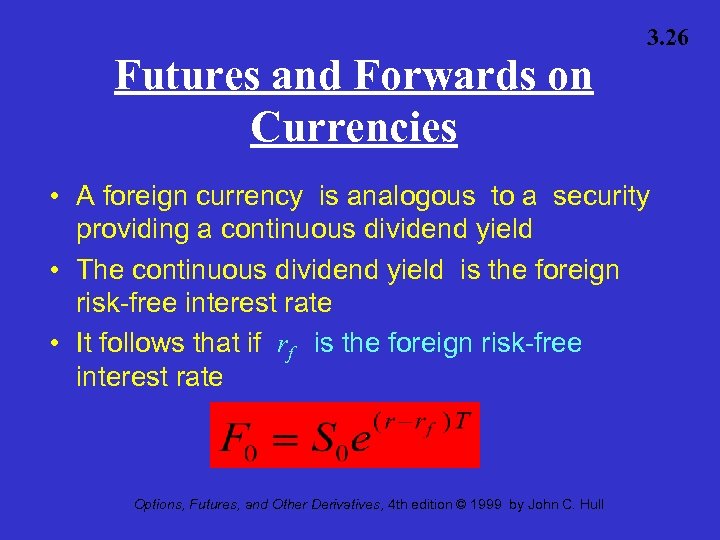

Futures and Forwards on Currencies 3. 26 • A foreign currency is analogous to a security providing a continuous dividend yield • The continuous dividend yield is the foreign risk-free interest rate • It follows that if rf is the foreign risk-free interest rate Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

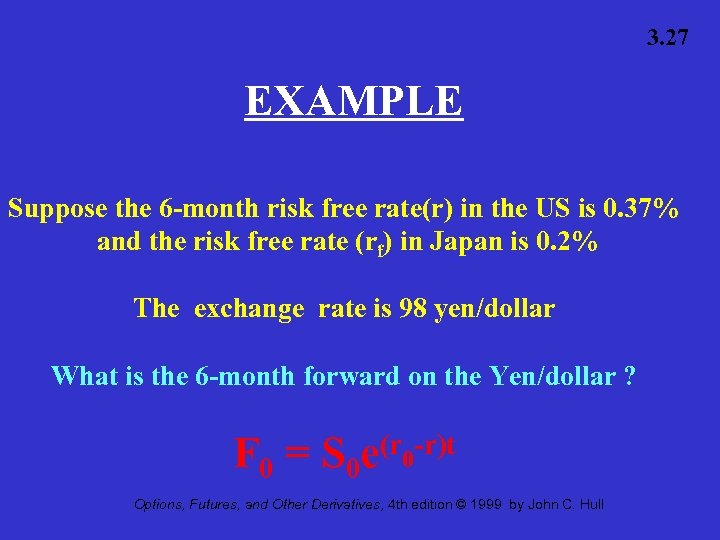

3. 27 EXAMPLE Suppose the 6 -month risk free rate(r) in the US is 0. 37% and the risk free rate (rf) in Japan is 0. 2% The exchange rate is 98 yen/dollar What is the 6 -month forward on the Yen/dollar ? F 0 = S 0 e(r 0 -r)t Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

3. 28 When the foreign interest rate is greater than the domestic interest rate ( rf>r), the equation shows that F 0 is always less than S 0. Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

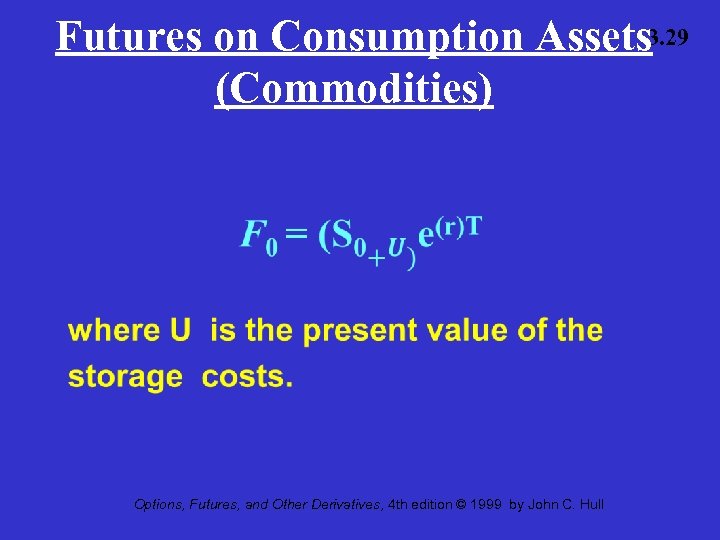

Futures on Consumption Assets 3. 29 (Commodities) • Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

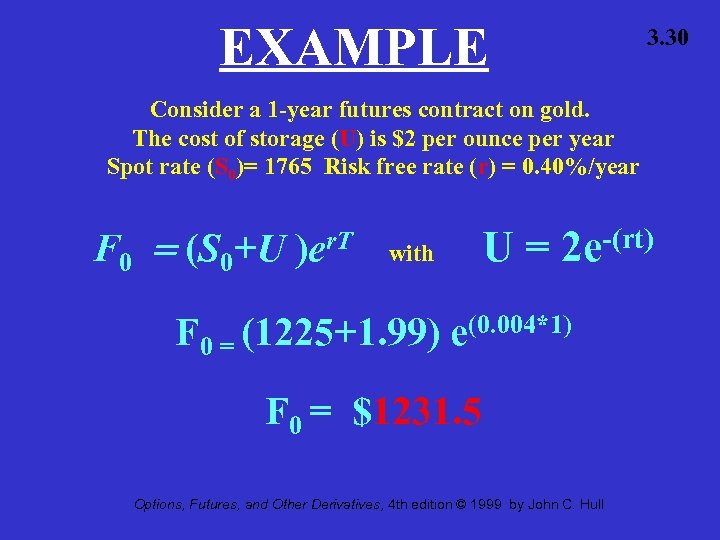

EXAMPLE 3. 30 Consider a 1 -year futures contract on gold. The cost of storage (U) is $2 per ounce per year Spot rate (S 0)= 1765 Risk free rate (r) = 0. 40%/year F 0 = (S 0+U )er. T with U= -(rt) 2 e F 0 = (1225+1. 99) e(0. 004*1) F 0 = $1231. 5 Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

3. 31 I HAVE HAD ENOUGH FOR TODAY ! SEE YOU IN ? HOURS !!! Options, Futures, and Other Derivatives, 4 th edition © 1999 by John C. Hull

e93f6084a6d95c68e654fa91335d92ee.ppt