479701276c5954dea24a4989d7dedf71.ppt

- Количество слайдов: 61

REINSURANCE

WHAT IS REINSURANCE ? REINSURANCE Whereby the insurer passes on that part of any risk which surpasses his financial strength to a reinsurer.

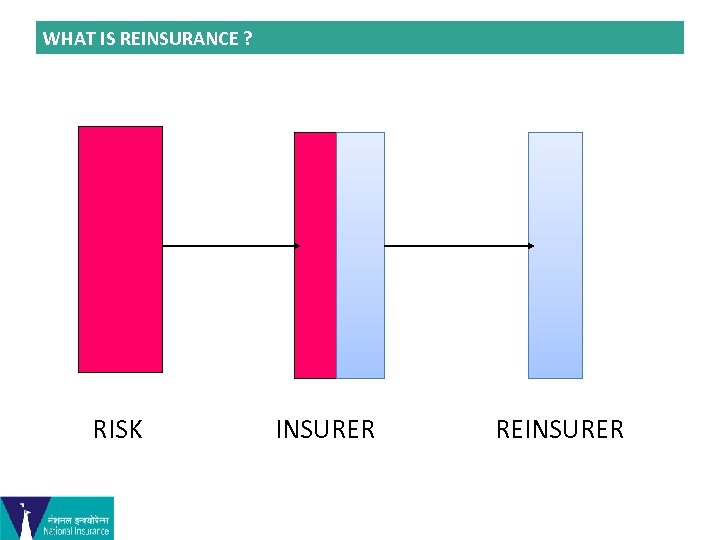

WHAT IS REINSURANCE ? RISK INSURER REINSURER

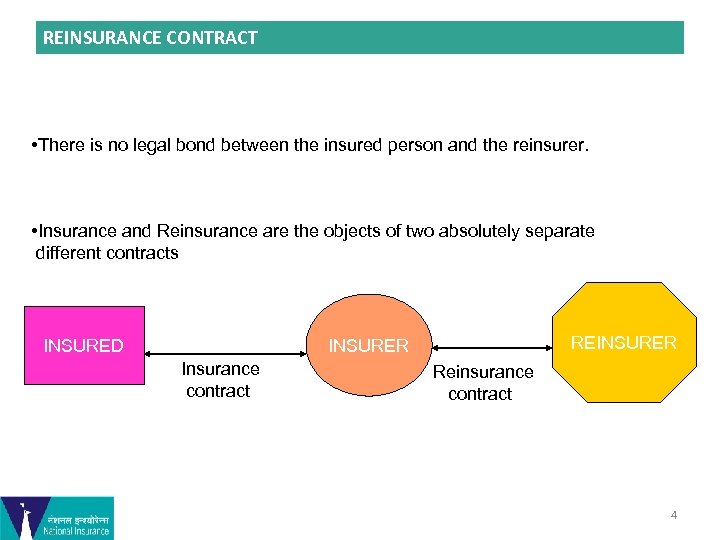

REINSURANCE CONTRACT • There is no legal bond between the insured person and the reinsurer. • Insurance and Reinsurance are the objects of two absolutely separate different contracts INSURED REINSURER Insurance contract Reinsurance contract 4

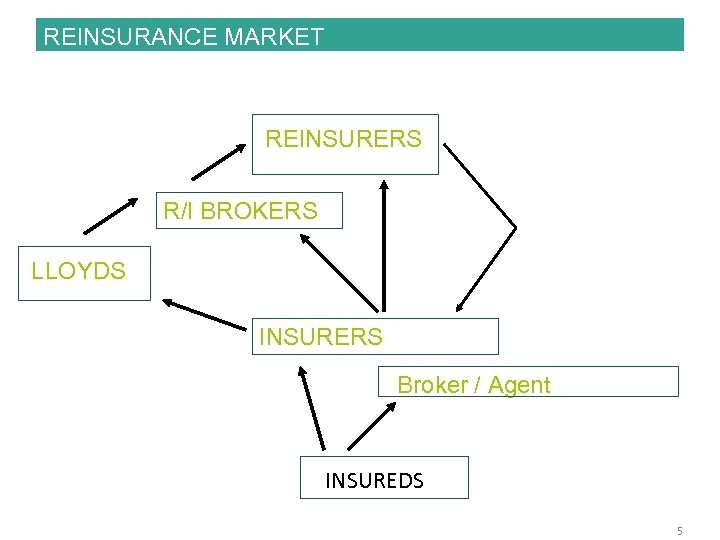

REINSURANCE MARKET REINSURERS R/I BROKERS LLOYDS INSURERS Broker / Agent INSUREDS 5

COMMON TERMS USED IN REINSURANCE CEDE : To give away a part of the risk by a company to another company. CESSION : The amount given away by way of reinsurance. CEDING COMPANY : The primary insurer, also called the REINSURED. COMMISSION : The part of the reinsurer’s share of premium retained by the insurer. RETROCESSION : Reinsurance of reinsurance. LINE : The amount of retention of the insurer.

FUCTION OF REINSURANCE 1. It provides additional underwriting capacity to the insurer. 2. It makes possible further spreading of risks internationally (some countries are traditionally exposed to natural disasters like earthquake, floods which can severely damage an economy, there is also the risk of man made disasters like Bhopal gas tragedy, WTC attack. 3. It helps a direct insurance company to expand the volume of business it writes at a faster rate than otherwise would be possible without a corresponding increase in its capital base.

FUCTION OF REINSURANCE One of the most common causes of failure of an insurance company is that claims exceed available funds generated by premiums, the main reasons being 1. Random increase in the frequency and/or severity of very large individual losses 2. Random increase in the frequency and/or severity of an accumulation of losses arising from one event 3. Random adverse fluctuation experience in the annual aggregate claims Traditionally the basic role of reinsurance is to offer protection against the above risks

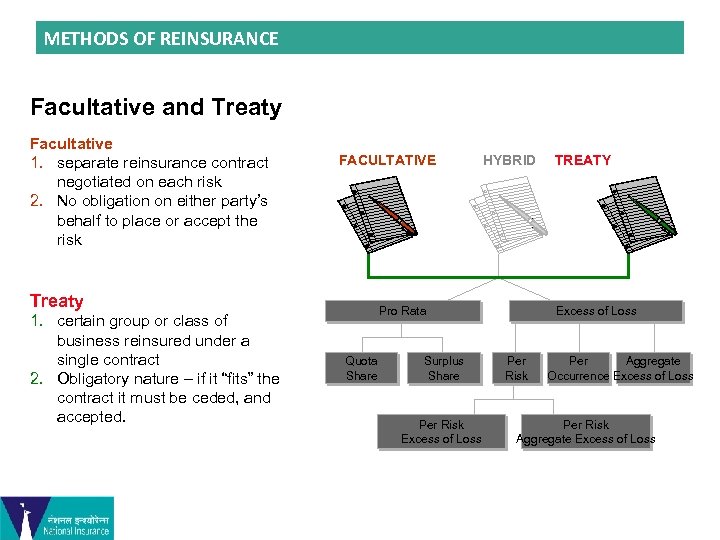

METHODS OF REINSURANCE Facultative and Treaty Facultative 1. separate reinsurance contract negotiated on each risk 2. No obligation on either party’s behalf to place or accept the risk FACULTATIVE Treaty 1. certain group or class of business reinsured under a single contract 2. Obligatory nature – if it “fits” the contract it must be ceded, and accepted. HYBRID Pro Rata Quota Share Surplus Share Per Risk Excess of Loss TREATY Excess of Loss Per Risk Per Aggregate Occurrence Excess of Loss Per Risk Aggregate Excess of Loss

Reasons to Buy Treaty Reinsurance • Spread of risk • Stabilization of underwriting results • Catastrophe relief (one occurrence affecting multiple policies, i. e. , Hud-hud, J&K Flood Loss) • Underwriting assistance • Premium capacity • Ease of use

Reasons to Buy Fac Reinsurance • Large line capacity • Treaty-excluded business • Treaty protection • Accommodation for a good agent or insured • Catastrophe (a large loss affects one policy versus five) • Underwriting expertise • Flexibility

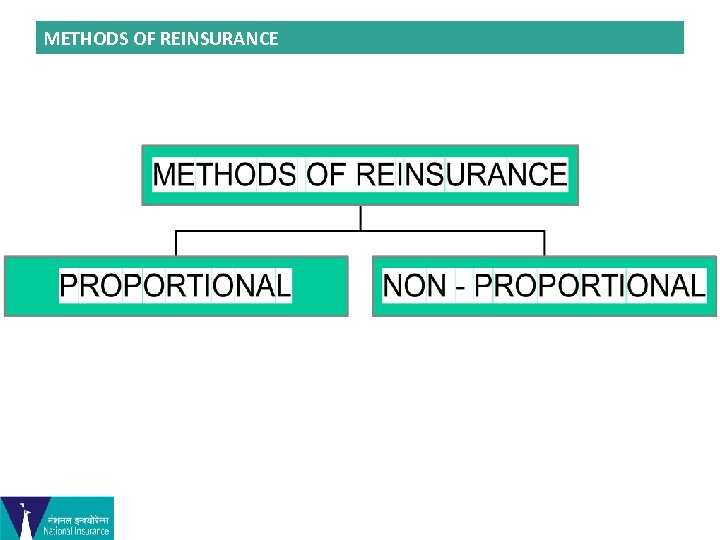

METHODS OF REINSURANCE

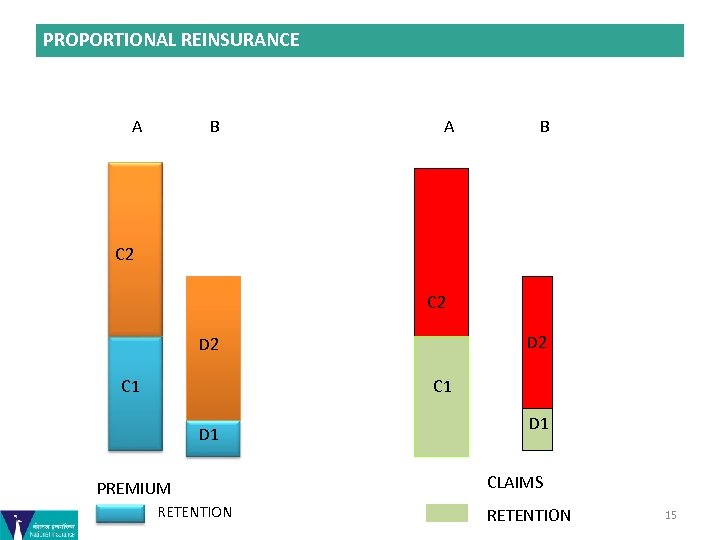

METHODS OF REINSURANCE – PROPORTIONAL Premiums and claims are shared in the same proportion between the insurer and the reinsurer. The reinsurer accepts a fixed share of the claims of the insurer.

METHODS OF REINSURANCE – PROPORTIONAL Example : Proportional Reinsurance A accepts an insurance for Rs. 100, 000 A cedes Rs. 70, 000 or 70% to Reinsurer B B accepts 70% of the liability B received 70% of premium If a claim of Say Rs. 1000 arises, B will pay to A his 70% share = Rs. 700

PROPORTIONAL REINSURANCE A B C 2 D 2 C 1 D 1 PREMIUM RETENTION D 1 CLAIMS RETENTION 15

REINSURANCE – FOR CAPACITY WHAT IS CAPACITY ? + Net Retention + Obligatory Cession + Pool – if any + Inter-company cession – if any + Company’s Surplus Treaty (ies)

RETENTION The retention is the amount that the insurance company can put at stake for its own account when underwriting a single risk or a group of risks.

RETENTION An amount expressed either in S. I. or PML applied on the S. I. or PML of the risk to arrive at the percentage of the risk retained.

RETENTION In practice insurance companies prefer to follow the empirical rule of fixing retention between 1 – 5% of the capital and free reserve, depending on portfolio experience and expected cost for the net protection, etc.

RETENTION – GRADING DOWN Having fixed the maximum retention the same may be graded down depending upon the adverse features of the risk.

REINSURANCE - TREATY What is a Treaty : “A treaty is an agreement invariably (though not necessarily) in writing between a ceding company and one or more reinsurers, whereby the ceding company agrees to cede and reinsuer agrees to accept all the risks written by the ceding company which fall within the terms of the treaty, subject to the limits specified therein” - R. L. Carter

REINSURANCE - TREATY Quota Share : A fixed proportion of all risks accepted by the insurer are ceded to the reinsurer. Surplus : Only amounts accepted by the primary insurer above its own retention are ceded to the reinsurer. Facultative : Facultative means optional. The reinsurer is free to accept or decline each risk, the reinsured is also not compelled to cede. No obligation on either side.

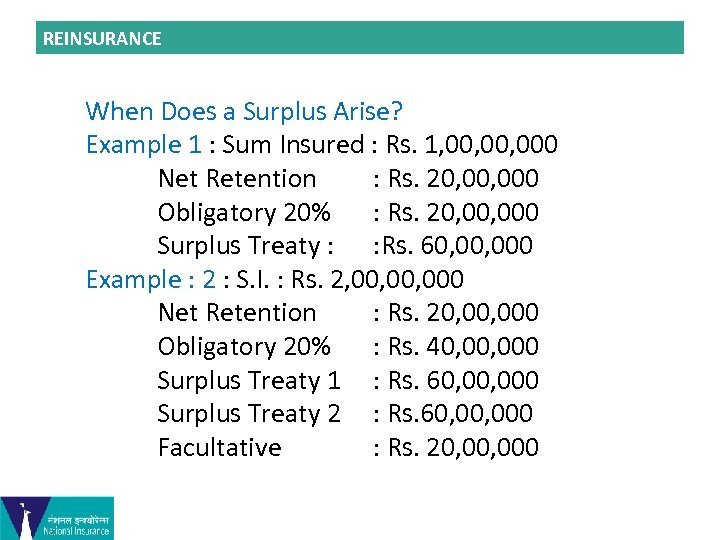

REINSURANCE When Does a Surplus Arise? Example 1 : Sum Insured : Rs. 1, 00, 000 Net Retention : Rs. 20, 000 Obligatory 20% : Rs. 20, 000 Surplus Treaty : : Rs. 60, 000 Example : 2 : S. I. : Rs. 2, 00, 000 Net Retention : Rs. 20, 000 Obligatory 20% : Rs. 40, 000 Surplus Treaty 1 : Rs. 60, 000 Surplus Treaty 2 : Rs. 60, 000 Facultative : Rs. 20, 000

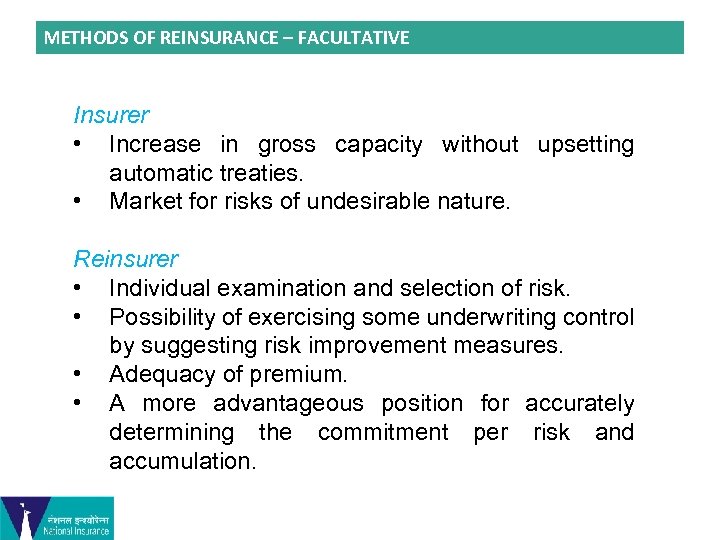

METHODS OF REINSURANCE – FACULTATIVE Insurer • Increase in gross capacity without upsetting automatic treaties. • Market for risks of undesirable nature. Reinsurer • Individual examination and selection of risk. • Possibility of exercising some underwriting control by suggesting risk improvement measures. • Adequacy of premium. • A more advantageous position for accurately determining the commitment per risk and accumulation.

METHODS OF REINSURANCE – FACULTATIVE • • • First Type Of Reinsurance Of Individual Risk. Underwritten In The Same Way As Insurance (Original Rates, Terms & Conditions).

METHODS OF REINSURANCE – FACULTATIVE Extensively used in : Large property and engineering risk. Aviation. Liability. Oil & energy. Any new type of business.

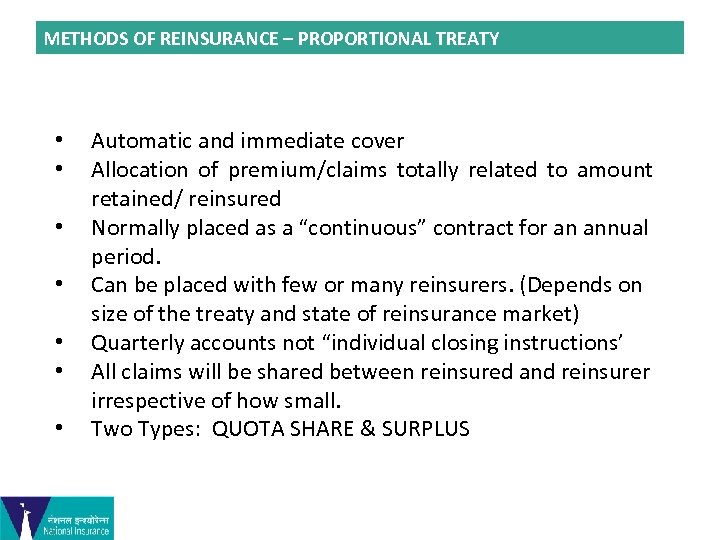

METHODS OF REINSURANCE – PROPORTIONAL TREATY • • Automatic and immediate cover Allocation of premium/claims totally related to amount retained/ reinsured Normally placed as a “continuous” contract for an annual period. Can be placed with few or many reinsurers. (Depends on size of the treaty and state of reinsurance market) Quarterly accounts not “individual closing instructions’ All claims will be shared between reinsured and reinsurer irrespective of how small. Two Types: QUOTA SHARE & SURPLUS

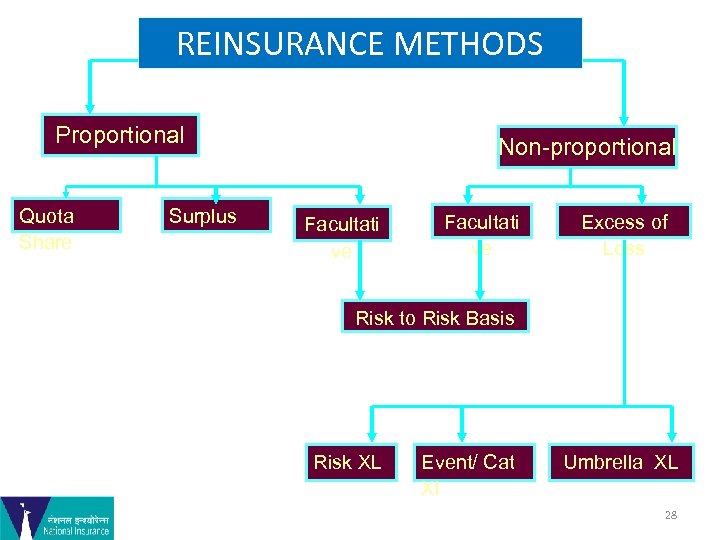

REINSURANCE METHODS Proportional Quota Share Surplus Non-proportional Facultati ve Excess of Loss Risk to Risk Basis Risk XL Event/ Cat Xl Umbrella XL 28

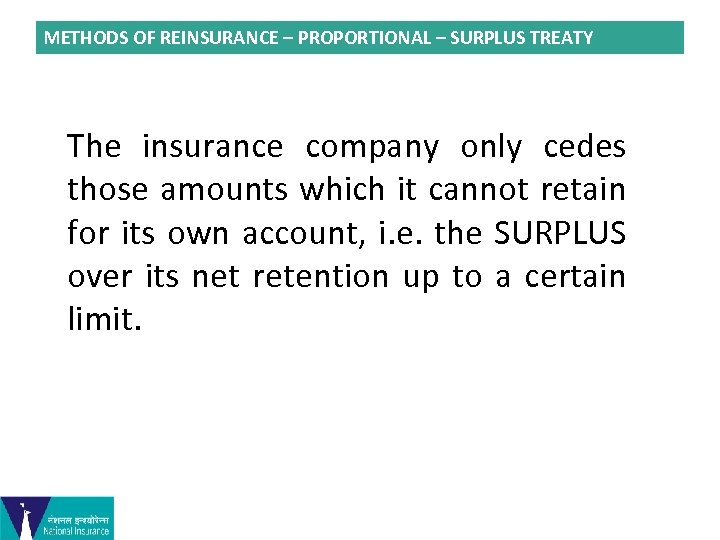

METHODS OF REINSURANCE – PROPORTIONAL – SURPLUS TREATY The insurance company only cedes those amounts which it cannot retain for its own account, i. e. the SURPLUS over its net retention up to a certain limit.

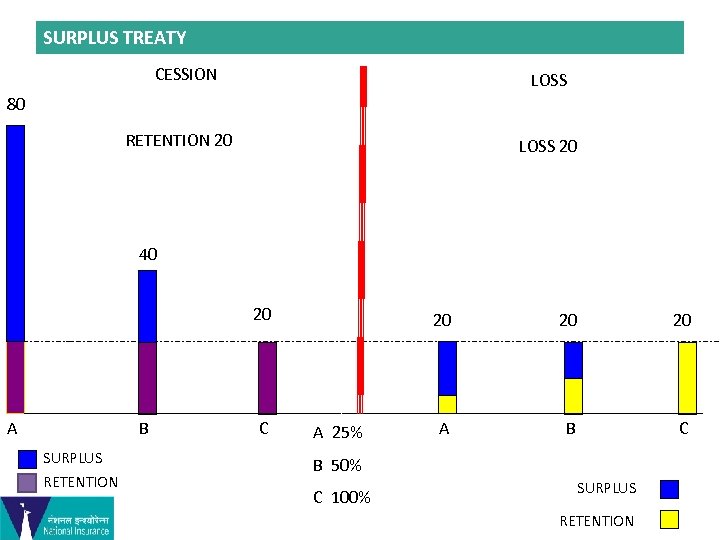

SURPLUS TREATY CESSION LOSS 80 RETENTION 20 LOSS 20 40 20 A B SURPLUS RETENTION C 20 A 25% 20 20 A B C B 50% C 100% SURPLUS RETENTION 30

PROPORTIONAL REINSURANCE SURPLUS TREATY A SURPLUS TREATY IS USUALLY ARRANGED IN TERMS OF LINES THERE MAY BE MORE THAN ONE SURPLUS TREATY IN A PARTICULAR CLASS OF BUSINESS

METHODS OF REINSURANCE – PROPORTIONAL – SURPLUS TREATY • • Is used by Cedant to obtain automatic underwriting capacity, enabling Cedant to compete in chosen market There must be a mutual understanding between Cedant and Reinsurers as to structure, content and original rating of the business ceded to Surplus Cedant decides the limit of liability it wishes to retain on anyone risk or class of risks. This limit - the retention - will be the maximum which Cedant retains - a lesser amount may be retained if desired. The surplus amount over and above the retention is allotted to Surplus Reinsurers

METHODS OF REINSURANCE – PROPORTIONAL – SURPLUS TREATY Obligatory Treaty Maximum Retention and Structure Full Use of Capacity Partial Use of Capacity Treaty Line

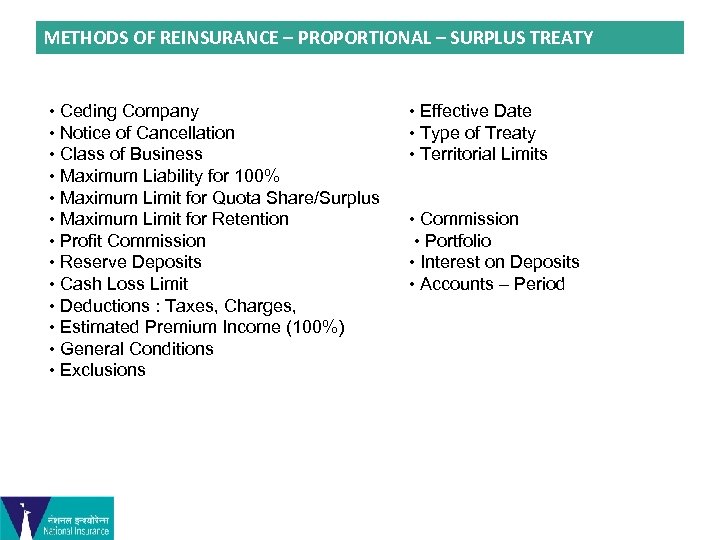

METHODS OF REINSURANCE – PROPORTIONAL – SURPLUS TREATY • Ceding Company • Notice of Cancellation • Class of Business • Maximum Liability for 100% • Maximum Limit for Quota Share/Surplus • Maximum Limit for Retention • Profit Commission • Reserve Deposits • Cash Loss Limit • Deductions : Taxes, Charges, • Estimated Premium Income (100%) • General Conditions • Exclusions • Effective Date • Type of Treaty • Territorial Limits • Commission • Portfolio • Interest on Deposits • Accounts – Period

METHODS OF REINSURANCE – PROPORTIONAL – QUOTA SHARE TREATY • • • Is an automatic reinsurance whereby the Cedant is bound to cede a fixed percentage of every risk written by it in an agreed class of business. The same percentage of every risk in the class of business covered is reinsured - No matter how large or small the sum insured and irrespective of whether the risk is “good” or “bad”. Premiums and claims are subject to same percentage

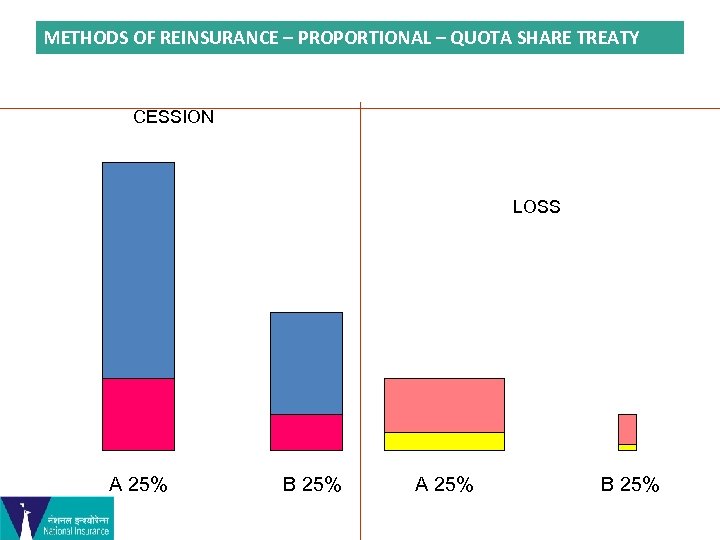

METHODS OF REINSURANCE – PROPORTIONAL – QUOTA SHARE TREATY CESSION LOSS A 25% B 25%

METHODS OF REINSURANCE – PROPORTIONAL – QUOTA SHARE TREATY ADVANTAGES Reinsurer participates on each and every risk – useful for new company or a new class of business Very little administrative work DISADVANTAGES Gives away profitable business which otherwise could have been retained by the company.

METHODS OF REINSURANCE – PROPORTIONAL – QUOTA SHARE TREATY Obligatory Treaty Fixed Retention % Fixed Cession %

METHODS OF REINSURANCE – NON-PROPORTIONAL While proportional treaty offers capacity in addition to the retention on individual risks, the reinsured should be concerned if an event loss ( where a number of policies are involved) causes a substantial loss on its net account.

METHODS OF REINSURANCE – NON-PROPORTIONAL Premiums and claims are not shared in the same proportion between the insurer and the reinsurer. The reinsurer only becomes liable if the claims incurred by the insurer exceeds some predetermined figure

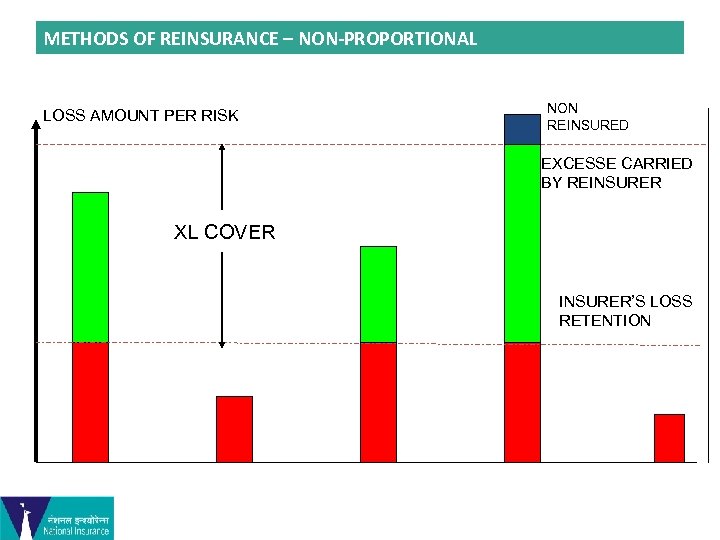

METHODS OF REINSURANCE – NON-PROPORTIONAL LOSS AMOUNT PER RISK NON REINSURED EXCESSE CARRIED BY REINSURER XL COVER INSURER’S LOSS RETENTION

METHODS OF REINSURANCE – NON-PROPORTIONAL REFERS MOSTLY TO Non proportional treaties known as excess of loss (xl) treaties CAN ALSO BE FACULTATIVE

METHODS OF REINSURANCE – NON-PROPORTIONAL FACULTATIVE • • First type of reinsurance conceived Reinsurance of an individual risk Both sides free to decide Reduces individual peak exposure & Element of uncertainty • Administration - cumbersome and Expensive

METHODS OF REINSURANCE – NON-PROPORTIONAL - TREATIES Non-Proportional Contracts are called Excess of Loss Contracts (XL) • A Accepts an insurance for Rs. 100, 000 • A takes out a reinsurance with B should the risk suffer a loss exceeding Rs. 30, 000 up to Rs. 100, 000. Scenario 1 : In the event of a claim upto Rs. 30, 000. B pays nil Scenario 2 : If the loss is for Rs. 40, 000 B pays 40, 000 – Rs. 30, 000 = Rs. 10, 000

METHODS OF REINSURANCE – NON-PROPORTIONAL - TREATIES EXCESS OF LOSS TREATIES CAN BE PER RISK or PER EVENT

NON PROPORTIONAL REINSURANCE PER EVENT C OVER Also known as catastrophe XL (CAT XL) cover as it protects the insurer against the accumulations resulting from numerous losses caused by the same event ( cyclone, earthquake, conflagration )

EXCESS OF LOSS TREATY It can be arranged in • Risk XL • Cat XL • Stop Loss/Aggregate XL This protection is basically arranged for any company’s net A/c exposure – it can be on Risk Attaching or Loss occurring during the period.

GENERAL CHARACTERISTICS OF TREATY All treaties, whether proportional or non proportional • • Are obligatory on both sides Are automatic in nature Have a limit Are annual contracts

CO- INSURANCE By coinsurance whereby one insurer shares direct responsibility of a risk with one or more insurer. This may be adopted for one or two risks but not practicable for thousands of risks underwritten by an insurer.

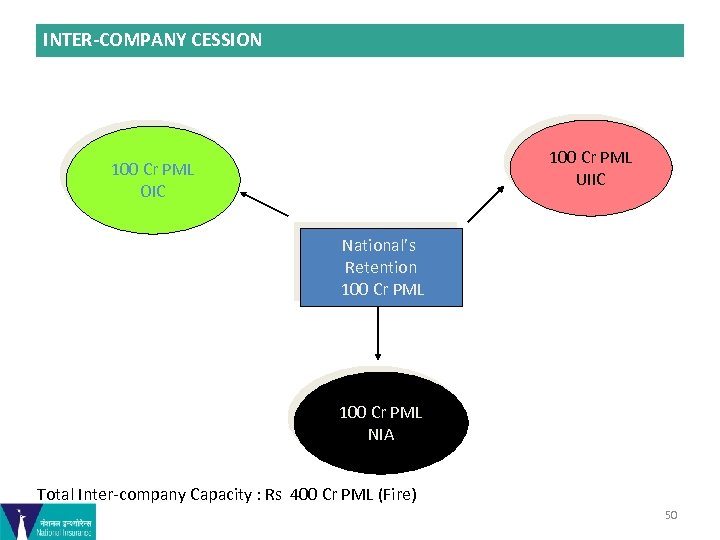

INTER-COMPANY CESSION 100 Cr PML UIIC 100 Cr PML OIC National’s Retention 100 Cr PML NIA Total Inter-company Capacity : Rs 400 Cr PML (Fire) 50

LET US LEARN Quota Share Example

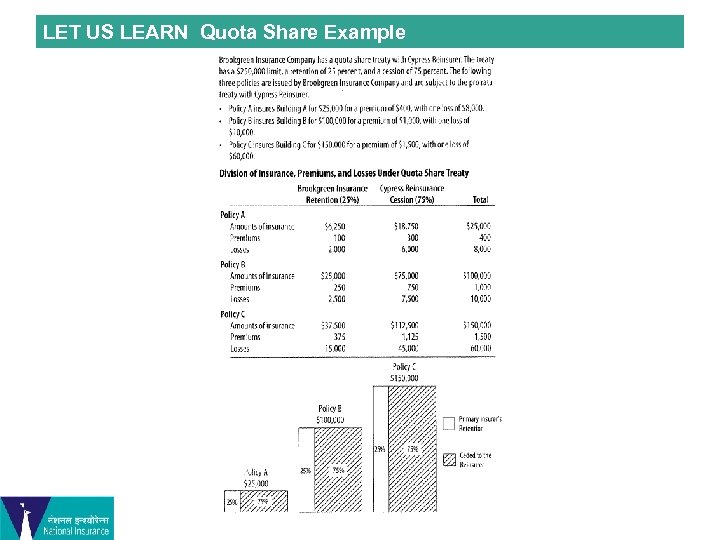

LET US LEARN Quota Share Example

LET US LEARN Surplus Share Example

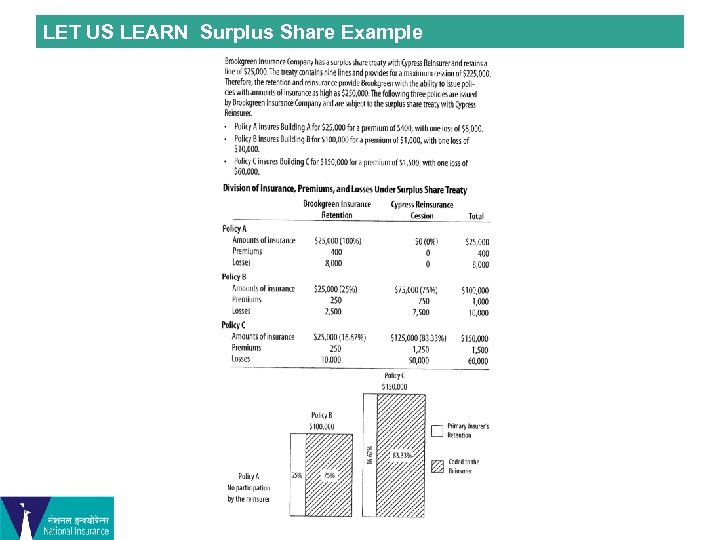

LET US LEARN Surplus Share Example

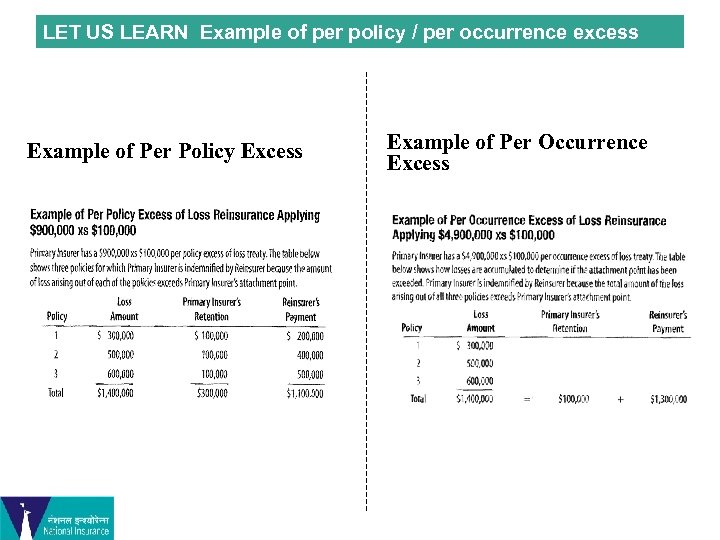

LET US LEARN Example of per policy / per occurrence excess Example of Per Policy Excess Example of Per Occurrence Excess

LET US LEARN CAT XL Example

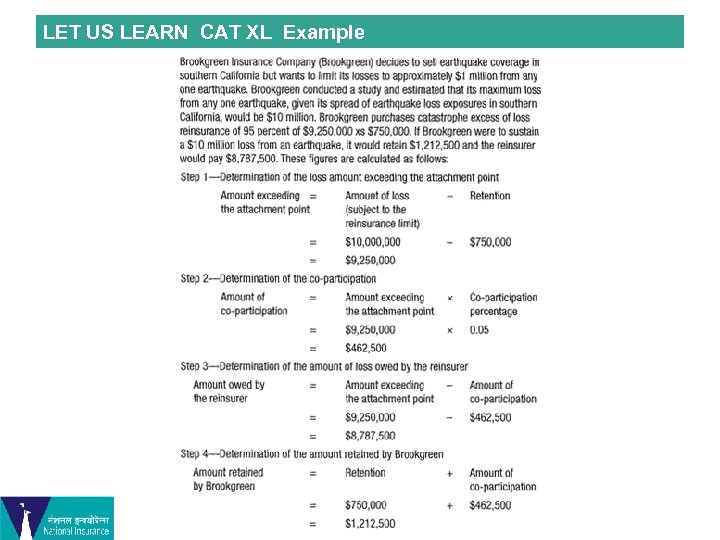

LET US LEARN CAT XL Example

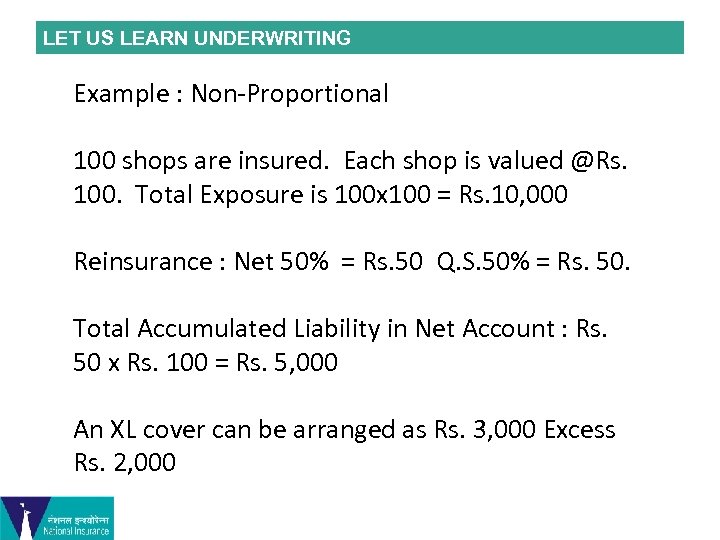

LET US LEARN UNDERWRITING Example : Non-Proportional 100 shops are insured. Each shop is valued @Rs. 100. Total Exposure is 100 x 100 = Rs. 10, 000 Reinsurance : Net 50% = Rs. 50 Q. S. 50% = Rs. 50. Total Accumulated Liability in Net Account : Rs. 50 x Rs. 100 = Rs. 5, 000 An XL cover can be arranged as Rs. 3, 000 Excess Rs. 2, 000

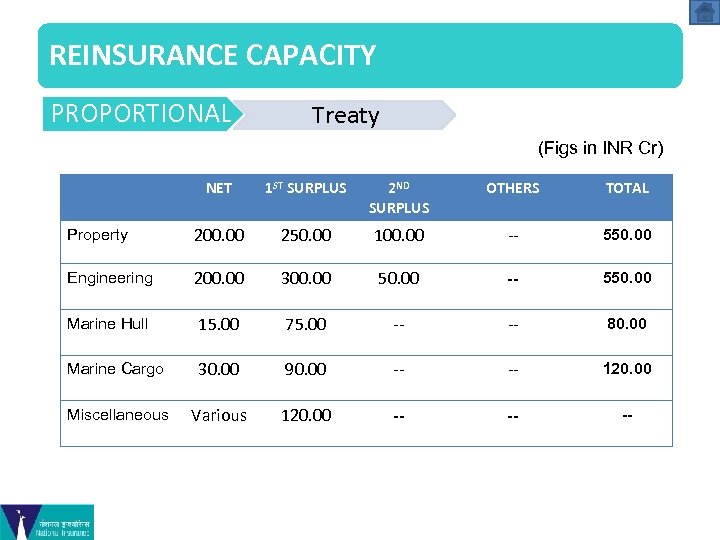

REINSURANCE CAPACITY PROPORTIONAL Treaty (Figs in INR Cr) NET 1 ST SURPLUS 2 ND SURPLUS OTHERS TOTAL Property 200. 00 250. 00 100. 00 -- 550. 00 Engineering 200. 00 300. 00 50. 00 -- 550. 00 Marine Hull 15. 00 75. 00 -- -- 80. 00 Marine Cargo 30. 00 90. 00 -- -- 120. 00 Miscellaneous Various 120. 00 -- -- --

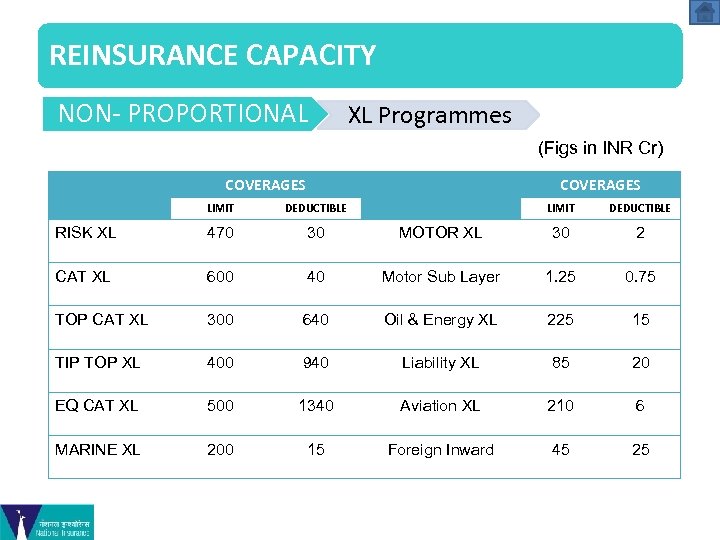

REINSURANCE CAPACITY NON- PROPORTIONAL XL Programmes (Figs in INR Cr) COVERAGES LIMIT DEDUCTIBLE RISK XL 470 30 MOTOR XL 30 2 CAT XL 600 40 Motor Sub Layer 1. 25 0. 75 TOP CAT XL 300 640 Oil & Energy XL 225 15 TIP TOP XL 400 940 Liability XL 85 20 EQ CAT XL 500 1340 Aviation XL 210 6 MARINE XL 200 15 Foreign Inward 45 25

THANK YOU

479701276c5954dea24a4989d7dedf71.ppt