91511084874fb5deffcccb31524e6ce0.ppt

- Количество слайдов: 108

REINSURANCE, THEORY PRACTICE & DESIGN PRESENTER: S GWASIRA – FIISA, AIRMSA

REINSURANCE, THEORY PRACTICE & DESIGN PRESENTER: S GWASIRA – FIISA, AIRMSA

Baobab Reinsurance Baobab Re offers the following capacities Fire US$ 20 Million Engineering US$ 10. 5 Million All Accident classes US$ 3 Million Marine Hull US$ 1. 5 Million Marine Cargo US$ 1. 5 Million Fire Treaty US$ 3 Million Engineering US$ 1. 5 Million Contacts treaties@baobabre. co. zw facultative@baobabre. co. zw riskmanagement@baobabre. co. zw

Baobab Reinsurance Baobab Re offers the following capacities Fire US$ 20 Million Engineering US$ 10. 5 Million All Accident classes US$ 3 Million Marine Hull US$ 1. 5 Million Marine Cargo US$ 1. 5 Million Fire Treaty US$ 3 Million Engineering US$ 1. 5 Million Contacts treaties@baobabre. co. zw facultative@baobabre. co. zw riskmanagement@baobabre. co. zw

Alternative Risk Transfer (ART) Products designed to offer risk solutions outside conventional insurance / reinsurance models. According to Guy Carpenter, these now account for 17% of Global Reinsurance capital i. e $ 68 Billion as @ 31/12/2015. Alternative carriers – Self insurance, Captives (insurance companies owned by parent), Pools (government entities or insurance companies grouping to provide coverage for certain risks). Alternative products – Finite risks (seek to reduce year to year volatility associated with commercial insurance policies) Contingent capital (transfer of cat risks to capital mkt via a bond issue) Weather derivatives (mitigate earnings volatility associated with weather changes) Credit securitisation (hedging against credit risks).

Alternative Risk Transfer (ART) Products designed to offer risk solutions outside conventional insurance / reinsurance models. According to Guy Carpenter, these now account for 17% of Global Reinsurance capital i. e $ 68 Billion as @ 31/12/2015. Alternative carriers – Self insurance, Captives (insurance companies owned by parent), Pools (government entities or insurance companies grouping to provide coverage for certain risks). Alternative products – Finite risks (seek to reduce year to year volatility associated with commercial insurance policies) Contingent capital (transfer of cat risks to capital mkt via a bond issue) Weather derivatives (mitigate earnings volatility associated with weather changes) Credit securitisation (hedging against credit risks).

CONTENT Reinsurance Language Functions Of Reinsurance Major Types Of Reinsurance (Facultative &Treaty ) Risk Measurement (EML, PML, MPL Application) Reinsurance Program Design Conclusion / Question & Answer

CONTENT Reinsurance Language Functions Of Reinsurance Major Types Of Reinsurance (Facultative &Treaty ) Risk Measurement (EML, PML, MPL Application) Reinsurance Program Design Conclusion / Question & Answer

REINSURANCE LANGUAGE Insurance Reinsurer Reinsurance Direct Writer/ Cedant / Primary Insurer Retrocession – Retrocedant – Retrocessionaire Retention Limit Insurance Vs Reinsurance

REINSURANCE LANGUAGE Insurance Reinsurer Reinsurance Direct Writer/ Cedant / Primary Insurer Retrocession – Retrocedant – Retrocessionaire Retention Limit Insurance Vs Reinsurance

REINSURANCE LANGUAGE The insurer insures the individual or the corporation.

REINSURANCE LANGUAGE The insurer insures the individual or the corporation.

REINSURANCE LANGUAGE Reinsurer THE REINSURER INSURES THE INSURANCE COMPANY Robert Kiln, Reinsurance Practice, 3 rd Edition

REINSURANCE LANGUAGE Reinsurer THE REINSURER INSURES THE INSURANCE COMPANY Robert Kiln, Reinsurance Practice, 3 rd Edition

REINSURANCE LANGUAGE Reinsurance definition “…Reinsurance is insurance of insurers. It is an agreement between an “… insurer and a reinsurer. Reinsurer agrees to indemnify all or part of loss which the ceding company may incur under certain policies of insurance that it has issued. In turn the cedant pays a consideration, typically a premium and discloses information needed to asses, price and manage risks covered by the reinsurance contract.

REINSURANCE LANGUAGE Reinsurance definition “…Reinsurance is insurance of insurers. It is an agreement between an “… insurer and a reinsurer. Reinsurer agrees to indemnify all or part of loss which the ceding company may incur under certain policies of insurance that it has issued. In turn the cedant pays a consideration, typically a premium and discloses information needed to asses, price and manage risks covered by the reinsurance contract.

REINSURANCE LANGUAGE Direct writer / cedant The insurance company Retrocession Transfer of risk from a reinsurer (retrocedant) to another reinsurer (retrocessionaire). Retention limit The amount of risk that cedant / insurance company keeps for its net account.

REINSURANCE LANGUAGE Direct writer / cedant The insurance company Retrocession Transfer of risk from a reinsurer (retrocedant) to another reinsurer (retrocessionaire). Retention limit The amount of risk that cedant / insurance company keeps for its net account.

FUNCTIONS OF REINSURANCE WHAT ARE THE FUNCTIONS?

FUNCTIONS OF REINSURANCE WHAT ARE THE FUNCTIONS?

FUNCTIONS OF REINSURANCE • Capacity • Stabilisation of underwriting results • Catastrophe protection • Surplus / capital relief • Underwriting expertise • Withdrawal from a territory or line of business • Risk spreading

FUNCTIONS OF REINSURANCE • Capacity • Stabilisation of underwriting results • Catastrophe protection • Surplus / capital relief • Underwriting expertise • Withdrawal from a territory or line of business • Risk spreading

LIMITATIONS OF REINSURANCE • WILL NOT MAKE BAD BUSINESS PROFITABLE • TRANSACTION COSTS INVOLVED

LIMITATIONS OF REINSURANCE • WILL NOT MAKE BAD BUSINESS PROFITABLE • TRANSACTION COSTS INVOLVED

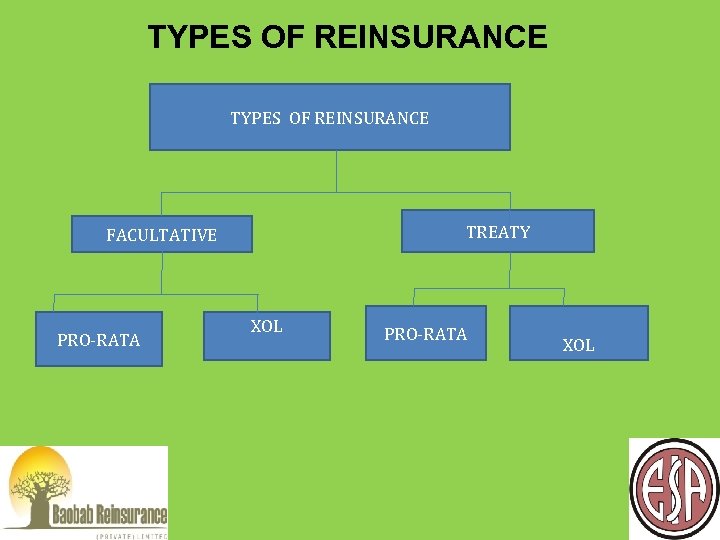

TYPES OF REINSURANCE TREATY FACULTATIVE PRO-RATA XOL

TYPES OF REINSURANCE TREATY FACULTATIVE PRO-RATA XOL

![FACULTATIVE A Facultative reinsurance]. . Is one in which each party to the transaction FACULTATIVE A Facultative reinsurance]. . Is one in which each party to the transaction](https://present5.com/presentation/91511084874fb5deffcccb31524e6ce0/image-14.jpg) FACULTATIVE A Facultative reinsurance]. . Is one in which each party to the transaction has absolute free choice in arranging the matter; the ceding company may choose, and the reinsurer has an entirely unfettered discretion (faculty) whether or not to accept any risk offered. It follows that each risk to be reinsured has to be dealt with separately and each facultative reinsurance forms a complete reinsurance contract in itself” The Law and Practice of Reinsurance - C. E. Golding

FACULTATIVE A Facultative reinsurance]. . Is one in which each party to the transaction has absolute free choice in arranging the matter; the ceding company may choose, and the reinsurer has an entirely unfettered discretion (faculty) whether or not to accept any risk offered. It follows that each risk to be reinsured has to be dealt with separately and each facultative reinsurance forms a complete reinsurance contract in itself” The Law and Practice of Reinsurance - C. E. Golding

FACULTATIVE The two basic features of the facultative method of handling reinsurances are: (1) Its optional character, with the ceding insurer and the prospective reinsurer being free respectively to offer or reject the reinsurance; and (2) Its use for placing individual risks’. Reinsurance (2 nd Edition) - R. L. Carter Facultative reinsurance can be written on either a pro rata or excess of loss basis. Premium and losses are shared in predetermined proportions. Requires disclosure of all material facts relating to risk being placed.

FACULTATIVE The two basic features of the facultative method of handling reinsurances are: (1) Its optional character, with the ceding insurer and the prospective reinsurer being free respectively to offer or reject the reinsurance; and (2) Its use for placing individual risks’. Reinsurance (2 nd Edition) - R. L. Carter Facultative reinsurance can be written on either a pro rata or excess of loss basis. Premium and losses are shared in predetermined proportions. Requires disclosure of all material facts relating to risk being placed.

FACULTATIVE Needs met by Facultative • Capacity is one of the best known reasons to buy facultative reinsurance. • Allows the underwriter to write or retain those accounts where additional capacity in excess of their net and treaty limits is needed to secure the order. • Acceptance of risks, though not excluded from the treaty but represent increased exposure and could distort treaty results. • Acceptance of tailor made policies (New products) for preferential clients that fall outside standard conditions owing to size and complexity. • Market conditions or geographic expansion may lead to a decision to entertain a new line of business. A partnership with a facultative reinsurer who has had the experience in the line can be a safe and cost effective investment to protect the company from unpredictable or large losses during the development and learning period.

FACULTATIVE Needs met by Facultative • Capacity is one of the best known reasons to buy facultative reinsurance. • Allows the underwriter to write or retain those accounts where additional capacity in excess of their net and treaty limits is needed to secure the order. • Acceptance of risks, though not excluded from the treaty but represent increased exposure and could distort treaty results. • Acceptance of tailor made policies (New products) for preferential clients that fall outside standard conditions owing to size and complexity. • Market conditions or geographic expansion may lead to a decision to entertain a new line of business. A partnership with a facultative reinsurer who has had the experience in the line can be a safe and cost effective investment to protect the company from unpredictable or large losses during the development and learning period.

FACULTATIVE Needs met by Facultative • Non availability of specific protection under a treaty or small number of policies issued by cedant which does not warrant treaty arrangement. • Acceptance of risks excluded from treaty eg geographical location, nature of business, perils etc. • Withdrawal from certain territory or line of business.

FACULTATIVE Needs met by Facultative • Non availability of specific protection under a treaty or small number of policies issued by cedant which does not warrant treaty arrangement. • Acceptance of risks excluded from treaty eg geographical location, nature of business, perils etc. • Withdrawal from certain territory or line of business.

FACULTATIVE Needs met by Facultative Alternative use of capital. The underwriter can choose the layer where it is more advantageous to use the company’s capacity. As an example, if the company’s capacity is US$ 5 million and the required limits are US$10 million, he or she can choose to use the company’s capacity by keeping the first million in-house and buying facultative reinsurance in the layer believed to have a more catastrophic potential. Then the underwriter can use the remaining net and treaty capacity in the next layer, which is considered to have less potential for a catastrophic loss to complete the required limits. For example $First million = ceding company $5 million xs $1 million = facultative reinsurer $4 million xs $6 million = ceding company

FACULTATIVE Needs met by Facultative Alternative use of capital. The underwriter can choose the layer where it is more advantageous to use the company’s capacity. As an example, if the company’s capacity is US$ 5 million and the required limits are US$10 million, he or she can choose to use the company’s capacity by keeping the first million in-house and buying facultative reinsurance in the layer believed to have a more catastrophic potential. Then the underwriter can use the remaining net and treaty capacity in the next layer, which is considered to have less potential for a catastrophic loss to complete the required limits. For example $First million = ceding company $5 million xs $1 million = facultative reinsurer $4 million xs $6 million = ceding company

FACULTATIVE Increases underwriting capacity. Advantages Allows flexibility of cedant’s underwriting policy. Good protection against frequency/severity potential. Protection of net retention on first dollar basis. Permits recovery on smaller losses. Provides access to reinsurer’s experience on specific types of risks or cover. Cedant is able to ascertain reinsurer’s level of response and service.

FACULTATIVE Increases underwriting capacity. Advantages Allows flexibility of cedant’s underwriting policy. Good protection against frequency/severity potential. Protection of net retention on first dollar basis. Permits recovery on smaller losses. Provides access to reinsurer’s experience on specific types of risks or cover. Cedant is able to ascertain reinsurer’s level of response and service.

FACULTATIVE Disadvantages Administratively cumbersome as each risk has to be placed individually. Time consuming and acceptances may not be obtained within the required time frames. The Error Factor inherent in hasty facultative placements. Cover can not be confirmed until Reinsurance placement has been confirmed (faculty). Lower commission levels available as compared to those offered under treaties (proportional).

FACULTATIVE Disadvantages Administratively cumbersome as each risk has to be placed individually. Time consuming and acceptances may not be obtained within the required time frames. The Error Factor inherent in hasty facultative placements. Cover can not be confirmed until Reinsurance placement has been confirmed (faculty). Lower commission levels available as compared to those offered under treaties (proportional).

FACULTATIVE EXCESS OF LOSS/NON PROP A term describing a reinsurance transaction that, subject to a specified limit, indemnifies a ceding company against the amount of loss in excess of a specified retention Advantages Good protection against frequency/severity potential depending upon the retention size Allows a greater net premium retention More economical in terms of reinsurance premium and the cost of administration

FACULTATIVE EXCESS OF LOSS/NON PROP A term describing a reinsurance transaction that, subject to a specified limit, indemnifies a ceding company against the amount of loss in excess of a specified retention Advantages Good protection against frequency/severity potential depending upon the retention size Allows a greater net premium retention More economical in terms of reinsurance premium and the cost of administration

FACULTATIVE Underwriting Considerations? Fire Risk Engineering

FACULTATIVE Underwriting Considerations? Fire Risk Engineering

Conclusion FACULTATIVE Facultative reinsurance is the oldest form of reinsurance. It is the offer from one insurer to another / reinsurer to accept part of an individual risk. The reinsurer reserves the right (faculty) to accept, decline or offer alternative terms. Time consuming and expensive. A reinsurer reserves the right to accept or decline ex-gratia request (s), any form of ex-gratia payment has to be in concurrence.

Conclusion FACULTATIVE Facultative reinsurance is the oldest form of reinsurance. It is the offer from one insurer to another / reinsurer to accept part of an individual risk. The reinsurer reserves the right (faculty) to accept, decline or offer alternative terms. Time consuming and expensive. A reinsurer reserves the right to accept or decline ex-gratia request (s), any form of ex-gratia payment has to be in concurrence.

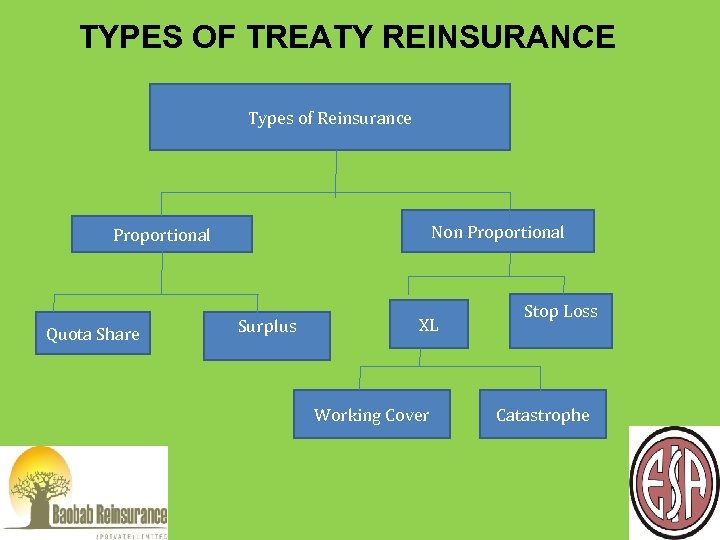

TYPES OF TREATY REINSURANCE Types of Reinsurance Non Proportional Quota Share Surplus XL Working Cover Stop Loss Catastrophe

TYPES OF TREATY REINSURANCE Types of Reinsurance Non Proportional Quota Share Surplus XL Working Cover Stop Loss Catastrophe

TREATY REINSURANCE An automatic agreement between the cedant and the reinsurer by which the reinsurer is bound to accept all risks ceded to it. Cessions to treaty do not require negotiation provided that the risk falls within the class of business and limits covered by the treaty. There are two forms of treaty reinsurance (1)Proportional Treaty • Quota share • Surplus • Facultative Obligatory / Automatic facultative (2)Non Proportional Treaty • Working / Single Risk XL • Catastrophe XL • Stop Loss / Aggregate XL

TREATY REINSURANCE An automatic agreement between the cedant and the reinsurer by which the reinsurer is bound to accept all risks ceded to it. Cessions to treaty do not require negotiation provided that the risk falls within the class of business and limits covered by the treaty. There are two forms of treaty reinsurance (1)Proportional Treaty • Quota share • Surplus • Facultative Obligatory / Automatic facultative (2)Non Proportional Treaty • Working / Single Risk XL • Catastrophe XL • Stop Loss / Aggregate XL

TREATY REINSURANCE Proportional Treaty Proportional reinsurance is based on the original sum insured Proportional reinsurance shares liabilities. The proportion in which the liability is shared determines the sharing of premiums and claims. Liability of the reinsurer begins simultaneously with that of the ceding company. Premium received by the reinsurer begins simultaneously with that of the ceding company. Ceding company is paid a reinsurance commission that covers the acquisition costs, premium taxes, and the cost of servicing the business.

TREATY REINSURANCE Proportional Treaty Proportional reinsurance is based on the original sum insured Proportional reinsurance shares liabilities. The proportion in which the liability is shared determines the sharing of premiums and claims. Liability of the reinsurer begins simultaneously with that of the ceding company. Premium received by the reinsurer begins simultaneously with that of the ceding company. Ceding company is paid a reinsurance commission that covers the acquisition costs, premium taxes, and the cost of servicing the business.

QUOTA SHARE REINSURANCE The reinsurer agrees to reinsure a fixed proportion (fixed percentage) of every risk accepted by the ceding company, sharing proportionately in all losses and receiving in return the same proportion of all direct premium, less the agreed reinsurance commission. Reinsurer’s liability is limited by an absolute sum insured. This is called the treaty limit. Up to this sum insured risks are shared between direct insurer and reinsurer according to the percentages agreed.

QUOTA SHARE REINSURANCE The reinsurer agrees to reinsure a fixed proportion (fixed percentage) of every risk accepted by the ceding company, sharing proportionately in all losses and receiving in return the same proportion of all direct premium, less the agreed reinsurance commission. Reinsurer’s liability is limited by an absolute sum insured. This is called the treaty limit. Up to this sum insured risks are shared between direct insurer and reinsurer according to the percentages agreed.

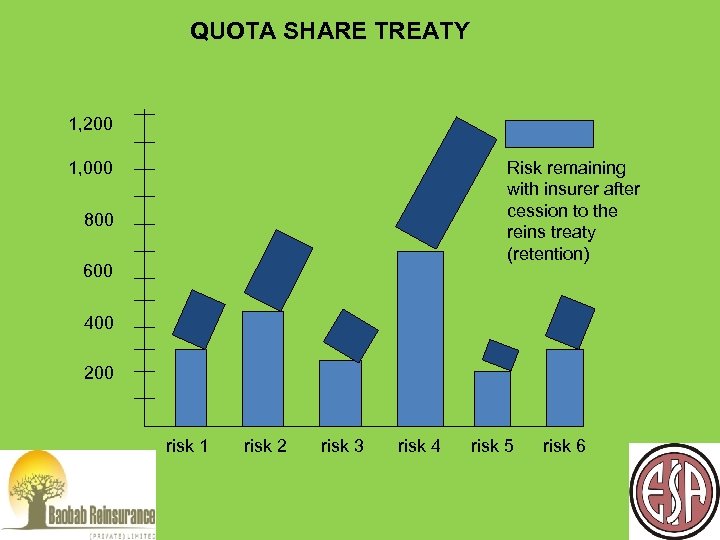

QUOTA SHARE TREATY 1, 200 1, 000 Risk remaining with insurer after cession to the reins treaty (retention) 800 600 400 200 risk 1 risk 2 risk 3 risk 4 risk 5 risk 6

QUOTA SHARE TREATY 1, 200 1, 000 Risk remaining with insurer after cession to the reins treaty (retention) 800 600 400 200 risk 1 risk 2 risk 3 risk 4 risk 5 risk 6

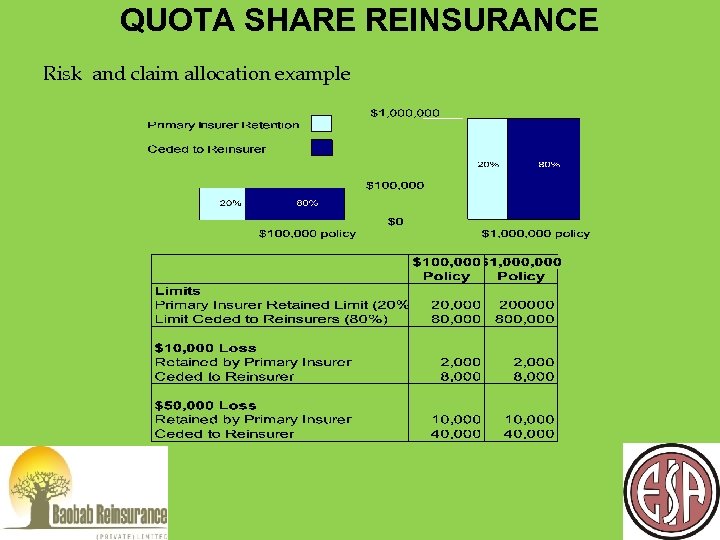

QUOTA SHARE REINSURANCE Risk and claim allocation example

QUOTA SHARE REINSURANCE Risk and claim allocation example

QUOTA SHARE REINSURANCE Provides for: Immediate capital increase. Risk reduction when entering new geographical area or new line of business. Risk spreading. Simplified administration and accounting. Loss recoveries irrespective of size. Major Draw back Cede too much premium away and therefore transfer too much profit to reinsurers.

QUOTA SHARE REINSURANCE Provides for: Immediate capital increase. Risk reduction when entering new geographical area or new line of business. Risk spreading. Simplified administration and accounting. Loss recoveries irrespective of size. Major Draw back Cede too much premium away and therefore transfer too much profit to reinsurers.

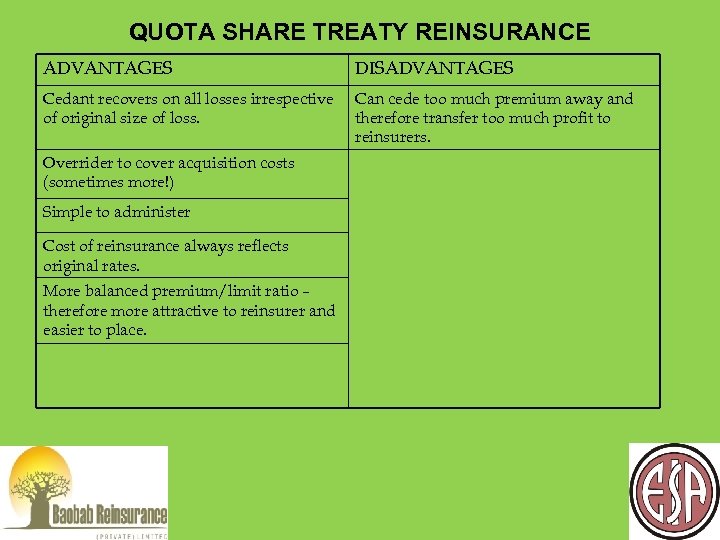

QUOTA SHARE TREATY REINSURANCE ADVANTAGES DISADVANTAGES Cedant recovers on all losses irrespective of original size of loss. Can cede too much premium away and therefore transfer too much profit to reinsurers. Overrider to cover acquisition costs (sometimes more!) Simple to administer Cost of reinsurance always reflects original rates. More balanced premium/limit ratio – therefore more attractive to reinsurer and easier to place.

QUOTA SHARE TREATY REINSURANCE ADVANTAGES DISADVANTAGES Cedant recovers on all losses irrespective of original size of loss. Can cede too much premium away and therefore transfer too much profit to reinsurers. Overrider to cover acquisition costs (sometimes more!) Simple to administer Cost of reinsurance always reflects original rates. More balanced premium/limit ratio – therefore more attractive to reinsurer and easier to place.

SURPLUS TREATY REINSURANCE Reinsurer takes a share of only those risks that exceed the direct insurer’s retention line. This line is expressed as an amount in dollars. Risks with sums insured lower than the direct insurer’s line are not ceded.

SURPLUS TREATY REINSURANCE Reinsurer takes a share of only those risks that exceed the direct insurer’s retention line. This line is expressed as an amount in dollars. Risks with sums insured lower than the direct insurer’s line are not ceded.

SURPLUS TREATY REINSURANCE Percentage or proportions shared depend on retention The line vary by class of business, risk, construction, occupancy and protection (Table of limits). Capacity is expressed as number of lines subject to a maximum dollar amount. The maximum single risk capacity is equal to number of lines plus One. Number of lines and cession Percentages vary by class of risk.

SURPLUS TREATY REINSURANCE Percentage or proportions shared depend on retention The line vary by class of business, risk, construction, occupancy and protection (Table of limits). Capacity is expressed as number of lines subject to a maximum dollar amount. The maximum single risk capacity is equal to number of lines plus One. Number of lines and cession Percentages vary by class of risk.

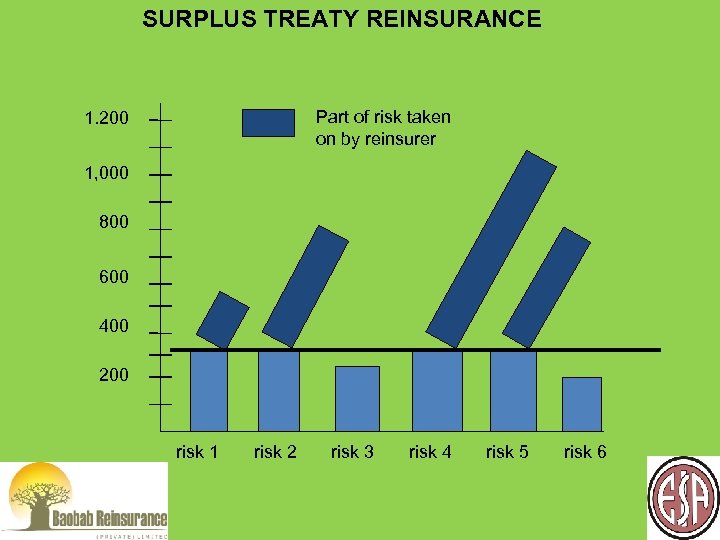

SURPLUS TREATY REINSURANCE Part of risk taken on by reinsurer 1. 200 1, 000 800 600 400 200 risk 1 risk 2 risk 3 risk 4 risk 5 risk 6

SURPLUS TREATY REINSURANCE Part of risk taken on by reinsurer 1. 200 1, 000 800 600 400 200 risk 1 risk 2 risk 3 risk 4 risk 5 risk 6

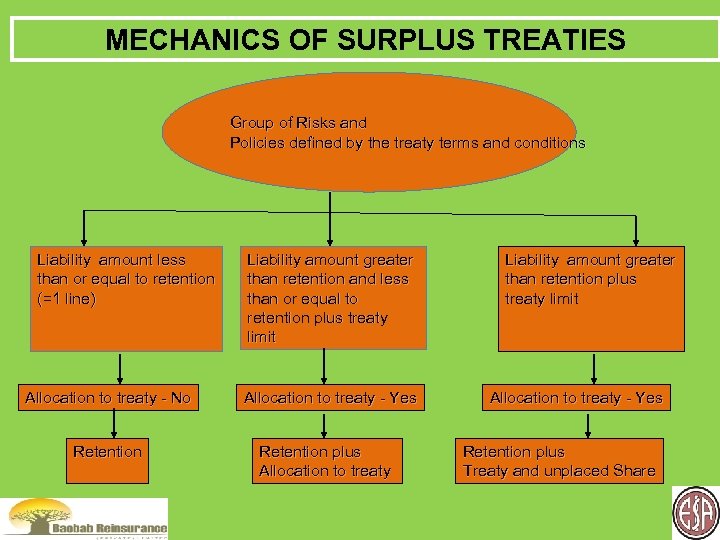

MECHANICS OF SURPLUS TREATIES Group of Risks and Policies defined by the treaty terms and conditions Liability amount less than or equal to retention (=1 line) Allocation to treaty - No Retention Liability amount greater than retention and less than or equal to retention plus treaty limit Allocation to treaty - Yes Retention plus Allocation to treaty Liability amount greater than retention plus treaty limit Allocation to treaty - Yes Retention plus Treaty and unplaced Share

MECHANICS OF SURPLUS TREATIES Group of Risks and Policies defined by the treaty terms and conditions Liability amount less than or equal to retention (=1 line) Allocation to treaty - No Retention Liability amount greater than retention and less than or equal to retention plus treaty limit Allocation to treaty - Yes Retention plus Allocation to treaty Liability amount greater than retention plus treaty limit Allocation to treaty - Yes Retention plus Treaty and unplaced Share

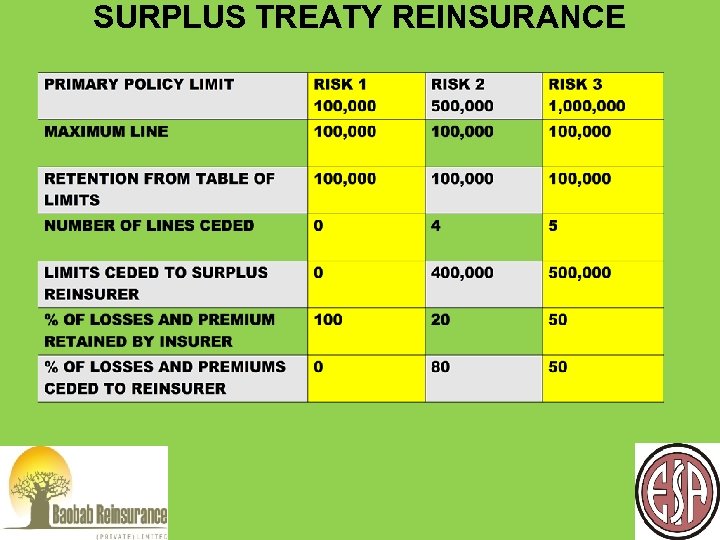

SURPLUS TREATY REINSURANCE

SURPLUS TREATY REINSURANCE

SURPLUS TREATY REINSURANCE Provides for Increased capacity Homogeneity of retained risks Capital / surplus relief Lower impact from large losses Limit the retained risk on volatile lines of business

SURPLUS TREATY REINSURANCE Provides for Increased capacity Homogeneity of retained risks Capital / surplus relief Lower impact from large losses Limit the retained risk on volatile lines of business

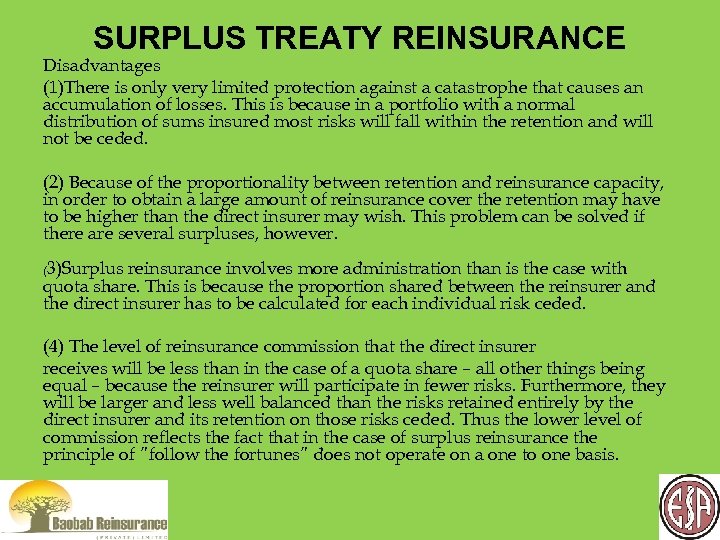

SURPLUS TREATY REINSURANCE Disadvantages (1)There is only very limited protection against a catastrophe that causes an accumulation of losses. This is because in a portfolio with a normal distribution of sums insured most risks will fall within the retention and will not be ceded. (2) Because of the proportionality between retention and reinsurance capacity, in order to obtain a large amount of reinsurance cover the retention may have to be higher than the direct insurer may wish. This problem can be solved if there are several surpluses, however. 3)Surplus reinsurance involves more administration than is the case with quota share. This is because the proportion shared between the reinsurer and the direct insurer has to be calculated for each individual risk ceded. ( (4) The level of reinsurance commission that the direct insurer receives will be less than in the case of a quota share – all other things being equal – because the reinsurer will participate in fewer risks. Furthermore, they will be larger and less well balanced than the risks retained entirely by the direct insurer and its retention on those risks ceded. Thus the lower level of commission reflects the fact that in the case of surplus reinsurance the principle of ”follow the fortunes” does not operate on a one to one basis.

SURPLUS TREATY REINSURANCE Disadvantages (1)There is only very limited protection against a catastrophe that causes an accumulation of losses. This is because in a portfolio with a normal distribution of sums insured most risks will fall within the retention and will not be ceded. (2) Because of the proportionality between retention and reinsurance capacity, in order to obtain a large amount of reinsurance cover the retention may have to be higher than the direct insurer may wish. This problem can be solved if there are several surpluses, however. 3)Surplus reinsurance involves more administration than is the case with quota share. This is because the proportion shared between the reinsurer and the direct insurer has to be calculated for each individual risk ceded. ( (4) The level of reinsurance commission that the direct insurer receives will be less than in the case of a quota share – all other things being equal – because the reinsurer will participate in fewer risks. Furthermore, they will be larger and less well balanced than the risks retained entirely by the direct insurer and its retention on those risks ceded. Thus the lower level of commission reflects the fact that in the case of surplus reinsurance the principle of ”follow the fortunes” does not operate on a one to one basis.

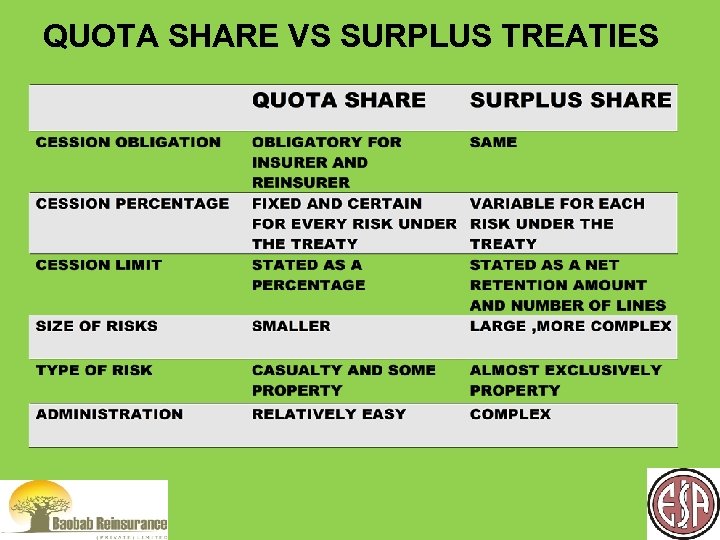

QUOTA SHARE VS SURPLUS TREATIES

QUOTA SHARE VS SURPLUS TREATIES

PROPORTIONAL TREATY REINSURANCE Basis of Underwriting Year basis Liability attaches to policies issued during treaty period but claims may still occur after treaty expiry. Treaty left to run until outstanding liabilities have been settled unless both parties agree to “loss commutation”. Clean cut Basis Involves calculation of unexpired / unearned premium, withdrawn from outgoing reinsurers and credited to incoming reinsurers (1/8 method, 1/24 th method) Premium Portfolio Transfer. Similarly, there will be outstanding losses at the expiry of the treaty and outgoing reinsures will be requested to settle based on outstanding loss figures (normally 90%) and funds will be credited to Incoming reinsurers who assume liabilities for outstanding losses plus those to occur in the following year. Outstanding Loss Portfolio Transfer. NB: Calculation with reasonable accuracy unexpired portion of premium and outstanding losses is key.

PROPORTIONAL TREATY REINSURANCE Basis of Underwriting Year basis Liability attaches to policies issued during treaty period but claims may still occur after treaty expiry. Treaty left to run until outstanding liabilities have been settled unless both parties agree to “loss commutation”. Clean cut Basis Involves calculation of unexpired / unearned premium, withdrawn from outgoing reinsurers and credited to incoming reinsurers (1/8 method, 1/24 th method) Premium Portfolio Transfer. Similarly, there will be outstanding losses at the expiry of the treaty and outgoing reinsures will be requested to settle based on outstanding loss figures (normally 90%) and funds will be credited to Incoming reinsurers who assume liabilities for outstanding losses plus those to occur in the following year. Outstanding Loss Portfolio Transfer. NB: Calculation with reasonable accuracy unexpired portion of premium and outstanding losses is key.

PROPORTIONAL TREATY REINSURANCE Loss Advice / Cash Loss Limit: a pre-agreed loss amount whereby the cedant is expected to advise reinsurers of potential claims likely to exceed the given amount. Should the claim materialise the cedant can call upon (Cash Call) reinsurers to immediately pay their share of the loss. However the cedant is required to refund Reinsurers the advance payments on submission of their quarterly statement of accounts. Follow the fortunes – All cessions under this Treaty shall be subject to the same terms and conditions as those binding upon the Reinsured under the original acceptances. The Reinsurers shall, subject to the terms and conditions of this Treaty, follow the underwriting fortunes of the Reinsured. Clause has been contentious as to whether Reinsurers should follow “blindly”.

PROPORTIONAL TREATY REINSURANCE Loss Advice / Cash Loss Limit: a pre-agreed loss amount whereby the cedant is expected to advise reinsurers of potential claims likely to exceed the given amount. Should the claim materialise the cedant can call upon (Cash Call) reinsurers to immediately pay their share of the loss. However the cedant is required to refund Reinsurers the advance payments on submission of their quarterly statement of accounts. Follow the fortunes – All cessions under this Treaty shall be subject to the same terms and conditions as those binding upon the Reinsured under the original acceptances. The Reinsurers shall, subject to the terms and conditions of this Treaty, follow the underwriting fortunes of the Reinsured. Clause has been contentious as to whether Reinsurers should follow “blindly”.

PROPORTIONALTREATY REINSURANCE Table of limits application: Risk classification according to exposure levels i. e Low, Medium or High exposure and Construction Type. Cessions should therefore be based according to table of retention to avoid over exposure.

PROPORTIONALTREATY REINSURANCE Table of limits application: Risk classification according to exposure levels i. e Low, Medium or High exposure and Construction Type. Cessions should therefore be based according to table of retention to avoid over exposure.

NON PROPORTIONAL TREATY REINSURANCE A reinsurance contract under-which the reinsurer is obligated to automatically assume all or a large share of all losses up to a specified limit when the losses exceed the ceding company’s deductible or priority. The deductible can apply on a per risk or occurrence basis: Excess of loss is only applied after all other recoveries e. g. fac. R/I, proportional treaties and salvage disposal (Ultimate net loss). Reinsurers premiums and losses involvement are dis-proportionate. Aggregate coverage is limited by the number of reinstatements allowed/AAL.

NON PROPORTIONAL TREATY REINSURANCE A reinsurance contract under-which the reinsurer is obligated to automatically assume all or a large share of all losses up to a specified limit when the losses exceed the ceding company’s deductible or priority. The deductible can apply on a per risk or occurrence basis: Excess of loss is only applied after all other recoveries e. g. fac. R/I, proportional treaties and salvage disposal (Ultimate net loss). Reinsurers premiums and losses involvement are dis-proportionate. Aggregate coverage is limited by the number of reinstatements allowed/AAL.

NON PROPORTIONAL TREATY REINSURANCE Basis of cover is not directly proportional to the original policies written. No regular periodical accounts. Premium payable – Deposit, Minimum Deposit Premium, and Adjustment Premiums at the end of Treaty Period. Losses Payable – Paid as and when due. No commissions payable as rate is net. Premium Reserve Deposits will not normally apply. Portfolio Premiums will not normally apply. Loss Reserve Deposits can apply. Profit Commissions can apply but very rare.

NON PROPORTIONAL TREATY REINSURANCE Basis of cover is not directly proportional to the original policies written. No regular periodical accounts. Premium payable – Deposit, Minimum Deposit Premium, and Adjustment Premiums at the end of Treaty Period. Losses Payable – Paid as and when due. No commissions payable as rate is net. Premium Reserve Deposits will not normally apply. Portfolio Premiums will not normally apply. Loss Reserve Deposits can apply. Profit Commissions can apply but very rare.

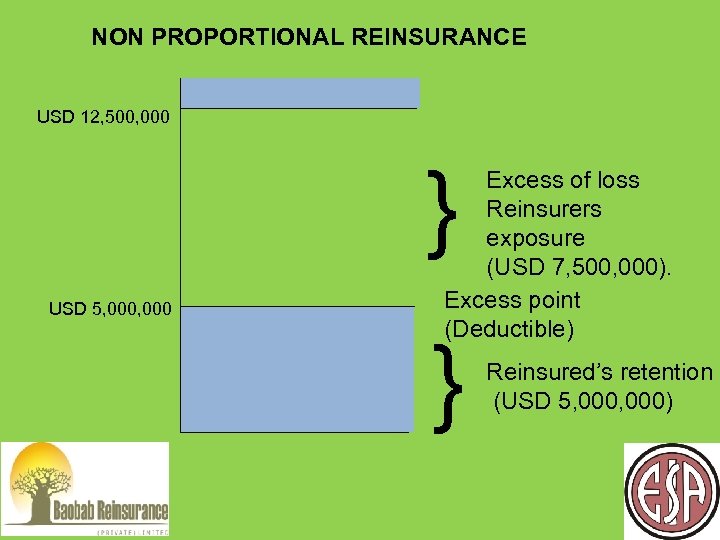

NON PROPORTIONAL REINSURANCE USD 12, 500, 000 } USD 5, 000 Excess of loss Reinsurers exposure (USD 7, 500, 000). Excess point (Deductible) } Reinsured’s retention (USD 5, 000)

NON PROPORTIONAL REINSURANCE USD 12, 500, 000 } USD 5, 000 Excess of loss Reinsurers exposure (USD 7, 500, 000). Excess point (Deductible) } Reinsured’s retention (USD 5, 000)

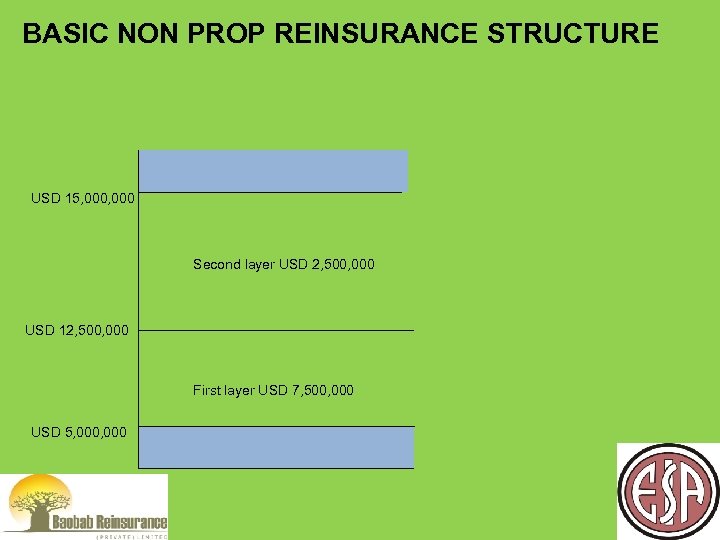

BASIC NON PROP REINSURANCE STRUCTURE USD 15, 000 Second layer USD 2, 500, 000 USD 12, 500, 000 First layer USD 7, 500, 000 USD 5, 000 Reinsured’s retention

BASIC NON PROP REINSURANCE STRUCTURE USD 15, 000 Second layer USD 2, 500, 000 USD 12, 500, 000 First layer USD 7, 500, 000 USD 5, 000 Reinsured’s retention

NON PROPORTIONAL TREATY TYPES The per risk working excess of loss (WXL/R) gives protection against losses on any one risk. The per event catastrophe excess of loss cover (Cat XL) gives protection against losses on any one accumulation event. The per risk and per event excess of loss WXL/E is a combination between WXL/R and a Cat XL cover. Stop loss /an aggregate excess of loss treaty- covers against the accumulation of all subject losses during a specified time period, usually one year. It usually covers all or part of the net retention of the cedant and protects net results, providing very strong stabilisation.

NON PROPORTIONAL TREATY TYPES The per risk working excess of loss (WXL/R) gives protection against losses on any one risk. The per event catastrophe excess of loss cover (Cat XL) gives protection against losses on any one accumulation event. The per risk and per event excess of loss WXL/E is a combination between WXL/R and a Cat XL cover. Stop loss /an aggregate excess of loss treaty- covers against the accumulation of all subject losses during a specified time period, usually one year. It usually covers all or part of the net retention of the cedant and protects net results, providing very strong stabilisation.

NON PROPORTIONAL TREATY REINSURANCE Needs that are met by Per Risk & CAT XOL Increased risk capacity. Provides stability from losses that accumulate from single occurrence. Smoothing results for quarterly / annual reporting. Severity protection.

NON PROPORTIONAL TREATY REINSURANCE Needs that are met by Per Risk & CAT XOL Increased risk capacity. Provides stability from losses that accumulate from single occurrence. Smoothing results for quarterly / annual reporting. Severity protection.

NON PROPORTIONAL TREATY REINSURANCE Needs met by stop loss / aggregate XOL Protection of / stabilisation of net results Reduction of a primary insurer’s costs for other XOL reinsurance by allowing the insurer to increase its per risk or per occurrence retentions on those treaties.

NON PROPORTIONAL TREATY REINSURANCE Needs met by stop loss / aggregate XOL Protection of / stabilisation of net results Reduction of a primary insurer’s costs for other XOL reinsurance by allowing the insurer to increase its per risk or per occurrence retentions on those treaties.

NON PROPORTIONAL TREATY REINSURANCE Stop loss / aggregate XOL Directly related to the Premium and Loss Exposure, ie ultimate loss ratio. Deductible and Cover fixed each year, mostly as percentages of Retained Premium Written. Recoveries can only be made after final Income & Loss ratio has been determined. Very limited market. Expensive.

NON PROPORTIONAL TREATY REINSURANCE Stop loss / aggregate XOL Directly related to the Premium and Loss Exposure, ie ultimate loss ratio. Deductible and Cover fixed each year, mostly as percentages of Retained Premium Written. Recoveries can only be made after final Income & Loss ratio has been determined. Very limited market. Expensive.

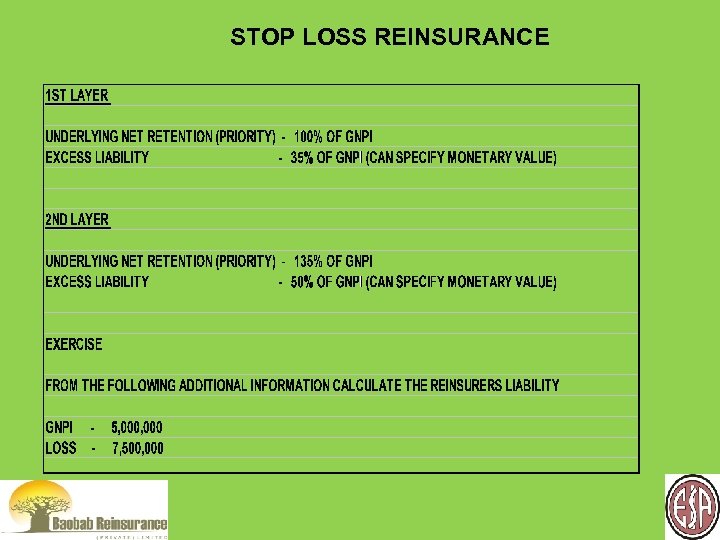

STOP LOSS REINSURANCE

STOP LOSS REINSURANCE

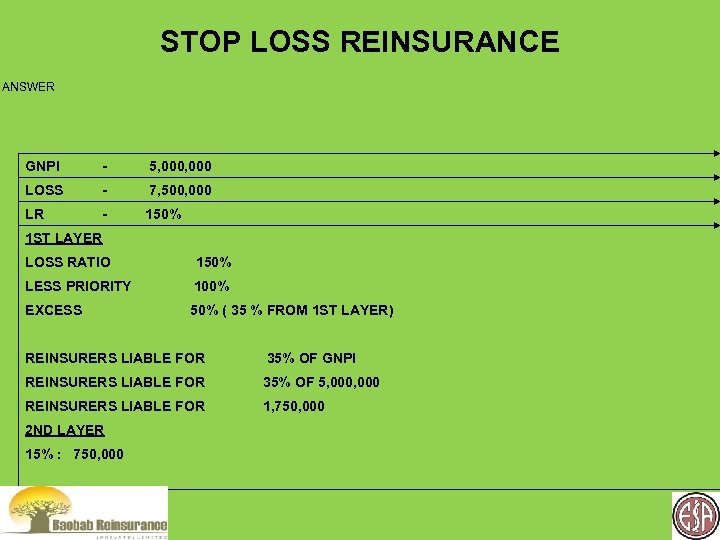

STOP LOSS REINSURANCE ANSWER GNPI - 5, 000 LOSS - 7, 500, 000 LR - 150% 1 ST LAYER LOSS RATIO 150% LESS PRIORITY 100% EXCESS 50% ( 35 % FROM 1 ST LAYER) REINSURERS LIABLE FOR 35% OF GNPI REINSURERS LIABLE FOR 35% OF 5, 000 REINSURERS LIABLE FOR 1, 750, 000 2 ND LAYER 15% : 750, 000

STOP LOSS REINSURANCE ANSWER GNPI - 5, 000 LOSS - 7, 500, 000 LR - 150% 1 ST LAYER LOSS RATIO 150% LESS PRIORITY 100% EXCESS 50% ( 35 % FROM 1 ST LAYER) REINSURERS LIABLE FOR 35% OF GNPI REINSURERS LIABLE FOR 35% OF 5, 000 REINSURERS LIABLE FOR 1, 750, 000 2 ND LAYER 15% : 750, 000

NON PROPORTIONAL TREATY REINSURANCE Treaty Period: issued normally for a period of 12 calendar months: Cover Basis: determines the reinsurer(s) who is liable; Losses Occurring- date of occurrence of an event giving rise to a claim must be within the treaty period. Risk Attaching - original policy of insurance must have been issued or renewed during the treaty period. Claims Made - caters for losses that become known during the treaty period irrespective of the above.

NON PROPORTIONAL TREATY REINSURANCE Treaty Period: issued normally for a period of 12 calendar months: Cover Basis: determines the reinsurer(s) who is liable; Losses Occurring- date of occurrence of an event giving rise to a claim must be within the treaty period. Risk Attaching - original policy of insurance must have been issued or renewed during the treaty period. Claims Made - caters for losses that become known during the treaty period irrespective of the above.

NON PROPORTIONAL TREATY REINSURANCE Class of Business - types of risks protected by the treaty Territorial scope - certain areas are excluded. Loss occurrence - per risk protects the cedant’s net retained account and catastrophe excess of loss protects cedant against an accumulation arising from a single event. Reinstatement Premium - normally do not provide unlimited cover. Can be free or at an additional premium pro-rata to amount only or and to time.

NON PROPORTIONAL TREATY REINSURANCE Class of Business - types of risks protected by the treaty Territorial scope - certain areas are excluded. Loss occurrence - per risk protects the cedant’s net retained account and catastrophe excess of loss protects cedant against an accumulation arising from a single event. Reinstatement Premium - normally do not provide unlimited cover. Can be free or at an additional premium pro-rata to amount only or and to time.

NON PROPORTIONAL TREATY REINSURANCE Reinstatement premium calculation takes the following formula: Loss Amount to Treaty X Mindep = R/Premium Treaty cover (if pro-rata to time the above is multiplied by the following) number of days the treaty is left to run 365 days

NON PROPORTIONAL TREATY REINSURANCE Reinstatement premium calculation takes the following formula: Loss Amount to Treaty X Mindep = R/Premium Treaty cover (if pro-rata to time the above is multiplied by the following) number of days the treaty is left to run 365 days

NON PROPORTIONAL TREATY REINSURANCE Clauses to note: Ultimate Net Loss: refers to the actual amount payable by cedant after accounting for co-insurances, facultative, proportional treaty reinsurance and any proceeds from the salvage disposal. Hours: defines in terms of time what constitutes a single event under Cat. X. O. L e. g 72 consecutive hours - riots, civil commotion, cyclone, earthquake e. t. c. Indexation / Stability: Protects reinsurers from severe effects of inflation. Ensures that the effects of inflation as they impact on the judicial awards or out of court settlement on third party bodily injuries are shared by both the insurer and the reinsurer.

NON PROPORTIONAL TREATY REINSURANCE Clauses to note: Ultimate Net Loss: refers to the actual amount payable by cedant after accounting for co-insurances, facultative, proportional treaty reinsurance and any proceeds from the salvage disposal. Hours: defines in terms of time what constitutes a single event under Cat. X. O. L e. g 72 consecutive hours - riots, civil commotion, cyclone, earthquake e. t. c. Indexation / Stability: Protects reinsurers from severe effects of inflation. Ensures that the effects of inflation as they impact on the judicial awards or out of court settlement on third party bodily injuries are shared by both the insurer and the reinsurer.

NON PROPORTIONAL TREATY REINSURANCE Deductible & layer limits increase in ratio to the rate of inflation. A franchise or cut off inflationary %age is sometimes allowed before adjustment is applied: Amount of payment X Base Index = Adjusted payment value Index @ date of payment All actual payments and adjusted payment values shall be separately totaled and the deductible and treaty cover shall be multiplied by the following: Total Actual Payments Total Adjusted Payment Values If the results in %age change in cover and deductible is less than the franchise then no adjustments are done.

NON PROPORTIONAL TREATY REINSURANCE Deductible & layer limits increase in ratio to the rate of inflation. A franchise or cut off inflationary %age is sometimes allowed before adjustment is applied: Amount of payment X Base Index = Adjusted payment value Index @ date of payment All actual payments and adjusted payment values shall be separately totaled and the deductible and treaty cover shall be multiplied by the following: Total Actual Payments Total Adjusted Payment Values If the results in %age change in cover and deductible is less than the franchise then no adjustments are done.

NON PROPORTIONAL TREATY Currency Fluctuation – seeks to establish fixed exchange rates at the inception of the contract. Normally for the reinsured with a worldwide portfolio (advent of Global programmes).

NON PROPORTIONAL TREATY Currency Fluctuation – seeks to establish fixed exchange rates at the inception of the contract. Normally for the reinsured with a worldwide portfolio (advent of Global programmes).

NON PROPORTIONAL TREATY Pricing methods: Experience rating - use of historic losses hence the term. (Pure Burning Cost - where there are losses Total Incurred (Paid and outstanding losses to XL Layer Total Protected Premium Income for Account Adjusted for Inflation + loadings for acquisition costs, profit margins, IBNR losses, management expenses, brokerage and reinsurer’s retrocession costs. Exposure rating - determined based on an analysis of the exposure inherent in the business to be covered and not on the loss experience the business has demonstrated in the past. Rate on line – over what period will premium quoted equal 1 total loss to the layer in question.

NON PROPORTIONAL TREATY Pricing methods: Experience rating - use of historic losses hence the term. (Pure Burning Cost - where there are losses Total Incurred (Paid and outstanding losses to XL Layer Total Protected Premium Income for Account Adjusted for Inflation + loadings for acquisition costs, profit margins, IBNR losses, management expenses, brokerage and reinsurer’s retrocession costs. Exposure rating - determined based on an analysis of the exposure inherent in the business to be covered and not on the loss experience the business has demonstrated in the past. Rate on line – over what period will premium quoted equal 1 total loss to the layer in question.

RISK MEASUREMENT E. M. L P. M. L M. P. L Estimated Maximum Loss Probable Maximum Loss Maximum Possible Loss

RISK MEASUREMENT E. M. L P. M. L M. P. L Estimated Maximum Loss Probable Maximum Loss Maximum Possible Loss

RISK MEASUREMENT Estimated Maximum Loss (EML) The maximum loss in respect of material damage which could be sustained from the perils under consideration as a result of a single incident considered to be within the realms of probability.

RISK MEASUREMENT Estimated Maximum Loss (EML) The maximum loss in respect of material damage which could be sustained from the perils under consideration as a result of a single incident considered to be within the realms of probability.

RISK MEASUREMENT Probable Maximum Loss (PML) The maximum loss that can be reasonably foreseen after making appropriate allowances for approved structural features and separation, fire fighting facilities and fixed protection.

RISK MEASUREMENT Probable Maximum Loss (PML) The maximum loss that can be reasonably foreseen after making appropriate allowances for approved structural features and separation, fire fighting facilities and fixed protection.

RISK MEASUREMENT Maximum Possible Loss (MPL) The maximum loss that may occur under extraordinary coincidences (worst case scenario).

RISK MEASUREMENT Maximum Possible Loss (MPL) The maximum loss that may occur under extraordinary coincidences (worst case scenario).

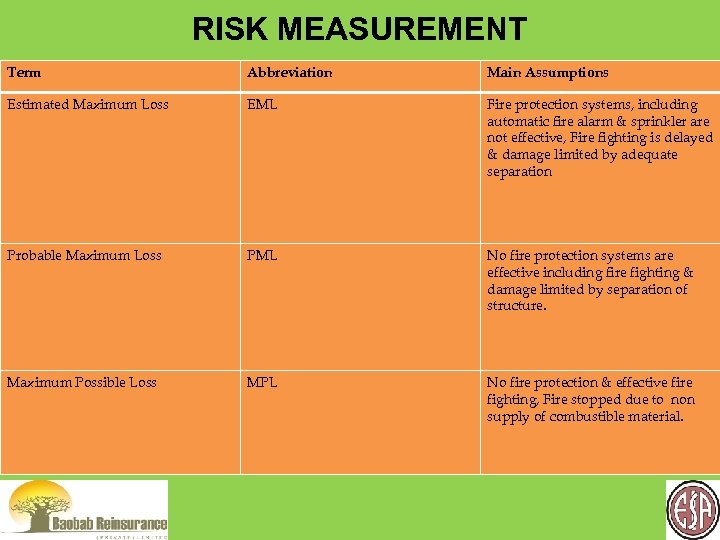

RISK MEASUREMENT Term Abbreviation Main Assumptions Estimated Maximum Loss EML Fire protection systems, including automatic fire alarm & sprinkler are not effective, Fire fighting is delayed & damage limited by adequate separation Probable Maximum Loss PML No fire protection systems are effective including fire fighting & damage limited by separation of structure. Maximum Possible Loss MPL No fire protection & effective fire fighting, Fire stopped due to non supply of combustible material.

RISK MEASUREMENT Term Abbreviation Main Assumptions Estimated Maximum Loss EML Fire protection systems, including automatic fire alarm & sprinkler are not effective, Fire fighting is delayed & damage limited by adequate separation Probable Maximum Loss PML No fire protection systems are effective including fire fighting & damage limited by separation of structure. Maximum Possible Loss MPL No fire protection & effective fire fighting, Fire stopped due to non supply of combustible material.

RISK MEASUREMENT Consequences of EML or MPL Error They are likely to affect: Underwriter’s acceptance Underwriter’s retention Cession to reinsurance Rating of the risk

RISK MEASUREMENT Consequences of EML or MPL Error They are likely to affect: Underwriter’s acceptance Underwriter’s retention Cession to reinsurance Rating of the risk

RISK MEASUREMENT Sum Insured vs EML or MPL Sum insured: theoretically you cannot lose more than agreed full value sum insured. Instead of ceding full value sum insured through reinsurances, cede risk on the basis of EML assessment.

RISK MEASUREMENT Sum Insured vs EML or MPL Sum insured: theoretically you cannot lose more than agreed full value sum insured. Instead of ceding full value sum insured through reinsurances, cede risk on the basis of EML assessment.

RISK MEASUREMENT EML, PML & MPL assessments Very important for Proportional, Risk Excess of Loss (sometimes Catastrophe Excess of Loss). Both reinsured and reinsurer must consider implications - they vary between two parties. Each must have trust in EML, PML & MPL - not a policy or contract warranty for insurance or reinsurance. If EML, PML OR MPL estimate goes wrong, full loss value paid.

RISK MEASUREMENT EML, PML & MPL assessments Very important for Proportional, Risk Excess of Loss (sometimes Catastrophe Excess of Loss). Both reinsured and reinsurer must consider implications - they vary between two parties. Each must have trust in EML, PML & MPL - not a policy or contract warranty for insurance or reinsurance. If EML, PML OR MPL estimate goes wrong, full loss value paid.

RISK MEASUREMENT Error potential 100% Total Sum Insured = 10, 000 Original Gross Premium = 10, 000 40% EML = 4, 000**** OGP remains unchanged = 10, 000 EML Error Factor = TSI/EML x 100/1 100%TSI/40% EML = 250% Error Factor **** From now on 4, 000 EML becomes 100% for purchase of any reinsurances.

RISK MEASUREMENT Error potential 100% Total Sum Insured = 10, 000 Original Gross Premium = 10, 000 40% EML = 4, 000**** OGP remains unchanged = 10, 000 EML Error Factor = TSI/EML x 100/1 100%TSI/40% EML = 250% Error Factor **** From now on 4, 000 EML becomes 100% for purchase of any reinsurances.

RISK MEASUREMENT Please remember - the lower the EML estimate, the higher the EML Error Factor (neg co-relation) Reinsurers impose minimum EML estimate (in this market 50%) on risks ceded to proportional treaties This restricts EML Error potential, for example: 100% TSI / 50% EML = 100% TSI / 30% EML = 100% TSI / 25% EML = 100% TSI / 20% EML = Why use of EML, PML or MPL? 200% Error Factor 333% Error Factor 400% Error Factor 500% Error Factor

RISK MEASUREMENT Please remember - the lower the EML estimate, the higher the EML Error Factor (neg co-relation) Reinsurers impose minimum EML estimate (in this market 50%) on risks ceded to proportional treaties This restricts EML Error potential, for example: 100% TSI / 50% EML = 100% TSI / 30% EML = 100% TSI / 25% EML = 100% TSI / 20% EML = Why use of EML, PML or MPL? 200% Error Factor 333% Error Factor 400% Error Factor 500% Error Factor

RISK MEASUREMENT Allows ceding companies to retain bulk of the premium. Reinsured could effectively safeguard their surplus reinsurers by protecting EML Error Potential. Would probably purchase Facultative Excess of Loss to cover the difference between EML and Full Value Sum Insured.

RISK MEASUREMENT Allows ceding companies to retain bulk of the premium. Reinsured could effectively safeguard their surplus reinsurers by protecting EML Error Potential. Would probably purchase Facultative Excess of Loss to cover the difference between EML and Full Value Sum Insured.

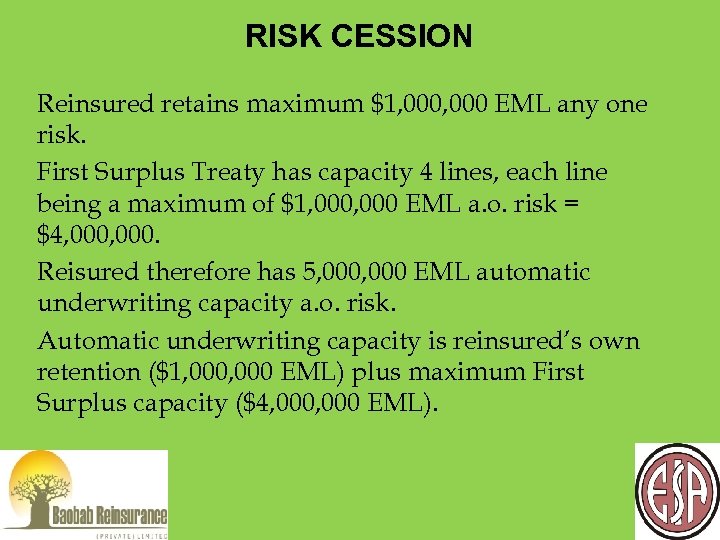

RISK CESSION Reinsured retains maximum $1, 000 EML any one risk. First Surplus Treaty has capacity 4 lines, each line being a maximum of $1, 000 EML a. o. risk = $4, 000. Reisured therefore has 5, 000 EML automatic underwriting capacity a. o. risk. Automatic underwriting capacity is reinsured’s own retention ($1, 000 EML) plus maximum First Surplus capacity ($4, 000 EML).

RISK CESSION Reinsured retains maximum $1, 000 EML any one risk. First Surplus Treaty has capacity 4 lines, each line being a maximum of $1, 000 EML a. o. risk = $4, 000. Reisured therefore has 5, 000 EML automatic underwriting capacity a. o. risk. Automatic underwriting capacity is reinsured’s own retention ($1, 000 EML) plus maximum First Surplus capacity ($4, 000 EML).

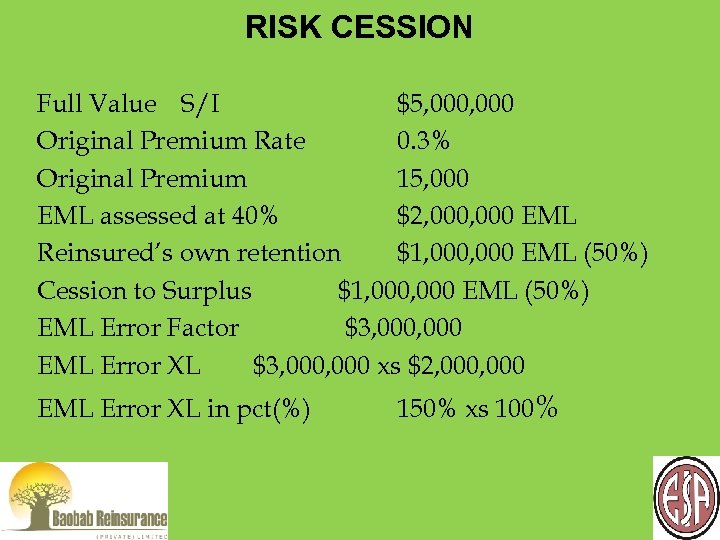

RISK CESSION Full Value S/I $5, 000 Original Premium Rate 0. 3% Original Premium 15, 000 EML assessed at 40% $2, 000 EML Reinsured’s own retention $1, 000 EML (50%) Cession to Surplus $1, 000 EML (50%) EML Error Factor $3, 000 EML Error XL $3, 000 xs $2, 000 EML Error XL in pct(%) 150% xs 100%

RISK CESSION Full Value S/I $5, 000 Original Premium Rate 0. 3% Original Premium 15, 000 EML assessed at 40% $2, 000 EML Reinsured’s own retention $1, 000 EML (50%) Cession to Surplus $1, 000 EML (50%) EML Error Factor $3, 000 EML Error XL $3, 000 xs $2, 000 EML Error XL in pct(%) 150% xs 100%

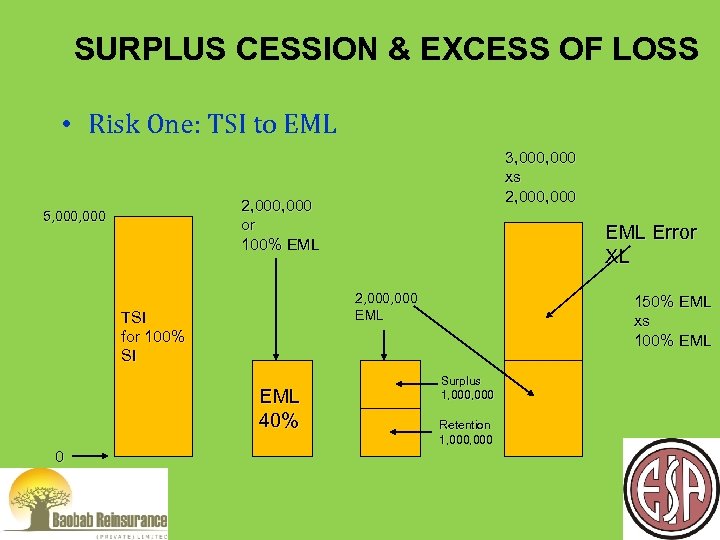

SURPLUS CESSION & EXCESS OF LOSS • Risk One: TSI to EML 2, 000 or 100% EML 5, 000 EML Error XL 2, 000 EML TSI for 100% SI EML 40% 0 3, 000 xs 2, 000 150% EML xs 100% EML Surplus 1, 000 Retention 1, 000 Not to Scale

SURPLUS CESSION & EXCESS OF LOSS • Risk One: TSI to EML 2, 000 or 100% EML 5, 000 EML Error XL 2, 000 EML TSI for 100% SI EML 40% 0 3, 000 xs 2, 000 150% EML xs 100% EML Surplus 1, 000 Retention 1, 000 Not to Scale

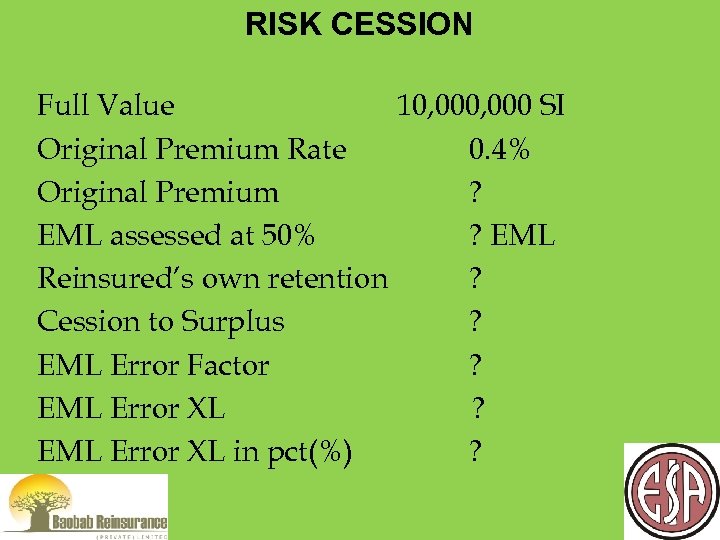

RISK CESSION Full Value 10, 000 SI Original Premium Rate 0. 4% Original Premium ? EML assessed at 50% ? EML Reinsured’s own retention ? Cession to Surplus ? EML Error Factor ? EML Error XL in pct(%) ?

RISK CESSION Full Value 10, 000 SI Original Premium Rate 0. 4% Original Premium ? EML assessed at 50% ? EML Reinsured’s own retention ? Cession to Surplus ? EML Error Factor ? EML Error XL in pct(%) ?

RISK CESSION Full Value 10, 000 SI Retention 1, 000 Number of Lines 5 Original Premium Rate 0. 4% Original Premium ? Reinsured’s own retention ? Cession to Surplus ? Facultative ? Premium due Surplus Treaty ? Facultative premium ?

RISK CESSION Full Value 10, 000 SI Retention 1, 000 Number of Lines 5 Original Premium Rate 0. 4% Original Premium ? Reinsured’s own retention ? Cession to Surplus ? Facultative ? Premium due Surplus Treaty ? Facultative premium ?

CLAIM RECOVERY Assume cedant of the above risk has the following XL programme with the following limits and conditions effective 01/01/2016: 1 st layer $250, 000 XS $250, 000 Mindep $50, 000 Reinstatements 2 @ 100% Additional Premium – Pro -rata to Amount & Time. 2 nd Layer $500, 00 XS $ 500, 000 Mindep $125, 000 Reinstatements 1 @ 50% Additional Premium – Pro-rata to Amount & Time A total loss of $10 M is suffered on 01/01/2016. Calculate amount due from Surplus Treaty, Facultative and Excess of Loss Treaty

CLAIM RECOVERY Assume cedant of the above risk has the following XL programme with the following limits and conditions effective 01/01/2016: 1 st layer $250, 000 XS $250, 000 Mindep $50, 000 Reinstatements 2 @ 100% Additional Premium – Pro -rata to Amount & Time. 2 nd Layer $500, 00 XS $ 500, 000 Mindep $125, 000 Reinstatements 1 @ 50% Additional Premium – Pro-rata to Amount & Time A total loss of $10 M is suffered on 01/01/2016. Calculate amount due from Surplus Treaty, Facultative and Excess of Loss Treaty

CONCLUSION • Treaty Reinsurance provides automatic cover provided risk falls within the pre-agreed terms and conditions. • Two forms of Treaty – Proportional and Non Proportional. • The basis on which the treaty is Underwritten determines the Reinsurer responsible for loss payment. • Proportional – Underwriting Year basis and Clean Cut basis. • Non Proportional – Risk Attaching, Losses Occurring / Claims Made basis. • Cash Call recovered from Reinsurer needs to Credited upon submission of Treaty returns.

CONCLUSION • Treaty Reinsurance provides automatic cover provided risk falls within the pre-agreed terms and conditions. • Two forms of Treaty – Proportional and Non Proportional. • The basis on which the treaty is Underwritten determines the Reinsurer responsible for loss payment. • Proportional – Underwriting Year basis and Clean Cut basis. • Non Proportional – Risk Attaching, Losses Occurring / Claims Made basis. • Cash Call recovered from Reinsurer needs to Credited upon submission of Treaty returns.

REINSURANCE PROGRAMME A reinsurance programme is a combination of reinsurance contracts that an insurer obtains to meet its reinsurance needs. Reinsurance programme design coordinates the insurer’s needs and the functions performed by reinsurance.

REINSURANCE PROGRAMME A reinsurance programme is a combination of reinsurance contracts that an insurer obtains to meet its reinsurance needs. Reinsurance programme design coordinates the insurer’s needs and the functions performed by reinsurance.

REINSURANCE PROGRAMME Objectives Automatic cover – provided by obligatory treaties in order to meet normal demands. Facultative – to provide additional capacity over and above that obtained from obligatory treaties. To enable acceptance of risks excluded from obligatory treaties Adequate limits (capacity) – this will depend on the company’s business plan and stage of development. Economic advantage – ability to obtain reinsurance commissions exceeding acquisitions costs and administration expenses of business ceded. Good security – reinsurers who are financially viable after big catastrophe losses and who are willing to support the ceding company should it be unfortunate to produce negative results.

REINSURANCE PROGRAMME Objectives Automatic cover – provided by obligatory treaties in order to meet normal demands. Facultative – to provide additional capacity over and above that obtained from obligatory treaties. To enable acceptance of risks excluded from obligatory treaties Adequate limits (capacity) – this will depend on the company’s business plan and stage of development. Economic advantage – ability to obtain reinsurance commissions exceeding acquisitions costs and administration expenses of business ceded. Good security – reinsurers who are financially viable after big catastrophe losses and who are willing to support the ceding company should it be unfortunate to produce negative results.

REINSURANCE PROGRAMME Deciding how to construct a Reinsurance Programme or how to modify an existing one, can be a very time consuming and detailed task. Before embarking on the planning process the cedent must have a firm grasp of the fundamental philosophies of Reinsurance and a sound knowledge of its principle and practices. The functions of Reinsurance – why reinsure at all? The forms of Reinsurance – how is reinsurance effected? The Reinsurance Markets – who are the Reinsurers? Reinsurance Security – where to place the Reinsurance?

REINSURANCE PROGRAMME Deciding how to construct a Reinsurance Programme or how to modify an existing one, can be a very time consuming and detailed task. Before embarking on the planning process the cedent must have a firm grasp of the fundamental philosophies of Reinsurance and a sound knowledge of its principle and practices. The functions of Reinsurance – why reinsure at all? The forms of Reinsurance – how is reinsurance effected? The Reinsurance Markets – who are the Reinsurers? Reinsurance Security – where to place the Reinsurance?

REINSURANCE PROGRAMME The planning and implementation of the programme addresses the other basic questions: 1. Retentions and Deductibles to be carried – When do we reinsure? 2. The classes of Business to be protected – What are we reinsuring? 3. The scope and Extent of cover? 4. The Types or Reinsurance to be used – Which Reinsurance to adopt?

REINSURANCE PROGRAMME The planning and implementation of the programme addresses the other basic questions: 1. Retentions and Deductibles to be carried – When do we reinsure? 2. The classes of Business to be protected – What are we reinsuring? 3. The scope and Extent of cover? 4. The Types or Reinsurance to be used – Which Reinsurance to adopt?

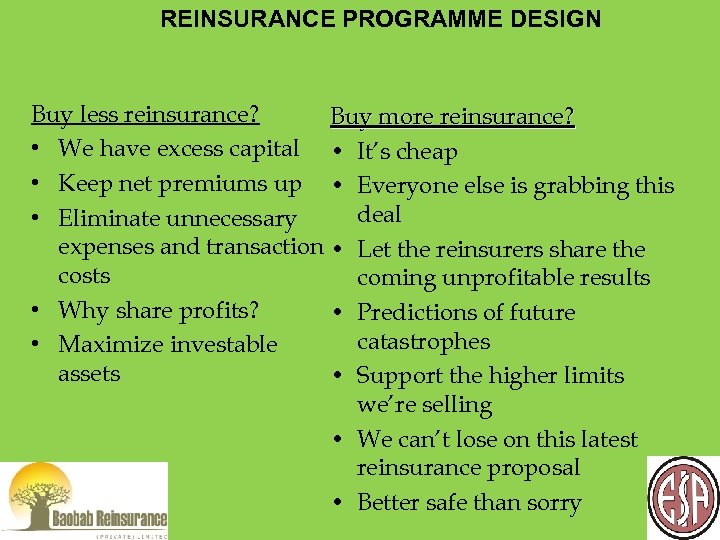

REINSURANCE PROGRAMME DESIGN Buy less reinsurance? Buy more reinsurance? • We have excess capital • It’s cheap • Keep net premiums up • Everyone else is grabbing this deal • Eliminate unnecessary expenses and transaction • Let the reinsurers share the costs coming unprofitable results • Why share profits? • Predictions of future catastrophes • Maximize investable assets • Support the higher limits we’re selling • We can’t lose on this latest reinsurance proposal • Better safe than sorry

REINSURANCE PROGRAMME DESIGN Buy less reinsurance? Buy more reinsurance? • We have excess capital • It’s cheap • Keep net premiums up • Everyone else is grabbing this deal • Eliminate unnecessary expenses and transaction • Let the reinsurers share the costs coming unprofitable results • Why share profits? • Predictions of future catastrophes • Maximize investable assets • Support the higher limits we’re selling • We can’t lose on this latest reinsurance proposal • Better safe than sorry

REINSURANCE PROGRAMME Programme Design stages: Business Strategy Growth Plans Lines of business written Size of the Company structure Geographic spread Company’s financial resources Gathering information Selecting the reinsurance programme Programme monitoring

REINSURANCE PROGRAMME Programme Design stages: Business Strategy Growth Plans Lines of business written Size of the Company structure Geographic spread Company’s financial resources Gathering information Selecting the reinsurance programme Programme monitoring

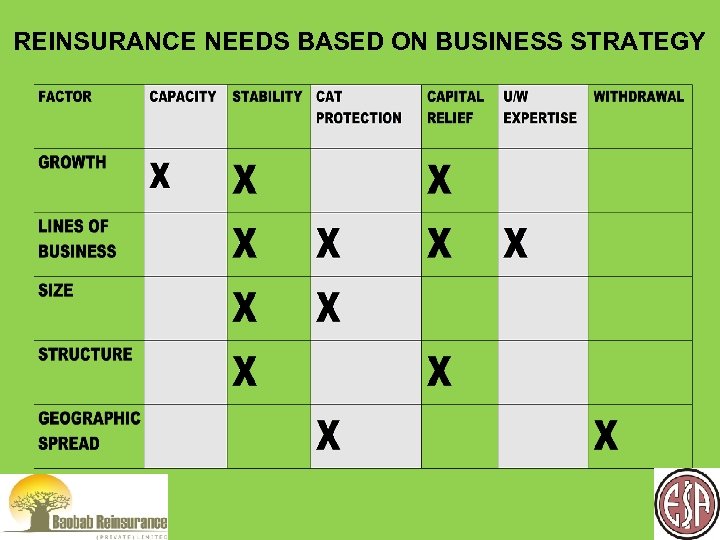

REINSURANCE NEEDS BASED ON BUSINESS STRATEGY

REINSURANCE NEEDS BASED ON BUSINESS STRATEGY

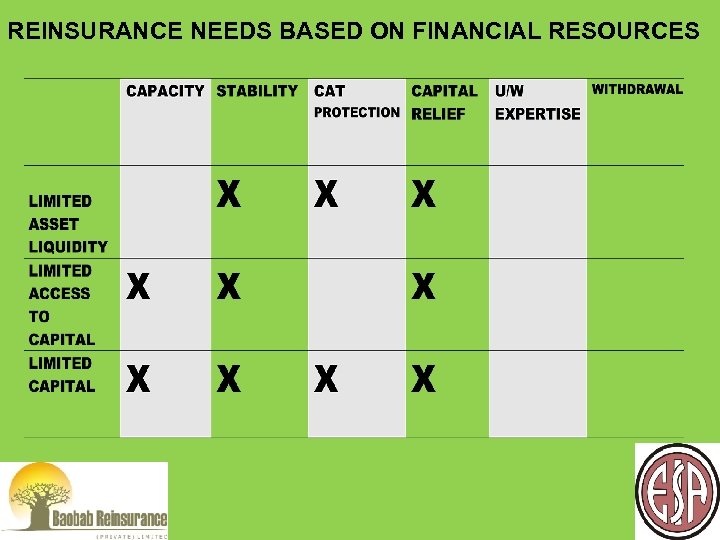

REINSURANCE PROGRAMME Financial Resources Asset liquidity Access to capital Capital strength

REINSURANCE PROGRAMME Financial Resources Asset liquidity Access to capital Capital strength

REINSURANCE NEEDS BASED ON FINANCIAL RESOURCES

REINSURANCE NEEDS BASED ON FINANCIAL RESOURCES

REINSURANCE PROGRAMME Management decides to buy reinsurance or not. Although statistical data and financial models might support the decision, the decision also reflects the executives’ level of comfort. Senior management must be comfortable with the degree of risk taken, particularly when setting retentions and changing the reinsurance programme. Senior management must be confident that other stakeholders are also comfortable with reinsurance programme changes, which should also encompass various stakeholders: -Board of Directors -Shareholders -Senior management

REINSURANCE PROGRAMME Management decides to buy reinsurance or not. Although statistical data and financial models might support the decision, the decision also reflects the executives’ level of comfort. Senior management must be comfortable with the degree of risk taken, particularly when setting retentions and changing the reinsurance programme. Senior management must be confident that other stakeholders are also comfortable with reinsurance programme changes, which should also encompass various stakeholders: -Board of Directors -Shareholders -Senior management

REINSURANCE PROGRAMME RISK AVERSE Very small retentions. Cedant relies on significant pro rata reinsurance capacity. The majority of risks are transferred to reinsurers. Small retentions should be easy to protect. If the portfolio is large enough result should be stable and profits guaranteed. However this needs careful underwriting. If the gross result is poor the insurer may loose pro rata capacity as reinsurers will be unwilling to provide capacity. Shows how confident the cedant is with the risk.

REINSURANCE PROGRAMME RISK AVERSE Very small retentions. Cedant relies on significant pro rata reinsurance capacity. The majority of risks are transferred to reinsurers. Small retentions should be easy to protect. If the portfolio is large enough result should be stable and profits guaranteed. However this needs careful underwriting. If the gross result is poor the insurer may loose pro rata capacity as reinsurers will be unwilling to provide capacity. Shows how confident the cedant is with the risk.

REINSURANCE PROGRAMME RISK SEEKING Very large gross retention. Little or no pro rata capacity. Gross retention is reduced down to technically viable level by excess of loss. Excess of Loss usually unbalanced. Is prone to swings in price from year to year. Company dependent on excess of loss. At mercy of reinsurers/market conditions either soft or hard.

REINSURANCE PROGRAMME RISK SEEKING Very large gross retention. Little or no pro rata capacity. Gross retention is reduced down to technically viable level by excess of loss. Excess of Loss usually unbalanced. Is prone to swings in price from year to year. Company dependent on excess of loss. At mercy of reinsurers/market conditions either soft or hard.

DETERMINING RETENTIONS Retentions Retention is the amount of risk that an insurer keeps for its own account. Business strategy, financial resources and management attitudes influence the retentions and limits that an insurer selects. Other factors include:

DETERMINING RETENTIONS Retentions Retention is the amount of risk that an insurer keeps for its own account. Business strategy, financial resources and management attitudes influence the retentions and limits that an insurer selects. Other factors include:

REINSURANCE PROGRAMME Reinsurer requirements Cost and type of reinsurance Capital (and free reserves) Level of premium income Portfolio results Types of reinsurance contract employed. The class of business The reinsurance market Catastrophe exposures

REINSURANCE PROGRAMME Reinsurer requirements Cost and type of reinsurance Capital (and free reserves) Level of premium income Portfolio results Types of reinsurance contract employed. The class of business The reinsurance market Catastrophe exposures

REINSURANCE PROGRAMME Information for programme design Premium by class of business Risk profiles Loss and loss adjustment expenses incurred Individual losses by class of business Rate change histories by class of business per town/city. Outline of existing reinsurance program.

REINSURANCE PROGRAMME Information for programme design Premium by class of business Risk profiles Loss and loss adjustment expenses incurred Individual losses by class of business Rate change histories by class of business per town/city. Outline of existing reinsurance program.

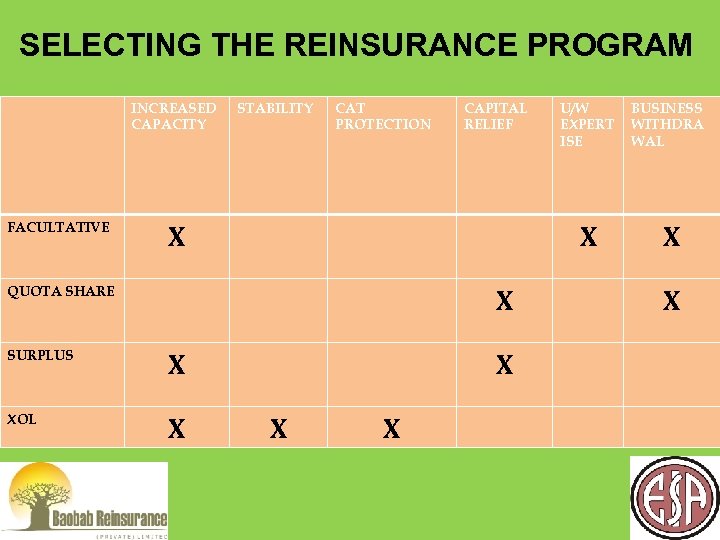

SELECTING THE REINSURANCE PROGRAM INCREASED CAPACITY FACULTATIVE STABILITY CAT PROTECTION CAPITAL RELIEF X X QUOTA SHARE X SURPLUS X XOL X U/W EXPERT ISE X X X BUSINESS WITHDRA WAL X X

SELECTING THE REINSURANCE PROGRAM INCREASED CAPACITY FACULTATIVE STABILITY CAT PROTECTION CAPITAL RELIEF X X QUOTA SHARE X SURPLUS X XOL X U/W EXPERT ISE X X X BUSINESS WITHDRA WAL X X

REINSURANCE PROGRAMME Factors determining the choice of treaty How much premium will be ceded? Commission Claims settlement Amount of cover Classes of business Accumulation exposure Relationship with the Reinsurer Cost of reinsurance

REINSURANCE PROGRAMME Factors determining the choice of treaty How much premium will be ceded? Commission Claims settlement Amount of cover Classes of business Accumulation exposure Relationship with the Reinsurer Cost of reinsurance

REINSURANCE PROGRAMME Reinsurance programmes are reviewed at renewal because conditions change Important aspect of review is to ensure that: Company continues to enjoy adequate reinsurance. Underwriters remain aware of treaty limits and exclusions. Claims reporting procedures are continually observed. Cost of reinsurances remain competitive.

REINSURANCE PROGRAMME Reinsurance programmes are reviewed at renewal because conditions change Important aspect of review is to ensure that: Company continues to enjoy adequate reinsurance. Underwriters remain aware of treaty limits and exclusions. Claims reporting procedures are continually observed. Cost of reinsurances remain competitive.

REINSURANCE ACCOUNTING Non proportional – Deposit or Minimum Deposit Premium payable calculated based on EGNPI and adjusted at the end of year once AGNPI has been established. Premiums payable at inception of the treaty either in advance or in arrears. Reinstatement premiums are chargeable on claims collected and calculated using Mindep. Require adjustment should this be necessary.

REINSURANCE ACCOUNTING Non proportional – Deposit or Minimum Deposit Premium payable calculated based on EGNPI and adjusted at the end of year once AGNPI has been established. Premiums payable at inception of the treaty either in advance or in arrears. Reinstatement premiums are chargeable on claims collected and calculated using Mindep. Require adjustment should this be necessary.

REINSURANCE ACCOUNTING Proportional Treaty Underwriting Year – accounts will be submitted until all liabilities and accounts entries have ceased. Clean cut – Premium portfolio Entry and Withdrawal as well as Loss portfolio Entry and Withdrawal assists in cutting out the number of accounts. Premium Portfolio – amount of money passed from one year’s reinsurers to the next to cover any Unexpired policy period still running. Loss portfolio – an amount of money paid from (by) this year’s reinsurers to incoming reinsurers based on outstanding loss figures (normally 90%) due to insurer’s tendency of over reserving.

REINSURANCE ACCOUNTING Proportional Treaty Underwriting Year – accounts will be submitted until all liabilities and accounts entries have ceased. Clean cut – Premium portfolio Entry and Withdrawal as well as Loss portfolio Entry and Withdrawal assists in cutting out the number of accounts. Premium Portfolio – amount of money passed from one year’s reinsurers to the next to cover any Unexpired policy period still running. Loss portfolio – an amount of money paid from (by) this year’s reinsurers to incoming reinsurers based on outstanding loss figures (normally 90%) due to insurer’s tendency of over reserving.

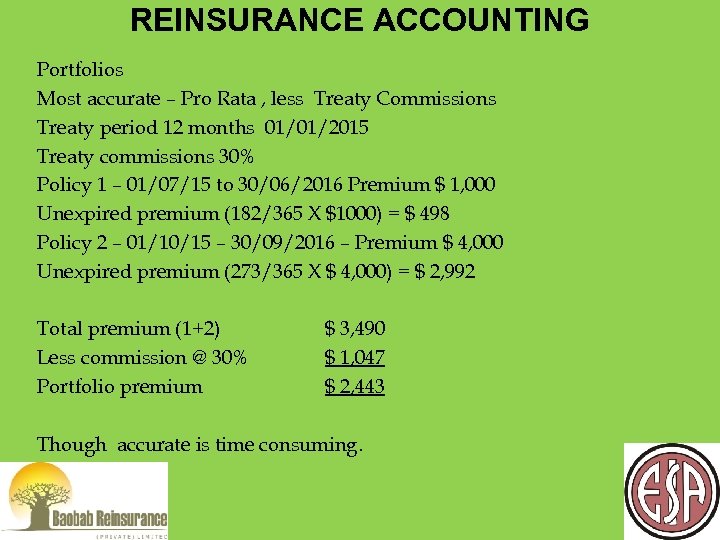

REINSURANCE ACCOUNTING Portfolios Most accurate – Pro Rata , less Treaty Commissions Treaty period 12 months 01/01/2015 Treaty commissions 30% Policy 1 – 01/07/15 to 30/06/2016 Premium $ 1, 000 Unexpired premium (182/365 X $1000) = $ 498 Policy 2 – 01/10/15 – 30/09/2016 – Premium $ 4, 000 Unexpired premium (273/365 X $ 4, 000) = $ 2, 992 Total premium (1+2) Less commission @ 30% Portfolio premium $ 3, 490 $ 1, 047 $ 2, 443 Though accurate is time consuming.

REINSURANCE ACCOUNTING Portfolios Most accurate – Pro Rata , less Treaty Commissions Treaty period 12 months 01/01/2015 Treaty commissions 30% Policy 1 – 01/07/15 to 30/06/2016 Premium $ 1, 000 Unexpired premium (182/365 X $1000) = $ 498 Policy 2 – 01/10/15 – 30/09/2016 – Premium $ 4, 000 Unexpired premium (273/365 X $ 4, 000) = $ 2, 992 Total premium (1+2) Less commission @ 30% Portfolio premium $ 3, 490 $ 1, 047 $ 2, 443 Though accurate is time consuming.

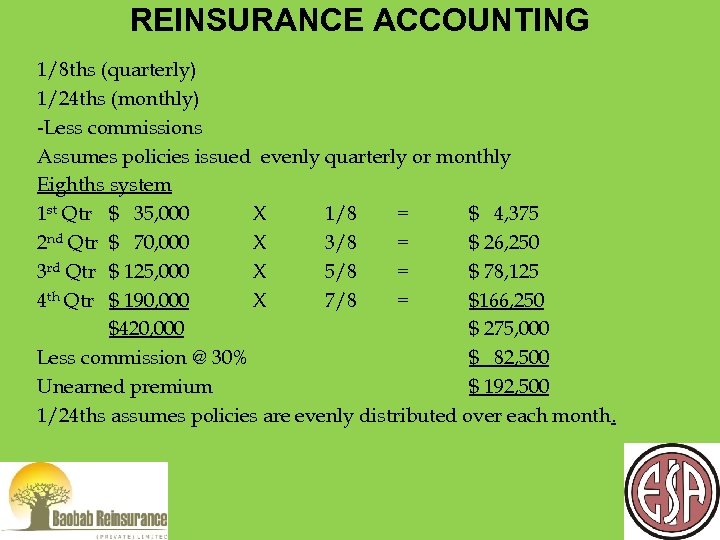

REINSURANCE ACCOUNTING 1/8 ths (quarterly) 1/24 ths (monthly) -Less commissions Assumes policies issued evenly quarterly or monthly Eighths system 1 st Qtr $ 35, 000 X 1/8 = $ 4, 375 2 nd Qtr $ 70, 000 X 3/8 = $ 26, 250 3 rd Qtr $ 125, 000 X 5/8 = $ 78, 125 4 th Qtr $ 190, 000 X 7/8 = $166, 250 $420, 000 $ 275, 000 Less commission @ 30% $ 82, 500 Unearned premium $ 192, 500 1/24 ths assumes policies are evenly distributed over each month.

REINSURANCE ACCOUNTING 1/8 ths (quarterly) 1/24 ths (monthly) -Less commissions Assumes policies issued evenly quarterly or monthly Eighths system 1 st Qtr $ 35, 000 X 1/8 = $ 4, 375 2 nd Qtr $ 70, 000 X 3/8 = $ 26, 250 3 rd Qtr $ 125, 000 X 5/8 = $ 78, 125 4 th Qtr $ 190, 000 X 7/8 = $166, 250 $420, 000 $ 275, 000 Less commission @ 30% $ 82, 500 Unearned premium $ 192, 500 1/24 ths assumes policies are evenly distributed over each month.

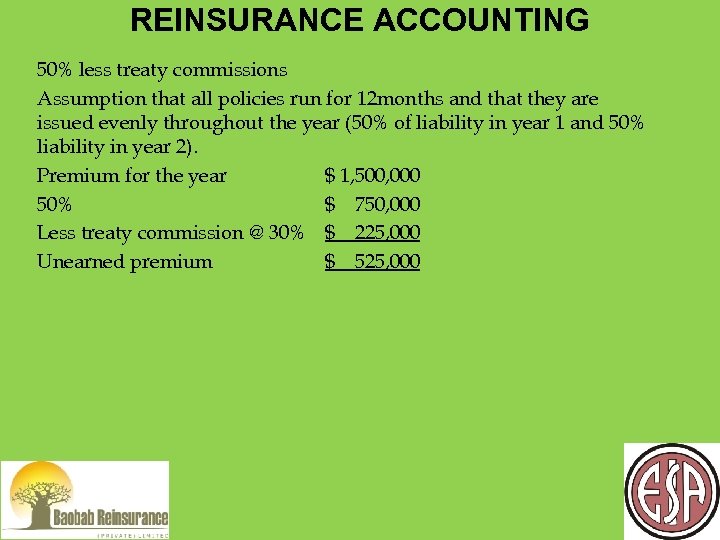

REINSURANCE ACCOUNTING 50% less treaty commissions Assumption that all policies run for 12 months and that they are issued evenly throughout the year (50% of liability in year 1 and 50% liability in year 2). Premium for the year $ 1, 500, 000 50% $ 750, 000 Less treaty commission @ 30% $ 225, 000 Unearned premium $ 525, 000

REINSURANCE ACCOUNTING 50% less treaty commissions Assumption that all policies run for 12 months and that they are issued evenly throughout the year (50% of liability in year 1 and 50% liability in year 2). Premium for the year $ 1, 500, 000 50% $ 750, 000 Less treaty commission @ 30% $ 225, 000 Unearned premium $ 525, 000

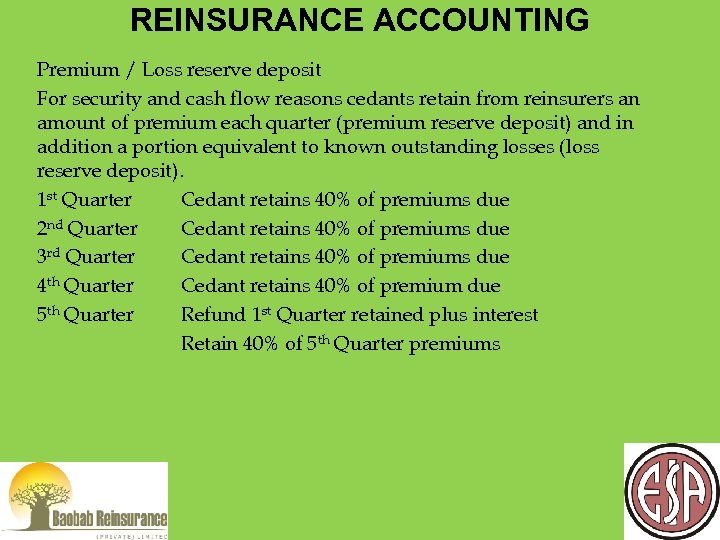

REINSURANCE ACCOUNTING Premium / Loss reserve deposit For security and cash flow reasons cedants retain from reinsurers an amount of premium each quarter (premium reserve deposit) and in addition a portion equivalent to known outstanding losses (loss reserve deposit). 1 st Quarter Cedant retains 40% of premiums due 2 nd Quarter Cedant retains 40% of premiums due 3 rd Quarter Cedant retains 40% of premiums due 4 th Quarter Cedant retains 40% of premium due 5 th Quarter Refund 1 st Quarter retained plus interest Retain 40% of 5 th Quarter premiums

REINSURANCE ACCOUNTING Premium / Loss reserve deposit For security and cash flow reasons cedants retain from reinsurers an amount of premium each quarter (premium reserve deposit) and in addition a portion equivalent to known outstanding losses (loss reserve deposit). 1 st Quarter Cedant retains 40% of premiums due 2 nd Quarter Cedant retains 40% of premiums due 3 rd Quarter Cedant retains 40% of premiums due 4 th Quarter Cedant retains 40% of premium due 5 th Quarter Refund 1 st Quarter retained plus interest Retain 40% of 5 th Quarter premiums

REINSURANCE ACCOUNTING Commissions – deductions To obtain business cedant incurs acquisition costs and therefore the treaty wording will describe the percentage of the commission payable under contract. But takes into account treaty performance, whether cessions are gross or net of local deductions and acquisition costs since these vary by class. Flat / fixed commissions – remains the same irrespective of treaty performance. Sliding scale – the better the loss ratio the higher the commission (Incurred losses (paid + outstanding) / Earned Premium). Sliding scale 30% - 50% Incurred loss ratio 47% and above and to below 20%. Subject to Payment of provisional commission Calculation of Incurred Loss Ratio Review of Incurred Loss Ratio against sliding scale commission table Payment of actual commission due subject to minimum and maximum

REINSURANCE ACCOUNTING Commissions – deductions To obtain business cedant incurs acquisition costs and therefore the treaty wording will describe the percentage of the commission payable under contract. But takes into account treaty performance, whether cessions are gross or net of local deductions and acquisition costs since these vary by class. Flat / fixed commissions – remains the same irrespective of treaty performance. Sliding scale – the better the loss ratio the higher the commission (Incurred losses (paid + outstanding) / Earned Premium). Sliding scale 30% - 50% Incurred loss ratio 47% and above and to below 20%. Subject to Payment of provisional commission Calculation of Incurred Loss Ratio Review of Incurred Loss Ratio against sliding scale commission table Payment of actual commission due subject to minimum and maximum

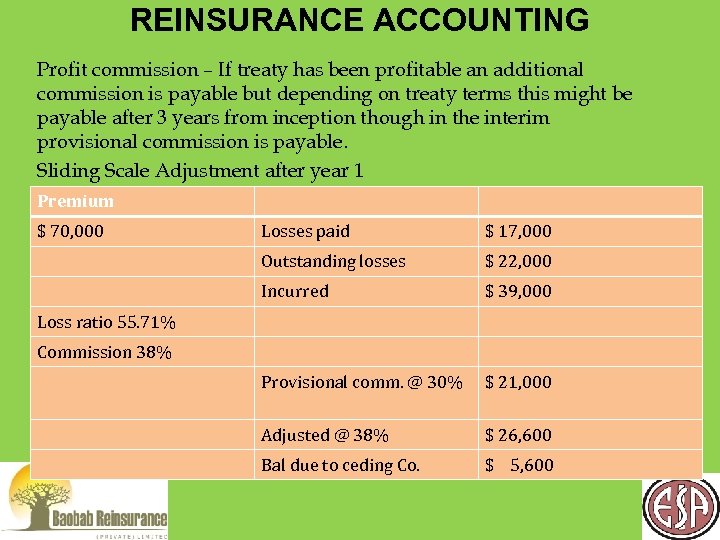

REINSURANCE ACCOUNTING Profit commission – If treaty has been profitable an additional commission is payable but depending on treaty terms this might be payable after 3 years from inception though in the interim provisional commission is payable. Sliding Scale Adjustment after year 1 Premium $ 70, 000 Losses paid $ 17, 000 Outstanding losses $ 22, 000 Incurred $ 39, 000 Provisional comm. @ 30% $ 21, 000 Adjusted @ 38% $ 26, 600 Bal due to ceding Co. $ 5, 600 Loss ratio 55. 71% Commission 38%

REINSURANCE ACCOUNTING Profit commission – If treaty has been profitable an additional commission is payable but depending on treaty terms this might be payable after 3 years from inception though in the interim provisional commission is payable. Sliding Scale Adjustment after year 1 Premium $ 70, 000 Losses paid $ 17, 000 Outstanding losses $ 22, 000 Incurred $ 39, 000 Provisional comm. @ 30% $ 21, 000 Adjusted @ 38% $ 26, 600 Bal due to ceding Co. $ 5, 600 Loss ratio 55. 71% Commission 38%

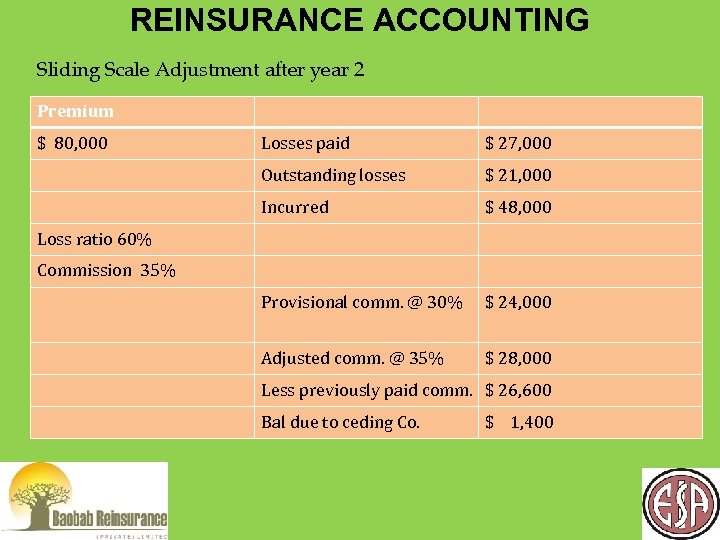

REINSURANCE ACCOUNTING Sliding Scale Adjustment after year 2 Premium $ 80, 000 Losses paid $ 27, 000 Outstanding losses $ 21, 000 Incurred $ 48, 000 Provisional comm. @ 30% $ 24, 000 Adjusted comm. @ 35% $ 28, 000 Loss ratio 60% Commission 35% Less previously paid comm. $ 26, 600 Bal due to ceding Co. $ 1, 400

REINSURANCE ACCOUNTING Sliding Scale Adjustment after year 2 Premium $ 80, 000 Losses paid $ 27, 000 Outstanding losses $ 21, 000 Incurred $ 48, 000 Provisional comm. @ 30% $ 24, 000 Adjusted comm. @ 35% $ 28, 000 Loss ratio 60% Commission 35% Less previously paid comm. $ 26, 600 Bal due to ceding Co. $ 1, 400

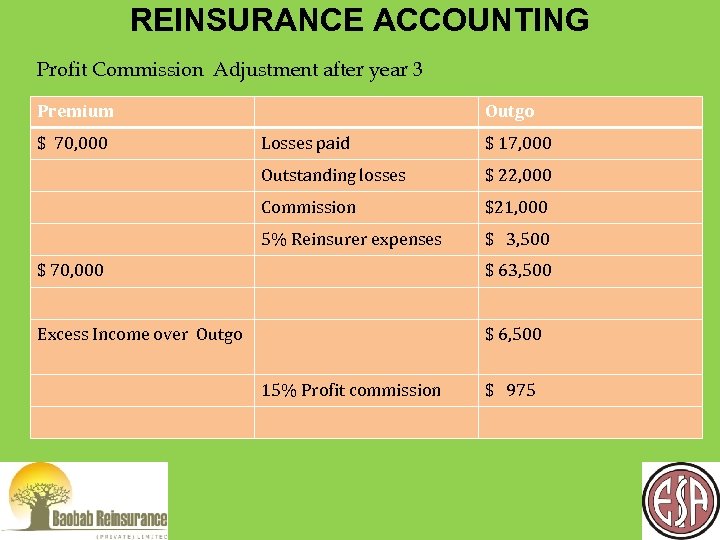

REINSURANCE ACCOUNTING Profit Commission Adjustment after year 3 Premium $ 70, 000 Outgo Losses paid $ 17, 000 Outstanding losses $ 22, 000 Commission $21, 000 5% Reinsurer expenses $ 3, 500 $ 70, 000 $ 63, 500 Excess Income over Outgo $ 6, 500 15% Profit commission $ 975

REINSURANCE ACCOUNTING Profit Commission Adjustment after year 3 Premium $ 70, 000 Outgo Losses paid $ 17, 000 Outstanding losses $ 22, 000 Commission $21, 000 5% Reinsurer expenses $ 3, 500 $ 70, 000 $ 63, 500 Excess Income over Outgo $ 6, 500 15% Profit commission $ 975

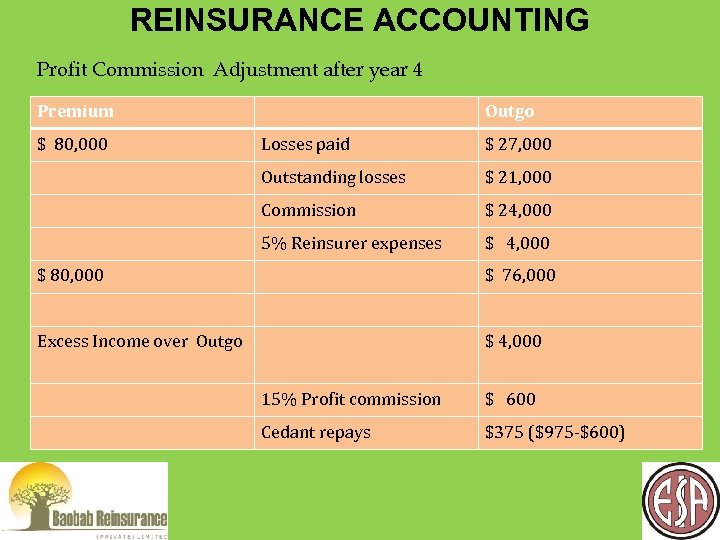

REINSURANCE ACCOUNTING Profit Commission Adjustment after year 4 Premium $ 80, 000 Outgo Losses paid $ 27, 000 Outstanding losses $ 21, 000 Commission $ 24, 000 5% Reinsurer expenses $ 4, 000 $ 80, 000 $ 76, 000 Excess Income over Outgo $ 4, 000 15% Profit commission $ 600 Cedant repays $375 ($975 -$600)

REINSURANCE ACCOUNTING Profit Commission Adjustment after year 4 Premium $ 80, 000 Outgo Losses paid $ 27, 000 Outstanding losses $ 21, 000 Commission $ 24, 000 5% Reinsurer expenses $ 4, 000 $ 80, 000 $ 76, 000 Excess Income over Outgo $ 4, 000 15% Profit commission $ 600 Cedant repays $375 ($975 -$600)

REINSURANCE ACCOUNTING Conclusion Non Proportional – Mindep are payable in Advance or Arrears, In full, Once an year, Quarterly or Half Yearly. Mindep is based on EGNPI and subject to Adjustment at the expiry of treaty period once AGNPI has been established. Proportional Treaty – basis of underwriting Underwriting or Clean Cut. Underwriting basis – accounts are tendered until all outstanding liabilities have been extinguished unless loss commutation is agreed. Clean cut – in coming reinsurers assumes liabilities of outstanding losses but receives loss portfolio entry as well as un-expired portion of the underwritten premium. The method for calculation unearned premiums. Commission payable – Flat, Sliding scale and or Profit.

REINSURANCE ACCOUNTING Conclusion Non Proportional – Mindep are payable in Advance or Arrears, In full, Once an year, Quarterly or Half Yearly. Mindep is based on EGNPI and subject to Adjustment at the expiry of treaty period once AGNPI has been established. Proportional Treaty – basis of underwriting Underwriting or Clean Cut. Underwriting basis – accounts are tendered until all outstanding liabilities have been extinguished unless loss commutation is agreed. Clean cut – in coming reinsurers assumes liabilities of outstanding losses but receives loss portfolio entry as well as un-expired portion of the underwritten premium. The method for calculation unearned premiums. Commission payable – Flat, Sliding scale and or Profit.

REINSURANCE PROGRAMME Thank You

REINSURANCE PROGRAMME Thank You