ddd3e8b01b77ed15357f0cc88aecf7c6.ppt

- Количество слайдов: 129

Reinsurance and Cross-Border Issues Session 1 September 20, 2006 Bryan Fuller - NAIC Senior Reinsurance Manager 1

Outline • Reinsurance basics • Purposes and Benefits of Reinsurance • Types of Reinsurance • Security of Reinsurance • Examining reinsurance 2

Five Functions of Reinsurance 1. Capacity / Spreading Risk Ability to write more premium while maximizing principle of insurance. 2. Loss Control / Catastrophe Protection Minimize financial impact from losses. 3. Financing Providing financial resources for growth. 4. Stabilization Minimize variations in financial results. 5. Services Facilitate operations of insurance companies. 3

Capacity Refers to an insurer’s ability to provide a high limit of insurance for a single risk, often a requirement in today’s market. Reinsurance can help limit an insurer’s loss from one risk to a level with which management and shareholders are comfortable. Most states require that the maximum “net retention” from one risk must be less than 10% of policyholders’ surplus. 4

Catastrophe Protection Objective is to limit adverse effects on P&L and surplus from a catastrophic event to a predetermined amount. Covers multiple smaller losses from numerous policies issued by one primary insurer arising from one event. 5

Financing It is growing and needs additional surplus to maintain acceptable premium to surplus ratios. Unearned premium demands reduce surplus. In a down cycle, underwriting results are bad and reduce surplus. Investment valuation negatively impacts surplus. Marketing considerations dictate that an insurer enter new lines of business or new territories. 6

Stabilization Marketing Consideration Policyholders and stockholders like to be identified with a stable and well managed company. Management Consideration Planning for long term growth and development requires a more stable environment than an insurance company’s book of business is apt to provide. 7

Services 1. Claims Audit 2. Underwriting 3. Product Development 4. Actuarial Review 5. Financial Advice 6. Accounting, EDP and other systems 7. Engineering - Loss Prevention 8

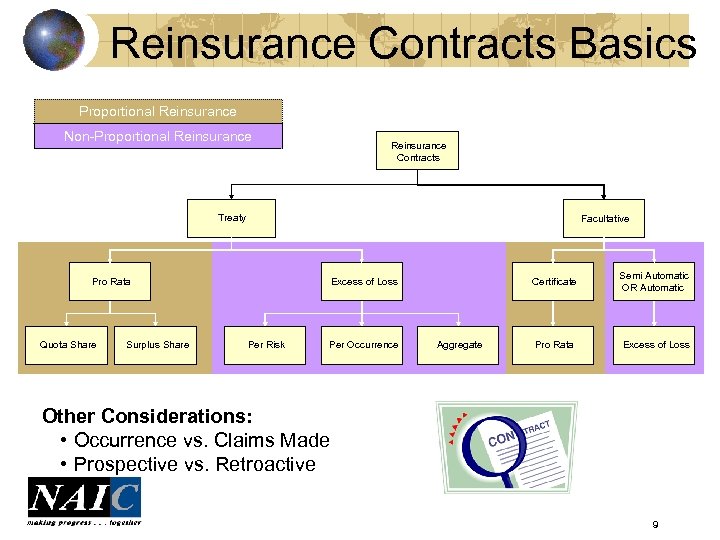

Reinsurance Contracts Basics Proportional Reinsurance Non-Proportional Reinsurance Contracts Treaty Facultative Pro Rata Quota Share Surplus Share Certificate Excess of Loss Per Risk Per Occurrence Aggregate Semi Automatic OR Automatic Pro Rata Excess of Loss Other Considerations: • Occurrence vs. Claims Made • Prospective vs. Retroactive 9

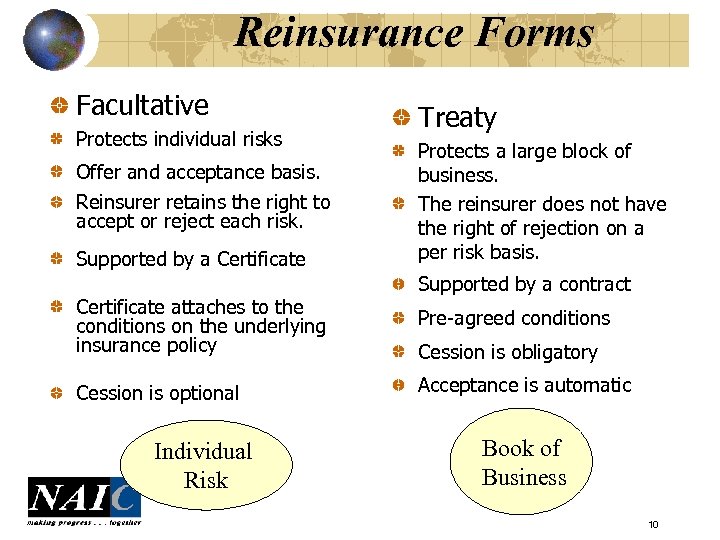

Reinsurance Forms Facultative Protects individual risks Offer and acceptance basis. Reinsurer retains the right to accept or reject each risk. Supported by a Certificate attaches to the conditions on the underlying insurance policy Cession is optional Individual Risk Treaty Protects a large block of business. The reinsurer does not have the right of rejection on a per risk basis. Supported by a contract Pre-agreed conditions Cession is obligatory Acceptance is automatic Book of Business 10

Types of Agreements Proportional • Quota Share • Surplus Share • Excess of Loss 11

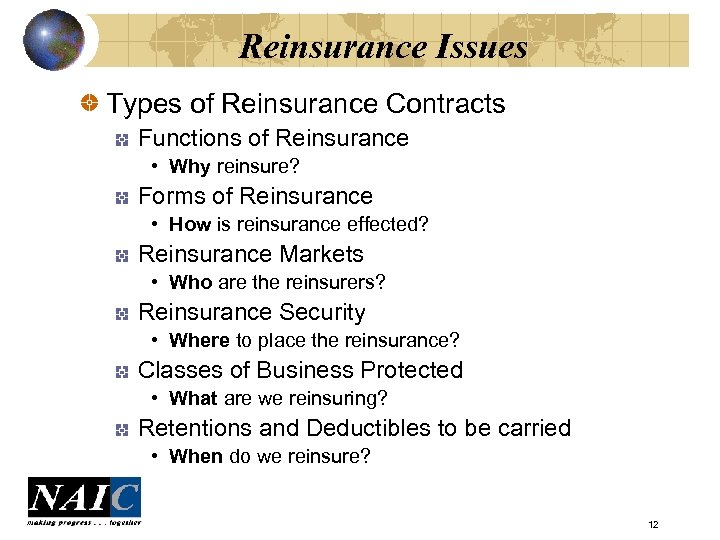

Reinsurance Issues Types of Reinsurance Contracts Functions of Reinsurance • Why reinsure? Forms of Reinsurance • How is reinsurance effected? Reinsurance Markets • Who are the reinsurers? Reinsurance Security • Where to place the reinsurance? Classes of Business Protected • What are we reinsuring? Retentions and Deductibles to be carried • When do we reinsure? 12

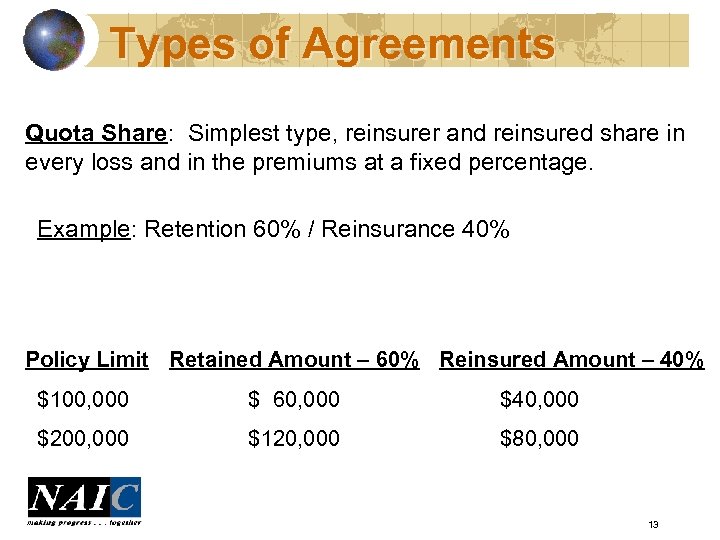

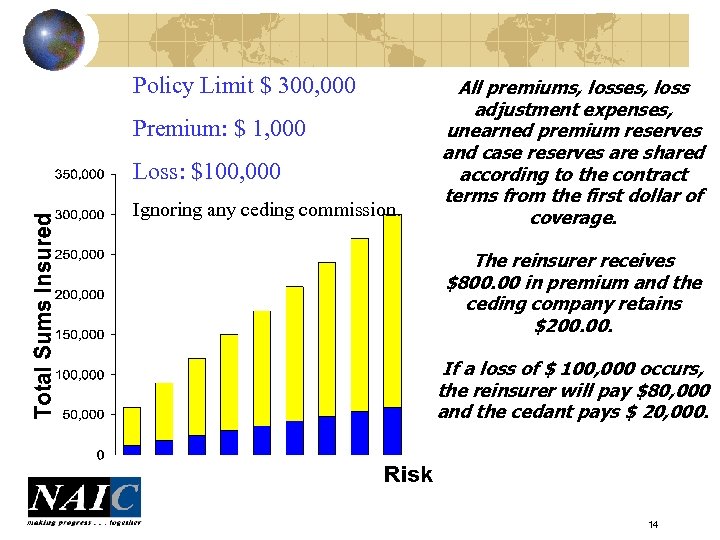

Types of Agreements Quota Share: Simplest type, reinsurer and reinsured share in every loss and in the premiums at a fixed percentage. Example: Retention 60% / Reinsurance 40% Policy Limit Retained Amount – 60% Reinsured Amount – 40% $100, 000 $ 60, 000 $40, 000 $200, 000 $120, 000 $80, 000 13

Policy Limit $ 300, 000 Premium: $ 1, 000 Loss: $100, 000 Ignoring any ceding commission. All premiums, losses, loss adjustment expenses, unearned premium reserves and case reserves are shared according to the contract terms from the first dollar of coverage. The reinsurer receives $800. 00 in premium and the ceding company retains $200. If a loss of $ 100, 000 occurs, the reinsurer will pay $80, 000 and the cedant pays $ 20, 000. 14

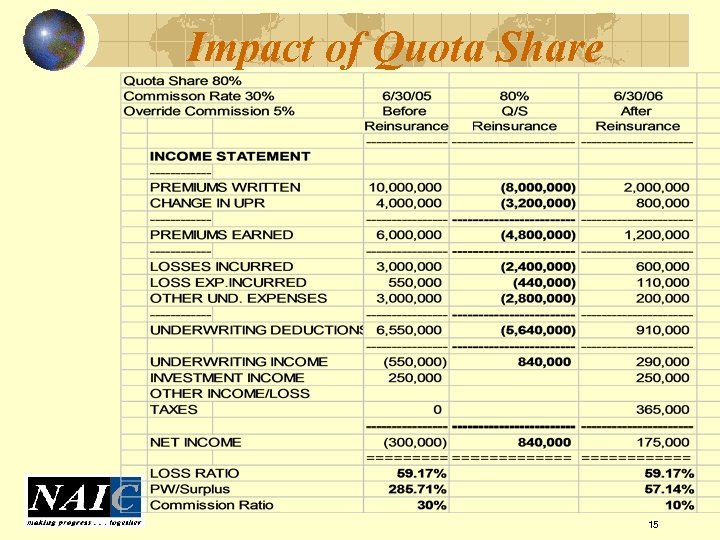

Impact of Quota Share 15

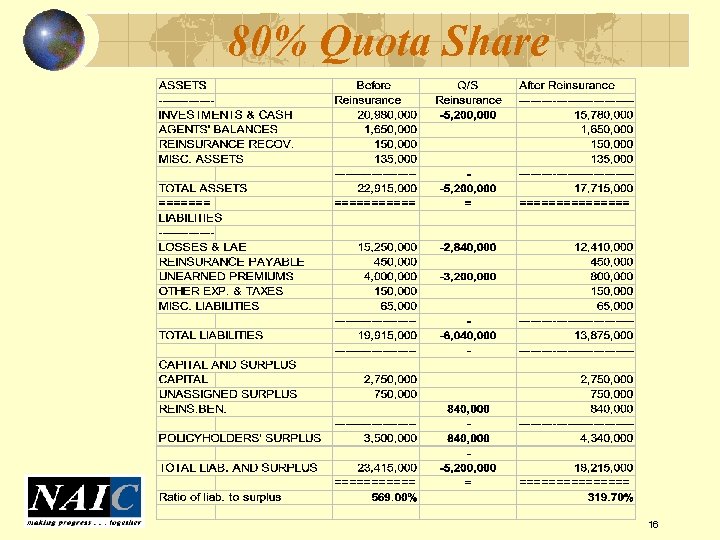

80% Quota Share 16

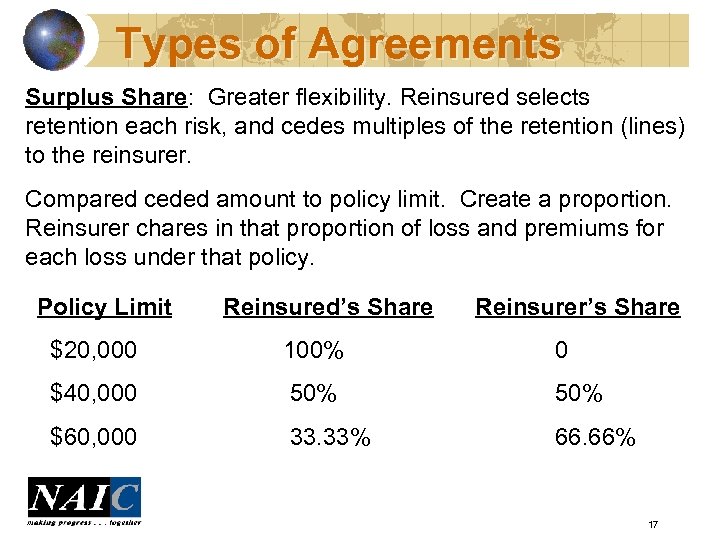

Types of Agreements Surplus Share: Greater flexibility. Reinsured selects retention each risk, and cedes multiples of the retention (lines) to the reinsurer. Compared ceded amount to policy limit. Create a proportion. Reinsurer chares in that proportion of loss and premiums for each loss under that policy. Policy Limit Reinsured’s Share Reinsurer’s Share $20, 000 100% 0 $40, 000 50% $60, 000 33. 33% 66. 66% 17

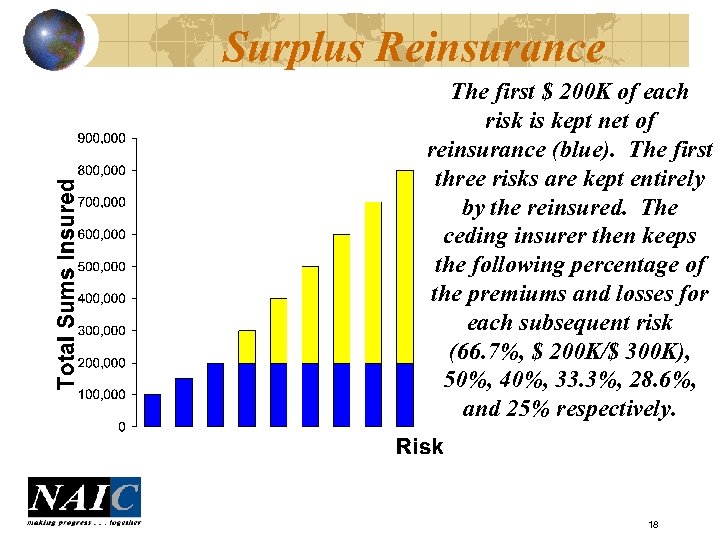

Surplus Reinsurance The first $ 200 K of each risk is kept net of reinsurance (blue). The first three risks are kept entirely by the reinsured. The ceding insurer then keeps the following percentage of the premiums and losses for each subsequent risk (66. 7%, $ 200 K/$ 300 K), 50%, 40%, 33. 3%, 28. 6%, and 25% respectively. 18

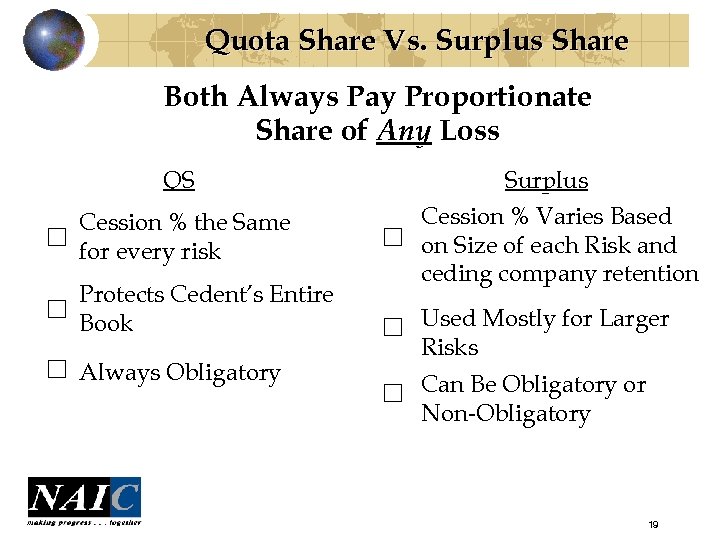

Quota Share Vs. Surplus Share Both Always Pay Proportionate Share of Any Loss QS Cession % the Same for every risk Protects Cedent’s Entire Book Always Obligatory Surplus Cession % Varies Based on Size of each Risk and ceding company retention Used Mostly for Larger Risks Can Be Obligatory or Non-Obligatory 19

Excess Of Loss Reinsured retains a predetermined dollar amount (the retention). The reinsurer then indemnifies loss excess of that retention up to a stated limit. • Per risk excess of loss • Per risk aggregate excess of loss • Per occurrence excess • Aggregate Excess of Loss (Catastrophe) 20

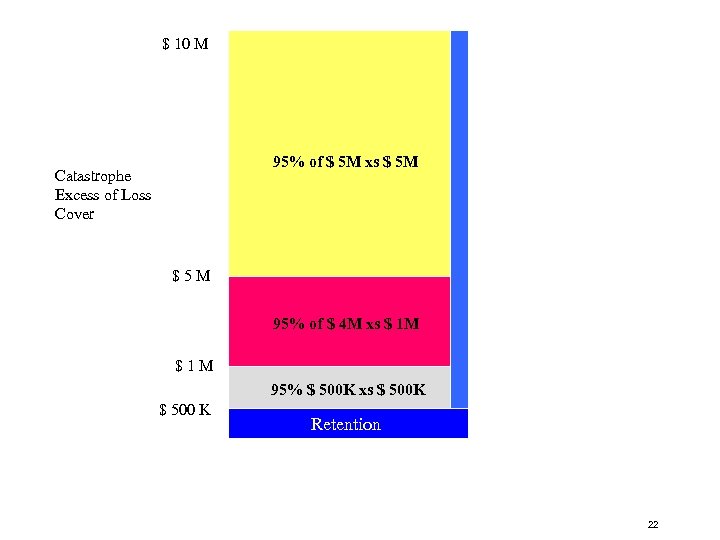

Excess Of Loss With excess of loss reinsurance no insurance is ceded and no sharing is involved. The reinsurer promises to reimburse the reinsured company for losses above a set retention in return for a stated premium rather than promising to share premiums and losses based on some proportional basis Excess of loss reinsurance is frequently provided in layers with the retention at each layer equal to the reinsured company’s retention plus the reinsurance limit of the layer(s) above. As the limits of the layer are exhausted the next layer of excess reinsurance becomes available. 21

20 $ 10 M 95% of $ 5 M xs $ 5 M Catastrophe Excess of Loss Cover $5 M 95% of $ 4 M xs $ 1 M $1 M 95% $ 500 K xs $ 500 K $ 500 K Retention 22

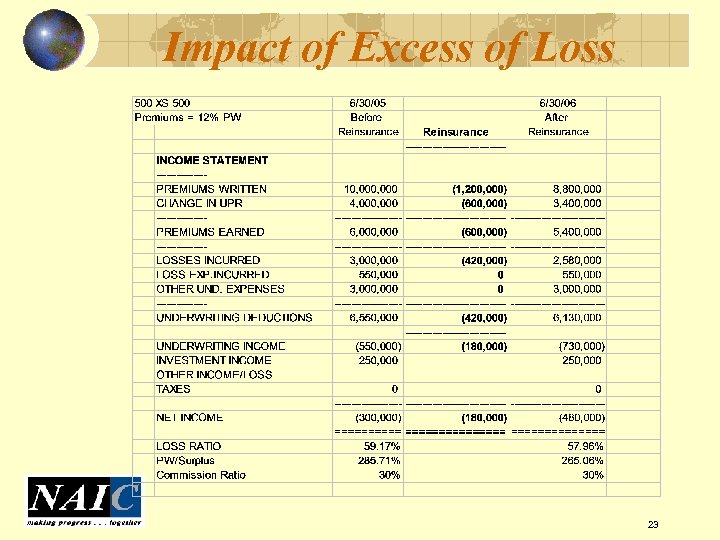

Impact of Excess of Loss 23

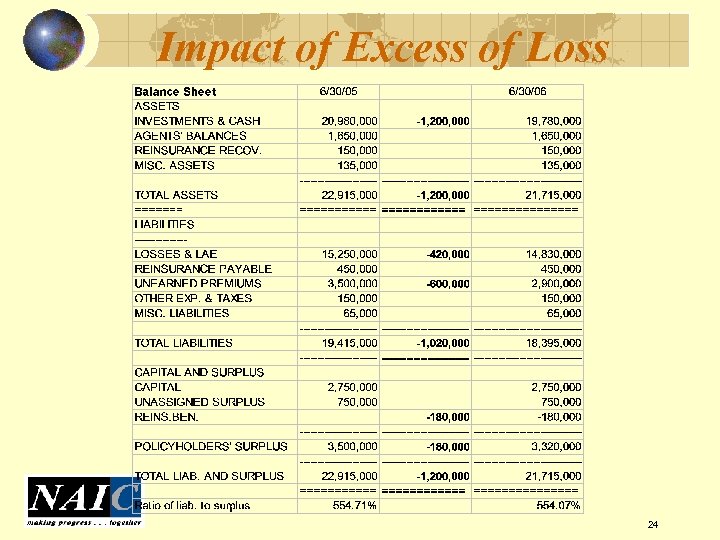

Impact of Excess of Loss 24

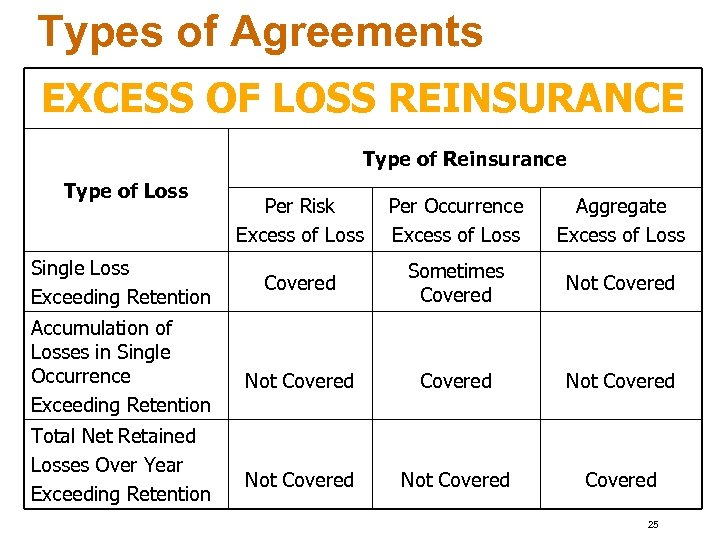

Types of Agreements EXCESS OF LOSS REINSURANCE Type of Reinsurance Type of Loss Single Loss Exceeding Retention Accumulation of Losses in Single Occurrence Exceeding Retention Total Net Retained Losses Over Year Exceeding Retention Per Risk Excess of Loss Per Occurrence Excess of Loss Aggregate Excess of Loss Covered Sometimes Covered Not Covered Not Covered 25

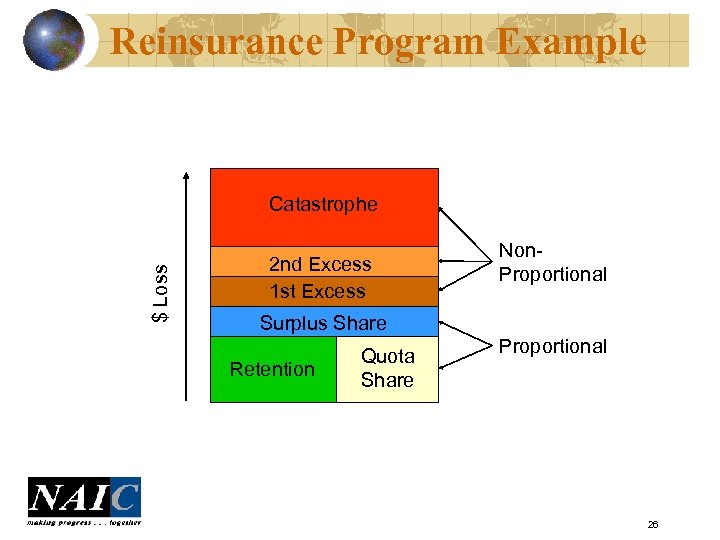

Reinsurance Program Example $ Loss Catastrophe 2 nd Excess 1 st Excess Non. Proportional Surplus Share Retention Quota Share Proportional 26

Elements of Reinsurance is a form of insurance. There are only two parties to the reinsurance contract - the Reinsurer and the Reinsured both of whom are insurers, i. e. entities empowered to insure. The subject matter of a reinsurance contract is the insurance liability of the Reinsured undertaken by it under insurance policies issued to its own policyholders. A reinsurance contract is an indemnity contract. 27

What Reinsurance Does 1. It converts the risk of loss of an insurer incurred by the reinsured under its policies according to its own needs. 2. It redistributes the premiums received by the reinsured, which now belong to the reinsured, according to its own business needs. 28

What Reinsurance Does Not Do u Reinsurance is not coinsurance. u Reinsurance is not banking – it is not the lending of money but it can have the same effect. u Reinsurance is not a security. It is not Alchemy. Reinsurance does not: Convert an uninsurable risk into an insurable risk. Make loss either more or less likely to happen. Make loss either greater or lesser in magnitude. Convert bad business into good business. 29

Types of Life Reinsurance Indemnity Traditional Financial Non-Proportional Retrocession Spread or Lessen Risk Meets Financial Goals Catastrophe, Stop Loss Reinsurance of Reinsurance Assumption Transfers Business Permanently 30

Reasons for Indemnity Reinsurance Transfer Mortality/Morbidity Risk Transfer Lapse or Surrender Risk Transfer Investment Risk Help Ceding Insurer Finance Acquisition Costs 31

Reasons for Indemnity Reinsurance Provide Ceding Company • • Underwriting Assistance Product Expertise Tax Planning Help Manage Capital and Surplus and/or RBC Objectives Limit Adverse Effects of Catastrophic Events Help Enter New Market 32

Assumption Reinsurance Sale of a block of business Novation of a contract Reasons For Assumption Divesture Raise Capital RBC Issues Help Ratings Rehabilitation 33

Yearly Renewable Term (YRT) Insurance Only the Mortality Risk is Transferred Premium varies yearly • Rates vary by age, sex, duration, smoking • Quoted by reinsurer, subject to negotiations • Not usually guaranteed, but rarely changed Coverage continues until original policy terminates 34

COINSURANCE Simplest and purest form of reinsurance; all significant risks are transferred Mortality, Investment, Lapse Risk Company receives same share of benefits and expense Premium = Policyholder Premium - Allowances Reinsurer holds its reserves that match with Company’s reserve credit 35

VARIATIONS OF COINSURANCE 2 common variations of coinsurance: Modified Coinsurance (Modco) • • • Similar to Coinsurance, except Assets remain with ceding company Interest credit to reinsurer replaces actual earnings (2) Coinsurance with funds withheld 36

MODIFIED COINSURANCE Ceding company retains reinsurer’s share of reserves & related assets Reinsurer pays amount equal to its share of reserve increase to company periodically 37

COINSURANCE WITH FUNDS WITHHELD Company takes reserve credit & reinsurer sets up its share of reserves Assets backing reinsurer’s reserve are withheld & retained with company 38

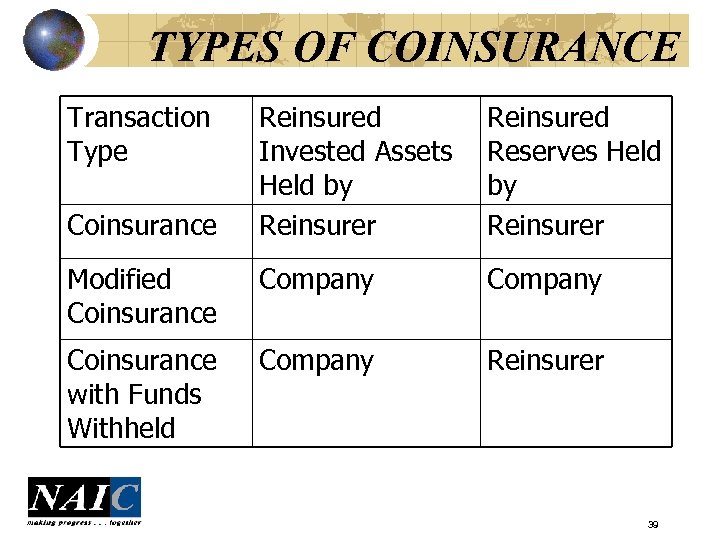

TYPES OF COINSURANCE Transaction Type Reinsured Invested Assets Held by Reinsurer Reinsured Reserves Held by Reinsurer Modified Coinsurance Company Coinsurance with Funds Withheld Company Reinsurer Coinsurance 39

Appendix A-791 Life & Health Reinsurance Agreements has a table reflecting products and their underlying risk components: Morbidity Mortality Lapse Credit Quality Reinvestment and Disintermediation 40

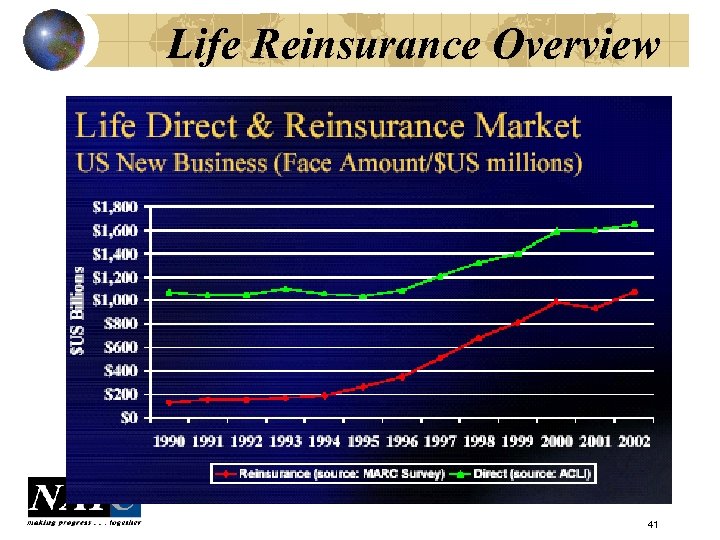

Life Reinsurance Overview 41

Appendix A-791 Lapse This is the risk that a policy will voluntarily terminate prior to the recoupment of a statutory surplus strain experienced at issue of the policy. 42

Appendix A-791 Credit Quality This is the risk that invested assets supporting the reinsured business will decrease in value. The main hazards are that assets will default or that there will be a decrease in earning power. It excludes market value declines due to changes in interest rate. 43

Appendix A-791 Reinvestment This is the risk that interest rates will fall and funds reinvested (coupon payments or monies received upon asset maturity or call) will therefore earn less than expected. If asset durations are less than liability durations, the mismatch will increase. 44

Appendix A-791 Disintermediation This is the risk that interest rates rise and policy loans and surrenders increase or maturing contracts do not renew at anticipated rates of renewal. If asset durations are greater than the liability durations, the mismatch will increase. Policyholders will move their funds into new products offering higher rates. The company may have to sell assets at a loss to provide for these withdrawals. 45

Sample Agreement (Life) Ø Ø In late 1998 and early 1999 a life insurer (Company A) agreed to offset a proportion of statutory reserves by a reassurance agreement valued at approximately 800 million. That reassurance eventually took the form of a stop loss treaty with a reinsurer (Reinsurer B). However, Company A gave Reinsurer B a side letter which provided that, should the withheld reinsurance claims balance exceed 100 million at the end of any year, and if no acceptable restructuring of the treaty could be achieved, the parties would cancel the treaty. In its annual return for 1998, Company A attributed a value of 793 million to this treaty, although it could not be relied upon for more than 100 million. As a result of this, one individual was banned by a jurisdiction. 46

Sample Agreements (Life) Ø Ø A ceding company seeking financial relief from what it perceives to be onerous reserving requirements based on the 1980 CSO mortality table, which is well above the bestestimated mortality experience. Thus, even allowing for a generous Mf. AD (“Margin for Adverse Deviation”), there is no loss anticipated, hence no provision required for future claims. A combination of co-insurance with funds withheld and modified co-insurance arrangement, whereby an arbitrary funds withheld amount is used to protect the reinsurer against any cash calls that could occur due to a temporary loss. If such a loss occurs due to either a fluctuation in mortality or to asset defaults, the funds withheld account is used first to pay the loss. The relief is provided on a quota share basis with the remainder of the reserves left on a modified coinsurance basis. All excess profit over the scheduled repayment is returned to the ceding company through an experience refund account. 47

Question What types of reinsurance are most commonly used in your jurisdiction, and what are the average levels of retention over the last 5 years? 48

Finite Risk, Defined Usually multiple-year Insured (or reinsured) pays significant portion of the losses Time value of money plays an important role in transaction value for both insurer and insured Relatively narrow band between potential profit and potential loss to counterparties Historically, long term budgeting and financial reporting have been key considerations 49

Finite Risk Reinsurance Spitzer jumped into the finite reinsurance issue following his splash with contingent commissions. SEC probes and civil lawsuits paved the way. In Senate testimony Spitzer complained that “favoritism, secrecy and conflicts” rule the insurance industry. Spitzer’s Targets Include Regulators Finite Reinsurance – Legitimate business tool? The Guidance Paper indicates that it can be. Regulatory issues concern risk transfer, accounting and disclosure requirements International Issues – Spitzer specifically implicates coordination of international insurance regulation 50

Does the level of risk match the accounting treatment? Crux of the issue because it impacts the solvency of the cedent Can’t always tell by the contract language Need to review and challenge assumptions underlying the cash flow models Are there “side” agreements that undo the initial risk transfer? 51

What is the right amount of risk transfer? “significant” loss (10/10? ) Both Underwriting and timing “taking a drop of risk and putting in a loan and calling it insurance is problematic” (Robert Herz, Chairman of FASB) No matter where line is drawn, products will be designed to just get over the minimum. 52

Risk Transfer NAIC Accounting Guidance – Risk is Defined as: Underwriting risk is the possibility that losses and expenses recoverable by the cedent from the reinsurer will exceed the consideration received by the reinsurer, thus resulting in an underwriting loss to the reinsurer. Timing risk exists when anticipated loss payment patterns are not considered during the development of recoverable losses under the reinsurance agreement, and result in a reduction in investment income to the reinsurer as an effect of the accelerated loss payments. 53

FAS 113 Establishes the conditions required for a reinsurance contract to be accounted for as reinsurance; Prescribes accounting and reporting standards; While “conditions” and “standards” established, methodology is not. 54

FAS 113 and SSAP 62 Test is on reinsurer gaining risk, not on insurer reducing risk Reasonable possibility of significant loss Terms invite informed judgment Provide consistent framework for such judgments 55

The Finite Risk Buyer’s Paradox There is a perception that insurers are transferring just enough risk to get credit for reinsurance “I want to hit a home run in protecting financials. ” “But I don’t want to raise any ‘red flags. ’” 56

Where can retail finite transactions still occur? Uninsurable risks Product recall Catastrophic property Adverse development Asbestos (? ) Risks more predictable over 5 -10 years than in any one year Basket aggregate transactions Post loss funding 57

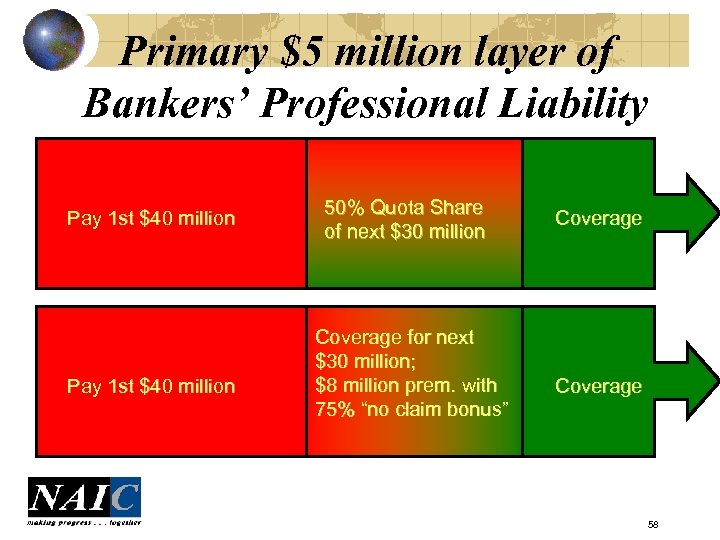

Primary $5 million layer of Bankers’ Professional Liability Pay 1 st $40 million 50% Quota Share of next $30 million Coverage for next $30 million; $8 million prem. with 75% “no claim bonus” Coverage 58

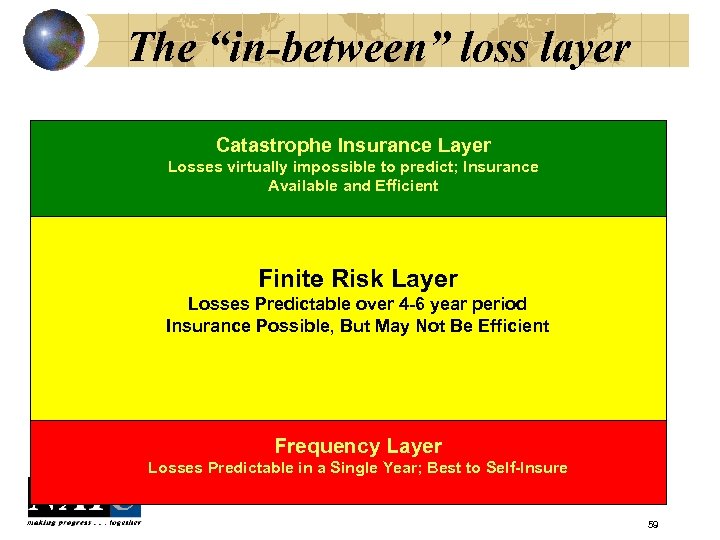

The “in-between” loss layer Catastrophe Insurance Layer Losses virtually impossible to predict; Insurance Available and Efficient Finite Risk Layer Losses Predictable over 4 -6 year period Insurance Possible, But May Not Be Efficient Frequency Layer Losses Predictable in a Single Year; Best to Self-Insure 59

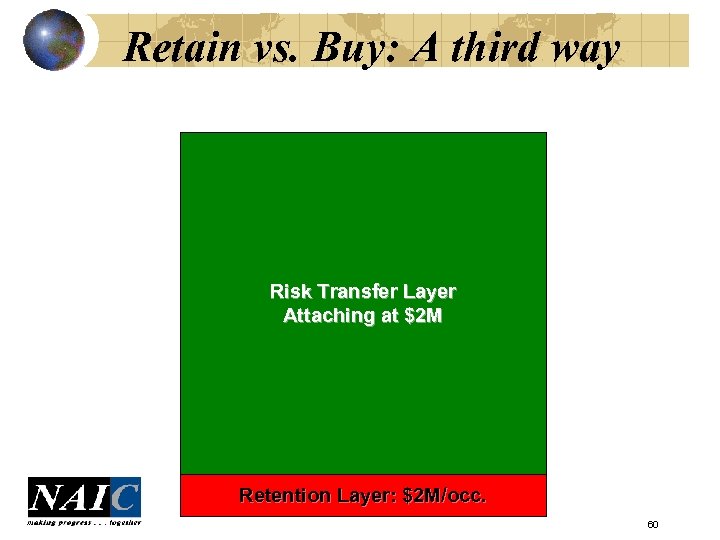

Retain vs. Buy: A third way Risk Transfer Layer Attaching at $2 M Retention Layer: $2 M/occ. 60

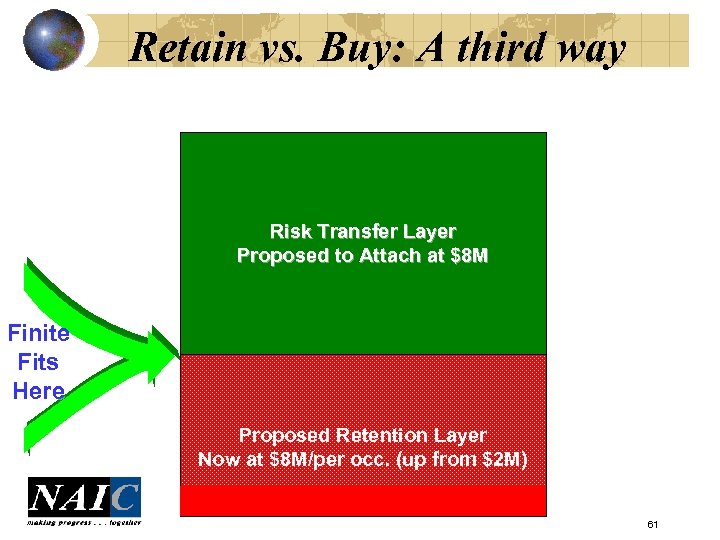

Retain vs. Buy: A third way Risk Transfer Layer Proposed to Attach at $8 M Finite Fits Here Proposed Retention Layer Now at $8 M/per occ. (up from $2 M) 61

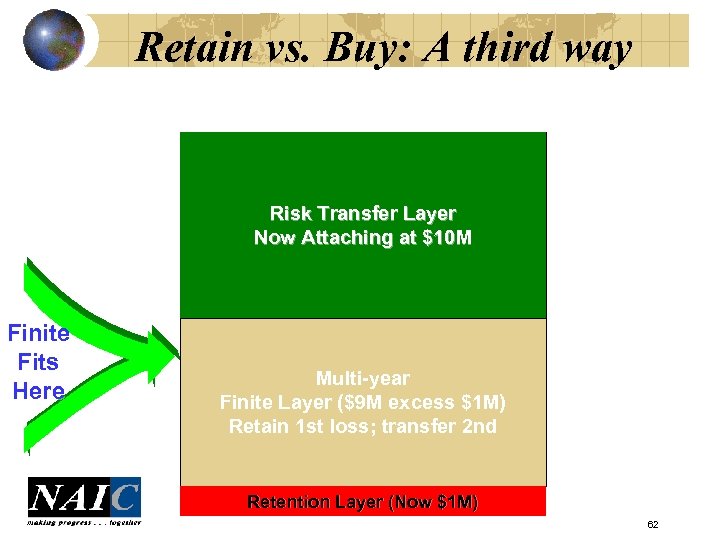

Retain vs. Buy: A third way Risk Transfer Layer Now Attaching at $10 M Now Attaching at $8 M Finite Fits Here Multi-year Finite Layer ($9 M excess $1 M) Retain 1 st loss; transfer 2 nd Retention Layer (Now $1 M) 62

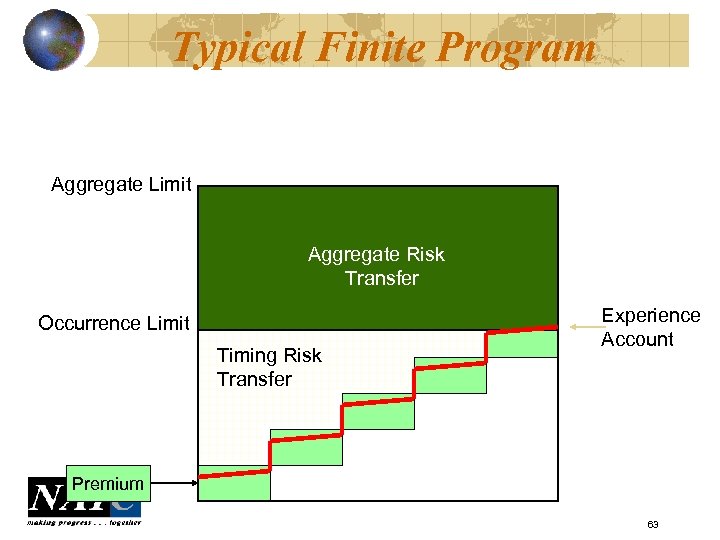

Typical Finite Program Aggregate Limit Aggregate Risk Transfer Occurrence Limit Timing Risk Transfer Experience Account Premium 63

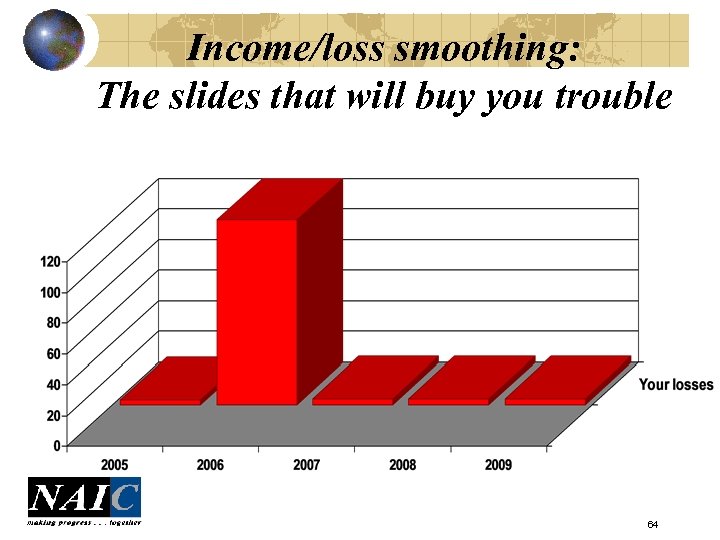

Income/loss smoothing: The slides that will buy you trouble 64

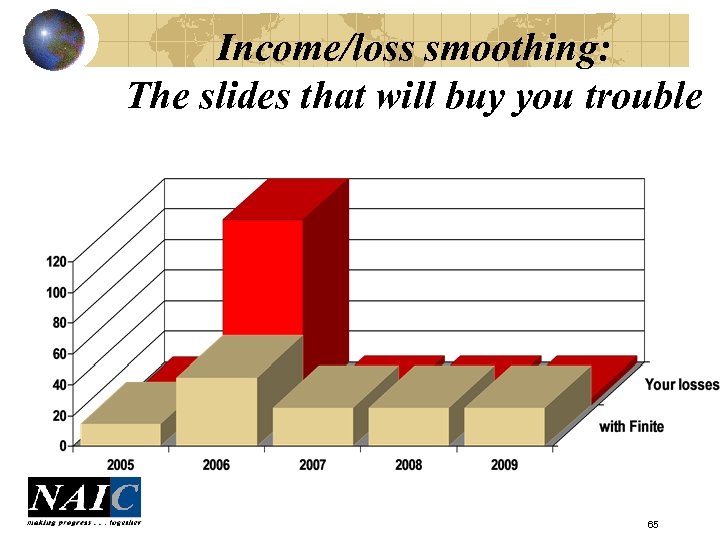

Income/loss smoothing: The slides that will buy you trouble 65

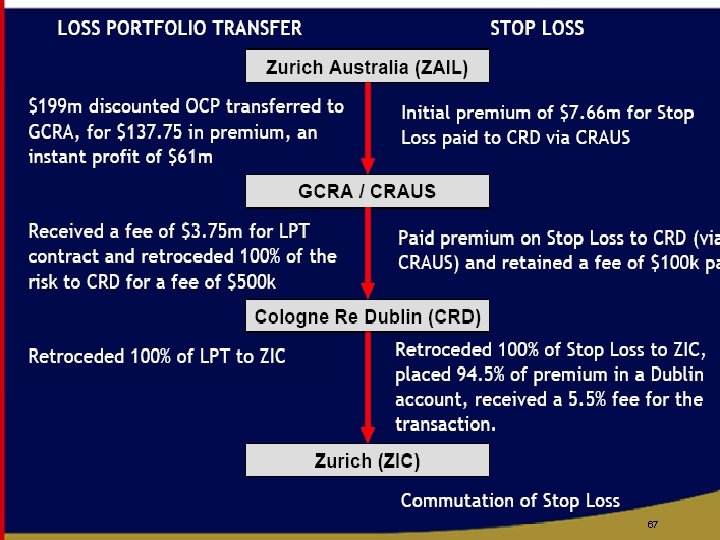

Example Ø Many of these finite reinsurance arrangements are structured as a series of transactions on a crossborder basis with multiple parties (some may be related) or can be one complex contract, which makes detection and risk assessment difficult for local supervisors. They may involve deceptive behaviour by insurance and other professionals. Effective supervision is enhanced through international cooperation among regulators and sharing of information about the fitness & propriety of the individuals involved in putting the arrangements together. 66

67

Key Characteristics of Structured Risk Broad Coverage - Tailored to client’s business, including “difficult to protect risks” Aggregate Limit of Liability Allows client to determine amount of coverage purchased Aggregate limit allows reinsurer to provide more attractive terms to client and preserves reinsurer’s ability to pay Multiple Year Term Allows for more accurate determination of limit to be purchased due to reduced volatility of multi year deal - Removes uncertainty from planning process since limit is guaranteed Recognition of Time Value of Money Substantial part of overall economics of the transaction With funds withheld, investment income can be generated at a more realistic rate than Reinsurer’s risk free pricing rate Alignment of Interests Potential for substantial profit sharing in the event of favorable experience 68

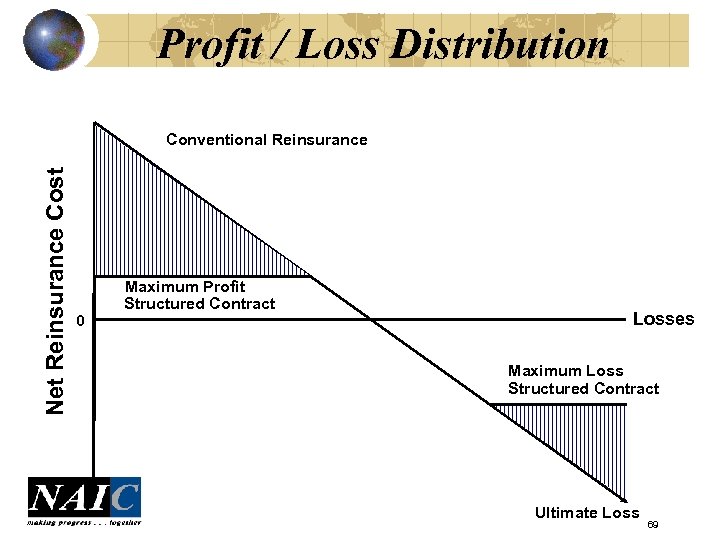

Profit / Loss Distribution Net Reinsurance Cost Conventional Reinsurance 0 Maximum Profit Structured Contract Losses Maximum Loss Structured Contract Ultimate Loss 69

Motivations for Purchasing Structured Risk Client motivations for use of structured reinsurance include: making - retention in limited capital Company experience is much better than average, reinsurance “too expensive” Company experience is much worse than average, reinsurance unavailable Company wants to exit lines of business Company wants to increase writings or take a larger existing portfolio, but is constrained by In all these cases, structured reinsurance gives clients options to purchase protection, but also to continue to participate in the underlying economics 70

Specific Types of Structured Risk Transactions Structured transactions provide cost effective alternatives to traditional covers. Can be either Retrospective or Prospective. Examples include: Adverse Development Cover / Loss Portfolio Transfer addresses old year liabilities, and permits management to focus on ongoing business. Can include transfer of claims management Structured Quota Share allows access to traditional pro rata protection while allowing the client to retain a share of the positive economics Catastrophe Excess - uses multiple years of coverage to reduce reinsurers’ risk charge Cover” Aggregate Stop Loss provides whole account protection against both frequency and severity of loss, a. k. a the “Ultimate Cat 71

The Benefits of Structured Risk Transactions Structured reinsurance provides a number of benefits to client: Cost of reinsurance dictated by client results, not market price Multi year cover gives customer stable term and conditions Potential for profit sharing with favorable experience Funds withheld structure, where only margin is paid to reinsurer, allows for: • Reduction in unsecured reinsurance recoverable balances • Improved cash flow • Recognition of reasonable investment returns in the Funds Withheld Account (FWA), resulting in higher loss payment capacity 72

Risks Contained in Structured Risk Transactions Continued There additional risks that are evaluated given the nature of these transactions: Credit Risk – the possibility that the client will default their payment obligations Investment Risk – the potential for asset return to differ from the obligation specified in the contract Regulatory / Accounting Risk – the potential for an Insurance Department or auditors to disapprove a transaction Legal Risk –the chance the contract wording will be interpreted by a court in an unintended way Reputational Risk – the risk of being associated with counterparties of questionable character or writing covers with questionable benefits 73

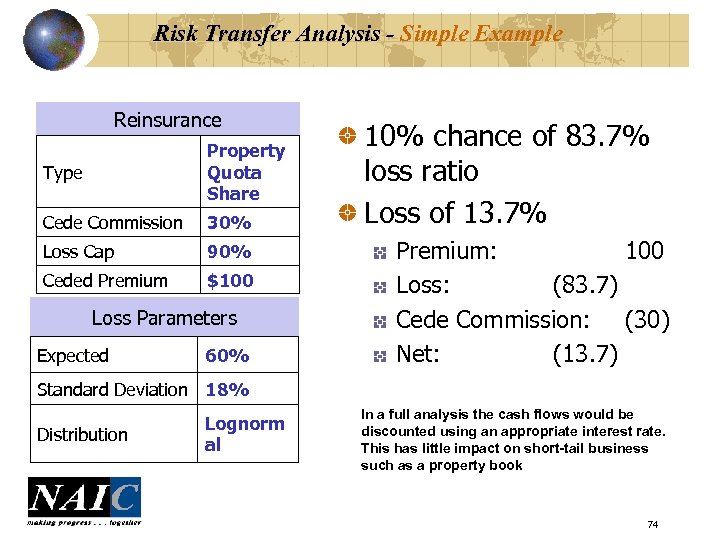

Risk Transfer Analysis - Simple Example Reinsurance Type Property Quota Share Cede Commission 30% Loss Cap 90% Ceded Premium $100 Loss Parameters Expected 60% 10% chance of 83. 7% loss ratio Loss of 13. 7% Premium: 100 Loss: (83. 7) Cede Commission: (30) Net: (13. 7) Standard Deviation 18% Distribution Lognorm al In a full analysis the cash flows would be discounted using an appropriate interest rate. This has little impact on short-tail business such as a property book 74

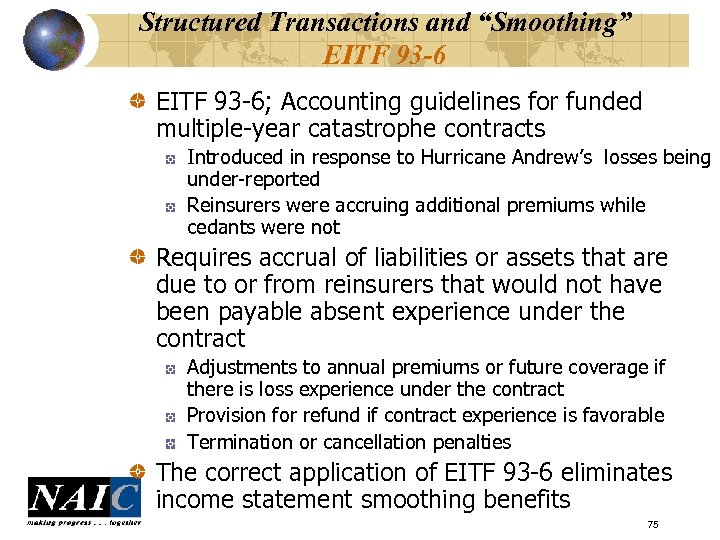

Structured Transactions and “Smoothing” EITF 93 -6; Accounting guidelines for funded multiple-year catastrophe contracts Introduced in response to Hurricane Andrew’s losses being under-reported Reinsurers were accruing additional premiums while cedants were not Requires accrual of liabilities or assets that are due to or from reinsurers that would not have been payable absent experience under the contract Adjustments to annual premiums or future coverage if there is loss experience under the contract Provision for refund if contract experience is favorable Termination or cancellation penalties The correct application of EITF 93 -6 eliminates income statement smoothing benefits 75

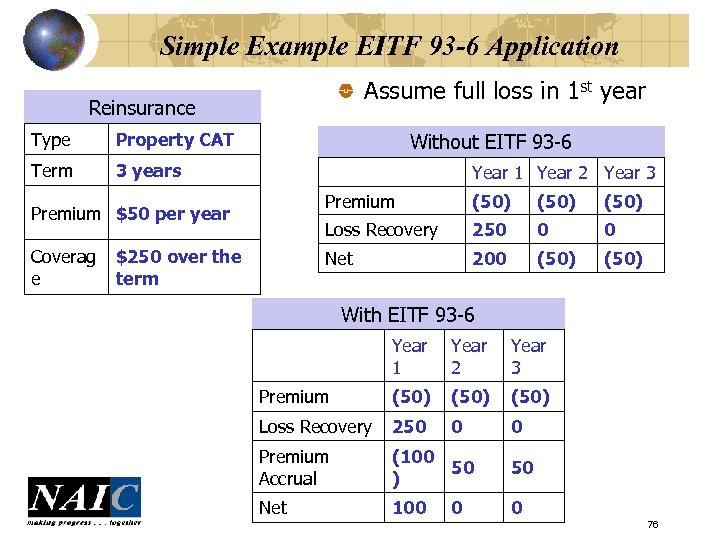

Simple Example EITF 93 -6 Application Assume full loss in 1 st year Reinsurance Type Property CAT Term 3 years Without EITF 93 -6 Year 1 Year 2 Year 3 Premium Coverag e (50) 250 0 0 Net $250 over the term (50) Loss Recovery Premium $50 per year 200 (50) With EITF 93 -6 Year 1 Year 2 Year 3 Premium (50) Loss Recovery 250 0 0 Premium Accrual (100 50 ) 50 Net 100 0 0 76

Current Risk Transfer Testing 77

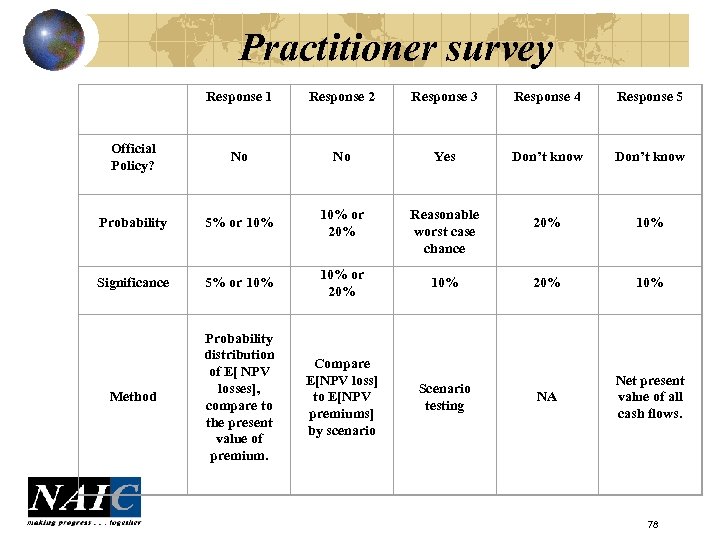

Practitioner survey Response 1 Response 2 Response 3 Response 4 Response 5 Official Policy? No Yes Don’t know Probability 5% or 10% or 20% Reasonable worst case chance 20% 10% Significance 5% or 10% or 20% 10% Method Probability distribution of E[ NPV losses], compare to the present value of premium. Compare E[NPV loss] to E[NPV premiums] by scenario Scenario testing NA Net present value of all cash flows. 78

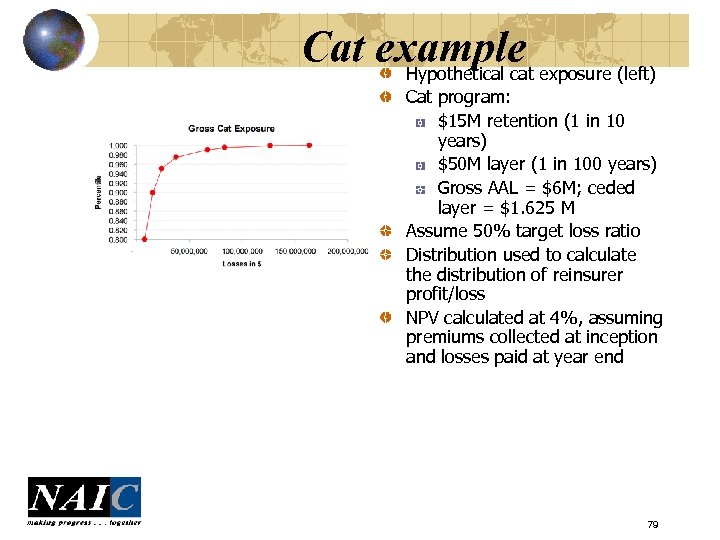

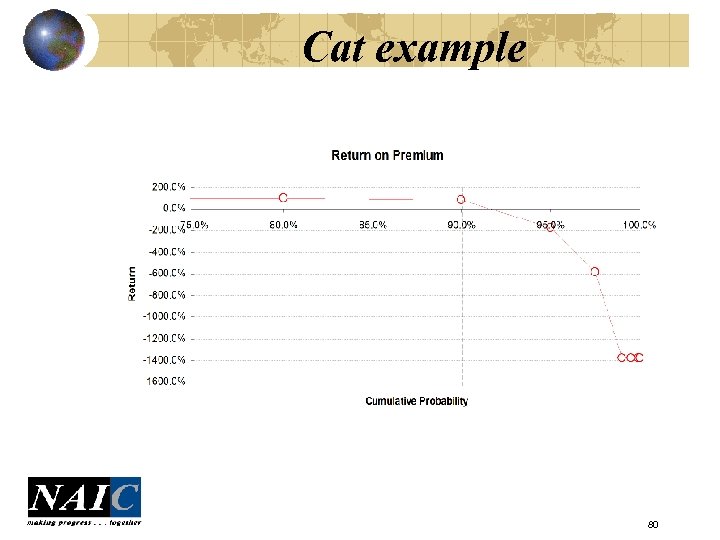

Cat example exposure (left) Hypothetical cat Cat program: $15 M retention (1 in 10 years) $50 M layer (1 in 100 years) Gross AAL = $6 M; ceded layer = $1. 625 M Assume 50% target loss ratio Distribution used to calculate the distribution of reinsurer profit/loss NPV calculated at 4%, assuming premiums collected at inception and losses paid at year end 79

Cat example 80

Considerations Burden of proof is on the cedant; “proof” is that the reinsurer can lose money, not that cedant risk is reduced Analysis should include: Distribution of possible results Cash flow estimates Appropriate, common discount rate Thorough understanding of contract terms Analysis does not include: Taxes Reinsurer expenses The 10 -10 rule, or Va. R tests in general are “sufficient, but not necessary. ” Risk assessment could/should consider the whole distribution…other risk metrics can be considered. 81

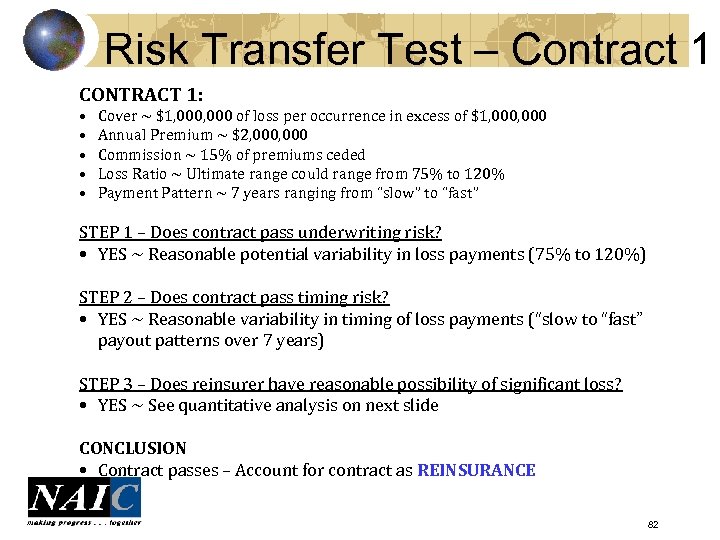

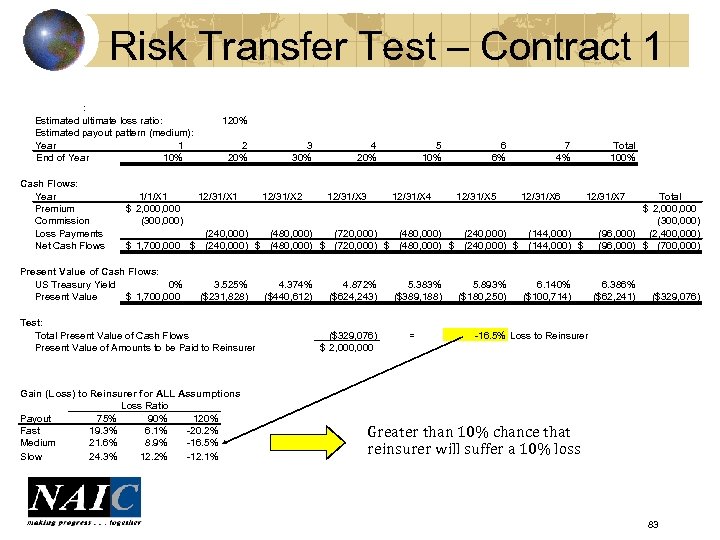

Risk Transfer Test – Contract 1 CONTRACT 1: • • • Cover ~ $1, 000 of loss per occurrence in excess of $1, 000 Annual Premium ~ $2, 000 Commission ~ 15% of premiums ceded Loss Ratio ~ Ultimate range could range from 75% to 120% Payment Pattern ~ 7 years ranging from “slow” to “fast” STEP 1 – Does contract pass underwriting risk? • YES ~ Reasonable potential variability in loss payments (75% to 120%) STEP 2 – Does contract pass timing risk? • YES ~ Reasonable variability in timing of loss payments (“slow to “fast” payout patterns over 7 years) STEP 3 – Does reinsurer have reasonable possibility of significant loss? • YES ~ See quantitative analysis on next slide CONCLUSION • Contract passes – Account for contract as REINSURANCE 82

Risk Transfer Test – Contract 1 Assumptions: Estimated ultimate loss ratio: Estimated payout pattern (medium): Year 1 End of Year 10% Cash Flows: Year Premium Commission Loss Payments Net Cash Flows 1/1/X 1 $ 2, 000 (300, 000) $ 1, 700, 000 Present Value of Cash Flows: US Treasury Yield 0% Present Value $ 1, 700, 000 120% 2 20% 3 30% 4 20% 5 10% 6 6% 7 4% 12/31/X 1 12/31/X 2 12/31/X 3 12/31/X 4 12/31/X 5 12/31/X 6 3. 525% ($231, 828) 4. 374% ($440, 612) 4. 872% ($624, 243) 5. 383% ($389, 188) 5. 893% ($180, 250) Total 100% Total $ 2, 000 (300, 000) (240, 000) (480, 000) (720, 000) (480, 000) (240, 000) (144, 000) (96, 000) (2, 400, 000) $ (240, 000) $ (480, 000) $ (720, 000) $ (480, 000) $ (240, 000) $ (144, 000) $ (96, 000) $ (700, 000) 6. 140% ($100, 714) Test: Total Present Value of Cash Flows Present Value of Amounts to be Paid to Reinsurer Gain (Loss) to Reinsurer for ALL Assumptions Loss Ratio Payout 75% 90% 120% Fast 19. 3% 6. 1% -20. 2% Medium 21. 6% 8. 9% -16. 5% Slow 24. 3% 12. 2% -12. 1% ($329, 076) $ 2, 000 = 12/31/X 7 6. 386% ($62, 241) ($329, 076) -16. 5% Loss to Reinsurer Greater than 10% chance that reinsurer will suffer a 10% loss 83

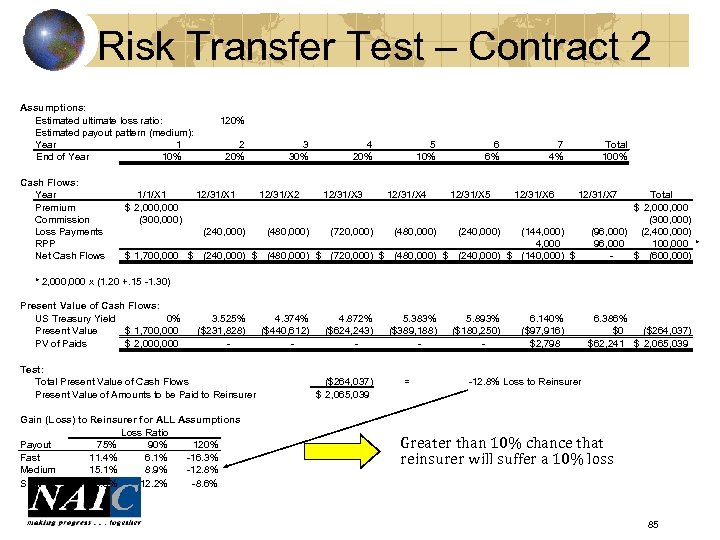

Risk Transfer Test – Contract 2 CONTRACT 2: • Base assumptions same as CONTRACT 1 • Retrospective rated premium (RPP) based on combined ratio of contract • Adjustable from minimum combined ratio of 100% capped at 130% • RPP is payable as of the end of Year 5 STEP 1 – Does contract pass underwriting risk? • YES ~ Reasonable potential variability in loss payments (75% to 120%) • RPP somewhat mitigates but significant amount of variability still present STEP 2 – Does contract pass timing risk? • YES ~ Reasonable variability in timing of loss payments (“slow to “fast” payout patterns over 7 years) STEP 3 – Does reinsurer have reasonable possibility of significant loss? • YES ~ See quantitative analysis on next slide CONCLUSION • Contract passes – Account for contract as REINSURANCE 84

Risk Transfer Test – Contract 2 Assumptions: Estimated ultimate loss ratio: Estimated payout pattern (medium): Year 1 End of Year 10% Cash Flows: Year Premium Commission Loss Payments RPP Net Cash Flows 1/1/X 1 $ 2, 000 (300, 000) 120% 2 20% 12/31/X 1 3 30% 12/31/X 2 4 20% 12/31/X 3 5 10% 12/31/X 4 6 6% 12/31/X 5 7 4% 12/31/X 6 Total 100% 12/31/X 7 Total $ 2, 000 (300, 000) (240, 000) (480, 000) (720, 000) (480, 000) (240, 000) (144, 000) (96, 000) (2, 400, 000) 4, 000 96, 000 100, 000 * $ 1, 700, 000 $ (240, 000) $ (480, 000) $ (720, 000) $ (480, 000) $ (240, 000) $ (140, 000) $ (600, 000) * 2, 000 x (1. 20 +. 15 -1. 30) Present Value of Cash Flows: US Treasury Yield 0% 3. 525% 4. 374% 4. 872% 5. 383% 5. 893% Present Value $ 1, 700, 000 ($231, 828) ($440, 612) ($624, 243) ($389, 188) ($180, 250) PV of Paids $ 2, 000 Test: Total Present Value of Cash Flows Present Value of Amounts to be Paid to Reinsurer Gain (Loss) to Reinsurer for ALL Assumptions Loss Ratio Payout 75% 90% 120% Fast 11. 4% 6. 1% -16. 3% Medium 15. 1% 8. 9% -12. 8% Slow 16. 0% 12. 2% -8. 6% ($264, 037) $ 2, 065, 039 = 6. 140% ($97, 916) $2, 798 6. 386% $0 ($264, 037) $62, 241 $ 2, 065, 039 -12. 8% Loss to Reinsurer Greater than 10% chance that reinsurer will suffer a 10% loss 85

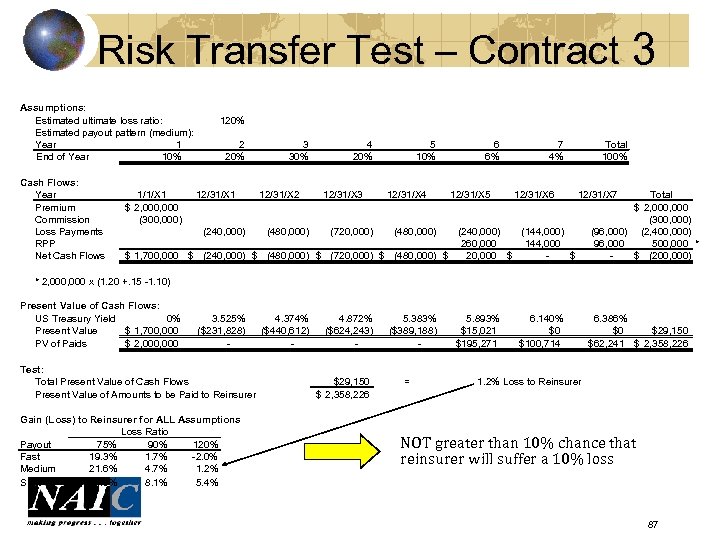

Risk Transfer Test – Contract 3 CONTRACT 3: • Base assumptions same as CONTRACT 1 • Retrospective rated premium (RPP) based on combined ratio of contract • Mo minimum combined ratio and capped at 110% • RPP is payable as of the end of Year 5 STEP 1 – Does contract pass underwriting risk? • YES ~ Reasonable potential variability in loss payments (75% to 120%) • RPP somewhat mitigates but significant amount of variability still present STEP 2 – Does contract pass timing risk? • YES ~ Reasonable variability in timing of loss payments (“slow to “fast” payout patterns over 7 years) STEP 3 – Does reinsurer have reasonable possibility of significant loss? • NO ~ See quantitative analysis on next slide CONCLUSION • Contract fails – Account for contract as DEPOSIT 86

Risk Transfer Test – Contract 3 Assumptions: Estimated ultimate loss ratio: Estimated payout pattern (medium): Year 1 End of Year 10% Cash Flows: Year Premium Commission Loss Payments RPP Net Cash Flows 1/1/X 1 $ 2, 000 (300, 000) 120% 2 20% 12/31/X 1 3 30% 12/31/X 2 4 20% 12/31/X 3 5 10% 12/31/X 4 6 6% 12/31/X 5 7 4% 12/31/X 6 Total 100% 12/31/X 7 Total $ 2, 000 (300, 000) (240, 000) (480, 000) (720, 000) (480, 000) (240, 000) (144, 000) (96, 000) (2, 400, 000) 260, 000 144, 000 96, 000 500, 000 * $ 1, 700, 000 $ (240, 000) $ (480, 000) $ (720, 000) $ (480, 000) $ 20, 000 $ $ (200, 000) * 2, 000 x (1. 20 +. 15 -1. 10) Present Value of Cash Flows: US Treasury Yield 0% 3. 525% 4. 374% 4. 872% 5. 383% Present Value $ 1, 700, 000 ($231, 828) ($440, 612) ($624, 243) ($389, 188) PV of Paids $ 2, 000 Test: Total Present Value of Cash Flows Present Value of Amounts to be Paid to Reinsurer Gain (Loss) to Reinsurer for ALL Assumptions Loss Ratio Payout 75% 90% 120% Fast 19. 3% 1. 7% -2. 0% Medium 21. 6% 4. 7% 1. 2% Slow 24. 3% 8. 1% 5. 4% $29, 150 $ 2, 358, 226 = 5. 893% $15, 021 $195, 271 6. 140% $0 $100, 714 6. 386% $0 $29, 150 $62, 241 $ 2, 358, 226 1. 2% Loss to Reinsurer NOT greater than 10% chance that reinsurer will suffer a 10% loss 87

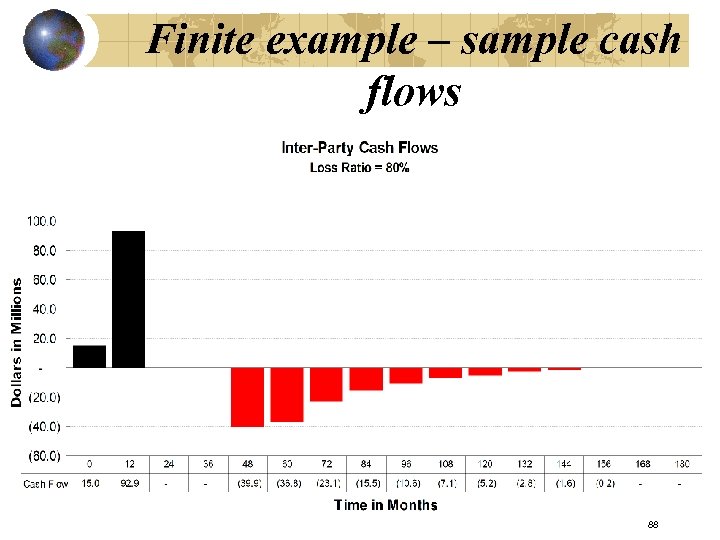

Finite example – sample cash flows 88

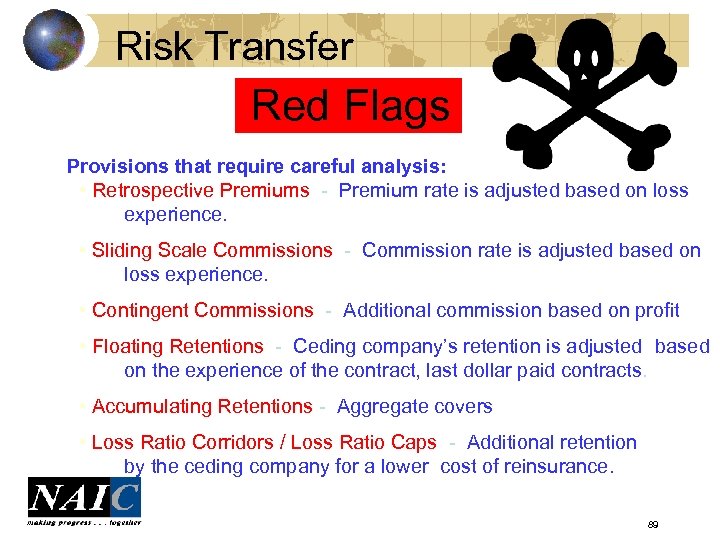

Risk Transfer Red Flags Provisions that require careful analysis: • Retrospective Premiums - Premium rate is adjusted based on loss Retrospective Premiums experience. • Sliding Scale Commissions - Commission rate is adjusted based on Sliding Scale Commissions loss experience. • Contingent Commissions - Additional commission based on profit Contingent Commissions • Floating Retentions - Ceding company’s retention is adjusted based Floating Retentions on the experience of the contract, last dollar paid contracts. • Accumulating Retentions - Aggregate covers Accumulating Retentions • Loss Ratio Corridors / Loss Ratio Caps - Additional retention Loss Ratio Corridors / Loss Ratio Caps by the ceding company for a lower cost of reinsurance. 89

CATF Considerations A principles-based standard should be maintained, yet additional interpretation and guidance should be provided. The proper standard should not be whether the reinsurer accepted risk, which focuses more on reinsurance pricing as opposed to risk transfer, but whether the cedant ceded sufficient risk. 90

CATF Considerations The accounting should follow the economics and intent of the contract from the ceding company’s view rather than the reinsurer’s view. Safe harbors should be established whereby only those contracts where loss transfer is not reasonably self-evident would require further evaluation of risk transfer. The 10/10 benchmark is not appropriate for all types of reinsurance contracts, nor is there likely to be any type of bright-line indicator that would work across all types of reinsurance contracts. 91

CATF Considerations Different methods for risk transfer testing should be allowed, similar to how there are many acceptable methods for loss reserving. In the past, documentation has not always been adequate to clearly demonstrate risk transfer. As the complexity of a reinsurance contract increases, the necessity of having actuarial involvement in analyzing risk transfer increases. 92

CATF Recommendations Consideration should be given to requiring actuarial involvement in some areas of risk transfer analysis. Guidance should be provided as to which contracts would most likely require actuarial evaluation. Data issues should be identified that may occur as more sophisticated risk transfer testing methods are used. Due to the short timeline of the project, additional testing and analysis still need to be performed on the proposals of methods of risk transfer evaluation included in the AAA report. 93

AAA Risk Transfer Working Group Technical Issues In Risk Transfer Testing, Cont’d What to do if interest rate on funds held or experience account is very different from interest rate used for discounting? Does “cash flows” mean cash that has changed hands or does it also include implied cash flows? Consideration of brokerage fees? Consideration of commutation clauses, sunset clauses or special termination provisions. Consideration of ceding commissions paid in the future or at contract expiration. Consideration of maintenance fees. 94

AAA Risk Transfer Working Group Technical Issues In Risk Transfer Testing, Cont’d Consideration of special cancellation rights Consideration of multi-year contracts What are the components of the numerator and the denominator in a test for significance of loss to the reinsurer? In a probabilistic analysis, should the numerator for each scenario, or to the weighted average of the denominator values for all scenarios? 95

AAA Risk Transfer Working Group Risk Transfer Testing Issues Regarding Data, Methods and Interpreting Results Data considerations for modeling the subjet business – e. g. sources, limitations, adjustments How should process risk, parameter risk and model risk be considered in risk transfer testing? • Constantly moving target? Granularity of Data? • Assumptions in Models? What type of analysis (e. g. point estimate vs. range vs. probabilistic scenario testing) is indicated by specific types of contracts/features? 96

AAA Risk Transfer Working Group Risk Transfer Testing Issues Regarding Data, Methods and Interpreting Results, Cont’d. What kinds of methods (e. g. , Value at Risk, Tail Value at Risk, Expected Reinsurer Deficit, Relative Risk testing) work with specific types of contracts/features? Provide comprehensive examples of risk transfer analysis, interpretation of results and accounting for various real-life contracts. Monitor FASB’s project on bifurcation and decide whether to give input 97

AAA Practice Note We believe that contracts in which risk and reward are effectively transferred away from the cedant regardless of the probability of loss, should not be subject to cashflow testing using a standard of “reasonable possibility of significant loss” as prescribed in SSAP 62. We believe that the Expected Reinsurer Deficit test described in the CAS Working Party report may be a useful testing method that follows the precepts for cashflow testing outlined in SSAP 62. However, we do not believe it is appropriate to apply it as a bright-line standard test, and we believe that further analysis is required to determine what threshold may be reasonable under various circumstances. 98

AAA Risk Transfer Working Group Safe Harbors and definition of “reasonably self-evident” Review current comment papers on this topic and make recommendations if appropriate Add examples to illustrate concepts Technical Issues In Risk Transfer Testing How to determine the appropriate interest rate to be used for discounting. How to treat a guaranteed interest rate on funds held or experience account (e. g. should this be additional premium? ) 99

Evaluating Risk Transfer – Process Ø The Substance of Arrangement Ø Identify the Contract or Contracts being evaluated Ø Obtain and Read Entire Contract and Related Contracts, if any Ø Substance does not Always Follow Form Ø Obtain from the Audited Company an Understanding of the Business Purpose and Substance of the Transaction. Ø Obtain and Review as much Background to the Transaction as Possible Ø Obtain and Review Underwriting Memo, Accounting Memo Risk and/or Risk Transfer Memo Ø In unavailable, there might be control implications and an inability for auditor to conclude on risk transfer 100

Alternatives to Va. R Tests 101

Alternative Measures of Risk Expected Deficit Tail Value at Risk Other Coherent Measures Exponential Transforms Transforming the 10 -10 Rule 102

Weaknesses of Methods Value-at-Risk (Va. R) method at 90% Only reflects severity of losses at one point on probability distribution and ignores all other information in the tail Fails low frequency/high severity contracts (e. g. , catastrophe covers) Fails some high frequency/low severity contracts (e. g. non-standard automobile) Deems acceptable those contracts engineered to “pass the test” What Method Should be used? 103

Better Methods Tail Va. R (TVa. R) = mean severity of PV (underwriting loss) at and beyond 90 th percentile Suggested by 2002 CAS Paper Expected Reinsurer Deficit =probability of PV (underwriting loss) X average severity (ERD = Frequency x Severity > A) Average severity = TVa. R @ economic breakeven point • Suggested by CAS Risk Transfer Working Party 2005 with A = 1%? (Consistent with 10% - 10% Rule) Why is ERD preferred? Reflects full right tail risk in severity definition Replaces separate Frequency and Severity requirements into single integrated measure 104

Expected Deficit Loss x Probability Single loss: 10 -10 ~ 5 -20 ~ 2 -50 etc. Or average deficit: expected value over all scenarios of the reinsurers loss in the losing scenarios = E(P – L)+ From examples: Property Catastrophe = -40% Quota Share = -3% Finite = -3% 105

Accounting Developments 106

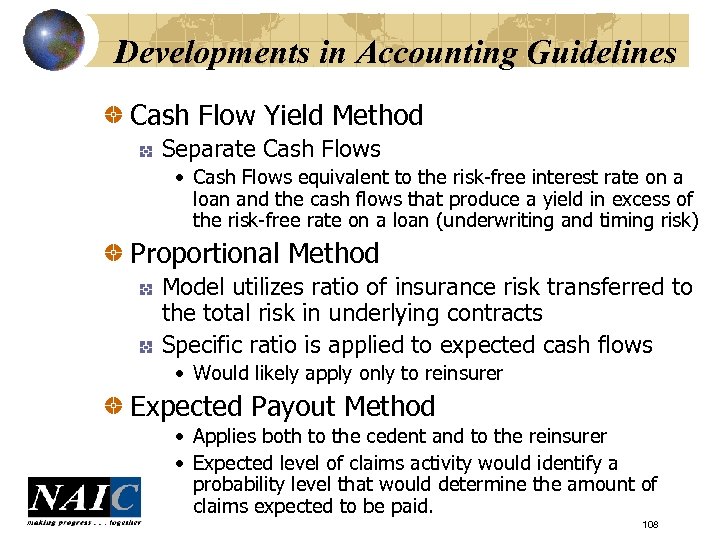

Developments in Accounting Guidelines FASB – Analyzing Potential Bifurcation of Insurance/Financing Risk What approaches to bifurcation would be most effective in improving transparency in and usefulness of financial statements? What contracts would be appropriate for bifurcation – that is, what, if any, safe harbors should be developed for contracts that would not require bifurcation analysis? How would bifurcated contracts be accounted for? 107

Developments in Accounting Guidelines Cash Flow Yield Method Separate Cash Flows • Cash Flows equivalent to the risk-free interest rate on a loan and the cash flows that produce a yield in excess of the risk-free rate on a loan (underwriting and timing risk) Proportional Method Model utilizes ratio of insurance risk transferred to the total risk in underlying contracts Specific ratio is applied to expected cash flows • Would likely apply only to reinsurer Expected Payout Method • Applies both to the cedent and to the reinsurer • Expected level of claims activity would identify a probability level that would determine the amount of claims expected to be paid. 108

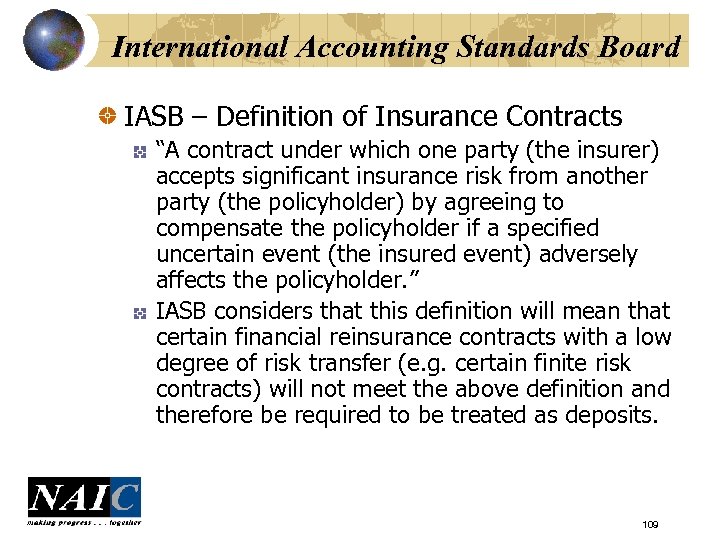

International Accounting Standards Board IASB – Definition of Insurance Contracts “A contract under which one party (the insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain event (the insured event) adversely affects the policyholder. ” IASB considers that this definition will mean that certain financial reinsurance contracts with a low degree of risk transfer (e. g. certain finite risk contracts) will not meet the above definition and therefore be required to be treated as deposits. 109

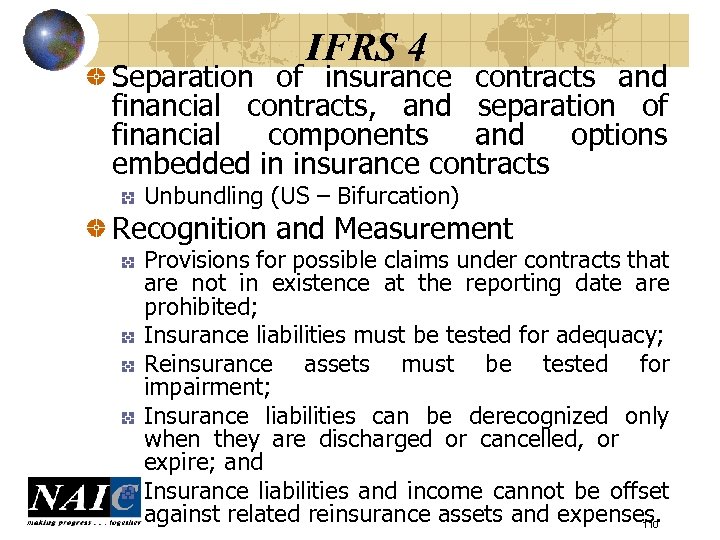

IFRS 4 Separation of insurance contracts and financial contracts, and separation of financial components and options embedded in insurance contracts Unbundling (US – Bifurcation) Recognition and Measurement Provisions for possible claims under contracts that are not in existence at the reporting date are prohibited; Insurance liabilities must be tested for adequacy; Reinsurance assets must be tested for impairment; Insurance liabilities can be derecognized only when they are discharged or cancelled, or expire; and Insurance liabilities and income cannot be offset against related reinsurance assets and expenses. 110

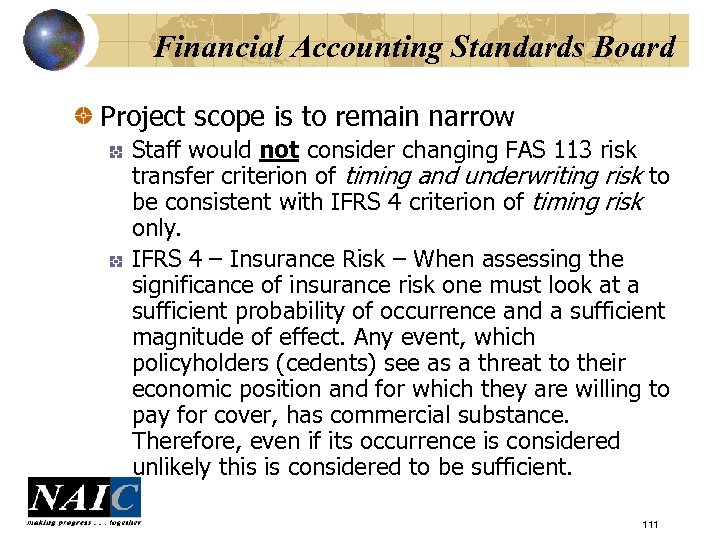

Financial Accounting Standards Board Project scope is to remain narrow Staff would not consider changing FAS 113 risk transfer criterion of timing and underwriting risk to be consistent with IFRS 4 criterion of timing risk only. IFRS 4 – Insurance Risk – When assessing the significance of insurance risk one must look at a sufficient probability of occurrence and a sufficient magnitude of effect. Any event, which policyholders (cedents) see as a threat to their economic position and for which they are willing to pay for cover, has commercial substance. Therefore, even if its occurrence is considered unlikely this is considered to be sufficient. 111

Industry Update – Possible Changes Ø Changes to SSAP 62? : ØA Significant Proposal – Bifurcation Ø Certain contracts, including quota share with limits, aggregate stop-loss and retroactive potentially subject to bifurcation Ø Bifurcation is the separation of a contract into financing and risk transfer components for accounting purposes Ø Would require actuarial evaluation to estimate/allocate premium and related consideration between the risk transfer and deposit components 112

Industry Update – Possible Changes Ø Proposed Bifurcation? ØPossible Benefits ØAn Ability to Better Match The Accounting with a Contract’s Economics ØWould Likely Eliminate the Benefit, and then eventually the Existence, of Those Contracts Viewed as Problematic by Regulators, Rating Agencies and Investors 113

Industry Update – Possible Changes Ø Proposed Bifurcation? ØPossible Concerns Ø Complexity – Bifurcation Could be Very Complicated, in particular for Certain Quota Share Arrangements with Risk Limiting Features Ø Potential Unintended Consequences Ø Change in Structure, Pricing of Traditional Market Ø Bifurcation of Contracts that are not viewed as Problematic or Viewed to have Significant Risk Limiting Features Ø Differences in Accounting between US SAP, US GAAP and other Accounting Bases 114

Supervisory Approach Attestation of Chief Executive Officer and Chief Financial Officer No separate written or oral agreements between the reporting entity (or its affiliates or companies it controls) and the assuming reinsurer that would under any circumstances, reduce, limit, mitigate or otherwise affect any actual or potential loss to the parties under the reinsurance contract other than inuring contracts that are explicitly defined in the reinsurance contract except as disclosed herein; For each such reinsurance contract, the reporting entity has an underwriting file documenting the economic purpose of the transaction and the risk transfer analysis evidencing the proper accounting treatment, which is available for review; and The entity has appropriate internal controls in place to monitor the use of reinsurance 115

Finite Interrogatories 298 reporting entities out of 2, 765 total Property and Casualty Insurers (10. 8%). 278 Insurers and 20 Risk Retention Groups 184 Nationally Significant and 114 Not Nationally Significant 116

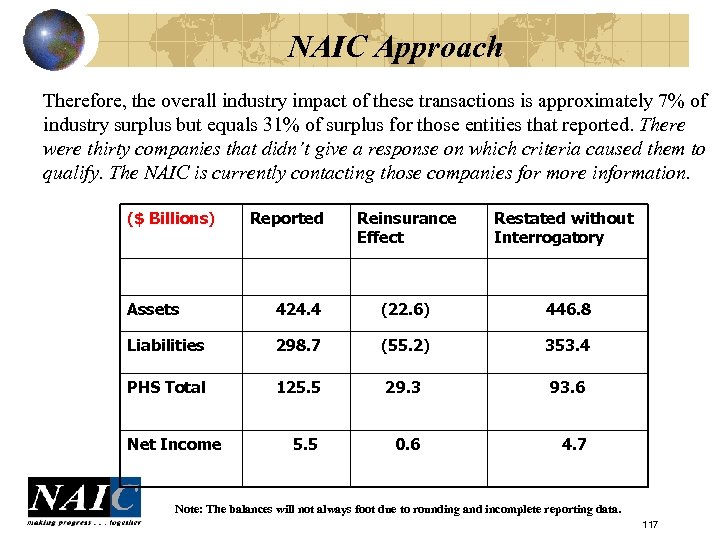

NAIC Approach Therefore, the overall industry impact of these transactions is approximately 7% of industry surplus but equals 31% of surplus for those entities that reported. There were thirty companies that didn’t give a response on which criteria caused them to qualify. The NAIC is currently contacting those companies for more information. ($ Billions) Reported Reinsurance Effect Restated without Interrogatory Assets 424. 4 (22. 6) 446. 8 Liabilities 298. 7 (55. 2) 353. 4 PHS Total 125. 5 29. 3 93. 6 5. 5 0. 6 4. 7 Net Income Note: The balances will not always foot due to rounding and incomplete reporting data. 117

Loss Reserve Reinsurance Deals that still work: “Economic” reinsurance protection - pure risk deals Reinsurance of a non-U. S. ceding company U. S. cedants not subject to GAAP or SAP - public entities U. S. insurance companies looking for statutory surplus protection Mergers and acquisitions - “Purchase Accounting” exception Loss reserve insurance deals - usually tax-motivated “No accounting impact” as the primary benefit 118

Dated Example - Statutory Surplus Protection Probably Will Cause Increased Suspicion Today! The Situation: Insurance Company A has $500 million of loss reserves on its balance sheet, including $50 million for Asbestos and Environmental claims (A&E). The Concern: The company wants to: 1. Unlock some of the “discount” in the loss reserves, and 2. Protect Statutory Surplus against further reserve increases 119

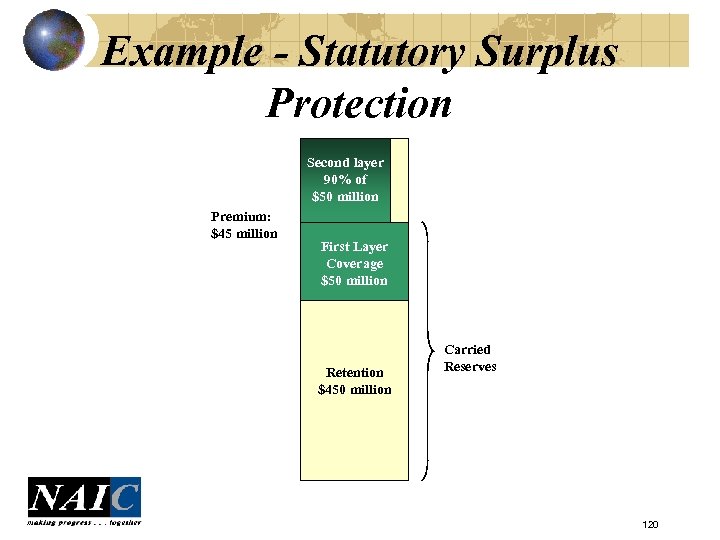

Example - Statutory Surplus Protection Second layer 90% of $50 million Premium: $45 million First Layer Second Layer Coverage $20 million $50 million Retention $450 million Carried Reserves 120

Example - Environmental Remediation Insurance The Situation: Company A, a gas utility, has $100 million of liabilities arising from pollution of old MGP sites. They have negotiated a claim settlement of $50 million with their casualty insurers, and payment is imminent. The Concern: Company A wants the claims settlement excluded from taxable income, and wants to avoid including the claims settlement in the calculation of a rate reduction for its customers. 121

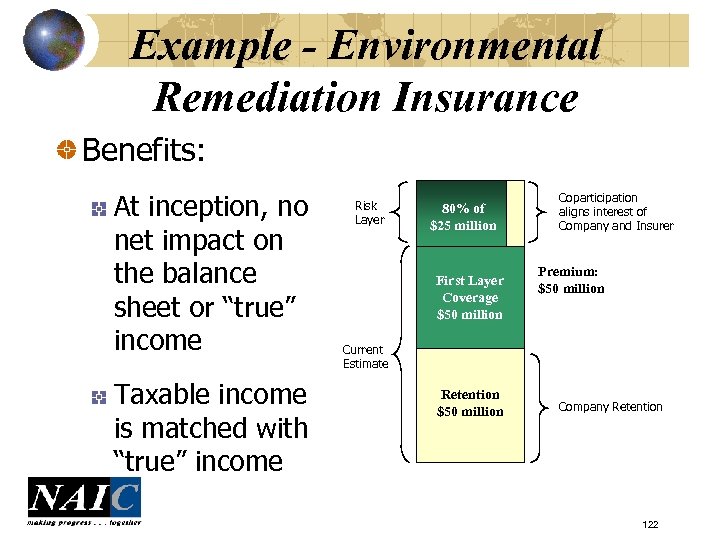

Example - Environmental Remediation Insurance Benefits: At inception, no net impact on the balance sheet or “true” income Taxable income is matched with “true” income Risk Layer 80% of $25 million Second Layer $20 million First Layer Coverage $50 million Coparticipation aligns interest of Company and Insurer Premium: $50 million Current Estimate Retention $50 million Company Retention 122

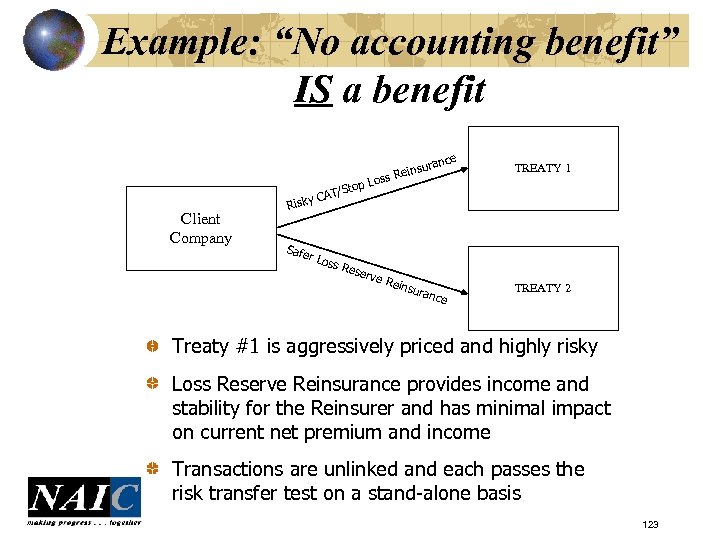

Example: “No accounting benefit” IS a benefit ance insur s Re Client Company Risky Safe s p Lo /Sto AT TREATY 1 C r Lo ss R eser ve R eins uran ce TREATY 2 Treaty #1 is aggressively priced and highly risky Loss Reserve Reinsurance provides income and stability for the Reinsurer and has minimal impact on current net premium and income Transactions are unlinked and each passes the risk transfer test on a stand-alone basis 123

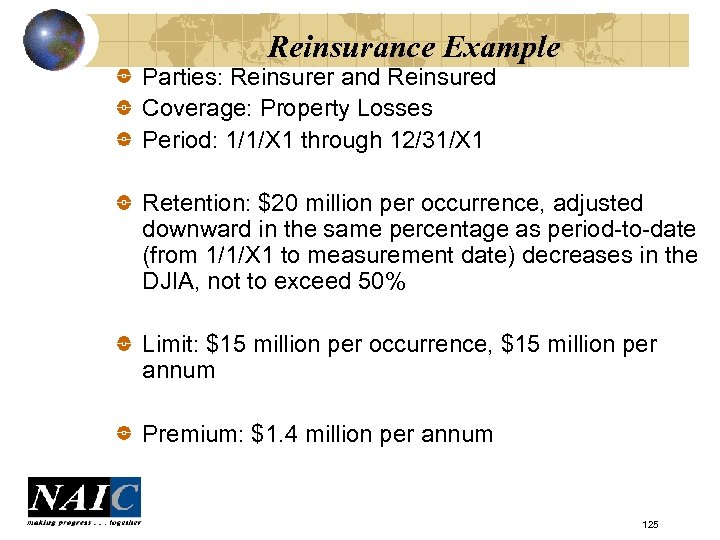

Reinsurance Example Reinsurer enters into a reinsurance contract with Reinsured to indemnify Reinsured for certain insured losses in excess of a defined retention. The coverage would include a retention amount that would be adjusted downward according to a scale tied to the Dow Jones Industrial Average (DJIA). If a catastrophic loss occurs, Reinsured would likely have to liquidate some of its investment holdings (bonds or equities) to pay its losses, which exposes Reinsured to significant investment risk in a down market. The adjustment feature provides protection against investment risk by allowing Reinsured to recover more losses in a declining investment market. Reinsured has no ability to receive appreciation in the DJIA. 124

Reinsurance Example Parties: Reinsurer and Reinsured Coverage: Property Losses Period: 1/1/X 1 through 12/31/X 1 Retention: $20 million per occurrence, adjusted downward in the same percentage as period-to-date (from 1/1/X 1 to measurement date) decreases in the DJIA, not to exceed 50% Limit: $15 million per occurrence, $15 million per annum Premium: $1. 4 million per annum 125

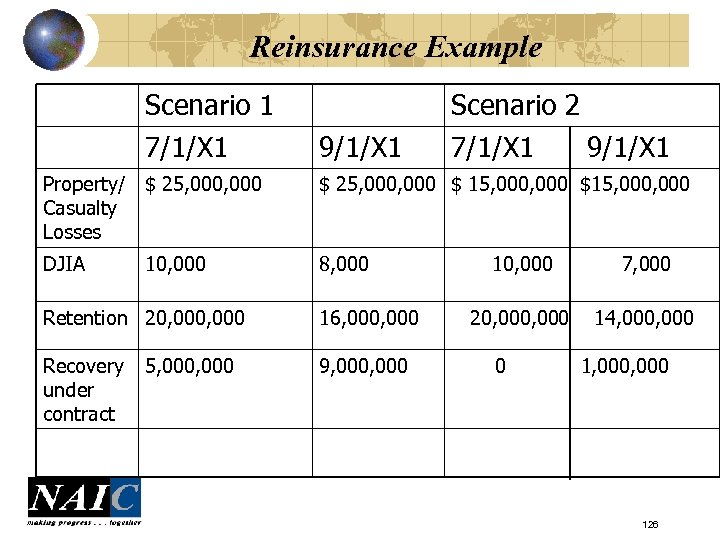

Reinsurance Example Scenario 1 7/1/X 1 9/1/X 1 Scenario 2 7/1/X 1 9/1/X 1 Property/ $ 25, 000 Casualty Losses $ 25, 000 $ 15, 000 $15, 000 DJIA 8, 000 10, 000 Retention 20, 000 16, 000 Recovery under contract 9, 000 5, 000 10, 000 7, 000 20, 000 14, 000 0 1, 000 126

Reinsurance Example Only those contracts for which payment of a claim is triggered only by a bona fide insurable exposure (that is, contracts comprising either solely insurance or both an insurance component and a derivative instrument) may qualify. In order to qualify, the contract must provide for a legitimate transfer of risk, not simply constitute a deposit or form of self-insurance. 127

FBI – NAIC – State Regulatory Role The FBI appears to be looking for potential violations of Title 18 of the U. S. Code, sections 1033/1034. These provisions of Federal law basically state it is a crime for those in the insurance industry who “knowingly, with the intent to deceive, make any false material statement or report or willfully and materially overvalue any land, property or security (A) in connection with any financial reports or documents presented to any insurance regulatory official or agency or an agent or examiner appointed by such official or agency to examine the affairs of such person, and (B) for the purpose of influencing the actions of such official or agency or such an appointed agent or examiner…” 128

Summary Ø The primary issues in finite reinsurance revolve around whethere is adequate risk transfer, the accounting and disclosure and the credit allowed in the solvency regime for reinsurance. Misuse of financial reinsurance has resulted in misrepresentation of the financial position to supervisors, policyholders, investors, creditors and other stakeholders requiring enhanced corporate governance and management accountability. Ø The main concern with these arrangements is when they are deliberately constructed as a deception or where there is intentional fraud by the company management (e. g. , links between related parities or “off contract” arrangements are concealed from the insurer’s stakeholders, regulators, and creditors). In this respect, they are no different from any other type of deception, which regulators cannot necessarily prevent. 129

ddd3e8b01b77ed15357f0cc88aecf7c6.ppt