Regulatory Requirements & Capital Adequacy

Regulatory Requirements & Capital Adequacy

What’s the Point of Regulation? • Enough Capital? • …or do I need a bailout? • Limit the risks a bank is taking… • And updated for financial crises. • Affects Model & Valuation!

What’s the Point of Regulation? • Enough Capital? • …or do I need a bailout? • Limit the risks a bank is taking… • And updated for financial crises. • Affects Model & Valuation!

Basel I (1988) • Risk-Weighted Assets Risk Weight Example Assets 0% 10% Certain public debt 20% • Capital Requirements Cash / government securities Interbank loans 50% Residential mortgages 100% Private sector debt • Tier 1 Ratio >= 4% • Total Capital Ratio >= 8% • Tier 2 Capital Cannot Exceed Tier 1 Capital • Leverage Ratio >= 3% (US only)

Basel I (1988) • Risk-Weighted Assets Risk Weight Example Assets 0% 10% Certain public debt 20% • Capital Requirements Cash / government securities Interbank loans 50% Residential mortgages 100% Private sector debt • Tier 1 Ratio >= 4% • Total Capital Ratio >= 8% • Tier 2 Capital Cannot Exceed Tier 1 Capital • Leverage Ratio >= 3% (US only)

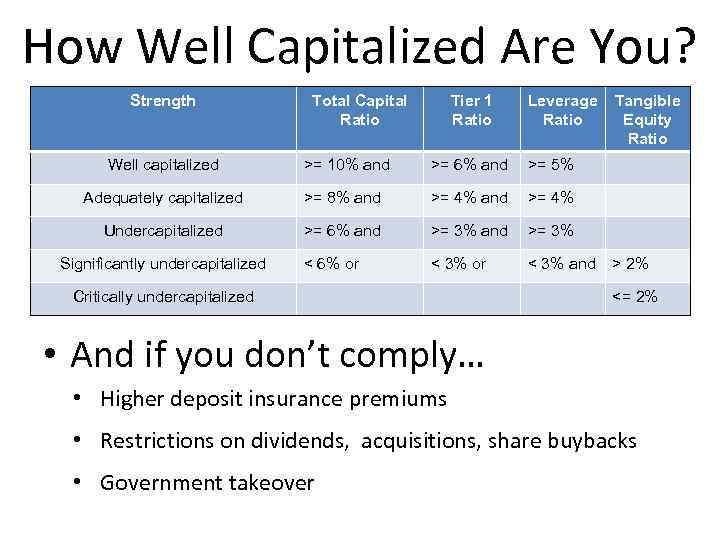

How Well Capitalized Are You? Strength Total Capital Ratio Tier 1 Ratio Leverage Ratio Well capitalized >= 10% and >= 6% and >= 5% Adequately capitalized >= 8% and >= 4% Undercapitalized >= 6% and >= 3% < 6% or < 3% and Tangible Equity Ratio Significantly undercapitalized Critically undercapitalized > 2% <= 2% • And if you don’t comply… • Higher deposit insurance premiums • Restrictions on dividends, acquisitions, share buybacks • Government takeover

How Well Capitalized Are You? Strength Total Capital Ratio Tier 1 Ratio Leverage Ratio Well capitalized >= 10% and >= 6% and >= 5% Adequately capitalized >= 8% and >= 4% Undercapitalized >= 6% and >= 3% < 6% or < 3% and Tangible Equity Ratio Significantly undercapitalized Critically undercapitalized > 2% <= 2% • And if you don’t comply… • Higher deposit insurance premiums • Restrictions on dividends, acquisitions, share buybacks • Government takeover

Problems with Basel I • All corporate loans are equally risky? • Loan classification • Securitizations / derivatives… • Narrow focus on credit risk • Is 8% always enough to save you?

Problems with Basel I • All corporate loans are equally risky? • Loan classification • Securitizations / derivatives… • Narrow focus on credit risk • Is 8% always enough to save you?

Basel II (2004) • More complex RWA Risk Weight Example Assets 0% 35% Residential mortgages 75% Credit / auto loans 100% Commercial real estate 100% • Different risks Cash and equivalents Other assets • Bank transparency Government securities By rating Interbank loans By rating • Supervisory review By rating Corporate loans

Basel II (2004) • More complex RWA Risk Weight Example Assets 0% 35% Residential mortgages 75% Credit / auto loans 100% Commercial real estate 100% • Different risks Cash and equivalents Other assets • Bank transparency Government securities By rating Interbank loans By rating • Supervisory review By rating Corporate loans

The Financial Crisis • Tier 1 Ratios – wrong? • Is the Leverage Ratio better? • No measures of liquidity • Managed reporting required? • Counterparty credit risk

The Financial Crisis • Tier 1 Ratios – wrong? • Is the Leverage Ratio better? • No measures of liquidity • Managed reporting required? • Counterparty credit risk

Basel III? • Stricter definition of Tier 1 Capital • Leverage Ratio requirement • Counter-cyclical capital buffers • Limits on counterparty credit risk • Liquidity Ratios

Basel III? • Stricter definition of Tier 1 Capital • Leverage Ratio requirement • Counter-cyclical capital buffers • Limits on counterparty credit risk • Liquidity Ratios

Why Do These Rules Matter? • We need them in our model • Impact on valuation

Why Do These Rules Matter? • We need them in our model • Impact on valuation

The Truth About Capital Adequacy • Calculation is tricky and bank-specific • Differs significantly by country • Have to rely on filings – no “standard” • More control in valuations / simple models

The Truth About Capital Adequacy • Calculation is tricky and bank-specific • Differs significantly by country • Have to rely on filings – no “standard” • More control in valuations / simple models