e532f5bf81f5cae0267bd469ec4e8ee6.ppt

- Количество слайдов: 37

REGULATORY ASSET BASE VALUATION USING ODRC Meralco Experience

Presentation Outline I. ODRC Background II. Asset Accounting III. Replacement Costs IV. Optimization V. Depreciation VI. Results of Meralco’s ODRC Valuation

Conceptual Framework Optimized Depreciated Replacement Cost (ODRC) is calculated based on the gross current replacement cost of assets that are adjusted for over-design, over-capacity and/or redundancy, less an allowance for depreciation.

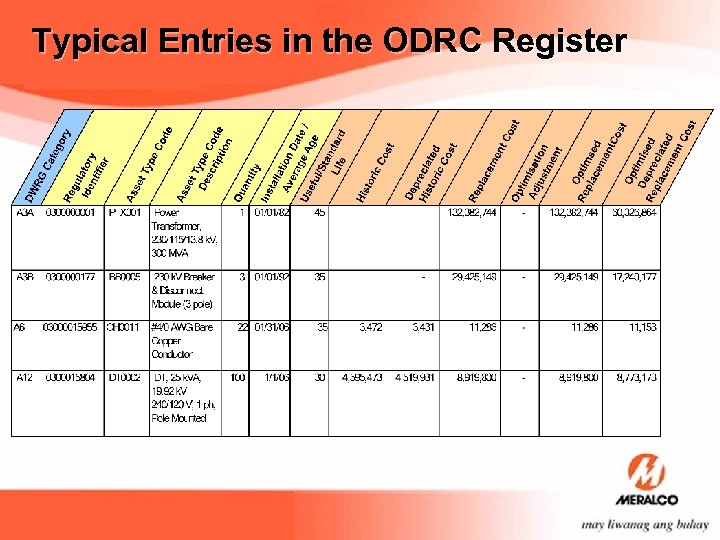

Typical Entries in the ODRC Register

Asset Accounting

Asset Accounting Tools 1. Fixed Asset Register (FAR) 2. Automated Mapping/Facilities Management (AM/FM) 3. Field Verification/Sampling

Challenges Encountered by Meralco Asset information was stored in several databases so asset tracker counts and other sources such as Mapguide & AM/FM, Meter Device Management System (MDMS), Transformer Inventory (TRINV), OTMS, CMS and SCADA have discrepancies. • Asset Tracker provided the historic costs, count, age • AM/FM system provided the physical location for verification • ERC used the Asset Tracker after comparison and verification with other asset database

Challenges Encountered by Meralco For Substation Assets Asset accounting was done using 100% field survey of all Meralco substations (79 major substations and 44 minor substations) • Installation date was captured during site inspections from name plate ratings • Count of equipment was determined usingle line diagrams • Extensive photographic records were taken

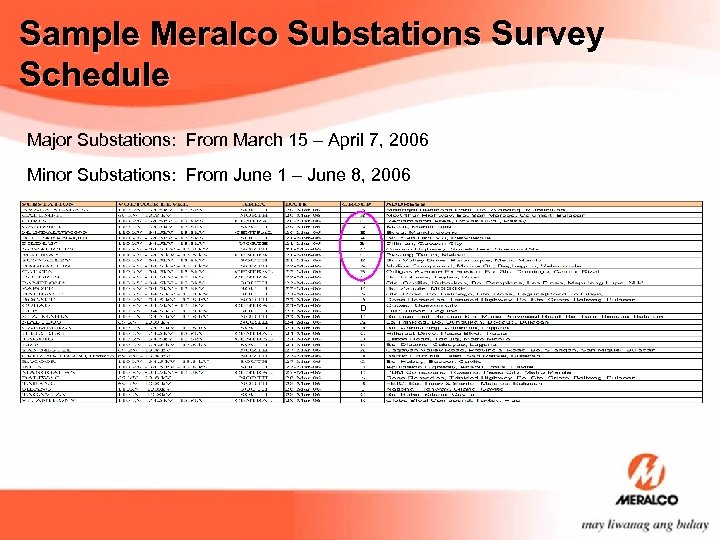

Sample Meralco Substations Survey Schedule Major Substations: From March 15 – April 7, 2006 Minor Substations: From June 1 – June 8, 2006 D

Actual Field Verification Pre-survey Meeting

Actual Field Verification of Single-line diagrams and nameplate ratings

Actual Field Verification of switchgear and control room equipment

Learnings on Asset Accounting 1. There should only be one facility manager per item who tracks the total count & other relevant information (installed, for test, under repair, available in stock, for disposal, monthly usage and if possible forecast requirements). 2. Revive the pole monitoring system. 3. Assign company numbers to all major equipment upon acceptance.

Replacement Cost (RC)

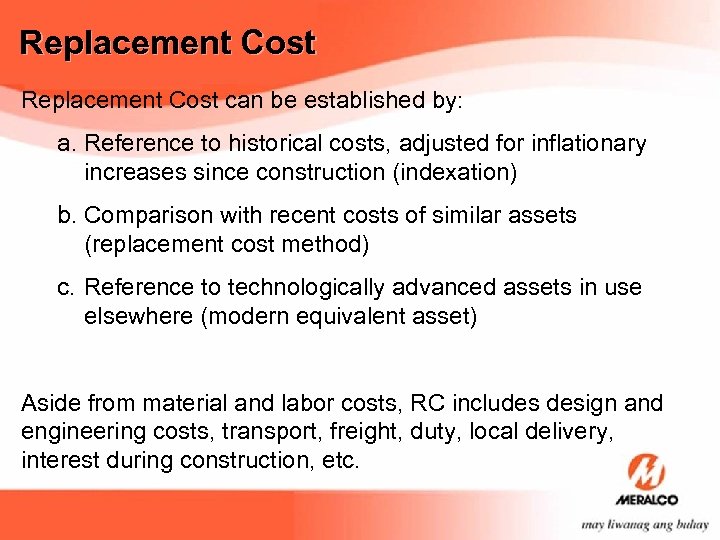

Replacement Cost can be established by: a. Reference to historical costs, adjusted for inflationary increases since construction (indexation) b. Comparison with recent costs of similar assets (replacement cost method) c. Reference to technologically advanced assets in use elsewhere (modern equivalent asset) Aside from material and labor costs, RC includes design and engineering costs, transport, freight, duty, local delivery, interest during construction, etc.

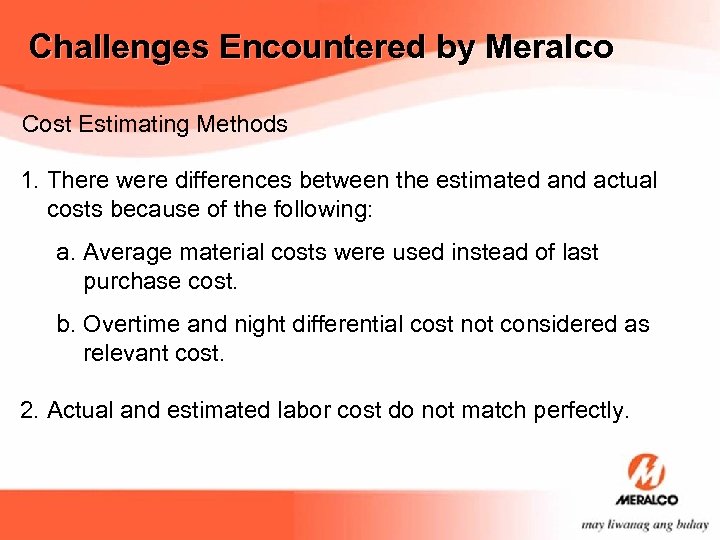

Challenges Encountered by Meralco Cost Estimating Methods 1. There were differences between the estimated and actual costs because of the following: a. Average material costs were used instead of last purchase cost. b. Overtime and night differential cost not considered as relevant cost. 2. Actual and estimated labor cost do not match perfectly.

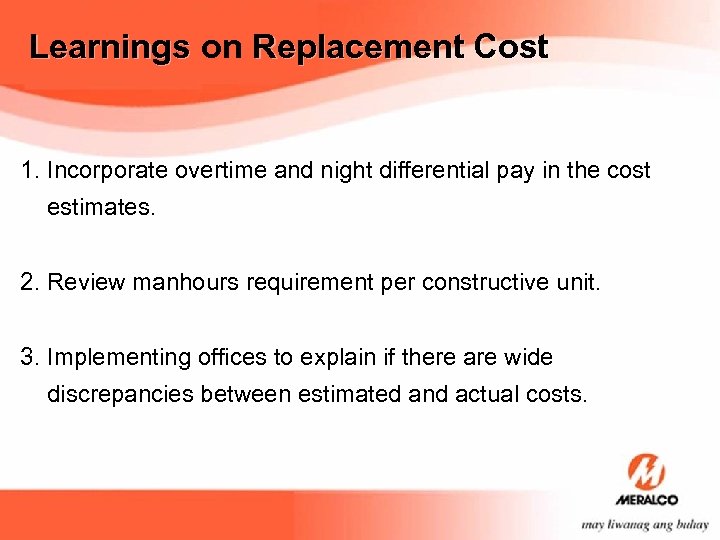

Learnings on Replacement Cost 1. Incorporate overtime and night differential pay in the cost estimates. 2. Review manhours requirement per constructive unit. 3. Implementing offices to explain if there are wide discrepancies between estimated and actual costs.

Optimization

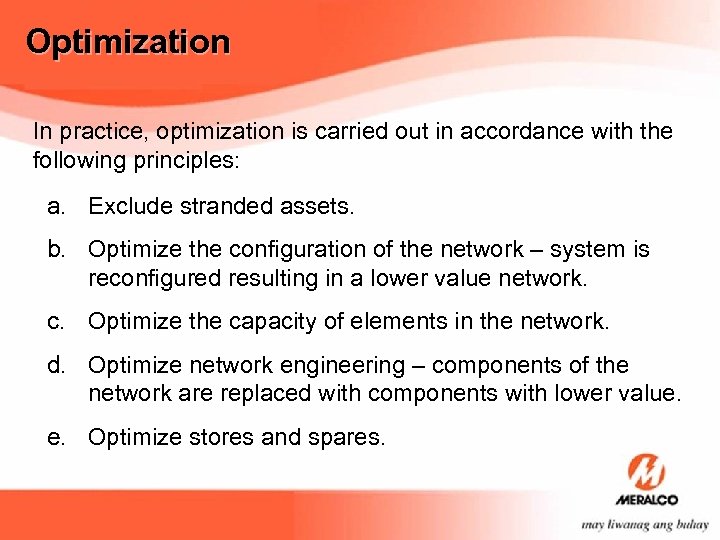

Optimization In practice, optimization is carried out in accordance with the following principles: a. Exclude stranded assets. b. Optimize the configuration of the network – system is reconfigured resulting in a lower value network. c. Optimize the capacity of elements in the network. d. Optimize network engineering – components of the network are replaced with components with lower value. e. Optimize stores and spares.

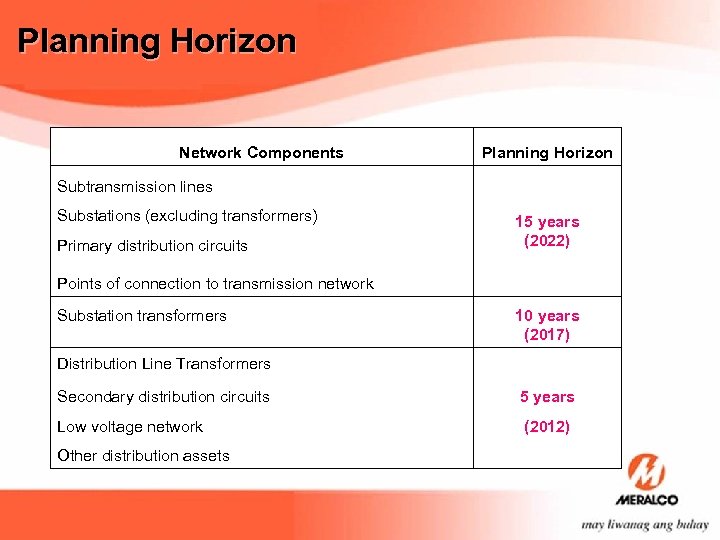

Planning Horizon Network Components Planning Horizon Subtransmission lines Substations (excluding transformers) 15 years (2022) Primary distribution circuits Points of connection to transmission network Substation transformers 10 years (2017) Distribution Line Transformers Secondary distribution circuits 5 years Low voltage network (2012) Other distribution assets

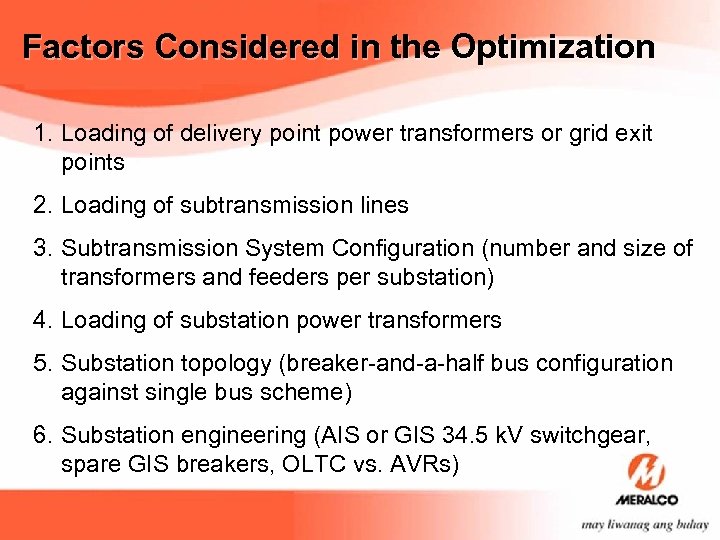

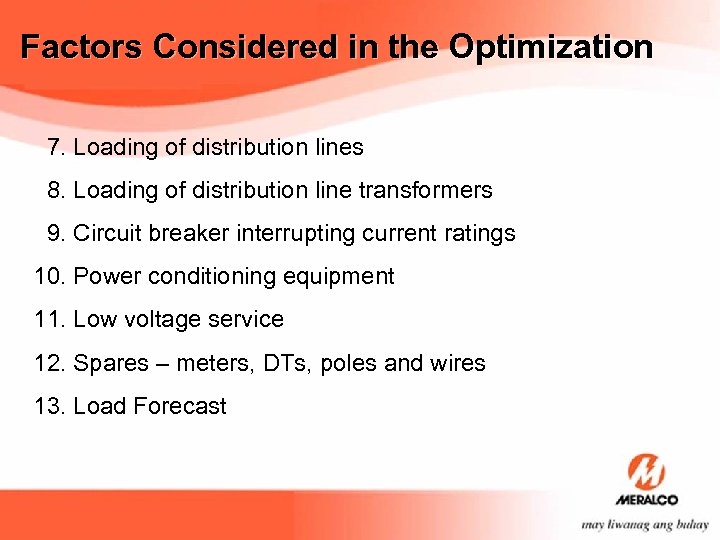

Factors Considered in the Optimization 1. Loading of delivery point power transformers or grid exit points 2. Loading of subtransmission lines 3. Subtransmission System Configuration (number and size of transformers and feeders per substation) 4. Loading of substation power transformers 5. Substation topology (breaker-and-a-half bus configuration against single bus scheme) 6. Substation engineering (AIS or GIS 34. 5 k. V switchgear, spare GIS breakers, OLTC vs. AVRs)

Factors Considered in the Optimization 7. Loading of distribution lines 8. Loading of distribution line transformers 9. Circuit breaker interrupting current ratings 10. Power conditioning equipment 11. Low voltage service 12. Spares – meters, DTs, poles and wires 13. Load Forecast

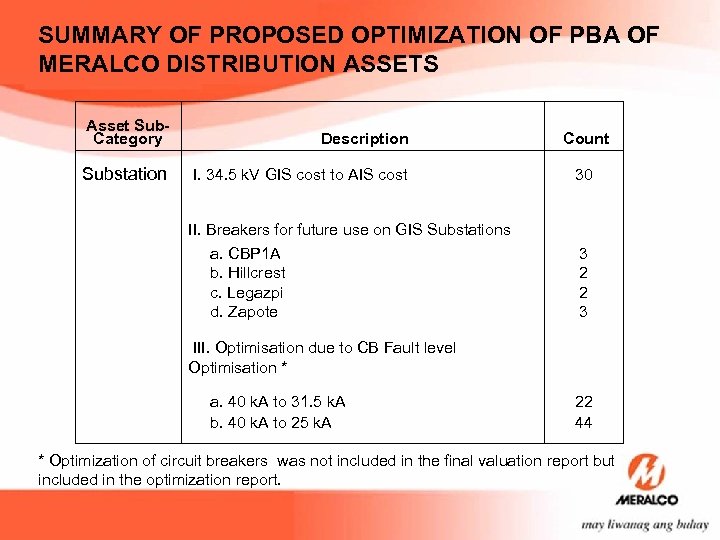

SUMMARY OF PROPOSED OPTIMIZATION OF PBA OF MERALCO DISTRIBUTION ASSETS Asset Sub. Category Description Substation I. 34. 5 k. V GIS cost to AIS cost II. Breakers for future use on GIS Substations a. CBP 1 A b. Hillcrest c. Legazpi d. Zapote III. Optimisation due to CB Fault level Optimisation * a. 40 k. A to 31. 5 k. A b. 40 k. A to 25 k. A Count 30 3 22 44 * Optimization of circuit breakers was not included in the final valuation report but included in the optimization report.

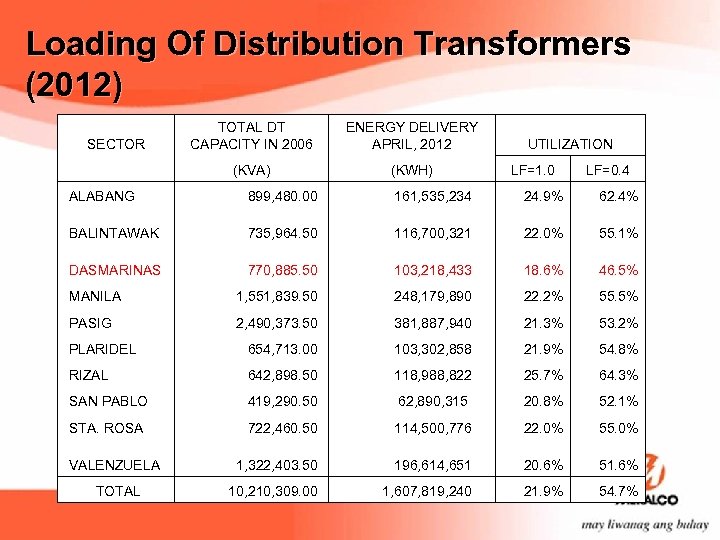

Loading Of Distribution Transformers (2012) SECTOR TOTAL DT CAPACITY IN 2006 ENERGY DELIVERY APRIL, 2012 (KVA) (KWH) UTILIZATION LF=1. 0 LF=0. 4 ALABANG 899, 480. 00 161, 535, 234 24. 9% 62. 4% BALINTAWAK 735, 964. 50 116, 700, 321 22. 0% 55. 1% DASMARINAS 770, 885. 50 103, 218, 433 18. 6% 46. 5% MANILA 1, 551, 839. 50 248, 179, 890 22. 2% 55. 5% PASIG 2, 490, 373. 50 381, 887, 940 21. 3% 53. 2% PLARIDEL 654, 713. 00 103, 302, 858 21. 9% 54. 8% RIZAL 642, 898. 50 118, 988, 822 25. 7% 64. 3% SAN PABLO 419, 290. 50 62, 890, 315 20. 8% 52. 1% STA. ROSA 722, 460. 50 114, 500, 776 22. 0% 55. 0% VALENZUELA 1, 322, 403. 50 196, 614, 651 20. 6% 51. 6% TOTAL 10, 210, 309. 00 1, 607, 819, 240 21. 9% 54. 7%

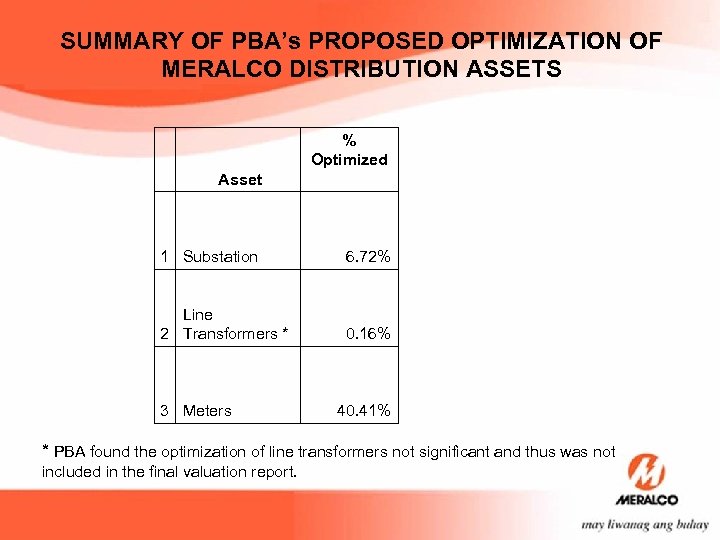

SUMMARY OF PBA’s PROPOSED OPTIMIZATION OF MERALCO DISTRIBUTION ASSETS % Optimized Asset 1 Substation 6. 72% Line 2 Transformers * 0. 16% 3 Meters 40. 41% * PBA found the optimization of line transformers not significant and thus was not included in the final valuation report.

Learnings on Optimization 1. Review policies on GIS modules and circuit breaker fault ratings. 2. Improve the process of DT monitoring (existence, SIN to DT connectivity, k. WH to k. W computation). 3. Review policies on DT sizing to increase the loading of the DTs (minimum capacity, initial k. VA size). 4. Review asset data on meters.

Depreciation

Depreciation Straight line depreciation is adopted. Factors to consider: 1. Effective lives – estimated life, assuming continued use in its present function as part of a continuing business. 2. Age of equipment

Factors in assessing effective lives 1. Manufacturers’ recommendations 2. Maintenance levels and life extension policies 3. Environment in which the assets reside 4. External factors such as supply/demand characteristics 5. Physical, technological, functional and economic obsolescence 6. Survivor data – failure rates

Challenges Encountered by Meralco • Insufficient validated failure rate records and asset life of equipment - Power Transformers, Breakers, Distribution Transformers, Meters, Poles and Wires - Not all asset data were available or easy to gather Aside from depreciation, this data is used to justify spare units

Learnings on Asset Lives Finalize failure rates for power transformers, distribution transformers and meters. PBA used a 10% annual DT failure rate (of the total DT population)

Results of Meralco’s ODRC Valuation

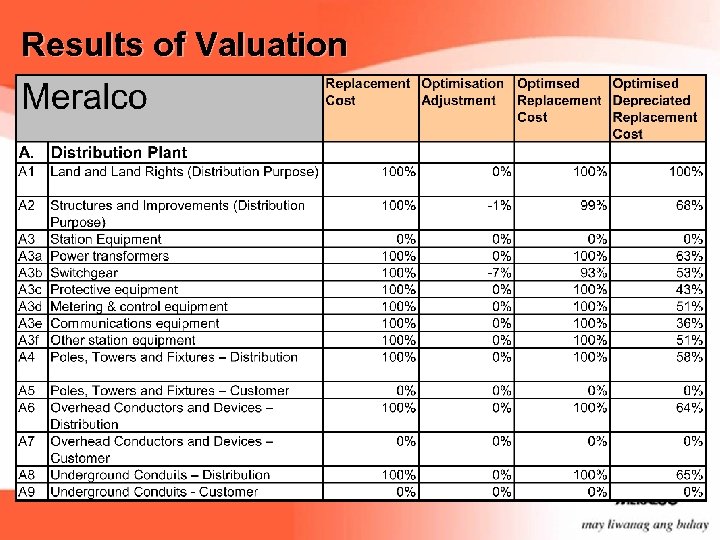

Results of Valuation

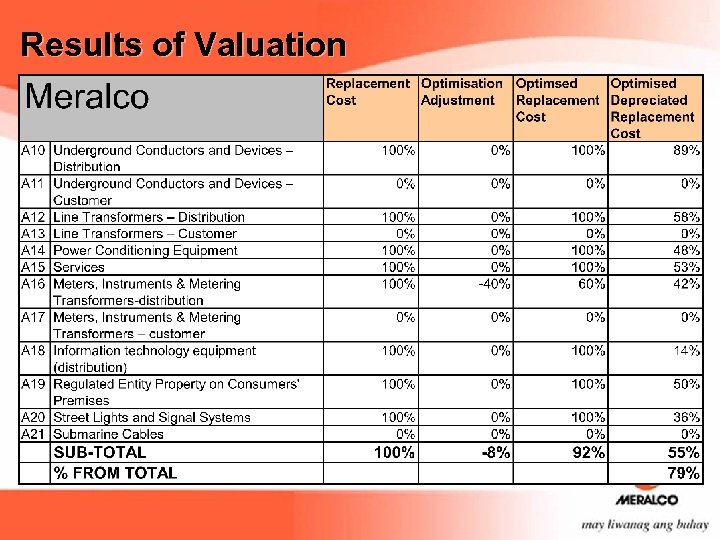

Results of Valuation

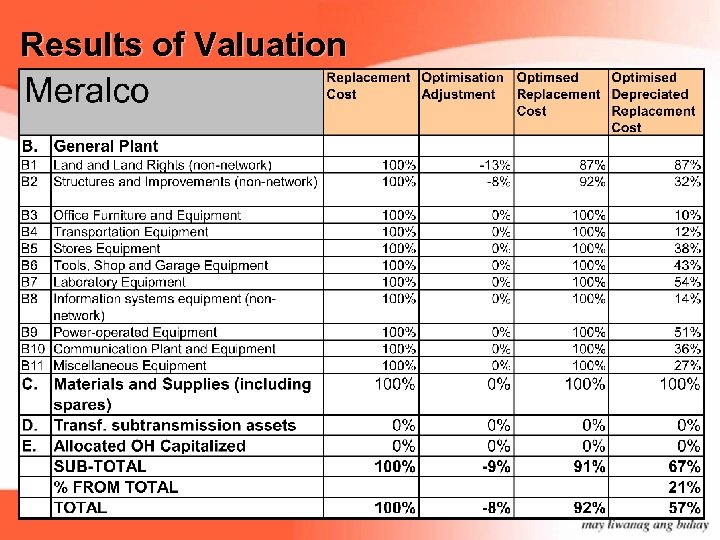

Results of Valuation

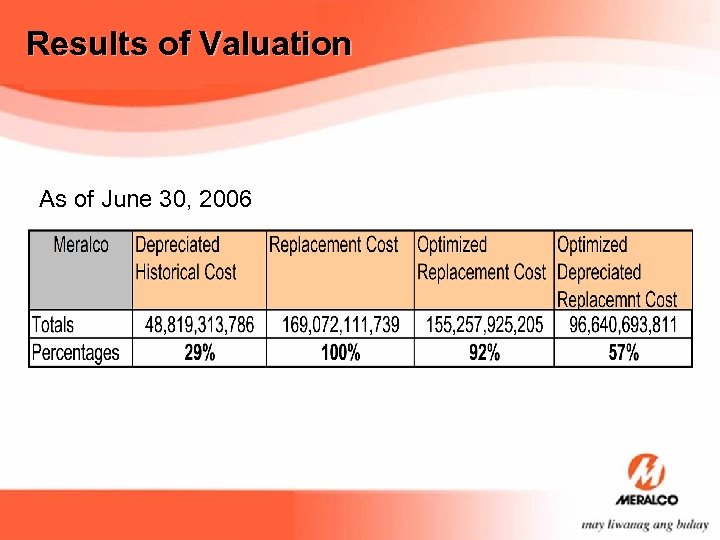

Results of Valuation As of June 30, 2006

THANK YOU!

e532f5bf81f5cae0267bd469ec4e8ee6.ppt