74fa2e9840dbac7990a2a2d8102bf146.ppt

- Количество слайдов: 44

Regulation CC: Funds Availability BY: ELIZABETH MADLEM, ASSOCIATE GENERAL COUNSEL

B 2 B HOUSEKEEPING RULES • This is only a broad overview—Always refer back to the actual provisions cited. • Not Legal Advice– Consult with bank counsel for more detailed inquiries. • Live questions will not be addressed, but please feel free to send in any follow-up questions to our Hotline: hotline@compliancealliance. com or 888 -353 -3933

Regulation CC “If money doesn’t grow on trees, then why do banks have branches? ” • History of the Law- Regulation CC • Basic Definitions • Funds Availability Policy Requirements – Deposit Availability – Availability Timeline Requirements – Cut-off Times • Exception Holds • Case-by-Case Holds • New Accounts Special Rules • Hypotheticals • CA’s Tools and Sample Forms

History of Law Regulation CC

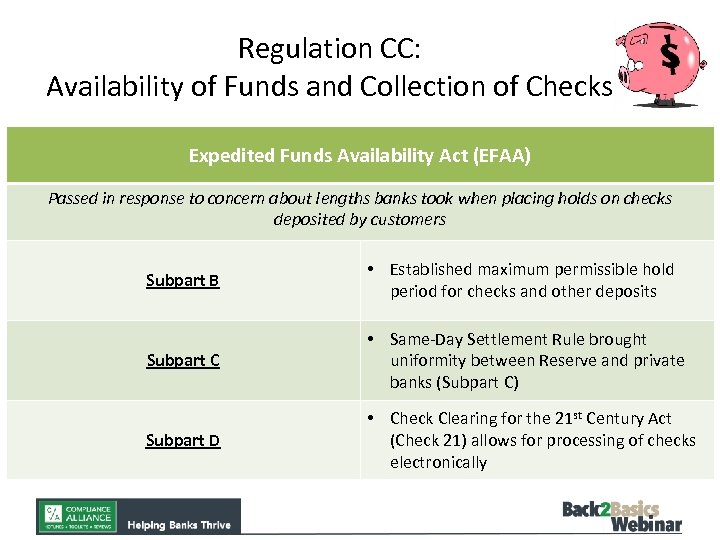

Regulation CC: Availability of Funds and Collection of Checks Expedited Funds Availability Act (EFAA) Passed in response to concern about lengths banks took when placing holds on checks deposited by customers Subpart B • Established maximum permissible hold period for checks and other deposits Subpart C • Same-Day Settlement Rule brought uniformity between Reserve and private banks (Subpart C) Subpart D • Check Clearing for the 21 st Century Act (Check 21) allows for processing of checks electronically

What Does That Mean? 1. Make funds deposited in transaction accounts available to your customers within specified time frames; 2. Pay interest on interest-bearing transaction accounts not later than the day the bank receives the credit; and 3. Disclose a funds availability policy to customers

Basic Definitions Regulation CC

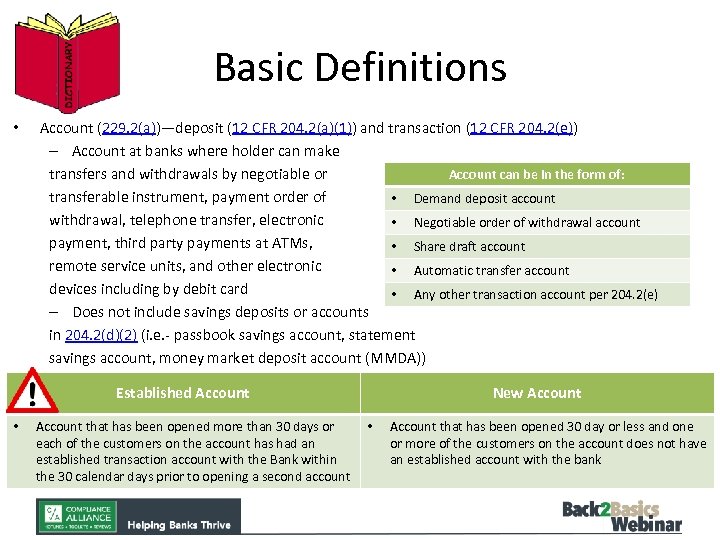

Basic Definitions • Account (229. 2(a))—deposit (12 CFR 204. 2(a)(1)) and transaction (12 CFR 204. 2(e)) – Account at banks where holder can make Account can be in the form of: transfers and withdrawals by negotiable or transferable instrument, payment order of • Demand deposit account withdrawal, telephone transfer, electronic • Negotiable order of withdrawal account payment, third party payments at ATMs, • Share draft account remote service units, and other electronic • Automatic transfer account devices including by debit card • Any other transaction account per 204. 2(e) – Does not include savings deposits or accounts in 204. 2(d)(2) (i. e. - passbook savings account, statement savings account, money market deposit account (MMDA)) Established Account • Account that has been opened more than 30 days or each of the customers on the account has had an established transaction account with the Bank within the 30 calendar days prior to opening a second account New Account • Account that has been opened 30 day or less and one or more of the customers on the account does not have an established account with the bank

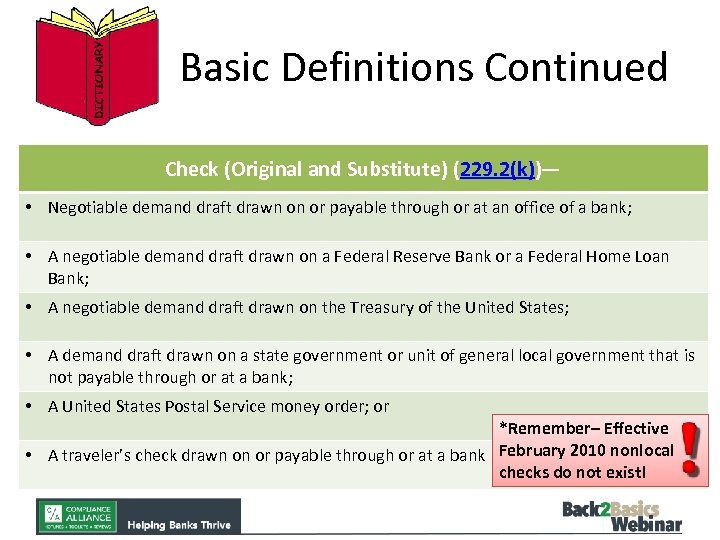

Basic Definitions Continued Check (Original and Substitute) (229. 2(k))— • Negotiable demand draft drawn on or payable through or at an office of a bank; • A negotiable demand draft drawn on a Federal Reserve Bank or a Federal Home Loan Bank; • A negotiable demand draft drawn on the Treasury of the United States; • A demand draft drawn on a state government or unit of general local government that is not payable through or at a bank; • A United States Postal Service money order; or *Remember– Effective • A traveler’s check drawn on or payable through or at a bank February 2010 nonlocal checks do not exist!

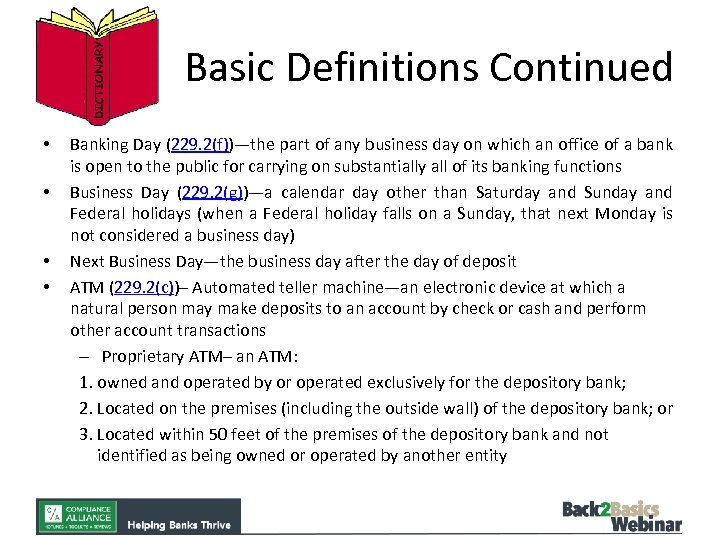

Basic Definitions Continued • • Banking Day (229. 2(f))—the part of any business day on which an office of a bank is open to the public for carrying on substantially all of its banking functions Business Day (229. 2(g))—a calendar day other than Saturday and Sunday and Federal holidays (when a Federal holiday falls on a Sunday, that next Monday is not considered a business day) Next Business Day—the business day after the day of deposit ATM (229. 2(c))– Automated teller machine—an electronic device at which a natural person may make deposits to an account by check or cash and perform other account transactions – Proprietary ATM– an ATM: 1. owned and operated by or operated exclusively for the depository bank; 2. Located on the premises (including the outside wall) of the depository bank; or 3. Located within 50 feet of the premises of the depository bank and not identified as being owned or operated by another entity

Funds Availability Policy

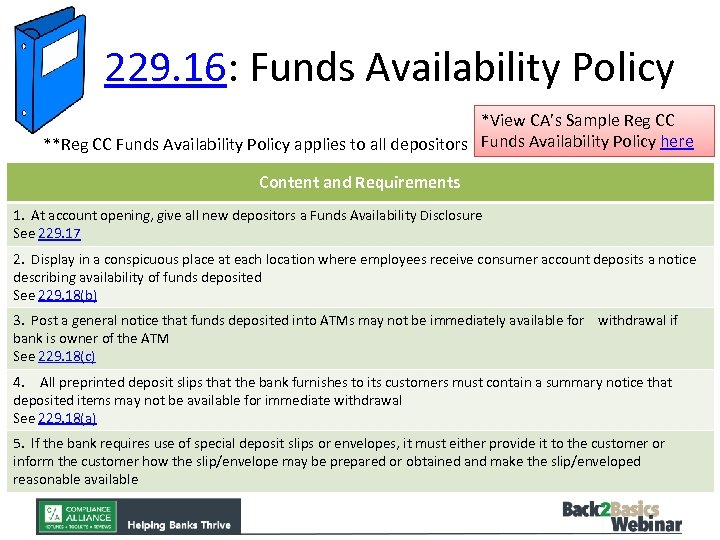

229. 16: Funds Availability Policy *View CA’s Sample Reg CC **Reg CC Funds Availability Policy applies to all depositors Funds Availability Policy here Content and Requirements 1. At account opening, give all new depositors a Funds Availability Disclosure See 229. 17 2. Display in a conspicuous place at each location where employees receive consumer account deposits a notice describing availability of funds deposited See 229. 18(b) 3. Post a general notice that funds deposited into ATMs may not be immediately available for withdrawal if bank is owner of the ATM See 229. 18(c) 4. All preprinted deposit slips that the bank furnishes to its customers must contain a summary notice that deposited items may not be available for immediate withdrawal See 229. 18(a) 5. If the bank requires use of special deposit slips or envelopes, it must either provide it to the customer or inform the customer how the slip/envelope may be prepared or obtained and make the slip/enveloped reasonable available

Deposit Availability • • Depending upon the type of deposit and how it is made, banks must make available to customers within specific business days following the banking day on which the deposit is made Reg CC provides the maximum length of time that can be held on any check; Banks are free to contractually make that number of days to funds availability shorter or extend on a case by case basis Distinction in availability requirements between deposits not made in person at a proprietary (or Bank owned ATM) versus non-proprietary (or ATM not owned by Bank) Expedited Funds Availability Act – requires the first $200 of a deposit that is not already subject to next-day availability to be made available by the first business day following the day of deposit **Remember: there is no difference between local and nonlocal checks as there is only one Reserve Bank check-processing region!

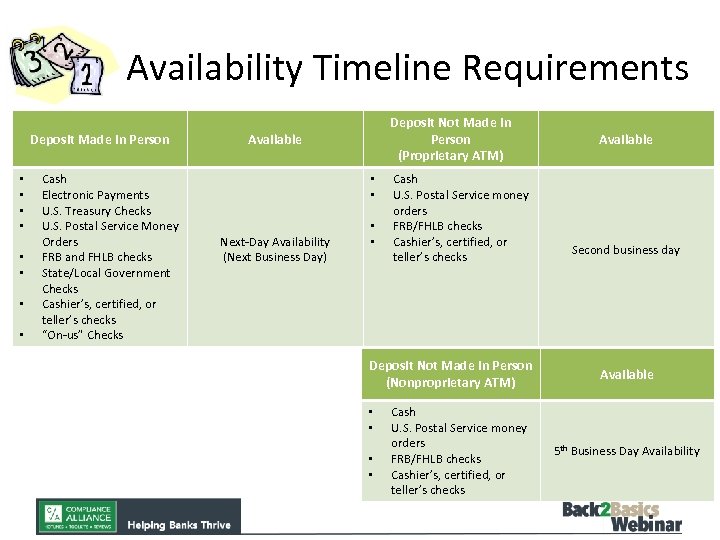

Availability Timeline Requirements Deposit Made In Person • • Cash Electronic Payments U. S. Treasury Checks U. S. Postal Service Money Orders FRB and FHLB checks State/Local Government Checks Cashier’s, certified, or teller’s checks “On-us” Checks Deposit Not Made In Person (Proprietary ATM) Available • • Next-Day Availability (Next Business Day) • • Cash U. S. Postal Service money orders FRB/FHLB checks Cashier’s, certified, or teller’s checks Deposit Not Made in Person (Nonproprietary ATM) • • Cash U. S. Postal Service money orders FRB/FHLB checks Cashier’s, certified, or teller’s checks Available Second business day Available 5 th Business Day Availability

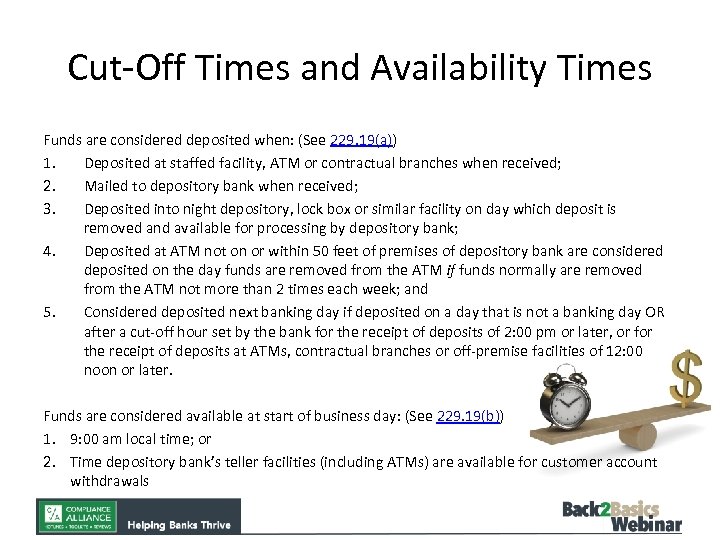

Cut-Off Times and Availability Times Funds are considered deposited when: (See 229. 19(a)) 1. Deposited at staffed facility, ATM or contractual branches when received; 2. Mailed to depository bank when received; 3. Deposited into night depository, lock box or similar facility on day which deposit is removed and available for processing by depository bank; 4. Deposited at ATM not on or within 50 feet of premises of depository bank are considered deposited on the day funds are removed from the ATM if funds normally are removed from the ATM not more than 2 times each week; and 5. Considered deposited next banking day if deposited on a day that is not a banking day OR after a cut-off hour set by the bank for the receipt of deposits of 2: 00 pm or later, or for the receipt of deposits at ATMs, contractual branches or off-premise facilities of 12: 00 noon or later. Funds are considered available at start of business day: (See 229. 19(b)) 1. 9: 00 am local time; or 2. Time depository bank’s teller facilities (including ATMs) are available for customer account withdrawals

Exception Holds

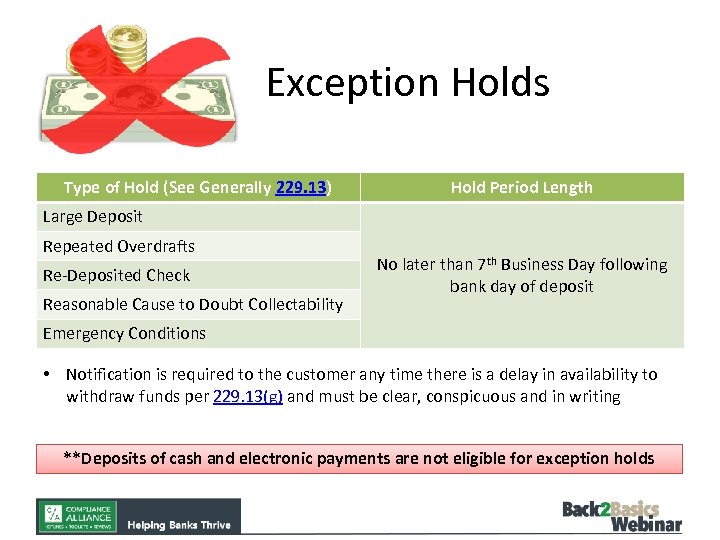

Exception Holds Type of Hold (See Generally 229. 13) Hold Period Length Large Deposit Repeated Overdrafts Re-Deposited Check Reasonable Cause to Doubt Collectability No later than 7 th Business Day following bank day of deposit Emergency Conditions • Notification is required to the customer any time there is a delay in availability to withdraw funds per 229. 13(g) and must be clear, conspicuous and in writing **Deposits of cash and electronic payments are not eligible for exception holds

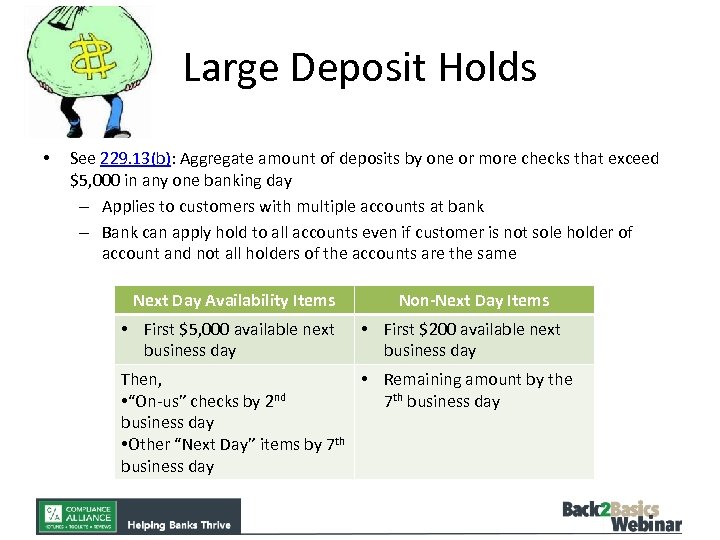

Large Deposit Holds • See 229. 13(b): Aggregate amount of deposits by one or more checks that exceed $5, 000 in any one banking day – Applies to customers with multiple accounts at bank – Bank can apply hold to all accounts even if customer is not sole holder of account and not all holders of the accounts are the same Next Day Availability Items • First $5, 000 available next business day Non-Next Day Items • First $200 available next business day Then, • Remaining amount by the • “On-us” checks by 2 nd 7 th business day • Other “Next Day” items by 7 th business day

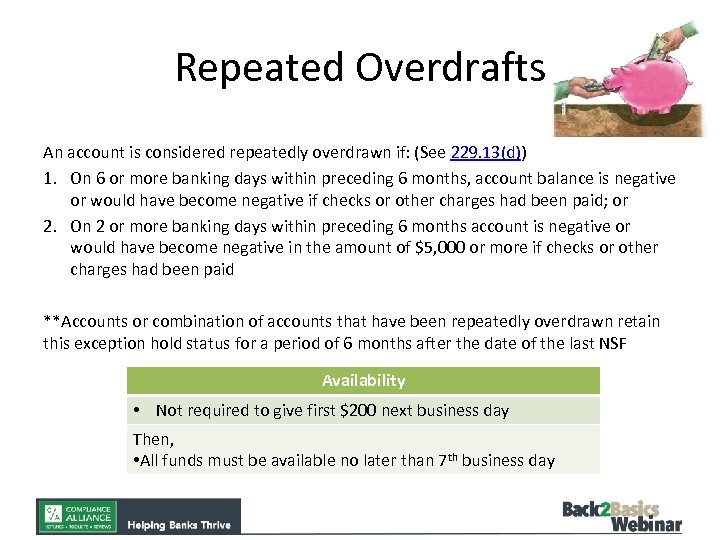

Repeated Overdrafts An account is considered repeatedly overdrawn if: (See 229. 13(d)) 1. On 6 or more banking days within preceding 6 months, account balance is negative or would have become negative if checks or other charges had been paid; or 2. On 2 or more banking days within preceding 6 months account is negative or would have become negative in the amount of $5, 000 or more if checks or other charges had been paid **Accounts or combination of accounts that have been repeatedly overdrawn retain this exception hold status for a period of 6 months after the date of the last NSF Availability • Not required to give first $200 next business day Then, • All funds must be available no later than 7 th business day

Re-Deposited Check A check that has been returned unpaid and redeposited by customer or depository bank does not follow the timing requirements and can have a reasonable hold length placed on it (See 229. 13(c)) This exception does not apply to: 1. Check that has been returned due to missing indorsement and redeposited after the missing indorsement has been obtained if the reason for return on check indicates returned due to missing indorsement; or 2. Check that has been returned because it was post dated if reason for return indicates returned because it was post dated and if the check is no longer postdated when redeposited

Reasonable Cause to Doubt Collectability See 229. 13(e): Bank must have reasonable cause to believe check is uncollectible from paying bank; reason of bank’s belief check is uncollectible must be included in notice required – Exception for Reason on Notice– kiting (use “Confidential”) Reasonable Cause— “…existence of facts that would cause a well-grounded belief in the mind of a reasonable person. ” – Cannot be based on fact that check is of a particular class or is deposited by a particular class of person Availability • Not required to give first $200 next business day Then, • All funds must be available no later than 7 th business day

Emergency Conditions See 229. 13(f): Includes the following if the depository bank exercises such diligence as the circumstances requires— 1. 2. 3. 4. An interruption of communications or computer or other equipment facilities; A suspension of payments by another bank; A war; or An emergency condition beyond the control of the depository bank (i. e. - natural disasters) Availability Must make funds available for withdrawal not later than a reasonable period after the emergency has ceased or the period established in 229. 10 and 229. 12, whichever is later.

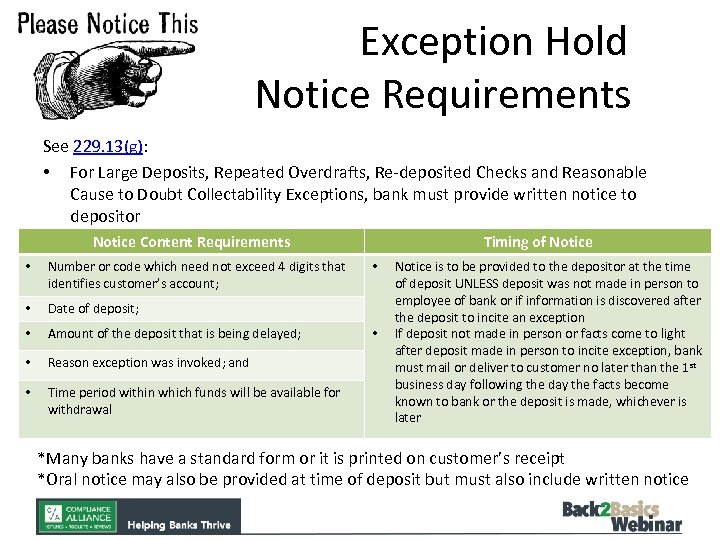

Exception Hold Notice Requirements See 229. 13(g): • For Large Deposits, Repeated Overdrafts, Re-deposited Checks and Reasonable Cause to Doubt Collectability Exceptions, bank must provide written notice to depositor Notice Content Requirements • Number or code which need not exceed 4 digits that identifies customer’s account; • Date of deposit; • Amount of the deposit that is being delayed; • Reason exception was invoked; and • Time period within which funds will be available for withdrawal Timing of Notice • • Notice is to be provided to the depositor at the time of deposit UNLESS deposit was not made in person to employee of bank or if information is discovered after the deposit to incite an exception If deposit not made in person or facts come to light after deposit made in person to incite exception, bank must mail or deliver to customer no later than the 1 st business day following the day the facts become known to bank or the deposit is made, whichever is later *Many banks have a standard form or it is printed on customer’s receipt *Oral notice may also be provided at time of deposit but must also include written notice

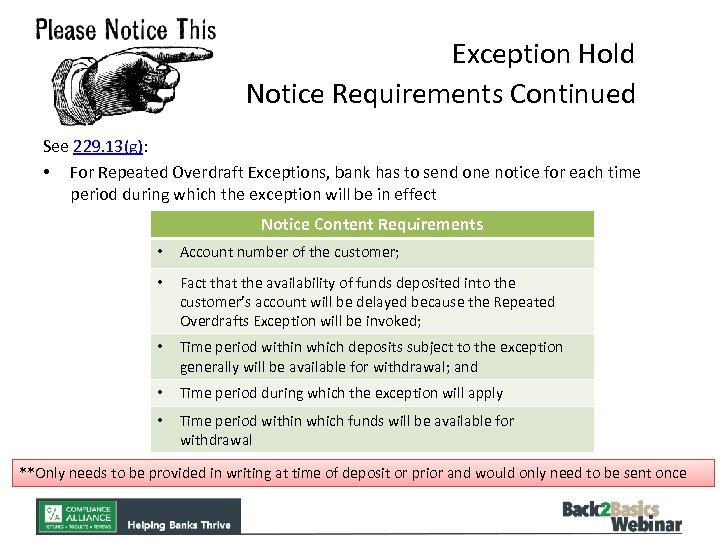

Exception Hold Notice Requirements Continued See 229. 13(g): • For Repeated Overdraft Exceptions, bank has to send one notice for each time period during which the exception will be in effect Notice Content Requirements • Account number of the customer; • Fact that the availability of funds deposited into the customer’s account will be delayed because the Repeated Overdrafts Exception will be invoked; • Time period within which deposits subject to the exception generally will be available for withdrawal; and • Time period during which the exception will apply • Time period within which funds will be available for withdrawal **Only needs to be provided in writing at time of deposit or prior and would only need to be sent once

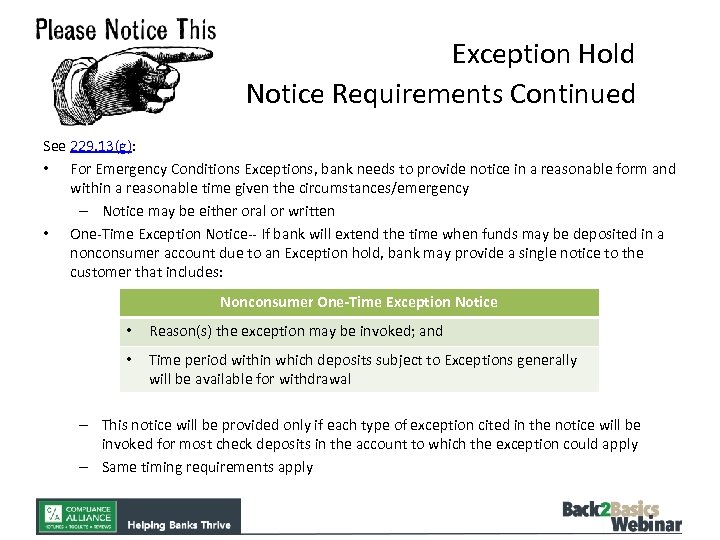

Exception Hold Notice Requirements Continued See 229. 13(g): • For Emergency Conditions Exceptions, bank needs to provide notice in a reasonable form and within a reasonable time given the circumstances/emergency – Notice may be either oral or written • One-Time Exception Notice-- If bank will extend the time when funds may be deposited in a nonconsumer account due to an Exception hold, bank may provide a single notice to the customer that includes: Nonconsumer One-Time Exception Notice • Reason(s) the exception may be invoked; and • Time period within which deposits subject to Exceptions generally will be available for withdrawal – This notice will be provided only if each type of exception cited in the notice will be invoked for most check deposits in the account to which the exception could apply – Same timing requirements apply

Case-by-Case Holds

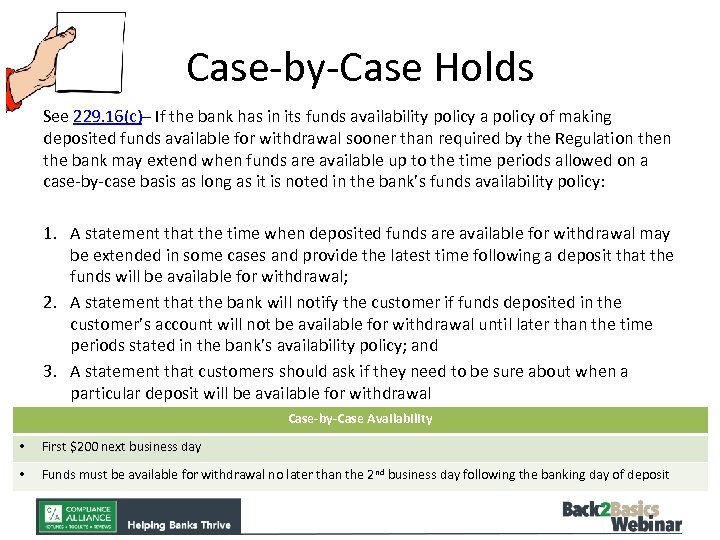

Case-by-Case Holds See 229. 16(c)– If the bank has in its funds availability policy a policy of making deposited funds available for withdrawal sooner than required by the Regulation the bank may extend when funds are available up to the time periods allowed on a case-by-case basis as long as it is noted in the bank’s funds availability policy: 1. A statement that the time when deposited funds are available for withdrawal may be extended in some cases and provide the latest time following a deposit that the funds will be available for withdrawal; 2. A statement that the bank will notify the customer if funds deposited in the customer’s account will not be available for withdrawal until later than the time periods stated in the bank’s availability policy; and 3. A statement that customers should ask if they need to be sure about when a particular deposit will be available for withdrawal Case-by-Case Availability • First $200 next business day • Funds must be available for withdrawal no later than the 2 nd business day following the banking day of deposit

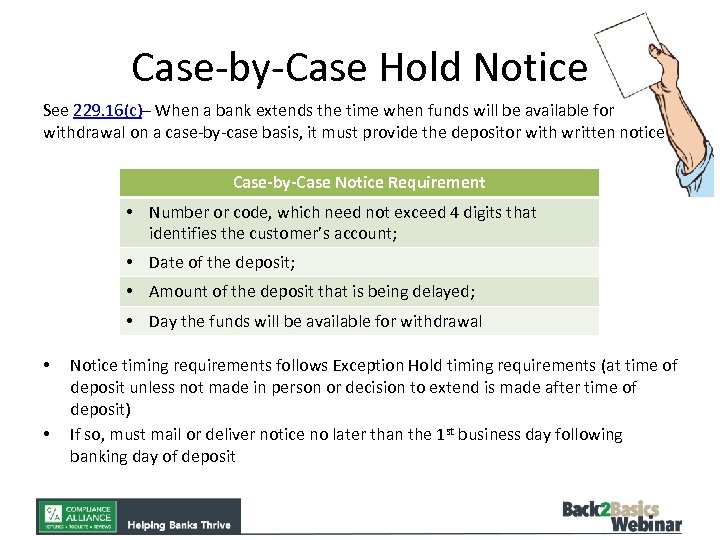

Case-by-Case Hold Notice See 229. 16(c)– When a bank extends the time when funds will be available for withdrawal on a case-by-case basis, it must provide the depositor with written notice Case-by-Case Notice Requirement • Number or code, which need not exceed 4 digits that identifies the customer’s account; • Date of the deposit; • Amount of the deposit that is being delayed; • Day the funds will be available for withdrawal • • Notice timing requirements follows Exception Hold timing requirements (at time of deposit unless not made in person or decision to extend is made after time of deposit) If so, must mail or deliver notice no later than the 1 st business day following banking day of deposit

New Accounts Special Rules

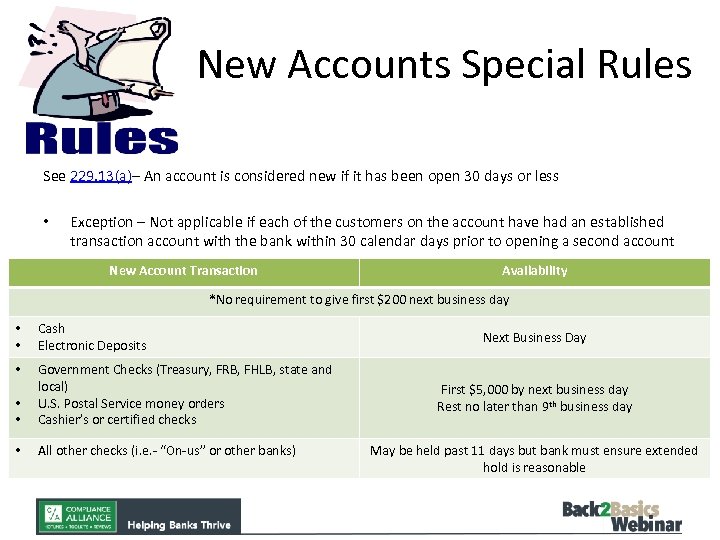

New Accounts Special Rules See 229. 13(a)– An account is considered new if it has been open 30 days or less • Exception – Not applicable if each of the customers on the account have had an established transaction account with the bank within 30 calendar days prior to opening a second account New Account Transaction Availability *No requirement to give first $200 next business day • • Cash Electronic Deposits • • • Government Checks (Treasury, FRB, FHLB, state and local) U. S. Postal Service money orders Cashier’s or certified checks • All other checks (i. e. - “On-us” or other banks) Next Business Day First $5, 000 by next business day Rest no later than 9 th business day May be held past 11 days but bank must ensure extended hold is reasonable

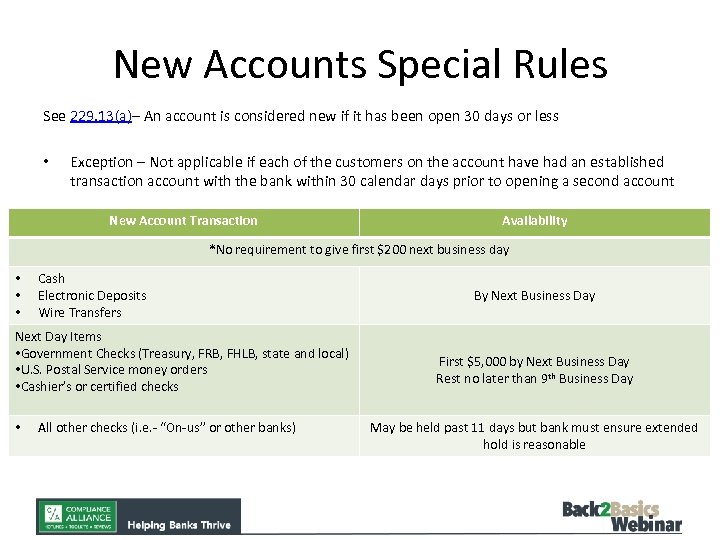

New Accounts Special Rules See 229. 13(a)– An account is considered new if it has been open 30 days or less • Exception – Not applicable if each of the customers on the account have had an established transaction account with the bank within 30 calendar days prior to opening a second account New Account Transaction Availability *No requirement to give first $200 next business day • • • Cash Electronic Deposits Wire Transfers Next Day Items • Government Checks (Treasury, FRB, FHLB, state and local) • U. S. Postal Service money orders • Cashier’s or certified checks • All other checks (i. e. - “On-us” or other banks) By Next Business Day First $5, 000 by Next Business Day Rest no later than 9 th Business Day May be held past 11 days but bank must ensure extended hold is reasonable

Hypotheticals

Hypo #1: Large Deposits Q: If a deposit consists of $5, 500 cash and $2, 500 assorted checks, does the large deposit hold apply? A: There would be no exception hold here. To qualify for the large deposit exception, the total amount deposited in checks only has to exceed $5, 000. You would not include cash deposits in the aggregate. Cash is always available by the next business day if made in person. Q: Can we place a large deposit hold on a U. S. Treasury Check? A: The bank would have to provide the first $5, 000 of the check by the next business day. Since it’s a U. S. Treasury check, the remainder would have to be provided no later than the 7 th business day.

Hypo #1: Large Deposits Q: Bank has a deposit of $6, 000 with 2 non-next day items. One is $4, 500 and the other is $1, 500. The bank only wants to hold the $4, 500 check. What about 1 non-next day and one next day deposits? A: The Large Deposit exception would still be applicable. The bank would have to give normal funds availability for the first $5, 000 and then hold the remainder. You have the discretion to aggregate the deposit and place the hold on anything over $5, 000. When the large deposit exception is being applied to deposits composed of a mix of checks that would otherwise be subject to differing availability schedules, the bank has discretion to choose the portion of the deposit to which it applies the exception. Q: The bank received notification from the Fed concerning a large dollar return item. The item, $10, 080. 00, was accepted for deposit two business days ago at which time the bank placed a large deposit hold on the account. Can the bank push out the hold date for the entire amount of the check at least until the bank receives the item back from the Fed returns? A: The bank cannot use the large hold exception to extend to the whole amount since the first $5, 000 has to be made available. But if the bank has reason to doubt collectability, that would have been a different hold. Since the hold has already been put in place, the bank has two options: it can take the risk and send out a revised hold notice for the entire amount on Reason to Doubt Collectability or it can keep the hold as it is. There is no specific allowance to send a revised hold notice but there is also no prohibition so it’s a risk determination the bank has to make.

Hypo #2: Repeated Overdrafts Q: How do you consider an account repeatedly overdrawn? A: The bank can consider an account repeatedly overdrawn if the account balance is negative on 6 or more banking days within the preceding 6 months. If the account is negative for 6 or more banking days, then the exception may apply for a period of 6 months after the last such overdraft. So below are the last 8 months with the number of times the account was negative: March- 0 February- 1 January- 0 December- 1 November- 0 October- 0 September -1 August- 5 The bank had 6 days overdrawn from August and September so September would have started the 6 month span for the exception. It applies to all checks – It does not have any distinctions for different types like some of the other exceptions.

Hypo #2: Repeated Overdrafts Q: On the exception for Repeated Overdrafts, the regulation says that the account would have to be negative if checks or other charges had been paid. Would the monthly service charge be included in other charges? A: The Commentary provides: “…The exception relates not only to overdrafts caused by checks drawn on the account, but also overdrafts caused by other debit charges (e. g. - ACH debits, point-of-sale transactions, returned checks, account fees, etc. ). …” So it would include those account fees as well.

Hypo #3: Re-Deposited Checks Q: A customer deposited a check on 3/1 that was returned unpaid. The bank resubmitted the check on 3/5 and are going to place a hold on the account. Can the bank use the 3/5 date as the deposit date on the hold notice as that is the date that they resubmitted the check? Or should the bank use the 3/1 date on the hold notice because that is the original deposit date? A: The bank would use the 3/5 date on the hold notice since that is the date that the check was re-deposited. Q: When the bank has a chargeback check, it has to make the decision to either charge it back at that time against the balance or send it back to the payor bank and see if it will pay the second time. What happens when the bank sends it back for re-deposit? A: The bank can place a hold on the re-deposited check for as long as reasonable but still has to provide the customer with notice. As long as the reason for the returned check was not for lack of indorsement or being post-dated, the bank does not have to follow the same timing requirements as for a first-deposited check.

Hypo #4: Reasonable Cause to Doubt Collectability Q: A teller placed a Reg CC hold on a check deposited for reasonable cause to doubt collectability. Upon reviewing the hold, it’s an international check. Does Reg CC still apply? A: If it is not drawn on U. S. currency or is drawn on a bank outside of the U. S. , it is not considered a check for Reg CC purposes so the entire regulation, including availability schedule does not apply. The bank would then need to refer to its Funds Availability Policy on how to proceed in regards to holds and length. Q: The bank has a check to deposit made payable to John Doe endorses the back and right underneath Suzie Smith signs her name. The check is deposited into Suzie’s account. For Reg CC, does the bank follow normal procedures or are there special circumstances for checks not made payable to their customer? A: There are no special circumstances unless the bank has procedures related to third party indorsements for risk purposes. But there’s no specific Reg CC reason. The bank could do a caseby-case hold or if it has some reason to doubt collectability, put a hold on that if they don’t feel it’s bene properly indorsed.

Hypo #5: Case-by-Case Hold Q: The bank has a personal money order from Wells Fargo. Can it put a hold on it? A: So it’s important to know what you’re looking at to determine whether a case by case hold applies. U. S. Postal Service money orders cannot have case by case holds; but personal money orders can. Q: The Florida bank accepted a check from the Department of Treasury for the Commonwealth of Kentucky. The amount of the check is less than $5, 000. Can the bank place a case-by-case hold on the funds for 2 days with $200 available? A: The bank could place a hold on the funds as long as the first $200 is given by the next business day, yes. If the check were drawn on the State of Florida or a local government within Florida it would be subject to next day availability for all amounts of $5, 000 or less unless there is an exception hold applicable.

Hypo # 6: New Account Holds Q: In regards to Reg CC, if a person has been a convenience signer on an account for more than a year and he decides to open an account as an owner/signer, can the bank put the opening deposit on a new account hold? A: Yes – it’s a new account and his relation as a convenience signer does not make him a customer or account owner for purposes of an exemption. Q: Joe Jones has an existing checking account with the bank. Today, Joe came in to add his new wife Sue to the existing account and also open a new joint checking account. Sue came in later that day with a $10, 000 check to deposit into the newly opened joint checking account. The bank manager made the decision to place a hold on the check. Can the bank use the “new account” reason? A: It is still a new account if Sue had no previous transaction accounts with the bank. If two customers that each have an established individual account with the bank open a joint account, the joint account is not subject to the new account exception.

CA’s Tools and Sample Forms

Toolkits and Sample Forms Electronic Code of Federal Regulations—Part 229 –Availability of Funds and Collection of Checks (Regulation CC and Sample Notice Forms) Board of Governors of the Federal Reserve System –Compliance Guide to Small Entities Compliance with Regulation CC- A Guide for Financial Institutions Regulation CC Manual CA’s General Reg CC Toolkit CA’s Reg CC Policy Template CA’s Funds Availability Training CA’s Compliance Minute Reg CC Ca’s Funds Availability Reference Guide

Questions? Thank you for your participation! We hope you found value in the presentation. If you have any additional questions, contact Compliance Alliance at hotline@compliancealliance. com or 888 -353 -3933.

74fa2e9840dbac7990a2a2d8102bf146.ppt