f47dc57fcb335e88f9517ee68e31f8a8.ppt

- Количество слайдов: 46

Regulation and Institutions for PPP Junglim Hahm World Bank Institute Tegucigalpa, Honduras/ April 22~24, 2008

Regulation and Institutions for PPP Junglim Hahm World Bank Institute Tegucigalpa, Honduras/ April 22~24, 2008

Contents 1. Regulatory framework for PPP 1. Legal regulatory framework 2. Implementation regulation 3. Ex-post regulation 2. Institutional framework for PPP 1. Overall design 2. PPP Unit 3. Conclusion

Contents 1. Regulatory framework for PPP 1. Legal regulatory framework 2. Implementation regulation 3. Ex-post regulation 2. Institutional framework for PPP 1. Overall design 2. PPP Unit 3. Conclusion

I. Regulatory Framework for PPP

I. Regulatory Framework for PPP

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü Sectoral law ü Public procurement law ü Comprehensive PPP law ü Transparency and flexibility ü Principle on when to consider PPP ü Land acquisition ü Government support ü Government’s role in creating PPP market

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü Sectoral law ü Public procurement law ü Comprehensive PPP law ü Transparency and flexibility ü Principle on when to consider PPP ü Land acquisition ü Government support ü Government’s role in creating PPP market

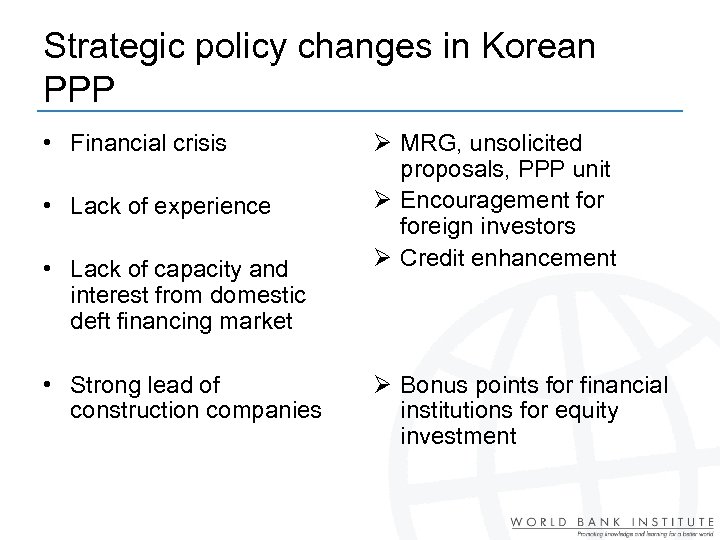

Strategic policy changes in Korean PPP • Financial crisis • Lack of experience • Lack of capacity and interest from domestic deft financing market • Strong lead of construction companies Ø MRG, unsolicited proposals, PPP unit Ø Encouragement foreign investors Ø Credit enhancement Ø Bonus points for financial institutions for equity investment

Strategic policy changes in Korean PPP • Financial crisis • Lack of experience • Lack of capacity and interest from domestic deft financing market • Strong lead of construction companies Ø MRG, unsolicited proposals, PPP unit Ø Encouragement foreign investors Ø Credit enhancement Ø Bonus points for financial institutions for equity investment

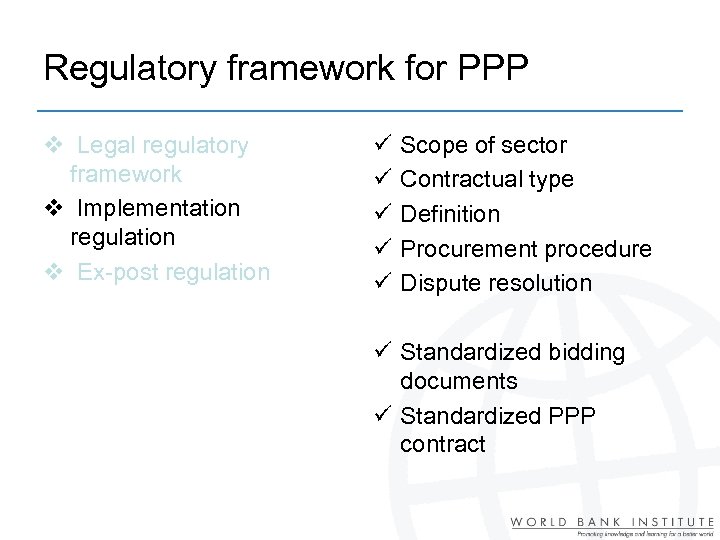

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü ü ü Scope of sector Contractual type Definition Procurement procedure Dispute resolution ü Standardized bidding documents ü Standardized PPP contract

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü ü ü Scope of sector Contractual type Definition Procurement procedure Dispute resolution ü Standardized bidding documents ü Standardized PPP contract

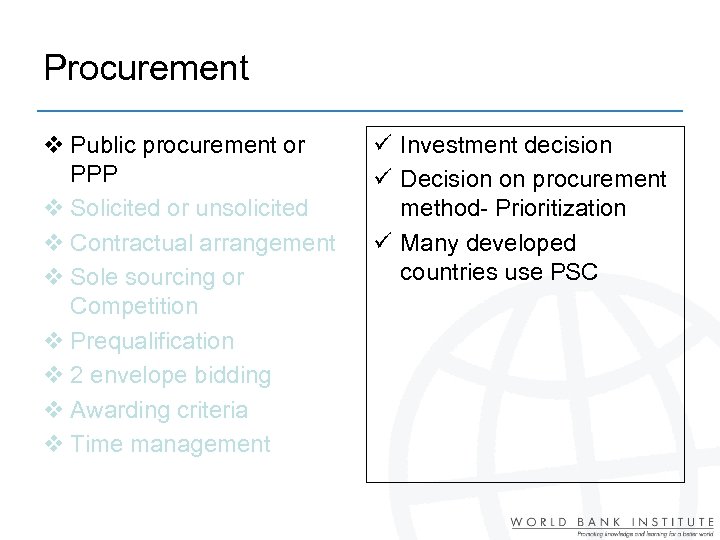

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management ü Investment decision ü Decision on procurement method- Prioritization ü Many developed countries use PSC

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management ü Investment decision ü Decision on procurement method- Prioritization ü Many developed countries use PSC

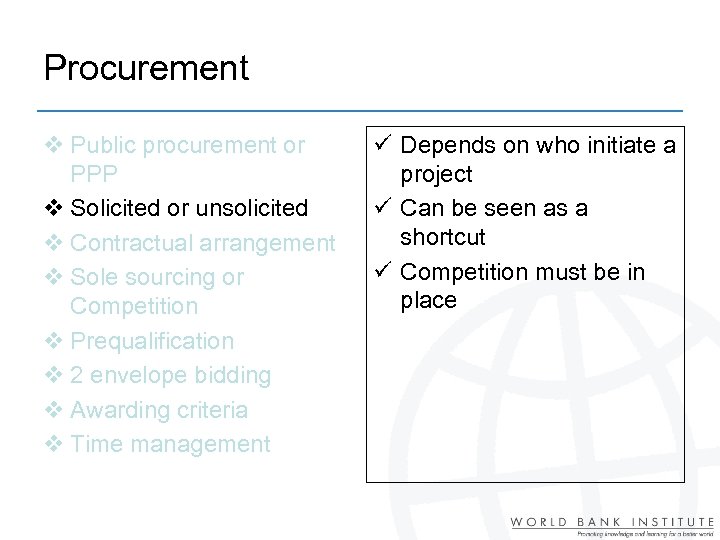

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management ü Depends on who initiate a project ü Can be seen as a shortcut ü Competition must be in place

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management ü Depends on who initiate a project ü Can be seen as a shortcut ü Competition must be in place

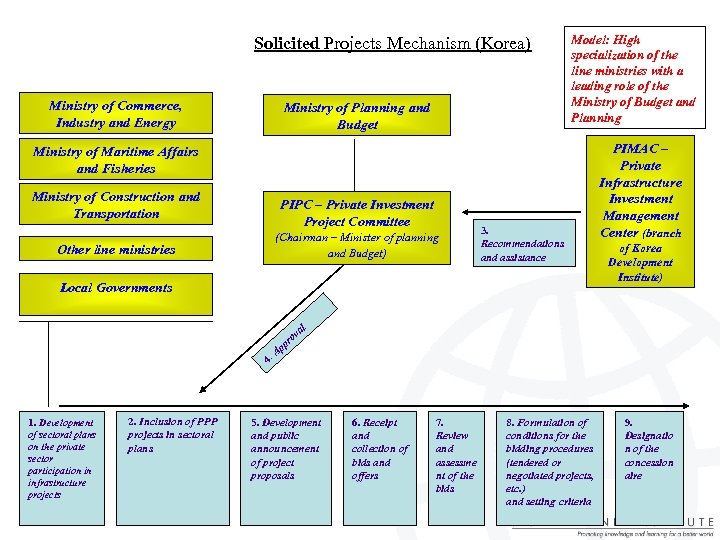

Solicited Projects Mechanism (Korea) Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Model: High specialization of the line ministries with a leading role of the Ministry of Budget and Planning Ministry of Maritime Affairs and Fisheries Ministry of Construction and Transportation PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Other line ministries 3. Recommendations and assistance Local Governments ov pr 4. 1. Development of sectoral plans on the private sector participation in infrastructure projects 2. Inclusion of PPP projects in sectoral plans PIMAC – Private Infrastructure Investment Management PIMAC – Center (branch Центр по of Korea анализу Development проектов ГЧП Institute) al Ap 5. Development and public announcement of project proposals 6. Receipt and collection of bids and offers 7. Review and assessme nt of the bids 8. Formulation of conditions for the bidding procedures (tendered or negotiated projects, etc. ) and setting criteria 9. Designatio n of the concession aire

Solicited Projects Mechanism (Korea) Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Model: High specialization of the line ministries with a leading role of the Ministry of Budget and Planning Ministry of Maritime Affairs and Fisheries Ministry of Construction and Transportation PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Other line ministries 3. Recommendations and assistance Local Governments ov pr 4. 1. Development of sectoral plans on the private sector participation in infrastructure projects 2. Inclusion of PPP projects in sectoral plans PIMAC – Private Infrastructure Investment Management PIMAC – Center (branch Центр по of Korea анализу Development проектов ГЧП Institute) al Ap 5. Development and public announcement of project proposals 6. Receipt and collection of bids and offers 7. Review and assessme nt of the bids 8. Formulation of conditions for the bidding procedures (tendered or negotiated projects, etc. ) and setting criteria 9. Designatio n of the concession aire

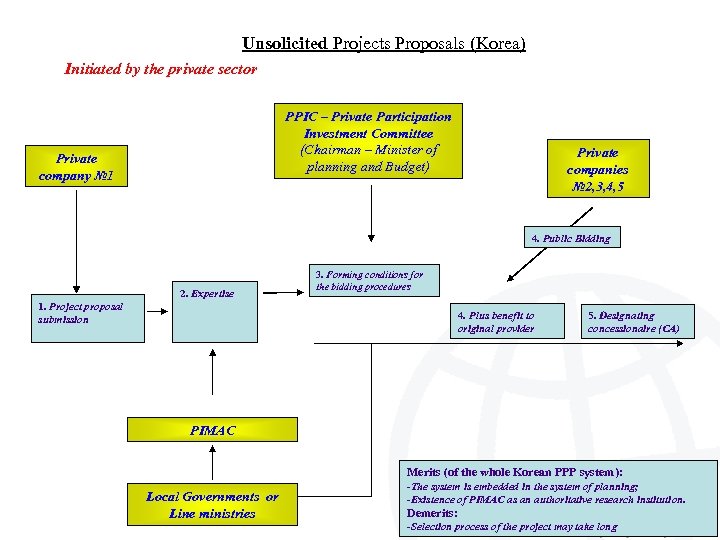

Unsolicited Projects Proposals (Korea) Initiated by the private sector PPIC – Private Participation Investment Committee (Chairman – Minister of planning and Budget) Private company № 1 Private companies № 2, 3, 4, 5 4. Public Bidding 2. Expertise 1. Project proposal submission 3. Forming conditions for the bidding procedures 4. Plus benefit to original provider 5. Designating concessionaire (CA) PIMAC Merits (of the whole Korean PPP system): Local Governments or Line ministries -The system is embedded in the system of planning; -Existence of PIMAC as an authoritative research institution. Demerits: -Selection process of the project may take long

Unsolicited Projects Proposals (Korea) Initiated by the private sector PPIC – Private Participation Investment Committee (Chairman – Minister of planning and Budget) Private company № 1 Private companies № 2, 3, 4, 5 4. Public Bidding 2. Expertise 1. Project proposal submission 3. Forming conditions for the bidding procedures 4. Plus benefit to original provider 5. Designating concessionaire (CA) PIMAC Merits (of the whole Korean PPP system): Local Governments or Line ministries -The system is embedded in the system of planning; -Existence of PIMAC as an authoritative research institution. Demerits: -Selection process of the project may take long

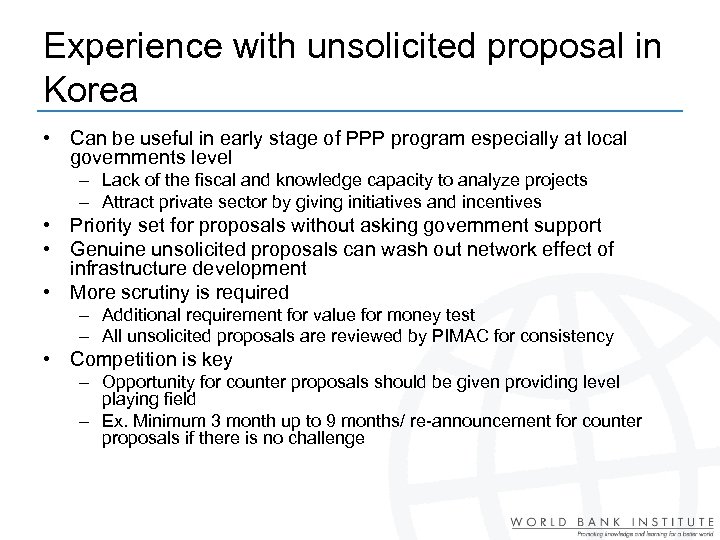

Experience with unsolicited proposal in Korea • Can be useful in early stage of PPP program especially at local governments level – Lack of the fiscal and knowledge capacity to analyze projects – Attract private sector by giving initiatives and incentives • Priority set for proposals without asking government support • Genuine unsolicited proposals can wash out network effect of infrastructure development • More scrutiny is required – Additional requirement for value for money test – All unsolicited proposals are reviewed by PIMAC for consistency • Competition is key – Opportunity for counter proposals should be given providing level playing field – Ex. Minimum 3 month up to 9 months/ re-announcement for counter proposals if there is no challenge

Experience with unsolicited proposal in Korea • Can be useful in early stage of PPP program especially at local governments level – Lack of the fiscal and knowledge capacity to analyze projects – Attract private sector by giving initiatives and incentives • Priority set for proposals without asking government support • Genuine unsolicited proposals can wash out network effect of infrastructure development • More scrutiny is required – Additional requirement for value for money test – All unsolicited proposals are reviewed by PIMAC for consistency • Competition is key – Opportunity for counter proposals should be given providing level playing field – Ex. Minimum 3 month up to 9 months/ re-announcement for counter proposals if there is no challenge

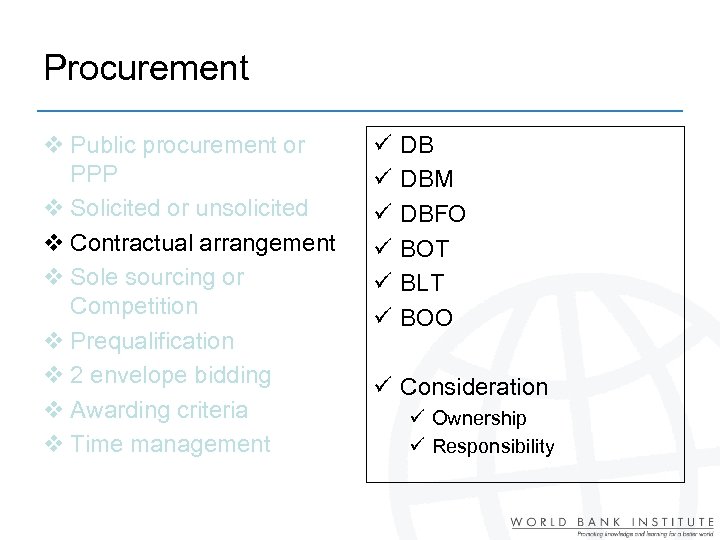

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management ü ü ü DB DBM DBFO BOT BLT BOO ü Consideration ü Ownership ü Responsibility

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management ü ü ü DB DBM DBFO BOT BLT BOO ü Consideration ü Ownership ü Responsibility

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management • Sole sourcing/direct bilateral negotiation is hard to ensure VFM of project – Low rate of renegotiation incidence in Latin America • If there is only one company capable of implementing the concerned project, alternative methods of procurement should be considered – Ex. Event of private sector’s default • Competition should be norm of PPP procurement

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management • Sole sourcing/direct bilateral negotiation is hard to ensure VFM of project – Low rate of renegotiation incidence in Latin America • If there is only one company capable of implementing the concerned project, alternative methods of procurement should be considered – Ex. Event of private sector’s default • Competition should be norm of PPP procurement

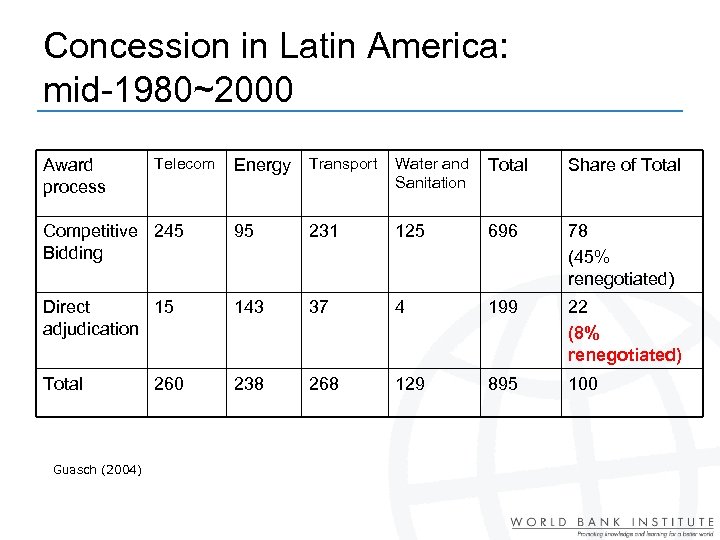

Concession in Latin America: mid-1980~2000 Energy Transport Water and Sanitation Total Share of Total Competitive 245 Bidding 95 231 125 696 78 (45% renegotiated) Direct 15 adjudication 143 37 4 199 22 (8% renegotiated) Total 238 268 129 895 100 Award process Guasch (2004) Telecom 260

Concession in Latin America: mid-1980~2000 Energy Transport Water and Sanitation Total Share of Total Competitive 245 Bidding 95 231 125 696 78 (45% renegotiated) Direct 15 adjudication 143 37 4 199 22 (8% renegotiated) Total 238 268 129 895 100 Award process Guasch (2004) Telecom 260

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management • Prequalification – Depending on the level of competition in the market – Can lower transaction cost • 2 envelop bidding/single stage bidding – Technical bid + Financial bid • Awarding criteria – Single criteria: minimum tariff, minimum subsidy, transfer price etc – Multi-criteria: weighted average-transparency required

Procurement v Public procurement or PPP v Solicited or unsolicited v Contractual arrangement v Sole sourcing or Competition v Prequalification v 2 envelope bidding v Awarding criteria v Time management • Prequalification – Depending on the level of competition in the market – Can lower transaction cost • 2 envelop bidding/single stage bidding – Technical bid + Financial bid • Awarding criteria – Single criteria: minimum tariff, minimum subsidy, transfer price etc – Multi-criteria: weighted average-transparency required

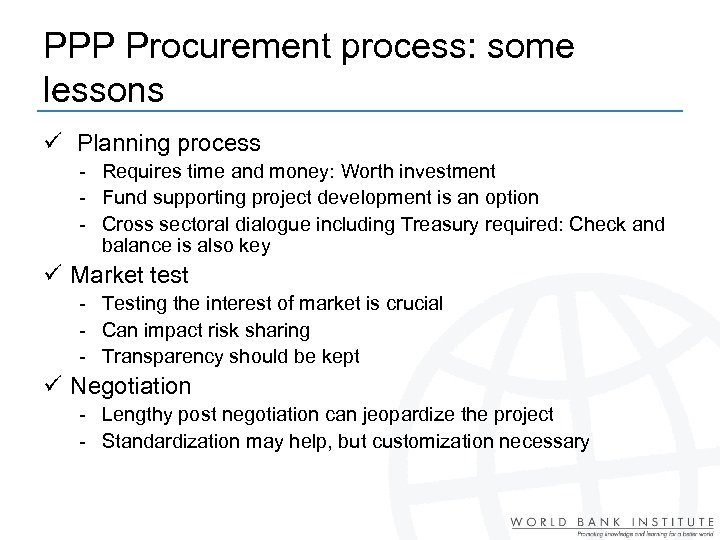

PPP Procurement process: some lessons ü Planning process - Requires time and money: Worth investment - Fund supporting project development is an option - Cross sectoral dialogue including Treasury required: Check and balance is also key ü Market test - Testing the interest of market is crucial - Can impact risk sharing - Transparency should be kept ü Negotiation - Lengthy post negotiation can jeopardize the project - Standardization may help, but customization necessary

PPP Procurement process: some lessons ü Planning process - Requires time and money: Worth investment - Fund supporting project development is an option - Cross sectoral dialogue including Treasury required: Check and balance is also key ü Market test - Testing the interest of market is crucial - Can impact risk sharing - Transparency should be kept ü Negotiation - Lengthy post negotiation can jeopardize the project - Standardization may help, but customization necessary

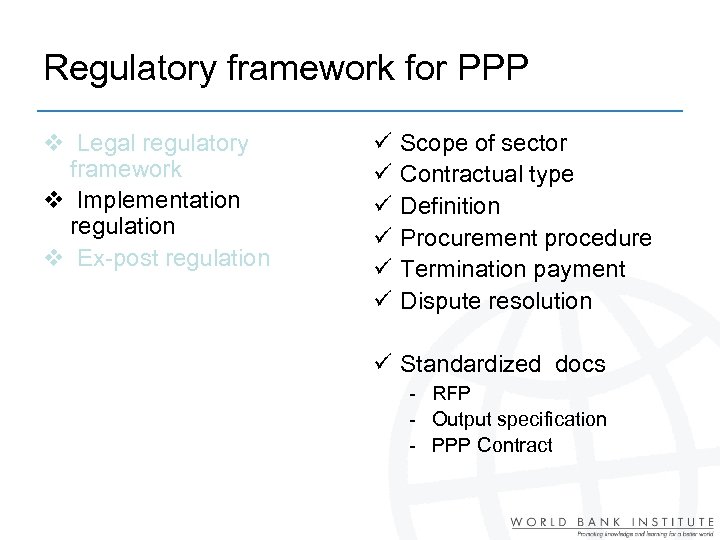

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü ü ü Scope of sector Contractual type Definition Procurement procedure Termination payment Dispute resolution ü Standardized docs - RFP - Output specification - PPP Contract

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü ü ü Scope of sector Contractual type Definition Procurement procedure Termination payment Dispute resolution ü Standardized docs - RFP - Output specification - PPP Contract

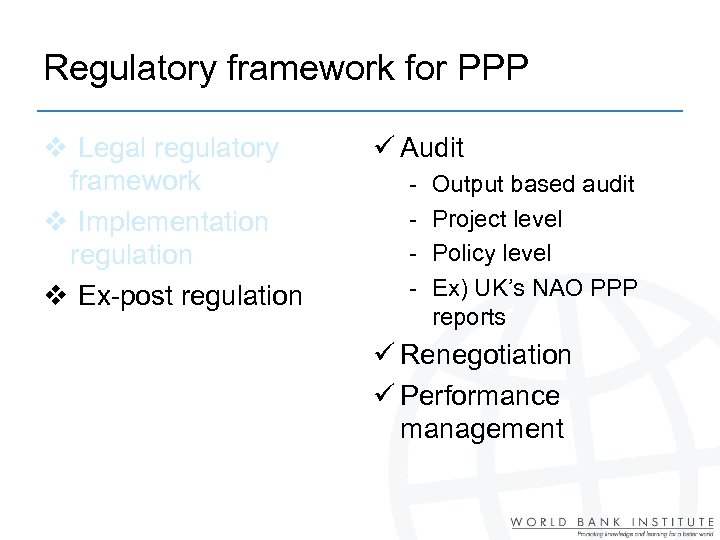

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü Audit - Output based audit Project level Policy level Ex) UK’s NAO PPP reports ü Renegotiation ü Performance management

Regulatory framework for PPP v Legal regulatory framework v Implementation regulation v Ex-post regulation ü Audit - Output based audit Project level Policy level Ex) UK’s NAO PPP reports ü Renegotiation ü Performance management

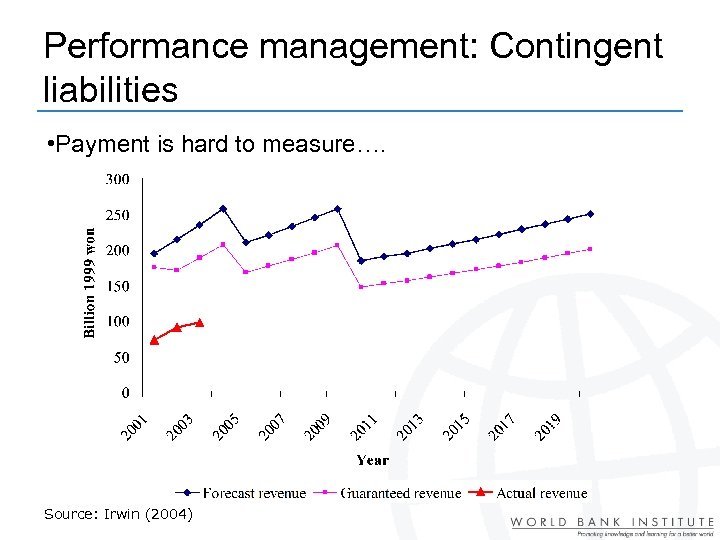

Performance management: Contingent liabilities • Payment is hard to measure…. Source: Irwin (2004)

Performance management: Contingent liabilities • Payment is hard to measure…. Source: Irwin (2004)

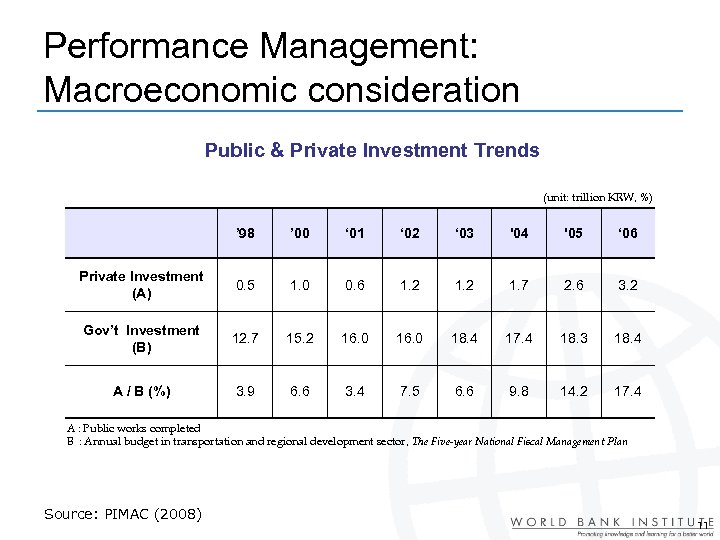

Performance Management: Macroeconomic consideration Public & Private Investment Trends (unit: trillion KRW, %) ’ 98 ’ 00 ‘ 01 ‘ 02 ‘ 03 '04 '05 ‘ 06 Private Investment (A) 0. 5 1. 0 0. 6 1. 2 1. 7 2. 6 3. 2 Gov’t Investment (B) 12. 7 15. 2 16. 0 18. 4 17. 4 18. 3 18. 4 A / B (%) 3. 9 6. 6 3. 4 7. 5 6. 6 9. 8 14. 2 17. 4 A : Public works completed B : Annual budget in transportation and regional development sector, The Five-year National Fiscal Management Plan Source: PIMAC (2008) 11

Performance Management: Macroeconomic consideration Public & Private Investment Trends (unit: trillion KRW, %) ’ 98 ’ 00 ‘ 01 ‘ 02 ‘ 03 '04 '05 ‘ 06 Private Investment (A) 0. 5 1. 0 0. 6 1. 2 1. 7 2. 6 3. 2 Gov’t Investment (B) 12. 7 15. 2 16. 0 18. 4 17. 4 18. 3 18. 4 A / B (%) 3. 9 6. 6 3. 4 7. 5 6. 6 9. 8 14. 2 17. 4 A : Public works completed B : Annual budget in transportation and regional development sector, The Five-year National Fiscal Management Plan Source: PIMAC (2008) 11

II. Institutional Framework for PPP

II. Institutional Framework for PPP

Institutions for PPP v Leading Government Ministry v PPP Unit v Risk Management Unit v PPP Nods v PPP Board

Institutions for PPP v Leading Government Ministry v PPP Unit v Risk Management Unit v PPP Nods v PPP Board

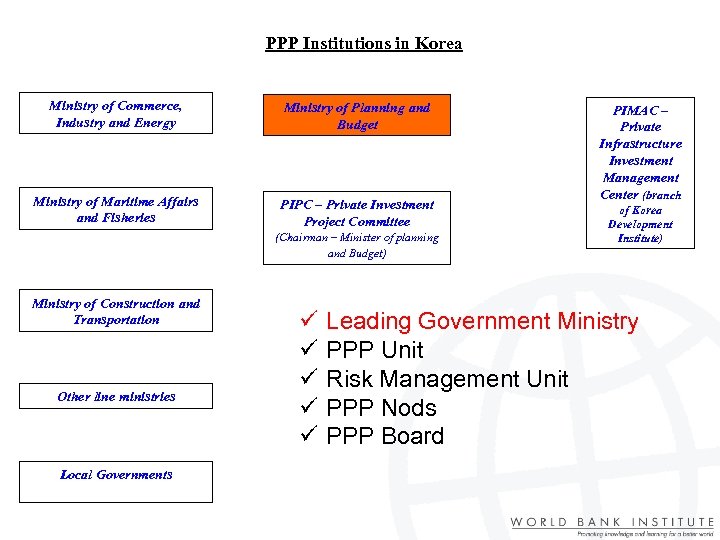

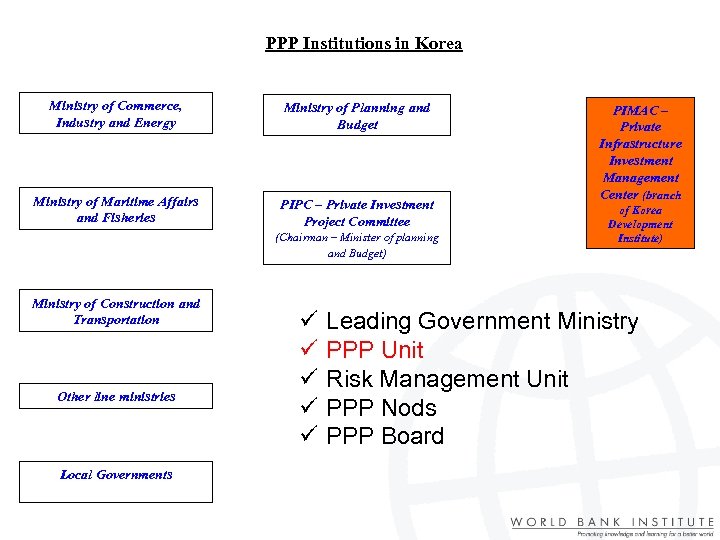

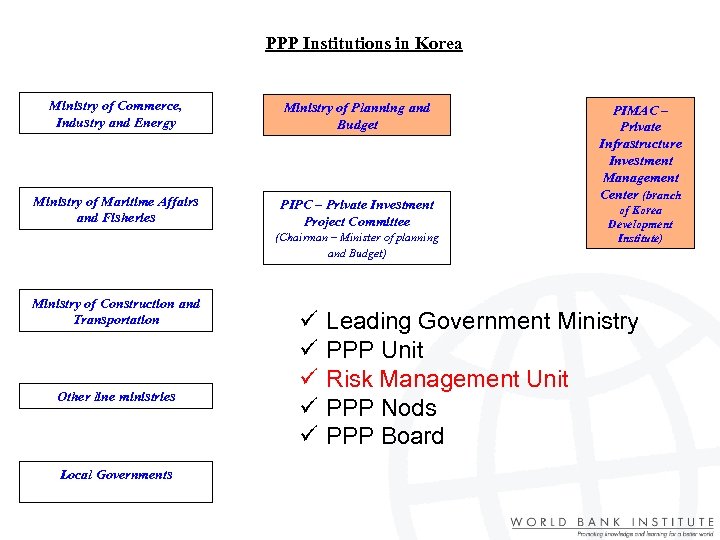

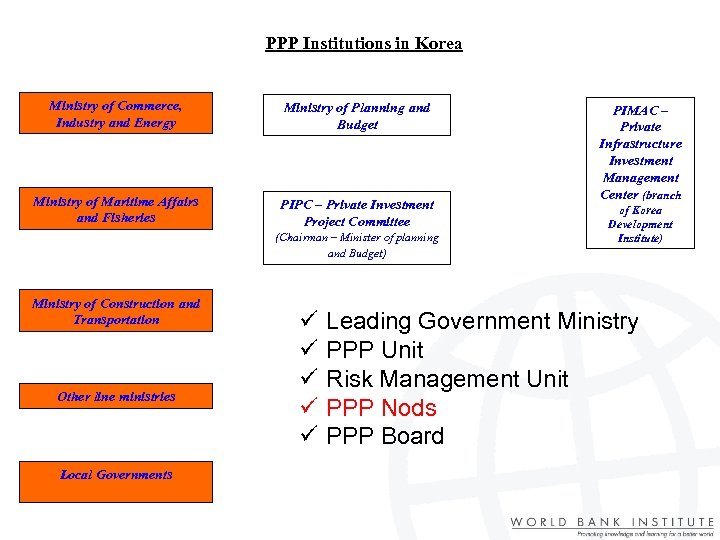

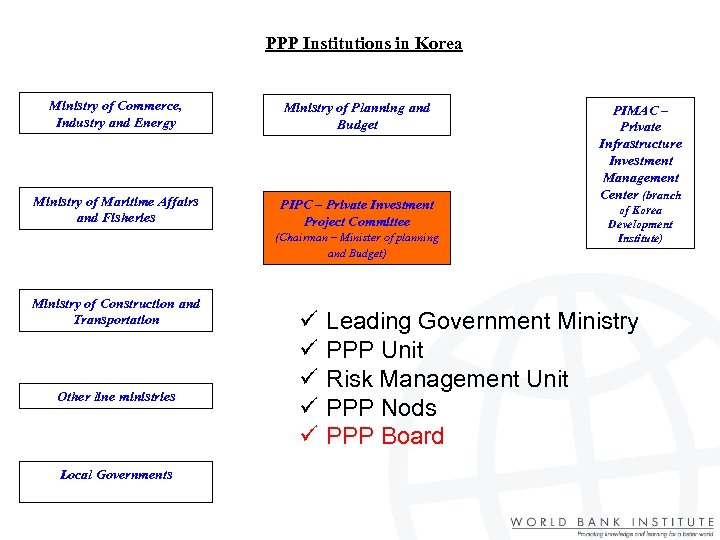

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

PPP Institutions in Korea Ministry of Commerce, Industry and Energy Ministry of Planning and Budget Ministry of Maritime Affairs and Fisheries PIPC – Private Investment Project Committee (Chairman – Minister of planning and Budget) Ministry of Construction and Transportation Other line ministries Local Governments ü ü ü PIMAC – Private Infrastructure Investment Management Center (branch of Korea Development Institute) Leading Government Ministry PPP Unit Risk Management Unit PPP Nods PPP Board

Institutions for PPP: Other than public sector v v v Credit enhancement fund Credit guarantee fund Project development fund PPP Associations NGO for awareness raising

Institutions for PPP: Other than public sector v v v Credit enhancement fund Credit guarantee fund Project development fund PPP Associations NGO for awareness raising

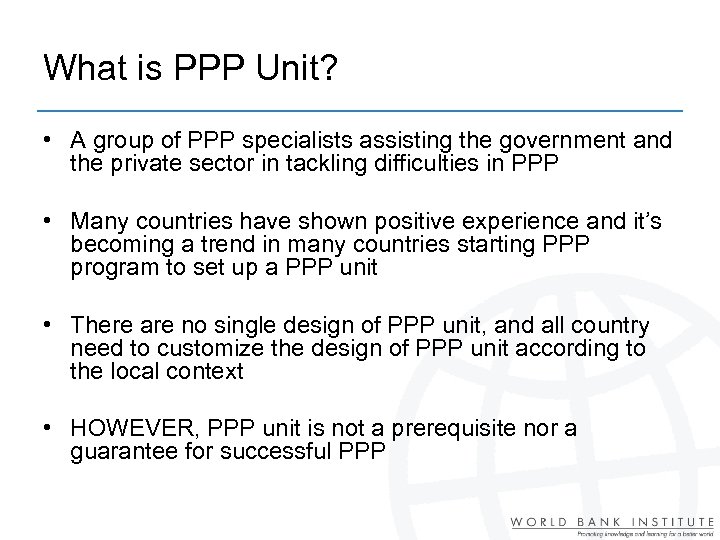

What is PPP Unit? • A group of PPP specialists assisting the government and the private sector in tackling difficulties in PPP • Many countries have shown positive experience and it’s becoming a trend in many countries starting PPP program to set up a PPP unit • There are no single design of PPP unit, and all country need to customize the design of PPP unit according to the local context • HOWEVER, PPP unit is not a prerequisite nor a guarantee for successful PPP

What is PPP Unit? • A group of PPP specialists assisting the government and the private sector in tackling difficulties in PPP • Many countries have shown positive experience and it’s becoming a trend in many countries starting PPP program to set up a PPP unit • There are no single design of PPP unit, and all country need to customize the design of PPP unit according to the local context • HOWEVER, PPP unit is not a prerequisite nor a guarantee for successful PPP

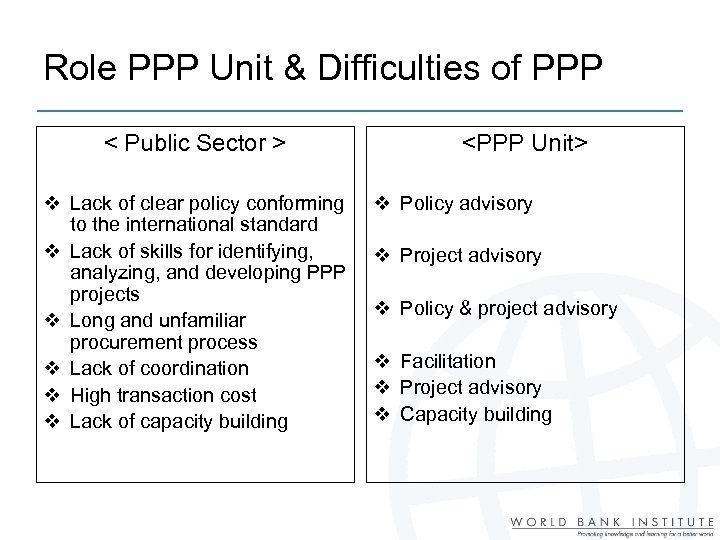

Role PPP Unit & Difficulties of PPP < Public Sector > v Lack of clear policy conforming to the international standard v Lack of skills for identifying, analyzing, and developing PPP projects v Long and unfamiliar procurement process v Lack of coordination v High transaction cost v Lack of capacity building

Role PPP Unit & Difficulties of PPP < Public Sector > v Lack of clear policy conforming to the international standard v Lack of skills for identifying, analyzing, and developing PPP projects v Long and unfamiliar procurement process v Lack of coordination v High transaction cost v Lack of capacity building

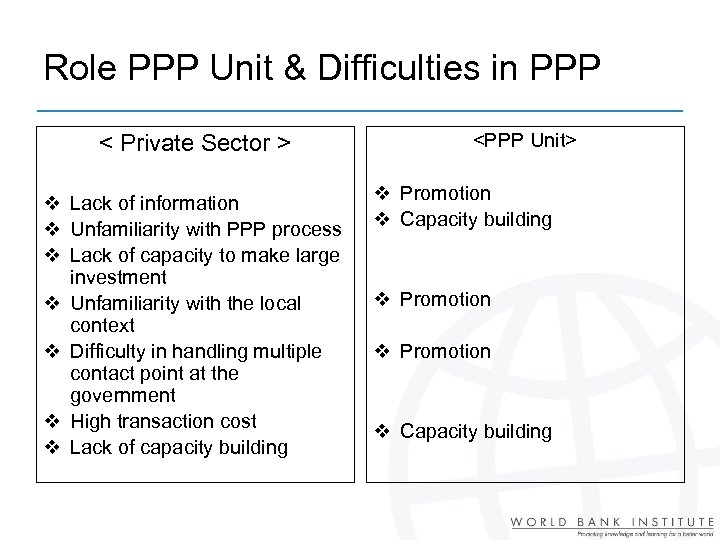

Role PPP Unit & Difficulties in PPP < Private Sector > v Lack of information v Unfamiliarity with PPP process v Lack of capacity to make large investment v Unfamiliarity with the local context v Difficulty in handling multiple contact point at the government v High transaction cost v Lack of capacity building

Role PPP Unit & Difficulties in PPP < Private Sector > v Lack of information v Unfamiliarity with PPP process v Lack of capacity to make large investment v Unfamiliarity with the local context v Difficulty in handling multiple contact point at the government v High transaction cost v Lack of capacity building

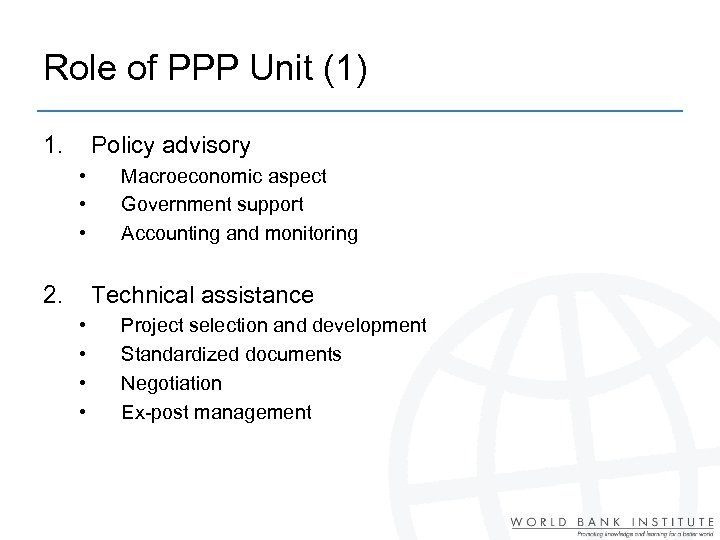

Role of PPP Unit (1) 1. Policy advisory • • • 2. Macroeconomic aspect Government support Accounting and monitoring Technical assistance • • Project selection and development Standardized documents Negotiation Ex-post management

Role of PPP Unit (1) 1. Policy advisory • • • 2. Macroeconomic aspect Government support Accounting and monitoring Technical assistance • • Project selection and development Standardized documents Negotiation Ex-post management

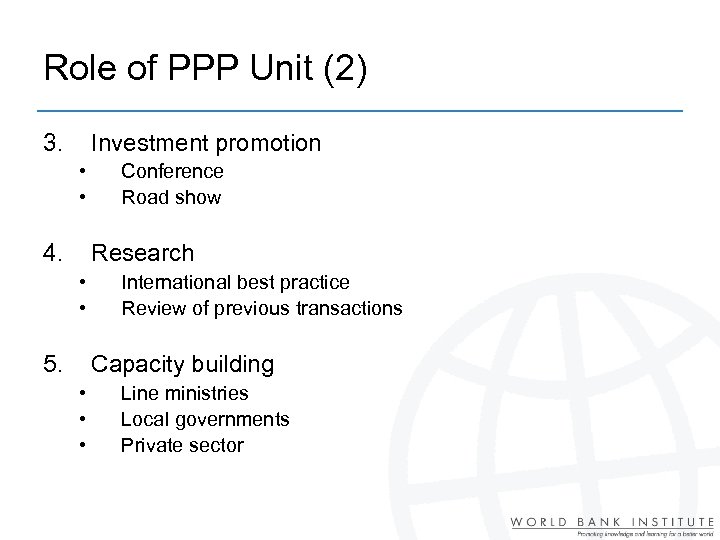

Role of PPP Unit (2) 3. Investment promotion • • 4. Conference Road show Research • • 5. International best practice Review of previous transactions Capacity building • • • Line ministries Local governments Private sector

Role of PPP Unit (2) 3. Investment promotion • • 4. Conference Road show Research • • 5. International best practice Review of previous transactions Capacity building • • • Line ministries Local governments Private sector

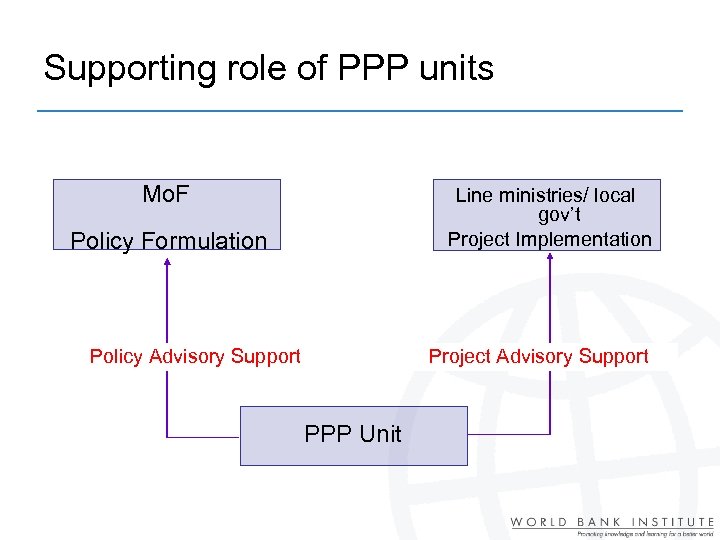

Supporting role of PPP units Mo. F Line ministries/ local gov’t Project Implementation Policy Formulation Policy Advisory Support Project Advisory Support PPP Unit

Supporting role of PPP units Mo. F Line ministries/ local gov’t Project Implementation Policy Formulation Policy Advisory Support Project Advisory Support PPP Unit

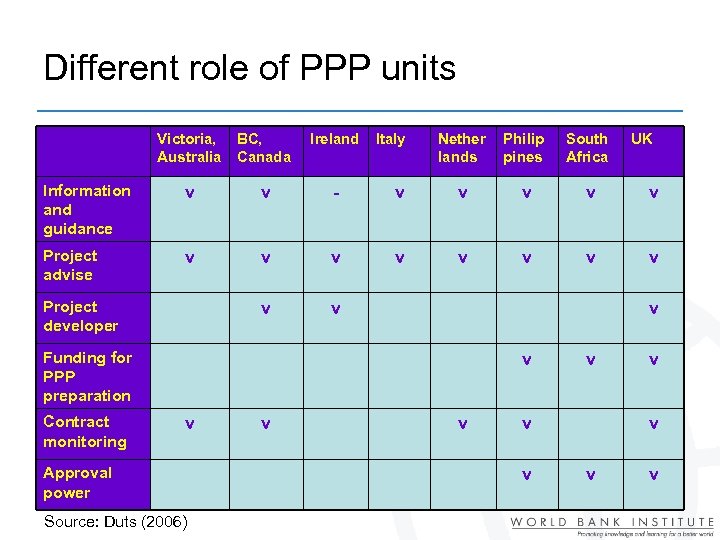

Different role of PPP units Victoria, Australia BC, Canada Ireland Information and guidance v v - Project advise v v v Project developer Italy Nether lands Philip pines South Africa v v v Funding for PPP preparation Contract monitoring v v Approval power Source: Duts (2006) v UK v v v v

Different role of PPP units Victoria, Australia BC, Canada Ireland Information and guidance v v - Project advise v v v Project developer Italy Nether lands Philip pines South Africa v v v Funding for PPP preparation Contract monitoring v v Approval power Source: Duts (2006) v UK v v v v

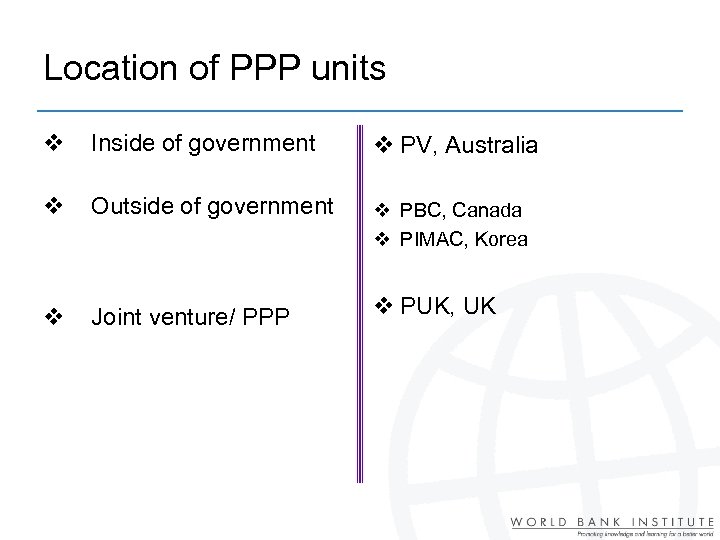

Location of PPP units v Inside of government v PV, Australia v Outside of government v PBC, Canada v PIMAC, Korea v Joint venture/ PPP v PUK, UK

Location of PPP units v Inside of government v PV, Australia v Outside of government v PBC, Canada v PIMAC, Korea v Joint venture/ PPP v PUK, UK

Staffing of PPP Unit v Staffs are PPP specialists who are familiar with the public and private practice together v The staffs includes economist, finance specialist, accountants, lawyers, as well as engineers in all sectors covered by PPP law v If the unit is located within the government, the payment level sometime becomes issue. v High turn over rate of PPP staffs can emerge as an issue after the Unit becomes fully operational.

Staffing of PPP Unit v Staffs are PPP specialists who are familiar with the public and private practice together v The staffs includes economist, finance specialist, accountants, lawyers, as well as engineers in all sectors covered by PPP law v If the unit is located within the government, the payment level sometime becomes issue. v High turn over rate of PPP staffs can emerge as an issue after the Unit becomes fully operational.

Funding of PPP Units v Directly funded by the government v PV, Australia v Charge fees to the public sector v PUK, UK - Fees are set in Framework Agreements signed with client and renewed every four years - Fees are benchmarked against private advisory companies

Funding of PPP Units v Directly funded by the government v PV, Australia v Charge fees to the public sector v PUK, UK - Fees are set in Framework Agreements signed with client and renewed every four years - Fees are benchmarked against private advisory companies

PPP Unit may not be always successful PPP unit may not be successful if it doesn’t demonstrate leaderships and specialties Line ministries which have a long experience in traditional procurement may not want to cooperate with new agency It is important to prove the efficiency and provide incentive to use PPP Close alignment with the central government is very important Good planning practice should be in place regardless of PPP or public infrastructure In the end, the success of PPP unit is defined by the success of PPP program in the country

PPP Unit may not be always successful PPP unit may not be successful if it doesn’t demonstrate leaderships and specialties Line ministries which have a long experience in traditional procurement may not want to cooperate with new agency It is important to prove the efficiency and provide incentive to use PPP Close alignment with the central government is very important Good planning practice should be in place regardless of PPP or public infrastructure In the end, the success of PPP unit is defined by the success of PPP program in the country

Case study: PIMAC, Korea Location and structure PIMAC is established by PPP law It was first put at the government think-tank in charge of setting the national development plan Then, was merged with the other organization in charge of public infrastructure Currently PIMAC is located at KDI, a government funded think-tank This structure allows competitive salary for the staffs, and also integration of public infrastructure planning and PPP infrastructure planning

Case study: PIMAC, Korea Location and structure PIMAC is established by PPP law It was first put at the government think-tank in charge of setting the national development plan Then, was merged with the other organization in charge of public infrastructure Currently PIMAC is located at KDI, a government funded think-tank This structure allows competitive salary for the staffs, and also integration of public infrastructure planning and PPP infrastructure planning

Case study: PIMAC, Korea Staffing When first established, the law put limit in staffing to be 30 and not it’s 80. The staffs includes economist, finance specialist, accountants, lawyers, as well as engineers in all sectors covered by PPP law The turn over of financial specialists and lawyers are relatively higher than engineers.

Case study: PIMAC, Korea Staffing When first established, the law put limit in staffing to be 30 and not it’s 80. The staffs includes economist, finance specialist, accountants, lawyers, as well as engineers in all sectors covered by PPP law The turn over of financial specialists and lawyers are relatively higher than engineers.

Case study: PIMAC, Korea Funding Fixed cost is paid by the government Part of the variables are charged to the clients Fee chart is decided through discussion with clients and announced regularly Fee level is lower than the service by the private sector

Case study: PIMAC, Korea Funding Fixed cost is paid by the government Part of the variables are charged to the clients Fee chart is decided through discussion with clients and announced regularly Fee level is lower than the service by the private sector

Case study: PIMAC, Korea Function Role of PIMAC is specified at the decree including – – – Pre-feasibility study of public infrastructure Support for PPP legal framework Support for PPP regulatory framework Support for bidding, negotiation for PPP projects Promotion, research, and capacity building PIMAC doesn’t have approval power, but some of PIMAC’s review is required by the law

Case study: PIMAC, Korea Function Role of PIMAC is specified at the decree including – – – Pre-feasibility study of public infrastructure Support for PPP legal framework Support for PPP regulatory framework Support for bidding, negotiation for PPP projects Promotion, research, and capacity building PIMAC doesn’t have approval power, but some of PIMAC’s review is required by the law

III. Conclusions

III. Conclusions

Conclusions ü There is no perfect design for regulation and institutions - Changing market condition needs to be reflected in PPP framework by modifying and updating regulatory and institutional design - Principles should be kept-competition & transparency ü Proactive usage of policy in market creation is important: Government’s vision, sustainability ü Do not neglect to engage the taxpayers in PPP dialogue ü In house skill within the government is crucial-importance of capacity building

Conclusions ü There is no perfect design for regulation and institutions - Changing market condition needs to be reflected in PPP framework by modifying and updating regulatory and institutional design - Principles should be kept-competition & transparency ü Proactive usage of policy in market creation is important: Government’s vision, sustainability ü Do not neglect to engage the taxpayers in PPP dialogue ü In house skill within the government is crucial-importance of capacity building

• Questions? jhahm@worldbank. org

• Questions? jhahm@worldbank. org