b4eee478b396ab155805c264ae947aed.ppt

- Количество слайдов: 20

Regulating the Banking Industry ECO 473 – Money & Banking – Dr. D. Foster

Rationales for Government Regulation Maintaining depository institution liquidity. Assuring bank solvency by limiting failures. Promoting an efficient financial system. Protecting consumers.

Federal Regulation: 1933– 1970 The Banking Act of 1933 (Glass-Steagall Act): ◦ Created the Federal Deposit Insurance Corporation (FDIC). ◦ Placed interest rate ceilings on checking deposits of commercial banks. ◦ Separated commercial and investment banking. ◦ Branching restrictions.

Partial Deregulation: 1971– 1989 Disintermediation in the 1970 s. 1980 - Depository Institutions Deregulation and Monetary Control Act (DIDMCA): ◦ Six-year phaseout of interest rate ceilings. ◦ Permitted NOW accounts. ◦ Increased FDIC coverage to $100, 000.

Partial Deregulation: 1971– 1989 The Garn–St. Germain Act of 1982: ◦ Authorized money market deposit accounts. ◦ Increase the DIDMCA limit on consumer loans and commercial paper. ◦ Authorized savings institutions to make commercial real estate loans. ◦ Gave these institutions the power to purchase “unsecured loans, ” including low-rated, “junk” bonds. ◦ Gave the FDIC power to permit troubled financial institutions to merge with healthier partners.

Partial Deregulation: 1971– 1989 - Financial Institutions Reform, Recovery & Enforcement Act (FIRREA): (FIRREA) ◦ Authorized taxpayer funds to cover cost of liquidating failed thrifts. --Insurance wasn’t enough! ◦ Abolished current thrift regulatory structure. --Created Office of Thrift Supervision. --Created the Resolution Trust Corp. to liquidate thrifts. ◦ Moved thrift insurance (FSLIC) into FDIC. ◦ Required insurance fund = 1. 25% of insured deposits.

Deposit Insurance Complications The moral-hazard problem of deposit insurance: insurance ◦ S&L crisis. Too-big-to-fail policy: policy ◦ Continental Illinois The FDIC Improvement Act Of 1991 -- Allowed for earlier intervention by the FDIC. -- Let FDIC set/change premiums to boost fund. -- Mandated risk-based premium structure.

Banking Failure: The Case of Continental Illinois

The Continental Illinois Story Origins to the Civil War … -- The Commercial National Bank. -- Mergers in 1910 and in 1929. -- Name change in 1932. $50 million loan to survive the Great Depression -- Reconstruction Finance Corp. (gov’t. ) One of two largest Chicago banks in 1900 s. Generally, a conservative bank … -- Until the 1970 s and its focus on commercial lending.

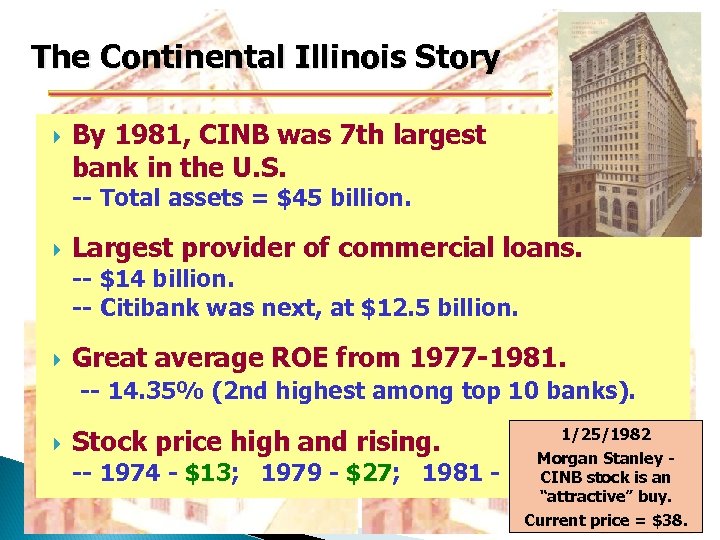

The Continental Illinois Story By 1981, CINB was 7 th largest bank in the U. S. -- Total assets = $45 billion. Largest provider of commercial loans. -- $14 billion. -- Citibank was next, at $12. 5 billion. Great average ROE from 1977 -1981. -- 14. 35% (2 nd highest among top 10 banks). Stock price high and rising. -- 1974 - $13; 1979 - $27; 1981 - 1/25/1982 Morgan Stanley $42. stock is an CINB “attractive” buy. Current price = $38.

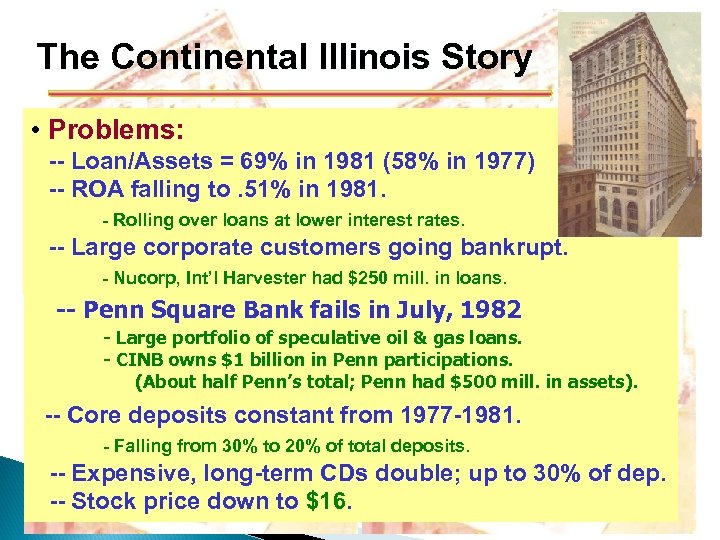

The Continental Illinois Story • Problems: -- Loan/Assets = 69% in 1981 (58% in 1977) -- ROA falling to. 51% in 1981. - Rolling over loans at lower interest rates. -- Large corporate customers going bankrupt. - Nucorp, Int’l Harvester had $250 mill. in loans. -- Penn Square Bank fails in July, 1982 - Large portfolio of speculative oil & gas loans. - CINB owns $1 billion in Penn participations. (About half Penn’s total; Penn had $500 mill. in assets). -- Core deposits constant from 1977 -1981. - Falling from 30% to 20% of total deposits. -- Expensive, long-term CDs double; up to 30% of dep. -- Stock price down to $16.

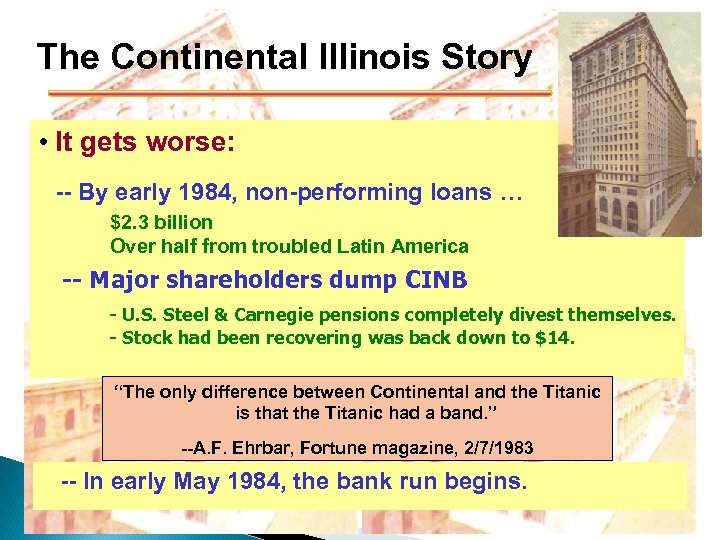

The Continental Illinois Story • It gets worse: -- By early 1984, non-performing loans … $2. 3 billion Over half from troubled Latin America -- Major shareholders dump CINB - U. S. Steel & Carnegie pensions completely divest themselves. - Stock had been recovering was back down to $14. “The only difference between Continental and the Titanic is that the Titanic had a band. ” --A. F. Ehrbar, Fortune magazine, 2/7/1983 -- In early May 1984, the bank run begins.

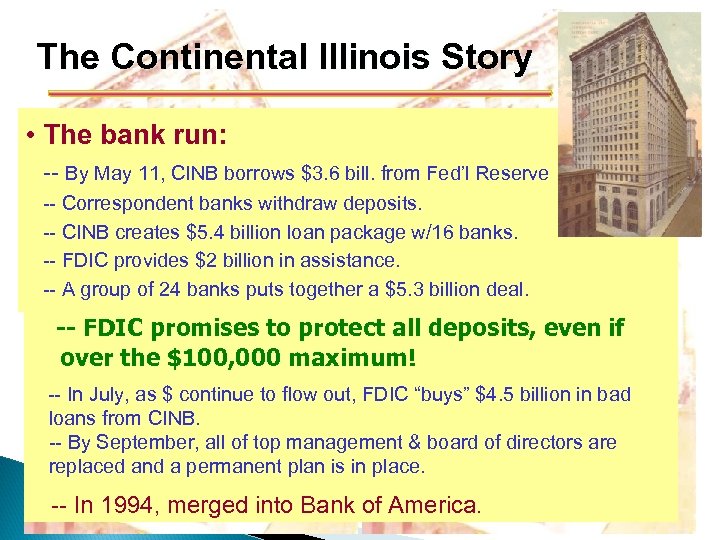

The Continental Illinois Story • The bank run: -- By May 11, CINB borrows $3. 6 bill. from Fed’l Reserve -- Correspondent banks withdraw deposits. -- CINB creates $5. 4 billion loan package w/16 banks. -- FDIC provides $2 billion in assistance. -- A group of 24 banks puts together a $5. 3 billion deal. -- FDIC promises to protect all deposits, even if over the $100, 000 maximum! -- In July, as $ continue to flow out, FDIC “buys” $4. 5 billion in bad loans from CINB. -- By September, all of top management & board of directors are replaced and a permanent plan is in place. -- In 1994, merged into Bank of America.

Lessons Learned? The moral-hazard problem of deposit insurance. Too-big-to-fail policy. Was their strategy bad, or was it something else?

Banking Failure: The Case of Continental Illinois

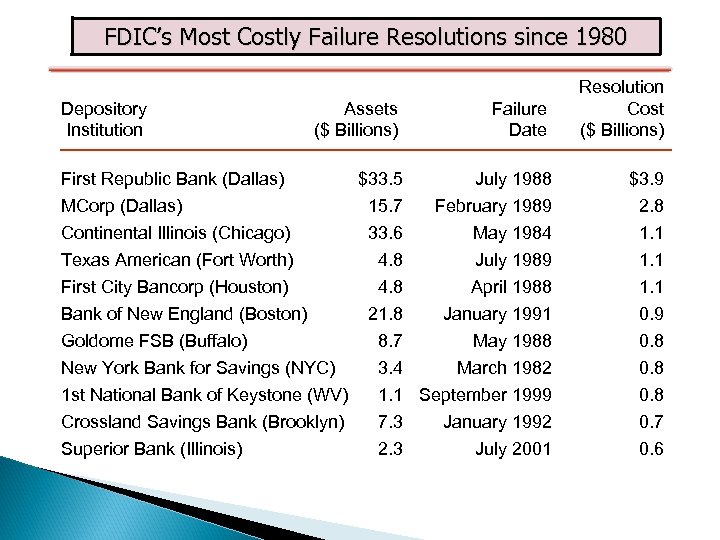

FDIC’s Most Costly Failure Resolutions since 1980 Depository Institution Assets ($ Billions) Failure Date Resolution Cost ($ Billions) $33. 5 July 1988 $3. 9 15. 7 February 1989 33. 6 May 1984 4. 8 July 1989 4. 8 April 1988 21. 8 January 1991 8. 7 May 1988 3. 4 March 1982 1. 1 September 1999 7. 3 January 1992 2. 3 July 2001 2. 8 1. 1 0. 9 0. 8 0. 7 0. 6 First Republic Bank (Dallas) MCorp (Dallas) Continental Illinois (Chicago) Texas American (Fort Worth) First City Bancorp (Houston) Bank of New England (Boston) Goldome FSB (Buffalo) New York Bank for Savings (NYC) 1 st National Bank of Keystone (WV) Crossland Savings Bank (Brooklyn) Superior Bank (Illinois)

Capital Requirements Capital requirements: requirements ◦ Minimum equity capital standards. Risk-based capital requirements: requirements ◦ Risk factors that distinguish different depository institutions. [Degree of capitalization. ] Risk-adjusted assets: assets ◦ A weighted average of bank assets to account for risk differences across types of assets. [Type of capitalization. ]

The Financial Services Modernization Act of 1999 (Gramm-Leach-Bliley Act) Act removes Glass-Steagall restrictions and permits: ◦ Securities firms and insurance companies to own commercial banks. ◦ Banks to underwrite insurance and securities, including shares of stock.

Regulatory Issues Off-balance-sheet banking: ◦ Loan commitment; credit default swaps. Asset valuation: ◦ Historical cost vs. market value Derivatives: ◦ Replacement cost exposure. ◦ Credit/market/operating risks. New wave of regulation: ◦ SOX; Dodd-Frank

Regulating the Banking Industry ECO 473 – Money & Banking – Dr. D. Foster

b4eee478b396ab155805c264ae947aed.ppt