1bf8a5bb75d4bab34fda63a5a6dd4943.ppt

- Количество слайдов: 35

Regulating The Accountants for AML/CFT Challenges and Way Forward Special Control Unit Against Money Laundering (SCUML) Barrister Igbodekwe Emmanuel 11 - 12 TH September, 2013

Regulating The Accountants for AML/CFT Challenges and Way Forward Special Control Unit Against Money Laundering (SCUML) Barrister Igbodekwe Emmanuel 11 - 12 TH September, 2013

Topic Ø Financial Action Task Force (FATF) requirements on accountants Ø Highlight of the FATF recommendations relevant to accountants Ø Way Forward in regulating accountants 2

Topic Ø Financial Action Task Force (FATF) requirements on accountants Ø Highlight of the FATF recommendations relevant to accountants Ø Way Forward in regulating accountants 2

FATF The Financial Action Task Force (FATF) : Ø an inter-governmental body Ø created in 1989 by ‘G 7’ Ø sets standards, develops and promotes policies to combat money laundering and terrorist financing Ø published 40+9 Recommendations to achieve its purpose Ø Now Revised to 40 Recommendations 3

FATF The Financial Action Task Force (FATF) : Ø an inter-governmental body Ø created in 1989 by ‘G 7’ Ø sets standards, develops and promotes policies to combat money laundering and terrorist financing Ø published 40+9 Recommendations to achieve its purpose Ø Now Revised to 40 Recommendations 3

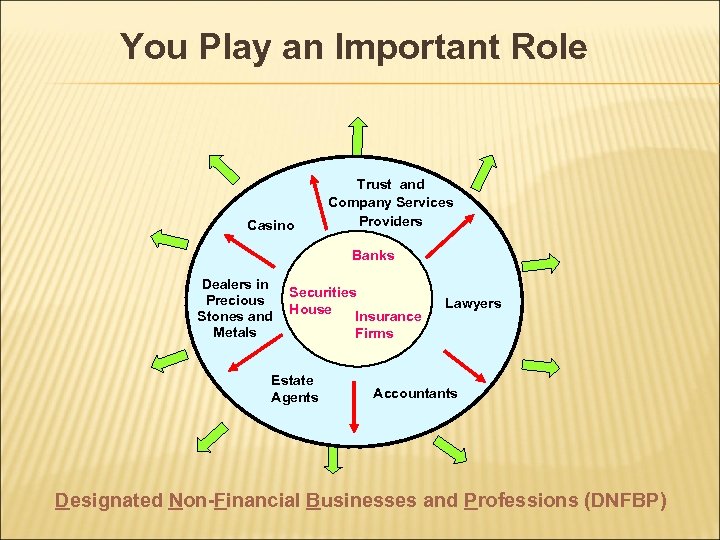

Designated Non-Financial Businesses and Professions (DNFBPs) DNFBPs as defined by Financial Action Task Force (FATF) are: Ø Lawyers Ø Accountants Ø Trust and Company Service Providers (TCSPs) Ø Real Estate Agents Ø Dealers in Precious Metals/ Stones Ø Casinos 4

Designated Non-Financial Businesses and Professions (DNFBPs) DNFBPs as defined by Financial Action Task Force (FATF) are: Ø Lawyers Ø Accountants Ø Trust and Company Service Providers (TCSPs) Ø Real Estate Agents Ø Dealers in Precious Metals/ Stones Ø Casinos 4

You Play an Important Role Casino Trust and Company Services Providers Banks Dealers in Precious Stones and Metals Securities House Insurance Firms Estate Agents Lawyers Accountants Designated Non-Financial Businesses and Professions (DNFBP)

You Play an Important Role Casino Trust and Company Services Providers Banks Dealers in Precious Stones and Metals Securities House Insurance Firms Estate Agents Lawyers Accountants Designated Non-Financial Businesses and Professions (DNFBP)

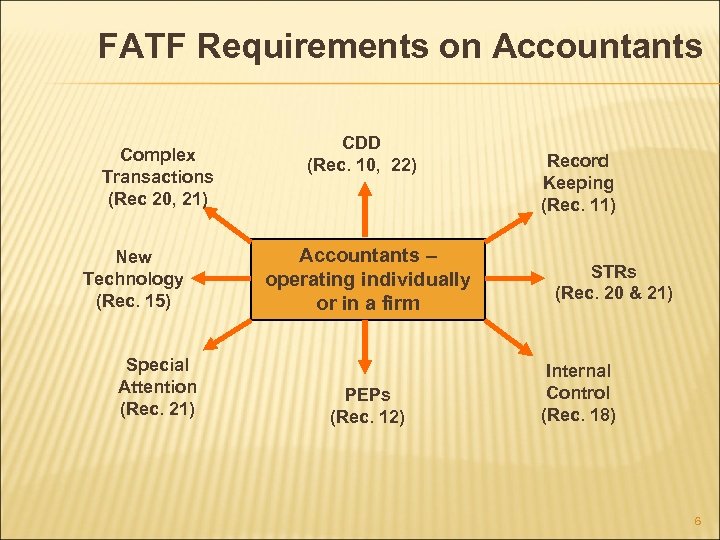

FATF Requirements on Accountants Complex Transactions (Rec 20, 21) New Technology (Rec. 15) Special Attention (Rec. 21) CDD (Rec. 10, 22) Accountants – operating individually or in a firm PEPs (Rec. 12) Record Keeping (Rec. 11) STRs (Rec. 20 & 21) Internal Control (Rec. 18) 6

FATF Requirements on Accountants Complex Transactions (Rec 20, 21) New Technology (Rec. 15) Special Attention (Rec. 21) CDD (Rec. 10, 22) Accountants – operating individually or in a firm PEPs (Rec. 12) Record Keeping (Rec. 11) STRs (Rec. 20 & 21) Internal Control (Rec. 18) 6

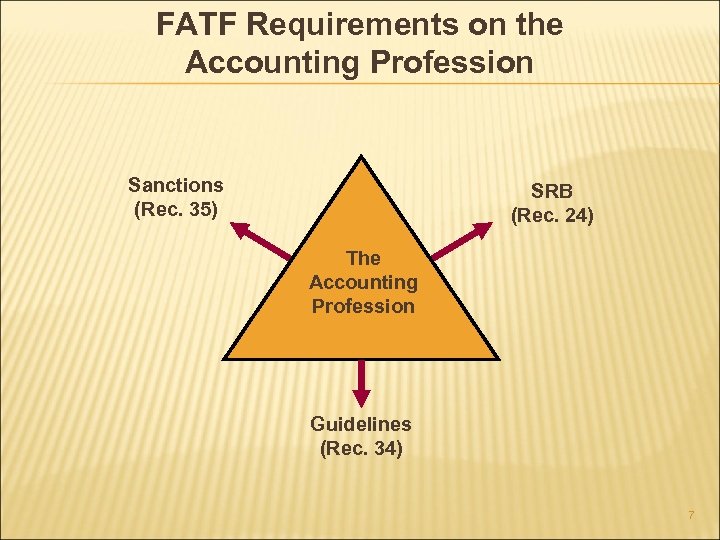

FATF Requirements on the Accounting Profession Sanctions (Rec. 35) SRB (Rec. 24) The Accounting Profession Guidelines (Rec. 34) 7

FATF Requirements on the Accounting Profession Sanctions (Rec. 35) SRB (Rec. 24) The Accounting Profession Guidelines (Rec. 34) 7

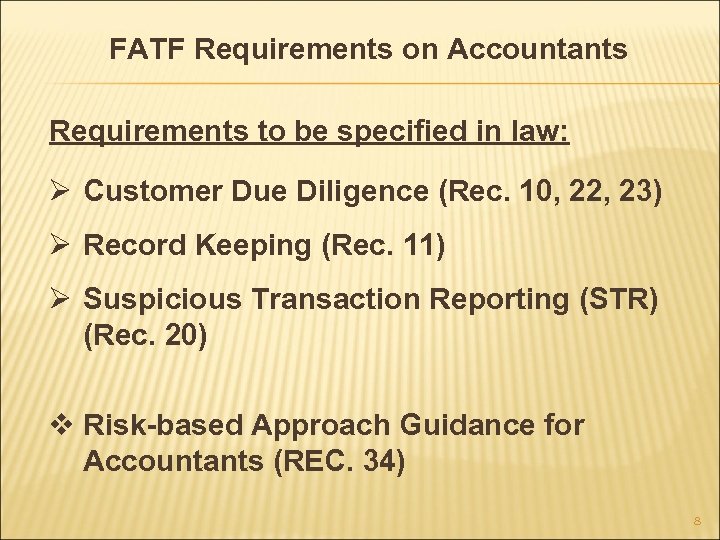

FATF Requirements on Accountants Requirements to be specified in law: Ø Customer Due Diligence (Rec. 10, 22, 23) Ø Record Keeping (Rec. 11) Ø Suspicious Transaction Reporting (STR) (Rec. 20) v Risk-based Approach Guidance for Accountants (REC. 34) 8

FATF Requirements on Accountants Requirements to be specified in law: Ø Customer Due Diligence (Rec. 10, 22, 23) Ø Record Keeping (Rec. 11) Ø Suspicious Transaction Reporting (STR) (Rec. 20) v Risk-based Approach Guidance for Accountants (REC. 34) 8

When to Conduct CDD? When accountants prepare for or carry out transactions in relation to: Ø Buying and selling of real estates; Ø Managing of client money, securities or other assets; Ø Management of bank, savings or securities accounts; Ø Organisation of contributions for the creation, operation or management of companies; Ø Creation, operation or management of legal persons or arrangements, and buying and selling of business entities. 9

When to Conduct CDD? When accountants prepare for or carry out transactions in relation to: Ø Buying and selling of real estates; Ø Managing of client money, securities or other assets; Ø Management of bank, savings or securities accounts; Ø Organisation of contributions for the creation, operation or management of companies; Ø Creation, operation or management of legal persons or arrangements, and buying and selling of business entities. 9

When to Conduct CDD? When accountants act as Trust and Company Service Providers and Ø Acting as a formation agent of legal person; Ø Acting as a director or secretary of a company; Ø Providing a registered office, etc for a company; Ø Acting as a trustee of an express trust; Ø Acting as a nominee shareholder for another person. v They have to comply with Rec. 5, 6, 8 -11, 21. 10

When to Conduct CDD? When accountants act as Trust and Company Service Providers and Ø Acting as a formation agent of legal person; Ø Acting as a director or secretary of a company; Ø Providing a registered office, etc for a company; Ø Acting as a trustee of an express trust; Ø Acting as a nominee shareholder for another person. v They have to comply with Rec. 5, 6, 8 -11, 21. 10

FATF Requirements on Accountants Other selected requirements: Ø Internal Controls (Rec. 18) Ø Self Regulatory Organisation (SRB) (Rec. 28 & 35) 11

FATF Requirements on Accountants Other selected requirements: Ø Internal Controls (Rec. 18) Ø Self Regulatory Organisation (SRB) (Rec. 28 & 35) 11

Internal Controls Ø To establish / maintain internal policies / procedures to prevent ML / TF. Ø Policies / procedures to cover CDD, record keeping and STR obligations. Ø To communicate these to employees. Ø To develop appropriate compliance management (e. g. AML/CFT Compliance Officer at management level). 12

Internal Controls Ø To establish / maintain internal policies / procedures to prevent ML / TF. Ø Policies / procedures to cover CDD, record keeping and STR obligations. Ø To communicate these to employees. Ø To develop appropriate compliance management (e. g. AML/CFT Compliance Officer at management level). 12

INTERNAL CONTROLS Ø On-going staff training. Ø Independent audit function to test compliance with the policies and procedures. Ø To put in place screening procedures to ensure high standards in hiring employees. Ø The type and extent of measures to be taken should commensurate with: v the level of ML / TF risk; and v the size of the business. 13

INTERNAL CONTROLS Ø On-going staff training. Ø Independent audit function to test compliance with the policies and procedures. Ø To put in place screening procedures to ensure high standards in hiring employees. Ø The type and extent of measures to be taken should commensurate with: v the level of ML / TF risk; and v the size of the business. 13

SRO – Responsibilities & Sanctions Ø Government authority or SRB to monitor and ensure compliance with AML / CFT requirements. Ø Power to sanction in case of noncompliance. Ø Effective, proportionate and dissuasive criminal, civil or administrative sanctions be available. 14

SRO – Responsibilities & Sanctions Ø Government authority or SRB to monitor and ensure compliance with AML / CFT requirements. Ø Power to sanction in case of noncompliance. Ø Effective, proportionate and dissuasive criminal, civil or administrative sanctions be available. 14

SRO - SANCTIONS Ø Range of sanctions available should be broad and proportionate to severity of noncompliance. Ø Sanctions should be available to legal persons, their directors and senior management. 15

SRO - SANCTIONS Ø Range of sanctions available should be broad and proportionate to severity of noncompliance. Ø Sanctions should be available to legal persons, their directors and senior management. 15

SRO - RESOURCES Ø Adequate structuring, funding, staff with sufficient technical and other resources to fully and effectively perform their functions. Ø Sufficient operational independence and autonomy to ensure freedom from interference. Ø Staff be of high professional standard & integrity and adequately trained for AML / CFT. 16

SRO - RESOURCES Ø Adequate structuring, funding, staff with sufficient technical and other resources to fully and effectively perform their functions. Ø Sufficient operational independence and autonomy to ensure freedom from interference. Ø Staff be of high professional standard & integrity and adequately trained for AML / CFT. 16

SRO - GUIDELINES Ø Government authority or SRO to establish guidelines to include the following: v v ML / FT techniques and methods; and any additional measures that accounting firms/accountants could take to ensure their AML / CFT measures are effective. 17

SRO - GUIDELINES Ø Government authority or SRO to establish guidelines to include the following: v v ML / FT techniques and methods; and any additional measures that accounting firms/accountants could take to ensure their AML / CFT measures are effective. 17

Action by Political Authority Ø Establishment of Central Co-ordinating Committee (CCC), NRA - CCC Ø To steer & co-ordinate the strategic development of AML/CFT regime in line with internationally recognised standards. 18

Action by Political Authority Ø Establishment of Central Co-ordinating Committee (CCC), NRA - CCC Ø To steer & co-ordinate the strategic development of AML/CFT regime in line with internationally recognised standards. 18

Action by Political Authority Ø Establishment of Ø Legal Framework Ø Institutional Framework Ø Designation of Institutions with AML / CFT matters and with specific responsibilities on financial sectors (FIUs). Ø Law Enforcement agencies Ø DNFBPs and Non-profit Organisations. 19

Action by Political Authority Ø Establishment of Ø Legal Framework Ø Institutional Framework Ø Designation of Institutions with AML / CFT matters and with specific responsibilities on financial sectors (FIUs). Ø Law Enforcement agencies Ø DNFBPs and Non-profit Organisations. 19

CHALLENGES ASSOCIATED WITH ACCOUNTANTS Ø Conflict of Accounting Concepts Ø Transparent Disclosure Ø Wholesome Importation of Principles and Procedures Ø Independence of Accountants Ø Legitimacy of Figure Manipulation Ø Background of Some Accounting personnel Ø Integrity and Ethical principles 20

CHALLENGES ASSOCIATED WITH ACCOUNTANTS Ø Conflict of Accounting Concepts Ø Transparent Disclosure Ø Wholesome Importation of Principles and Procedures Ø Independence of Accountants Ø Legitimacy of Figure Manipulation Ø Background of Some Accounting personnel Ø Integrity and Ethical principles 20

Challenges Con’d Ø knowledge of AML/CFT Ø AML/CFT Displacement Ø Disregard for good governance and Accountability Ø Complexity of Practice Ø Whistle blower Ø Customer Confidentiality Ø The culture of get rich syndrome Ø New technologies

Challenges Con’d Ø knowledge of AML/CFT Ø AML/CFT Displacement Ø Disregard for good governance and Accountability Ø Complexity of Practice Ø Whistle blower Ø Customer Confidentiality Ø The culture of get rich syndrome Ø New technologies

Challenges Con’d General Ø Political Factors Ø Economic Factors Ø Technological factors Ø Environmental Factor Ø Legislative Factors

Challenges Con’d General Ø Political Factors Ø Economic Factors Ø Technological factors Ø Environmental Factor Ø Legislative Factors

Way Forward Legislation on CDD & Record Keeping Ø Phase I : Financial Sectors Ø Phase II: DNFBPs Ø Political Will Ø Management Will 23

Way Forward Legislation on CDD & Record Keeping Ø Phase I : Financial Sectors Ø Phase II: DNFBPs Ø Political Will Ø Management Will 23

Way Forward Contd… Ø Consultation on Legislative Proposals and Amendments. v Continued reliance on unregulated Third Parties by Financial Institutions. (Financial Inclusion). Ø AML/CFT included as part of Financial Reporting Standards Requirements. 24

Way Forward Contd… Ø Consultation on Legislative Proposals and Amendments. v Continued reliance on unregulated Third Parties by Financial Institutions. (Financial Inclusion). Ø AML/CFT included as part of Financial Reporting Standards Requirements. 24

Way Forward Contd. . Ø Step up outreaching activities to raise awareness on AML / CFT and work closely with professional bodies. Ø Seminars, Workshops, Ø one-on-one Inter-Face with Stakeholders Ø Sector Specific Guidelines. Ø Interactive System Mechanism. 25

Way Forward Contd. . Ø Step up outreaching activities to raise awareness on AML / CFT and work closely with professional bodies. Ø Seminars, Workshops, Ø one-on-one Inter-Face with Stakeholders Ø Sector Specific Guidelines. Ø Interactive System Mechanism. 25

Way Forward Contd. . Consultation Issues Ø Timeline Ø Compliance costs Ø Regulatory Authority Ø Bye-Laws (Regulations) 26

Way Forward Contd. . Consultation Issues Ø Timeline Ø Compliance costs Ø Regulatory Authority Ø Bye-Laws (Regulations) 26

Timeline (1) 2010 2011 2015 2013 2012 2014 2016 27

Timeline (1) 2010 2011 2015 2013 2012 2014 2016 27

Timeline (2) FATF 36 members 28

Timeline (2) FATF 36 members 28

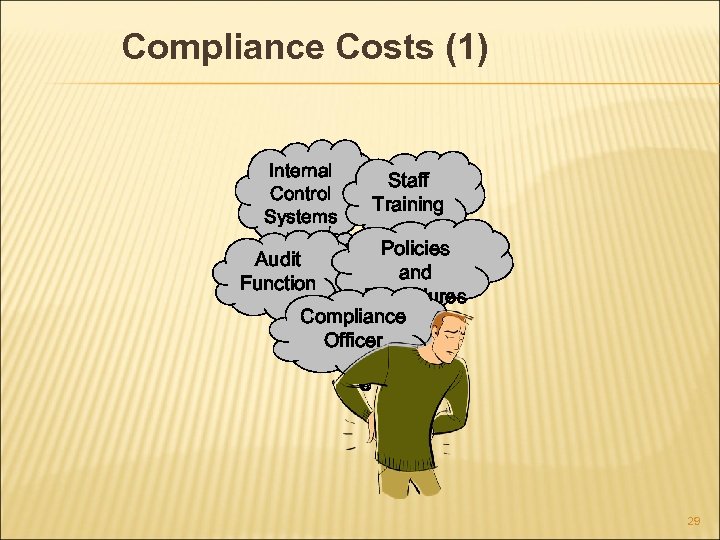

Compliance Costs (1) Internal Control Systems Staff Training Policies and Procedures Compliance Officer Audit Function 29

Compliance Costs (1) Internal Control Systems Staff Training Policies and Procedures Compliance Officer Audit Function 29

Compliance Costs (2) Compliance Cost International Standards 30

Compliance Costs (2) Compliance Cost International Standards 30

Compliance Costs? (1) Business Costs and Legal Obligations Professional Status and Reputation 31

Compliance Costs? (1) Business Costs and Legal Obligations Professional Status and Reputation 31

Compliance Costs? (2) 32

Compliance Costs? (2) 32

Open-minded 33

Open-minded 33

Partnership 34

Partnership 34

Thank you! 35

Thank you! 35