cc146e7e7b63c9e61ffa6ef020cf2719.ppt

- Количество слайдов: 34

“Regional Strategies in Skills Development -Addressing the issue of the skills shortage facing industry in NE England Process Industries” ECRN Congress of European Chemical Regions Network, Ludwigshafen, Germany Thursday 29 th November 2007 George Ritchie SVP Semb. Corp Utilities & Chair NEPIC Skills & Education Engagement

“Regional Strategies in Skills Development -Addressing the issue of the skills shortage facing industry in NE England Process Industries” ECRN Congress of European Chemical Regions Network, Ludwigshafen, Germany Thursday 29 th November 2007 George Ritchie SVP Semb. Corp Utilities & Chair NEPIC Skills & Education Engagement

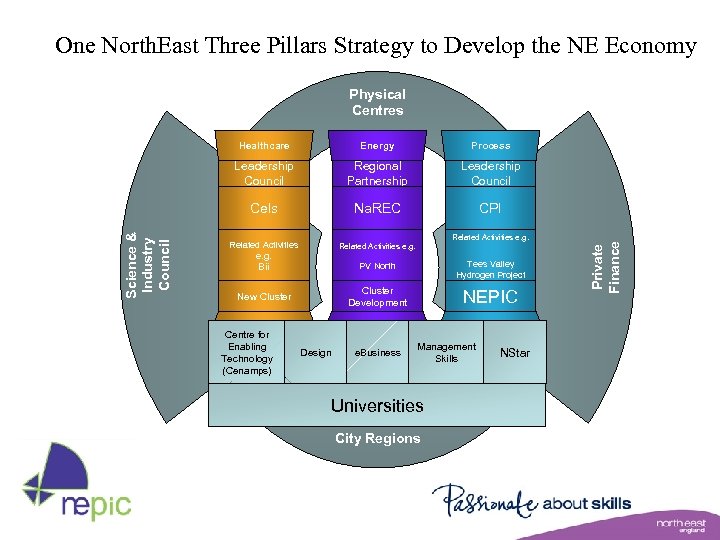

One North. East Three Pillars Strategy to Develop the NE Economy Physical Centres Process Regional Partnership Leadership Council Cels Na. REC CPI Related Activities e. g. Bii PV North Tees Valley Hydrogen Project New Cluster Development NEPIC Centre for Enabling Technology (Cenamps) Related Activities e. g. Design e. Business Management Skills Universities City Regions NStar Private Finance Energy Leadership Council Science & Industry Council Healthcare

One North. East Three Pillars Strategy to Develop the NE Economy Physical Centres Process Regional Partnership Leadership Council Cels Na. REC CPI Related Activities e. g. Bii PV North Tees Valley Hydrogen Project New Cluster Development NEPIC Centre for Enabling Technology (Cenamps) Related Activities e. g. Design e. Business Management Skills Universities City Regions NStar Private Finance Energy Leadership Council Science & Industry Council Healthcare

Clusters…? Clusters are groups of inter-related industries that drive wealth creation in a region. Often they represent the entire value chain of a broadly defined industry from suppliers to end products, and are interconnected by the flow of goods and services throughout this chain.

Clusters…? Clusters are groups of inter-related industries that drive wealth creation in a region. Often they represent the entire value chain of a broadly defined industry from suppliers to end products, and are interconnected by the flow of goods and services throughout this chain.

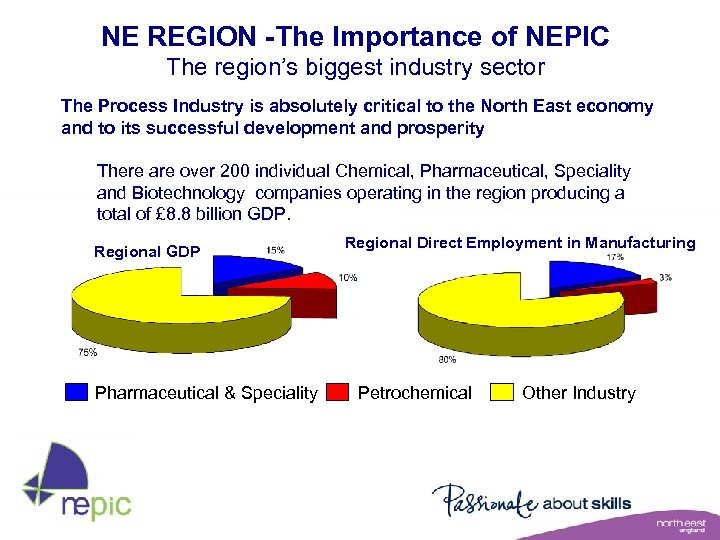

NE REGION -The Importance of NEPIC The region’s biggest industry sector The Process Industry is absolutely critical to the North East economy and to its successful development and prosperity There are over 200 individual Chemical, Pharmaceutical, Speciality and Biotechnology companies operating in the region producing a total of £ 8. 8 billion GDP. Regional GDP Pharmaceutical & Speciality Regional Direct Employment in Manufacturing Petrochemical Other Industry

NE REGION -The Importance of NEPIC The region’s biggest industry sector The Process Industry is absolutely critical to the North East economy and to its successful development and prosperity There are over 200 individual Chemical, Pharmaceutical, Speciality and Biotechnology companies operating in the region producing a total of £ 8. 8 billion GDP. Regional GDP Pharmaceutical & Speciality Regional Direct Employment in Manufacturing Petrochemical Other Industry

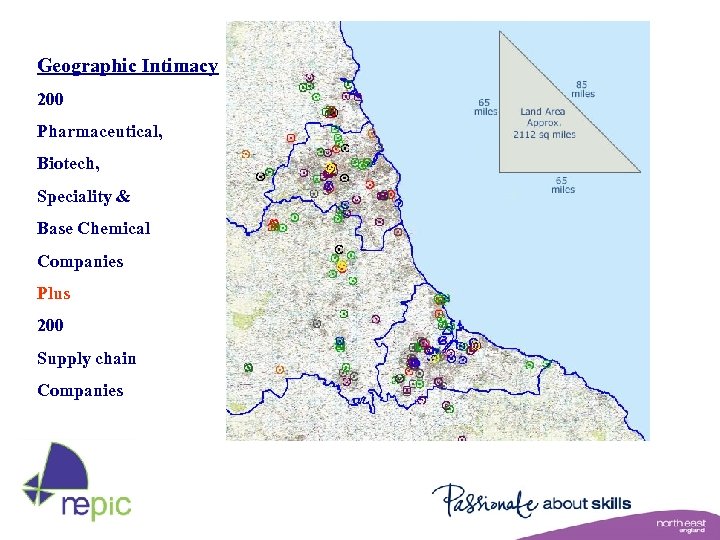

Geographic Intimacy 200 Pharmaceutical, Biotech, Speciality & Base Chemical Companies Plus 200 Supply chain Companies

Geographic Intimacy 200 Pharmaceutical, Biotech, Speciality & Base Chemical Companies Plus 200 Supply chain Companies

NEPIC’s Economic Impact has many features of a true economic cluster • Teesside Petrochemical cluster is the largest integrated chemicals complex in the UK in terms of manufacturing capacity • North East Pharmaceuticals includes the top three global pharmaceutical manufacturers producing in excess of 33% of the UK’s pharmaceutical GDP • UK’s second largest port 70% occupied by Process Industry Goods • Largest non-military R&D Centre in Europe & see also next slide • Region has many top speciality and consumer products manufacturers • The Supply Chain of these combined industry sectors has more than 350 companies based in the North East • 350 of these companies are already formally engaged through membership • Together the companies in the combined cluster employ 34, 000 people directly with a further 280, 000 are indirectly impacted

NEPIC’s Economic Impact has many features of a true economic cluster • Teesside Petrochemical cluster is the largest integrated chemicals complex in the UK in terms of manufacturing capacity • North East Pharmaceuticals includes the top three global pharmaceutical manufacturers producing in excess of 33% of the UK’s pharmaceutical GDP • UK’s second largest port 70% occupied by Process Industry Goods • Largest non-military R&D Centre in Europe & see also next slide • Region has many top speciality and consumer products manufacturers • The Supply Chain of these combined industry sectors has more than 350 companies based in the North East • 350 of these companies are already formally engaged through membership • Together the companies in the combined cluster employ 34, 000 people directly with a further 280, 000 are indirectly impacted

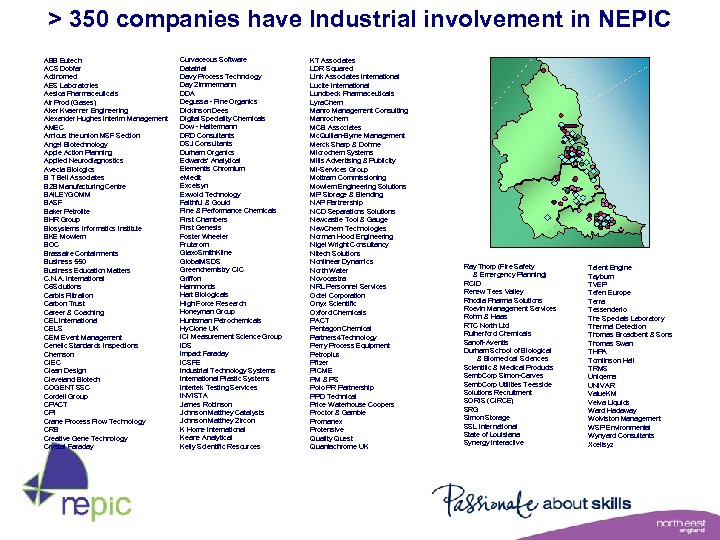

> 350 companies have Industrial involvement in NEPIC ABB Eutech ACS Dobfar Actinomed AES Laboratories Aesica Pharmaceuticals Air Prod (Gases) Aker Kvaerner Engineering Alexander Hughes Interim Management AMEC Amicus the union MSF Section Angel Biotechnology Apple Action Planning Applied Neurodiagnostics Avecia Biologics B T Bell Associates B 2 B Manufacturing Centre BAILEYGOMM BASF Baker Petrolite BHR Group Biosystems Informatics Institute BKE Mowlem BOC Brassaire Containments Business 550 Business Education Matters C. N. A. International C 6 Solutions Carbis Filtration Carbon Trust Career & Coaching CEL International CELS CEM Event Management Cenelic Standards Inspections Chemson CIEC Clean Design Cleveland Biotech COGENT SSC Cordell Group CPACT CPI Crane Process Flow Technology CRB Creative Gene Technology Crystal Faraday Curvaceous Software Datatrial Davy Process Technology Day Zimmermann DDA Degussa - Fine Organics Dickinson Dees Digital Speciality Chemicals Dow - Haltermann DRD Consultants DSJ Consultants Durham Organics Edwards’ Analytical Elementis Chromium e. Medit Excelsyn Exwold Technology Faithful & Gould Fine & Performance Chemicals First Chambers First Genesis Foster Wheeler Frutarom Glaxo. Smith. Kline Global. MSDS Greenchemistry CIC Griffon Hammonds Hart Biologicals High Force Research Honeyman Group Huntsman Petrochemicals Hy. Clone UK ICI Measurement Science Group IDS Impact Faraday ICSPE Industrial Technology Systems International Plastic Systems Intertek Testing Services INVISTA James Robinson Johnson Matthey Catalysts Johnson Matthey Zircon K Home International Keane Analytical Kelly Scientific Resources KT Associates LDR Squared Link Associates International Lucite International Lundbeck Pharmaceuticals Lyra. Chem Manro Management Consulting Manrochem MCB Associates Mc. Quillan-Byrne Management Merck Sharp & Dohme Microchem Systems Mills Advertising & Publicity Mi-Services Group Mottram Commissioning Mowlem Engineering Solutions MP Storage & Blending NAP Partnership NCD Separations Solutions Newcastle Tool & Gauge New. Chem Technologies Norman Hood Engineering Nigel Wright Consultancy Nitech Solutions Nonlinear Dynamics North Water Novocastra NRL Personnel Services Octel Corporation Onyx Scientific Oxford Chemicals PACT Pentagon Chemical Partners 4 Technology Perry Process Equipment Petroplus Pfizer PICME PM & PS Polo PR Partnership PPD Technical Price Waterhouse Coopers Proctor & Gamble Promanex Protensive Quality Quest Quantachrome UK Ray Thorp (Fire Safety & Emergency Planning) RCID Renew Tees Valley Rhodia Pharma Solutions Roevin Management Services Rohm & Haas RTC North Ltd Rutherford Chemicals Sanofi-Aventis Durham School of Biological & Biomedical Sciences Scientific & Medical Products Semb. Corp Simon-Carves Semb. Corp Utilities Teesside Solutions Recruitment SORIS (CIRCE) SRG Simon Storage SSL International State of Louisiana Synergy Interactive Talent Engine Tayburn TVEP Tefen Europe Terra Tessenderlo The Specials Laboratory Thermal Detection Thomas Broadbent & Sons Thomas Swan THPA Tomlinson Hall TRMS Uniqema UNIVAR Value. KM Velva Liquids Ward Hadaway Wolviston Management WSP Environmental Wynyard Consultants Xcellsyz

> 350 companies have Industrial involvement in NEPIC ABB Eutech ACS Dobfar Actinomed AES Laboratories Aesica Pharmaceuticals Air Prod (Gases) Aker Kvaerner Engineering Alexander Hughes Interim Management AMEC Amicus the union MSF Section Angel Biotechnology Apple Action Planning Applied Neurodiagnostics Avecia Biologics B T Bell Associates B 2 B Manufacturing Centre BAILEYGOMM BASF Baker Petrolite BHR Group Biosystems Informatics Institute BKE Mowlem BOC Brassaire Containments Business 550 Business Education Matters C. N. A. International C 6 Solutions Carbis Filtration Carbon Trust Career & Coaching CEL International CELS CEM Event Management Cenelic Standards Inspections Chemson CIEC Clean Design Cleveland Biotech COGENT SSC Cordell Group CPACT CPI Crane Process Flow Technology CRB Creative Gene Technology Crystal Faraday Curvaceous Software Datatrial Davy Process Technology Day Zimmermann DDA Degussa - Fine Organics Dickinson Dees Digital Speciality Chemicals Dow - Haltermann DRD Consultants DSJ Consultants Durham Organics Edwards’ Analytical Elementis Chromium e. Medit Excelsyn Exwold Technology Faithful & Gould Fine & Performance Chemicals First Chambers First Genesis Foster Wheeler Frutarom Glaxo. Smith. Kline Global. MSDS Greenchemistry CIC Griffon Hammonds Hart Biologicals High Force Research Honeyman Group Huntsman Petrochemicals Hy. Clone UK ICI Measurement Science Group IDS Impact Faraday ICSPE Industrial Technology Systems International Plastic Systems Intertek Testing Services INVISTA James Robinson Johnson Matthey Catalysts Johnson Matthey Zircon K Home International Keane Analytical Kelly Scientific Resources KT Associates LDR Squared Link Associates International Lucite International Lundbeck Pharmaceuticals Lyra. Chem Manro Management Consulting Manrochem MCB Associates Mc. Quillan-Byrne Management Merck Sharp & Dohme Microchem Systems Mills Advertising & Publicity Mi-Services Group Mottram Commissioning Mowlem Engineering Solutions MP Storage & Blending NAP Partnership NCD Separations Solutions Newcastle Tool & Gauge New. Chem Technologies Norman Hood Engineering Nigel Wright Consultancy Nitech Solutions Nonlinear Dynamics North Water Novocastra NRL Personnel Services Octel Corporation Onyx Scientific Oxford Chemicals PACT Pentagon Chemical Partners 4 Technology Perry Process Equipment Petroplus Pfizer PICME PM & PS Polo PR Partnership PPD Technical Price Waterhouse Coopers Proctor & Gamble Promanex Protensive Quality Quest Quantachrome UK Ray Thorp (Fire Safety & Emergency Planning) RCID Renew Tees Valley Rhodia Pharma Solutions Roevin Management Services Rohm & Haas RTC North Ltd Rutherford Chemicals Sanofi-Aventis Durham School of Biological & Biomedical Sciences Scientific & Medical Products Semb. Corp Simon-Carves Semb. Corp Utilities Teesside Solutions Recruitment SORIS (CIRCE) SRG Simon Storage SSL International State of Louisiana Synergy Interactive Talent Engine Tayburn TVEP Tefen Europe Terra Tessenderlo The Specials Laboratory Thermal Detection Thomas Broadbent & Sons Thomas Swan THPA Tomlinson Hall TRMS Uniqema UNIVAR Value. KM Velva Liquids Ward Hadaway Wolviston Management WSP Environmental Wynyard Consultants Xcellsyz

NEPIC GDP Growth and Investment Team The Team’s Challenge The North East is short of £ 9 billion of GDP compared to the average UK Region (per capita calculation) The Process Industry is 25% of the NE Economy - £ 8 billion of £ 32 billion Therefore, Can the Industry contribute £ 2 billion of additional GDP to help close this GDP Gap within the next 10 years? (The Opportunity – The Leitch Dividend) About £ 1800 productivity gain per employee in NE

NEPIC GDP Growth and Investment Team The Team’s Challenge The North East is short of £ 9 billion of GDP compared to the average UK Region (per capita calculation) The Process Industry is 25% of the NE Economy - £ 8 billion of £ 32 billion Therefore, Can the Industry contribute £ 2 billion of additional GDP to help close this GDP Gap within the next 10 years? (The Opportunity – The Leitch Dividend) About £ 1800 productivity gain per employee in NE

NEPIC is leading and aiming higher than ever before Marketing, Communication & Networking Growing the activity to achieve regional spread, UK and Global recognition and the involvement of all sectors Skills and Education Expanding targeted activities in the adult skills and science education to deliver a better trained workforce across all sectors. GDP Growth and Investment Focusing regional resources to increase investment opportunities and indigenous growth Trade Growth Establishing a greater understanding of region, industry and company capability enabling companies to find and fulfill new business opportunities Innovation, Research and Development Creating Collaborative mechanisms to build projects between industrial and academic partners Manufacturing & Productivity Leveraging regional providers to drive performance and take up improvement programs

NEPIC is leading and aiming higher than ever before Marketing, Communication & Networking Growing the activity to achieve regional spread, UK and Global recognition and the involvement of all sectors Skills and Education Expanding targeted activities in the adult skills and science education to deliver a better trained workforce across all sectors. GDP Growth and Investment Focusing regional resources to increase investment opportunities and indigenous growth Trade Growth Establishing a greater understanding of region, industry and company capability enabling companies to find and fulfill new business opportunities Innovation, Research and Development Creating Collaborative mechanisms to build projects between industrial and academic partners Manufacturing & Productivity Leveraging regional providers to drive performance and take up improvement programs

NEPIC’s big idea Key to the development and delivery NEPIC’s programmes will be the sub-teams populated by more than 120 industry leaders from its sector in the North East who will lead and develop strategic priorities for the NEPIC executive and Industry support bodies in 7 programme areas: 1. 2. 3. 4. 5. Marketing, Communication & Networking International Trade Innovation GDP gap closure & Investment Manufacturing & Productivity 6. Skills & Education

NEPIC’s big idea Key to the development and delivery NEPIC’s programmes will be the sub-teams populated by more than 120 industry leaders from its sector in the North East who will lead and develop strategic priorities for the NEPIC executive and Industry support bodies in 7 programme areas: 1. 2. 3. 4. 5. Marketing, Communication & Networking International Trade Innovation GDP gap closure & Investment Manufacturing & Productivity 6. Skills & Education

Some simple facts • Today over 70% of our 2020 workforce have already completed their compulsory education • In UK one third of adults do not hold the equivalent of a basic school leaving qualification • One half of adults have difficulty with numbers • One seventh are not functionally literate

Some simple facts • Today over 70% of our 2020 workforce have already completed their compulsory education • In UK one third of adults do not hold the equivalent of a basic school leaving qualification • One half of adults have difficulty with numbers • One seventh are not functionally literate

The Leitch Vision and Ambition –The Opportunity Ø UK to commit to becoming a world leader in skills by 2020 • 95% adults achieve functional literacy & numeracy • Exceeding 90% of adult population qualified to at least Level 2 (currently 70%) • Shifting the balance of intermediate skills from Level 2 to Level 3(doubling the number of apprentices to 500 K, most of growth from adults) • Exceeding 40% of adult population qualified to Level 4 and above

The Leitch Vision and Ambition –The Opportunity Ø UK to commit to becoming a world leader in skills by 2020 • 95% adults achieve functional literacy & numeracy • Exceeding 90% of adult population qualified to at least Level 2 (currently 70%) • Shifting the balance of intermediate skills from Level 2 to Level 3(doubling the number of apprentices to 500 K, most of growth from adults) • Exceeding 40% of adult population qualified to Level 4 and above

The Leitch Vision and Ambition –The Opportunity continued • • • We all need to embrace it Hasn’t sunk in yet It actually means at least a doubling of the level of attainment (employers to change behaviours) i. e. Every 2 nd person in the NE needs to attain another level qualification than has now – Just to stand still WHY: Skilled workers are better able to adapt to new technologies and market opportunities Higher levels of skills drive innovation, facilitate investment and improve leadership and management Without world class skills, UK businesses will find it increasingly difficult to compete and innovate. The Global playing field is changing fast – the biggest restructuring of the world economy since the rise of the USA e. g. over the next 10 years China & India will double in economic size – the UK will only be 25% bigger? ?

The Leitch Vision and Ambition –The Opportunity continued • • • We all need to embrace it Hasn’t sunk in yet It actually means at least a doubling of the level of attainment (employers to change behaviours) i. e. Every 2 nd person in the NE needs to attain another level qualification than has now – Just to stand still WHY: Skilled workers are better able to adapt to new technologies and market opportunities Higher levels of skills drive innovation, facilitate investment and improve leadership and management Without world class skills, UK businesses will find it increasingly difficult to compete and innovate. The Global playing field is changing fast – the biggest restructuring of the world economy since the rise of the USA e. g. over the next 10 years China & India will double in economic size – the UK will only be 25% bigger? ?

The problem as we see it • Fewer school children taking science plus 16 to 18 year old population going into decline from 2007 • Insufficient technicians coming through via apprenticeships • Not enough engineering and science graduates – viewed as difficult • Difficulty recruiting engineers & scientists and demand is very high – Poor reputation of the industry – Lack of engagement over past 5 years from industry • New investment and technology is driving the need for recruitment and enhancing skills – both for construction and operation • New technologies require a new higher level of employee skills • Demographics –aging workforce 15% are over 55 • Industry regionally has now more Global ownership and regionally need to be more productive/competitive –the forces of globalisation are not going to fade away, they are only getting stronger

The problem as we see it • Fewer school children taking science plus 16 to 18 year old population going into decline from 2007 • Insufficient technicians coming through via apprenticeships • Not enough engineering and science graduates – viewed as difficult • Difficulty recruiting engineers & scientists and demand is very high – Poor reputation of the industry – Lack of engagement over past 5 years from industry • New investment and technology is driving the need for recruitment and enhancing skills – both for construction and operation • New technologies require a new higher level of employee skills • Demographics –aging workforce 15% are over 55 • Industry regionally has now more Global ownership and regionally need to be more productive/competitive –the forces of globalisation are not going to fade away, they are only getting stronger

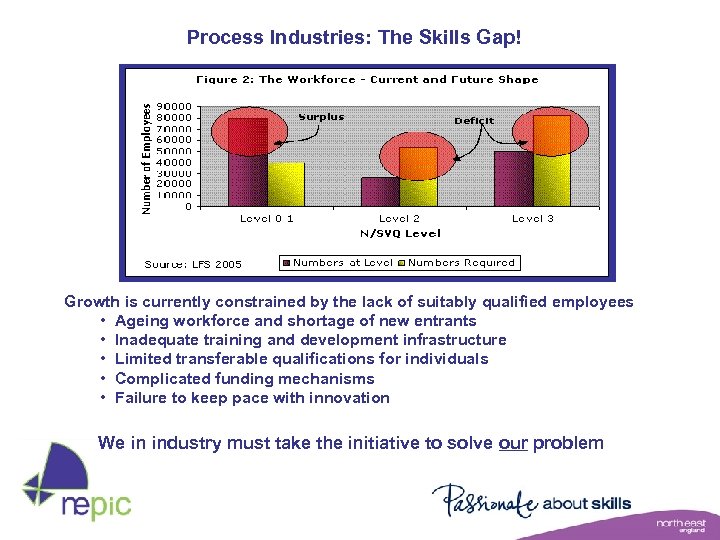

Process Industries: The Skills Gap! Growth is currently constrained by the lack of suitably qualified employees • Ageing workforce and shortage of new entrants • Inadequate training and development infrastructure • Limited transferable qualifications for individuals • Complicated funding mechanisms • Failure to keep pace with innovation We in industry must take the initiative to solve our problem

Process Industries: The Skills Gap! Growth is currently constrained by the lack of suitably qualified employees • Ageing workforce and shortage of new entrants • Inadequate training and development infrastructure • Limited transferable qualifications for individuals • Complicated funding mechanisms • Failure to keep pace with innovation We in industry must take the initiative to solve our problem

So our Challenge TO DO SOMETHING ABOUT IT! • I cannot get involved, I have not got the time. • UK Training and Education is not my concern, we are Singaporean owned. • I am only concerned when I cannot recruit. • It is a waste of time getting involved, it makes no difference. • We are expanding and in a high tech area, we have no problems. • We can hide our heads in the sand pretend we won’t be affected – but the consequences will be disastrous – a slow but inevitable economic decline Does it have an Effect? Two multinational companies have stopped validation of training (not the training) as they lost too many people to the North Sea. Question: How much should an employer be involved ? Prime directive: Profit : Key Question: is it a cost ? Over what timescale? Or is it a value?

So our Challenge TO DO SOMETHING ABOUT IT! • I cannot get involved, I have not got the time. • UK Training and Education is not my concern, we are Singaporean owned. • I am only concerned when I cannot recruit. • It is a waste of time getting involved, it makes no difference. • We are expanding and in a high tech area, we have no problems. • We can hide our heads in the sand pretend we won’t be affected – but the consequences will be disastrous – a slow but inevitable economic decline Does it have an Effect? Two multinational companies have stopped validation of training (not the training) as they lost too many people to the North Sea. Question: How much should an employer be involved ? Prime directive: Profit : Key Question: is it a cost ? Over what timescale? Or is it a value?

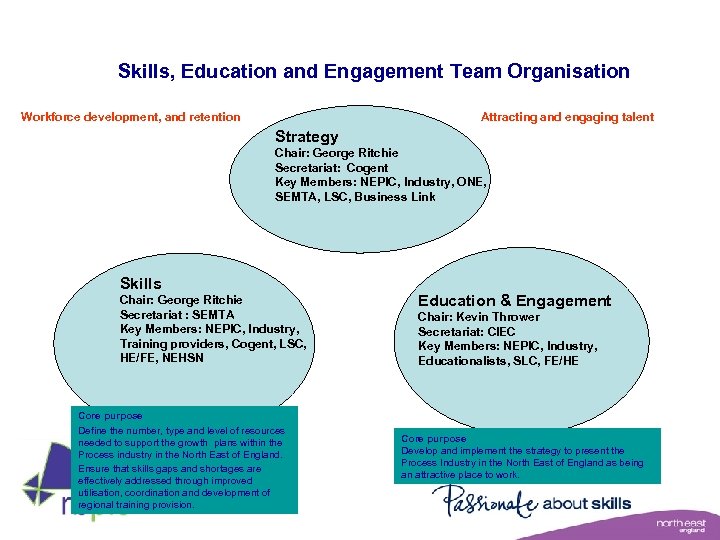

Skills, Education and Engagement Team Organisation Workforce development, and retention Attracting and engaging talent Strategy Chair: George Ritchie Secretariat: Cogent Key Members: NEPIC, Industry, ONE, SEMTA, LSC, Business Link Skills Chair: George Ritchie Secretariat : SEMTA Key Members: NEPIC, Industry, Training providers, Cogent, LSC, HE/FE, NEHSN Core purpose Define the number, type and level of resources needed to support the growth plans within the Process industry in the North East of England. Ensure that skills gaps and shortages are effectively addressed through improved utilisation, coordination and development of regional training provision. Education & Engagement Chair: Kevin Thrower Secretariat: CIEC Key Members: NEPIC, Industry, Educationalists, SLC, FE/HE Core purpose Develop and implement the strategy to present the Process Industry in the North East of England as being an attractive place to work.

Skills, Education and Engagement Team Organisation Workforce development, and retention Attracting and engaging talent Strategy Chair: George Ritchie Secretariat: Cogent Key Members: NEPIC, Industry, ONE, SEMTA, LSC, Business Link Skills Chair: George Ritchie Secretariat : SEMTA Key Members: NEPIC, Industry, Training providers, Cogent, LSC, HE/FE, NEHSN Core purpose Define the number, type and level of resources needed to support the growth plans within the Process industry in the North East of England. Ensure that skills gaps and shortages are effectively addressed through improved utilisation, coordination and development of regional training provision. Education & Engagement Chair: Kevin Thrower Secretariat: CIEC Key Members: NEPIC, Industry, Educationalists, SLC, FE/HE Core purpose Develop and implement the strategy to present the Process Industry in the North East of England as being an attractive place to work.

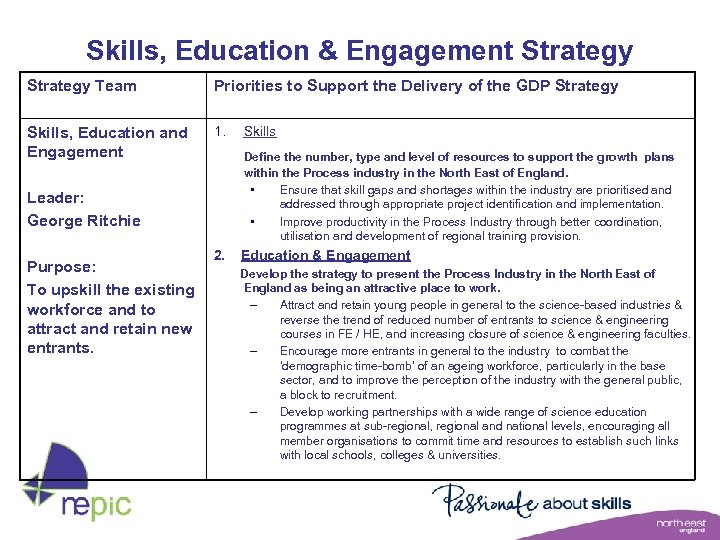

Skills, Education & Engagement Strategy Team Priorities to Support the Delivery of the GDP Strategy Skills, Education and Engagement 1. Define the number, type and level of resources to support the growth plans within the Process industry in the North East of England. • Ensure that skill gaps and shortages within the industry are prioritised and addressed through appropriate project identification and implementation. • Improve productivity in the Process Industry through better coordination, utilisation and development of regional training provision. Leader: George Ritchie Purpose: To upskill the existing workforce and to attract and retain new entrants. Skills 2. Education & Engagement Develop the strategy to present the Process Industry in the North East of England as being an attractive place to work. – Attract and retain young people in general to the science-based industries & reverse the trend of reduced number of entrants to science & engineering courses in FE / HE, and increasing closure of science & engineering faculties. – Encourage more entrants in general to the industry to combat the ‘demographic time-bomb’ of an ageing workforce, particularly in the base sector, and to improve the perception of the industry with the general public, a block to recruitment. – Develop working partnerships with a wide range of science education programmes at sub-regional, regional and national levels, encouraging all member organisations to commit time and resources to establish such links with local schools, colleges & universities.

Skills, Education & Engagement Strategy Team Priorities to Support the Delivery of the GDP Strategy Skills, Education and Engagement 1. Define the number, type and level of resources to support the growth plans within the Process industry in the North East of England. • Ensure that skill gaps and shortages within the industry are prioritised and addressed through appropriate project identification and implementation. • Improve productivity in the Process Industry through better coordination, utilisation and development of regional training provision. Leader: George Ritchie Purpose: To upskill the existing workforce and to attract and retain new entrants. Skills 2. Education & Engagement Develop the strategy to present the Process Industry in the North East of England as being an attractive place to work. – Attract and retain young people in general to the science-based industries & reverse the trend of reduced number of entrants to science & engineering courses in FE / HE, and increasing closure of science & engineering faculties. – Encourage more entrants in general to the industry to combat the ‘demographic time-bomb’ of an ageing workforce, particularly in the base sector, and to improve the perception of the industry with the general public, a block to recruitment. – Develop working partnerships with a wide range of science education programmes at sub-regional, regional and national levels, encouraging all member organisations to commit time and resources to establish such links with local schools, colleges & universities.

Key issues • Skills, Education & Engagement Action Plan. • Business Plan submission to ONE. • DVD’s produced for graduate recruitment/ Careers in Science – Choose your own adventure. • Closer working with Schools and universities • IMech. E Great Skills Debate. • Careers Fairs. • Skills Survey – analysis by ONE. • National Skills Conference – York 16 th to 17 th July. • NE Skills & Education Conference – 8 th November. • NSAPI.

Key issues • Skills, Education & Engagement Action Plan. • Business Plan submission to ONE. • DVD’s produced for graduate recruitment/ Careers in Science – Choose your own adventure. • Closer working with Schools and universities • IMech. E Great Skills Debate. • Careers Fairs. • Skills Survey – analysis by ONE. • National Skills Conference – York 16 th to 17 th July. • NE Skills & Education Conference – 8 th November. • NSAPI.

NEPIC – Business Plan for Science Education Industry Attractiveness Programme 2008 – 2011 to extend current programmes to reach over 1500 schools, 55 K pupils and work with 6 K teachers A Business Plan that is central to the Process Industry’s need to attract 16, 000 people into careers in the sector in the North East of England over the next 10 years. The Business Plan has been endorsed by the Leadership Team and Member Companies and submitted to ONE. Need to support our Science Education Units in the region along with SETPOINT (part of STEMNET) promoting Science, Technology, Engineering and Mathematics subjects to 5 – 19 year olds

NEPIC – Business Plan for Science Education Industry Attractiveness Programme 2008 – 2011 to extend current programmes to reach over 1500 schools, 55 K pupils and work with 6 K teachers A Business Plan that is central to the Process Industry’s need to attract 16, 000 people into careers in the sector in the North East of England over the next 10 years. The Business Plan has been endorsed by the Leadership Team and Member Companies and submitted to ONE. Need to support our Science Education Units in the region along with SETPOINT (part of STEMNET) promoting Science, Technology, Engineering and Mathematics subjects to 5 – 19 year olds

NEPIC Skills Survey – further analysis by ONE • Skills Survey has been issued. • Need 400 apprentices per year. • Need 8, 000 new technicians by 2015. • Need 8, 000 new graduates by 2015. • Data have been supplied to NSAPI. • Data have been further analysed by ONE – meeting held to review this and action plan being drawn up for 2008 implementation. • Agreed with ONE that this will be an annual survey from NEPIC.

NEPIC Skills Survey – further analysis by ONE • Skills Survey has been issued. • Need 400 apprentices per year. • Need 8, 000 new technicians by 2015. • Need 8, 000 new graduates by 2015. • Data have been supplied to NSAPI. • Data have been further analysed by ONE – meeting held to review this and action plan being drawn up for 2008 implementation. • Agreed with ONE that this will be an annual survey from NEPIC.

Why the North. East Universities? • Students already here, so positively disposed to region • Easier to build a relationship • Placements and projects easier logistically • Students’ partners may also to be local • Work with Universities re curriculum what the industry is looking for

Why the North. East Universities? • Students already here, so positively disposed to region • Easier to build a relationship • Placements and projects easier logistically • Students’ partners may also to be local • Work with Universities re curriculum what the industry is looking for

What we should focus on to attract new graduates • Building a positive image for the industry • Stress careers at forefront of technology • Opportunity to travel, within multinationals, anchored locally • CPD

What we should focus on to attract new graduates • Building a positive image for the industry • Stress careers at forefront of technology • Opportunity to travel, within multinationals, anchored locally • CPD

Process Industries • • • Business Plan submitted to Learning & Skills Council National Office on 31/5/07. £ 1 m has been pledged by employers and there is still a need for more demonstrable financial support from the employer base as over 50% of this has been raised by NEPIC (£ 575 k), to-date. Ministerial authority was made on 7 th November 2007 to operate the academy.

Process Industries • • • Business Plan submitted to Learning & Skills Council National Office on 31/5/07. £ 1 m has been pledged by employers and there is still a need for more demonstrable financial support from the employer base as over 50% of this has been raised by NEPIC (£ 575 k), to-date. Ministerial authority was made on 7 th November 2007 to operate the academy.

The Vision • The vision of the Academy is that it will lead the UK Process Industries in ‘Creating a World-Class Workforce’ • NSAPI will lead the drive to ensure that employers within the Process Industries have sufficient skilled people to achieve their business objectives, thereby enabling them to continue to contribute significantly to regional and national economic growth. It will do this by: – Deploying Standards – Developing Training Provision – Directing Funding – Supporting Employers • The aim of the Academy is to reach a state where skills drive the UK Process Industries rather than constrain them.

The Vision • The vision of the Academy is that it will lead the UK Process Industries in ‘Creating a World-Class Workforce’ • NSAPI will lead the drive to ensure that employers within the Process Industries have sufficient skilled people to achieve their business objectives, thereby enabling them to continue to contribute significantly to regional and national economic growth. It will do this by: – Deploying Standards – Developing Training Provision – Directing Funding – Supporting Employers • The aim of the Academy is to reach a state where skills drive the UK Process Industries rather than constrain them.

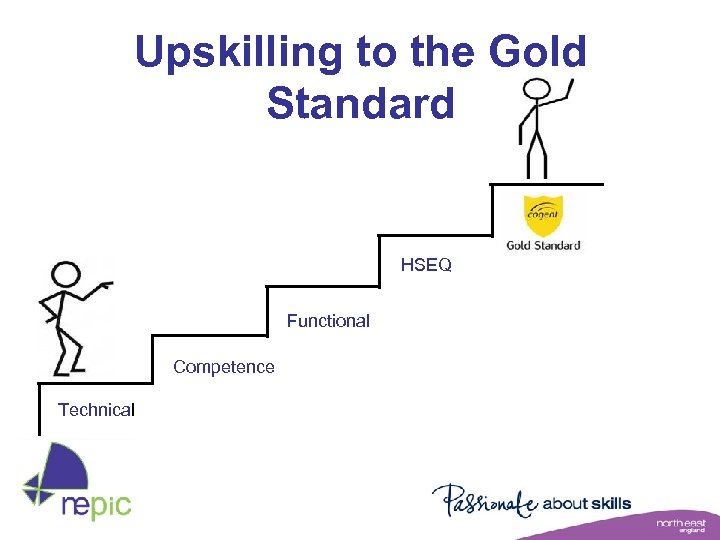

Upskilling to the Gold Standard HSEQ Functional Competence Technical

Upskilling to the Gold Standard HSEQ Functional Competence Technical

Challenges for industry • Image - This is outdated and inaccurate and not understood by many people outside the industry. It is up to the industry to go out and sell itself – Process industry needs to be perceived as an exciting place to work – Process industry needs to be seen as solving climate change and other environmental issues – Process industry needs to market the benefits of its products and show that it takes product safety concerns seriously – Process industry needs to be attractive to women and all sections of society • Resources - Industry needs to commit management and employee time and expenditure to meeting the skills issue – Training and development as a priority – Nurturing new employees – Committing effort to publicise the issue generally and support sector as a whole as well as examining own company needs

Challenges for industry • Image - This is outdated and inaccurate and not understood by many people outside the industry. It is up to the industry to go out and sell itself – Process industry needs to be perceived as an exciting place to work – Process industry needs to be seen as solving climate change and other environmental issues – Process industry needs to market the benefits of its products and show that it takes product safety concerns seriously – Process industry needs to be attractive to women and all sections of society • Resources - Industry needs to commit management and employee time and expenditure to meeting the skills issue – Training and development as a priority – Nurturing new employees – Committing effort to publicise the issue generally and support sector as a whole as well as examining own company needs

Challenges for industry • Development and upskilling of existing workforce - this is a key resource - it is not just about new recruits – Setting high standards and expectations – Committing necessary resource to deliver development and training • Industry needs to have increased involvement with education providers at all levels especially in recognised programmes which are mutually beneficial – Primary schools – Secondary schools – Further education • Industry needs to take a longer term view – Skills shortage issue will not go away – Short term effort for longer term gain – Support NSAPI

Challenges for industry • Development and upskilling of existing workforce - this is a key resource - it is not just about new recruits – Setting high standards and expectations – Committing necessary resource to deliver development and training • Industry needs to have increased involvement with education providers at all levels especially in recognised programmes which are mutually beneficial – Primary schools – Secondary schools – Further education • Industry needs to take a longer term view – Skills shortage issue will not go away – Short term effort for longer term gain – Support NSAPI

Challenges for education • Have an up to date view of roles and opportunities available in process industry • Understand breadth of opportunities - not just science and engineering based but also in finance, supply chain, procurement, sales and marketing , IT etc • Sponsor science and technical subjects - show they can be used to provide benefits to society. Many examples right here on our doorstep • Follow integrated and recognised programmes when interacting with industry e. g. children challenging industry and don’t have too many vehicles - keep it simple • Show a simple roadmap to industry of how everything fits together. Understand that everyone in industry is extremely busy and working with education needs to be made as efficient as possible.

Challenges for education • Have an up to date view of roles and opportunities available in process industry • Understand breadth of opportunities - not just science and engineering based but also in finance, supply chain, procurement, sales and marketing , IT etc • Sponsor science and technical subjects - show they can be used to provide benefits to society. Many examples right here on our doorstep • Follow integrated and recognised programmes when interacting with industry e. g. children challenging industry and don’t have too many vehicles - keep it simple • Show a simple roadmap to industry of how everything fits together. Understand that everyone in industry is extremely busy and working with education needs to be made as efficient as possible.

The Crusade • Process industry in North East is a success story • We all need to ensure this continues and the industry becomes even more successful ON, GI skilled and • This will not happen without. RE a highly RE, UR is ready. U face the challenges educated workforce O which FUT to DS IT’S OUR AN of global competition ’S must. UR H significant time and IT • Industry and education N O commit ’S I occurs resources to ensure this IT

The Crusade • Process industry in North East is a success story • We all need to ensure this continues and the industry becomes even more successful ON, GI skilled and • This will not happen without. RE a highly RE, UR is ready. U face the challenges educated workforce O which FUT to DS IT’S OUR AN of global competition ’S must. UR H significant time and IT • Industry and education N O commit ’S I occurs resources to ensure this IT

To sum up – something is Na happening! tio Short term na Don’t forget the greater employer engagement in workforce – Accept need for some Pr l. S development (more apprentices & graduates) and MANAGE IT k l path – Provide clear leadership to oc the Primary youngsters to do down supply e future, iencouraging as many of & our this particular career ss ls A • Education Ind ca Secondary • Vocational • AND emotional us dem Schools trie • Long term y – Deliver NEPIC S&EE Action Plan s • – Work with achievements Talk up ourothers to achieve The Leitch Implementation Plan – NSAPI • no Talk We haveandchoice, it is merely a it happen. of how well we work up ourcollaborate to make question future together Talk up our importance • I believe in the NE we have made a start building on a strong foundation and viewed as best practice too. – We have had success and we expect it to be repeated and praised. Talk up our people

To sum up – something is Na happening! tio Short term na Don’t forget the greater employer engagement in workforce – Accept need for some Pr l. S development (more apprentices & graduates) and MANAGE IT k l path – Provide clear leadership to oc the Primary youngsters to do down supply e future, iencouraging as many of & our this particular career ss ls A • Education Ind ca Secondary • Vocational • AND emotional us dem Schools trie • Long term y – Deliver NEPIC S&EE Action Plan s • – Work with achievements Talk up ourothers to achieve The Leitch Implementation Plan – NSAPI • no Talk We haveandchoice, it is merely a it happen. of how well we work up ourcollaborate to make question future together Talk up our importance • I believe in the NE we have made a start building on a strong foundation and viewed as best practice too. – We have had success and we expect it to be repeated and praised. Talk up our people