416f3c7477be1c6c14ed54232e01d81c.ppt

- Количество слайдов: 27

Regional Selective Assistance September 2014

Purpose Of The Grant Ø Aims to improve job opportunities provided in the Assisted Areas of Scotland • Supporting investment projects which create/safeguard jobs • Open to limited companies, sole traders or partnerships • Discretionary grant dependent on a number of factors……. .

Key Features Ø Based on specific projects based on: • Expansion • Reinvestment Ø Can be used more than once for different projects as long as separate assets and jobs, and this separation is verifiable Ø Grant calculated with reference to either: • Capital expenditure (fixed assets); or • Creation of new jobs (2 years’ wages for new jobs)

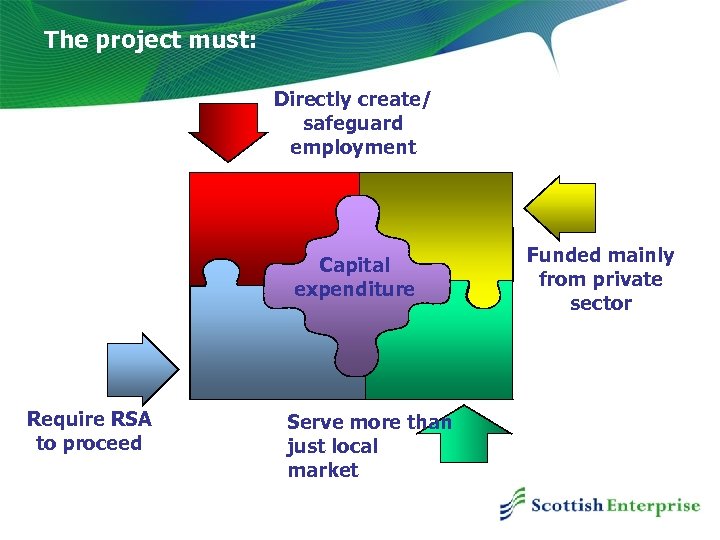

The project must: Directly create/ safeguard employment Capital expenditure Require RSA to proceed Serve more than just local market Funded mainly from private sector

Criteria Jobs Ø Ideally projects should create new jobs. Ø Increase in jobs not to be offset by job losses elsewhere (job displacement) Ø Can assist if a real threat of jobs being lost in the near future if a project does not proceed – safeguarding Ø Only jobs directly created by the applicant are eligible Ø We look for at least 2 -3 new jobs in the first year of the project

Criteria Capital Expenditure Ø Expenditure on ‘capital’ items – those that the business will own for a long time: • Land & buildings • Plant and machinery • Computer equipment Ø Does not include general running costs of the business: • Marketing costs

Criteria Need for assistance (1) Demonstrate RSA is necessary to: - Ø Fill a funding gap Ø Satisfy parent company investment criteria (e. g. payback, ROC, IRR) Ø Reduce gearing and risks to an acceptable level Ø Make the project happen in an Assisted Area

Criteria Need for assistance (2) Ø Prior Commitment - companies seeking grant assistance should not proceed with projects or enter into expenditure commitments until the appraisal process has been completed

Criteria Viability Ø Proposals must make sound commercial sense Ø Applicant and the project must be financially viable Ø We will share risks but the venture must have a good chance of success

Sectors We Cannot Support EC Legislation Ø Ø Ø Ø Fisheries and aquaculture Growing agricultural products Coal industry Steel industry Shipbuilding Synthetic fibres Purchase of transport equipment in the transport sector

Sectors We Are Unlikely To Support Ø Ø Ø Mining and construction Tourism Charitable organisations Public sector e. g. health service, colleges/schools, defence etc Energy generation Tobacco

Types Of Businesses We Do Not Support (1) Ø Businesses operating in a ‘local market’ – where customers come from the nearby area and have a wide choice of where to buy the product/service: • Retail • Restaurants, hotels, cafes, bars • Nurseries, soft play, crèche • Joiners, plumbers, electricians, double glazing, garages • Hairdressers, newsagents, bakers

Types Of Businesses We Do Not Support (2) • We consider the following to be well served markets: Ø Ø Ø Printing sector Basic metal fabrication Double glazing Leisure and tourism Retail Professions (lawyer, accountant, doctor, dentist) v These markets are highly competitive and it is hard to differentiate between businesses. The project would likely lead to significant job displacement – no point in supporting one project if it just moves businesses/jobs from another company.

Types of businesses we don’t support (3) Charitable Organisations Ø The grant scheme is not really designed for charities/social businesses Ø We can only support a commercial activity i. e. the part that aims to make a profit and does not rely on donations. This may only be a small part of the charity’s activities. Ø In general, it is difficult to show that the commercial activity aims to make a profit and is a viable business in its own right. Ø Often, the commercial activity operates on a local basis (e. g. shop) or is in a well-served market (e. g. training) and would therefore be ineligible.

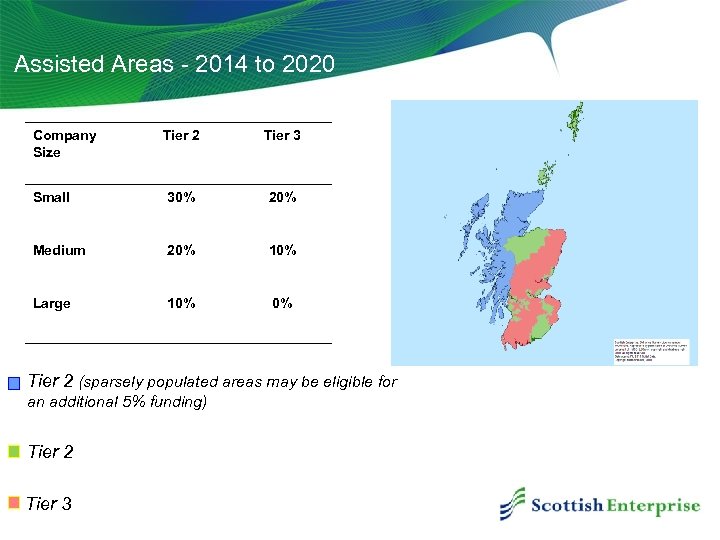

Assisted Areas - 2014 to 2020 Company Size Tier 2 Tier 3 Small 30% 20% Medium 20% 10% Large 10% 0% Tier 2 (sparsely populated areas may be eligible for an additional 5% funding) Tier 2 Tier 3

Large Companies Summary • Large companies can only receive regional aid for “initial investment in favour of new economic activity” in the area concerned. This means large companies are only eligible where they are: Ø Setting up a new establishment in a different NUTS 3 region Ø from any existing operations of the firm; or Diversifying the activity of an establishment to one that is not the same or similar to that previously performed

Large Companies (2) “Initial Investment in new economic activity” Initial investment relates to: Ø Setting up of a new establishment, or Ø Diversification of the activity of an establishment under the condition that the new activity is not the same or similar to the activity previously performed in the establishment Ø ‘the same or similar activity’ : activity falling under the same class (4 digit code) of the NACE Rev 2 statistical classification of economic activities. Ø If the project is “the same or similar activity” in the same NUTS 3 area then it cannot be supported. Ø NUT 3 areas generally follow local authority boundaries, with a few exceptions.

Large Companies (3) New establishment Ø If the project is by a business not already in Scotland then it is “new establishment” and “new economic activity in the area concerned”. Ø If a project is proposed by a business already in Scotland but in a different NUTS 3 area then it can also be regarded as new economic activity in the area concerned if is it related to setting up a new establishment. There is no requirement to show that this is not “the same or similar activity”. Ø The exception to this is relocation

Large Companies (4) Relocation Ø What about a relocation from one NUTS 3 to another – is that eligible? • No - If the project is an outcome of a closure of the same or similar activity anywhere in the EEA in the previous 2 years it cannot be supported. Also, if, at the time of the application for aid, there are concrete plans to close down such an activity within 2 years following the initial investment, this would also mean a project is ineligible for support. This will mean most relocations will be ineligible for support.

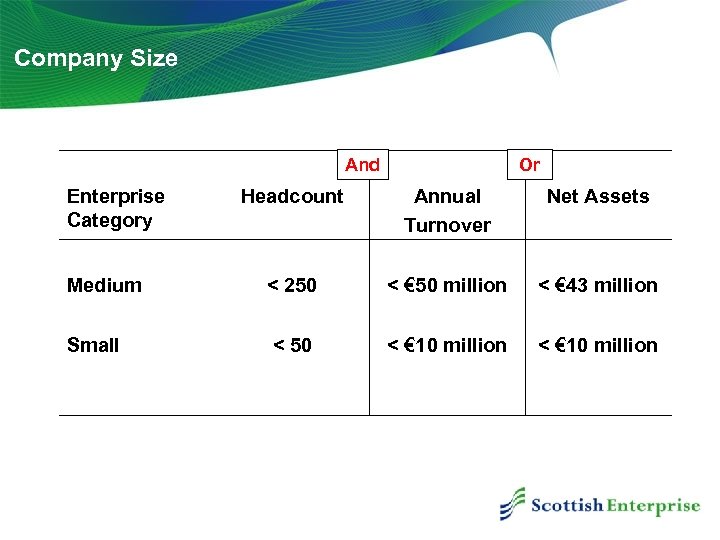

Company Size And Enterprise Category Or Headcount Annual Turnover Net Assets Medium < 250 < € 50 million < € 43 million Small < 50 < € 10 million

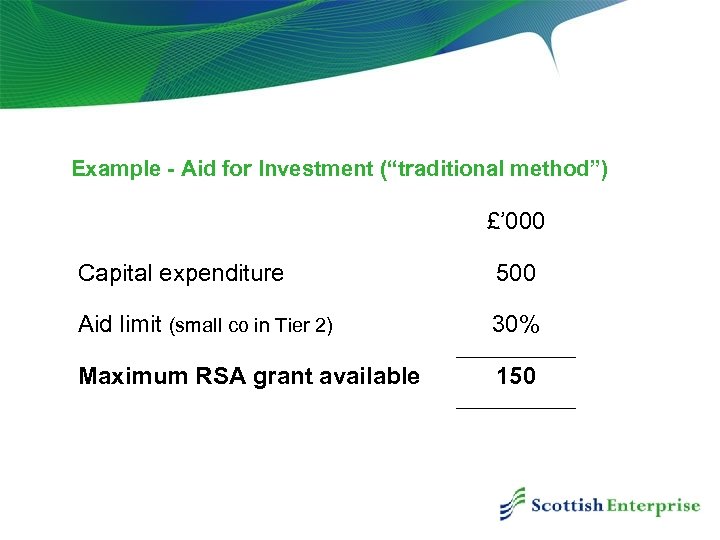

Example - Aid for Investment (“traditional method”) £’ 000 Capital expenditure 500 Aid limit (small co in Tier 2) 30% Maximum RSA grant available 150

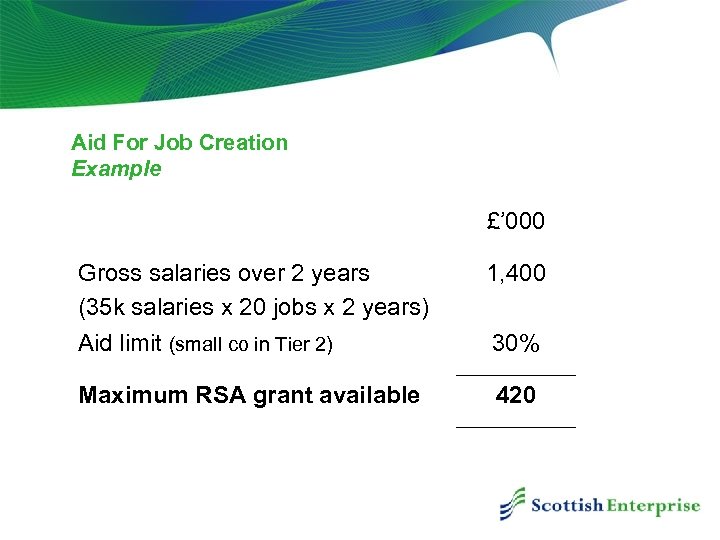

Aid For Job Creation Example £’ 000 Gross salaries over 2 years (35 k salaries x 20 jobs x 2 years) Aid limit (small co in Tier 2) 1, 400 Maximum RSA grant available 420 30%

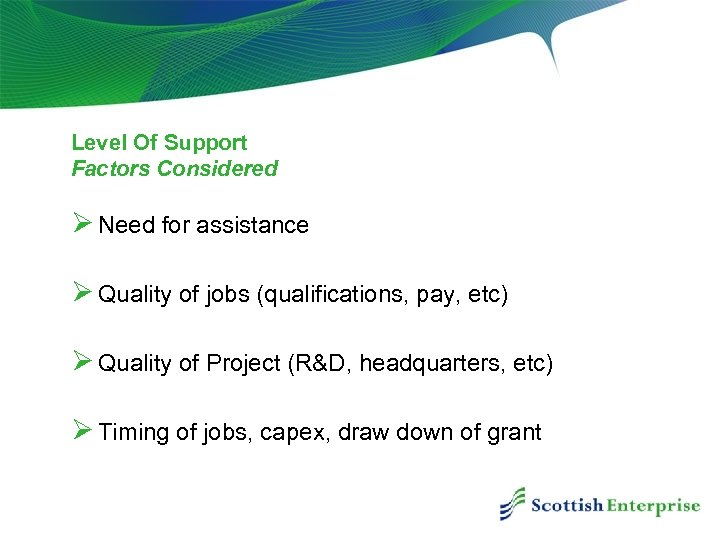

Level Of Support Factors Considered Ø Need for assistance Ø Quality of jobs (qualifications, pay, etc) Ø Quality of Project (R&D, headquarters, etc) Ø Timing of jobs, capex, draw down of grant

RSA Project Appraisal Process Ø Initial enquiry • High level review of project against scheme criteria Ø Appraisal of application • Size and impact of project • Market assessment • Financial viability • Need for assistance Ø Decision (Approval group for grants >£ 500 k) Ø Turnaround 10 -40 working days depending on size of grant

Appraisal Teams Ø RSA team handles • Scottish companies • UK companies already established in Scotland Ø SDI team handles • New inward investment cases • Overseas owned companies • UK companies setting up in Scotland initially

Payment Of Grant Ø Paid in instalments, in arrears, over the life of the project Ø Need to meet conditions to trigger instalment: • Capex • Jobs • Gross wages (Af. JC only) Ø Standard conditions include provisions that assets and jobs are maintained for a period of time after final payment (3 to 5 years there are specific EU rules)

RSA Annual Results 2013 -2014 Ø 117 offers of RSA in Scotland were accepted, totalling over £ 52. 5 million. Ø These offers relate to projects with planned capital expenditure of over £ 267 million and the expected creation or safeguarding of 6, 161 jobs. Ø 12 offers accepted of £ 1 million or more were accepted. Ø SMEs accounted for 85 (73%) of the accepted RSA offers, totalling almost £ 18 million. • These projects involve planned investment of over £ 66. 6 million with the aim of creating or safeguarding 2, 368 jobs. • 32 of these offers, totalling over £ 6. 2 million and aiming to create and safeguard over 1, 070 jobs, were for our ‘Tier 3’ RSA grant aimed solely at SMEs

416f3c7477be1c6c14ed54232e01d81c.ppt