b70aed8a21c47681ca65b12574e806e5.ppt

- Количество слайдов: 38

Regional Outlook: New EU members from Central and Eastern Europe Anchoring Policies in Uncertain Times Fall 2006 Susan Schadler European Department International Monetary Fund

Questions I. How does economic performance in the region shape up by emerging market standards II. Does this performance warrant markets’ relatively favorable perception of risks III. What are the policy imperatives given the opportunities, risks and uncertainties facing the region?

Conclusions • By emerging market (EM) standards, economic performance in CECs is good, but not in class of its own. • Markets, however, view the CECs in something of a class apart. • Keeping this good will as euro adoption schedules lengthen and risks rise will require strong, clearly communicated policy anchors, • But euro adoption remains an irreplaceable opportunity to boost trade and growth and exit growing forex risk.

The global environment, though strong, is becoming more uncertain.

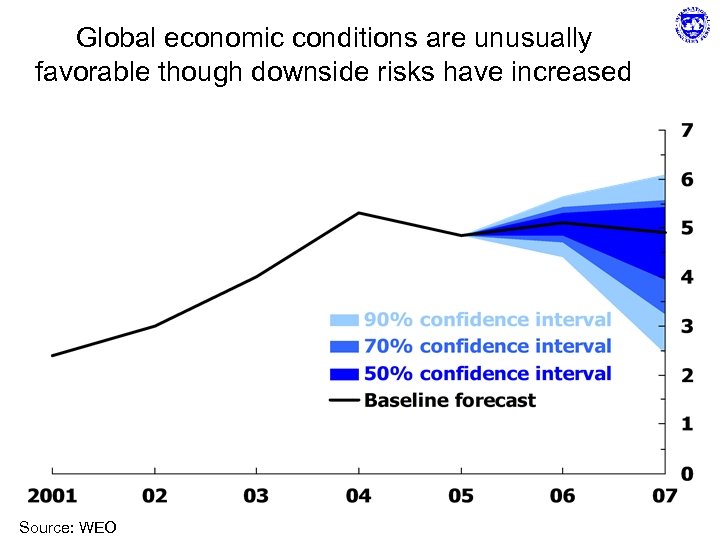

Global economic conditions are unusually favorable though downside risks have increased Source: WEO

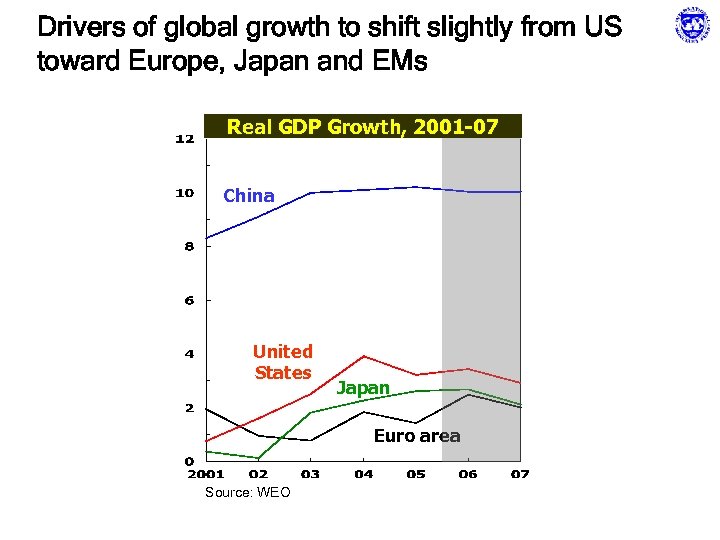

Drivers of global growth to shift slightly from US toward Europe, Japan and EMs Real GDP Growth, 2001 -07 China United States Japan Euro area Source: WEO

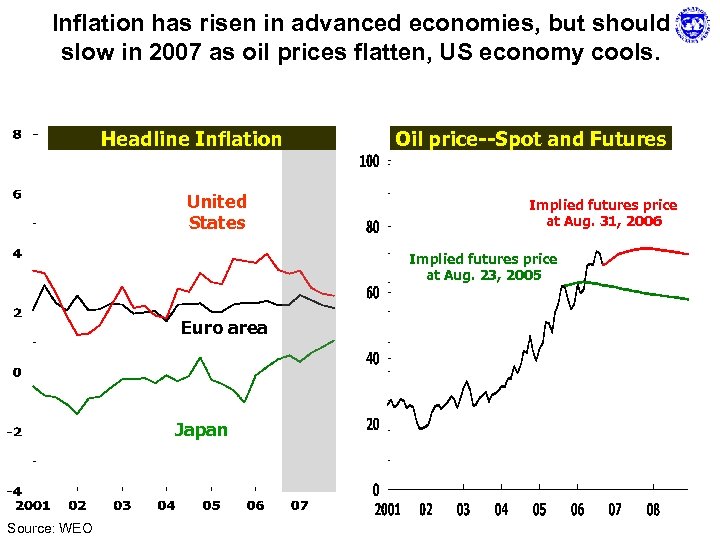

Inflation has risen in advanced economies, but should slow in 2007 as oil prices flatten, US economy cools. Headline Inflation United States Oil price--Spot and Futures Implied futures price at Aug. 31, 2006 Implied futures price at Aug. 23, 2005 Euro area Japan Source: WEO

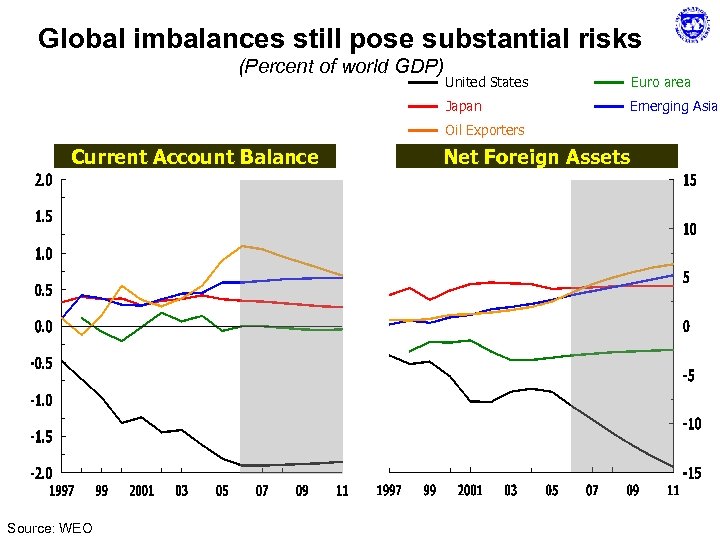

Global imbalances still pose substantial risks (Percent of world GDP) United States Euro area Japan Emerging Asia Oil Exporters Current Account Balance Source: WEO Net Foreign Assets

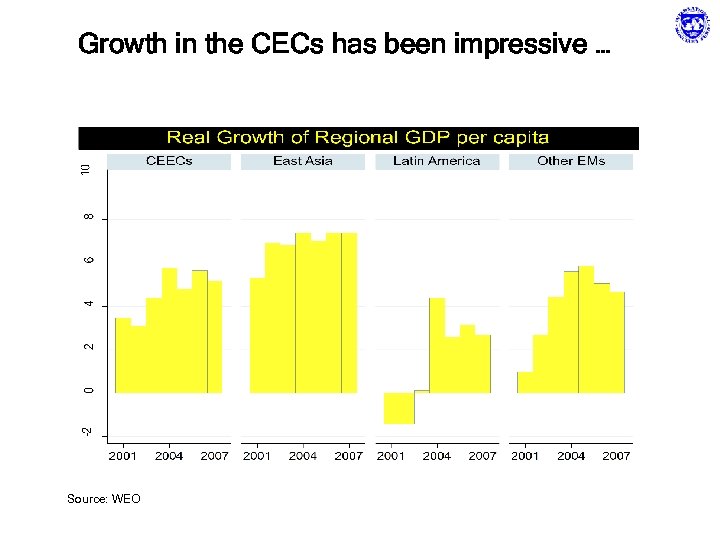

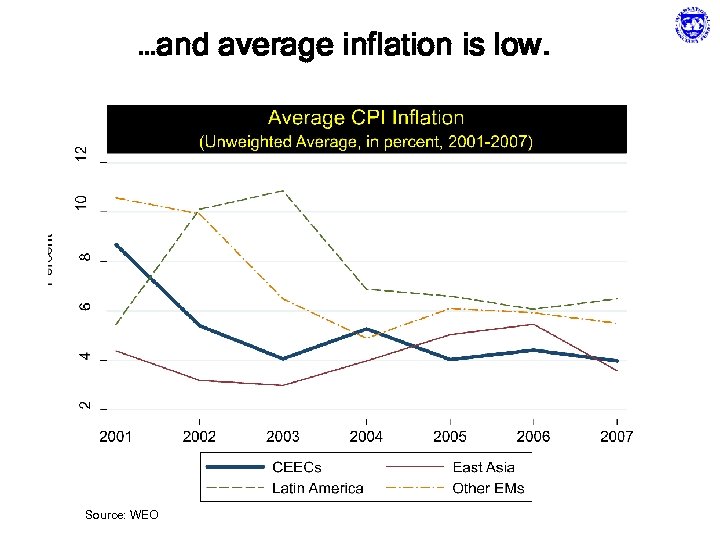

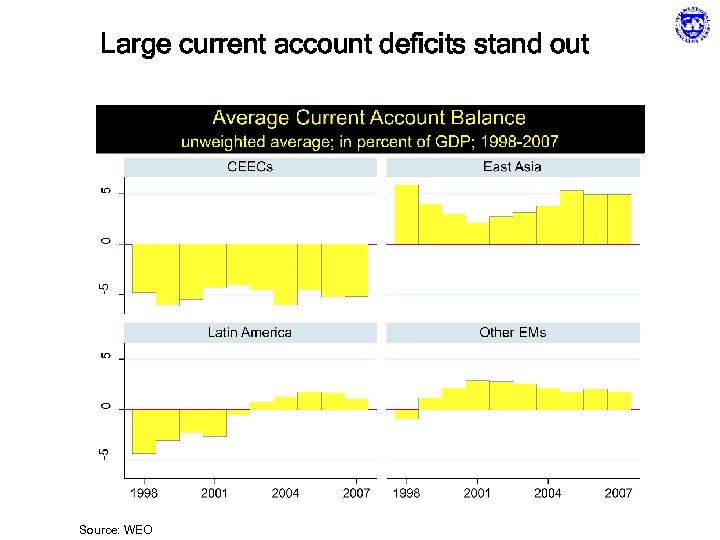

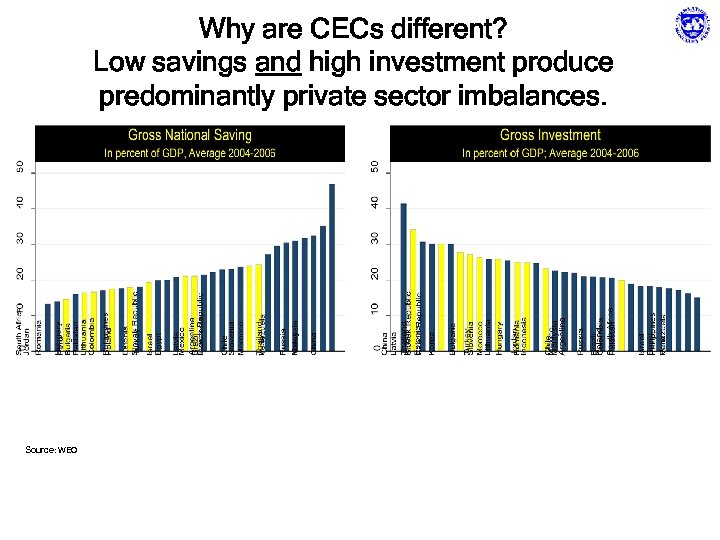

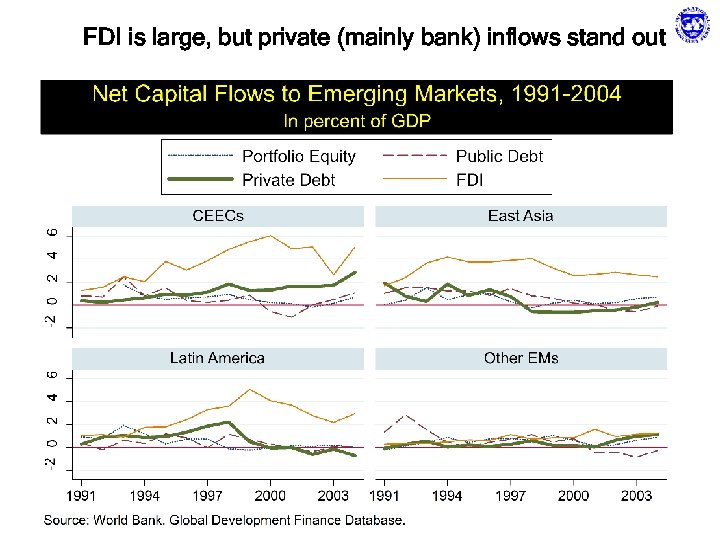

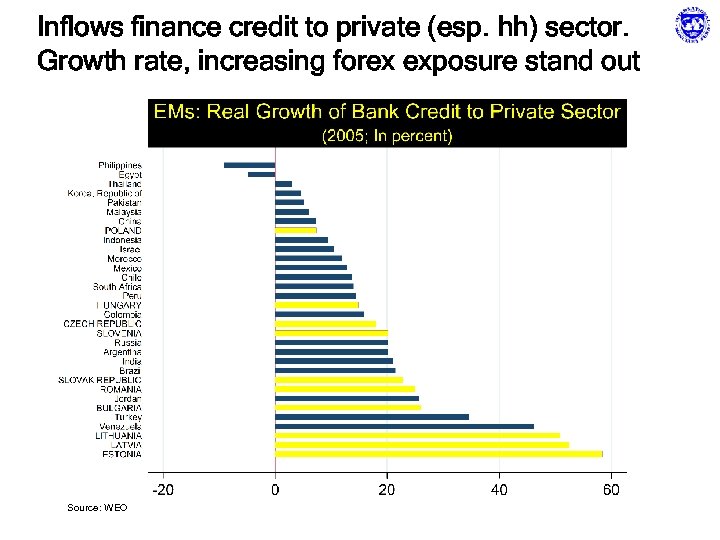

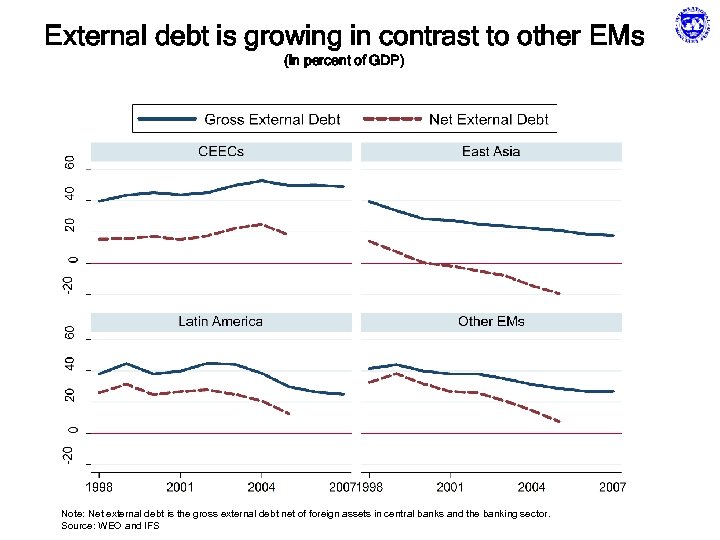

I. How does CEC macro picture compare to other EMs? • Relatively strong growth and low inflation • But with low savings and high investment, CECs use foreign savings heavily • This affects the risk profile in three main ways -Large current account deficits (as other EMs shift to surpluses) -CECs attract FDI as in other EMs, but private (mostly bank) inflows outpace other EMs -Growing external indebtedness, household forex exposure

Growth in the CECs has been impressive … Source: WEO

…and average inflation is low. Source: WEO

Large current account deficits stand out Source: WEO

Why are CECs different? Low savings and high investment produce predominantly private sector imbalances. Source: WEO

FDI is large, but private (mainly bank) inflows stand out

Inflows finance credit to private (esp. hh) sector. Growth rate, increasing forex exposure stand out Source: WEO

External debt is growing in contrast to other EMs (in percent of GDP) Note: Net external debt is the gross external debt net of foreign assets in central banks and the banking sector. Source: WEO and IFS

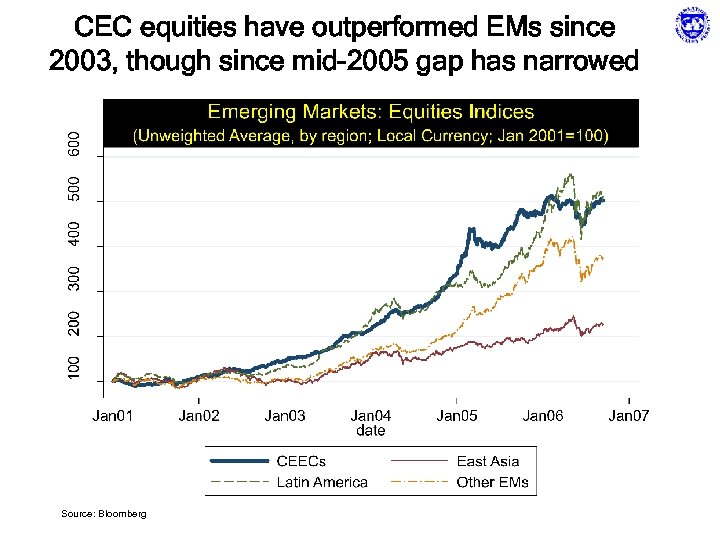

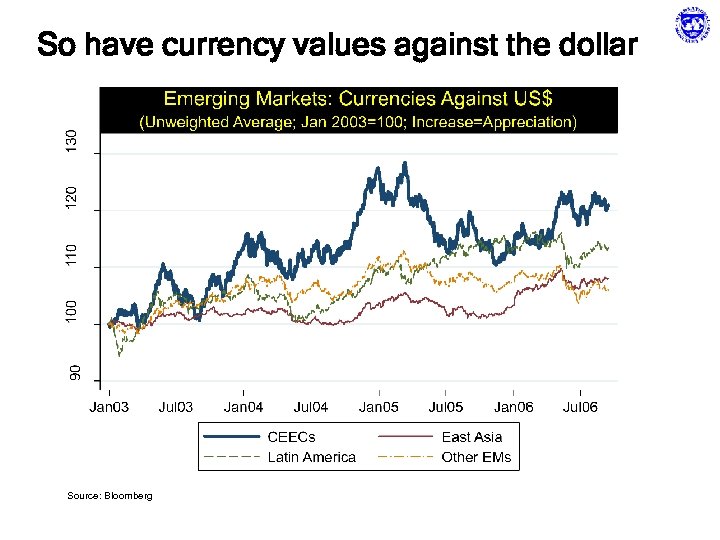

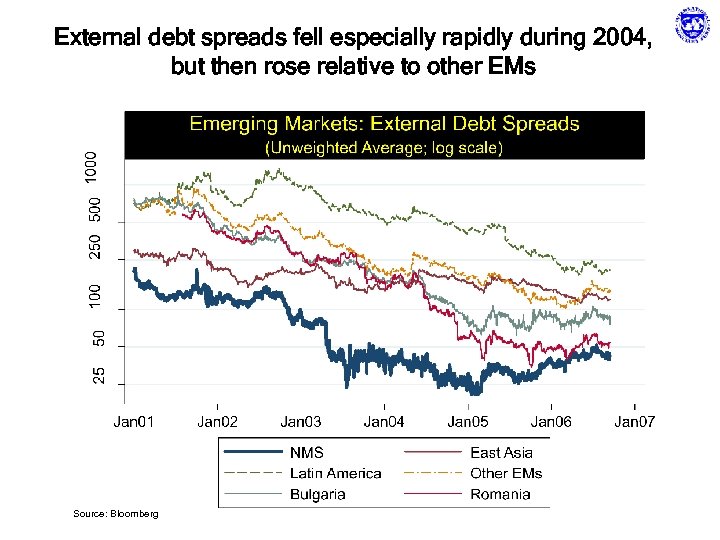

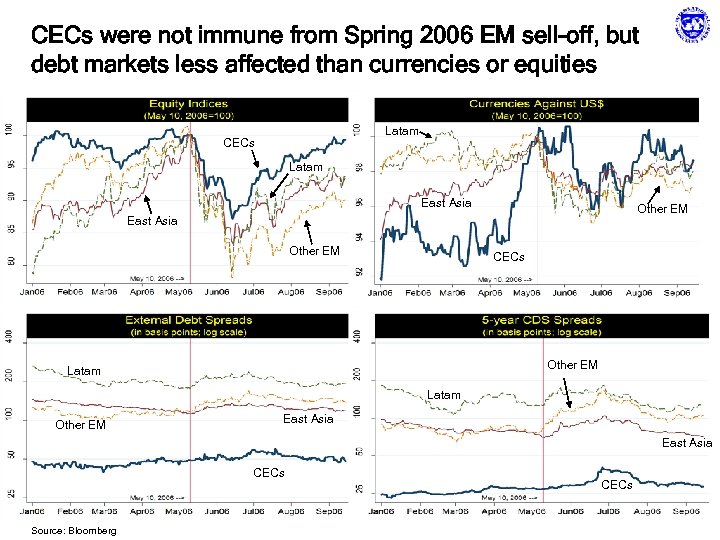

II. How do markets view the high growth/high private sector imbalance situation in CECs? Different markets tell different stories. But broadly • Market view improved steadily relative to other EMs during 2003 -04 (later in Bulgaria, Romania) • Perception gap leveled off during 2005 • EM sell-off in spring 2006 affected most CECs, but generally not harshly • CECs maintain an edge over other EM groups (lower spreads on external debt), but this edge has diminished

CEC equities have outperformed EMs since 2003, though since mid-2005 gap has narrowed Source: Bloomberg

So have currency values against the dollar Source: Bloomberg

External debt spreads fell especially rapidly during 2004, but then rose relative to other EMs Source: Bloomberg

CECs were not immune from Spring 2006 EM sell-off, but debt markets less affected than currencies or equities Latam CECs Latam East Asia Other EM CECs Other EM Latam Other EM East Asia CECs Source: Bloomberg CECs

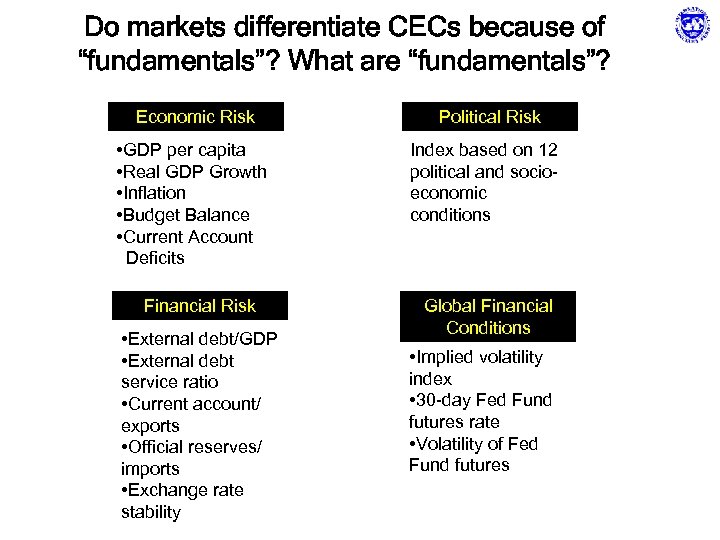

Do markets differentiate CECs because of “fundamentals”? What are “fundamentals”? Economic Risk Political Risk • GDP per capita • Real GDP Growth • Inflation • Budget Balance • Current Account Deficits Index based on 12 political and socioeconomic conditions Financial Risk • External debt/GDP • External debt service ratio • Current account/ exports • Official reserves/ imports • Exchange rate stability Global Financial Conditions • Implied volatility index • 30 -day Fed Fund futures rate • Volatility of Fed Fund futures

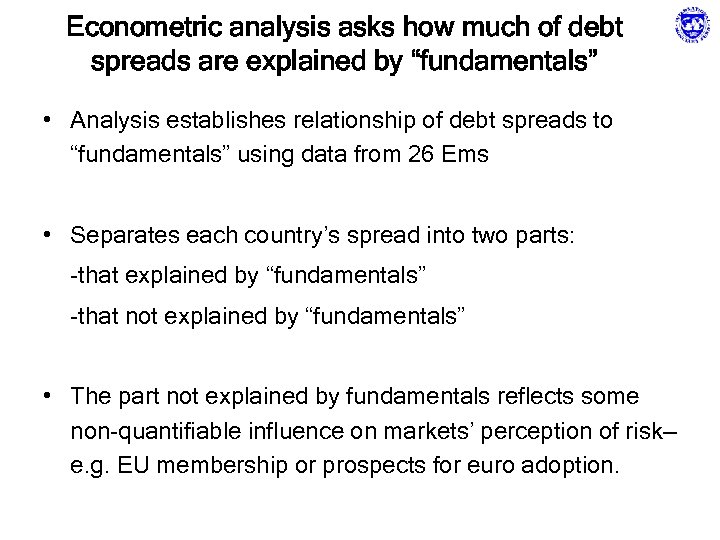

Econometric analysis asks how much of debt spreads are explained by “fundamentals” • Analysis establishes relationship of debt spreads to “fundamentals” using data from 26 Ems • Separates each country’s spread into two parts: -that explained by “fundamentals” -that not explained by “fundamentals” • The part not explained by fundamentals reflects some non-quantifiable influence on markets’ perception of risk— e. g. EU membership or prospects for euro adoption.

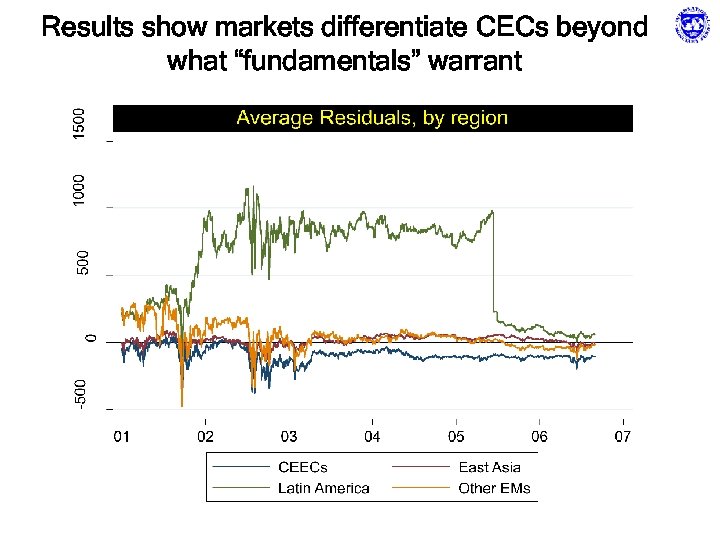

Results show markets differentiate CECs beyond what “fundamentals” warrant

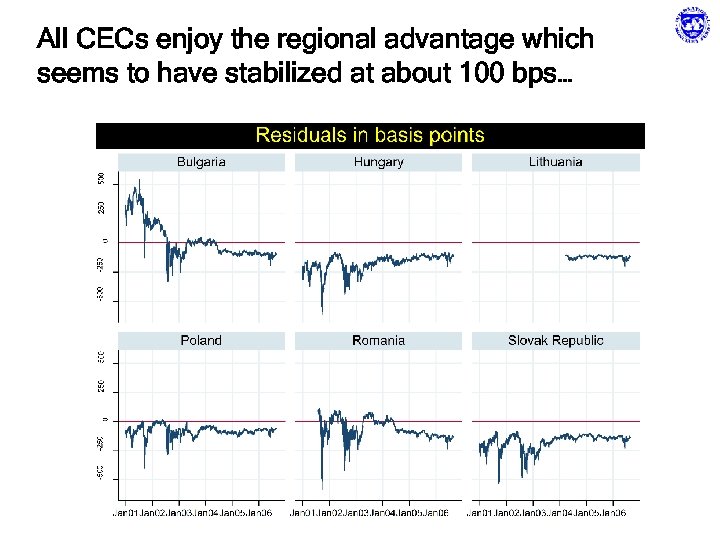

All CECs enjoy the regional advantage which seems to have stabilized at about 100 bps…

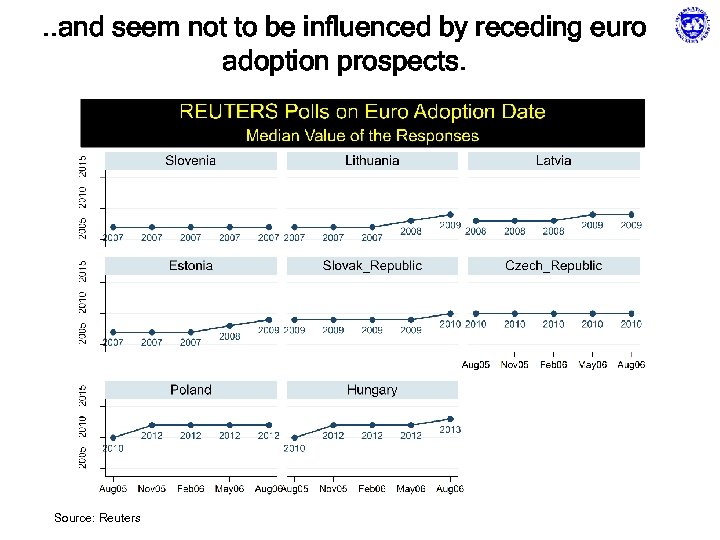

. . and seem not to be influenced by receding euro adoption prospects. Source: Reuters

Summarizing the picture so far • Strong economic performance • Classic risks from private sector imbalances— investment-savings gaps, rising indebtedness fed by rapid growth of bank credit • Markets appear impressed by the strong growth but not concerned by large imbalances. • Sine qua non in this high risk/high return strategy is to meet market expectations for sustained, strong growth

III. What policy anchors can reinforce market good will, sustain growth? • Euro adoption -medium-long term boost for trade, growth -eliminate emerging market risk premium -exit strategy from growing private sector forex exposures • But with euro adoption schedules receding, it is losing its value as a near-term benchmark • Markets to judge CECs increasingly on conventional policy anchors

Policy anchors must work in tandem to achieve five policy goals • Low inflation (inflation targeting/currency board) • Moderate current account deficits (restraining fiscal policy) • Financial sector soundness (supervision) • Transparent risk (transparency of public and private accounts) • Competitive business environment (low wage and nonwage costs of doing business)

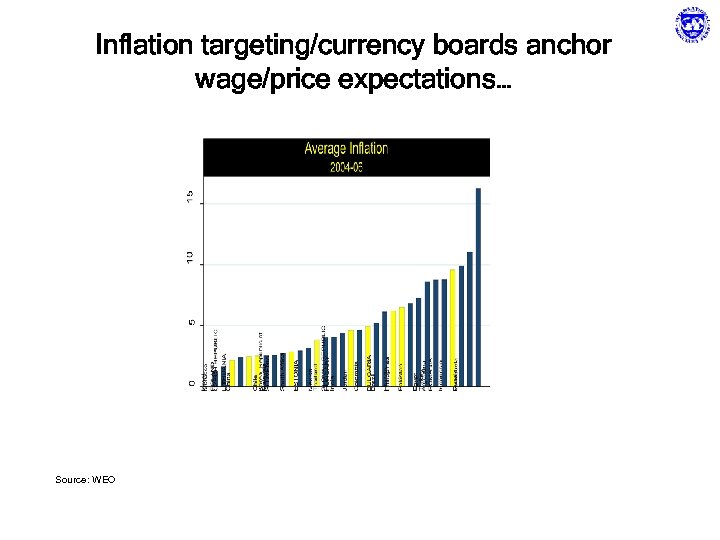

Inflation targeting/currency boards anchor wage/price expectations… Source: WEO

…but, with open capital accounts, are inefficient in • Curbing surges in capital inflows • Reducing large current account deficits • Sustaining competitiveness • Addressing risks of private sector forex exposure

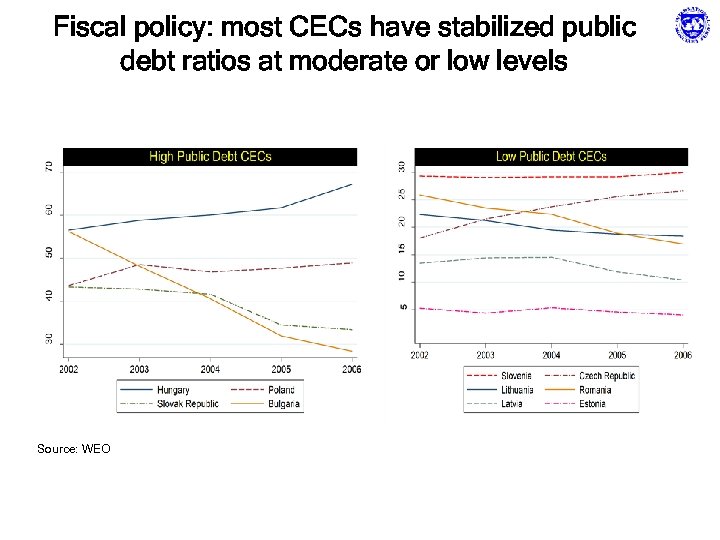

Fiscal policy: most CECs have stabilized public debt ratios at moderate or low levels Source: WEO

But in some, rising debt or insufficient credibility requires more than discretionary policy Fiscal responsibility laws are increasingly used in other EMs to sustain/signal commitment – Expenditure or deficit ceiling – Fiscal transparency code – Medium-term budgeting commitment

And when growth is strong and private imbalances large, fiscal policy needs to go beyond debt stabilization In boom conditions fiscal policy becomes the sole macroeconomic policy instrument that can • Relieve demand pressures • Contain current account deficit • Limit appreciation

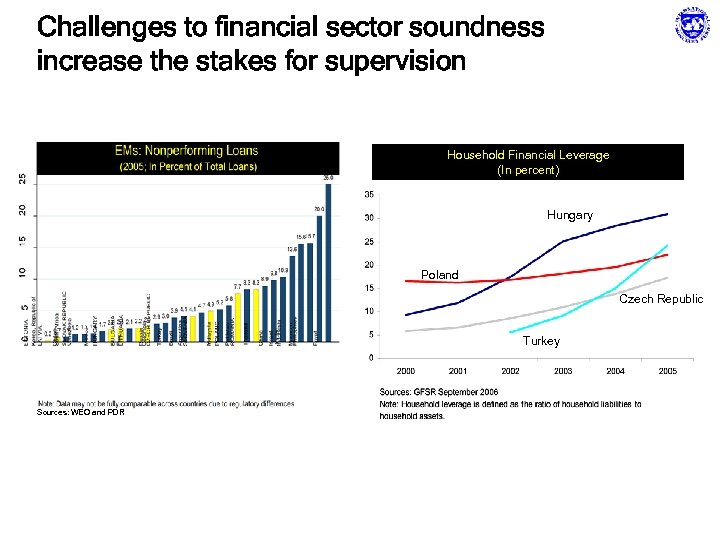

Challenges to financial sector soundness increase the stakes for supervision Household Financial Leverage (In percent) Hungary Poland Czech Republic Turkey Sources: WEO and PDR

Transparency—there can’t be too much • No ready measures of transparency • Wide agreement that deficiencies were central to Asian currency crises in the 1990 s • Key is to ensure that risks are clear to investors and leveraged residents • Ensure that public accounts are clear, complete • Guard against impressions of implicit guarentees

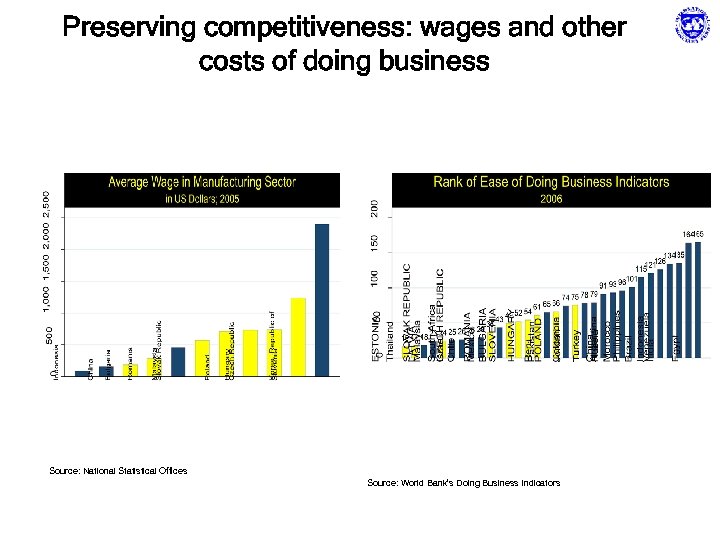

Preserving competitiveness: wages and other costs of doing business Source: National Statistical Offices Source: World Bank’s Doing Business Indicators

Conclusions • Economic performance in CECs is good by EM standards, but not in class of its own. • Markets, however, view the CECs in something of a class apart. CEC edge is shrinking but still significant. • To keep this good will as euro adoption prospects recede, policy anchors need to be clearly communicated/oriented toward sustaining high growth. • Euro adoption is a major opportunity and should remain a key goal of policy

b70aed8a21c47681ca65b12574e806e5.ppt