3a74058b3edfd5fe01dbb8dce75502aa.ppt

- Количество слайдов: 34

Regional Context & Priorities January 15, 2007 (Ford Fellowship in Regionalism and Sustainable Development)

Regional Context & Priorities January 15, 2007 (Ford Fellowship in Regionalism and Sustainable Development)

Agenda • • About Our Chamber Regional Economic Context Regional Public Policy and Political Challenges Our Chamber’s Regional Priorities

Agenda • • About Our Chamber Regional Economic Context Regional Public Policy and Political Challenges Our Chamber’s Regional Priorities

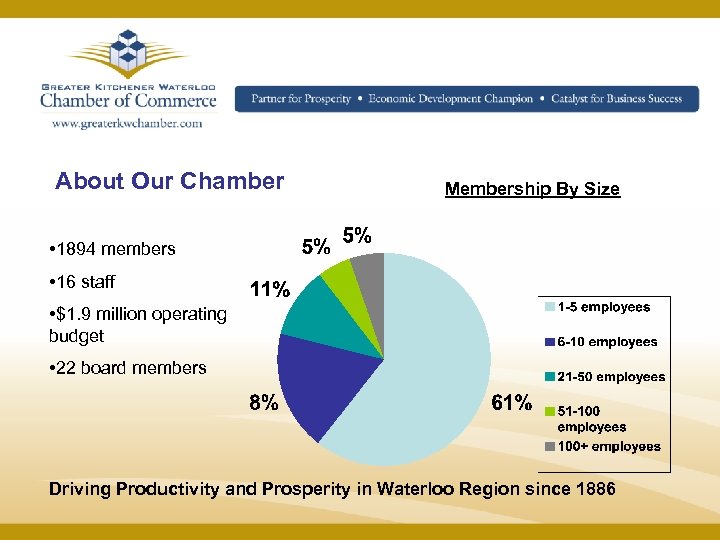

About Our Chamber Membership By Size • 1894 members • 16 staff • $1. 9 million operating budget • 22 board members Driving Productivity and Prosperity in Waterloo Region since 1886

About Our Chamber Membership By Size • 1894 members • 16 staff • $1. 9 million operating budget • 22 board members Driving Productivity and Prosperity in Waterloo Region since 1886

Our Vision The Greater Kitchener Waterloo Chamber of Commerce is a business association of economic development champions. As the voice of business for the Greater Kitchener Waterloo area, the Chamber is a strong advocate for continued development of our community and a partner for prosperity. By working together and focusing on initiatives that support growth, members use the services of the Chamber as an important catalyst for their business success. Recognized as a leader in one of Canada’s most forward-thinking business communities, the Greater Kitchener Waterloo Chamber of Commerce strives to be the best Chamber of Commerce in Canada.

Our Vision The Greater Kitchener Waterloo Chamber of Commerce is a business association of economic development champions. As the voice of business for the Greater Kitchener Waterloo area, the Chamber is a strong advocate for continued development of our community and a partner for prosperity. By working together and focusing on initiatives that support growth, members use the services of the Chamber as an important catalyst for their business success. Recognized as a leader in one of Canada’s most forward-thinking business communities, the Greater Kitchener Waterloo Chamber of Commerce strives to be the best Chamber of Commerce in Canada.

Selected Member Companies Manulife Financial Research In Motion Budd Canada Home Hardware Challenger Motor Freight Sun Life Financial ATS Automation Tooling Systems Maple Leaf / Schneider Foods CBCL Outsourcing UW / WLU / Conestoga College Unique Aspects of our Chamber Largest accredited chamber in Ontario Best networking organization in Region 2006 Two successful chamber mergers in last 15 years 2006 Ontario Business Achievement Award for Export Development Recognized Provincially and Nationally for Community/Next Generation Leadership Competitors of our Chamber Cdn Federation of Independent Business Cambridge Chamber of Commerce Communitech Technology Association Rotary Clubs

Selected Member Companies Manulife Financial Research In Motion Budd Canada Home Hardware Challenger Motor Freight Sun Life Financial ATS Automation Tooling Systems Maple Leaf / Schneider Foods CBCL Outsourcing UW / WLU / Conestoga College Unique Aspects of our Chamber Largest accredited chamber in Ontario Best networking organization in Region 2006 Two successful chamber mergers in last 15 years 2006 Ontario Business Achievement Award for Export Development Recognized Provincially and Nationally for Community/Next Generation Leadership Competitors of our Chamber Cdn Federation of Independent Business Cambridge Chamber of Commerce Communitech Technology Association Rotary Clubs

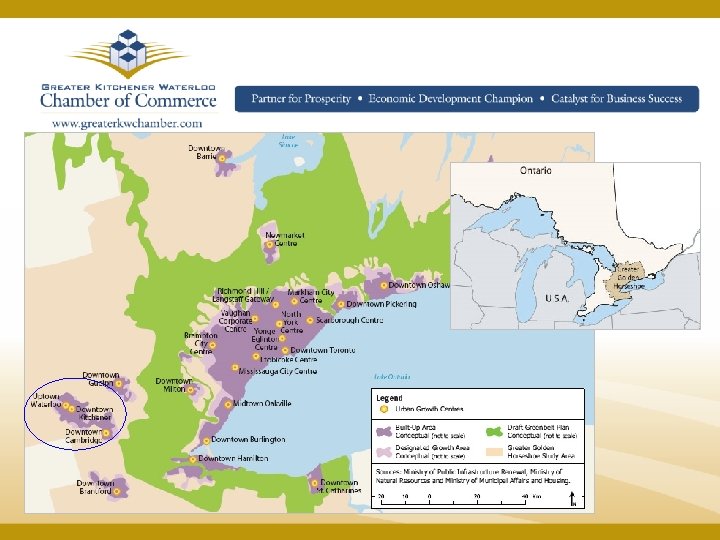

Waterloo Region: Canada’s Technology Triangle Population Driving CTT: 90 min west of Toronto 508, 000 SWO: 90 min north west of Buffalo 2. 3 million GGH: 2. 5 hrs north east of Detroit 7. 8 million Northwest Airlines makes 3 flights daily from KW to Detroit

Waterloo Region: Canada’s Technology Triangle Population Driving CTT: 90 min west of Toronto 508, 000 SWO: 90 min north west of Buffalo 2. 3 million GGH: 2. 5 hrs north east of Detroit 7. 8 million Northwest Airlines makes 3 flights daily from KW to Detroit

Regional Economic/Demographic Context • Canada’s 10 th largest and Ontario’s 4 th largest urban area • Regional GDP of $19. 4 billion (2004) • 508, 000 people (Regional Municipality of Waterloo 2006) • Population growth of 8. 2% (1996 -2001 Stats. Can) • Planning for 255, 000 more people and 158, 000 more jobs by 2031 • Work force of 270, 000 (July 2005 HRSDC) / 26% employed in manufacturing • Net inflow of 29, 462 skilled and talented people (1996 -2002 Stats. Can) • 3 rd youngest median age (35 yrs) of major urban areas (2001 Stats. Can) • 5. 4% unemployment rate (Stats. Can 2006 Annual Average) • Median income $29, 800 - ranking third among Canadian CMAs (2003)

Regional Economic/Demographic Context • Canada’s 10 th largest and Ontario’s 4 th largest urban area • Regional GDP of $19. 4 billion (2004) • 508, 000 people (Regional Municipality of Waterloo 2006) • Population growth of 8. 2% (1996 -2001 Stats. Can) • Planning for 255, 000 more people and 158, 000 more jobs by 2031 • Work force of 270, 000 (July 2005 HRSDC) / 26% employed in manufacturing • Net inflow of 29, 462 skilled and talented people (1996 -2002 Stats. Can) • 3 rd youngest median age (35 yrs) of major urban areas (2001 Stats. Can) • 5. 4% unemployment rate (Stats. Can 2006 Annual Average) • Median income $29, 800 - ranking third among Canadian CMAs (2003)

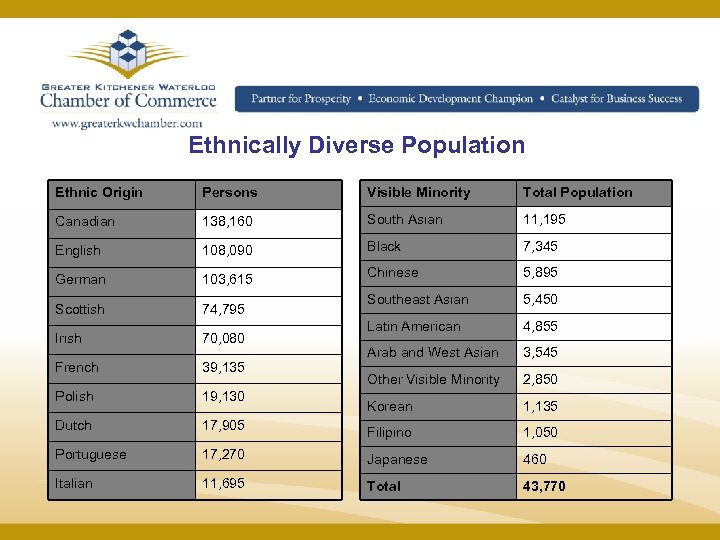

Ethnically Diverse Population Ethnic Origin Persons Visible Minority Total Population Canadian 138, 160 South Asian 11, 195 English 108, 090 Black 7, 345 German 103, 615 Chinese 5, 895 Scottish 74, 795 Southeast Asian 5, 450 Irish 70, 080 Latin American 4, 855 French 39, 135 Arab and West Asian 3, 545 Other Visible Minority 2, 850 Polish 19, 130 Korean 1, 135 Dutch 17, 905 Filipino 1, 050 Portuguese 17, 270 Japanese 460 Italian 11, 695 Total 43, 770

Ethnically Diverse Population Ethnic Origin Persons Visible Minority Total Population Canadian 138, 160 South Asian 11, 195 English 108, 090 Black 7, 345 German 103, 615 Chinese 5, 895 Scottish 74, 795 Southeast Asian 5, 450 Irish 70, 080 Latin American 4, 855 French 39, 135 Arab and West Asian 3, 545 Other Visible Minority 2, 850 Polish 19, 130 Korean 1, 135 Dutch 17, 905 Filipino 1, 050 Portuguese 17, 270 Japanese 460 Italian 11, 695 Total 43, 770

Global / Export - Oriented Economy • $12 Billion Goods Exported (2004) – Major markets: US, UK, China, Germany and Japan – $50, 000 product exports per employee compared to $31, 000 for Ontario (2004) – Waterloo Region exports are greater than that of five provinces • More Than 240 Foreign-Owned Firms – Major sources of foreign investment: US, Germany, UK, France, Japan and The Netherlands

Global / Export - Oriented Economy • $12 Billion Goods Exported (2004) – Major markets: US, UK, China, Germany and Japan – $50, 000 product exports per employee compared to $31, 000 for Ontario (2004) – Waterloo Region exports are greater than that of five provinces • More Than 240 Foreign-Owned Firms – Major sources of foreign investment: US, Germany, UK, France, Japan and The Netherlands

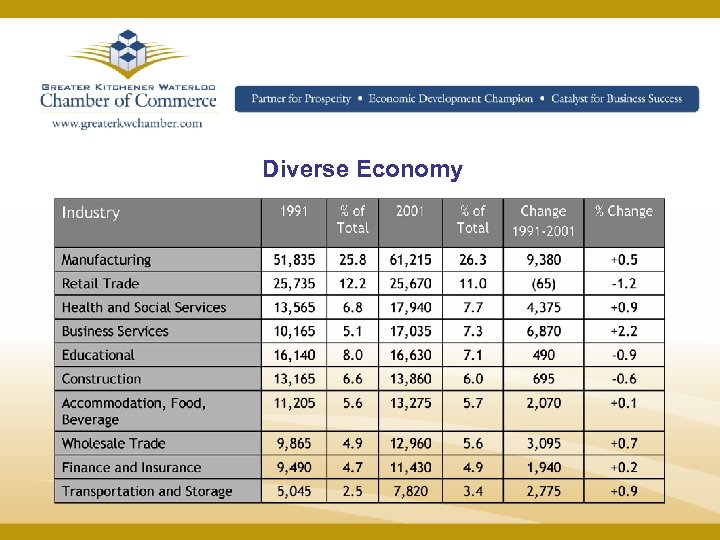

Diverse Economy

Diverse Economy

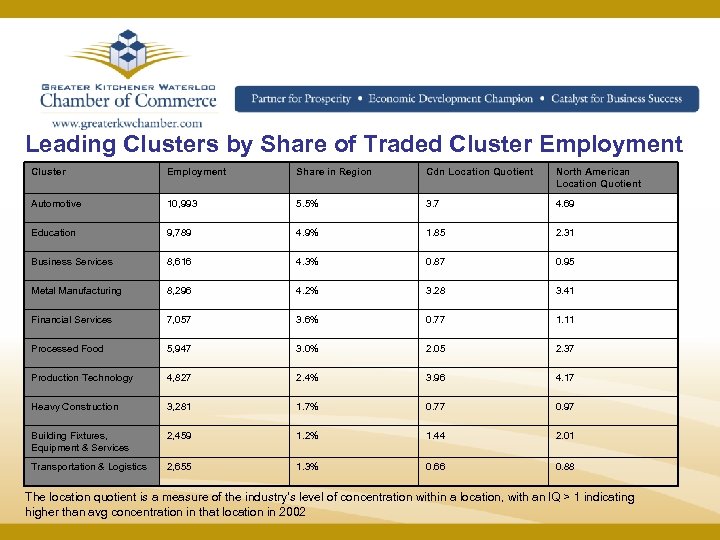

Leading Clusters by Share of Traded Cluster Employment Share in Region Cdn Location Quotient North American Location Quotient Automotive 10, 993 5. 5% 3. 7 4. 69 Education 9, 789 4. 9% 1. 85 2. 31 Business Services 8, 616 4. 3% 0. 87 0. 95 Metal Manufacturing 8, 296 4. 2% 3. 28 3. 41 Financial Services 7, 057 3. 6% 0. 77 1. 11 Processed Food 5, 947 3. 0% 2. 05 2. 37 Production Technology 4, 827 2. 4% 3. 96 4. 17 Heavy Construction 3, 281 1. 7% 0. 77 0. 97 Building Fixtures, Equipment & Services 2, 459 1. 2% 1. 44 2. 01 Transportation & Logistics 2, 655 1. 3% 0. 66 0. 88 The location quotient is a measure of the industry’s level of concentration within a location, with an l. Q > 1 indicating higher than avg concentration in that location in 2002

Leading Clusters by Share of Traded Cluster Employment Share in Region Cdn Location Quotient North American Location Quotient Automotive 10, 993 5. 5% 3. 7 4. 69 Education 9, 789 4. 9% 1. 85 2. 31 Business Services 8, 616 4. 3% 0. 87 0. 95 Metal Manufacturing 8, 296 4. 2% 3. 28 3. 41 Financial Services 7, 057 3. 6% 0. 77 1. 11 Processed Food 5, 947 3. 0% 2. 05 2. 37 Production Technology 4, 827 2. 4% 3. 96 4. 17 Heavy Construction 3, 281 1. 7% 0. 77 0. 97 Building Fixtures, Equipment & Services 2, 459 1. 2% 1. 44 2. 01 Transportation & Logistics 2, 655 1. 3% 0. 66 0. 88 The location quotient is a measure of the industry’s level of concentration within a location, with an l. Q > 1 indicating higher than avg concentration in that location in 2002

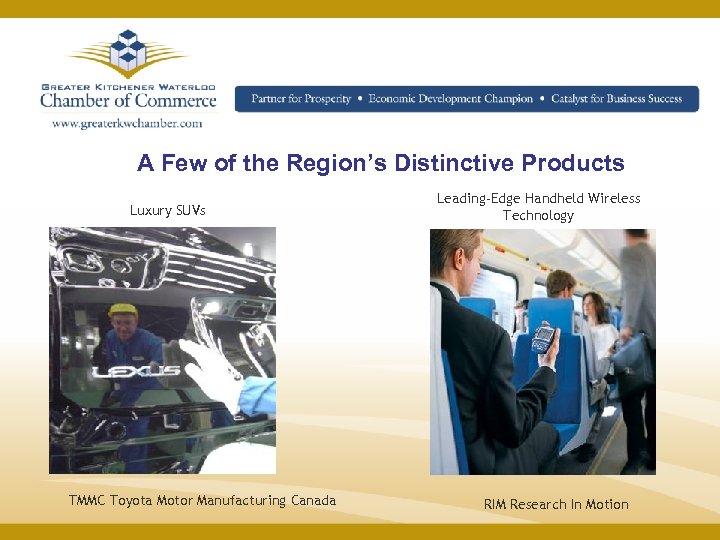

A Few of the Region’s Distinctive Products Luxury SUVs TMMC Toyota Motor Manufacturing Canada Leading-Edge Handheld Wireless Technology RIM Research In Motion

A Few of the Region’s Distinctive Products Luxury SUVs TMMC Toyota Motor Manufacturing Canada Leading-Edge Handheld Wireless Technology RIM Research In Motion

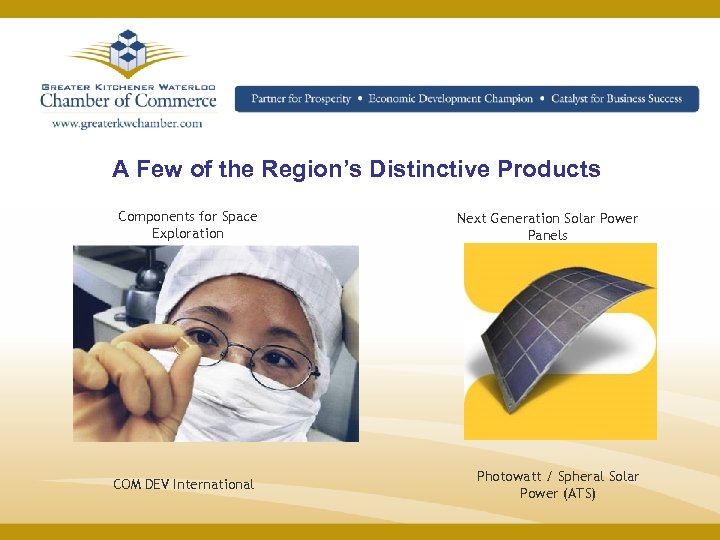

A Few of the Region’s Distinctive Products Components for Space Exploration Next Generation Solar Power Panels COM DEV International Photowatt / Spheral Solar Power (ATS)

A Few of the Region’s Distinctive Products Components for Space Exploration Next Generation Solar Power Panels COM DEV International Photowatt / Spheral Solar Power (ATS)

A Few of the Region’s Distinctive Products Amphibious Vehicles ODG Ontario Drive & Gear Quality Delicatessen Meats Schneiders Foods

A Few of the Region’s Distinctive Products Amphibious Vehicles ODG Ontario Drive & Gear Quality Delicatessen Meats Schneiders Foods

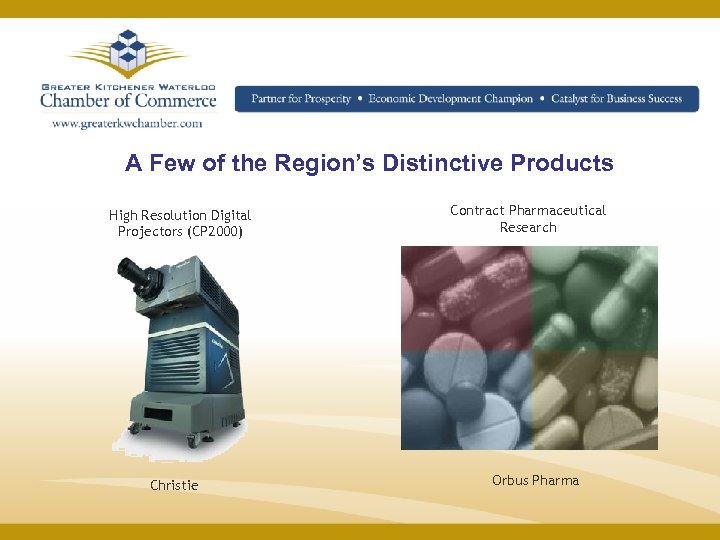

A Few of the Region’s Distinctive Products High Resolution Digital Projectors (CP 2000) Christie Contract Pharmaceutical Research Orbus Pharma

A Few of the Region’s Distinctive Products High Resolution Digital Projectors (CP 2000) Christie Contract Pharmaceutical Research Orbus Pharma

A Few of the Region’s Distinctive Products Biologicals for Agriculture Agri. Biotics (Merck KGa. A) Stunningly Designed Office Furniture Krug

A Few of the Region’s Distinctive Products Biologicals for Agriculture Agri. Biotics (Merck KGa. A) Stunningly Designed Office Furniture Krug

A Few of the Region’s Distinctive Products Insurance Components for Landing Gear Manulife Financial Héroux-Devtek

A Few of the Region’s Distinctive Products Insurance Components for Landing Gear Manulife Financial Héroux-Devtek

50, 000 FT and 14, 000 PT Post-secondary Students University of Waterloo – “Best Overall” and “Most Innovative” in Canada – World’s Largest in Cooperative Education – Canada’s Largest Engineering School – Largest Mathematics Faculty in the world Wilfrid Laurier University – A leading Undergraduate University in Ontario – One of Canada’s Largest Business Schools – Canada’s Largest Business Co-op Program – Specialties in Logistics, Science and Music University of Guelph – A Leading Research-Intensive Comprehensive University – Strengths in Agri-Science, Veterinary and Environmental Studies Conestoga College ITAL – Ontario’s #1 Ranked College – Offering Applied Degrees, Diplomas, Apprenticeship, Parttime and Customized Training – Focus on Engineering Technology, IT, Business, Health Sciences, Media and Skilled Trades

50, 000 FT and 14, 000 PT Post-secondary Students University of Waterloo – “Best Overall” and “Most Innovative” in Canada – World’s Largest in Cooperative Education – Canada’s Largest Engineering School – Largest Mathematics Faculty in the world Wilfrid Laurier University – A leading Undergraduate University in Ontario – One of Canada’s Largest Business Schools – Canada’s Largest Business Co-op Program – Specialties in Logistics, Science and Music University of Guelph – A Leading Research-Intensive Comprehensive University – Strengths in Agri-Science, Veterinary and Environmental Studies Conestoga College ITAL – Ontario’s #1 Ranked College – Offering Applied Degrees, Diplomas, Apprenticeship, Parttime and Customized Training – Focus on Engineering Technology, IT, Business, Health Sciences, Media and Skilled Trades

Home to Think Tanks with Global Ambition Perimeter Institute for Theoretical Physics, The Centre for International Governance Innovation (CIGI), and The Academic Council on the United Nations System (ACUNS) 150 Research Centres

Home to Think Tanks with Global Ambition Perimeter Institute for Theoretical Physics, The Centre for International Governance Innovation (CIGI), and The Academic Council on the United Nations System (ACUNS) 150 Research Centres

Innovative Private Sector Research • Private Sector Investment in Research – $277 M in private R&D in 2002, of which • Manufacturing: $162 M • Services: $108 M – An 82% increase from 1995 • Major Sectors Undertaking R&D – Computer System Design Industry: $79 M – Machinery Industry: $28 M Source: 2004 Community Benchmarks

Innovative Private Sector Research • Private Sector Investment in Research – $277 M in private R&D in 2002, of which • Manufacturing: $162 M • Services: $108 M – An 82% increase from 1995 • Major Sectors Undertaking R&D – Computer System Design Industry: $79 M – Machinery Industry: $28 M Source: 2004 Community Benchmarks

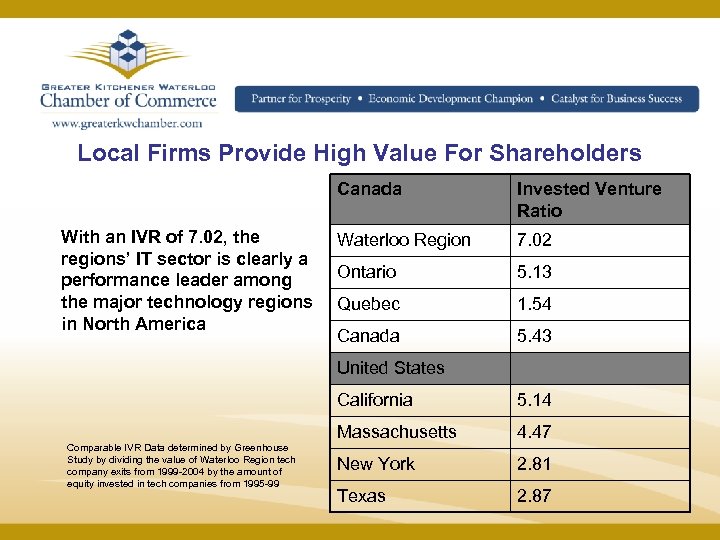

Local Firms Provide High Value For Shareholders Canada With an IVR of 7. 02, the regions’ IT sector is clearly a performance leader among the major technology regions in North America Invested Venture Ratio Waterloo Region 7. 02 Ontario 5. 13 Quebec 1. 54 Canada 5. 43 United States California Massachusetts Comparable IVR Data determined by Greenhouse Study by dividing the value of Waterloo Region tech company exits from 1999 -2004 by the amount of equity invested in tech companies from 1995 -99 5. 14 4. 47 New York 2. 81 Texas 2. 87

Local Firms Provide High Value For Shareholders Canada With an IVR of 7. 02, the regions’ IT sector is clearly a performance leader among the major technology regions in North America Invested Venture Ratio Waterloo Region 7. 02 Ontario 5. 13 Quebec 1. 54 Canada 5. 43 United States California Massachusetts Comparable IVR Data determined by Greenhouse Study by dividing the value of Waterloo Region tech company exits from 1999 -2004 by the amount of equity invested in tech companies from 1995 -99 5. 14 4. 47 New York 2. 81 Texas 2. 87

The Record, September 1, 2005. Editorial Cartoon, The Record, October 1, 2005.

The Record, September 1, 2005. Editorial Cartoon, The Record, October 1, 2005.

Waterloo Region is: Diverse, Fast-growing, Entrepreneurial and Innovative

Waterloo Region is: Diverse, Fast-growing, Entrepreneurial and Innovative

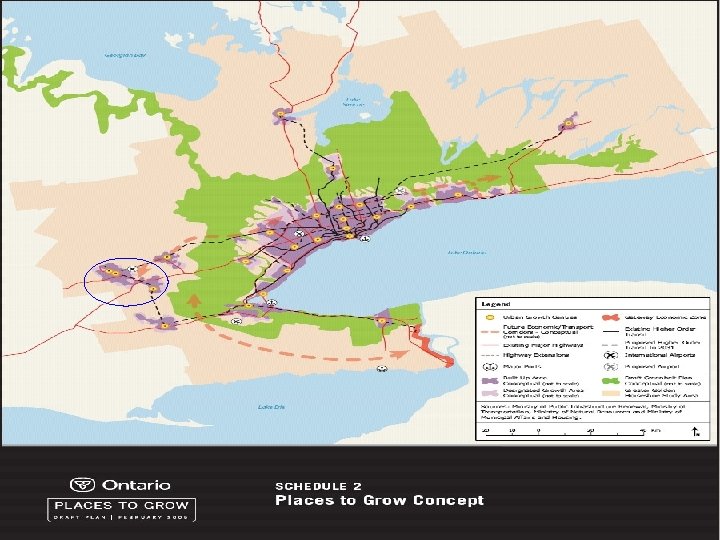

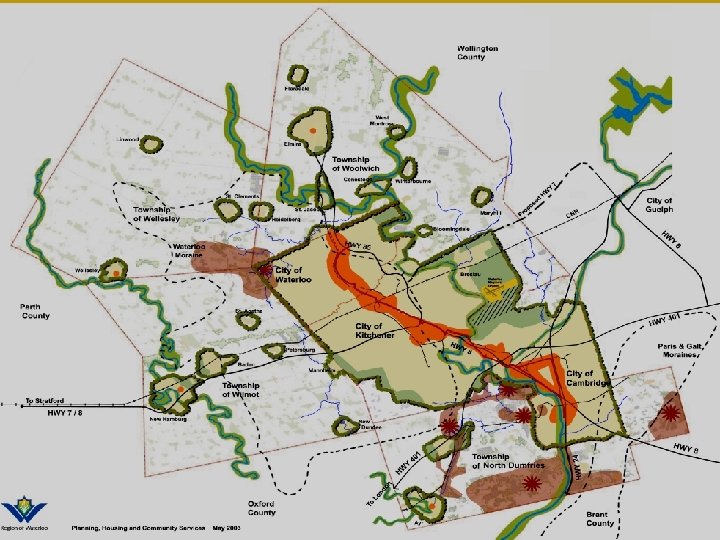

Regional Public Policy / Political Challenges 1. Managing Growth • • 2. Competing for talent, investment and jobs world-wide • • • 3. Transportation Water Supply / Quality Physicians / Health Care Employment Lands Integrating immigrants Keeping/attracting the next generation Making Waterloo Region a really cool place: Arts & Culture Development Governance and Better Service Delivery • • Emergency response times Water quality

Regional Public Policy / Political Challenges 1. Managing Growth • • 2. Competing for talent, investment and jobs world-wide • • • 3. Transportation Water Supply / Quality Physicians / Health Care Employment Lands Integrating immigrants Keeping/attracting the next generation Making Waterloo Region a really cool place: Arts & Culture Development Governance and Better Service Delivery • • Emergency response times Water quality

Competing for talent, investment and jobs world-wide • Integrating immigrants • • • Keeping/attracting the next generation • • 1 in 5 regional residents are foreign born 14% unemployment versus 5% for Canadian-born residents 80% of graduates find careers outside region Employment vacancies taking longer to fill Physician Shortages Making Waterloo Region a really cool place • • Fragmented arts and culture infrastructure Limited financial sustainability in the arts

Competing for talent, investment and jobs world-wide • Integrating immigrants • • • Keeping/attracting the next generation • • 1 in 5 regional residents are foreign born 14% unemployment versus 5% for Canadian-born residents 80% of graduates find careers outside region Employment vacancies taking longer to fill Physician Shortages Making Waterloo Region a really cool place • • Fragmented arts and culture infrastructure Limited financial sustainability in the arts

Governance and Better Service Delivery • Eight governments for 500, 000 people • Overlapping jurisdictions & service responsibilities • Regional Growth Management Strategy • Expansion of Employment Lands • Emergency Response Times • Water Supply and Quality • Light Rapid Transit Proposal

Governance and Better Service Delivery • Eight governments for 500, 000 people • Overlapping jurisdictions & service responsibilities • Regional Growth Management Strategy • Expansion of Employment Lands • Emergency Response Times • Water Supply and Quality • Light Rapid Transit Proposal

Our Chamber’s Regional Efforts 1. Prosperity Council 2. Waterloo Region Immigrant Employment Network 3. Chamber Health Care Recruitment Council

Our Chamber’s Regional Efforts 1. Prosperity Council 2. Waterloo Region Immigrant Employment Network 3. Chamber Health Care Recruitment Council

Prosperity Council Key Partners: Cambridge Chamber of Commerce, Communitech Technology Association, CTT Inc. Major Challenges: Collaborating with competitors; navigating multiple municipal jurisdictions; operating sustainability Major Successes: Joint Advocacy resulting in: • Proposed 300 net new acres of employment land • New investment in physician recruitment and provincial capital investment • Entrepreneurship Hall of Fame

Prosperity Council Key Partners: Cambridge Chamber of Commerce, Communitech Technology Association, CTT Inc. Major Challenges: Collaborating with competitors; navigating multiple municipal jurisdictions; operating sustainability Major Successes: Joint Advocacy resulting in: • Proposed 300 net new acres of employment land • New investment in physician recruitment and provincial capital investment • Entrepreneurship Hall of Fame

Waterloo Region Immigrant Employment Network Key Partners: Community foundations, Prosperity partners, Immigrants, Settlement organizations, Governments, Educational institutions Major Challenges: Collaborating with multiple stakeholders; Engaging employers Major Successes: Launch of network

Waterloo Region Immigrant Employment Network Key Partners: Community foundations, Prosperity partners, Immigrants, Settlement organizations, Governments, Educational institutions Major Challenges: Collaborating with multiple stakeholders; Engaging employers Major Successes: Launch of network

Chamber Health Care Recruitment Council Key Partners: Hospitals, Corporations, Municipalities, Postsecondary institutions, Physicians Major Challenges: Continued Shortages (~40), other healthcare fundraising campaigns, recognition of foreign-trained credentials, competing jurisdictions Major Successes: • Regained Underserviced Area Designation allowing financial incentives • Recruited 94 physicians in past 9 years (6 in 2006) • Recruited six corporate investors in 2006

Chamber Health Care Recruitment Council Key Partners: Hospitals, Corporations, Municipalities, Postsecondary institutions, Physicians Major Challenges: Continued Shortages (~40), other healthcare fundraising campaigns, recognition of foreign-trained credentials, competing jurisdictions Major Successes: • Regained Underserviced Area Designation allowing financial incentives • Recruited 94 physicians in past 9 years (6 in 2006) • Recruited six corporate investors in 2006