a40050e433ec7cdcba11ef0c3e4f6577.ppt

- Количество слайдов: 28

Reframing the Debate: A Revenue, Not a Spending, Problem Dr. William Barclay Chicago Political Economy Group Testimony to Illinois Legislative Pension Committee Hearing July 8, 2013

Dr. William Barclay - Background Worked 22 years at Chicago exchanges ◦ Mid. America Commodity Exchange, CBOT, CBOE and Chicago Stock Exchange ◦ Responsibilities included: Product development Strategic planning Market research ◦ Worked with: Exchange staff Members (individual and institutions) Regulators: CFTC and SEC ◦ Occasional trader of derivative products Founding member Chicago Political Economy Group (CPEG) Dr. William Barclay, CPEG 7/8/2013 2

Financial Transaction Tax

A Revenue Source What do Switzerland, Australia, Hong Kong and Singapore have in common? ◦ They are all ranked in the top 5 countries on the Heritage Foundation’s “Index of Economic Freedom. ” ◦ They also all have a financial transaction tax (FTT). FTTs are, therefore: ◦ Not an unusual tax. ◦ Not a threat to successful financial markets. Keynes, James Tobin and Larry Summers have all advocated FTTs – as did Pope Benedict XVI. Dr. William Barclay, CPEG 7/8/2013 4

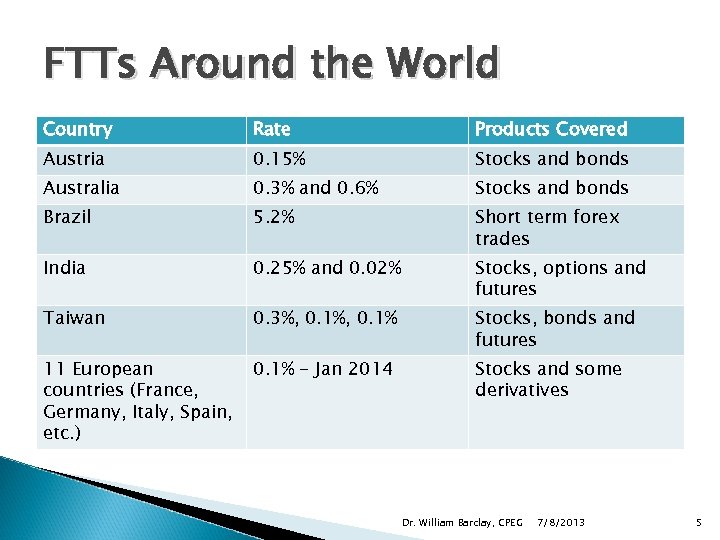

FTTs Around the World Country Rate Products Covered Austria 0. 15% Stocks and bonds Australia 0. 3% and 0. 6% Stocks and bonds Brazil 5. 2% Short term forex trades India 0. 25% and 0. 02% Stocks, options and futures Taiwan 0. 3%, 0. 1% Stocks, bonds and futures 11 European countries (France, Germany, Italy, Spain, etc. ) 0. 1% - Jan 2014 Stocks and some derivatives Dr. William Barclay, CPEG 7/8/2013 5

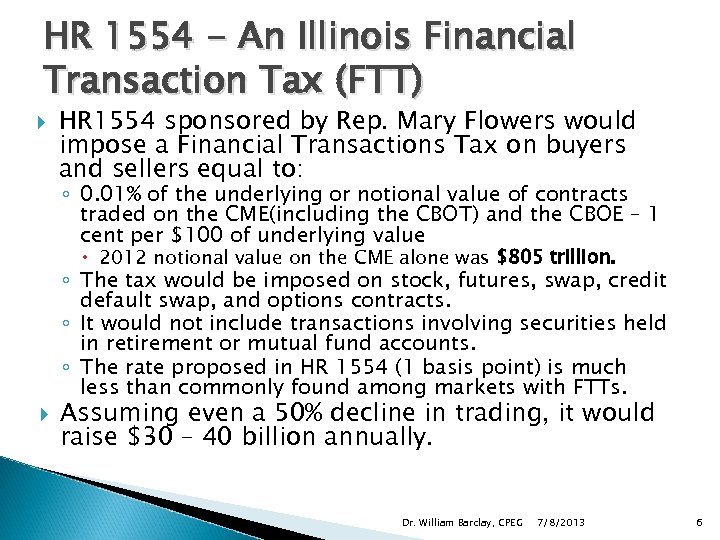

HR 1554 - An Illinois Financial Transaction Tax (FTT) HR 1554 sponsored by Rep. Mary Flowers would impose a Financial Transactions Tax on buyers and sellers equal to: ◦ 0. 01% of the underlying or notional value of contracts traded on the CME(including the CBOT) and the CBOE – 1 cent per $100 of underlying value 2012 notional value on the CME alone was $805 trillion. ◦ The tax would be imposed on stock, futures, swap, credit default swap, and options contracts. ◦ It would not include transactions involving securities held in retirement or mutual fund accounts. ◦ The rate proposed in HR 1554 (1 basis point) is much less than commonly found among markets with FTTs. Assuming even a 50% decline in trading, it would raise $30 – 40 billion annually. Dr. William Barclay, CPEG 7/8/2013 6

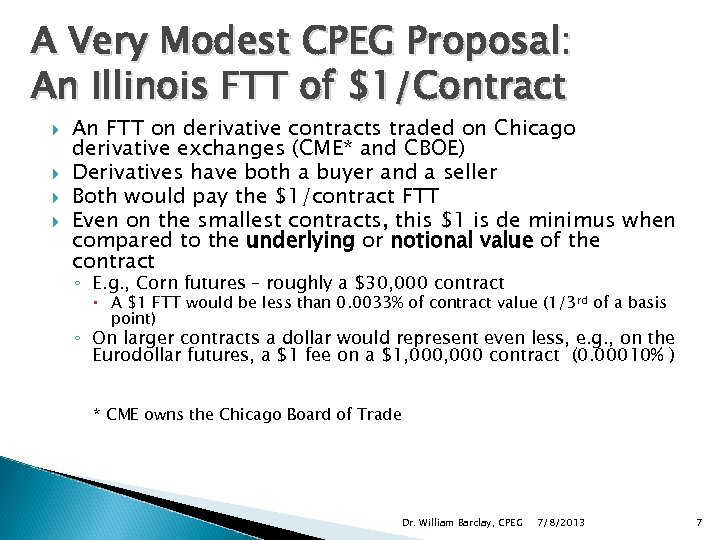

A Very Modest CPEG Proposal: An Illinois FTT of $1/Contract An FTT on derivative contracts traded on Chicago derivative exchanges (CME* and CBOE) Derivatives have both a buyer and a seller Both would pay the $1/contract FTT Even on the smallest contracts, this $1 is de minimus when compared to the underlying or notional value of the contract ◦ E. g. , Corn futures – roughly a $30, 000 contract A $1 FTT would be less than 0. 0033% of contract value (1/3 rd of a basis point) ◦ On larger contracts a dollar would represent even less, e. g. , on the Eurodollar futures, a $1 fee on a $1, 000 contract (0. 00010% ) * CME owns the Chicago Board of Trade Dr. William Barclay, CPEG 7/8/2013 7

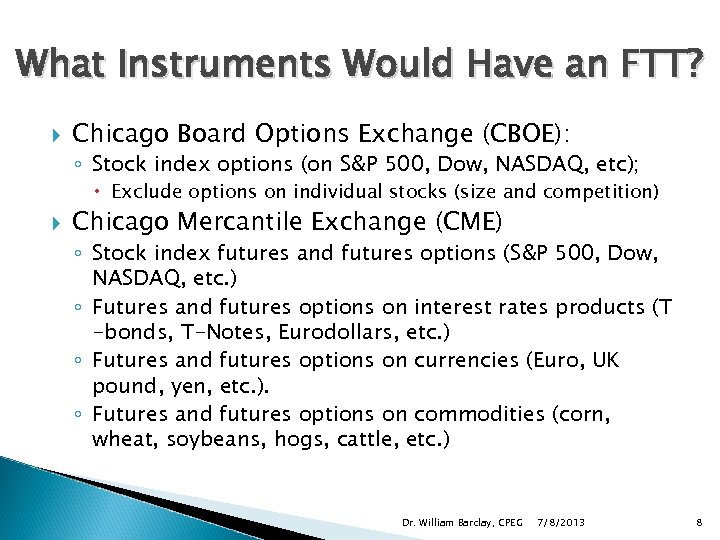

What Instruments Would Have an FTT? Chicago Board Options Exchange (CBOE): ◦ Stock index options (on S&P 500, Dow, NASDAQ, etc); Exclude options on individual stocks (size and competition) Chicago Mercantile Exchange (CME) ◦ Stock index futures and futures options (S&P 500, Dow, NASDAQ, etc. ) ◦ Futures and futures options on interest rates products (T -bonds, T-Notes, Eurodollars, etc. ) ◦ Futures and futures options on currencies (Euro, UK pound, yen, etc. ). ◦ Futures and futures options on commodities (corn, wheat, soybeans, hogs, cattle, etc. ) Dr. William Barclay, CPEG 7/8/2013 8

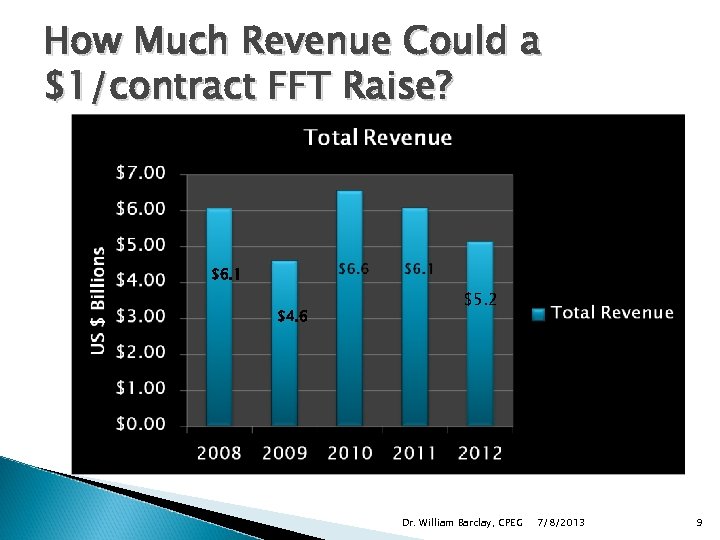

How Much Revenue Could a $1/contract FFT Raise? $6. 1 $4. 6 $5. 2 Dr. William Barclay, CPEG 7/8/2013 9

All Taxes Face Counter Arguments The most common one is: “The exchanges will move out of state. ” Another common one is: “Traders will take their business elsewhere. ” Yet another one is: “The tax could be easily evaded and/or costly to collect. ” Let’s consider each in turn by looking at the economic arithmetic of an FTT (the incentives involved). Dr. William Barclay, CPEG 7/8/2013 10

The Economic Arithmetic of an FTT: Exchanges The relevant question: Have exchanges moved when FTTs were implemented? No – this has not occurred. Why? The tax is not paid by the exchange. There is no economic incentive for the exchange to move. ◦ An FTT is levied on the act of trading. The exchange simply functions as the collection agency for an FTT. Dr. William Barclay, CPEG 7/8/2013 11

The Economic Arithmetic of an FTT for Traders: I Consider 3 very active futures contracts: Corn: E-Mini S&P 500: 10 Year T-Note: A $1/contract FTT is less than the minimum tick. ◦ Each contract is for 5000 bushels ◦ Smallest price change (minimum tick) is $0. 0025 = $12. 50 ◦ Each contract is $50 x the index (about $81, 000 today) ◦ Minimum tick (smallest price change) is. 25 index points = $12. 50 ◦ Each contract of for $100, 000 face value ◦ Minimum tick is 1/64 of a point = $15. 625 Dr. William Barclay, CPEG 7/8/2013 12

The Economic Arithmetic of an FTT for Traders: II Consider this economic arithmetic from the perspective of a trader (hedger, e. g. , farmer, portfolio manager) or a speculator: If the $1/contract FTT was levied, the trader would give up a fraction of the smallest first and last price change: ◦ $1 of $6. 25, $12. 50 or $15. 625 ($25 on the big S&P 500 Index futures) ◦ What kind of trading strategy or trader is looking for price changes less than the smallest amount a contract can change in value? Another way of thinking about this: The $1/contract FTT is significantly less than the difference between the bid and ask prices for these contracts. The economic incentive for a trader to move is very limited. Dr. William Barclay, CPEG 7/8/2013 13

The Economic Arithmetic of an FTT for Traders: III The relevant question: To where would traders go? Some products trade under exclusive licenses. ◦ These include almost all stock index products. Derivative exchange competition is not primarily product based. ◦ Very few identical products are listed on different derivative exchanges. ◦ This may reflect 1980 s/early 1990 s competition in FX and petroleum products. Consistent outcome: one exchange won all the volume. It also reflects the problem of liquidity creation in derivatives trading. Dr. William Barclay, CPEG 7/8/2013 14

Administering an FTT The argument that an FTT would be easy to evade/costly to administer also has little merit. Clearing houses match and clear all trades (CME’s Clearing House and OCC for CBOE). The CH already serves as a collection agency for transaction fees. The CH could easily collect an FTT. Thus an FTT is very low cost to administer and difficult to evade. Dr. William Barclay, CPEG 7/8/2013 15

Who Would Pay the FTT? The FFT is on the act of trading – like a sales tax for buying clothes, food, a car, etc. ◦ It is on both buying and selling the derivative. The FFT is a very progressive tax because of who trades and thus who would pay the tax : ◦ Institutions such as banks, hedge funds, brokerdealers ◦ High-income individuals ◦ Day traders Dr. William Barclay, CPEG 7/8/2013 16

FFT: A Tax for the People, Not on the People What is good tax policy: ◦ A good tax should be a small amount for any single event. ◦ A good tax should fall on those able to bear the tax. ◦ A good tax should tax activity that we want to limit or discourage. Lord Adair Turner – much of what goes on in finance is “socially useless” activity. ◦ A good tax should further economic or social justice. Dr. William Barclay, CPEG 7/8/2013 17

An FTT is Good Tax Policy A $1/contract FTT meets the criteria for a good tax: ◦ The FFT rate is very low compared to the value of a contract. Total notional value of trading on the CME in 2012 was $806 trillion. ◦ The FFT would fall primarily on high income individuals and wealthy institutions. ◦ The FFT would probably discourage some “socially useless” short term trading. ◦ An FFT taxes the sector that caused the financial crisis that led to the Great Recession. Dr. William Barclay, CPEG 7/8/2013 18

“When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done. ” - John Maynard Keynes Dr. William Barclay, CPEG 7/8/2013 19

A Graduated Income Tax Raising Revenue from Those Who Can Afford It

Taxes in Illinois Some claim Illinois is a high tax state. That depends on where your household falls in the income continuum. Consider all major taxes: income, property and sales taxes. ◦ IL bottom quintile households pay taxes at the 2 nd highest rate in the US. ◦ Middle income quintile households pay taxes at the 5 th highest rate in the US. ◦ However, top 1% income households pay taxes at the only the 30 th highest rate in the US. ◦ The next 4% of households by income pay taxes at only the 15 th highest rate in the US. A graduated income tax would help remedy this unfair distribution of taxation. Dr. William Barclay, CPEG 7/8/2013 21

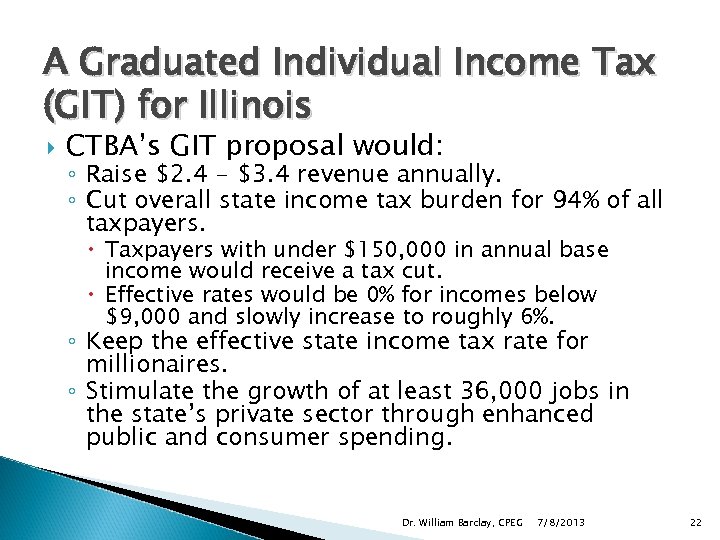

A Graduated Individual Income Tax (GIT) for Illinois CTBA’s GIT proposal would: ◦ Raise $2. 4 - $3. 4 revenue annually. ◦ Cut overall state income tax burden for 94% of all taxpayers. Taxpayers with under $150, 000 in annual base income would receive a tax cut. Effective rates would be 0% for incomes below $9, 000 and slowly increase to roughly 6%. ◦ Keep the effective state income tax rate for millionaires. ◦ Stimulate the growth of at least 36, 000 jobs in the state’s private sector through enhanced public and consumer spending. Dr. William Barclay, CPEG 7/8/2013 22

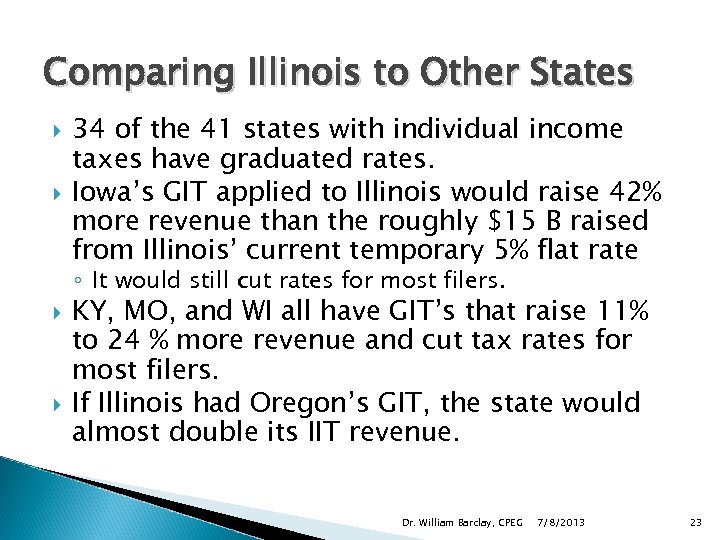

Comparing Illinois to Other States 34 of the 41 states with individual income taxes have graduated rates. Iowa’s GIT applied to Illinois would raise 42% more revenue than the roughly $15 B raised from Illinois’ current temporary 5% flat rate ◦ It would still cut rates for most filers. KY, MO, and WI all have GIT’s that raise 11% to 24 % more revenue and cut tax rates for most filers. If Illinois had Oregon’s GIT, the state would almost double its IIT revenue. Dr. William Barclay, CPEG 7/8/2013 23

Raising Revenue by Closing Tax Loopholes A Summary of Dr. Ron Baiman’s July 3, 2013, Testimony

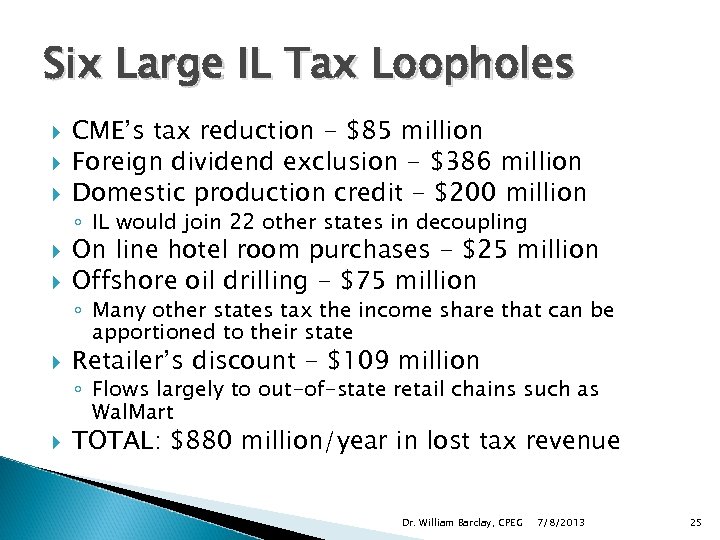

Six Large IL Tax Loopholes CME’s tax reduction - $85 million Foreign dividend exclusion - $386 million Domestic production credit - $200 million ◦ IL would join 22 other states in decoupling On line hotel room purchases - $25 million Offshore oil drilling - $75 million ◦ Many other states tax the income share that can be apportioned to their state Retailer’s discount - $109 million ◦ Flows largely to out-of-state retail chains such as Wal. Mart TOTAL: $880 million/year in lost tax revenue Dr. William Barclay, CPEG 7/8/2013 25

IL Tax Loopholes vs. Pension Funding Gap Allocate the $880 million to a dedicated fund. Use the same IDOR return and investment assumptions that underlie the $95 billion “pension shortfall. ” Use IDOR’s same 33 year period. Net present value of these 6 tax loopholes: $70. 5 billion Dr. William Barclay, CPEG 7/8/2013 26

A Summing Up Illinois has potential revenue sources. Illinois can enact legislation that would: ◦ Solve the “pension funding crisis. ” ◦ Not take away from teachers, state employees, and others their earned benefits. ◦ Pass constitutional scrutiny. An FTT is a particularly attractive path. It is time to act. Dr. William Barclay, CPEG 7/8/2013 27

Dr. William Barclay, CPEG 7/8/2013 28

a40050e433ec7cdcba11ef0c3e4f6577.ppt