fe50ef091a79e875eb6d1dce98e64e77.ppt

- Количество слайдов: 31

Referrals/Earn Your Business/Expansion Not to be used in New York. © 2013 -2014 Primerica/48386/8. 14/US/11 PFS 648 -21

5 Reasons People Desire a Change… 1. They don’t like their current job and are looking for a career change & better income potential. 2. They love what they do… but earning extra part-time income each month would make a positive difference. 3. They want to get a financial education so they can learn how to win the money game. 4. They love helping people and making a difference. 5. They dream of having their own business. Can you see how most people would be interested in at least one of these areas?

• Founded in 1977 with 85 people • More than 4 million lives insured and more than 2 million client investment accounts. • Largest financial services marketing organization in North America • Listed on NYSE (PRI) All of this without any national TV or radio advertising

Ask Yourself Three Questions As We Go Through The Presentation 1. Is there a need for what we do? 2. Are these financial concepts helpful for you? 3. If your family and friends implemented these concepts, would they be better off? Our Mission: To help families earn more income and become properly protected, debt free and financially independent

The Headlines Tell The Story Six in 10 workers say that they are living paycheck to paycheck. Career. Builder. com Survey, April 12, 2014 The average American household with at least one credit card has nearly $15, 950 in credit card debt. ” CNNMoney. com, viewed July 18, 2013 More than half of Americans have no emergency savings. Time. com, August 11, 2014 Bankruptcies topped 1. 5 million CNNMoney. com, January 3, 2013 95 million U. S. adults have no life insurance. LIMRA, “Facts About Life 2011, ” September 2013 More than half of all workers have less than $25, 000 in savings and investments for retirement. The typical American household made less money last year than the typical household made a full decade ago. How real and serious are these problems?

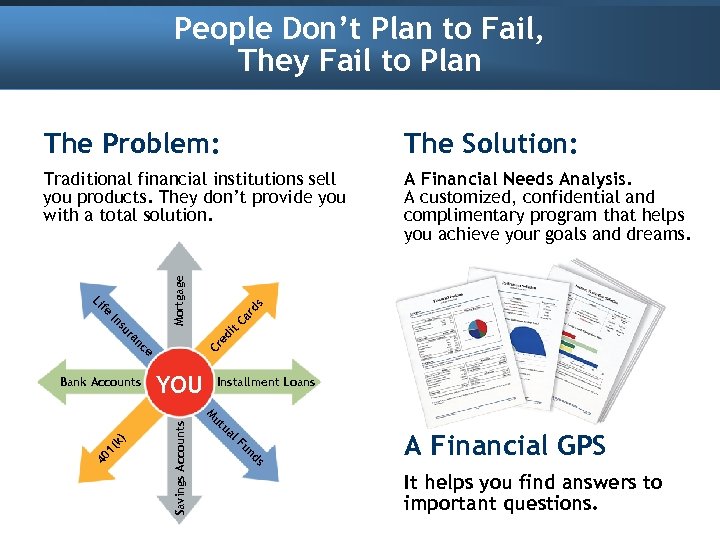

People Don’t Plan to Fail, They Fail to Plan The Solution: Traditional financial institutions sell you products. They don’t provide you with a total solution. A Financial Needs Analysis. A customized, confidential and complimentary program that helps you achieve your goals and dreams. nc e YOU Savings Accounts k) 40 1( rd s Cr ed a ur Bank Accounts Ca s In it fe Li Mortgage The Problem: Installment Loans M ut ua l. F un ds A Financial GPS It helps you find answers to important questions.

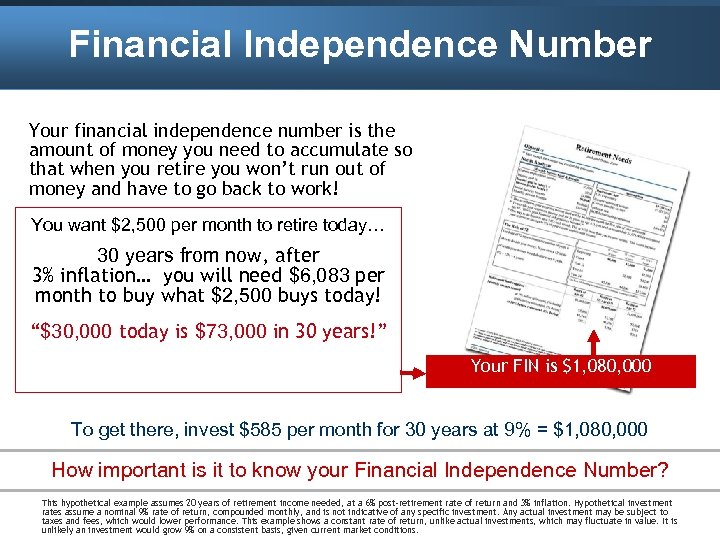

Financial Independence Number Your financial independence number is the amount of money you need to accumulate so that when you retire you won’t run out of money and have to go back to work! You want $2, 500 per month to retire today… 30 years from now, after 3% inflation… you will need $6, 083 per month to buy what $2, 500 buys today! “$30, 000 today is $73, 000 in 30 years!” Your FIN is $1, 080, 000 To get there, invest $585 per month for 30 years at 9% = $1, 080, 000 How important is it to know your Financial Independence Number? This hypothetical example assumes 20 years of retirement income needed, at a 6% post-retirement rate of return and 3% inflation. Hypothetical investment rates assume a nominal 9% rate of return, compounded monthly, and is not indicative of any specific investment. Any actual investment may be subject to taxes and fees, which would lower performance. This example shows a constant rate of return, unlike actual investments, which may fluctuate in value. It is unlikely an investment would grow 9% on a consistent basis, given current market conditions.

Bypass the Middleman — Become an Owner, Not a Loaner Traditional Financial Institutions Banks, Credit Unions, Insurance Companies = Historically Low Rates of Return Do The Banks Want You To Know This? CDs and savings accounts are generally FDIC insured up to $250, 000. Cash value life insurance offers life insurance components in addition to the investment component.

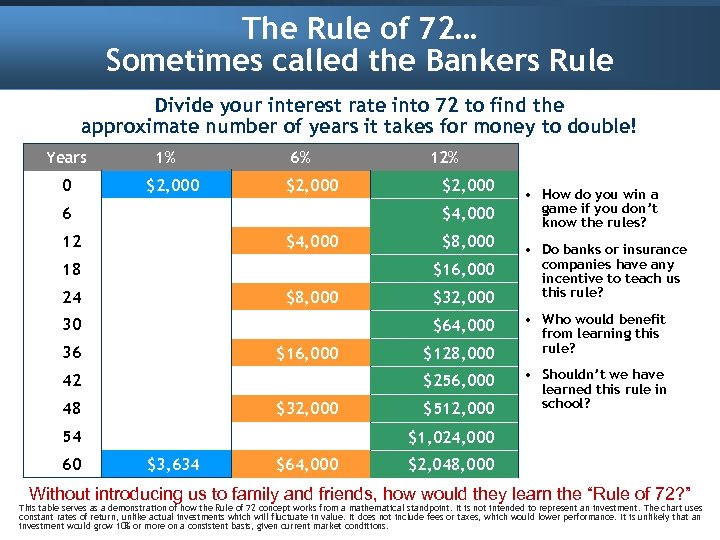

The Rule of 72… Sometimes called the Bankers Rule Divide your interest rate into 72 to find the approximate number of years it takes for money to double! Years 0 1% $2, 000 6% $2, 000 $4, 000 6 $4, 000 12 $8, 000 $16, 000 18 24 $8, 000 30 $32, 000 $64, 000 36 $16, 000 $128, 000 $256, 000 42 48 $32, 000 54 60 12% $512, 000 • How do you win a game if you don’t know the rules? • Do banks or insurance companies have any incentive to teach us this rule? • Who would benefit from learning this rule? • Shouldn’t we have learned this rule in school? $1, 024, 000 $3, 634 $64, 000 $2, 048, 000 Without introducing us to family and friends, how would they learn the “Rule of 72? ” This table serves as a demonstration of how the Rule of 72 concept works from a mathematical standpoint. It is not intended to represent an investment. The chart uses constant rates of return, unlike actual investments which will fluctuate in value. It does not include fees or taxes, which would lower performance. It is unlikely that an investment would grow 10% or more on a consistent basis, given current market conditions.

The First Step to Financial Success is Pay Yourself First When you don’t, there’s a high cost of waiting. $100 Monthly Savings @ 9% for 40 Years (Age 27 -67) 27 $471, 640 Wait 1 year ($1, 200) 28 $430, 040 (-$41, 600) Wait 5 years ($6, 000) 32 Wait 15 years 42 ($18, 000) $296, 380 (-$175, 260) $112, 950 (-$358, 690) Who are people hurting if they wait? Rates of return are constant and nominal rates, compounded monthly. Contributions are assumed to be made at the beginning of the month. The chart above is not indicative of any particular investment or savings vehicle where rates of return fluctuate. It does not take into consideration taxes or other applicable deductions, which would lower results.

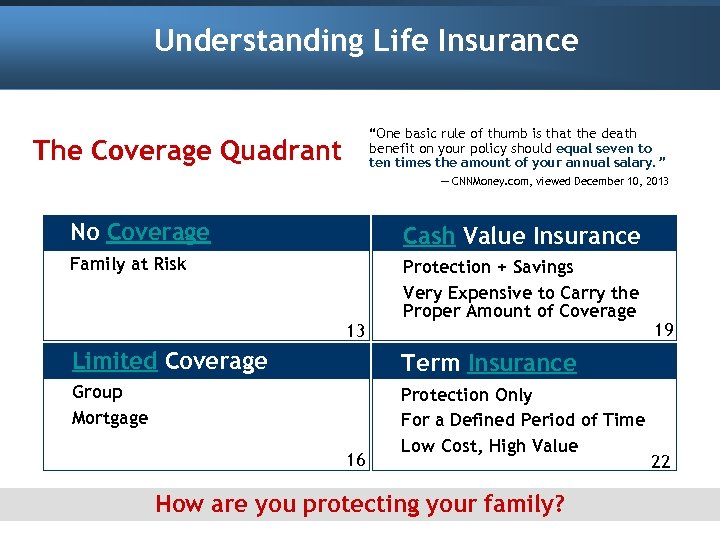

Understanding Life Insurance “One basic rule of thumb is that the death benefit on your policy should equal seven to ten times the amount of your annual salary. ” The Coverage Quadrant — CNNMoney. com, viewed December 10, 2013 No Coverage Cash Value Insurance Family at Risk Protection + Savings Very Expensive to Carry the Proper Amount of Coverage 13 Limited Coverage Term Insurance Group Mortgage Protection Only For a Defined Period of Time Low Cost, High Value 19 16 How are you protecting your family? 22

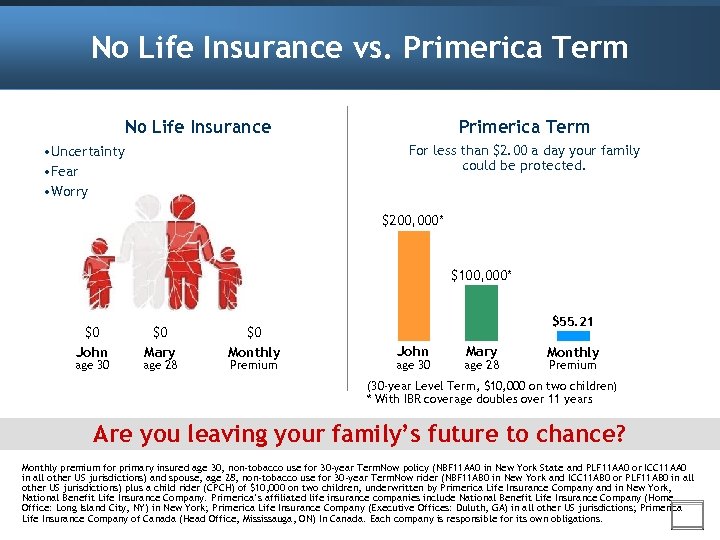

No Life Insurance vs. Primerica Term No Life Insurance • Uncertainty • Fear • Worry For less than $2. 00 a day your family could be protected. $200, 000* $100, 000* $0 John age 30 $0 Mary age 28 $0 Monthly Premium $55. 21 John age 30 Mary age 28 Monthly Premium (30 -year Level Term, $10, 000 on two children) * With IBR coverage doubles over 11 years Are you leaving your family’s future to chance? Monthly premium for primary insured age 30, non-tobacco use for 30 -year Term. Now policy (NBF 11 AA 0 in New York State and PLF 11 AA 0 or ICC 11 AA 0 in all other US jurisdictions) and spouse, age 28, non-tobacco use for 30 -year Term. Now rider (NBF 11 AB 0 in New York and ICC 11 AB 0 or PLF 11 AB 0 in all other US jurisdictions) plus a child rider (CPCH) of $10, 000 on two children, underwritten by Primerica Life Insurance Company and in New York, National Benefit Life Insurance Company. Primerica’s affiliated life insurance companies include National Benefit Life Insurance Company (Home Office: Long Island City, NY) in New York; Primerica Life Insurance Company (Executive Offices: Duluth, GA) in all other US jurisdictions; Primerica Life Insurance Company of Canada (Head Office, Mississauga, ON) In Canada. Each company is responsible for its own obligations.

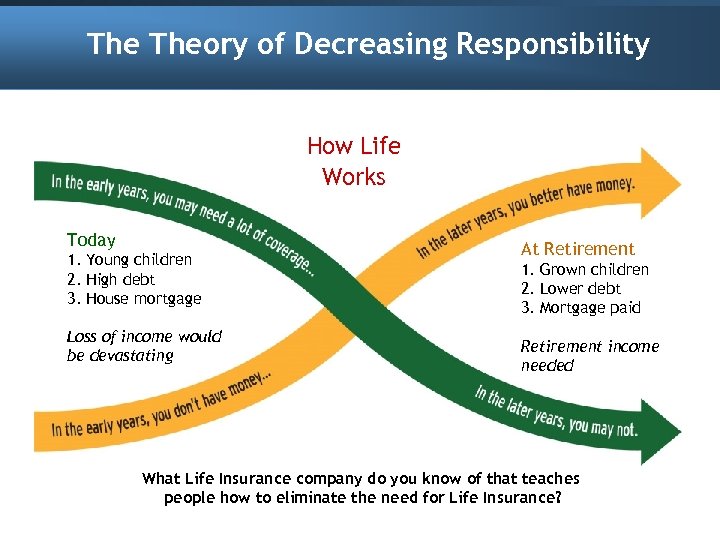

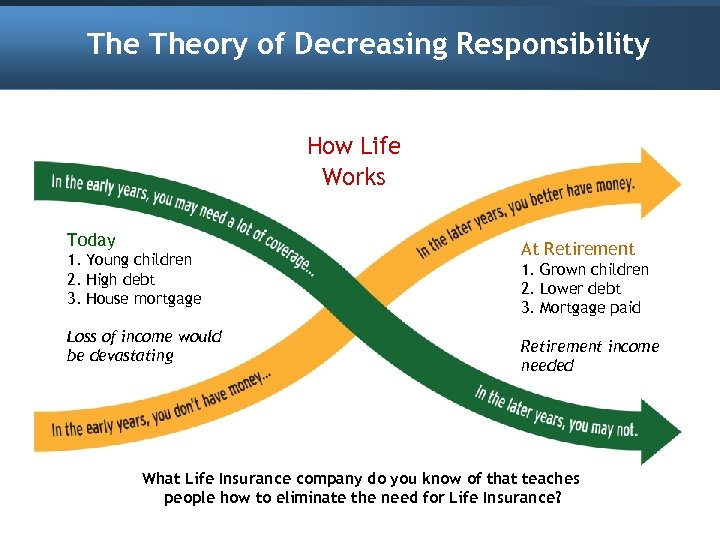

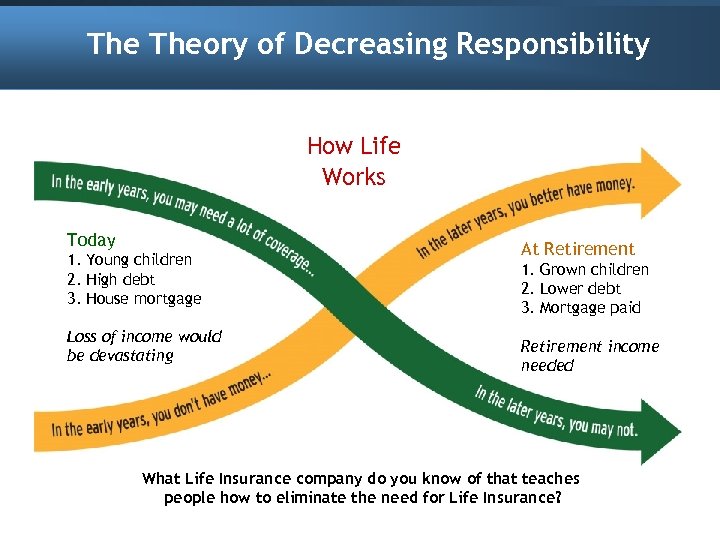

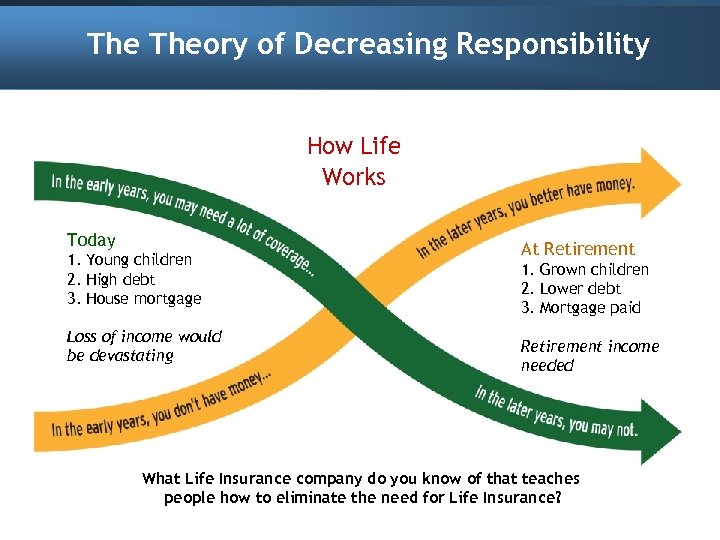

The Theory of Decreasing Responsibility How Life Works Today 1. Young children 2. High debt 3. House mortgage Loss of income would be devastating At Retirement 1. Grown children 2. Lower debt 3. Mortgage paid Retirement income needed What Life Insurance company do you know of that teaches people how to eliminate the need for Life Insurance?

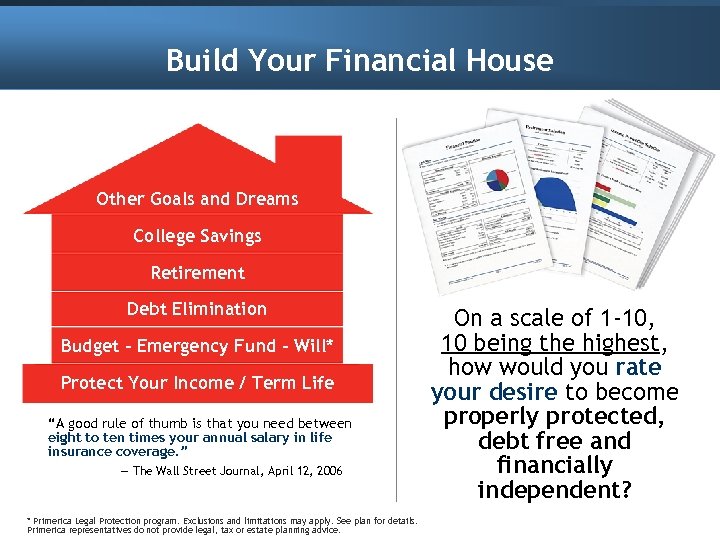

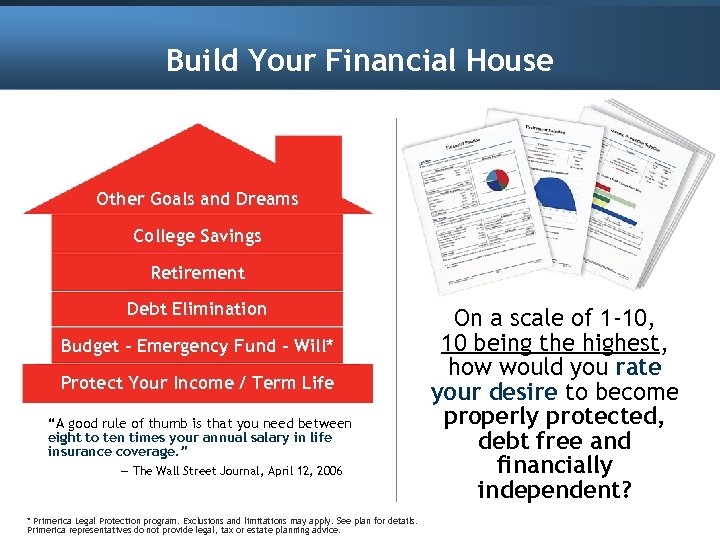

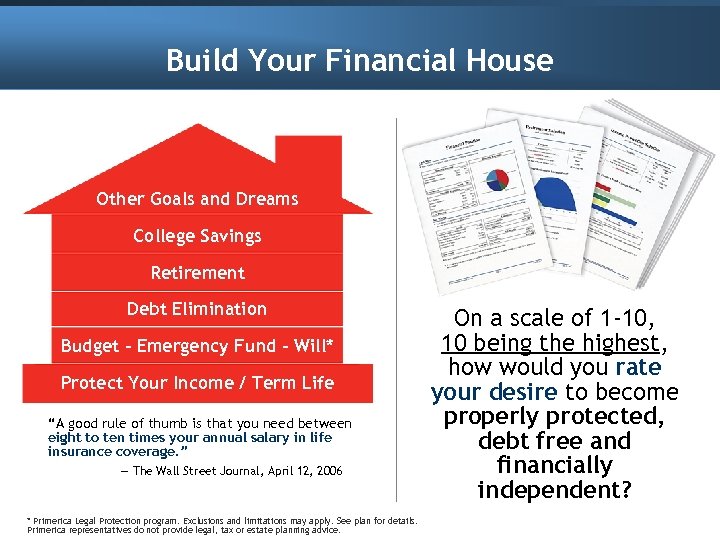

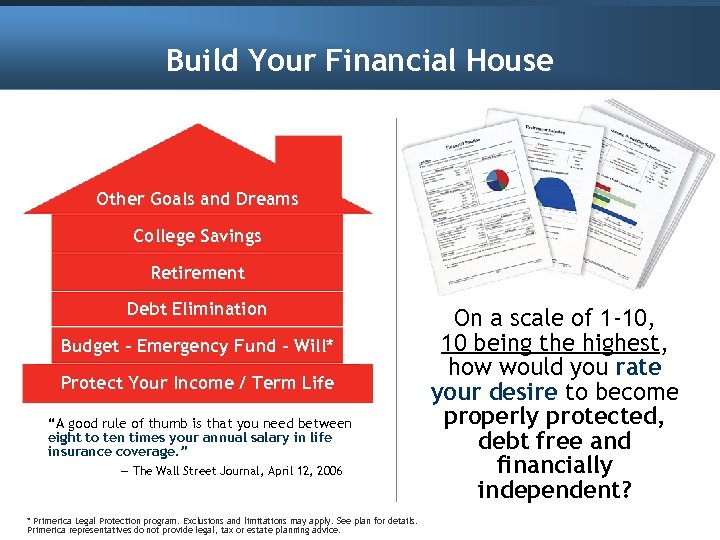

Build Your Financial House Other Goals and Dreams College Savings Retirement Debt Elimination Budget - Emergency Fund - Will* Protect Your Income / Term Life “A good rule of thumb is that you need between eight to ten times your annual salary in life insurance coverage. ” — The Wall Street Journal, April 12, 2006 * Primerica Legal Protection program. Exclusions and limitations may apply. See plan for details. Primerica representatives do not provide legal, tax or estate planning advice. On a scale of 1 -10, 10 being the highest, how would you rate your desire to become properly protected, debt free and financially independent?

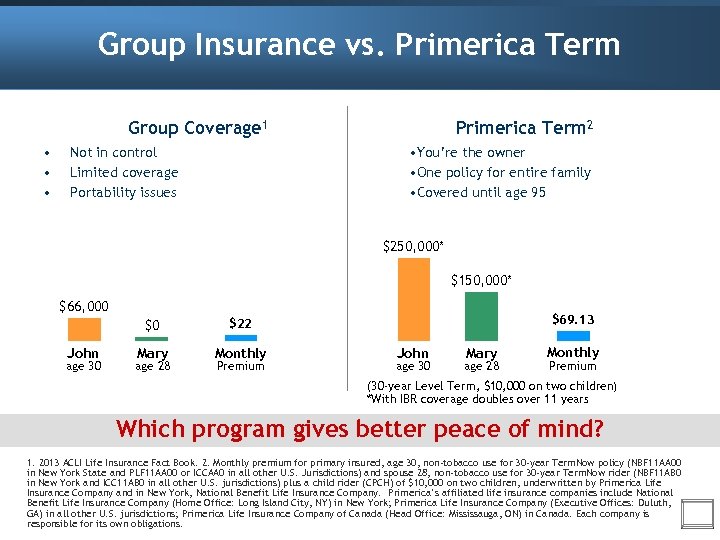

Group Insurance vs. Primerica Term 2 Group Coverage 1 • • You’re the owner • One policy for entire family • Covered until age 95 Not in control Limited coverage Portability issues $250, 000* $150, 000* $66, 000 $0 John age 30 Mary Monthly $69. 13 $22 age 28 Premium John age 30 Mary age 28 Monthly Premium (30 -year Level Term, $10, 000 on two children) *With IBR coverage doubles over 11 years Which program gives better peace of mind? 1. 2013 ACLI Life Insurance Fact Book. 2. Monthly premium for primary insured, age 30, non-tobacco use for 30 -year Term. Now policy (NBF 11 AA 00 in New York State and PLF 11 AA 00 or ICCAA 0 in all other U. S. Jurisdictions) and spouse 28, non-tobacco use for 30 -year Term. Now rider (NBF 11 AB 0 in New York and ICC 11 AB 0 in all other U. S. jurisdictions) plus a child rider (CPCH) of $10, 000 on two children, underwritten by Primerica Life Insurance Company and in New York, National Benefit Life Insurance Company. Primerica’s affiliated life insurance companies include National Benefit Life Insurance Company (Home Office: Long Island City, NY) in New York; Primerica Life Insurance Company (Executive Offices: Duluth, GA) in all other U. S. jurisdictions; Primerica Life Insurance Company of Canada (Head Office: Mississauga, ON) in Canada. Each company is responsible for its own obligations.

The Theory of Decreasing Responsibility How Life Works Today 1. Young children 2. High debt 3. House mortgage Loss of income would be devastating At Retirement 1. Grown children 2. Lower debt 3. Mortgage paid Retirement income needed What Life Insurance company do you know of that teaches people how to eliminate the need for Life Insurance?

Build Your Financial House Other Goals and Dreams College Savings Retirement Debt Elimination Budget - Emergency Fund - Will* Protect Your Income / Term Life “A good rule of thumb is that you need between eight to ten times your annual salary in life insurance coverage. ” — The Wall Street Journal, April 12, 2006 * Primerica Legal Protection program. Exclusions and limitations may apply. See plan for details. Primerica representatives do not provide legal, tax or estate planning advice. On a scale of 1 -10, 10 being the highest, how would you rate your desire to become properly protected, debt free and financially independent?

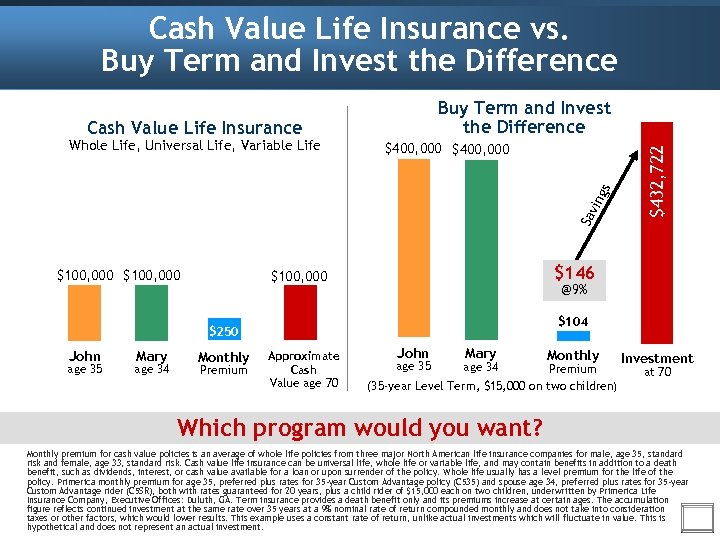

Cash Value Life Insurance vs. Buy Term and Invest the Difference Cash Value Life Insurance $400, 000 Sav i ngs Whole Life, Universal Life, Variable Life $100, 000 $146 $100, 000 @9% $104 $250 John age 35 Mary age 34 Monthly Premium $432, 722 Buy Term and Invest the Difference Approximate Cash Value age 70 John age 35 Mary age 34 Monthly Premium (35 -year Level Term, $15, 000 on two children) Investment at 70 Which program would you want? Monthly premium for cash value policies is an average of whole life policies from three major North American life insurance companies for male, age 35, standard risk and female, age 33, standard risk. Cash value life insurance can be universal life, whole life or variable life, and may contain benefits in addition to a death benefit, such as dividends, interest, or cash value available for a loan or upon surrender of the policy. Whole life usually has a level premium for the life of the policy. Primerica monthly premium for age 35, preferred plus rates for 35 -year Custom Advantage policy (C 535) and spouse age 34, preferred plus rates for 35 -year Custom Advantage rider (C 5 SR), both with rates guaranteed for 20 years, plus a child rider of $15, 000 each on two children, underwritten by Primerica Life Insurance Company, Executive Offices: Duluth, GA. Term insurance provides a death benefit only and its premiums increase at certain ages. The accumulation figure reflects continued investment at the same rate over 35 years at a 9% nominal rate of return compounded monthly and does not take into consideration taxes or other factors, which would lower results. This example uses a constant rate of return, unlike actual investments which will fluctuate in value. This is hypothetical and does not represent an actual investment.

The Theory of Decreasing Responsibility How Life Works Today 1. Young children 2. High debt 3. House mortgage Loss of income would be devastating At Retirement 1. Grown children 2. Lower debt 3. Mortgage paid Retirement income needed What Life Insurance company do you know of that teaches people how to eliminate the need for Life Insurance?

Build Your Financial House Other Goals and Dreams College Savings Retirement Debt Elimination Budget - Emergency Fund - Will* Protect Your Income / Term Life “A good rule of thumb is that you need between eight to ten times your annual salary in life insurance coverage. ” — The Wall Street Journal, April 12, 2006 * Primerica Legal Protection program. Exclusions and limitations may apply. See plan for details. Primerica representatives do not provide legal, tax or estate planning advice. On a scale of 1 -10, 10 being the highest, how would you rate your desire to become properly protected, debt free and financially independent?

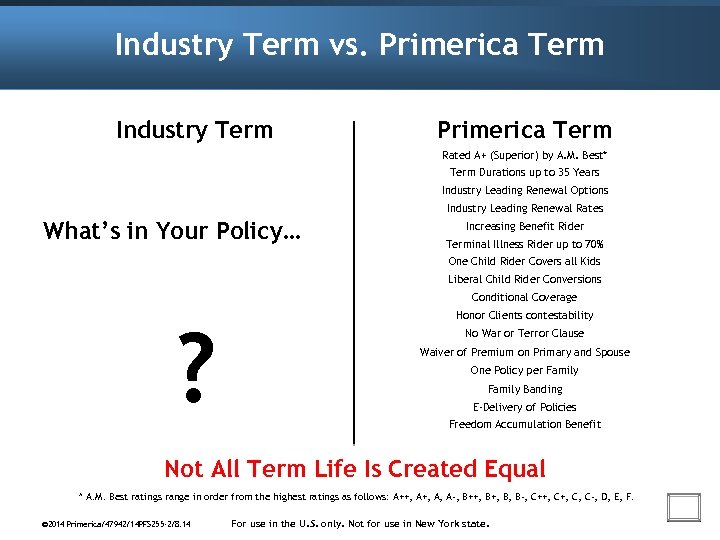

Industry Term vs. Primerica Term Industry Term Primerica Term Rated A+ (Superior) by A. M. Best* Term Durations up to 35 Years Industry Leading Renewal Options Industry Leading Renewal Rates What’s in Your Policy… Increasing Benefit Rider Terminal Illness Rider up to 70% One Child Rider Covers all Kids Liberal Child Rider Conversions Conditional Coverage ? Honor Clients contestability No War or Terror Clause Waiver of Premium on Primary and Spouse One Policy per Family Banding E-Delivery of Policies Freedom Accumulation Benefit Not All Term Life Is Created Equal * A. M. Best ratings range in order from the highest ratings as follows: A++, A, A-, B++, B, B-, C++, C, C-, D, E, F. © 2014 Primerica/47942/14 PFS 255 -2/8. 14 For use in the U. S. only. Not for use in New York state.

The Theory of Decreasing Responsibility How Life Works Today 1. Young children 2. High debt 3. House mortgage Loss of income would be devastating At Retirement 1. Grown children 2. Lower debt 3. Mortgage paid Retirement income needed What Life Insurance company do you know of that teaches people how to eliminate the need for Life Insurance?

Build Your Financial House Other Goals and Dreams College Savings Retirement Debt Elimination Budget - Emergency Fund - Will* Protect Your Income / Term Life “A good rule of thumb is that you need between eight to ten times your annual salary in life insurance coverage. ” — The Wall Street Journal, April 12, 2006 * Primerica Legal Protection program. Exclusions and limitations may apply. See plan for details. Primerica representatives do not provide legal, tax or estate planning advice. On a scale of 1 -10, 10 being the highest, how would you rate your desire to become properly protected, debt free and financially independent?

Business Opportunity Referrals/Earn Your Business/Expansion Not to be used in New York. © 2013 -2014 Primerica/48386/8. 14/US/11 PFS 648 -21

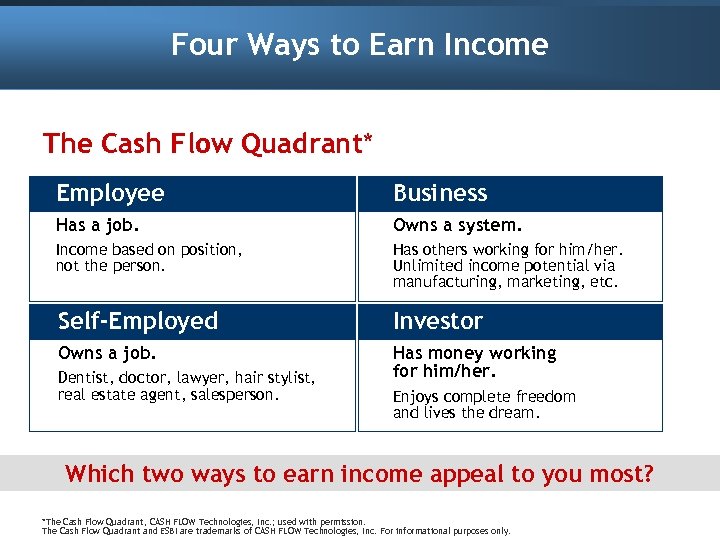

Four Ways to Earn Income The Cash Flow Quadrant* Employee Business Has a job. Owns a system. Income based on position, not the person. Has others working for him/her. Unlimited income potential via manufacturing, marketing, etc. Self-Employed Investor Owns a job. Has money working for him/her. Dentist, doctor, lawyer, hair stylist, real estate agent, salesperson. Enjoys complete freedom and lives the dream. Which two ways to earn income appeal to you most? *The Cash Flow Quadrant, CASH FLOW Technologies, Inc. ; used with permission. The Cash Flow Quadrant and ESBI are trademarks of CASH FLOW Technologies, Inc. For informational purposes only.

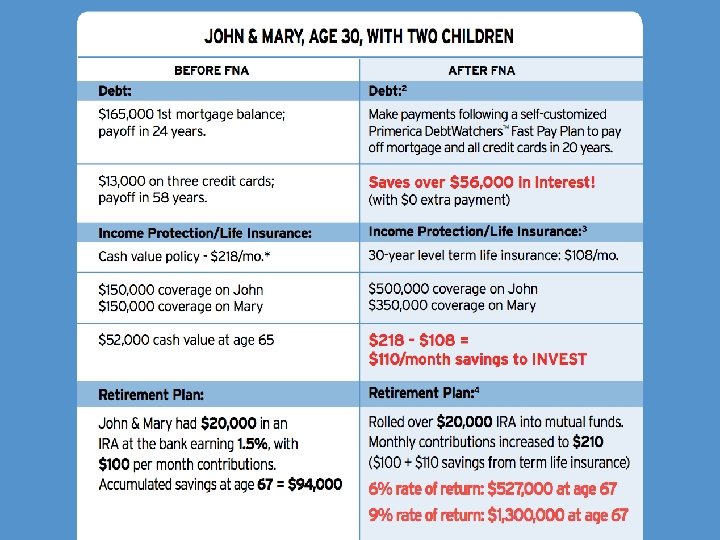

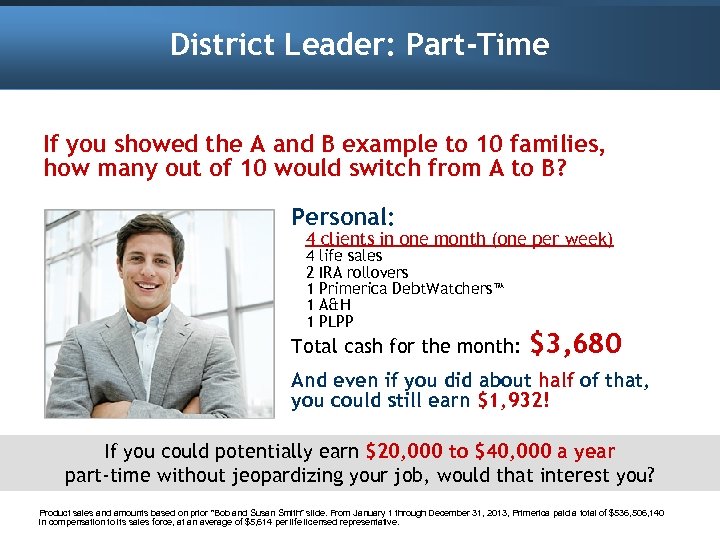

District Leader: Part-Time If you showed the A and B example to 10 families, how many out of 10 would switch from A to B? Personal: 4 clients in one month (one per week) 4 2 1 1 1 life sales IRA rollovers Primerica Debt. Watchers™ A&H PLPP Total cash for the month: $3, 680 And even if you did about half of that, you could still earn $1, 932! If you could potentially earn $20, 000 to $40, 000 a year part-time without jeopardizing your job, would that interest you? Product sales and amounts based on prior “Bob and Susan Smith” slide. From January 1 through December 31, 2013, Primerica paid a total of $536, 506, 140 in compensation to its sales force, at an average of $5, 614 per life licensed representative.

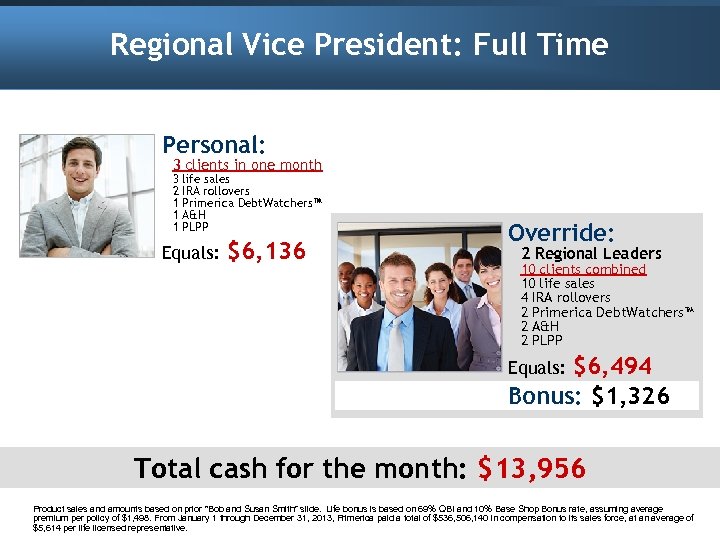

Regional Vice President: Full Time Personal: 3 clients in one month 3 2 1 1 1 life sales IRA rollovers Primerica Debt. Watchers™ A&H PLPP Equals: $6, 136 Override: 2 Regional Leaders 10 clients combined 10 life sales 4 IRA rollovers 2 Primerica Debt. Watchers™ 2 A&H 2 PLPP $6, 494 Bonus: $1, 326 Equals: Total cash for the month: $13, 956 Product sales and amounts based on prior “Bob and Susan Smith” slide. Life bonus is based on 69% QBI and 10% Base Shop Bonus rate, assuming average premium per policy of $1, 498. From January 1 through December 31, 2013, Primerica paid a total of $536, 506, 140 in compensation to its sales force, at an average of $5, 614 per life licensed representative.

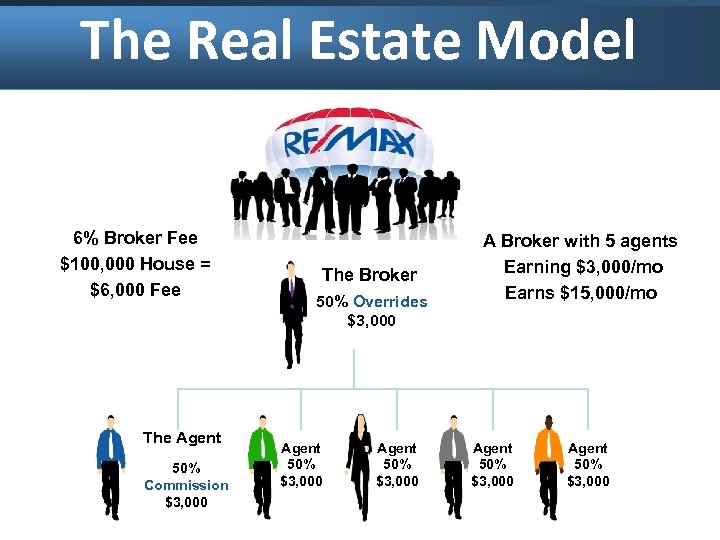

The Real Estate Model 6% Broker Fee $100, 000 House = $6, 000 Fee The Agent 50% Commission $3, 000 The Broker 50% Overrides $3, 000 Agent 50% $3, 000 A Broker with 5 agents Earning $3, 000/mo Earns $15, 000/mo Agent 50% $3, 000

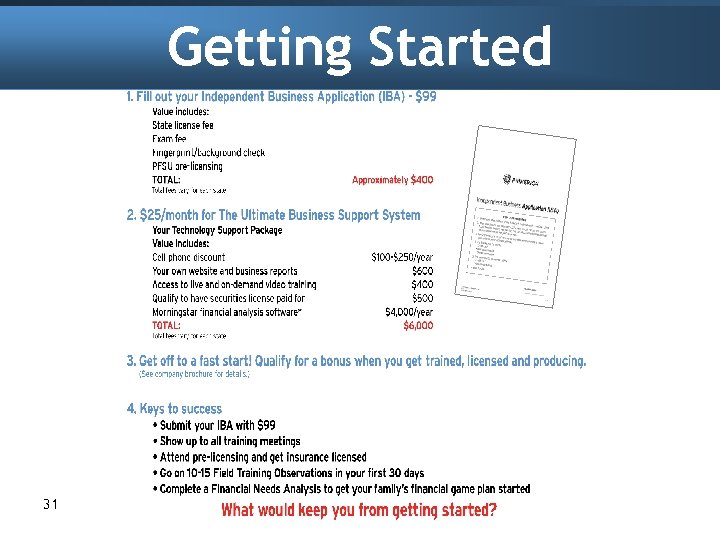

Getting Started 31

fe50ef091a79e875eb6d1dce98e64e77.ppt