d4e523e72903cd86a90d41c9c7a5a601.ppt

- Количество слайдов: 36

RECTIFICATION OF MISTAKE UNDER SECTION 154 OF THE INCOME TAX ACT, 1961 CA. MAHENDRA SANGHVI 18 -Apr-15 1

RECTIFICATION OF MISTAKE UNDER SECTION 154 OF THE INCOME TAX ACT, 1961 CA. MAHENDRA SANGHVI 18 -Apr-15 1

Section 154 empowers the Income tax authority to rectify any mistake which is apparent from the record and amend: a. any order passed by the Income tax authority under the provisions of the Act: b. any Intimation or deemed intimation under section 143(1): c. any Intimation under section 200 A(1). The authority concerned— (i) may make an amendment of its own motion, and (ii) shall make such amendment for rectifying any such mistake which has been brought to its notice by the assessee or by the deductor and where the authority concerned is the Commissioner (Appeals), by the Assessing Officer also. 18 -Apr-15 2

Section 154 empowers the Income tax authority to rectify any mistake which is apparent from the record and amend: a. any order passed by the Income tax authority under the provisions of the Act: b. any Intimation or deemed intimation under section 143(1): c. any Intimation under section 200 A(1). The authority concerned— (i) may make an amendment of its own motion, and (ii) shall make such amendment for rectifying any such mistake which has been brought to its notice by the assessee or by the deductor and where the authority concerned is the Commissioner (Appeals), by the Assessing Officer also. 18 -Apr-15 2

(iii) An amendment, which has the effect of enhancing an assessment or reducing a refund or otherwise increasing the liability of the assessee, shall not be made under this section unless the authority concerned has given notice to the assessee of its intention so to do and has allowed the assessee a reasonable opportunity of being heard. (iv) Where an amendment is made under this section, an order shall be passed in writing by the income-tax authority concerned. (v) Where any such amendment has the effect of reducing the assessment, the Assessing Officer shall make any refund which may be due to such assessee or the deductor. (vi) Where any such amendment has the effect of enhancing the assessment or reducing a refund already made or otherwise increasing the liability of the assessee or deductor, the Assessing Officer shall serve on the assessee a notice of demand in the prescribed form specifying the sum payable, and such notice of demand shall be deemed to be issued under section 156 and the provisions of this Act shall apply accordingly. 18 -Apr-15 3

(iii) An amendment, which has the effect of enhancing an assessment or reducing a refund or otherwise increasing the liability of the assessee, shall not be made under this section unless the authority concerned has given notice to the assessee of its intention so to do and has allowed the assessee a reasonable opportunity of being heard. (iv) Where an amendment is made under this section, an order shall be passed in writing by the income-tax authority concerned. (v) Where any such amendment has the effect of reducing the assessment, the Assessing Officer shall make any refund which may be due to such assessee or the deductor. (vi) Where any such amendment has the effect of enhancing the assessment or reducing a refund already made or otherwise increasing the liability of the assessee or deductor, the Assessing Officer shall serve on the assessee a notice of demand in the prescribed form specifying the sum payable, and such notice of demand shall be deemed to be issued under section 156 and the provisions of this Act shall apply accordingly. 18 -Apr-15 3

(vii) Save as otherwise provided in section 155 or sub-section (4) of section 186 no amendment under this section shall be made after the expiry of four years from the end of the financial year in which the order sought to be amended was passed (viii) Without prejudice to the provisions of sub-section (7), where an application for amendment under this section is made by the assessee on or after the 1 st day of June, 2001 to an income-tax authority referred to in subsection (1), the authority shall pass an order, within a period of six months from the end of the month in which the application is received by it, — (a) making the amendment; or (b) refusing to allow the claim. 18 -Apr-15 4

(vii) Save as otherwise provided in section 155 or sub-section (4) of section 186 no amendment under this section shall be made after the expiry of four years from the end of the financial year in which the order sought to be amended was passed (viii) Without prejudice to the provisions of sub-section (7), where an application for amendment under this section is made by the assessee on or after the 1 st day of June, 2001 to an income-tax authority referred to in subsection (1), the authority shall pass an order, within a period of six months from the end of the month in which the application is received by it, — (a) making the amendment; or (b) refusing to allow the claim. 18 -Apr-15 4

1) Let us understand the meaning of certain terms used in the section: A. Record ‘Record’ includes the entire proceedings The ‘record’ referred to in section 154 does not mean only the order of assessment but it comprises all proceedings on which the assessment order is based and the assessing officer is entitled for the purpose of exercising his juris diction under section 154 to look into the whole evidence and the law applicable to ascertain whethere was an error. ‘Record’ under section 154 means record of the case comprising the entire proceedings including documents and materials produced by the parties and taken on record by the authorities which were available at the time of passing of the order which is the sub ject matter of the proceedings for rectification. hey cannot T go beyond the records and look into fresh evidence or materials which were not on record at the time the order sought to be rectified was passed Gammon India Ltd. v. CIT [1995] 214 ITR 50 (Bom. ). 18 -Apr-15 5

1) Let us understand the meaning of certain terms used in the section: A. Record ‘Record’ includes the entire proceedings The ‘record’ referred to in section 154 does not mean only the order of assessment but it comprises all proceedings on which the assessment order is based and the assessing officer is entitled for the purpose of exercising his juris diction under section 154 to look into the whole evidence and the law applicable to ascertain whethere was an error. ‘Record’ under section 154 means record of the case comprising the entire proceedings including documents and materials produced by the parties and taken on record by the authorities which were available at the time of passing of the order which is the sub ject matter of the proceedings for rectification. hey cannot T go beyond the records and look into fresh evidence or materials which were not on record at the time the order sought to be rectified was passed Gammon India Ltd. v. CIT [1995] 214 ITR 50 (Bom. ). 18 -Apr-15 5

Documents outside the record cannot be referred to Under sec tion 154, there has to be a mistake apparent from the record. In other words, a look at the record must show that there has been an error and that error may be rectified. Reference to documents outside the record and the law is impermissible when applying the provisions of section 154 CIT v. Keshri Metal (P. ) Ltd. [1999] 237 ITR 165 (SC). The ‘record’ for purpose of section 154(1) is the record available to the authorities at the time of initiation of the proceedings for rectification and not merely the record of the original proceeding sought to be rectified CIT v. M. R. M. Plantations (P. ) Ltd. [1999] 240 ITR 660 (Mad. ). Entire record of the assessee can be looked into The power of rectification under section 154 is to be exercised with reference to the records of the assessee available with the Assessing Officer and not with particular reference to the assessment alone. The error apparent on the face of the record cannot be said to be the record of one particular assessment but the entire record of the assessee relating to all the assessment years Upasana Hospital and Nursing Home v. CIT [2002] 253 ITR 507 (Ker. ). Also ref: Mahendra Mills Ltd Vs. P. B. Desai, ACIT (1975) 99 ITR 135 (SC). 18 -Apr-15 6

Documents outside the record cannot be referred to Under sec tion 154, there has to be a mistake apparent from the record. In other words, a look at the record must show that there has been an error and that error may be rectified. Reference to documents outside the record and the law is impermissible when applying the provisions of section 154 CIT v. Keshri Metal (P. ) Ltd. [1999] 237 ITR 165 (SC). The ‘record’ for purpose of section 154(1) is the record available to the authorities at the time of initiation of the proceedings for rectification and not merely the record of the original proceeding sought to be rectified CIT v. M. R. M. Plantations (P. ) Ltd. [1999] 240 ITR 660 (Mad. ). Entire record of the assessee can be looked into The power of rectification under section 154 is to be exercised with reference to the records of the assessee available with the Assessing Officer and not with particular reference to the assessment alone. The error apparent on the face of the record cannot be said to be the record of one particular assessment but the entire record of the assessee relating to all the assessment years Upasana Hospital and Nursing Home v. CIT [2002] 253 ITR 507 (Ker. ). Also ref: Mahendra Mills Ltd Vs. P. B. Desai, ACIT (1975) 99 ITR 135 (SC). 18 -Apr-15 6

B. Mistake The dictionary meaning of the word ‘mistake’ is incorrect idea or opinion, thing incorrectly done or thought, error of judgement, misunderstand the meaning of. This word has a special significance in the Income Tax Act because only those mistakes which are apparent from record could only be rectified. Thus, the mistake which can be rectified u/s 154 is not confined to clerical or arithmetical mistakes. The Supreme Court in the case of T. S. Balaram, ITO v. Volkart Brothers and ors. [1971] 82 ITR 50 (SC), had held that a mistake apparent from the record must be an obvious and patent mistake. It should not be such which can be established by a long drawn process of reasoning on points in which there may be conceivably two opinions. That is, the mistake may be a mistake of fact or mistake of law but it must not involve a debatable point of law. Further, where the mistake has to be determined on fresh investigation of facts, rectification will not be justified. 18 -Apr-15 7

B. Mistake The dictionary meaning of the word ‘mistake’ is incorrect idea or opinion, thing incorrectly done or thought, error of judgement, misunderstand the meaning of. This word has a special significance in the Income Tax Act because only those mistakes which are apparent from record could only be rectified. Thus, the mistake which can be rectified u/s 154 is not confined to clerical or arithmetical mistakes. The Supreme Court in the case of T. S. Balaram, ITO v. Volkart Brothers and ors. [1971] 82 ITR 50 (SC), had held that a mistake apparent from the record must be an obvious and patent mistake. It should not be such which can be established by a long drawn process of reasoning on points in which there may be conceivably two opinions. That is, the mistake may be a mistake of fact or mistake of law but it must not involve a debatable point of law. Further, where the mistake has to be determined on fresh investigation of facts, rectification will not be justified. 18 -Apr-15 7

Rectification u/s 154 is possible where the mandatory provisions of the Income Tax Law have been overlooked by the authorities. Application of wrong provision of Act or erroneous application of same will amount to mistake apparent on the face of record 18 -Apr-15 8

Rectification u/s 154 is possible where the mandatory provisions of the Income Tax Law have been overlooked by the authorities. Application of wrong provision of Act or erroneous application of same will amount to mistake apparent on the face of record 18 -Apr-15 8

Effect of Apex Court Order Law subsequently interpreted by Supreme Court-A mistake arising as a result of subsequent interpretation of law by Supreme Court would constitute a ‘mistake apparent from records’ and rectification under section 154 would be in order. Therefore, where an assessee moves an application under Section 154 on the premise that a mistake has occurred in his assessment in light of the pronouncement of Supreme Court, the application shall be acted upon, provided the same has been filed within the prescribed time limit. 18 -Apr-15 9

Effect of Apex Court Order Law subsequently interpreted by Supreme Court-A mistake arising as a result of subsequent interpretation of law by Supreme Court would constitute a ‘mistake apparent from records’ and rectification under section 154 would be in order. Therefore, where an assessee moves an application under Section 154 on the premise that a mistake has occurred in his assessment in light of the pronouncement of Supreme Court, the application shall be acted upon, provided the same has been filed within the prescribed time limit. 18 -Apr-15 9

Rectification on the basis of a binding decision which overrules earlier decision If assessment order is based on interpretation or application of law which is ultimately found to be erroneous or incorrect in the light of subsequent judicial pronouncement, such an order should be regarded to disclose or suffer from, a mistake apparent on record and if an application was filed within time, such an order was bound to be rectified. If the order is passed by an authority on the basis of a judicial decision which decision is reversed subsequently, such an order is liable to be rectified. A binding decision rendered by a Court is retrospective, which means such a decision declares law what it has always been. Decision which is overruled should be regarded as a decision which was never the law. The decision which has overruled an earlier decision should be deemed to be in force even on the day on which impugned order based on earlier decision was passed. Ref: Kil. Kotagiri Tea & Coffee Estates Co. Ltd. vs. ITAT (1988) 174 ITR 579 (Ker) 18 -Apr-15 10

Rectification on the basis of a binding decision which overrules earlier decision If assessment order is based on interpretation or application of law which is ultimately found to be erroneous or incorrect in the light of subsequent judicial pronouncement, such an order should be regarded to disclose or suffer from, a mistake apparent on record and if an application was filed within time, such an order was bound to be rectified. If the order is passed by an authority on the basis of a judicial decision which decision is reversed subsequently, such an order is liable to be rectified. A binding decision rendered by a Court is retrospective, which means such a decision declares law what it has always been. Decision which is overruled should be regarded as a decision which was never the law. The decision which has overruled an earlier decision should be deemed to be in force even on the day on which impugned order based on earlier decision was passed. Ref: Kil. Kotagiri Tea & Coffee Estates Co. Ltd. vs. ITAT (1988) 174 ITR 579 (Ker) 18 -Apr-15 10

Whether Rectification on the basis of subsequent decision of jurisdictional High Court in cases where other High Courts have taken different view is justified? There is difference of opinion amongst High Courts on the point as to whether power of rectification could be exercised on the basis of the decision of the jurisdictional High Court on a point on which there was conflict of opinion amongst the High Courts. Ref: Omega Sports & Radio Works vs. CIT (1982) 134 ITR 28 (All) CIT vs. Ramjibhai. Hirjibhai& Sons (1977) 110 ITR 411 (Guj) CIT vs. Mohan Lal Kansal (1978) 114 ITR 583 (P&H) V. R. Sonti vs. CIT(1979) 117 ITR 838 (Cal) 18 -Apr-15 11

Whether Rectification on the basis of subsequent decision of jurisdictional High Court in cases where other High Courts have taken different view is justified? There is difference of opinion amongst High Courts on the point as to whether power of rectification could be exercised on the basis of the decision of the jurisdictional High Court on a point on which there was conflict of opinion amongst the High Courts. Ref: Omega Sports & Radio Works vs. CIT (1982) 134 ITR 28 (All) CIT vs. Ramjibhai. Hirjibhai& Sons (1977) 110 ITR 411 (Guj) CIT vs. Mohan Lal Kansal (1978) 114 ITR 583 (P&H) V. R. Sonti vs. CIT(1979) 117 ITR 838 (Cal) 18 -Apr-15 11

Effect of Retrospective amendment A mistake can be glaring and obvious in the light of a retrospective amendment of the statue , unless the extend of retrospectivity is debatable. ITO v Bombay Dyeing & Mfg Co Ltd (1958) 34 ITR 143(SC) In S. A. L. Narayan Row v Ishwarlal. Bhagwandas (1965) 57 ITR 149 (SC), an erroneous order may become valid in the light of retrospective legislation. A rectification may become necessary consequent on giving effect to appellate orders, for it may become necessary to carry forward or set off a loss determined in consequence thereof. 18 -Apr-15 12

Effect of Retrospective amendment A mistake can be glaring and obvious in the light of a retrospective amendment of the statue , unless the extend of retrospectivity is debatable. ITO v Bombay Dyeing & Mfg Co Ltd (1958) 34 ITR 143(SC) In S. A. L. Narayan Row v Ishwarlal. Bhagwandas (1965) 57 ITR 149 (SC), an erroneous order may become valid in the light of retrospective legislation. A rectification may become necessary consequent on giving effect to appellate orders, for it may become necessary to carry forward or set off a loss determined in consequence thereof. 18 -Apr-15 12

Remedy where the time limit of 4 years lapse : As per sub-section 7 of S. 154 no amendment shall be made after the expiry of four years from the end of the financial year in which the order sought to be rectified is passed. Consider a situation were the application for rectification is made within the above time limit but, no rectification is carried out till the expiry of four years from the end of the financial year in which the order sought to be rectified is passed. What will be the state of the pending rectification? Tax payers were facing great difficulty in matters relating to rectification of arrear demand disputed by the assessee once the limitation period of 4 years has lapsed. 18 -Apr-15 13

Remedy where the time limit of 4 years lapse : As per sub-section 7 of S. 154 no amendment shall be made after the expiry of four years from the end of the financial year in which the order sought to be rectified is passed. Consider a situation were the application for rectification is made within the above time limit but, no rectification is carried out till the expiry of four years from the end of the financial year in which the order sought to be rectified is passed. What will be the state of the pending rectification? Tax payers were facing great difficulty in matters relating to rectification of arrear demand disputed by the assessee once the limitation period of 4 years has lapsed. 18 -Apr-15 13

Once the limitation period of 4 years lapses it has been noted that the Assessing Officers in many cases have expressed their inability to correct or reconcile such disputed arrear demand in respect of the application made by the assessee for rectification. Thus tax payers are facing great practical problem with no fault of theirs. In many cases the Assessing Officers have uploaded such disputed arrear demand on the Financial Accounting System (FAS) portal of Centralized Processing Center (CPC), Bengaluru which has resulted in adjustment of refund arising out of processing of returns against such arrear demand which has been disputed by such assessees on the grounds that such demand has already been paid or has been reduced/eliminated in the appeals, etc. The arrear demands, in these cases also were not corrected/reconciled for the reasons that the period of limitation of four years has elapsed. However, due to the time limit as mentioned in the said section in many cases the Assessing Officers were not ready to carry out the rectification orders specially because of the expiry of this time limit. This issue has been sorted out by the Central Board of Direct Taxes (CBDT). 18 -Apr-15 14

Once the limitation period of 4 years lapses it has been noted that the Assessing Officers in many cases have expressed their inability to correct or reconcile such disputed arrear demand in respect of the application made by the assessee for rectification. Thus tax payers are facing great practical problem with no fault of theirs. In many cases the Assessing Officers have uploaded such disputed arrear demand on the Financial Accounting System (FAS) portal of Centralized Processing Center (CPC), Bengaluru which has resulted in adjustment of refund arising out of processing of returns against such arrear demand which has been disputed by such assessees on the grounds that such demand has already been paid or has been reduced/eliminated in the appeals, etc. The arrear demands, in these cases also were not corrected/reconciled for the reasons that the period of limitation of four years has elapsed. However, due to the time limit as mentioned in the said section in many cases the Assessing Officers were not ready to carry out the rectification orders specially because of the expiry of this time limit. This issue has been sorted out by the Central Board of Direct Taxes (CBDT). 18 -Apr-15 14

CBDT has issued Circular No. 4 of 2012 dated 20 th June, 2012 wherein they have authorized the Assessing Officers to make appropriate corrections in the figures of such disputed arrear demands after due verification/reconciliation and after examining the same on the merits, whether by way of rectification or otherwise, irrespective of the fact that the period of limitation of four years as provided under section 154(7) of the Act has elapsed. Further, CBDT has decided that in the category of cases which where based on the figure of arrear demand uploaded by the Assessing Officer but disputed by the assessee, the Centralized Process Centre (CPC), Bengaluru has already adjusted refund arising out of processing of return, the jurisdictional Assessing Officer shall verify the claim of the assessee on the merits. After due verification of such claim on the merits, the Assessing Officer shall issue refund of the excess amount, if any, so adjusted by CPC due to inaccurate figures of arrear demand uploaded by the Assessing Officer. The Assessing Officer, in appropriate cases, will also upload amended figure of arrear demand on FAS portal of Centralized Processing Centre (CPC), Bengaluru where there is balance outstanding arrear demand still remaining after aforesaid correction/reconciliation. 18 -Apr-15 15

CBDT has issued Circular No. 4 of 2012 dated 20 th June, 2012 wherein they have authorized the Assessing Officers to make appropriate corrections in the figures of such disputed arrear demands after due verification/reconciliation and after examining the same on the merits, whether by way of rectification or otherwise, irrespective of the fact that the period of limitation of four years as provided under section 154(7) of the Act has elapsed. Further, CBDT has decided that in the category of cases which where based on the figure of arrear demand uploaded by the Assessing Officer but disputed by the assessee, the Centralized Process Centre (CPC), Bengaluru has already adjusted refund arising out of processing of return, the jurisdictional Assessing Officer shall verify the claim of the assessee on the merits. After due verification of such claim on the merits, the Assessing Officer shall issue refund of the excess amount, if any, so adjusted by CPC due to inaccurate figures of arrear demand uploaded by the Assessing Officer. The Assessing Officer, in appropriate cases, will also upload amended figure of arrear demand on FAS portal of Centralized Processing Centre (CPC), Bengaluru where there is balance outstanding arrear demand still remaining after aforesaid correction/reconciliation. 18 -Apr-15 15

Different aspects of rectification Interpretation of law: (a) Where only one interpretation of a provision of law is possible: Where only one interpretation one section of the Act is possible and any other interpretation is not possible, an earlier order which is not in conformity with the only possible interpretation of the section would be liable to be rectified as the mistake would be regarded as one apparent from record. ITO vs. Raleigh Investment Co. Ltd. (1976) 102 ITR 616 (Cal) India Carbon Ltd. vs. CIT (1989) 175 ITR 27 (Gau) 18 -Apr-15 16

Different aspects of rectification Interpretation of law: (a) Where only one interpretation of a provision of law is possible: Where only one interpretation one section of the Act is possible and any other interpretation is not possible, an earlier order which is not in conformity with the only possible interpretation of the section would be liable to be rectified as the mistake would be regarded as one apparent from record. ITO vs. Raleigh Investment Co. Ltd. (1976) 102 ITR 616 (Cal) India Carbon Ltd. vs. CIT (1989) 175 ITR 27 (Gau) 18 -Apr-15 16

(b)Where two interpretations of a provision of law are possible: If a statutory provision was capable of two interpretations, and one such interpretation has been adopted in passing the original order, such an order cannot be amended so as to bring it in conformity with the other possible interpretation by exercise of power of rectification under s. 154. This is because the mistake, if at all there was one, was not one which came in the category of a mistake apparent from record. Travancore Rayons Ltd. vs. ITO &Anr. (1977) 109 ITR 43 (Ker) 18 -Apr-15 17

(b)Where two interpretations of a provision of law are possible: If a statutory provision was capable of two interpretations, and one such interpretation has been adopted in passing the original order, such an order cannot be amended so as to bring it in conformity with the other possible interpretation by exercise of power of rectification under s. 154. This is because the mistake, if at all there was one, was not one which came in the category of a mistake apparent from record. Travancore Rayons Ltd. vs. ITO &Anr. (1977) 109 ITR 43 (Ker) 18 -Apr-15 17

Existence of two conceivable views on a particular controversy would oust the jurisdiction to take resort of rectification CIT vs. Shell Petroleum Co. Ltd. (1986) 164 ITR 357 (Cal) Adarsha. Dugdhalaya (P) Ltd. vs. ITO (1987) 168 ITR 48 (Bom) CIT vs. Jagannath Narayan Kutumbik Trust (1983) 144 ITR 526 (MP) 18 -Apr-15 18

Existence of two conceivable views on a particular controversy would oust the jurisdiction to take resort of rectification CIT vs. Shell Petroleum Co. Ltd. (1986) 164 ITR 357 (Cal) Adarsha. Dugdhalaya (P) Ltd. vs. ITO (1987) 168 ITR 48 (Bom) CIT vs. Jagannath Narayan Kutumbik Trust (1983) 144 ITR 526 (MP) 18 -Apr-15 18

Conflicting decisions of Courts Where there is difference of opinion amongst the High Courts on the relevant matter. Power of rectification cannot be exercised where two reasonable interpretations of a provision of law are possible applies with equal force to the matter on which there is difference of opinion amongst the High Courts. The very fact that there was difference of opinion amongst High Courts would prima facie indicate that two reasonable interpretations are possible. In the following cases, the exercise of power of rectification has been held to be not justified in relation to a matter on which there was difference of opinion amongst High Courts : (Pat) CIT vs. Jeewanlal (P) Ltd. (1990) 183 ITR 128 (Cal) Veena Theatres vs. Union of India & Ors. (1977)109 ITR 748 Raja Harichand Raj Singh vs. CIT (1978) 114 ITR 727 (All) 18 -Apr-15 19

Conflicting decisions of Courts Where there is difference of opinion amongst the High Courts on the relevant matter. Power of rectification cannot be exercised where two reasonable interpretations of a provision of law are possible applies with equal force to the matter on which there is difference of opinion amongst the High Courts. The very fact that there was difference of opinion amongst High Courts would prima facie indicate that two reasonable interpretations are possible. In the following cases, the exercise of power of rectification has been held to be not justified in relation to a matter on which there was difference of opinion amongst High Courts : (Pat) CIT vs. Jeewanlal (P) Ltd. (1990) 183 ITR 128 (Cal) Veena Theatres vs. Union of India & Ors. (1977)109 ITR 748 Raja Harichand Raj Singh vs. CIT (1978) 114 ITR 727 (All) 18 -Apr-15 19

There could be a case where only one High Court has taken a view different from uniform view taken by many other High Courts and the view taken by such High Court was prima facie "unreasonable"'. In such a case whether above principle would not apply and can it be treated to be a case where no two views are possible? 18 -Apr-15 20

There could be a case where only one High Court has taken a view different from uniform view taken by many other High Courts and the view taken by such High Court was prima facie "unreasonable"'. In such a case whether above principle would not apply and can it be treated to be a case where no two views are possible? 18 -Apr-15 20

Whether relief not claimed by assessee is allowable in rectification proceedings if it was apparent from the record that the assessee was entitled to a particular relief? Ref: Goetze (India) Ltd. vs. CIT (2006) 284 ITR 323 (SC) CIT vs Pruthvi Brokers & Shareholders P. Ltd. (2012) 349 ITR 336 (Bom) CIT v. K. N. Oil Industries [1983] 142 ITR 13 (MP). § If credit of TDS/TCS not allowed can be claimed subsequently? Ref: Section 155(4); credit to be allowed on production of certificate before the assessing officer within two years from the end of the assessment year in which such Income is assessable 18 -Apr-15 21

Whether relief not claimed by assessee is allowable in rectification proceedings if it was apparent from the record that the assessee was entitled to a particular relief? Ref: Goetze (India) Ltd. vs. CIT (2006) 284 ITR 323 (SC) CIT vs Pruthvi Brokers & Shareholders P. Ltd. (2012) 349 ITR 336 (Bom) CIT v. K. N. Oil Industries [1983] 142 ITR 13 (MP). § If credit of TDS/TCS not allowed can be claimed subsequently? Ref: Section 155(4); credit to be allowed on production of certificate before the assessing officer within two years from the end of the assessment year in which such Income is assessable 18 -Apr-15 21

7) Review vis-a-vis rectification Order cannot be reviewed or revised under the garb of rectification Sec. 154 of the 1961 Act permitted rectification of only such errors or mistakes which were apparent from the record. Those provisions did not authorise review or revision of the original order under the garb of rectification. CIT vs. O. RM. M. SV. Sevugan (1948) 16 ITR 59 (Mad) The order of the ITO purporting to rectify the assessment order was found in substance to be an order reviewing the earlier order and making reassessment and hence was quashed. K. Parameswaran Pillai vs. Addl. ITO (1955) 28 ITR 885 (COCH) 18 -Apr-15 22

7) Review vis-a-vis rectification Order cannot be reviewed or revised under the garb of rectification Sec. 154 of the 1961 Act permitted rectification of only such errors or mistakes which were apparent from the record. Those provisions did not authorise review or revision of the original order under the garb of rectification. CIT vs. O. RM. M. SV. Sevugan (1948) 16 ITR 59 (Mad) The order of the ITO purporting to rectify the assessment order was found in substance to be an order reviewing the earlier order and making reassessment and hence was quashed. K. Parameswaran Pillai vs. Addl. ITO (1955) 28 ITR 885 (COCH) 18 -Apr-15 22

The ITO had before him two decisions of Supreme Court for guidance in making a computation and he made the computation in conformity with principle laid down in one of these two decisions while his successor made fresh computation on the assumption that there was mistake in the original computation because that computation was not in conformity with principle laid down in the other decision of the Supreme Court. It was held that this amounted to revising or reviewing the earlier order in a case involving highly debatable question of law and as such it was not justified. CIT vs. United Mercantile Co. (P) Ltd. (1986) 158 ITR 41 (Raj) 18 -Apr-15 23

The ITO had before him two decisions of Supreme Court for guidance in making a computation and he made the computation in conformity with principle laid down in one of these two decisions while his successor made fresh computation on the assumption that there was mistake in the original computation because that computation was not in conformity with principle laid down in the other decision of the Supreme Court. It was held that this amounted to revising or reviewing the earlier order in a case involving highly debatable question of law and as such it was not justified. CIT vs. United Mercantile Co. (P) Ltd. (1986) 158 ITR 41 (Raj) 18 -Apr-15 23

Intimation cannot be rectified after issue of notice If a notice has been issued under section 143(2) after sending the intimation under section 143(1)(a), proceedings under section 154(1)(b) cannot be initiated for rectifying that intimation Lakhanpal National Ltd. v. Dy. CIT [1996] 222 ITR 151 (Guj. ). 18 -Apr-15 24

Intimation cannot be rectified after issue of notice If a notice has been issued under section 143(2) after sending the intimation under section 143(1)(a), proceedings under section 154(1)(b) cannot be initiated for rectifying that intimation Lakhanpal National Ltd. v. Dy. CIT [1996] 222 ITR 151 (Guj. ). 18 -Apr-15 24

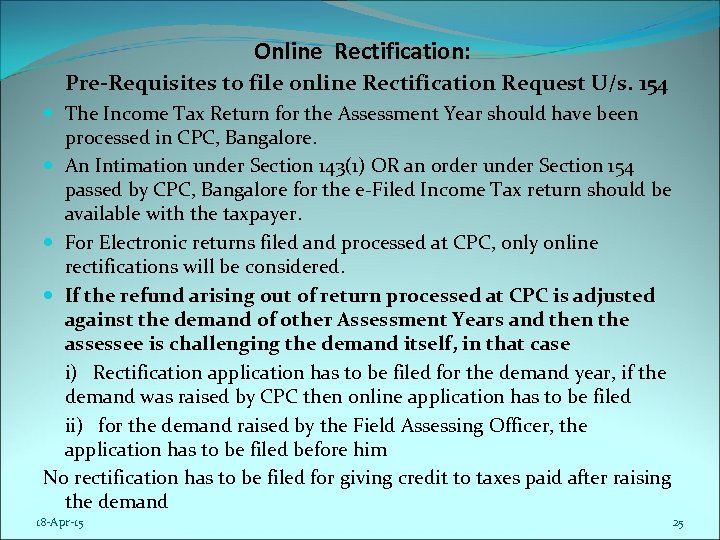

Online Rectification: Pre-Requisites to file online Rectification Request U/s. 154 The Income Tax Return for the Assessment Year should have been processed in CPC, Bangalore. An Intimation under Section 143(1) OR an order under Section 154 passed by CPC, Bangalore for the e-Filed Income Tax return should be available with the taxpayer. For Electronic returns filed and processed at CPC, only online rectifications will be considered. If the refund arising out of return processed at CPC is adjusted against the demand of other Assessment Years and then the assessee is challenging the demand itself, in that case i) Rectification application has to be filed for the demand year, if the demand was raised by CPC then online application has to be filed ii) for the demand raised by the Field Assessing Officer, the application has to be filed before him No rectification has to be filed for giving credit to taxes paid after raising the demand 18 -Apr-15 25

Online Rectification: Pre-Requisites to file online Rectification Request U/s. 154 The Income Tax Return for the Assessment Year should have been processed in CPC, Bangalore. An Intimation under Section 143(1) OR an order under Section 154 passed by CPC, Bangalore for the e-Filed Income Tax return should be available with the taxpayer. For Electronic returns filed and processed at CPC, only online rectifications will be considered. If the refund arising out of return processed at CPC is adjusted against the demand of other Assessment Years and then the assessee is challenging the demand itself, in that case i) Rectification application has to be filed for the demand year, if the demand was raised by CPC then online application has to be filed ii) for the demand raised by the Field Assessing Officer, the application has to be filed before him No rectification has to be filed for giving credit to taxes paid after raising the demand 18 -Apr-15 25

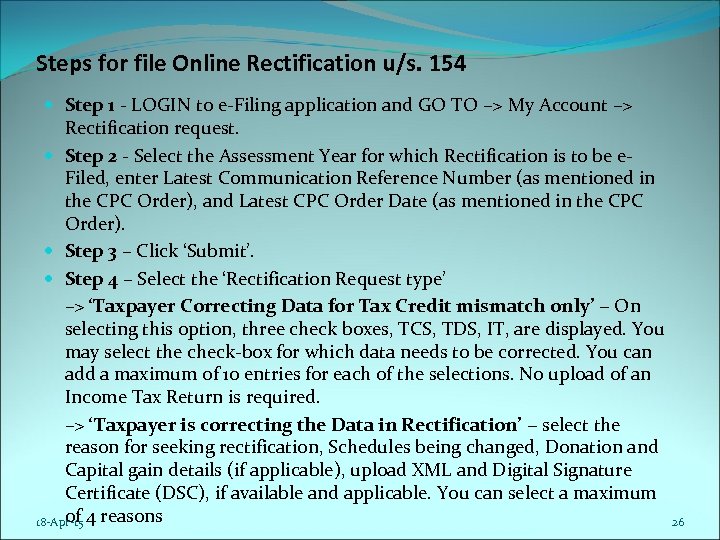

Steps for file Online Rectification u/s. 154 Step 1 - LOGIN to e-Filing application and GO TO –> My Account –> Rectification request. Step 2 - Select the Assessment Year for which Rectification is to be e. Filed, enter Latest Communication Reference Number (as mentioned in the CPC Order), and Latest CPC Order Date (as mentioned in the CPC Order). Step 3 – Click ‘Submit’. Step 4 – Select the ‘Rectification Request type’ –> ‘Taxpayer Correcting Data for Tax Credit mismatch only’ − On selecting this option, three check boxes, TCS, TDS, IT, are displayed. You may select the check-box for which data needs to be corrected. You can add a maximum of 10 entries for each of the selections. No upload of an Income Tax Return is required. –> ‘Taxpayer is correcting the Data in Rectification’ − select the reason for seeking rectification, Schedules being changed, Donation and Capital gain details (if applicable), upload XML and Digital Signature Certificate (DSC), if available and applicable. You can select a maximum of 4 reasons 18 -Apr-15 26

Steps for file Online Rectification u/s. 154 Step 1 - LOGIN to e-Filing application and GO TO –> My Account –> Rectification request. Step 2 - Select the Assessment Year for which Rectification is to be e. Filed, enter Latest Communication Reference Number (as mentioned in the CPC Order), and Latest CPC Order Date (as mentioned in the CPC Order). Step 3 – Click ‘Submit’. Step 4 – Select the ‘Rectification Request type’ –> ‘Taxpayer Correcting Data for Tax Credit mismatch only’ − On selecting this option, three check boxes, TCS, TDS, IT, are displayed. You may select the check-box for which data needs to be corrected. You can add a maximum of 10 entries for each of the selections. No upload of an Income Tax Return is required. –> ‘Taxpayer is correcting the Data in Rectification’ − select the reason for seeking rectification, Schedules being changed, Donation and Capital gain details (if applicable), upload XML and Digital Signature Certificate (DSC), if available and applicable. You can select a maximum of 4 reasons 18 -Apr-15 26

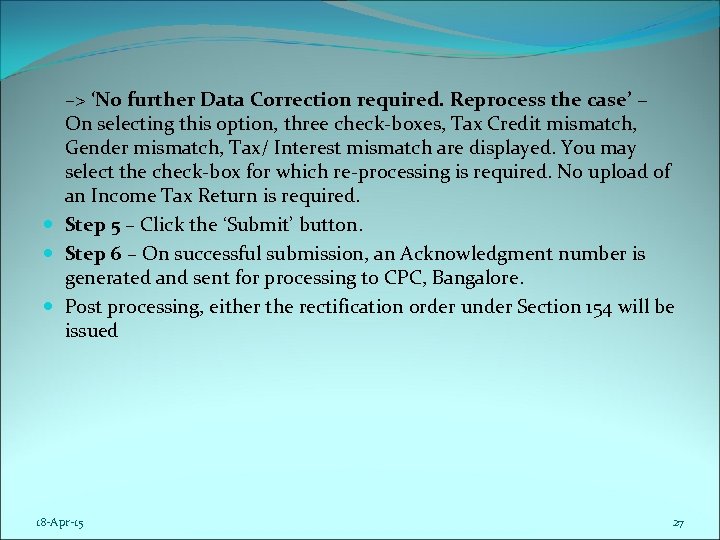

–> ‘No further Data Correction required. Reprocess the case’ − On selecting this option, three check-boxes, Tax Credit mismatch, Gender mismatch, Tax/ Interest mismatch are displayed. You may select the check-box for which re-processing is required. No upload of an Income Tax Return is required. Step 5 – Click the ‘Submit’ button. Step 6 – On successful submission, an Acknowledgment number is generated and sent for processing to CPC, Bangalore. Post processing, either the rectification order under Section 154 will be issued 18 -Apr-15 27

–> ‘No further Data Correction required. Reprocess the case’ − On selecting this option, three check-boxes, Tax Credit mismatch, Gender mismatch, Tax/ Interest mismatch are displayed. You may select the check-box for which re-processing is required. No upload of an Income Tax Return is required. Step 5 – Click the ‘Submit’ button. Step 6 – On successful submission, an Acknowledgment number is generated and sent for processing to CPC, Bangalore. Post processing, either the rectification order under Section 154 will be issued 18 -Apr-15 27

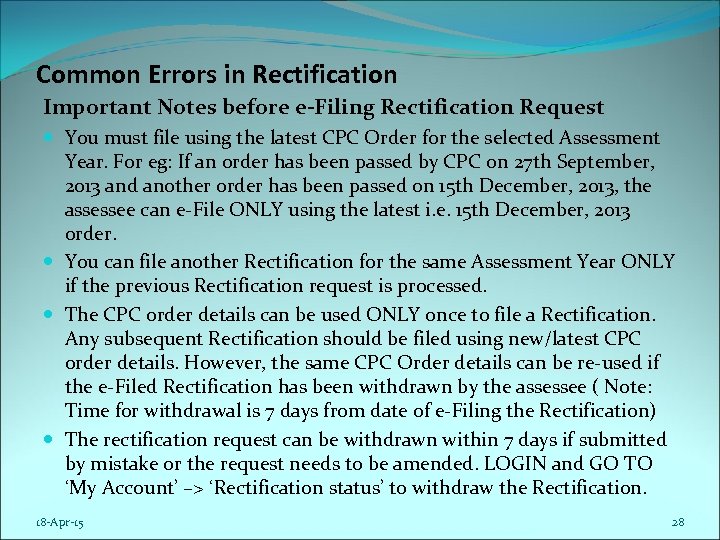

Common Errors in Rectification Important Notes before e-Filing Rectification Request You must file using the latest CPC Order for the selected Assessment Year. For eg: If an order has been passed by CPC on 27 th September, 2013 and another order has been passed on 15 th December, 2013, the assessee can e-File ONLY using the latest i. e. 15 th December, 2013 order. You can file another Rectification for the same Assessment Year ONLY if the previous Rectification request is processed. The CPC order details can be used ONLY once to file a Rectification. Any subsequent Rectification should be filed using new/latest CPC order details. However, the same CPC Order details can be re-used if the e-Filed Rectification has been withdrawn by the assessee ( Note: Time for withdrawal is 7 days from date of e-Filing the Rectification) The rectification request can be withdrawn within 7 days if submitted by mistake or the request needs to be amended. LOGIN and GO TO ‘My Account’ –> ‘Rectification status’ to withdraw the Rectification. 18 -Apr-15 28

Common Errors in Rectification Important Notes before e-Filing Rectification Request You must file using the latest CPC Order for the selected Assessment Year. For eg: If an order has been passed by CPC on 27 th September, 2013 and another order has been passed on 15 th December, 2013, the assessee can e-File ONLY using the latest i. e. 15 th December, 2013 order. You can file another Rectification for the same Assessment Year ONLY if the previous Rectification request is processed. The CPC order details can be used ONLY once to file a Rectification. Any subsequent Rectification should be filed using new/latest CPC order details. However, the same CPC Order details can be re-used if the e-Filed Rectification has been withdrawn by the assessee ( Note: Time for withdrawal is 7 days from date of e-Filing the Rectification) The rectification request can be withdrawn within 7 days if submitted by mistake or the request needs to be amended. LOGIN and GO TO ‘My Account’ –> ‘Rectification status’ to withdraw the Rectification. 18 -Apr-15 28

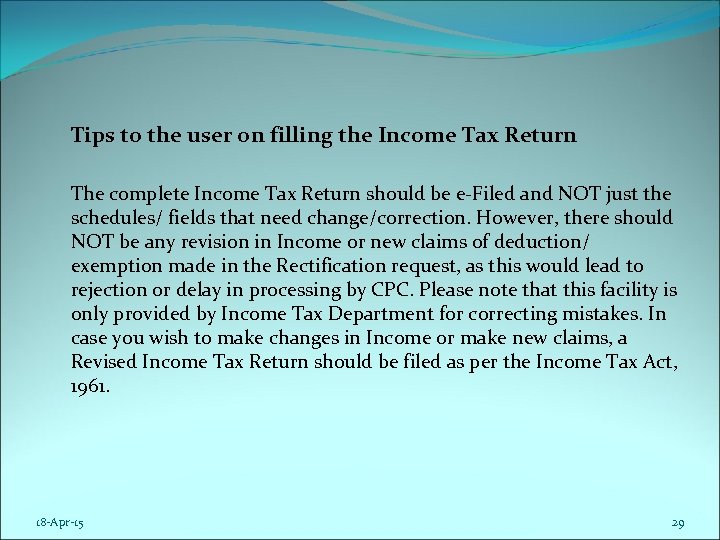

Tips to the user on filling the Income Tax Return The complete Income Tax Return should be e-Filed and NOT just the schedules/ fields that need change/correction. However, there should NOT be any revision in Income or new claims of deduction/ exemption made in the Rectification request, as this would lead to rejection or delay in processing by CPC. Please note that this facility is only provided by Income Tax Department for correcting mistakes. In case you wish to make changes in Income or make new claims, a Revised Income Tax Return should be filed as per the Income Tax Act, 1961. 18 -Apr-15 29

Tips to the user on filling the Income Tax Return The complete Income Tax Return should be e-Filed and NOT just the schedules/ fields that need change/correction. However, there should NOT be any revision in Income or new claims of deduction/ exemption made in the Rectification request, as this would lead to rejection or delay in processing by CPC. Please note that this facility is only provided by Income Tax Department for correcting mistakes. In case you wish to make changes in Income or make new claims, a Revised Income Tax Return should be filed as per the Income Tax Act, 1961. 18 -Apr-15 29

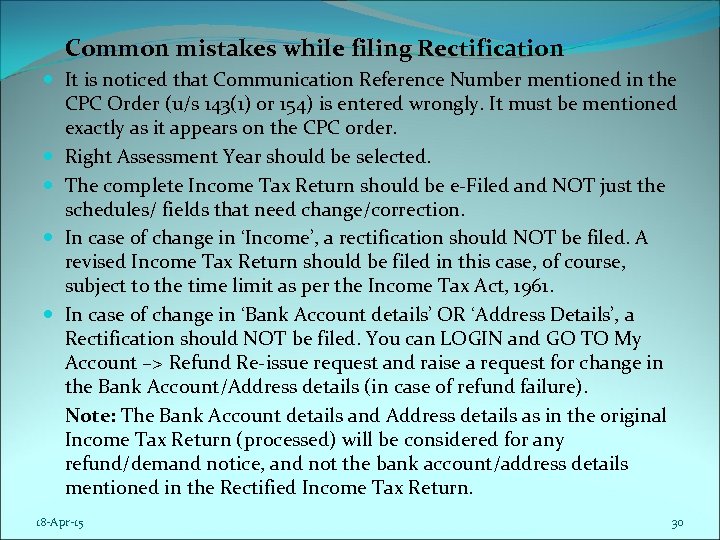

Common mistakes while filing Rectification It is noticed that Communication Reference Number mentioned in the CPC Order (u/s 143(1) or 154) is entered wrongly. It must be mentioned exactly as it appears on the CPC order. Right Assessment Year should be selected. The complete Income Tax Return should be e-Filed and NOT just the schedules/ fields that need change/correction. In case of change in ‘Income’, a rectification should NOT be filed. A revised Income Tax Return should be filed in this case, of course, subject to the time limit as per the Income Tax Act, 1961. In case of change in ‘Bank Account details’ OR ‘Address Details’, a Rectification should NOT be filed. You can LOGIN and GO TO My Account –> Refund Re-issue request and raise a request for change in the Bank Account/Address details (in case of refund failure). Note: The Bank Account details and Address details as in the original Income Tax Return (processed) will be considered for any refund/demand notice, and not the bank account/address details mentioned in the Rectified Income Tax Return. 18 -Apr-15 30

Common mistakes while filing Rectification It is noticed that Communication Reference Number mentioned in the CPC Order (u/s 143(1) or 154) is entered wrongly. It must be mentioned exactly as it appears on the CPC order. Right Assessment Year should be selected. The complete Income Tax Return should be e-Filed and NOT just the schedules/ fields that need change/correction. In case of change in ‘Income’, a rectification should NOT be filed. A revised Income Tax Return should be filed in this case, of course, subject to the time limit as per the Income Tax Act, 1961. In case of change in ‘Bank Account details’ OR ‘Address Details’, a Rectification should NOT be filed. You can LOGIN and GO TO My Account –> Refund Re-issue request and raise a request for change in the Bank Account/Address details (in case of refund failure). Note: The Bank Account details and Address details as in the original Income Tax Return (processed) will be considered for any refund/demand notice, and not the bank account/address details mentioned in the Rectified Income Tax Return. 18 -Apr-15 30

![CBDT Instruction No. 3/2013[F. NO. 225/76/2013/ITA. II], dated 5 -7 -2013 for Assessing Officer CBDT Instruction No. 3/2013[F. NO. 225/76/2013/ITA. II], dated 5 -7 -2013 for Assessing Officer](https://present5.com/presentation/d4e523e72903cd86a90d41c9c7a5a601/image-31.jpg) CBDT Instruction No. 3/2013[F. NO. 225/76/2013/ITA. II], dated 5 -7 -2013 for Assessing Officer to maintain “Rectification Register” Hon’ble Delhi High Court vide Judgment in case of Court On its Own Motion v. UOI and Ors. in W. P. (C) 2659/2012 dated 14. 03. 2013 has issued several Mandamuses for necessary action by income-tax Department one of which is regarding maintenance of “Rectification Register”in which details like receipt of applications under section 154 of the IT Act, their processing and disposal are to be maintained. In view of the said order it has been decided by the Board that henceforth all applications received under section 154 of the I. T. Act by the concerned jurisdictional authorities shall be dealt with in the following manner- 18 -Apr-15 31

CBDT Instruction No. 3/2013[F. NO. 225/76/2013/ITA. II], dated 5 -7 -2013 for Assessing Officer to maintain “Rectification Register” Hon’ble Delhi High Court vide Judgment in case of Court On its Own Motion v. UOI and Ors. in W. P. (C) 2659/2012 dated 14. 03. 2013 has issued several Mandamuses for necessary action by income-tax Department one of which is regarding maintenance of “Rectification Register”in which details like receipt of applications under section 154 of the IT Act, their processing and disposal are to be maintained. In view of the said order it has been decided by the Board that henceforth all applications received under section 154 of the I. T. Act by the concerned jurisdictional authorities shall be dealt with in the following manner- 18 -Apr-15 31

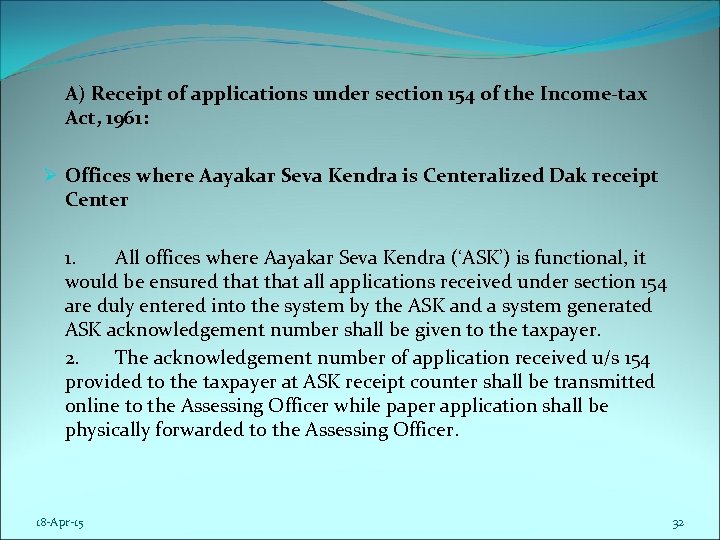

A) Receipt of applications under section 154 of the Income-tax Act, 1961: Ø Offices where Aayakar Seva Kendra is Centeralized Dak receipt Center 1. All offices where Aayakar Seva Kendra (‘ASK’) is functional, it would be ensured that all applications received under section 154 are duly entered into the system by the ASK and a system generated ASK acknowledgement number shall be given to the taxpayer. 2. The acknowledgement number of application received u/s 154 provided to the taxpayer at ASK receipt counter shall be transmitted online to the Assessing Officer while paper application shall be physically forwarded to the Assessing Officer. 18 -Apr-15 32

A) Receipt of applications under section 154 of the Income-tax Act, 1961: Ø Offices where Aayakar Seva Kendra is Centeralized Dak receipt Center 1. All offices where Aayakar Seva Kendra (‘ASK’) is functional, it would be ensured that all applications received under section 154 are duly entered into the system by the ASK and a system generated ASK acknowledgement number shall be given to the taxpayer. 2. The acknowledgement number of application received u/s 154 provided to the taxpayer at ASK receipt counter shall be transmitted online to the Assessing Officer while paper application shall be physically forwarded to the Assessing Officer. 18 -Apr-15 32

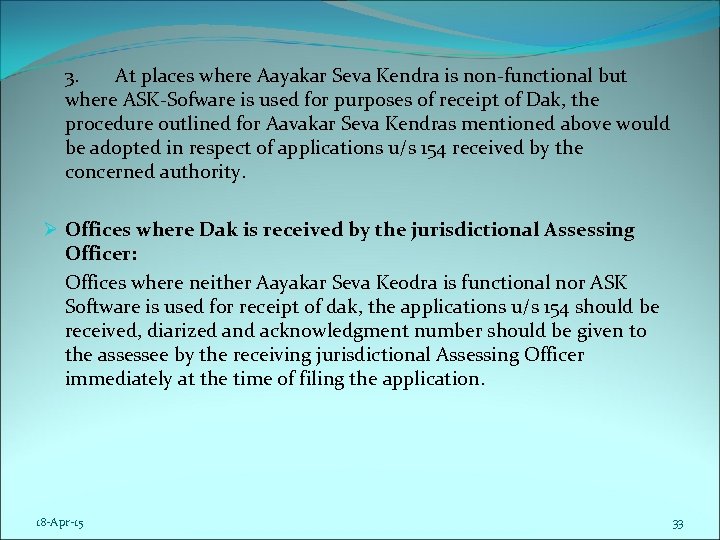

3. At places where Aayakar Seva Kendra is non-functional but where ASK-Sofware is used for purposes of receipt of Dak, the procedure outlined for Aavakar Seva Kendras mentioned above would be adopted in respect of applications u/s 154 received by the concerned authority. Ø Offices where Dak is received by the jurisdictional Assessing Officer: Offices where neither Aayakar Seva Keodra is functional nor ASK Software is used for receipt of dak, the applications u/s 154 should be received, diarized and acknowledgment number should be given to the assessee by the receiving jurisdictional Assessing Officer immediately at the time of filing the application. 18 -Apr-15 33

3. At places where Aayakar Seva Kendra is non-functional but where ASK-Sofware is used for purposes of receipt of Dak, the procedure outlined for Aavakar Seva Kendras mentioned above would be adopted in respect of applications u/s 154 received by the concerned authority. Ø Offices where Dak is received by the jurisdictional Assessing Officer: Offices where neither Aayakar Seva Keodra is functional nor ASK Software is used for receipt of dak, the applications u/s 154 should be received, diarized and acknowledgment number should be given to the assessee by the receiving jurisdictional Assessing Officer immediately at the time of filing the application. 18 -Apr-15 33

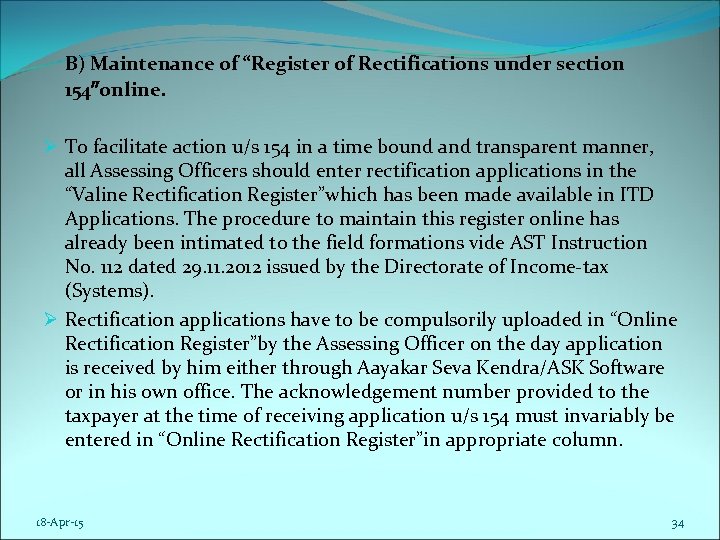

B) Maintenance of “Register of Rectifications under section 154″online. Ø To facilitate action u/s 154 in a time bound and transparent manner, all Assessing Officers should enter rectification applications in the “Valine Rectification Register”which has been made available in ITD Applications. The procedure to maintain this register online has already been intimated to the field formations vide AST Instruction No. 112 dated 29. 11. 2012 issued by the Directorate of Income-tax (Systems). Ø Rectification applications have to be compulsorily uploaded in “Online Rectification Register”by the Assessing Officer on the day application is received by him either through Aayakar Seva Kendra/ASK Software or in his own office. The acknowledgement number provided to the taxpayer at the time of receiving application u/s 154 must invariably be entered in “Online Rectification Register”in appropriate column. 18 -Apr-15 34

B) Maintenance of “Register of Rectifications under section 154″online. Ø To facilitate action u/s 154 in a time bound and transparent manner, all Assessing Officers should enter rectification applications in the “Valine Rectification Register”which has been made available in ITD Applications. The procedure to maintain this register online has already been intimated to the field formations vide AST Instruction No. 112 dated 29. 11. 2012 issued by the Directorate of Income-tax (Systems). Ø Rectification applications have to be compulsorily uploaded in “Online Rectification Register”by the Assessing Officer on the day application is received by him either through Aayakar Seva Kendra/ASK Software or in his own office. The acknowledgement number provided to the taxpayer at the time of receiving application u/s 154 must invariably be entered in “Online Rectification Register”in appropriate column. 18 -Apr-15 34

C) Disposal of applications under section 154 of the Income-tax Act, 1961: Ø As per provisions of Section 154 of the I. T, Act, 196 l, each application under that Section has to be disposed of by passing appropriate order within 6 months from the end of the month in which application is received. However, under Citizens Charter of 2010, the service delivery standard in respect of deciding rectification application has been fixed as 2 months. The concerned authorities should therefore, abide by this standard and ensure that rectification applications are decided as far as possible within a period of two months from the end of the month in which application is received. Ø Every Rectification application has to be processed through ITD applications only. Ø In cases where applications were received through Aayakar Seva Kendra/ASK Software, Assessing Officer should also flag/mark the disposal of rectification application in ASK Software so that its disposed status could be tracked down. 18 -Apr-15 35

C) Disposal of applications under section 154 of the Income-tax Act, 1961: Ø As per provisions of Section 154 of the I. T, Act, 196 l, each application under that Section has to be disposed of by passing appropriate order within 6 months from the end of the month in which application is received. However, under Citizens Charter of 2010, the service delivery standard in respect of deciding rectification application has been fixed as 2 months. The concerned authorities should therefore, abide by this standard and ensure that rectification applications are decided as far as possible within a period of two months from the end of the month in which application is received. Ø Every Rectification application has to be processed through ITD applications only. Ø In cases where applications were received through Aayakar Seva Kendra/ASK Software, Assessing Officer should also flag/mark the disposal of rectification application in ASK Software so that its disposed status could be tracked down. 18 -Apr-15 35

THANK YOU 18 -Apr-15 36

THANK YOU 18 -Apr-15 36