23df63d138ac6c8ac6cf71e0189bc0bb.ppt

- Количество слайдов: 24

Reconsidering Vietnam’s Exchange Rate Mechanism: A Preliminary Discussion VND Kenichi Ohno (VDF & GRIPS) USD Jan. 2004

Reconsidering Vietnam’s Exchange Rate Mechanism: A Preliminary Discussion VND Kenichi Ohno (VDF & GRIPS) USD Jan. 2004

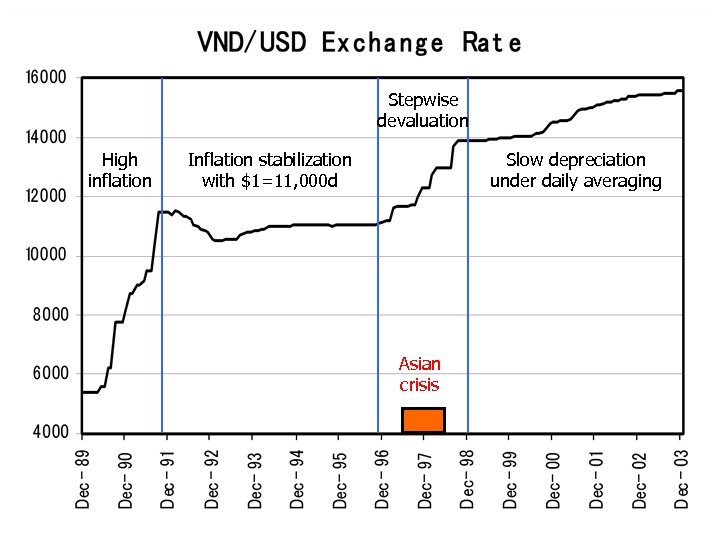

Brief History n n n Late 1980 s: multiple rates and high inflation under international isolation Early 1990 s: global integration starts, inflation stabilization succeeds 1991 -96: $1=11, 000 d (nominal anchor) 1996 -98: stepwise devaluations, coping with the Asian crisis Feb. 1999 -now: slow depreciation

Brief History n n n Late 1980 s: multiple rates and high inflation under international isolation Early 1990 s: global integration starts, inflation stabilization succeeds 1991 -96: $1=11, 000 d (nominal anchor) 1996 -98: stepwise devaluations, coping with the Asian crisis Feb. 1999 -now: slow depreciation

Stepwise devaluation High inflation Inflation stabilization with $1=11, 000 d Slow depreciation under daily averaging Asian crisis

Stepwise devaluation High inflation Inflation stabilization with $1=11, 000 d Slow depreciation under daily averaging Asian crisis

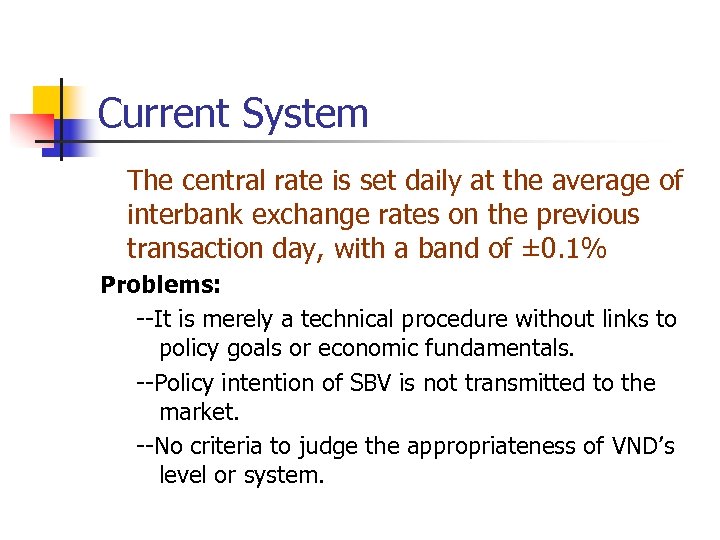

Current System The central rate is set daily at the average of interbank exchange rates on the previous transaction day, with a band of ± 0. 1% Problems: --It is merely a technical procedure without links to policy goals or economic fundamentals. --Policy intention of SBV is not transmitted to the market. --No criteria to judge the appropriateness of VND’s level or system.

Current System The central rate is set daily at the average of interbank exchange rates on the previous transaction day, with a band of ± 0. 1% Problems: --It is merely a technical procedure without links to policy goals or economic fundamentals. --Policy intention of SBV is not transmitted to the market. --No criteria to judge the appropriateness of VND’s level or system.

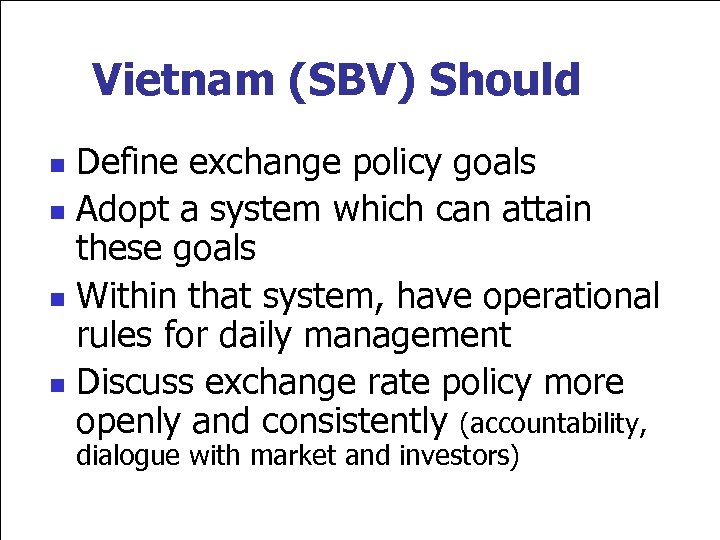

Vietnam (SBV) Should Define exchange policy goals n Adopt a system which can attain these goals n Within that system, have operational rules for daily management n Discuss exchange rate policy more openly and consistently (accountability, n dialogue with market and investors)

Vietnam (SBV) Should Define exchange policy goals n Adopt a system which can attain these goals n Within that system, have operational rules for daily management n Discuss exchange rate policy more openly and consistently (accountability, n dialogue with market and investors)

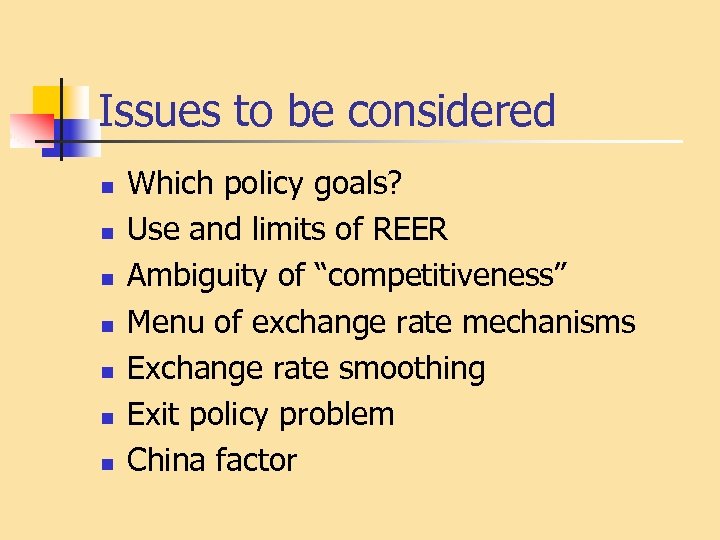

Issues to be considered n n n n Which policy goals? Use and limits of REER Ambiguity of “competitiveness” Menu of exchange rate mechanisms Exchange rate smoothing Exit policy problem China factor

Issues to be considered n n n n Which policy goals? Use and limits of REER Ambiguity of “competitiveness” Menu of exchange rate mechanisms Exchange rate smoothing Exit policy problem China factor

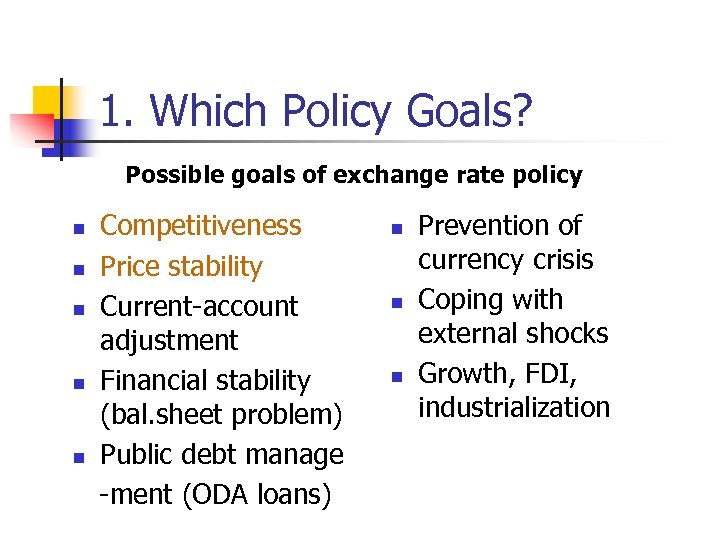

1. Which Policy Goals? Possible goals of exchange rate policy n n n Competitiveness Price stability Current-account adjustment Financial stability (bal. sheet problem) Public debt manage -ment (ODA loans) n n n Prevention of currency crisis Coping with external shocks Growth, FDI, industrialization

1. Which Policy Goals? Possible goals of exchange rate policy n n n Competitiveness Price stability Current-account adjustment Financial stability (bal. sheet problem) Public debt manage -ment (ODA loans) n n n Prevention of currency crisis Coping with external shocks Growth, FDI, industrialization

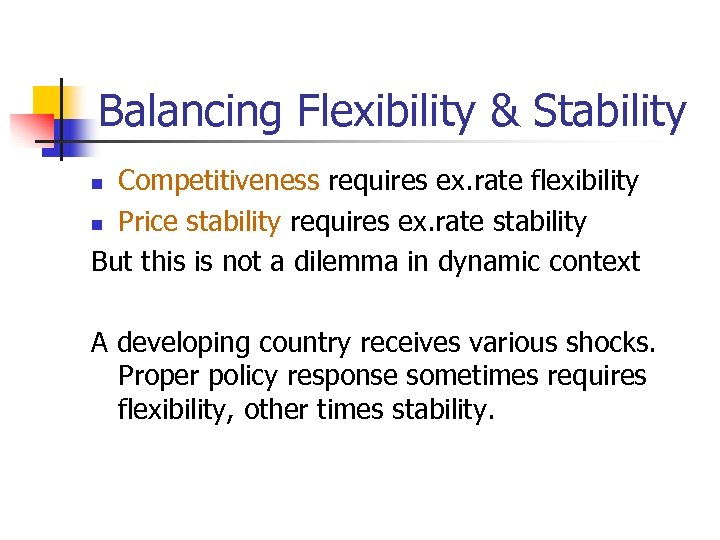

Balancing Flexibility & Stability Competitiveness requires ex. rate flexibility n Price stability requires ex. rate stability But this is not a dilemma in dynamic context n A developing country receives various shocks. Proper policy response sometimes requires flexibility, other times stability.

Balancing Flexibility & Stability Competitiveness requires ex. rate flexibility n Price stability requires ex. rate stability But this is not a dilemma in dynamic context n A developing country receives various shocks. Proper policy response sometimes requires flexibility, other times stability.

Goals: General Advice --In normal times, the goal should be balancing exchange rate flexibility and stability: maintain competitiveness under price stability --Policy judgment should always be exercised. VND cannot be put on an autopilot. Do not expect a simple formula. --Adopt a system in which the degree of flexibility and stability can be adjusted at any time without causing crisis or political problem (both free float and rigid fix are undesirable since they do not satisfy this condition. )

Goals: General Advice --In normal times, the goal should be balancing exchange rate flexibility and stability: maintain competitiveness under price stability --Policy judgment should always be exercised. VND cannot be put on an autopilot. Do not expect a simple formula. --Adopt a system in which the degree of flexibility and stability can be adjusted at any time without causing crisis or political problem (both free float and rigid fix are undesirable since they do not satisfy this condition. )

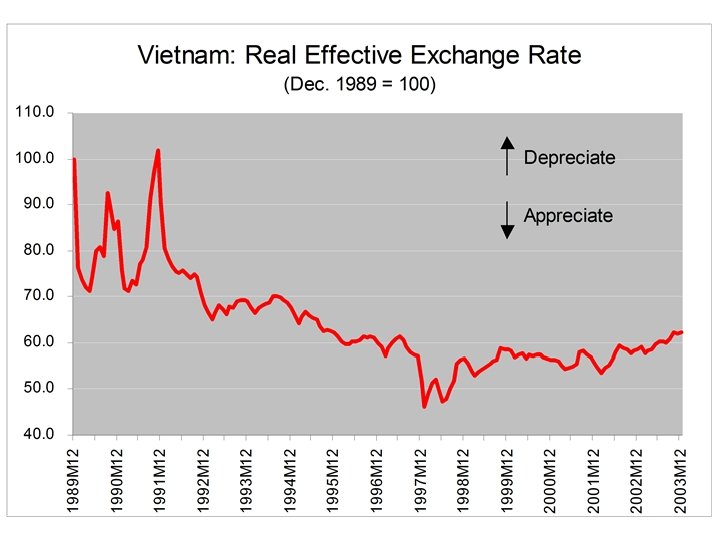

2. Real Effective Exchange Rate n n REER should be regularly calculated by SBV as a basic indicator of overall competitiveness. However, limits of REER should also be recognized: --Base year problem --Choice of price index --Choice of partner countries --Data availability --International comparability of commodity baskets

2. Real Effective Exchange Rate n n REER should be regularly calculated by SBV as a basic indicator of overall competitiveness. However, limits of REER should also be recognized: --Base year problem --Choice of price index --Choice of partner countries --Data availability --International comparability of commodity baskets

3. Ambiguity of “Competitiveness” Apart from REER limits, the concept of competitiveness faces fundamental problems in developing countries. n Vertical trade structure --Major trading partners (Japan/EU/US) are not true competitors (China/ASEAN/Mexico. . . ) n Low domestic content of major exports --primary commodities, garment, footwear, electronics n High exchange rate pass-through --As prices adjust, any VND/USD rate can be the “correct” rate n Structural changes under doi moi & global integration

3. Ambiguity of “Competitiveness” Apart from REER limits, the concept of competitiveness faces fundamental problems in developing countries. n Vertical trade structure --Major trading partners (Japan/EU/US) are not true competitors (China/ASEAN/Mexico. . . ) n Low domestic content of major exports --primary commodities, garment, footwear, electronics n High exchange rate pass-through --As prices adjust, any VND/USD rate can be the “correct” rate n Structural changes under doi moi & global integration

SBV Should: --Calculate REER regularly for policy input. --Also systematically monitor a large number of economic variables including: growth, prices, money, budget, trade & BOP, forex market, FDI & investment, banks, business conditions, asset markets, etc. --Use judgment and information above to make a policy decision. --Conduct research on measuring competitiveness, pass-through, global & regional trends, etc.

SBV Should: --Calculate REER regularly for policy input. --Also systematically monitor a large number of economic variables including: growth, prices, money, budget, trade & BOP, forex market, FDI & investment, banks, business conditions, asset markets, etc. --Use judgment and information above to make a policy decision. --Conduct research on measuring competitiveness, pass-through, global & regional trends, etc.

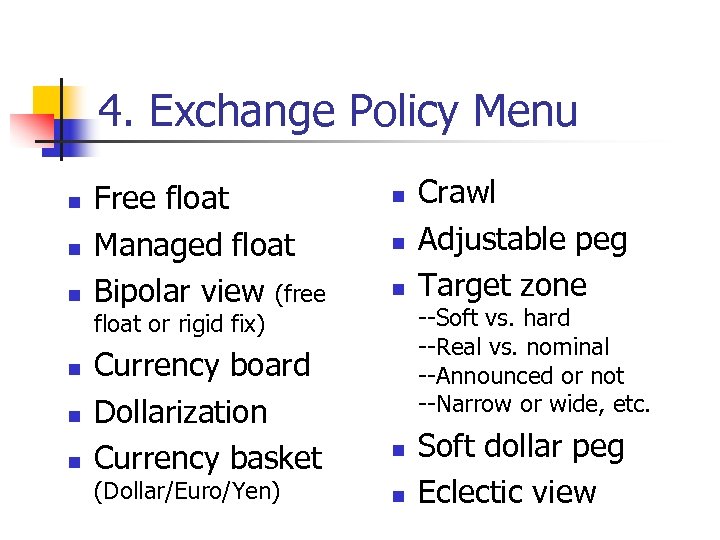

4. Exchange Policy Menu n n n Free float Managed float Bipolar view (free n n n --Soft vs. hard --Real vs. nominal --Announced or not --Narrow or wide, etc. float or rigid fix) n n n Currency board Dollarization Currency basket (Dollar/Euro/Yen) Crawl Adjustable peg Target zone n n Soft dollar peg Eclectic view

4. Exchange Policy Menu n n n Free float Managed float Bipolar view (free n n n --Soft vs. hard --Real vs. nominal --Announced or not --Narrow or wide, etc. float or rigid fix) n n n Currency board Dollarization Currency basket (Dollar/Euro/Yen) Crawl Adjustable peg Target zone n n Soft dollar peg Eclectic view

--Names do not matter much. Actual operation is the key. --Pick a system which allows a mix of exchange rate stability and flexibility. As a general rule, I recommend: Short-term stability against USD Long-term flexibility against USD Namely, exchange-rate smoothing (filtering out high-frequency movement)

--Names do not matter much. Actual operation is the key. --Pick a system which allows a mix of exchange rate stability and flexibility. As a general rule, I recommend: Short-term stability against USD Long-term flexibility against USD Namely, exchange-rate smoothing (filtering out high-frequency movement)

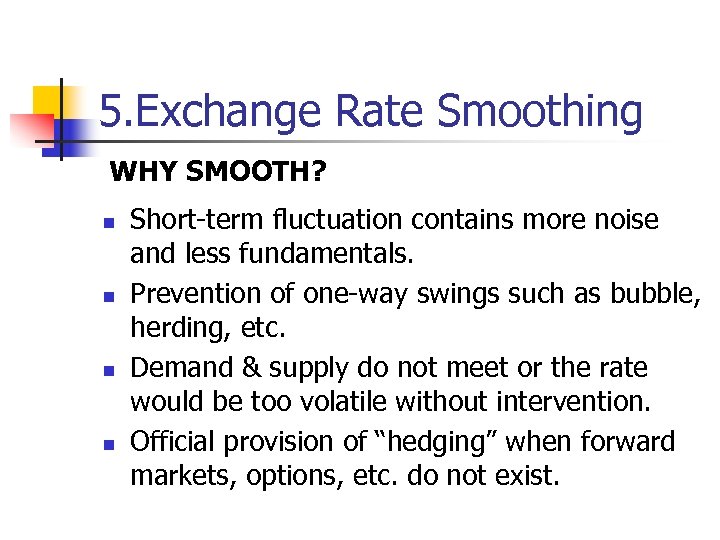

5. Exchange Rate Smoothing WHY SMOOTH? n n Short-term fluctuation contains more noise and less fundamentals. Prevention of one-way swings such as bubble, herding, etc. Demand & supply do not meet or the rate would be too volatile without intervention. Official provision of “hedging” when forward markets, options, etc. do not exist.

5. Exchange Rate Smoothing WHY SMOOTH? n n Short-term fluctuation contains more noise and less fundamentals. Prevention of one-way swings such as bubble, herding, etc. Demand & supply do not meet or the rate would be too volatile without intervention. Official provision of “hedging” when forward markets, options, etc. do not exist.

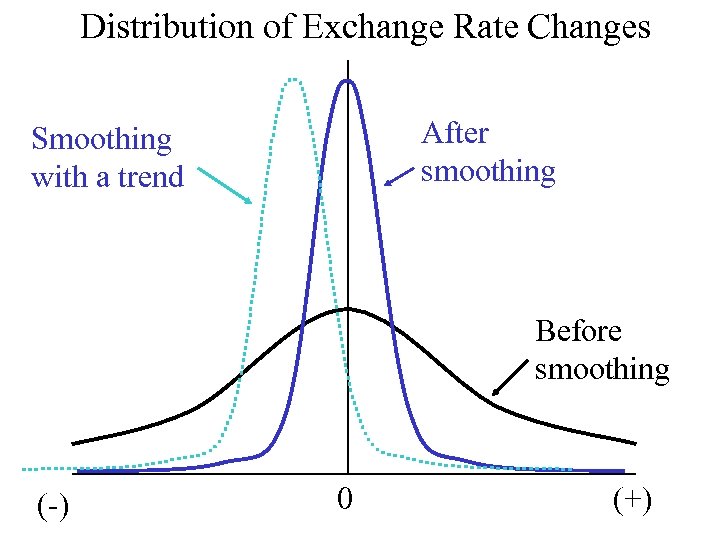

Distribution of Exchange Rate Changes After smoothing Smoothing with a trend Before smoothing (-) 0 (+)

Distribution of Exchange Rate Changes After smoothing Smoothing with a trend Before smoothing (-) 0 (+)

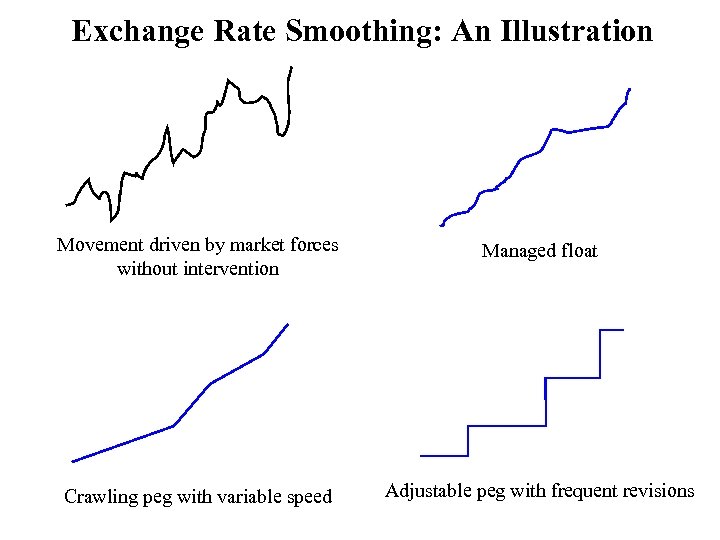

Exchange Rate Smoothing: An Illustration Movement driven by market forces without intervention Managed float Crawling peg with variable speed Adjustable peg with frequent revisions

Exchange Rate Smoothing: An Illustration Movement driven by market forces without intervention Managed float Crawling peg with variable speed Adjustable peg with frequent revisions

6. Exit Policy Problem n n n How to transit from a fixed to a more flexible exchange rate system without crisis. Again, the key is to adopt a system where the mix of flexibility and stability can be adjusted. Normal operation and crisis response must be clearly distinguished.

6. Exit Policy Problem n n n How to transit from a fixed to a more flexible exchange rate system without crisis. Again, the key is to adopt a system where the mix of flexibility and stability can be adjusted. Normal operation and crisis response must be clearly distinguished.

Sometimes, the exchange rate comes under severe pressure --The critical decision is whether to resist the pressure or to float. If float, the timing of floating is important. --If it is decided to float, prepare measures that minimize the shock and the period of floating: Temporary trade & capital controls, social protection, protection of banks & firms, etc (Kazakhstan in 1999). Don’t accelerate reforms or tighten macro policies during attack. --In a typical currency crisis, a 30% depreciation is normal. But shocks may be heavy or light depending on policies.

Sometimes, the exchange rate comes under severe pressure --The critical decision is whether to resist the pressure or to float. If float, the timing of floating is important. --If it is decided to float, prepare measures that minimize the shock and the period of floating: Temporary trade & capital controls, social protection, protection of banks & firms, etc (Kazakhstan in 1999). Don’t accelerate reforms or tighten macro policies during attack. --In a typical currency crisis, a 30% depreciation is normal. But shocks may be heavy or light depending on policies.

7. China Factor n n Lessons for Vietnam China as a risk factor for Vietnam --Bursting of the Chinese bubble (consumption and housing) --Mishandling of RMB policy and regional currency repercussions (China now faces a sort of the exit policy problem)

7. China Factor n n Lessons for Vietnam China as a risk factor for Vietnam --Bursting of the Chinese bubble (consumption and housing) --Mishandling of RMB policy and regional currency repercussions (China now faces a sort of the exit policy problem)

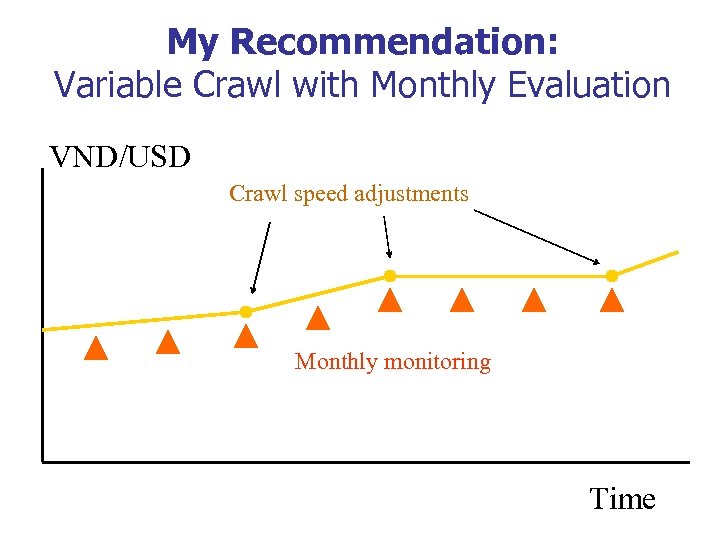

My Recommendation: Variable Crawl with Monthly Evaluation VND/USD Crawl speed adjustments Monthly monitoring Time

My Recommendation: Variable Crawl with Monthly Evaluation VND/USD Crawl speed adjustments Monthly monitoring Time

Variable Crawl for Vietnam n SBV mainly sets the rate, while market force is used as a supplementary input. (VN’s financial markets are still primitive. ) n n SBV monitors the situation monthly and adjusts the crawling speed if necessary. The actual movement may not be very different from today, but SBV assumes more accountability based on proper analysis.

Variable Crawl for Vietnam n SBV mainly sets the rate, while market force is used as a supplementary input. (VN’s financial markets are still primitive. ) n n SBV monitors the situation monthly and adjusts the crawling speed if necessary. The actual movement may not be very different from today, but SBV assumes more accountability based on proper analysis.

The End If enough interest exists, VDF will start research on exchange rate management

The End If enough interest exists, VDF will start research on exchange rate management