0e053414d28f55476dfb492477989a37.ppt

- Количество слайдов: 34

Recent Developments In Theory And Practice Of Islamic Banking And Finance Humayon Dar Loughborough University

Recent Developments In Theory And Practice Of Islamic Banking And Finance Humayon Dar Loughborough University

References ¡ El-Gamal, M. A. 2000 A Basic Guide to Contemporary Islamic Banking and Finance. ONLINE RESOURCE http: //www. ruf. rice. edu/~elgamal/files/primer. pdf ¡ Al-Jarhi, M. A. and Iqbal, M. 2001 Islamic Banking: Answers to Some Frequently Asked Questions. Jeddah: IRTI.

References ¡ El-Gamal, M. A. 2000 A Basic Guide to Contemporary Islamic Banking and Finance. ONLINE RESOURCE http: //www. ruf. rice. edu/~elgamal/files/primer. pdf ¡ Al-Jarhi, M. A. and Iqbal, M. 2001 Islamic Banking: Answers to Some Frequently Asked Questions. Jeddah: IRTI.

Lecture Plan Introduction ¡ Models of Islamic banking and finance l Earlier models l Later models ¡ Practice l Pre-1980 l 1980 -1990 l 1990 onwards ¡

Lecture Plan Introduction ¡ Models of Islamic banking and finance l Earlier models l Later models ¡ Practice l Pre-1980 l 1980 -1990 l 1990 onwards ¡

Lecture Plan … Recent developments ¡ Change in thinking/emphasis ¡ Future ¡ Conclusions ¡

Lecture Plan … Recent developments ¡ Change in thinking/emphasis ¡ Future ¡ Conclusions ¡

Introduction ¡ Banking and finance in commensurate with the Shariah – Islamic law l Shariah-compliant banking? l Halal banking?

Introduction ¡ Banking and finance in commensurate with the Shariah – Islamic law l Shariah-compliant banking? l Halal banking?

Introduction… ¡ Banking and finance as an integral part of an Islamic economic system l Banking and finance to achieve policy objectives of an Islamic system? l Social Banking?

Introduction… ¡ Banking and finance as an integral part of an Islamic economic system l Banking and finance to achieve policy objectives of an Islamic system? l Social Banking?

Introduction… Spread all over the world ¡ Over 50 -75 countries ¡ About 250 Islamic financial institutions ¡ $200 -$800 billion in size ¡ Average annual growth of 15% ¡

Introduction… Spread all over the world ¡ Over 50 -75 countries ¡ About 250 Islamic financial institutions ¡ $200 -$800 billion in size ¡ Average annual growth of 15% ¡

How Did It All Start? It is a modern banking style: post-1950 phenomenon ¡ Egypt (1963), Malaysia (1963) and Pakistan (1965) early experimentation ¡ Malaysia stands out Pakistan and Egypt left behind ¡ The Middle East as a hub of Islamic Finance ¡

How Did It All Start? It is a modern banking style: post-1950 phenomenon ¡ Egypt (1963), Malaysia (1963) and Pakistan (1965) early experimentation ¡ Malaysia stands out Pakistan and Egypt left behind ¡ The Middle East as a hub of Islamic Finance ¡

What Was The Initial Thinking? Ills of interest highlighted interest-based financial system: a cause of under-development ¡ Need for an Islamic alternative socio-economic development, equity and justice etc emphasised ¡ Idea of social or community banking Mit Ghamr was a social bank ¡

What Was The Initial Thinking? Ills of interest highlighted interest-based financial system: a cause of under-development ¡ Need for an Islamic alternative socio-economic development, equity and justice etc emphasised ¡ Idea of social or community banking Mit Ghamr was a social bank ¡

What Was The Initial Thinking? ¡ Development motive was at the heart of Islamic banking thinking Islamic Development Bank (1974)

What Was The Initial Thinking? ¡ Development motive was at the heart of Islamic banking thinking Islamic Development Bank (1974)

Modelling Islamic Banking And Finance Modelling of Islamic banking shifted the emphasis from social banking to profit loss sharing and profit-motive ¡ Two-Tier Mudaraba Model profit motive emphasised ¡ Conventional banking style was adopted as a way forward private banks or special Islamic banks (1974 - ) ¡

Modelling Islamic Banking And Finance Modelling of Islamic banking shifted the emphasis from social banking to profit loss sharing and profit-motive ¡ Two-Tier Mudaraba Model profit motive emphasised ¡ Conventional banking style was adopted as a way forward private banks or special Islamic banks (1974 - ) ¡

Practice … Murabaha or fixed-return modes dominated PLS marginalised ¡ Idea of social/ community/ development banking faded away ¡ Era of Islamic commercial banking earning profit as opposed to charging interest ¡

Practice … Murabaha or fixed-return modes dominated PLS marginalised ¡ Idea of social/ community/ development banking faded away ¡ Era of Islamic commercial banking earning profit as opposed to charging interest ¡

Practice… Anglo-Saxon model of banking ¡ Profitability as a yardstick of success ¡

Practice… Anglo-Saxon model of banking ¡ Profitability as a yardstick of success ¡

Current Issues Transition from interest-free paradigm to asset-based paradigm ¡ Pricing of Islamic financial products ¡ Screening principles for investing in equity and stocks ¡

Current Issues Transition from interest-free paradigm to asset-based paradigm ¡ Pricing of Islamic financial products ¡ Screening principles for investing in equity and stocks ¡

Current Issues… Financial innovation ¡ Regulation of Islamic financial services ¡ Towards a theory of Islamic financial firm ¡

Current Issues… Financial innovation ¡ Regulation of Islamic financial services ¡ Towards a theory of Islamic financial firm ¡

Interest-Free Versus Asset-Based Interest-free banking was a hallmark of Islamic finance pre-1990 emphasis ¡ Institutionalisation of Murabaha post-1990 phenomenon ¡ Return on asset-backed financial assets is acceptable ¡

Interest-Free Versus Asset-Based Interest-free banking was a hallmark of Islamic finance pre-1990 emphasis ¡ Institutionalisation of Murabaha post-1990 phenomenon ¡ Return on asset-backed financial assets is acceptable ¡

An Example! ¡ ¡ 1. 2. I need £ 100, 000 for a business venture for a period of one year. I have got two options Borrowing at a rate of interest of 7% Going Islamic way First is not acceptable to my Shariah Advisor What about the second?

An Example! ¡ ¡ 1. 2. I need £ 100, 000 for a business venture for a period of one year. I have got two options Borrowing at a rate of interest of 7% Going Islamic way First is not acceptable to my Shariah Advisor What about the second?

Option 2 My advisor issues securities worth £ 100, 000 on my house ¡ The securities are sold to a third party with a buy-back clause of one year ¡ The buyer then rents the house to me for one year on a rental equivalent to 7% of the stocks’ worth (£ 100, 000) ¡

Option 2 My advisor issues securities worth £ 100, 000 on my house ¡ The securities are sold to a third party with a buy-back clause of one year ¡ The buyer then rents the house to me for one year on a rental equivalent to 7% of the stocks’ worth (£ 100, 000) ¡

Option 2… Is it acceptable? YES… This is what we do in securitisation!!!

Option 2… Is it acceptable? YES… This is what we do in securitisation!!!

What’s The Difference? Option 1 involves Riba while Option 2 involves trade Probably right But… Are they really different? Yes… Probably not… ¡

What’s The Difference? Option 1 involves Riba while Option 2 involves trade Probably right But… Are they really different? Yes… Probably not… ¡

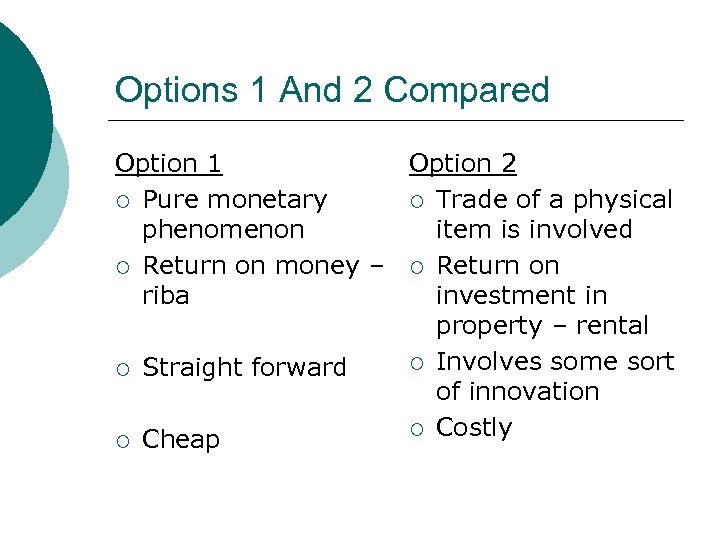

Options 1 And 2 Compared Option 1 Option 2 ¡ Pure monetary ¡ Trade of a physical phenomenon item is involved ¡ Return on money – ¡ Return on riba investment in property – rental ¡ Involves some sort ¡ Straight forward of innovation ¡ Costly ¡ Cheap

Options 1 And 2 Compared Option 1 Option 2 ¡ Pure monetary ¡ Trade of a physical phenomenon item is involved ¡ Return on money – ¡ Return on riba investment in property – rental ¡ Involves some sort ¡ Straight forward of innovation ¡ Costly ¡ Cheap

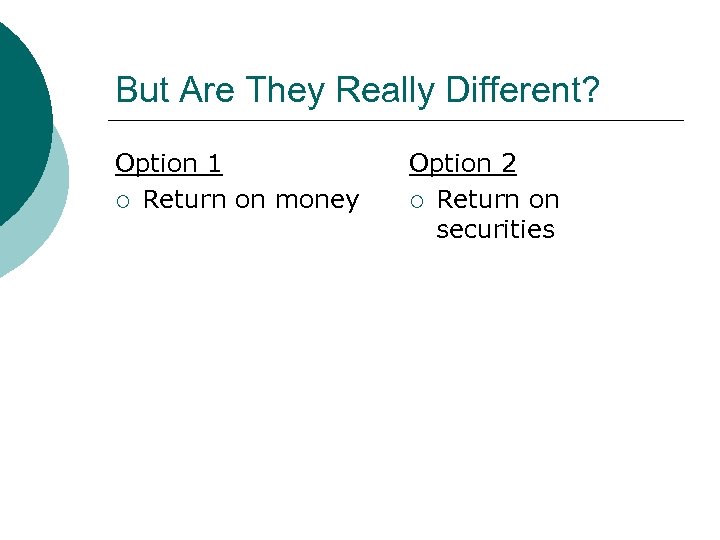

But Are They Really Different? Option 1 ¡ Return on money Option 2 ¡ Return on securities

But Are They Really Different? Option 1 ¡ Return on money Option 2 ¡ Return on securities

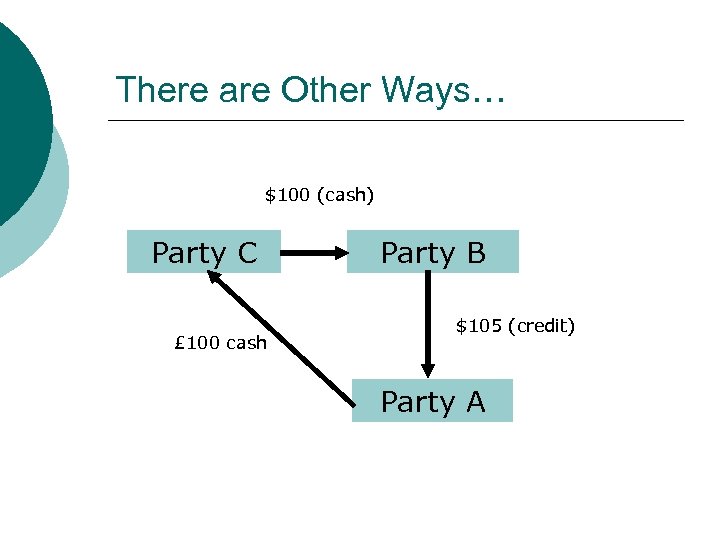

There are Other Ways… $100 (cash) Party C £ 100 cash Party B $105 (credit) Party A

There are Other Ways… $100 (cash) Party C £ 100 cash Party B $105 (credit) Party A

Result Asset-based financing has become a hallmark of Islamic banking and finance in the 21 st century

Result Asset-based financing has become a hallmark of Islamic banking and finance in the 21 st century

Pricing Of Islamic Financial Products Interest remains relevant ¡ Benchmarking with LIBOR, KLIBOR ¡ Positive correlation between interest and prices of Islamic financial products ¡ Normally a “mark-up” over the benchmarked interest ¡

Pricing Of Islamic Financial Products Interest remains relevant ¡ Benchmarking with LIBOR, KLIBOR ¡ Positive correlation between interest and prices of Islamic financial products ¡ Normally a “mark-up” over the benchmarked interest ¡

Consequently… Demand for Islamic finance remains sluggish at a grassroots level ¡ Islamic finance’s focus remains on the so-called “captive market” ¡ Islamic finance as an elitist phenomenon ¡ Is it supply-driven? ¡

Consequently… Demand for Islamic finance remains sluggish at a grassroots level ¡ Islamic finance’s focus remains on the so-called “captive market” ¡ Islamic finance as an elitist phenomenon ¡ Is it supply-driven? ¡

Principles Of Islamic Investing in stocks in a Halal/ Islamic way ¡ Dow Jones and FT Islamic Indices ¡ Full details available on the respective websites http: //www. djindexes. com http: //www. ftse. com/indices_marke tdata/ground_rules/global-islamicground-rules. pdf ¡ Islamic investment/ mutual fund industry ¡

Principles Of Islamic Investing in stocks in a Halal/ Islamic way ¡ Dow Jones and FT Islamic Indices ¡ Full details available on the respective websites http: //www. djindexes. com http: //www. ftse. com/indices_marke tdata/ground_rules/global-islamicground-rules. pdf ¡ Islamic investment/ mutual fund industry ¡

Financial Innovation Strong need for financial innovation for further growth in Islamic finance ¡ Securitisation ¡ Sukuk structures ¡

Financial Innovation Strong need for financial innovation for further growth in Islamic finance ¡ Securitisation ¡ Sukuk structures ¡

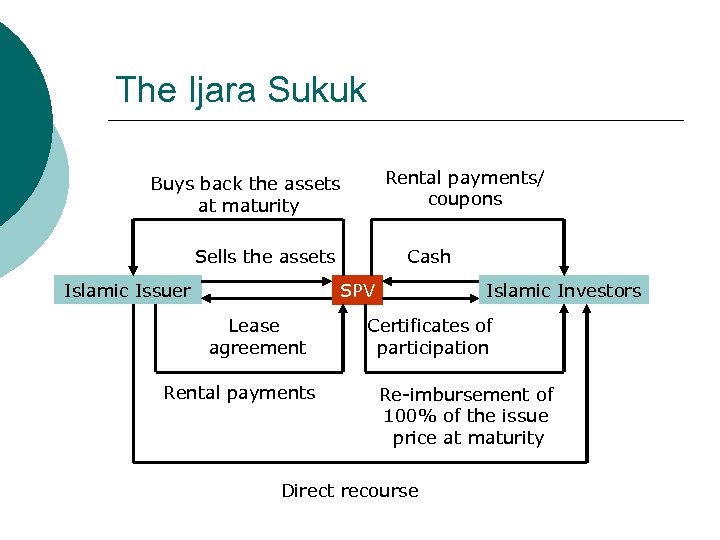

The Ijara Sukuk Rental payments/ coupons Buys back the assets at maturity Sells the assets Islamic Issuer Cash Islamic Investors SPV Lease agreement Rental payments Certificates of participation Re-imbursement of 100% of the issue price at maturity Direct recourse

The Ijara Sukuk Rental payments/ coupons Buys back the assets at maturity Sells the assets Islamic Issuer Cash Islamic Investors SPV Lease agreement Rental payments Certificates of participation Re-imbursement of 100% of the issue price at maturity Direct recourse

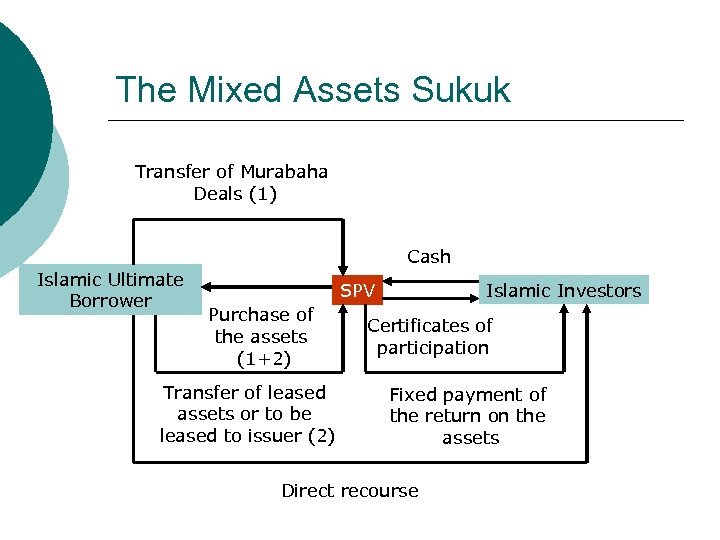

The Mixed Assets Sukuk Transfer of Murabaha Deals (1) Cash Islamic Ultimate Borrower Islamic Investors SPV Purchase of the assets (1+2) Transfer of leased assets or to be leased to issuer (2) Certificates of participation Fixed payment of the return on the assets Direct recourse

The Mixed Assets Sukuk Transfer of Murabaha Deals (1) Cash Islamic Ultimate Borrower Islamic Investors SPV Purchase of the assets (1+2) Transfer of leased assets or to be leased to issuer (2) Certificates of participation Fixed payment of the return on the assets Direct recourse

Regulation of Islamic Financial Services Separate regulatory framework for Islamic finance is considered a necessity ¡ AAIOFI ¡ IFSB ¡

Regulation of Islamic Financial Services Separate regulatory framework for Islamic finance is considered a necessity ¡ AAIOFI ¡ IFSB ¡

Towards A Theory Of The Islamic Financial Firm Definition(s) ¡ Objectives ¡ Analysis ¡

Towards A Theory Of The Islamic Financial Firm Definition(s) ¡ Objectives ¡ Analysis ¡

Future Of Islamic Finance Not much different from conventional finance ¡ Need for re-direction ¡ Need for genuine innovation ¡ Future lies in Islamic homelands and not in the Western financial centres ¡

Future Of Islamic Finance Not much different from conventional finance ¡ Need for re-direction ¡ Need for genuine innovation ¡ Future lies in Islamic homelands and not in the Western financial centres ¡

Conclusion Thank you

Conclusion Thank you