1466aafb7792e3fc36f6473ddfc2bb31.ppt

- Количество слайдов: 24

Recent developments in auditing Public Private Partnerships (PPPs) Richard Wade National Audit Office EUROSAI Prague, November 2006 HELPING THE NATION SPEND WISELY

Three main topics § UK experience to date § Major audit issues – financial & performance § A comprehensive audit approach HELPING THE NATION SPEND WISELY

Desired benefits are unchanged Private Finance Initiative (PFI) model should offer § Modern Facilities built with Whole Life Approach § Delivered to Time and Budget § Increased Efficiency in Service Provision § Reduced Cost and/or Better Quality of Service HELPING THE NATION SPEND WISELY

PFI schemes – some examples Bridges Schools Tramways Hospitals Roads Prisons HELPING THE NATION SPEND WISELY

UK PPP experience to date § 670 signed deals, 430 operational § Over 50 published NAO reports on PPP/PFI since 1997 § Individual deals and thematic/cross cutting reports – Construction perfomance – Financial analysis and financing issues – Operational performance of prisons HELPING THE NATION SPEND WISELY

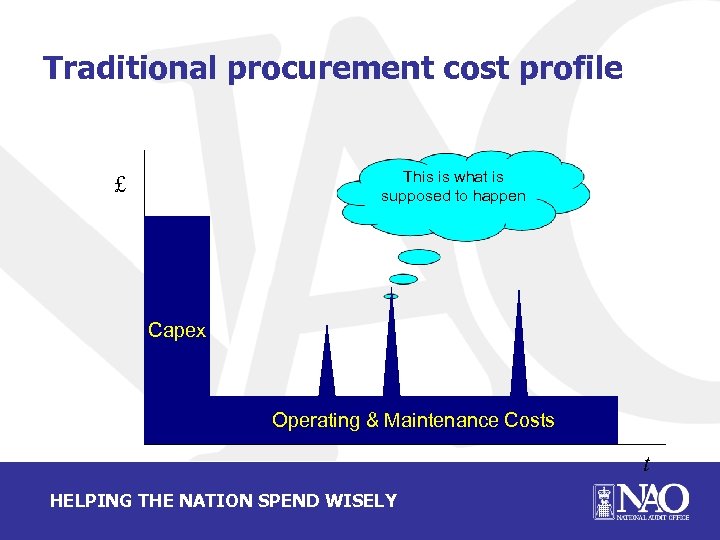

Traditional procurement cost profile This is what is supposed to happen £ Capex Operating & Maintenance Costs t HELPING THE NATION SPEND WISELY

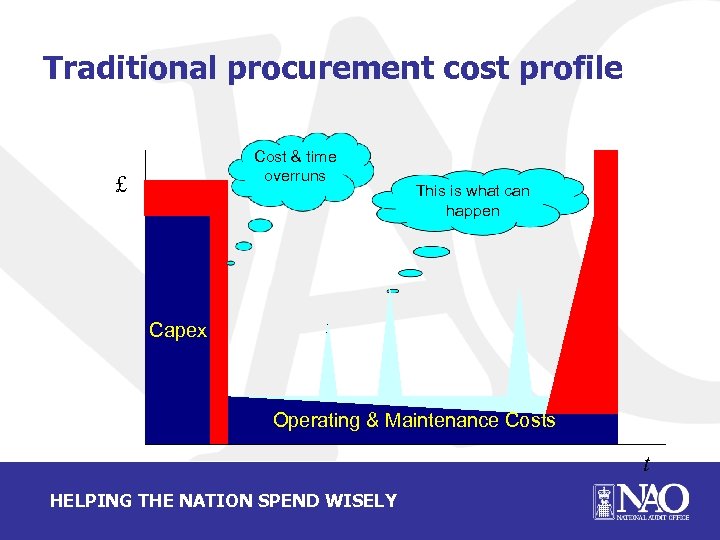

Traditional procurement cost profile Cost & time overruns £ This is what can happen Capex Operating & Maintenance Costs t HELPING THE NATION SPEND WISELY

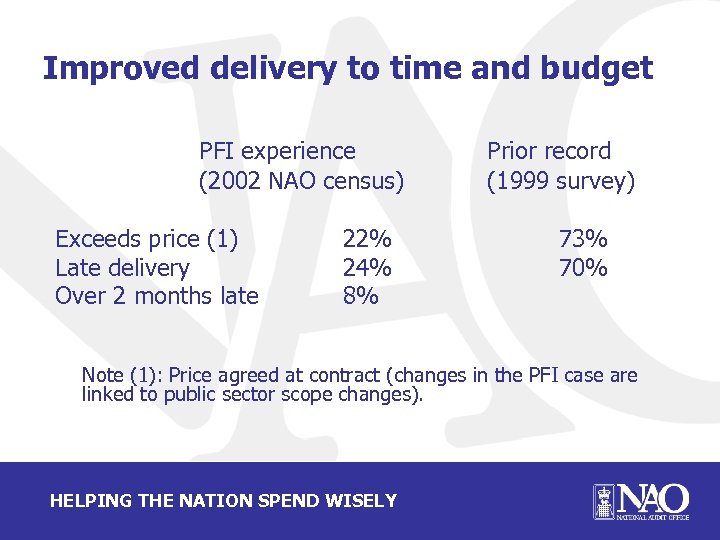

Improved delivery to time and budget PFI experience (2002 NAO census) Exceeds price (1) Late delivery Over 2 months late 22% 24% 8% Prior record (1999 survey) 73% 70% Note (1): Price agreed at contract (changes in the PFI case are linked to public sector scope changes). HELPING THE NATION SPEND WISELY

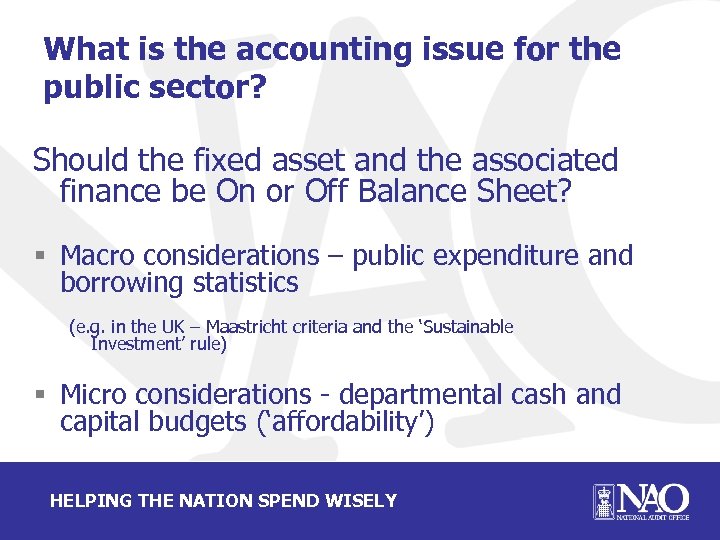

What is the accounting issue for the public sector? Should the fixed asset and the associated finance be On or Off Balance Sheet? § Macro considerations – public expenditure and borrowing statistics (e. g. in the UK – Maastricht criteria and the ‘Sustainable Investment’ rule) § Micro considerations - departmental cash and capital budgets (‘affordability’) HELPING THE NATION SPEND WISELY

The dangers of Off Balance Sheet Accounting § Government liabilities are understated § Payment burdens are shifted onto future generations - will the debt repayment be manageable? § Risks associated with the service provision may be overlooked § Value for Money may be compromised HELPING THE NATION SPEND WISELY

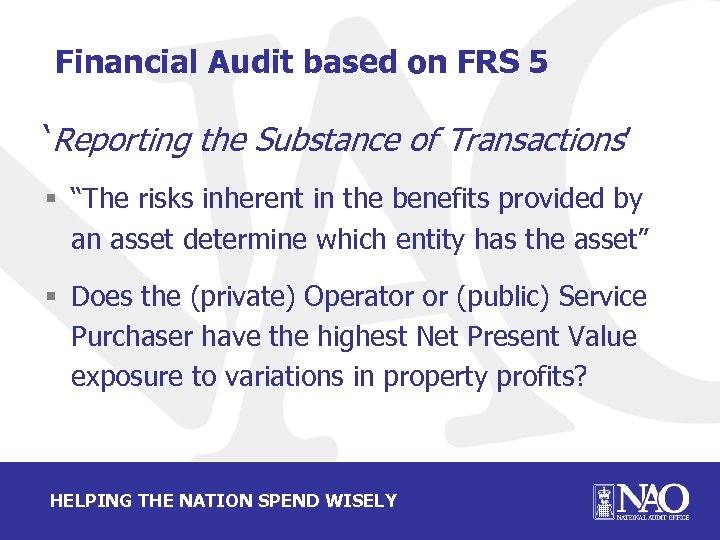

Financial Audit based on FRS 5 ‘Reporting the Substance of Transactions’ § “The risks inherent in the benefits provided by an asset determine which entity has the asset” § Does the (private) Operator or (public) Service Purchaser have the highest Net Present Value exposure to variations in property profits? HELPING THE NATION SPEND WISELY

FRS 5 – two key risks § “Demand risk: that demand for the property will be greater or less than predicted or expected. Where demand risk is significant, it will normally give the clearest evidence of who should record an asset of the property”. § “Residual value risk: that the actual value of the property at the end of the contract will vary. Where it is significant, residual value risk will normally give clear evidence of who should record an asset of the property”. INTOSAI Privatisation Working Group September 2006

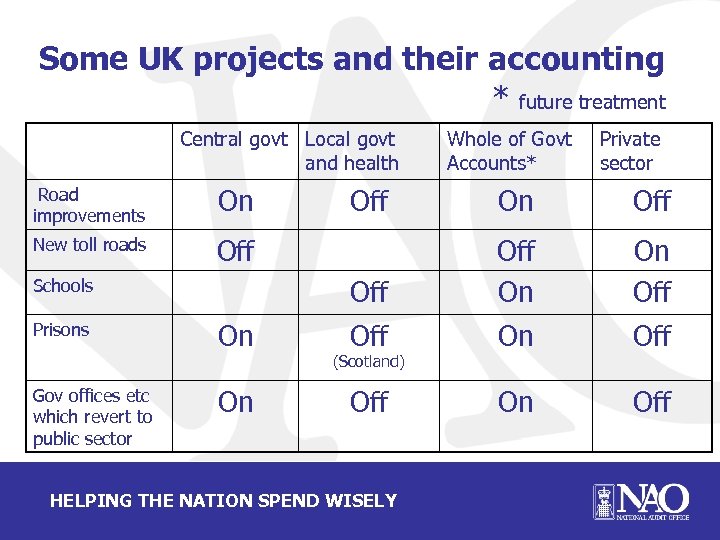

Some UK projects and their accounting * future treatment Central govt Local govt and health Road improvements On New toll roads Off Gov offices etc which revert to public sector Private sector On On Off Off Schools Prisons Whole of Govt Accounts* Off On On Off Off On Off (Scotland) HELPING THE NATION SPEND WISELY

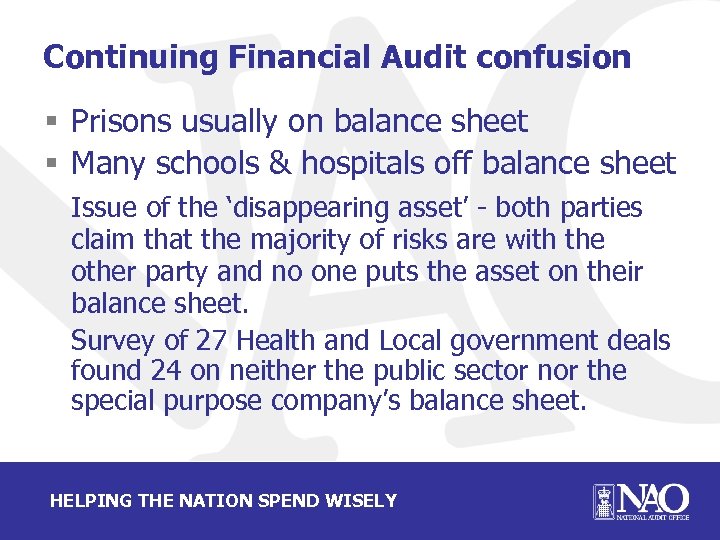

Continuing Financial Audit confusion § Prisons usually on balance sheet § Many schools & hospitals off balance sheet Issue of the ‘disappearing asset’ - both parties claim that the majority of risks are with the other party and no one puts the asset on their balance sheet. Survey of 27 Health and Local government deals found 24 on neither the public sector nor the special purpose company’s balance sheet. HELPING THE NATION SPEND WISELY

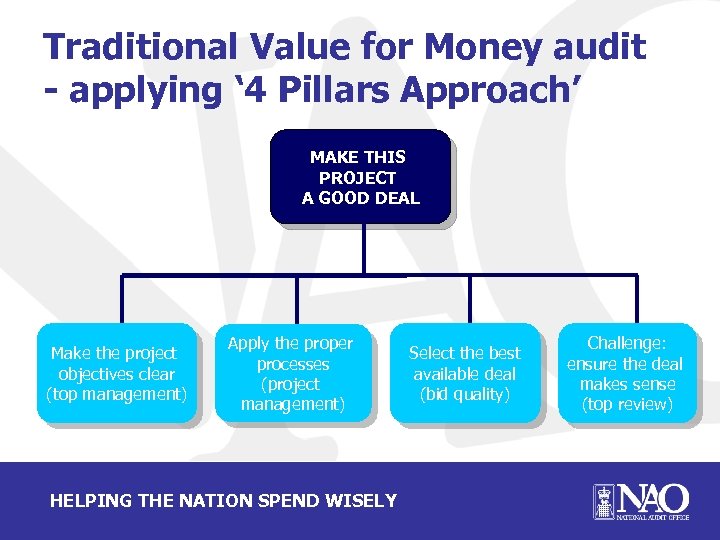

Traditional Value for Money audit - applying ‘ 4 Pillars Approach’ MAKE THIS PROJECT A GOOD DEAL Make the project objectives clear (top management) Apply the proper processes (project management) HELPING THE NATION SPEND WISELY Select the best available deal (bid quality) Challenge: ensure the deal makes sense (top review)

Time to update the audit approach § Published methodology looks at the deal as closed § There is little published guidance once deals are operational § The value for money assessment can change over the contract period HELPING THE NATION SPEND WISELY

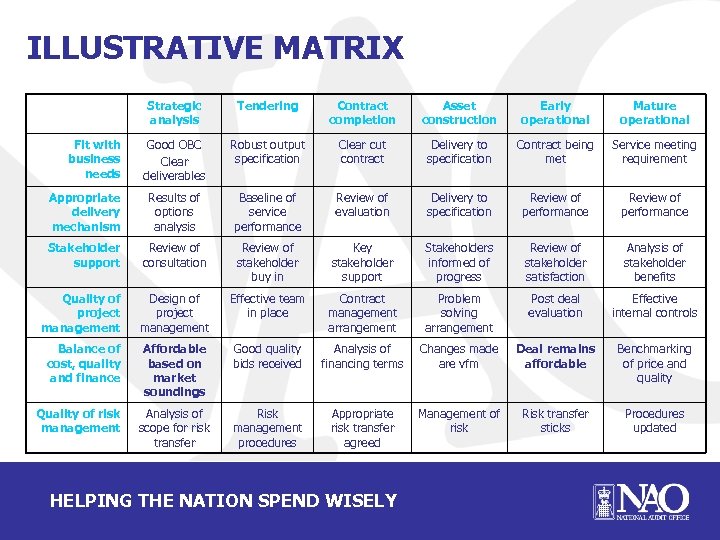

A new approach – May 2006 § Two dimensional matrix § Chronological approach based on key stages § Key performance themes/indicators, supported by detailed audit questions “what you would expect to find if a project delivers value for money at every stage” HELPING THE NATION SPEND WISELY

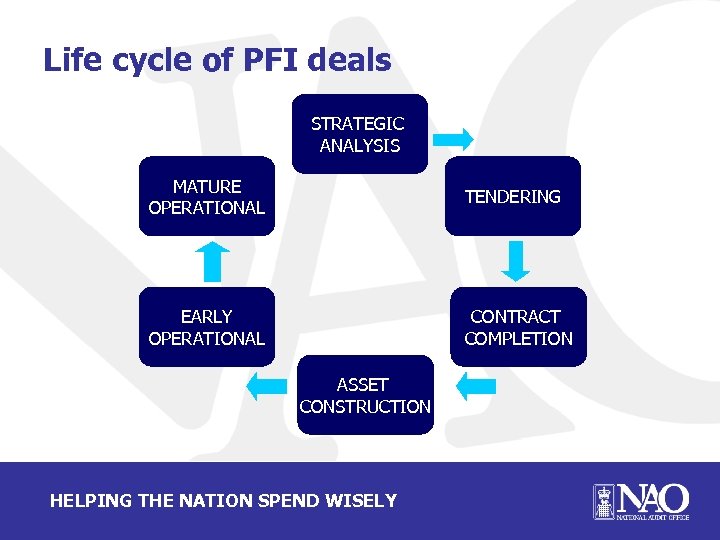

Life cycle of PFI deals STRATEGIC ANALYSIS MATURE OPERATIONAL TENDERING EARLY OPERATIONAL CONTRACT COMPLETION ASSET CONSTRUCTION HELPING THE NATION SPEND WISELY

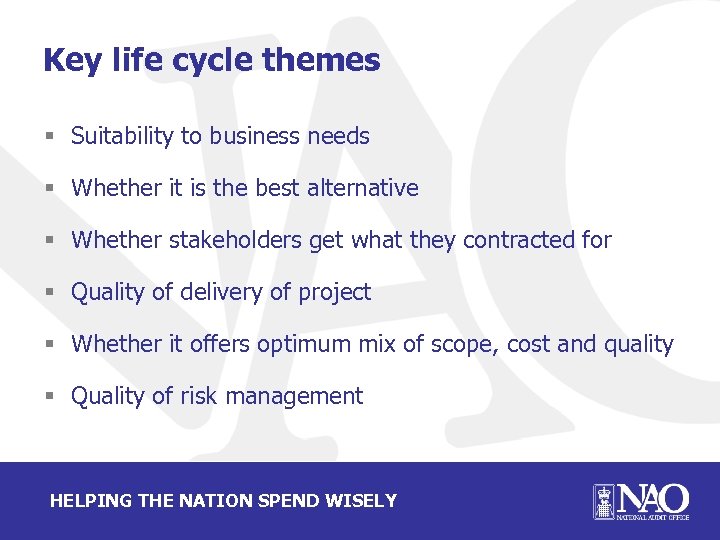

Key life cycle themes § Suitability to business needs § Whether it is the best alternative § Whether stakeholders get what they contracted for § Quality of delivery of project § Whether it offers optimum mix of scope, cost and quality § Quality of risk management HELPING THE NATION SPEND WISELY

ILLUSTRATIVE MATRIX Strategic analysis Tendering Contract completion Asset construction Early operational Mature operational Good OBC Clear deliverables Robust output specification Clear cut contract Delivery to specification Contract being met Service meeting requirement Appropriate delivery mechanism Results of options analysis Baseline of service performance Review of evaluation Delivery to specification Review of performance Stakeholder support Review of consultation Review of stakeholder buy in Key stakeholder support Stakeholders informed of progress Review of stakeholder satisfaction Analysis of stakeholder benefits Quality of project management Design of project management Effective team in place Contract management arrangement Problem solving arrangement Post deal evaluation Effective internal controls Balance of cost, quality and finance Affordable based on market soundings Good quality bids received Analysis of financing terms Changes made are vfm Deal remains affordable Benchmarking of price and quality Analysis of scope for risk transfer Risk management procedures Appropriate risk transfer agreed Management of risk Risk transfer sticks Procedures updated Fit with business needs Quality of risk management HELPING THE NATION SPEND WISELY

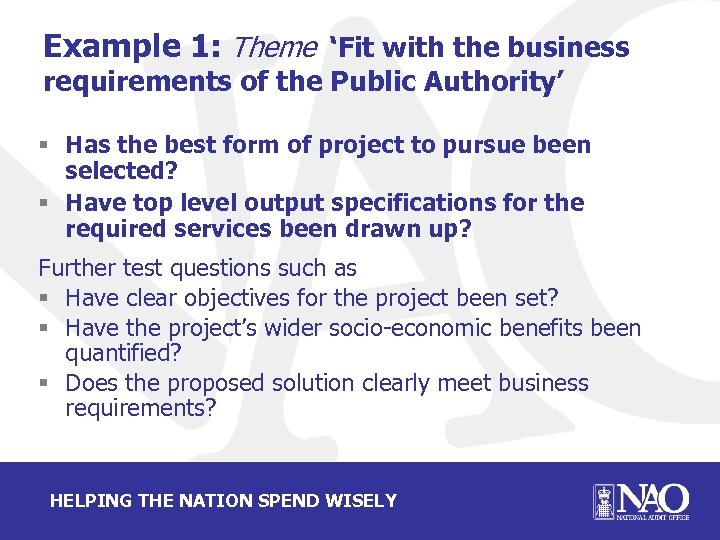

Example 1: Theme ‘‘Fit with the business requirements of the Public Authority’ § Has the best form of project to pursue been selected? § Have top level output specifications for the required services been drawn up? Further test questions such as § Have clear objectives for the project been set? § Have the project’s wider socio-economic benefits been quantified? § Does the proposed solution clearly meet business requirements? HELPING THE NATION SPEND WISELY

Example 2: Theme ‘PFI is the appropriate’ delivery mechanism § Has the project been assessed as part of a suitable investment programme for PFI? § Has a good outline business case justifying a PFI procurement route been produced? § Are the qualitative reasons for proceeding with PFI clearly justified? HELPING THE NATION SPEND WISELY

HOW THE APPROACH CAN BE USED § As a guide to VFM of individual deals § At a programme level § As a “traffic light” system to highlight main risks HELPING THE NATION SPEND WISELY

More recent PFI issues § Does EU ‘competitive dialogue’ imply fully funded bids with duplication of costs? § Early UK deals are now reaching the stage of periodic ‘market testing’ for the cost of service delivery. What are the issues for auditors? HELPING THE NATION SPEND WISELY

1466aafb7792e3fc36f6473ddfc2bb31.ppt