88af37ee4c58b737a15a9ccb200761b9.ppt

- Количество слайдов: 92

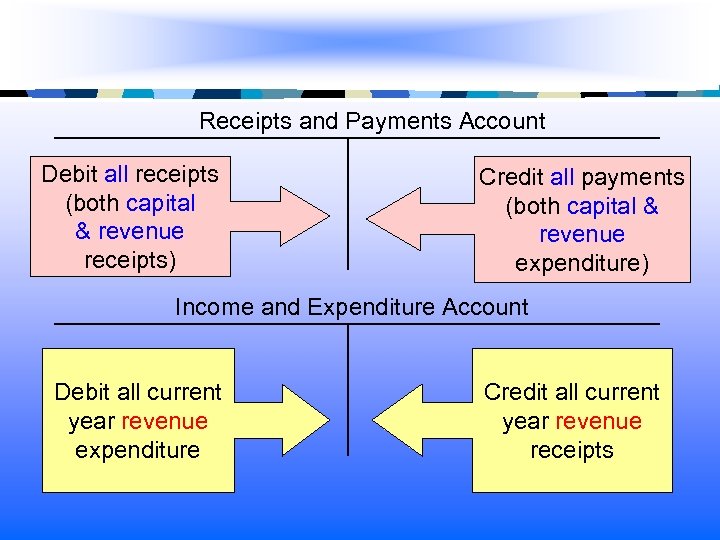

Receipts and Payments Account Debit all receipts (both capital & revenue receipts) Credit all payments (both capital & revenue expenditure) Income and Expenditure Account Debit all current year revenue expenditure Credit all current year revenue receipts

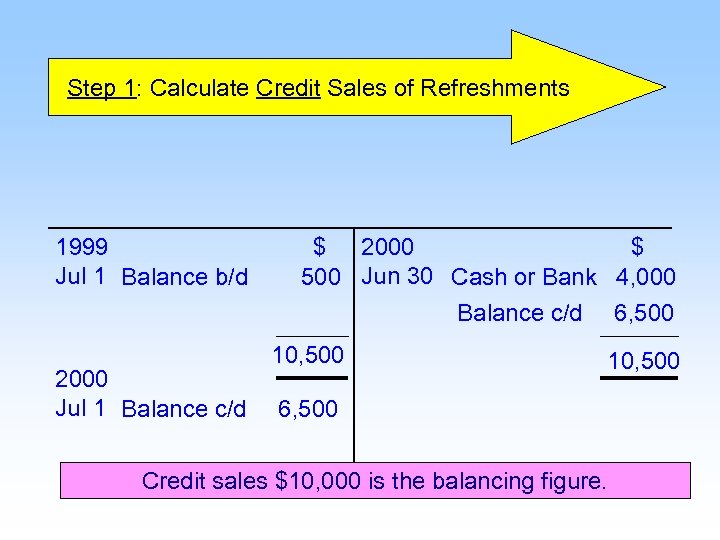

Step 1: Calculate Credit Sales of Refreshments

Step 1: Calculate Credit Sales of Refreshments 1999 Jul 1 Balance b/d 2000 Jul 1 Balance c/d $ 2000 $ 500 Jun 30 Cash or Bank 4, 000 Balance c/d 6, 500 10, 500 6, 500 Credit sales $10, 000 is the balancing figure.

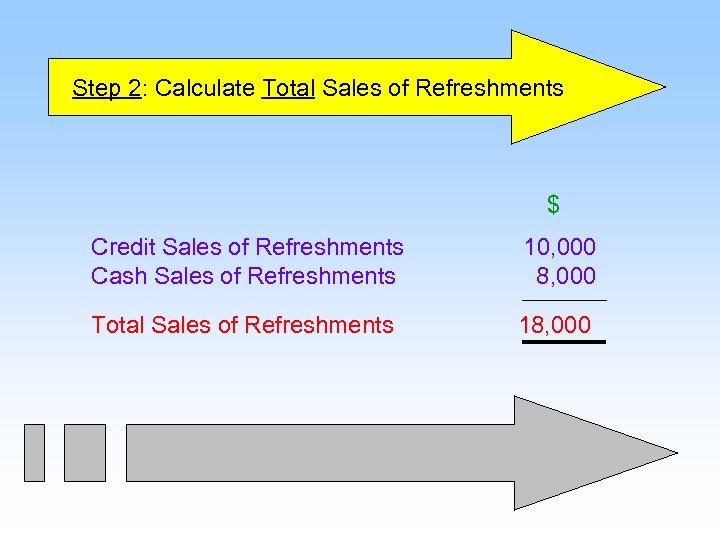

Step 2: Calculate Total Sales of Refreshments

Step 2: Calculate Total Sales of Refreshments $ Credit Sales of Refreshments Cash Sales of Refreshments 10, 000 8, 000 Total Sales of Refreshments 18, 000

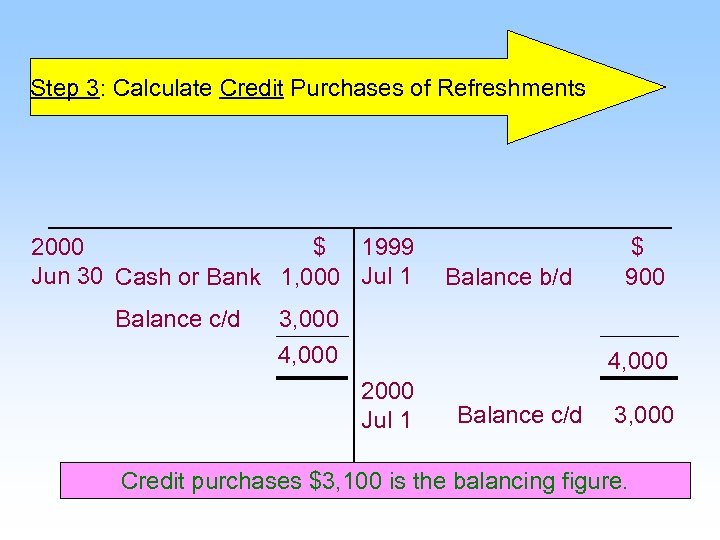

Step 3: Calculate Credit Purchases of Refreshments

Step 3: Calculate Credit Purchases of Refreshments 2000 $ 1999 Jun 30 Cash or Bank 1, 000 Jul 1 Balance c/d Balance b/d 3, 000 4, 000 $ 900 4, 000 2000 Jul 1 Balance c/d 3, 000 Credit purchases $3, 100 is the balancing figure.

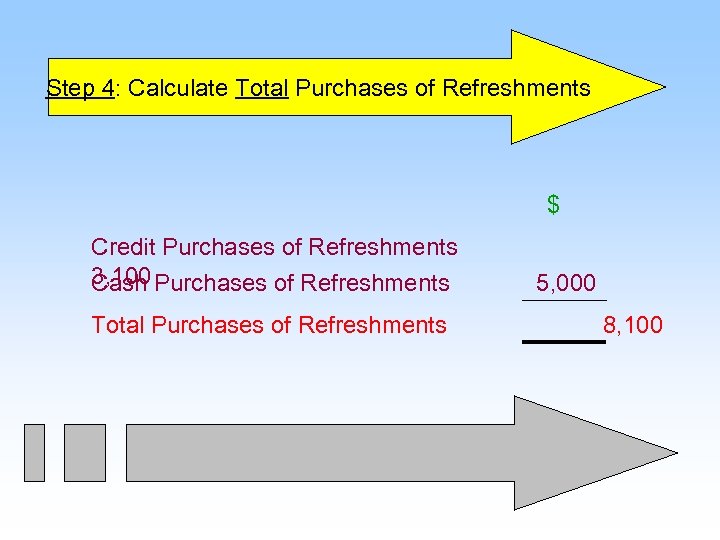

Step 4: Calculate Total Purchases of Refreshments $ Credit Purchases of Refreshments 3, 100 Purchases of Refreshments Cash Total Purchases of Refreshments 5, 000 8, 100

Step 5: Calculate wages for the preparation of refreshment

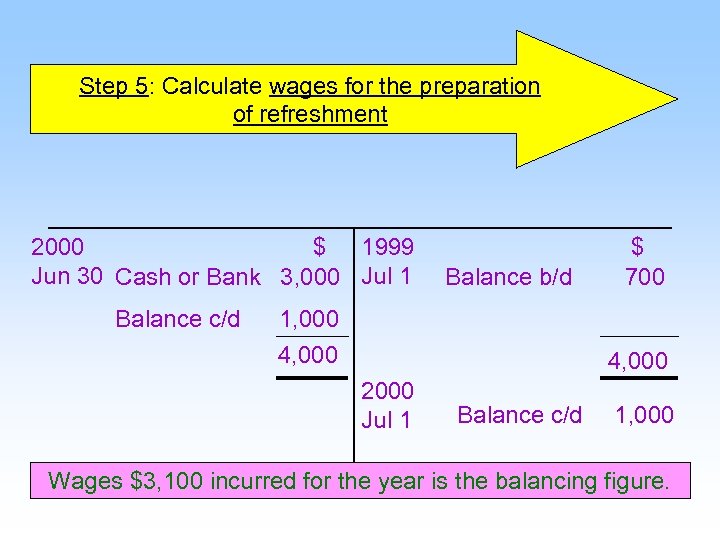

Step 5: Calculate wages for the preparation of refreshment 2000 $ 1999 Jun 30 Cash or Bank 3, 000 Jul 1 Balance c/d Balance b/d 1, 000 4, 000 $ 700 4, 000 2000 Jul 1 Balance c/d 1, 000 Wages $3, 100 incurred for the year is the balancing figure.

Step 6: Prepare the Refreshment Trading Account $ $

Step 7: Transferring refreshment net profit to the Income and Expenditure Account Debit all current year revenue expenditure Credit all current year revenue receipts

Step 7: Transferring refreshment net profit to the Income and Expenditure Account

Dr Subscriptions Account $ Cr $

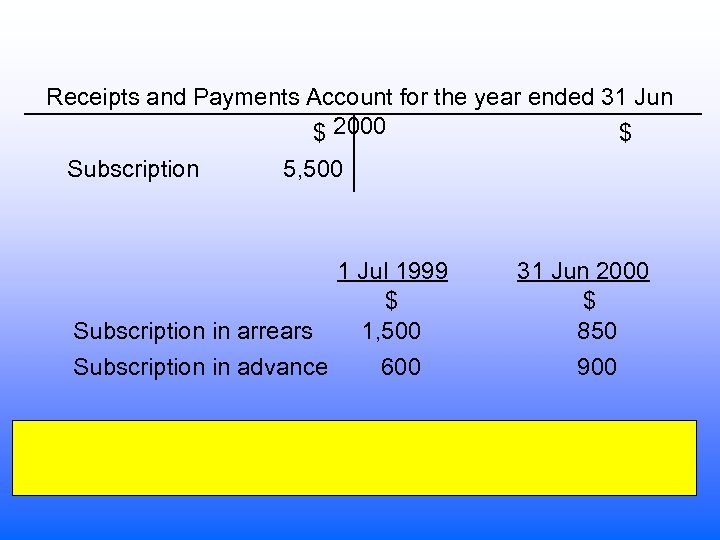

Receipts and Payments Account for the year ended 31 Jun $ 2000 $ Subscription 5, 500 1 Jul 1999 $ Subscription in arrears 1, 500 Subscription in advance 600 31 Jun 2000 $ 850 900

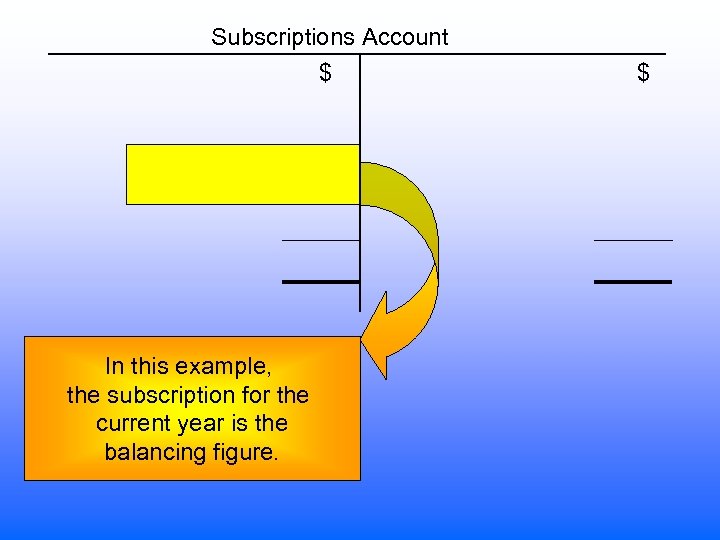

Subscriptions Account $ In this example, the subscription for the current year is the balancing figure. $

Subscriptions Account $ $

Subscriptions Account $ $

Subscriptions Account $ Balance Sheet as at 30 June 2000 $ $ $

Subscriptions Account $ Balance Sheet as at 30 June 2000 $ $ $

Everyday Dance Club Income and Expenditure Account for the year ended 31 Jun 2000 $ $ Gain from dance competition ($330 -$200) 130

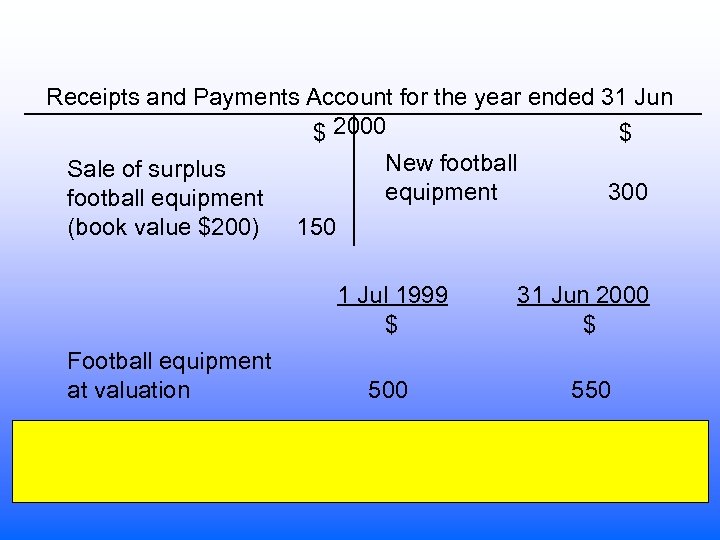

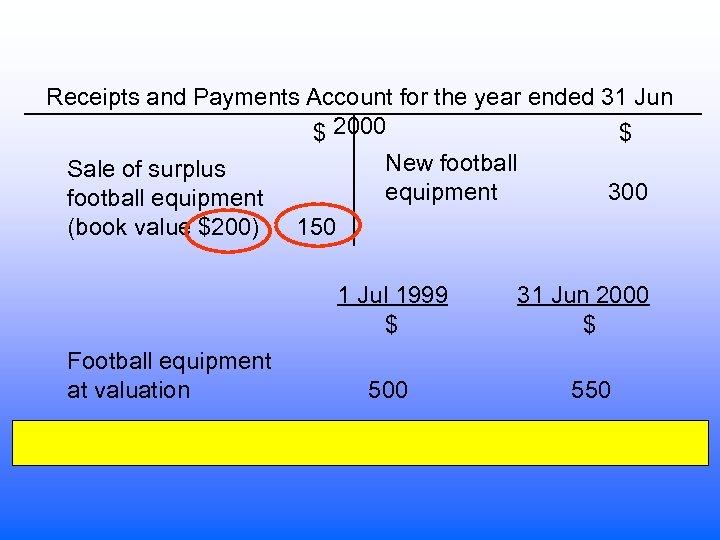

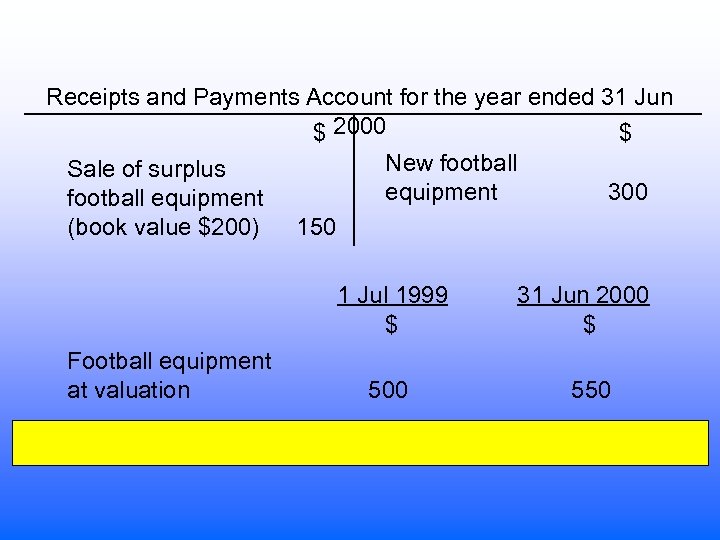

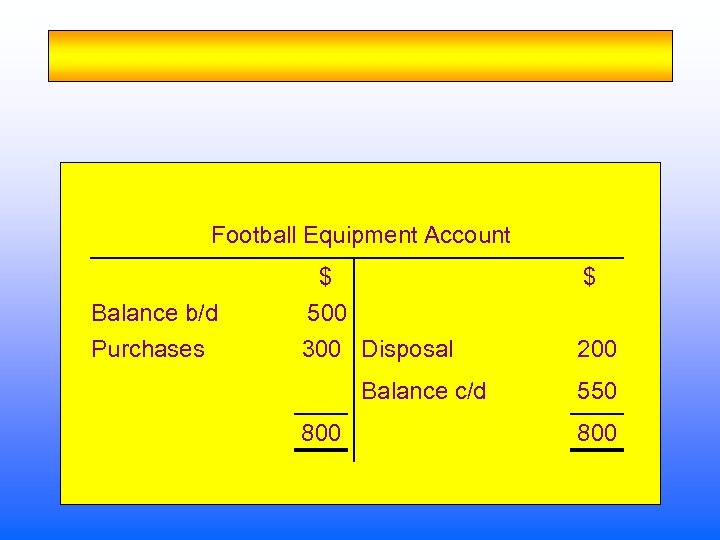

Receipts and Payments Account for the year ended 31 Jun $ 2000 $ New football Sale of surplus equipment 300 football equipment (book value $200) 150 1 Jul 1999 $ Football equipment at valuation 500 31 Jun 2000 $ 550

Receipts and Payments Account for the year ended 31 Jun $ 2000 $ New football Sale of surplus equipment 300 football equipment (book value $200) 150 1 Jul 1999 $ Football equipment at valuation 500 31 Jun 2000 $ 550

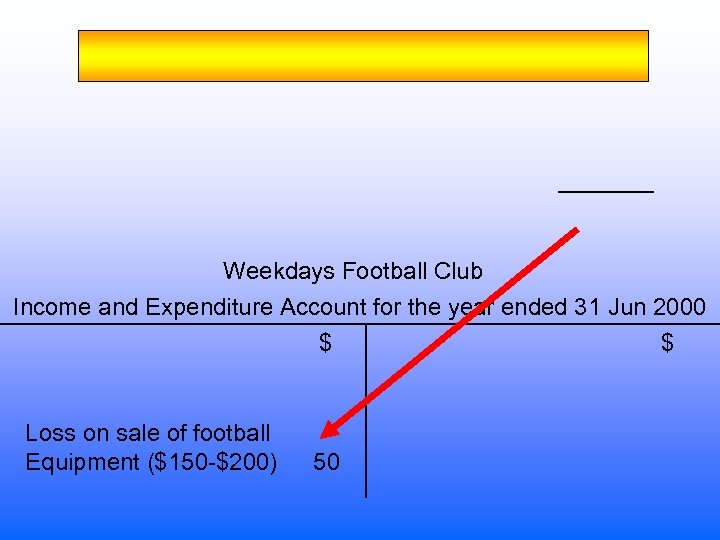

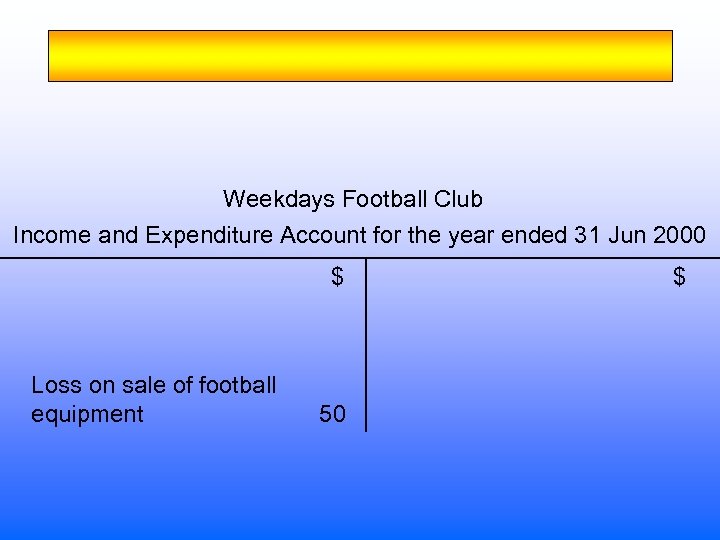

Weekdays Football Club Income and Expenditure Account for the year ended 31 Jun 2000 $ $ Loss on sale of football Equipment ($150 -$200) 50

Receipts and Payments Account for the year ended 31 Jun $ 2000 $ New football Sale of surplus equipment 300 football equipment (book value $200) 150 1 Jul 1999 $ Football equipment at valuation 500 31 Jun 2000 $ 550

Football Equipment Account Balance b/d Purchases $ 500 300 Disposal Balance c/d 800 $ 200 550 800

Weekdays Football Club Income and Expenditure Account for the year ended 31 Jun 2000 $ Loss on sale of football equipment 50 $

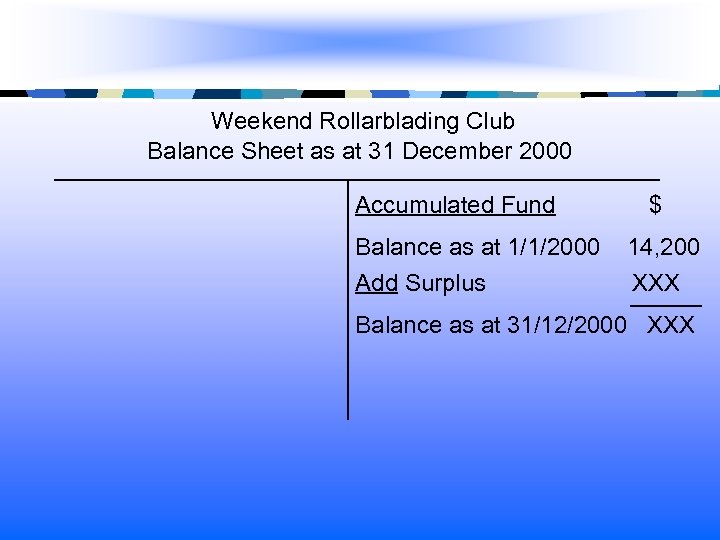

Weekend Rollarblading Club Balance Sheet as at 31 December 2000 Accumulated Fund Balance as at 1/1/2000 Add Surplus $ 14, 200 XXX Balance as at 31/12/2000 XXX

88af37ee4c58b737a15a9ccb200761b9.ppt