7efc017e4eb687f69222cdc84640610b.ppt

- Количество слайдов: 46

Realizing the American Dream Protecting Your Investment

Realizing the American Dream Protecting Your Investment

Agenda • Getting to know your home • Assuring home safety • Saving energy and money • Preventive maintenance and minor repairs • Remodeling and major repairs • Investing in your neighborhood

Agenda • Getting to know your home • Assuring home safety • Saving energy and money • Preventive maintenance and minor repairs • Remodeling and major repairs • Investing in your neighborhood

Agenda (Cont’d) • Asset building • Keeping records • Taxes and insurance • Protecting your equity • Prepaying your mortgage • Coping with hardship

Agenda (Cont’d) • Asset building • Keeping records • Taxes and insurance • Protecting your equity • Prepaying your mortgage • Coping with hardship

Why Protect Your Home • Three-way Investment 1) shelter for your household 2) life and heart for your community 3) financial asset for your future

Why Protect Your Home • Three-way Investment 1) shelter for your household 2) life and heart for your community 3) financial asset for your future

Things You Need to Know • • Main cutoff valves for water and gas Main electrical switch Marked fuse or circuit breakers Hot water heater thermostat

Things You Need to Know • • Main cutoff valves for water and gas Main electrical switch Marked fuse or circuit breakers Hot water heater thermostat

Questions for the Seller • What is the history of the home? • Are there wiring diagrams or blueprints? • Are any appliances or repairs under warranty? • When is trash day? Who picks it up? • Who provides water and sewer? • What other services are available?

Questions for the Seller • What is the history of the home? • Are there wiring diagrams or blueprints? • Are any appliances or repairs under warranty? • When is trash day? Who picks it up? • Who provides water and sewer? • What other services are available?

More Questions • Who is the fuel oil supplier? • How to use energy-efficient systems • What seasonal maintenance has been done? • Who has worked on the house? • How much do the utilities and services cost? • Is there extra (matching) paint available?

More Questions • Who is the fuel oil supplier? • How to use energy-efficient systems • What seasonal maintenance has been done? • Who has worked on the house? • How much do the utilities and services cost? • Is there extra (matching) paint available?

Building a Healthy Environment • Eliminate smoking from home • Check smoke and carbon monoxide alarms • Avoid accumulation of moisture and chemical pollutants indoors • Vacuum weekly and reduce clutter • Increase air flow in the home • Reduce use of pesticides • Do not run car in attached garage

Building a Healthy Environment • Eliminate smoking from home • Check smoke and carbon monoxide alarms • Avoid accumulation of moisture and chemical pollutants indoors • Vacuum weekly and reduce clutter • Increase air flow in the home • Reduce use of pesticides • Do not run car in attached garage

More Ways to Healthy Environment • Do not heat home with unvented heater • Address water leaks ASAP • Use cleaners and pesticides in well-ventilated area • Look for natural alternatives to household products • Keep food and trash in sealed containers

More Ways to Healthy Environment • Do not heat home with unvented heater • Address water leaks ASAP • Use cleaners and pesticides in well-ventilated area • Look for natural alternatives to household products • Keep food and trash in sealed containers

First Priorities on Move-In • Post emergency numbers • Have a fire safety inspection • Install smoke and carbon monoxide alarms • Place fire extinguishers on each floor • Plan fire escape route • Stock first-aid kit (out of children’s reach)

First Priorities on Move-In • Post emergency numbers • Have a fire safety inspection • Install smoke and carbon monoxide alarms • Place fire extinguishers on each floor • Plan fire escape route • Stock first-aid kit (out of children’s reach)

Keep Safe and Secure! • Change all locks on doors & windows • Lock doors and windows when you go out • Trim shrubs that hide windows and doors • Install outside lighting • Put up “beware of dog” sign • Stop mail and newspaper when you go away

Keep Safe and Secure! • Change all locks on doors & windows • Lock doors and windows when you go out • Trim shrubs that hide windows and doors • Install outside lighting • Put up “beware of dog” sign • Stop mail and newspaper when you go away

Energy-Saving Tips • Turn lights off when you leave a room • Don’t let water run during chores • Plan meals to cook more than one item at a time • Don’t use appliances during the heat of the day • Close windows when the heat or AC is on • Close the refrigerator door completely • Dress appropriately for the season • Adjust thermostat to the season

Energy-Saving Tips • Turn lights off when you leave a room • Don’t let water run during chores • Plan meals to cook more than one item at a time • Don’t use appliances during the heat of the day • Close windows when the heat or AC is on • Close the refrigerator door completely • Dress appropriately for the season • Adjust thermostat to the season

Energy-Savings Tips for the Home • Add attic insulation • Change to low-flow faucets, shower heads and toilets • Service furnace and change filter regularly • Caulk around doors and windows • Install storm windows and doors

Energy-Savings Tips for the Home • Add attic insulation • Change to low-flow faucets, shower heads and toilets • Service furnace and change filter regularly • Caulk around doors and windows • Install storm windows and doors

More Energy-Savings Tips • Set water heater low and cover with blanket • Install attic fans or vents • Buy energy-efficient appliances with Energy Star® logo • Install ceiling fans • Monitor your heating and cooling systems

More Energy-Savings Tips • Set water heater low and cover with blanket • Install attic fans or vents • Buy energy-efficient appliances with Energy Star® logo • Install ceiling fans • Monitor your heating and cooling systems

The Cost of Replacement • High-efficiency forced air furnace $2, 500 - $5, 000 • 50 -gallon electric hot water heater $400 - $600 • Roof for an average, 3 -bedroom ranch house $10, 000 - $15, 000

The Cost of Replacement • High-efficiency forced air furnace $2, 500 - $5, 000 • 50 -gallon electric hot water heater $400 - $600 • Roof for an average, 3 -bedroom ranch house $10, 000 - $15, 000

Do-it-Yourself Repairs Resources: – Books – Videos – Classes • Community Center • Lowe’s, Home Depot

Do-it-Yourself Repairs Resources: – Books – Videos – Classes • Community Center • Lowe’s, Home Depot

Basic Tools • Screwdrivers • Claw hammer • Pliers • Adjustable wrench • Hand saw • Assorted nails, screws, etc.

Basic Tools • Screwdrivers • Claw hammer • Pliers • Adjustable wrench • Hand saw • Assorted nails, screws, etc.

More Basic Tools • Tape measure • Flashlight with batteries • Putty knife • Utility knife • Caulking gun

More Basic Tools • Tape measure • Flashlight with batteries • Putty knife • Utility knife • Caulking gun

Still More Basic Tools • Plunger • Handheld power drill • Carpenter’s level • Ladders • Sandpaper

Still More Basic Tools • Plunger • Handheld power drill • Carpenter’s level • Ladders • Sandpaper

Most Common Problems • • • Clogged toilet, sink, tub or shower Running toilet Tripped circuit breaker Tripped GFCI outlet Malfunctioning heating/cooling system

Most Common Problems • • • Clogged toilet, sink, tub or shower Running toilet Tripped circuit breaker Tripped GFCI outlet Malfunctioning heating/cooling system

Questions to Ask Before You Remodel or Repair Ø Do you need to hire a contractor? Ø Will the job add value to your house? Ø How much can you afford to spend?

Questions to Ask Before You Remodel or Repair Ø Do you need to hire a contractor? Ø Will the job add value to your house? Ø How much can you afford to spend?

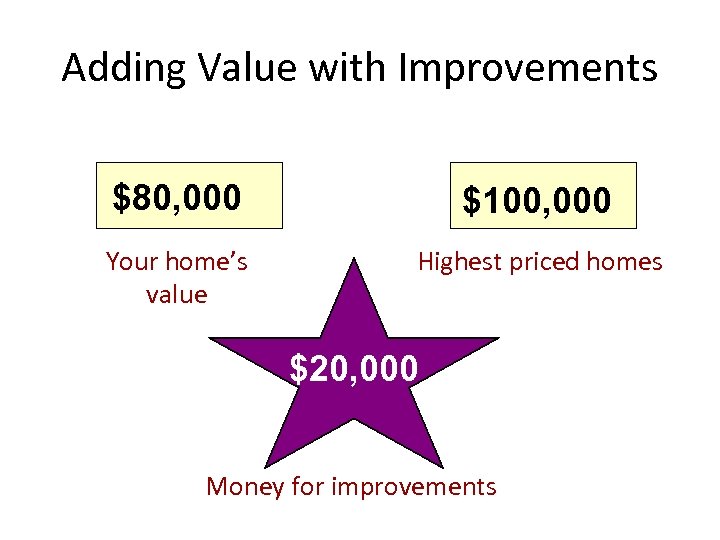

Adding Value with Improvements $80, 000 $100, 000 Your home’s value Highest priced homes $20, 000 Money for improvements

Adding Value with Improvements $80, 000 $100, 000 Your home’s value Highest priced homes $20, 000 Money for improvements

Improvements that Usually Add Value • Adding another bathroom • Modernizing a kitchen • Creating more closet and storage space • Building a garage • Adding a deck, patio, screened porch and skylights (if they’re common in your area)

Improvements that Usually Add Value • Adding another bathroom • Modernizing a kitchen • Creating more closet and storage space • Building a garage • Adding a deck, patio, screened porch and skylights (if they’re common in your area)

Planning Your Project • Think about the finished product • Consider your budget • Make sketches • Do research on local permits and codes • Think about timing and weather

Planning Your Project • Think about the finished product • Consider your budget • Make sketches • Do research on local permits and codes • Think about timing and weather

Working with Contractors • Decide which type of contractor you need • Interview at least three contractors • Get references • Visit at least one completed job • Ask how long the contractor has been in business

Working with Contractors • Decide which type of contractor you need • Interview at least three contractors • Get references • Visit at least one completed job • Ask how long the contractor has been in business

More to Know About Contractors • Check out the contractor’s reputation • Check the contractor’s insurance • Ask about guarantees • Get firm, line item bids • Get contract specifics

More to Know About Contractors • Check out the contractor’s reputation • Check the contractor’s insurance • Ask about guarantees • Get firm, line item bids • Get contract specifics

Managing Your Contractor • Control costs by controlling changes • Agree on payment up front • Don’t make the final payment until the job is done • Specify responsibility for permits • Get a lien waiver on larger jobs

Managing Your Contractor • Control costs by controlling changes • Agree on payment up front • Don’t make the final payment until the job is done • Specify responsibility for permits • Get a lien waiver on larger jobs

Know Your Community • Meet your neighbors • Read community newspapers • Contact Welcome Wagon • Visit city or town hall • Join a service or professional club • Volunteer for special events • Attend neighborhood association meetings

Know Your Community • Meet your neighbors • Read community newspapers • Contact Welcome Wagon • Visit city or town hall • Join a service or professional club • Volunteer for special events • Attend neighborhood association meetings

Asset Building • Manage your money • • Mortgage payments Utilities Maintenance & repairs Reserves • Develop a savings plan • Beware of the credit trap

Asset Building • Manage your money • • Mortgage payments Utilities Maintenance & repairs Reserves • Develop a savings plan • Beware of the credit trap

Keeping Records • Design a system for filing records in fire-safe box • Collect important papers from the sale, making copies if kept in the home • Keep copies of homeowners insurance policy, service contracts, owner’s manuals, warranties, and model numbers • Take photos of home’s exterior and interior • Make list of documents in file

Keeping Records • Design a system for filing records in fire-safe box • Collect important papers from the sale, making copies if kept in the home • Keep copies of homeowners insurance policy, service contracts, owner’s manuals, warranties, and model numbers • Take photos of home’s exterior and interior • Make list of documents in file

Income Tax Deductions • Mortgage interest • Mortgage insurance (years ‘ 08, ‘ 09, ‘ 10) • Points • Moving expenses (sometimes) • Property taxes • Capital Gains exemption on sale of home

Income Tax Deductions • Mortgage interest • Mortgage insurance (years ‘ 08, ‘ 09, ‘ 10) • Points • Moving expenses (sometimes) • Property taxes • Capital Gains exemption on sale of home

Filing a Homeowners Insurance Claim • Report burglaries to police • Call your agent immediately • Make temporary repairs • Provide data to your insurance company • Keep receipts for additional living expenses • Re-read your insurance policy • Get a claim identification number

Filing a Homeowners Insurance Claim • Report burglaries to police • Call your agent immediately • Make temporary repairs • Provide data to your insurance company • Keep receipts for additional living expenses • Re-read your insurance policy • Get a claim identification number

Other Insurance • Mortgage Insurance (required by lender with less than 20% down payment) • Life insurance • Term insurance • Whole life insurance

Other Insurance • Mortgage Insurance (required by lender with less than 20% down payment) • Life insurance • Term insurance • Whole life insurance

When There’s Equity, There are Options q Refinance your home q Get a home equity loan q Get a reverse mortgage

When There’s Equity, There are Options q Refinance your home q Get a home equity loan q Get a reverse mortgage

Common Reasons for Refinancing Your Home • Save money by lowering your interest rate • Convert to another type of mortgage • Build up equity faster • Convert some equity to cash • Hope for Homeowners as refinancing option

Common Reasons for Refinancing Your Home • Save money by lowering your interest rate • Convert to another type of mortgage • Build up equity faster • Convert some equity to cash • Hope for Homeowners as refinancing option

Warning: You Pay a Price With a Predatory Lender • High-pressure sales tactics and steering • High interest rates and fees • Balloon payments and negative amortization • “Packing” and padding costs and fees

Warning: You Pay a Price With a Predatory Lender • High-pressure sales tactics and steering • High interest rates and fees • Balloon payments and negative amortization • “Packing” and padding costs and fees

Predatory Lending Practices • Flipping • Locking in borrowers • Equity stripping • Deceptive practices and fraud

Predatory Lending Practices • Flipping • Locking in borrowers • Equity stripping • Deceptive practices and fraud

Protect Yourself from Predatory Lenders • Shop around • Don’t sign incomplete documents or anything you do not understand • Work with a homeownership or credit counselor • Use your right to cancel (three-day right of rescission for refinance)

Protect Yourself from Predatory Lenders • Shop around • Don’t sign incomplete documents or anything you do not understand • Work with a homeownership or credit counselor • Use your right to cancel (three-day right of rescission for refinance)

What to Do If … • Cannot meet your financial responsibility • Are in danger of foreclosure COMMUNICATE WITH YOUR LENDER AS SOON AS TROUBLE STARTS!! Call national foreclosure prevention hotline: 888 -995 -HOPE

What to Do If … • Cannot meet your financial responsibility • Are in danger of foreclosure COMMUNICATE WITH YOUR LENDER AS SOON AS TROUBLE STARTS!! Call national foreclosure prevention hotline: 888 -995 -HOPE

Loan Workout Programs • Payment plan • Forbearance • Loan modification • Partial claim

Loan Workout Programs • Payment plan • Forbearance • Loan modification • Partial claim

Moving On • Pre-foreclosure sale • Deed in lieu of foreclosure

Moving On • Pre-foreclosure sale • Deed in lieu of foreclosure

Delinquency Counseling: There’s Help for You • Nonprofit agency that helped you buy • HUD: (800) CALL FHA or hud@custhelp. com • Your mortgage insurance company • National foreclosure prevention hotline: 1 -888995 -HOPE • Local VA office for a VA loan

Delinquency Counseling: There’s Help for You • Nonprofit agency that helped you buy • HUD: (800) CALL FHA or hud@custhelp. com • Your mortgage insurance company • National foreclosure prevention hotline: 1 -888995 -HOPE • Local VA office for a VA loan

Make the Most of Delinquency Counseling • Be honest • Be cooperative about gathering information • Be willing to make sacrifices and changes

Make the Most of Delinquency Counseling • Be honest • Be cooperative about gathering information • Be willing to make sacrifices and changes

Summary • How to keep your home and family safe • How to save money by conserving energy • The importance of preventive maintenance • Asset building with timely payments and value-adding improvements

Summary • How to keep your home and family safe • How to save money by conserving energy • The importance of preventive maintenance • Asset building with timely payments and value-adding improvements

Summary (Cont’d) • The importance of becoming involved in your community • When it makes sense to consider refinancing • How to cope when disaster strikes

Summary (Cont’d) • The importance of becoming involved in your community • When it makes sense to consider refinancing • How to cope when disaster strikes

Your Best Resource For more information, contact: Neighbor. Works® America 1325 G St. , NW, Suite 800 Washington, DC 20005 Call 202. 220. 2300 or 800. 438. 5547 or visit www. nw. org

Your Best Resource For more information, contact: Neighbor. Works® America 1325 G St. , NW, Suite 800 Washington, DC 20005 Call 202. 220. 2300 or 800. 438. 5547 or visit www. nw. org