Realizing the American Dream Are You Ready to Buy a Home?

Realizing the American Dream Are You Ready to Buy a Home?

Agenda • • • Is owning a home right for you How you buy a home Your homeownership team Mortgage payment and other costs How much you can afford Qualifying ratios

Agenda • • • Is owning a home right for you How you buy a home Your homeownership team Mortgage payment and other costs How much you can afford Qualifying ratios

Advantages of Homeownership • Stable housing costs • Tax benefits • Equity • Control over your environment • Stability

Advantages of Homeownership • Stable housing costs • Tax benefits • Equity • Control over your environment • Stability

Disadvantages of Homeownership • Monthly costs • No guarantees • Maintenance and repairs • Decreased mobility • Fewer features included

Disadvantages of Homeownership • Monthly costs • No guarantees • Maintenance and repairs • Decreased mobility • Fewer features included

Steps in the Homebuying Process • Attend homeownership education class • Determine how much you can afford • Meet with lender for pre-approval • Determine wants and needs in a home • Shop for a home

Steps in the Homebuying Process • Attend homeownership education class • Determine how much you can afford • Meet with lender for pre-approval • Determine wants and needs in a home • Shop for a home

Steps (Cont’d) • Make an offer • Have professional home inspection • Apply for mortgage loan • Obtain homeowners insurance • Close the loan

Steps (Cont’d) • Make an offer • Have professional home inspection • Apply for mortgage loan • Obtain homeowners insurance • Close the loan

Your Homebuying Team • Homeownership Counselor • Title Insurance Agent • Real Estate Agent • Appraiser • Lender • Surveyor • Attorney or Escrow Agent • Homeowners Insurance Agent • Home Inspector

Your Homebuying Team • Homeownership Counselor • Title Insurance Agent • Real Estate Agent • Appraiser • Lender • Surveyor • Attorney or Escrow Agent • Homeowners Insurance Agent • Home Inspector

The Mortgage Payment • Principal • Interest • Taxes • Insurance

The Mortgage Payment • Principal • Interest • Taxes • Insurance

Costs of Buying a Home Upfront Costs Ongoing Costs • Down payment • Mortgage payment • Closing costs • Utilities • Escrows • Maintenance and repairs • Reserves • Moving costs

Costs of Buying a Home Upfront Costs Ongoing Costs • Down payment • Mortgage payment • Closing costs • Utilities • Escrows • Maintenance and repairs • Reserves • Moving costs

The 4 Cs of Credit • Capital • Capacity • Credit History • Collateral

The 4 Cs of Credit • Capital • Capacity • Credit History • Collateral

Ordering a Credit Report Experian www. experian. com (800) 831 -5614 Trans. Union www. transunion. com (800) 888 -4213 Equifax www. equifax. com (800) 685 -1111

Ordering a Credit Report Experian www. experian. com (800) 831 -5614 Trans. Union www. transunion. com (800) 888 -4213 Equifax www. equifax. com (800) 685 -1111

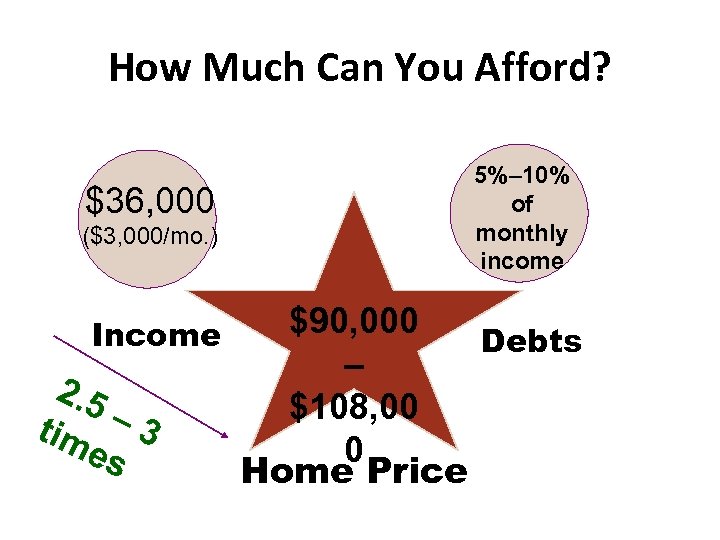

How Much Can You Afford? $36, 000 ($3, 000/mo. ) Income 2. 5 tim – 3 es 5%– 10% of monthly income $90, 000 Debts – $108, 00 0 Home Price

How Much Can You Afford? $36, 000 ($3, 000/mo. ) Income 2. 5 tim – 3 es 5%– 10% of monthly income $90, 000 Debts – $108, 00 0 Home Price

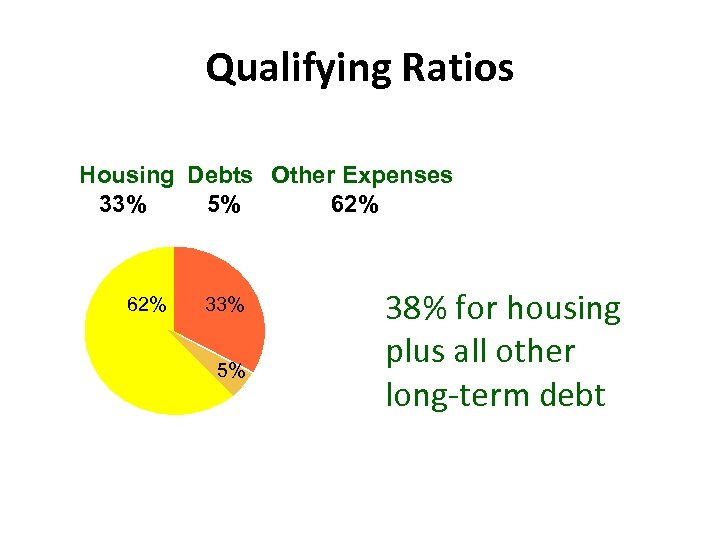

Qualifying Ratios Housing Debts Other Expenses 33% 5% 62% Expenses 62% 33% 5% 38% for housing plus all other long-term debt

Qualifying Ratios Housing Debts Other Expenses 33% 5% 62% Expenses 62% 33% 5% 38% for housing plus all other long-term debt

Prequalification Financial Calculations Ø How much money the lender will lend you Ø What price home you can afford Ø How much down payment you need Ø How much your monthly payments will be This is not a guarantee

Prequalification Financial Calculations Ø How much money the lender will lend you Ø What price home you can afford Ø How much down payment you need Ø How much your monthly payments will be This is not a guarantee

Summary • Pros and cons of ownership • Key steps and professionals involved in the homebuying process • Mortgage payment and other costs • How lenders determine creditworthiness and affordability

Summary • Pros and cons of ownership • Key steps and professionals involved in the homebuying process • Mortgage payment and other costs • How lenders determine creditworthiness and affordability

Next Steps Ø Sign up for education or counseling Ø Order copies of your credit report

Next Steps Ø Sign up for education or counseling Ø Order copies of your credit report