e488c8c4d4c4ef3e9d405aba6b175fdb.ppt

- Количество слайдов: 45

Reality Investing at Stern The Michael Price Student Investment Fund April 25, 2006 ____________________ The Fund Stern Alumni Presentation April 25 th 2006 1

Reality Investing at Stern The Michael Price Student Investment Fund April 25, 2006 ____________________ The Fund Stern Alumni Presentation April 25 th 2006 1

Tonight’s Program Overview of MPSIF – Richard Levich, Faculty Advisor MPSIF Experience – Debbie Jones, President The MPSIF Funds – Fixed Income Growth Small Cap Value Questions & Answers The Fund Stern Alumni Presentation April 25 th 2006 2

Tonight’s Program Overview of MPSIF – Richard Levich, Faculty Advisor MPSIF Experience – Debbie Jones, President The MPSIF Funds – Fixed Income Growth Small Cap Value Questions & Answers The Fund Stern Alumni Presentation April 25 th 2006 2

Overview of MPSIF Origin of The Michael Price Student Investment Fund (MPSIF) Organizational Overview MPSIF as an MBA Course MPSIF as an Endowment Fund Goals for the Future The Fund Stern Alumni Presentation April 25 th 2006 3

Overview of MPSIF Origin of The Michael Price Student Investment Fund (MPSIF) Organizational Overview MPSIF as an MBA Course MPSIF as an Endowment Fund Goals for the Future The Fund Stern Alumni Presentation April 25 th 2006 3

MPSIF Established in 1999 Founded with $2. 0 million gift - Michael F. Price - Managing partner of MFP Investors and former chairman of Franklin Mutual Series funds. Gift enabled establishment of three funds Three Funds - Red, Green and Blue - Each allocated $600, 000. Each Fund had a different investment objective. Note: $200, 000 allocated for administrative expenses Fund part of the overall NYU endowment Fund has a mandated 5% per annum distribution Distribution provides scholarships to selected students from the Price College of Business at the Univ. of Oklahoma for study at NYU Stern. The Fund Stern Alumni Presentation April 25 th 2006 4

MPSIF Established in 1999 Founded with $2. 0 million gift - Michael F. Price - Managing partner of MFP Investors and former chairman of Franklin Mutual Series funds. Gift enabled establishment of three funds Three Funds - Red, Green and Blue - Each allocated $600, 000. Each Fund had a different investment objective. Note: $200, 000 allocated for administrative expenses Fund part of the overall NYU endowment Fund has a mandated 5% per annum distribution Distribution provides scholarships to selected students from the Price College of Business at the Univ. of Oklahoma for study at NYU Stern. The Fund Stern Alumni Presentation April 25 th 2006 4

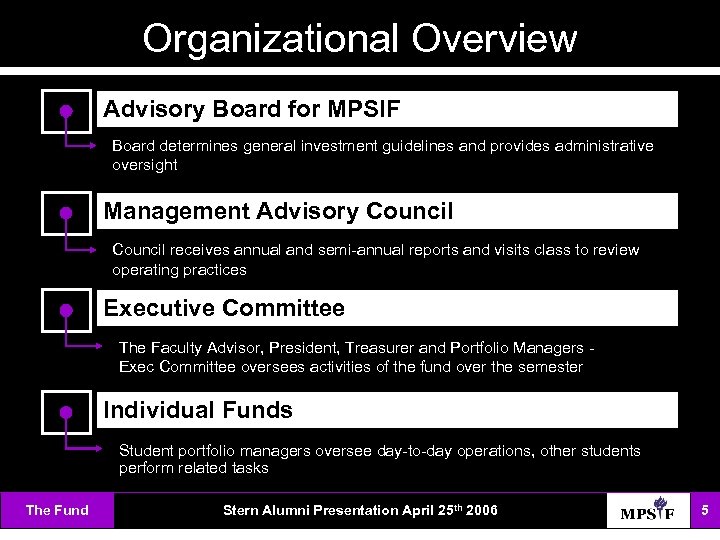

Organizational Overview Advisory Board for MPSIF Board determines general investment guidelines and provides administrative oversight Management Advisory Council receives annual and semi-annual reports and visits class to review operating practices Executive Committee The Faculty Advisor, President, Treasurer and Portfolio Managers Exec Committee oversees activities of the fund over the semester Individual Funds Student portfolio managers oversee day-to-day operations, other students perform related tasks The Fund Stern Alumni Presentation April 25 th 2006 5

Organizational Overview Advisory Board for MPSIF Board determines general investment guidelines and provides administrative oversight Management Advisory Council receives annual and semi-annual reports and visits class to review operating practices Executive Committee The Faculty Advisor, President, Treasurer and Portfolio Managers Exec Committee oversees activities of the fund over the semester Individual Funds Student portfolio managers oversee day-to-day operations, other students perform related tasks The Fund Stern Alumni Presentation April 25 th 2006 5

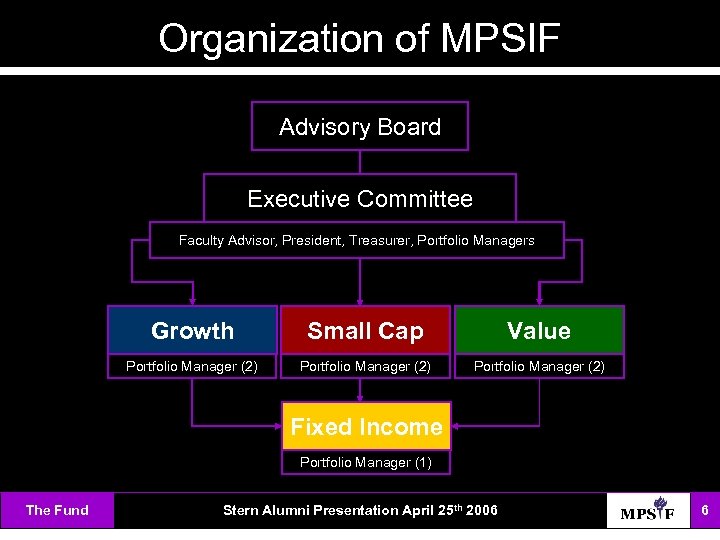

Organization of MPSIF Advisory Board Executive Committee Faculty Advisor, President, Treasurer, Portfolio Managers Growth Small Cap Value Portfolio Manager (2) Fixed Income Portfolio Manager (1) The Fund Stern Alumni Presentation April 25 th 2006 6

Organization of MPSIF Advisory Board Executive Committee Faculty Advisor, President, Treasurer, Portfolio Managers Growth Small Cap Value Portfolio Manager (2) Fixed Income Portfolio Manager (1) The Fund Stern Alumni Presentation April 25 th 2006 6

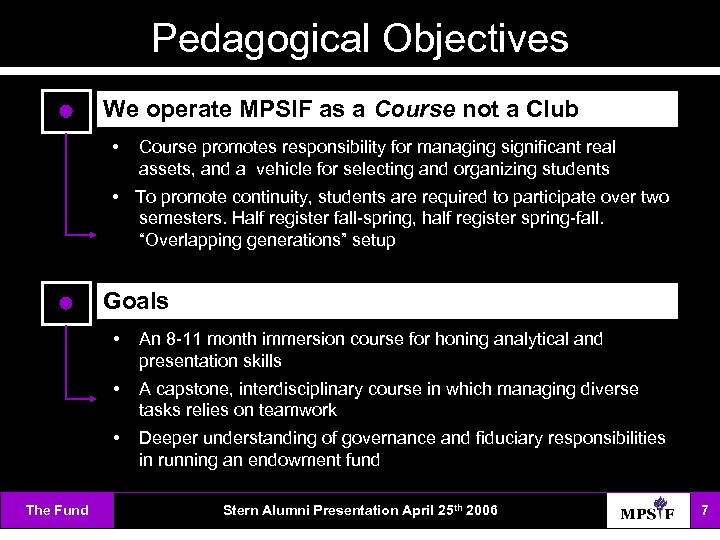

Pedagogical Objectives We operate MPSIF as a Course not a Club • Course promotes responsibility for managing significant real assets, and a vehicle for selecting and organizing students • To promote continuity, students are required to participate over two semesters. Half register fall-spring, half register spring-fall. “Overlapping generations” setup Goals • • A capstone, interdisciplinary course in which managing diverse tasks relies on teamwork • The Fund An 8 -11 month immersion course for honing analytical and presentation skills Deeper understanding of governance and fiduciary responsibilities in running an endowment fund Stern Alumni Presentation April 25 th 2006 7

Pedagogical Objectives We operate MPSIF as a Course not a Club • Course promotes responsibility for managing significant real assets, and a vehicle for selecting and organizing students • To promote continuity, students are required to participate over two semesters. Half register fall-spring, half register spring-fall. “Overlapping generations” setup Goals • • A capstone, interdisciplinary course in which managing diverse tasks relies on teamwork • The Fund An 8 -11 month immersion course for honing analytical and presentation skills Deeper understanding of governance and fiduciary responsibilities in running an endowment fund Stern Alumni Presentation April 25 th 2006 7

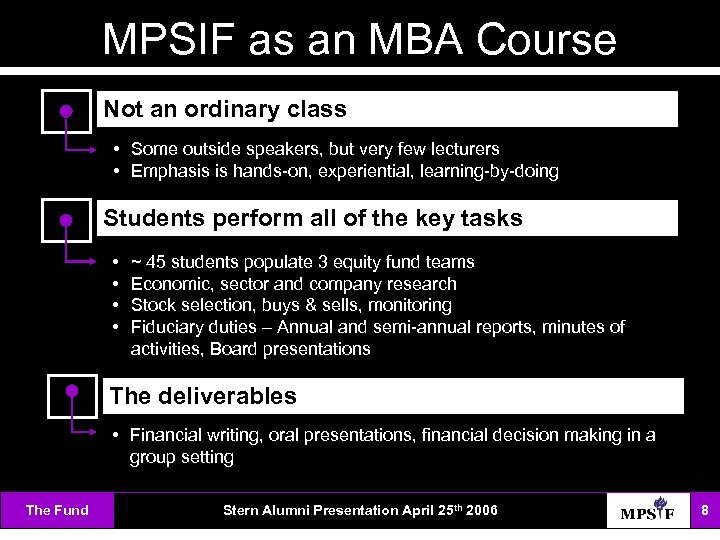

MPSIF as an MBA Course Not an ordinary class • Some outside speakers, but very few lecturers • Emphasis is hands-on, experiential, learning-by-doing Students perform all of the key tasks • • ~ 45 students populate 3 equity fund teams Economic, sector and company research Stock selection, buys & sells, monitoring Fiduciary duties – Annual and semi-annual reports, minutes of activities, Board presentations The deliverables • Financial writing, oral presentations, financial decision making in a group setting The Fund Stern Alumni Presentation April 25 th 2006 8

MPSIF as an MBA Course Not an ordinary class • Some outside speakers, but very few lecturers • Emphasis is hands-on, experiential, learning-by-doing Students perform all of the key tasks • • ~ 45 students populate 3 equity fund teams Economic, sector and company research Stock selection, buys & sells, monitoring Fiduciary duties – Annual and semi-annual reports, minutes of activities, Board presentations The deliverables • Financial writing, oral presentations, financial decision making in a group setting The Fund Stern Alumni Presentation April 25 th 2006 8

Recent MPSIF Initiatives Management Advisory Council Wilshire analytics portfolio analysis Alumni Panel and Alumni Reunion Annual Report upgrade Web-site upgrade “The Educated Investor” newsletter Resume book Proxy voting, litigation filings Re-balancing of MPSIF portfolio • Gross flows in excess of $400, 000 The Fund Stern Alumni Presentation April 25 th 2006 9

Recent MPSIF Initiatives Management Advisory Council Wilshire analytics portfolio analysis Alumni Panel and Alumni Reunion Annual Report upgrade Web-site upgrade “The Educated Investor” newsletter Resume book Proxy voting, litigation filings Re-balancing of MPSIF portfolio • Gross flows in excess of $400, 000 The Fund Stern Alumni Presentation April 25 th 2006 9

Deliverables The Fund Stern Alumni Presentation April 25 th 2006 10

Deliverables The Fund Stern Alumni Presentation April 25 th 2006 10

MPSIF as an Endowment Fund Student run MPSIF, but within limits “Rules of the Game” • MPSIF is a long-only endowment fund. • Permitted securities include: Stocks, bonds, money market instruments, and limited mutual funds. NYU is a tax exempt institution. • Goals include (a) returns in excess of inflation over a 3 -5 year period, (b) returns exceeding an appropriate benchmark, (c) focus on long-term opportunities rather than short-term trading gains, (d) an acceptable level of diversification MPSIF Operates on an open book policy • Stands ready to make its results, activities, reports available to anyone within the NYU community with an interest. (Active web site) The Fund Stern Alumni Presentation April 25 th 2006 11

MPSIF as an Endowment Fund Student run MPSIF, but within limits “Rules of the Game” • MPSIF is a long-only endowment fund. • Permitted securities include: Stocks, bonds, money market instruments, and limited mutual funds. NYU is a tax exempt institution. • Goals include (a) returns in excess of inflation over a 3 -5 year period, (b) returns exceeding an appropriate benchmark, (c) focus on long-term opportunities rather than short-term trading gains, (d) an acceptable level of diversification MPSIF Operates on an open book policy • Stands ready to make its results, activities, reports available to anyone within the NYU community with an interest. (Active web site) The Fund Stern Alumni Presentation April 25 th 2006 11

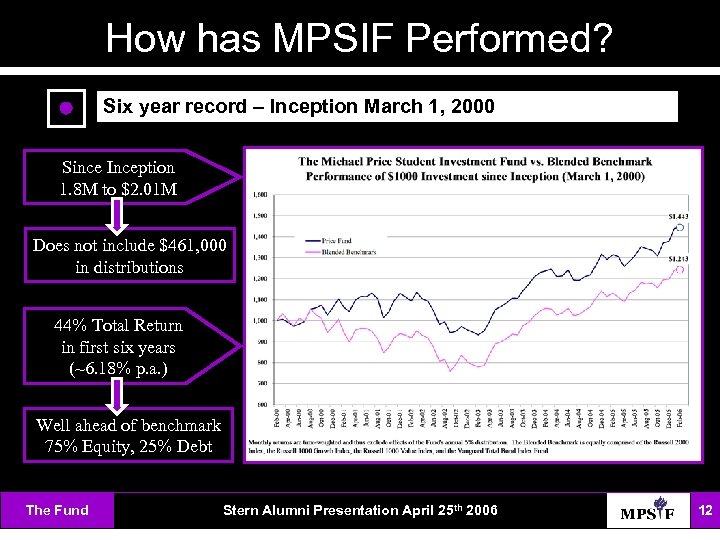

How has MPSIF Performed? Six year record – Inception March 1, 2000 Since Inception 1. 8 M to $2. 01 M Does not include $461, 000 in distributions 44% Total Return in first six years (~6. 18% p. a. ) Well ahead of benchmark 75% Equity, 25% Debt The Fund Stern Alumni Presentation April 25 th 2006 12

How has MPSIF Performed? Six year record – Inception March 1, 2000 Since Inception 1. 8 M to $2. 01 M Does not include $461, 000 in distributions 44% Total Return in first six years (~6. 18% p. a. ) Well ahead of benchmark 75% Equity, 25% Debt The Fund Stern Alumni Presentation April 25 th 2006 12

Goals for the Future Enhance MPSIF profile inside and outside Stern Enhance MPSIF as a vehicle for student recruitment and placement, as well as fundraising Attract more funds under management – from NYU endowment or other benefactors The Fund Stern Alumni Presentation April 25 th 2006 13

Goals for the Future Enhance MPSIF profile inside and outside Stern Enhance MPSIF as a vehicle for student recruitment and placement, as well as fundraising Attract more funds under management – from NYU endowment or other benefactors The Fund Stern Alumni Presentation April 25 th 2006 13

MPSIF – Student Experience The Michael Price Student Investment Fund President: Debbie Jones __________________ The Fund Stern Alumni Presentation April 25 th 2006 14

MPSIF – Student Experience The Michael Price Student Investment Fund President: Debbie Jones __________________ The Fund Stern Alumni Presentation April 25 th 2006 14

My Story…Why NYU, Why MPSIF Why to get my MBA Previously analyzed mutual funds…needed to improve my fundamental stock picking skills Where to get my MBA Met with alum from my undergraduate school who was also the original MPSIF President How to get a job/internship First Annual Student Alumni Mixer Deutsche Bank CMC & NYU Financial Modeling? DCF? Stock pitches are standard for MBA internship and fulltime job applicants (both buy side and sell side) MPSIF After Stern With six years of history there are numerous MPSIF alum working in the investment management profession The Fund Stern Alumni Presentation April 25 th 2006 15

My Story…Why NYU, Why MPSIF Why to get my MBA Previously analyzed mutual funds…needed to improve my fundamental stock picking skills Where to get my MBA Met with alum from my undergraduate school who was also the original MPSIF President How to get a job/internship First Annual Student Alumni Mixer Deutsche Bank CMC & NYU Financial Modeling? DCF? Stock pitches are standard for MBA internship and fulltime job applicants (both buy side and sell side) MPSIF After Stern With six years of history there are numerous MPSIF alum working in the investment management profession The Fund Stern Alumni Presentation April 25 th 2006 15

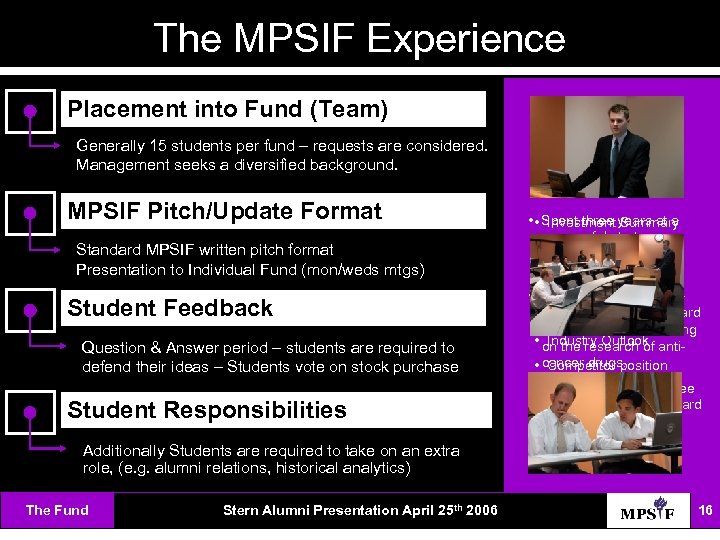

The MPSIF Experience Placement into Fund (Team) Generally 15 students per fund – requests are considered. Management seeks a diversified background. MPSIF Pitch/Update Format Standard MPSIF written pitch format Presentation to Individual Fund (mon/weds mtgs) Student Feedback Question & Answer period – students are required to defend their ideas – Students vote on stock purchase Student Responsibilities • • Spent three years at a Investment Summary successful start-up • biopharmaceutical Performance • company. (DCF, Valuation multiples, etc. • Spent a year as a post • doctoral fellow at Harvard Business Description Medical School, focusing • on the research of anti. Industry Outlook • cancer drugs. Competitor position • • He holds a. Outlook Earnings Ph. D. degree in chemistry from Harvard • University. Financial Statements Additionally Students are required to take on an extra role, (e. g. alumni relations, historical analytics) The Fund Stern Alumni Presentation April 25 th 2006 16

The MPSIF Experience Placement into Fund (Team) Generally 15 students per fund – requests are considered. Management seeks a diversified background. MPSIF Pitch/Update Format Standard MPSIF written pitch format Presentation to Individual Fund (mon/weds mtgs) Student Feedback Question & Answer period – students are required to defend their ideas – Students vote on stock purchase Student Responsibilities • • Spent three years at a Investment Summary successful start-up • biopharmaceutical Performance • company. (DCF, Valuation multiples, etc. • Spent a year as a post • doctoral fellow at Harvard Business Description Medical School, focusing • on the research of anti. Industry Outlook • cancer drugs. Competitor position • • He holds a. Outlook Earnings Ph. D. degree in chemistry from Harvard • University. Financial Statements Additionally Students are required to take on an extra role, (e. g. alumni relations, historical analytics) The Fund Stern Alumni Presentation April 25 th 2006 16

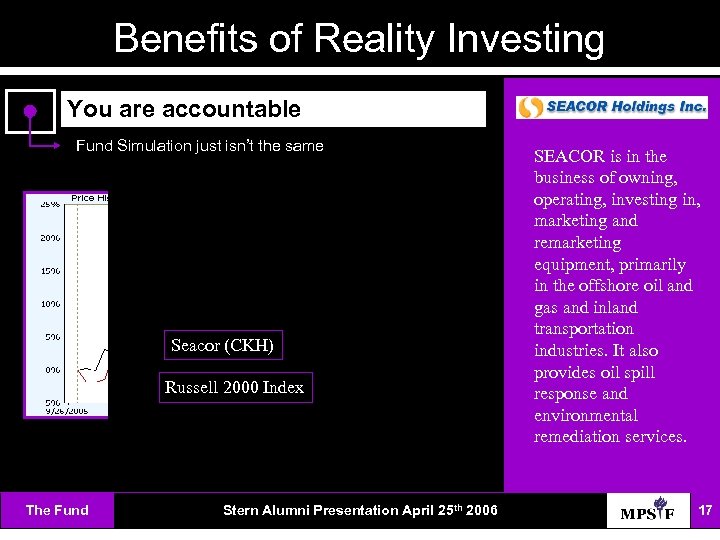

Benefits of Reality Investing You are accountable Fund Simulation just isn’t the same Seacor (CKH) Russell 2000 Index The Fund Stern Alumni Presentation April 25 th 2006 SEACOR is in the business of owning, operating, investing in, marketing and remarketing equipment, primarily in the offshore oil and gas and inland transportation industries. It also provides oil spill response and environmental remediation services. 17

Benefits of Reality Investing You are accountable Fund Simulation just isn’t the same Seacor (CKH) Russell 2000 Index The Fund Stern Alumni Presentation April 25 th 2006 SEACOR is in the business of owning, operating, investing in, marketing and remarketing equipment, primarily in the offshore oil and gas and inland transportation industries. It also provides oil spill response and environmental remediation services. 17

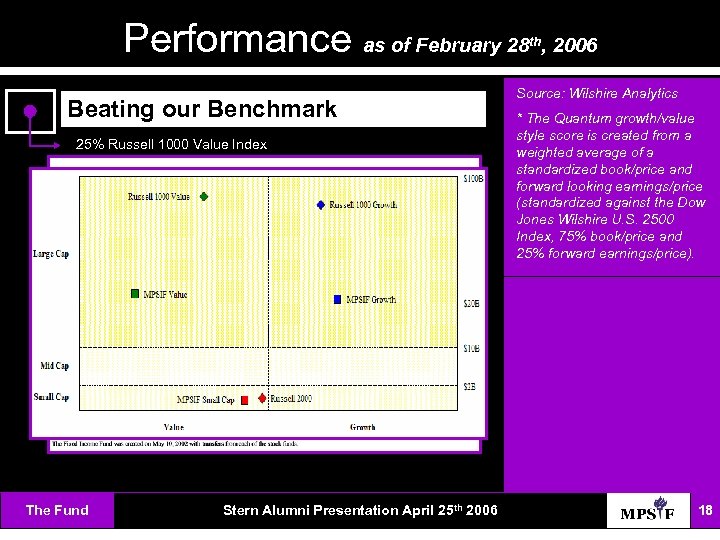

Performance as of February 28 Beating our Benchmark 25% Russell 1000 Value Index 25% Russell 1000 Growth Index 25% Russell 2000 Index 25% Vanguard Total Bond Index The Fund Stern Alumni Presentation April 25 th 2006 th, 2006 Source: Wilshire Analytics * The Quantum growth/value style score is created from a weighted average of a standardized book/price and forward looking earnings/price (standardized against the Dow Jones Wilshire U. S. 2500 Index, 75% book/price and 25% forward earnings/price). 18

Performance as of February 28 Beating our Benchmark 25% Russell 1000 Value Index 25% Russell 1000 Growth Index 25% Russell 2000 Index 25% Vanguard Total Bond Index The Fund Stern Alumni Presentation April 25 th 2006 th, 2006 Source: Wilshire Analytics * The Quantum growth/value style score is created from a weighted average of a standardized book/price and forward looking earnings/price (standardized against the Dow Jones Wilshire U. S. 2500 Index, 75% book/price and 25% forward earnings/price). 18

The Fixed Income Fund The Michael Price Student Investment Fund Portfolio Managers: Marc Strauss and Michael Flood __________________ Fixed Income The Fund Stern Alumni Presentation April 25 th 2006 19

The Fixed Income Fund The Michael Price Student Investment Fund Portfolio Managers: Marc Strauss and Michael Flood __________________ Fixed Income The Fund Stern Alumni Presentation April 25 th 2006 19

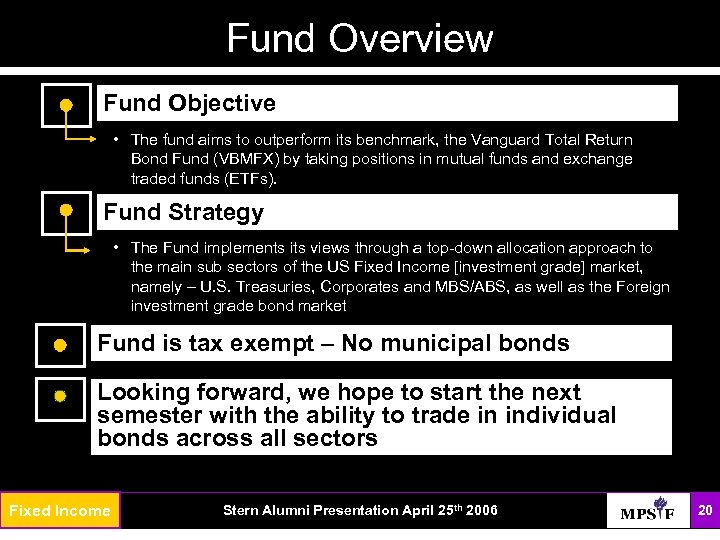

Fund Overview Fund Objective • The fund aims to outperform its benchmark, the Vanguard Total Return Bond Fund (VBMFX) by taking positions in mutual funds and exchange traded funds (ETFs). Fund Strategy • The Fund implements its views through a top-down allocation approach to the main sub sectors of the US Fixed Income [investment grade] market, namely – U. S. Treasuries, Corporates and MBS/ABS, as well as the Foreign investment grade bond market Fund is tax exempt – No municipal bonds Looking forward, we hope to start the next semester with the ability to trade in individual bonds across all sectors The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 20

Fund Overview Fund Objective • The fund aims to outperform its benchmark, the Vanguard Total Return Bond Fund (VBMFX) by taking positions in mutual funds and exchange traded funds (ETFs). Fund Strategy • The Fund implements its views through a top-down allocation approach to the main sub sectors of the US Fixed Income [investment grade] market, namely – U. S. Treasuries, Corporates and MBS/ABS, as well as the Foreign investment grade bond market Fund is tax exempt – No municipal bonds Looking forward, we hope to start the next semester with the ability to trade in individual bonds across all sectors The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 20

Performance as of February 28 th, 2006 For the six months ended February 28, 2006, the fund had a negative net return of 69 basis points, trailing our benchmark by 50 basis points • Overexposure to the short end of the Treasury yield curve • Failure to capitalize on the continued strength of the MBS market • Slight overweighting of the Corporate sector After bottoming out in October 2005, the fund enjoyed four straight months of positive returns, with a YTD return of 98 basis points, 70 basis points above our benchmark Over the past three months, we have focused our attention to being more closely aligned with our benchmark, reducing our exposure to the foreign sector and spreading our exposure to Treasuries across the yield curve The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 21

Performance as of February 28 th, 2006 For the six months ended February 28, 2006, the fund had a negative net return of 69 basis points, trailing our benchmark by 50 basis points • Overexposure to the short end of the Treasury yield curve • Failure to capitalize on the continued strength of the MBS market • Slight overweighting of the Corporate sector After bottoming out in October 2005, the fund enjoyed four straight months of positive returns, with a YTD return of 98 basis points, 70 basis points above our benchmark Over the past three months, we have focused our attention to being more closely aligned with our benchmark, reducing our exposure to the foreign sector and spreading our exposure to Treasuries across the yield curve The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 21

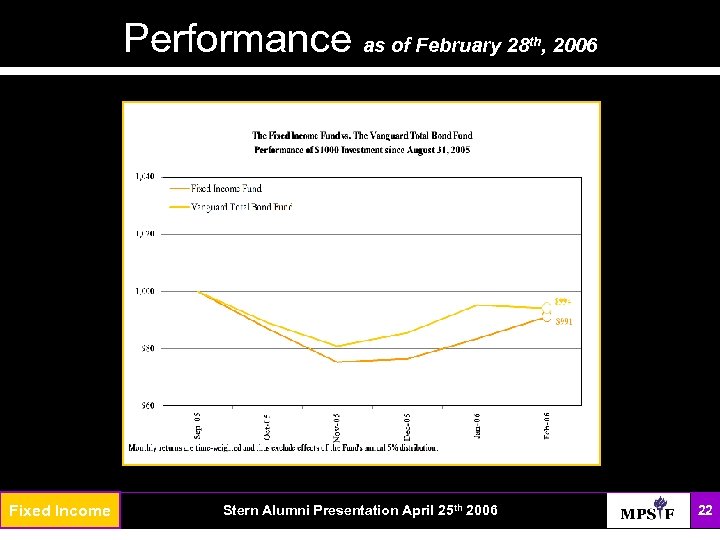

Performance as of February 28 The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 th, 2006 22

Performance as of February 28 The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 th, 2006 22

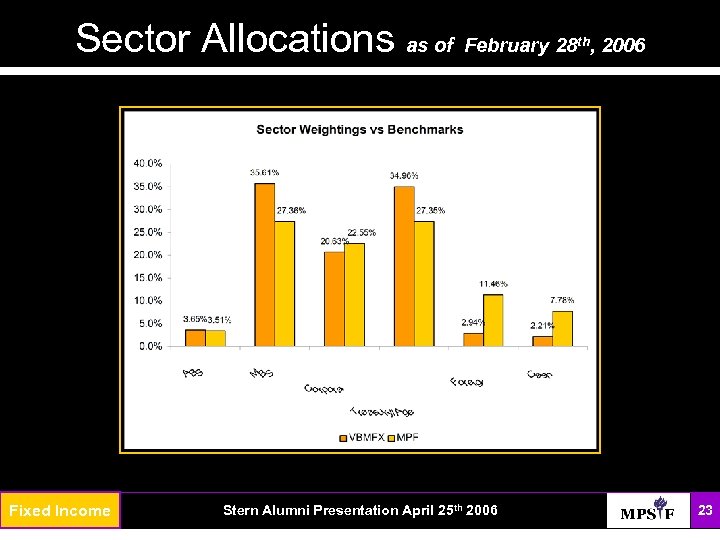

Sector Allocations as of February 28 The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 th, 2006 23

Sector Allocations as of February 28 The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 th, 2006 23

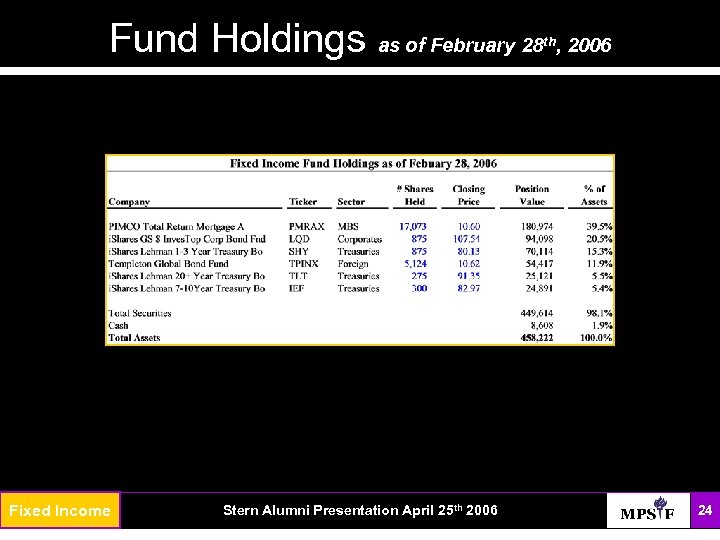

Fund Holdings as of February 28 The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 th, 2006 24

Fund Holdings as of February 28 The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 th, 2006 24

Sector Update and Outlook U. S. Treasuries • The Federal Reserve, reacting to inflationary fears as the economy remains resilient, is likely to continue to raise rates one or two more times in the short term. Future policy is likely to remain data dependent. • Should the economy start to sputter, rate cuts are a distinct possibility by Q 4 2006. • Although the calendar year started with softness in the Treasury market, we are bullish on Treasuries and recommend overweighting the index with longer duration positions. MBS • With mortgage rates forecasted to rise to as much as 6. 40% by the fourth quarter of 2006, slower growth in the housing market is expected. Higher rates will slow prepayments and curb home price appreciation, creating potential credit challenges ahead. • As spreads widen we will continue take a slightly underweight position with respect to the index. The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 25

Sector Update and Outlook U. S. Treasuries • The Federal Reserve, reacting to inflationary fears as the economy remains resilient, is likely to continue to raise rates one or two more times in the short term. Future policy is likely to remain data dependent. • Should the economy start to sputter, rate cuts are a distinct possibility by Q 4 2006. • Although the calendar year started with softness in the Treasury market, we are bullish on Treasuries and recommend overweighting the index with longer duration positions. MBS • With mortgage rates forecasted to rise to as much as 6. 40% by the fourth quarter of 2006, slower growth in the housing market is expected. Higher rates will slow prepayments and curb home price appreciation, creating potential credit challenges ahead. • As spreads widen we will continue take a slightly underweight position with respect to the index. The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 25

Sector Update and Outlook cont. Corporates • In terms of business fundamentals, competition from emerging economies has challenged many U. S. companies and industries. • Rising interest rates will likely erode future profitability as borrowing costs rise and consumer spending slows. • We recommend avoiding sectors like consumer discretionary, which may be adversely affected by a slowing housing market and high energy prices. Foreign • A shrinking interest rate differential, coupled with an ever growing current account deficit, could spell trouble for the dollar. • With rates in Europe and Japan likely to rise, we will look to further reduce our exposure in the near term, especially as the Fed looks to put the brakes on future rate hikes. The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 26

Sector Update and Outlook cont. Corporates • In terms of business fundamentals, competition from emerging economies has challenged many U. S. companies and industries. • Rising interest rates will likely erode future profitability as borrowing costs rise and consumer spending slows. • We recommend avoiding sectors like consumer discretionary, which may be adversely affected by a slowing housing market and high energy prices. Foreign • A shrinking interest rate differential, coupled with an ever growing current account deficit, could spell trouble for the dollar. • With rates in Europe and Japan likely to rise, we will look to further reduce our exposure in the near term, especially as the Fed looks to put the brakes on future rate hikes. The Income Fixed Fund Growth Fund Stern Alumni Presentation April 25 th 2006 26

Challenges Looking Forward Challenges • • Future Fed Policy Future of the MBS market Dollar weakness Tight credit spreads Switching Platform • Performing our own credit research The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 27

Challenges Looking Forward Challenges • • Future Fed Policy Future of the MBS market Dollar weakness Tight credit spreads Switching Platform • Performing our own credit research The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 27

The Growth Fund The Michael Price Student Investment Fund Portfolio Managers: Nelson Shim and Rafael Tejada __________________ Growth Fund The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 28

The Growth Fund The Michael Price Student Investment Fund Portfolio Managers: Nelson Shim and Rafael Tejada __________________ Growth Fund The Income Fixed Fund Stern Alumni Presentation April 25 th 2006 28

Fund Overview Fund Objective • Achieve returns above Russell 1000 Growth Index benchmark. • Achieve positive absolute returns. Investment Strategy • Search for stocks with long-term EPS growth expectations exceeding 15%. that are attractively priced on a fundamental and relative basis. • Search for stocks with a long-term, sustainable competitive advantage. • Such companies may be: Ø pioneering a new product or service that will see dramatic future demand Ø altering pre-established norms in a static industry and gaining significant market share Ø applying their business model to new regions or leading in an industry that is experience high levels of growth The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 29

Fund Overview Fund Objective • Achieve returns above Russell 1000 Growth Index benchmark. • Achieve positive absolute returns. Investment Strategy • Search for stocks with long-term EPS growth expectations exceeding 15%. that are attractively priced on a fundamental and relative basis. • Search for stocks with a long-term, sustainable competitive advantage. • Such companies may be: Ø pioneering a new product or service that will see dramatic future demand Ø altering pre-established norms in a static industry and gaining significant market share Ø applying their business model to new regions or leading in an industry that is experience high levels of growth The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 29

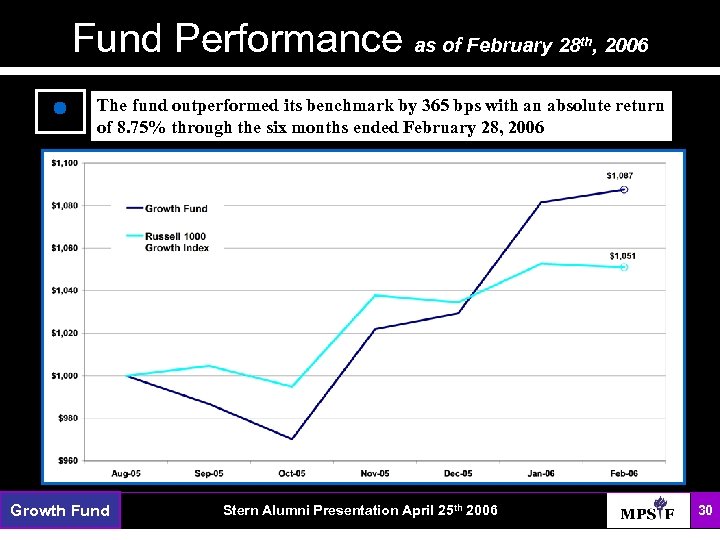

Fund Performance as of February 28 th, 2006 The fund outperformed its benchmark by 365 bps with an absolute return of 8. 75% through the six months ended February 28, 2006 The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 30

Fund Performance as of February 28 th, 2006 The fund outperformed its benchmark by 365 bps with an absolute return of 8. 75% through the six months ended February 28, 2006 The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 30

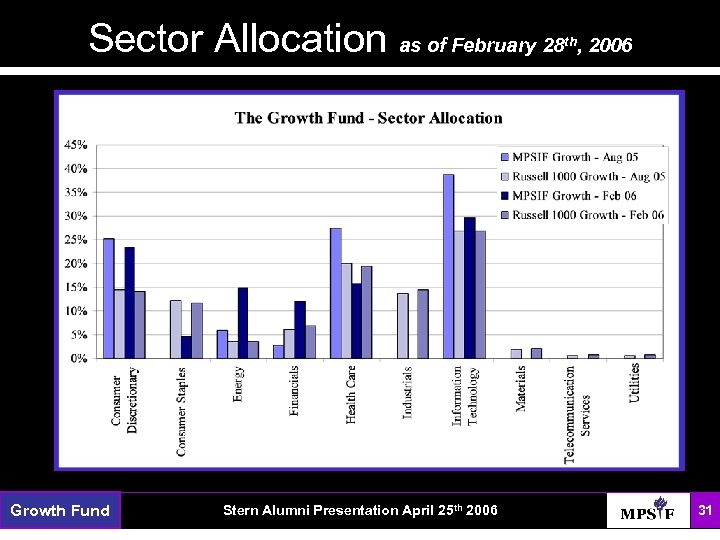

Sector Allocation as of February 28 The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 th, 2006 31

Sector Allocation as of February 28 The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 th, 2006 31

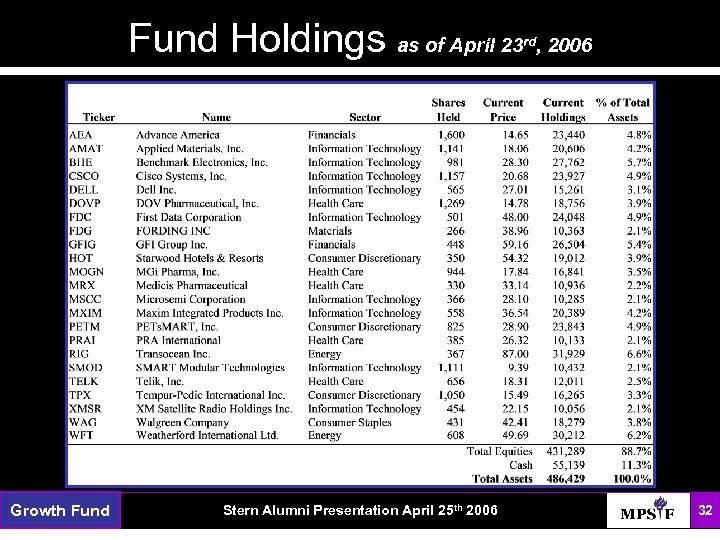

Fund Holdings as of April 23 The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 rd, 2006 32

Fund Holdings as of April 23 The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 rd, 2006 32

The Small Cap Fund The Michael Price Student Investment Fund Portfolio Managers: Shivanker Saxena and Lei Mu __________________ Small Cap The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 33

The Small Cap Fund The Michael Price Student Investment Fund Portfolio Managers: Shivanker Saxena and Lei Mu __________________ Small Cap The Fund Growth Fund Stern Alumni Presentation April 25 th 2006 33

Fund Overview Strategy • Focused upon stock selection and Identifying small-cap companies with strong fundamental prospects, and that are under followed by the market. • No explicit bias toward “growth” or “value” investing. • Invest exclusively in U. S. -traded equities, (market cap < $2 B). • Concentrated portfolio of 20 to 25 positions, with a standard position size of $20, 000. • Security selection driven primarily by bottom-up fundamental research. • In conjunction with the team’s overall sector and economic views. Objective • Achieve returns above Russell 2000 Index benchmark. • Achieve positive absolute returns. The Fund Small Cap Stern Alumni Presentation April 25 th 2006 34

Fund Overview Strategy • Focused upon stock selection and Identifying small-cap companies with strong fundamental prospects, and that are under followed by the market. • No explicit bias toward “growth” or “value” investing. • Invest exclusively in U. S. -traded equities, (market cap < $2 B). • Concentrated portfolio of 20 to 25 positions, with a standard position size of $20, 000. • Security selection driven primarily by bottom-up fundamental research. • In conjunction with the team’s overall sector and economic views. Objective • Achieve returns above Russell 2000 Index benchmark. • Achieve positive absolute returns. The Fund Small Cap Stern Alumni Presentation April 25 th 2006 34

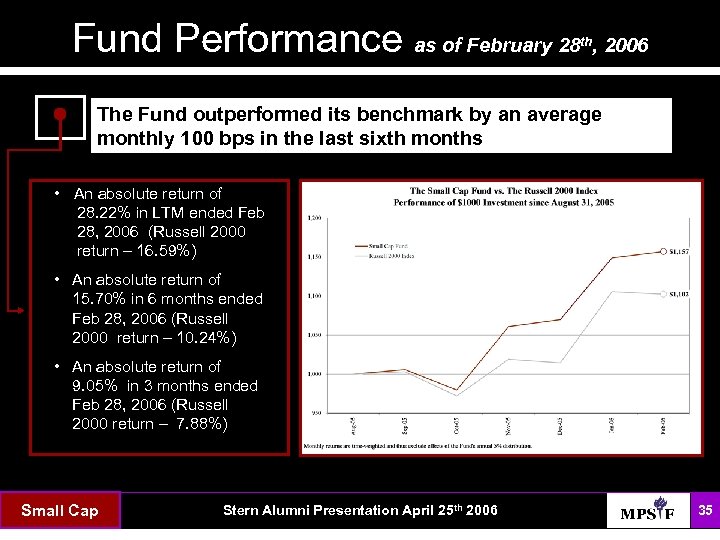

Fund Performance as of February 28 th, 2006 The Fund outperformed its benchmark by an average monthly 100 bps in the last sixth months • An absolute return of 28. 22% in LTM ended Feb 28, 2006 (Russell 2000 return – 16. 59%) • An absolute return of 15. 70% in 6 months ended Feb 28, 2006 (Russell 2000 return – 10. 24%) • An absolute return of 9. 05% in 3 months ended Feb 28, 2006 (Russell 2000 return – 7. 88%) The Fund Small Cap Stern Alumni Presentation April 25 th 2006 35

Fund Performance as of February 28 th, 2006 The Fund outperformed its benchmark by an average monthly 100 bps in the last sixth months • An absolute return of 28. 22% in LTM ended Feb 28, 2006 (Russell 2000 return – 16. 59%) • An absolute return of 15. 70% in 6 months ended Feb 28, 2006 (Russell 2000 return – 10. 24%) • An absolute return of 9. 05% in 3 months ended Feb 28, 2006 (Russell 2000 return – 7. 88%) The Fund Small Cap Stern Alumni Presentation April 25 th 2006 35

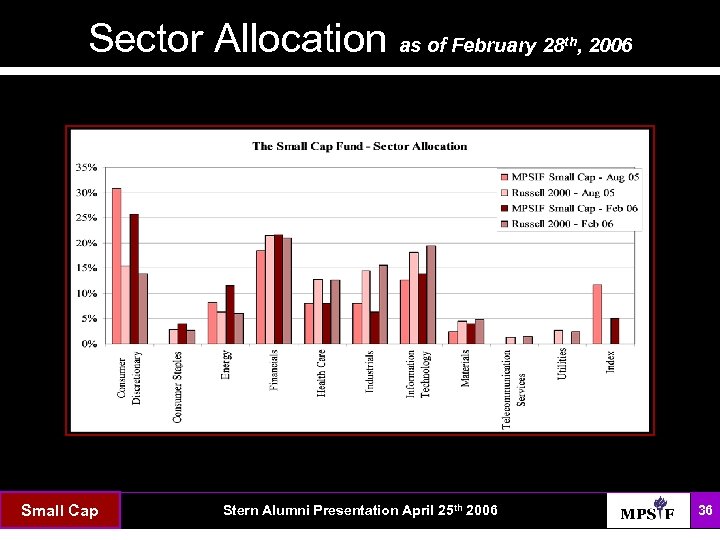

Sector Allocation as of February 28 The Fund Small Cap Stern Alumni Presentation April 25 th 2006 th, 2006 36

Sector Allocation as of February 28 The Fund Small Cap Stern Alumni Presentation April 25 th 2006 th, 2006 36

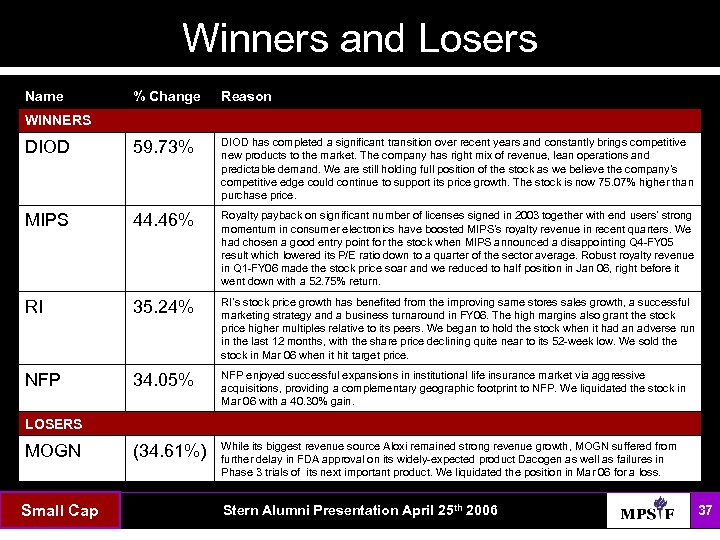

Winners and Losers Name % Change Reason DIOD 59. 73% DIOD has completed a significant transition over recent years and constantly brings competitive new products to the market. The company has right mix of revenue, lean operations and predictable demand. We are still holding full position of the stock as we believe the company’s competitive edge could continue to support its price growth. The stock is now 75. 07% higher than purchase price. MIPS 44. 46% Royalty payback on significant number of licenses signed in 2003 together with end users’ strong momentum in consumer electronics have boosted MIPS’s royalty revenue in recent quarters. We had chosen a good entry point for the stock when MIPS announced a disappointing Q 4 -FY 05 result which lowered its P/E ratio down to a quarter of the sector average. Robust royalty revenue in Q 1 -FY 06 made the stock price soar and we reduced to half position in Jan 06, right before it went down with a 52. 75% return. RI 35. 24% RI’s stock price growth has benefited from the improving same stores sales growth, a successful marketing strategy and a business turnaround in FY 06. The high margins also grant the stock price higher multiples relative to its peers. We began to hold the stock when it had an adverse run in the last 12 months, with the share price declining quite near to its 52 -week low. We sold the stock in Mar 06 when it hit target price. NFP 34. 05% NFP enjoyed successful expansions in institutional life insurance market via aggressive acquisitions, providing a complementary geographic footprint to NFP. We liquidated the stock in Mar 06 with a 40. 30% gain. (34. 61%) While its biggest revenue source Aloxi remained strong revenue growth, MOGN suffered from further delay in FDA approval on its widely-expected product Dacogen as well as failures in Phase 3 trials of its next important product. We liquidated the position in Mar 06 for a loss. WINNERS LOSERS MOGN The Fund Small Cap Stern Alumni Presentation April 25 th 2006 37

Winners and Losers Name % Change Reason DIOD 59. 73% DIOD has completed a significant transition over recent years and constantly brings competitive new products to the market. The company has right mix of revenue, lean operations and predictable demand. We are still holding full position of the stock as we believe the company’s competitive edge could continue to support its price growth. The stock is now 75. 07% higher than purchase price. MIPS 44. 46% Royalty payback on significant number of licenses signed in 2003 together with end users’ strong momentum in consumer electronics have boosted MIPS’s royalty revenue in recent quarters. We had chosen a good entry point for the stock when MIPS announced a disappointing Q 4 -FY 05 result which lowered its P/E ratio down to a quarter of the sector average. Robust royalty revenue in Q 1 -FY 06 made the stock price soar and we reduced to half position in Jan 06, right before it went down with a 52. 75% return. RI 35. 24% RI’s stock price growth has benefited from the improving same stores sales growth, a successful marketing strategy and a business turnaround in FY 06. The high margins also grant the stock price higher multiples relative to its peers. We began to hold the stock when it had an adverse run in the last 12 months, with the share price declining quite near to its 52 -week low. We sold the stock in Mar 06 when it hit target price. NFP 34. 05% NFP enjoyed successful expansions in institutional life insurance market via aggressive acquisitions, providing a complementary geographic footprint to NFP. We liquidated the stock in Mar 06 with a 40. 30% gain. (34. 61%) While its biggest revenue source Aloxi remained strong revenue growth, MOGN suffered from further delay in FDA approval on its widely-expected product Dacogen as well as failures in Phase 3 trials of its next important product. We liquidated the position in Mar 06 for a loss. WINNERS LOSERS MOGN The Fund Small Cap Stern Alumni Presentation April 25 th 2006 37

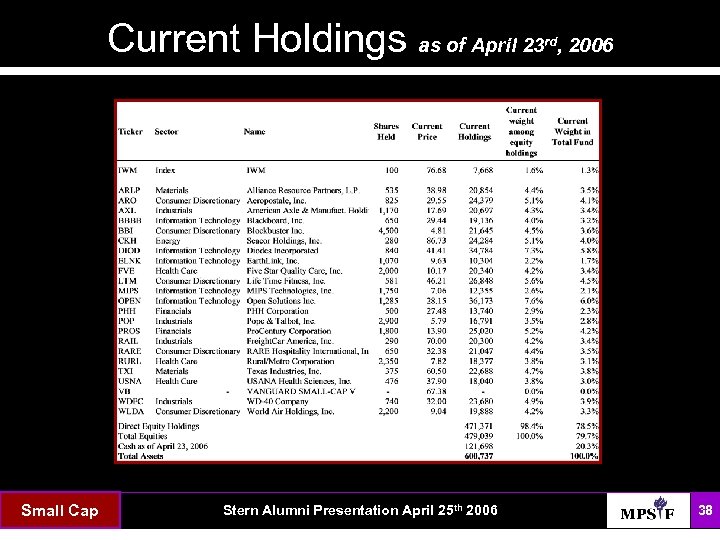

Current Holdings as of April 23 The Fund Small Cap Stern Alumni Presentation April 25 th 2006 rd, 2006 38

Current Holdings as of April 23 The Fund Small Cap Stern Alumni Presentation April 25 th 2006 rd, 2006 38

The Value Fund The Michael Price Student Investment Fund Portfolio Managers: Benjamin Macdonald and Chao Mui __________________ Value Fund The Fund Small Cap Stern Alumni Presentation April 25 th 2006 39

The Value Fund The Michael Price Student Investment Fund Portfolio Managers: Benjamin Macdonald and Chao Mui __________________ Value Fund The Fund Small Cap Stern Alumni Presentation April 25 th 2006 39

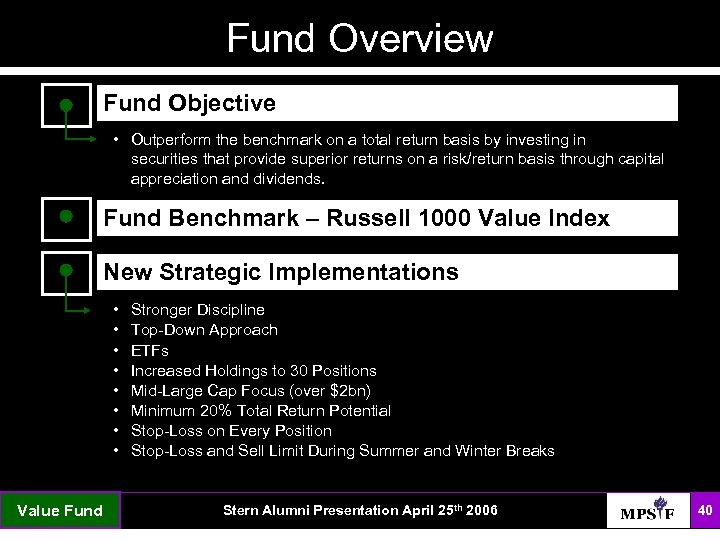

Fund Overview Fund Objective • Outperform the benchmark on a total return basis by investing in securities that provide superior returns on a risk/return basis through capital appreciation and dividends. Fund Benchmark – Russell 1000 Value Index New Strategic Implementations • • The Fund Value Fund Stronger Discipline Top-Down Approach ETFs Increased Holdings to 30 Positions Mid-Large Cap Focus (over $2 bn) Minimum 20% Total Return Potential Stop-Loss on Every Position Stop-Loss and Sell Limit During Summer and Winter Breaks Stern Alumni Presentation April 25 th 2006 40

Fund Overview Fund Objective • Outperform the benchmark on a total return basis by investing in securities that provide superior returns on a risk/return basis through capital appreciation and dividends. Fund Benchmark – Russell 1000 Value Index New Strategic Implementations • • The Fund Value Fund Stronger Discipline Top-Down Approach ETFs Increased Holdings to 30 Positions Mid-Large Cap Focus (over $2 bn) Minimum 20% Total Return Potential Stop-Loss on Every Position Stop-Loss and Sell Limit During Summer and Winter Breaks Stern Alumni Presentation April 25 th 2006 40

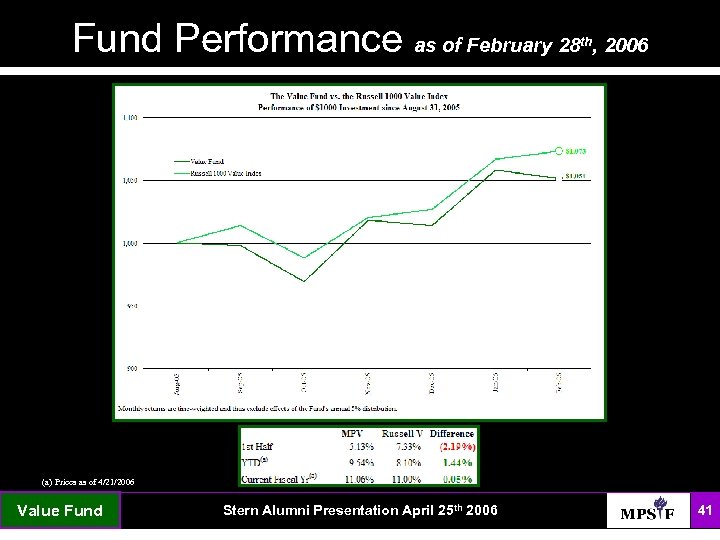

Fund Performance as of February 28 th, 2006 (a) Prices as of 4/21/2006 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 41

Fund Performance as of February 28 th, 2006 (a) Prices as of 4/21/2006 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 41

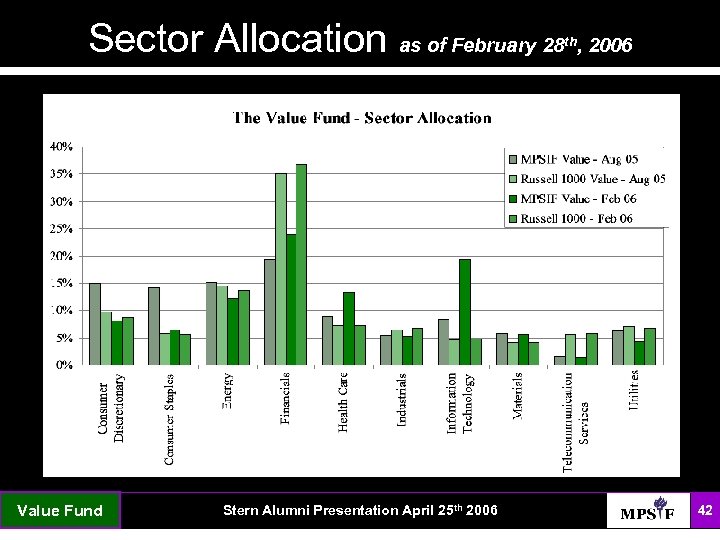

Sector Allocation as of February 28 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 th, 2006 42

Sector Allocation as of February 28 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 th, 2006 42

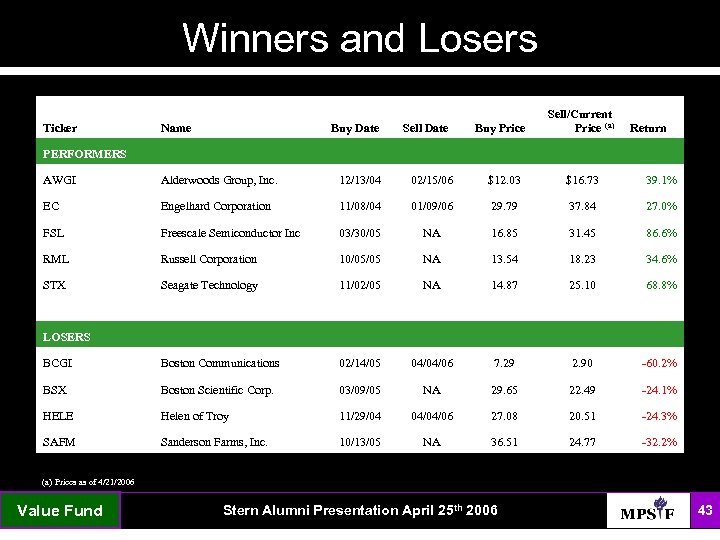

Winners and Losers Ticker Name Buy Date Sell Date Buy Price Sell/Current Price (a) Return PERFORMERS AWGI Alderwoods Group, Inc. 12/13/04 02/15/06 $12. 03 $16. 73 39. 1% EC Engelhard Corporation 11/08/04 01/09/06 29. 79 37. 84 27. 0% FSL Freescale Semiconductor Inc 03/30/05 NA 16. 85 31. 45 86. 6% RML Russell Corporation 10/05/05 NA 13. 54 18. 23 34. 6% STX Seagate Technology 11/02/05 NA 14. 87 25. 10 68. 8% LOSERS BCGI Boston Communications 02/14/05 04/04/06 7. 29 2. 90 -60. 2% BSX Boston Scientific Corp. 03/09/05 NA 29. 65 22. 49 -24. 1% HELE Helen of Troy 11/29/04 04/04/06 27. 08 20. 51 -24. 3% SAFM Sanderson Farms, Inc. 10/13/05 NA 36. 51 24. 77 -32. 2% (a) Prices as of 4/21/2006 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 43

Winners and Losers Ticker Name Buy Date Sell Date Buy Price Sell/Current Price (a) Return PERFORMERS AWGI Alderwoods Group, Inc. 12/13/04 02/15/06 $12. 03 $16. 73 39. 1% EC Engelhard Corporation 11/08/04 01/09/06 29. 79 37. 84 27. 0% FSL Freescale Semiconductor Inc 03/30/05 NA 16. 85 31. 45 86. 6% RML Russell Corporation 10/05/05 NA 13. 54 18. 23 34. 6% STX Seagate Technology 11/02/05 NA 14. 87 25. 10 68. 8% LOSERS BCGI Boston Communications 02/14/05 04/04/06 7. 29 2. 90 -60. 2% BSX Boston Scientific Corp. 03/09/05 NA 29. 65 22. 49 -24. 1% HELE Helen of Troy 11/29/04 04/04/06 27. 08 20. 51 -24. 3% SAFM Sanderson Farms, Inc. 10/13/05 NA 36. 51 24. 77 -32. 2% (a) Prices as of 4/21/2006 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 43

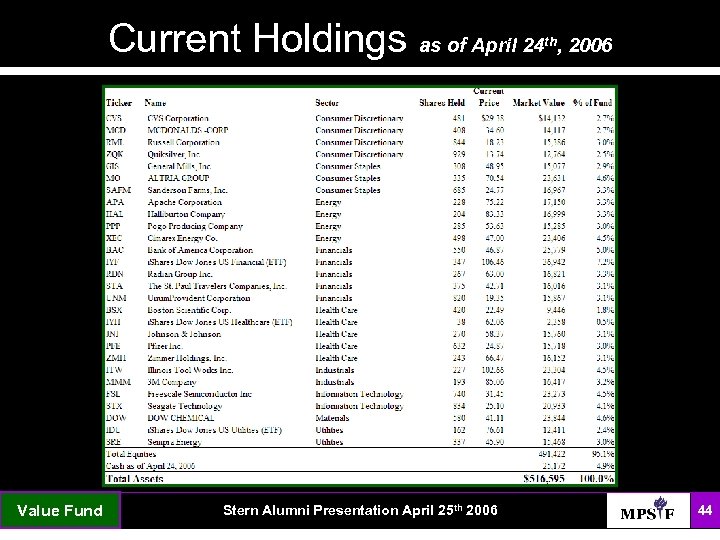

Current Holdings as of April 24 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 th, 2006 44

Current Holdings as of April 24 The Fund Value Fund Stern Alumni Presentation April 25 th 2006 th, 2006 44

Reality Investing at Stern Questions & Answers __________________ The Fund Stern Alumni Presentation April 25 th 2006 45

Reality Investing at Stern Questions & Answers __________________ The Fund Stern Alumni Presentation April 25 th 2006 45