525d5ea069343dc18e16093d3431f145.ppt

- Количество слайдов: 29

Real Estate Principles and Practices Chapter 9 Marketing and Selling Real Estate © 2014 On. Course Learning

Real Estate Principles and Practices Chapter 9 Marketing and Selling Real Estate © 2014 On. Course Learning

Key Terms Auction Bill of sale Counteroffer Disclosure statement Earnest money Equitable interest Errors and omissions insurance Home warranties Lease option Lease Purchase Marketable title Purchase agreement Right of first refusal Straw man Trust account © 2014 On. Course Learning

Key Terms Auction Bill of sale Counteroffer Disclosure statement Earnest money Equitable interest Errors and omissions insurance Home warranties Lease option Lease Purchase Marketable title Purchase agreement Right of first refusal Straw man Trust account © 2014 On. Course Learning

Overview Purchase agreement Presenting counteroffers Earnest money deposits Seller disclosure statement © 2014 On. Course Learning

Overview Purchase agreement Presenting counteroffers Earnest money deposits Seller disclosure statement © 2014 On. Course Learning

The Purchase Agreement Prequalify buyer Buyer’s cost estimate Purchase agreement Upon acceptance it becomes a contract Statue of frauds: in writing to be enforceable Practice of law? Presented to seller by listing agent © 2014 On. Course Learning

The Purchase Agreement Prequalify buyer Buyer’s cost estimate Purchase agreement Upon acceptance it becomes a contract Statue of frauds: in writing to be enforceable Practice of law? Presented to seller by listing agent © 2014 On. Course Learning

Presenting the Offer Copy to offeror Presented to offeree Usually by listing agent If sellers agree – sign acceptance Copy left with seller Notify buyer of acceptance Receives signed copy Offer may be rescinded any time prior to acceptance © 2014 On. Course Learning

Presenting the Offer Copy to offeror Presented to offeree Usually by listing agent If sellers agree – sign acceptance Copy left with seller Notify buyer of acceptance Receives signed copy Offer may be rescinded any time prior to acceptance © 2014 On. Course Learning

Counteroffers Counteroffer: revokes previous offer with entirely new offer Not a partial acceptance Available for another offer Withdraw counteroffer prior to accepting a new offer © 2014 On. Course Learning

Counteroffers Counteroffer: revokes previous offer with entirely new offer Not a partial acceptance Available for another offer Withdraw counteroffer prior to accepting a new offer © 2014 On. Course Learning

Earnest-Money Deposits Purchaser’s deposit Demonstrates good intent Placed in broker’s trust account Credited to buyer at closing Returned if offer is not accepted © 2014 On. Course Learning

Earnest-Money Deposits Purchaser’s deposit Demonstrates good intent Placed in broker’s trust account Credited to buyer at closing Returned if offer is not accepted © 2014 On. Course Learning

Earnest-Money Deposits Buyer default could result in forfeiture of funds Disclose in writing prior to presentation of contract May be split between seller and broker after broker expenses Interpleader © 2014 On. Course Learning

Earnest-Money Deposits Buyer default could result in forfeiture of funds Disclose in writing prior to presentation of contract May be split between seller and broker after broker expenses Interpleader © 2014 On. Course Learning

Trust Accounts Clients and customers money must be kept in a trust account Ledgers & journals Sales and rents kept separately © 2014 On. Course Learning

Trust Accounts Clients and customers money must be kept in a trust account Ledgers & journals Sales and rents kept separately © 2014 On. Course Learning

Trust Accounts Broker entitled to money only after final sale Interest v. non-interest bearing accounts Audits © 2014 On. Course Learning

Trust Accounts Broker entitled to money only after final sale Interest v. non-interest bearing accounts Audits © 2014 On. Course Learning

Lease Options Lease option: leasing with option to buy Purchase within a set period of time Price and terms defined Rent may be applied to down payment © 2014 On. Course Learning

Lease Options Lease option: leasing with option to buy Purchase within a set period of time Price and terms defined Rent may be applied to down payment © 2014 On. Course Learning

Lease Options Right of first refusal: tenant may match any offer owner receives Tenant is not obligated to purchase Disadvantage to owner © 2014 On. Course Learning

Lease Options Right of first refusal: tenant may match any offer owner receives Tenant is not obligated to purchase Disadvantage to owner © 2014 On. Course Learning

Lease Options Tenant must purchase at the end of the lease Allows time to arrange financing or clear title Portion of rent may be applied to purchase © 2014 On. Course Learning

Lease Options Tenant must purchase at the end of the lease Allows time to arrange financing or clear title Portion of rent may be applied to purchase © 2014 On. Course Learning

Lease Options Equitable interest: buyer’s interest in property once offer is accepted Assignment is allowed unless specifically prohibited Straw Man: offer made with intent to transfer prior to closing © 2014 On. Course Learning

Lease Options Equitable interest: buyer’s interest in property once offer is accepted Assignment is allowed unless specifically prohibited Straw Man: offer made with intent to transfer prior to closing © 2014 On. Course Learning

Lease Options Bill of Sale: used to transfer chattel Personal property © 2014 On. Course Learning

Lease Options Bill of Sale: used to transfer chattel Personal property © 2014 On. Course Learning

Lease Options Marketable title: free of defects, liens and encumbrances © 2014 On. Course Learning

Lease Options Marketable title: free of defects, liens and encumbrances © 2014 On. Course Learning

Sale by Auction: absolute sale sold to the highest bidder Licensed auctioneer Absolute: sold no matter how high the bid Seller is offeror © 2014 On. Course Learning

Sale by Auction: absolute sale sold to the highest bidder Licensed auctioneer Absolute: sold no matter how high the bid Seller is offeror © 2014 On. Course Learning

Sale by Auction With reserve: bid may be rejected Bidder is offeror No warranties except Property is being sold Right to sell and transfer title © 2014 On. Course Learning

Sale by Auction With reserve: bid may be rejected Bidder is offeror No warranties except Property is being sold Right to sell and transfer title © 2014 On. Course Learning

Representing the Seller Owe fair treatment to the buyer Confidentiality to the seller Full disclosure to the buyer © 2014 On. Course Learning

Representing the Seller Owe fair treatment to the buyer Confidentiality to the seller Full disclosure to the buyer © 2014 On. Course Learning

Representing the Seller Disclosure Statement from Seller Disclosure statement: checklist of inspections and potential problem areas Seller must disclose all defects Latent - hidden Patent - visible © 2014 On. Course Learning

Representing the Seller Disclosure Statement from Seller Disclosure statement: checklist of inspections and potential problem areas Seller must disclose all defects Latent - hidden Patent - visible © 2014 On. Course Learning

Representing the Seller Errors and Omissions Insurance Errors and omissions insurance: malpractice insurance Mandated by many states Brokers may require the disclosure in nonmandated states © 2014 On. Course Learning

Representing the Seller Errors and Omissions Insurance Errors and omissions insurance: malpractice insurance Mandated by many states Brokers may require the disclosure in nonmandated states © 2014 On. Course Learning

Buyer’s Warranties HOME BUYER’S INSURANCE HOW: Home owner’s warranty 10 year warranty plan for new homes Covers defects © 2014 On. Course Learning

Buyer’s Warranties HOME BUYER’S INSURANCE HOW: Home owner’s warranty 10 year warranty plan for new homes Covers defects © 2014 On. Course Learning

Buyer’s Warranties HOME WARRANTY INSURANCE Insurance for existing homes Purchased by buyer or seller Deductible amount © 2014 On. Course Learning

Buyer’s Warranties HOME WARRANTY INSURANCE Insurance for existing homes Purchased by buyer or seller Deductible amount © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE Protection against financial loss due to damage Premiums are invested to build reserves Lender requires a policy Endorsement or rider: covers additional risk © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE Protection against financial loss due to damage Premiums are invested to build reserves Lender requires a policy Endorsement or rider: covers additional risk © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE 5 different types of policies HO-1: basic HO-2: broader scope HO-5: covers all risks except specific exclusions © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE 5 different types of policies HO-1: basic HO-2: broader scope HO-5: covers all risks except specific exclusions © 2014 On. Course Learning

Basic Homeowner Coverage Fire Lightning Windstorm or hail Explosion Property removal from endangered premises Riot Aircraft Vehicles Smoke Theft Vandalism Breaking of glass Collapse Falling objects Weight of ice, snow or sleet Hot water heating system or appliance Frozen plumbing Electrical appliances Artificially generated current © 2014 On. Course Learning

Basic Homeowner Coverage Fire Lightning Windstorm or hail Explosion Property removal from endangered premises Riot Aircraft Vehicles Smoke Theft Vandalism Breaking of glass Collapse Falling objects Weight of ice, snow or sleet Hot water heating system or appliance Frozen plumbing Electrical appliances Artificially generated current © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE Tenant insurance for personal belongs Commercial: Business equipment Interruption of business Flood Insurance Optional coverage Deductibles © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE Tenant insurance for personal belongs Commercial: Business equipment Interruption of business Flood Insurance Optional coverage Deductibles © 2014 On. Course Learning

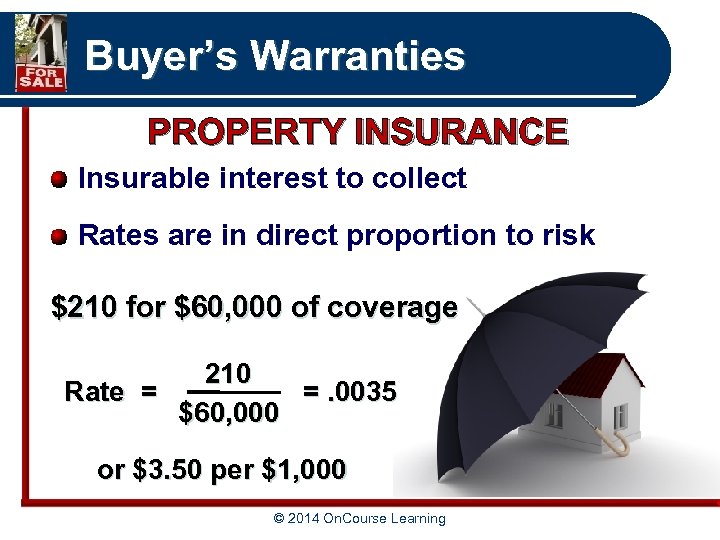

Buyer’s Warranties PROPERTY INSURANCE Insurable interest to collect Rates are in direct proportion to risk $210 for $60, 000 of coverage 210 Rate = =. 0035 $60, 000 or $3. 50 per $1, 000 © 2014 On. Course Learning

Buyer’s Warranties PROPERTY INSURANCE Insurable interest to collect Rates are in direct proportion to risk $210 for $60, 000 of coverage 210 Rate = =. 0035 $60, 000 or $3. 50 per $1, 000 © 2014 On. Course Learning

Buyers Warranties Liability Personal liability from injury to oneself or others Annual fee © 2014 On. Course Learning

Buyers Warranties Liability Personal liability from injury to oneself or others Annual fee © 2014 On. Course Learning