ea32a0ad74b34d72d82ef9856806d936.ppt

- Количество слайдов: 64

Real Estate Investment & Portfolio Management Prof C Bhattacharjee

Real Estate Investment & Portfolio Management Prof C Bhattacharjee

Marketing is marketing; its everywhere - Prof. Michael S Baker

Marketing is marketing; its everywhere - Prof. Michael S Baker

External and Internal Environment factors for an MNC n n n Socio-Cultural Legal Economic Political - Domestic - Local - International Technological n n n Regulators Competitors Suppliers Consumers/External Customers Internal Customers

External and Internal Environment factors for an MNC n n n Socio-Cultural Legal Economic Political - Domestic - Local - International Technological n n n Regulators Competitors Suppliers Consumers/External Customers Internal Customers

Components of the General Environment Economic Demographic Sociocultural Industry Environment Competitive Environment Political/ Legal Global Technological

Components of the General Environment Economic Demographic Sociocultural Industry Environment Competitive Environment Political/ Legal Global Technological

Components of the General Environment

Components of the General Environment

External Environmental Analysis The external environmental analysis process should be conducted on a continuous basis. This process includes four activities: Scanning: Identifying early signals of environmental changes and trends Monitoring: Detecting meaning through ongoing observations of environmental changes and trends Forecasting: Developing projections of anticipated outcomes based on monitored changes and trends Assessing: Determining the timing and importance of environmental changes and trends for firms' strategies and their management

External Environmental Analysis The external environmental analysis process should be conducted on a continuous basis. This process includes four activities: Scanning: Identifying early signals of environmental changes and trends Monitoring: Detecting meaning through ongoing observations of environmental changes and trends Forecasting: Developing projections of anticipated outcomes based on monitored changes and trends Assessing: Determining the timing and importance of environmental changes and trends for firms' strategies and their management

Scanning models Delphi Technique n Spire Approach – Systematic Probing and Identification of the Relevant Environment* 1) fgfgf 2) kk n *Klein and Newman

Scanning models Delphi Technique n Spire Approach – Systematic Probing and Identification of the Relevant Environment* 1) fgfgf 2) kk n *Klein and Newman

Environment Scanning n n Competitor Intelligence Strategic Analysis The SPIRE Approach (Systematic Probing and Identification of the Relevant Environment)* - Detailed list of environment variables - Set out strategic marketing components - Facilitate interactions of different factors for any linkages Scenario Building * Klein and Newman, How to Integrate New Environmental Forces into Strategic Planning, “Management Review”, Volume 69, July 1980, pp. 40 -48

Environment Scanning n n Competitor Intelligence Strategic Analysis The SPIRE Approach (Systematic Probing and Identification of the Relevant Environment)* - Detailed list of environment variables - Set out strategic marketing components - Facilitate interactions of different factors for any linkages Scenario Building * Klein and Newman, How to Integrate New Environmental Forces into Strategic Planning, “Management Review”, Volume 69, July 1980, pp. 40 -48

Scenario Building Stage 1: Analysis of the Decisions n Stage 2: Identification of Key Decision Factors n Stage 3: Identifying the Socio-Cultural Factors n Stage 4: Analysis of each of the key variables separately n Stage 5: Selection of Scenario Logics n

Scenario Building Stage 1: Analysis of the Decisions n Stage 2: Identification of Key Decision Factors n Stage 3: Identifying the Socio-Cultural Factors n Stage 4: Analysis of each of the key variables separately n Stage 5: Selection of Scenario Logics n

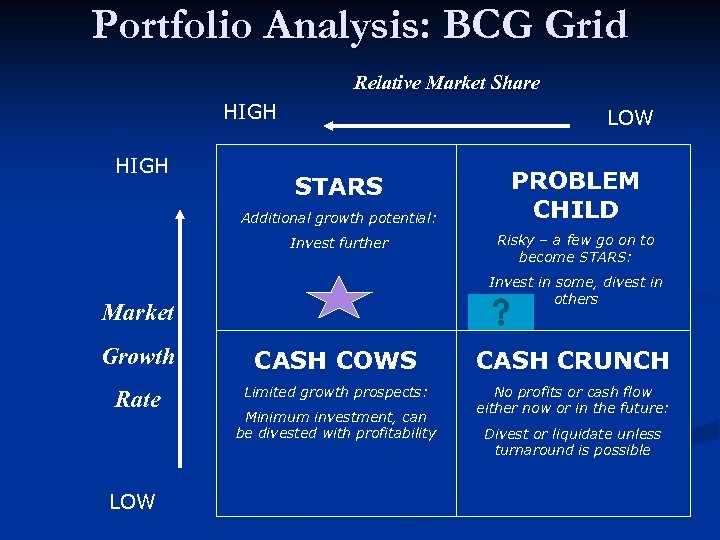

Portfolio Analysis: BCG Grid Relative Market Share HIGH LOW STARS Additional growth potential: Invest further PROBLEM CHILD Risky – a few go on to become STARS: Invest in some, divest in others Market Growth CASH COWS CASH CRUNCH Rate Limited growth prospects: No profits or cash flow either now or in the future: LOW Minimum investment, can be divested with profitability Divest or liquidate unless turnaround is possible

Portfolio Analysis: BCG Grid Relative Market Share HIGH LOW STARS Additional growth potential: Invest further PROBLEM CHILD Risky – a few go on to become STARS: Invest in some, divest in others Market Growth CASH COWS CASH CRUNCH Rate Limited growth prospects: No profits or cash flow either now or in the future: LOW Minimum investment, can be divested with profitability Divest or liquidate unless turnaround is possible

Strategies: BCG Grid Relative Market Share HIGH INVEST LOW STARS REVENUE + + + EXPENSE - - - PROBLEM CHILD DIVEST/ INVEST REVENUE ++ + EXPENSE - - Market Growth Rate HOLD/HARVEST LOW NET + + NET - - CASH COWS CASH CRUNCH REVENUE + + EXPENSE - - EXPENSE - - - - NET + + + NET - - DIVEST

Strategies: BCG Grid Relative Market Share HIGH INVEST LOW STARS REVENUE + + + EXPENSE - - - PROBLEM CHILD DIVEST/ INVEST REVENUE ++ + EXPENSE - - Market Growth Rate HOLD/HARVEST LOW NET + + NET - - CASH COWS CASH CRUNCH REVENUE + + EXPENSE - - EXPENSE - - - - NET + + + NET - - DIVEST

A Perceptual Map of apparel retailers “For Me” Raymond’s Shoppe Big Bazaar Shoppers’ Stop Fashion Street Westside Pantaloons Apna Bazar High Price Low Price Sheetal Boutique Globus Thanks ‘Flea markets’ “Not For Me”

A Perceptual Map of apparel retailers “For Me” Raymond’s Shoppe Big Bazaar Shoppers’ Stop Fashion Street Westside Pantaloons Apna Bazar High Price Low Price Sheetal Boutique Globus Thanks ‘Flea markets’ “Not For Me”

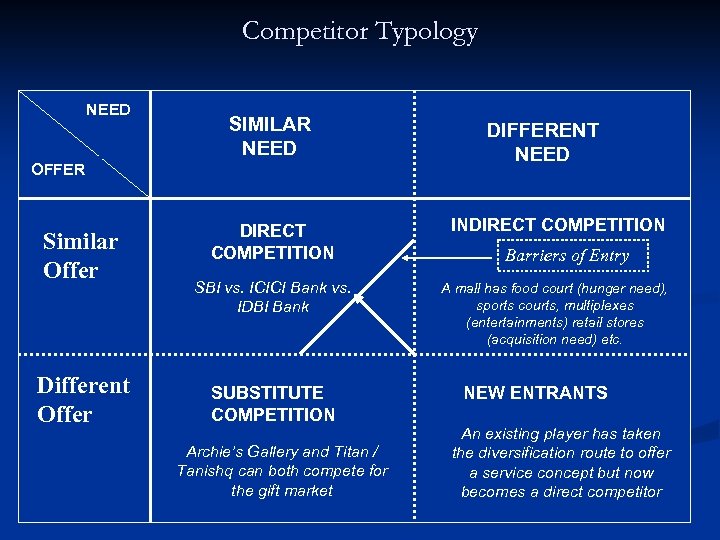

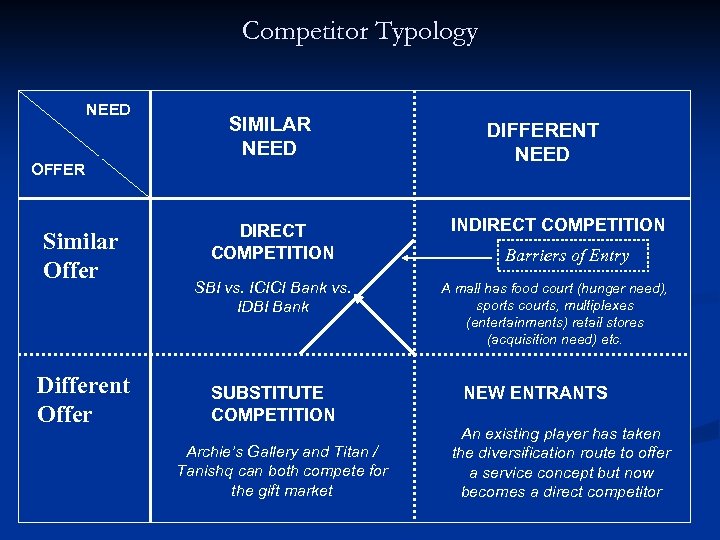

Competitor Typology NEED SIMILAR NEED OFFER Similar Offer Different Offer DIFFERENT NEED DIRECT COMPETITION INDIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank A mall has food court (hunger need), sports courts, multiplexes (entertainments) retail stores (acquisition need) etc. SUBSTITUTE COMPETITION Archie’s Gallery and Titan / Tanishq can both compete for the gift market Barriers of Entry NEW ENTRANTS An existing player has taken the diversification route to offer a service concept but now becomes a direct competitor

Competitor Typology NEED SIMILAR NEED OFFER Similar Offer Different Offer DIFFERENT NEED DIRECT COMPETITION INDIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank A mall has food court (hunger need), sports courts, multiplexes (entertainments) retail stores (acquisition need) etc. SUBSTITUTE COMPETITION Archie’s Gallery and Titan / Tanishq can both compete for the gift market Barriers of Entry NEW ENTRANTS An existing player has taken the diversification route to offer a service concept but now becomes a direct competitor

Porter’s Five Forces Model of Competition Threat of New Entrants Bargaining Power of Suppliers Rivalry Among Competing Firms in Industry Threat of Substitute Products Bargaining Power of Buyers

Porter’s Five Forces Model of Competition Threat of New Entrants Bargaining Power of Suppliers Rivalry Among Competing Firms in Industry Threat of Substitute Products Bargaining Power of Buyers

Managing the External Environment 1969

Managing the External Environment 1969

The Chinese have not ONE but TWO words for “crises”: “Danger’ & “Opportunity”

The Chinese have not ONE but TWO words for “crises”: “Danger’ & “Opportunity”

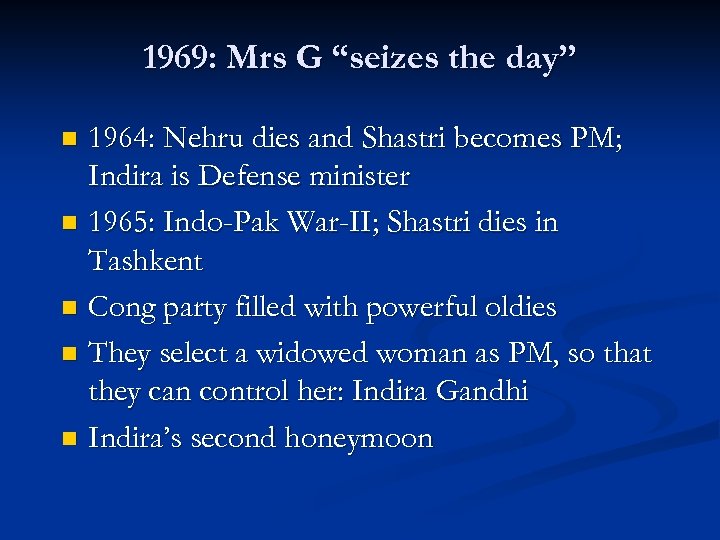

1969: Mrs G “seizes the day” 1964: Nehru dies and Shastri becomes PM; Indira is Defense minister n 1965: Indo-Pak War-II; Shastri dies in Tashkent n Cong party filled with powerful oldies n They select a widowed woman as PM, so that they can control her: Indira Gandhi n Indira’s second honeymoon n

1969: Mrs G “seizes the day” 1964: Nehru dies and Shastri becomes PM; Indira is Defense minister n 1965: Indo-Pak War-II; Shastri dies in Tashkent n Cong party filled with powerful oldies n They select a widowed woman as PM, so that they can control her: Indira Gandhi n Indira’s second honeymoon n

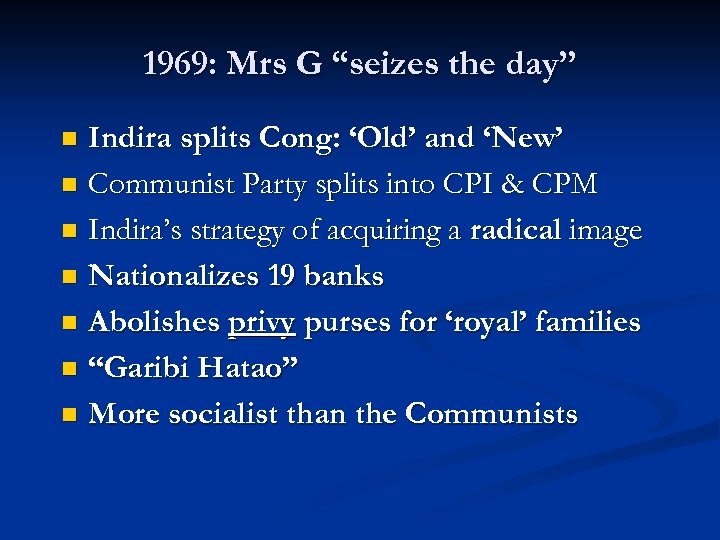

1969: Mrs G “seizes the day” Indira splits Cong: ‘Old’ and ‘New’ n Communist Party splits into CPI & CPM n Indira’s strategy of acquiring a radical image n Nationalizes 19 banks n Abolishes privy purses for ‘royal’ families n “Garibi Hatao” n More socialist than the Communists n

1969: Mrs G “seizes the day” Indira splits Cong: ‘Old’ and ‘New’ n Communist Party splits into CPI & CPM n Indira’s strategy of acquiring a radical image n Nationalizes 19 banks n Abolishes privy purses for ‘royal’ families n “Garibi Hatao” n More socialist than the Communists n

ITC n n n n n P N Haksar & Ajit Haksar ‘Only tobacco’ to ‘Also tobacco’ 1969: Hotels Paper Packaging ITH – travel & cargo Sangeet Research Academy Edible Oil – ‘Crystal’ Foods – ‘Aashirwaad’ vs n n TAJ Ajit Kerkar Single Hotel: Hotel Taj Mahal Multiple Hotels India’s own MNC • Hotels, motels, palaces, “indovilles”

ITC n n n n n P N Haksar & Ajit Haksar ‘Only tobacco’ to ‘Also tobacco’ 1969: Hotels Paper Packaging ITH – travel & cargo Sangeet Research Academy Edible Oil – ‘Crystal’ Foods – ‘Aashirwaad’ vs n n TAJ Ajit Kerkar Single Hotel: Hotel Taj Mahal Multiple Hotels India’s own MNC • Hotels, motels, palaces, “indovilles”

Those who forget history are condemned to repeat it - Georghe Santyana

Those who forget history are condemned to repeat it - Georghe Santyana

Managing the Internal Environment factors for International Marketing n n n Socio-Cultural Legal Economic Political - Domestic - Local - International Technological n n n Regulators Competitors Suppliers Consumers/External Customers Internal Customers

Managing the Internal Environment factors for International Marketing n n n Socio-Cultural Legal Economic Political - Domestic - Local - International Technological n n n Regulators Competitors Suppliers Consumers/External Customers Internal Customers

Forces affecting DMP PSYCHOLOGICAL/ INDIVIDUAL/ INTERNAL FORCES SOCIAL/ EXTERNAL/ GROUP FORCES INFORMATION SOURCES D M P SITUATIONAL FACTORS

Forces affecting DMP PSYCHOLOGICAL/ INDIVIDUAL/ INTERNAL FORCES SOCIAL/ EXTERNAL/ GROUP FORCES INFORMATION SOURCES D M P SITUATIONAL FACTORS

Examples of accessibility objectives : n To locate retail stores near high pedestrian traffic n To set up ATMs in major petrol bunks to cater to high vehicular traffic. n To set up a mall which is within twenty minutes drive from at least five major residential areas (e. g. Centre One, the mall that opened at Vashi, Navi Mumbai desires a catchment area of the whole of the seven nodes of Navi Mumbai).

Examples of accessibility objectives : n To locate retail stores near high pedestrian traffic n To set up ATMs in major petrol bunks to cater to high vehicular traffic. n To set up a mall which is within twenty minutes drive from at least five major residential areas (e. g. Centre One, the mall that opened at Vashi, Navi Mumbai desires a catchment area of the whole of the seven nodes of Navi Mumbai).

Selecting a location: A Clear idea of n n n n The volume of the business Market share Competition Customer segments Sociological factors as the degree of urbanization Suburbanization Population density cluster Customer type (Are the residents mostly from the lower class, upper-middle class or upper class and are the residential areas slums, low income zones or posh areas? etc. ).

Selecting a location: A Clear idea of n n n n The volume of the business Market share Competition Customer segments Sociological factors as the degree of urbanization Suburbanization Population density cluster Customer type (Are the residents mostly from the lower class, upper-middle class or upper class and are the residential areas slums, low income zones or posh areas? etc. ).

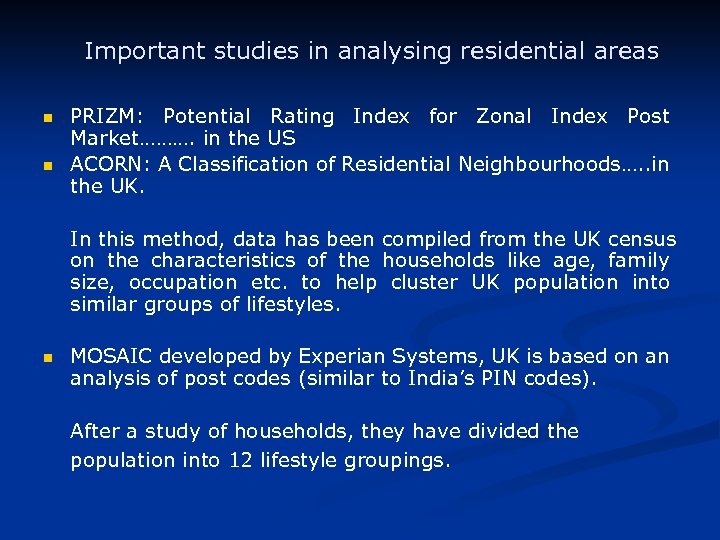

Important studies in analysing residential areas n n PRIZM: Potential Rating Index for Zonal Index Post Market………. in the US ACORN: A Classification of Residential Neighbourhoods…. . in the UK. In this method, data has been compiled from the UK census on the characteristics of the households like age, family size, occupation etc. to help cluster UK population into similar groups of lifestyles. n MOSAIC developed by Experian Systems, UK is based on an analysis of post codes (similar to India’s PIN codes). After a study of households, they have divided the population into 12 lifestyle groupings.

Important studies in analysing residential areas n n PRIZM: Potential Rating Index for Zonal Index Post Market………. in the US ACORN: A Classification of Residential Neighbourhoods…. . in the UK. In this method, data has been compiled from the UK census on the characteristics of the households like age, family size, occupation etc. to help cluster UK population into similar groups of lifestyles. n MOSAIC developed by Experian Systems, UK is based on an analysis of post codes (similar to India’s PIN codes). After a study of households, they have divided the population into 12 lifestyle groupings.

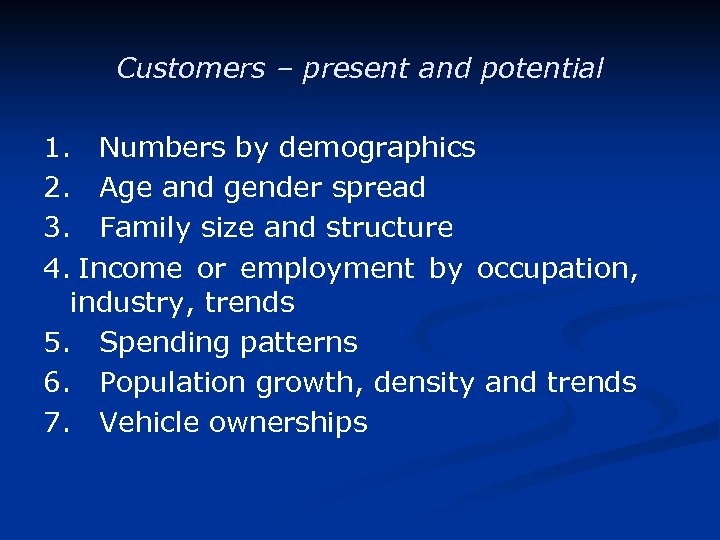

Customers – present and potential 1. Numbers by demographics 2. Age and gender spread 3. Family size and structure 4. Income or employment by occupation, industry, trends 5. Spending patterns 6. Population growth, density and trends 7. Vehicle ownerships

Customers – present and potential 1. Numbers by demographics 2. Age and gender spread 3. Family size and structure 4. Income or employment by occupation, industry, trends 5. Spending patterns 6. Population growth, density and trends 7. Vehicle ownerships

Accessibility 1. Site visibility 2. Pedestrian flows 3. Barriers such as railway tracks, streams, slums 4. Type of location zone 5. Road conditions and network 6. Parking 7. Public transports

Accessibility 1. Site visibility 2. Pedestrian flows 3. Barriers such as railway tracks, streams, slums 4. Type of location zone 5. Road conditions and network 6. Parking 7. Public transports

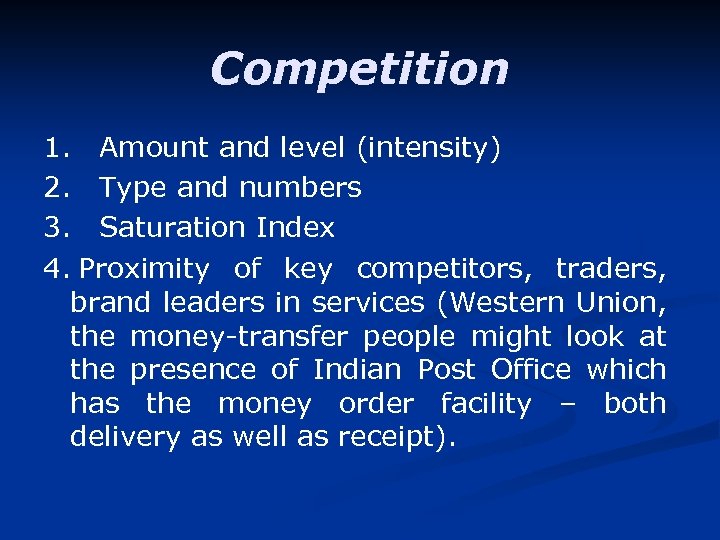

Competition 1. Amount and level (intensity) 2. Type and numbers 3. Saturation Index 4. Proximity of key competitors, traders, brand leaders in services (Western Union, the money-transfer people might look at the presence of Indian Post Office which has the money order facility – both delivery as well as receipt).

Competition 1. Amount and level (intensity) 2. Type and numbers 3. Saturation Index 4. Proximity of key competitors, traders, brand leaders in services (Western Union, the money-transfer people might look at the presence of Indian Post Office which has the money order facility – both delivery as well as receipt).

Costs 1. Building costs 2. Rent costs 3. Rates payable 4. Delivery and supply (transportation) costs 5. Insurance costs 6. Labour rates 7. Bank interest rates

Costs 1. Building costs 2. Rent costs 3. Rates payable 4. Delivery and supply (transportation) costs 5. Insurance costs 6. Labour rates 7. Bank interest rates

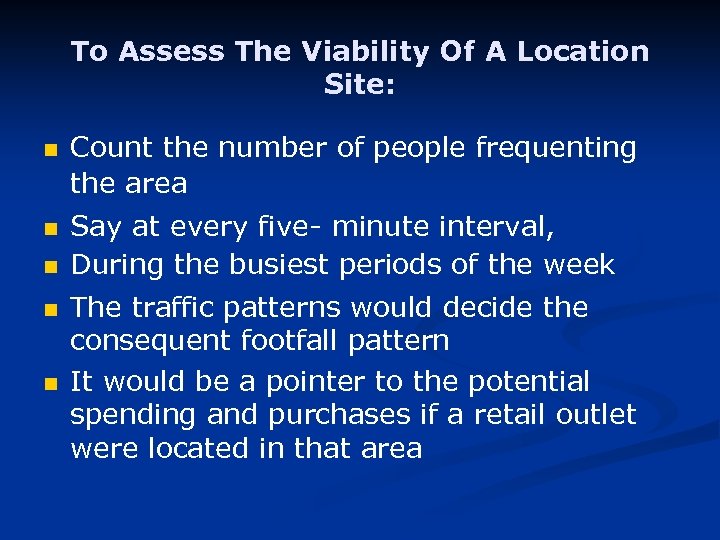

To Assess The Viability Of A Location Site: n n n Count the number of people frequenting the area Say at every five- minute interval, During the busiest periods of the week The traffic patterns would decide the consequent footfall pattern It would be a pointer to the potential spending and purchases if a retail outlet were located in that area

To Assess The Viability Of A Location Site: n n n Count the number of people frequenting the area Say at every five- minute interval, During the busiest periods of the week The traffic patterns would decide the consequent footfall pattern It would be a pointer to the potential spending and purchases if a retail outlet were located in that area

Example: n n n 100 people are passing by the area in five minutes Expenditure person: weighting the money at say Rs. 5, 000 person Potential for the area would be around Rs 500, 000. The whole process is normalized by taking into account whether the location is in the suburb/periphery of the town or downtown and other central places. For every additional 100 people frequenting the area, the potential sales for the retail stores will also increase accordingly.

Example: n n n 100 people are passing by the area in five minutes Expenditure person: weighting the money at say Rs. 5, 000 person Potential for the area would be around Rs 500, 000. The whole process is normalized by taking into account whether the location is in the suburb/periphery of the town or downtown and other central places. For every additional 100 people frequenting the area, the potential sales for the retail stores will also increase accordingly.

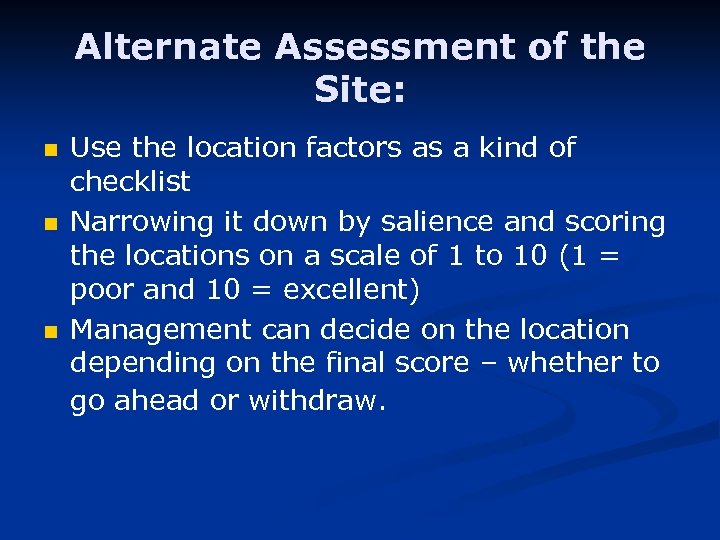

Alternate Assessment of the Site: n n n Use the location factors as a kind of checklist Narrowing it down by salience and scoring the locations on a scale of 1 to 10 (1 = poor and 10 = excellent) Management can decide on the location depending on the final score – whether to go ahead or withdraw.

Alternate Assessment of the Site: n n n Use the location factors as a kind of checklist Narrowing it down by salience and scoring the locations on a scale of 1 to 10 (1 = poor and 10 = excellent) Management can decide on the location depending on the final score – whether to go ahead or withdraw.

Catchments Area: It is the area within a specified boundary, within which people are attracted to the store; and beyond which people are uninterested in the store or are pulled by some other store.

Catchments Area: It is the area within a specified boundary, within which people are attracted to the store; and beyond which people are uninterested in the store or are pulled by some other store.

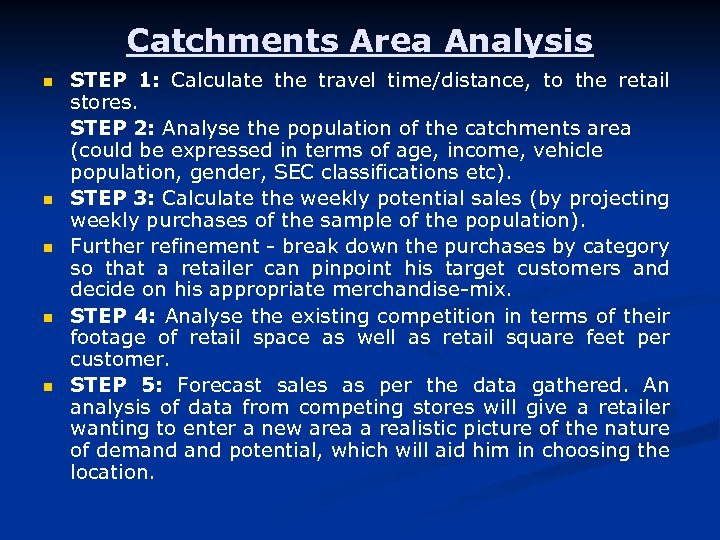

Catchments Area Analysis n n n STEP 1: Calculate the travel time/distance, to the retail stores. STEP 2: Analyse the population of the catchments area (could be expressed in terms of age, income, vehicle population, gender, SEC classifications etc). STEP 3: Calculate the weekly potential sales (by projecting weekly purchases of the sample of the population). Further refinement - break down the purchases by category so that a retailer can pinpoint his target customers and decide on his appropriate merchandise-mix. STEP 4: Analyse the existing competition in terms of their footage of retail space as well as retail square feet per customer. STEP 5: Forecast sales as per the data gathered. An analysis of data from competing stores will give a retailer wanting to enter a new area a realistic picture of the nature of demand potential, which will aid him in choosing the location.

Catchments Area Analysis n n n STEP 1: Calculate the travel time/distance, to the retail stores. STEP 2: Analyse the population of the catchments area (could be expressed in terms of age, income, vehicle population, gender, SEC classifications etc). STEP 3: Calculate the weekly potential sales (by projecting weekly purchases of the sample of the population). Further refinement - break down the purchases by category so that a retailer can pinpoint his target customers and decide on his appropriate merchandise-mix. STEP 4: Analyse the existing competition in terms of their footage of retail space as well as retail square feet per customer. STEP 5: Forecast sales as per the data gathered. An analysis of data from competing stores will give a retailer wanting to enter a new area a realistic picture of the nature of demand potential, which will aid him in choosing the location.

Gravitational Model n n Developed by W. J. Reilly, in 1929 Proposes that consumers are attracted to a certain location because of its pull effect or its drawing power as opposed to that of other outlets The model works on the principle of gravitational attraction It must include two counterpoises (attractions) and their relative ‘weights’ two retail outlets and their drawing powers.

Gravitational Model n n Developed by W. J. Reilly, in 1929 Proposes that consumers are attracted to a certain location because of its pull effect or its drawing power as opposed to that of other outlets The model works on the principle of gravitational attraction It must include two counterpoises (attractions) and their relative ‘weights’ two retail outlets and their drawing powers.

Gravitational Model includes the following factors: 1. The population of two competing locations, say X and Y. Thus population of location X would be P(X) and that of Y would be P(Y). 2. The distance between the two locations in kilometres, say D. 3. A point of indifference between the two locations to enable the marking of respective catchments areas. 4. The point of indifference is a certain geographic outer limit, wherein the customers would be uninterested in either of the two stores located at X or Y.

Gravitational Model includes the following factors: 1. The population of two competing locations, say X and Y. Thus population of location X would be P(X) and that of Y would be P(Y). 2. The distance between the two locations in kilometres, say D. 3. A point of indifference between the two locations to enable the marking of respective catchments areas. 4. The point of indifference is a certain geographic outer limit, wherein the customers would be uninterested in either of the two stores located at X or Y.

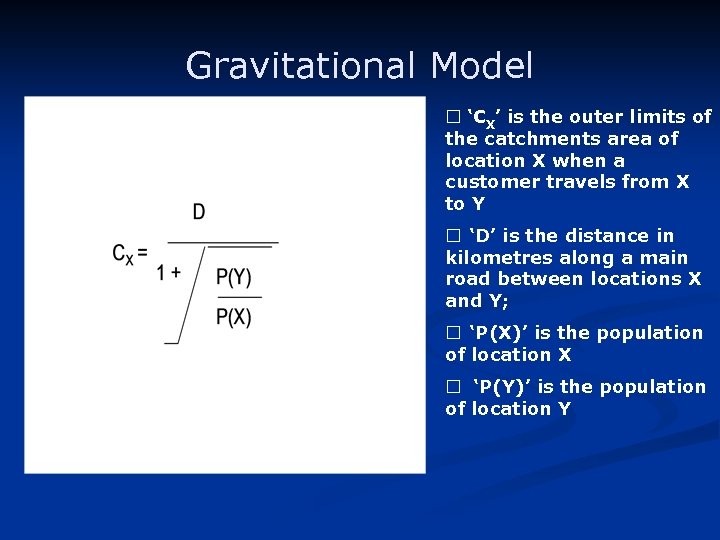

Gravitational Model ¨ ‘CX’ is the outer limits of the catchments area of location X when a customer travels from X to Y ¨ ‘D’ is the distance in kilometres along a main road between locations X and Y; ¨ ‘P(X)’ is the population of location X ¨ ‘P(Y)’ is the population of location Y

Gravitational Model ¨ ‘CX’ is the outer limits of the catchments area of location X when a customer travels from X to Y ¨ ‘D’ is the distance in kilometres along a main road between locations X and Y; ¨ ‘P(X)’ is the population of location X ¨ ‘P(Y)’ is the population of location Y

Gravitational Model Cx = Outer Limits X ‘D’ km P(X) Y P (Y)

Gravitational Model Cx = Outer Limits X ‘D’ km P(X) Y P (Y)

Growth Option: How would you grow?

Growth Option: How would you grow?

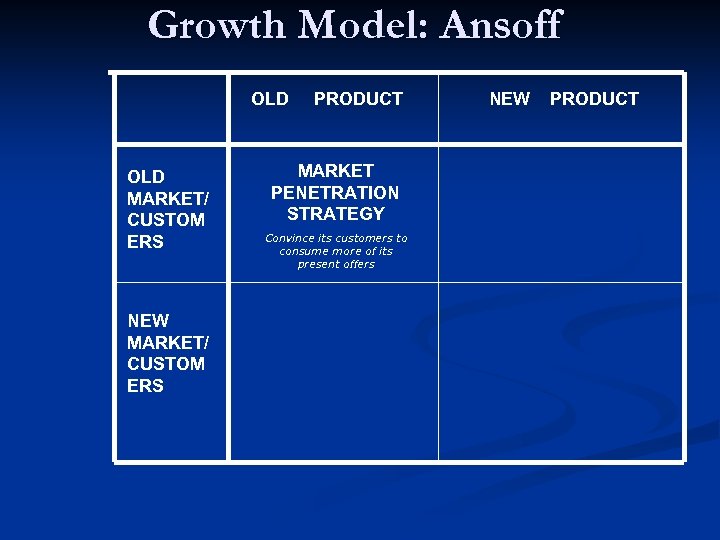

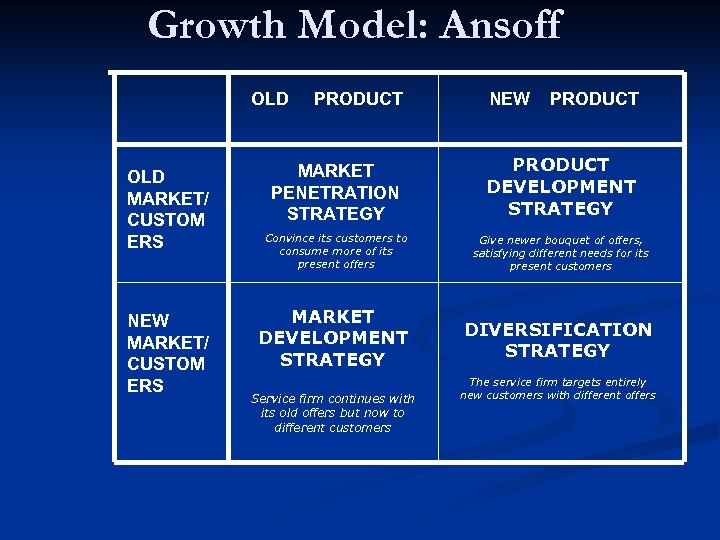

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT NEW PRODUCT

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT NEW PRODUCT

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY Convince its customers to consume more of its present offers NEW PRODUCT

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY Convince its customers to consume more of its present offers NEW PRODUCT

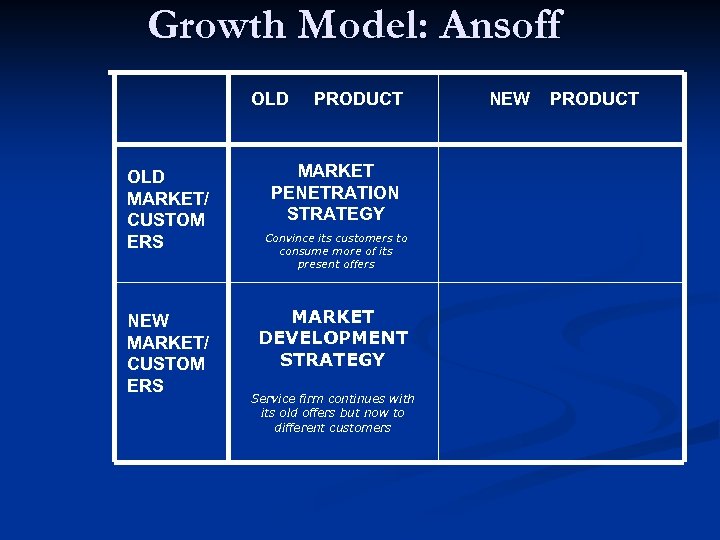

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY Convince its customers to consume more of its present offers MARKET DEVELOPMENT STRATEGY Service firm continues with its old offers but now to different customers NEW PRODUCT

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY Convince its customers to consume more of its present offers MARKET DEVELOPMENT STRATEGY Service firm continues with its old offers but now to different customers NEW PRODUCT

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY Convince its customers to consume more of its present offers MARKET DEVELOPMENT STRATEGY Service firm continues with its old offers but now to different customers NEW PRODUCT DEVELOPMENT STRATEGY Give newer bouquet of offers, satisfying different needs for its present customers

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY Convince its customers to consume more of its present offers MARKET DEVELOPMENT STRATEGY Service firm continues with its old offers but now to different customers NEW PRODUCT DEVELOPMENT STRATEGY Give newer bouquet of offers, satisfying different needs for its present customers

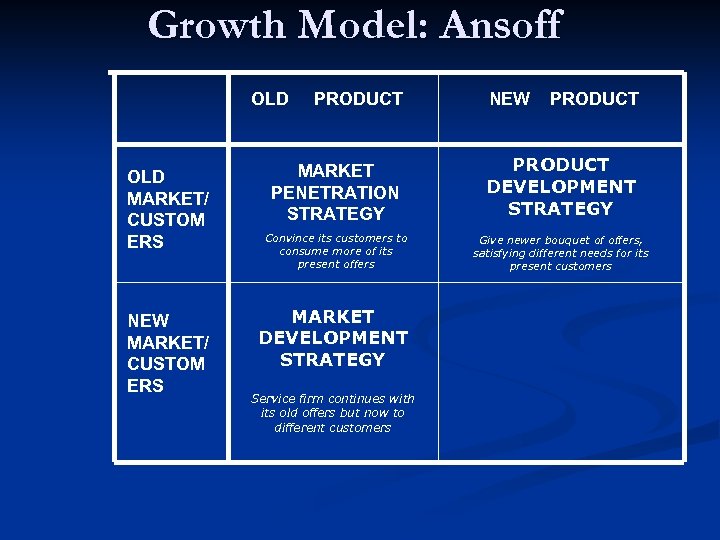

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY NEW PRODUCT DEVELOPMENT STRATEGY Convince its customers to consume more of its present offers Give newer bouquet of offers, satisfying different needs for its present customers MARKET DEVELOPMENT STRATEGY DIVERSIFICATION STRATEGY Service firm continues with its old offers but now to different customers The service firm targets entirely new customers with different offers

Growth Model: Ansoff OLD MARKET/ CUSTOM ERS NEW MARKET/ CUSTOM ERS PRODUCT MARKET PENETRATION STRATEGY NEW PRODUCT DEVELOPMENT STRATEGY Convince its customers to consume more of its present offers Give newer bouquet of offers, satisfying different needs for its present customers MARKET DEVELOPMENT STRATEGY DIVERSIFICATION STRATEGY Service firm continues with its old offers but now to different customers The service firm targets entirely new customers with different offers

You’ve got babies, and you’ve got money: - How would you allocate your resources? How would you categorize your SBUs?

You’ve got babies, and you’ve got money: - How would you allocate your resources? How would you categorize your SBUs?

If you don’t have a competitive advantage, don’t compete - Jack Welch, GE

If you don’t have a competitive advantage, don’t compete - Jack Welch, GE

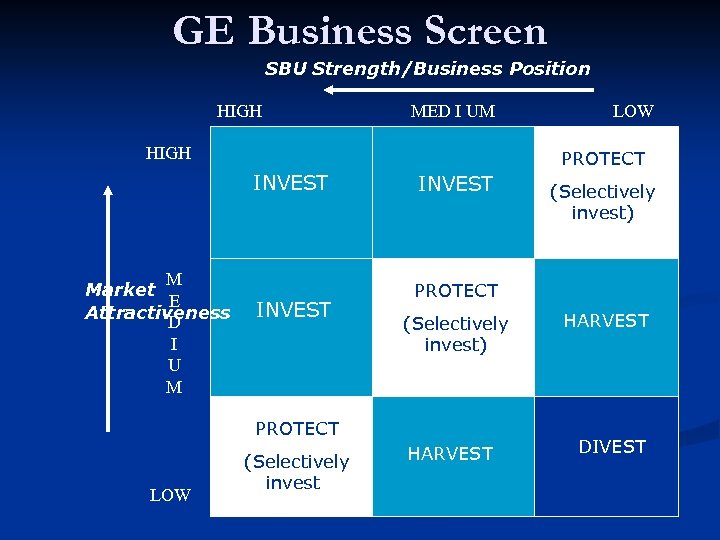

GE Business Screen SBU Strength/Business Position HIGH MED I UM HIGH INVEST M Market E Attractiveness D INVEST I U M INVEST LOW PROTECT (Selectively invest) HARVEST DIVEST PROTECT (Selectively invest) LOW

GE Business Screen SBU Strength/Business Position HIGH MED I UM HIGH INVEST M Market E Attractiveness D INVEST I U M INVEST LOW PROTECT (Selectively invest) HARVEST DIVEST PROTECT (Selectively invest) LOW

Market attractiveness: Market size n Market growth rate n Market entry barriers n Competition – number and type of competitors n Technological requirements n Profit margins, etc. n

Market attractiveness: Market size n Market growth rate n Market entry barriers n Competition – number and type of competitors n Technological requirements n Profit margins, etc. n

SBU strength/business position: n n n n SBU size Market share Research and development capabilities Power or strength of differential advantage(s) Cost controls Production capabilities and capacities Management expertise and depth, etc.

SBU strength/business position: n n n n SBU size Market share Research and development capabilities Power or strength of differential advantage(s) Cost controls Production capabilities and capacities Management expertise and depth, etc.

Ratings of the SBUs Criteria are assigned weights n Each SBU/product is rated with respect to all criteria n Overall ratings are calculated for all SBs/products n Each SBU/product is then rated as high, medium or low according to market attractiveness and then business position/SBU strength. n

Ratings of the SBUs Criteria are assigned weights n Each SBU/product is rated with respect to all criteria n Overall ratings are calculated for all SBs/products n Each SBU/product is then rated as high, medium or low according to market attractiveness and then business position/SBU strength. n

Pros & cons: portfolio models n n Constant product audit through profitability screen Judicious mixture of portfolio-mix n n n Too narrow focus on costs Nothing on innovation No weightage to risks

Pros & cons: portfolio models n n Constant product audit through profitability screen Judicious mixture of portfolio-mix n n n Too narrow focus on costs Nothing on innovation No weightage to risks

Where To Grow Related/Unrelated Diversification n Value Chain n

Where To Grow Related/Unrelated Diversification n Value Chain n

RELATED AND UNRELATED BUSINESS OPENING NEW BUSINES LINES NEW ENTRANT CUSTOMERS “Coming Closer” Going “Upstream” or Forward Integration CO. “Coming Closer” SUPPLIERS VERTICAL INTEGRATION “Downstream” or Backward Integration SUPPLIERS

RELATED AND UNRELATED BUSINESS OPENING NEW BUSINES LINES NEW ENTRANT CUSTOMERS “Coming Closer” Going “Upstream” or Forward Integration CO. “Coming Closer” SUPPLIERS VERTICAL INTEGRATION “Downstream” or Backward Integration SUPPLIERS

Competition ?

Competition ?

Competition n ICICI Bank Air Deccan Titan Watches n n n TBZ ? Volvo ? Archie’s Gift Gallery ?

Competition n ICICI Bank Air Deccan Titan Watches n n n TBZ ? Volvo ? Archie’s Gift Gallery ?

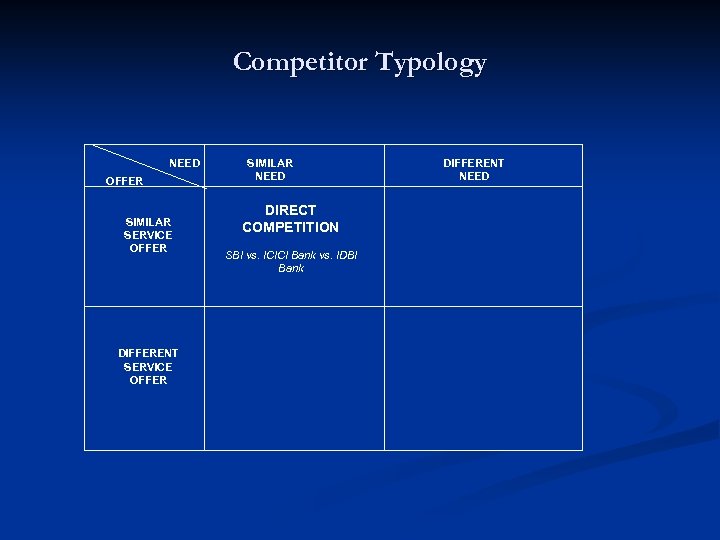

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIFFERENT NEED

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIFFERENT NEED

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank DIFFERENT NEED

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank DIFFERENT NEED

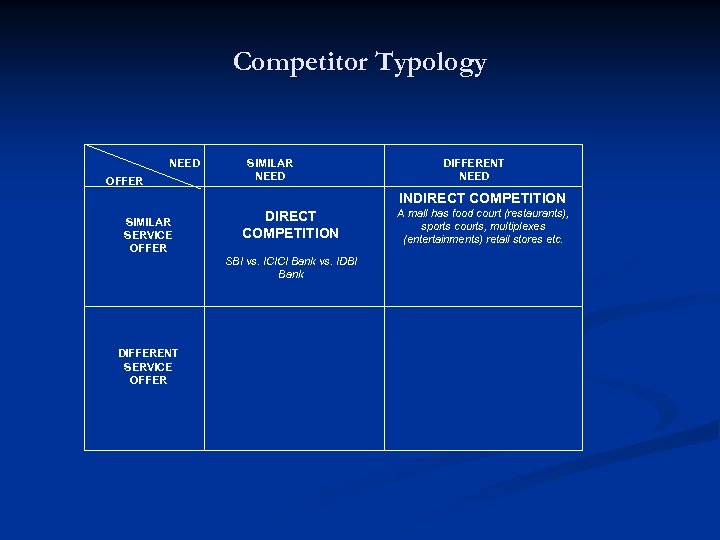

Competitor Typology NEED OFFER SIMILAR NEED DIFFERENT NEED INDIRECT COMPETITION SIMILAR SERVICE OFFER DIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank DIFFERENT SERVICE OFFER A mall has food court (restaurants), sports courts, multiplexes (entertainments) retail stores etc.

Competitor Typology NEED OFFER SIMILAR NEED DIFFERENT NEED INDIRECT COMPETITION SIMILAR SERVICE OFFER DIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank DIFFERENT SERVICE OFFER A mall has food court (restaurants), sports courts, multiplexes (entertainments) retail stores etc.

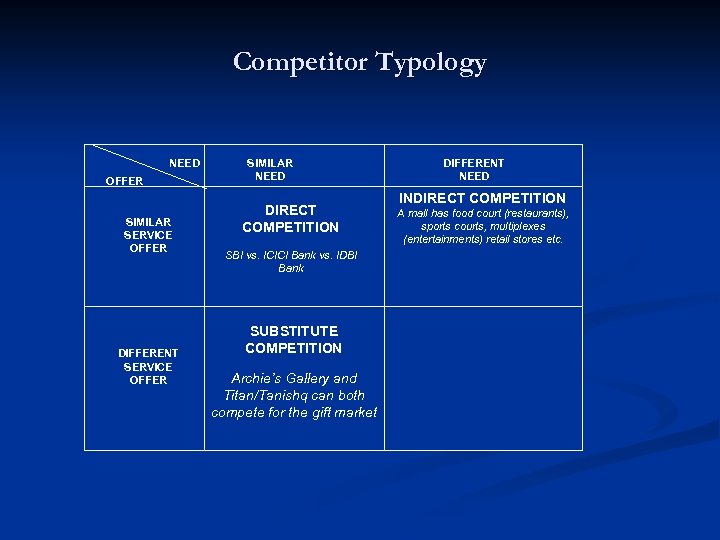

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank SUBSTITUTE COMPETITION Archie’s Gallery and Titan/Tanishq can both compete for the gift market DIFFERENT NEED INDIRECT COMPETITION A mall has food court (restaurants), sports courts, multiplexes (entertainments) retail stores etc.

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank SUBSTITUTE COMPETITION Archie’s Gallery and Titan/Tanishq can both compete for the gift market DIFFERENT NEED INDIRECT COMPETITION A mall has food court (restaurants), sports courts, multiplexes (entertainments) retail stores etc.

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIRECT COMPETITION DIFFERENT NEED INDIRECT COMPETITION A mall has food court (restaurants), sports courts, multiplexes (entertainments) retail stores etc. SBI vs. ICICI Bank vs. IDBI Bank SUBSTITUTE COMPETITION NEW ENTRANT Archie’s Gallery and Titan/Tanishq can both compete for the gift market An existing player has taken the diversification route to offer a service concept but now becomes a direct competitor Barriers of Entry

Competitor Typology NEED OFFER SIMILAR SERVICE OFFER DIFFERENT SERVICE OFFER SIMILAR NEED DIRECT COMPETITION DIFFERENT NEED INDIRECT COMPETITION A mall has food court (restaurants), sports courts, multiplexes (entertainments) retail stores etc. SBI vs. ICICI Bank vs. IDBI Bank SUBSTITUTE COMPETITION NEW ENTRANT Archie’s Gallery and Titan/Tanishq can both compete for the gift market An existing player has taken the diversification route to offer a service concept but now becomes a direct competitor Barriers of Entry

Competitor Typology NEED SIMILAR NEED OFFER Similar Offer Different Offer DIFFERENT NEED DIRECT COMPETITION INDIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank A mall has food court (hunger need), sports courts, multiplexes (entertainments) retail stores (acquisition need) etc. SUBSTITUTE COMPETITION Archie’s Gallery and Titan / Tanishq can both compete for the gift market Barriers of Entry NEW ENTRANTS An existing player has taken the diversification route to offer a service concept but now becomes a direct competitor

Competitor Typology NEED SIMILAR NEED OFFER Similar Offer Different Offer DIFFERENT NEED DIRECT COMPETITION INDIRECT COMPETITION SBI vs. ICICI Bank vs. IDBI Bank A mall has food court (hunger need), sports courts, multiplexes (entertainments) retail stores (acquisition need) etc. SUBSTITUTE COMPETITION Archie’s Gallery and Titan / Tanishq can both compete for the gift market Barriers of Entry NEW ENTRANTS An existing player has taken the diversification route to offer a service concept but now becomes a direct competitor

Porter’s Five Forces Model of Competition Threat of New Entrants Bargaining Power of Suppliers Rivalry Among Competing Firms in Industry Threat of Substitute Products Bargaining Power of Buyers

Porter’s Five Forces Model of Competition Threat of New Entrants Bargaining Power of Suppliers Rivalry Among Competing Firms in Industry Threat of Substitute Products Bargaining Power of Buyers

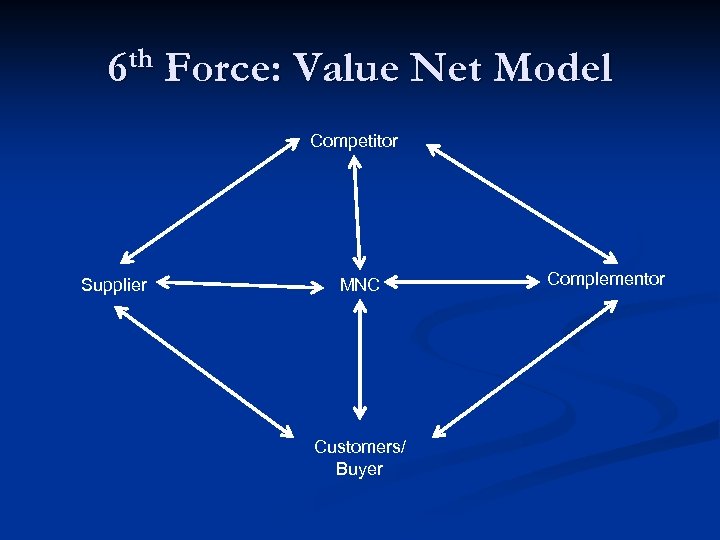

th 6 Force: Value Net Model Competitor Supplier MNC Customers/ Buyer Complementor

th 6 Force: Value Net Model Competitor Supplier MNC Customers/ Buyer Complementor

Thank You

Thank You