0cde5ae0405acf1e03124762623dea65.ppt

- Количество слайдов: 30

Real Client Managed Portfolio Diamond Offshore (DO) October 25, 2012 Presented By: Eric Hoffman Patrick O’Donnell Xiaohua (Leah) Xu

Agenda • Diamond Offshore in the Portfolio • Macro-Economic Review • Stock Market Prospects • Diamond Offshore (the Business) • Financial Analysis • Financial Projections • Application of Financial Tools • Recommendation

Diamond Offshore In the Portfolio February 2008 • Purchased 100 shares @ $122. 90 for a total cost of $12, 290 • Give portfolio exposure to oil and drilling sector November 2008 • Purchased 50 shares @ $72. 96 for a total cost of $3, 648 September 2009 • Written call option exercised, sold 100 shares at adjusted price of $76. 25 totaling $7, 625 • Strike price adjusted to $76. 25 from original strike price of $80. 00 due to a special cash dividend of $1. 875 paid twice over the holding period of the option • Realized loss of $4, 665 November 2010 • Purchased 100 shares @ $68. 10 As of October 24, 2012 • Diamond offshore price: 69. 52 • Currently have 150 shares with unrealized loss of -. 2% • Currently represents 3 % of the total portfolio (7. 6 of portfolio equity holdings)

The Company • The company originally started as Diamond M Drilling company. In 1980, Loews Corp bought the distressed company’s assets. The company was renamed to Diamond offshore and held private until 1995. • Currently one of the largest off-shore drilling corporations • Headquartered in Huston, TX – Global presence (primarily in South America, Middle East, Africa, Asia and Pacific Asia) • 98% owned by 447 institutional and Mutual fund shareholders • 50. 4% Owned by Loews Corporation (Jim Tisch).

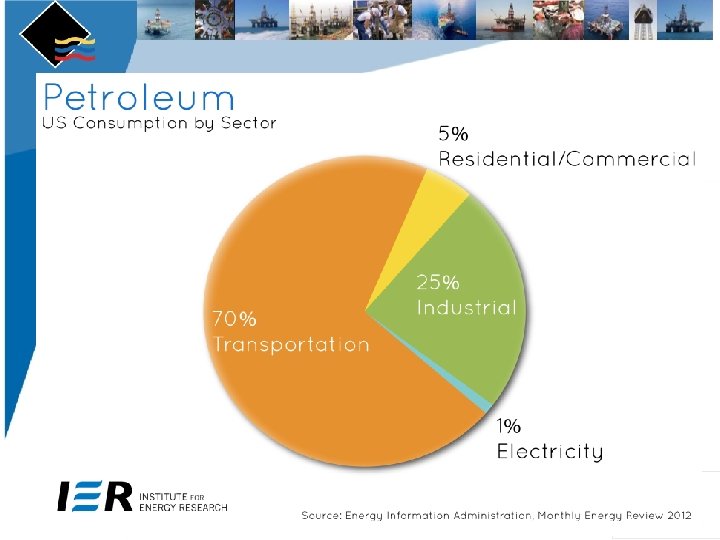

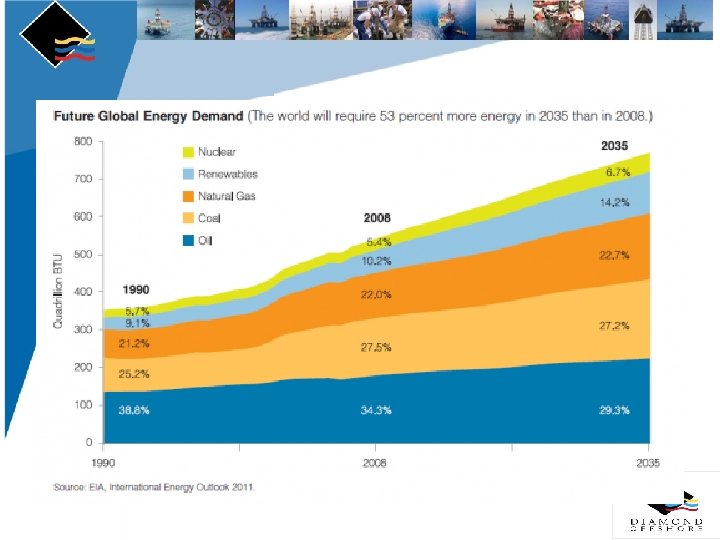

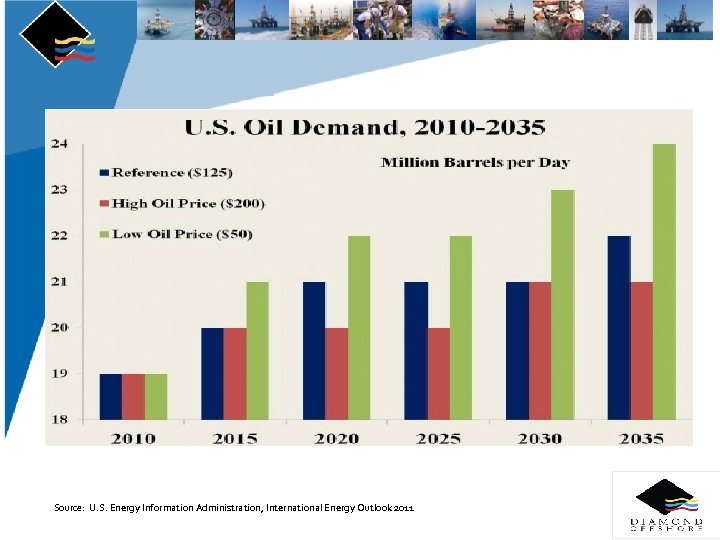

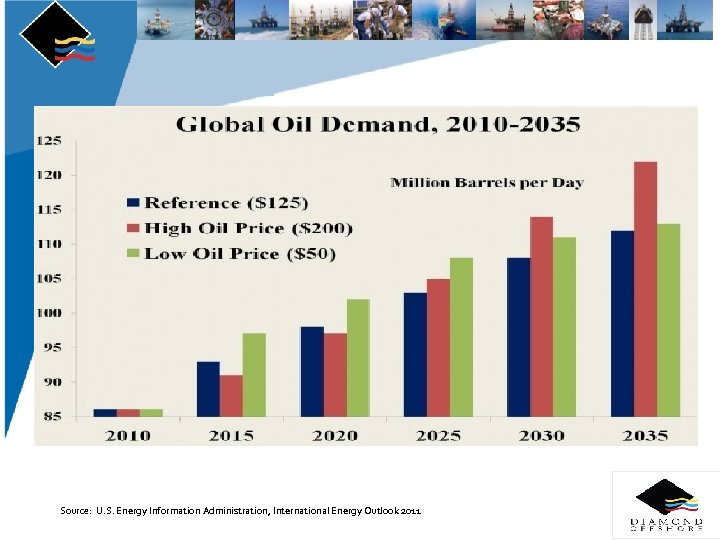

Macro Economic Review • The primary driver of the drilling market is energy consumption. – Easier for DO to earn contracts – Determines capacity/daily use rates of rigs – Greater demand for product naturally shifts power from buyer to supplier.

Source: U. S. Energy Information Administration, International Energy Outlook 2011 :

Source: U. S. Energy Information Administration, International Energy Outlook 2011

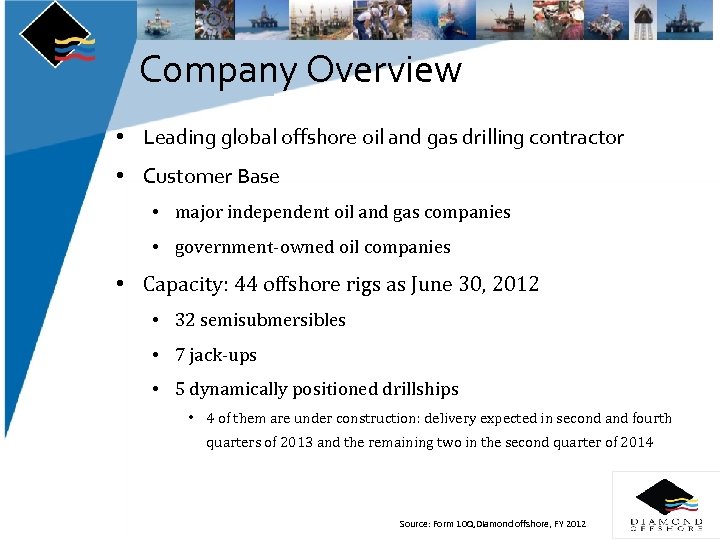

Company Overview • Leading global offshore oil and gas drilling contractor • Customer Base • major independent oil and gas companies • government-owned oil companies • Capacity: 44 offshore rigs as June 30, 2012 • 32 semisubmersibles • 7 jack-ups • 5 dynamically positioned drillships • 4 of them are under construction: delivery expected in second and fourth quarters of 2013 and the remaining two in the second quarter of 2014 Source: Form 10 Q, Diamond offshore, FY 2012

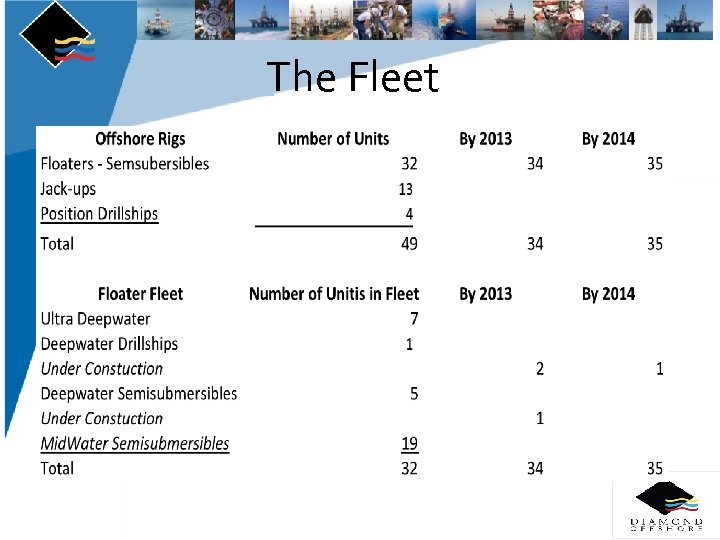

The fleet Source: Form 10 k, Diamond offshore, FY 2011

Stock performance BP oil spill in the Gulf of Mexico Source: Yahoo Finance, dates from 1/1/08 – 10/24/12

Competitors • Transocean (RIG): 9 Billion sales • Noble Corporation (NE): 3 Billion sales • Ensco PLC (ESV): 4 Billion sales Source: Yahoo Finance, dates from 1/1/08 – 10/24/12

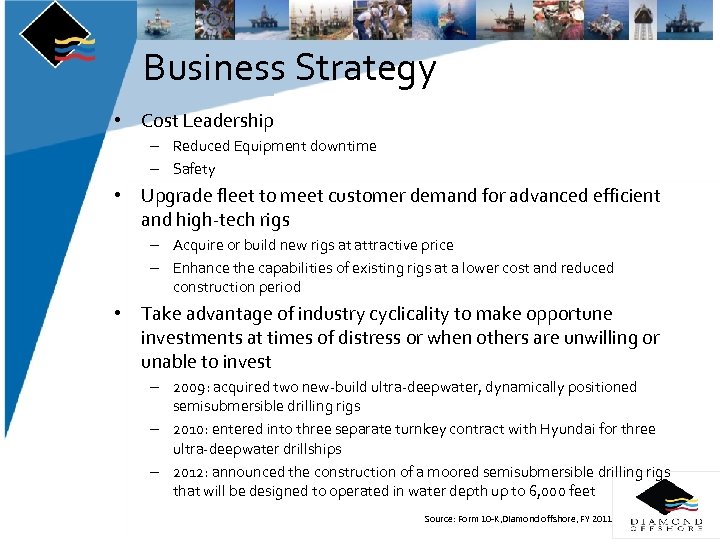

Business Strategy • Cost Leadership – Reduced Equipment downtime – Safety • Upgrade fleet to meet customer demand for advanced efficient and high-tech rigs – Acquire or build new rigs at attractive price – Enhance the capabilities of existing rigs at a lower cost and reduced construction period • Take advantage of industry cyclicality to make opportune investments at times of distress or when others are unwilling or unable to invest – 2009: acquired two new-build ultra-deepwater, dynamically positioned semisubmersible drilling rigs – 2010: entered into three separate turnkey contract with Hyundai for three ultra-deepwater drillships – 2012: announced the construction of a moored semisubmersible drilling rigs that will be designed to operated in water depth up to 6, 000 feet Source: Form 10 -K, Diamond offshore, FY 2011

Business Model Obtain contract through competitive bidding processes / Direct negotiation Type of Contract • Exploratory: to find new oil or gas deposits • Development: to prepare the discovery for production Duration of Contract • Well-to-well contract • Term Contract: fixed period of time Revenue • Majority: fixed dayrate • Incentive bonus based upon performance

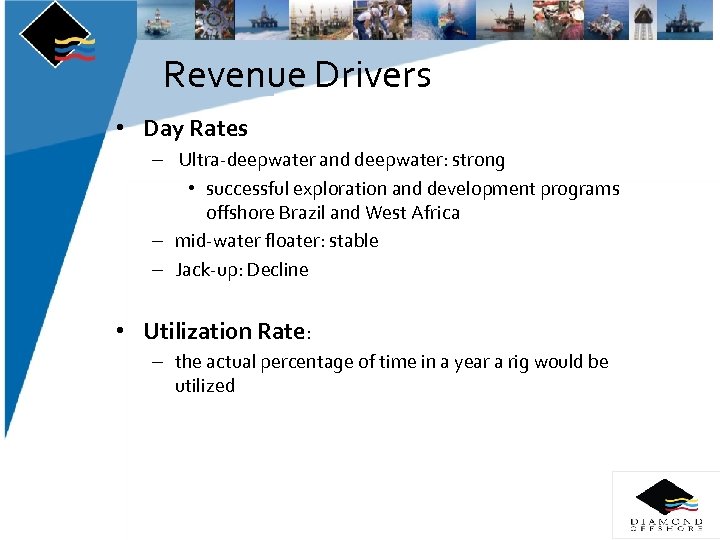

Revenue Drivers • Day Rates – Ultra-deepwater and deepwater: strong • successful exploration and development programs offshore Brazil and West Africa – mid-water floater: stable – Jack-up: Decline • Utilization Rate: – the actual percentage of time in a year a rig would be utilized

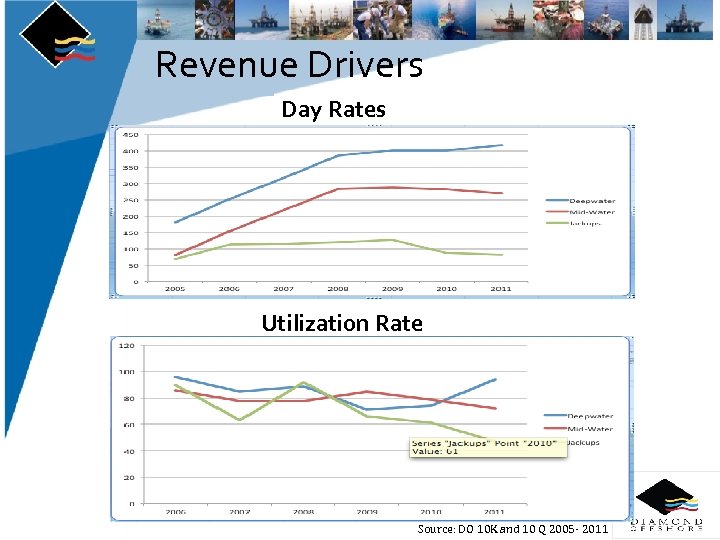

Revenue Drivers Day Rates Utilization Rate Source: DO 10 K and 10 Q 2005 - 2011

Financial Analysis • So…How does this company make money? • Jack ups (10 – 350 Ft) • Intermediate Submersibles (4000 ft) • Deep-water Drillships/Submersibles (greater than 4000 ft)

The Fleet

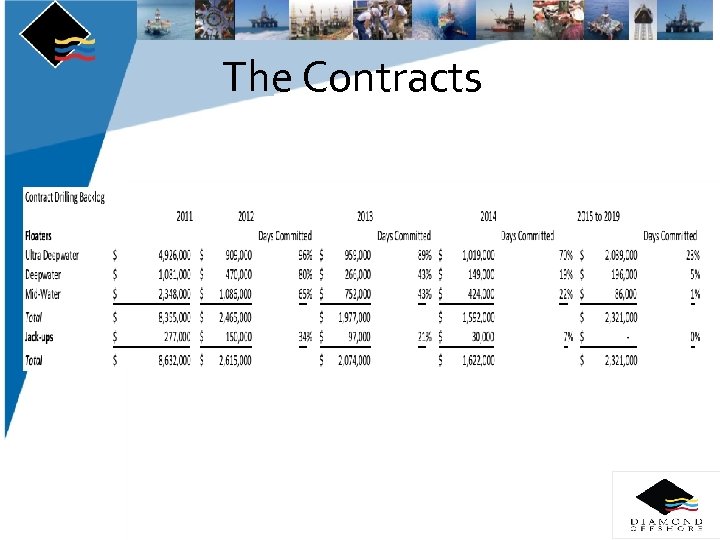

The Contracts

The Estimates • See Excel “Estimate”

So where is the revenue coming from? • Customers: DO’s five largest customers in the aggregate accounted for 62% of our consolidated revenues primarily lead by Petrobras and OGX (who accounted for approximately 35% and 14% of DO’s consolidated revenues in 2011). • Location: – 40% North America – 20% South America – 20% Africa/ Europe/Mediterranean – 20% Asia/Pacific Asia

So where is the revenue leaving? • Depreciation • Bad Debt Expense • Impairment • Sell for Loss Transactions • Foreign Exchange

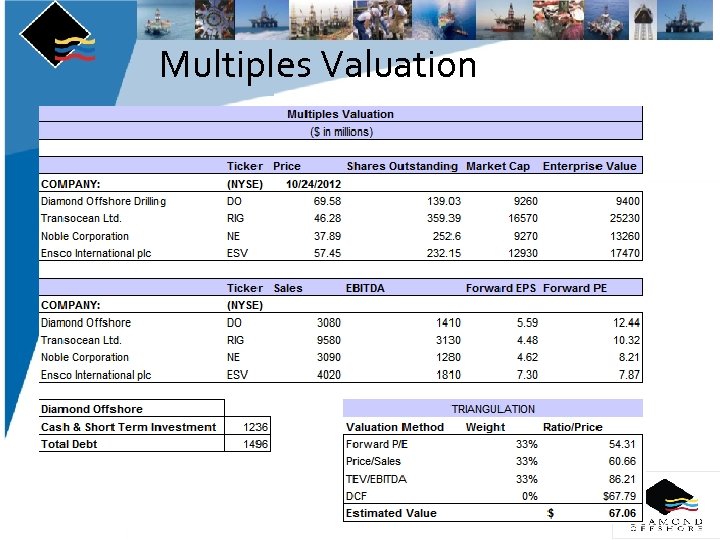

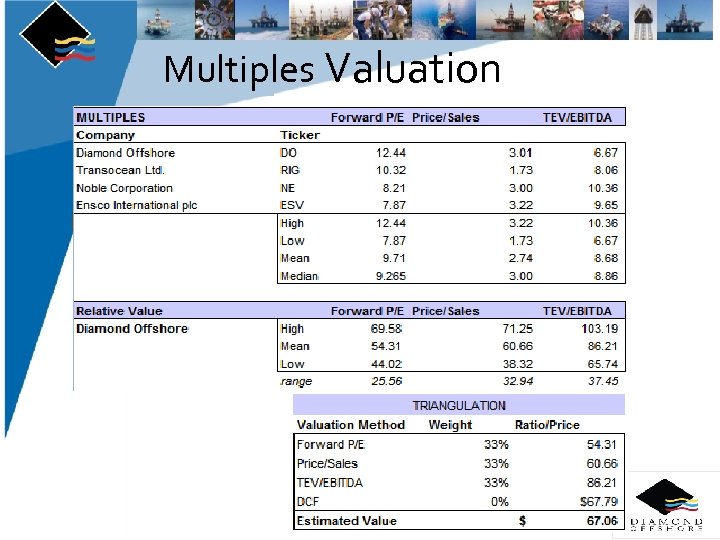

Multiples Valuation

Multiples Valuation

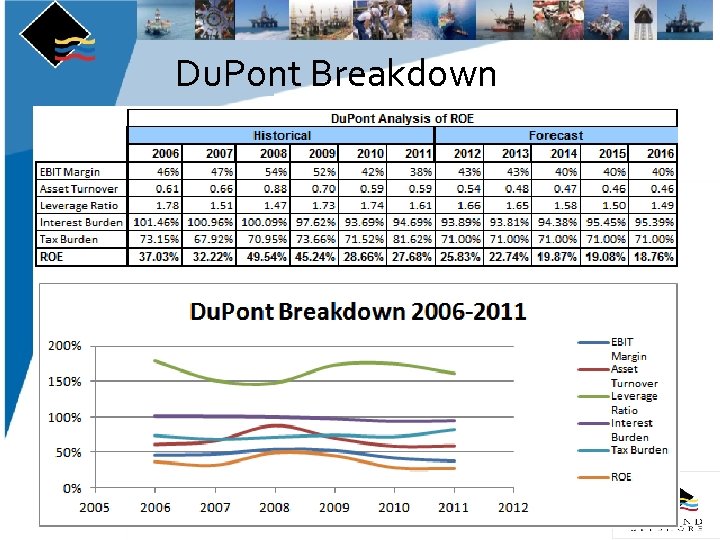

Du. Pont Breakdown

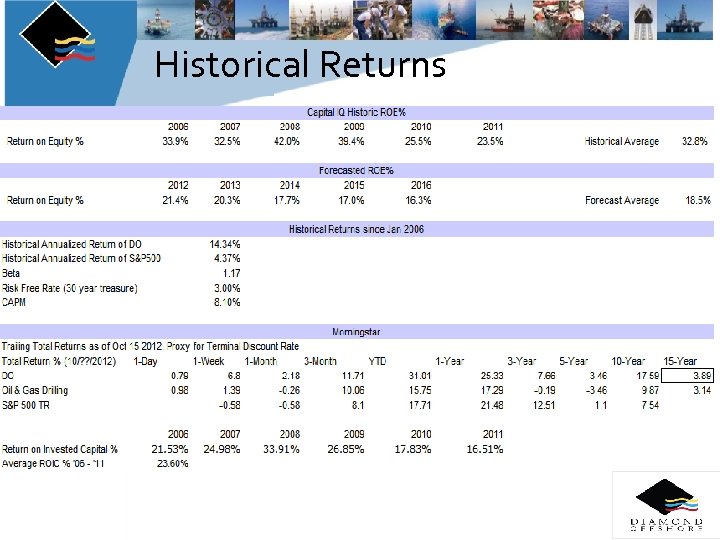

Historical Returns

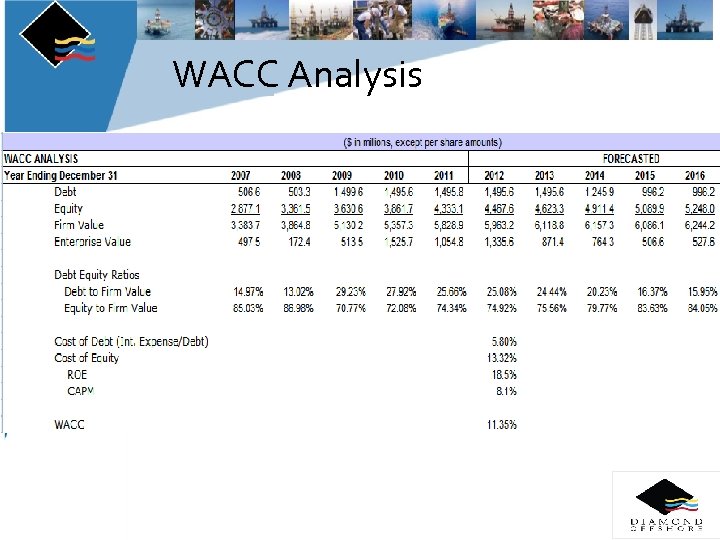

WACC Analysis

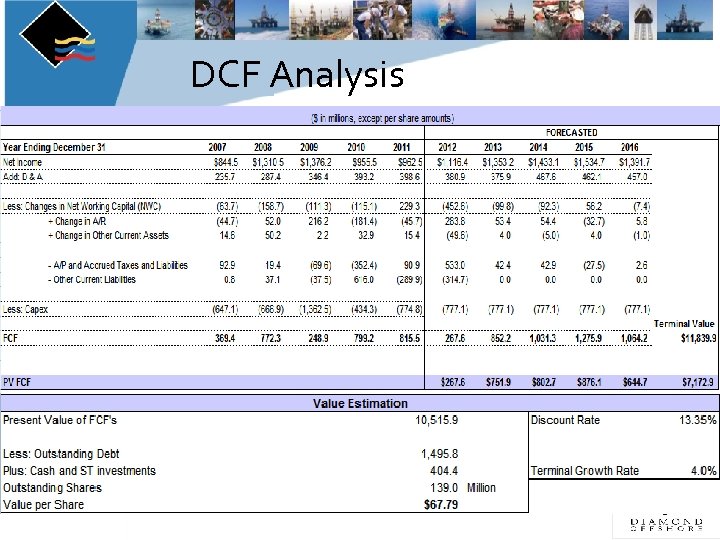

DCF Analysis

Recommendation: Hold • Current Stock Price: $69. 52 • DCF Valuation: $67. 79 • Comparable Companies Valuation: $67. 06 • Recommendation: Hold 150 shares

0cde5ae0405acf1e03124762623dea65.ppt