c5d045810c5f05d70b580e82defb5d1a.ppt

- Количество слайдов: 21

REACTING TO NEW CHALLENGES RECENT CHANGES IN SOCIAL HOUSING POLICY 11 MARCH 2016 Charlotte Cook – Partner www. wslaw. co. uk

REACTING TO NEW CHALLENGES RECENT CHANGES IN SOCIAL HOUSING POLICY 11 MARCH 2016 Charlotte Cook – Partner www. wslaw. co. uk

Introduction • 24 DASH – David Orr interview, 07/09/2015: “This period of change is unprecedented in my career… And we would be wrong to think the time of change is over. ”

Introduction • 24 DASH – David Orr interview, 07/09/2015: “This period of change is unprecedented in my career… And we would be wrong to think the time of change is over. ”

Timeline • Housing and Planning Bill - in the House of Lords • Spending Review – 2 November 2015 • Welfare Reform and Work Bill“Ping Pong”

Timeline • Housing and Planning Bill - in the House of Lords • Spending Review – 2 November 2015 • Welfare Reform and Work Bill“Ping Pong”

Agenda 1. 2. 3. 4. 5. 6. Rent Cuts Pay to Stay Right to Buy Universal Credit De-classification and De-regulation Planning and Development

Agenda 1. 2. 3. 4. 5. 6. Rent Cuts Pay to Stay Right to Buy Universal Credit De-classification and De-regulation Planning and Development

Rent Cuts I General Needs • • • RPs will be forced to cut their rents by 1% a year four years starting 1 April 2016 Cumulatively 12% reductions over four years Exclusions/Exemptions: – Shared Ownership; – Mortgagees in Possession; or – where it would “jeopardise the financial viability of the RP”

Rent Cuts I General Needs • • • RPs will be forced to cut their rents by 1% a year four years starting 1 April 2016 Cumulatively 12% reductions over four years Exclusions/Exemptions: – Shared Ownership; – Mortgagees in Possession; or – where it would “jeopardise the financial viability of the RP”

Rent Cuts II Supported Housing • • Exempt for 12 months “while a review is carried out” What housing is covered? includes: sheltered accommodation for older people extra care housing almshouses as well as: “specialised housing” high level of support no/negligible public subsidy commissioned in line with local health, social services or strategies

Rent Cuts II Supported Housing • • Exempt for 12 months “while a review is carried out” What housing is covered? includes: sheltered accommodation for older people extra care housing almshouses as well as: “specialised housing” high level of support no/negligible public subsidy commissioned in line with local health, social services or strategies

Rent Cuts III • Effect on providers? o o o • revise business plans asset cover in loan agreements delivery of new homes? lender confidence staffing continued existence UNCERTAINTY

Rent Cuts III • Effect on providers? o o o • revise business plans asset cover in loan agreements delivery of new homes? lender confidence staffing continued existence UNCERTAINTY

Pay to Stay I • Any households in social rented accommodation earning £ 30 k+ (rest of England) or £ 40 k+ (London) • 10% of social housing tenants affected • Tenants required to declare their incomes • Incremental increase in rent from April 2017 • Councils are required to pay the additional rental income to the Treasury. RPs keep the extra rent

Pay to Stay I • Any households in social rented accommodation earning £ 30 k+ (rest of England) or £ 40 k+ (London) • 10% of social housing tenants affected • Tenants required to declare their incomes • Incremental increase in rent from April 2017 • Councils are required to pay the additional rental income to the Treasury. RPs keep the extra rent

Pay to Stay II • The Observer 05. 03. 2016 climb down in advance of EU referendum • House of Lords cross-party attack • Softer increases

Pay to Stay II • The Observer 05. 03. 2016 climb down in advance of EU referendum • House of Lords cross-party attack • Softer increases

Extension of Right to Buy to HA Sector 1980 s 2016?

Extension of Right to Buy to HA Sector 1980 s 2016?

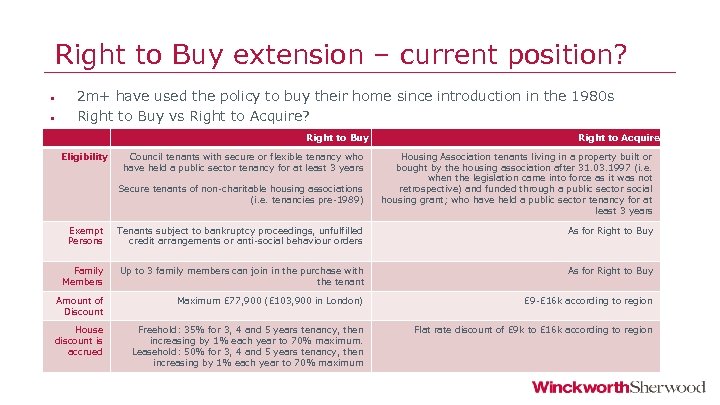

Right to Buy extension – current position? • • 2 m+ have used the policy to buy their home since introduction in the 1980 s Right to Buy vs Right to Acquire? Right to Buy Eligibility Council tenants with secure or flexible tenancy who have held a public sector tenancy for at least 3 years Secure tenants of non-charitable housing associations (i. e. tenancies pre-1989) Right to Acquire Housing Association tenants living in a property built or bought by the housing association after 31. 03. 1997 (i. e. when the legislation came into force as it was not retrospective) and funded through a public sector social housing grant; who have held a public sector tenancy for at least 3 years Exempt Persons Tenants subject to bankruptcy proceedings, unfulfilled credit arrangements or anti-social behaviour orders As for Right to Buy Family Members Up to 3 family members can join in the purchase with the tenant As for Right to Buy Amount of Discount Maximum £ 77, 900 (£ 103, 900 in London) £ 9 -£ 16 k according to region House discount is accrued Freehold: 35% for 3, 4 and 5 years tenancy, then increasing by 1% each year to 70% maximum. Leasehold: 50% for 3, 4 and 5 years tenancy, then increasing by 1% each year to 70% maximum Flat rate discount of £ 9 k to £ 16 k according to region

Right to Buy extension – current position? • • 2 m+ have used the policy to buy their home since introduction in the 1980 s Right to Buy vs Right to Acquire? Right to Buy Eligibility Council tenants with secure or flexible tenancy who have held a public sector tenancy for at least 3 years Secure tenants of non-charitable housing associations (i. e. tenancies pre-1989) Right to Acquire Housing Association tenants living in a property built or bought by the housing association after 31. 03. 1997 (i. e. when the legislation came into force as it was not retrospective) and funded through a public sector social housing grant; who have held a public sector tenancy for at least 3 years Exempt Persons Tenants subject to bankruptcy proceedings, unfulfilled credit arrangements or anti-social behaviour orders As for Right to Buy Family Members Up to 3 family members can join in the purchase with the tenant As for Right to Buy Amount of Discount Maximum £ 77, 900 (£ 103, 900 in London) £ 9 -£ 16 k according to region House discount is accrued Freehold: 35% for 3, 4 and 5 years tenancy, then increasing by 1% each year to 70% maximum. Leasehold: 50% for 3, 4 and 5 years tenancy, then increasing by 1% each year to 70% maximum Flat rate discount of £ 9 k to £ 16 k according to region

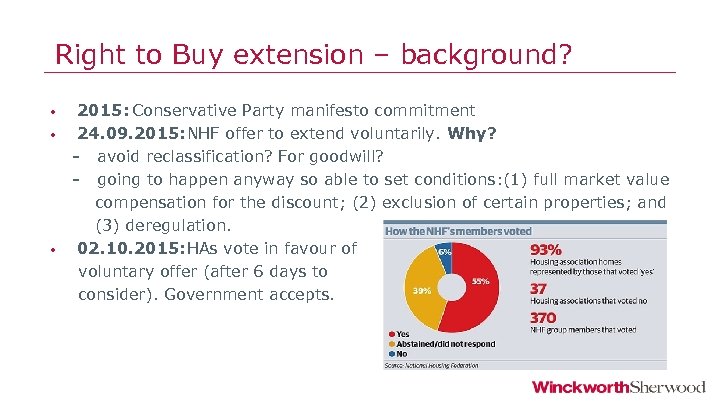

Right to Buy extension – background? • • • 2015: Conservative Party manifesto commitment 24. 09. 2015: NHF offer to extend voluntarily. Why? - avoid reclassification? For goodwill? - going to happen anyway so able to set conditions: (1) full market value compensation for the discount; (2) exclusion of certain properties; and (3) deregulation. 02. 10. 2015: HAs vote in favour of voluntary offer (after 6 days to consider). Government accepts.

Right to Buy extension – background? • • • 2015: Conservative Party manifesto commitment 24. 09. 2015: NHF offer to extend voluntarily. Why? - avoid reclassification? For goodwill? - going to happen anyway so able to set conditions: (1) full market value compensation for the discount; (2) exclusion of certain properties; and (3) deregulation. 02. 10. 2015: HAs vote in favour of voluntary offer (after 6 days to consider). Government accepts.

Right to Buy – piloting the scheme • • L & Q; Riverside; Saffron Housing; Sovereign; TVHA Joint Applications: partner or up to 3 family Up to 1. 3 m HA tenants eligible in England

Right to Buy – piloting the scheme • • L & Q; Riverside; Saffron Housing; Sovereign; TVHA Joint Applications: partner or up to 3 family Up to 1. 3 m HA tenants eligible in England

Right to Buy extension – some questions • Mechanics: implementation, compensation, enforcement, protections? • Extent of application –what properties will be excluded? • Funding the discount? • Impact on existing documents? Porting the discount? • Will receipts from the sale of council properties be ring-fenced? • How popular will it be?

Right to Buy extension – some questions • Mechanics: implementation, compensation, enforcement, protections? • Extent of application –what properties will be excluded? • Funding the discount? • Impact on existing documents? Porting the discount? • Will receipts from the sale of council properties be ring-fenced? • How popular will it be?

Universal Credit • • • What is Universal Credit? Who will it be paid to and how? The “roll-out” period How does Universal Credit affect RPs? – Housing benefit paid to tenant and not to landlord – Risk of arrears and evictions – Administrative cost of rent collection – IT problems Protection mechanisms for landlords

Universal Credit • • • What is Universal Credit? Who will it be paid to and how? The “roll-out” period How does Universal Credit affect RPs? – Housing benefit paid to tenant and not to landlord – Risk of arrears and evictions – Administrative cost of rent collection – IT problems Protection mechanisms for landlords

Declassification • Private non-financial corporations Public non-financial corporations Decision: 30 October 2015 • Effective from: 22 July 2008 • • • Cause: Too much public sector control Effect: Added approximately £ 63 bn in public sector net debt (4% increase).

Declassification • Private non-financial corporations Public non-financial corporations Decision: 30 October 2015 • Effective from: 22 July 2008 • • • Cause: Too much public sector control Effect: Added approximately £ 63 bn in public sector net debt (4% increase).

Get your skates on • • Public Land available to public sector agencies 40 day window to bid before go to the market e. PIMS BUT • • Statistical change not a legal one Market impact

Get your skates on • • Public Land available to public sector agencies 40 day window to bid before go to the market e. PIMS BUT • • Statistical change not a legal one Market impact

Deregulation What next? • Deregulation • Timescale: under 2 years • Special administration regime • s 172 consent regime likely to change

Deregulation What next? • Deregulation • Timescale: under 2 years • Special administration regime • s 172 consent regime likely to change

Planning and Development • • • “Planning in principle” Starter Homes Initiatives…the new “affordable housing” Buy to Let – 3% additional SDLT Neighbourhood planning Administration regime changes

Planning and Development • • • “Planning in principle” Starter Homes Initiatives…the new “affordable housing” Buy to Let – 3% additional SDLT Neighbourhood planning Administration regime changes

What Next? • Early days? Or the end of the road… • Confidence for straight talking in Lords

What Next? • Early days? Or the end of the road… • Confidence for straight talking in Lords

Thank You Charlotte Cook Partner ccook@wslaw. co. uk 020 7593 5107 Solicitors and Parliamentary Agents Minerva House 5 Montague Close London SE 1 9 BB DX 156810 London Bridge 6 T. 020 7593 5000 F. 020 7593 5099 www. wslaw. co. uk

Thank You Charlotte Cook Partner ccook@wslaw. co. uk 020 7593 5107 Solicitors and Parliamentary Agents Minerva House 5 Montague Close London SE 1 9 BB DX 156810 London Bridge 6 T. 020 7593 5000 F. 020 7593 5099 www. wslaw. co. uk