f5213e75d345f6355a96795cdb2128aa.ppt

- Количество слайдов: 27

REACHING US E&O Insurance for RIAs HOW TO REACH US: Alex E. Wayne, RPLU Alexander J. Wayne and Associates, Inc. 2551 North Clark Street, Suite 601 Chicago, IL 60614 TEL: (773)-305 -7686 or 773 -328 -0500 ext. 129 FAX: (773)-328 -0508 E-MAIL: alexwayne@ajwayne. com 1

REACHING US E&O Insurance for RIAs HOW TO REACH US: Alex E. Wayne, RPLU Alexander J. Wayne and Associates, Inc. 2551 North Clark Street, Suite 601 Chicago, IL 60614 TEL: (773)-305 -7686 or 773 -328 -0500 ext. 129 FAX: (773)-328 -0508 E-MAIL: alexwayne@ajwayne. com 1

Loss Prevention Seminar OUTLINE 1. FINRA ARBITRATION STATISTICS Claims Against Financial Professionals 2. LOSS PREVENTION 3. THE INSURANCE MARKETS 2

Loss Prevention Seminar OUTLINE 1. FINRA ARBITRATION STATISTICS Claims Against Financial Professionals 2. LOSS PREVENTION 3. THE INSURANCE MARKETS 2

Loss Prevention Seminar NASD ARBITRATION STATISTICS 3

Loss Prevention Seminar NASD ARBITRATION STATISTICS 3

Loss Prevention Seminar NASD ARBITRATION STATISTICS 4

Loss Prevention Seminar NASD ARBITRATION STATISTICS 4

Loss Prevention Seminar NASD ARBITRATION STATISTICS 5

Loss Prevention Seminar NASD ARBITRATION STATISTICS 5

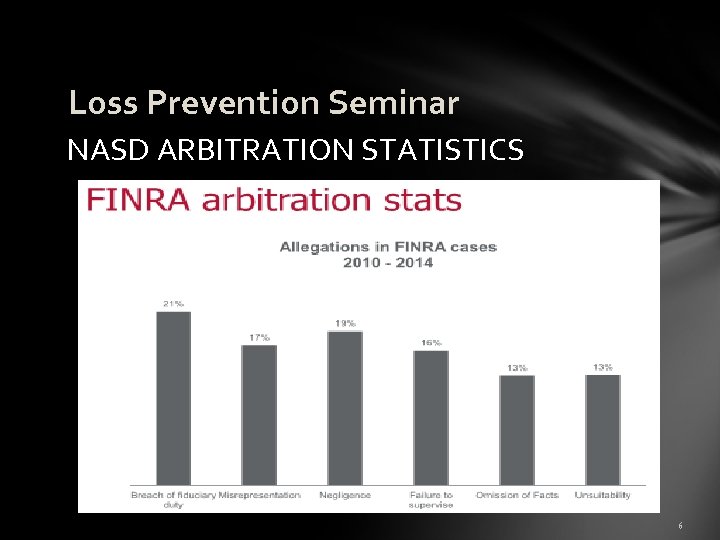

Loss Prevention Seminar NASD ARBITRATION STATISTICS 6

Loss Prevention Seminar NASD ARBITRATION STATISTICS 6

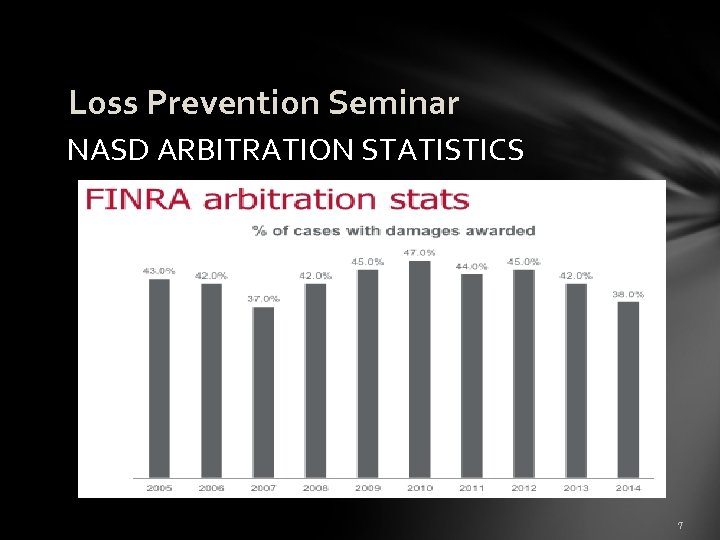

Loss Prevention Seminar NASD ARBITRATION STATISTICS 7

Loss Prevention Seminar NASD ARBITRATION STATISTICS 7

Loss Prevention Seminar THE ABC’s OF LOSS PREVENTION AVOIDING LOSS IS NEITHER BRAIN SURGERY NOR ROCKET SCIENCE A. Trade Matching and Confirmation B. Client Selection (and De-Selection) C. DOCUMENT, DOCUMENT!!! D. A Word on “Alternative” Investments 8

Loss Prevention Seminar THE ABC’s OF LOSS PREVENTION AVOIDING LOSS IS NEITHER BRAIN SURGERY NOR ROCKET SCIENCE A. Trade Matching and Confirmation B. Client Selection (and De-Selection) C. DOCUMENT, DOCUMENT!!! D. A Word on “Alternative” Investments 8

Loss Prevention Seminar TRADEPREVENTION CONFIRMATION LOSS MATCHING AND THE EASEST CLAIMS TO AVOID ARE EXECUTION ERRORS Match Every Order Against the Return Confirmation, and Promptly Resolve Discrepancies Example: - Trade was forwarded by fax to Andrews Air Force Base, failure to trade remained undetected for two months; loss of $70, 000 - Verbal order to buy was executed in shares, not dollars, as securities title contained the word “shares”; trade was outstanding for 7 minutes, resulting in $20, 000 loss 9

Loss Prevention Seminar TRADEPREVENTION CONFIRMATION LOSS MATCHING AND THE EASEST CLAIMS TO AVOID ARE EXECUTION ERRORS Match Every Order Against the Return Confirmation, and Promptly Resolve Discrepancies Example: - Trade was forwarded by fax to Andrews Air Force Base, failure to trade remained undetected for two months; loss of $70, 000 - Verbal order to buy was executed in shares, not dollars, as securities title contained the word “shares”; trade was outstanding for 7 minutes, resulting in $20, 000 loss 9

Loss Prevention Seminar LOSS PREVENTION We have come to know: Ø Avoid Trades at market opening Ø Avoid end of day trades Ø Expect market corrections Ø When possible, have a separation of duties Ø Keep a log of erroneous trades, look for patterns and address them Ø Avoid market orders and stop loss orders due to “flash crash” of electronic trading systems 10

Loss Prevention Seminar LOSS PREVENTION We have come to know: Ø Avoid Trades at market opening Ø Avoid end of day trades Ø Expect market corrections Ø When possible, have a separation of duties Ø Keep a log of erroneous trades, look for patterns and address them Ø Avoid market orders and stop loss orders due to “flash crash” of electronic trading systems 10

Loss Prevention Seminar LOSS SELECTION (AND DE-SELECTION) CLIENTPREVENTION MANY CLIENTS WOULD BE BETTER SERVED BY YOUR FRIENDLY COMPETITOR DOWN THE STREET l Chronic Overspenders l Undisciplined l Won’t accept prudent advice l High maintenance, low return l Risk Tolerance inconsistent w/ life l Have sued other professionals l Announce (usually with pride) that l Unethical or Immoral – the circumstances they have “beat the system” “Sniff” test l Partners in Conflict l Afraid of investment losses l Abusive l The “Uneasy Feeling” 11

Loss Prevention Seminar LOSS SELECTION (AND DE-SELECTION) CLIENTPREVENTION MANY CLIENTS WOULD BE BETTER SERVED BY YOUR FRIENDLY COMPETITOR DOWN THE STREET l Chronic Overspenders l Undisciplined l Won’t accept prudent advice l High maintenance, low return l Risk Tolerance inconsistent w/ life l Have sued other professionals l Announce (usually with pride) that l Unethical or Immoral – the circumstances they have “beat the system” “Sniff” test l Partners in Conflict l Afraid of investment losses l Abusive l The “Uneasy Feeling” 11

Loss Prevention Seminar LOSS PREVENTION DOCUMENT, DOCUMENT!! NEWS FLASH – CLIENTS ARE NOT ALWAYS TRUTHFUL A WELL DOCUMENTED (I. E. DEFENSIBLE) CLAIMS FILE WILL CONTAIN: • Documentation of life circumstances, tolerance for risk, investment objectives and “style”, leading to plan and/or broad (but brief) investment policy statement • Dated and Organized File notes on every interaction with the client – need not be extensive, but should capture essence of interaction 12

Loss Prevention Seminar LOSS PREVENTION DOCUMENT, DOCUMENT!! NEWS FLASH – CLIENTS ARE NOT ALWAYS TRUTHFUL A WELL DOCUMENTED (I. E. DEFENSIBLE) CLAIMS FILE WILL CONTAIN: • Documentation of life circumstances, tolerance for risk, investment objectives and “style”, leading to plan and/or broad (but brief) investment policy statement • Dated and Organized File notes on every interaction with the client – need not be extensive, but should capture essence of interaction 12

Loss Prevention Seminar LOSS PREVENTION DOCUMENT, DOCUMENT!! NEWS FLASH – CLIENTS ARE NOT ALWAYS TRUTHFUL (2) A WELL DOCUMENTED CLAIMS FILE WILL CONTAIN: • Complete documentation of any changes in objectives, advice given, but not heeded • BEST PRACTICE – Quarterly summary of activity or discussion which is signed by client acknowledging understanding • And if you have a claim, it will be more defensible 13

Loss Prevention Seminar LOSS PREVENTION DOCUMENT, DOCUMENT!! NEWS FLASH – CLIENTS ARE NOT ALWAYS TRUTHFUL (2) A WELL DOCUMENTED CLAIMS FILE WILL CONTAIN: • Complete documentation of any changes in objectives, advice given, but not heeded • BEST PRACTICE – Quarterly summary of activity or discussion which is signed by client acknowledging understanding • And if you have a claim, it will be more defensible 13

Loss Prevention Seminar THE ANATOMY OF A Y 2 K MARKET LOSS PREVENTION LOSS CLAIM THE NEGLIGENCE CASE l Prove standard which advisor should have met l Advisor failed to meet the standard l Failure is casually related to client’s loss l Damages are measurable SETTLEMENT IS APPORTIONMENT BETWEEN l Market decline l Client contributory negligence l Advisor Negligence 14

Loss Prevention Seminar THE ANATOMY OF A Y 2 K MARKET LOSS PREVENTION LOSS CLAIM THE NEGLIGENCE CASE l Prove standard which advisor should have met l Advisor failed to meet the standard l Failure is casually related to client’s loss l Damages are measurable SETTLEMENT IS APPORTIONMENT BETWEEN l Market decline l Client contributory negligence l Advisor Negligence 14

Loss Prevention Seminar ALTERNATIVE INVESTMENTS – RISK AN LOSS PREVENTION ALTERNATIVE VIEW RISK HAS TRADITIONALLY BEEN DEFINED AS PRICE VOLATILITY. THE MORE OF THE ELEMENTS BELOW WHICH EXIST, THE GREATER THE POTENTIAL FOR LOSS: l Minimal, Non-Existent or Ineffective l Single asset class l Lack of a robust secondary market l. Complex manager compensation l Excessive Leverage l. Investments issued serially and controlled by l Undisclosed manager compensation l Large minimum investment required l Reputational motive for shifting income l Inability to review manager’s credentials and l Investor expectations of high rates of return l Lack of fiduciary duty to clients (market Regulatory Oversight/Control among several investments l Lack of investment scrutiny single management group past performance makers) 15

Loss Prevention Seminar ALTERNATIVE INVESTMENTS – RISK AN LOSS PREVENTION ALTERNATIVE VIEW RISK HAS TRADITIONALLY BEEN DEFINED AS PRICE VOLATILITY. THE MORE OF THE ELEMENTS BELOW WHICH EXIST, THE GREATER THE POTENTIAL FOR LOSS: l Minimal, Non-Existent or Ineffective l Single asset class l Lack of a robust secondary market l. Complex manager compensation l Excessive Leverage l. Investments issued serially and controlled by l Undisclosed manager compensation l Large minimum investment required l Reputational motive for shifting income l Inability to review manager’s credentials and l Investor expectations of high rates of return l Lack of fiduciary duty to clients (market Regulatory Oversight/Control among several investments l Lack of investment scrutiny single management group past performance makers) 15

Loss Prevention Seminar IMPACT ON FINANCIAL PROFESSIONALS THE INSURANCE MARKETS FINANCIAL ADVISORY PROFESSIONAL HAVE BEEN PARTICULARLY HARD HIT OVER THE YEARS • Many insurers were largely undisciplined, in pricing and risk selection, during the 1990’s • Several insurers have thrown in the towel, resulting in diminished financial capacity to underwrite the business • Lack of underwriting expertise and experience resulted in limited insurance marketplace • Claims have increased in severity and frequency • Competitors have priced themselves out of the reach of smaller advisors • Large pricing gap between smaller RIAs and middle market portfolio managers For the reasonably foreseeable future, until competitive conditions improve, broker dealers and middle market RIA’s may expect relatively high premiums, more restrictive terms and higher deductibles 16

Loss Prevention Seminar IMPACT ON FINANCIAL PROFESSIONALS THE INSURANCE MARKETS FINANCIAL ADVISORY PROFESSIONAL HAVE BEEN PARTICULARLY HARD HIT OVER THE YEARS • Many insurers were largely undisciplined, in pricing and risk selection, during the 1990’s • Several insurers have thrown in the towel, resulting in diminished financial capacity to underwrite the business • Lack of underwriting expertise and experience resulted in limited insurance marketplace • Claims have increased in severity and frequency • Competitors have priced themselves out of the reach of smaller advisors • Large pricing gap between smaller RIAs and middle market portfolio managers For the reasonably foreseeable future, until competitive conditions improve, broker dealers and middle market RIA’s may expect relatively high premiums, more restrictive terms and higher deductibles 16

Loss Prevention Seminar IMPACT ON FINANCIAL PROFESSIONALS SUMMARY BATTEN DOWN THE HATCHES – PRACTICE DEFENSIVELY • Institute Trade Confirmation Practices • Carefully Review Problematical Clients • Put the files in order and institute rigorous client documentation procedures • Institute periodic training sessions for staff to keep up to date with latest loss control tools and procedures • Carefully review adequacy and completeness of disclosures • Think of alternative investments in the context of Risk vs. Reward • Insurance is a business asset and a risk management tool 17

Loss Prevention Seminar IMPACT ON FINANCIAL PROFESSIONALS SUMMARY BATTEN DOWN THE HATCHES – PRACTICE DEFENSIVELY • Institute Trade Confirmation Practices • Carefully Review Problematical Clients • Put the files in order and institute rigorous client documentation procedures • Institute periodic training sessions for staff to keep up to date with latest loss control tools and procedures • Carefully review adequacy and completeness of disclosures • Think of alternative investments in the context of Risk vs. Reward • Insurance is a business asset and a risk management tool 17

Loss Prevention Seminar ERRORS AND OMISSIONS Covers “Mistakes” – Errors & Omissions Claims Made & Reported Defense Costs / Allegations Covered Defense Costs Within Limits Deductible Applies to Defense & Indemnity Exclusions Various Policy Provisions 18

Loss Prevention Seminar ERRORS AND OMISSIONS Covers “Mistakes” – Errors & Omissions Claims Made & Reported Defense Costs / Allegations Covered Defense Costs Within Limits Deductible Applies to Defense & Indemnity Exclusions Various Policy Provisions 18

Loss Prevention Seminar CLAIMS-MADE VS. OCCURRENCE 19

Loss Prevention Seminar CLAIMS-MADE VS. OCCURRENCE 19

Loss Prevention Seminar COVERAGE ISSUES Professional Services Definition Exclusions Uninsurable Covered Elsewhere Negotiable Other Policy Provisions Duty to Defend Choice of Counsel Settlement Provisions Incident Trigger 20

Loss Prevention Seminar COVERAGE ISSUES Professional Services Definition Exclusions Uninsurable Covered Elsewhere Negotiable Other Policy Provisions Duty to Defend Choice of Counsel Settlement Provisions Incident Trigger 20

Loss Prevention Seminar APPLICATION PROCESS Application / Submission requirements: Application ADV Part I (if not available online) ADV Part II with Schedules (if not available online) Client Contracts Financial Information Performance Figures (some companies) 21

Loss Prevention Seminar APPLICATION PROCESS Application / Submission requirements: Application ADV Part I (if not available online) ADV Part II with Schedules (if not available online) Client Contracts Financial Information Performance Figures (some companies) 21

Professional Liability Insurance POTENTIAL MARKETS Markel Cambridge/Evanston/Essex Houston Casualty Scottsdale ACE Chubb CNA Travelers Hartford Am. Trust AXIS 22

Professional Liability Insurance POTENTIAL MARKETS Markel Cambridge/Evanston/Essex Houston Casualty Scottsdale ACE Chubb CNA Travelers Hartford Am. Trust AXIS 22

Loss Prevention Seminar BROKER DEALER VS. INDIVIDUAL COVERAGE Group Plan Depletion of Limits Income Source / Liability Cost Autonomy Control Over Policy Provisions Prior acts / exit plan 23

Loss Prevention Seminar BROKER DEALER VS. INDIVIDUAL COVERAGE Group Plan Depletion of Limits Income Source / Liability Cost Autonomy Control Over Policy Provisions Prior acts / exit plan 23

Loss Prevention Seminar OTHER INSURANCE PRODUCTS Directors and Officers Management Liability Employment Practices Liability including Third Party Discrimination Combo policies vs. stand alone coverage 24

Loss Prevention Seminar OTHER INSURANCE PRODUCTS Directors and Officers Management Liability Employment Practices Liability including Third Party Discrimination Combo policies vs. stand alone coverage 24

Loss Prevention Seminar OTHER INSURANCE PRODUCTS Cyber Liability coverage / Data Breach: Types of exposures covered this type of insurance: First Party coverage – notification costs Third Party coverage – liability for cost of data breach Extortion, Media Liability, Business Interruption, Cyber Crime Wire transfer fraud - not covered by cyber liability Social Engineering or Cyber Deception - usually covered under crime, but may be covered by Cyber Liability 25

Loss Prevention Seminar OTHER INSURANCE PRODUCTS Cyber Liability coverage / Data Breach: Types of exposures covered this type of insurance: First Party coverage – notification costs Third Party coverage – liability for cost of data breach Extortion, Media Liability, Business Interruption, Cyber Crime Wire transfer fraud - not covered by cyber liability Social Engineering or Cyber Deception - usually covered under crime, but may be covered by Cyber Liability 25

REACHING US E&O Insurance for RIAs HOW TO REACH US: Alex E. Wayne, RPLU Alexander J. Wayne and Associates, Inc. 2551 North Clark Street, Suite 601 Chicago, IL 60614 TEL: (773)-305 -7686 or 773 -328 -0500 ext. 129 FAX: (773)-328 -0508 E-MAIL: alexwayne@ajwayne. com 26

REACHING US E&O Insurance for RIAs HOW TO REACH US: Alex E. Wayne, RPLU Alexander J. Wayne and Associates, Inc. 2551 North Clark Street, Suite 601 Chicago, IL 60614 TEL: (773)-305 -7686 or 773 -328 -0500 ext. 129 FAX: (773)-328 -0508 E-MAIL: alexwayne@ajwayne. com 26

REACHING US E&O Insurance for RIAs HOW TO REACH US: Suzie Dodds, CIC Alexander J. Wayne and Associates, Inc. 2551 North Clark Street, Suite 601 Chicago, IL 60614 TEL: (773) 572 -0047 FAX: (773)-328 -0508 E-MAIL: suziedodds@ajwayne. com 27

REACHING US E&O Insurance for RIAs HOW TO REACH US: Suzie Dodds, CIC Alexander J. Wayne and Associates, Inc. 2551 North Clark Street, Suite 601 Chicago, IL 60614 TEL: (773) 572 -0047 FAX: (773)-328 -0508 E-MAIL: suziedodds@ajwayne. com 27