8f011fa37ba2939c1ab72c100d145fd0.ppt

- Количество слайдов: 38

Re-Inventing CPG New Insight into the Shopping Process presented by IRI / MCA Europe: Louis-Michel Barbotin IRI U. S. : Valerie Skala Walker Reinventing CPG Summit February 28, 2005 Copyright © 2005 Information Resources, Inc. All Rights Reserved

Re-Inventing CPG New Insight into the Shopping Process presented by IRI / MCA Europe: Louis-Michel Barbotin IRI U. S. : Valerie Skala Walker Reinventing CPG Summit February 28, 2005 Copyright © 2005 Information Resources, Inc. All Rights Reserved

Agenda Understanding the Shopping Process Key Findings from Shopper. Link Research in Europe Shopper. Link Now Available in the U. S. Copyright © 2005 Information © 2004 IRI France. Rights Reserved Copyright Resources, Inc. All

Agenda Understanding the Shopping Process Key Findings from Shopper. Link Research in Europe Shopper. Link Now Available in the U. S. Copyright © 2005 Information © 2004 IRI France. Rights Reserved Copyright Resources, Inc. All

Why is it important to study shopper behavior in-store? Copyright © 2004 IRI France. 3

Why is it important to study shopper behavior in-store? Copyright © 2004 IRI France. 3

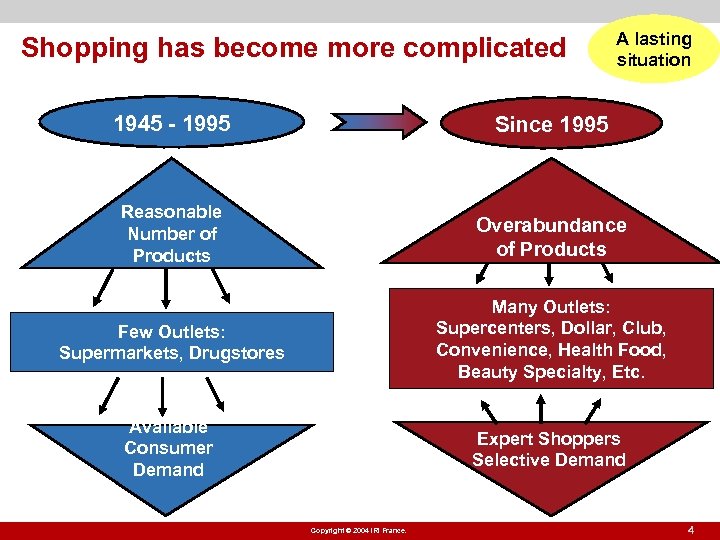

Shopping has become more complicated A lasting situation 1945 - 1995 Since 1995 Reasonable Number of Products Overabundance of Products Few Outlets: Supermarkets, Drugstores Many Outlets: Supercenters, Dollar, Club, Convenience, Health Food, Beauty Specialty, Etc. Available Consumer Demand Expert Shoppers Selective Demand Copyright © 2004 IRI France. 4

Shopping has become more complicated A lasting situation 1945 - 1995 Since 1995 Reasonable Number of Products Overabundance of Products Few Outlets: Supermarkets, Drugstores Many Outlets: Supercenters, Dollar, Club, Convenience, Health Food, Beauty Specialty, Etc. Available Consumer Demand Expert Shoppers Selective Demand Copyright © 2004 IRI France. 4

Consumers have developed a "shopping expertise" Number of CPG Items Available 970, 000 SKUs Number of CPG Items in a Typical Supermarket 20, 000 to 50, 000 SKUs Number of CPG Items Purchased Annually by Typical U. S. HH 650 SKUs Number of CPG Items in a Typical Supermarket Shopping Basket 20 to 50 SKUs Source: IRI Dictionary, Info. Scan Reviews, and Household Panel Copyright © 2004 IRI France. 5

Consumers have developed a "shopping expertise" Number of CPG Items Available 970, 000 SKUs Number of CPG Items in a Typical Supermarket 20, 000 to 50, 000 SKUs Number of CPG Items Purchased Annually by Typical U. S. HH 650 SKUs Number of CPG Items in a Typical Supermarket Shopping Basket 20 to 50 SKUs Source: IRI Dictionary, Info. Scan Reviews, and Household Panel Copyright © 2004 IRI France. 5

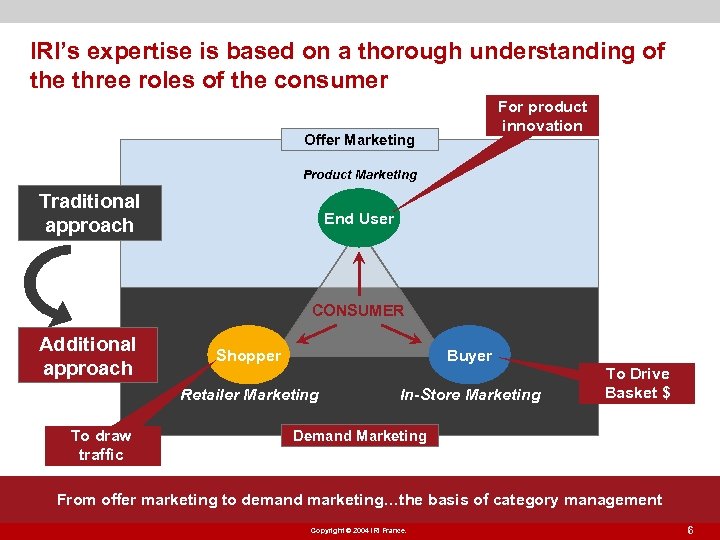

IRI’s expertise is based on a thorough understanding of the three roles of the consumer For product innovation Offer Marketing Product Marketing Traditional approach End User CONSUMER Additional approach Shopper Buyer Retailer Marketing To draw traffic In-Store Marketing To Drive Basket $ Demand Marketing From offer marketing to demand marketing…the basis of category management Copyright © 2004 IRI France. 6

IRI’s expertise is based on a thorough understanding of the three roles of the consumer For product innovation Offer Marketing Product Marketing Traditional approach End User CONSUMER Additional approach Shopper Buyer Retailer Marketing To draw traffic In-Store Marketing To Drive Basket $ Demand Marketing From offer marketing to demand marketing…the basis of category management Copyright © 2004 IRI France. 6

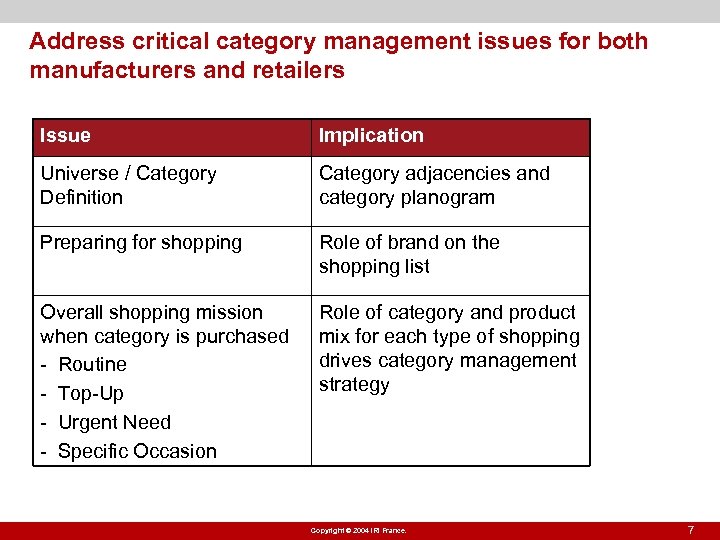

Address critical category management issues for both manufacturers and retailers Issue Implication Universe / Category Definition Category adjacencies and category planogram Preparing for shopping Role of brand on the shopping list Overall shopping mission when category is purchased - Routine - Top-Up - Urgent Need - Specific Occasion Role of category and product mix for each type of shopping drives category management strategy Copyright © 2004 IRI France. 7

Address critical category management issues for both manufacturers and retailers Issue Implication Universe / Category Definition Category adjacencies and category planogram Preparing for shopping Role of brand on the shopping list Overall shopping mission when category is purchased - Routine - Top-Up - Urgent Need - Specific Occasion Role of category and product mix for each type of shopping drives category management strategy Copyright © 2004 IRI France. 7

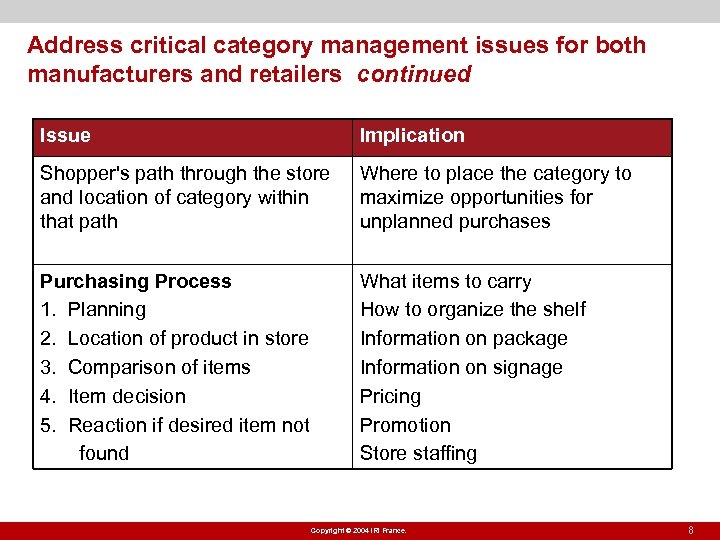

Address critical category management issues for both manufacturers and retailers continued Issue Implication Shopper's path through the store and location of category within that path Where to place the category to maximize opportunities for unplanned purchases Purchasing Process 1. Planning 2. Location of product in store 3. Comparison of items 4. Item decision 5. Reaction if desired item not found What items to carry How to organize the shelf Information on package Information on signage Pricing Promotion Store staffing Copyright © 2004 IRI France. 8

Address critical category management issues for both manufacturers and retailers continued Issue Implication Shopper's path through the store and location of category within that path Where to place the category to maximize opportunities for unplanned purchases Purchasing Process 1. Planning 2. Location of product in store 3. Comparison of items 4. Item decision 5. Reaction if desired item not found What items to carry How to organize the shelf Information on package Information on signage Pricing Promotion Store staffing Copyright © 2004 IRI France. 8

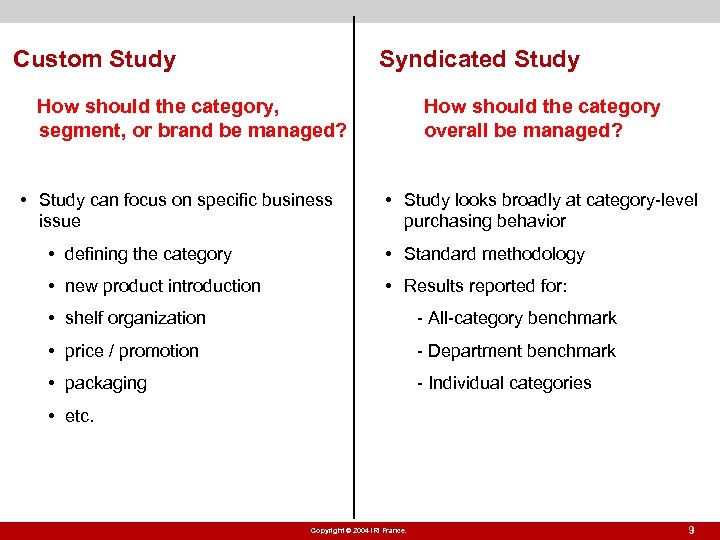

Custom Study Syndicated Study How should the category, segment, or brand be managed? • Study can focus on specific business issue How should the category overall be managed? • Study looks broadly at category-level purchasing behavior • defining the category • Standard methodology • new product introduction • Results reported for: • shelf organization - All-category benchmark • price / promotion - Department benchmark • packaging - Individual categories • etc. Copyright © 2004 IRI France. 9

Custom Study Syndicated Study How should the category, segment, or brand be managed? • Study can focus on specific business issue How should the category overall be managed? • Study looks broadly at category-level purchasing behavior • defining the category • Standard methodology • new product introduction • Results reported for: • shelf organization - All-category benchmark • price / promotion - Department benchmark • packaging - Individual categories • etc. Copyright © 2004 IRI France. 9

Agenda Understanding the shopping process Key Findings from Shopper. Link Research in Europe Shopper. Link Now Available in the U. S. Copyright © 2005 Information © 2004 IRI France. Rights Reserved Copyright Resources, Inc. All

Agenda Understanding the shopping process Key Findings from Shopper. Link Research in Europe Shopper. Link Now Available in the U. S. Copyright © 2005 Information © 2004 IRI France. Rights Reserved Copyright Resources, Inc. All

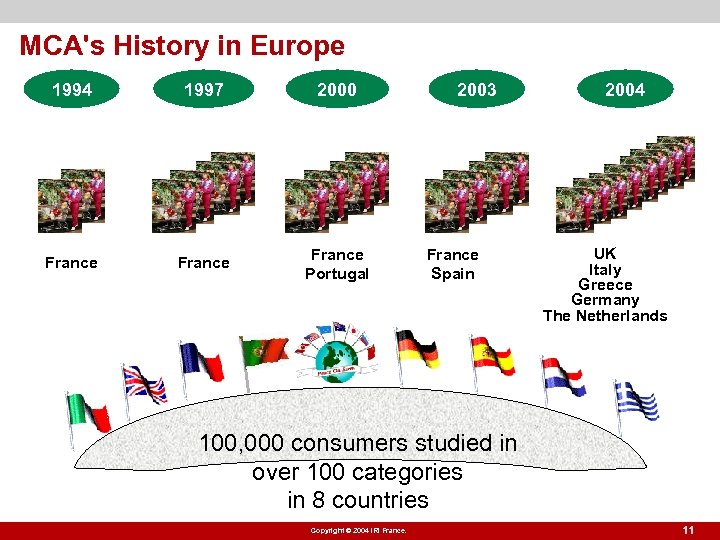

MCA's History in Europe 1994 1997 2000 France Portugal 2003 France Spain 2004 UK Italy Greece Germany The Netherlands 100, 000 consumers studied in over 100 categories in 8 countries Copyright © 2004 IRI France. 11

MCA's History in Europe 1994 1997 2000 France Portugal 2003 France Spain 2004 UK Italy Greece Germany The Netherlands 100, 000 consumers studied in over 100 categories in 8 countries Copyright © 2004 IRI France. 11

78 Manufacturers Have Participated Copyright © 2004 IRI France. 12

78 Manufacturers Have Participated Copyright © 2004 IRI France. 12

80 Retailers Took Part in the Research Copyright © 2004 IRI France. 13

80 Retailers Took Part in the Research Copyright © 2004 IRI France. 13

Striking insights from the European research conducted in 8 countries End User CONSUMER Buyer Shopper Copyright © 2004 IRI France. 14

Striking insights from the European research conducted in 8 countries End User CONSUMER Buyer Shopper Copyright © 2004 IRI France. 14

The shopper's mission when your category is bought should influence your category management strategy Overall Trip Mission CONSUMER Shopper Europe Average (all categories, all stores) Business Strategy Routine shopping (weekly, monthly) 47% Building loyalty Small current purchases (fresh products, top up) 22% Recruiting Emergency purchases (products urgently needed) 15% Store nearby Specific occasion purchases (e. g. , birthday party, special sale on desired item) 17% Recruiting Copyright © 2004 IRI France. 15

The shopper's mission when your category is bought should influence your category management strategy Overall Trip Mission CONSUMER Shopper Europe Average (all categories, all stores) Business Strategy Routine shopping (weekly, monthly) 47% Building loyalty Small current purchases (fresh products, top up) 22% Recruiting Emergency purchases (products urgently needed) 15% Store nearby Specific occasion purchases (e. g. , birthday party, special sale on desired item) 17% Recruiting Copyright © 2004 IRI France. 15

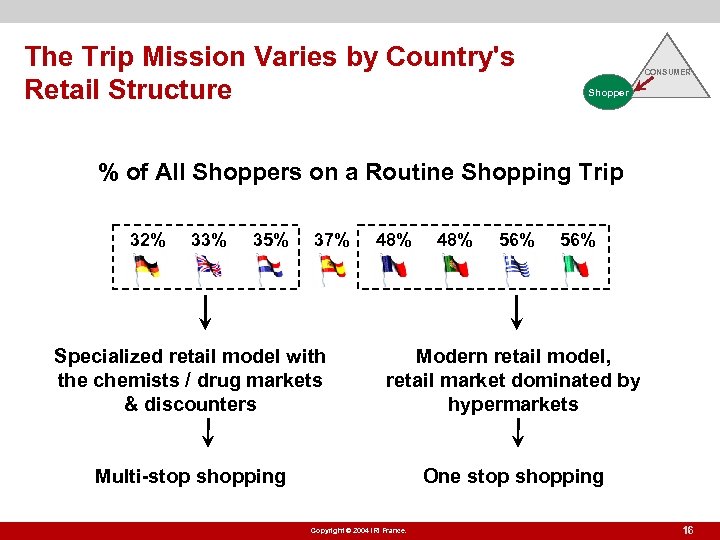

The Trip Mission Varies by Country's Retail Structure CONSUMER Shopper % of All Shoppers on a Routine Shopping Trip 32% 33% 35% 37% 48% 56% Specialized retail model with the chemists / drug markets & discounters Modern retail model, retail market dominated by hypermarkets Multi-stop shopping One stop shopping Copyright © 2004 IRI France. 16

The Trip Mission Varies by Country's Retail Structure CONSUMER Shopper % of All Shoppers on a Routine Shopping Trip 32% 33% 35% 37% 48% 56% Specialized retail model with the chemists / drug markets & discounters Modern retail model, retail market dominated by hypermarkets Multi-stop shopping One stop shopping Copyright © 2004 IRI France. 16

The retailer structure in Germany vs. Greece leads to very different shopping habits Other types of shopping Routine shopping HM 22% Hard Discounters 9% HM 34% Specific 11% 10% 78% 48% 17% 11% 91% 58% 17% 9% 35% 50% Small SM 35% 65% Medium SM Emergency 58% 42% Drug Stores Small current 19% 13% 3% 50% 29% 18% 3% 66% 44% Copyright © 2004 IRI France. 21% 1% 17

The retailer structure in Germany vs. Greece leads to very different shopping habits Other types of shopping Routine shopping HM 22% Hard Discounters 9% HM 34% Specific 11% 10% 78% 48% 17% 11% 91% 58% 17% 9% 35% 50% Small SM 35% 65% Medium SM Emergency 58% 42% Drug Stores Small current 19% 13% 3% 50% 29% 18% 3% 66% 44% Copyright © 2004 IRI France. 21% 1% 17

The Shopping Expertise Begins at Home % of shoppers who prepared a shopping list ALL shoppers 70% 57% 51% 45% 43% 37% 33% 24% ROUTINE shoppers 74% 75% 60% 52% 55% Copyright © 2004 IRI France. 49% 42% 37% 18

The Shopping Expertise Begins at Home % of shoppers who prepared a shopping list ALL shoppers 70% 57% 51% 45% 43% 37% 33% 24% ROUTINE shoppers 74% 75% 60% 52% 55% Copyright © 2004 IRI France. 49% 42% 37% 18

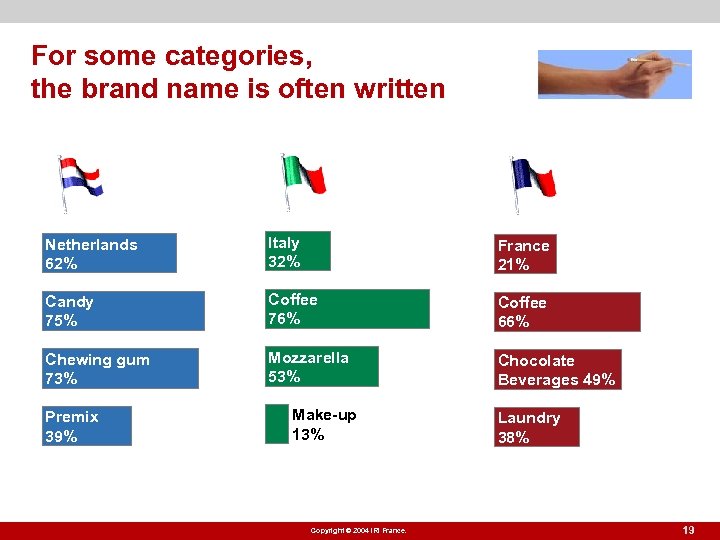

For some categories, the brand name is often written Netherlands 62% Italy 32% France 21% Candy 75% Coffee 76% Coffee 66% Chewing gum 73% Mozzarella 53% Chocolate Beverages 49% Premix 39% Make-up 13% Copyright © 2004 IRI France. Laundry 38% 19

For some categories, the brand name is often written Netherlands 62% Italy 32% France 21% Candy 75% Coffee 76% Coffee 66% Chewing gum 73% Mozzarella 53% Chocolate Beverages 49% Premix 39% Make-up 13% Copyright © 2004 IRI France. Laundry 38% 19

Striking insights from the European research conducted in 8 countries End User CONSUMER Buyer Shopper Copyright © 2004 IRI France. 20

Striking insights from the European research conducted in 8 countries End User CONSUMER Buyer Shopper Copyright © 2004 IRI France. 20

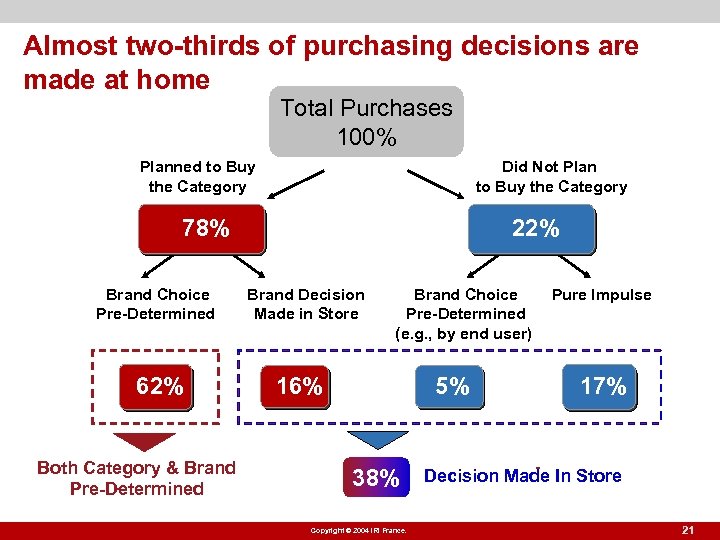

Almost two-thirds of purchasing decisions are made at home Total Purchases 100% Planned to Buy the Category Did Not Plan to Buy the Category 78% 79% Brand Choice Pre-Determined 62% 61% Both Category & Brand Pre-Determined 22% 21% Brand Decision Made in Store Brand Choice Pre-Determined (e. g. , by end user) 16% 18% Pure Impulse 5% 38% Copyright © 2004 IRI France. 17% 16% - Decision Made In Store 21

Almost two-thirds of purchasing decisions are made at home Total Purchases 100% Planned to Buy the Category Did Not Plan to Buy the Category 78% 79% Brand Choice Pre-Determined 62% 61% Both Category & Brand Pre-Determined 22% 21% Brand Decision Made in Store Brand Choice Pre-Determined (e. g. , by end user) 16% 18% Pure Impulse 5% 38% Copyright © 2004 IRI France. 17% 16% - Decision Made In Store 21

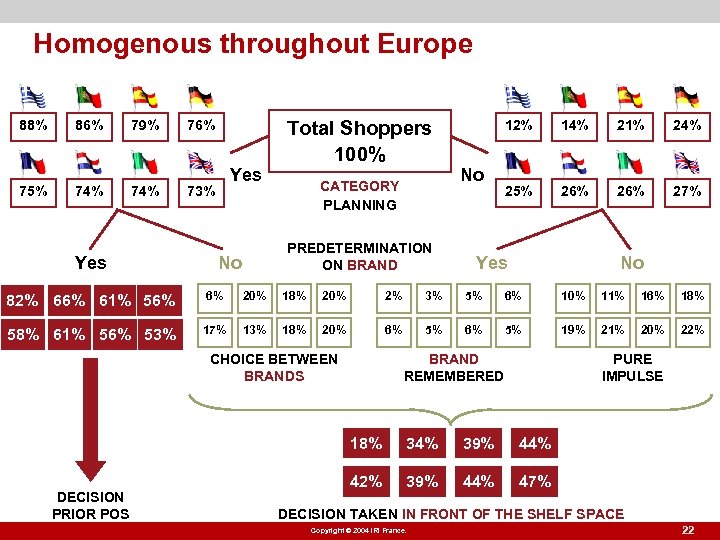

Homogenous throughout Europe 88% 75% 86% 74% 79% 74% Yes 76% Yes 73% Total Shoppers 100% CATEGORY PLANNING PREDETERMINATION ON BRAND No 12% No 14% 21% 24% 25% 26% 27% Yes No 82% 66% 61% 56% 6% 20% 18% 20% 2% 3% 5% 6% 10% 11% 16% 18% 58% 61% 56% 53% 17% 13% 18% 20% 6% 5% 19% 21% 20% 22% CHOICE BETWEEN BRANDS BRAND REMEMBERED PURE IMPULSE 18% DECISION PRIOR POS 34% 39% 44% 42% 39% 44% 47% DECISION TAKEN IN FRONT OF THE SHELF SPACE Copyright © 2004 IRI France. 22

Homogenous throughout Europe 88% 75% 86% 74% 79% 74% Yes 76% Yes 73% Total Shoppers 100% CATEGORY PLANNING PREDETERMINATION ON BRAND No 12% No 14% 21% 24% 25% 26% 27% Yes No 82% 66% 61% 56% 6% 20% 18% 20% 2% 3% 5% 6% 10% 11% 16% 18% 58% 61% 56% 53% 17% 13% 18% 20% 6% 5% 19% 21% 20% 22% CHOICE BETWEEN BRANDS BRAND REMEMBERED PURE IMPULSE 18% DECISION PRIOR POS 34% 39% 44% 42% 39% 44% 47% DECISION TAKEN IN FRONT OF THE SHELF SPACE Copyright © 2004 IRI France. 22

Planned vs. Decided In-Store to Buy Category Variation Across Categories in Italy All Cat Avg Planned 56% Decided In-Store Coffee 73% 27% Bottled Water 72% 28% Cheese 60% Air Fresheners 46% Make Up 36% Candy 29% Frozen Meals 25% 34% 40% 54% 64% 71% 75% Copyright © 2004 IRI France. 23

Planned vs. Decided In-Store to Buy Category Variation Across Categories in Italy All Cat Avg Planned 56% Decided In-Store Coffee 73% 27% Bottled Water 72% 28% Cheese 60% Air Fresheners 46% Make Up 36% Candy 29% Frozen Meals 25% 34% 40% 54% 64% 71% 75% Copyright © 2004 IRI France. 23

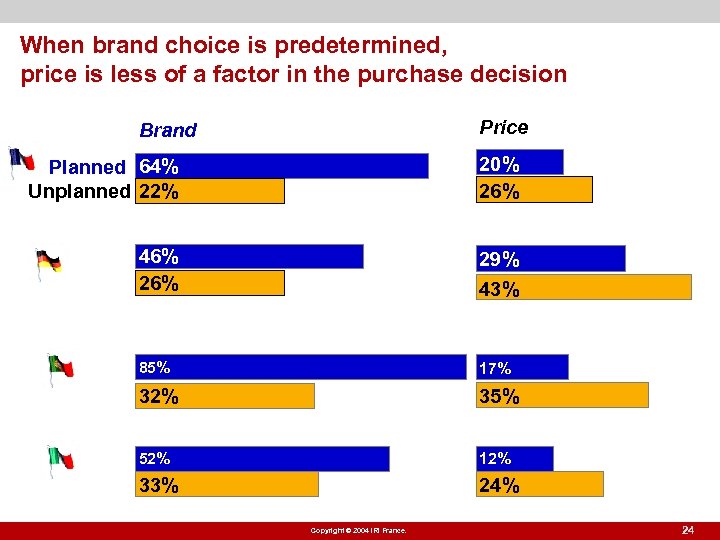

When brand choice is predetermined, price is less of a factor in the purchase decision Price Brand Planned 64% Unplanned 22% 20% 26% 46% 29% 85% 17% 32% 35% 52% 12% 33% 24% 43% 44% Copyright © 2004 IRI France. 24

When brand choice is predetermined, price is less of a factor in the purchase decision Price Brand Planned 64% Unplanned 22% 20% 26% 46% 29% 85% 17% 32% 35% 52% 12% 33% 24% 43% 44% Copyright © 2004 IRI France. 24

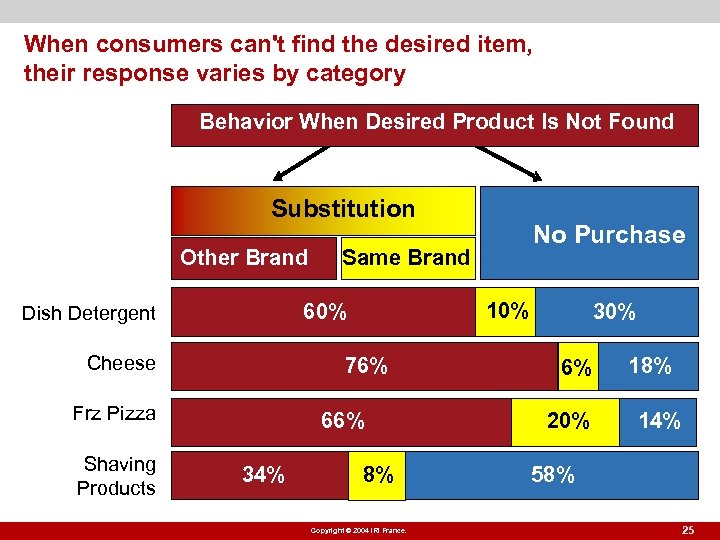

When consumers can't find the desired item, their response varies by category Behavior When Desired Product Is Not Found Substitution Other Brand Cheese 10% 76% Frz Pizza Shaving Products Same Brand 60% Dish Detergent 66% 34% No Purchase 8% Copyright © 2004 IRI France. 30% 6% 20% 18% 14% 58% 25

When consumers can't find the desired item, their response varies by category Behavior When Desired Product Is Not Found Substitution Other Brand Cheese 10% 76% Frz Pizza Shaving Products Same Brand 60% Dish Detergent 66% 34% No Purchase 8% Copyright © 2004 IRI France. 30% 6% 20% 18% 14% 58% 25

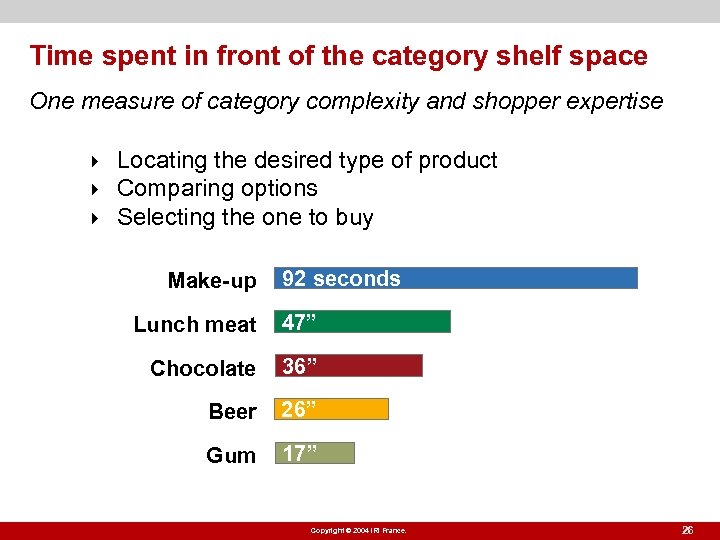

Time spent in front of the category shelf space One measure of category complexity and shopper expertise } } } Locating the desired type of product Comparing options Selecting the one to buy Make-up 92 seconds Lunch meat 47” Chocolate 36” Beer 26” Gum 17” Copyright © 2004 IRI France. 26

Time spent in front of the category shelf space One measure of category complexity and shopper expertise } } } Locating the desired type of product Comparing options Selecting the one to buy Make-up 92 seconds Lunch meat 47” Chocolate 36” Beer 26” Gum 17” Copyright © 2004 IRI France. 26

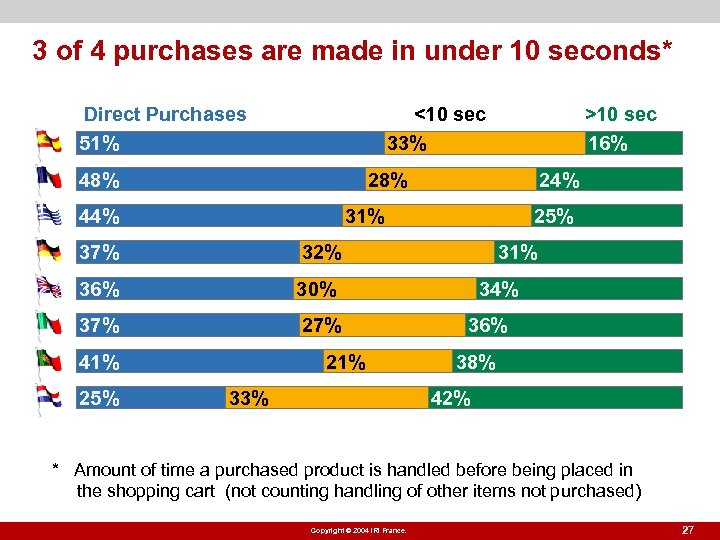

3 of 4 purchases are made in under 10 seconds* <10 sec 33% Direct Purchases 51% 48% 28% 44% 24% 31% 37% 36% 30% 37% 25% 32% 41% 25% >10 sec 16% 21% 33% 31% 34% 36% 38% 42% * Amount of time a purchased product is handled before being placed in the shopping cart (not counting handling of other items not purchased) Copyright © 2004 IRI France. 27

3 of 4 purchases are made in under 10 seconds* <10 sec 33% Direct Purchases 51% 48% 28% 44% 24% 31% 37% 36% 30% 37% 25% 32% 41% 25% >10 sec 16% 21% 33% 31% 34% 36% 38% 42% * Amount of time a purchased product is handled before being placed in the shopping cart (not counting handling of other items not purchased) Copyright © 2004 IRI France. 27

Agenda Understanding the shopping process Key Findings from Shopper. Link Research in Europe Shopper. Link Now Available in the U. S. Copyright © 2005 Information © 2004 IRI France. Rights Reserved Copyright Resources, Inc. All

Agenda Understanding the shopping process Key Findings from Shopper. Link Research in Europe Shopper. Link Now Available in the U. S. Copyright © 2005 Information © 2004 IRI France. Rights Reserved Copyright Resources, Inc. All

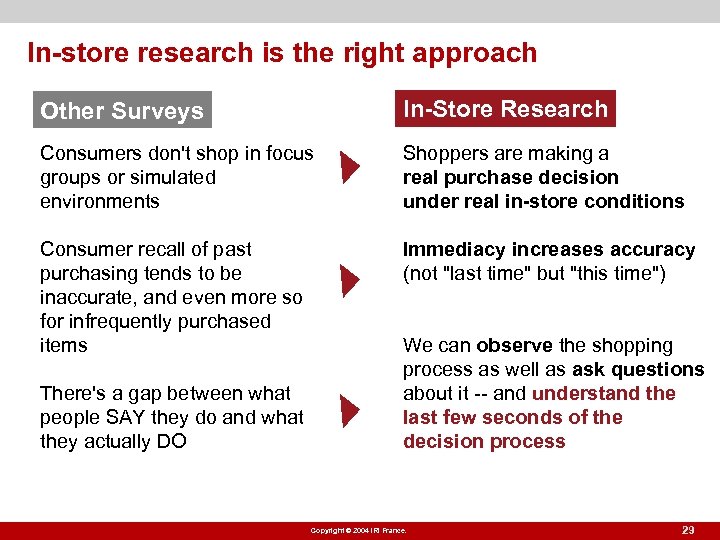

In-store research is the right approach Other Surveys In-Store Research Consumers don't shop in focus groups or simulated environments Shoppers are making a real purchase decision under real in-store conditions Consumer recall of past purchasing tends to be inaccurate, and even more so for infrequently purchased items Immediacy increases accuracy (not "last time" but "this time") There's a gap between what people SAY they do and what they actually DO We can observe the shopping process as well as ask questions about it -- and understand the last few seconds of the decision process Copyright © 2004 IRI France. 29

In-store research is the right approach Other Surveys In-Store Research Consumers don't shop in focus groups or simulated environments Shoppers are making a real purchase decision under real in-store conditions Consumer recall of past purchasing tends to be inaccurate, and even more so for infrequently purchased items Immediacy increases accuracy (not "last time" but "this time") There's a gap between what people SAY they do and what they actually DO We can observe the shopping process as well as ask questions about it -- and understand the last few seconds of the decision process Copyright © 2004 IRI France. 29

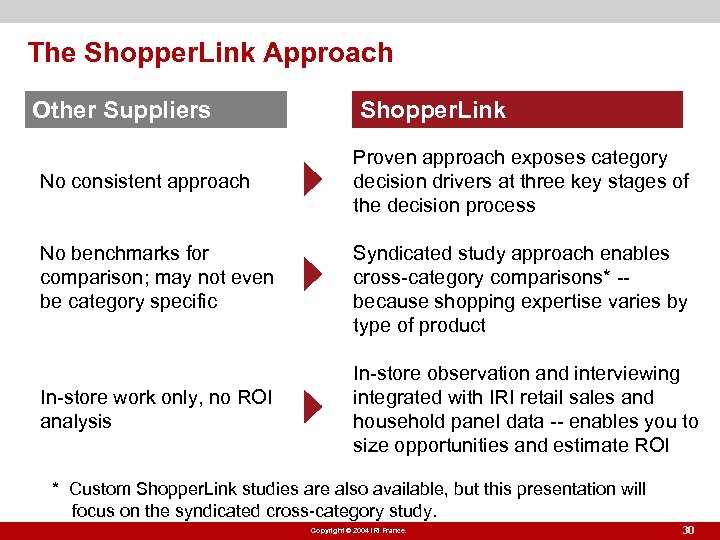

The Shopper. Link Approach Other Suppliers No consistent approach No benchmarks for comparison; may not even be category specific In-store work only, no ROI analysis Shopper. Link Proven approach exposes category decision drivers at three key stages of the decision process Syndicated study approach enables cross-category comparisons* -because shopping expertise varies by type of product In-store observation and interviewing integrated with IRI retail sales and household panel data -- enables you to size opportunities and estimate ROI * Custom Shopper. Link studies are also available, but this presentation will focus on the syndicated cross-category study. Copyright © 2004 IRI France. 30

The Shopper. Link Approach Other Suppliers No consistent approach No benchmarks for comparison; may not even be category specific In-store work only, no ROI analysis Shopper. Link Proven approach exposes category decision drivers at three key stages of the decision process Syndicated study approach enables cross-category comparisons* -because shopping expertise varies by type of product In-store observation and interviewing integrated with IRI retail sales and household panel data -- enables you to size opportunities and estimate ROI * Custom Shopper. Link studies are also available, but this presentation will focus on the syndicated cross-category study. Copyright © 2004 IRI France. 30

Benefits: The Bottom Line Identify your biggest in-store opportunity: Determine what levers to pull to accomplish that goal Draw more people into the aisle Convert more category browsers to buyers Drive a brand switch Increase volume per purchase Improve resource allocation, focusing on those marketing efforts with the best pay-back Bring new insights to retailer partners to facilitate collaborative category management Copyright © 2004 IRI France. 31

Benefits: The Bottom Line Identify your biggest in-store opportunity: Determine what levers to pull to accomplish that goal Draw more people into the aisle Convert more category browsers to buyers Drive a brand switch Increase volume per purchase Improve resource allocation, focusing on those marketing efforts with the best pay-back Bring new insights to retailer partners to facilitate collaborative category management Copyright © 2004 IRI France. 31

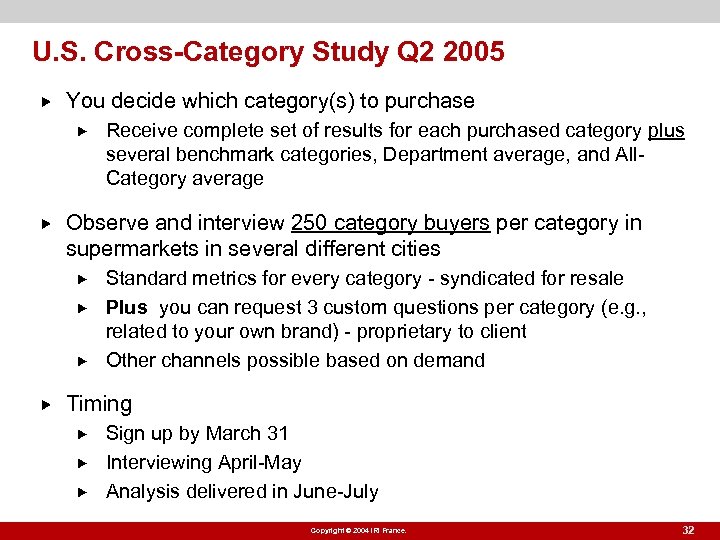

U. S. Cross-Category Study Q 2 2005 You decide which category(s) to purchase Observe and interview 250 category buyers per category in supermarkets in several different cities Receive complete set of results for each purchased category plus several benchmark categories, Department average, and All. Category average Standard metrics for every category - syndicated for resale Plus you can request 3 custom questions per category (e. g. , related to your own brand) - proprietary to client Other channels possible based on demand Timing Sign up by March 31 Interviewing April-May Analysis delivered in June-July Copyright © 2004 IRI France. 32

U. S. Cross-Category Study Q 2 2005 You decide which category(s) to purchase Observe and interview 250 category buyers per category in supermarkets in several different cities Receive complete set of results for each purchased category plus several benchmark categories, Department average, and All. Category average Standard metrics for every category - syndicated for resale Plus you can request 3 custom questions per category (e. g. , related to your own brand) - proprietary to client Other channels possible based on demand Timing Sign up by March 31 Interviewing April-May Analysis delivered in June-July Copyright © 2004 IRI France. 32

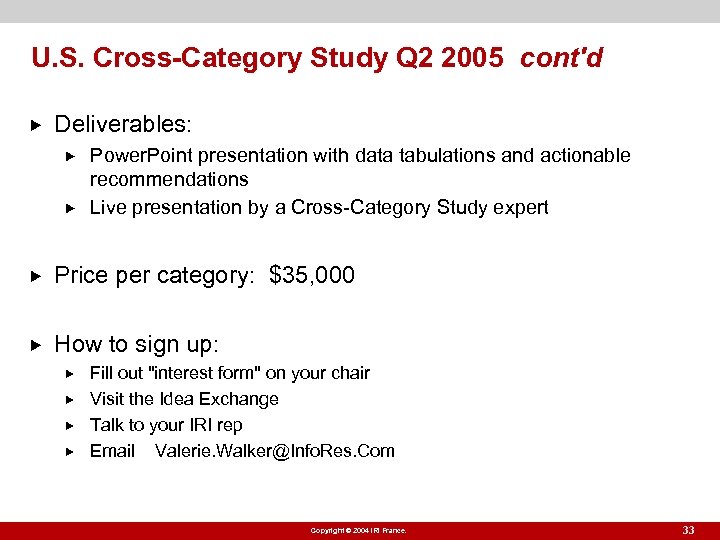

U. S. Cross-Category Study Q 2 2005 cont'd Deliverables: Power. Point presentation with data tabulations and actionable recommendations Live presentation by a Cross-Category Study expert Price per category: $35, 000 How to sign up: Fill out "interest form" on your chair Visit the Idea Exchange Talk to your IRI rep Email Valerie. Walker@Info. Res. Com Copyright © 2004 IRI France. 33

U. S. Cross-Category Study Q 2 2005 cont'd Deliverables: Power. Point presentation with data tabulations and actionable recommendations Live presentation by a Cross-Category Study expert Price per category: $35, 000 How to sign up: Fill out "interest form" on your chair Visit the Idea Exchange Talk to your IRI rep Email Valerie. Walker@Info. Res. Com Copyright © 2004 IRI France. 33

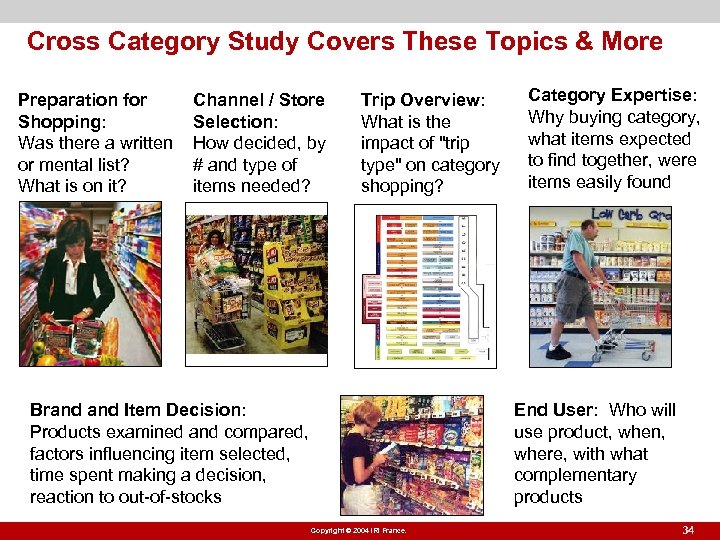

Cross Category Study Covers These Topics & More Preparation for Shopping: Was there a written or mental list? What is on it? Channel / Store Selection: How decided, by # and type of items needed? Trip Overview: What is the impact of "trip type" on category shopping? Brand Item Decision: Products examined and compared, factors influencing item selected, time spent making a decision, reaction to out-of-stocks Category Expertise: Why buying category, what items expected to find together, were items easily found End User: Who will use product, when, where, with what complementary products Copyright © 2004 IRI France. 34

Cross Category Study Covers These Topics & More Preparation for Shopping: Was there a written or mental list? What is on it? Channel / Store Selection: How decided, by # and type of items needed? Trip Overview: What is the impact of "trip type" on category shopping? Brand Item Decision: Products examined and compared, factors influencing item selected, time spent making a decision, reaction to out-of-stocks Category Expertise: Why buying category, what items expected to find together, were items easily found End User: Who will use product, when, where, with what complementary products Copyright © 2004 IRI France. 34

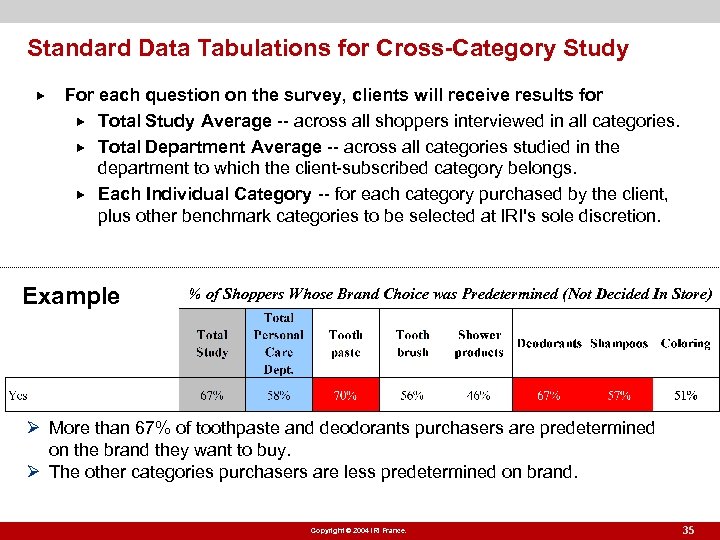

Standard Data Tabulations for Cross-Category Study For each question on the survey, clients will receive results for Total Study Average -- across all shoppers interviewed in all categories. Total Department Average -- across all categories studied in the department to which the client-subscribed category belongs. Each Individual Category -- for each category purchased by the client, plus other benchmark categories to be selected at IRI's sole discretion. Example % of Shoppers Whose Brand Choice was Predetermined (Not Decided In Store) Ø More than 67% of toothpaste and deodorants purchasers are predetermined on the brand they want to buy. Ø The other categories purchasers are less predetermined on brand. Copyright © 2004 IRI France. 35

Standard Data Tabulations for Cross-Category Study For each question on the survey, clients will receive results for Total Study Average -- across all shoppers interviewed in all categories. Total Department Average -- across all categories studied in the department to which the client-subscribed category belongs. Each Individual Category -- for each category purchased by the client, plus other benchmark categories to be selected at IRI's sole discretion. Example % of Shoppers Whose Brand Choice was Predetermined (Not Decided In Store) Ø More than 67% of toothpaste and deodorants purchasers are predetermined on the brand they want to buy. Ø The other categories purchasers are less predetermined on brand. Copyright © 2004 IRI France. 35

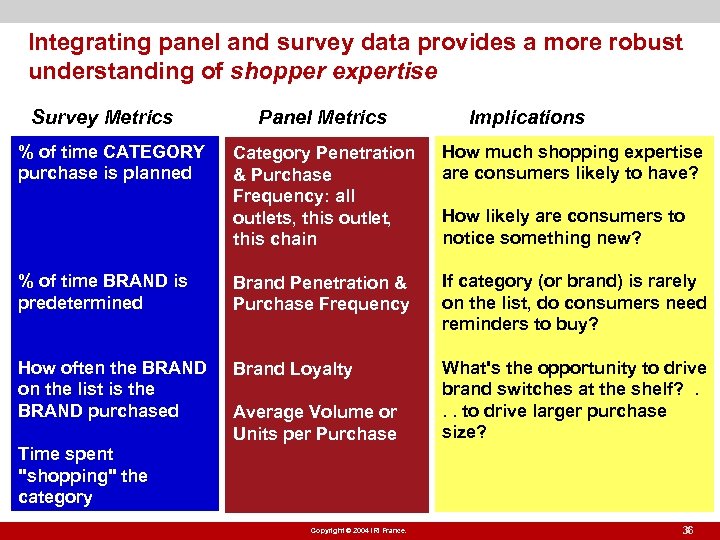

Integrating panel and survey data provides a more robust understanding of shopper expertise Survey Metrics % of time CATEGORY purchase is planned Panel Metrics Implications Category Penetration & Purchase Frequency: all outlets, this outlet, this chain How much shopping expertise are consumers likely to have? % of time BRAND is predetermined Brand Penetration & Purchase Frequency If category (or brand) is rarely on the list, do consumers need reminders to buy? How often the BRAND on the list is the BRAND purchased Brand Loyalty What's the opportunity to drive brand switches at the shelf? . . . to drive larger purchase size? Average Volume or Units per Purchase How likely are consumers to notice something new? Time spent "shopping" the category Copyright © 2004 IRI France. 36

Integrating panel and survey data provides a more robust understanding of shopper expertise Survey Metrics % of time CATEGORY purchase is planned Panel Metrics Implications Category Penetration & Purchase Frequency: all outlets, this outlet, this chain How much shopping expertise are consumers likely to have? % of time BRAND is predetermined Brand Penetration & Purchase Frequency If category (or brand) is rarely on the list, do consumers need reminders to buy? How often the BRAND on the list is the BRAND purchased Brand Loyalty What's the opportunity to drive brand switches at the shelf? . . . to drive larger purchase size? Average Volume or Units per Purchase How likely are consumers to notice something new? Time spent "shopping" the category Copyright © 2004 IRI France. 36

Custom Studies Will Also Be Available Business-issue specific Advantage of working with IRI vs. working directly with an in-store research supplier: Leverage IRI's knowledge of your category, market structure, etc. in study design Leverage IRI/MCA's understanding of shopper expertise in study design IRI integrates store & panel data with survey data to provide a more complete view of the issue IRI brings analytic expertise, versus field execution Copyright © 2004 IRI France. 37

Custom Studies Will Also Be Available Business-issue specific Advantage of working with IRI vs. working directly with an in-store research supplier: Leverage IRI's knowledge of your category, market structure, etc. in study design Leverage IRI/MCA's understanding of shopper expertise in study design IRI integrates store & panel data with survey data to provide a more complete view of the issue IRI brings analytic expertise, versus field execution Copyright © 2004 IRI France. 37

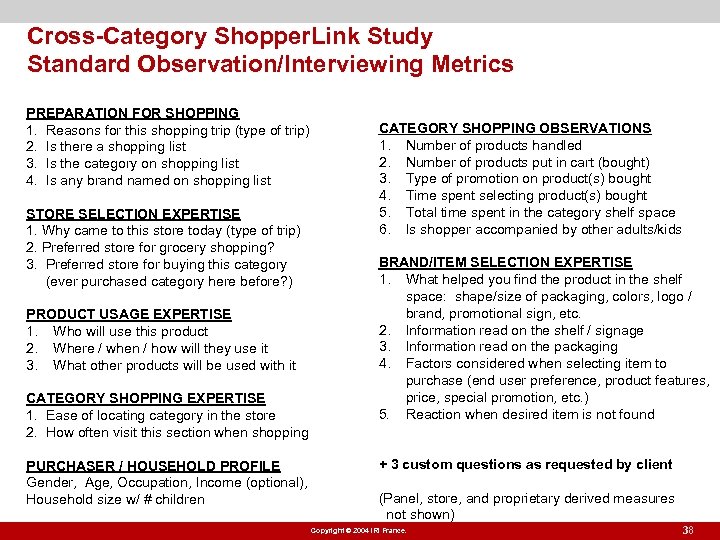

Cross-Category Shopper. Link Study Standard Observation/Interviewing Metrics PREPARATION FOR SHOPPING 1. Reasons for this shopping trip (type of trip) 2. Is there a shopping list 3. Is the category on shopping list 4. Is any brand named on shopping list STORE SELECTION EXPERTISE 1. Why came to this store today (type of trip) 2. Preferred store for grocery shopping? 3. Preferred store for buying this category (ever purchased category here before? ) PRODUCT USAGE EXPERTISE 1. Who will use this product 2. Where / when / how will they use it 3. What other products will be used with it CATEGORY SHOPPING EXPERTISE 1. Ease of locating category in the store 2. How often visit this section when shopping PURCHASER / HOUSEHOLD PROFILE Gender, Age, Occupation, Income (optional), Household size w/ # children CATEGORY SHOPPING OBSERVATIONS 1. Number of products handled 2. Number of products put in cart (bought) 3. Type of promotion on product(s) bought 4. Time spent selecting product(s) bought 5. Total time spent in the category shelf space 6. Is shopper accompanied by other adults/kids BRAND/ITEM SELECTION EXPERTISE 1. What helped you find the product in the shelf space: shape/size of packaging, colors, logo / brand, promotional sign, etc. 2. Information read on the shelf / signage 3. Information read on the packaging 4. Factors considered when selecting item to purchase (end user preference, product features, price, special promotion, etc. ) 5. Reaction when desired item is not found + 3 custom questions as requested by client (Panel, store, and proprietary derived measures not shown) Copyright © 2004 IRI France. 38

Cross-Category Shopper. Link Study Standard Observation/Interviewing Metrics PREPARATION FOR SHOPPING 1. Reasons for this shopping trip (type of trip) 2. Is there a shopping list 3. Is the category on shopping list 4. Is any brand named on shopping list STORE SELECTION EXPERTISE 1. Why came to this store today (type of trip) 2. Preferred store for grocery shopping? 3. Preferred store for buying this category (ever purchased category here before? ) PRODUCT USAGE EXPERTISE 1. Who will use this product 2. Where / when / how will they use it 3. What other products will be used with it CATEGORY SHOPPING EXPERTISE 1. Ease of locating category in the store 2. How often visit this section when shopping PURCHASER / HOUSEHOLD PROFILE Gender, Age, Occupation, Income (optional), Household size w/ # children CATEGORY SHOPPING OBSERVATIONS 1. Number of products handled 2. Number of products put in cart (bought) 3. Type of promotion on product(s) bought 4. Time spent selecting product(s) bought 5. Total time spent in the category shelf space 6. Is shopper accompanied by other adults/kids BRAND/ITEM SELECTION EXPERTISE 1. What helped you find the product in the shelf space: shape/size of packaging, colors, logo / brand, promotional sign, etc. 2. Information read on the shelf / signage 3. Information read on the packaging 4. Factors considered when selecting item to purchase (end user preference, product features, price, special promotion, etc. ) 5. Reaction when desired item is not found + 3 custom questions as requested by client (Panel, store, and proprietary derived measures not shown) Copyright © 2004 IRI France. 38