6d7edee35d420d51c50043012418378f.ppt

- Количество слайдов: 36

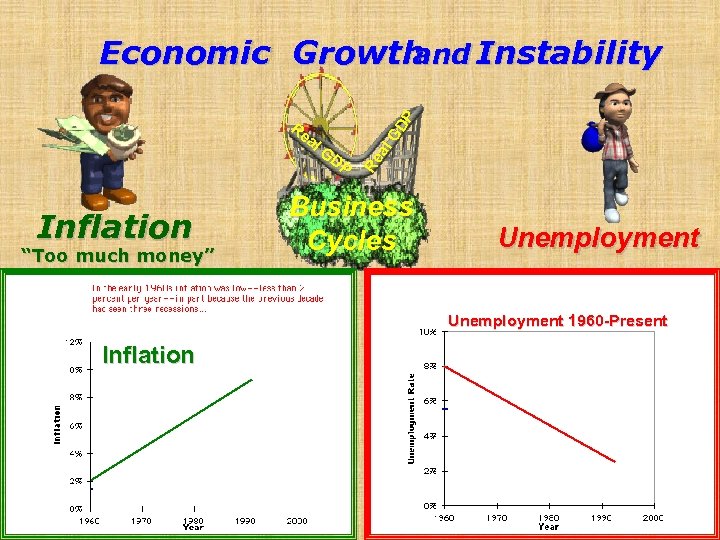

Re al GD P Inflation “Too much money” Re al GD P Economic Growth and Instability Business Cycles Unemployment 1960 -Present Inflation

Re al GD P Inflation “Too much money” Re al GD P Economic Growth and Instability Business Cycles Unemployment 1960 -Present Inflation

ECONOMIC GROWTH An increase in Real GDP over time An increase in Real GDP per capita over time [Real GDP/population = Real GDP per capita] GDP capita • Growth is a Goal because it lessens the burden of scarcity (everyone has more of everything). • Main Sources of Growth • Increases in Resources • Increases in Productivity (Health, training, and education).

ECONOMIC GROWTH An increase in Real GDP over time An increase in Real GDP per capita over time [Real GDP/population = Real GDP per capita] GDP capita • Growth is a Goal because it lessens the burden of scarcity (everyone has more of everything). • Main Sources of Growth • Increases in Resources • Increases in Productivity (Health, training, and education).

Growth in the United States Improved Products - iceboxes to refrigerators Icebox – cooled by “natural” ice 1927 GE Monitor Top electric refrigerator-$300 From LPs to CDs Added Leisure [Workweek decreased from 50 to 35 hours]

Growth in the United States Improved Products - iceboxes to refrigerators Icebox – cooled by “natural” ice 1927 GE Monitor Top electric refrigerator-$300 From LPs to CDs Added Leisure [Workweek decreased from 50 to 35 hours]

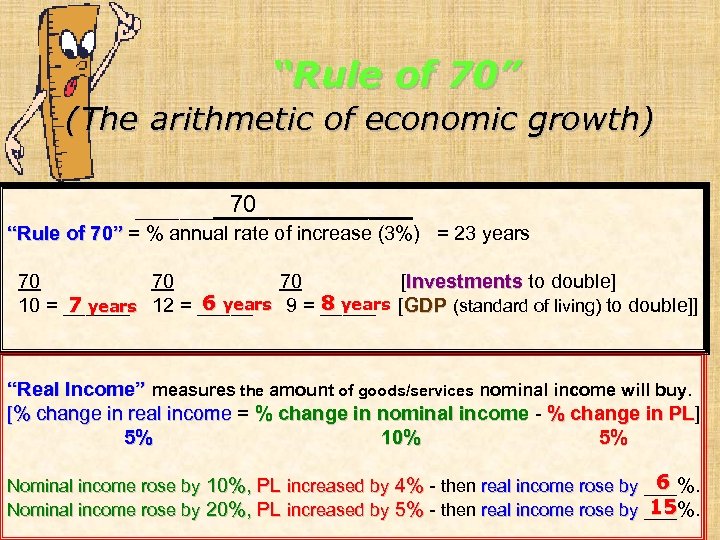

“Rule of 70” (The arithmetic of economic growth) 70 _____________ “Rule of 70” = % annual rate of increase (3%) = 23 years 70 70 70 [Investments to double] 8 years 6 years 9 = _____ [GDP (standard of living) to double]] 10 = ______ 12 = _____ 7 years “Real Income” measures the amount of goods/services nominal income will buy. [% change in real income = % change in nominal income - % change in PL] PL 5% 10% 5% 6 Nominal income rose by 10%, PL increased by 4% - then real income rose by ___%. 15 Nominal income rose by 20%, PL increased by 5% - then real income rose by ___%.

“Rule of 70” (The arithmetic of economic growth) 70 _____________ “Rule of 70” = % annual rate of increase (3%) = 23 years 70 70 70 [Investments to double] 8 years 6 years 9 = _____ [GDP (standard of living) to double]] 10 = ______ 12 = _____ 7 years “Real Income” measures the amount of goods/services nominal income will buy. [% change in real income = % change in nominal income - % change in PL] PL 5% 10% 5% 6 Nominal income rose by 10%, PL increased by 4% - then real income rose by ___%. 15 Nominal income rose by 20%, PL increased by 5% - then real income rose by ___%.

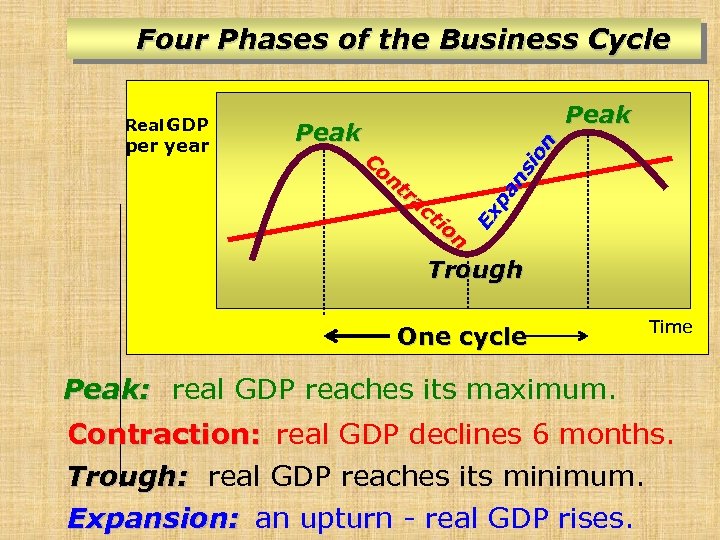

Four Phases of the Business Cycle per year Peak Co nt ra ct io n Ex pa ns io n Real GDP Trough One cycle Time Peak: real GDP reaches its maximum. Contraction: real GDP declines 6 months. Trough: real GDP reaches its minimum. Expansion: an upturn - real GDP rises.

Four Phases of the Business Cycle per year Peak Co nt ra ct io n Ex pa ns io n Real GDP Trough One cycle Time Peak: real GDP reaches its maximum. Contraction: real GDP declines 6 months. Trough: real GDP reaches its minimum. Expansion: an upturn - real GDP rises.

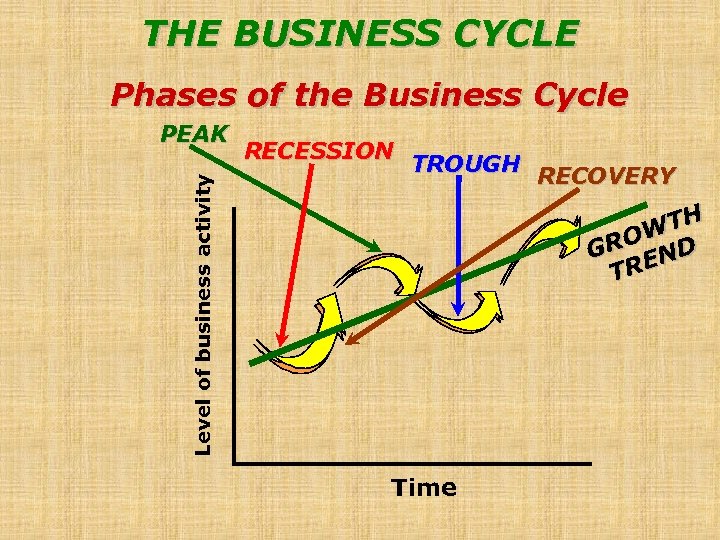

THE BUSINESS CYCLE Phases of the Business Cycle Level of business activity PEAK RECESSION TROUGH RECOVERY TH W RO D G REN T Time

THE BUSINESS CYCLE Phases of the Business Cycle Level of business activity PEAK RECESSION TROUGH RECOVERY TH W RO D G REN T Time

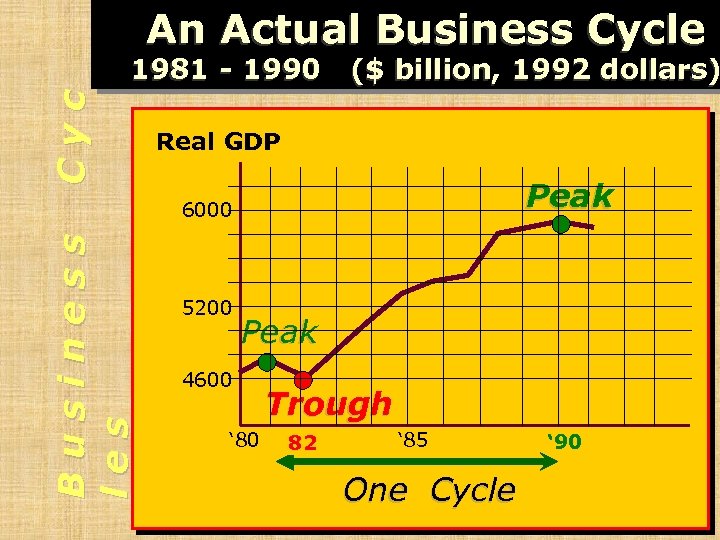

An Actual Business Cycle Cyc 1981 - 1990 ($ billion, 1992 dollars) Real GDP Peak Business les 6000 5200 Peak 4600 ‘ 80 Trough 82 ‘ 85 One Cycle ‘ 90

An Actual Business Cycle Cyc 1981 - 1990 ($ billion, 1992 dollars) Real GDP Peak Business les 6000 5200 Peak 4600 ‘ 80 Trough 82 ‘ 85 One Cycle ‘ 90

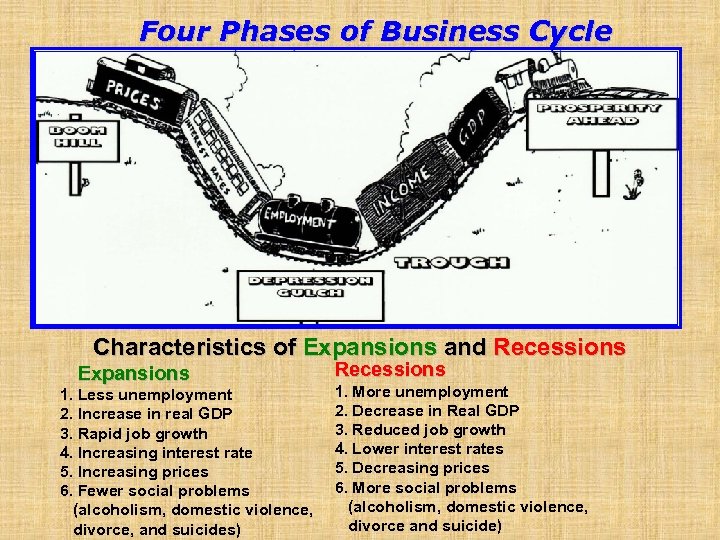

Four Phases of Business Cycle Characteristics of Expansions and Recessions Expansions 1. Less unemployment 2. Increase in real GDP 3. Rapid job growth 4. Increasing interest rate 5. Increasing prices 6. Fewer social problems (alcoholism, domestic violence, divorce, and suicides) Recessions 1. More unemployment 2. Decrease in Real GDP 3. Reduced job growth 4. Lower interest rates 5. Decreasing prices 6. More social problems (alcoholism, domestic violence, divorce and suicide)

Four Phases of Business Cycle Characteristics of Expansions and Recessions Expansions 1. Less unemployment 2. Increase in real GDP 3. Rapid job growth 4. Increasing interest rate 5. Increasing prices 6. Fewer social problems (alcoholism, domestic violence, divorce, and suicides) Recessions 1. More unemployment 2. Decrease in Real GDP 3. Reduced job growth 4. Lower interest rates 5. Decreasing prices 6. More social problems (alcoholism, domestic violence, divorce and suicide)

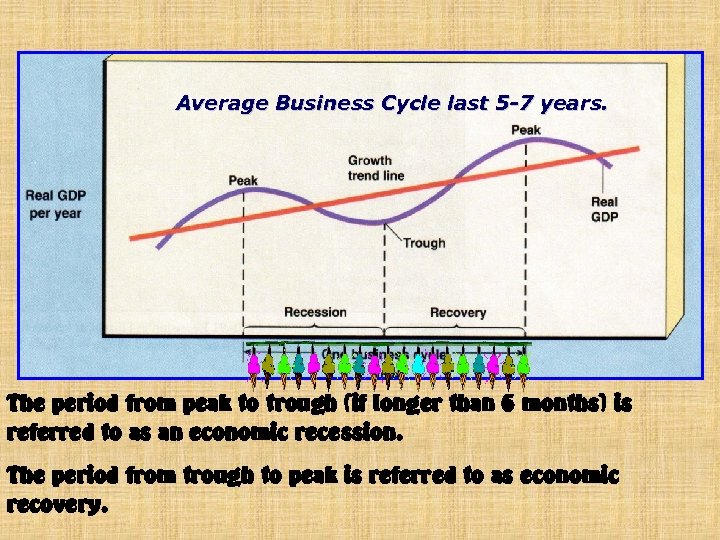

Average Business Cycle last 5 -7 years. The period from peak to trough (if longer than 6 months) is referred to as an economic recession. The period from trough to peak is referred to as economic recovery.

Average Business Cycle last 5 -7 years. The period from peak to trough (if longer than 6 months) is referred to as an economic recession. The period from trough to peak is referred to as economic recovery.

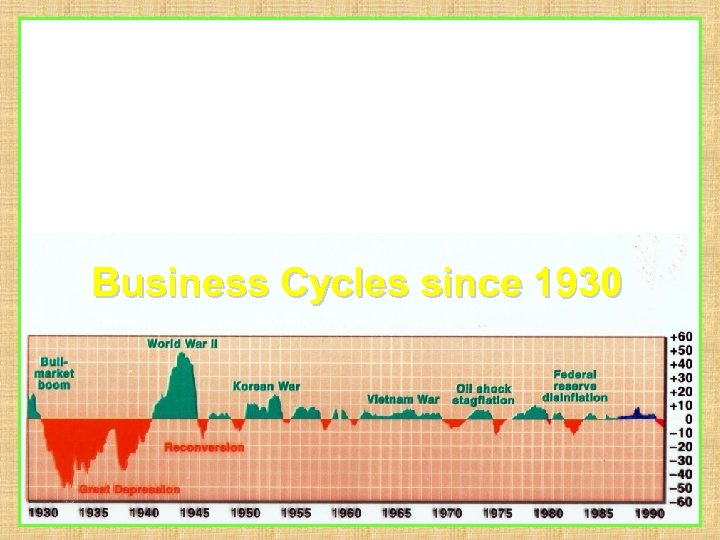

Business Cycles since 1930

Business Cycles since 1930

There has been 10 recessions since 1930. They have ranged from 6 months to 10 years in length (averaging 7 years. ) Periods of expansion have averaged 2 -10 years. There has been a recession each decade in the our 200 year history. Usually 1 out of every 20 workers loses their job. But the other 19 are better off Because interest rates go down.

There has been 10 recessions since 1930. They have ranged from 6 months to 10 years in length (averaging 7 years. ) Periods of expansion have averaged 2 -10 years. There has been a recession each decade in the our 200 year history. Usually 1 out of every 20 workers loses their job. But the other 19 are better off Because interest rates go down.

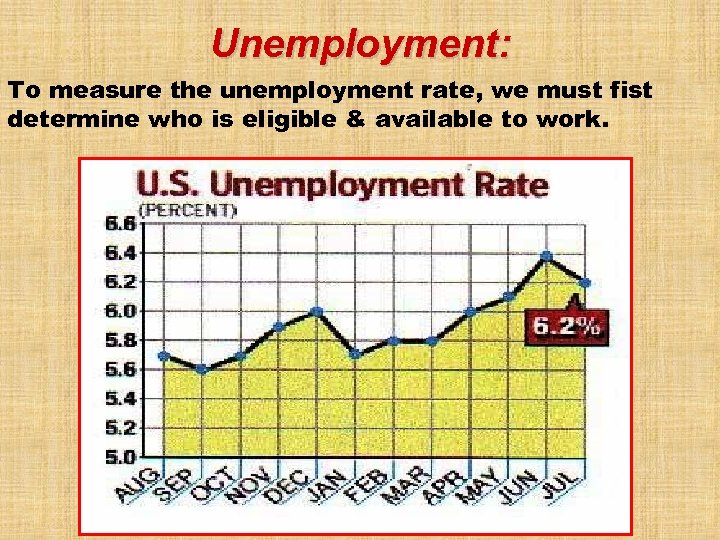

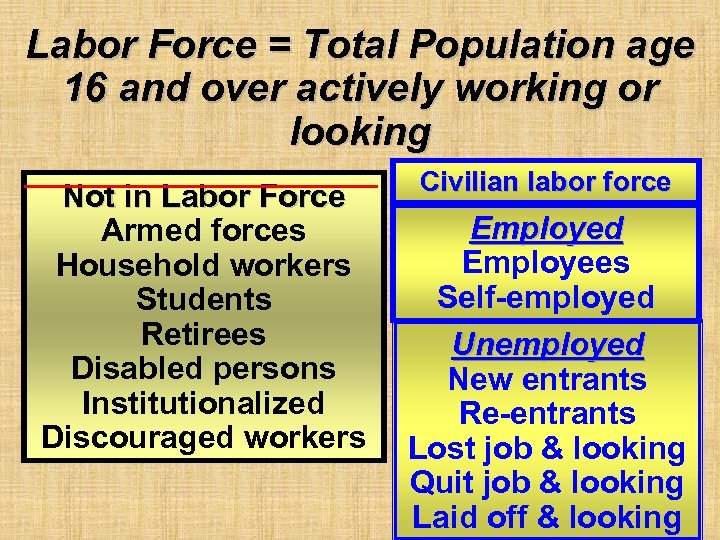

Unemployment: To measure the unemployment rate, we must fist determine who is eligible & available to work.

Unemployment: To measure the unemployment rate, we must fist determine who is eligible & available to work.

Labor Force = Total Population age 16 and over actively working or looking Not in Labor Force Armed forces Household workers Students Retirees Disabled persons Institutionalized Discouraged workers Civilian labor force Employed Employees Self-employed Unemployed New entrants Re-entrants Lost job & looking Quit job & looking Laid off & looking

Labor Force = Total Population age 16 and over actively working or looking Not in Labor Force Armed forces Household workers Students Retirees Disabled persons Institutionalized Discouraged workers Civilian labor force Employed Employees Self-employed Unemployed New entrants Re-entrants Lost job & looking Quit job & looking Laid off & looking

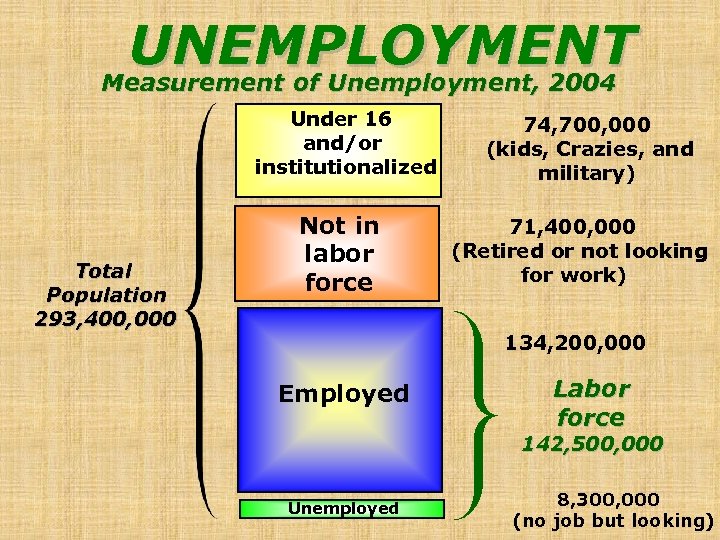

UNEMPLOYMENT Measurement of Unemployment, 2004 Under 16 and/or institutionalized Total Population 293, 400, 000 Not in labor force 74, 700, 000 (kids, Crazies, and military) 71, 400, 000 (Retired or not looking for work) 134, 200, 000 Employed Labor force 142, 500, 000 Unemployed 8, 300, 000 (no job but looking)

UNEMPLOYMENT Measurement of Unemployment, 2004 Under 16 and/or institutionalized Total Population 293, 400, 000 Not in labor force 74, 700, 000 (kids, Crazies, and military) 71, 400, 000 (Retired or not looking for work) 134, 200, 000 Employed Labor force 142, 500, 000 Unemployed 8, 300, 000 (no job but looking)

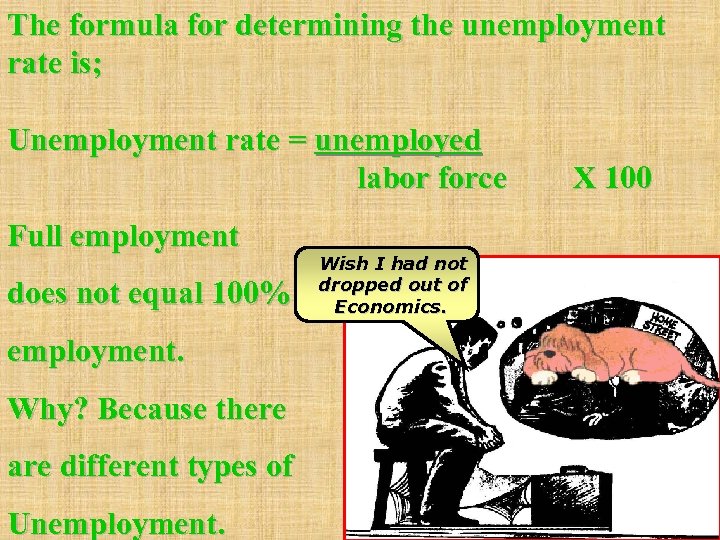

The formula for determining the unemployment rate is; Unemployment rate = unemployed labor force Full employment does not equal 100% employment. Why? Because there are different types of Unemployment. Wish I had not dropped out of Economics. X 100

The formula for determining the unemployment rate is; Unemployment rate = unemployed labor force Full employment does not equal 100% employment. Why? Because there are different types of Unemployment. Wish I had not dropped out of Economics. X 100

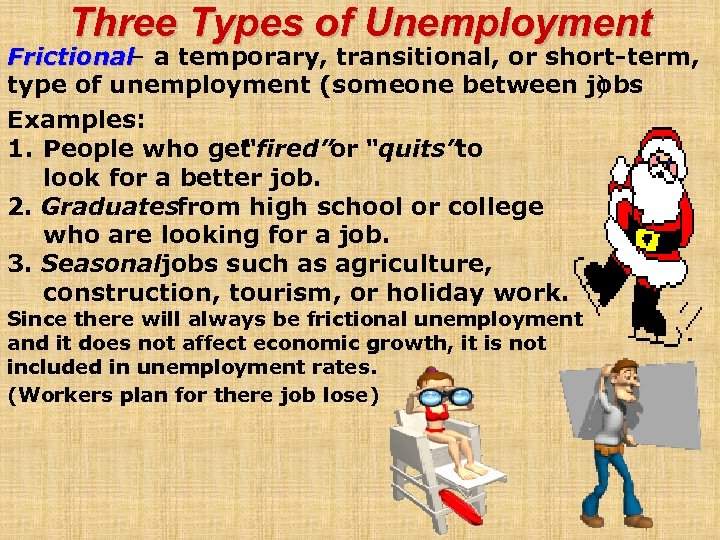

Three Types of Unemployment Frictional– a temporary, transitional, or short-term, type of unemployment (someone between jobs ) Examples: 1. People who get “fired”or “quits”to look for a better job. 2. Graduatesfrom high school or college who are looking for a job. 3. Seasonaljobs such as agriculture, construction, tourism, or holiday work. Since there will always be frictional unemployment and it does not affect economic growth, it is not included in unemployment rates. (Workers plan for there job lose)

Three Types of Unemployment Frictional– a temporary, transitional, or short-term, type of unemployment (someone between jobs ) Examples: 1. People who get “fired”or “quits”to look for a better job. 2. Graduatesfrom high school or college who are looking for a job. 3. Seasonaljobs such as agriculture, construction, tourism, or holiday work. Since there will always be frictional unemployment and it does not affect economic growth, it is not included in unemployment rates. (Workers plan for there job lose)

Structural– a technological, or long-term type of unemployment, caused by changes in the job market that make certain skills obsolete. Causes of structural unemployment; • Automation • Consumer taste • Creative destruction; jobs are created jobs are as lost. (The creation of the auto reduced the need for carriage makers. ) Even though these jobs do not come back, structural unemployment is not counted in unemployment rates. Most workers will be retained (out of the labor force) until they can find a new job. Also structural changes are good for economic growth.

Structural– a technological, or long-term type of unemployment, caused by changes in the job market that make certain skills obsolete. Causes of structural unemployment; • Automation • Consumer taste • Creative destruction; jobs are created jobs are as lost. (The creation of the auto reduced the need for carriage makers. ) Even though these jobs do not come back, structural unemployment is not counted in unemployment rates. Most workers will be retained (out of the labor force) until they can find a new job. Also structural changes are good for economic growth.

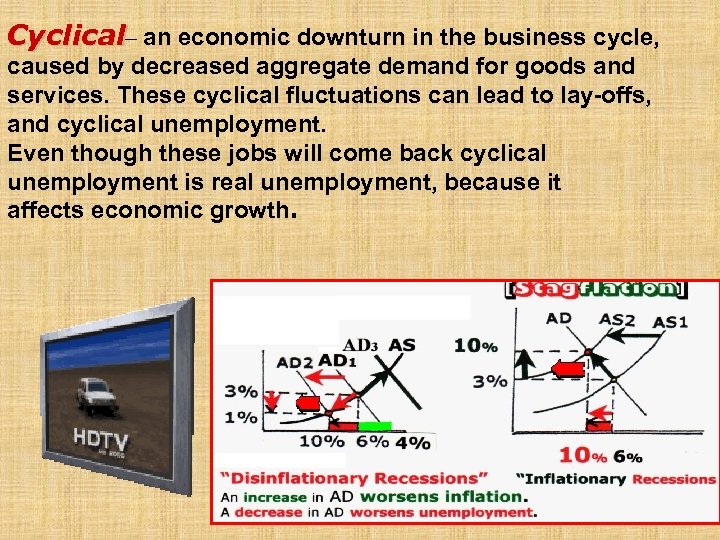

Cyclical– an economic downturn in the business cycle, caused by decreased aggregate demand for goods and services. These cyclical fluctuations can lead to lay-offs, and cyclical unemployment. Even though these jobs will come back cyclical unemployment is real unemployment, because it affects economic growth.

Cyclical– an economic downturn in the business cycle, caused by decreased aggregate demand for goods and services. These cyclical fluctuations can lead to lay-offs, and cyclical unemployment. Even though these jobs will come back cyclical unemployment is real unemployment, because it affects economic growth.

When the number of job seekers equals the number of job vacancies the economy is said to be at its natural rate of unemployment. At the NRU, the economy is said to be producing its potential output. The NRU is set at about 4% unemployment. This is the unemployment that the economy works best at.

When the number of job seekers equals the number of job vacancies the economy is said to be at its natural rate of unemployment. At the NRU, the economy is said to be producing its potential output. The NRU is set at about 4% unemployment. This is the unemployment that the economy works best at.

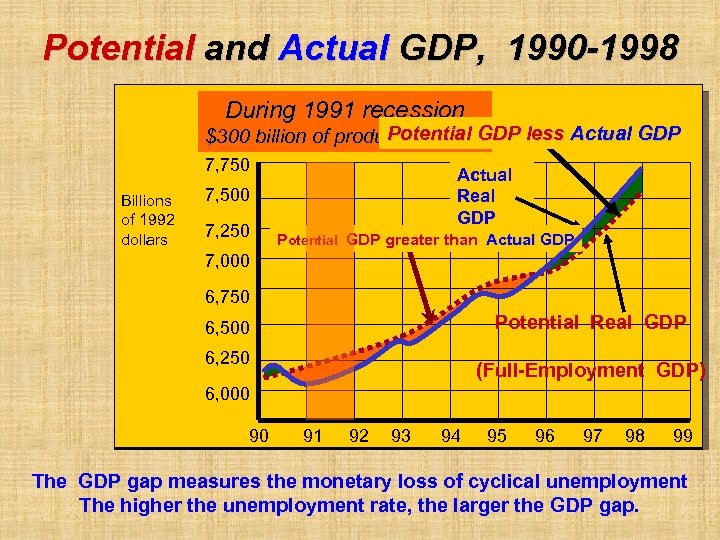

When the economy fails to create enough jobs for all who are able and willing to work (unemployment is on the rise), then the economy loses it full potential to produce goods and services. This called the GDP gap = the amount by which actual GDP falls short of potential GDP.

When the economy fails to create enough jobs for all who are able and willing to work (unemployment is on the rise), then the economy loses it full potential to produce goods and services. This called the GDP gap = the amount by which actual GDP falls short of potential GDP.

Potential and Actual GDP, 1990 -1998 During 1991 recession Potential GDP less Actual GDP $300 billion of production is lost 7, 750 Billions of 1992 dollars Actual Real GDP 7, 500 7, 250 Potential GDP greater than Actual GDP 7, 000 6, 750 Potential Real GDP 6, 500 6, 250 (Full-Employment GDP) 6, 000 90 91 92 93 94 95 96 97 98 99 The GDP gap measures the monetary loss of cyclical unemployment The higher the unemployment rate, the larger the GDP gap.

Potential and Actual GDP, 1990 -1998 During 1991 recession Potential GDP less Actual GDP $300 billion of production is lost 7, 750 Billions of 1992 dollars Actual Real GDP 7, 500 7, 250 Potential GDP greater than Actual GDP 7, 000 6, 750 Potential Real GDP 6, 500 6, 250 (Full-Employment GDP) 6, 000 90 91 92 93 94 95 96 97 98 99 The GDP gap measures the monetary loss of cyclical unemployment The higher the unemployment rate, the larger the GDP gap.

Okun’s Law – for every percentage point of unemployment above the natural rate (4%), there will occur a 2% lose of economic potential. (A 2% GDP gap will be created for every percent above NRU. )

Okun’s Law – for every percentage point of unemployment above the natural rate (4%), there will occur a 2% lose of economic potential. (A 2% GDP gap will be created for every percent above NRU. )

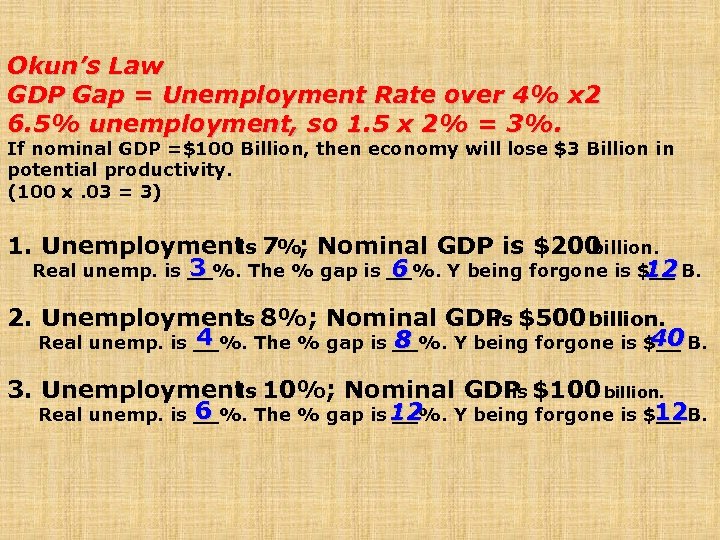

Okun’s Law GDP Gap = Unemployment Rate over 4% x 2 6. 5% unemployment, so 1. 5 x 2% = 3%. If nominal GDP =$100 Billion, then economy will lose $3 Billion in potential productivity. (100 x. 03 = 3) 1. Unemployment 7%; Nominal GDP is $200 is billion. 3 Real unemp. is __%. The % gap is __%. Y being forgone is $__ B. 6 12 2. Unemployment 8%; Nominal GDP $500 billion. is is 4 40 8 Real unemp. is __%. The % gap is __%. Y being forgone is $__ B. 3. Unemployment 10%; Nominal GDP $100 billion. is is 6 12 Real unemp. is __%. The % gap is 12 __%. Y being forgone is $__ B.

Okun’s Law GDP Gap = Unemployment Rate over 4% x 2 6. 5% unemployment, so 1. 5 x 2% = 3%. If nominal GDP =$100 Billion, then economy will lose $3 Billion in potential productivity. (100 x. 03 = 3) 1. Unemployment 7%; Nominal GDP is $200 is billion. 3 Real unemp. is __%. The % gap is __%. Y being forgone is $__ B. 6 12 2. Unemployment 8%; Nominal GDP $500 billion. is is 4 40 8 Real unemp. is __%. The % gap is __%. Y being forgone is $__ B. 3. Unemployment 10%; Nominal GDP $100 billion. is is 6 12 Real unemp. is __%. The % gap is 12 __%. Y being forgone is $__ B.

Inflation: Inflation; is a rise in the general level of prices. Moderate inflation (about 3%) is necessary for economic stability. It is the byproduct of a strong spending/full employment economy. It also makes it easier for businesses to adjust real wages downward if demand falls.

Inflation: Inflation; is a rise in the general level of prices. Moderate inflation (about 3%) is necessary for economic stability. It is the byproduct of a strong spending/full employment economy. It also makes it easier for businesses to adjust real wages downward if demand falls.

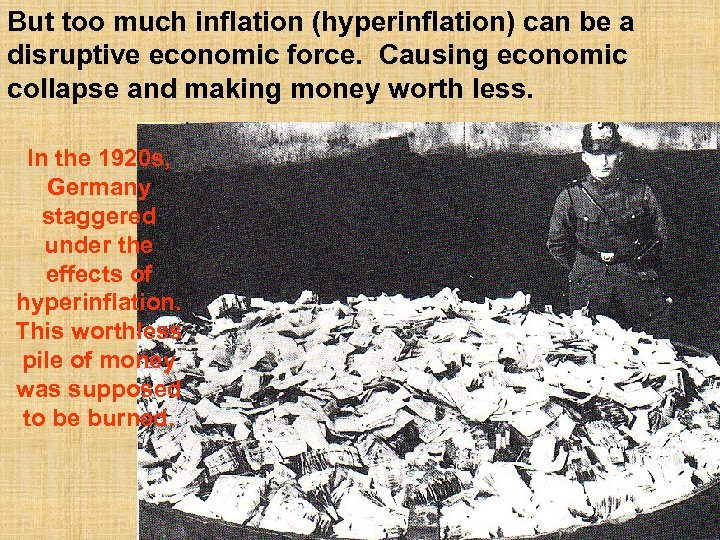

But too much inflation (hyperinflation) can be a disruptive economic force. Causing economic collapse and making money worth less. In the 1920 s, Germany staggered under the effects of hyperinflation. This worthless pile of money was supposed to be burned.

But too much inflation (hyperinflation) can be a disruptive economic force. Causing economic collapse and making money worth less. In the 1920 s, Germany staggered under the effects of hyperinflation. This worthless pile of money was supposed to be burned.

Regardless of the amount all inflation hurts the following people; • Those on fixed-incomes; inflation causes their real income to fall. • Savers; inflation deteriorates the value of savings. • Creditors; inflation deteriorates the value of loans to be paid back. If inflation is anticipated creditors can avoid the affects of it, by charging enough interest to cover inflation rates.

Regardless of the amount all inflation hurts the following people; • Those on fixed-incomes; inflation causes their real income to fall. • Savers; inflation deteriorates the value of savings. • Creditors; inflation deteriorates the value of loans to be paid back. If inflation is anticipated creditors can avoid the affects of it, by charging enough interest to cover inflation rates.

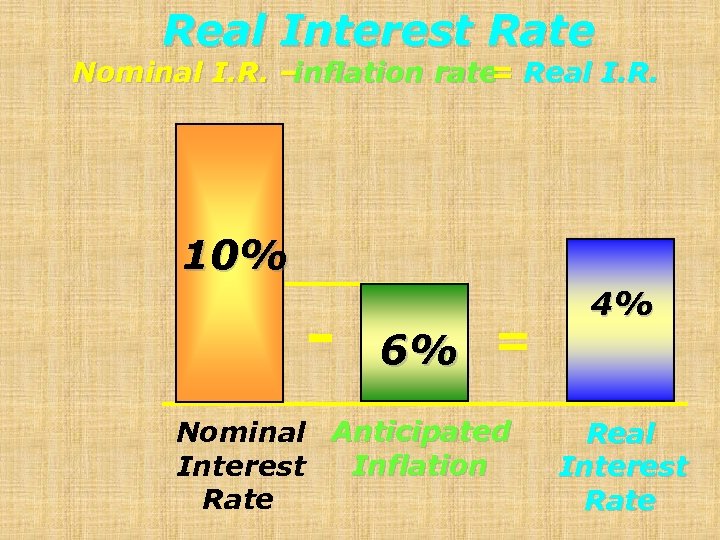

Real Interest Rate Nominal I. R. – inflation rate Real I. R. = 10% - 6% = Nominal Anticipated Inflation Interest Rate 4% Real Interest Rate

Real Interest Rate Nominal I. R. – inflation rate Real I. R. = 10% - 6% = Nominal Anticipated Inflation Interest Rate 4% Real Interest Rate

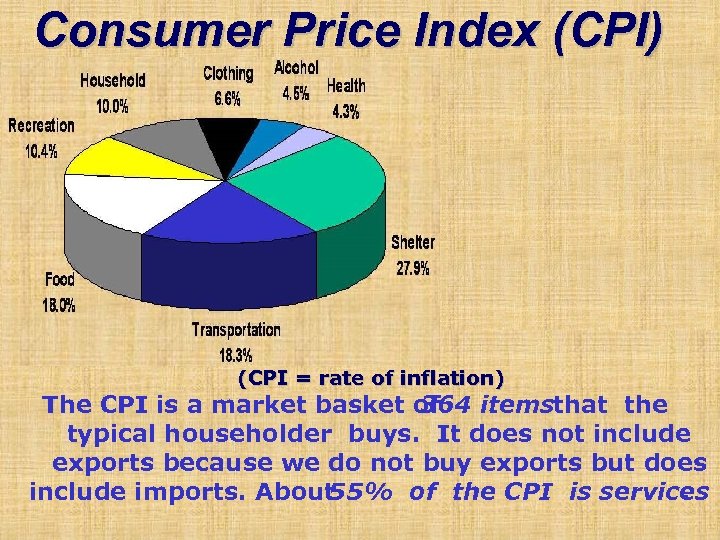

Consumer Price Index (CPI) (CPI = rate of inflation) The CPI is a market basket of 364 itemsthat the typical householder buys. It does not include exports because we do not buy exports but does include imports. About 55% of the CPI is services.

Consumer Price Index (CPI) (CPI = rate of inflation) The CPI is a market basket of 364 itemsthat the typical householder buys. It does not include exports because we do not buy exports but does include imports. About 55% of the CPI is services.

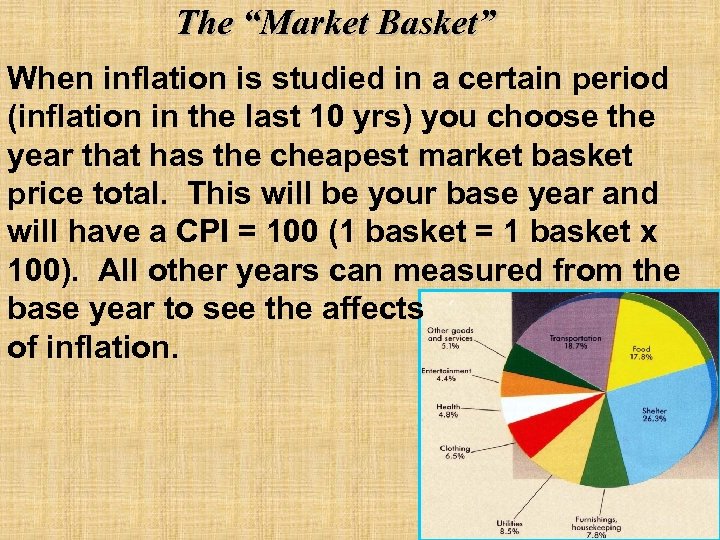

The “Market Basket” When inflation is studied in a certain period (inflation in the last 10 yrs) you choose the year that has the cheapest market basket price total. This will be your base year and will have a CPI = 100 (1 basket = 1 basket x 100). All other years can measured from the base year to see the affects of inflation.

The “Market Basket” When inflation is studied in a certain period (inflation in the last 10 yrs) you choose the year that has the cheapest market basket price total. This will be your base year and will have a CPI = 100 (1 basket = 1 basket x 100). All other years can measured from the base year to see the affects of inflation.

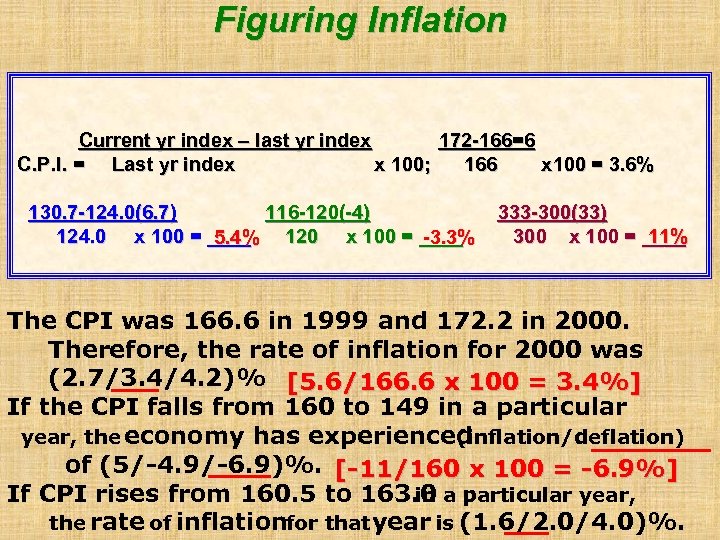

Figuring Inflation Current yr index – last yr index 172 -166=6 C. P. I. = Last yr index x 100; 166 x 100 = 3. 6% 130. 7 -124. 0(6. 7) 116 -120(-4) 124. 0 x 100 = ____ -3. 3% 5. 4% 120 x 100 = ____ 333 -300(33) 11% 300 x 100 = ____ The CPI was 166. 6 in 1999 and 172. 2 in 2000. Therefore, the rate of inflation for 2000 was (2. 7/3. 4/4. 2)% [5. 6/166. 6 x 100 = 3. 4%] If the CPI falls from 160 to 149 in a particular year, the economy has experienced (inflation/deflation) of (5/-4. 9/-6. 9)%. [-11/160 x 100 = -6. 9%] If CPI rises from 160. 5 to 163. 0 a particular year, in the rate of inflationfor that year is (1. 6/2. 0/4. 0)%.

Figuring Inflation Current yr index – last yr index 172 -166=6 C. P. I. = Last yr index x 100; 166 x 100 = 3. 6% 130. 7 -124. 0(6. 7) 116 -120(-4) 124. 0 x 100 = ____ -3. 3% 5. 4% 120 x 100 = ____ 333 -300(33) 11% 300 x 100 = ____ The CPI was 166. 6 in 1999 and 172. 2 in 2000. Therefore, the rate of inflation for 2000 was (2. 7/3. 4/4. 2)% [5. 6/166. 6 x 100 = 3. 4%] If the CPI falls from 160 to 149 in a particular year, the economy has experienced (inflation/deflation) of (5/-4. 9/-6. 9)%. [-11/160 x 100 = -6. 9%] If CPI rises from 160. 5 to 163. 0 a particular year, in the rate of inflationfor that year is (1. 6/2. 0/4. 0)%.

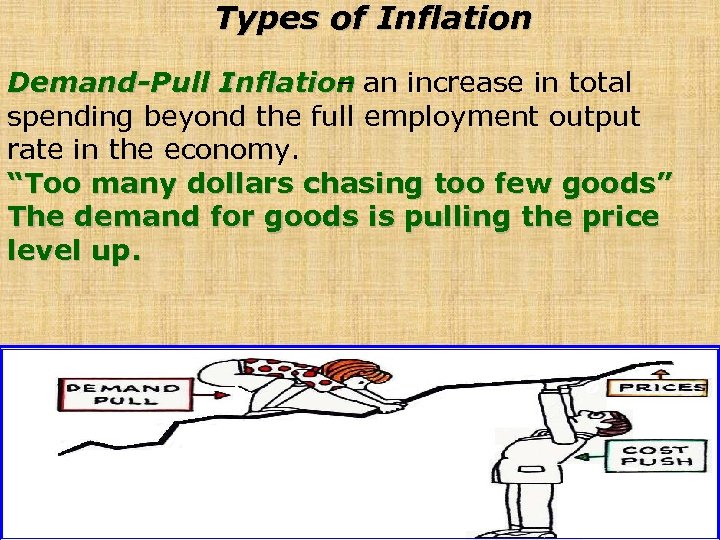

Types of Inflation Demand-Pull Inflation an increase in total – spending beyond the full employment output rate in the economy. “Too many dollars chasing too few goods” The demand for goods is pulling the price level up.

Types of Inflation Demand-Pull Inflation an increase in total – spending beyond the full employment output rate in the economy. “Too many dollars chasing too few goods” The demand for goods is pulling the price level up.

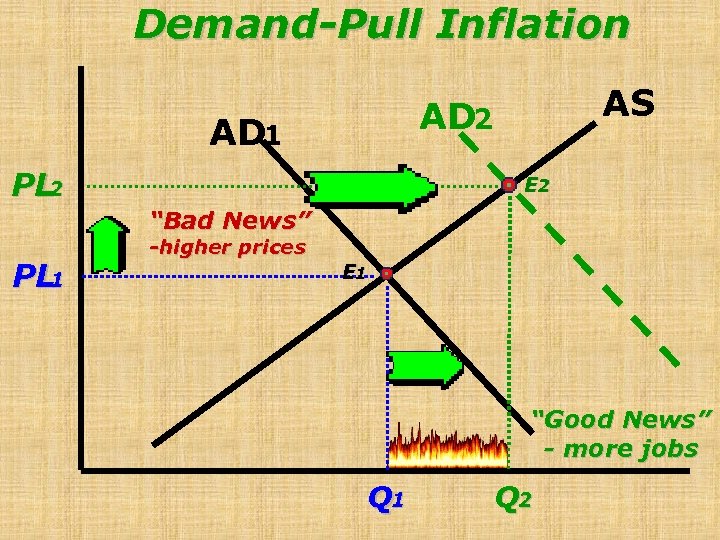

Demand-Pull Inflation AS AD 2 AD 1 PL 2 E 2 “Bad News” PL 1 -higher prices E 1 “Good News” - more jobs Q 1 Q 2

Demand-Pull Inflation AS AD 2 AD 1 PL 2 E 2 “Bad News” PL 1 -higher prices E 1 “Good News” - more jobs Q 1 Q 2

Cost-Push Inflationan increase in per-unit – production cost, which cause higher price levels. Caused by; 1. Wage-push– an increase labor wages increase production cost. 2. Supply-side shocks increase in the cost of – raw materials (oil prices).

Cost-Push Inflationan increase in per-unit – production cost, which cause higher price levels. Caused by; 1. Wage-push– an increase labor wages increase production cost. 2. Supply-side shocks increase in the cost of – raw materials (oil prices).

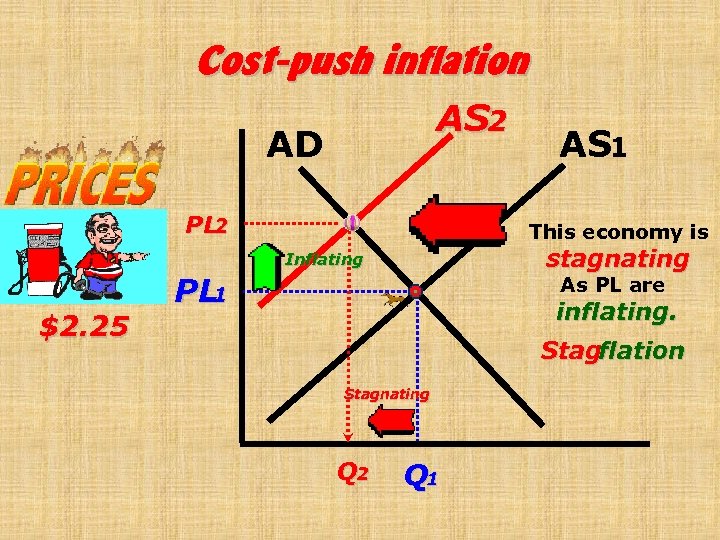

Cost-push inflation AS 2 AD PL 2 This economy is stagnating Inflating $2. 25 AS 1 PL 1 As PL are inflating. Stagflation Stagnating Q 2 Q 1

Cost-push inflation AS 2 AD PL 2 This economy is stagnating Inflating $2. 25 AS 1 PL 1 As PL are inflating. Stagflation Stagnating Q 2 Q 1

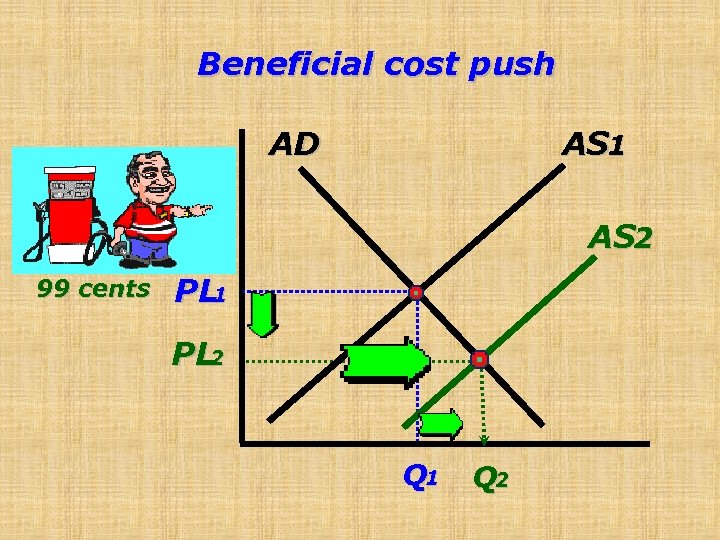

Beneficial cost push AD AS 1 AS 2 99 cents PL 1 PL 2 Q 1 Q 2

Beneficial cost push AD AS 1 AS 2 99 cents PL 1 PL 2 Q 1 Q 2

The End

The End