6a77b6fe42659f67f73bd414f1e67849.ppt

- Количество слайдов: 26

RDBMS Industry and technology trends Guy Harrison Chief Architect, Database Solutions Copyright © 2006 Quest Software

Agenda • Review of market share and competitive landscape • Open source and disruptive technology • Technical directions – Grids & clusters – Self-managing databases – Application development technologies • Industry trends: – Security and compliance – Outsourcing – Globalization of data and the database • Visions for the future of the DBMS

History of RDBMS competition • 1990: Client server revolution – Sybase vs. Ingres vs. Oracle – Multi threaded servers (SMP support) – Stored procedures/Client server capabilities • 1996: Object Oriented Database distractions – Informix vs. IBM vs. Oracle – OODBMS vs. Object relational vs. relational • 2000: Internet gold rush – – • Internet and Java compatibility Best of breed configurations with EMC, Solaris & Oracle Infinite scale-up anticipated Oracle price gouging creates some drift to IBM and SQL Server 2005: ROI/ TCO/ Compliance – – Battle not over capability but over cost SQL Server disrupts Oracle – but constrained by Windows OS market Oracle disrupting IBM/MF and the high end via grid/RAC. IBM pursues enigmatic Information As A Service (IAAS) strategy

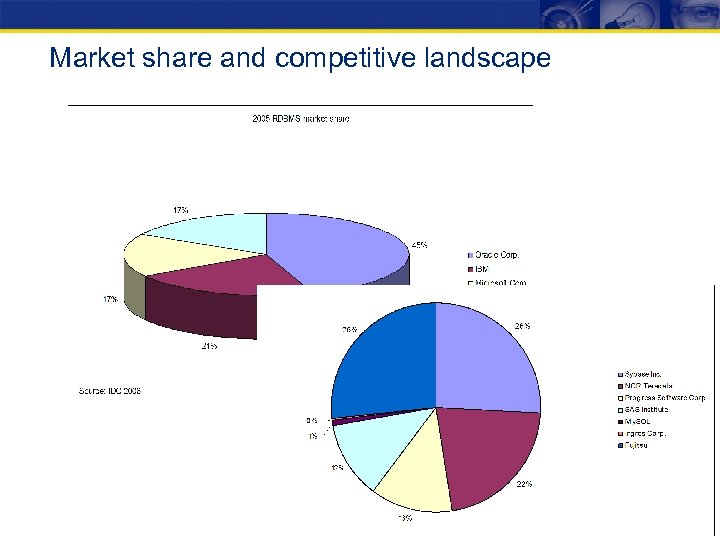

Market share and competitive landscape

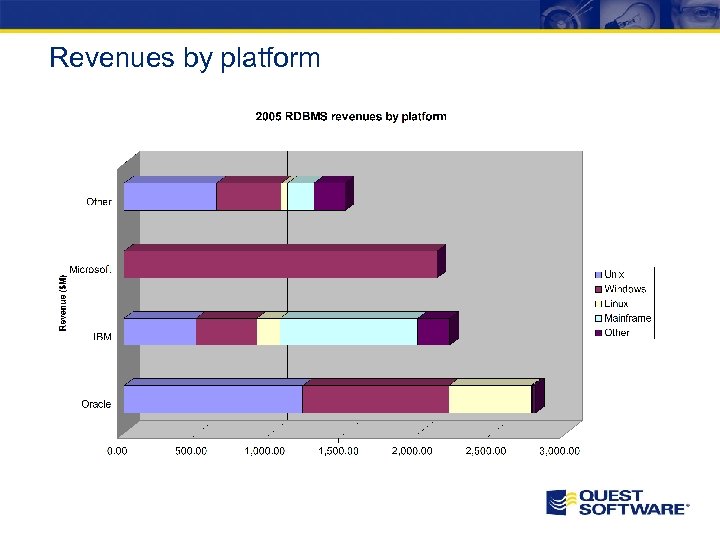

Revenues by platform

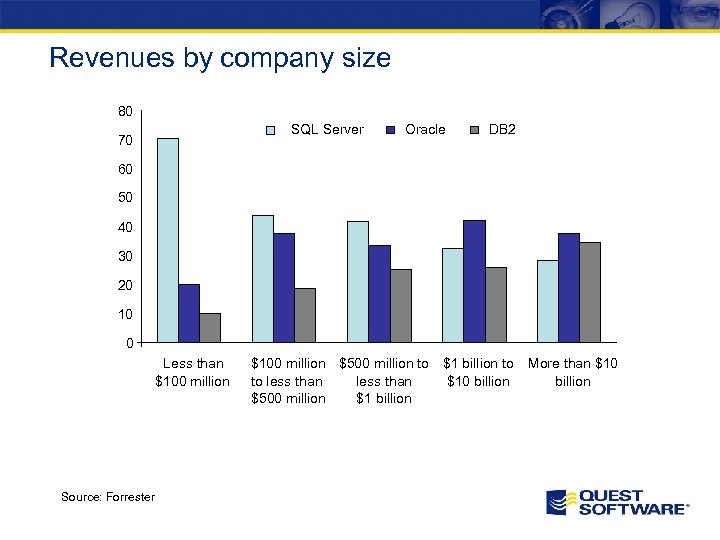

Revenues by company size 80 SQL Server 70 Oracle DB 2 60 50 40 Less than $100 million Source: Forrester $100 million $500 million to $1 billion to to less than $10 billion $500 million $1 billion DB 2 SQL Server Oracle DB 2 SQL Server Oracle DB 2 0 SQL Server 10 DB 2 20 SQL Server Oracle 30 More than $10 billion

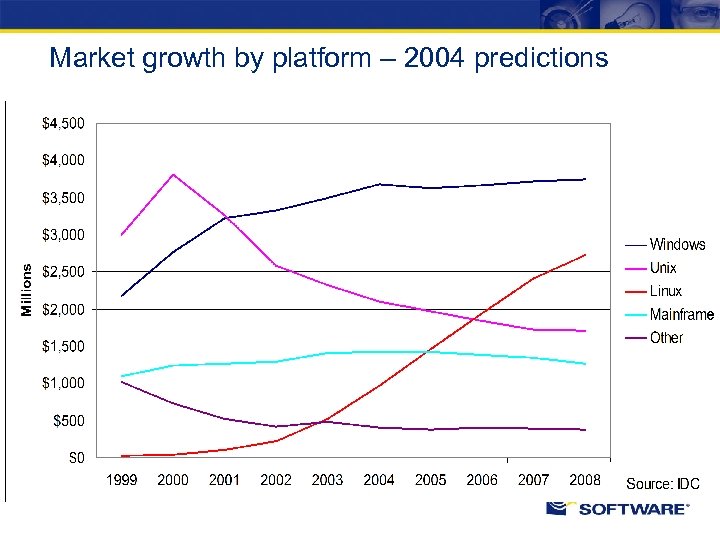

Market growth by platform – 2004 predictions

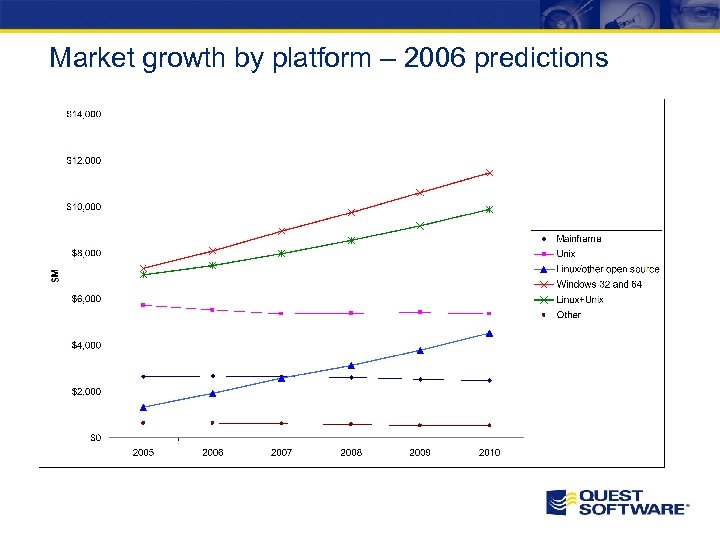

Market growth by platform – 2006 predictions

Market share conclusions and speculations • Oracle continues to dominate non-mainframe RDBMS landscape. • However, most shops support >1 RDBMS type (Oracle/SQLServer) and DBA managers at least need to understand more than one technology • Growth of Windows as a server platform ensures a healthy growth trend for SQL Server • Similarly, Oracle stands to be the main beneficiary from the growth of Linux • No compelling reason to believe that either vendor is going to dominate • Server platform choices are key in RDBMS vendor decisions and viceversa. • The above ignores the possibility of sudden disruption….

Disruptive technology • “Disruptive innovation” occurs when a technology or a technical approach emerges that offers a radically cheaper way of meeting a need. – Lower cost alternatives to low-end utilization – Lower cost creates new consumers • Established players are motivated to move towards the more profitable high-end of the market. – Existing customers tend to demand features at the high end – High end has higher profit margins – High end is less effected by disruptive technology • But as both the established and disruptive technologies advance, the established technology “overshoots” while the disruptive technology gains the mainstream. – See “The Innovators Dilemma”, Clayton Christensen, HUP

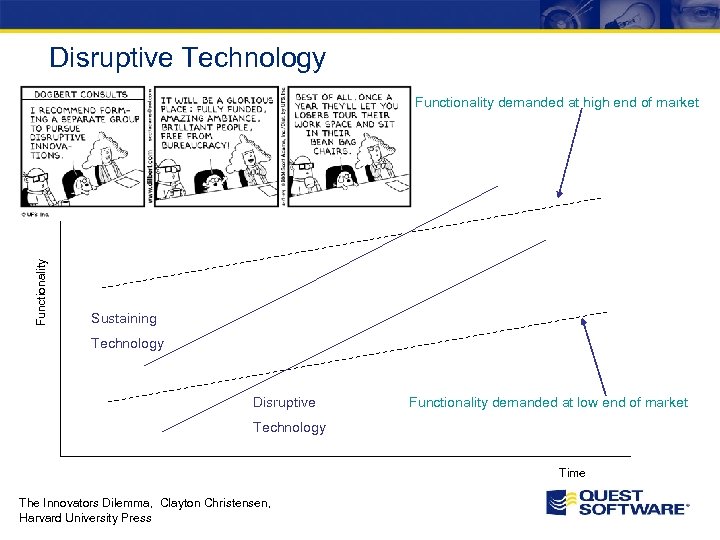

Disruptive Technology Functionality demanded at high end of market Sustaining Technology Disruptive Functionality demanded at low end of market Technology Time The Innovators Dilemma, Clayton Christensen, Harvard University Press

OSDBMS - My. SQL • Advantages: – Huge install base – Many mission-critical deployments (Sabre, Yahoo, NASA, etc) – Critical part of the LAMP stack • Well placed to leverage Linux server growth • But don’t forget WAMP – Disruptive both as low-cost innovation and competing against nonconsumption – Providing 90 s style RDBMS for free (internal) or <10% of Oracle cost (commercial) • Challenges: – Attempts to monetize the install base not yet successful • My. SQL users are completely satisfied by the free offering • Many OSS companies are disturbingly reminiscent of Y 2000 Dot. coms (millions of non-paying customers; VC funded; unproven business model) – Commercial vendors have all read “The Innovators Dilemma” • All have a free version for entry level use • Oracle aggressively counter-disrupting via strategic acquisition – Many competing demands on My. SQL R&D • Unlike Red Hat, My. SQL don’t get the software for free

Industry trends - Outsourcing • 15% of companies report they plan to outsource DBA roles (Gartner 2004) b/c of: – Reduced cost – Difficulty maintaining expertise in house • But BIG obstacles to widespread adoption: – High risk (cost of database failure > savings from outsourcing) – Security implications – Quality of service • Adoption is relatively narrow and shallow: – Minority of companies (but tend to be large) outsourcing only routine DBA activities

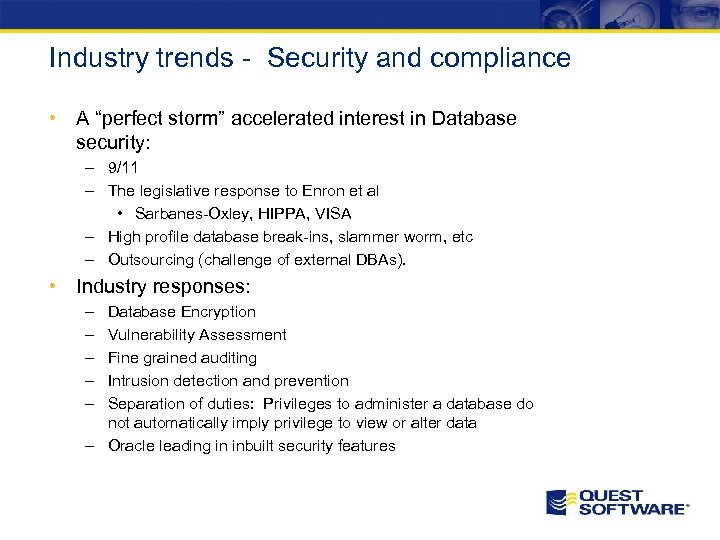

Industry trends - Security and compliance • A “perfect storm” accelerated interest in Database security: – 9/11 – The legislative response to Enron et al • Sarbanes-Oxley, HIPPA, VISA – High profile database break-ins, slammer worm, etc – Outsourcing (challenge of external DBAs). • Industry responses: – – – Database Encryption Vulnerability Assessment Fine grained auditing Intrusion detection and prevention Separation of duties: Privileges to administer a database do not automatically imply privilege to view or alter data – Oracle leading in inbuilt security features

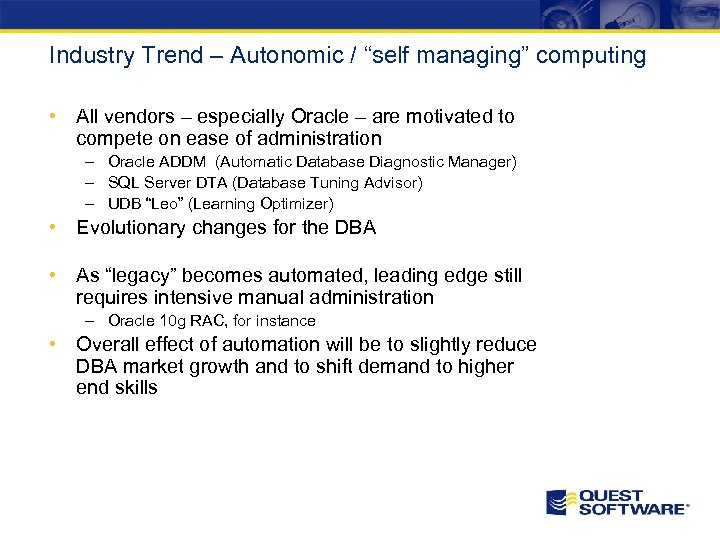

Industry Trend – Autonomic / “self managing” computing • All vendors – especially Oracle – are motivated to compete on ease of administration – Oracle ADDM (Automatic Database Diagnostic Manager) – SQL Server DTA (Database Tuning Advisor) – UDB “Leo” (Learning Optimizer) • Evolutionary changes for the DBA • As “legacy” becomes automated, leading edge still requires intensive manual administration – Oracle 10 g RAC, for instance • Overall effect of automation will be to slightly reduce DBA market growth and to shift demand to higher end skills

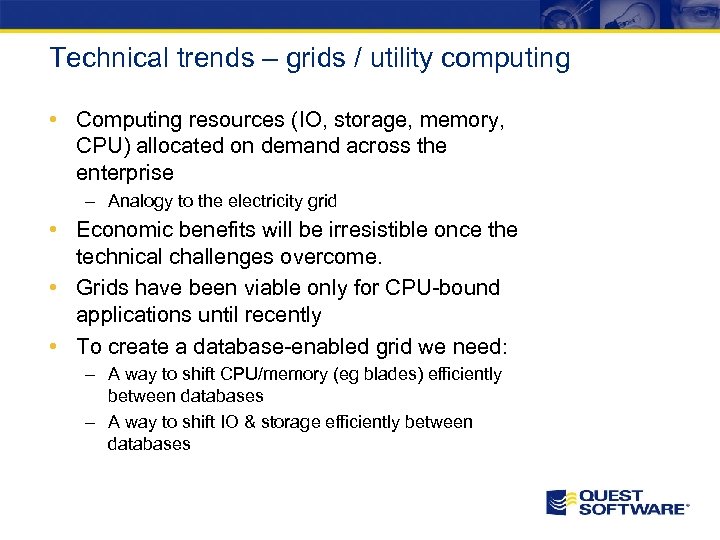

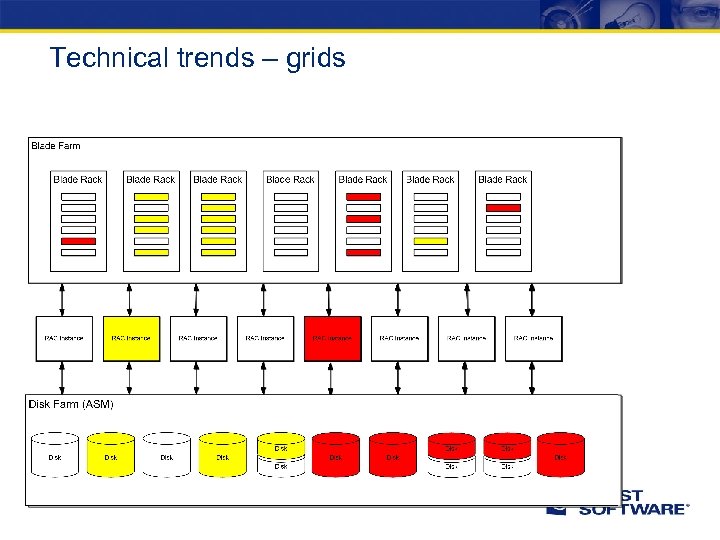

Technical trends – grids / utility computing • Computing resources (IO, storage, memory, CPU) allocated on demand across the enterprise – Analogy to the electricity grid • Economic benefits will be irresistible once the technical challenges overcome. • Grids have been viable only for CPU-bound applications until recently • To create a database-enabled grid we need: – A way to shift CPU/memory (eg blades) efficiently between databases – A way to shift IO & storage efficiently between databases

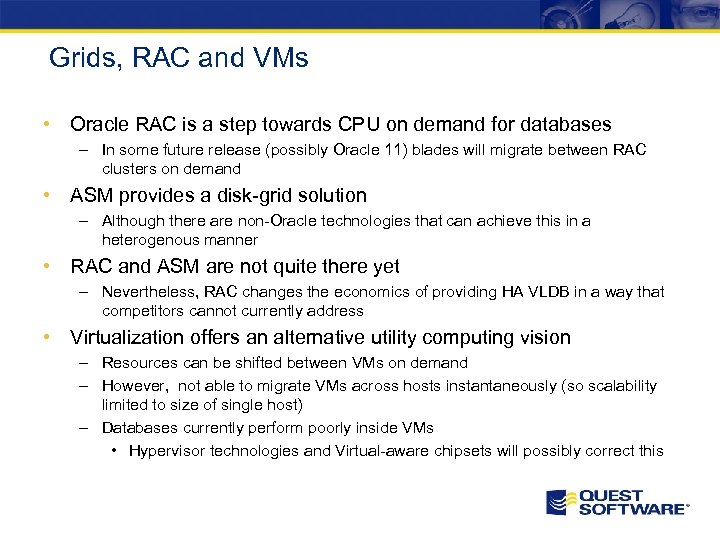

Grids, RAC and VMs • Oracle RAC is a step towards CPU on demand for databases – In some future release (possibly Oracle 11) blades will migrate between RAC clusters on demand • ASM provides a disk-grid solution – Although there are non-Oracle technologies that can achieve this in a heterogenous manner • RAC and ASM are not quite there yet – Nevertheless, RAC changes the economics of providing HA VLDB in a way that competitors cannot currently address • Virtualization offers an alternative utility computing vision – Resources can be shifted between VMs on demand – However, not able to migrate VMs across hosts instantaneously (so scalability limited to size of single host) – Databases currently perform poorly inside VMs • Hypervisor technologies and Virtual-aware chipsets will possibly correct this

Technical trends – grids

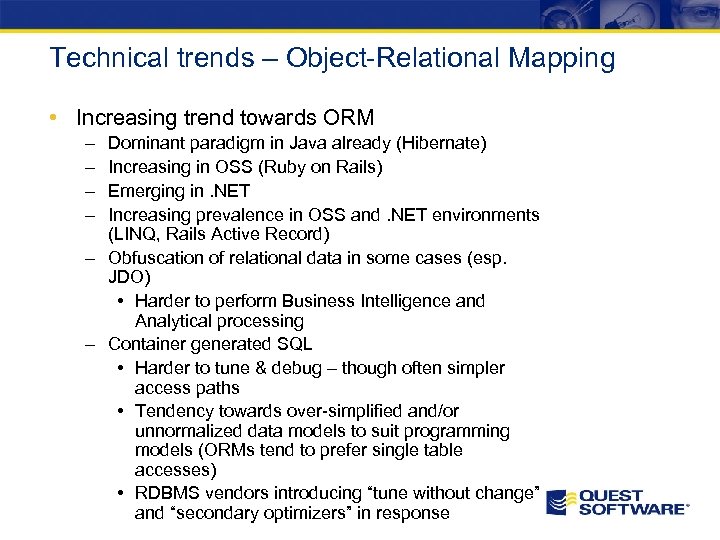

Technical trends – Object-Relational Mapping • Increasing trend towards ORM – – Dominant paradigm in Java already (Hibernate) Increasing in OSS (Ruby on Rails) Emerging in. NET Increasing prevalence in OSS and. NET environments (LINQ, Rails Active Record) – Obfuscation of relational data in some cases (esp. JDO) • Harder to perform Business Intelligence and Analytical processing – Container generated SQL • Harder to tune & debug – though often simpler access paths • Tendency towards over-simplified and/or unnormalized data models to suit programming models (ORMs tend to prefer single table accesses) • RDBMS vendors introducing “tune without change” and “secondary optimizers” in response

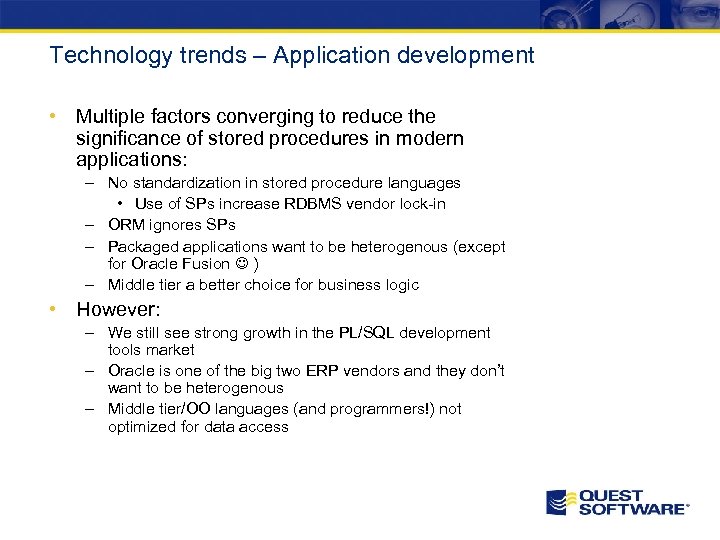

Technology trends – Application development • Multiple factors converging to reduce the significance of stored procedures in modern applications: – No standardization in stored procedure languages • Use of SPs increase RDBMS vendor lock-in – ORM ignores SPs – Packaged applications want to be heterogenous (except for Oracle Fusion ) – Middle tier a better choice for business logic • However: – We still see strong growth in the PL/SQL development tools market – Oracle is one of the big two ERP vendors and they don’t want to be heterogenous – Middle tier/OO languages (and programmers!) not optimized for data access

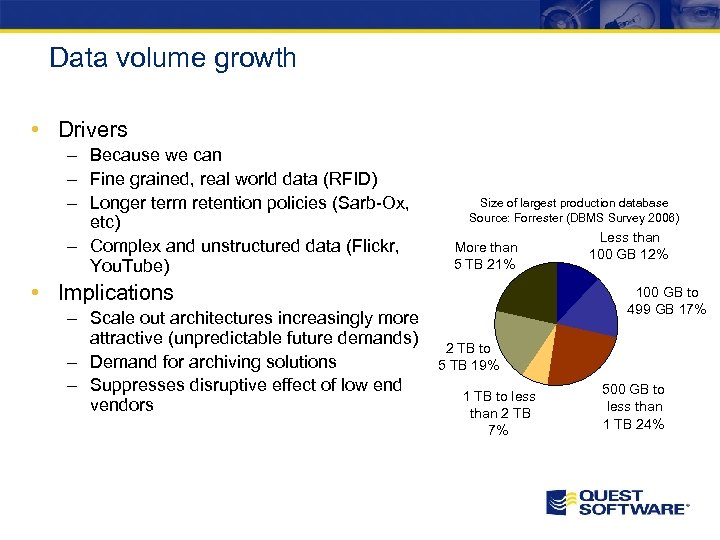

Data volume growth • Drivers – Because we can – Fine grained, real world data (RFID) – Longer term retention policies (Sarb-Ox, etc) – Complex and unstructured data (Flickr, You. Tube) Size of largest production database Source: Forrester (DBMS Survey 2006) More than 5 TB 21% • Implications – Scale out architectures increasingly more attractive (unpredictable future demands) – Demand for archiving solutions – Suppresses disruptive effect of low end vendors Less than 100 GB 12% 100 GB to 499 GB 17% 2 TB to 5 TB 19% 1 TB to less than 2 TB 7% 500 GB to less than 1 TB 24%

Growing demand for data search and linking • Islands of information need to be broken down • Motivations for “globalising” and unifying data: – RFID/Supply chain – Web services/mash-ups/co-operative e-commerce – Expectations raised by internet content search • But: – No clear technical solution – Significant societal issues in respect of security and privacy

Visions of the future of DBMS – Larry Ellison: • A single, global, logical (Oracle) instance/cluster tied together with grids and data pump technology • Both data and computing resources will be made available across the network on demand • Data sharing through consolidation – Web services standards bodies: • All interactions will occur through well-defined Web Service interfaces utilizing specifications such as WS-transaction, WS-security, etc. • RDBMS is a local “persistence” store only – Open Source/Web 2. 0 community: • Same as above, but “mash-ups” not Standardsbased WS

Visions of the future of DBMS • Adam Bosworth (Google) – Something radically different is going to emerge. – Orders of magnitude more data is going to be stored on the net in the near future and the expectation is going to be that we can find and possibly modify it from anywhere – Formal, tightly coupled web services will give way to simple, sloppy (maybe RSS based) protocols – Matching will result not from a worldwide standardization of data or a “semantic web”, but from stupid but powerful algorithms (similar to Google spell check) – Centralized relational Databases of today are going to seem “so twentieth century” and “one of those technologies that never got the internet”

Visions of the future of DBMS • Michael Stonebraker (creator of Posgres/Ingres) et al – One Size Fits All (OSFA) RDBMS architecture cannot meet the needs of current and emerging demands: • OLTP, stream processing (telco, web), OLAP/DW, Unstructured, mobile, embedded, multi-dimensional, etc – Specialized databases can generated 10 x performance improvements • For instance, column based organization instead of row based – The competing demand of data integration will probably preclude a re-fragmentation of data – They suggest either: • Hybrid system with various underlying storage engines (a la My. SQL) • Data federation • A new “from scratch” DBMS system with relational features but also able to perform column based operations

Questions?

6a77b6fe42659f67f73bd414f1e67849.ppt