6b0d2ebb1398fc2378f8a89619b88184.ppt

- Количество слайдов: 24

rd 3 The Annual Life Science Conference February 2001 From Business Plans to Business Financing Miranda Toledano - Ernst & Young, Israel

Bio-Sector Climate in Israel • Lack of well-defined or central bio-infrastructure • Biotech start-ups require international partnering & IR strategies from the outset • The trade-off: – viable implementation of global strategy for success – dealing with local issues of the biotech start-up • Balancing act Tech Expertise (Strong IP( Winner Strategy February 2001 Financing 2

Early Stage Decision Making • • • Joining the incubator (implications for the future( Leaving the incubator in a sound position Retaining IP from academia Dictating flow of technology development Recruiting and retaining key employees, management and SAB • Selecting Application-driven models that have clear and defined market potential • Impressing the investor with viable business model February 2001 3

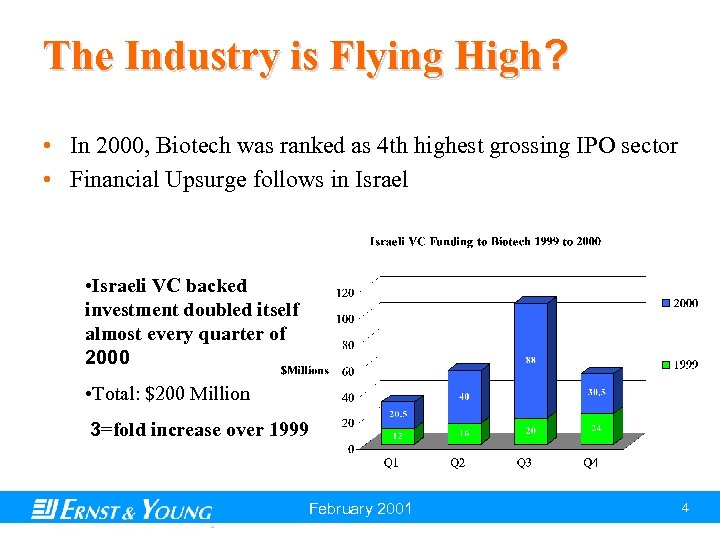

The Industry is Flying High? • In 2000, Biotech was ranked as 4 th highest grossing IPO sector • Financial Upsurge follows in Israel • Israeli VC backed investment doubled itself almost every quarter of 2000 • Total: $200 Million 3=fold increase over 1999 February 2001 4

Internal Drivers: Communicating Success • Entrepreneur’s talent + Availability of funding • Universal Theme for Biotech start-ups – technological know-how is there – ability to position tech in commercial setting is not • Key Success Factor: the company that can communicate and execute its potential to be a viable investment and a profitable business • This takes strategic planning – identifying critical junctions to arrive at desired outcome – articulation of tasks by management February 2001 5

Business Plans can Help • Simple tool of communication between start-up and investors • Contribution: exchange of ideas, information, and brainstorming that lead to the launch of a new venture • A concise explanation of why we are creating a new business and what is its value proposition to the biotech sector: – technological evaluation of current state of market – logical flow of critical R&D milestones – early stage identification of potential partnering opportunities • Goal: Translate mission into “revolutionary concept” that will achieve financing goals February 2001 6

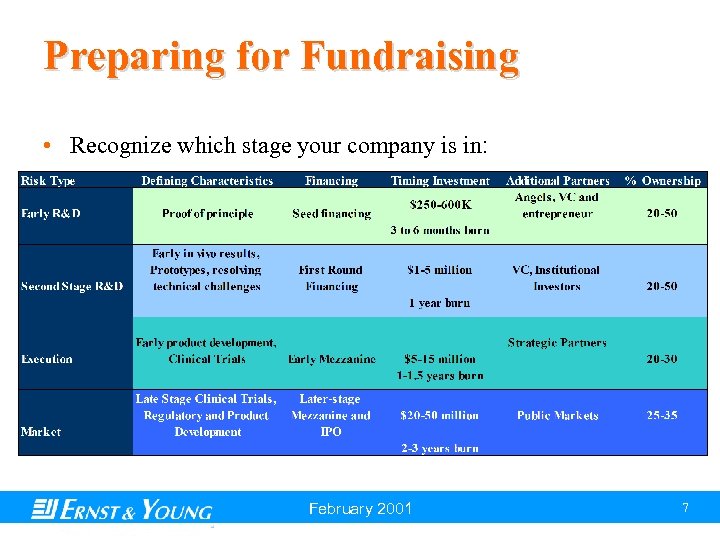

Preparing for Fundraising • Recognize which stage your company is in: February 2001 7

Early R&D Stage: Monitoring Risk and Delivering Value • All business involves risk but not all risk is equal • Earlier stage financing partners absorb greatest risk – they are impacted by current and subsequent stages of risk – they deserve greater opportunity for upside return! • How to achieve successful seed/first round: – understand when to raise how much cash from whom – developing rational financing/business plan that: • Reduces risk • Minimizes equity dilution • Increases opportunity for success February 2001 8

Overcoming Business Risks Experienced Management IP Protection Balanced Business Model World Class Science Market Focus INVESTOR RETURNS Communication Technology Portfolio Innovation and Research Team Building February 2001 Funder Support 9

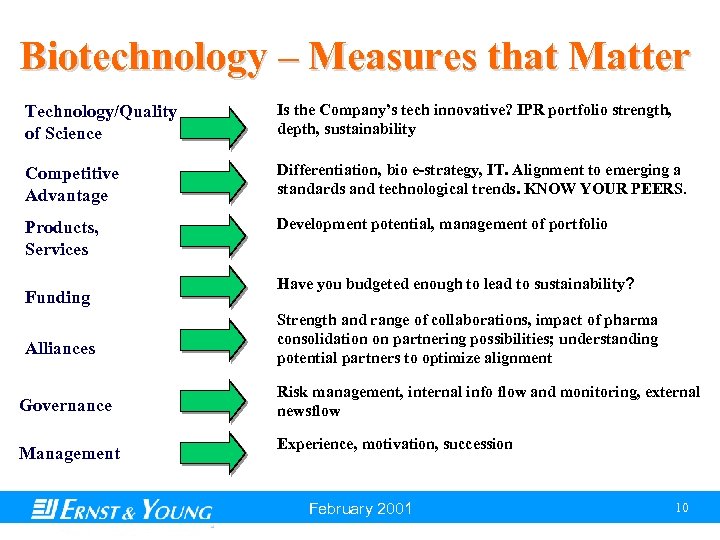

Biotechnology – Measures that Matter Technology/Quality of Science Is the Company’s tech innovative? IPR portfolio strength, depth, sustainability Competitive Advantage Differentiation, bio e-strategy, IT. Alignment to emerging a standards and technological trends. KNOW YOUR PEERS. Products, Services Development potential, management of portfolio Funding Alliances Governance Management Have you budgeted enough to lead to sustainability? Strength and range of collaborations, impact of pharma consolidation on partnering possibilities; understanding potential partners to optimize alignment Risk management, internal info flow and monitoring, external newsflow Experience, motivation, succession February 2001 10

Budgeting. . . • Natural tendency for biotech start-up is to ask for as little as possible at stages where investors demand a relatively large equity position • Remember though: – underestimating funding requirements to avoid dilution could mean: • Running out of Cash • Reentering IR climate too soon (or during a market downturn( • Ultimately, slowing down R&D program February 2001 11

Modeling the Business • Design a modular approach to establish credibility and focus (Like Rome, most successful biotech companies were not built in day(! • All biotech start-ups must have a clear mission and identity • Non-core competencies needs can be outsourced • Create realistic and achievable short-term goals to increase share-holder value: – first concentrate on “R & D” stage but always remember your market positioning. Stay FLEXIBLE February 2001 12

Short & Long Term Survival Through Strategic Alliances (SA( • SA are the fastest and most efficient way to do business in biotech & constitute an increasingly important source of funding, they: – – – enable partners to gain non-core competency products and services help develop core competency or hedge industry standard validate the biotech start-ups know-how in the commercial setting Knowledge management and strategy are key IP protection comes first But, Biotech business models must recognize external communication obligation February 2001 13

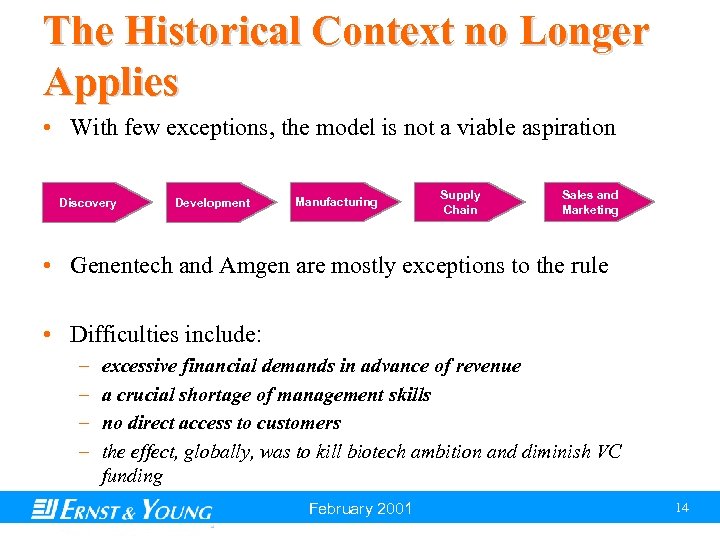

The Historical Context no Longer Applies • With few exceptions, the model is not a viable aspiration Discovery Development Manufacturing Supply Chain Sales and Marketing • Genentech and Amgen are mostly exceptions to the rule • Difficulties include: – – excessive financial demands in advance of revenue a crucial shortage of management skills no direct access to customers the effect, globally, was to kill biotech ambition and diminish VC funding February 2001 14

SA Need to Move with Increasing Demands of Sector Investors Pharmaceutical Companies • demand for growth • • patent expiry need new products consolidation cash rich Healthcare Providers & Governments • new products • lower cost • public expectations STRATEGIC ALLIANCES • provide innovation • need cash Biotechnology Companies February 2001 15

New Dynamics of SA • Basic premise of biotech is to streamline process of discovering promising drugs and to develop them into marketable therapies • Constructive relationships with “Big Pharma” and “Big Biotech” must happen, even earlier on in the game • Need to Show: – How can “big pharma” decrease true cost of innovation – How does “big pharma” or investor understand that environment will provide opportunity to achieve financial return • Interrelation of multiple technologies will drive Israeli biotech industry forward (2 models( February 2001 16

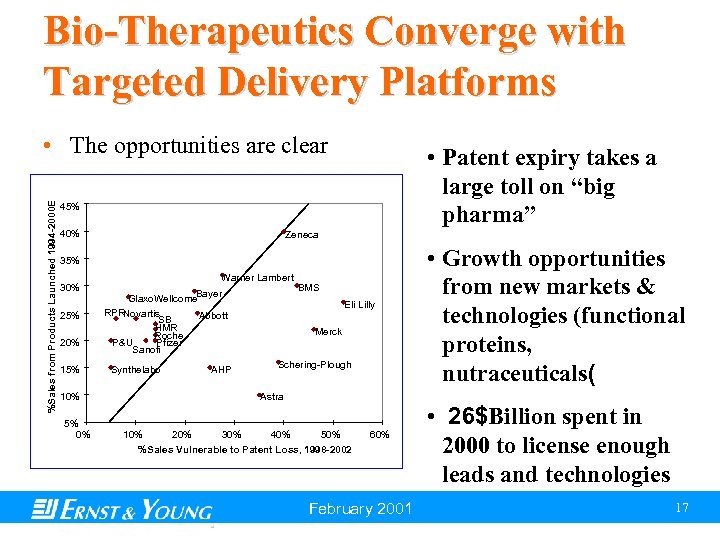

Bio-Therapeutics Converge with Targeted Delivery Platforms %Sales from Products Launched 1994 -2000 E • The opportunities are clear • Patent expiry takes a large toll on “big pharma” 45% 40% Zeneca 35% 30% 25% 20% 15% 10% 5% 0% Warner Lambert Bayer Glaxo. Wellcome RPRNovartis Abbott SB HMR Roche P&U Pfizer Sanofi Synthelabo AHP BMS Eli Lilly Merck Schering-Plough Astra 10% 20% 30% 40% 50% %Sales Vulnerable to Patent Loss, 1998 -2002 60% February 2001 • Growth opportunities from new markets & technologies (functional proteins, nutraceuticals( • 26$Billion spent in 2000 to license enough leads and technologies 17

Israeli Bio-Delivery Model • Develop horizontal pipelines that ensure short and long term growth – Delivery platform as short term partnering objective • • • Significantly less R&D time Aims to derive initial top-line growth Establish investor confidence & increase valuation Demonstrate value creation & validate technology Serve your partners’ immediate needs – Therapeutic development as mid or long term partnering objective • Mid-Term: After Phase I/IIa (Safety & Dosage( • Long-Term: After Phase II (Efficacy and Side Effects( February 2001 18

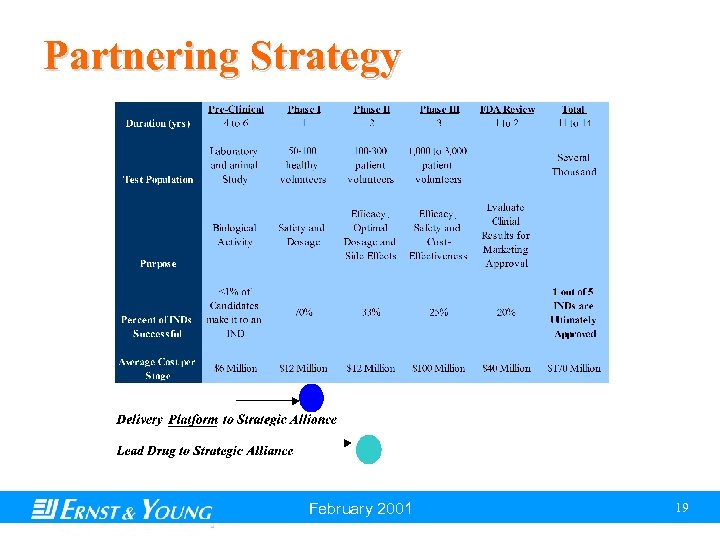

Partnering Strategy February 2001 19

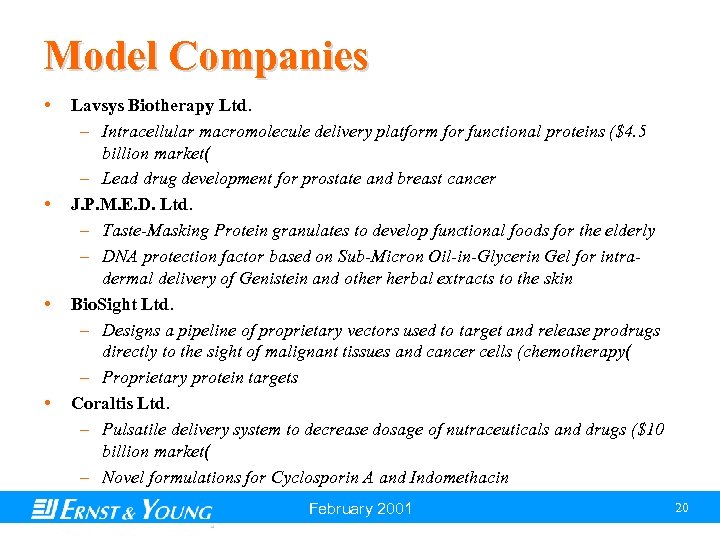

Model Companies • • Lavsys Biotherapy Ltd. – Intracellular macromolecule delivery platform for functional proteins ($4. 5 billion market( – Lead drug development for prostate and breast cancer J. P. M. E. D. Ltd. – Taste-Masking Protein granulates to develop functional foods for the elderly – DNA protection factor based on Sub-Micron Oil-in-Glycerin Gel for intradermal delivery of Genistein and other herbal extracts to the skin Bio. Sight Ltd. – Designs a pipeline of proprietary vectors used to target and release prodrugs directly to the sight of malignant tissues and cancer cells (chemotherapy( – Proprietary protein targets Coraltis Ltd. – Pulsatile delivery system to decrease dosage of nutraceuticals and drugs ($10 billion market( – Novel formulations for Cyclosporin A and Indomethacin February 2001 20

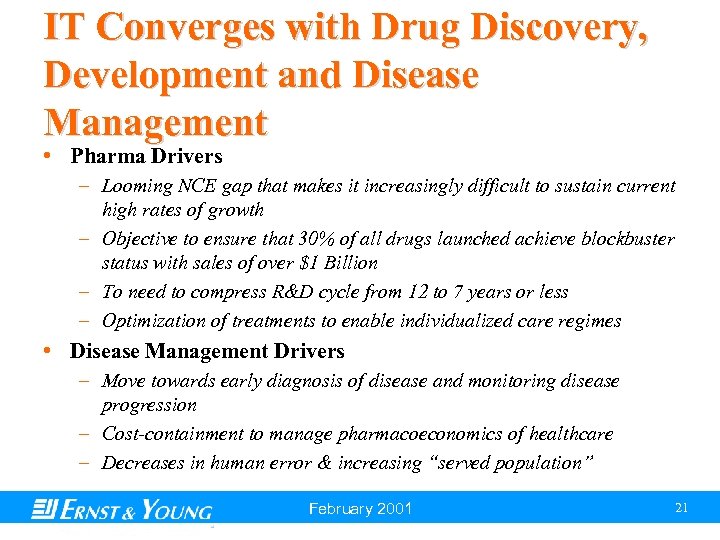

IT Converges with Drug Discovery, Development and Disease Management • Pharma Drivers – Looming NCE gap that makes it increasingly difficult to sustain current high rates of growth – Objective to ensure that 30% of all drugs launched achieve blockbuster status with sales of over $1 Billion – To need to compress R&D cycle from 12 to 7 years or less – Optimization of treatments to enable individualized care regimes • Disease Management Drivers – Move towards early diagnosis of disease and monitoring disease progression – Cost-containment to manage pharmacoeconomics of healthcare – Decreases in human error & increasing “served population” February 2001 21

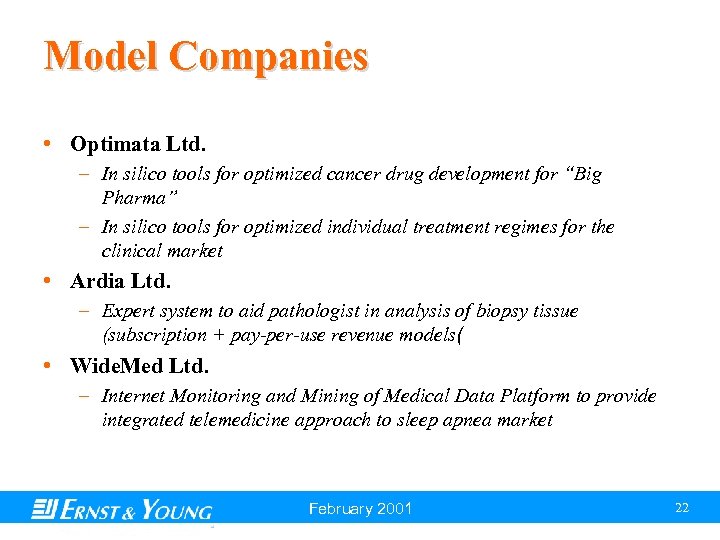

Model Companies • Optimata Ltd. – In silico tools for optimized cancer drug development for “Big Pharma” – In silico tools for optimized individual treatment regimes for the clinical market • Ardia Ltd. – Expert system to aid pathologist in analysis of biopsy tissue (subscription + pay-per-use revenue models( • Wide. Med Ltd. – Internet Monitoring and Mining of Medical Data Platform to provide integrated telemedicine approach to sleep apnea market February 2001 22

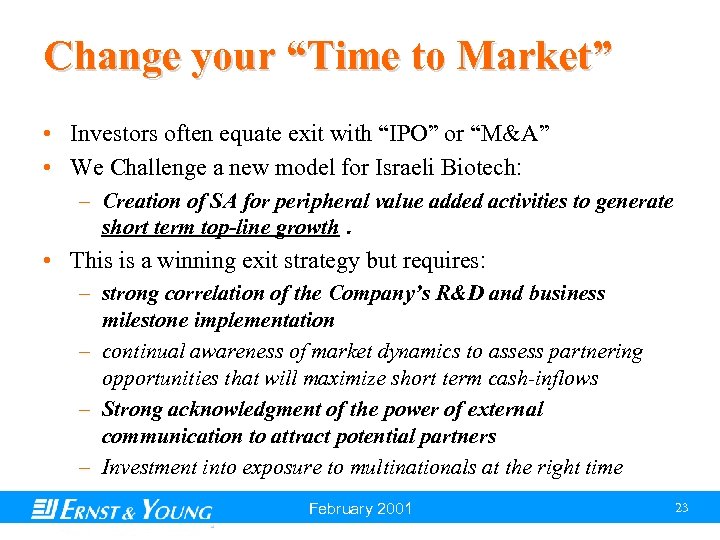

Change your “Time to Market” • Investors often equate exit with “IPO” or “M&A” • We Challenge a new model for Israeli Biotech: – Creation of SA for peripheral value added activities to generate short term top-line growth. • This is a winning exit strategy but requires: – strong correlation of the Company’s R&D and business milestone implementation – continual awareness of market dynamics to assess partnering opportunities that will maximize short term cash-inflows – Strong acknowledgment of the power of external communication to attract potential partners – Investment into exposure to multinationals at the right time February 2001 23

– Technology transfer of early stage findings to generate returns for mission critical development goals will alter the investment community’s perception of biotech in Israel February 2001 24

6b0d2ebb1398fc2378f8a89619b88184.ppt